Research Article: 2024 Vol: 23 Issue: 4

Employee Relations, Ethical Orientation And Job Performance: A Study Of Selected Deposit Money Banks In Lagos State, Nigeria.

David Orenuga, Covenant University

Rowland Worlu, Covenant University

Olabode Oyewunmi, Covenant University

Odunayo Salau, Covenant University

Citation Information: Orenuga, D, Worlu, R, Oyewunmi. R & Salau, O. (2024). Employee relations, ethical orientation and job performance: a study of selected deposit money banks in lagos state, nigeria. Academy of Strategic Management Journal, 23(4), 1-21.

Introduction

The mercurial nature of the global financial markets and by extension the banking industry in Nigeria has ramped up the pressure on the human element responsible for carrying out the day to day tasks needed to realise the strategic objectives of the organisations which make up the industry. This has been further exacerbated by the COVID-19 pandemic leading to a race for cutting-edge technological solutions and the reimagining of contemporary work, the workplace and the workers. This unprecedented shift in the way things are done has been aptly termed the “new normal” and all organisations are trying to come to terms with this new reality.

Over the past few years, the banking sector, which had hitherto flourished, suffered significantly in the wake of the upheavals in the global financial markets. Consequently, in an attempt to remain afloat, several banks have had to resort to privately-sourced capital injection or government aid leading academics and policy-makers to re-evaluate the dynamic complexities of employee-relations. Banks in Nigeria have had to survive many turbulent periods in the recent past. The merging of some major banks and restructuring of their services are all indicators of the increasing pressures banks continuously face to deliver value in the face of increasing competition and regulations. All of these pressures are passed on to employees in form of greater workload and anxieties over their job security. All of this calls for a detailed look at how banks are employing their human resource in the face of these challenges. The employee relations strategies utilised by these banks and the implication for job performance is what this study hopes to analyse.

Given increasing global contest for market share, organisations have emphasised greater employee efficiency and tighter cost control, all of which call for more robust strategies to enhance employee relations which elicits maximum output from employees. It remains to be seen whether employee relations has yielded this efficiency in the Nigerian banking sector. What is apparent is the laying off of bank staff in droves and the perpetually increasing anxiety which bank staff constantly grapple with in the face of these pressures; the latest requiring the interference of the Central Bank of Nigeria in stopping the planned layoff of staff of a major bank in Nigeria. Pearce and Robinson (2019) noted that firms pursue smooth employee relations regardless of the existence, or lack thereof, of binding union contracts. This seems to be the case with most banks in Nigeria, as they seek performance and good relations with their staff despite not being members of any recognised unions. It becomes pertinent that questions are asked as to how these banks relate with their staff to ensure performance in spite of all of these pressures. Thus, this study seeks to investigate employee relations and job performance through the mediating scope of ethical orientation in selected deposit money banks in Lagos state.

Literature Review

Stiff competition, occasioned by the accelerated advances in financial technological products and services, as well as the emergence of virtual banks has led to a rapid disruption of the global banking sector. A consequence of this development is the need for commercial banks to constantly update their personnel management strategies in order to boost employee productivity levels (Ngui, 2016). One of such strategies is enhanced employee relations; which has been touted as one of the keys to unlocking better job performance of employees. It is an essential factor to realising higher levels of organisational productivity and performance (Worlu, Osibanjo, Ogunnaike, (Salau et al., 2016).

In this context, employee relations refers to the full range of activities that employers use in maintaining a work environment that satisfies employees. It entails the crafting of systems and structures which bring about improved employee work output, without compromising job satisfaction. Employee relations also covers issues relating to degree of employee participation in matters of managerial import, conflict minimisation and resolution, channels of communication, employee development, as well as policies for increased organisational synergy across board.

Globally, a prerequisite to achieving organisational goals in the current business climate is employee input and output; hence, organisations constantly explore various avenues to incentivise and motivate employees to meet up with deliverables commensurate with organisational targets. Cardinal to all firms is performance level of the employees; therefore, peak employee performance levels should be the desired outcome of every firm policy. Mechanisms for boosting the productivity of employees, as well as assessing their performance, are important for organisational excellence. A lack of such mechanisms will result in increased strain on organisational resources and hamper its capacity to compete in its industry. According to Eberendu et al. (2018), hallmarks of the Nigerian banking sector are bloated workloads and protracted work hours. In a bid to be a leading player in the banking industry, bank managers may overwork employees. On their part, employees strive to keep their jobs by working much longer hours even when this takes a toll on their personal life.

Organisations have identified employee ethical behaviour as the behaviour that drives performance and success. Despite the many good effects of ethical behaviour, unethical business practices and behaviour are frequent in organisations (de Silva et al., 2018). The banking sector has been characterized by rising attention to ethics during the last 30 years, which has heightened as a result of the global financial crisis (Vigano, 2020). Banks have the privilege and duty of directly working with a diverse range of clients, and they are expected to build long-term relationships with them based on trust, transparency, and proper conduct. Where bank employees conduct falls short of these, there will be huge problems for the bank.

This problem has affected financial giant all around the world. The financial crisis in the West in 2007 is a good example of the devastating implications of unethical activity by personnel in huge global banks (de Silva et al., 2018). Over the years, the banking industry has seen a number of notable bank collapses and crises, with internal control weaknesses being one of the causes. Recent scandals have shown circumstances when corporations engaged in unethical accounting practices to hide crucial information regarding firms' financial records, such as Oceanic Bank, Intercontinental Bank, and Bank PHB all in Nigeria, as well as Alpha Bank in South Africa and Royal Bank of Zimbabwe (Umar & Umar-Dikko, 2018).

Extant literature have stressed that ethical orientation is indispensable in strengthening performance of employees in the workplace (Matloob, 2018). A definition of ethical orientation is an individual’s predisposition to favour a certain perspective. Disagreements on what is ethical may arise due to misalignments in ethical orientation, and the contexts in which individuals apply judgment (Johari et al., 2020). Their ethical orientation in terms of how idealistic or relativistic they are when it comes to ethical issues may determine how they perform on the job. Some employees may do their utmost on the job as a matter of principle while others may take it with a bit of levity. It is important that employee relations seeks to resolve individual issues employees have on the job so as to attain optimum job performance.

Employee relations refer to the full range of activities by which organisations interact with their workers to deliver organisational objectives. It is often used synonymously with industrial relations. However, Industrial relations more readily refer to collective bargaining and the processes that lead to agreement between employers and trade unions. Employment implies a transactional relationship, with socioeconomic and political dimensions, in which employers compensate employees’ for either mental and/or manual labour (Wangila, & Kiiru, 2019).

Banking sector regulatory reform made possession of 25 billion Naira capital base a minimum operational criterion for commercial banks (Okoye, Omankhanlen, Okoh, Ezeji, & Ibileke, 2020). This development necessitated several strategic coalitions between and among commercial banks, by mergers and acquisitions. Many banks have had to develop new strategies to substantially scale-up the customer and capital base, and expand business operations. As a consequence of these new realities, managers demand much higher outputs from employees. In trying to match these increased performance expectations, employees will more than likely lose out in maintaining a healthy work-life balance. Exacerbating the problem further is the widely-held notion that the organisational work culture in commercial banks is poor; encompassing practices such as employers compromising properly scheduled work-leave of employees, and employers reneging on the leave policy stated in their terms of employment. Potential fallout of all these may be unhealthy, stifling workloads which may have grave adverse consequences for the employees.

These issues significantly bear on both the psychological and emotional wellbeing of employees, with possible implications such as declining employee performance, unacceptable service delivery and increased incidence and prevalence of health-related issues (Eberendu et al., 2018)). Among bank employees, job satisfaction was reported to be just 59% worldwide (Orumwense, 2018). Nigerian commercial banks’ records indicated: (a) a drop in productivity levels, (b) increased overhead costs, and (c) widespread service failures (Usman, Afza, & Amran, 2015). It was reported that Nigerian bank employees’ turnover rate was an astounding 85% due to dwindling job satisfaction (Usman et al., 2015). Flagging productivity and reduced profitability are direct outcomes of job dissatisfaction (Shobe, 2018). The declines in productivity and profitability are due to employees’ job dissatisfaction (Usman et al., 2015). At the macro level, the general business challenge confronting banking sector leaders was increased job dissatisfaction among bank employees. At the micro level, the specific business challenge was bank leaders’ poor understanding of the interrelatedness of human relations at work, conflict management, compensation management, staff movement, performance appraisal and job satisfaction of employees.

Due to increased competition in the banking business and rapid technical advances, such as digitization, banks throughout the world confront a significant problem in developing, sustaining, and retaining ethical personnel at work. Employee unethical behaviour is a major source of concern for businesses because of the numerous negative implications. Reduced organizational performance, financial losses, harm to the business image/reputation, loss of public faith and confidence, customer and market share losses, and financial losses due to lawsuits are just a few examples of negative repercussions of having unethical employees (de Silva et al., 2018). There is an urgent need for banks to examine ethical orientation of their staff and put in place appropriate strategies to curtail these negative repercussions.

With the enormous task of performing in a fast-paced environment, it becomes even more difficult where employees do not have a good relationship with their employers. Poor relations in terms of conflict, remuneration, communication, job structure and physical work conditions, among others, can be very deflating for employees. It is difficult to attain any reasonable level of job satisfaction or performance where employees have to deal with poor relationship with their employers. This study therefore explores the role of employee relations and ethical orientation in enhancing job performance in the selected banks.

The broad objective of this study is to explore the role of employee relations and ethical orientation in enhancing job performance in selected deposit money banks in Lagos, Nigeria. Meanwhile, the specific objectives are to:

• Examine the influence of conflict management on job performance (i.e. employee satisfaction, employee productivity, task performance and contextual performance);

• Examine the relationship between employee remuneration and job performance;

• Ascertain the effect of employee communication on job performance;

• Examine the impact of employee empowerment on job performance; and

• To investigate the moderating role of ethical orientation on employee relations and job performance.

The following research hypotheses stated in null form were tested in this study:

H0: Conflict management plays no significant role in enhancing job performance.

H0: Employee remuneration does not significantly affect job performance.

H0: Employee communication does not significantly affect job performance.

H0: Employee empowerment does not significantly affect job performance.

H0: Ethical orientation does not significantly moderate the relationship between employee relations and job performance.

Conceptual Review

Employee Relations

Employee Relations refers to the field of employment that is responsible for managing employer-employee relationships in a way that benefits all parties concerned. Employee Relations is primarily concerned with the prevention and resolution of difficulties in the workplace (Trif & Paolucci, 2019). Employee Relations refers to the set of management tools used to keep meaningful working connections between stakeholders in a company. Adopting a management culture that prioritizes fair and respectful employee involvement can improve organizational performance.

According to Armstrong (2006), the prime goal of employee relations is to maximise employee productivity, which is achieved by carefully organising the employer-employee contact to reduce friction. Indeed both the employer and the employee have a role to play in establishing a meaningful employer-employee relationship. The former is in charge of establishing the structural and managerial framework as well as the environment in which a well-oriented employee can perform meaningful, measurable work; the latter is in charge of working within the reasonable set of guidelines with utmost professionalism and sense of duty. Pearce and Robinson (2019) observed that organisations should strive to improve employee work satisfaction through well-planned job responsibilities, effective management, and a sufficient compensation package.

Employee relations, according to Trif and Paolucci (2019), ensures the employer and employee share a healthy link in order to achieve the primary goal of optimized products and services delivery by moderating demotivating work conditions. Employee relations majorly concerns the socio-economic relationships which bond the employer and the employee. Employee relations, according to Akanbiemu (2021), also include beneficial relationships that result in a highly engaged and contented workforce, as evidenced by desirable key job performance indices.

Ethical Orientation

Individuals understand and/or respond to ethical challenges depending on their ethical orientation. There are two essential facets of ethical orientation which are ethical formalism and ethical utilitarianism. Ethical formalism is based on Immanuel Kant's theory of deontology, while ethical utilitarianism is based on Jeremy Bentham and John Stuart Mills' theory of teleology. People who are motivated by ethical formalism conduct their lives according to a set of rules or standards. Depending on how closely they conform to these rules, their actions are either ethical or immoral. The results or outcomes of an activity decide whether or not it is ethical for utilitarians. They look at whether the effects or consequences of behaviours are ethical or not, rather than the actions themselves (Alder et al., 2008).

Forsyth’s (1980) Ethics Position Questionnaire (EPQ) is utilised in determining a person's ethical orientation, which can be depicted as a continuum extending from idealism to relativism. Idealism is concerned with human happiness, or, to put it another way, the idea that desirable outcomes can be achieved without violating moral norms. A person's concern for a system of universal rules or standards is referred to as relativism. Idealistic people should make a conscious effort to avoid making decisions that may harm others, as this is something they tend to avoid (Forsyth, 1980).

Idealism: The philosophical notion that moral principles are universal and primary in nature is known as idealism. Fichte and Kant's ethical philosophy emphasizes the importance of moral responsibility over all other commitments. Moral responsibility comes first, according to the idealist, and morality is self-evidently derived from the natural world. Absolutism and exceptionism are two forms of idealist philosophy that both believe in clear, universal moral principles but disagree in how they apply them.

Relativism: Relativism is used by many philosophers in various ways. The word "relativism" is described as the polar opposite of the term "idealism." Indeed, ethical relativism is defined as the belief that fundamental moral disagreements cannot be resolved by resorting to a universal moral hierarchy.

Job Performance

The sheer volume of research on job performance carried out by various scholars emphasizes the importance of highly productive individuals to organisations. It is well recognized that companies place a premium on their top performers; as a result, it is critical to evaluate employees' job performance (Sultana, 2020). Nonetheless, current literature indicates that there are discrepancies in how work performance is studied and rated; it is therefore assumed that these differing perspectives on the idea arise from the intrinsic differences in diverse jobs (Metin & Demirer, 2021). Atatsi et al., (2019) define job performance as scalable activities, behaviours, and results that individuals engage in or bring about that are linked to and contribute to organisational goals.

In general, Job performance refers to the contribution of an employee to the overall accomplishment of the company. Job performance can be broken down into many factors when broken down to a granular level (Metin & Demirer, 2021). Having said that, technocrats typically agree that job performance comprises two parts: Contextual performance and Task performance. The activities that come within the scope of the allocated duties of an employee are what are referred to as task performance. It is also known as 'in-role mandated behaviour' since it feeds directly into the key performance indicators that constitute the basis of employee appraisal. Contextual performance, often known as "discretionary extra-role behaviour," comprises elements that fall outside of typical job descriptions (Metin & Demirer, 2021). Organisational citizenship is inextricably linked to contextual performance.

Performance is defined by Taouab & Issor (2019) as the extent to which intended objectives are attained as measured by a variety of financial and non-financial metrics. In a different definition, Varghese (2020) defined job performance as an individual's efficient execution of duties given available resources and other conditions. The definition and breadth of job performance vary depending on the job in question; nonetheless, some scholars have developed general performance methods for a number of jobs. Experts have claimed that job performance is multidimensional, consisting mostly of task and context factors. The notion that there are several techniques to quantifying work performance in various organisational contexts has been documented in the literature, many diverse factors having been found as influencing job performance indicators.

Social Exchange Theory

The social exchange theory can be traced back to American sociologist George Homans (1958). According to Social Exchange Theory (SET), which is one of the oldest theories of social behaviour, all encounters between individuals are a resource exchange (Homans, 1958). Social exchange theory proposes that an action by one party is reciprocated in a similar manner by the other party, in a quid pro quo manner (Cooper-Thomas & Morrison, 2018). Physical goods, including commodities and money, or intangible resources, like social advantages or relationships, could be exchanged. The primary concept of SET is that people form and maintain connections with the goal of gaining something from them (Blau, 1968). The authors of SET include sociologists and social psychologists Blau, Emerson, Thibaut and Kelley. They were the first to construct a systematic theory that focused on social behaviour as an exchange (Blau, 1968). Blau (1968) may have coined the phrase "theory of social exchange" to describe his perspective on "social interaction as a trading activity."

Exchange interactions, according to SET, result in economic and social outcomes. Every one of the exchange relationship participant compares the economic and social outcomes of these interactions over time to the ones available from other trading options in order to determine how reliant they are on the exchange relationship. Positive economic and social impacts over time improve the parties' trust in one another and dedication to the exchange partnership. Positive trade connections lead to the formation of relational exchange norms, which guide the interactions of exchange partners over time.

Employee relations practices take place in the context of social exchanges in which employers and employees are the primary players. The Social Exchange Theory is important in this study because employee relations practices take place in the context of social exchanges in which employers and employees are the primary players. Employees have come to anticipate economic and social incentives from their employers over time. The more they interact socially, the more positive feelings they create, leading to increasing trust and commitment over time. In a social exchange relationship, the more undesirable outcomes are exchanged, the lower the trust and commitment between the partners.

Methods

The nature of this study was descriptive adopting a cross-sectional survey research design. This was done so as to get the perception of respondents on a variety of issues regarding the subject matter of the study. The study utilised a structured questionnaire to get the opinions of the target respondents. The main reason for adopting a survey research design was so as to get comprehensive information about the topic and enable analysis of the variables under study.

Population of the Study

According to Etikan & Babatope (2019), a population is a set of objects, items or people with similar attributes, who can be observed, with conclusions drawn from the observations. The population of this study was Tier 1 deposit money banks in Nigeria, which have their headquarters in Lagos state Nigeria. These are the biggest banks in Nigeria with the largest asset base and market share. Based on the classification by the apex bank (Central Bank of Nigeria) the banks are Access bank, First bank, Guarantee Trust (GT) bank, United Bank of Africa (UBA), and Zenith bank. According to the banks’ annual reports, Access bank has 7898 employees; First bank have 9014 employees, Guarantee Trust bank has about 3509 employees; UBA have a total of 9787 employees; and Zenith bank has 7074 employees (2019). This makes the total population for the study 37,282 Table 1.

| Table 1 Target Population of the Study | |||

| S/N | Banks | Population | Year of Establishment |

| 1. | First Bank of Nigeria | 9014 | 1894 |

| 2. | United Bank of Africa | 9787 | 1961 |

| 3. | Guaranty Trust Bank | 3509 | 1990 |

| 4. | Access Bank | 7898 | 1994 |

| 5. | Zenith Bank | 7074 | 1990 |

| Total | 37282 | ||

Sample Size Determination

Because the target population of the study was too large to be sampled, there was a need to select a representative sample. For the quantitative study, all the levels of employees were covered, from the junior level to senior level staff. These employees were those who work at the head office. Other employees that were included are head office staff, from the human resource department, legal department, commercial and corporate departments. These are the various departments identified as being present in the head office. For this study, the Gill, Johnson and Clark (2010) table was used to determine the sample size.

For the quantitative method, the study population, which comprised all the employees in the country, was a total of 37,282. According to Gill et al. (2010), this would give a sample size figure of 381 with a margin error of 0.05 and 95% confidence level as depicted Table 2.

| Table 2 Determination of Sample Size | |||

| Variance of the population P=50% | |||

| Confidence level=95% Margin of error =5% | |||

| Population Size | 5 | 3 | 1 |

| 50 | 44 | 48 | 50 |

| 75 | 63 | 70 | 74 |

| 100 | 79 | 91 | 99 |

| 150 | 108 | 132 | 148 |

| 200 | 132 | 168 | 196 |

| 250 | 151 | 203 | 244 |

| 300 | 168 | 234 | 291 |

| 400 | 196 | 291 | 384 |

| 500 | 217 | 340 | 475 |

| 600 | 234 | 384 | 565 |

| 700 | 248 | 423 | 652 |

| 800 | 260 | 457 | 738 |

| 1000 | 278 | 516 | 906 |

| 1500 | 306 | 624 | 1297 |

| 2000 | 322 | 696 | 1655 |

| 3000 | 341 | 787 | 2286 |

| 5000 | 357 | 879 | 3288 |

| 10000 | 370 | 964 | 4899 |

| 25000 | 378 | 1023 | 6939 |

| 50000 | 381 | 1045 | 8057 |

| 100000 | 383 | 1056 | 8762 |

Sample Frame

The study administered copies of questionnaire to employees from the five different banks, as

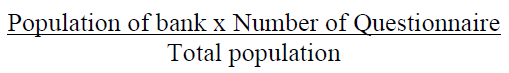

determined by the sample frame. The respondents were chosen using the probability proportional size method of selection. This meant that the proportionate sampling technique was used to determine the size of respondents from each bank. This was to ensure that the sample size representation was equal for the banks involved. To achieve this, the formula by Bartlett, Kotrlik & Higgins (2001) is given as:

From the formula of Bartlett et al. (2001) the sample frame is determined Table 3.

| Table 3 Distribution of Selected Banks and Sample Size | ||||

| S/N | Banks | Number of Employees | Questionnaire Proportion | Sample Size |

| 1. | First Bank of Nigeria | 9014 | 9014 x 381/37282 | 92 |

| 2. | United Bank for Africa | 9787 | 9787 x 381/37282 | 100 |

| 3. | Guaranty Trust Bank | 3709 | 3709 x 381/37282 | 37 |

| 4. | Access Bank | 7898 | 7898 x 381/37282 | 80 |

| 5. | Zenith Bank Plc | 7074 | 7074 x 381/37282 | 72 |

| 37282 | 381 | |||

Results

In this study, the respondents were the staff of all the five (5) selected banks with international authorisation in Nigeria. The Nigerian Banks include Access bank (Second or New Generation Bank), First Bank of Nigeria (First or Old Generation Bank), Guarantee Trust Bank (Second or New Generation Bank), United Bank of Africa (First or Old Generation Bank), and Zenith Bank Plc (Second or New Generation Bank). Each institution has unique sets of organisational employee relations principles, ethical orientation mechanisms and performance measurement. 381 employees received copies of the structured questionnaire. 316 copies of the questionnaire were found to be usable for analysis after follow-ups. This equated to an 82.9 per cent response rate, which is significant enough to establish a baseline and hence valid for the study problem's conclusion and the link between the variables' reliability. The response rate to the questionnaire that was sent out Table 4.

| Table 4 Respondents’ Response Rate | ||

| Sample Size | Number | Percentage |

| Correctly filled and Returned | 316 | 82.9% |

| Not Returned and not filled | 65 | 17.1% |

| Total | 381 | 100% |

Research Objective One

To examine the influence of conflict management on job performance (i.e. employee satisfaction, employee productivity, task performance and contextual performance).

In this sense, conflict management refers to the process of detecting and effectively resolving disagreements. It necessitates the use of effective communication tools as well as strong negotiation abilities. 'Prevention is better than cure,' says an adage. As a result, using a conflict management plan to prevent organizational conflict is critical (Saka, 2020). Understanding that people see things differently and may not have the same information about a situation or issue is the first step in conflict resolution. Various researches on conflict, its management, and the organisational outcomes have been conducted. Accommodation, collaboration, competitiveness, avoidance, and compromise are the five (5) conflict management approaches defined by Igbinoba (2016). Integration, obligation, compromise, dominating, and avoiding are five (5) conflict management methods examined by Rahim & Magner (1995). the frequency distribution for conflict management based on these dimensions Table 5.

| Table 5 Frequency Distribution for Conflict Management | ||||||||

| s/n | Items | Frequency Distribution | ||||||

| Strongly agree | Agree | Disagree | Strongly Disagree | Total | Mean | SD | ||

| 1 | I prefer to stay away from disagreement within the organisation | 121 38.3% |

120 38% |

20 6.3% |

55 17.6% |

316 100% |

3.238 | .898 |

| 2 | I pursue my interest during negotiations. | 28 8.9% |

108 34.2% |

38 12% |

142 46% |

316 100% |

3.068 | .931 |

| 3 | I go along with the suggestions of the management during negotiations. | 141 44.6% |

105 33.2% |

24 7.6% |

46 14.5% |

316 100% |

3.139 | .894 |

| 4 | I support the management to come up with decisions acceptable to us. | 85 26.9% |

136 43% |

21 6.6% |

74 23.4% |

316 100% |

3.238 | .898 |

| 5 | I prefer "give and take" strategy so that a compromise can be made | 52 16.5% |

159 50.3% |

46 14.6% |

59 18.6% |

316 100% |

3.068 | .931 |

| 3.148 | 0.908 | |||||||

The measures of conflict management for the selected institutions. From the table, it was revealed that 120 (38%) and 121 (38.3%) of the respondents agree and strongly agree, agreed that they prefer to stay away from disagreement within the organisation; 20 (6.3%) disagreed, while 55 (17.4%) of them strongly disagreed. This implies that most of the staff of the selected Nigerian Banks representing 76.3% affirmed that the importance of staying away from disagreement within the organisation.

It was also revealed that 108 (34.2%) and 28 (8.9%) of the respondents agree and strongly agree, agreed that they pursued their interests during negotiations; 38 (12%) disagreed, while 142 (45%) of them strongly disagreed. This infers that the majority of the staff across various levels representing 45% disagreed to pursue their interest during negotiations.

However, 105 (33.2%) and 141 (44.6%) of the respondents agree and strongly agree, concurred that they go along with the suggestions of the management during negotiations; 24 (7.6%) disagreed, while 46 (14.5%) strongly disagreed. This indicates that most of the staff of the selected Nigerian Banks representing 67.4% ascertained that they appreciate the suggestions of the management during negotiations.

It was also revealed that 136 (43%) and 85 (26.9%) of the respondents agree and strongly agree, concurred that they support the management to come up with decisions acceptable to them; 21 (6.6%) disagreed, while 74 (23.4%) of them strongly disagreed. This infers that most of the staff across various levels representing 69.9% indicated their support for the management to come up with decisions acceptable to them.

Lastly, 159 (50.3%) and 52 (16.5%) of the respondents agree and strongly agree, concurred to the statement that they prefer "give and take" strategy so that a compromise can be made; 46 (14.6%) disagreed, while 59 (18.6%) strongly disagreed. This indicates that most of the staff of the selected Nigerian Banks representing 66.9% ascertained that they prefer "give and take" strategy so that a compromise can be made.

The study found empirical evidence showing a wide range of abilities in managing conflict had a good connection to job performance. These findings confirm the theoretical claims of Akanbi (2020) and O'Neill & Mclarnon (2018) empirically. The implication is that banks should have more training for staff (bankers) especially managers, to develop their skills in managing conflicts so that they can function more efficiently.

Research Objective Two

Examine the relationship between employee remuneration and job performance (i.e. employee satisfaction, employee productivity, task performance and contextual performance).

Employee remuneration is the overall salary earned by an employee in this context. It includes an employee's base salary as well as any bonuses, commissions, overtime pay, or other financial benefits they may receive from their employer. The three main goals of remuneration are to attract new employees, elicit strong work performance, and sustain devotion to the organisation. Job performance, according to popular belief, is a combination of ability and motivation. In other words, employee pay is frequently viewed as a management tool for achieving business goals. the frequency distribution for employee remuneration Table 6.

| Table 6 Frequency Distribution for Employee Remuneration | ||||||||

| s/n | Items | Frequency and Percentage | Total | Mean | SD | |||

| Strongly agree | Agree | Disagree | Strongly Disagree | |||||

| 1 | My salary is adequate | 90 28.5% |

103 32.6% |

74 23.4% |

49 27.2% |

316 100% |

3.442 | .817 |

| 2 | I am satisfied with the allowances given | 92 28.4% |

115 36.4% |

76 24.5% |

33 10.4% |

316 100% |

3.238 | .944 |

| 3 | Performance based pay is given in the organisation | 123 38.9% |

125 39.5% |

52 16.5% |

16 5.1% |

316 100% |

3.042 | .861 |

| 4 | Bonuses are offered to staff in my organisation | 90 28.5% |

137 43.4% |

50 15.8% |

39 12.3% |

316 100% |

3.238 | .944 |

| Average Means Score | 3.241 | 0.874 | ||||||

| Decision (3.241) = Satisfied | ||||||||

The measures of employee remuneration for the selected institutions. From the table, it was revealed that 103 (32.6%) and 90 (28.5%) of the respondents agree and strongly agree concurred saying their salary is adequate; 74 (23.4%) disagreed, while 49 (27.2%) of the respondents strongly disagreed. This indicates that most of the banks’ employees representing 61.1% affirmed that their salary is adequate.

It was also revealed that 115 (36.4%) and 92 (28.4%) of the respondents agree and strongly agree concurred that they are satisfied with the allowances given; 76 (24.5%) disagreed, while 33 (10.4%) of the respondents strongly disagreed. This indicates that most of the staff across various levels representing 65% were satisfied with the allowances given.

However, 125 (39.5%) and 123 (38.9%) of the respondents agree and strongly agree concurred that performance based pay is given in the selected banks; 52 (16.5%) disagreed, while 16 (5.1%) strongly disagreed. This indicates that most of the staff of the selected Nigerian Banks representing 78.4% ascertained the significance of Performance based pay.

Lastly, it was also revealed that 137 (43.4%) and 90 (28.5%) of the respondents agree and strongly concurred that they were satisfied with the allowances given; 50 (15.8%) disagreed, while 39 (12.3%) of them strongly disagreed. This indicates that most of the staff across various levels representing 71.9% are satisfied with the allowances given.

According to the conclusions of the study, employee remuneration has a positive impact on employee performance. These findings are consistent with those of Martono, Khoiruddin and Wulansari (2018) and Balogun & Omotoye (2020), who discovered a strong link between employee pay and performance. The managers of the selected banks can use these findings to make decisions on remuneration and rewards, as well as establish human resource policies on a number of issues including remuneration, recruitment and retention policies, according to this study.

Research Objective Three

To ascertain the effect of employee communications on job performance (i.e. employee satisfaction, employee Productivity, task Performance and contextual performance).

Communication is a fundamental human need. It entails the clear and understandable expression of one's thoughts, ideas, and opinions. Communication, whether verbal or nonverbal, is an important part of any successful organisation. Effective communication in the workplace increases employee trust in their bosses, aids staff comprehension of the company's vision and mission, and fosters internal relationships among employees. A lack of communication in an organisation could result in misunderstanding that could disrupt work progress, company advancement and cause feud among workers. The frequency distribution for employee communication Table 7.

| Table 7 Frequency Distribution for Employee Communication | ||||||||

| s/n | Items | Frequency and Percentage | Total | Mean | SD | |||

| Strongly agree | Agree | Disagree | Strongly Disagree | |||||

| 1 | There is free-flow of information across all levels in my bank | 100 31.6% |

119 37.7% |

62 19.6% |

35 11.1% |

316 100% |

2.037 | .957 |

| 2 | Information are timely passed to the staff of the bank | 118 37.3% |

95 30.1% |

56 17.7% |

47 14.9% |

316 100% |

3.207 | .852 |

| 3 | Open door policy is practiced by the management in my bank | 42 13.3% |

53 16.8% |

67 21.2% |

154 48.7% |

316 100% |

3.161 | .873 |

| 4 | There is adequate feedback mechanism in my bank | 49 15.5% |

60 19% |

74 23.4% |

133 42.1% |

316 100% |

3.161 | .873 |

| Average Means Score | 2.802 | 0.894 | ||||||

| Decision (2.802) = Satisfied | ||||||||

The measures of employee communication for the selected institutions. From the table above, it was revealed that 119 (37.7%) and 100 (31.6%) of the respondents agree and strongly agree concurred that there is free-flow of information across all levels; 62 (19.6%) disagreed, while 35 (11.1%) of respondents strongly disagreed. This implies that most of the staff of the selected Nigerian Banks representing 68.3% affirmed that there is free-flow of information across all levels of the selected banks.

It was also revealed that 95 (30.1%) and 118 (37.3%) of the respondents agree and strongly agree concurred that information are timely passed to the staff of the bank; 56 (38.5%) disagreed, while 47 (14.9%) of the respondents strongly disagreed. This infers that most of the staff across various levels representing 67.4% asserted that information are timely passed to the staff of the selected banks.

However, 53 (16.8%) and 42 (13.3%) of the respondents agree and strongly agree concurred that open door policy is practiced by the management; 67 (21.2%) disagreed, while 154 (48.7) strongly disagreed. The majority of staff of the selected Nigerian Banks representing 69.9% ascertained that open door policy is practiced.

Lastly, it was also revealed that 60 (19%) and 49 (15.5%) of the respondents agree and strongly agree concurred that there is adequate feedback mechanism in my bank; 74 (23.4%) disagreed, while 133(42.1%) of the respondents strongly disagreed. This infers that majority of the staff across various levels representing 65.5% asserted that there is no adequate feedback mechanism in my bank.

The findings of this study suggest that greater employee communication is associated with increased performance. These findings are consistent with Hee et al., (2019) who alluded that the message and channel of communication are integral parts of job features that contribute to employee performance. This was also supported by Kalogiannidis (2020). This suggests that the roles of employee communication cannot be over-emphasised when it comes to improved performance.

Research Objective Four

To examine the impact of employee empowerment on job performance (i.e. employee satisfaction, employee Productivity, task Performance and contextual performance).

Employee empowerment refers to how organisations provide their employees with the tools they need to succeed. When employees are empowered, they understand that they have the capability to achieve anything and are assured in their capabilities. Organisational empowerment is a practical concept that is applicable across business contexts public or private such as educational, healthcare etc. (Dabo & Ndan, 2018). These organisational empowering factors include: involvement in decision making, acknowledgement of employees’ inputs, implementation of employees’ resolutions, and sense of belongings. In other words, employee empowerment is often seen as management tools to stimulate and direct the efforts of people towards the achievement of corporate objectives Table 8.

| Table 8 Frequency Distribution for Employee Empowerment | ||||||||

| s/n | Items | Frequency and Percentage | Total | Mean | SD | |||

| Strongly agree | Agree | Disagree | Strongly Disagree | |||||

| 1 | My opinion regarding work is considered in decision making | 98 31% |

142 44.9% |

62 19.6% |

14 4.4% |

316 100% |

3.074 | .829 |

| 2 | Employees inputs are acknowledged by supervisor/management | 115 36.4% |

112 35.4% |

65 20.6% |

24 7.6% |

316 100% |

2.929 | .835 |

| 3 | Resolutions from employees are implemented by the management | 99 31.3% |

104 32.9% |

98 31% |

15 4.7% |

316 100% |

3.178 | .882 |

| 4 | I feel encouraged to solve problems on my own | 120 38% |

102 32.3% |

71 22.5% |

23 7.3% |

316 100% |

2.929 | .835 |

| Average Means Score | 3.060 | 0.849 | ||||||

| Decision (3.060) = Satisfied | ||||||||

The measures of employee empowerment for the selected institutions. From the table, it was revealed that 142 (44.9%) and 98 (31%) of the respondents agree and strongly concurred that their opinions regarding work are considered in decision making; 62 (19.6%) disagreed, while 14 (4.4%) of the respondents strongly disagreed. This implies that most of the staff of the selected Nigerian banks representing 75.9% affirmed that opinion regarding work is considered in decision making.

It was also revealed that 112 (35.4%) and 115 (36.4%) of the respondents agree and strongly agree concurred that employees inputs are acknowledged by supervisor/management; 65 (20.6%) disagreed, while 24 (7.6%) of the respondents strongly disagreed. This infers that most of the staff across various levels representing 71.8% asserted that the employees’ inputs are acknowledged by supervisor/management.

However, 104 (32.9%) and 99 (31.3%) of the respondents agree and strongly agree concurred that resolutions from employees are implemented by the management; 98 (31%) disagreed, while 15 (4.7%) strongly disagreed. This indicates that most of the staff of the selected Nigerian banks representing 64.2% of employees believed that management follows through on employee resolutions.

Lastly, it was also revealed that 102 (32.3%) and 120 (38%) of the respondents agree and strongly agree concurred that they felt encouraged to solve problems on their own; 71 (22.5%) disagreed, while 23 (7.5%) of the respondents strongly disagreed. This means that most of the staff across various levels representing 70.3% asserted that they felt encouraged to solve problems on their own.

Employee empowerment, as shown by high motivation and knowledge flowing across the organisations at all levels, was found to contribute to job performance in the current study. This is very much in line with the findings of Nuskiya (2018) and Yuvaraj & Nadheya (2018) who found a significant relationship between empowerment and job performance. According to this study therefore, bank managers are encouraged to empower employees in every way they can to attain improved performance.

Research Objective Five

To investigate the moderating role of ethical orientation on employee relations and job performance (i.e. employee satisfaction, employee productivity, task performance and contextual performance).

Processes and regulations are used to influence ethical decisions in ethical orientation. These regulations are absolute, which means that they must be followed regardless of the consequences. Ethics are a set of moral behaviours and beliefs that guide people in everything they do. Extant literature has shown that with idealism on one extreme and relativism on the other, ethical orientation can be thought of as a spectrum. Idealism is concerned with human wellbeing, or, to put it another way, it is the notion that desirable outcomes can be reached without breaching moral principles. Relativism refers to a person's concern for a system of universal principles or standards. In this context, ethical orientation was measured using two significant indicators Table 9.

| Table 9 Frequency Distribution for Relativism | ||||||||

| s/n | Items | Frequency and Percentage | Total | Mean | SD | |||

| Strongly agree | Agree | Disagree | Strongly Disagree | |||||

| 1 | There are no ethical principles that are so important that they should be a part of any code of ethics. | 88 27.9% |

134 42.4% |

44 13.9% |

50 15.8% |

316 100% |

3.255 | .9785 |

| 2 | What is ethical varies from one situation and society to another. | 121 38.3% |

109 34.5% |

53 16.8% |

33 10.4% |

316 100% |

2.807 | .7922 |

| 3 | Moral standards should be seen as being individualistic; what one person considers to be moral may be judged to be immoral by another person. | 113 35.8% |

98 31% |

61 19.3% |

44 13.9% |

316 100% |

2.745 | .7444 |

| 4 | Different types of morality cannot be compared as to “rightness.” | 49 15.5% |

90 28.5% |

68 21.5% |

109 34.5% |

316 100% |

3.785 | .8330 |

| 5 | Questions of what is ethical for everyone can never be resolved since what is moral or immoral is up to the individual. | 88 27.8% |

89 28.2% |

81 25.6% |

58 18.4% |

316 100% |

3.856 | .9677 |

| 6 | Moral standards are simply personal rules that indicate how a person should behave, and are not to be applied in making judgments of others. | 122 38.6% |

90 28.5% |

38 12% |

66 20.9% |

316 100% |

3.694 | .9092 |

| 7 | Ethical considerations in interpersonal relations are so complex that individuals should be allowed to formulate their own individual codes. | 113 35.8% |

119 37.7% |

46 14.5% |

38 12% |

316 100% |

3.348 | .9172 |

| 8 | Rigidly codifying an ethical position that prevents certain types of actions could stand in the way of better human relations and adjustment. | 101 32% |

124 39.2% |

54 17.1% |

37 11.7% |

316 100% |

3.173 | .9541 |

| 9 | No rule concerning lying can be formulated; whether a lie is permissible or not permissible totally depends upon the situation. | 109 34.5% |

102 32.3% |

58 18.3% |

47 14.9% |

316 100% |

3.127 | .9730 |

| 10 | Whether a lie is judged to be moral or immoral depends upon the circumstances surrounding the action. | 127 40.2% |

100 31.6% |

49 15.5% |

40 12.7% |

316 100% |

2.677 | .7135 |

| Average Means Score | 3.148 | 0.837 | ||||||

| Decision (3.148) = Satisfied | ||||||||

From the table above, it was revealed that 134 (42.4%) and 88 (27.9%) of the respondents agree and strongly agree concurred that there are no ethical principles that are so important that they should be a part of any code of ethics; 44 (13.9%) disagreed, while 50 (15.8%) of the respondents strongly disagreed. This implies that most of the staff of the selected Nigerian banks representing 70.3% affirmed this.

It was also revealed that 109 (34.5%) and 121 (38.3%) of the respondents agree and strongly agree concurred that what is ethical varies from one situation and society to another; 53 (16.8%) disagreed, while 33 (10.4%) of the respondents strongly disagreed with this assertion.

However, 98 (31%) and 113 (35.8%) of the respondents agree and strongly agree concurred Moral standards should be seen as being individualistic; what one person considers to be moral may be judged to be immoral by another person; 61 (19.3%) disagreed, while 44 (13.9%) strongly disagreed.

it was also revealed that 90 (28.5%) and 49 (15.5%) of the respondents agree and strongly agree concurred that different types of morality cannot be compared as to “rightness.”; 68 (21.5%) disagreed, while 109 (34.5%) of the respondents strongly disagreed.

It was also affirmed that 89 (28.2%) and 88 (27.8%) of the respondents agree and strongly agree concurred that Questions of what is ethical for everyone can never be resolved since what is moral or immoral is up to the individual; 81 (25.6%) disagreed, while 58 (18.4%) of the respondents strongly disagreed.

In the same vein, 90 (28.5%) and 122 (38.6%) of the respondents agree and strongly agree concurred that moral standards are simply personal rules that indicate how a person should behave, and are not to be applied in making judgments of others; 38 (12%) disagreed, while 66 (20.9%) strongly disagreed.

Besides, it was revealed that 119 (37.7%) and 113 (35.8%) of the respondents agree and strongly agree concurred that ethical considerations in interpersonal relations are so complex that individuals should be allowed to formulate their own individual codes; 46 (14.5%) disagreed, while 38 (12%) of the respondents strongly disagreed.

It was also affirmed that 124 (39.2%) and 101 (32%) of the respondents agree and strongly agree concurred rigidly codifying an ethical position that prevents certain types of actions could stand in the way of better human relations and adjustment.; 54 (17.1%) disagreed, while 37 (11.7%) of the respondents strongly disagreed.

It was also revealed that 102 (32.3%) and 109 (34.5%) of the respondents agree and strongly agree concurred that no rule concerning lying can be formulated; whether a lie is permissible or not permissible totally depends upon the situation; 58 (18.3%) disagreed, while 47 (14.9%) of the respondents strongly disagree with the statement.

Besides, it was also affirmed that 100 (31.6%) and 127 (40.2%) of the respondents agree and strongly agree concurred whether a lie is judged to be moral or immoral depends upon the circumstances surrounding the action; 49 (15.5%) disagreed, while 40 (12.7%) of the respondents strongly disagreed.

Using the criteria for understanding the mean scores of satisfaction level it can be depicted that all the selected banks ranging from Bank ‘A’ to Bank ‘E’ were extremely satisfied (with an average mean score of 3.148) with the level of relativism Table 10.

| Table 10 Frequency Distribution for Idealism | ||||||||

| s/n | Items | Frequency and Percentage | Total | Mean | SD | |||

| Strongly agree | Agree | Disagree | Strongly Disagree | |||||

| 1 | People should make certain that their actions never intentionally harm another even to a small degree. | 85 26.9% |

131 41.5% |

67 21.2% |

33 10.4% |

316 100% |

3.176 | .8613 |

| 2 | Risks to another should never be tolerated, irrespective of how small the risks might be. | 119 37.7% |

105 33.2% |

72 22.8% |

20 6.3% |

316 100% |

3.076 | .9185 |

| 3 | The existence of potential harm to others is always wrong, irrespective of the benefits to be gained. | 68 21.5% |

125 39.6% |

88 27.8% |

35 11.1% |

316 100% |

3.351 | .8926 |

| 4 | One should never psychologically or physically harm another person. | 121 38.3% |

109 34.5% |

42 13.3% |

44 13.9% |

316 100% |

2.810 | .7618 |

| 5 | One should not perform an action which might in any way threaten the dignity and welfare of another individual. | 119 37.7% |

112 35.4% |

46 14.6% |

39 12.3% |

316 100% |

2.751 | .7651 |

| 6 | If an action could harm an innocent other, then it should not be done. | 104 32.9% |

107 33.9% |

70 22.1% |

35 11.1% |

316 100% |

2.827 | .7878 |

| 7 | Deciding whether or not to perform an act by balancing the positive consequences of the act against the negative consequences of the act is immoral. | 107 33.9% |

135 42.7% |

29 9.2% |

45 14.2% |

316 100% |

3.846 | 8843 |

| 8 | The dignity and welfare of the people should be the most important concern in any society. | 158 50% |

64 20.3% |

50 15.8% |

44 13.9% |

316 100% |

3.691 | .9731 |

| 9 | It is never necessary to sacrifice the welfare of others. | 109 34.5% |

136 43% |

45 14.3% |

26 8.2% |

316 100% |

2.666 | .7280 |

| 10 | Moral behaviours are actions that closely match ideals of the most “perfect” action. | 119 37.7% |

139 44% |

25 7.9% |

33 10.4% |

316 100% |

2.544 | .6519 |

| Average Means Score | 3.103 | 0.859 | ||||||

| Decision (3.103) = Satisfied | ||||||||

The measures of idealism for the selected banks. From the table, it was revealed that 131 (41.5%) and 85 (26.9%) of the respondents agree and strongly agree concurred that people should make certain that their actions never intentionally harm another even to a small degree; 67 (21.2%) disagreed, while 33 (10.4%) of the respondents strongly disagreed.

Also, it was affirmed that 105 (33.2%) and 119 (37.7%) of the respondents agree and strongly agree concurred that risks to another should never be tolerated, irrespective of how small the risks might be; 72 (22.8%) disagreed, while 20 (6.3%) of the respondents strongly disagreed.

However, 125 (39.6%) and 68 (21.5%) of the respondents agree and strongly agree concurred to the statement that the existence of potential harm to others is always wrong, irrespective of the benefits to be gained; 88 (27.8%) disagreed, while 35 (11.1%) strongly disagreed.

In the same vein, 109 (34.5%) and 121 (38.3%) of the respondents agree and strongly agree concurred to the statement that one should never psychologically or physically harm another person; 42 (13.3%) disagreed, while 44 (13.9%) strongly disagreed.

it was revealed that 112 (35.4%) and 119 (37.7%) of the respondents agree and strongly agree concurred that one should not perform an action which might in any way threaten the dignity and welfare of another individual; 46 (14.6%) disagreed, while 39 (12.3%) of the respondents strongly disagreed.

More so, it was also revealed that 107 (33.9%) and 104 (32.9%) of the respondents agree and strongly agree concurred that if an action could harm an innocent other, then it should not be done; 70 (22.1%) disagreed, while 35 (11.1%) of the respondents strongly disagree with the statement.

However, 135 (42.7%) and 107 (33.9%) of the respondents agree and strongly agree concurred that deciding whether or not to perform an act by balancing the positive consequences of the act against the negative consequences of the act is immoral; 29 (9.2%) disagreed, while 45 (14.2%) strongly disagreed.

It was revealed that 64 (20.3%) and 158 (50%) of the respondents agree and strongly agree concurred that the dignity and welfare of the people should be the most important concern in any society; 50 (15.8%) disagreed, while 44 (13.9%) of the respondents strongly disagreed Viganò, (2020) .

More so, it was also revealed that 136 (43%) and 109 (34.5%) of the respondents agree and strongly agree concurred that it is never necessary to sacrifice the welfare of others; 45 (14.3%) disagreed, while 26 (8.2%) of the respondents strongly disagreed.

Lastly, 139 (44%) and 119 (37.7%) of the respondents agree and strongly agree concurred that moral behaviours are actions that closely match ideals of the most “perfect” action.; 25 (7.9%) disagreed, while 33 (10.4%) strongly disagreed.

The average mean score of idealism aligns with the frequency and percentage section. Using the criteria for understanding the mean scores of satisfaction level it can be depicted that all the selected banks ranging from Bank ‘A’ to Bank ‘E’ were relatively satisfied (with an average mean score of 3.103) with the level of idealism. Forsyth (1980) describes four categories of ethical reasoning: Situationists, Absolutists, Subjectivists and Exceptionists. Situationists are those who reject conventional morals and take each situation as it comes. These individuals exhibit high levels of idealism and high levels of relativism. Using these criteria to understand the result of the bank employees sampled here, it implies that the bank employees are situationist as they exhibit a high level of idealism and relativism.

Discussion

Employee relations in the workplace can either promote performance by increasing the focus and commitment of employees, or have a detrimental impact on performance if not properly managed. The process of judging a stimulus as either a challenge to be fulfilled or an overwhelming hurdle from which to flee is referred to as ethical orientation. This study is a contribution to the on-going debate on the examination of the relationship that exists among employee relations, ethical orientation and job performance of selected banks in Nigeria. Ethical orientation explains the choice based on the person’s expertise, knowledge and experience to concentrate on the task rather than the danger of a situation. Establishing a positive narrative and consistently participating in challenges strengthens trust and increases job performance as observed in the banks in this study.

Objective one assessed the influence of conflict management on job performance in the selected Nigerian banks. This hypothesis predicted that conflict management does not significantly influence job performance in the selected banks. The study found empirical evidence showing a wide range of abilities in managing conflict had a good connection to job performance. These findings confirm the theoretical claims of Akanbi (2020) and O'Neill & Mclarnon (2018) empirically. The implication is that banks should have more training for staff (bankers) especially managers, to develop their skills in managing conflicts so that they can function more efficiently. Also, It can be inferred that incorporating interpersonal communication and conflict management in an employee relations strategy may result in more pleasant and less antagonistic interactions.

Objective two examined the relationship between employee remuneration and job performance in the selected Nigerian banks. The second hypothesis predicted that employee remuneration does not significantly influence job performance in the selected banks. The findings revealed that employee remuneration has a positive impact on employee performance. These findings are consistent with those of Martono, Khoiruddin and Wulansari (2018) and Balogun & Omotoye (2020), who discovered a strong link between employee pay and performance. The managers of the selected banks can use these findings to make decisions on remuneration and rewards, as well as establish human resource policies on a number of issues including remuneration, recruitment and retention policies. The work of Calvin (2017) also supports these findings and he claimed that remuneration instils trust in employees if the benefits are regarded to be fair. He also added that remuneration should be considered as one of the most effective investments an organisation can make. If the perks are considered equitable, remuneration boosts overall employee morale.

Objective three was to ascertain the effect of employee communication on job performance. The third hypothesis predicted that employee communication does not significantly influence job performance in the selected banks. The findings suggest that greater employee communication is associated with increased performance. These findings are consistent with Hee et al., (2019) who alluded that the message and channel of communication are integral parts of job features that contribute to employee performance. This was also supported by Kalogiannidis (2020). This suggests that the roles of employee communication cannot be over-emphasised when it comes to improved performance. The bank management need a deeper understanding of the value of employee communication in improving employee performance. To do this, management may place a greater emphasis on soft skills development, such as capacity to clearly voice one’s opinions among colleagues. To foster excellent bonding between superiors and subordinates, management should schedule more events such as inter-departmental meetings and team-bonding exercises. To achieve efficient communication in the organization, a proper training and development strategy should also be implemented.

Objective four was to examine the impact of employee empowerment on job performance. The fourth hypothesis predicted that employee empowerment does not significantly influence job performance in Nigerian banks. Employee empowerment, as shown by high motivation and knowledge flowing across the organisations at all levels, was found to contribute to job performance in the current study. This is very much in line with the findings of Nuskiya (2018) and Yuvaraj & Nadheya (2018) who found a significant relationship between empowerment and job performance. According to this study therefore, bank managers are encouraged to empower employees in every way they can to attain improved performance.

Objective five was to investigate the moderating role of ethical orientation on employee relations and job performance. The fifth hypothesis investigated the extent to which ethical orientation (relativism and idealism) moderates the relationship between employee relations and job performance in Nigerian banks. . Employee relations is an important task, and there are a variety of tools and tactics that may be used to improve the effectiveness and efficiency of the process to yield better job performance. The ethicality of employees is one of the major determinants of whether employee relations will yield better job performance by employees of the banks under study. The findings revealed that the bank employees are situationists as they exhibit a high level of idealism and relativism. As a result, null hypothesis five (H0) indicating that ethical orientation does not significantly moderate the relationship between employee relations and job performance is rejected. Principally, the findings ascertained that ethical orientation is a significant predictor of employee relations and job performance of the selected banks. The findings of this study on the effect of ethical orientation and employee relations on job performance were comparable to previous researches on the subject (Farouk & Jabeen, 2018; Tamunomiebi & Elechi, 2020).

Conclusion

This study primarily aimed at assessing how employee relations and ethical orientation can enhance job performance in selected deposit money banks in Lagos, Nigeria. As revealed, the relationships between employee relations and job performance agree with what is generally found in the literature. A lot of factors influence employee satisfaction in the workplace, including employee relations. Therefore, many banks are focusing more resources on strengthening employee interactions in order to keep their workplaces healthy. It was discovered that banks with positive employee relations get a slew of perks. They found it easier to engage, motivate, comprehend, and keep their people satisfied in general. Also in the observed banks, employee satisfaction and empowerment enhanced productivity of employees. Banks with well-structured employee relations can be expected to have increased productivity, revenues, and profitability as they are free of conflict and employees are properly motivated with equitable remuneration and empowerment.

Business leaders are placing a greater emphasis on ethics, but Nigerian banks are struggling to establish an ethical culture. To fully embed an ethical culture, banks must improve training, communication, and leadership. How these policies are incorporated and applied determines the banks' ability to profit from an ethical performance culture. This study proposes a cognitive model for evaluating banks' ethical performance as a first step in incorporating ethical components into job performance. Bank leaders and HR must implement a proper ethical orientation approach in HR and organisational policy as a top priority.

This study recommends that efforts should be made to strengthen quality of banks’ staff to facilitate improved performance. Banks’ administrators should endeavour to organize seminars and workshops for all staff in the banks irrespective of their gender and affiliation on how to effectively use management techniques to facilitate effectively increased performance. These seminars, workshops and team-bonding exercises can also help limit conflict among staff and improve communication between them. All of these is sure to improve the atmosphere and culture in the workplace and lead to improved job performance. The study also recommends that the banks’ staff should be encouraged and motivated with equitable remuneration that helps in bringing about job satisfaction and performance.

References

Akanbi, K. L. (2020). Impact of conflict management dynamics on staff performance In tertiary healthcare institutions in North-central, Nigeria (Doctoral dissertation, Kwara State University (Nigeria)).

Akanbiemu, A. A. (2021). Employee Relations, Job Satisfaction and Employee Commitment of Librarians in universities in Ondo State, Nigeria. Employee Relations, 16(3).

Alder, G. S., Schminke, M., Noel, T. W., & Kuenzi, M. (2008). Employee reactions to internet monitoring: The moderating role of ethical orientation. Journal of business ethics, 80, 481-498.

Indexed at, Google Scholar, Cross Ref

Armstrong, M. (2006). A handbook of human resource management practice. Kogan Page Publishers.

Atatsi, E. A., Stoffers, J., & Kil, A. (2019). Factors affecting employee performance: a systematic literature review. Journal of Advances in Management Research, 16(3), 329-351.

Indexed at, Google Scholar, Cross Ref

Balogun, A. R., & Omotoye, O. O. (2020). Remuneration and employee performance in global communication limited, Lagos Nigeria. IOSR Journal of Business and Management (IOSR-JBM), 22(2), 15-21.

Blau, P. M. (1968). Social exchange. International encyclopedia of the social sciences, 7(4), 452-457.

Calvin, O. Y. (2017). The impact of remuneration on employees’ performance (a study of Abdul Gusau Polytechnic, Talata-Mafara and state college of education Maru, Zamfara State). Arabian Journal of Business and management review (Nigerian chapter), 4(2), 34-43.

Indexed at, Google Scholar, Cross Ref

Cooper-Thomas, H. D., & Morrison, R. L. (2018). Give and take: Needed updates to social exchange theory. Industrial and Organizational Psychology, 11(3), 493-498.

Indexed at, Google Scholar, Cross Ref

Dabo, Z., & Ndan, R. T. (2018). Impact of employee empowerment on organization performance: evidence from quoted bottling companies in kaduna. International Journal of Economics, Business and Management Research, 2(1), 360-369.

De Silva, V., Opatha, H. H. D. N. P., & Gamage, A. (2018). Does ethical orientation of HRM impact on employee ethical attitude and behavior? Evidence from Sri Lankan commercial banks. International Business Research, 11(1), 217-229.

Indexed at, Google Scholar, Cross Ref

Eberendu, I. F., Ozims, S. J., Agu, G. C., Ihekaire, D. E., Obioma-Elemba, J. E., Amah, H. C., ... & Amah, C. C. (2018). Workplace health risks associated diseases and health promotion in the Nigerian banking sector. International Journal of Advanced Research in Biological Sciences, 5(2), 197-208.

Etikan, I., & Babtope, O. (2019). A basic approach in sampling methodology and sample size calculation. Med Life Clin, 1(2), 1006.

Farouk, S., & Jabeen, F. (2018). Ethical climate, corporate social responsibility and organizational performance: evidence from the UAE public sector. Social Responsibility Journal, 14(4), 737-752.

Indexed at, Google Scholar, Cross Ref

Forsyth, D. R. (1980). A taxonomy of ethical ideologies. Journal of Personality and Social psychology, 39(1), 175.

Indexed at, Google Scholar, Cross Ref

Hee, O. C., Qin, D. A. H., Kowang, T. O., Husin, M. M., & Ping, L. L. (2019). Exploring the impact of communication on employee performance. International Journal of Recent Technology and Engineering, 8(3), 654-658.

Indexed at, Google Scholar, Cross Ref

Homans, G. C. (1958). Social behavior as exchange. American journal of sociology, 63(6), 597-606.

Indexed at, Google Scholar, Cross Ref

Igbinoba, E. E. (2016). Conflict management strategies and academic staff productivity: A study of selected public and private universities in South-West Nigeria (Ph. D Thesis, Covenant University, Otta, Nigeria) (Doctoral dissertation, Doktorska disertacija, Covenant University, Nigeria).

Johari, R. J., Rosnidah, I., Nasfy, S. S. A., & Hussin, S. A. H. S. (2020). The effects of ethical orientation, individual culture and ethical climate on ethical judgement of public sector employees in Malaysia. Economics & Sociology, 13(1), 132-145.

Indexed at, Google Scholar, Cross Ref

Kalogiannidis, S. (2020). Impact of effective business communication on employee performance. European Journal of Business and Management Research, 5(6).

Indexed at, Google Scholar, Cross Ref

Kotrlik, J. W. K. J. W., & Higgins, C. C. H. C. C. (2001). Organizational research: Determining appropriate sample size in survey research appropriate sample size in survey research. Information technology, learning, and performance journal, 19(1), 43.

Nuskiya, A. F. (2018). The effect of information technology on employees’ performance in the banking industry in Sri Lanka. Empirical study based on the banks in Ampara District. European Journal of Business and Management, 10(16), 47-52.

O'Neill, T. A., & McLarnon, M. J. (2018). Optimizing team conflict dynamics for high performance teamwork. Human Resource Management Review, 28(4), 378-394.

Indexed at, Google Scholar, Cross Ref

Rahim, M. A., & Magner, N. R. (1995). Confirmatory factor analysis of the styles of handling interpersonal conflict: first-order factor model and its invariance across groups. Journal of applied psychology, 80(1), 122.

Indexed at, Google Scholar, Cross Ref

Salau, O. P., Worlu, R., Osibanjo, A., Ogunnaike, O., & Oni-Ojo, E. (2016). Employee relations strategy: Implication for performance in Lagos state university, South-West, Nigeria. Is ve Insan Dergisi, 3(1), 53-63.

Indexed at, Google Scholar, Cross Ref

Shobe, K. (2018). Productivity driven by job satisfaction, physical work environment, management support and job autonomy. Business and Economics Journal, 9(2), 1-9.

Indexed at, Google Scholar, Cross Ref

Sultana, A. (2020). Multidimensionality of job performance: an empirical assessment through scale development. Ilkogretim Online, 19(4).

Indexed at, Google Scholar, Cross Ref

Tamunomiebi, M. D., & Elechi, B. C. (2020). Ethical managerial orientations: Emerging issues. European Journal of Human Resource Management Studies.

Indexed at, Google Scholar, Cross Ref

Taouab, O., & Issor, Z. (2019). Firm performance: Definition and measurement models. European Scientific Journal, 15(1), 93-106.

Indexed at, Google Scholar, Cross Ref

Umar, H., & Umar-Dikko, M. (2018). Effect of internal control on performance of commercial banks in Nigeria: A proposed framework. Sahel Analysts: Journal of Management Sciences, 16(3), 86-105.

Viganò, L. (2020). Ethical Orientation in Banks: Original Roots in Bank Governance and Current Challenges. Handbook on Ethics in Finance, 1-27.

Yuvaraj, S., & Nadheya, R. (2018). A study on the role of technology on employee behaviour and their performance. International Journal of Mechanical Engineering and Technology, 9(7), 244-251.

Received: 02-May-2024, Manuscript No. ASMJ-23-14612; Editor assigned: 04-May-2024, PreQC No. ASMJ-23-14612(PQ); Reviewed: 17- May-2024, QC No. ASMJ-23-14612; Revised: 22-May-2024, Manuscript No. ASMJ-23-14612(R); Published: 28-May-2024