Review Article: 2022 Vol: 26 Issue: 6

Effect of High Frequency Trading: A study on Market Returns of NSE India

Anita C Raman, IBS, IFHE

Sashikala Parimi, IBS, IFHE

Vishal Roy, IBS, IFHE

Citation Information Raman, A.C., Parimi, S. & Roy, V. (2022). Effect of high frequency trading: a study on market returns of nse india. Academy of Marketing Studies Journal, 26(6), 1-12.

Abstract

With the advances in automation and technology over past two decades there is shift in the equity trading of Financial markets. Algo and High Frequency Trades (HFT) led to liquidity and narrowed spreads in financial markets. . In this backdrop, a study is made to identify the effect of HFT on stock market returns, to examine the role of HFT in price discovery at different time level & to examine the HFT s’ influence on stock market volatility. The study includes predictive analysis of specific stock prices, using - 1 min price data, 5 min, 10 min, 15 min, 30 min price data. The results show that there is an effect of HFTs on market returns, volatility and price discovery.

Keywords

Algo Trading, High Frequency Trade, Volatility, OLS, GARCH, ARIMA.

Introduction

Stock exchanges enable multiple functions in an economy. On one hand it provides a platform that facilitates business/firms to access funds of investors through primary markets by means of various financial instruments. On the other hand, in the secondary market, it facilitates financial instruments to be listed, that allows the buyers and sellers to trade. The primary goal of the stock exchange is to allow companies raise capital for companies and the secondary goal is to provide liquidity to traders/investors for listed financial instruments on the exchange.

An investor chooses to invest money in stock, as he trusts that the company would generate profits in future. The price listed on the stock exchange often reflects the performance of a company. In an efficient market place, `security prices at any time fully reflect all the information available’ Fama (1970) If a company performs/earns well, it is often reflected in its listed price and high volumes and great demand for the company’s stock on the exchange; otherwise, if a company performs poor, the investors would evidently withdraw money from the stock that results in low volumes of trades. `Financial markets have two major functions in asset pricing – liquidity and price discovery for incorporating information in prices’ Brogaard et al. (2014) The information plays a vital role in buy/sell decisions of investors/traders in any financial market. In this backdrop, stock exchanges have an indispensable role to play in information dissemination by being transparent. Pre and post listing, companies are supposed to disclose relevant financial information to the stock exchanges. As a mandate, exchanges too are required to divulge the information provided by the company to the public to safeguard investor interest Brogaard (2010).

Revolutionary changes have taken place in the field of stock trading from the inception of stock market 1602 when first stock market was established in Amsterdam; where pigeons and telegraphs were used to share information. Advent of the first Bloomberg terminal in 1981 and later emergence of trading through super computers and microchips has become the norm of the day Brogaard et al. (2017).

Currently, usage of real-time data, application of powerful analytics tools to conduct in-depth research, communication of breaking news (Bloomberg Professional Services, 2018) has changed the modus-operandi of stock exchanges. Every phase of the trading method, from order entry to trading location to back office, is now extremely automated; The advent of technology now facilitate a trader to process the available information and succumb orders at whirlwind speed. Subsequently, it reduced significant expenses incurred by intermediaries; Further, technology enabled to share risk effectively, facilitated hedges, enhanced liquidity, made prices more effective.

High Frequency Trading (HFT), a new phenomenon has emerged on the stock exchanges with the arrival of technology. From the literature, HFT is more or less found to be defined as - usage of an automated trading system through complex algorithms to identify and analyze various markets for existence of smallest opportunities and execute millions of orders at speeds faster than the traditional market participants.

The High Frequency (HF) trades have become predominant on the stock exchanges due to a variety of reasons – the HF trades are executed 1000 times faster than an order placed by humans i.e., Low latency time, as execution of massive number of transactions at exorbitant speed in shortest time frame; Usage of proprietary algorithms in HF trade through technology platforms provide an edge over Non-High Frequency Trades (n)HF Trades. Further, co-location (to have computer stationed where stock exchange’s servers are housed) Picardo (2018) provides an added advantage to the HF traders to access stock price information in milliseconds before the other traders.

Irrespective of the trade strategy, the HF traders attempt to make huge profits by being smarter and quicker than (n) HF Trades. As HF trades are in humungous volumes of stock, even a small price fluctuation would result enormous profits; high frequency trading is highly profitable Baron et al. (2012). Additional advantage of usage of Algos in the trade facilitates to split the deals into small sizes and enables HF traders to move in and exit the stock positions, which minimizes risk Baron et al. (2019).

U.S. Securities and Exchange Commission (SEC) approved electronic exchanges in 1998, paved a way for computerized HFT. As HFT is performed on an automated trading platform; orders get executed based on the programmed algorithm in accordance with an embedded targeted strategy. The complex algorithms are designed to identify and analyze arbitration opportunities and price inefficiencies in multiple financial markets; besides, the inbuilt mathematical functions facilitate to predict the trends and execute the trade automatically Cross (2015) .Since then, HFT is adopted by large financial firms (like hedge funds and investments banks) to trade on stock exchanges, transactions which often last for less than a second; every day millions of shares are being traded through this technology platform to gain edge over (n) HF Trades. From the literature, it is gazed more than 50% of HF trades executed on the major stock exchanges Peter Gomber & Martin Haferkorn (2015).

Literature Review & Research Gap

There is multitude of different algorithms used by many different types of market participants. According to Jovanovic & Menkveld (2016), some hedge funds and broker-dealers provide liquidity through algorithms, competing with designated market-makers and other liquidity providers. For assets trading in various locations, liquidity buyers often use intelligent order routers to determine where to send an order Foucault and Menkveld (2013). Statistical arbitration funds use computers to quickly process large amounts of information contained in the order flow and price movements in different securities, trading at a high frequency based on data patterns. Algorithms are used by institutional investors to trade large amounts of stock gradually over time. Now nearly every major broker-dealer provides its institutional customers a suite of algorithms to assist them perform orders in a single stock, in pairs of stocks, or in stock baskets Jones (2013).

High Frequency Trading (HFT) is nascent to Indian markets when compared to other international markets, and has very limited research on Indian stock market. Most of the researchers from extant literature are based on NASDAQ and NYSE. The researchers like Muthuswamy et al. (2010) and Boehmer & Shankar (2014) who have done their research on NSE India mostly focused on - order level or order flow due to algorithmic trading in the market, impact on returns, liquidity and volatility of equities. Bang & Thirumalai (2018) investigated trading pattern of HFTs when and how high frequency traders earn higher profits from market. Agrawal (2010) examined effect of regulatory policies on algorithmic trading. Agrawal (2014) examined the casual impact of algorithmic trading on market quality, focused on the effect of HFT on stock market returns, its effect on market volatility and to identify how low latency benefits future prediction (price discovery).

According to memorandum of SEBI (2018) unequal access to Algo Traders due to lower latency and availability of Tick-by-Tick (TBT) data, contribution to price volatility, market noise (excessive order entry and cancellation); denial of profit opportunities to other investors; clogging the pipe which carries the orders thus slowing down the order messages of other investors, etc. some of the issues that have drawn regulatory attention O’hara (2015) Table 1.

| Table 1 Reviews |

|

|---|---|

| Goodhart & O’Hara (1997) | Study focuses use, analysis and application of high frequency data and its effects on market structure. Study also uses high frequency data to determine the linkages between markets and determines the applicability of temporal trading rules. |

| Ekkehart Boehmer (2009) | Paper successfully finds the consequences of Algorithmic Trading in equities. It found the impact of latency on co-movement in order flow, returns, and a range of liquidity measures. |

| Aggarwal et al. (2014) | Study examined two events, 1. Impact of increase in fee (on order-to-trade OTR in 2009) to reduce the load on infrastructure; 2. Increase of fee by regulator to bring down HFT (2013). Results found that first event resulted in low OTR and also low market quality and second event fee doubling has less binding. Findings show that interventions tend to be effective only with well-defined objectives and if it can be measured. |

| Álvaro Cartea and José Penalva (2012) | Study analyses the Impact of HF Trading on different types of HF traders (liquidity traders, professional traders and High frequency traders) on financial markets. |

| Allen Carrion (2013) | The trading performance, trading cost of High Frequency Traders on market efficiency using NASDAQ data. |

| Hagströmer & Nordén (2013) | Paper categorizes HFT strategies into market making and opportunistic HFTs. Results show that more than 80% trading volumes amount to market-making strategies and have higher order-to-trade ratios and lower latency than opportunistic HFTs. Further study concludes that tick size regulation could be a possible solution limiting traffic. |

| Nupur Pavan Bang (2013) | Paper investigates how HF traders trading pattern strategies around macro economic shocks (interest rate changes and unexpected firm-level earnings and announcement surprises. |

| MaureenO’Hara (2015) | The implications of technology and high frequency trading on market microstructure. |

| Tim Klaus & Brian Elzweig (2017) | Paper addresses HFT strategies, systems, controversies and also analyses current and potential laws, regulations and impact on market place. |

| Peti (2018) | Specific event (6th may 2010) was studied and found that high frequency trades did not impact the volatility financial markets |

An efficient market is to be constructed in such a manner that it should provide equal platform with same market information to all the investors. According to SEBI, information symmetry must prevail among all the traders and investors to protect their interests. Retail traders/investors do trade often through D-MAT account provided by broking houses and flow of market information to them have 1 min lag in comparison with high frequency traders. HF Traders often procure market information through exchanges on huge payment basis and execute thin trade with lower time lags. Often such facilities are not availed by retail investors (due to cost and infrastructure) lags often lead to losses or low earnings Chung & Lee (2016).

Due to which, HF Traders could easily manipulate the opening/closing prices and the market positions within seconds even before retail investors could determine a market view.

Data and Research Methodology

Markets like NASDAQ (1971), NYSE (1792), London Stock Exchange (1698) and FTSE (1984) in which strong evidence of HFT or algorithmic trading and its effect are already observed by many researchers like Charles (1997), Cartea & Penalve (2012), Carrion (2013) and many more. In comparison to foreign exchanges, National Stock Exchange (NSE) established in 1992, is nascent market for HFT and not much research is done in this market, our study is based on data collected from NSE. This study helps to understand the effect of Nifty50 HFT returns on selected stocks in equities market and bank Nifty. Further study intends to comprehend how HFT impacts the volatility of selected stocks in equity markets as well as to understand the relationship between latency and price discovery Udacity India (2018).

The following study considers three objectives:

1. To identify the impact of HFT on stock market returns.

2. To examine the impact of HFT on volatility of Equities.

3. To examine the role of HFT in price discovery at different time latencies.

The null hypothesis for all the objectives is as follows,

H1: There is no impact of High Frequency Trading on stock market returns (chosen stocks).

H2: There is no impact of High Frequency Trading on Volatility of equity stocks.

H3: There is no impact of HFT (low latency) on price Discovery.

The data consisting of three months from 1st January 2020 to 31th March 2020 is considered for study, and is collected from NSE India, for the selected stocks with different time latencies as mentioned below:

1. 1 min data,

2. 5 min data,

3. 10 min data,

4. 15 min data,

5. 30 min data,

6. 60 min data

7. 1 day data

Indices such as Nifty50 and bank Nifty, and companies such as - Reliance Industries Ltd, Tata Consultancy Services Ltd and State Bank of India are chosen for study based on the following reasons Goldstein et al. (2014):

1. Nifty50 – National Stock Exchange (NSE) (established in1992) is the1st electronic stock market in India and positions’ itself as the fourth largest on the globe in terms of volumes as on 2015. Nifty50 is a stock benchmark index, established on 21st April 1996 by NSE; although Bombay Stock exchange (BSE) was established prior to the NSE, it was a manual exchange and slowly got automated in the due course. HFT is

more prevalent on NSE and the data (tick-by-tick) was easily obtained for research.

2. Bank Nifty (BN)- includes all the bank stocks present in Nifty50. Compared to all other indices, it constitutes of high volume stocks with highest volatility.

3. Reliance Industries Ltd (RIL) - is one of the largest companies which have the highest market capitalization (refer table-2) with high volumes in NSE. From literature, it is found that price changes in Reliance have an

impact on NSE market in a great manner.

4. State Bank of India (SBI) - is one of the largest financial institutions in Indian banking sector with largest network with highest market capitalization and traded volumes on NSE Table 2.

| Table 2 Represents Market Capitalization And Volumes Traded On Nse India |

|||

|---|---|---|---|

| Sr No | Symbol | Security Name | Market Cap (INR) |

| 1 | Reliance | Reliance Industries Ltd | 7778364790002.30 |

| 2 | Tcs | Tata Consultancy Serv Lt | 7557678036354.60 |

| 3 | Hdfcbank | Hdfc Bank Ltd | 5654329400952.75 |

| 4 | Hindunilvr | Hindustan Unilever Ltd. | 3816817248744.75 |

| 5 | Itc | Itc Ltd | 3412085936119.30 |

| 6 | Hdfc | Hdfc Ltd | 3299806436114.70 |

| 7 | Infy | Infosys Limited | 3274488041151.90 |

| 8 | Sbin | State Bank Of India | 2620705129359.10 |

| 9 | Kotakbank | Kotak Mahindra Bank Ltd | 2394948425194.50 |

| 10 | Icicibank | Icici Bank Ltd. | 2347095589008.55 |

1. Tata Consultancy Services Ltd (TCS) - is one of the technology giant in Indian IT sector and stock retains highest market capitalization as well as volumes on NSE.

2. As mentioned in the table -3, it is evident that the financial services constitute around 38.55% of the composition of Nifty50, two major players TCS (from Information Technology) and SBI (from banking

sector) were included in the study Table 3.

| Table 3 Sector Wise Composition Of Nifty50 |

||

|---|---|---|

| Sector Exposure | Nifty 50 (%) | All Listed Equity Stocks On Nse (%) |

| Financial Services | 38.85 | 33.34 |

| Consumer | 17.91 | 19.04 |

| Energy | 15.30 | 12.29 |

| It | 13.67 | 10.60 |

| Commodities | 6.05 | 7.74 |

| Manufacturing | 3.66 | 8.55 |

| Healthcare | 2.42 | 5.02 |

| Telecommunications | 1.51 | 1.40 |

| Services | 0.64 | 2.02 |

| Total | 100.00 | 100.0 |

This Paper employs statistical tools such as Dicky Fuller Test to check stationarity, Johensen Co-Integration test is used to check the relationship between the variables the and Granger (1969) Causality test to test the direction of Impact, OLS is applied to test the impact, GARCH is applied to check the impact of volatility GARCH = C(3) + C(4)*RESID(-1)^2 + C(5)*GARCH(-1) and ARIMA is used for Price Discovery. E-Views software was employed to process data and to procure the results Goldberger (1964).

Results and Analysis

The following tests/models were employed to check the impact of HF Trades on selected stock returns. In the process, to check stationarity of the data, Augmented Dickey-Fuller test (Unit root) was adopted; it was found that all the factors were stationary. Each of the variables (both dependent and independent variables) mentioned above were passed through three tests, namely Johansen (1991) Co-Integration, the Granger Causality and the Ordinary Less Square.

In order to determine the impact of HFT on stock market returns (specific stocks), the study considered NIFTY50 returns as an independent variable and returns from specific stock index /stock returns such as bank nifty, Reliance Industries Ltd, TCS Ltd and SBI as dependent variables. To test the existence of relationship between independent variable and dependent variables, Johansen Co-Integration was applied. Results obtained had two co-integration equations – which states that there is a relationship between dependent and independent variables for all time latencies (1-min, 5-min, 10-min, 15-min and 30-min) as the p-values obtained were less than critical value of 0.05. Further, to the same time latencies, Granger Causality was applied to test the direction of impact, and the results obtained indicated the impact is unidirectional, i.e., dependent over independent variable. Based on the results, since the p-value value is less than 0.05, we conclude that returns from Nifty granger cause returns from other considered stocks Gupta (2019).

Ordinary Least Square (OLS) test was considered to test the impact of independent variable on dependent variables. Each of the dependent variables was considered individually to develop the model for different time latencies Zook & Grote (2017). In case of Reliance Industries Ltd (RIL), RIL`1-min’ had more impact on the Nifty 50 when compared to other time latencies; In case of TCS Ltd too, `1-min’ of TCS had high impact on the Nifty 50 over all the other considered latencies Virgilio (2016). In case of SBI Ltd, `15 min’ time latency had more impact on Nifty 50 compared to all other latencies. In case of BankNifty, ‘30 min latency’ was found to have high impact than other time spans Biais (2011) Table 4.

| Table 4 Test ordinary least square’ |

||||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| Variable’<< | 1 Min’ | 5 Min< | 10 Min | 15 Min | 30 min | |||||

| Coefficient’ value’ | Probability’<< | Coefficient | Probability’<< | Coefficient | Probability’<< | Coefficient | Probability’<< | Coefficient | Probability’<< | |

| BNR | 0.9935 | 0.0000 | 1.0014 | 0.0000 | 1.0099 | 0.0000 | 1.0027 | 0.0000 | 1.0318 | 0.000 |

| RIL | 1.4784 | 0.0000 | 1.4587 | 0.0000 | 1.4758 | 0.0000 | 1.4171 | 0.0000 | 0.0983 | 0.000 |

| TCS << | 0.8251 | 0.0000 | 0.7085 | 0.0000 | 0.6919 | 0.0000 | 0.6810 | 0.0000 | 0.7422 | 0.000 |

| SBI << | 1.2555 | 0.0000 | 1.3871 | 0.0000 | 1.3717 | 0.0000 | 1.4044 | 0.0000 | 1.3851 | 0.000 |

Overall P value-for each time interval is 0.0000.

Further, it was also established that the OLS model is significant as the p-value is less than 0.05 and the variables understudy are also significant (Table 1).

To test the validity of objective 2, GARCH model was employed to test the impact of volatility of independent variable over dependent variables as in the following Table 5 Sornette & von der Becke (2011) Table 5.

| Table 5 Dependent Variabls |

||||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| Variables | 1 min | 5 min | 10 min | 15 min | 30 min | |||||

| RESID(-1)^2 | GARCH(-1) | RESID(-1)^2 | GARCH(-1) | RESID(-1)^2 | GARCH(-1) | RESID(-1)^2 | GARCH(-1) | RESID(-1)^2 | GARCH(-1) | |

| BN | 0.0914 | 0.8967 | 0.1092 | 0.8707 | 0.1597 | 0.6482 | 0.1808 | 0.5323 | 0.1121 | 0.2805 |

| RIL | 0.1092 | 0.8706 | 0.2082 | 0.6580 | 0.2406 | 0.6277 | 0.3806 | 0.4267 | 0.1272 | 0.3190 |

| TCS | 0.3094 | 0.5982 | 0.1564 | 0.8315 | 0.3073 | 0.5732 | 0.3721 | 0.3923 | 0.2631 | 0.1755 |

| SBI | 0.0805 | 0.8885 | 0.0805 | 0.8885 | 0.1244 | 0.7251 | 0.1495 | 0.6407 | 0.0494 | 0.9024 |

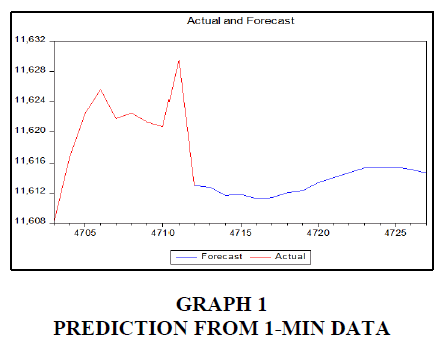

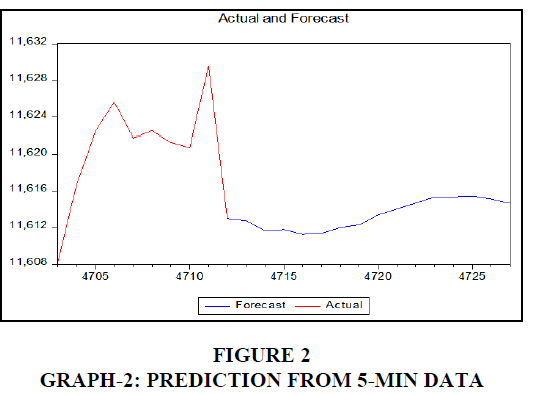

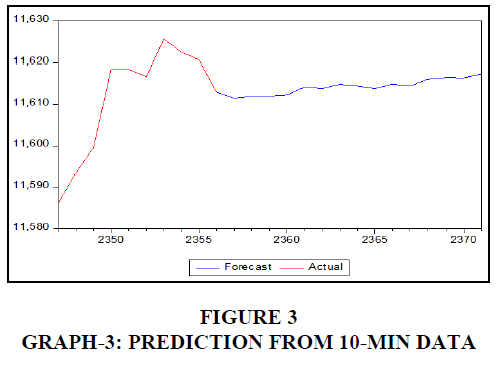

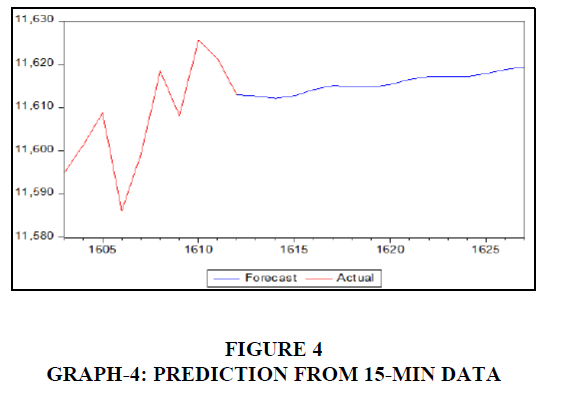

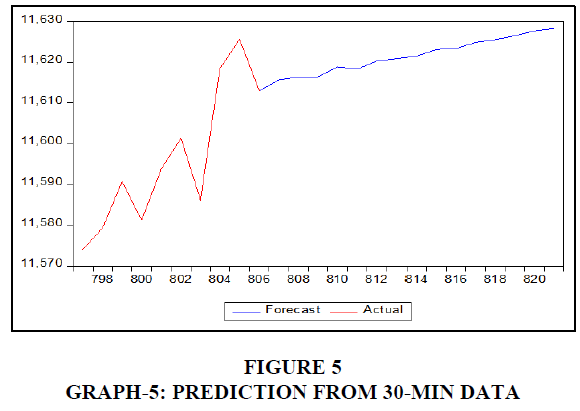

To test the validity of objective 3, ARIMA was applied to predict the future prices or price discovery. In order to predict value of Nifty50 for next 15 min of different time latencies (through 1-minute, 5-minute, 10 minute, 15 minute and 30-minute) 3 months data (Jan 2020 to March 2020) is applied through ARIMA model. The results obtained from this model are the graphically depicted (refer graphs 1 to 5. Red line in the graphs indicates the price of Nifty50 for time period considered (3 months 1st Jan 2020 to 31st March 2020 – historical); and blue lines in the graph show the predicted price of 15 min for all the time latencies Figures 1 - 5.

Implications

The study is based on data collected from NSE which is relatively a new market when compared with other markets such as NASDAQ (1971), NYSE (1792), London Stock Exchange (1698) and FTSE (1984). A strong evidence of HFT or algorithmic trading and its effect are already observed by many researchers like Charles (1997), Cartea & Penalve (2012), Carrion (2013) and many more. However, NSE is still a fresh market for HFT while comparing with other stipulated market mentioned above. This study helps to understand the effect of HFT on returns from market equities. It also facilitates to comprehend how HFT impact the volatility of the equity as well as to understand the relationship between latency and price discovery. Study will assist for further research works in future on the same topic related to Indian financial market.

Limitations

1. HF Trades get feed actively on economic factors and news, however study does not include the amount of

Effect of any specific/ particular economic information on stock market returns.

2. The data collected and analyzed for 3 months only (from Jan to march 2020) which may not sufficiently/uniformly represent the trades or volumes of HF trades throughout the year.

3. Although NSE stock exchange includes NIFTY 50 include 50 stocks, only three stocks were taken into considered for the study.

4. HFT also works in micro-seconds or in seconds, the study did not include seconds/micro-seconds data for empirical analysis.

Findings and Conclusion

In this paper, the effect of high frequency trades and impact on volatility of chosen stocks was studied. Further, study builds a predictive model to forecast the Nifty50 with different latencies to benefit investors.

Following are the findings of the each of the objectives.

The results obtained from OLS conclude that bank nifty `30 min’ latency had shown significant positive influence and is observed to impact highest than other time span.

The study estimated that one 1 minute time latency of RIL had highest influence on Nifty 50 when compared to 5 min, 10 min and 15 min. `1 min’ latency trade in RIL stock is found to be more beneficial than `1 hour’ latency or `1 day’ to HF trader. From this we can infer a HF trader could capture on the volatility factor and could benefit more due to HF trade than a retail investor..

From results obtained, TCS also had shown a similar impact like RIL. `1 minute’ latency of TCS is found to have high influence on Nifty50. As time latency increased from 1 min to 5 min and then 10 min, influence of TCS on Nifty 50 had decreased. HF Traders could encash on 1 min volatility to have a gain when compare to other time latencies.

From the study it is found that `15 min latency’ of SBI is found to be more influential when compared to 1 min and other time latencies.. Further, RIL and TCS have influenced HF Trades due to volatility, while Bank Nifty and SBI have not influenced by HF trades.

In second objective, GARCH model is applied to find the volatility impact of chosen stocks with different time latencies on Nifty50.

From GARCH model, study establishes that the volatility influence on chosen stocks is showing unusual effects according to time. It was found that 1 min latency of Bank Nifty has more volatility impact over other time latencies. The same trend is observed for RIL. Further the volatility impact of RIL on Nifty50 for 30 min latency shows large drop over other time latencies (1-min, 5-min, 10-min, 15-min, and 30 min). The impact of volatilities over different time latencies is found to have random patterns in SBI and does not indicate any visible pattern. It was found that 5 min time latency of TCS is found to have more volatility impact when compared to other time latencies. With respect to HF trades, volatility effect is unpredictable with respect to time latencies.

In third objective, to find the future 15 min after the time frame of that which has been taken in the analysis, Study used ARIMA model.

The results from the ARIMA model indicate the upward movement of Nifty50 for next 15 min for all time latencies. The delineation accurately predicts the next 15 minute Nifty50 index with 1-min time latency compared to 5min,10min,15min and 30 min latencies. This indicates that the precision of forecast is more accurate with low time latencies and as the time lapses (with 5-min,10-min,15-min and 30-min) the accuracy of forecast is found to deviate wide. The possible inference could be data with low latency is more stable and accurate in prediction of next 15 min Nifty50. As the time progresses the data with higher latency show wide deviation and the factors/reasons for same can be explored with further research.

From the analysis and findings we can conclude that HF traders have information advantage over (n)HF traders (due to time lag) to have inputs on time latencies, if utilized, could prove beneficial for both major stocks in RIL and TCS.

From the study it is concluded that 15-min latency of SBI was found to have more impact with a value of 0.1495 on the Nifty 50 when compared to 1 min and other time latencies. For, Bank Nifty, 15-min time latency is found to be more impactful when compared to all time latencies with a value of 0.1808

From the results, we could infer that the impact of returns of HF trades is not uniform on all time latencies and all the stocks selected. The choice of HF trade done on various stocks may vary for different time latencies. To determine any specific trade pattern of HF trades, longer time duration with multiple stocks for longer time span can be studied.

From the results obtained and analysis, it is apparent - HFT impacts the returns from stocks, causes volatility in the short run. Further, with predictive models, a stocks’ price forecast could facilitate in price discovery. This warrants that time lag in information forms vital aspect for any traders (be it HF Traders of (n) HF Traders). As HF Traders have access to information in seconds, with which one could place buy or sell order of millions of stocks in seconds with minimal human intervention and obtain better returns than (n) HF Traders, which can cause distress for the latter in terms of earnings from same stock.

HF Traders could have advantage when compared to (n) HF Traders. HF Traders get market information with in very short lag; this facilitates HF Traders to have maximum chance to tap the market at most competitive rates. Further, they can exit from the market with more than normal fair benefits. As HF Trades through algorithms can predict the market prior to (n) HF trades as well as with high accuracy which is a disadvantage for (n) HF Traders in terms of investment.

References

Aggarwal, N., Chakravarty, S., & Panchapagesan, V. (2014). Do regulatory hurdles on algorithmic trading work?.

Bang, N.P., & Thirumalai, R. S. (2018) How do High-Frequency Traders Trade. Working Paper as a part of the NSE-NYU Stern School of Business Initiative Accessed from the web on as a working paper).

Baron, M., Brogaard, J., & Kirilenko, A. (2012). The trading profits of high frequency traders.Unpublished manuscript.

Baron, M., Brogaard, J., Hagströmer, B., & Kirilenko, A. (2019). Risk and return in high-frequency trading.Journal of Financial and Quantitative Analysis,54(3), 993-1024.

Indexed at, Google Scholar, Cross Ref

Biais, B., Foucault, T., & Moinas, S. (2011). Equilibrium high frequency trading. InProceedings from the fifth annual Paul Woolley Centre conference, London School of Economics.

Boehmer, E., & Shankar, R.L. (2014). Low latency trading and the comovement of order flow, prices, and market conditions.NSE-NYU Stern School of Business Initiative for the Study of Indian Capital Markets.

Brogaard, J. (2010). High frequency trading and its impact on market quality.Northwestern University Kellogg School of Management Working Paper,66.

Brogaard, J., Hendershott, T., & Riordan, R. (2014). High-frequency trading and price discovery.The Review of Financial Studies,27(8), 2267-2306.

Indexed at, Google Scholar, Cross Ref

Brogaard, J., Hendershott, T., & Riordan, R. (2017). High frequency trading and the 2008 short-sale ban.Journal of Financial Economics,124(1), 22-42.

Indexed at, Google Scholar, Cross Ref

Carrion, A. (2013). Very fast money: High-frequency trading on the NASDAQ.Journal of Financial Markets,16(4), 680-711.

Indexed at, Google Scholar, Cross Ref

Cartea, Á., & Penalva, J. (2012). Where is the value in high frequency trading?.The Quarterly Journal of Finance,2(03), 1250014.

Indexed at, Google Scholar, Cross Ref

Chung, K.H., & Lee, A.J. (2016). High-frequency trading: Review of the literature and regulatory initiatives around the world.Asia-Pacific Journal of Financial Studies,45(1), 7-33.

Indexed at, Google Scholar, Cross Ref

Cross, D. (2015). The Rise of High-Frequency Trading: A Brief History.TraderHQ. com.

Fama, E.F. (1970). Efficient capital markets: A review of theory and empirical work.The journal of Finance,25(2), 383-417.

Indexed at, Google Scholar, Cross Ref

Goldberger, Arthur S. (1964). "Classical Linear Regression". Econometric Theory. New York: John Wiley & Sons. 156–212.

Goldstein, M.A., Kumar, P., & Graves, F. C. (2014). Computerized and high-frequency trading.Financial Review,49(2), 177-202.

Indexed at, Google Scholar, Cross Ref

Goodhart, C.A., & O'Hara, M. (1997). High frequency data in financial markets: Issues and applications.Journal of Empirical Finance,4(2-3), 73-114.

Indexed at, Google Scholar, Cross Ref

Granger, C.W. (1969). Investigating causal relations by econometric models and cross-spectral methods.Econometrica: journal of the Econometric Society, 424-438.

Indexed at, Google Scholar, Cross Ref

Gupta, A. (2019). History of Algorithmic Trading, HFT and News Based Trading, 2017.

Hagströmer, B., & Nordén, L. (2013). The diversity of high-frequency traders.Journal of Financial Markets,16(4), 741-770.

Indexed at, Google Scholar, Cross Ref

Johansen, S. (1991). Estimation and hypothesis testing of cointegration vectors in Gaussian vector autoregressive models.Econometrica: journal of the Econometric Society, 1551-1580.

Indexed at, Google Scholar, Cross Ref

Jones, C.M. (2013). What do we know about high-frequency trading?.Columbia Business School Research Paper, (13-11).

Indexed at, Google Scholar, Cross Ref

Jovanovic, B., & Menkveld, A.J. (2016). Middlemen in limit order markets.Available at SSRN 1624329.

Indexed at, Google Scholar, Cross Ref

Menkveld, A.J. (2013). High frequency trading and the new market makers.Journal of financial Markets,16(4), 712-740.

Indexed at, Google Scholar, Cross Ref

Muthuswamy, J., Palmer, J., Richie, N., & Webb, R. (2010). High-frequency trading: implications for markets, regulators, and efficiency.The Journal of Trading,6(1), 87-97.

Indexed at, Google Scholar, Cross Ref

O’hara, M. (2015). High frequency market microstructure.Journal of financial economics,116(2), 257-270.

Indexed at, Google Scholar, Cross Ref

Peter Gomber and Martin Haferkorn, (2015) Article on High Frequency Reading, Encyclopedia of Information Science and Technology.

Peti, J., & Iania, L. " The impact of high-frequency trading on the volatility of the financial markets.

SEBI guide line (2018),

Sornette, D., & von der Becke, S. (2011). Crashes and High Frequency Trading, Swiss Finance Institute Research Paper No. 11-63, August.

Udacity India (2018), Scope of HFT in India, Medium Corporation article.

Virgilio, G. (2016). The impact of high-frequency trading on market volatility.The Journal of Trading,11(2), 55-63.

Indexed at, Google Scholar, Cross Ref

Zook, M., & Grote, M.H. (2017). The microgeographies of global finance: High-frequency trading and the construction of information inequality.Environment and Planning A: Economy and Space,49(1), 121-140.

Indexed at, Google Scholar, Cross Ref

Received: 19-Jul-2022, Manuscript No. AMSJ-22-12344; Editor assigned: 22-Jul-2022, PreQC No. AMSJ-22-12344(PQ); Reviewed: 16-Aug-2022, QC No. AMSJ-22-12344; Revised: 28-Aug-2022, Manuscript No. AMSJ-22-12344(R); Published: 16-Sep-2022