Research Article: 2022 Vol: 26 Issue: 5S

Empirical Analysis of the Contribution of Agriculture and Value Added Tax (Vat) Revenue on Sustainable Economic Growth in Nigeria

Ijing, Joseph Agida, Cross River University of Technology

Grace N. Ofoegbu, University of Nigeria Enugu campus

Citation Information: Agida, I.J., & Ofoegbu, G.N. (2022). Empirical analysis of the contribution of agriculture and value added tax (vat) revenue on sustainable economic growth in Nigeria. Academy of Accounting and Financial Studies Journal, 26(S5), 1-12.

Abstract

This study on an empirical analysis of the contributions of agriculture and value added tax (VAT) revenue on sustainable economic growth in Nigeria was carried out to examine the extent to which revenue generated from this two sources can influence sustainable economic growth in Nigeria. Expost facto research design was adopted for the study and time series data collected from the central bank of Nigeria (CBN) statistical bulletin and Nigeria bereu of statistics (NBS) for the period 1995 to 2018 were used. Ordinary least square (OLS) regression technique was adopted to ascertain the extent to which revenue from agriculture and value added tax (VAT) contribute to sustainable economic growth in Nigeria. The findings of the study show that agriculture revenue contributes significantly to sustainable economic growth in Nigeria. VAT equally show a significant contribution in terms of revenue generated to sustainable economic growth in Nigeria. The researchers then concluded that agriculture and VAT revenue has significant contribution to sustainable economic growth in Nigeria. It was equally concluded that agriculture if given proper attention alongside value added tax, will lead to sustainable economic growth in Nigeria as both impact each other. It was then recommended that government has a role to play for the two source of revenue generation to contribute adequately to sustainable economic growth in Nigeria. Government will need to strengthen the agriculture sector for increase production, and equally prudently manage revenue generated from value added tax and be accountable to the citizens in providing basic amenities and security for continuous existence.

Keywords

Economic Growth, Sustainable Economic Growth, Gross Domestic Product, Per Capita Income, Agriculture, Value Added Tax.

Introduction

Nigeria as a nation is expected to grow continually until it is developed. Nigeria in the sixties sustained its economy through non-oil revenue. However, Nigeria’s overdependence on crude oil revenue has affected the economy negatively thereby reducing productivity in the economy. Economic growth has to do with the increase in the output level of an economy which can also means an increase in income level. Economic growth of a country can be determined in the productivity level, volume of trade, investment in both human and physical capital. According to Anyanwu & Oaikhenan economic growth is simply defined as the increase overtime of a country’s or an economic capacity to produce those goods and services needed to improve the wellbeing of the citizens in increasing numbers and diversity.

Sustainable economic growth is the rate of growth which can be maintained without creating other significant economic problems for the future generations. The growth is measured using per capita income as it relates to increase in population (Ajie et al., 2019).

Agriculture is important to the growth of every developing country like Nigeria. Nigeria is so endowed with the needed resources for agriculture to strive again as it was before the discovery of oil. The relationship of agriculture sector and other sectors equally help to facilitate sustainable economic growth, most especially the value added tax drive. This is because value added tax are taxes levied on goods and services as a form of indirect tax.

The position of agriculture in the strive for industrialization can never be over-emphasized. It is a prerequisite for industrialization through increase in rural incomes and provision of industrial raw materials, provision of domestic market for industry and making available resources to support industries. At any time the sector is neglected, it leads to slow economic growth and inequality of income distribution.

Agriculture when pursued vigorously in addition to an effective drive of value added tax (VAT) can result to sustainable economy growth. Value added tax (VAT) is a form of indirect tax that is levied on goods and services to generate revenue for the government. As a form of indirect tax, it reduces or eliminates the incidence of tax evasion and avoidance. Government of a country can also generate more revenue when goods and services are produced and VAT is charged on them. And as a form of taxation, VAT leads to income redistribution as it is been levied on goods and services that is consumed by citizens.

Objectives of the study

The main objective of this study was to examine the contributions of the agriculture and value added tax (VAT) on sustainable economic growth in Nigeria. The specific objectives are;

1. Ascertain the level to which agriculture contributes to gross domestic product (GDP) and per capita income (PCI) in Nigeria.

2. Examine the contributions of value added tax (VAT) to gross domestic product (GDP) and per capita income (PCI) in Nigeria.

Hypotheses of the study

H1: Agriculture revenue does not significantly contribute to gross domestic product (GDP) and Per capita income (PCI) in Nigeria

H2: Value added tax (VAT) does not have significant contributions to gross domestic product (GDP) and per capita income (PCI) in Nigeria

Literature Review

Concept of agriculture, Value Added Tax (VAT) and economic growth in Nigeria.

The Role of Agriculture in the Economic growth of Nigeria

Agriculture as defined by Ezema is the production of both food and cash crops for consumption of mankind. Agriculture can equally be seen as the science of making use of the land to raise plants and animals. It is also seen as the simplification of natures food webs and the rechanneling of energy for human planting and animal consumption. Agriculture is the predominant activity in most of the zones in Nigeria. Increases in agricultural output brings about by increasing land and labour productivity, will make food cheaper; benefit both rural and urban poor people who spend much of their income on food.

According to Orji agricultural development can promote the economic development of the underdeveloped countries in four distinct ways by: increasing the supply of food for domestic consumption and releasing the labor force needed for industrial employment; enlarging the size of the domestic market for the manufacturing sector; increasing the supply of domestic savings; and providing the foreign exchange earned by agricultural imports. As Kuznets put it in his classical study of the role of agriculture:

“One of the crucial problems of modern economic growth is how to extract from the product of agriculture a surplus for the financing of capital formation necessary for industrial growth without at the same time blighting the growth of agriculture”.

Finally, successful industrialization requires efficient use of the surplus transferred. Though, Beinteman & Stadt asserted that, most African nations remain dominated by small-scale farmers who employed crude tools and the use of largely fragmented land to cultivate the crop and rear animals for man’s advantage. This reduces the level of economic growth. Johnston & Mellor as cited by Ezema observe that agriculture contributes to economic growth and development through five inter-sectoral linkages. The sectors are linked via: (i) supply of surplus labor to firms in the industrial sector; (ii) provision of market for industrial output; (iii) supply of food for domestic consumption; (iv) supply of foreign exchange from agricultural export earnings to finance import of intermediate and capital goods (v) supply of domestic savings for industrial investment.

Value added tax and Economic Growth in Nigeria

Many scholars have done research on value added taxes and economic growth. Ajakaiye in his study found that VAT has a negative effect on economic growth in Nigeria. In a more broad study, Romer & Romer resolved that if tax system is progressive it affords policy makers the opportunity to pursue counter-cyclical fiscal policies which drives economic growth. Specifically, they are of the view that VAT can only increase growth when enforcement and implementation procedures are effective. This position was strengthened by McCarten. According to Akwe, the most effective tax for developing countries is one that produces the largest amount of revenue in the least costly and disproportionate manner. He identified broad based VAT as an ideal tax that suits the situation. However, Emran & Stiglitz argued that the recent resolution that favours the gradual reduction and the subsequent elimination of sales taxes in favour of VAT as an instrument of indirect taxes in developing economies is worrisome. According to them, it is built on a fragile result derived from an incomplete model that relegates the presence of active informal sector (Hlavova, 2015).

Theoretical Framework

The theory that was used for this study was the resource curse theory. Resource curse theory: It is known as the resource curse theory or paradox of plenty and takes its root in the works of Pizeworski Adam in 1991 Akinwale. Pizeworski argues that this happens as a result of neglect of the other economic sectors thereby causing a decline in the competitiveness of these sectors. This decline in competitiveness of other sectors attribute to an appreciation of the real exchange rate of the revenue from this sole revenue often leading to volatility of revenues caused by market swings, mismanagement by government’s corrupt and unstable institutions and agencies. The theory summarily states that even with abundant resources the nation remains undeveloped due to waste of resources and over reliance on one source.

Empirical Review

Related studies to this paper were reviewed as follows

Sertoglu et al. (2017) examined the contribution of agricultural sector on economic growth in Nigeria. This study sought to empirically examine the impact of agricultural sector on the economic growth of Nigeria, using time series data for the period 1981 to 2013. The study findings revealed that real gross domestic product; agricultural output and oil rents have a long-run equilibrium relationship. Vector error correction model result showed that, the speed of adjustment of the variables towards their long run equilibrium path was low, though agricultural output had a positive impact on economic growth. Based on the findings, it then was recommended that, the government and policy makers should embark on diversification and enhance more allocation in terms of budgeting to the agricultural sector.

Oyakhilomen & Zibah (2014) did a study on agricultural production and economic growth in Nigeria. This study was carried out to provide empirical information on the relationship between agricultural production and the growth of Nigerian economy with focus on poverty reduction. Time series data were employed in this research and the analyses of the data were carried out using unit root tests and the bounds (ARDL) testing approach to cointegration (Olumide et al., 2013). The findings of the data analysis showed that agricultural production is significant in influencing the favourable trend of economic growth in Nigeria. It was then recommended that better policies on agriculture should be designed for alleviating rural poverty through increased investments in agricultural development by the public and private sector (Edeme et al., 2018).

Ahungwa et al. (2014) did a study on trend analysis of the contribution of agriculture to the gross domestic product of Nigeria (1960-2012). The study examined the contribution of agriculture to the gross domestic product (GDP) of Nigeria within a time frame of 53 years (1960-2012). Time-series data were used for analysis using trend and regression analysis. The regression results revealed that agriculture has a positive relationship with GDP and contributes significantly. The study recommended that government should create an enabling environment by increasing the budgetary allocation, friendly policies framework for strong and efficient agricultural sector that can accelerate the attainment of Nigeria’s economy growth.

Akarue & Eyovwunu (2017) carried out an empirical assessment of the contribution of agricultural sector to Nigerian economy (1970-2012). The paper analysed the impact of agricultural sector to the economic growth and development (GDP) of the Nigerian economy. Data were collected from the database of the food and agricultural organisation, 1970-2012. The results indicated that the agricultural sector had a significantly positive impact on the Nigerian growth and development. Based on the findings, it was recommended that government should provide the enabling environment that will help improve the level of productivity of agricultural sector.

Eze (2017) did a study on Agricultural sector performance and Nigeria’s Economic growth. This study investigated the contributions of agricultural sector output to the growth of domestic economy in Nigeria for the period 1980-2014. The VECM result on the other hand, revealed that value of agricultural output (VAO) has positive and insignificant contribution to real GDP. The study recommends that government should increase its budgetary allocation on agriculture in order to boost the growth performance of the sector.

Chebbi & Lachaal (2007) evaluated Agricultural sector and economic growth in Tunisia: evidence from Co-integration and error correction mechanism. The paper examined the agricultural sector role into the economic growth in Tunisia and its interactions with the other sectors using time-series co-integration techniques. Annual data from 1961 to 2005 was used to estimate a VAR model that includes GDP indices of five sectors in Tunisian economy. Empirical results from this study showed that in the long-run all economic sectors tend to move together (co-integrate). In the short-run, the agricultural sector seems to have a limited role as a driving force for the growth of the other sectors of the economy. In addition, growth of the agricultural output may not be conducive directly to non-agricultural economic sector in the short-run.

Raza et al. (2012) examined the role of agriculture in economic growth of pakistan. The research based on the role of agriculture in the economic growth of Pakistan. Secondary data were collected from the year 1980-2010 from the government authentic websites. Simple regression applied to identify the significance relationship of agricultural sub-sectors with GDP. Results showed that there is the significance role of agriculture sub-sectors towards the economic growth only forestry showed insignificant relationship with GDP.

Matahir did a study on the empirical investigation of the nexus between agricultural and industrial sectors in Malaysia. The paper investigates the agricultural-industrial sectors relationship in Malaysia within the period of 1970 to 2009. Johansen & Juselius Cointegration procedure was adopted to examine the existence of long-run relationship and employed granger 1969 and TODA-Yamamoto 1996 causality tests to test the causality direction between the sectors in the short and long run. The empirical evidence revealed that agricultural and industrial sector are Cointegrated in the long run (Onuiru et al., 2015).

Adesoye et al. (2018) did a study on enhancing agricultural value chain for economic diversification in Nigeria. The study examined how enhancing the agricultural value chain can contribute to rapid economic diversification in Nigeria for the period of 1981-2015. The autoregressive distributed lag (ARDL) model was employed as the econometric method of estimation. The inferences were drawn at 5% significant level. The result showed that the agriculture expenditure had positive and significant impact on agriculture sector productivity in Nigeria (Anoyemi et al., 2017).

Awoyemi carried out a study on Agricultural productivity and economic growth: impact analysis from Nigeria. The study examined the impact of agricultural productivity on economic growth in Nigeria within 1981 to 2015. The johansen cointegration test was employed to determine the existence of long run relationship between agricultural productivity and economic growth (Olalekan et al., 2016). Error Correction Model (ECM) was employed to determine the short run impact of agricultural productivity on economic growth. It was then found that the agricultural labour productivity and agricultural value added were the positive determinants of economic growth. It was recommended that the government should encourage labour force participation in the agricultural sector by increasing investment in the agricultural sector (Kemi, 2016).

Odetola & Etumnu, (2013) examined the contribution of agriculture to economic growth in Nigeria. The paper investigates the contribution of the agriculture sector to economic growth in Nigeria using the growth accounting framework and time series data within the period 1960 to 2011. It was found that the agriculture sector has contributed positively and consistently to economic growth in Nigeria; it was recommended that, increased efforts in developing the livestock, fisheries and forestry subsectors will foster the contributions of agriculture sector to the Nigerian economy (Hlarova, 2015).

Olajide, et al. (2013) did a study on Agriculture resource and economic growth in Nigeria. This paper analyses the relationship between agricultural resource and economic growth in Nigeria. Ordinary least square regression method was used to analyze the data. The results showed a positive cause and effect relationship between gross domestic product (GDP) and agricultural output in Nigeria. To improve agriculture, government should see that special incentives are given to farmers, provide adequate funding, and also provide infrastructural facilities such as good roads, pipe borne water and electricity.

Karimou, (2018) examined the impact of agricultural output on economic growth in west Africa: Case of Benin. This study was to analyse the impact of agricultural output on economic growth in West Africa using the case of Benin. The time series data covering the period of 1961 to 2014 were used. The secondary data were analysed through a vector error correction model (VECM). Results of the study revealed that there is a long run, or equilibrium, relationship between agricultural output, industrial output, capital and GDP.

Adhikari (2015) evaluated the contribution of agriculture sector to national economy in Nepal. In this study, gross domestic product was regressed with domestic savings, government expenditure on agriculture and foreign direct investment on agriculture with the data from fy 2002/03 to 2014/15 to examine the contribution of agriculture sector to national economy in Nepal. The analysis revealed that the contribution of government expenditure on agriculture to gross domestic product was found significant whereas the domestic savings and foreign direct investment on agriculture were found insignificant.

Dim & Ezenekwe, (2013) did a study on Does agriculture matter for economic development? Empirical evidence from Nigeria .The study aimed at answering the question, ‘does agriculture matter for economic development in Nigeria?’ The impact of agricultural expenditure was revealed to be positive but non significant.

Sertoglu et al. (2017) examined the contribution of agricultural sector on economic growth of Nigeria. The study empirically examines the impact of agricultural sector on the economic growth of Nigeria, using time series data within 1981 to 2013. Findings of the study showed that real gross domestic product, agricultural output and oil rents have a long-run equilibrium relationship. It recommended that, the government and policy makers should embark on diversification and enhance more allocation in terms of budgeting to the agricultural sector.

Oyinbo & Rekwot (2014) did a study on agricultural production and economic growth in Nigeria: implication for rural poverty alleviation. The study was carried out to provide empirical information on the relationship between agricultural production and the growth of Nigerian economy with emphasis on poverty reduction. Time series data were employed in this research study. The analyses of the data were done using unit root tests and the bounds (ARDL) testing approach to cointegration. The result of the analysis indicated that agricultural production was significant in influencing the favourable trend of economic growth in Nigeria. It was then recommended that proper policies should be designed for alleviating rural poverty through increased investments in agricultural development by the public and private sector.

Yunana & Ahmed (2018) examined the impact of agricultural and mining sector on economic growth in Nigeria. This study aimed at analysing the impact of agricultural and mining sector on economic growth in Nigeria between 1999 and 2017 using ordinary least squared (OLS) regression model. The variables used for the study were first subjected to unit root test using augmented dickey-fuller test. The result revealed that both agriculture and mining outputs have significant and positive impact on economic growth in Nigeria. The study then recommended that the government should take concrete measures to improve agricultural and mining sectors in Nigeria.

Izuchukwu, (2011) carried out an analysis of the contribution of agricultural sector on the Nigerian economic development. The paper attempted to examine the impact of the agricultural sector on the Nigerian economy. The panel data was sourced from the statistical bulletin of the central bank of Nigeria and World Bank’s development indicators. Multiple regression was used to analyze the data and the result indicated a positive relationship between gross domestic product (GDP) Vis a Vis domestic saving, government expenditure on agriculture and foreign direct investment within the period of 1986-2007. It is recommended that government should provides more funding for agricultural universities in Nigeria to carry out researches on all areas of agricultural production as this will lead to more exports and improvement in the competitiveness of Nigeria agriculture production in international markets (Maduaka, 2014).

Adejaro evaluated value added tax and economic growth: the Nigerian experience. The study examined empirically the effect of value added tax (VAT) on Nigeria economy. Secondary data were obtained from central bank of Nigeria statistical bulletin covering the period of 1994 to 2010. Multiple regressions were employed to analyze data on such variables Gross Domestic Product (GDP), value added tax, inflation, interest rate and exchange rate. Exports were all found to have significant effects on the Economics Growth.

Afishe examined the impact of value added tax on economic growth in Nigeria. This study aimed at empirically analyzing the impact of Value Added Tax (VAT) on economic growth (GDP) in Nigeria from 1994 to 2012. Relevant secondary data were collected from Central Bank of Nigeria (CBN) statistical bulletin and Federal Inland Revenue Service (FIRS) reports. Ordinary Least Square statistical technique was used to estimate three models in line with the formulated hypotheses. The findings from the models revealed a strong positive significant impact of VAT on economic growth as proxy by GDP in Nigeria. It was recommended among other things that government should put in place measures to effectively utilize generated VAT revenue for infrastructural and economic development.

Oghuma carried out a study on value added tax and economic growth in Nigeria. This study examined the contribution of Value Added Tax (VAT) on economic growth in Nigeria. Time series data covering a period of twenty years (1994-2013) were employed. Secondary data were obtained from Central Bank of Nigeria (CBN) statistical bulletin and Federal Inland Revenue Service (FIRS). Diagnostic tests consisting of normality test, Ramsey RESET test for misspecification and Breusch–Pagan- Godfrey Serial Correlation LM test for the presence of auto correlation. The statistical tool employed was simple linear Ordinary Least Square (OLS) regression was carried out. The result showed that VAT is statistically significant, suggesting that VAT has positive relationship with economic growth in Nigeria. The study recommended among others that the government should reform the Value Added Tax system for better effectiveness and increase the present VAT rate of 5% to 10% in line the prevailing rate of others countries in the world.

Oraka examined the effect of value added tax on the Nigerian economy. The objective of this study was to determine the extent to which value added tax has affected the Nigerian economy. Ex-post facto research design was adopted for this study since it used secondary data. Gross Domestic Product (GDP), Per Capital Income (PCI) and Total Revenue (TR) were used in the study for the period 2003 to 2015 to measure economic growth. Secondary data were obtained on value added tax, gross domestic product, per capital income and total revenue. The data were obtained from CBN statistical bulletin, Federal Inland Revenue Services federal ministry of finance, and journals. The data were analyzed using Simple regression analysis. Results showed that value added tax have not significantly affected Gross Domestic Product of Nigeria economy. It further showed that VAT has a negative relationship with per capital income. Lastly, it was found that VAT has a positive relationship with total revenue generation of Federal government of Nigeria.

Methodology

Ex-post facto design was adopted for the study. This is because already existing data (secondary data) were be used. The researcher relied mainly on secondary data extracted from statistical bulletin of Central Bank of Nigeria (CBN). The data were used to establish a relationship agriculture and value added tax (VAT) revenue on sustainable economic growth in Nigeria. The population of this study shall comprise of all the data on non-oil revenue and Gross Domestic Product (GDP) and per capita income (PCI) in Nigeria over the years. The sample size of the study covered a period of 1995-2018. Agriculture and value added tax (VAT) revenue, Gross Domestic Product (GDP) and per capita income (PCI) within this period were be used. The reason for this sample size is due to the fact that value added tax as one of the variables became operational in Nigeria from 1995. Sampling techniques to be adopted for the study shall be judgmental sampling. This techniques is preferred because of the sample were selected based on the researcher’s judgment.

Model Specification

The researcher shall modify the model of Awe & Ajayi (2009). Gross Domestic Product (GDP) and per capita income (PCI) as a function of agriculture and value added tax (VAT) revenue.

GDP = f (agriculture and VAT revenue)

Analytical model

GDP = f(AGRC, VATRC) …….. (1)

Thus linear equation (1) we obtained

GDP = β0 + β1 AGRC + β2 VAT + U…..(2)

Where;

β0 = The intercept or autonomous parameter estimate

β1 – β2 are the slope of the coefficient of the independent variables to be determined

AGRC = Agricultural Revenue Contributions

VATRC = value added tax contributions

GDP Gross Domestic Product

U = error term (stochartie term)

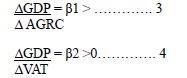

Apriori Expectation

This refers to the supposed relationship between and or among dependent or independent variables of the models as determined by the postulations of economic theory. We then differentiate partially with respect to each variable to obtain apriori sign expectations.

On the apriori expectations, positive = β0, β1, β2, depicts a direct relationship between GDP and AGRC and VATRC. It shows that on apriori basis, the GDP increase due to an increase in ARC, MRC, SMRC, VATRC.

The second model and equation (ii), using per capita income for sustainable economic growth is as follows:

PCI = f(AGRC and VATRC) …….. (2)

Thus linear equation (II) we obtained

PCI = β0 + β1 AGRC + β2 VATRC + U….. (3)

Where;

β0 = The intercept or autonomous parameter estimate

β1 – β2 are the slope of the coefficient of the independent variables to be determined

AGRC = Agricultural Revenue Contributions

VATRC = value added tax contributions

PCI = Per capita income

U = error term (stochartie term)

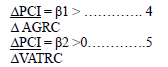

Apriori Expectation

This refers to the supposed relationship between and or among dependent or independent variables of the models as determined by the postulations of economic theory. We then differentiate partially with respect to each variable to obtain apriori sign expectations.

On the apriori expectations, positive = β0, β1, and β2 depicts a direct relationship between PCI and AGRC and VATRC. It shows that on apriori basis, the PI increase due to an increase in AGRC and VATRC.

In order to analyze agriculture and VAT revenue to sustainable economic growth in Nigeria, we investigated the relationship between the real gross domestic product (RGDP) and agriculture and VAT revenue and equally investigated the relationship between per capita income (PCI) and agriculture and VAT revenue. In addition, we determine the causality between agriculture and VAT revenue and economic growth variables. We applied the following five tests: Unit Root test, Cointegration test, Error Correction Model, Impulse Response Function, and Causality test (Musa, 2016).

The unit root test was important to ensure that all variables included in the model are stationary. That is to ensure that any variable has a constant mean and constant variance. This made prediction of future values sensible. If variables are non-stationary, as expected for most macroeconomic variables, the normal way to investigate the relationship among variables, for example the OLS technique, makes no sense. When variables are non-stationary, we still can investigate the relationship among them using the cointegration test. The idea is to test if we can build a long run relationship among variables that are non stationary.

Results and Interpretation

The analysis shows that agriculture revenue has a significant contribution on the gross domestic product (GDP) in Table 1. The coefficient of determination R2 is 0.99 meaning that 99% of the variability in GDP (dependent variable) was influenced by the agriculture revenue contribution (independent variable). The F-statistic of 1744.642 is greater than 2, showing overall significance of the regression model. The F. sig level of 0.0002 is less than the 0.5 which suggest that Ho is not true. Therefore, agriculture revenue has significant and positive contribution on gross domestic product (GDP). Thus agriculture revenue is an instrument or a revenue source for economic growth in Nigeria in Table 2.

| Table 1 Summary Of Tests For The Regression Model For Hypothesis 1 On Gdp |

||||

|---|---|---|---|---|

| R2 | F-Stat | DW | x2(HET) | RESET-F |

| 0.99 | 1744.642 | 2.8 | 0.28 | 0.06 |

Source: Researcher’s Computation (2019)

| Table 2 Summary Of Tests For The Regression Model For Hypothesis 1 On Pc |

||||

|---|---|---|---|---|

| R2 | F-Stat | DW | x2(HET) | RESET-F |

| 0.97 | 368.1705 | 1.6 | 0.28 | 1.11 |

Source: Researcher’s Computation (2019) .

The analysis shows that agriculture revenue has a significant contribution on the per capita income (PCI). The coefficient of determination R2 is 0.97 meaning that 97% of the variability in PCI (dependent variable) was influenced by the agriculture revenue contribution (independent variable). The F-statistic of 368.1705 is greater than 2, showing overall significance of the regression model. The F. sig level of 0.0002 is less than the 0.5 which suggest that Ho is not true. Therefore, agriculture revenue has significant and positive contribution on Per Capita Income (PCI). Thus agriculture revenue is an instrument or a revenue source for sustainable economic growth in Nigeria in Table 3.

| Table 3 Summary Of Tests For The Regression Model For Hypothesis 11 On Gdp |

||||

|---|---|---|---|---|

| R2 | F-Stat | DW | x2(HET) | RESET-F |

| 0.99 | 2138.898 | 2.4 | 0.72 | 0.001 |

Source: Researcher’s Computation (2019).

The analysis shows that Value Added Tax revenue (VAT) has a significant contribution on the Gross Domestic Product (GDP). The coefficient of determination R2 is 0.99 meaning that 99% of the variability in GDP (dependent variable) was influenced by the VAT revenue contribution (independent variable). The F-statistic of 2138.898 is greater than 2, showing overall significance of the regression model. The F. sig level of 0.0048 is less than the 0.5 which suggest that Ho is not true. Therefore, VAT revenue has significant and positive contribution on Gross Domestic Product (GDP). Thus VAT revenue is an instrument or a revenue source for economic growth in Nigeria in Table 4:

| Table 4 Summary Of Tests For The Regression Model For Hypothesis 11 On Pci |

||||

|---|---|---|---|---|

| R2 | F-Stat | DW | x2(HET) | RESET-F |

| 0.97 | 367.8316 | 1.5 | 0.61 | 1.50 |

Source: Researcher’s Computation (2019).

The analysis shows that Value Added Tax (VAT) revenue has a significant contribution on the Per Capita Income (PCI). The coefficient of determination R2 is 0.97 meaning that 97% of the variability in PCI (dependent variable) was influenced by the VAT revenue contribution (independent variable). The F-statistic of 367.8316 is greater than 2, showing overall significance of the regression model. The F. sig level of 0.0048 is less than the 0.5 which suggest that Ho is not true. Therefore, VAT revenue has significant and positive contribution on Per Capita Income (PCI). Thus VAT revenue is an instrument or a revenue source for sustainable economic growth in Nigeria.

Conclusion and Recommendations

Based on the findings of this study, it was concluded that agriculture revenue has significant contribution to sustainable economic growth in Nigeria. Value Added Tax (VAT) was equally found to be contributing significantly to sustainable economic growth in Nigeria. Agriculture if given proper attention alongside effective VAT policy put in place and properly implemented can help Nigeria economy to blossom. These policies if sincerely carried out will lead to income redistribution while encouraging rural dwellers most especially young school leavers to be self employed. The abundant natural resources will be adequately utilized if majority of the populace engage themselves in agriculture.

It was recommended that government should create an enabling environment for agriculture to strive. This government should do by providing soft loans and grants to the real farmers and ensure that it is been utilized for the purpose for which it was made available. Government should equally make available for farmers subsidized farm inputs; organize agricultural programmes to educate farmers amongst other things. Practical agriculture should be reintroduced to students in higher institutions. Government should make available basic amenities for rural dwellers to reduce the level of rural urban migration. Good schools, roads, hospitals among others should be made available for the use of the rural dwellers. Government should be accountable for revenue generated from tax to encourage tax payment. They should be transparency in the tax system. Government should equally make available tax incentives to encourage payment of tax. Security of lives and properties of citizens should be given serious attention to guarantee the safety of farmers. Prudent management of revenue generated from tax will give the tax payers a sense of sincerity from the side of government and this will result to increase in revenue generation from taxes.

Acknowledgement

This study contributes to existing literature on how agriculture and value added tax revenue can be of importance to sustainable economic growth. This study is one of very few studies which have investigated agriculture alongside Value Added Tax (VAT) on sustainable economic growth.

References

Adesoye, B.A., Adelowokan, O.A., Maku, E.O., & salau, S.O. (2018). Enhancing agricultural value chain for economic diversification in Nigeria. African Journal of Economics Review, 6(3), 97-101.

Adhikari, S. (2015). Contribution of agriculture sector to national economy in Nepal. The Journal of Agriculture and Environment, 16(2), 204-215.

Indexed at, Google Scholar, Cross Ref

Ahungwa, G.T., Haruna, U., & Rakiya, Y.A. (2014). Trend analysis of the contribution of agriculture to the Gross domestic Product of Nigeria (1960-2012). Journal of Agriculture and Veterinary Science, 7(2), 200-208.

Indexed at, Google Scholar, Cross Ref

Ajie, C.O., Okoh, A.S., & Ojiya, E.A. (2019). The impact of solid minerals resources on economic growth in Nigeria: An OLS and causality approach. International Journal of Humanities, Art and Social Studies, 4(1), 150-163.

Akarue, B.O., & Eyovwunu, D. (2017). An empirical assessment of the contribution of agricultural sector to Nigerian economy (1970-2012). International Journal of Innovative Agriculture and Biology Research, 5(2), 90-99.

Anoyemi, B.O., Afolabi, B., & Akomolage, K.J. (2017). Agricultural productivity and economic growth: Impact analysis from Nigeria. Scientific Research Journal, 5(2), 37-45.

Chebbi, H.E., & Lachaal, L. (2007). Agricultural sector and economic growth in Tunisia. Evidence from Cointegration and error correction mechanism. Paper prepared for presentation at the Mediterranean conference of Agro-food, Barcelona, Spain.

Damulak, D. (2017). Nigeria solid mineral resources potentials: An overview.

Dim, C., & Ezenekwe, U. (2013). Does Agriculture matter for Economic Development? Empirical Evidence from Nigeria. Journal of Finance and Economics, 1(3), 120-12.

Indexed at, Google Scholar, Cross Ref

Edeme, R.K., Onoja, T.C., & Damulak, D.D. (2018). Attaining sustainable economic growth in Nigeria: Any role for solid mineral development? Academic Journal of Economic studies, 4(1), 60-69.

Eze, O.M. (2017). Agricultural sector performance and Nigeria’s economic growth. Asian Journal of Agricultural Extension, Economics and Sociology 15(1), 245-256.

Indexed at, Google Scholar, Cross Ref

Hlarova, I.N. (2015). The impact of mineral resources on economic growth. International Journal of Arts and Commerce 4(2), 153-161.

Hlavova, I.N. (2015). The impact of mineral resources on economic growth. Journal of Arts and Commerce 4(3), 81-90.

Izuchukwu, O. (2011). Analyis of the contribution of Agricultural sector on the Nigerian economic development. World Review of Business Research, 1(3), 71-80.

Karimou, S.M. (2018). Impact of Agricultural output on economic growth in west Africa: Case of Benin. 14th International Conference of Agricultural Economist.

Kemi, A.O. (2016). Diversification of Nigeria economy through Agricultural production. Journal of Economics and Finance, 7(2), 144-156.

Maduaka, A.C. (2014). Contribution of solid minerals sector to Nigeria’s economic development. Published M.Sc thesis.

Musa, M. (2016). “Towards a diversified Nigerian economy” the contribution of agriculture to GDP of Nigeria. International Journal of Economics, Commerce and Management, 4(1), 35-4.

Odetola, T, & Etunmu, C. (2013). Contribution of Agriculture to economic growth in Nigeria. Paper to be presented at the 18th Annual conference of the African economic Society, Accra, Ghana.

Olajide, O.T., Akinlabi, B.H., & Tijani, A.A. (2013). Agriculture resources and economic growth in Nigeria. European Scientific Journal, 8(2), 195-206.

Indexed at, Google Scholar, Cross Ref

Olalekan, D.O., Afees, N.O., & Ayodele, A.S. (2016). An empirical analysis of the contribution of mining sector to economic development in Nigeria. Khazar Journal of Humanities and Social Sciences, 19(2), 155-167.

Indexed at, Google Scholar, Cross Ref

Olumide, S.A., Akongwale, S., & Udefuna, P.N. (2013). Economic diversification in Nigeria: Any role for solid mineral development? Mediterranean Journal of science, 4(3), 94-106.

Indexed at, Google Scholar, Cross Ref

Onuiru, E.E., Ogbonna, A.E, Alli-Shehu, B., & Maduakulam, C. (2015). Mineral resources management information system. European Centre for Research, Training and Development, 2(3), 77-84.

Oyakhilomen, O., & Zibah, R.G. (2014). Agricultural production and economic growth in Nigeria: Implication for rural poverty alleviation. Quarterly Journal of International Agriculture, 53(4), 247-259.

Indexed at, Google Scholar, Cross Ref

Oyinbo, O., & Rekwot, G.Z. (2014). Agricultural production and Economic growth in Nigeria. Implication for Rural poverty Alleviation. Quarterly Journal of International Agriculture, 53(3), 211-221.

Indexed at, Google Scholar, Cross Ref

Raza, S.A., Ali, Y., & Mehboob, F. (2012). Role of agriculture in economic growth of Pakistan. International Journal of Finance and Economics, 83(4), 280-291.

Sertoghu, K., Ugural, A., & Bekun, F.V. (2017). The contribution of Agricultural sector on economic growth of Nigeria. International Journal of Economics and Financial Issues, 7(2), 153-162.

Received: 25-Jul-2021, Manuscript No. AAFSJ-21-6232; Editor assigned: 27-Jul-2021, PreQC No. AAFSJ-21-6232(PQ); Reviewed: 10-Aug-2021, QC No. AAFSJ-21-6232; Revised: 11-Mar-2022, Manuscript No. AAFSJ-21-6232(R); Published: 18-Mar-2022