Research Article: 2018 Vol: 22 Issue: 3

Effective Investment Policy as a Factor of Successful Economic Development

Larisa Makhova, Saint-Petersburg Mining University, Russia

Abstract

The investment climate, which is designed to ensure the reproduction of fixed capital, is an important factor in economic development. Thus, this article examines the urgent problems of country’s investment policy. The specifics of the factors negatively influencing the investment policy of the Russian Federation are investigated. Thus, the main factors are immaturity of financial markets, problems of interaction between the state and business, and protection of property rights. The article also notes that the Russian economy has been on the stage of serious political and institutional changes for decades, which, in turn, have a huge impact on private investment activity. Similarities with other Post-Soviet countries are defined. On the basis of the study, the author affirms that it is possible to get out of the investment crisis only if the volumes of private investment grow and their quality improves.

Keywords

Investment Policy, Economic Development, World Financial Markets, Institutional Factors, Fixed Capital.

JEL Classification: G30, G31, G38

Introduction

The investment climate, which aims to ensure the reproduction of fixed capital, can be regarded as a key factor of economic development (Dollar et al., 2005; Ghisellini et al., 2016; Nam et al., 2016; Budanov, 2017; Sargsyan, 2017). According to the experts from the World Bank, a decline of confidence from investors is primarily due to the lack of complex structural reforms, as well as using of the growth model, based on «large-scale public investment projects, the continuous growth of salaries in the public sector and remittance» (from the Report from March 2014). According to the experts, this situation appeared due to significant inflows of oil revenues that have been observed in recent decades (Frynas et al., 2017). That was the main factor behind the growth model of the economy, based on the exploitation of natural raw materials. The experts say that herewith the lingering problems of investors` confidence turned into a crisis of confidence that led to localization of certain defects of the current model of economic growth (Darovskii, 2017).

The experts paid special attention to the problem of impact of the foreign economic policy and the overall geopolitical environment on investment and consumption decisions and commodity circulation, considering the investment policy of the Russian Federation in the September Report of the World Bank. The presence of high volatility of stock and currency markets and increased investment risks is also reported (Postalyuk et al., 2016). Moreover, uncertainty of the economic policy, which was driven by geopolitical tensions, contributed to the aggravation of the crisis of investor` confidence (Russia Economic Report, 2014a).

Raw material industries have been actively affecting the Russian economy competitiveness for last 10 years, in particular, high price of raw materials contributed to the development and formation of the structure of the economy and exports in favor of oil, gas and mining sectors. The model has been significantly narrowed for the last twenty years. Other industries have been constrained by the high profitability of the raw material sector. Thus, the main problems in the investment industry are incorrect actions taken at the stage of the market transformation of the economic system. Steps to change investment policy, in the context of the ruble devaluation, default of external and domestic obligations, skyrocketing prices of the domestic raw materials and the subsequent successful resolution of the political crisis, were not taken since the mid-90s (Russia Economic Report, 2016b). Hence, there is a need to consider new ways to develop effective raw material economic model (Nedosekin, 2016).

This article describes the features of Russian investment environment in the context of tense geopolitical situation and western sanctions policy

Thus, the purpose of the article is to consider the problems of the investment policy of the Russian Federation in a crisis.

Method

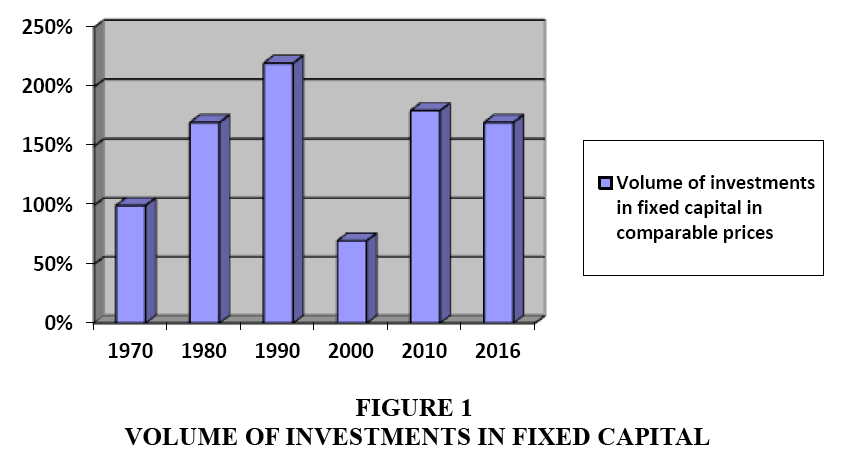

The authors examined volume of investments in fixed capital in the period from 1970 to 2016. The proposed indicator is used for both the analysis and evaluation at the international level and at the level of individual country. Thus, the practices of other Post-Soviet countries were examined in order to define similarities.

In our research, we used annual values. Main results are summarized and presented in figures. Relevant factors affecting the investment policy of the Russian Federation were also defined. Thus, immaturity of financial markets, condition of investment climate, infrastructure provision of investment processes, problems of interaction between government and business, protection of property rights, as well as high organizational, informational, technological, regulatory barriers were taken into account.

The comparison analysis was based on data from Russia Economic Reports and Federal State Statistics Service of Russia (Federal State Statistics Service). Statistical data analysis was carried out with the IBM SPSS Statistics 22.

Data, Analysis And Results

Currently, the volume of investments in fixed capital in comparable prices is correlated with the level of 1980 (Figure 1).

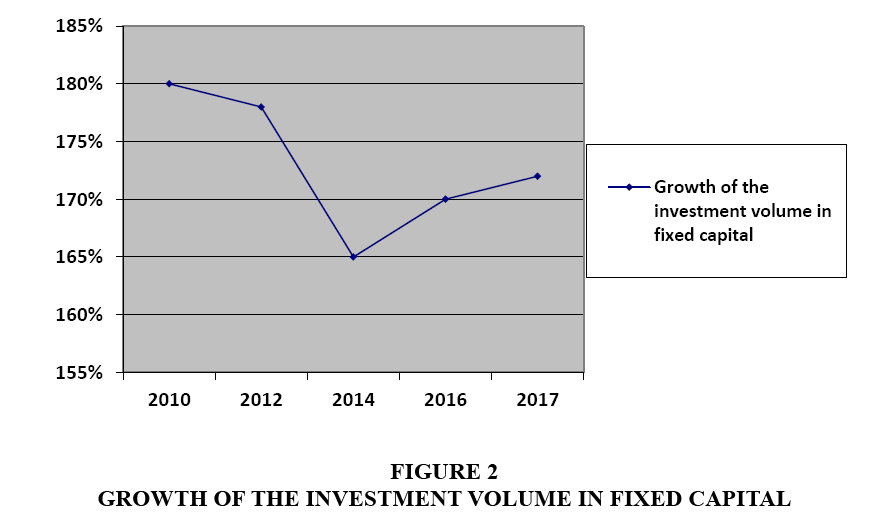

Figure 1 illustrates the dynamics of investments in fixed capital in Russia in the period from 1970 to 2016. In particular, we see that there is a stable dynamics of increase of investment volumes in fixed capital from 1970 to 1990. There is a sharp decline in investments in the 2000s, and volumes are restored only in 2010. There is a slight decline in investment activity in the Russian Federation in 2016. The first two quarters of 2017 are characterized by positive dynamics of investments in fixed capital (Figure 2). However, in our opinion, this is not enough for successful development of economy. In addition, currently there is a range of factors, adversely affecting the investment policy of the Russian Federation and accordingly, the economic development. These factors include (Cooper, 2013; Zubov & Inozemcev, 2015): immaturity of financial markets, condition of investment climate, infrastructure provision of investment processes, problems of interaction between government and business, protection of property rights, as well as high organizational, informational, technological, regulatory barriers (Figure 2).

The improvement of investment policy faces certain problems, such as increasing of investment attractiveness of regions. The difficulty is that private investors may rely only on market categories, taking decisions of a financial nature, and as a conclusion, do not invest in industrial non-developed regions (Igoshin, 2001; Hmyz, 2011; Kotljarov, 2013).

The formation of the state Russian policy displays these processes in other Post-Soviet States. The main similarity is:

1. This traditional role of the state in managing the economy. The government took the initiative of reform (Kudrin & Gurvich, 2015; Magerram & Sergey, 2015).

2. Functioning of the market economy, which aims to provide the best return from actions of subjects of investment activities and from the long-term prospects of the state policy (Russia Economic Report, 2014a; Mau, 2015)?

3. Features of transition period (political and economic instability, the world financial crisis, the lack of clear and correct development of the real sector of the economy) (Silka, 2014; Postalyuk et al., 2016).

There is a tendency of decreasing of the level of population income in Russia at the moment; herewith the domestic demand is low, despite the rate of decline of GDP has reduced significantly (Frenkel et al., 2015).

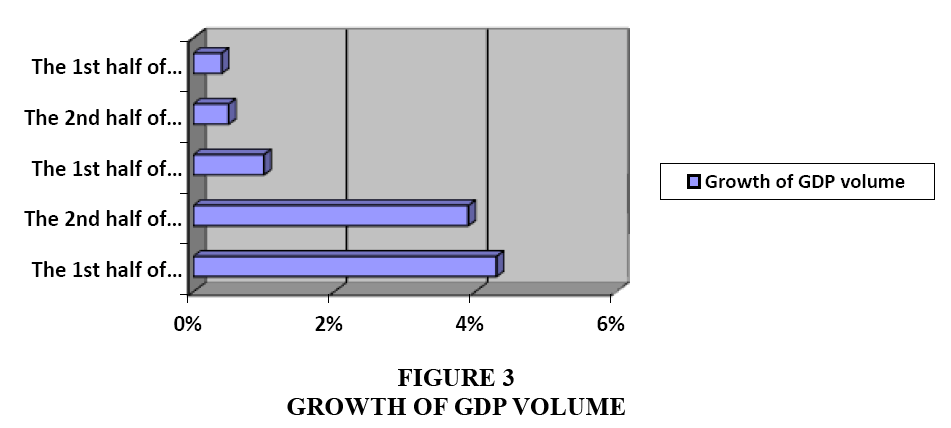

For example, real GDP reduced by 0.9% in the first six months of 2016, if compare with the same period of the last year 3.7% (Figure 3).

According to the experts, the counter measures of the economic policy that have been undertaken by the Russian government over the past two years contributed to the development of the process of adaptation of the economy to changings of geopolitical conditions. This also applies to the flexible exchange rate policy, reduction of budget spending in real terms and the recapitalization of banks, with using of the Reserve Fund. (Federal'naja tamozhennaja sluzhba, 2017).

However, investments in fixed capital decreased by 4.3% during the first half of 2016, if compare with the same period of the last year (Bard, 2000), and all this amid the formed uncertain economic policy, low consumer demand and high loans prices.

The innovation activity was recorded in several sectors in 2016, while investment decline continued in the others.

In particular, there was a sharp decline in investment activity in the manufacturing industry at the beginning of 2016 that led to a deterioration of the capital base, and also negatively affected labour productivity.

According to the experts, the main reason for the weak investment activity in the Russian Federation is the low level of diversification, manifested in the limited growth of non-energy exports (Federal'naja tamozhennaja sluzhba, 2017).

According to the aggregate data, slow export growth in 2015, and the reduction of Russian exports in 2016 caused by the low activity of the investment policy.

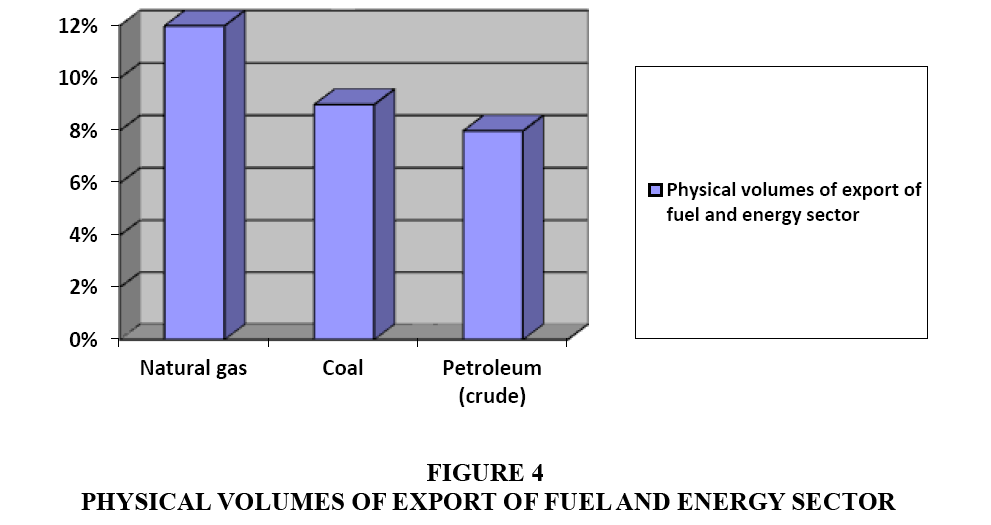

According to the FCS, Russia's exports, reduced by more than 21%, in 2016, compared with 2015. Thus, its physical volume increased by 3.2%, due to the reducing value of fuel and energy products.

Physical volumes of export of natural gas increased by 12%, coal-by 9%, petroleum (crude) by 8% (Figure 4).

In addition, export of food products, timber, textiles and metals increased in 2016 [9].

The Russian economy has been standing for over the decades at the stage of serious political and institutional changes that has an enormous impact on private investment activity. These changes include:

1. increasing of the tax burden, at both the federal and regional levels (the transition to cadastral value with the calculation of the property tax of companies, the cancel of the threshold wage with the calculation of insurance contributions to the HIF, the introduction of trading fees, etc.);

2. strengthening of the state influence on economic life and its supervisory functions;

3. Strengthening of control over economic agents (for example, when prices in trade are unreasonably high, currency speculation takes place, etc.);

4. growing influence of security agencies and a legislative extension of their rights (in particular, in investigation of tax offences);

5. Increasing of the concentration of raw materials, centrally allocated from state-controlled public corporations, enterprises and banks.

These factors, unfortunately, do not promote the formation and development of effective investment policy.

Investment crisis causes long recessions, increases the decline in living standards and increases lag behind from the competitor countries.

Coming out of crisis is possible only in case of growth of private investment and increasing of their efficiency, only then we can talk about improving of business and investment climate, serious institutional changes, which, in turn, enhance the level of trust.

Another significant factor affecting the efficiency of investment processes is a system install. Thus, the political and economic ideology prevails over economic expediency and managers seek to improve the economic trend by using social (emotional) support from public resources in Russia (Russia Economic Report, 2016b).

Considering all the factors, it should be noted, that the first group includes originally objective factors (they are caused by natural, geographical, climate, raw materials, natural conditions, herewith they are real and do not depend on managerial decisions).

The second group includes factors, that are subjective in nature (characterize the result of subjective perceptions and people activities).

It should be noted, that the main barrier for foreign investors is the factors of the subjective managerial nature and institutional factors, which include:

1. Administrative, legal and political conditions.

2. General condition of business and investment climate.

3. Inefficiency of the systems of interaction between government and business.

4. Problems of protection of property rights.

5. High level of organizational, technological and other barriers.

According to the international experts, the quality of institutions and the institutional environment in Russia is mostly negative than positive.

Institutional barriers and constraints are largely the reasons for the current investment crisis and low investment attractiveness of the country (FSGS, 2017).

There are factors of institutional environment, which largely affect the quality of investment attractiveness:

1. Quality of professional competence and training of public employees.

2. Level of control over business processes in private sectors.

3. Level of protection of contractual rights.

4. Time indicator (determines the amount of time which is necessary to start new business).

5. Level of public administrative intervention in the formation and development of economic processes.

6. Nature and extent of using of official powers by government officials for private gain.

7. Level of stability of the political system.

8. Quality indicator of the level of civil liberties, political rights, independence of media.

9. Indicator of the safety and security of physical and legal persons and their property from capture and unreasonable interference of state structures.

10. Quality indicator of public services, etc.

Discussion

The dominant approach to assessing the investment process in Russia is based on calculating the profitability of investments. There is a question of the economic aspect of the problem of accumulation; i.e., business does not create an investment good, which does not cost anything (The Ministry of Economic Development of Russia).

The World Bank Report in April 2015 argued that Russia keeps a low level of investment, which hampers economic development. According to the experts, one of the major factors, that prevents the investment activity, is «the uncertainty, connected with geopolitical tensions and sanctions». The experts say that the most possible, that it needs some more time to restore investor `confidence (Russia Economic Report, 2014b).

The main reason for “the continuing decline of investment in private sector amid rising capital costs and reduced consumer demand” is the uncertain economic policy of the Russian Federation in the conditions of the geopolitical situation and the preservation of the international sanctions (from the World Bank Report in September 2015) (Russia Economic Report, 2015a).

According to the Report of the World Bank in April 2016, the economic sanctions restrict the access to global financial markets, and also prevent the flow of capital and continue to undermine investor` confidence. According to the experts, the adaptation of the Russian economy goes, as a rule, due to a sharp drop in revenues, decreasing in household consumption and reduction in consumer demand, which has a negative impact on the investment climate (Russia Economic Report, 2015b). A significant decline in consumer demand, which was caused by a sharp drop in the income level of the population, was the reason for significant increase in the level of poverty. According to the experts, not only external factors, but also internal opportunities for «the adaptation of macroeconomics and budget to complicated situation», have a tremendous impact on the growth of the economy (Russia Economic Report, 2015b).

Gross capital formation is rapidly declining, because today's enterprises often do not have incentives for investment growth (due to the increase in the cost of borrowings and a decline in consumer demand). Thus, it declined by more than 19% in 2016.However, positive indicators (export growth, etc.) are observed in a number of companies in non-energy commodity sectors: metallurgy, coal and chemical industry. Many experts associate this with the devaluation of the ruble, export diversification and the access to non-traditional markets (Russia Economic Report, 2016a). Despite the decrease in the level of Federal budget spending, the budget deficit, which reached 3.5% of GDP, was financed by the Reserve Fund in 2016. It`s amount had dropped from 31, 30 to 16.03 billion dollars by the end of 2016 (Bard, 2000).

However, the impact of fiscal consolidation was reduced due to the implementation of anti-crisis plan, which could ensure the indexation of pensions and support the financial sector through the recapitalization of banks. Serious limitations are still imposed on Russia from the Western partners, that reduces the competitiveness of exports (Stent, 2015), and that is very difficult to overcome today.

There are also the problems of bureaucracy and corruption among the traditional problems of the Russian public and economic relations.

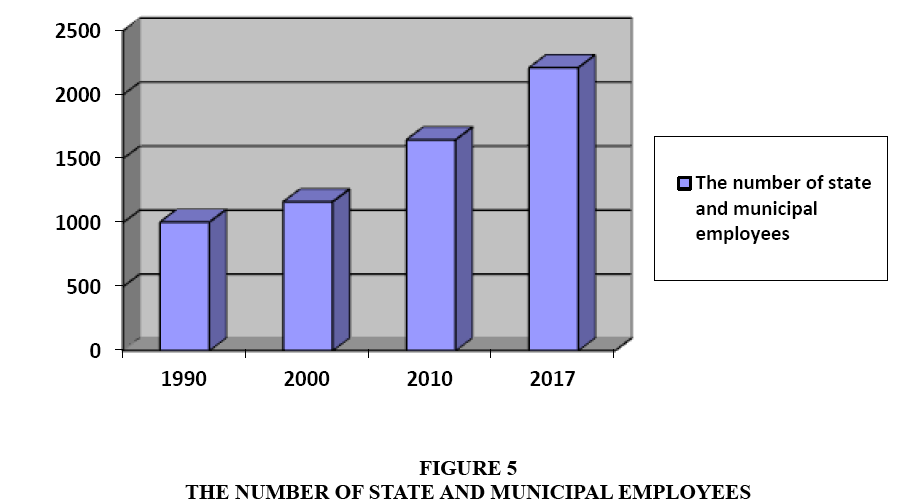

The number of bureaucracies (employees of state authorities and local self-government) has more than 2500 thousand people, it's twice more than it was in the 90s (Figure 5).

It is obviously, that the efficiency of state and municipal management is connected primarily with the quality of decisions and their timeliness and operative ness.

The whole control system in general will be effective only when activities of state and municipal employees will be effective.

The growth of quantity of state and municipal employees for more than twice for several decades did not allow our country to strengthen the economic position and make investment climate more positive. In addition, Gross Domestic Product decreased by 40% over this period (Guriev, 2014). It says about the negative effectiveness of the Russian system of state and municipal management.

As for corruption in Russia, it represents a serious obstacle, limiting the flow of investment. More corruption is manifested in the regional systems of support of investment when starting new objects or projects.

It happens because the entry of investment into regions, as a rule, is carried out with the participation of the local administration. The implementation of any project, construction, is possible only after getting a number of approvals, permits, etc.

According to the experts, the problem of corruption in the institutional plane can be solved by the creation of conditions for the use of methods of economic regulation, which will motivate and stimulate investment activity (FSGS, 2017; Plaksunova et al., 2017).

Moreover, corruption can be reduced by improving institutions, inefficient by nature.

Conclusion

Thus, immaturity of financial markets, condition of investment climate, infrastructure provision of investment processes, problems of interaction between government and business, protection of property rights, as well as high organizational, informational, technological, regulatory barriers adversely affecting the investment policy of the Russian Federation and, accordingly, economic development. These factors, unfortunately, do not contribute to the formation and development of effective investment policy. Investment crisis causes long recessions, increases the decline in living standards and increases lag behind competitor countries. Coming out of crisis is possible only in case of growth of private investment, increasing of their efficiency, only then we can talk about improvement of business and investment climate.

References

- Bard, V.S. (2000). Investicionnye problemy rossijskoj jekonomiki, Jekzamen, pp. 385.

- Bekaert, G. & Harvey, C.R. (2014). Emerging equity markets in a globalizing world. Retrieved from: http://docshare04.docshare.tips/files/26185/261853149.pdf

- Budanov, I.A. (2017). Formation of an investment model of economic development of Russia. Studies on Russian Economic Development, 28(1), 1-10.

- Cooper, J. (2013). The Russian economy twenty years after the end of the socialist economic system. Journal of Eurasian Studies, 4(1), 55-64.

- Darovskii, I. (2017). From stagflation to sustainable economic growth: Imperatives of Russian macroeconomic policy. Economic Policy, 3, 38-79.

- Dollar, D., Hallward-Driemeier, M. & Mengistae, T. (2005). Investment climate and firm performance in developing economies. Economic Development and Cultural Change, 54(1), 1-31.

- Federal State Statistics Service. http://www.gks.ru/wps/wcm/connect/rosstat_main/rosstat/en/main/

- Federal'naja tamozhennaja sluzhba (2017). Tamozhennaja statistika vneshnej torgovli. http://customs.ru/index2.php?option=com_content&view=article&id=24460:-2016-&catid=1981.

- Frenkel, A., Sergienko, Y., Tikhomirov, B. & Roshina, L. (2015). The Russian economy under the circumstances of crisis. Economic Policy, 4, 113-155.

- Frynas, J.G., Wood, G. & Hinks, T. (2017). The resource curse without natural resources: Expectations of resource booms and their impact. African Affairs, 116 (463), 233-260.

- FSGS (2017) URL: http://www.gks.ru.

- Ghisellini, P., Cialani, C. & Ulgiati, S.S. (2016). A review on circular economy: the expected transition to a balanced interplay of environmental and economic systems. Journal of Cleaner Production, 114, 11-32.

- Guriev, S. (2014). Corruption has laid waste to the Russian economy. Financial Times, 7, 21.

- Hmyz, O.V. (2011). Institucional'nye investory i investicionnyj potencial Rossii v postkrizisnyj period. Finansy i kredit, 7, 33-39.

- Igoshin, N.V. (2001). Investicii, Juniti-Dana, 543.

- Kotljarov, M.A. (2013). Vlijanie mer gosudarstvennoj podderzhki na investicionnuju aktivnost' v Rossii’. Finansy i kredit, 27, 2-5.

- Kudrin, A. & Gurvich, E. (2015). A new growth model for the Russian economy. Russian journal of economics, 1 (1), 30-54.

- Magerram, G. & Sergey, Z. (2015). Neo-industrial base of network social prosperity in the Russian economy. Procedia-Social and Behavioral Sciences, 166, 97-102.

- Mau, V. (2015). Economic crises in post-communist Russia, Economic Policy, 10.

- Nam, D.I., Kim, J., Arthurs, J.D., Sosik, J.J. & Cullen, J.B. (2016). Measurement and structural invariance of entrepreneurial investment climate: A cross-country scale development. International Business Review, 25 (5), 1053-1065.

- Nedosekin, A. (2016). Alternative methods of investments of basic industries of the RF’. The notes of mining institute, 219, 482-489.

- Russia Economic Report (2014a). World Bank Group, 31, 5-10.

- Russia Economic Report (2014b). World Bank Group, 32, 11-25.

- Russia Economic Report (2015a). World Bank Group, 33, 6-9.

- Russia Economic Report (2015b). World Bank Group, 34, 6-10.

- Russia Economic Report (2016a). World Bank Group, 35, 7-9.

- Russia Economic Report (2016b). World Bank Group, 36, 11-17.

- Plaksunova, T., Litvinova, A., Loginova, E., Litvinov, E., Parfenova, M. & Talalaeva, N. (2017). Determinants of innovational development of economy of modern Russia, Journal of Applied Economic Sciences, 12(2) , 356-373.

- Postalyuk, M., Fatkhiev, A. & Safiullin, L. (2016). Innovatization of planning institutions in the system of Russian economic management. http://www.alliedacademies.org/articles/volume-15-special-issue-4.pdf#page=52

- Sargsyan, L. (2017). Impact of foreign direct investment on economic growth in the world and in Armenia. American Journal of Sociology, 2339.

- Silka, D.N. (2014). On priority measures for creating the basis for the development of the Russian economy. Life Science Journal, 11(7s), 310-313.

- Stent, A.E. (2015). The limits of partnership: US-Russian relations in the twenty-first century, Princeton University press.

- The Ministry of Economic Development of Russia. Macroeconomics. http://www.economy.gov.ru/minec/ activity/sections/macro/.

- Zubov, V.M. & Inozemcev, V.L. (2015). Surrogatnaja investicionnaja sistema. Voprosy jekonomiki, 3, 70-81.