Research Article: 2023 Vol: 27 Issue: 5

Effect Of Service Quality On Customer Satisfaction And Loyalty In Private Banks, Hawassa, Ethiopia

Alemyahu Balcha, Hawassa Agricultural Research Centre

Sintayehu Gurmessa, Hawassa Agricultural Research Centre

Gebeyehu Girma, Hawassa Agricultural Research Centre

Citation Information: Balcha,A., Gurmessa,S., Girma,S., (2023) Effect Of Service Quality On Customer Satisfaction And Loyalty In Private Banks, Hawassa, Ethiopia. International Journal of Entrepreneurship, 27(5), 1-17

Abstract

The major objectives of the present study were to determine whether customers are satisfied and loyal to the services provided by the private banks and to identify the mediation role of customer satisfaction between service quality and customer loyalty, in private banks operating in Hawassa, Ethiopia. A self-administrated questionnaire was used to collect primary data from conveniently selected 238 (return rate = 81.93%) customers of nine private banks in Hawassa city. The questionnaire included 18 items for the five dimensions (tangibility, reliability, responsiveness assurance and empathy) of SERVPERF model, and five items for each of customer satisfaction, and loyalty. All five dimensions of service quality were significantly correlated with service quality, customer satisfaction, and loyalty. Regression analysis showed that reliability, responsiveness, and assurance had significant effect on both customer satisfaction and loyalty. Customer satisfaction had partial mediation between service quality and customer loyalty. This study suggested that giving more emphasis to reliability, responsiveness, and assurance dimensions of the service quality would increase customers’ satisfaction and keep them loyal to the private banks. In addition to customer satisfaction, other factors that influence the relationship between service quality and customer loyalty should be studied in the future

Keywords

Service Quality, Customer Satisfaction, Loyalty, Servperf, Private Banks.

Introduction

Service Quality

A service is any act or performance one offers to the other that is essentially intangible and does not result in the ownership of anything. The production of service may or may not involve physical products (Kotler & Keller, 2012). On the other hand, service quality refers to the difference between customers’ expectations of service and their perceptions of the performance of actual service offered (Parasuraman et al., 1988). Customers' expectations are influenced by their knowledge of a company's products or services, the marketing strategies employed by the company, the psychological state of the customer at the time the service is provided, as well as their norms, values, background, and relationships with other companies (Kant & Jaiswal, 2017).

The SERVQUAL model, developed by Parasuraman et al. (1988), is frequently used to evaluate the quality of services. This model has five components: tangibility (physical facilities, equipment, and employee appearance), reliability (ability to deliver the promised service consistently), responsiveness (willingness to assist customers and provide prompt service), assurance (knowledge and courtesy of employees and their capacity to inspire trust and confidence), and empathy (caring, individualized attention the firm provides its customers). These dimensions each consist of four or five questions, giving a total of 22 paired questions to test the expectations and perceptions of customers at the same time.

It has been reported that SERVQUAL model has limited use in determining the quality of services. According to Brady and Cronin (2001), besides there is no evidence that customers evaluate service quality using SERVQUAL gap score resulting from perception minus expectation, administering expectation and perception questions twice which are identical, contribute to respondents' fatigue, confusion, and low response rates. The simultaneous ratings of expectations and perceptions also influence how respondents view the later inquiries (Tourangeau & Rasinski, 1988). In addition, it has been reported that respondents typically give the expectation component a higher score than the perception component (Smith, 1995). Thus, the present study has employed SERVPERF model, a performance-only instrument, or customer’s service perception component of SERVQUAL model, because it better captures the variation in customers' overall perceptions of service quality (Cronin and Taylor, 1992; Brady et al., 2002).

Customer Satisfaction

Customer satisfaction is an emotional response that varies in intensity depending on how well a customer's expectations were met during or after using a particular good or service (Giese & Cote, 2000). Positive disconfirmation results from customers' perceptions of product or service performance that exceeds expectations, while negative disconfirmation, or dissatisfaction, results from perceptions of underperformance, and zero disconfirmation results from perceptions of performance that is equal to expectations (Furrer et al., 2000; Sureshchandar et al., 2002). Customer satisfaction influences customers ‘commitment, customer retention, tolerance for service errors, and positive word-of- mouth (Gounaris et al., 2003).

Customer satisfaction is influenced by service quality dimensions (tangibles, reliability, responsiveness, assurance, and empathy), although the extent of influence of each dimension can variety from one situation to the other (Parasuraman et al., 1988; Arasli et al., 2005; Shanka, 2012; Gnawali, 2016; Kant & Jaiswal, 2017; Supriyanto et al., 2021). For example, the presence of physical equipment, and employees’ physical appearance, as well as their communication skills, politeness, and willingness and ability to provide the promised service promptly and accurately influence customers’ satisfaction. Due to the intangibility, inseparability, perishability, and heterogeneity of services, however, customer satisfaction is more influenced by the human aspects of service quality than by the tangibles (Parasuraman et al., 1988; Lenka et al., 2009).

Customer Loyalty

Customer loyalty combines both attitudinal and behavioral loyalty. Attitudinal loyalty refers to the customers' positive propensity toward a good or service based on their overall experiences. If a competitive brand with better quality and a lower price becomes available on the market, these customers are more likely to switch. Contrarily, behavioral loyalty refers to customers’ commitment to buy the good or service in question despite the presence of competitive alternatives on the market (Dick and Basu, 1994; Lenka et al., 2009). In general, the indicators of loyalty include less intention of customers to switch to competitors despite the existence of uniformity in banking goods and services (Chakravarty et al., 2004), and repurchase intents and favorable word-of-mouth to others (Lenka et al., 2009; Supriyanto et al., 2021).

Several studies have shown that service quality affects customer loyalty through customer satisfaction(Siddiqi, 2011; Ngo & Nguyen, 2016; Kasiri et al., 2017; Pakurár et al., 2019;Supriyanto et al., 2021). Although, customer loyalty is positively correlated with service quality and customer satisfaction (Dick & Basu, 1994; Siddiqi, 2011; Shanka, 2012; Gnawali, 2016; Ngo & Nguyen, 2016; Supriyanto et al., 2021), customers satisfied with the service are not always loyal, despite loyal customers are those satisfied with the services offered (Supriyanto et al., 2021).

Objectives of the Study

Even though, banks are constantly introducing new goods and services to their customers, the information with regard to service quality, customer satisfaction, and loyalty is scanty in banking sector in Ethiopia. Thus, the objectives of the present study were to determine whether customers are satisfied and loyal to the services provided by the private banks and to identify the mediation role of customer satisfaction between service quality and customer loyalty, in private banks operating in Hawassa.

Conceptual Model and Hypothesis

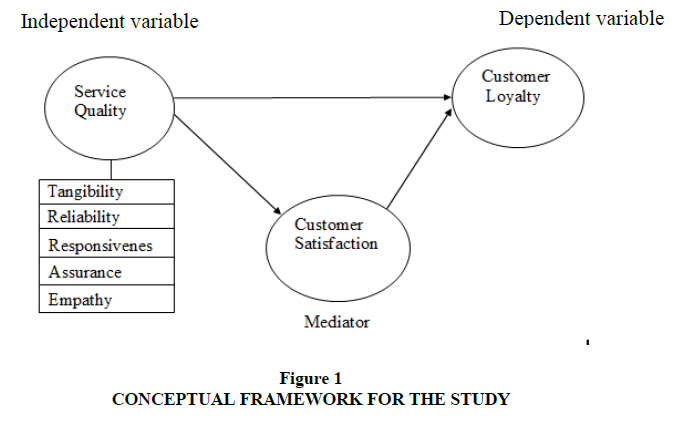

Figure 1 illustrates the conceptual model for the study. This model starts with measurement of service quality dimensions: tangibility, reliability, responsiveness, assurance, and empathy. It shows that service quality is an independent variable, customer satisfaction is a mediator and customer loyalty is a dependent variable. In this study, the following hypotheses were examined:

• H1: Service quality significantly affects customer satisfaction

• H2: Service quality significantly affects customer loyalty

• H3: Customer satisfaction significantly affects customer loyalty

• H4: Service quality significantly affects customer loyalty in the presence of customer satisfaction

Research Methodology

Description of the Study Area

This study was carried out in Hawassa, the capital city of regional state of Sidama, located 275 kilometers south of Addis Ababa, capital city of Ethiopia. The population of Hawassa has been estimated to be 436,992. In the city, there are two public banks (Commercial Bank of Ethiopia, and Development Bank of Ethiopia) and 28 private banks, at the start of this study in February, 2023.This study was based on selected customers from main branches of nine private banks, namely Addis International, Awash International, Bank of Abyssinia, Berhan, Dashen, Debub Global, Hibret, Nib International, and Wogagen banks, which are different in their number of branches, number of years in the market, and financial performance (https://en.wikipedia.org/wiki/List of banks in Ethiopia). The main branches were chosen due to their high level of activity compared to other branches in Hawassa.

Sampling Size and Data Collection

According to Hair et al. (2019), an acceptable sample size is one that includes at least 50 observations but preferably 100 or more. As an alternative, they recommend a minimum of 5 to 10 respondents for each questionnaire item. Although, a minimum of 140 respondents were needed to complete the current questionnaire, which included 18 items on the dimensions of service quality (Parasuraman et al., 1988), and five items for each of customer satisfaction and customer loyalty obtained from published works (Lenka et al., 2009; Siddiqi, 2011; Bhat et al., 2018; Islam et al., 2020), 238 self-administered questionnaires were conveniently distributed to volunteer customers who were able to complete the questionnaires. The questionnaire also included seven personal profile questions.

Respondents were selected from each main branch bank based on their proportion in the total number of 198 000 customers in main branches of nine private banks considered at the start of the study in February, 2023. A 5-point Likert scale with the options of 1=strongly disagree, 2=disagree, 3=neutral, 4=agree, and 5=strongly agree, was used to assess how well services were perceived by customers, as well as their satisfaction and loyalty.

Data Analysis

Data were analyzed with Statistical Package for Social Sciences (SPSS) software, version 23. Pearson correlation was done among service quality, service quality dimensions, customer satisfaction and loyalty. In addition, regression analysis was used to estimate the effect of service quality dimensions on customer satisfaction and loyalty. Both three simple and one multiple regression analyses were conducted to investigate the mediation effect of customer satisfaction in the relationship between service quality and customer loyalty (Baron & Kenny, 1986).

Results and Discussion

Response Rates

For two hundred thirty eight self-administered questionnaires, after discarding incomplete responses, the valid response rate was 195(81.93%). Due to their extensive customer bases, Awash International (15.15%), Bank of Abyssinia (12.63%), and Dashen (20.20%) banks contributed the majority of respondents in the sample (Table 1).

| Table 1 Number Of Customers, Sample Size, Frequency Of Responses And Response Rate For Main Branches Of Nine Private Banks In Hawassa, 2023 |

|||||

|---|---|---|---|---|---|

| Bank | Number of customers | Percent | Frequency in the sample | Frequency of responses | % Response rate |

| Addis International | 15000 | 7.58 | 18 | 13 | 7.56 |

| Awash International | 30000 | 15.15 | 36 | 32 | 15.13 |

| Bank of Abyssinia | 25000 | 12.63 | 30 | 28 | 12.61 |

| Berhan | 20000 | 10.1 | 24 | 17 | 10.08 |

| Dashen | 40000 | 20.2 | 48 | 44 | 20.17 |

| Debub Global | 15000 | 7.58 | 18 | 12 | 7.56 |

| Hibret | 17000 | 8.59 | 21 | 14 | 8.82 |

| Nib International | 16000 | 8.08 | 19 | 17 | 7.98 |

| Wogagen | 20000 | 10.1 | 24 | 18 | 10.08 |

| Total | 198000 | 100 | 238 | 195 | 100 |

Profiles of Respondents

Gender, age, occupation, experience with the bank, type of account owned, and marital status were items included in the respondents' profile information (Table 2). Male respondents made up 64.1% of the sample, while female respondents were 34.9%. Age groups 20-29 (17.9%), 30-39 (37.2%), and 40-49 years (22.1%) represented 77.20% of the respondents. Government employees made up 54.4% of the respondents, followed by self-employed respondents (26.7%) and business owners (17.4%), whereas majority of the respondents had 1-5(51.8%), and 6-10(25.6%) years of experience in using private bank services. Regarding education, the majority of respondents were bachelor's (46.7%) and master's (29.7%) degree holders, while 10.8% had diploma level qualifications. Saving account (52.8%) and current account (44.6%) were held by the majority of respondents, while fixed account (3.6%) was the least common. Among the respondents, 25.6% were single, 70.8% were married, and 3.6% had divorced.

| Table 2 Profiles Of Respondents Of Nine Private Banks Customers In Hawassa, 2023 |

||

|---|---|---|

| Items | Frequency(n=195) | Percent |

| Gender | ||

| Male | 127 | 65.1 |

| Female | 68 | 34.9 |

| Age | ||

| Below 20 years | 4 | 2.1 |

| 20-29 years | 35 | 17.9 |

| 30-39 years | 92 | 37.2 |

| 40–49 years | 43 | 22.1 |

| 50 years and above | 21 | 10.8 |

| Occupation | ||

| Government employee | 106 | 54.4 |

| Student | 3 | 1.5 |

| Business owner | 34 | 17.4 |

| Self employed | 52 | 26.7 |

| Education | ||

| Primary school | 11 | 5.6 |

| High school complete | 14 | 7.2 |

| Diploma | 21 | 10.8 |

| Bachelor’s degree | 91 | 46.7 |

| Master’s degree | 58 | 29.7 |

| Experience with the Bank | ||

| Less than one year | 22 | 11.3 |

| 1- 5 years | 101 | 51.8 |

| 6-10 years | 50 | 25.6 |

| 10-15 years | 17 | 8.7 |

| More than 15 years | 5 | 2.6 |

| Type of Account | ||

| Saving account | 103 | 52.8 |

| Current account | 86 | 44.1 |

| Fixed account | 6 | 3.1 |

| Marital Status | ||

| Single | 50 | 25.6 |

| Married | 138 | 70.8 |

| Divorced | 7 | 3.6 |

Validity and Reliability Tests

Validity Test

When a measurement accurately captures the underlying construct that it is intended to measure, that measurement is said to be valid (Hair et al., 2019). The questionnaire was pre-tested with 20 selected private bank customers who were able to offer pertinent suggestions for the refinement of the questionnaire. With the suggestion of those respondents, one item from each of reliability, responsiveness, assurance, and empathy dimensions was discarded because of ambiguity of their meanings, reducing the total number of items of service quality (Parasuraman et al., 1988) from 22 to 18.

| Table 3 Cronbach’s Alpha Values, Mean, Standard Deviations Of Service Quality Dimensions, And Service Quality For Respondents (N = 195) Of Nine Private Banks Customers In Hawassa, 2023 |

||||

|---|---|---|---|---|

| Dimension | Cronbach's alpha for dimensions | Cronbach's alpha if item deleted | Mean | SD |

| Tangibility | 0.777 | 4.01 | 0.698 | |

| The bank has up-to-date equipment | 0.735 | 4.09 | 0.844 | |

| Bank’s physical facilities are visually appealing | 0.718 | 4.02 | 0.905 | |

| Bank’s employees are well dressed and appear neat | 0.727 | 4.19 | 0.908 | |

| The appearance of the physical facilities of the bank is keeping with the type of services provided | 0.712 | 3.74 | 0.945 | |

| Reliability | 0.79 | 3.78 | 0.749 | |

| When the bank promises to do something by a certain time, it does so | 0.737 | 3.51 | 1.012 | |

| The bank is dependable | 0.736 | 4.08 | 0.87 | |

| The bank provides its service at the time it promises to do so. | 0.719 | 3.59 | 0.987 | |

| The bank keeps its records accurately | 0.76 | 3.92 | 0.949 | |

| Responsiveness | 0.834 | 3.94 | 0.807 | |

| You receive prompt service from bank’s employees | 0.769 | 4.04 | 0.946 | |

| Employees of bank are always willing to help customers | 0.741 | 4.06 | 0.871 | |

| Employees of bank are never too busy to respond to customer requests promptly | 0.802 | 3.71 | 0.974 | |

| Assurance | 0.85 | 3.84 | 0.818 | |

| You can trust employees of the bank | 0.761 | 3.78 | 0.966 | |

| You feel safe in your transactions with the bank’s employees | 0.795 | 3.91 | 0.895 | |

| Employees of the bank are polite | 0.813 | 3.83 | 0.936 | |

| Empathy | 0.873 | 3.53 | 0.819 | |

| The bank give you individual attention | 0.825 | 3.62 | 0.979 | |

| Employees of the bank give you personal attention | 0.825 | 3.49 | 0.981 | |

| Employees of the bank understand what your needs are | 0.846 | 3.65 | 0.98 | |

| The bank has your best interests at heart | 0.855 | 3.35 | 0.904 | |

| Service quality | 0.842 | |||

Reliability Test

Reliability refers to the consistency of a variable or group of variables with respect to the construct they are supposed to measure, after serval trials. The internal consistency of items which measure the same construct should be highly inter-correlated, and is commonly evaluated with the minimum Cronbach’s alpha value of 0.70 (Hair et al., 2019). All dimensions of service quality as well as customer satisfaction and customer loyalty had Cronbach’s alpha values greater than 0.70, confirming the internal consistency of items employed to measure these concepts (Table.3, and Table.4). The Cronbach’s alpha value ranged from 0.777 for tangibility to 0.878 of customer satisfaction. The cause of low reliability of an instrument includes confusing questions and the respondent’s unfamiliarity with or doesn’t care about the questions (Marczyk et al., 2005).

| Table 4 Cronbach’s Alpha Values, Mean, And Standard Deviations Of Respondents (N = 195) Of Nine Private Banks Customers To The Customer Satisfaction And Loyalty Items, Hawassa, 2023 |

||||

|---|---|---|---|---|

| Dimension | Cronbach's alpha for dimensions | Cronbach's alpha if item deleted | Mean | SD |

| Customer satisfaction | 0.878 | 3.87 | 0.741 | |

| Overall, I am satisfied with the physical setting of the bank | 0.843 | 4.05 | 0.817 | |

| I am satisfied with the banking skills, courtesy and friendliness of bank employees | 0.842 | 4.02 | 0.861 | |

| I am satisfied with individual attention and complaint handling of the bank | 0.859 | 3.71 | 0.832 | |

| I am satisfied with employees’ response and prompt services provided by my bank | 0.847 | 3.88 | 1.023 | |

| I am satisfied with products and services offered by my bank | 0.867 | 3.71 | 0.969 | |

| Customer loyalty | 0.857 | 3.59 | 0.807 | |

| I recommend this bank to families, relatives and friends | 0.83 | 3.68 | 0.931 | |

| I will continue to use this banking service in the future | 0.812 | 3.77 | 0.947 | |

| I often tell positive things about my bank to other people | 0.819 | 3.59 | 1.043 | |

| I have no intention to switch over to other | 0.852 | 3.35 | 1.056 | |

| I prefer this bank over other banks | 0.82 | 3.54 | 1.075 | |

Service Quality Dimensions

Table 4 showed that the mean scores for tangibility items ranged from 3.74 (the appearance of the physical facilities of the bank is keeping with the type of services provided) to 4.19 (bank’s employees are well dressed and appear neat) with the tangibility mean score of 4.01, whereas the mean scores for reliability items ranged from 3.51 (when the bank promises to do something by a certain time, it does so) to 4.08 (the bank is dependable) with the mean of 3.78. Similarly, the mean scores of responsiveness items ranged from 3.71(employees of bank are never too busy to respond to customer requests promptly) to 4.06 (employees of bank are always willing to help customers) with the mean of 3.94. The mean scores for the assurance items were 3.78 (you can trust employees of the bank), 3.91(you feel safe in your transactions with the bank’s employees), and 3.83 (employees of the bank are polite) with the assurance mean of 3.84, whereas that of empathy items ranged from 3.35 (the bank has your best interests at heart) to 3.65 (employees of the bank understand what your needs are) with the mean score for the empathy dimension of 3.53.

Using the criteria of strongly disagree (1.00 -1.80), disagree (1.81- 2.60), neutral (2.61-3.40), agree (3.41-4.20), and strongly agree (4.21-5.00) (Nyutu et al., 2021), the respondents agreed with the presence of tangibility, provision of accurate and dependable services at promised times, less waiting to obtain services, employees are trustworthy and polite in handling customers, and banks and their employees give individual attentions and understand customer needs, in private banks, except that their response was neutral for the item: The bank has your best interests at heart.

Customer Satisfaction and Customer Loyalty

Table 4 showed that the mean scores for the customer satisfaction items ranged from 3.71(I am satisfied with individual attention and complaint handling of the bank, and I am satisfied with products and services offered by my bank) to 4.05 (Overall, I am satisfied with the physical setting of the bank) with the customer satisfaction mean score of 3.87, whereas the mean scores for the customer loyalty items ranged from 3.35(I have no intention to switch over to other) to 3.77 (I will continue to use this banking service in the future) with the customer loyalty mean score of 3.59. This showed that customers were generally satisfied with the private banks' service offerings and loyalty to them, except that their response to the item: I have no intention to switch over to other, was neutral (3.35).

Correlation Analysis

The Pearson correlation coefficients for service quality dimensions, service quality, customer satisfaction, and loyalty were shown in Table 5. The five service quality dimensions were positively correlated with service quality (r = 0.738 to 0.807, p < 0.01), customer satisfaction (r = 0.545 to 0.743, p < 0.01), and customer loyalty (r = 0.513 to 0.649, p < 0.01). The within-service dimensions correction coefficients were also positive (r = 0.365 to 0.596, p < 0.01). indicating that the improvement in one dimension would have a positive influence on the other.

| Table 5 Pearson Correlation Coefficients Among Service Quality Dimensions, Service Quality, Customer Satisfaction And Customer Loyalty Across Nine Private Banks Customers (N = 195) In Hawasa, 2023 |

|||||||

|---|---|---|---|---|---|---|---|

| Items | REL | RES | ASS | EMP | SQ | CS | CL |

| TAN | 0.596** | 0.529** | 0.466** | 0.365** | 0.738** | 0.545** | 0.513** |

| REL | 0.559** | 0.556** | 0.469** | 0.805** | 0.651** | 0.578** | |

| RES | 0.510** | 0.548** | 0.807** | 0.743** | 0.649** | ||

| ASS | 0.575** | 0.800** | 0.638** | 0.581** | |||

| EMP | 0.766** | 0.601** | 0.522** | ||||

| SQ | 0.813** | 0.727** | |||||

| CS | 0.821** | ||||||

| TAN = tangibility; REL = reliability; RES = responsiveness; ASS = assurance; EMP = empathy; SQ = service quality; CS = customer satisfaction; CL = customer loyalty; ** = significant at p < 0.01 probability level. | |||||||

Using the criteria for the interpretation of correlation coefficient (r) as r = 0.1 is small, r = 0.3 is medium, and r = 0.5 or more is large (Gravetter et al., 2020), the correlation coefficient of service quality with customer satisfaction (r = 0.813, p=0.01) and customer loyalty (r = 0.727, p < 0.01), and that between customer satisfaction and customer loyalty (r = 0.821, p < 0.01) were strong. Correlation analysis also demonstrated that improving overall service quality and its dimensions will result in satisfied and more devoted customers (Lenka et al., 2009; Siddiqi, 2011; Shanka, 2012; Ali & Raza, 2015; Slack & Singh, 2020; Supriyanto et al., 2021).

Regression Analysis

F-test showed that the effects of tangibility, reliability, responsiveness, assurance and empathy explained 68.9% of the variation in customer satisfaction and was significant (p = 0.000) (Table 6). The coefficient of determination (R2) value was moderate according to the criteria of R2 values of 0.75, 0.50, and 0.25 are substantial, moderate, and weak, respectively (Hair et al., 2019). These service quality dimensions (tangibility, reliability, responsiveness, assurance, and empathy) have also been used to predict customer satisfaction in service industry (Parasuraman et al., 1988; Cronin & Taylor, 1992; Arasli et al., 2005; Awan et al., 2011; Islam et al., 2020).

| Table 6 Significance Of Regression Model Of Service Quality Dimensions On Customer Satisfaction Across Nine Private Banks Customers (N = 195) In Hawassa, 2023 |

|||||

|---|---|---|---|---|---|

| Source of variationa | Sum of Squares | df | Mean Square | F | P |

| Regression | 73.359 | 5 | 14.672 | 83.606 | 0 |

| Residual | 33.167 | 189 | 0.175 | ||

| Total | 106.526 | 194 | |||

| aDependent variable = customer satisfaction (CS); independent variables: tangibility, reliability, responsiveness, assurance, empathy; df = degree of freedom; R2 = 0.689, standard error of the estimate (SE) = 0.419. | |||||

Table 7 demonstrated that, with the exception of tangibility, each dimension of service quality had a statistically significant effect on customer satisfaction. This agrees with the correlation analysis except for tangibility. The unit change in reliability, responsiveness, assurance and empathy would increase customer satisfaction by 0.203, 0.385, 0.187 and 0.123 units, respectively. The standardized regression coefficients, or beta coefficients (β) use standardized data and show the direct effect of independent variables on dependent variable (Hair et al., 2019). The direct effects of reliability, responsiveness, and assurance and empathy dimensions on customer satisfaction were 0.205, 0.420, 0.206 and 0.132, respectively, suggesting that any improvement in these dimensions would increase customer satisfaction. The significant impact of reliability (Ali & Raza, 2015; Gnawali, 2016), and that of responsiveness, assurance and empathy (Shanka, 2012; Ali & Raza, 2015; Gnawali, 2016; Kant & Jaiswal, 2017) on customer satisfaction have also been reported in previous studies.

| Table 7 Regression Coefficients For Relationship Between Service Quality Dimensions And Customer Satisfaction Across Nine Private Banks Customers (N = 195) In Hawassa, 2023 |

|||||

|---|---|---|---|---|---|

| Model | Unstandardized coefficients | Standardized coefficients | |||

| B | SE | β | t | P | |

| (Constant) | 0.202 | 0.197 | 1.022 | 0.308 | |

| Tangibility | 0.059 | 0.057 | 0.056 | 1.04 | 0.3 |

| Reliability | 0.203 | 0.057 | 0.205 | 3.587 | 0 |

| Responsiveness | 0.385 | 0.051 | 0.42 | 7.559 | 0 |

| Assurance | 0.187 | 0.05 | 0.206 | 3.747 | 0 |

| Empathy | 0.123 | 0.048 | 0.136 | 2.54 | 0.012 |

Despite the fact that poor tangibles would lead to customer disappointment (Parasuraman et al., 1988; Arasli et al.,2005), the insignificant effect of tangibility on customer satisfaction could be because private banks might have similar offers in terms of up to-date equipment, visually appealing facilities, and neat and well-dressed employees. The insignificant effect of tangibility on customer satisfaction has also been reported by other studies (Arasli et al., 2005; Shanka, 2012).

F-test showed that the effects of tangibility, reliability, responsiveness, assurance and empathy explained 54.4% of the variation in customer loyalty and was significant (p = 0.000) (Table 8).

| Table 8 Significance Of Regression Model Of Service Quality Dimensions On Customer Loyalty Across Nine Private Banks Customers (N = 195) In Hawassa, 2023 |

|||||

|---|---|---|---|---|---|

| Source of variation | df | Sum of squares | Mean square | F | P |

| Regression | 5 | 68.672 | 13.734 | 45.017 | 0 |

| Residual | 189 | 57.663 | 0.305 | ||

| Total | 194 | 126.335 | |||

aDependent variable = customer loyalty (CL); independent variables: tangibility, reliability, responsiveness, assurance, empathy; df = degree of freedom; R2 = 0.544; standard error of the estimate (SE) = 0.552.

Table 9 indicated that, in agreement with correlation analysis, reliability, responsiveness and assurance, except tangibility and empathy dimensions, had a statistically significant effect on customer loyalty. The unit increase in reliability, responsiveness, and assurance would increase customer loyalty by 0.176, 0.343 and 0.209 units, respectively. The direct effect (β) of reliability, responsiveness, and assurance dimensions on customer loyalty was also, 0.163, 0.343, and 0.212, respectively.

| Table 9 Regression Coefficients For Relationship Between Service Quality Dimensions And Customer Loyalty Across Nine Private Banks Customers (N = 195) In Hawassa, 2023 |

|||||

|---|---|---|---|---|---|

| Model | Unstandardized coefficients | Standardized coefficients | |||

| B | SE | β | t | P | |

| (Constant) | -0.037 | 0.26 | -0.144 | 0.886 | |

| Tangibility | 0.115 | 0.075 | 0.099 | 1.538 | 0.126 |

| Reliability | 0.176 | 0.075 | 0.163 | 2.357 | 0.019 |

| Responsiveness | 0.343 | 0.067 | 0.343 | 5.103 | 0 |

| Assurance | 0.209 | 0.066 | 0.212 | 3.176 | 0.002 |

| Empathy | 0.099 | 0.064 | 0.1 | 1.548 | 0.123 |

Tolerance and the variance inflation factor (VIF) are commonly used to assess multicollinearity, or the degree of correlation in independent variables. Tolerance is determined as 1-R2, i.e., the variability of an independent variable that cannot be explained by the other independent variables, after regressing independent variables on another independent variable, and it should be more than 0.10 to demonstrate that the independent variables do not contribute significantly to the variation of that independent variable. Variance inflation factor (VIF), which should be generally less than 10, is an inverse of the tolerance value and its square root indicates the degree to which the standard error would be increased(Hair et al., 2019). Thus, in this study, there has been no multicollinearity problem with regard to service quality dimensions (Table 10).

| Table 10 Values Of Tolerance And Variance Inflation Factor For Service Quality Dimensions Across Nine Private Banks Customers (N = 195) In Hawassa, 2023 |

||

|---|---|---|

| Dimensions | Tolerance | VIF |

| Tangibility | 0.578 | 1.729 |

| Reliability | 0.505 | 1.979 |

| Responsiveness | 0.535 | 1.871 |

| Assurance | 0.542 | 1.843 |

| Empathy | 0.576 | 1.736 |

| aVIF = variance inflation factor | ||

Customer Satisfaction as a Mediator

The following three simple linear regressions and one multiple regression were conducted to assess the role of customer satisfaction(mediator) in the relationship between service quality (independent variable) and customer loyalty (dependent variable) (Baron & Kenny, 1986).

• Model 1: Service quality significantly affects customer satisfaction

• Model 2: Service quality significantly affects customer loyalty

• Model 3: Customer satisfaction significantly affects customer loyalty

• Model 4: Service quality insignificantly affects customer loyalty in the presence of customer satisfaction

Complete mediation exists if all four conditions are met, and partial mediation exists if only the first three conditions are significant (Baron & Kenny, 1986). Simple regression analysis showed that the effect of service quality on customer satisfaction and loyalty, and that of customer satisfaction on customer loyalty was significant (p =0.000) and had moderate R-square (R2 = 0.529 to 0.674) values. Multiple regression showed that the effects of service quality and customer satisfaction on customer loyalty were significant (p = 0.000) suggesting that customer satisfaction was a partial mediator between service quality and customer loyalty (Table 11).

| Table 11 Significance Of Regression Models To Test Customer Satisfaction As A Mediator Between Service Quality And Customer Loyalty Across Nine Private Banks Customers (N = 195) In Hawassa, 2023 |

||||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| Dependent variable | Independent variable(s) | Source of variation | Sum of Squares | df | Mean Square | F | P | R-square | SE | |

| 1 | CS | SQ | Regression | 70.463 | 1 | 70.463 | 377.1 | 0 | 0.661 | 0.432 |

| Residual | 36.063 | 193 | 6.187 | |||||||

| Total | 106.526 | 194 | ||||||||

| 2 | CL | SQ | Regression | 66.859 | 1 | 66.859 | 216.957 | 0 | 0.529 | 0.555 |

| Residual | 59.476 | 193 | 0.308 | |||||||

| Total | 126.335 | 194 | ||||||||

| 3 | CL | CS | Regression | 85.15 | 1 | 85.15 | 399.027 | 0 | 0.674 | 0.462 |

| Residual | 41.185 | 193 | 0.213 | |||||||

| Total | 126.335 | 194 | ||||||||

| 4 | CL | CS, SQ | Regression | 86.483 | 2 | 43.242 | 208.332 | 0 | 0.685 | 0.456 |

| Residual | 39.852 | 192 | 0.208 | |||||||

| Total | 126.335 | 194 | ||||||||

| aCS =customer satisfaction; CL = customer loyalty; SQ = service quality; df = degree of freedom; SE = standard error of the estimate | ||||||||||

Table 12 showed that, in simple regression, a unit increase in service quality would increase customer satisfaction by 0.988 and customer loyalty by 0.962, whereas a unit increase in customer satisfaction would increase customer loyalty by 0.894. The significant effect of service quality on customer satisfaction and that of customer satisfaction on customer loyalty have also been reported in previous studies (Lenka, et al., 2009; Shanka, 2012; Kasiri et al., 2017; Islam et al., 2020; Supriyanto et al., 2021). The direct (standardized) effects of service quality on customer satisfaction and customer loyalty were 0.813 and 0.727, respectively, while that of customer satisfaction on customer loyalty was 0.821.

| Table 12 Significance Of Regression Coefficients For Relationship Between Service Quality, Customer Satisfaction And Customer Loyalty Across Nine Private Banks Customers (N = 195) In Hawassa, 2023 |

||||||||

|---|---|---|---|---|---|---|---|---|

| Model | Dependent variable | Independent variable(s) | Unstandardized Coefficients | Standardized Coefficients | ||||

| B | SE | β | t | P | ||||

| 1 | CS | SQ | Constant | 0.099 | 0.197 | 0.505 | 0.614 | |

| SQ | 0.988 | 0.051 | 0.813 | 19.419 | 0 | |||

| 2 | CL | SQ | Constant | -0.087 | 0.253 | -0.344 | 0.731 | |

| SQ | 0.962 | 0.065 | 0.727 | 14.729 | 0 | |||

| 3 | CL | CS | Constant | 0.126 | 0.176 | 0.715 | 0.475 | |

| CS | 0.894 | 0.045 | 0.821 | 19.976 | 0 | |||

| 4 | CL | CS, SQ | Constant | -0.16 | 0.208 | -0.772 | 0.441 | |

| SQ | 0.234 | 0.092 | 0.177 | 2.534 | 0.012 | |||

| CS | 0.738 | 0.076 | 0.677 | 9.724 | 0 | |||

| aCS =customer satisfaction, CL = customer loyalty; SQ = service quality; SE = standard error of the estimate. | ||||||||

In multiple regression, the substantial reduction in the direct effect of service quality on customer loyalty to 0.177, in the presence of customer satisfaction and the significant indirect effect (0.813 x 0.677 = 0.550) according to Sobel test (Z = 7.776, p = 0.000) would show that customer satisfaction is a more crucial factor for customer loyalty than service quality. The role of customer satisfaction as a mediator between service quality and customer loyalty has also been reported in previous studies (Siddiqi, 2011; Ngo & Nguyen, 2016; Kasiri et al., 2017; Pakurár et al., 2019; Slack & Singh, 2020; Supriyanto et al., 2021). Even though customer satisfaction is a strong mediator, the significant effect of service quality in the presence of customer satisfaction would show that multiple mediating factors occur between service quality and customer loyalty (Baron and Kenny, 1986). It has also been reported that satisfied customers are not always loyal (Bhat et al., 2018; Supriyanto et al., 2021). For instance, Bhat et al., (2018) suggested that satisfaction can lead to loyalty when customers build trust

Conclusion

This study showed that all service quality dimensions (tangibility, reliability, responsiveness, assurance and empathy) were positively correlated with service quality, customer satisfaction and customer loyalty, suggesting that improving service quality would improve customer satisfaction and loyalty in private banks. In this study, reliability, responsiveness and assurance dimensions were most important determinants of customer satisfaction and loyalty, suggesting that their improvement would enhance customer satisfaction and loyalty in private banks. Service quality had large indirect effect on customer loyalty through customer satisfaction, suggesting that implementing service quality improvement strategies which ensure customer satisfaction, would in return lead to customer loyalty.

Recommendations

Based on this study, the following recommendations would be suggested to enhance service quality, customer satisfaction and loyalty in private banks:

• The significant effects of reliability, responsiveness, and assurance on customer satisfaction and loyalty, would suggest that the focus would be given to these dimensions to retain the existing customers and to attract the new ones.

• The non-significant effect of tangibility on both customer satisfaction and loyalty, and that of empathy on customer loyalty would suggest that implementing strategies to differentiate these dimensions would give private banks competitive advantages.

• The strong mediation role of customer satisfaction between service quality and customer satisfaction would suggest that improving service quality to enhance customer satisfaction would increase customer loyalty.

• Even though customer satisfaction strongly mediated the relationship between service quality and customer loyalty in this study, other factors affecting this relationship should also be studied.

• Both private and public banks would be studied in the future in order to better understand the relationship between service quality, customer satisfaction and customer loyalty in Ethiopian banking industry.

Acknowledgements

This article is part of the master’s study self-sponsored by the first author.

References

Ahrholdt, D. C., Gudergan, S. P., & Ringle, C. M. (2017). Enhancing service loyalty: The roles of delight, satisfaction, and service quality. Journal of Travel Research, 56(4), 436-450.

Ali, M., & Raza, S. A. (2017). Service quality perception and customer satisfaction in Islamic banks of Pakistan: the modified SERVQUAL model. Total Quality Management & Business Excellence, 28(5-6), 559-577.

Arasli, H., Mehtap?Smadi, S., & Turan Katircioglu, S. (2005). Customer service quality in the Greek Cypriot banking industry. Managing Service Quality: An International Journal, 15(1), 41-56.

Awan, H. M., Bukhari, K. S., & Iqbal, A. (2011). Service quality and customer satisfaction in the banking sector: A comparative study of conventional and Islamic banks in Pakistan. Journal of Islamic Marketing, 2(3), 203-224.

Baron, R. M., & Kenny, D. A. (1986). The moderator–mediator variable distinction in social psychological research: Conceptual, strategic, and statistical considerations. Journal of personality and social psychology, 51(6), 1173..

Bhat, S. A., Darzi, M. A., & Parrey, S. H. (2018). Antecedents of customer loyalty in banking sector: a mediational study. Vikalpa, 43(2), 92-105.

Brady, M. K., & Cronin Jr, J. J. (2001). Some new thoughts on conceptualizing perceived service quality: a hierarchical approach.Journal of marketing,65(3), 34-49.

Brady, M. K., Cronin Jr, J. J., & Brand, R. R. (2002). Performance-only measurement of service quality: a replication and extension. Journal of business research, 55(1), 17-31.

Chakravarty, S., Feinberg, R., & Rhee, E. Y. (2004). Relationships and individuals' bank switching behavior. Journal of Economic Psychology, 25(4), 507-527.

Cronin Jr, J. J., & Taylor, S. A. (1992). Measuring service quality: a reexamination and extension. Journal of marketing, 56(3), 55-68.

Dick, A. S., & Basu, K. (1994). Customer loyalty: toward an integrated conceptual framework. Journal of the academy of marketing science, 22, 99-113.

Furrer, O., Liu, B. S. C., & Sudharshan, D. (2000). The relationships between culture and service quality perceptions: Basis for cross-cultural market segmentation and resource allocation. Journal of service research, 2(4), 355-371.

Giese, J. L., & Cote, J. A. (2000). Defining consumer satisfaction. Academy of marketing science review, 1(1), 1-22.

Gnawali, A. (2016). Effects of Service Quality on Customer Satisfaction in Nepalese Commercial Banks. Journal of Development and Administrative Studies, 24(1-2), 1-16.

Gounaris, S. P., Stathakopoulos, V., & Athanassopoulos, A. D. (2003). Antecedents to perceived service quality: an exploratory study in the banking industry. International journal of bank marketing, 21(4), 168-190.

Gravetter, F. J., Wallnau, L. B., Forzano, L. A. B., & Witnauer, J. E. (2020).Essentials of statistics for the behavioral sciences. 10th ed., Cengage Learning, USA.

Khoa, B. T., & Nguyen, M. H. (2022). The moderating role of anxiety in the relationship between the perceived benefits, online trust and personal information disclosure in online shopping. International Journal of Business and Society, 23(1), 444-460.

Islam, R., Ahmed, S., Rahman, M., & Al Asheq, A. (2020). Determinants of service quality and its effect on customer satisfaction and loyalty: an empirical study of private banking sector. The TQM Journal, 33(6), 1163-1182.

Jasinskas, E., Streimikiene, D., Svagzdiene, B., & Simanavicius, A. (2016). Impact of hotel service quality on the loyalty of customers. Economic research-Ekonomska istra?ivanja, 29(1), 559-572.

Kant, R., & Jaiswal, D. (2017). The impact of perceived service quality dimensions on customer satisfaction: An empirical study on public sector banks in India.International Journal of Bank Marketing, 35(3), 411-430.

Kasiri, L. A., Cheng, K. T. G., Sambasivan, M., & Sidin, S. M. (2017). Integration of standardization and customization: Impact on service quality, customer satisfaction, and loyalty.Journal of Retailing and Consumer Services,35, 91-97.

Kotler, P., & Keller, K. (2012).Marketing Management (14th edition). Pearson Education Limited.

Lenka, U., Suar, D., & Mohapatra, P. K. (2009). Service quality, customer satisfaction, and customer loyalty in Indian commercial banks. The Journal of Entrepreneurship, 18(1), 47-64.

Marczyk, G. R., DeMatteo, D., & Festinger, D. (2010). Essentials of research design and methodology (Vol. 2). John Wiley & Sons.

Ngo, V. M., & Nguyen, H. H. (2016). The relationship between service quality, customer satisfaction and customer loyalty: An investigation in Vietnamese retail banking sector.Journal of competitiveness, 8 (2), 103–116

Nyutu, E. N., Cobern, W. W., & Pleasants, B. A. (2021). Correlational Study of Student Perceptions of Their Undergraduate Laboratory Environment with Respect to Gender and Major.International Journal of Education in Mathematics, Science and Technology,9(1), 83-102.

Pakurár, M., Haddad, H., Nagy, J., Popp, J., & Oláh, J. (2019). The service quality dimensions that affect customer satisfaction in the Jordanian banking sector.Sustainability,11(4), 1113.

Parasuraman, A., Zeithaml V.A., & Berry L.L. (1988). SERVQUAL: a multiple-item scale for measuring customer perceptions of service quality. J. Retailing. 64: 12-40.

Shanka, M. S. (2012). Bank service quality, customer satisfaction and loyalty in Ethiopian banking sector.Journal of Business Administration and Management Sciences Research,1(1), 001-009.

Siddiqi, K. O. (2011). Interrelations between service quality attributes, customer satisfaction and customer loyalty in the retail banking sector in Bangladesh.International journal of business and management,6(3), 12.

Slack, N. J., & Singh, G. (2020). The effect of service quality on customer satisfaction and loyalty and the mediating role of customer satisfaction: Supermarkets in Fiji.The TQM Journal,32(3), 543-558.

Smith, A. M. (1995). Measuring service quality: is SERVQUAL now redundant?.Journal of marketing management,11(1-3), 257-276.

Supriyanto, A., Wiyono, B. B., & Burhanuddin, B. (2021). Effects of service quality and customer satisfaction on loyalty of bank customers.Cogent Business & Management,8(1), 1937847.

Sureshchandar, G. S., Rajendran, C., & Anantharaman, R. N. (2002). The relationship between management's perception of total quality service and customer perceptions of service quality.Total Quality Management,13(1), 69-88.

Tourangeau, R., & Rasinski, K. A. (1988). Cognitive processes underlying context effects in attitude measurement.Psychological bulletin,103(3), 299.

Received: 28-Jun-2023, Manuscript No. IJE-23-13752; Editor assigned: 30-Jun-2023, Pre QC No. IJE-23-13752(PQ); Reviewed: 14-Jul-2023, QC No. IJE-23-13752; Revised: 18-Jul-2023, Manuscript No. IJE-23-13752(R); Published: 25-Jul-2023