Research Article: 2021 Vol: 20 Issue: 3

Effects of Depositors Funds on the Performance and Growth of Financial Institution: A Case Study of BancABC

Wadesango Newman, University of Limpopo

Faith A Nkhambala, Midlands State University

Stephen Malatji, Tshwane University of Technology

Abstract

A background of continuously rising trend in the bank’s deposits and profits has been a major cause for concern as questions have been raised as to whether or not the two variables have a relationship. The purpose of the study was therefore to establish the effects of depositor’s funds on the performance and growth of financial institution a sample size of twenty-eight employees from BancABC was used as well as two managers from the bank. The research used primary sources of collecting data. To choose the sampling units stratified-random sampling method was used and data were collected using questionnaires and structured interviews. Data were processed by use of descriptive statistics after editing have been done. The computer software SPSS latest version was used as a device to accommodate analysis. The findings indicated that there is a positive significant relationship between deposits and performance of the bank. The findings also showed that there are variables that affect the deposits and in turn profitability, it showed that a positive change in deposits interest rate affects the level of deposits received and later on the profitability of the bank. Based on this, the study recommends the bank to develop strategies towards marketing and mobilisation of more deposits as they are indispensable tools towards the profitability of the bank.

Keywords

Depositor, Funds, Performance, Growth, Financial Institution, BANCABC.

Introduction and Literature Review

The Central Bank of Zimbabwe (RBZ) and institutions that takes deposits such as building societies, commercial banks, microfinance institutions, cooperatives is the financial sector in Zimbabwe. As of February 2020, there are 19 licensed banks, commercial banks are 13, 1 saving bank and 5 building societies. The banking sector in Zimbabwe, from the year 2002 to 2009 suffered so much that the political challenges and also economic challenges almost led to the collapse of the industry completely, and according to the independence, this caused the economy to shrink significantly. During the period the local currency which is the Zimbabwean dollar was no longer of value. People were resorting not to make transactions in Zimbabwean dollar and this had an effect in the financial sector as deposits reduced.

The multi-currency was introduced early 2009 but at first the changes to the economy were not significant. Banks took years to recover from the damages they faced. People no longer had trust in them. According to Donovan (2012) instability and people losing sureness in the banking system has led people to fail and underutilize the services of the banking sector. However, the situation did not remain the same, the economy started to slowly recover and also the deposits base of the banks increased since the customers began to put their funds in banks again. The research by Ankrah (2012) indicated that if people consider a bank as well capitalized they feel confident enough to bank with the bank as they will be able to have their monies with no restrictions and that’s how the confidence of people was regained.

Recent research (research market, 2020) indicated that the new multicurrency regime, credited for stabilizing the economy, has made banks face liquidity challenges that have decreased their lending capacity. Liquidity in the banking sector has been at the ebb since dollarization of the economy in 2009. Lack of liquidity hampers the capacity of banking institutions to perform their functions fully according to Mankiw (2010). The central bank provides an appropriate case study where they are unable to fulfil the lender of last resort function to banking institutions, a function that is critical in alleviating short term liquidity challenges in the sector. Therefore, liquidity can be viewed as a driving force to the performance and sustenance of the banking industry in Zimbabwe. According to Manab et al. (2010), profitability increased with deposit rich institutions posting good profits while other institutions fought to breakeven. The competition for deposits has been intense with most clients opting to bank with those institutions that they perceived to be strong (flight to quality).

The research’s aim was to investigate whether the depositors’ funds have effects on the profitability of the bank. Garo (2015) mentioned that if there are no deposits banks cannot survive. Naceur & Goaied (2001) also provided evidence on the fact that if a bank manages to have more deposits, it usually performs better. Once there are more deposits mobilised, they should be invested again in the public in different ways (Aslam, 2018). However, according to Haron et al. (2006), the banks are only able to provide loans for their customers if they are able to attract more deposits. The circulation of funds through mobilization of deposits and loan disbursement affects growth and how banks perform (Tuyishime et al., 2015). Poor performance, however, of bank leads to banking failure, crises and this affects the economic growth negatively (Alshebam et al., 2020). There are factors that may limit the operations of the banks and the research is focused to examine performance and growth of commercial banks in relation to bank deposits. The research by Dancan (2012) showed that a review of a number of global studies exposes that there seem to be different opinions, globally, on the correlation that the bank’s deposits have with the bank’s performance.

Results

Variables Affecting the Depositors’ Funds

The table below highlights the responses of the respondents from the returned questionnaires.

Statistics

Findings in Table 1 in general, indicate that these factors affect the deposits and this is supported by Teshome (2011); Haron et al. (2006) and Mushtaq & Siddiqui (2017) as well. Of the 28 respondents 60.7%, 42.9%, 85.7%, 78.5%, 75%, and 78.5% agreed to that technology, GDP, interest rates, deposit rates, quality of services and inflation respectively have impact on the depositors’ funds. While 14.3%, 35.7%, 7.1%, 14.3%, 17.9% and 14.3% were uncertain, with 25%, 21.4%, 7.2%, 7.2%, 7.2% and 7.2% disagreeing.

| Table 1 Variables Affecting the Depositors’ Funds | |||||||

| Technology | GDP | Interest Rates | Deposit Rates | Quality Of Services | Inflation | ||

| N | Valid | 28 | 28 | 28 | 28 | 28 | 28 |

| Missing | 0 | 0 | 0 | 0 | 0 | 0 | |

| Mean | 3.86 | 3.29 | 4.11 | 4.39 | 4.11 | 4.25 | |

| Median | 5.00 | 3.00 | 4.00 | 5.00 | 4.00 | 5.00 | |

| Mode | 5 | 3 | 4 | 5 | 5 | 5 | |

| Std. Deviation | 1.380 | 1.213 | .956 | 1.100 | 1.066 | 1.076 | |

| Minimum | 1 | 1 | 1 | 1 | 1 | 1 | |

| Maximum | 5 | 5 | 5 | 5 | 5 | 5 | |

| Percentiles | 25 | 2.25 | 3.00 | 4.00 | 4.00 | 3.25 | 4.00 |

| 50 | 5.00 | 3.00 | 4.00 | 5.00 | 4.00 | 5.00 | |

| 75 | 5.00 | 4.00 | 5.00 | 5.00 | 5.00 | 5.00 | |

The likert scale present that strongly agrees is the highest with a score of 5 and the lowest is strongly disagree with a score of 1. Therefore, taking this into consideration, a mean score below 2.5 suggests that the variable in concern is insignificant and above significant. As evident in Table 1 all of the variables scored above 2.5 cut-off point, therefore they affect the deposits significantly. The highest mean score is deposit rates with 4.39 and the lowest is GDP with 3.29.

The Relationship between Depositors’ Funds and Performance and Growth in Banks

Well Capitalized Banks Attract Deposits More Than Poorly Capitalized Banks

13 respondents out of 28 representing 46% strongly agreed that if banks are well capitalized, they are able to attract more deposits than those poorly capitalized banks. 6 respondents agreed also to this with a percentage of 21. 2 respondents out of the 28 were uncertain with a percentage of 7. Out of the 28 respondents 4 disagreed as well representing 14% and 3 with a representation of 11% strongly disagreed. Findings presented in the Table 2 above show a mode of 4 meaning many participants agreed and also a mean of 3.54 is above 2.5. A conclusion that banks with well capitalized banks attract deposits more than poorly capitalized banks, a total of 67% have supported this and only 25% were against this. Grigorian & Manole (2006) agree to this also, they showed that the banks that are at the top in the ability to attract deposits than banks with poor capital base.

| Table 2 Relationship Between the Depositors’ Funds and the Deposits | ||||

| How the bank performs relate to the bank’s ability to attract deposits from individuals | growth in deposits affects profitability significantly | Well capitalized banks attract deposits more than poorly capitalized banks | ||

| N | Valid | 28 | 28 | 28 |

| Missing | 0 | 0 | 0 | |

| Mean | 3.82 | 4.00 | 3.54 | |

| Median | 4.00 | 4.00 | 4.00 | |

| Mode | 5 | 4 | 4 | |

| Std. Deviation | 1.156 | 1.018 | 1.290 | |

| Minimum | 1 | 1 | 1 | |

| Maximum | 5 | 5 | 5 | |

| Percentiles | 25 | 3.00 | 3.25 | 2.25 |

| 50 | 4.00 | 4.00 | 4.00 | |

| 75 | 5.00 | 5.00 | 4.00 | |

Growth in Deposits Affects Profitability Significantly

The questionnaires showed that 10 respondents with a percentage of 36 strongly agreed and 11 of the 28 respondents with a weight of 39% agreed to that increase in deposits affects profitability significantly. 5 respondents representing 18% were uncertain. Whilst 1 respondent strongly disagreed and it is representing 4% of the respondents and also 1 respondent representing 4% disagreed that growth in deposits affects profitability significantly. The Table 2 above is showing a mode of 4 meaning that the majority agreed to that increase in the bank’s deposits strongly affects the profits of the bank. This is also in line with the study carried out by Ladime et al. (2013), which reported that those banks that make great profits have ever increasing deposits and also loans. These results seem to suggest that the profits of the banks depend on the deposits they collect; therefore the rise in the deposits will result in the rise in profits as well. In total 75% agreed to this and only 7% were against the fact.

How the Bank Performs Relate to the Bank’s Ability to Attract Deposits from Individuals

Table 2 highlights responses statistically and the results are showing a mean of 3.82 above 2.5 cut-off showing that individual deposits improve the performance of the banks. The mode of 5 showed that most respondents strongly agreed. This is in harmony with Tuyishime et al. (2015), who explain the importance of deposit and clearly reviewed that they are the funds that the banks use for lending out loans and generating revenue. To conclude, the study is suggesting that the way the bank performs is related to the bank’s ability to attract deposits from individuals.

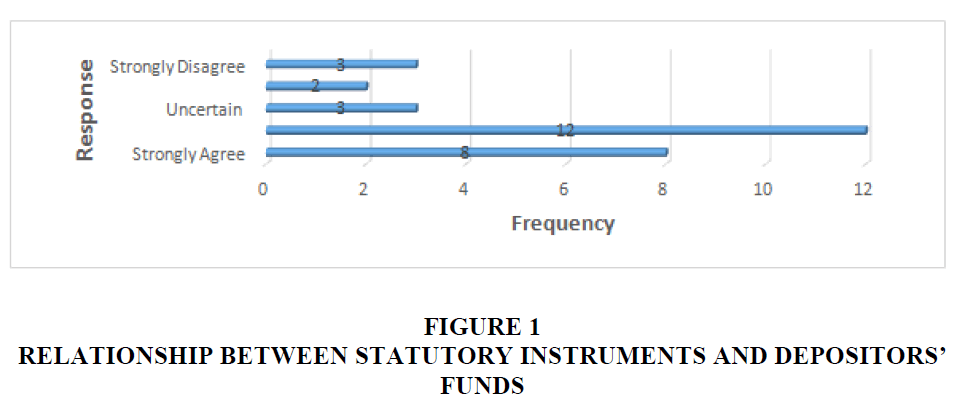

The Relationship between Statutory Instruments and Depositors’ Funds

The findings that are presented as per Figure 1 show that the majority strongly agreed and agreed as well. The statistics above bring up a suggestion that there exists a relationship between statutory instruments and depositors’ funds; this was further reinforced by the interviewees who indicated that the statutory instruments are crucial for they affect decision making of the banking in terms of rates and other crucial aspects of the bank. The results seem to agree with the study carried out by Nguyen et al. (2017), which reviewed that the performance of the bank is related to the monetary policies.

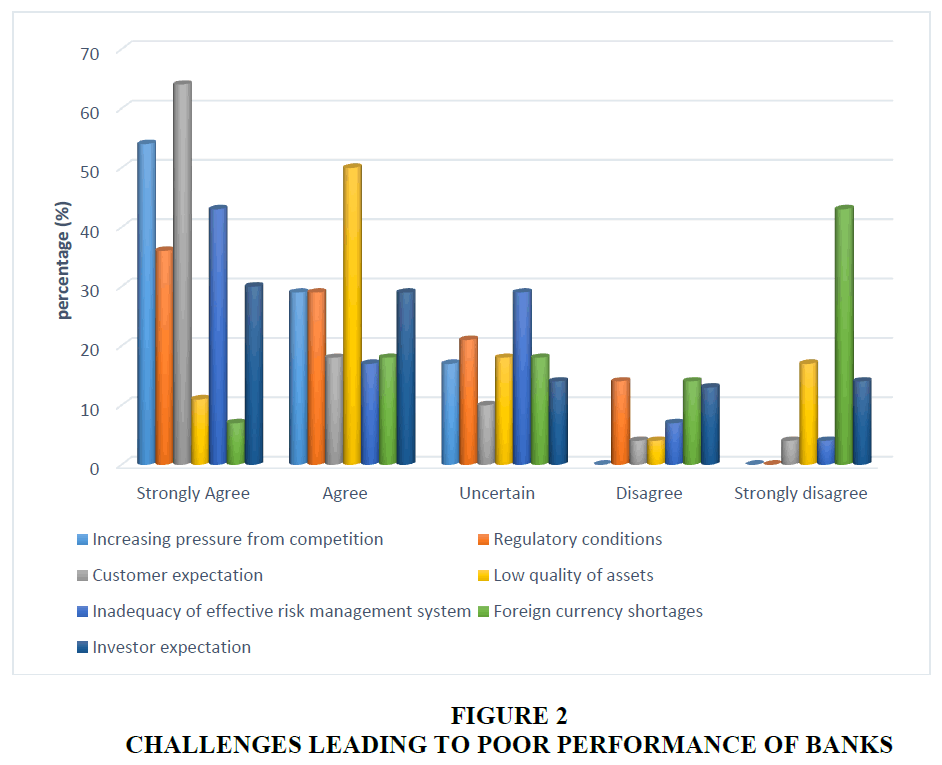

Challenges Leading to Banks Not Performing Well

The study findings below indicate that the challenges stated in questionnaires are affecting the bank significantly. The majority of the respondents concurred to this as evidenced by the responses shown in Figure 2 below with 62% indicating that they agree and 18% are uncertain and 20% disagree. For this reason, these factors are a cause of concern and steps should be taken to curb the problems caused by the factors. We can therefore conclude that the factors stated in the figure below are contributing to the problems that the banks are facing.

Strategies Effectively Address the Problem of Poor Performance

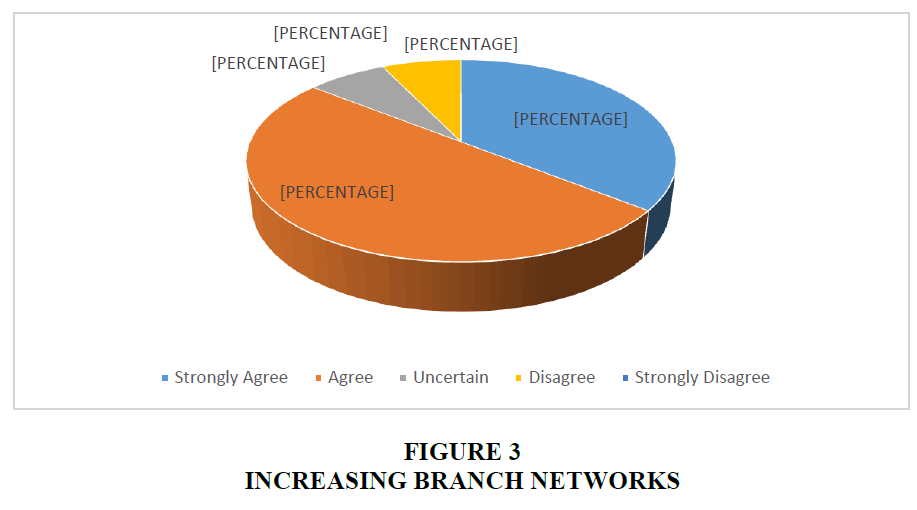

Increase branch networks

The Figure 3 below shows that 36% strongly agreed that increasing branch networks of the bank improve the bank’s performance whilst 50% respondents agreed. 7% were uncertain and 7% disagreed. None of the respondents strongly disagreed that increasing branch networks of the bank effectively address the problem of poor performance. The results are showing that increasing branch networks of the bank improve the bank’s performance. These findings go hand in hand with the findings of Bhattacherjee (2012), if a bank has more branches it will be able to mobilise more deposits.

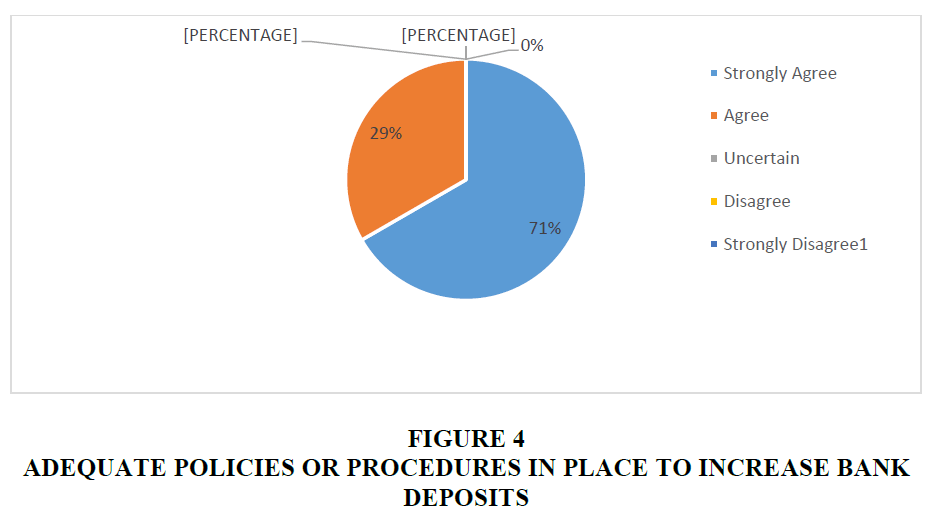

The Banks Should Have Appropriate Policies Prepared to Increase Bank Deposits

From the 28 participants 20 thus 71% strongly agreed increase bank deposits whilst 8 respondents representing 29% also agreed that the bank should have adequate policies or procedures in place to increase bank deposits. None of the participants disagreed or were uncertain; this gives assurance to the fact that for banks to improve their performance they have to take this as one of their strategies. 100% agreed and none disagreed, therefore the suggestion is that banks should have appropriate policies in place to increase bank deposits (Figure 4).

Introduce New Products and Services

The results show (Table 3) that 54% strongly agreed, this is 15 respondents. A total of 5 BancABC employees also agreed, giving 18%. 21 respondents were uncertain that the new products and services help in improving the performance of the bank. 3.5% strongly disagreed and also 3.5% disagreed. The author discovered that those banks with new ideas, banking services that are excellent attract deposits. A similar study was also conducted by Iswary (2015) and the results are consistent with this research suggestion.

| Table 3 Introducing New Products and Services | |||||

| Frequency | Percent | Valid Percent | Cumulative Percent | ||

| Valid | Strongly Disagree | 1 | 3.6 | 3.6 | 3.6 |

| Disagree | 1 | 3.6 | 3.6 | 7.1 | |

| Uncertain | 6 | 21.4 | 21.4 | 28.6 | |

| Agree | 5 | 17.9 | 17.9 | 46.4 | |

| Strongly Agree | 15 | 53.6 | 53.6 | 100.0 | |

| Total | 28 | 100.0 | 100.0 | ||

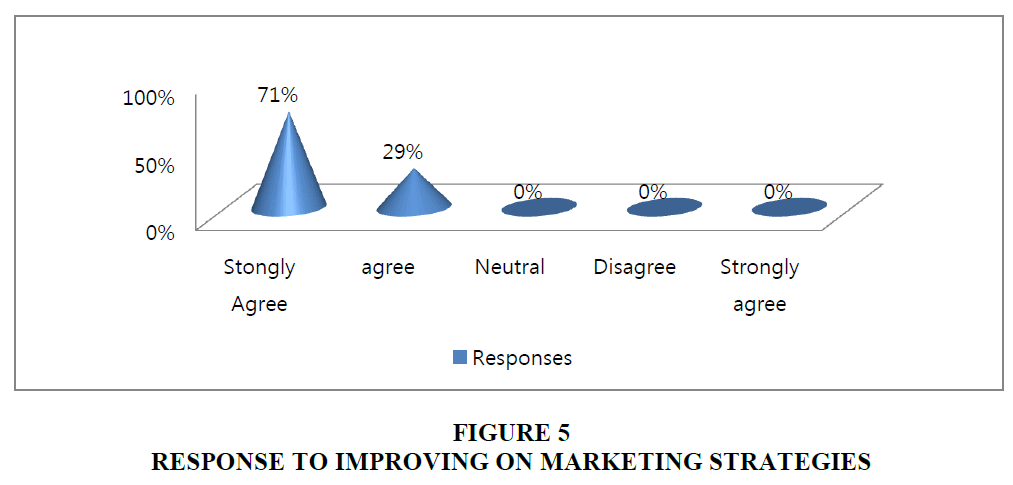

Improve on Marketing Strategies

The Figure 5 below shows results to whether improving on marketing strategies would mean improved performance. None were uncertain on whether the improvement on marketing strategies would improve performance at BancABC. There was a 100% agreement as clearly presented below, giving a conclusion that improvement on marketing strategies at BancABC is adequate in improving performance. This is in harmony with the findings of the author suggested that banks should aim in providing awareness of their services to the people out there, the author noted that most people are not aware of what the bank offers in Islamic banks.

The Bank Should Ensure Security

The findings in Table 4 below indicate that the bank should consider security as a strategy, customers need the assurance that their funds are safe with the bank they bank with. The results are evidenced by 57% of the respondents who agreed, with 18% being uncertain and 25% disagreeing. The findings concur with the work which was done by Samuel (2015) which indicated that a bank is able to attract more depositors’ funds if it has better security for the savings of their customers.

| Table 4 The Bank Should Ensure Security | |||||

| Frequency | Percent | Valid Percent | Cumulative Percent | ||

| Valid | Strongly Disagree | 6 | 21.4 | 21.4 | 21.4 |

| Disagree | 1 | 3.6 | 3.6 | 25.0 | |

| Uncertain | 5 | 17.9 | 17.9 | 42.9 | |

| Agree | 10 | 35.7 | 35.7 | 78.6 | |

| Strongly Agree | 6 | 21.4 | 21.4 | 100.0 | |

| Total | 28 | 100.0 | 100.0 | ||

Conclusion

From this research the conclusion is that there is a strong relationship between depositors’ funds and the performance and growth of the financial institutions, having BancABC as the case study. For banks to survive and to grow they need funds and the revenue generation and loan disbursement can only be made possible if the banks have enough deposits. Therefore, the deposits matters. One of the strategies that can be used to mobilise deposits is strong marketing strategies. If the deposit interest rates increase, the deposits will increase as well. Improved technology helps the banks to come up with innovative services and the services gives rise to deposits. BancABC adopted agency banking, this made financial services of the bank accessible to the unbanked people and they gained more savings.

References

Ankrah, E. (2012). Technology and service quality in the banking industry in Ghana. Information and knowledge management.

Aslam, A.L. (2018). Interest rate dynamics on savings: Evidence from Sri Lanka. World Scientific News, 107, 224-232.

Bhattacherjee, A. (2012). Social science research: Principles, methods, and practices.

Dancan, M.O. (2012). The effect of level of deposits on financial performance of commercial banks in Kenya. Nairobi, Kenya.

Donovan, K. (2012). Mobile Money more Freedom? The Impact of M-PESA's Network Power on Development as Freedom.

Garo, G. (2015). Determinants of deposit mobilization and related costs of commercial banks in Ethiopia.

Grigorian, D.A., & Manole, V. (2006). Determinants of commercial bank performance in transition: An application of data envelopment analysis. Comparative Economic Studies, 48(3), 497-522.

Haron, S., Azmi, W.N.W., & Shafie, S. (2006). Deposit determinants of commercial banks in Malaysia. Finance India, 20(2), 531.

Iswary, L.I. (2015). Preservation of Japanese corporate founder collections. Asian Journal of Library and Information Science, 1(1), 1-7.

Ladime, J., Sarpong-Kumankoma, E., & Osei, K.A. (2013). Determinants of bank lending behaviour in Ghana. Journal of Economics and Sustainable Development, 4(17), 42-47.

Manab, N.A., Kassim, I., & Hussin, M.R. (2010). Enterprise-wide risk management (EWRM) practices: Between corporate governance compliance and value. International Review of Business Research Papers, 6(2), 239-252.

Mankiw, G. (2010). What’s sustainable about this budget?. The New York Times.

Mushtaq, S., & Siddiqui, D. A. (2017). Effect of interest rate on bank deposits: Evidences from Islamic and non-Islamic economies. Future Business Journal, 3(1), 1-8.

Naceur, S.B., & Goaied, M. (2001). The determinants of the Tunisian deposit banks' performance. Applied Financial Economics, 11(3), 317-319.

Nguyen, T.N., Vu, N.H., & Le, H.T. (2017). Impacts of monetary policy on commercial banks’ profits: The case of Vietnam. Asian Social Science, 13(8), 32-40.

Teshome, F. (2011). Determinants of commercial banks deposit in Ethiopia.

Tuyishime, R., Memba, F., & Mbera, Z. (2015). The effects of deposits mobilization on financial performance in commercial banks in Rwanda. A case of equity bank Rwanda limited. International Journal of Small Business and Entrepreneurship Research, 3(6), 44-71.