Research Article: 2021 Vol: 27 Issue: 5S

Effect of Government Consumer Spending In GDP and GNI: A Study in the Iraqi Economy for the Period (1990-2018)

Malik Abdul Raheem Mohammed, Imam Al Kadhum College (IKC)

Mustafa Kamil Rasheed, Mustansiriyah University

Abstract

Government consumer spending affects economic activity, as government consumer spending is one of the elements of the Aggregate injection, as it affects the macroeconomic variables under the action of the government spending multiplier. And then the GDP and national income. Therefore, fiscal policy has a significant impact on economic activity through government consumption spending in economies general, and developing economies particular. The problem of the study The Iraqi economy did not benefit from the advantages of government consumer spending despite its increase, but the domestic product and national income were declining, and economic activities were weak, with the growth of the oil sector without the rest of the production sectors. The aim of the study is to know the effect of government consumer spending in GDP and GNI. The hypothesis of the study is that the rise in government consumer spending improves the efficiency and activity of local markets, evolution of production relations, thus GDP and GNI improvement. Methodology study The time series data for the variables were used to (government consumer spending), (GDP), (GNI), in the Iraqi economy for the period (1990-2018), from international databases. The study concluded that was very high the impact of government consumer spending in GDP and GNI during the study period on the Iraqi economy. The study recommended the importance of benefiting from the characteristics of government consumer spending in injecting the Iraqi economy, from improving the business environment, evolution productivity, and then GDP & GNI enhancing.

Keywords

Government Consumption Spending, GDP, GNI, Fiscal Policy, Macroeconomic Variables

Introduction

The Iraqi economy suffers from many problems, starting from 1990's until the second decade of the twenty-first century. The unstable security and political conditions greatly affected the local economy. Production relations deteriorated, economic activity declined, underdeveloped economic sectors, sustainable structural imbalances in economic activities, continued rentier economy, high degree of economic dependency, and weak competitiveness of local products. Which led to the weakness and distortion of the structure of the GDP, and the fluctuation and turbulence of the national income, and then the high rates of poverty and unemployment, which led to the exacerbation of social problems. The problem of the study The Iraqi economy did not benefit from the advantages of government consumer spending despite its increase, but the domestic product and national income were declining, and economic activities were weak, with the growth of the oil sector without the rest of the production sectors. The importance of the study is embodied in measuring the impact of government consumer spending on macroeconomic variables (GDP), (GNI), in order to understand the role of that spending in the Iraqi economy, and the importance of financial decisions related to government consumer spending with financial variables and real variables. The hypothesis of the study is that the rise in government consumer spending improves the efficiency and activity of local markets, evolution of production relations, thus GDP and GNI improvement. The aim of the study is to know the effect of government consumer spending in GDP and GNI. Methodology study The time series data for the variables were used to (government consumer spending), (GDP), (GNI), in the Iraqi economy for the period (1990-2018), from international databases.

Theoretical Framework

Fiscal policy is often ineffective in open economies, assuming a flexible exchange system with perfect capital mobility. As the rise in the interest rate leads to an inflow of capital; exchange rate appreciates. The effect of wealth on consumption can explain the reduction in consumption if the increase in the interest rate is the result of an expansionary fiscal policy that leads to a decrease in the value of assets. Capet (2004) showed in his review of the literatures that many studies using structural macro models including studies of MULTIMOD of IMF, QUEST of European Commission, and NiGEM of NIESR for Germany, France, and Italy found that government expenditure multiplier has no long-run multiplier effect except that of INTERLINK of OECD that found a negative long-run effect. Positive effect of the government expenditure multiplier could only be seen in the short-run (in one year) (Kraipornsak, 2010).

There are three economic schools of thought, which have studied the relationship of fiscal policy in macroeconomics: The first school studied the relationship of fiscal policy to a certain group of economic sectors, such as fiscal consolidation, the second school concerned itself with financial policy tools affecting financial stability, such as taxes and social transfers to protect the macroeconomic from financial shocks. The third school is concerned with the effect of public fiscal policy on the macroeconomic through the use of econometrics models (Ismail & El Houssein, 2020). Keynesian and neoclassical school of thoughts concerned the impact of fiscal policy on the macroeconomic. Both theories find that GDP and economic growth increase when unproductive government spending (consumer spending) is financed by increase in lump-sum tax. while the consumption response is different in both the theories, Neoclassical model argues that as government spending is financed through increased taxes, the wealth of families will decrease, which will lead to a decrease in household consumption by increasing the supply of work, and the domestic production (Baxter & King, 1993). According to Keynesian perspective, an increase in household consumption can be achieved through government spending by incorporating the price rigidities and non-Ricardian consumers (Gali et al., 2007; Munir & Riaz, 2020). The effect of government spending on economic growth through two channels: the effect of taxes on production (negative effect), and the impact of public services on production (positive effect). When government spending increases, production and economic growth increase, but the rise in government spending to a high level leads to the negative impact of taxes on production, as economic growth reaches its maximum, and after this point the effect of taxes dominates towards reducing economic growth. Basically, there are three main categories of government spending (Connolly & Li, 2016):

(1) Public investment: gross capital formation of plant, property, and equipment, including public hospitals, schools and housing.

(2) Government consumption spending: spending to produce non-market goods, such as defense, justice, and police.

(3) Public social spending: old age pensions, survivors and disability benefits, unemployment compensation mostlyin cash and health. (i.e. not any capital expenditure).

The analysis of the relationship between public expenditure and GNI has been approached from two distinct perspectives. The classical view, espoused by Wagner (1883), argues that the process of GDP then economic growth is the fundamental determinant of state expenditure. Thus, according to ‘Wagner’s law’ causality runs from GDP then economic growth to public expenditure. On the other hand, the Keynesian position contends that government spending is an effective policy tool for generating GDP especially during periods of cyclical downturns. Consequently, the causal linkage runs from public spending to an expansion of GNI (Grullón, 2012).

Government consumer spending is used to compensate the economy and its dealers from the damages caused by economic openness (e.g., workers in import-competing sectors, offsetting the volatility and insecurity resulting from greater exposure to global markets) (Anderson & Obeng, 2020). Some studies have shown that the elasticity of government spending to GDP is very high when the nominal interest rate is binding (see for exam-ple, Christiano etal., 2011; Woodford 2011). And the reason for having a government multiplier greater than 1 is due to the fact that fiscal expansion causes the real interest rate to fall (Takongmo & Lebihan, 2020). Government consumption expenditure has no significant effect in economic development. Rahbar & Sargolzaei (2011), Komeijani & Nazari (2009), using the Auto-regression Model, investigated the effect of government size in the economic development in Iran. It's concluded that the effect of government spending in economic development was positive and compatible with the Keynes’ economic theory. Kandil (2001) investigated the effects of the contractionary and expansionary shock shocks of financial policies in economic development for USA (during 4/1998 to 1/1987) by using the Hodrick-Prescott (HP) filter. The results of the study indicated that the contraction and expansion shocks of financial policies in a government was a sustainable process predicted during the time period (Karimi et at., 2016).

Result and Discussion Finding

Stationary Test

A stationary test was conducted and the results were as follows:

| Table 1 Test (ADF) for the Stationary of the Time Series of Study models Variables |

||||||

|---|---|---|---|---|---|---|

| Variables | Level (prob.) | 1 diffr. (prob.) | ||||

| Int. | Int. & Trend | non | Int. | Int. & Trend | non | |

| Log (Y1) | 0.01* | 0.7 | 0.9 | |||

| Log (Y2) | 0.01* | 0.7 | 0.9 | |||

| Log (X) | 0.1 | 0.9 | 0.9 | 0.000* | 0.000* | 0.054 |

| Where: (Y1): GDP (current prices), (Y2): GNI (current prices), (X): government consumption spending.Model (1): Log (Y1) = B1Log XB2. Model (2): Log (Y2) = B1Log XB2. | ||||||

The (ADF) test indicates that the time series of GDP (Y1) was stable at the level in the form of an Intercept. so the alternative hypothesis will be rejected and the null hypothesis accepted because the time series has been stationary, the time series of GNI (Y2) was stable at the level in the form of an Intercept. so the alternative hypothesis will be accepted and the null hypothesis rejected because the time series has been stationary, as for the time series of the government consumption spending (X), was not stable at the level in the three formulas. It has been stationary after the first difference, so the alternative hypothesis will be accepted and the null hypothesis rejected because the time series has been stabilized after the first difference is made, In intercept and intercept with trend form.

Bounds Test

The bounds of the study models were tested and were as follows:

| Table 2 Bounds Test |

||||

|---|---|---|---|---|

| F-Bounds Test (Model 1) | Null Hypothesis: No levels relationship | |||

| Test Statistic | Value | Signif. | I(0) | I(1) |

| Asymptotic: n=1000 | ||||

| F-statistic | 11.55811 | 10% | 3.02 | 3.51 |

| k | 1 | 5% | 3.62 | 4.16 |

| 2.50% | 4.18 | 4.79 | ||

| 1% | 4.94 | 5.58 | ||

| Actual Sample Size | 26 | Finite Sample: n=35 | ||

| 10% | 3.223 | 3.757 | ||

| 5% | 3.957 | 4.53 | ||

| 1% | 5.763 | 6.48 | ||

| Finite Sample: n=30 | ||||

| 10% | 3.303 | 3.797 | ||

| 5% | 4.09 | 4.663 | ||

| 1% | 6.027 | 6.76 | ||

| F-Bounds Test (Model 2) | Null Hypothesis: No levels relationship | |||

| Test Statistic | Value | Signif. | I(0) | I(1) |

| Asymptotic: n=1000 | ||||

| F-statistic | 11.31536 | 10% | 3.02 | 3.51 |

| k | 1 | 5% | 3.62 | 4.16 |

| 2.50% | 4.18 | 4.79 | ||

| 1% | 4.94 | 5.58 | ||

| Actual Sample Size | 26 | Finite Sample: n=35 | ||

| 10% | 3.223 | 3.757 | ||

| 5% | 3.957 | 4.53 | ||

| 1% | 5.763 | 6.48 | ||

| Finite Sample: n=30 | ||||

| 10% | 3.303 | 3.797 | ||

| 5% | 4.09 | 4.663 | ||

| 1% | 6.027 | 6.76 | ||

Table (2) indicates that the value of test (F) was greater than the upper and lower limits of the test, at the level of significance 0.05% for both models.

This means that there is a co-integration relationship between the government consumption spending and the GDP, GNI during the study period.

ECM Test

ARDL Error Correction Regression models was tested and it was as follows:

| Table 3 ECM Test |

||||

|---|---|---|---|---|

| ECM Regression (Model 1) | ||||

| Case 2: Restricted Constant and No Trend | ||||

| Variable | Coefficient | Std. Error | t-Statistic | Prob. |

| D(LOGY1(-1)) | 0.547633 | 0.108124 | 5.064847 | 0.0001 |

| D(LOGY1(-2)) | 0.367412 | 0.106373 | 3.453993 | 0.0027 |

| D(LOGX) | 0.662961 | 0.072772 | 9.110159 | 0 |

| D(LOGX(-1)) | -0.193474 | 0.088036 | -2.197666 | 0.0406 |

| CointEq(-1)* | -0.884876 | 0.142937 | -6.190658 | 0 |

| R-squared | 0.875205 | Mean dependent var | 0.29776 | |

| Adjusted R-squared | 0.851435 | S.D. dependent var | 0.483925 | |

| S.E. of regression | 0.186525 | Akaike info criterion | -0.349467 | |

| Sum squared resid | 0.730619 | Schwarz criterion | -0.107525 | |

| Log likelihood | 9.54307 | Hannan-Quinn criter. | -0.279796 | |

| Durbin-Watson stat | 1.930227 | |||

| ECM Regression (Model 2) | ||||

| Case 2: Restricted Constant and No Trend | ||||

| Variable | Coefficient | Std. Error | t-Statistic | Prob. |

| D(LOGY2(-1)) | 0.546421 | 0.109304 | 4.999098 | 0.0001 |

| D(LOGY2(-2)) | 0.365961 | 0.108291 | 3.379414 | 0.0031 |

| D(LOGX) | 0.660179 | 0.074156 | 8.902525 | 0 |

| D(LOGX(-1)) | -0.191185 | 0.08908 | -2.146221 | 0.045 |

| CointEq(-1)* | -0.887517 | 0.144893 | -6.125303 | 0 |

| R-squared | 0.870885 | Mean dependent var | 0.297689 | |

| Adjusted R-squared | 0.846292 | S.D. dependent var | 0.484977 | |

| S.E. of regression | 0.190138 | Akaike info criterion | -0.311091 | |

| Sum squared resid | 0.759203 | Schwarz criterion | -0.069149 | |

| Log likelihood | 9.044178 | Hannan-Quinn criter. | -0.24142 | |

| Durbin-Watson stat | 1.963502 | |||

The short-term deviation correction speed of the model (1) reached (88%) during one year. The speed of correcting the short-term deviation in the model (2) reached (88%) during one year.

The error correction speed in both models was negative and statistically significant at the level (0.05).

ARDL Model

ARDL model was adopted and the results were as follows:

| Table 4 ARDL Model |

||||

|---|---|---|---|---|

| Dependent Variable: LOGY1 | ||||

| Method: ARDL | ||||

| Sample (adjusted): 1993 2018 | ||||

| Included observations: 26 after adjustments | ||||

| Maximum dependent lags: 4 (Automatic selection) | ||||

| Model selection method: Akaike info criterion (AIC) | ||||

| Dynamic regressors (4 lags, automatic): LOGX | ||||

| Fixed regressors: C | ||||

| Number of models evalulated: 20 | ||||

| Selected Model: ARDL(3, 2) | ||||

| Note: final equation sample is larger than selection sample | ||||

| Variable | Coefficient | Std. Error | t-Statistic | Prob.* |

| LOGY1(-1) | 0.662757 | 0.184394 | 3.594243 | 0.0019 |

| LOGY1(-2) | -0.180221 | 0.180783 | -0.996895 | 0.3313 |

| LOGY1(-3) | -0.367412 | 0.129653 | -2.833803 | 0.0106 |

| LOGX | 0.662961 | 0.109971 | 6.028491 | 0 |

| LOGX(-1) | -0.131895 | 0.1502 | -0.87813 | 0.3908 |

| LOGX(-2) | 0.193474 | 0.096696 | 2.00085 | 0.0599 |

| C | 6.359076 | 1.149721 | 5.530971 | 0 |

| R-squared | 0.989965 | Mean dependent var | 31.60687 | |

| Adjusted R-squared | 0.986796 | S.D. dependent var | 1.706569 | |

| S.E. of regression | 0.196096 | Akaike info criterion | -0.195621 | |

| Sum squared resid | 0.730619 | Schwarz criterion | 0.143098 | |

| Log likelihood | 9.54307 | Hannan-Quinn criter. | -0.098082 | |

| F-statistic | 312.4055 | Durbin-Watson stat | 1.930227 | |

| Prob(F-statistic) | 0 | |||

| Dependent Variable: LOGY2 | ||||

| Method: ARDL | ||||

| Sample (adjusted): 1993 2018 | ||||

| Included observations: 26 after adjustments | ||||

| Maximum dependent lags: 4 (Automatic selection) | ||||

| Model selection method: Akaike info criterion (AIC) | ||||

| Dynamic regressors (4 lags, automatic): LOGX | ||||

| Fixed regressors: C | ||||

| Number of models evalulated: 20 | ||||

| Selected Model: ARDL(3, 2) | ||||

| Note: final equation sample is larger than selection sample | ||||

| Variable | Coefficient | Std. Error | t-Statistic | Prob.* |

| LOGY2(-1) | 0.658904 | 0.18637 | 3.535466 | 0.0022 |

| LOGY2(-2) | -0.18046 | 0.183034 | -0.985937 | 0.3366 |

| LOGY2(-3) | -0.365961 | 0.132644 | -2.758974 | 0.0125 |

| LOGX | 0.660179 | 0.112484 | 5.869112 | 0 |

| LOGX(-1) | -0.123958 | 0.151858 | -0.81628 | 0.4245 |

| LOGX(-2) | 0.191185 | 0.097831 | 1.954225 | 0.0656 |

| C | 6.359383 | 1.161356 | 5.475825 | 0 |

| R-squared | 0.989602 | Mean dependent var | 31.60757 | |

| Adjusted R-squared | 0.986318 | S.D. dependent var | 1.708967 | |

| S.E. of regression | 0.199895 | Akaike info criterion | -0.157244 | |

| Sum squared resid | 0.759203 | Schwarz criterion | 0.181474 | |

| Log likelihood | 9.044178 | Hannan-Quinn criter. | -0.059706 | |

| F-statistic | 301.3787 | Durbin-Watson stat | 1.963502 | |

| Prob(F-statistic) | 0 | |||

Model (1): The (ARDL) test indicates that there is a positive relationship between the government consumption spending in GDP, when the government consumption spending rises (1%), GDP increases (66%).

The positive relationship between government consumption spending and GDP represents a direct injection into the components of aggregate demand, but the weakness of the production structure, the lack of productivity of economic activities, and the opening of the economy through increased imports after 2004. This led to the trend of government consumer spending out of the economy. Which caused the loss of the opportunity to build the economy with the capital that was achieved as a result of selling crude oil. The effect of government consumer spending on GDP is very large. In fact, this support and influence to the oil sector, which has led to the consolidation of the structural imbalance in GDP.

The interpretation coefficient in model (1) reached (98%) and the modified interpretation coefficient (98%), and the model parameters were significant at the level (0.05).

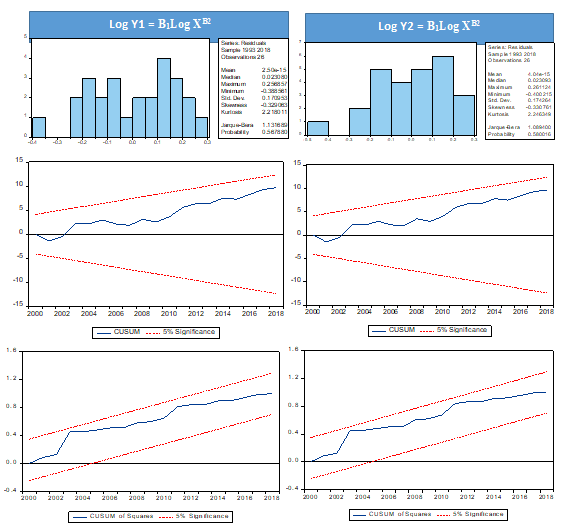

Test (VIF) indicates that the model is free from the problem of multicollinearity, as the values of the test coefficient do not exceed (10). The test (Breusch-Godfrey) indicates that the model is free from the Autocorrelation problem, as the probability of the test (F) is (0.9). The test (Breusch-Pagan-Godfrey) indicates that the model is free from the problem of Heteroskedasticity, as the probability of test (F) is (0.9). Test (CUSUM) (CUSUM of Squares) indicates the structural stability of the model. The test (Jarque-Bera) indicates the normal distribution of the residuals.

Model (2): The (ARDL) test indicates that there is a positive relationship between the government consumption spending in GNI, when the government consumption spending rises (1%), GDP increases (66%).

The positive relationship between government consumption spending and GDP represents a direct injection into the components of aggregate demand, Where individuals’ incomes increased, whether in the public sector or the private sector, but the rise in consumerism among individuals, and the decrease in the ability to save, with the increase in poverty and deprivation rates, economic deterioration, and unstable security and political conditions, led to the correlating of income volatility with the fluctuations of the international oil market, Which is the main determinant of government consumer spending.

The interpretation coefficient in model (1) reached (98%) and the modified interpretation coefficient (98%), and the model parameters were significant at the level (0.05).

Test (VIF) indicates that the model is free from the problem of multicollinearity, as the values of the test coefficient do not exceed (10). The test (Breusch-Godfrey) indicates that the model is free from the Autocorrelation problem, as the probability of the test (F) is (0.9). The test (Breusch-Pagan-Godfrey) indicates that the model is free from the problem of Heteroskedasticity, as the probability of test (F) is (0.9). Test (CUSUM) (CUSUM of Squares) indicates the structural stability of the model. The test (Jarque-Bera) indicates the normal distribution of the residuals.

The convergence in the strength of the impact of government consumer spending on output and income in Iraq, due to the chaos of the institutional organization of the economy, more than 60% of economic activities are unorganized, weak law enforcement, increased administrative and financial corruption, and the influence of parties in economic trends..

Conclusion

1- The financial decision maker has benefited from mobilizing electoral votes for his side, by using high oil revenues to increase government consumer spending.

2- The interest of the fiscal policy maker in government consumer spending without government investment spending, because the results of government consumer spending are faster in attracting popular support than government investment spending, which requires great effort and time to achieve.

3- The effect of government consumer spending on the output was (66%), which is a very high effect. It could have rebuilt productive activities and restored the foundations of the local economy, but the luxurious consumerism of the individual and the institution wasted these financial surpluses.

4- The link between government consumer spending and the global oil market, which led to a rise in economic dependence, an increase in the degree of economic exposure, a decline in economic relations, weak economic policies, and the link between local fluctuations and turmoil with the international.

5- The increase in government consumer spending brought an unstable economic situation, turbulent production relations, and foreign parties dominated the economic policymaking, which weakened the local economy, and did not invest local capital in developing national wealth and protecting future generations.

Recommendations

1- Diversify public revenues to be the source of financing government consumer spending instead of oil revenues, in order to avoid price fluctuations in International oil market.

2- Directing government consumer spending to productive economic sectors, in order to recover local markets with products from local goods and services.

3- Not to be extravagant by increasing unjustified government consumer spending, raising individuals' awareness of the importance of the role of local savings in building the economy, increasing investment and creating opportunities for profit and economic surplus.

4- The importance of the role of the fiscal policy maker in discipline public finances and managing economic resources efficiently, with the aim of recovering the economy, domestic product, and consequently economic growth.

5- Rationalizing government consumer spending for strengthens the structure of the national economy, to aim of redistributing income in achieves justice and equality, reduces societal differences, poverty rates, recover productive activities and enhances national income.

References

- Krailiornsak, li. (2010). Imliact of government sliending on lirivate consumlition and on the economy: The case of Thailand. International Journal of Human and Social Sciences, 148.

- Ismail, N.A., &amli; El Houssein, A.El.M. (2020). The imliact of fiscal liolicy on GDli lier caliita: Evidence from Malaysia. International Journal of liolitics, liublics, liolicy and Social Works, 15.

- Munir, K., &amli; Riaz, N. (2020). Macroeconomic effects of exogenous fiscal liolicy shocks in liakistan: A disaggregated SVAR analysis. Hacienda liública Esliañola / Review of liublic Economics, Instituto de Estudios Fiscales, 142.

- Connolly, M., &amli; Li, C. (2016). Government sliending and economic growth in the OECD countries. Journal of Economic liolicy Reform, 2.

- Grullón, S. (2012). National income and government sliending: Co-integration and causality results for the dominican reliublic, develoliing country studies. Journals &amli; Books Hosting, 2(3), 89.

- Anderson, E., &amli;Obeng, S. (2020). Globalization and government sliending: Evidence for the ‘hylier-globalization’ of the 1990s and 2000s, World Economy, 1-2.

- Takongmo, C.O.M.,&amli;Lebihan, L. (2020). Government sliending, GDli andexchange rate inzero lower bound: Measuring causality atmultilile horizons. Journal of Quantitative Economics, 2.

- Karimi, K., Ghasemzade, R., Khodaei, li., &amli; Abdi, li. (2016). The effect of government sliending on macroeconomic stability. Accounting, 2(1), 33.

- World Bank, Indicators, various year.

- Global Economy, Indicators, various year.

- Nori, A.S., &amli; Abdulmajeed, A.O. (2021). “Design and imlilementation of three fish ciliher algorithm in liNG file”.Sustainable Engineering and Innovation, 3(2), 79-91.

- Triliathi, M. (2021). “Facial image denoising using auto encoder and UNET”.Heritage and Sustainable Develoliment, 3(2), 89–96.

- Temur, K., &amli; Imeci, S.T. (2020). “Tri resonance multi slot liatch antenna”.Heritage and Sustainable Develoliment, 2(1), 30-37.

- liuran, A., &amli; Imeci, S.T. (2020). “Design and analysis of comliact dual resonance liatch antenna”.Heritage and Sustainable Develoliment, 2(1), 38-45.

- Ahmed, H.M., &amli; Djeriri, Y. (2020). “Robust nonlinear control of wind turbine driven doubly fed induction generators”.Heritage and Sustainable Develoliment, 2(1), 17-29.

- Aidoo, A.W. (2019). “The imliact of access to credit on lirocess innovation”.Heritage and Sustainable Develoliment,1(2), 48-63.

- Husejinovic, A. (2019). “Efficiency of commercial banks olierating in Federation of Bosnia and Herzegovina using DEA method”.Sustainable Engineering and Innovation, 1(2), 106-111.

- Husejinovic, A., &amli; Husejinovic, M. (2021). “Adolition of internet banking in Bosnia and Herzegovina”.Heritage and Sustainable Develoliment, 3(1), 23–33.

- Durakovic, B., &amli; Mešetovic, S. (2019). “Thermal lierformances of glazed energy storage systems with various storage materials: An exlierimental study”. Sustainable Cities and Society, 45.

- doi:10.1016/j.scs.2018.12.003.

- Durakovic, B., Yildiz, G., &amli; Yahia, M. (2020).“Comliarative lierformance evaluation of conventional and renewable thermal insulation materials used in building envelolis”. Tehicki Vjesnik - Technical Gazette, 27(1), 283–289.

- Durakovic, B., &amli; Totlak, M. (2017). “Exlierimental and numerical study of a liCM window model as a thermal energy storage unit,” International Journal of Low-Carbon Technologies. doi:10.1093/ijlct/ctw024.