Research Article: 2018 Vol: 22 Issue: 4

Effectiveness of Risk Management Systems on Financial Performance in a Public Setting

Wadesango Newman, University of Limpopo, RSA

Mhaka Charity, Midlands State University, Zimbabwe

Shava Faith, Midlands State University, Zimbabwe

Abstract

The purpose of this study was to evaluate the effectiveness of risk management systems on financial performance in a Public Sector Setting. The study was triggered by the financial turmoil which had been experienced in a developing country by some institutions from 2014-2016 as a result of fraud risks. This situation also resulted in poor service delivery. A quantitative research approach was employed in the study. Target population constituted 65 participants and a sample size of 50 respondents drawn from the ministry’s departments in Harare region. Data was collected using a questionnaire. Analysis of data was done using percentages and mode and results were presented in tables, graphs and charts. The researchers established that effectiveness of risk management (RM) system in the ministry was negatively affected by major challenges such as lack of trained personnel that resulted in knowledge gap to adopt a formal system, non-existence of audit committee and lack of management commitment and coordination. Engaging the Auditor General to act as a RM consultant and provide training services may abridge the existing knowledge gap.

Keywords

Risk Management, Financial Performance, Public Sector, Auditor General, Audit.

Introduction

Risk management is defined as a process by which an organization identifies and analyses threats, examines alternatives and mitigate the threats before they obstruct activities of the organization for an improved financial performance Stanton (2012). This study focused on establishing the effectiveness of risk management systems on financial performance in a Public Sector Setting of a developing country. Notable scholars (Kinyua et al., 2015; OECD, 2014; COSO, 2013; Kuat, 2014, 2013; Tunji, 2013; Wadesango et al., 2016) asserted that there is no significant relationship between risk management system and financial performance of an entity. The same scholars contented through management and stakeholders’ views that risk based audit and internal control system covers all part of risk management system, hence influence financial performance. However, their argument was condensed by remarkable researchers (Boahene et al., 2012; Husein & Karl, 2013; Oluwagbemiga, 2016; Zubairi & Ahson, 2015) who affirmed that integrating risk management systems result in a high and positive significant effect on financial performance of private listed companies. Considerable literature reviews (Al-Matari et al., 2012) on all the arguments revealed that a significant gap was not covered by researchers as centred on private entities of developed countries that are listed on and governed by financial securities such as the Stock Exchange. This study therefore, sought to bridge the gap by establishing the effectiveness of risk management systems on financial performance in a public sector setting in developing countries.

Challenges in Implementing Proper Risk Management Processes

Implementation of risk management processes among the public sector organisations in developing countries is still showing no improvement (Chapman, 2012; Wadesango et al., 2017). Egmond (2012) argued that challenges in implementing risk management systems affects performance and overall objectivity of the organisation. A number of literature reviews evaluated challenges that affect the implementation of risk management processes within the background of developed countries, therefore this study critically reviewed the challenges in context of developing countries.

Lack of Professional Skills and Knowledge

A research carried by Arashpour et al. (2012) reveals that management in public sector setting lacks the fundamental skills and professional knowledge in implementing proper risk management therefore implementation of risk management becomes unsuccessful. Perera et al. (2014) acknowledged lack of knowledge and necessary skills in management as critical challenges in implementing effective risk management processes. Absence of skilled personnel in different levels of organisational hierarchy has become a great concern in implementing Risk Management Systems (RMS) in most of the developing countries (Ghoddousi et al., 2015; Wadesango et al., 2016). In their review of literature, Ofori & Toor (2012) asserted that the cause of majority problem in successful RMS implementation can be identified as lack of knowledge and essential skills in developing countries. In support of this, Goh & Abdul-Rahman (2013) observed that lack of knowledge can be linked to cost; hence knowledge is a reward of cost. Kululanga (2012) noted that the gap of effective RMS implementation in developing is difficult to bridge because of lack of skills and knowledge. He added that there is no link between university academics and main practical problem solving pertaining risk management processes implication.

Some authors, Chileshe & Yirenkyi-Fianko (2012) argued that it is not knowledge and skills which are main barriers but the major challenges to implementation of RMS in developing countries is lack of adequate information, awareness, experience and lack of coordination between personnel involved in implementation phases. In another study, Chileshe & Kikwasi (2014) agreed that challenges in RMS implementation involves; lack of sufficient appropriate information, lack of coordination between management and time constraints. However, United Nations (2015) identified that it is monetary and human capacity in undertaking roles in implementation of RMS in developing countries. COSO (2014) also disagreed on the issue of lack of knowledge and skills but advocated for knowledge sharing as a critical challenge where available knowledge is not being shared or distributed among all levels of authority in an organisation. According to Silva et al. (2013), it is time and costs that affect proper implementation of RMS in developing countries. Most governments’ fiscal policy is weak in financing risk management processes such that first priority is given to other budgets like education scholarships, added Silva et al. (2013). Zhao et al. (2014) also argued that commitments as well as support from leadership of the board and senior personnel are counted as critical barriers to RMS implementation.

Todayon et al. (2012) were not clear in identifying the challenges in implementing Risk Management processes; they indicated that RMS is not usually implemented in developing countries due to various challenges. Bowers & Khorakian (2014) supported this by reiterating the same findings identified by Todayon et al. (2012). However, Silva et al. (2013) were neutral and attested that developing countries are not interested in risk management implication in order to mitigating risks than in developed countries. Bowers & Khorakian (2014) in another review established that RM should be applied in different simple ways of the early innovation phase with additional significant quantitative methods being incorporated for later phases.

Lack of Formal Risk Management Systems (RMS)

Choudhry & Iqbal (2013) collectively attested that non-existence of both formal risk management systems and mechanisms for joint RM by stakeholders were strong challenges and most serious challenges faced by most organisations in developing countries. They also contented that without formal RMS, implementation can be dependent to expertise and general knowledge of either employees or external experts, therefore the system becomes ineffective. In another study by Posch/Nguyen & Tristan (2012), it was proved that lack of formal RMS posed a great challenge of misunderstanding of techniques related to risk processes such as identification, assessment, evaluation, treating and monitoring of risks. Kerstin et al. (2014) added that where there is no formal risk management system they are no RM team for collection of information pertaining to all types of risks and previous audit work is difficulty to review.

A contradiction study by Bowers & Khorakian (2014) suggested that formalising risk management is not necessary but RMS should be determined by good reasoning capacity by those charged with governance. Bowers & Khorakian (2014) and Wadesango et al. (2017) argued against formalising RMS by bringing his thought that compliance to regulations and policies is difficult. He added that many companies experience challenges in complying with mandatory requirements of specific laws. Another reviewer, OCEG (2012) observed that it is not a matter of formal system, instead integrating principles are lacking for effective RM implementation. Corruption Watch (2012) argued that hindrance in implementing RMS is due to lack of commitment by top management and overall support of the Public Sector management. Corruption Watch insisted that those on top position tend to relax regarding RMS implementation. “Had there been effective commitment and support of management, appropriate review and remedial measures would have been undertaken to ensure all that all financial risks are identified,” Corruption Watch (2012).

Todayon et al. (2012) in their study could not either support or contradict the formalisation of RMS as a challenge. They observed that risk management is always not implemented in developing countries due to ignorance. Bowers & Khorakian (2014) supported Todayon et al. (2012) by adding that due to lack of knowledge and proficiency, implementing RM becomes a challenge. Kuluanga (2012) indicated that the majority of organizations in developing countries are still small hence lacking strategic planning and direction as well as capacity growth. Furthermore, understanding of the reasoning for particular control measures, official views and information technology is not fully used therefore the challenges are inevitable. According to Institute of Internal Auditors (2013), the study which they conducted on the same issue concluded that most of public service setting failed to implement RMS due to no effective mechanism.

Reports of Auditor General (2014-2016) highlighted that due to non–existence of audit committee in the MHTESTD, risk management system cannot be a formal system or full function. Kuluanga (2012) posited that all the mentioned challenges were researched from the companies registered under the Kenya Stock Exchange.

Unavailability of Risk Management Consultancy

Chileshe & Fianko (2012) agreed that absence of specialist risk management consultants in developing countries is a great challenge to successful RM implementation. In addition they also suggested that non- coordination between management is a cause to unavailability of RM consultancy. In another study by Chileshe & Kikwasi (2014), absence of risk management specialist is a barrier to RM implementation. Caldwell (2016) mentioned lack of guidance in implementation is a critical challenge. Cater & Chinyio (2012) identified that management consultancy as a major barrier which delays implementation in most companies. They also added that organisations end up using incompetency personnel and this makes adoption of RMS unsuccessful.

According to Hwang et al. (2013), the challenges are poor budgeting, shortage of manpower and technological equipment as well as untrained personnel. They echoed that hiring consultants is not a solution but training personnel is an ideal. Varghese (2012) argued that challenges are costs of implementation and time constraints that hinder implementation. Another study by Paape & Speckle (2012), showed that reliable information and time are barrier for RMS. Van Egmond (2012) established that collaboration between management has a negative impact in implementation. Ofori (2012) noted that risk management processes are undermined by lack of management skills in developing countries.

In another study, Varghese (2012) could not be clear on specific challenges. He suggested that some projects in developing countries become incomplete due to barriers in implementing RMS. Ofori (2012) also added that challenges in adopting RM processes are due to inherent weakness. Mahamid (2012) confirmed that all challenges reviewed can be homogenous in affecting the RM process.

Review of audit reports by a Parliamentary Accounting Committee (PAC) (2015) revealed that failure to implement a sound risk management by MHTESTD as required by the PFMA Section 80 was a mere indicator of challenges in fully adopting the RMS. However, the challenges indicated by Chileshe & Kikwasi (2014), were drawn from reviews of financial institutions that are monitored under the stock exchange of Kenya.

Significance of the Study

The research was done with the intention of enhancing knowledge on how best the government can address improve its financial risks management for better service delivery. Findings from the study assist MHTESTD institutions to improve on the financial performance through formulating of the foundation of better policies that can be maneuvered to manage risk in Public Finance Management (PFM) for better service delivery.

The study may assist policy makers with knowledge of effects of integrated risk management systems in the public sector and proper guidance for implementing better systems.

Research Methodology

The study adopted a quantitative research approach. Rovai et al. (2014) described quantitative research approach as a deductive and reasonable method that has a reality independent objective of observations. Use of quantitative approach was preferred in the research for it can generalise the whole population as well as involving larger sample of the study. This study’s target population was selected from individuals from different departments which comprises 15 heads of departments, 15 Finance Officers and 15 Internal Auditors, 10 Accounting Assistant and 10 Administration Officers in the MHTESTD Harare region. The selected population was mainly those whose responsibility was to ensure implementation of sound internal controls and providing assurance to compliance to policies in place. Internal auditors were being the partakers of risk based audit in risk management. According to Boddy (2016), a sample is a small group of individuals pulled out of the whole target population. A study sample size extracted from the whole target population comprised of 12 heads of departments, 12 Finance Officers, 11 Internal Auditors, 8 Accounting assistants and 7 Administration Officers were randomly selected. Financial and time constraints limited involvement of the whole population into the study. This study considered use of simple random sampling, a probability technique. For the success of this study, data was collected from a target population of the ministries through structured questionnaires.

Data Presentation and Analysis

Management Lacks Fundamental Skills and Knowledge in Implementing RM

The study was examining whether professional skills and knowledge was a challenge in implementing a formal risk management system in the MHTESTD.

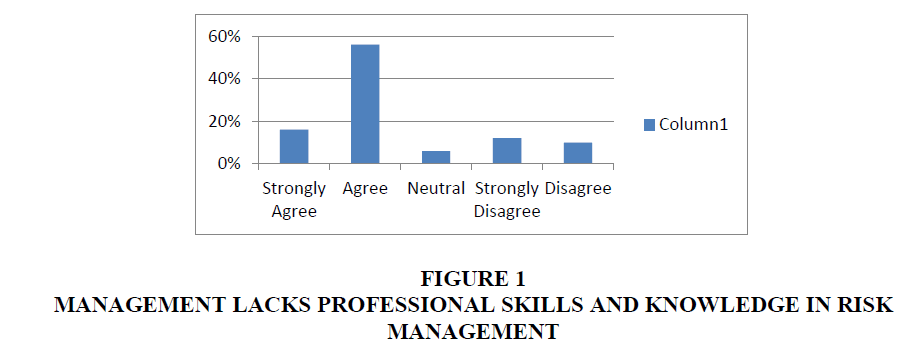

Respondents were required to show their responses on whether lack of professional skills and knowledge by management is a challenge in implementing proper risk management system in the MHTESTD and Table 1 and Figure 1 show the results:

| Table 1 MANAGEMENT LACKS FUNDAMENTAL SKILLS AND KNOWLEDGE |

||||||

| Remark | Strongly Agreed | Agreed | Neutral | Strongly disagreed | Disagreed | Total |

| Response Rate | 8 | 28 | 3 | 6 | 5 | 50 |

Results portrayed that 8 out of 50 (16%) strongly agreed that management lacks fundamental skills and knowledge in implementing formal risk management system. 28 out of 50 (56%) agreed, 3 out of 50 (6%) were neutral, 6 out of 50 (12%) strongly disagreed and 5 out 50 (10%) disagreed.

The aggregation of results upon rating indicated that 36 out of 50 (72%) agreed that management lack of fundamental skills and knowledge in implementing RM. This means that essential skills and knowledge are major challenges in executing RM processes in the MHTESTD as supported by Ofori & Toor (2012) who posited that the cause of the main problem in successful implementation of RM is identified as lack of knowledge and essential skills in developing countries. 3 out of 50 (6%) respondents were neutral which implies that they were not certain whether lacking fundamental skills and knowledge contribute to failure or success RM implementation as it may have effect in public sector setting. The response is in link to Wadesango et al. (2017) who observed that RM developing countries are not interested in RM than in developed countries. 11 out of 50 (22%) disagreed, meaning that skills and knowledge is not a major concern to RM implementation in the ministry. The result was in line with Zhao et al. (2014) who argued that a major barrier is lack of commitment and support from senior personnel. The mode was being 72% of respondents who agreed and this implies that management in the MHTESTD lacks fundamental skills and knowledge in implementing RM processes, therefore the challenge need attention of top management.

The Ministry Has no Formal Risk Management System and Policy

The questionnaire was seeking to establish whether the ministry has a formal risk management system.

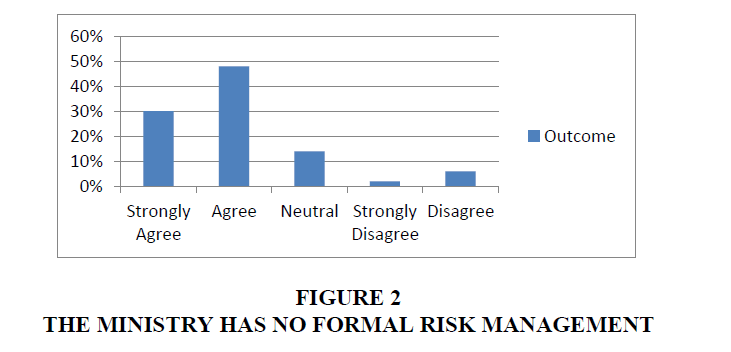

15 respondents out of 50 (30%) strongly agreed that the ministry has no formal risk management system and policy. 24 out of 50 (48%) agreed, 7 out of 50 (14%) were neutral, 1 out of 50 (2%) strongly disagreed and 3 out of 50 (6%) disagreed. The overall outcome revealed that 39 out of 50 (78%) respondents agreed that the MHTESTD had no formal risk management system which means that absence of a formal or proper RMS is a critical barrier and adoption of risk management processes and implementation can be ineffective. This result is in line with Kerstin et al. (2014) who postulated that without a proper risk management system, there is also a RM team that can collect information related to the types of risks, and hence, audit work cannot be reviewed. 7 out of 50 (14%) respondents were neutral which means they were not either agreeing or disagreeing whether a formal RMS values or not, instead they might have their own views. This can be linked to Wadesango et al. (2016) who could not support or oppose on the formalisation of risk management as challenge (Table 2 and Figure 2).

| Table 2 THE MINISTRY HAS NO FORMAL RISK MANAGEMENT SYSTEM AND POLICY |

||||||

| Remark | Strongly Agree | Agree | Neutral | Strongly Disagree | Disagree | Total |

| Response rate | 15 | 24 | 1 | 7 | 3 | 50 |

4 out of 50 (8%) disagreed meaning that they had other views they regard as a major challenge than formalising RMS. This is also in relation with Kerstin et al. (2012) who argued challenges for risk management is compliance to regulations and policies. A mode of 78% agreed that absence of a formal RM consultancy is a challenge in adopting RM guidelines in the MHTESTD and it reveals that the ministry cannot implement guidelines in absence of a formal RM.

Lack of Risk Management Consultancy is a Challenge to Implementation

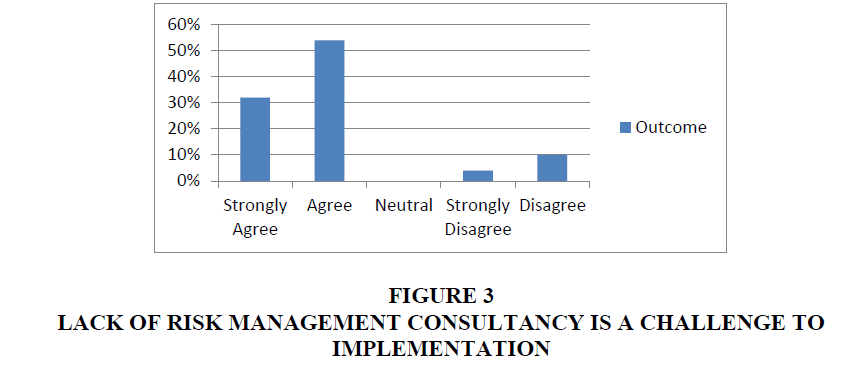

The questionnaire sought to find if lack of risk management consultancy is a barrier in implementing RM in the ministry. The Table 3 and Figure 3 below summarises the findings of the questionnaire.

| Table 3 LACK OF RISK MANAGEMENT CONSULTANCY IS A CHALLENGE TO IMPLEMENTATION |

||||||

| Remark | Strongly Agree | Agree | Neutral | Strongly Disagree | Disagree | Total |

| Response Rate | 16 | 27 | 0 | 2 | 5 | 50 |

Results shows that 16 out of 50 (32%) strongly agreed, 27 out of 50 (54%) agreed, no one was uncertain, 2 out of 50 (4%) strongly disagreed and 5 out 50 (10%) disagreed.

Overall responses reveal that, 43 out of 50 (86%) agreed which implies that the MHTESTD has a challenge of RM consultancy which means that implementation of a formal RMS could not be successful and without a consultancy knowledge gap remained unfilled. This is a similar result with Chileshe & Yirenkyi-Fianko (2012) who asserted that absence of RM specialist or consultant is a challenge in many companies. However, 7 out of 50 (14%) respondents disagreed meaning that they have other views that contradict that lack of consultancy is a challenge to RM adoption. In line with Hwang et al. (2013) who posited the barrier to risk management adoption is poor budgeting and shortage of technological link.

The mode response is represented by 86% and this represents that lack of RM consultancy is a critical challenge.

Fraud Risk Reductions Positively Affects Organizational Performance

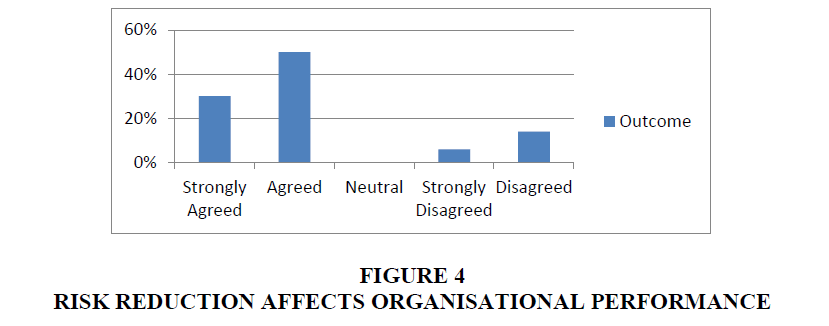

The questionnaire was intending to find if risk reduction can positively affect performance of an organisation. Results are shown in Table 4 and Figure 4.

| Table 4 FRAUD RISK REDUCTION POSITIVELY AFFECTS ORGANISATIONAL PERFORMANCE |

||||||

| Remark | Strongly Agree | Agree | Neutral | Strongly Disagree | Disagree | Total |

| Rating | 15 | 25 | 0 | 3 | 7 | 50 |

The results indicate that 15 out of 50 (30%) strongly agreed, that reducing fraud risk positively affects performance of an organisation. 25 out of 50 (50%) agreed, 3 out of 50 (6%) strongly disagreed and 7 out of 50 (14%) disagreed.

The overall responses show that 40 out of 50 (80%) agreed that fraud risk reduction positively affects organisational performance meaning that reduction of fraud risk has positive impact on performance of an organisation. This result concurred with Mahamid (2012) who confirmed that the practice of mitigating risks significantly influence performance of organisational finances by reducing the frequency of risk occurrence. 10 respondents out of 50 (20%) disagreed which means that they viewed that risk reduction has no significant relationship with organisational performance and the view may be based on other thoughts. Their view coincided with Ongore & Kusa (2013) who posited that there is a weak relationship between risk management and performance.

mode of responses was 80% who agreed meaning that risk reduction positively and significantly affects the organisation’s performance.

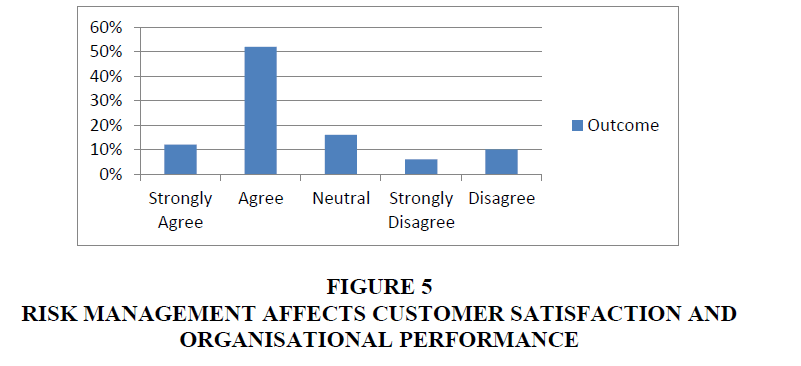

Risk Management Affects Customer Satisfaction and Customer Satisfaction Affects

Participants were asked to show by means of rating if customer satisfaction was an effect of risk management. Results are illustrated by means of Table 5 and Figure 5.

| Table 5 RISK MANAGEMENT AFFECTS CUSTOMER SATISFACTION AND CUSTOMER SATISFACTION AFFECTS |

||||||

| Table 5: Risk management affects customer satisfaction and customer satisfaction affects Remark | Strongly Agree | Agree | Neutral | Strongly Disagree | Disagree | Total |

| Rating | 6 | 26 | 8 | 3 | 7 | 50 |

The interpretation of results shows that 6 out of 50 (12%) strongly agreed that risk management affects customer satisfaction. 26 out of 50 (52%) agreed, 8 out of 50 (16%) were neutral, 3 out 50 (6%) strongly disagreed and 7 out 50 (14%) disagreed.

Aggregate outcome of results on this questionnaire indicates that 32 out of 50 (64%) agreed that RM significantly affects customer satisfaction. This implies that customer satisfaction significantly and positively affects performance. This is in harmony with Hossein & Shahmoradi (2016) who found that customer satisfaction and loyalty has a positive significant effect on financial performance. 8 out of 50 (16%) respondents were neutral, meaning that their views were impartial to the exact effect of customer satisfaction. The result was corresponding with Wadesango et al. (2017) who posited that satisfying customers is not sufficient as marketers have to show the background of organisational improvement. 10 out of 50 (20%) disagreed and this implies that customer satisfaction is not important than other factors. This is alike Yap et al (2012) who argued that the firm’s performance is a result of the aspects of economics and convenience of other branches (Al-Matari et al., 2012).

The mode of responses is 64% of those respondents who agreed and this means that customer satisfaction has a significant and positive impact on the organisation’s performance (Al-Hersh et al., 2014).

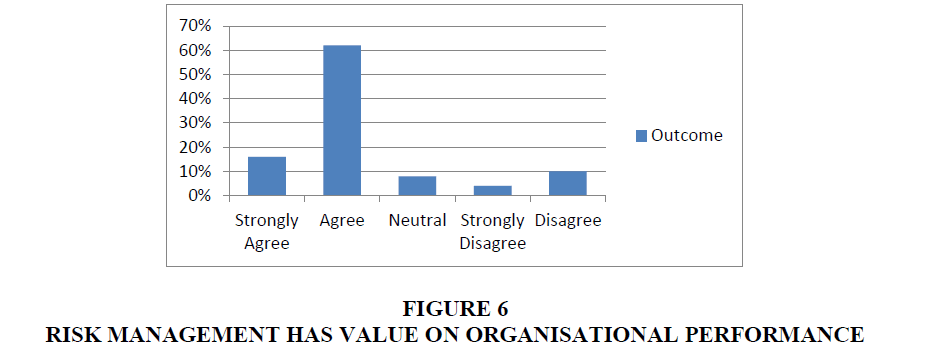

Risk Management Has Value on Organizational Performance

Respondents were required to show their knowledge on the value of risk management on organisational performance. According to Auditor General (AG) report (2015), MHTESTD has an audit risk based system so the research questionnaire aimed at evaluating whether the ministry personnel is aware of RM value

The research outcome indicates that 8 out of 50 (16%) strongly agreed that risk management has value on organisational performance. 31 out of 50 (62%) agreed, 4 out of 50 (8%) were neutral, 2 out 50 (4%) strongly disagreed and 5 out of 50 (10%) disagreed.

An overall total of 39 out of 50 (78%) respondents agreed and this posits that risk management significantly and positively values organisational performance. The result was in line with Wadesango et al. (2017) who observed that risk management has a positive significant influence on organisation’s value and performance. 4 out of 50 (8%) were neutral and their impression was impartial to the outcome and corresponds with Chileshe & Kikwasi (2014) who claimed that even if other things being equal or not, RM can have or not have great influence on the value of firm. The research was based on financial institution of Kenya. 7 out of 50 (14%) disagreed which interprets that there is no relationship between RM and firm value in public sector setting. This concurred with Retno (2012) who argued that the organisation’s value can be significantly influenced by its long term objectives Table 6 and Figure 6.

| Table 6 RISK MANAGEMENT HAS VALUE ON ORGANISATIONAL PERFORMANCE |

||||||

| Remark | Strongly Agree | Agree | Neutral | Strongly Disagree | Disagree | Total |

| Rating | 8 | 31 | 4 | 2 | 5 | 50 |

A mode was maintained at 78% where respondents agreed that RM has value on firm’s performance meaning that there exists a strong, positive and significant impact between RM and organisational performance.

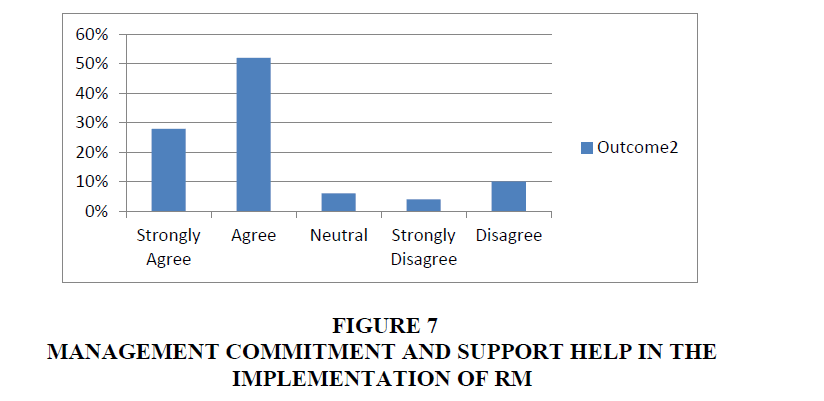

Management Commitment and Support Can Help in the Implementation of RM

The respondents were asked to show the extent to which they agree or disagree that management commitment and support is a success factor in implementing risk management system. Table 7 and Figure 7 show results.

| Table 7 MANAGEMENT COMMITMENT AND SUPPORT CAN HELP IN IMPLEMENTING RM |

||||||

| Remark | Strongly Agree | Agree | Neutral | Strongly Disagree | Disagree | Total |

| Rating | 14 | 26 | 3 | 2 | 5 | 50 |

Results displayed by Figure 7 shows that 14 out of 50 (28%) strongly agreed that management commitment and support can help in implementation of risk management processes. 26 out of 50 (52%) agreed, 3 out of 50 (6%) were not certain, 2 out of 50 (4%) strongly disagreed and 5 out of 50 (10%) disagreed.

The outcome also revealed that 40 out of 50 (80%) agreed that management commitment and support make RM implementation successful which means that successful implementation of RM is needed and backed up by management commitment and support therefore it is needed in the ministry. This is in connection with Corruption Watch (2012) which posited that for risks can be identified and achieved if corrective measures are taken by commitment of management and leaders. 3 out of 50 (6%) were neutral meaning that there were impartial to agree or disagree. Chileshe & Yirenki-Fianko had the same view when they posited that they had no specific solutions regarding commitment. 7 out of 50 (14%) disagreed. This implies that they had a better success factor that influences risk management adoption than management commitment. This concurred with Barclay (2013) who argued that an effective internal audit function is a success factor that reduces risks.

The mode of responses was 80% agreed that commitment and support by management is considered to be the most vital success factor in implementing RM.

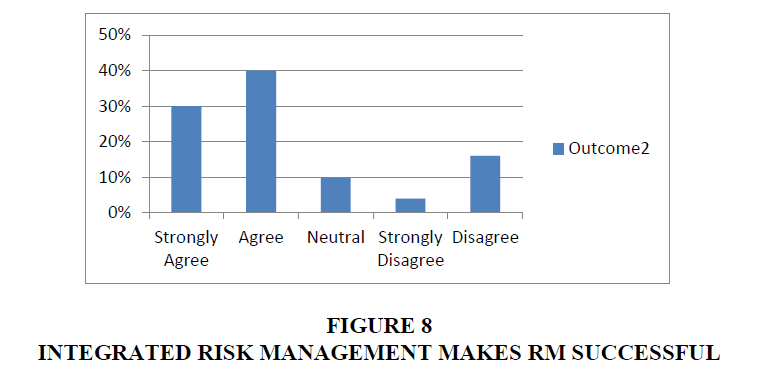

Integrated Risk Management Makes RM Implementation Successful

Views of respondents were tested on whether integrating risk management within the ministry can make it successful. Results are shown in Table 8 and Figure 8.

| Table 8 INTEGRATED RISK MANAGEMENT MAKES RM SUCCESSFUL. |

||||||

| Remark | Strongly Agree | Agree | Neutral | Strongly Disagree | Disagree | Total |

| Rating | 15 | 20 | 5 | 2 | 8 | 50 |

Out of 50 respondents, 15 (30%) strongly agreed, that integrating of risks management makes implementation successful. 20 out of 50 (40%) agreed, 5 out of 50 (10%) were neutral, 2 out of 50 (4%) strongly disagreed and 8 out of 50 (16%) disagreed.

Results also shows that 35 out of 50 (70%) agreed or supported that integrated risk management makes it successful for the RM system. Implication to this result reveals that risk if integration is taken into consideration by management, adoption of RM may be successful. The result was in line with Paape & Speckle (2012) whose study showed that in developing a risk plan or fraud reduction, inclusive of processes in departments is needed. 5 out of 50 (10%) respondents were indifferent in providing a clear response which shows that they may have a view that integration may have or not have impact on RM. The result was similar with Allwright (2013) who observed that no action against corruption and criminal risks had been taken in the public sector regardless of regulations for financial risks mitigation. 10 out of 50 (20%) disagreed meaning that risk integration is not a solution to the success of RMS implementation than other factors. Concurrence is found in Barclay (2013) who posited that effectiveness internal audit function is a key factor to risk mitigation. However, 70% represents the mode of responses which implies that integrated RM is success factor which the ministry should consider in RM adoption.

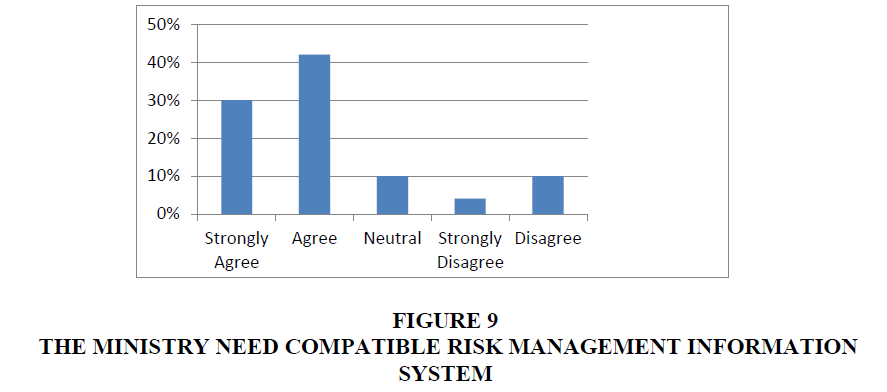

The Ministry Need Compatible Risk Management Information System

Respondents were asked whether the ministry need compatible risk management information system. Reponses are illustrated by means of Table 9 which was expressed in percentage in Figure 9.

| Table 9 THE MINISTRY NEED COMPATIBLE RISK MANAGEMENT INFORMATION SYSTEM |

||||||

| Remark | Strongly Agreed | Agreed | Neutral | Strongly Disagreed | Disagreed | Total |

| Rating | 15 | 21 | 5 | 2 | 7 | 50 |

Results shows that 15 out of 50 (30%) strongly agreed that the ministry needs compatible risk management system to implement RMS. 21 out of 50 (42%) agreed, 5 out 50 (10%) were neutral, 2 out of 50 (10%) strongly disagreed and 7 out of 50 (14%) disagreed that for a successful implementation of risk management, the ministry need compatible risk management information system. The outcome also indicated that 36 out of 50 (72%) agreed or supported that compatible information system is needed for RM implementation. It means that the ministry may have failed to implement RM guidelines due to lacking the information system; therefore risk management information system is a success factor. The finding corresponds with Mohammad (2014) who asserted that risk information technology of a company improves with the existence of technology, hence improves the gap between management and employees.

5 out of 50 (10%) respondents were neutral on then information technology as a success factor. This may means that the respondents were not interested to give a clear response. Gates et al. (2012) had a similar response when he noted that adopting RMS is difficulty in many countries. However, 9 out of 50 (18%) disagreed meaning that compatible information system is not considered as success factor than other factors. This is in line with Dugguh & Diggi (2015) who argued that new ideas improve risk management system.

72% was the mode of responses and it implies that compatible risk management information system is a success factor and has a positive relationship with risk management system.

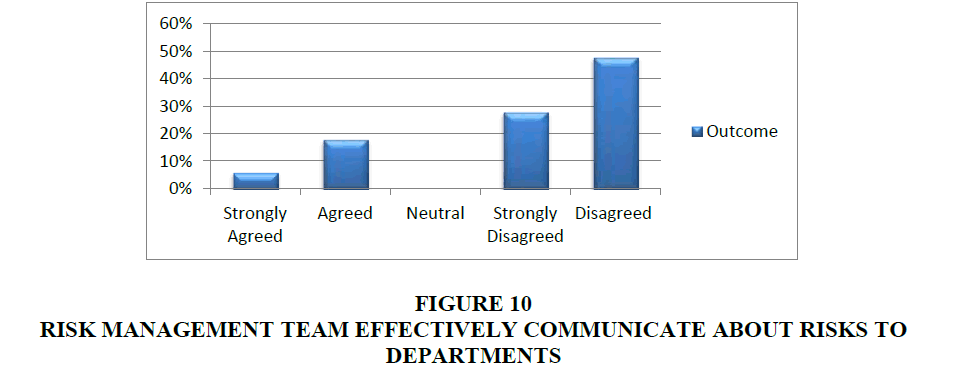

Risk Management Team Effectively Communicate About Risks to Departments

The question was asked to analyse if risk management team in the ministry is able to effectively communicate about the risks to departments and responses were received as illustrated on Table 10 and Figure 10.

| Table 10 RISK MANAGEMENT TEAM EFFECTIVELY COMMUNICATE RISKS TO DEPARTMENTS |

||||||

| Remark | Strongly Agree | Agree | Neutral | Strongly Disagree | Disagree | Total |

| Rating | 3 | 9 | 0 | 14 | 24 | 50 |

3 out of 50 (6%) strongly agreed that risk management team communicate about risks to departments. 9 out of 50 (18%) agreed, 14 out of 50 (28%) strongly disagreed and 24 out of 50 (48%) disagreed.

The total number of respondents who agreed was 12 out of 50 (24%). The outcome gives an impression that risk management team do effectively communicate risks to departments. This was in line with Paape & Speckle (2012) who asserted that evaluation empowers communication managers in demonstrating activities. 38 out of 50 (76%) disagreed meaning that risks were not being communicated in the ministry and this implies that communication skills are not adequate in the ministry and where there is no communication there is no transparency. Likely & Watson (2013) supported by positing that the importance of the process of communication is being initially neglected by professionals. However, 76% of the outcome was representing the mode.

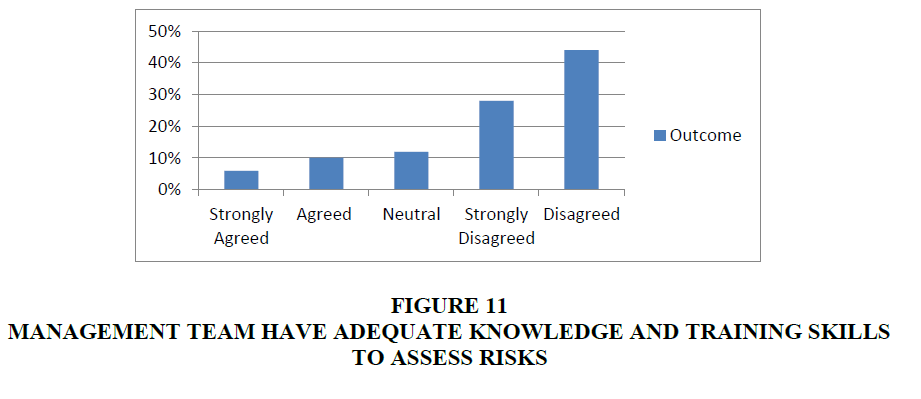

Management Team Have Adequate Knowledge and Training Skills to Assess Risks

Research questionnaire was evaluating whether the risk management team in the ministry possess adequate risk knowledge and training skills. Responses received are shown as below.

From the research findings, it clearly indicates that 3 out of 50 (6%) strongly agreed that the RM team need adequate risk knowledge and training skills. 5 out of 50 (10%) agreed, 6 out of 50 (12%) were impartial, 14 out of 50 (28%) strongly disagreed and 22 out of 50 (44%) disagreed (Table 11 & Figure 11).

| Table 11 RISK MANAGEMENT TEAM HAVE ADEQUATE RISK KNOWLEDGE AND TRAINING SKILLS. |

||||||

| Remarks | Strongly Agreed | Agreed | Neutral | Strongly Disagreed | Disagreed | Total |

| Rating | 3 | 5 | 6 | 14 | 22 | 50 |

Overall results also revealed that 8 out of 50 (16%) agreed meaning that they supported and believe that management team should have adequate knowledge and training skills to monitor risks. This is similar to Noble (2014) who asserted that management should be strongly equipped with knowledge. 5 out of 37 were impartial which means they could not stand is full support of knowledge as a skill. Study by Slipiceviv & Masic (2012) who posited that both knowledge and communication skills are all necessary. 36 out of 50 (72%) disagreed that management have enough knowledge skills which the ministry was lacking personnel with those skills. It implies that knowledge is a concern in the MHTESTD. This concurred with Watson (2013) who posited that knowledge sharing enables exchanging of recognized in relation to RM solutions. Knowledge sharing comes out of training skills.

However, the mode of responses was 72% of respondents disagree that management team have adequate knowledge skills. The outcome indicates that the RM team lacks knowledge and training skills.

Conclusion

The effects of RM have been proven as significant and positive to the organisational performance through a reduction in the fraud risks, customer satisfaction and retention of customer loyalty. However, the research established that adoption and application of an effective risk management system is negatively affected by major barriers such as lack of trained personnel that results in knowledge gap, non-existence of audit committee and lack of management commitment and coordination. Vital success factors that can provide solution to the effective execution of risk management processes were studied through remarkable scholars. The research also studied the effects of implementing risk management on the organisational performance where such effects were observed as fraud reduction and customer satisfaction. The researchers believe that the recommendations from the study will assist management in establishing a formal risk management system.

Recommendations

With concern to the key findings, the research draws the following recommendations for successful adoption of a proper risk management system successful.

Enhancement of Efficient and Effective Financial Performance

Recommendation to the ministry to adopt effective risk management practices which includes risk assessment, evaluation, monitoring and controlling for enhancement of efficient and effective of organisational performance and proper management of public funds.

References

- Al-Hersh, A.M. & Saaty, A.S. (2014). The impact of customer relationship marketing on customer satisfaction of the Arab bank services. International Journal of Academic Research in Business and Social Sciences, 4 (5), 67-83.

- Allwright, E. (2013). The Real Cost of Corruption-Part One. Pretoria: Edward, Nathan & Sonnenbergs Law Partners.

- Al-Matari, E.M., Al-Swidi, A.K., Fadzil, F.H. & Al-Matari, Y.A. (2012). The Impact of board characteristics on Firm Performance: Evidence from Nonfinancial Listed Companies in Kuwaiti Stock Exchange. International Journal of Accounting and Financial Reporting, 2(2), 310-332.

- Barclay, C. (2013). Preferential Procurement in the South African Context. London: ABA Section of International Law.

- Boahene, S.H., Dasah, J. & Agyei, S.K. (2012). Credit risk and profitability of selected banks in Ghana. Research Journal of Finance and Accounting, 3(7), 6-14.

- Bowers, J. & Khorakian, A. (2014). Integrating risk management in the innovation project. European Journal of innovation management, 17(1), 25-40.

- Caldwell, F. (2012). 5 Principles for effective GRC. Retrieved on 5 October, 2017: www.https://exchanges.nyx.com /allison-orourke/ 5principles-effective-grc-programs

- Chapman, R.J. (2012). Simple tools and techniques for enterprise risk management. John Wiley & Sons.

- Chileshe, N. & Kikwasi, G.J. (2014). Critical success factors for implementation of risk assessment and management practices within the Tanzanian construction industry. Engineering, Construction and Architectural Management, 21(3), 291-319.

- Chileshe, N. & Yirenkyi-Fianko, A.B. (2012). An evaluation of risk factors impacting construction projects in Ghana. Journal of Engineering, Design and Technology, 10(3), 306-329.

- Choudhry, R.M. & Iqbal, K. (2013). Identification of Risk Management System in Construction Industry in Pakistan. Journal of Management in Engineering, 29(1), 42-49.

- Corruption Watch. (2012). Citizens Reporting Corruption in South Africa. Pretoria: Corruption Watch South Africa.

- COSO. (2013). Internal Control-Integrated Framework.

- Dugguh, S.I. & Diggi, J. (2015). Risk management strategies in financial institutions in Nigeria: The experience of commercial banks. International Journal, 2(6), 66-73.

- Egmond, E.V. (2012). Case studies of construction technology development and innovation in developing countries. In: Ofori G, editor. Contemporary issues in construction in developing countries (442477). London: Spoon Press, Taylor & Francis.

- Ghoddousi, P., Poorafshar, O., Chileshe, N. & Hosseini, M.R. (2015). Labour productivity in Iranian construction projects: Perceptions of chief executive officers. International Journal of Productivity and Performance Management, 64(6), 811-830.

- Goh, C.S. & Abdul-Rahman, H. (2013). The identification and management of major risks in the Malaysian construction industry. Journal of Construction in Developing Countries, 18(1), 19- 32.

- Hwang, B.G. & Ng, W.J. (2013). Project management knowledge and skills for green construction: Overcoming challenges. International Journal of Project Management, 31(2), 272-284.

- Jafari, F.M. (2014). Strategic cost-cutting in information technology: Toward a framework for enhancing the business value of IT. Iranian Journal of Management Studies (IJMS), 7(1), 21-39.

- Kerstin, D. Simone, O. & Nicole, Z. (2014). Challenges in implementing enterprise risk management. ACRN Journal of Finance and Risk Perspectives, 3(3), 1-14.

- King, R.G. & Levine, R. (2013). Finance and growth: Schumpter might be right. The Quaterly Journal of Economics, 5(2), 207-214.

- Kinyua, J.K. (2015). Effect of internal control environment on the financial performance of companies quoted in the Nairobi Securities Exchange. International Journal of Business and Law Research, 3(4), 26- 42.

- Kululanga, G. (2012). Capacity building of construction industries in Sub-Saharan developing countries: A case for Malawi. Engineering, Construction and Architectural Management, 19(1), 86-100.

- Nugroho, D.P. (2013). Efek Enterprise Risk Management (ERM) Studi Empirik pada Reaksi Pasar dan Kinerja Perusahaan, Tesis Universitas Gajah Mada.

- OCEG. (2012). GRC Maturity Survey & Research http://www.oceg.org/downloads/grc-maturitysurvey-research-2012.pdf (12.4.2014)

- OECD. (2014). Risk management and corporate governance’, OECD Publishing,[Online] Available at http://dx.doi.org/10. accessed on 29 June 2017.

- Ofori, G. & Toor, S.U.R. (2012). Leadership and construction industry development in developing countries. Journal of Construction in Developing Countries, 17(1), 1-21.

- Oluwagbemiga, O.E., Ogungbade, O. & Idode, P. (2016). The relationship between the risk management practices and financial performance of the Nigerian listed banks. Journal of Accounting and Management Information Systems, 15(3), 565-587.

- Paape, L. & Speklè, R.F. (2012). The adoption and design of enterprise risk management practices: An empirical study. European Accounting Review, 21(3), 533-564.

- Perera, B.A.K.S., Rameezdeen, R., Chileshe, N. & Hosseini, M.R. (2014). Enhancing the effectiveness of risk management practices in Sri Lankan road construction projects: A Delphi approach, International Journal of Construction Management, 14(1), 1-14.

- Poudel, R.P. (2012). The impact of credit risk management on financial performance of commercial banks in Nepal. International of Journal Arts and Commerce, 5(6), 9-15.

- Retno, R., D. & Priantinah, G. 2012). Pengaruh good corporate governance dan pengungkapan corporate social responsibility terhadap nilai perusahaan (Studi Empiris pada Perusahaan yang Terdaftar di Bursa Efek Indonesia Periode 2007-2010). Journal Nominal, 7(4), 33-57.

- Rovai, A.P., Baker, J.D. & Ponton, M.K. (2014). Social science research design and statistics. Chesapeake, VA: Watertree Press LLC.

- Todayon, M.T., Jaafar, M. & Nasri, E. (2012). An assessment of risk identification in large construction projects in Iran. Journal of Construction in Developing Countries, 17(1), 22-31.

- Silva, E.S., Wu, Y. & Ojiako, U. (2013). Developing risk management as a competitive capability. Strategic Change, 22 (5/6), 281-294.

- Siyanbola, T.T. (2013). Effective internal controls system as antidote for distress in the banking industry in Nigeria. Journal of Economics and international Business Research, 1(5), 106-123.

- Varghese, K. (2012). Information communication technology usage by construction ?rms in developing. Taylor & Francis, 15(4), 126-143.

- Wadesango, N., Tasa E., Milondzo, K. & Wadesango V.O. (2016). An empirical study of the influence of IAS/IFRS and regulations on quality of financial reporting of listed companies. Risk Governance and control: Financial markets & institutions, 6(4), 76-83.

- Wadesango, N., Tasa, E., Milondzo, K. & Wadesango, V.O. (2016). A literature review on the impact of IAS/IFRS and regulations on quality of financial reporting. Risk Governance and control: Financial markets & institutions, 6(4), 102-108.

- Wadesango, N. & Wadesango, O. (2016). The need for financial statements to disclose true business performance to stakeholders. Corporate Board: Role, duties and composition, 12(2), 77-84.

- Wadesango N, Mhaka, C. & Wadesango, V.O. (2017). Contribution of enterprise risk management and internal audit function towards quality of financial reporting in universities in a developing country. Risk Governance and control: Financial markets & institutions, 7(2), 170-176.

- Wadesango, N., Chinamasa, T., Mhaka, C. & Wadesango, V.O. (2017). Challenges faced by Management in Implementing Audit Recommendations: A literature Review. Risk Governance and Control: Financial Markets & Institutions, 7(4), 51-61.

- Wadesango, N. Mhaka, C., Chinamasa, T. & Wadesango, V.O. (2017). An investigation into Management’s reluctance in implementing Audit recommendations and its effects to risk. Corporate Board: Role, Duties & Composition, 13(2), 61-70.

- Wadesango, N., Nani, L., Mhaka, C. & Wadesango, V.O (2017). An analysis of the impacts of liquidity constraints on new financial product development. Risk governance & control: Financial Markets & Institutions, 7(3), 65-76

- Wadesango, N. & Mhaka, C. (2017). The effectiveness of enterprise risk management and internal audit function on quality of financial reporting in universities. Journal of Economics and Behavioral Studies, 9(4), 230-241.

- Wadesango, N, Katiyo, E.M., Mhaka, C. & Wadesango, V.O. (2017). An evaluation of the effectiveness of Financial Statements in disclosing true business performance to stakeholders in hospitality industry (A case of Lester-Lesley Limited). Academy of Accounting and Financial Studies Journal, 21(3): 1-22

- Watson, T. (2012). The evolution of public relations measurement and evaluation. Public Relations Review, 38(3), 390-398.

- Yap, B. W., Ramayah, T. & Shahidan, W.N.W. (2012). Satisfaction and trust on customer loyalty: a PLS approach. Business Strategy Series, 13(4), 154-167.

- Zhao, X., Hwang, B.G., Low, S.P. & Wu, P. (2014). Reducing hindrances to enterprise risk management implementation in construction firms. Journal of Construction Engineering and Management, 141(3), pp. 04-14.