Research Article: 2022 Vol: 28 Issue: 1S

Effect of Sharia Compliance, Governance, and Social Responsibility on Business Sustainability: Mediating Role of Business Growth

Muhammad Yusuf, Institut Teknologi dan Bisnis Bank Rakyat Indonesia

Arisson Hendry, Indonesia Banking School

Maya Sova, Universitas Respati Indonesia

Kumiko Azizah, STIT Rakeyan Santang

Arum Indrasari, Universitas Muhammadiyah Yogyakarta

Netti Natarida Marpaung, Sekolah Tinggi Ilmu Ekonomi Tribuana

Dewi Cahyani Pangestuti, UPN Veteran Jakarta

Rachmaniar Myrianda Dwiputri, Universitas Krisnadwipayana

Karnawi Kamar, STIE Insan Pembangunan

Endri Endri, Universitas Mercu Buana

Citation Information: Yusuf, M., Hendry, A., Sova, M., Azizah, K., Indrasari, A., Marpaung, N.N., Rubadi, R., Pangestuti, D.C., Dwiputri, R.M., Kamar, K., & Endri, E. (2022). Efeect of sharia complaince, governance, and socisl responsibility on business sustainability: mediating role of busniess growth. Academy of Entrepreneurship Journal, 28(S1), 1-11.

Abstract

The research was done by testing the influence of variable business sustainability with business growth as intervening from Shariah compliance, governance, and social responsibility on the USPPS and KSPPS. Methods of data analysis used was Shem (Structural Equation Modeling) with Lisrel 8.80 data analysis tool. Variable Shariah compliance, corporate governance, social responsibility and good business growth partially or simultaneous effect significantly to sustainability efforts. Partially, the governance of the reflected by the dimensions of the influential independent positive and most dominant against the growth of the business. Partially, the Sharia compliance is reflected from the spiritual coaching with dimensions include DPS provide an indication of the influence is dominant in sustainability efforts. Responsibility that is reflected by this type of activity social Baitul Mal give positive impact and significantly to sustainability efforts. Partially, the reflected business growth of the dimensions of operational services turns out to be the most dominant in influencing the sustainability efforts of cooperatives. Business growth is the full intervening variables on influence of Shariah compliance, governance, and social responsibility a positive and significant effect against the sustainability of the cooperative.

Keywords

Good Governance, Shariah Compliance, Social Responsibility, Business Growth, and Sustainability Efforts.

Introduction

Cooperatives are service business entities like micro and small businesses that operate close to small communities. Cooperatives are also a kind of organized financial institution and therefore the existence and continuation of development are taken into consideration by the government and community. As a consideration, what form or type of cooperative should be of more concern, where the sources of funds come from, members' business development procedures, leadership systems, strategies for dealing with various risks or business constraints, and how to evaluate cooperatives have sound governance. Through the role of the Ministry of Cooperatives and SMEs, the government has a high interest in the success of cooperatives, because cooperatives are considered capable of playing a role as productive economic and social economic drivers. In this case, the government provides protection for its existence, provides empowerment programs, and provides business opportunities for cooperatives to advance, as well as improving the quality of human resources (HR), through counseling or special training. Quality human resources will be a role model or good figure for others. The main foundation of human resources is to have the right capacity and competence, and to have an attitude or morals that will drive the acceleration of cooperative performance (Virgiawan et al., 2021).

To build good governance, demanding a management system that is entrusted to management must be able to apply the principle of partnership that is the relationship of cooperation with members and other communities on the basis of trust, equality, and independence. Structuring the cooperative operational management system is directed to have similarities with other financial institutions as a credible financial institution in the eyes of the public. At least run good governance, risk management, the principle of prudence, and actively participate in the community. The main issues that are the focus of this study, both of which greatly affect the way bank management manages existing risks. The first problem is the management of loan products which will ultimately result in profitability, and the second problem is the increase in e-channel bank transactions in making bank operations efficient and can generate profitability (Yusuf & Azwar, 2020).

In cooperative management, management must be able to synergize all available resources and especially members. They must be closely interrelated with one another in promoting business or reviving businesses, as a consequence of the cutting edge and the main pillar of business sustainability. Thus the strength of cooperatives depends on the quantity and quality of the cooperative members respectively (Saluy et al., 2021). Considering that the Islamic cooperative is based on operational transactions referring to the DSN MUI fatwas, the role of the Sharia Supervisory Board structure and social responsibility services is expected to be able to encourage increased business growth and even be biased to encourage business continuity. Funds for social activities can come from the allowance for SHU and funds for zakat, Infaq, shadaqah, and endowments. The legality of this social activity can work together with the Amil Zakat Agency (BAZ), the Amil Zakat Institution (LAZ) or with the Indonesian Waqf Agency (BWI). The object of research is the cooperative type Savings and Loans and Sharia Financing or abbreviated as KSPPS and general or all-round cooperatives that have Sharia Savings and Loans and Financing Business Units (USPPS), are already members of the BMT Syariah Cooperative Parent, carrying out organizational functions significantly such as implementing RATs during three years in a row and have financial reports, have real social activities in the lives of the people in their environment even though they do not yet have a Baitul Mal unit and finally the location limitation factor was chosen in Java, namely 6 provinces of DKI Jakarta, Banten, West Java, Central Java, DI Yogyakarta, and East Java.

Literature Review

Governance

The cooperative is a financial institution, because it must be supported by the strength of regulation and sufficient capital resources so that it can truly create as an appropriate container to meet the aspirations and economic needs of members or the community and also financial institutions that grow to be strong (liquid), healthy and capital adequacy (wealth), independent (independent), and resilient (reliable). Healthy governance for a cooperative is a system that aims to protect members, investors from opportunistic behavior or management disharmony, including management, supervisors and employees. A good and healthy governance system will be able to create a system of control and balance in preventing the misuse (fraud) of resources and continue to encourage growth and performance achievements. However, with regard to growth and sustainability there are exogenous factors that influence cooperatives, namely the close relationship between cooperatives and their members and cooperatives with their surrounding communities.

In its sharia operations mechanism, universal principles such as openness and honesty in disclosure (Amanah & Shidiq), suitability in carrying out regulations or policies taken (Tha`at), fairness in decision making (`fair) and consistent in carrying out plans and work program (Istiqamah), is expected to ensure business continuity and good performance so that it benefits all stakeholders. The results of this study support the results of a previous study by Maulana and Akbar (2019), which concluded that government regulations have a significant influence on BMT business developments, regarding capital and credit guarantee schemes, and programs to strengthen the capacity and scope of funding.

Shariah Compliance

Compliance or compliance is compliance with operational principles or regulations that have been established, including the fulfillment of elements of legality, completeness of documents, adequacy of the device, and have a foundation of values, and actions that support the creation of compliance. The meaning of "sharia compliance" is the operational implementation of the cooperative was based on work values and culture, Islamic work ethics and ethics, and even able to create an atmosphere of inner peace and tranquility (Suryadi et al., 2021). Shariah compliance can be used as an indicator of the disclosure of management and managerial responsibilities in the way of producing, selling, and how to obtain profits from products or services that are transacted whether they are still usurious or not, or have a tyrannical element. In general, the foundation of each transaction has a clear type of contract because it will be the most important element in the validity assessment. A clear contract can be the main determinant of halal or haram of a transaction. In its implementation, the parties involved must have basic values, namely; first `an taraadhin, like and like (mutual pleasure); secondly, it cannot be wronged or abused, i.e. there are no intentional losses or persecution. Third, tablig, namely openness or clarity of transactions and objects to be transacted. Fourth, writing or recording, or documenting official and legal transactions.

To stabilize the sharia compliance step, the role of SSB can be optimized in terms of spiritual inward and outward guidance, which is to take responsibility for improving the mental attitude of all organizational instruments, starting from holding meetings of members, management, supervisors and members, who jointly carry out the principle principles of sharia economics in order to achieve good business growth. The results of this study indicate that by channeling the financing as much as possible then the bank will also get a high income as well, either from the income margin of sale and purchase, rental and income derived from the profit sharing so that in the end will increase profit and cause a positive relationship to profitability. Therefore, the success of a bank in achieving profit or profit requires the service of financing as its main services, in accordance with targets and plans set by the bank. Distribution of financing is the allocation of funds or funnel funds that have been collected from the community to the needy in the form of loans (Yusuf & Surjaatmandja, 2018). The results of this study support the results of previous studies by Faruq (2021) which concludes that DPS as the holder of a supervisory authority for sharia compliance has responsibilities that are regulated through strict legal provisions. The position of SSB is crucial to the creation of sharia compliance, which is the main element in the existence and continuity of business for the Islamic financial industry.

Social Responsibilities

Sharia cooperatives certainly also have a form of responsibility towards all stakeholders, namely as an inseparable part of the business ecosystem, which is to provide benefits (shared value), care in social activities, and participate in promoting the environment (Fathony et al., 2020). In accordance with the teachings of Islam, every benefit obtained by a person or an institution can actually come from the support of the lower classes or the poor as well. Every income or income earned, then there are rights for the poor, beggar, or poor. In order to be properly accommodated, and follow the rules or conformity with sharia as the responsibility of sharia cooperatives, it is recommended to have a Baitul mal unit, and in general its function is similar to the Amil Zakat Agency or Institution. The role of Baitulmaal is expected to be able to encourage the growth of members and prospective cooperative members who are not yet economically ready for business. As a first step, for example, funds are given to candidates or members who are categorized as poor or poor but who have a strong will to improve their household economy. Then the stimulus funds from the Baitulmaal can be given and if the time ends it can be offered to become a permanent member and continuously provide knowledge and skills assistance to become independent. Automatically it also affects the growth of the business continuity of the Islamic cooperative.

Business Growth

Business growth or performance of KSPPS and USSPP entities is often associated with work between plans and realization and in general the criteria are growth in the number of members, the amount of capital raised, improved methods of service, level of efficiency, and of course business results obtained and distributed to its members (Abidin et al., 2021). All forms of growth are marked by the increasing level of high confidence so that it can simplify and expand the system of adding membership. Another very important thing is the increase in incoming funds in the form of savings or loans or attractive financing offers, so that members and the community use cooperatives as an appropriate intermediary container in business development. The ability to raise the image of cooperatives in the eyes of the community is not easy, the management must at least have the right strategy, namely adequate capital, liquidity management, independence, efficiency, and the quality of fund distribution. In carrying out business development plans, of course cooperatives will face vulnerability towards their goals. Global developments function as competitive weapons, direct penetration into the market can drain important cash flow from operations. Lost opportunities, reduced profits and limited service can reduce competitiveness. For this reason, the role of the Management, Supervisor and Manager must be strong in governance and firm in carrying out its management functions.

Sustainability of Busoiness

As a business and social entity in KSPPS and USPPS, however, it still has a tendency to optimize short-term profitability (performance), there are still many cooperatives that do not always guarantee their true identity or have resilience to the challenges or shocks faced, in maintaining long-term business (sustainability). As well as to show the existence of non-financial benefits to the environment in which the cooperative is located. Determining the sustainability of a business in a business environment is not easy, because it is still influenced by economic forces, for example determining what types of object activities such as, for what activities, and whether there are many benefits to the environment or adapt to a rapidly changing environment. Islamic cooperatives must continuously seek solutions to achieve business goals and increase long-term value for members by integrating economic, social and environmental into their business strategies. The role of the Management and Manager becomes very important, must be able to articulate the Vision and Mission and be able to make adjustments (adaptation) to environmental changes. In general, the condition of problems related to maintaining business continuity is the negative trend of the main operation, for example operational losses, lack of working capital, or negative cash flow from business activities and some of the most important financial ratios dropped dramatically. Another factor that is equally important is the difficulty in fulfilling debt obligations, such as short-term debt, as well as the mixing of personal transactions into cooperative operations. The final factor is disharmony with external parties (depositors or savers or other creditors such as banks) (Endri et al., 2020).

Framework

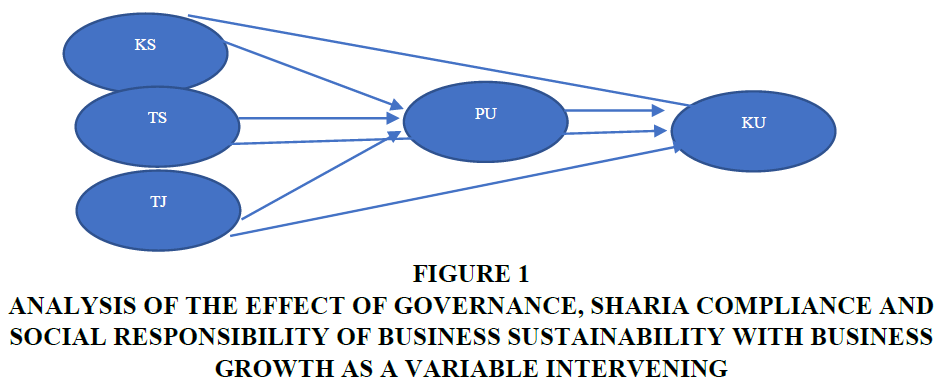

Governance, sharia compliance and social responsibility, which is carried out by management (management), will it have an effect or positive value for KSPPS and USPPS as entities, to members as owners and users.

As an entity, to members as owners and users and to other stakeholders and the end is a direct or indirect influence on business growth (performance), image, credibility and economic stability in the environment. The implementation of three important variables of governance, sharia compliance and social responsibility makes KSPPS USPPS able to compete in a healthy manner, and synergize with other institutions. In another sense, it encourages the creation of an efficient, transparent and consistent economic market, with legislation accompanied by derivative regulations. From Figure 1 above, we can see the causality between Governance (TS), Shariah Compliance (KS), and Social Responsibility (TJ) as independent variables where each can influence business growth (PU) and Sustainability (KU). In the one independent variable model, TS for example can affect two dependent variables namely Business Growth (PU) and Business Sustainability (KU). If the model is a double relationship with two or more independent variables and one dependent variable.

Figure 1 Analysis of the Effect of Governance, Sharia Compliance and Social Responsibility of Business Sustainability with Business Growth as a Variable Intervening

The implementation of governance will look good, if the implementation of KSPPS and USPPS business governance is guided through its principles namely Transparent, Accountability, Accountability, Independence, and Justice. Given the fierce competition between cooperatives and other financial institutions, and supported by the age of globalization, there must be a commitment to run business achievements in an orderly and orderly manner for quality business output. The implementation of sharia compliance seen from the regulatory aspect is the existence of DPS (Sharia Supervisory Board) officially included in the organizational structure, the number of members of at least 2 people and the duties and authority that are guided in specific guidelines. Guidelines for the implementation of sharia compliance will encourage order, regularity, the running of a process in accordance with religious principles, such as products issued, implementation of contracts and models of fostering human resources or employees and members or the general public around cooperatives. Implementation of social responsibility viewed from the regulatory aspect is the existence of Baitul mal included in the official organizational structure, with its own manager as well, and the tasks and authorities that are guided in specific guidelines. Guidelines for implementing the Baitul mal will encourage social care, help solve the social problems of members and the environment. To prove the synergy in cooperative business activities between business and social, Baitul mal must have a special agenda that is also interdependent. The general function of Baitul maal is raising funds and channeling funds in the form of empowerment and helping solve other social problems.

Methodology

The object to be examined is the cooperative as an official microfinance institution and is endorsed by the government, because the cooperative is a kind of financial institution that is capable of dealing with microfinance and the recipients are middle-to-lower class people who need very encouragement and guidance in business development and capital support which is needed quickly and has the same elements of interests and principles to the family. Considering that Islamic cooperatives have played a role in assisting the empowerment of economically weak communities including micro and small entrepreneurs, it is of course necessary to know the extent of the power relations between the institutions created and developed with members and their communities. What factors can influence the growth and development of these institutions and are qualified to be used as research material. Judging from the object of cooperative empowerment, of course there must be a regulation, HR, and other tools that can support the success of the two directions between KSPPS and USPPS, Members, and the community. As we all know, in general there are still many micro-entrepreneurs who do not understand the importance of financial structuring in businesses and families as sources of defense and enhancing life values and are strongly encouraged to take full responsibility in their management.

In this study a series of simultaneous relationships were carried out between the principles of good governance (sharia business governance), shariah compliance, and social responsibility. The approach to the implementation of governance, sharia compliance and social responsibility has become a trend of business growth, and business continuity cannot be ignored by practitioners and KSPPS policy makers. Through data analysis techniques using Structural Equation Modeling (SEM) is done to explain thoroughly the relationship between variables in research. In this study, it is more complex by taking into account the criteria of each independent variable as a sub variable. In accordance with its title, namely the Effect of Good Governance, Sharia Compliance, and Social Responsibility on Business Growth and Business Continuation for Savings and Loans Cooperatives and Sharia Financing, there are 3 latent variables or constructs, which cannot be measured directly. To measure it, dimensions and indicators need to be made in a variable instrumentation. Good Governance (healthy governance) has 5 free sub-variables, Sharia Compliance (adherence to applying sharia principles) has 3 free sub-variables, and Social Responsibility (empathy or possesses social responsibility to the environment from the existence of the institution) has 3 free sub-variables.

Results

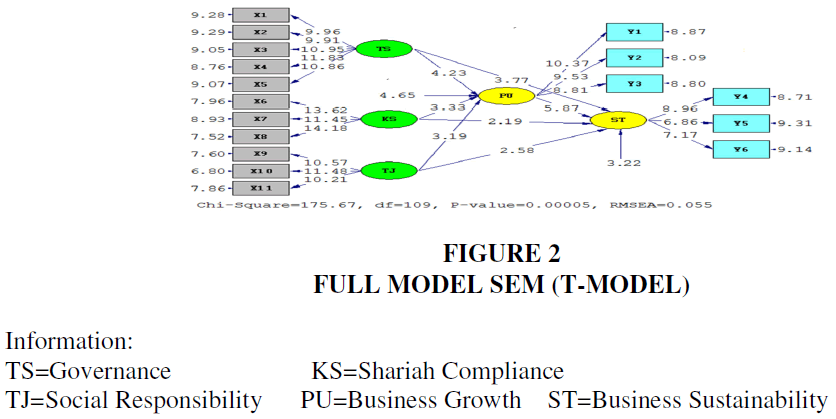

The statistical measures used in the descriptive analysis of this study are frequency and percentage. The purpose of this analysis is to look at the level of response distribution of respondents' answers. First, the frequency distribution and percentage per indicator are combined into the total dimensional frequency and percentage. Second, calculate the weighted average of each dimension which is a single measure, illustrating the overall level of respondents' perception of variable dimensions with a range of scores from 1 to 5 shows in Figure 2

Figure 2 Full Model SEM (T-Model)

Information:

TS=Governance KS=Shariah Compliance

TJ=Social Responsibility PU=Business Growth ST=Business Sustainability

Simultaneous Code of Conduct, Sharia Compliance and Social Responsibility Have a Positive and Significant Impact on Business Growth.

The results of the analysis of the data by statistical tests state that governance, sharia compliance and social responsibility simultaneously have a positive and significant effect on business growth in USPPS KSPPS, with a large contribution together of 64%, while 36% is influenced by other variables besides governance, sharia compliance and social responsibility. Based on the three variables that influence business growth, the governance variable is partially the most dominant variable whose effect on business growth is 0.36 or with a contribution of 12.96%. Thus the facts of the research results prove that governance, sharia compliance and simultaneous social responsibility have a positive and significant impact on business growth in KSPPS and USPPS. The results of this study are the same as the results of previous studies, such as the results of research from Endri et al. (2021), which concludes that the use of short-term financing sources and long-term financing sources will cause a leverage effect. The use of debt, called a lever, can greatly affect the degree and degree of changes in stock returns; The results of research from Baehaqi (2017), which concluded that Sharia Governance can be seen from several aspects, namely institutional, business activities and liquidity management as well as financial instruments; The results of research from Tanisah & Maftuhah (2015) which concluded that BMT has strength in the form of loyal members, strategic location, proactive marketing, prioritizing kinship, varied products and services, assistance for micro businesses, using profit sharing systems.

Governance Has a Positive and Significant Impact on Business Sustainability

Based on the results of the research data which was then carried out statistical tests showed that governance, especially reflected in the independence dimension, had a positive and significant effect on business sustainability, especially as reflected in the volume of business with an effect of 0.34 or with a direct contribution of 11.56%. This means that the independence dimension as measured by the level of authority for approval of loan or financing eligibility or placement of funds in certain institutions, and in collaboration with other financial institutions (banks) or special investors in cooperative business growth gives a dominant indication in forming governance in USPPS KSPPS which also effect on increasing the sustainability of the KSPPS and USPPS businesses which is reflected in the high volume of business. Thus the facts of the research results prove that governance has a positive and significant impact on business sustainability. The results of this study support the results of research conducted by Maulana and Akbar (2019), which concluded that government regulations have a significant influence on BMT business developments, regarding capital and credit guarantee schemes, and programs to strengthen capacity and scope of funding.

Shariah Compliance Has a Positive and Significant Impact on Business Sustainability

Based on the results of research data which was then carried out statistical tests showed that sharia compliance, especially those reflected by the dimensions of spiritual guidance, had a positive and significant effect on business sustainability, especially those that were reflected with the dimensions of business volume with an effect of 0.16 or with a direct contribution of 2.56%. This means that the dimension of spiritual guidance as measured by the level of DPS participation in the growth of cooperative businesses provides a dominant indication in sharia compliance and also affects the increased sustainability of the USPPS KSPPS business which is reflected in the high volume of business. Thus the facts of the research results prove that sharia compliance has a positive and significant impact on business sustainability. The results of this study support the results of research conducted by Nurhisam (2016), which concludes that DPS as the holder of a supervisory authority for sharia compliance has responsibilities that are regulated through strict legal provisions. The position of SSB is crucial to the creation of sharia compliance, which is the main element in the existence and continuity of business for the Islamic financial industry.

Social Responsibility Has a Positive and Significant Impact on Business Sustainability

Based on the results of statistical tests show that social responsibility, especially those reflected by the dimensions of the Type of Baitulmaal Activity have a positive and significant effect on business sustainability, especially those that are reflected with the dimensions of business volume with an influence of 0.20 or with a direct contribution of 4.00%. This means that the dimensions of the types of baitulmaal activities provide a dominant indication in shaping social responsibility for KSPPS and USPPS, and even have an effect on increasing business sustainability in KSPPS and USPPS which is reflected in the high volume of business Thus the facts of the research results prove that social responsibility has a positive and significant impact on business sustainability. The results of this study support the results of research conducted by Nurhisam (2016), which concludes that DPS as the holder of a supervisory authority for sharia compliance has responsibilities that are regulated through strict legal provisions. The position of SSB is crucial to the creation of sharia compliance, which is the main element in the existence and continuity of business for the Islamic financial industry.

Business Growth Has a Positive and Significant Impact on Business Sustainability

Based on the analysis of respondents' responses to the description of business growth variables in KSPPS and USPPS, it shows that business growth is in the already high category with an average score of 4.13 in the range of 3.41-4.20 regions of the high category. The dimensions of the construct of business growth after testing the level of validity and reliability indicate that the dimensions of Number of Members and Growth of Deposits, Operational Services, and Human Resources are declared valid and reliable, so that it is a dimension in building business growth constructs. Based on the results of research data which then performed statistical tests showed that business growth, especially reflected by the operational service dimensions had a positive and significant effect on business sustainability, especially those reflected in the business volume dimension with an influence of 0.40 or with a direct contribution of 16.00%. This means that the dimensions of operational services as measured by the level of service office opening provide a dominant indication in shaping the growth of the KSPPS and USPPS businesses which also influences business sustainability in the USPPS KSPPS which is reflected in the high volume of business. Thus the facts of the research results prove that social responsibility has a positive and significant impact on business sustainability. The results of this study support the results of research conducted by Nurhisam (2016), which concludes that DPS as the holder of a supervisory authority for sharia compliance has responsibilities that are regulated through strict legal provisions. The position of SSB is crucial to the creation of sharia compliance, which is the main element in the existence and continuity of business for the Islamic financial industry.

Good Corporate Governance, Sharia Compliance, Social Responsibility, and Business Growth together influence Business Sustainability

The results of data analysis with statistical tests state that governance, sharia compliance, social responsibility, and business growth simultaneously have a positive and significant effect on business sustainability in the USPPS KSPPS, with a joint contribution of 84%, while 16% is influenced by other variables besides governance, sharia compliance, social responsibility, and business growth. Based on the four variables that affect business sustainability, partially the business growth variable is the most dominant variable the effect on business continuity that is equal to 0.40 or with an influence contribution of 16.00%. Thus the facts of the research results prove that healthy governance, sharia compliance, social responsibility, and business growth simultaneously have a positive and significant effect on sustainability in KSPPS and USPPS. The results of this study complement some of the results of previous studies, such as the results of research from Razak et al. (2020) which concludes that the use of short-term financing sources and long-term financing sources will cause an effect commonly called leverage. The use of debt, called a lever, can greatly affect the degree and degree of changes in stock returns; The results of research from Baehaqi (2017) which concluded that Sharia governance can be seen from several aspects, namely institutional, business activities and liquidity management as well as financial instruments; The results of research from Tanisah & Maftuhah (2015), which concluded that BMT has strength in the form of loyal members, strategic location, proactive marketing, prioritizing kinship, varied products and services, assistance for micro businesses, using profit sharing systems; Nurhisam (2016), which concludes that DPS as the holder of a supervisory authority for sharia compliance has responsibilities that are regulated through strict legal provisions. The position of DPS is crucial to the creation of sharia compliance which is the main element in the existence and continuity of business for the Islamic financial industry.

Conclusion

The results of the discussion can be concluded as follows:

1. Healthy governance has a positive and significant impact on business sustainability with business growth as an intervening in KSPPS and USPPS, where the five aspects of indicators of governance principles: transparent or open, accountable, responsive or meeting requirements and regulations, independent or independence, and justice or fairness must go well and perceived high average value.

2. Sharia compliance has a positive and significant impact on business sustainability with business growth as an intervening in KSPPS and USPPS, where the three aspects of the indicator are: the existence of the DPS unit accompanied by personal qualification standards, then there is evidence of inspection as the main function, including reporting on its activities, and The participation of DPS members in coaching in the socialization of cooperatives and at the same time spiritual guidance for members and the wider community is perceived very high.

3. Social responsibility has a positive and significant effect on business sustainability with business growth as intervening in KSPPS and USPPS, where the three indicators: the existence of special Baitul maal units accompanied by the completeness of legality permits, the existence of activities or programs as part of directed activities, and special reporting again written in the members' meeting, was highly perceived.

References

Baehaqi, J.F. (2017). The juridical framework of sharia compliance in sharia banking operations in Indonesia. Al-Daulah: Journal of Islamic Law and Legislation, 7(1), 188-222.

Endri, E., Marlina, A., & Hurriyaturrohman (2020). Impact of internal and external factors on the net interest margin of banks in Indonesia. Banks and Bank Systems, 15(4), 99-107.

Fathony, M., Khaq, A., & Endri, E. (2020). The effect of corporate social responsibility and financial performance on stock returns. International Journal of Innovation, Creativity and Change, 13(1), 240-252.

Maulana, M.I., & Akbar, N. (2019). The potential of Bait al-M l wa Tamwil (BMT) in developing the border area of Indonesia-Malaysia. Al-Iqtishad: Jurnal Ilmu Ekonomi Syariah, 11(1).

Nurhisam, L. (2016). Sharia Compliance (Sharia Compliance) in the Islamic Finance Industry. Journal of Law Ius Quia Iustum, 23(1), 77-96.

Razak, A., Nurfitriana, F.V., Wana, D., Ramli, R., Umar, I., & Endri, E. (2020). The effects of financial performance on stock returns: Evidence of machine and heavy equipment companies in Indonesia. Research in World Economy, 11(6), 131-138.

Saluy, A.B., Abidin, Z., Djamil, M., Kemalasari, N., Hutabarat, L., Pramudena, S.M., & Endri, E. (2021). Employee productivity evaluation with human capital management strategy: The case of covid-19 in Indonesia. Academy of Entrepreneurship Journal, 27(5), 1-9.

Tanisah, T., & Maftukhah, I. (2015). The effects of service quality, customer satisfaction, Trust, and perceived value towards customer loyalty. Journal of Management Dynamics, 6(1).

Yusuf, M., & Azwar, A. (2020). The model of digital banking in islamic commercial banks: A financial engineering perspective. International Journal of Advanced Science and Technology, 29(9s), 4860-4869.

Yusuf, M., & Surjaatmadja, S. (2018). Analysis of financial performance on profitability with non performace financing as variable moderation. International Journal of Economics and Financial Issues, 8(4), 126.