Research Article: 2021 Vol: 25 Issue: 4

Empirical Analysis of Public Accounts Committee and Accountability of Funds in Nigeria

Ashishie Peter Uklala, University of Calabar

Peter Kekung Bessong, University of Calabar

Peter A. Oti, University of Calabar

Arzizeh Tiesieh Tapang, Michael Okpara University of Agriculture Umudike

Egu Usang Inah, University of Calabar

Abstract

This study examined the empirical analysis of public accounts committee and accountability of funds in Nigeria. Specifically, the study was set in order to meet five objectives, namely; to understand how Public account committee promotes accountability in public sector organizations, to examine the relationship between public account committee and auditor-general in promoting accountability in public funds, to ascertain public account committee, civil society organizations (CSOs) appeal, and directives of public account committee Tribunal in south-south states of Nigeria and the influence of accountability of public funds in ministries, departments and agencies (MDAs) and other public institutions, and to identify challenges that Public Accounts Committee faces in promoting accountability of funds in the public sectors. The study was conducted in the south-south states of Nigeria. The study made use of both descriptive and survey research design and data analyzed using multiple regression. The study revealed that the quality of the public account committee has a significant effect on the accountability of public funds in the south-south states of Nigeria. The study also revealed that the timeliness of the public account committee has a significant effect on the accountability of public funds in the south-south states of Nigeria. The study further revealed that the political influence of the public account committee has no significant effect on the accountability of public funds in the south-south states of Nigeria. Finally, the study revealed that recommendations and appeals of public account committee have a significant effect on the accountability of public funds in south-south states of Nigeria. Conclusively, the study has shown that the public account committee has influenced on accountability of public fund and in fact, apart from all the benefits that public account committee have achieved in extending the level of accountability in public fund management, there is a moderate follow-up of audit report, timely discussion of audit report and response of clients through audit recommendations. The study recommended that the public account committee which is an arm of the legislature should train its members on all aspects of information technology for effectiveness and efficiency. Finally, there should be full effectiveness of public account committee in enhancing accountability on public fund management in south-south states of Nigeria public sector by ensuring that there is full coverage of audit mandate on expenditure and revenue auditing.

Keywords

Accountability, Audit Institution, Public Account Committee, Public Monetary Management, Public Sector.

Introduction

The Public Account Committee report has become one of the 21st century veritable financial hubs for ensuring accountability and transparency in the public sector. Much has been researched in the area of Public Account Committee reports and its effects in the public service. In spite of all these, the issue of accuracy and clear of funds in the service of public is yet to be fully addressed. The main responsibility of government is the enthronement and sustenance of good governance. Good governance entails respect for the rule of law, ensuring effective utilization of public resources, delivery of services and accountability. The legislative arm of government in a democratic setting plays an important role in enhancing accountability and transparency. The arm has a constitutional duty of ensuring that whatever is appropriated in the budget is properly accounted for by those entrusted with public resources. The Public Account Committee is a special committee of the National and State Assemblies established in accordance with the provisions of sections 58 and 57 of the 1999 Constitution respectively.

Public Account Committee has been described as a selected committee of the National and State Assemblies saddled with the duty to examine the account showing the appropriation of sum granted by the National/State Assembly (Johnson, 1999). It is pertinent to state that, in a democratic Nigeria, citizens work in different offices on our behalf. As a result of the environment today, the civil and public servant and political appointees are representatives acting as stewards to ensure accountability and transparency in their activities and operations.

It has been argued by Azie (2002) that

“The concept of public accountability and transparency demand that those entrusted with public funds and resources are answerable and responsible to the stakeholders and a means of ensuring that the purpose and objectives of specific programmes, projects and services are achieved. Accountability and transparency are fundamental for effective management of resources.”

Public Accountability can be effective if the officers who are charged with public funds and resources understand the rules under which they are required to operate and apply due care when implementing them. Again, several laws, circulars, regulations and control procedure are put in place to ensure effective and efficient performance of our public sector. The rules and Laws as they affects public funds include but not limited to: treasury circularization, appropriation acts, financial instruction/memoranda, the Nigerian constitution, the audit act of 1956 (amended), financial control and management act of 1958 (Amended).

Public accountability and transparency is primarily achieved through the application of public sector accounting and audits rules and regulations in the management of funds. The goal of Public Sector Accounting is in three dimensions; a) to provide important information for the purpose of planning, management and control of government activities. b) To provide evidence of accountability for the stewardship of public resources. c) To ensure that transaction are in agreement with budgeted envelopes.

In order to ensure prudence in the management of public finances, the south-south states of Nigeria government passed the states public finance management Act 2011. The law provides for legal compliance with applicable laws and regulations in the efficient management of public funds for maximum outcomes. The law as provided in section 1 is to secure the efficient coordination, transparency, accountability and sound management of the revenue expenditure, assets and liabilities of the State Government and its Ministries, Departments, Agencies, the judiciary and the legislature.

Funds management – also referred to as asset management – covers any kind of system that maintains the value of an entity. It may be applied to both intangible assets like intellectual property, goodwill and financial assets, or human capital, and tangible assets, such as real estate. It is the systematic process of operating, deploying, maintaining, disposing and upgrading assets in the most cost-efficient and profit-yielding way possible.

In the financial world, the term "fund management" ultimately describes people and institutions that manage investments on behalf of investors. An example would be investment managers who fix the assets of pension funds for pension investors. Fund management may be divided into four different industries: the financial investment industry, the infrastructure industry, the business and enterprise industry, and the public sector. The most common usage of the term "fund management" covers investment management or financial management in the financial sector that manages investment funds for client accounts. The fund manager's job includes studying the client's needs and financial goals, creating an investment plan, and executing the investment strategy.

Based on frequent complains on Public Accounts Committee operations and in relation to Accountablity of Public Funds, the issues arising from the accompanying quality, timeliness as well as engrossed political influence on the Public Accounts Committtee members etc, this study examined the activities and operations of the Public Accounts Committtee as a tool in ensuring accountability of Public Funds in the South-South States of Nigeria.

It has been observed over time that the Nigerian society and in particular the public system is occupied with inadequate stories financial training ranging from unknown staff on roll pay in (MDAs’) Departments, additional Ministerial Facilities and Equipments, putting on fire office, warehousing sensitive document, inflation of contract price and large scale embezzlement by public office holders in Nigeria Public Service Sector.

However, the striking research problem that the researcher identified as a gap created in other studies was the inability of the researchers to comprehensively examined the public account committee process and articulate quality, political influence, timeliness, adequacy, implementation of recommendations and especially appeals of civil society organizations that would help correct the inadequacies in the public service as to achieve accountability of public funds. Frequently, Public Accounts Committtee have been ignored of abandoned due to the observed inadequacy in the quality, the lateness in the submission audited account by the Audit Institutions and the obvivious political influence entranched in the operations of Public Accounts Committtee. Thses drawbacks have redicules and makes Public Accounts Committtee activities of none effect, thus making the Public Accounts Committtee role in ensuring accountability of public funds in South-South States of Nigeria deviants of its original creation.

Weak or poor recommendations will rubbish Public Accounts Committtee work before the Government. This in turn affects implementation, which is a strict function of the quality. Though implementation is to a large extent influenced by the political will, a good report will beg for comments from stakeholders. Would the quality of the Public Accounts Committtee work encourage handlers of the public funds to be accountable or render public service according to the regulations and circulars? Recommendations of Public Accounts Committtee work and level of implementation may have an influence on accountability of public funds. This is so because if the Auditor Generals’ findings and recommendation are seriously considered by the Public Accounts Committee then, accounting officers in the public service will be accountable. Another issue of concern is accountability in fund matters in the public service. It is also reasoned that the quality of the report, nature and type of recommendations and of course level of implementation by Public Accounts Tribunal will to a great extent affect accountability in fund management. Public officers entrusted with public funds require some level of caution to sit up.

There is poor fund management in States Public Service as a result of non-adherence to recommendations and suggestions of PAC and lack of enforcement by Public Accounts Tribunal. The focus of the study therefore was to examine the issues raised here and assess the extent they influence fund management in the South-South States public Service of Nigeria. The specific objectives were:

1. To determine the amount to which quality of public account committee affects accountability of public funds in South-South States public service.

2. To evaluate the extent to which timeliness of public account committee affects accountability of public funds in South-South States public service.

3. To ascertain the extent to which political influence of public account committee affects accountability of public funds in South-South States public service.

4. To determine the extent to which recommendations and appeals of public account committee affects accountability of public funds in South-South States public service.

Literature Review

Theoretical Framework

Pareto Efficiency Theory of Public Accountability

Pareto efficiency theory is also called Pareto optimality theory. This theory holds that the allocation of state resources makes it unfeasible to create any one person adequate off absence creating at minimum one other person bad off. The theory is termed after Italian engineer and economist, pareto optimality as sometime referred is applied by economist to demonstrate the proper management of public resources. Pareto proper described the delivering of public materials which are that no segment of the system is better off while no other sector is made worse off. When this does not occur, it will lead to public sector failure. The theory of Pareto efficiency arises from positive economics in addressing the public sectors failure in terms of accountability of public resources.

Public/ Economics Choice Theory

Public decision or public decision proposition termed to "the use of economic tools to deal with traditional problems of political science". Its constituents comprise the work of character of political. It is the follow of helpful proposition politically that learns own-amazed members and their associations, which can be displayed in a couple of methods applying quality limited utility optimatization.

The public choice proposition of accountability and transparency was introduced by Stigler, 1971 in an attempt to offer a basis of theory for the previous position on law political that will regulate members of governance. Gary Becker advances a more acceptable explanation by combining the element of positive theories with that of normative theories. The major drawback with the public/economic theory is that they are unable to give a concise explanation on regulation that bind the system.

Accountability and Transparency Theory

Accountability and transparency are associated and equal executing. Without Transparency in the system like the South-South States Public Service, it would be massive to ask open region body (MDA’s) to respond till there is responsibility which is a mechanism to state on the applied of open funds and the result of lacking to meet the displayed aims, then clearness will be of small worh.

The presence of accountability and transparency of public account committee and accountability on the use of public funds or resources is to achieve sustainable human development through efficient and effective governance of public resources. Okoh and Ohwoyibo (2009) maintained that responsibility shows the requirement for ruling and its MDA’s to provide service and function the open properly and in respond with rules of the serve land.

Achua (2009), opine that

“Serious consideration is being accorded to the need of public agencies. As such, the agencies need to be more accountable for the sums or resources at their disposal or command of governance which exercise administrative and political authority over the actions and affairs of political unit of people. Government spending is a huge business and the people or public demand to know whether the vast outlays of funds are being managed wisely for public interest”.

Agency Theory of Managing Public Resources in Government

The Agency theory of ensuring accountability and transparency of public funds or resources emphasized that the public, who are the ‘principal’, entrust their resources to government which acts as their ‘agents’. It is important to state that in this model, government as an agent renders an account or stewardship to the public.

A good-working open expenses administration body is regarded to be a main bone of ruling properly by main experts, who position it on par with a little-alter tax body and a properly tax management. It is thus unfortunate that there is so small economic study on the pattern of PEM body, particularly on the side of theory. On the side of empirical, document have universally concentrated on the properly of open expenses in main region in government MDA’s, and only a small moments have been created to amount the package lacks related with a least PEM body. They every focus to rather maximum price of economy. For instance, an open purchasing looking map in in south-south states of Nigeria on Public Account Committee and Accountability of Public Funds concludes that there is dismal accountability of public resources. The main of the given expenses was either applied by open officials for reason unassociated to approve programmes of government.

The Institutional Theory

The study of Public Account Committee and Accountability of Public Funds in Nigeria: Evidence from south-south states is responsible with the formation of open body of organization. Such system stated the importance of native and social concepts of organizational surrounding rather than the job and mechanical substance offer meaning on law of contingency and material regarding laws (see Donaldson, 1995; Oliver, 1991).

The application of the institutional theory to the study

The prevalence of poor financial management of public funds in Nigeria’s public service especially in the South-South public service has generated many out cries in the country and concern among the leadership. Institutional mechanisms such as the Public Accounts Committee (PAC), Audit Alarm Committee, EFCC, BMPIU within others have been put in place to control the vice, in this regard, the public accounts committee had over the years discovered and announced that indiscipline had become the order of the day. It further explains that the situation had reached such an alarming stage that fraud, embezzlement, irregularities and malpractices of unbearable dimensions are now being perpetuated with reckless abandon and regulations breached with impunity.

The Westminster Model of Accountability

The Westminster theory of open monetary accuracy as enshrined in the United Kingdom arrangement for outside open audit and ex-post monetary checks by a legislative and parliament appoint member, arise in a particular open area ruling concepts and originated in reply to alteration in that meaning. Some characteristics of “Westminster” model have enhanced the constituents of the open audit and legislative accuracy surrounding in major common wealth nations.

Conceptual Framework

The Concept of public Accountability of funds and Public Account Committee

Public Account Committee is traced to United Kingdom in 1861, the house of common set up a committee on public account. This committee was strengthened following the promulgation exchequers and audit department of 1866. This act provided for the selection of Universal Auditor and Regulator as an independent office to report directly to the parliament on the finance of the government. The function of public account committee in the United Kingdom is to examine the accounting indicating the right addition given by the parliament to meet open expenses and certain another account put before parliament as the mebers thought. (Fayemi, 1963). It is worthy to state that Nigeria today as a sovereign state was a colony of Britain. Most of the Laws applicable in Nigeria were borrowed from British Laws. Military regimes in Nigeria operate public account committee which reports to the Armed Forces Ruling Council. Today, the National Assembly and various state assemblies operate a Public Account Committee as provided in section 125(5), 103 (1), 85(5) of the 1999 constitution (Margetts, 2006).

General principles of internal control in South–South States of Nigerian Public Service

Howard, (1982) defines Internal control as the whole system or set of controls which includes those that relate to financial transactions or or else set up by the administration, to carry out on the affairs of the organization in an organized and proper condition, so as to adhere to administration laws, protection its resources and defend as much as likely the whole and reliability of its document and ensure compliance with statutory requirements. This means that every organization worth its salt has the responsibility of establishing an internal control mechanism to achieve accuracy and reliability of records and eradicate extravagance as well as waste. The efficiency of control is therefore, a function of so many factors both interior and outside to the institution; in any case, the choice of control is a reflection of the cost-benefit analysis. Also, it has been noted that the internal control system adopted, no matter how elaborate, cannot be perfect even though for there to be accurate efficiency both internal and external control is the responsibility of both control system. This assertion is buttressed by Agu (2004), when he noted, in view of their primary importance, the safety and authenticity of the accounting records have to be ensured from their point of collection i.e. (origin) to the point of their final stages. Therefore, effective internal control system in the South- South States of Nigeria is seen as the leeway in which the management can conduct its activities to avoid the risk of manipulations, irregularities and fraud in the South - South States in Nigeria. Internal control mechanisms emphasize that, tasks or activities in the organization should not be concentrated in the hand of one person, rather they should be segregation of duties and responsibilities. In other words, the activities of one person should be checked by another in order to conform to the laid down procedures. This statement corroborates the views of Nwabueze (2000) that, arrangement of duties among staff in a department should be such that no one person in a position should carry out the work of a particular operation alone by which fraud is impossible or greatly minimized.

The place of internal control mechanisms and accountability

Some systems of control are provided and designed in the States government system such as in the South-South States of Nigeria to ensure effectiveness, efficiency, orderliness and safe-guarding of the assets in the South-South States Government and the reliability of its records. To achieve and consider the annual estimates proposals of all Departments in the South-South States in Nigeria, as collated by the Heads of Accounts department and to focus the treasures in the equipment of the prepared of the yearly outcomes of money and expenses of the in the different States Government. To accept or amend the draft estimates submitted by the treasurer and to submit the agreed draft annual estimates for the consideration of the different Ministries in the South-South States. These provisions above are provided to aid in efficient operations of the enterprise. Again section 1-12 of the Revised Financial Memoranda stipulates that the Finance Department will be responsible for the protection and care of the States ruling moey, whether in money or held in the native ruling account bank.

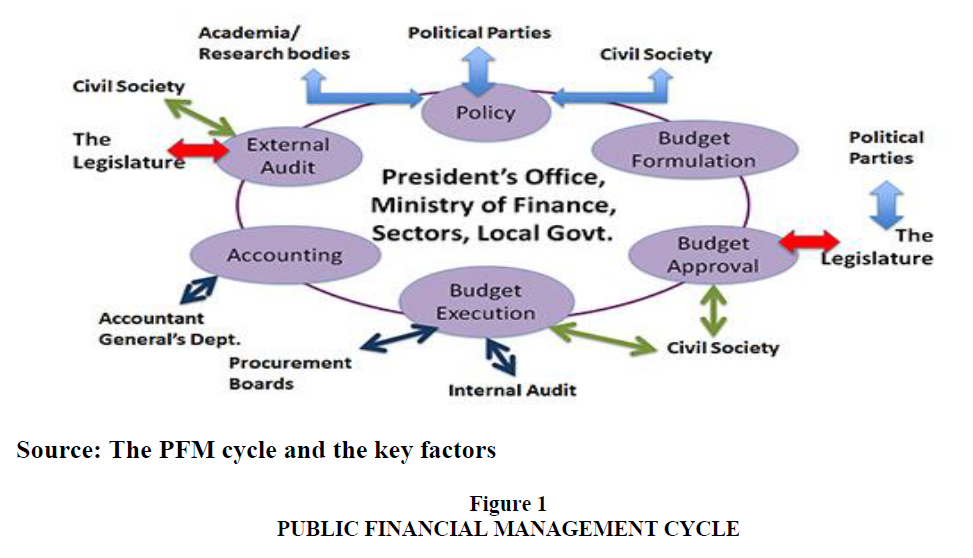

The public financial management context of responsibility

Public monetary administration means to the group of rules, guilding, body and mechanism applied by reign country, to mobilize money, share open money, went open expenses, account for money and checks outcomes. It comprises a wider group of roles than monetary administration and is usually perceived as a state of six cycle, starting with law pattern and finalizing with outside check and assessment Figure 1. A big population of participants participate in this “PFM cycle” to make sure it works properly and effectively, while protecting responsibility.

Empirical Review

Pere et al. (2015) conducted a study to investigate working effect of open Account membe on open Nigeria responsibility. The primary objective of the study and in the expanding reason and complex environment the growing line of work being conducted on inadequate administration of open money, the work has two aims. To look at the association among open Account member on open responsibility and the effect of open Account member on clearness and Nigeria responsibility.

Premchand (1999), investigated in his study capacity to achieve full accountability in the public sector has been and continue to be insufficient, halfly as a result of the pattern of responsibity and maybe as a result of the wide span of objective and related apart joined to responsibility. The methodology adopted in his study was descriptive survey reach the design which administered questionnaires provided primary data for the study. The analyses and estimation of data were done by single regression method of analysis. His findings established a strong relationship between PAC and responsibility of open money in the open region.

Ackerman (2005), in his study investigated Social responsibility in the open region: A meaningful explanation. His study wants to clear one area of the expanding writing on civic dediction: nation function in enhancing authority responsibility – a mechanism rising being refer as “social accountability”.

Onuorah et al. (2012), undertook a study to assess the administration of open money in condition of little of how open officers offer responsibility stated of their work. The work applied post ex factors work pattern. Writing information si applied from the Nigeria Central Bank Statistical substance for the time 1961-2008 for authority money, continuous expenses and capital expenses. The information gathered for the work from the substance were evaluated applying normal minimum square, software Excel aid them to change the alteration into a changes comfortable for examination.

Ojoakor (2009), in his study Nigerian Socio-Politcal Develoment: Issues and Problems concluded and recommends that there is no meaningful development can take put in any society absence principle open official who can be responsible for their deeds, behaviors and for the materials on their protection every whereas in the office and prolong after they have left the place. An wants has been created in this study on responsibility issues as a pre-situation or determing mechanism in the expansion and improvement of a nation state such as Nigeria, while pertinent factors militating against accountability and financial management circled round corruption were discussed. A nation's improvement and expanding ability are assessed by the capable of its open officer’s state of responsibility. Kaduna South local government was chosen due to its grassroots level of government to the people. Government at this level and all levels is often characterized by miss-management, inefficient and ineffective use of scarce resources and frequent reported cases of large scale impropriety, malpractices and fraud. Data gathered through the used of questionnaires were analysed using multiple regression analysis. Ojoakor equally maintained the same position in his study that even though the impediments to accountability in public fund management plays a dominant role in an organizational setting, he argues that a number of forces act as impediment to responsibility and clearness in fund management in the Nigeria open service region which include corruption, tribalism, etc.

Okoh et al. (2009), in their study of public financial accountability opined that responsibility shows the requirement for authority and its members to function the open properly in respect with their rules of land. They maintained that massive reason is being handled to the requirement to be extra responsible for the likely vest quantity of investment in materials and the force of authority, which enforce managerial and power of political about the deeds and area of government spending.

Explanative and pointed statistics were applied to evaluate the infoemation for this work. The explanative statistics are usually applied for the evaluating and know of nay cure of number information, which do not used universalition, whereas the point statistics are applied to make universlaisation, thught and calculated about a collected information (Baridam, 2007). In this work, a two-stage least square estimation has been accepted, t –examined statistical apparatus and depression were balance applied to examine the proposition articulated in this work.

Kenneth Enoch Okpala (2013) undertook a study in public Account member and look Nigeria role: a structure construct on deeping sand. The objective of this work was designed to assess the proper the member look role and to state the important monetary abuse and excess of national Nigeria mateirlas open region. The number of this work consists of gathering of national, MDas and a species extent of 150 workers appointed at aimlessly. Organized questionnaire was applied by the researcher to elicit responses and 128 valid data was analyzed. The “Z” distribution was used as the parametric test statistic.

Emenyonu (2007), explores the public Accounts Committee oversight function and agree with Kenneth Enoch Okpala that the authority of executing the AG document is put in the State and National Assemblies via PAC. Newly certain of his observation include extra invoicing, non-removal of cash expenses, inadequate of inside check supervisor, payment for work not carried out or poorly executed, contract rise and shameless violation financial regulations etc.

Stanpenhurst et al, (2005), explore Public Account Committee success and identifies factors affecting its performance. This study was based on data gathered by Bank world International (WBI) in 2002, where a survey questionnaire was administered to 51 Commonwealth countries. The WBI study observed that availability of information and non-partisan were critical success factors of the public account committee as ascribed by McGee. The survey also resulted that two other factors were equally important including the institutional design of PAC and the PAC’s operational model. The study observed the extent of institutionalization and nature of powers and mandate of a PAC directly contributes to its effectiveness. The results of the survey reached to the conclusion that the greater focus of the PAC’s on government’s financial activity and accountability were important rather on the assessment of the content of government’s policies.

Haslida Abu Hasan (2013), undertook a study from a work on open activities evaluation reign ina select enhanced countries. The objectives of the study was on open trust and trust in the authority meber and its effect on meaning of pertaking and managing public resource. The work accepted a paradign which enable for mix process in information gathering. The replied were 22 native power and concentrated of the work focused in the region of monetary responsibility and check. Utilizing the 22 cases – method report, displayed examination outcome, yearly accounts questionnaires and assessment were gathered, keep and analyzed.

Hood (2006), in a similar study thought that clearness looks to have set up certain types of religious quasi power as rules of contemporary of ruling. Rising clearness as assessed by certain index may be massive inactually as a result to the space among normal clear and proper fund management. (Heald, 2006), the writer explained the space as clearness observation. The writer also document that a receptor able of refining, intake and applying the data is vital for proper fund management. The researcher equally write that clearness is accepted to helpfully joined to activities as a result of open to public observation job as activated. The writer document that, thus, clearness about functioning meaning of mechanism ca impact behavior in unwanted methods. The writer also thought that beginning or rising clearness may have injured impacts raher helpful apart if it is observed to create a separation. The writer describes that if clearness is helpful, it could result to stoppage or decrease of bribery and buse of attacker. Open information origin fro maximum clearness would result to higher cynicism and probably extensed bribery if the bribery open moves. But if trust is regularly seen, it is massive collected and simply released.

O’Neill (2006) thought that those who reason to spread must patterned their speech-action with protection, take account of the real able and faith of their voice and must meet a span of episteme and moral rules that are comprisies of right data. Only when those rules are required, clearness may then widen information by creating assessable to certain voice. In the happening when they are absence met, clearness amy bad messages by moving bad, probable, false faith, and lack data. O’Neill additional explained:

Power (2004) put a certain statement that the actual aim of certain application of clearness is absence to defend the open or users, but to defend offer and anothers by moving liability for imjured. Stasavage’s (2006) work of the Minster council of European discovered that calm of taking council has resulted to massive challenges of responsibility, as a delegates could explained various things in open and quiet and stop body place on laws. Improvement of technology also pertake in improved clearness, in which numerous authority members comprising native authority applied the internet to spread data.

Thus, digital may create authority additional clear, there are obstacles to it, which are the probable and probability created by electronic mechanism, rise compound, and massive of moving digital authority as a result of its extent or pattern (Margett, 2006). Numerous other works discovered association among trust in authority with sensed of freedom (Marlowe, 2004); wants for clearness and need with authority functions (Van Ryzin, Muzzio and Immerwahr, 2004); and that civic pertaking is elevated in little position than in elevated ones (Oliver, 2001). Power (1997) stated that the check open has its basis in the lack of trust in modern nation, and thus, it has become vital to offer an account of individual reactio. Therefore, the facilitated rules leading from recent open administration find to create authority officer responsible. Power (1997) argues that checks offer maximum responsibility, prper and standard, but stated that they help abuse; the checker would become little honour when they adjust their behavior carefully in reply to the check mechanism.

Methods

The research designs selected in this work were both explanative and mapped. The survey pattern was used in collecting the main information illustrating a section of concentrated nmber of South-South States open responsible officials of MDAs, Accountants, Budget Officers, Civil Society Organization and Auditors. The descriptive research design nature of this study is that it contains more than sub units of analysis which include Government official with MDA’s, Internal Auditors, External auditors, office of the Auditor General and South-South States House of Assembly who are responsible to Public Account Committee. Again, there was need for the researcher to compare information from sub unit of analysis which is integrated into single research study. Osuala (2001) identify that descriptive research is the main for every kinds of study in examing the condition as a important to inference and universal of the result findings.

The number of the work comprise mostly auditors, responsible officlas of ministries, department and agencies, accountant, civil society organizations and members of public accounts committee in south-south states of Nigeria. The size of the primary survey in the south-south states of this study was 684. Asika (2008), identify that sampling involves taken any portion of a given population as representative of that population in order to have such advantages as reduced cost, wider coverage, accessibility, precision and accuracy. The larger, the size of the sample the more precise the information given about the population. The sample size of the study stood at 253 covering the south-south states of Nigeria using the Taro Yamane formula in determining sample size.

Model specification

In applying the precise mathematical model for the study, the research was guided by the adaptation of a numerous depression model. This theory become function in opposition to the basis that the work conducted to set up the peculiarities of public Account Committee and accountability of public funds in South-South States of Nigeria public service. The specified model was as follows:

APF= a + ß1QPAC + ß2TPAC + ß3PIPAC + ß4RAPAC + e

Where: APF = Accountability of Public Fund

QPAC = Quality of Public Account Committee

TPAC = Timeliness of Public Account Committee

PIPAC = Political Influence of Public Account Committee

RAPAC= Recommendations and Appeals of Public Account Committee

a = Intercept in each case

ß1 – ß4= is the Regression coefficient for each model

e = error term

Findings

This work was set to assert the public account committee (PAC) and accountability of public fund in South-South States public service of Nigeria. The study was carried out across the south-south states of Cross River, Akwa Ibom, Rivers, Bayelsa, Edo and Delta. The result of the study revealed the following findings:

1. The study revealed that quality of public account committee has a significant effect on accountability of public funds in south-south states of Nigeria.

2. The study further revealed that timeliness of public account committee has a significant effect on accountability of public funds in south-south states of Nigeria.

3. The study revealed that political influence of public account committee has no significant effect on accountability of public funds in south-south states of Nigeria.

4. The study revealed that recommendations and appeals of public account committee have a significant effect on accountability of public funds in south-south states of Nigeria.

Conclusion and Recommendations

The main objective of the study was to assess Public Account Committee in enhancing accountability of public funds in public service in South-South States of Nigeria. Empirically, the study has shown from the research findings that public account committee have influenced on accountability of public fund and infact, apart from all the benefits that public account committee have achieved in extending the level of accountability in public fund management, there is moderate follow-up of audit report, timely discussion of audit report and response of clients through audit recommendations. The properness and adequate of the open account committee in faciliataing responsibility of public funds has ben enforced over the eras, mainly via able improvement gatherings. Ihe study therefore concludes that public account committee to a moderate extent have effect on accountability of public funds in South-South States public service of Nigeria.

In line with our findings and conclusion, the study recommended as follows:

1. The public account committee which is an arm of the legislature should train its members on all aspects of information technology for effectiveness and efficiency. Also the process of hiring staff to work in public account committee should be designed in a way that only skilled workers in information technology are hired and the budgeted envelope for the committee be improved considerably for the purpose of oversight function.

2. The public account committee members should inculcate the spirit of motivation which is one of the tools for inspiring and galvanizing users of public resources towards proper accountability of public funds as the fear of a bleak future is eminent for the system.

3. Auditor-General and public account committee work should be uploaded in its website for public knowledge and awareness, and all important issues be discussed on media and newspapers. This mechanism will make Audit Institution and Public Account Committee more accountable and transparent.

4. A mutial functioning association among the public Account Committee and audit institution should be controlled. The Public Account Committee should be pertake in a calm change with the universal check to make sure full data is offered when it is required, in a feasible and important pattern and its should not be restricted below audit institutions capacity.

5. Public account committee reports should be implemented timely; this will help reduce the problem of turning out substandard reports

6. Lastly, the study recommend that there should be a full effectiveness of public account committee reports in enhancing accountability on public fund management in south-south states of Nigeria public sector by ensuring that there is a full coverage of audit mandate on expenditure and revenue auditing.

References

- Achua, J.K. (2009). Reinventing governmental accounting for accountability assurance in Nigeria. Nigeria Research Journal of Accounting, 1(1), 1-16.

- Azie, V.S.C. (2002). Welcome Address Delivered at the Annual Workshop on Public Sector Accounting and Auditing organized by the office of the Auditor- pp 690-703 General for the federation 20th October, -1st November. Jos

- Emenyonu, E. (2007). The Accounting Profession, the Church and the Nigeria State: Potent Change Agents for National Rebirth. Public Lecture Series, Covenant University, Ota

- Fayemi, O. (1993) Government Accounting, Lagos Chapter: Ten Publication Limited.

- Hood, C. (2006). Transparency in Historical perspective in Hood, Christopher and Heald, David (ed.), Transparency, The Key to Better Governance?, Oxford University Press: US, 2006, 3-23

- Margetts, H. (2006). Transparency and Digital Government in Hood, Christopher and Heald, David (ed.), Transparency, The Key to Better Governance?, Oxford University Press: US, 2006, 197-207

- Okoh, L., & Ohwoyibo, O. (2010). Public Accountability: Vehicle for Socio- Economic Development of Nigeria, International Journal of Investment and Finance, 3(1&2),145-149.

- Okpala, K.E. (2013). Public Accounts Committee and Oversight Function in Nigeria: A Tower Built on Sinking Sand. International Journal of Business and Management, 8(13).

- Premchand, A. (1999). Public Financial Accountability in Schviavo-Campo, S. (ed). Governance, Corruption and Public Financial Management. Asian Development bank Manila, Philippines. www.adb.org

- Van Ryzin, G., Muzzio, D., & Immerwahr, S. (2004). Explaining the race gap in satisfaction with urban services, Urban Affairs Review, 39(5), 613-632.