Research Article: 2021 Vol: 25 Issue: 6

Efficiency Analysis of Zakat Institutions in Indonesia: Data Envelopment Analysis (DEA) And Free Disposal Hull (FDH) Approaches

Muhamad Nafik Hadi Ryandono, Universitas Airlangga

A Syifaul Qulub, Universitas Airlangga

Eko Fajar Cahyono, Universitas Airlangga

Tika Widiastuti, Universitas Airlangga

Binti Nur Aisyah, IAIN Tulungagung

Anidah Robani, Universiti Teknikal Malaysia

Citation Information: Ryandono, M.N.H., Qulub, A.S., Cahyono, E.F., Widiastuti, T., Aisyah, B.N., & Robani, A. (2021). Efficiency Analysis of Zakat Institutions in Indonesia: Data Envelopment Analysis (DEA) And Free Disposal Hull (FDH) Approaches. Academy of Accounting and Financial Studies Journal, 25(6), 1-12.

Abstract

This study aimed at assessing the efficiency of zakat organizations in Indonesia by the use of non-parametric efficiency measurement methods. In addition, a cluster analysis based on the affiliation type was also used to assess the efficiency of Zakat organizations. A quantitative approach with the DEA and FDH methods was applied to this research, during which the latest data from the financial reports of each Zakat Institution have been utilized. This period ranges from 2014 to 2018 for the 14 Zakat Institutions. Based on the results, Zakat Institutions have equal efficiency between DEA and FDH methods if the clusters of government, corporation, and social community are combined. Research data on measuring efficiency show that the DEA method contributes 21% of all Decision-Making Units (DMU) to the total, while the FDH method contributes 25%. The research is one of the first studies to focus on the efficiency of the Zakat Institutions and its associated clusters: government, corporation, and social community. This research can be useful for Zakat Institutions in the form of critical application evaluation considering the research input variables, such as salaries, operational costs, and cost of socialization, and research output variables, for example zakat fund, zakat distribution taking maqasid sharia aspects into consideration.

Keywords

Zakat Institutions, Data Envelopment Analysis, Free Disposal Hull, Efficiency, Cluster of Zakat Institution.

Introduction

The potential of Zakat for Muslims is great, but it needs to be explored and managed. In Indonesia, Zakat is managed by Badan Amil Zakat Nasional (BAZNAZ) and Zakat Institutions, which are formed by the community in conjunction with BAZNAZ. While in the cluster corporations, Zakat institutions are formed to manifest Islamic social responsibility through the management of profits, social community clusters, namely Zakat Institutions based on the social fabric of communities, are formed to bring muzakki with mustahik closer to their surroundings.

BAZNAS estimates that Indonesia has a zakat potential of 327.6 trillion IDR in the year 2021. The potential for zakat in Indonesia in 2020 is explained in detail in Table 1 below:

| Table 1 Potential of Zakat in Indonesia in 2020 | ||

| Number | Types of Zakat | Potency |

| 1 | Zakat of company | IDR 144.5 trillion |

| 2 | Zakat of income | IDR 139.07 trillion |

| 3 | Cash zakat | IDR 58.76 trillion |

| 4 | Agricultural zakat | IDR 19.79 trillion |

| 5 | Zakat on livestock | IDR 9.51 trillion |

However, the total funds raised only made up 3.14% of Indonesia's total zakat potential. Therefore, confidence in zakat organizations will affect the steps that can be taken to maximize its potential (Asmalia et al., 2018). Bin-Nashwan et al., (2010) propose a fair zakat system, mutual morality (zakat compliance from muzakki, zakat-sensitive behaviour towards others, and awareness from Muslims to contribute to Zakat institutions. In order to maximize zakat, muzakki must be trusted, so zakat is channeled directly to mustahiq, since most of the zakat given is used for management in operations (Anwar & Arifin, 2018). In addition to promotion costs, employee salaries (amil) are also included in the analysis. Zakat, when managed efficiently, can have great benefits for communities, such as reducing poverty, raising the dignity of the community, and raising the social welfare of the community.

There has been research on zakat management, including that from (Lubis & Azizah, 2018). However, this research does not focus exclusively on the efficiency of zakat management from various institutions with different characteristics. On the other hand, a study by Wahab & Rahman, (2013) examines the efficiency of Zakat Institutions in Malaysia using the Malmquist Productivity Index (MPI). This study examines the cost, quality, and time of managing zakat. The evaluation of Zakat Institutions by assessing their efficiency score also aims to convince muzakki that zakat is distributed to those who are eligible (Alim et al., 2020). As Tahir & Oziev, (2018) point out, mismanagement of zakat distribution happens when zakat funds are used to build mosques, fund research intended to increase knowledge around zakat, and zakat recipients are closest to distributing zakat. In this case, zakat cannot alleviate poverty and benefit the community since asnaf has a right to zakat .

In light of the above problems, this study seeks to compare the efficiency of zakat management by using two different methods, namely Data Envelopment Analysis (DEA) and Free Disposal Hull (FDH). The DEA technique is an analytical method for determining the relative efficiency of a DMU by getting its inputs and outputs to match (Rahim, 2015), while the FDH technique can detect even very small levels of efficiency (Fukuyama et al., 2015). In previous research, no clustering was taken into account in evaluating Zakat Institutions' efficiency. By using the FDH and DEA methodology, this study completes previous research by analyzing the difference in the efficiency of each Zakat Institution's cluster at 14 Zakat Institutions, which are divided into three groups: governmental clusters, corporate clusters, and social community clusters. This grouping is based on the Decree of the Minister of Religion No. 333 of 2015 concerning Zakat Institution Permits. In this decree, Islamic associations, Islamic foundations, and Islamic social organizations may propose Zakat institutions. Analysis of Zakat Institutions based on affiliation can be extremely valuable because different clusters target different collections. In general, the cluster government collects revenue from the cluster corporations and the government. In the meantime, it is the affiliated community that is mainly targeted for collecting the social community cluster. Hence, different sources or collection targets will have an impact on zakat management in every zakat institution.

This study should provide insight to the government, which can intervene in how zakat is managed to make it more efficient through regulations. According to this study, DEA and FDH both rank Zakat institutions equally according to the efficiency of each cluster (government, corporation, and social community). Nonetheless, FDH results of Zakat Institutions demonstrate greater efficiency than DEA results, which means that FDH analysis captures the ability to maximize efficiency to a greater extent compared to DEA.

Zakat Management

Zakat can be seen as a fiscal instrument that promotes socioeconomic justice and can alleviate poverty (Samad & Glenn, 2010). The Zakat Institutions are social organizations that are not for profit and serve a social purpose (Gleidt & Parker, 2007). A major aspect of Islam, argues Karadogan (2015), is its unique commitment to social solidarity (Abdu-Azeez Ibn Baaz, 2004), along with an emphasis on implementing Islamic finance so that the maqasid sharia can be realized. In Indonesia, zakat is administered by BAZNAS and Zakat Institutions, created both by corporations and local groups. The institutional zakat system helps strengthen the process of managing zakat. The establishment of Zakat institutions will enhance the corporate entity's potential as a profit-making firm and an institution that can adapt to social needs (Di Carlo, 2020). However, in a review by Al Haq and Wahab (2017), it was mentioned that zakat is ineffectively organized and managed, especially in its distribution, so it is not effective in reducing poverty.

In general, Zakat Institutions in Indonesia can be sorted according to a group of founders. The first is the Zakat Institution established by the government - Badan Amil Zakat Nasional. The second, is the Zakat Institutions established by social communities, namely LAZISNU, LAZISMU, Dompet Dhuafa, Nurul Hayat, Global Zakat, Inisiatif Zakat Indonesia, Mizan Amanah, LAZ Al-Azhar, Rumah Zakat and Dewan Dakwah. And the third group of institutions includes corporate zakat institutions, such as YBM PLN, Baitul Maal Muamalat, LAZNAS Bank Syariah Mandiri, and Majlis Taklim Telkomsel.

Efficiency of Zakat Management

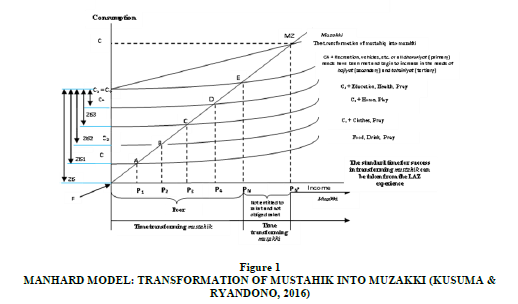

The purpose of zakat is to distribute wealth from the rich to the poor, thereby reducing income inequality (Aziz & Mohamad, 2016). Therefore, Zakat must be managed in a way that aligns with Islamic principles and fulfills the maqasid sharia (Maqasid: objectives; Sharia: Islamic Law) (Anuar et al., 2019). In economics, efficiency can be defined as the ability for a system to produce the maximum output with the available technology (Wahab & Rahman, 2013). In order to be effective in zakat management, there must be a standard operating procedure, a zakat planning approach, ISO certification (quality management method) and monthly work plan (BAZNAS, 2020a). Based on efficiency in non-profit institutions, service costs measure the total amount spent on social work compared with the total amount spent on each social worker (Kim & Lee, 2018). It is important to note that inefficiency in zakat is a result of distribution factors and how it is distributed (Zainal et al., 2016) in Figure 1.

The efficiency of a Zakat Institution should be measured by how well it converts mustahik into muzakki. Muzakki has a new role of zakat, protecting assets, as part of maqasid sharia. The fulfilment of maslahah, namely the protection of religion (din), intellect ('aql), life (nafs), lineage (nasl), and wealth (mal), is defined as maqasid sharia (Hosen et al., 2019). Wahbah al-Zuhaili defines maqasid shariah as the values and goals of sharia (HT & Rama, 2018). It is part of the success of measuring the efficiency of Zakat Institutions with the realizations of maqasid sharia. The maqasid sharia as defined by Ibn Ashur is based on making justice and transparency core components of efficient Zakat Institutions (Soualhi, 2015).

Methodology

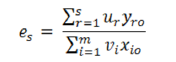

This study employs a quantitative approach with non-parametric research methods, namely Data Envelopment Analysis (DEA) and Free Disposal Hull (FDH). Data Envelopment Analysis (DEA) is a method developed to evaluate the performance of an organization known as Decision Making Units (DMUs) (Retnowati, 2018). Efficient Decision-Making Units (DMUs) will produce a frontier line consisting of all efficient units with a score of one, while relatively inefficient DMUs have a score of less than one (Tamatam et al., 2019). DEA provides efficiency scores and frontier projections based on weak scores for inefficient decision-making units (Nourani et al., 2018). The following is the Data Envelopment Analysis (DEA) formulation (Sherman & Zhu, 2006):

j = number of service unit (SU)

yrj = amount of output r used by service unit j

xrj = amount of input I used by service unit j

i = Number of inputs used by the SUs

r = number of outputs generated by the SUs

ur = coefficient or weight assigned by DEA to output r

vi = coefficient or weight assigned by DEA to input i

FDH Approach is another non-parametric measurement method used to estimate the technical efficiency of DMUs. By encoding inputs and outputs as disposable, this model avoids assumptions about convexity (Shiraz et al., 2016). Using the FDH method, input and output are compared to the production limit to produce more output with fewer inputs (Maria et al., 2018).

Utilizing the MAXDEA software, the efficiency value is calculated based on the DEA and FDH methods. This study combines secondary data gathered from panel data, covering a period between 2014 and 2018. The input and output variables supported in this study are consistent with the production theory, which focuses on the process of converting inputs into outputs (Kao & colleagues, 1995). Variable input costs include managerial and labor costs, as well as socialization and benefits expenses. Additionally, the output variable includes the zakat distribution and funds for zakat. Data was gathered from the annual reports of each Zakat institution. In this study, we used purposive sampling to sample from an entire population of Zakat Institutions in Indonesia. We used criteria such as Zakat Institutions that hosted financial reports from 2014 to 2018. We also revealed the posts that became the input and output variables in this study.

Using these criteria, the study sample consists of 14 Zakat Institutions in Indonesia, including, namely (1) BAZNAS (Badan Amil Zakat Nasional), (2) Al-Azhar (Zakat Institutions Al-Azhar Indonesia), (3) DD (Zakat Dewah Dakwah Institutions), (4) BMM (Baitul Maal Muamalat), (5) RZ (Rumah Zakat), (6) MTT (Majlis Taklim Telkomsel), (7) Mizan (Zakat Institutions Mizan Amanah), (8) GZ (Global Zakat), (9) YBM (Baitul Mal PLN Foundation), (10) NU (LAZIS Nahdlatul Ulama), (11) DDR (Dompet Dhuafa Republika), (12) YAKESMA (Yayasan Kesejahteraan Madani), (13) IZI (Indonesian Zakat Initiative), (14) BSM (LAZNAS Bank Syariah Mandiri).

Results

This study aims to measure and analyze the efficiency score. First, there are three input variables used, namely operational expense, wage expense, and socialization expense. Next, zakat funds and distribution of zakat are used as output variables. As a result, Table 2 below summarizes the descriptive statistics:

| Table 2 Descriptive Statistics Input and Output Variables of Zakat Institutions in Indonesia, Research Year 2014-2018 (In Rupiah) | |||||

| Indicators | Input | Output | |||

| Operational Expense | Salary Expense | Socialization Expense | Zakat Fund | Zakat Distribution | |

| Mean | 10,677,305,242 | 7,624,019,383 | 3,825,212,334 | 62,686,113,219 | 62,365,159,114 |

| Max | 70,001,294,079 | 51,895,788,070 | 23,367,138,542 | 229,788,106,390 | 288,670,038,833 |

| Min | 12,804,807 | 11,604,300 | 5,121,923 | 1,594,266,277 | 2,338,004,030 |

As seen in table 2 of the research data for the 2014-2018 period, there is a variable input with average operational expenses having the largest value, followed by Salary Expense and Socialization Expense.

Efficiency Level with Data Envelopment Analysis (DEA) and Free Disposal Hull (FDH)

It can be concluded that the entity with a value of 1 is efficient and can combine optimal output from its input. Additionally, Table 3 presents information about efficiency scores and ratings, as follows:

From Table 3, it can be seen that YBM Zakat Institutions were the benchmark during the 2014-2018 period. There are three Zakat Institutions with the greatest efficiency score: YBM, RZ, and BAZNAS. As part of this study, the average efficiency score of each Zakat institution was calculated, namely the YBM with the highest entry in the cluster corporation, followed by RZ in the social community cluster and finally BAZNAS in the government cluster.

| Table 3 Measurement of Efficiency, Average, and Ranking of Zakat Institutions in Indonesia using the Dea and Fdh Approach, 2014-2018 Research Period | |||||||||||||

| Rank | Zakat Institutions | Years | Average | ||||||||||

| 2014 | 2015 | 2016 | 2017 | 2018 | |||||||||

| DEA | FDH | DEA | FDH | DEA | FDH | DEA | FDH | DEA | FDH | DEA | FDH | ||

| 1 | YBM | - | - | - | - | 1.000 | 1.000 | 1.000 | 1.000 | 1.000 | 1.000 | 1.000 | 1.000 |

| 2 | RZ | 0.856 | 0.878 | 0.978 | 1.000 | 1.000 | 1.000 | 1.000 | 1.000 | 1.000 | 1.000 | 0.967 | 0.972 |

| 3 | BAZNAS | 0.765 | 0.787 | 0.846 | 0.868 | 0.750 | 0.772 | 1.000 | 1.000 | 1.000 | 1.000 | 0.872 | 0.885 |

| 4 | BMM | - | - | - | - | 0.324 | 0.346 | 1.000 | 1.000 | 1.000 | 1.000 | 0.775 | 0.782 |

| 5 | DDR | 0.595 | 0.617 | 0.672 | 0.694 | 0.66 7 | 0.689 | 0.636 | 0.658 | 0.681 | 0.703 | 0.650 | 0.672 |

| 6 | YAKESMA | - | - | 0.969 | 1.000 | 0.208 | 0.230 | 0.219 | 0.241 | - | - | 0.465 | 0.490 |

| 7 | NU | - | - | - | - | 1.000 | 1.000 | 0.159 | 0.181 | 0.176 | 0.198 | 0.445 | 0.460 |

| 8 | MTT | 1.000 | 1.000 | 0.194 | 0.216 | 0.169 | 0.191 | 0.179 | 0.201 | 0.169 | 0.191 | 0.342 | 0.360 |

| 9 | IZI | - | - | - | - | 0.283 | 0.305 | 0.247 | 0.269 | 0.284 | 0.306 | 0.271 | 0.293 |

| 10 | BSM | - | - | - | - | 0.206 | 0.228 | 0.277 | 0.299 | - | - | 0.242 | 0.264 |

| 11 | Al-Azhar | - | - | 0,196 | 0.218 | 0,207 | 0.229 | 0,141 | 0.163 | 0,150 | 0.172 | 0,174 | 0.196 |

| 12 | DD | 0,157 | 0.179 | 0,163 | 0.185 | 0,128 | 0.150 | 0,149 | 0.171 | 0,103 | 0.125 | 0,140 | 0.162 |

| 13 | Mizan | 0,115 | 0.137 | 0,175 | 0.197 | 0,117 | 0.139 | 0,066 | 0.088 | 0,071 | 0.093 | 0,109 | 0.131 |

| 14 | GZ | 0,027 | 0.049 | 0,022 | 0.044 | 0,024 | 0.046 | 0,066 | 0.088 | 0,031 | 0.053 | 0,034 | 0.056 |

In table 4, the results of public sector efficiency are (1) Government with a score of 0.872 followed by (2) Corporation with a score of 0.570, and lastly (3) Social community with a score of 0.410. By examining the above results, this study shows the same efficiency measurement results even when using different analysis tools, namely FDH and DEA. This study is robust considering 2 methods that rank efficiency by identifying three clusters. Thus, the FDH method has a wider efficiency value than the DEA method.

| Table 4 Average Efficiency Score Based on the Dea and Fdh Approach Cluster, 2014-2018 Research Year | ||||||||||||

| Cluster | 2014 | 2015 | 2016 | 2017 | 2018 | Average | ||||||

| DEA | FDH | DEA | FDH | DEA | FDH | DEA | FDH | DEA | FDH | DEA | FDH | |

| Government | 0.765 | 0.787 | 0.846 | 0.868 | 0.750 | 0.772 | 1.000 | 1.000 | 1.000 | 1.000 | 0.872 | 0.885 |

| Corporate | 1.000 | 1.000 | 0.194 | 0.216 | 0.425 | 0.441 | 0.614 | 0.625 | 0.723 | 0.730 | 0.590 | 0.601 |

| Social Community | 0.350 | 0.372 | 0.454 | 0.477 | 0.404 | 0.421 | 0.298 | 0.318 | 0.312 | 0.331 | 0.362 | 0.382 |

Return to Scale Results for DEA and FDH Approaches

Both DEA and FDH approaches used in this study will put each zakat institution in a specific state of return to scale, such as decreasing return to scale (DRS), constant return to scale (CRS), or increasing return to scale (IRS). Consequently, Table 5 describes the conditions for return to scale (RTS) as follows:

| Table 5 Return to Scale for Zakat Institutions in Indonesia Dea Aand Fdh Approaches, Research Year 2013-2018 | |||||||||||

| Cluster | Zakat Institutions | Years | |||||||||

| 2014 | 2015 | 2016 | 2017 | 2018 | |||||||

| DEA | FDH | DEA | FDH | DEA | FDH | DEA | FDH | DEA | FDH | ||

| Government | BAZNAS | IRS | IRS | IRS | IRS | IRS | IRS | IRS | IRS | IRS | IRS |

| Corporation | YBM | - | - | - | - | CRS | CRS | CRS | CRS | CRS | CRS |

| Corporation | BMM | - | - | - | - | IRS | IRS | CRS | CRS | CRS | CRS |

| Corporation | MTT | CRS | CRS | IRS | IRS | IRS | IRS | IRS | IRS | IRS | IRS |

| Corporation | BSM | - | - | - | - | IRS | IRS | IRS | IRS | - | - |

| Social Community | RZ | IRS | IRS | IRS | CRS | CRS | CRS | CRS | CRS | CRS | CRS |

| Social Community | NU | - | - | - | - | CRS | CRS | IRS | IRS | IRS | IRS |

| Social Community | YAKESMA | - | - | IRS | CRS | IRS | IRS | IRS | IRS | - | - |

| Social Community | DDR | IRS | IRS | IRS | IRS | IRS | IRS | IRS | IRS | IRS | IRS |

| Social Community | IZI | - | - | - | - | IRS | IRS | IRS | IRS | IRS | IRS |

| Social Community | Mizan | IRS | IRS | IRS | IRS | IRS | IRS | IRS | IRS | IRS | IRS |

| Social Community | Al-Azhar | - | - | IRS | IRS | IRS | IRS | IRS | IRS | IRS | IRS |

| Social Community | DD | IRS | IRS | IRS | IRS | IRS | IRS | IRS | IRS | IRS | IRS |

| Social Community | GZ | IRS | IRS | IRS | IRS | IRS | IRS | IRS | IRS | IRS | IRS |

According to Table 5, the results of the return of scale with both the DEA and FDH approaches are nearly identical, which distinguishes (1) Zakat Institutions RZ in 2015 with the DEA method having increasing (IRS) conditions but the FDH method having a constant method (CRS), and (2) YAKESMA's Zakat Institutions in 2015 with the DEA method having increasing conditions (IRS) but the FDH method having a constant method (CRS) (CRS). In this case, the increase in output exceeds the increase in input portion.

Total Potential Improvement (TPI)

According to Table 6, there is a total potential improvement in determining the inefficiency that Zakat Institutions in Indonesia must carry out using both the DEA and FDH methods, namely reducing salary expenses by -27.64 percent, operating costs by -27.96 percent, and socialisation expenses by -29.47 percent. Meanwhile, it is emphasised that the amount of funds must be increased to 3.57 percent on the output side. Zakat distribution must be increased by 11.36 percent.

| Table 6 Total Potential Improvement of Zakat Institutions in Indonesia | |||||

Method |

Input | Output | |||

| Salary Expense | Operational Expense | Socialization Expense | Zakat Fund | Zakat Distribution | |

| DEA | -27.64%, | -27.96% | -29,47% | 3.57% | 11.36%. |

| FDH | -27.64%, | -27.96% | -29,47% | 3.57% | 11.36%. |

Discussion/Analysis

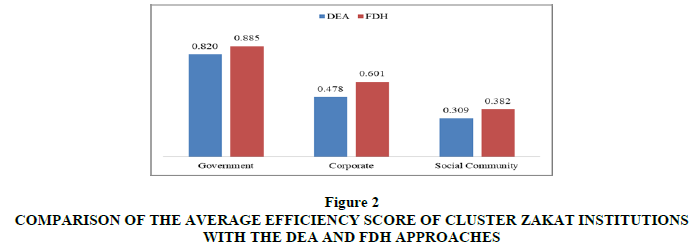

According to the results, Zakat Institutions have the same order efficiency (based on clusters) for both the DEA and FDH methods Figure 2.

Figure 2 Comparison of the Average Efficiency Score of Cluster Zakat Institutions with the Dea and Fdh Approaches

This analysis was based on 3 clusters of Zakat institutions using the DEA and the FDH. According to Boente & Lustosa, (2019), efficiency is typically driven by the social cultural system, as well as the cluster of Zakat institutions from government elements, which are mandated to be managed accountably (Nurlinda & Zuhirsyan, 2019). In this case, it is the government can ensure a proper fund management system (Aziz & Mohamad, 2016). In Indonesia, government clusters (BAZNAS) are most efficient since they are under government control (Schäublin, 2009), although not structurally, but collectively within society, as Indonesia is not an Islamic state. In the second position is the corporation cluster, where the corporation can produce efficiency as necessary to reinforce the corporation's performance (Rusydiana & Marlina, 2019a). Third, is a social community cluster, which is more difficult to find muzakki because social community clusters do not have permanent muzakki except for individual muzakki or zakat. Social communities at institutions are involved in working with certain institutions or communities that encourage employees or their members to pay zakat to the social communities at institutions. For this reason, more socialization costs are needed to invite Muslims to give zakat.

The inefficiency value appears based on the results of the efficiency score. The greatest inefficiency in Zakat Institutions is in socialization, so socialization expenses must be reduced by 29.47 percent. Socialization is more effective when technology is used to achieve larger goals. To make Zakat Institutions more efficient, human resources must be made more efficient by reducing salary expenses by 27.64 percent, as is done in public services (Baos et al., 2019). Overcoming the inefficiency issue has the potential to improve the zakat management system. The amil zakat professional association is one example of how capacity can be increased. However, the costs incurred by Zakat Institutions will have different interpretations and cannot be equated with profit institutions because these costs arose to benefit the people. Sharia's main goal can be summarized as making facilities available and removing obstacles for humans (Abdullah, 2018). There is almost no difference in return to scale between the two methods DEA and FDH, only that in 2015 Zakat Institutions RZ and YAKESMA DEA method has increased and the FDH method has stayed constant. It is generally found that return to scale efficiency values increase over time. Among those institutions that have improved efficiency are BMM, MTT, RZ, and NU.

If an institution is not yet effective, it can use the five Zakat institutions that are highly effective. The efficiency of Zakat Institutions must be seen not only in terms of cost, but also in terms of the success of the business process being carried out, as well as the achievement of the maqasid sharia element, namely the fulfilment of the needs for faith, physicality, reason / knowledge, family, and asset protection (Zakaria et al., 2019). According to Marangos, (2013), Islamic economics and spirituality are interrelated. Due to the business processes (collection, management, distribution, and utilization) of zakat, Zakat institutions are different from profit-making businesses. Among the ways zakat can be utilized is to support entrepreneurship in weak communities (Hoque et al., 2015), where people in low social classes have difficulty accessing financial institutions to support their entrepreneurs (Kaur & Kapuria, 2020). A large amount of money is necessary to use zakat through entrepreneurship because it is a long and complex process.

Conclusion

In this study, two methods are used to measure and analyze the efficiency of Zakat Institutions. They are the DEA and FDH methods. In this study, Zakat Institutions are grouped into 3 clusters, namely cluster government, cluster corporations, and cluster social communities. After testing both DEA and FDH methods, it was concluded that the average efficiency price is determined by the clusters of the government, the corporation, and the social community. Nevertheless, FDH analysis shows greater efficiency results than DEA for Zakat Institutions, meaning that the potential for efficiency is captured in more detail by FDH analysis than DEA.

It is important to note that there is a slight difference in the individual efficiency ratings. As shown in the cluster corporation chart, Zakat institutions have the highest efficiency, but the average efficiency is 1. The Zakat Institutions with a growing output include BAZNAS, DDR, IZI, Mizan, Al-Azhar, DD, GZ in each successive year. In order to test for the efficiency of Zakat institutions, there is an urgent need to contemplate their financial efficiency as well as their achievement of the maqasid sharia zakat. The efficiency and inefficiency values for this study differ from those obtained with DEA and FDH. Hence, Zakat Institutions may choose these 2 methods so that they are tailored to the wishes of each Zakat Institution, due to the fact that Indonesia does not have a set standard for calculating efficiency.

This study adds to the literature on zakat by demonstrating that zakat institutions controlled by the government have the highest efficiency score, compared to institutions managed by corporations of social communities. This means that the government-established zakat institutions have all of the resources, facilities, and technology they need to function effectively. Corporations and social community zakat institutions, on the other hand, may need to come up with significant investment capital to provide facilities and technologies in order to remain efficient. Due to data limitations, this study only uses data from 14 zakat institutions for five operational years, beginning in 2014 and ending in 2018. More data from zakat institutions must be used in future research, as well as a longer period of observation. Different input and output variables can be used in future research. For example, further research could include the number of employees as an input variable and the number of mustahik assisted by zakat institutions as an output variable.

Acknowledgement

The authors would like to express gratitude to the Direktorat Riset dan Pengabdian Masyarakat, Deputi Bidang Penguatan Riset dan Pengembangan Kementerian Riset dan Teknologi/ Badan Riset dan Inovasi Nasional for funding support. The authors would also like to express gratitude to representatives of the zakat institution for their active participation and contributions in completing this research.

References

- Abdu-Azeez Ibn Baaz, S. (2004). The Book of Zakaah (T. Vista (ed.). Islam House Publications.

- Abdullah, M. (2018). Waqf, Sustainable Development Goals (SDGs) and maqasid al-shariah. International Journal of Social Economics, 45(1), 158–172. https://doi.org/10.1108/IJSE-10-2016-0295

- Abdurrahman, A.F., & Herianingrum, S. (2019). Implementasi Pengelolaan Dana Zakat, Infak, Sedekah (ZIS) pada Rumah Singgah Pasien (RSP) Lembaga Amil Zakat (LAZ) Inisiatif Zakat Indonesia (IZI). Jurnal Eknomi Syariah Teori Dan Terapan, 6(9), 1909–1923.

- Al Haq, M.A., & Abd. Wahab, N.B. (2017). Effective Zakah Distribution: Highlighting Few Issues and Gaps in Kedah, Malaysia. Al-Iqtishad: Journal of Islamic Economics, 9(2), 259–288. https://doi.org/10.15408/aiq.v9i2.4002

- Alim, M.N., Basri, Y.Z., & Mariyanti, T. (2020). Financial Determinants In Zakat Institution Management Effecting Muzakky loyalty In Indonesia. International Journal of Business and Management Invetnion (IJBMI), 9(2), 35–47.

- Anuar, F.S., Alwi, N.M., & Ariffin, N.M. (2019). Financial Management Practices and Performance of Zakat Institutions in Malaysia. IPN Journal of Research and Practice in Public Sector Accounting and Management, 9(1), 1–26. http://jurnal.ipn.gov.my/1. Financial Management Practices and Performance of Zakat Institutions in Malaysia.pdf

- Anwar, A.Z., & Arifin, M. (2018). The Degree Of Understanding Of Zakat On Profession/Income In Jepara Regency. Jurnal Ilmiah Al-Syir’ah, 16(2), 138–147. https://doi.org/10.30984/jis.v16i2.665

- Asmalia, S., Kasri, R.A., & Ahsan, A. (2018). Exploring the Potential of Zakah for Supporting Realization of Sustainable Development Goals (SDGs) in Indonesia. International Journal of Zakat, 3(4), 51–69. https://doi.org/10.37706/ijaz.v3i4.106

- Aziz, M.N., & Mohamad, O.B. (2016). Islamic Social Business to Alleviate Poverty and Social Inequality. International Journal of Social Economics, 43(6), 1–27. http://dx.doi.org/10.1108/03068299110143436%

- Baños, J.F., Rodriguez-Alvarez, A., & Suarez-Cano, P. (2019). The efficiency of public employment services: a matching frontiers approach. Applied Economic Analysis, 27(81), 169–183. https://doi.org/10.1108/aea-06-2019-0006

- BAZNAS. (2021). Outlook Zakat Indonesia 2021. Pusat Kajian Strategis - Badan Amil Zakat Nasional (PUSKAS BAZNAS).

- Bin-Nashwan, S.A., Abdul-Jabbar, H., Aziz, S.A., & Viswanathan, K.K. (2020). A socio-economic model of Zakah compliance. International Journal of Sociology and Social Policy, 40(3–4), 304–320. https://doi.org/10.1108/IJSSP-11-2019-0240

- Boente, D.R., & Lustosa, P.R.B. (2019). Efficiency of electricity distribution companies. RAUSP Management Journal, 55(2), 177–193. https://doi.org/10.1108/RAUSP-11-2018-0123

- Di Carlo, E. (2020). The Real Entity Theory and the Primary Interest of the Firm: Equilibrium Theory, Stakeholder Theory and Common Good Theory. https://doi.org/https://doi.org/10.1007/978-3-030-31193-3_1

- Duwimustaroh, S., Astuti, R., & Lestari, E.R. (2016). Performance Analysis of Cashew (Anacardium Occidentale Linn) Supply Chain using Data Envelopment Analysis (DEA) at PT Supa Surya Niaga, Gedangan Sidoarjo, East Java. Industria: Jurnal Teknologi Dan Manajemen Agroindustri, 5(3), 169–180. https://doi.org/10.21776/ub.industria.2016.005.03.7

- Fukuyama, H., Hougaard, J.L., Sekitani, K., & Shi, J. (2015). Efficiency Measurement With a Non-Convex Free Disposal Hull Technology. Journal of the Operational Research Society, 67(1), 1–11. https://doi.org/10.1057/jors.2015.41

- Hoque, N., Khan, M.A., & Mohammad, K.D. (2015). Poverty Alleviation by Zakah in a Transitional Economy: a Small Business Entrepreneurial Framework. Journal of Global Entrepreneurship Research, 5(7). https://doi.org/10.1186/s40497-015-0025-8

- Hosen, M.N., Jie, F., Muhari, S., & Khairman, M. (2019). The Effect of Financial Ratios, Maqasid Sharia Index, and Index of Islamic Social Reporting to Profitability of Islamic Bank in Indonesia. Al-Iqtishad: Jurnal Ilmu Ekonomi Syariah, 11(2), 201–222. https://doi.org/10.15408/aiq.v11i2.11588

- HT, H.A., & Rama, A. (2018). Indeks Kinerja Perbankan Syariah di Asia Tenggara Berdasarkan Konsep Maqâshid al-Syarî`ah. Madania: Jurnal Kajian Keislaman, 22(1), 33. https://doi.org/10.29300/madania.v22i1.782

- Kao, C., Chen, L.H., Wang, T.Y., Kuo, S., & Horng, S.D. (1995). Productivity Improvement: Efficiency Approach vs Effectiveness Approach. Omega, Int. J. Mgmt Sci, 23(2), 197–204. https://doi.org/10.1016/0305-0483(94)00058-I

- Karadogan, S. (2015). Islamic Economics On Definition and Methodology (Sercan Karadogan (ed.)). ASKON.

- Kaur, S., & Kapuria, C. (2020). Determinants of Financial Inclusion in Rural India: does Gender Matter? International Journal of Social Economics, 47(6), 747–767. https://doi.org/10.1108/IJSE-07-2019-0439

- Khanjani Shiraz, R., Fukuyama, H., Tavana, M., & Di Caprio, D. (2016). An integrated data envelopment analysis and free disposal hull framework for cost-efficiency measurement using rough sets. Applied Soft Computing Journal, 46, 204–219. https://doi.org/10.1016/j.asoc.2016.04.043

- Kim, H., & Lee, C.W. (2018). Efficiency analysis for nonprofit organizations using DEA. Asia Pacific Journal of Innovation and Entrepreneurship, 12(2), 165–180. https://doi.org/10.1108/apjie-04-2018-0018

- Kusuma, K.A., & Ryandono, M.N.H. (2016). Zakah index : Islamic economics’ Welfare Measurement. Indonesian Journal of Islam and Muslim Societies, 6(2), 273–301. https://doi.org/10.18326/ijims.v6i2.273-301

- Lubis, M., & Azizah, A. H. (2018). Towards achieving the efficiency in zakat management system: Interaction design for optimization in indonesia. Communications in Computer and Information Science, 886. https://doi.org/10.1007/978-981-13-1628-9_26

- Marangos, J. (2013). Introduction to the Islamic Economies. In Consistency and Viability of Islamic Economic Systems and the Transition Process (pp. 3–10). Palgrave Macmillan. https://doi.org/https://doi.org/10.1057/9781137327260_1

- Maria, A., Cabral, R., & Ramos, F.S. (2018). Efficiency Container Ports in Brazil : A DEA and FDH Approach. Central European Review of Economics and Management, 2(1), 43–64.

- Nourani, M., Devadason, E.S., & Chandran, V.G.R. (2018). Measuring Technical Efficiency of Insurance Companies using Dynamic Network DEA: An Intermediation Approach. Technological and Economic Development of Economy, 24(5), 1909–1940. https://doi.org/10.3846/20294913.2017.1303649

- Nurlinda, N., & Zuhirsyan, M. (2019). Accountability For Zakat, Infak/Sedeqah Management. ICASI, Juli 18-19, 1–5. https://doi.org/10.4108/eai.18-7-2019.2288632

- Rahim, R.A. (2015). Ranking of malaysian commercial banks: Super-efficiency data envelopment analysis (DEA) approach. Asian Academy of Management Journal of Accounting and Finance, 11(1), 123–143.

- Retnowati, D. (2018). The Performance and Efficiency of Zakat Institutions in Jambi. International Journal of Zakat, 3(2), 29–40. https://doi.org/10.37706/ijaz.v3i2.76

- Rusydiana, A.S., & Marlina, L. (2019a). Financial and Social Efficiency on Indonesian Islamic Banks: a Non Parametric Approach. Journal of Islamic Monetary Economics and Finance, 5(3), 579–602. https://doi.org/10.21098/jimf.v5i3.1154

- Samad, A., & Glenn, L.M. (2010). Development of Zakah and Zakah Coverage in Monotheistic Faiths. International Journal of Social Economics, 37(4), 302–315. https://doi.org/10.1108/03068291011025264

- Schäublin, E. (2009). Role and Governance of Islamic Charitable Institutions: The West Bank Zakat Committees (1977-2009) in the Local Context.

- Sherman, H.D., & Zhu, J. (2006). Service productivity management: Improving service performance using data envelopment analysis (DEA). In Service Productivity Management: Improving Service Performance using Data Envelopment Analysis (DEA). https://doi.org/10.1007/0-387-33231-6

- Soualhi, Y. (2015). Application of Shari ‘ ah contracts in contemporary Islamic finance : a Maqa?id perspective. Intellectual Discourse, 23, 333–354.

- Tahir, I.N., & Oziev, G. (2018). Zakat Administration: An Analysis of the Past Approach. International Journal of Economics, Management and Finance, 26(1), 57–90.

- Tamatam, R., Dutta, P., Dutta, G., & Lessmann, S. (2019). Efficiency analysis of Indian banking industry over the period 2008–2017 using data envelopment analysis. Benchmarking, 26(8), 2417–2442. https://doi.org/10.1108/BIJ-12-2018-0422

- Wahab, Norazlina Abd, & Rahman, A.R.A. (2013). Determinants of efficiency of zakat institutions in Malaysia: A non-parametric approach. Asian Journal of Business and Accounting, 6(2), 33–64.

- Zainal, H., Basarud-din, S.K., Yusuf, R.M., & Omar, S.N.Z. (2016). Managing Zakat Fund in Malaysia. Journal of Global Business and Social Entrepreneurship, 1(2), 46–53. https://doi.org/10.3896/IBRA.1.48.1.05

- Zakaria, M. (2014). The influence of Human Needs in the Perspective of Maqasid al-Syari’ah on Zakat distribution Effectiveness. Asian Social Science, 10(3), 165–173. https://doi.org/10.5539/ass.v10n3p165

- Zakaria, M., Yusoff, M.S.A., & Sanusi, Z. (2019). Governance and Efficiency of Zakah Distributions based on the Dire Necessities of Maqasid Al-Syariah. International Journal of Financial Research, 10(5), 191–203. https://doi.org/10.5430/ijfr.v10n5p191

- Zakariyah, L. (2015). Harmonising Legality with Morality in Islamic Banking and Finance : A quest for Maqa?id al- Shari ‘ ah Paradigm. Intellectual Discourse, 23, 355–376.