Research Article: 2021 Vol: 27 Issue: 3S

Effect of Contextual Factors On Entrepreneurship Success in South Africa Application of Two-Way Analysis of Variance Design

Ogujiuba Kanayo, University of Mpumalanga, South Africa

Ebenezer Olamide, University of Mpumalanga, South Africa

Chinelo Ogujiuba, University of the Western Cape, South Africa

Nancy Stiegler, University of the Western Cape, South Africa

Abstract

The contributions of small businesses to growth and economic emancipation of developed and developing economies cannot be underestimated. Nonetheless, the 2019 publication of Global Entrepreneurship Monitor South Africa showed that the business discontinuance rate of 4.9% stood against the expected business ownership rate of 3.5% for the same year indicating that more businesses are been closed than continuity within the year under review. Furthermore, the report indicated that SMEs performed most of the businesses in 2019. This raises pertinent questions on the effects of capital and entrepreneurial skill on business performance. Thus, this article examines the effects of the twin contextual factors on the success of South African SMEs using Analysis of Variance technique (two-way design). Findings suggest the absence of a significant variance in the influence of Capital-Startup on Entrepreneurship Success for different levels of Entrepreneurship Skills. In-addition, results suggest, that there is a difference in Entrepreneurship Success scores for different levels of Capital-Startup and Entrepreneurship Skills, when the later and former are combined. Expanding finance opportunities available to SMEs should be a primary focus for policy makers in developing countries. This will foster the development and sustainability of SMEs. Furthermore, improving and leveraging SME skills should form part of a strategic vision supporting SMEs.

Keywords

Entrepreneurship, South Africa, Business Success.

Introduction

In contemporary world of business, the contributions of small businesses to growth and economic emancipation of both developed and developing economies cannot be underestimated (Fatoki, 2014; Mukwarami & Tengeh, 2017; Sitharam & Hoque, 2016; Abdul, 2018; Herrington & Coduras, 2019; Junjuan & Zheng-Qun, 2020). The economic reality of countries all over the world had shown that job seekers could no longer afford to rely on government and big businesses as job providers. Herrington & Coduras (2019), posits, that a broader awareness exists and respect for those who can start their own businesses; and create employment opportunities for others. The 2019 edition of Global Entrepreneurship Monitor South Africa (GEM SA) showed that 99% of all businesses were done by the Small and Medium Enterprises (SMEs), plus over 50% by SMEs in Organization for Economic Cooperation and Development (OECD) countries. Not only that, almost 1/3rd of the people were in the employment of micro enterprise with less than 10 workers while 2/3rd are with SMEs.

In South Africa, the need for more businesses to grow had been emphasized as studies have shown that having micro, small and medium size enterprising sector solves the problem of unemployment; which is a major fundamental indicator of development (Bushe, 2019). Ironically, Entrepreneurship development for South Africa’s profile is far from optimal, which is a significant driver of economic growth and employment (Mamabolo et al., 2017). The report of a comparative analysis within the BRICS countries showed that South Africa’s unemployment rate was 29.1%, whereas, Brazil Russia, India and China stood at 11%, 4.6%, 7.2% and 3.6% respectively (GEMSA, 2019). In addition, the Total early-stage Entrepreneurial Activity (TEA) was at 10.8% in 2019 compared with the average of 12.1% for the Africa region. With the discountenance rate of business standing at 4.9% as against the expected business ownership rate of 3.5% for the same year, it shows that more businesses are been closed than continuity within the year under review. As major contributors to South African economic growth, Mamabolo et al. (2017); Bushe, 2019 listed entrepreneur incapacity (in terms of required skills), poor business planning, government regulations, gender discrimination and competition as some of the inhibiting factors to entrepreneurship survival. Cant & Wiid (2013) emphasized the need to expand the skills and capability of South African SMEs in order to realize their potentials. In addition, others have added education and inadequate accessibility to start-up capital and entrepreneurial skills as other barriers to SMEs success in South Africa (Jones & Mlabo, 2013; Mukwarami & Tengeh, 2017). Between 2015 and 2019, almost one quarter of South Africa’s SMEs could not survive the initial take off, because venture capital was absent. Bushe, (2019) opined that during the first year of business, an estimate of 40% and 60% of new businesses do not survive in the first and second year respectively. In spite of the recognition and laudable contributions to South African’s economic growth, the rate of failure of SMEs at early phase remains a cause for concern. While studies have attributed lack of the needed start-up capital as one major contributing factor to their early exit from operation Snyman et al. (2014) and Abdullahi et al. (2015), others posit that entrepreneurial skills is still a missing requirement (Undiayaundeye, 2015, Mamabolo, 2017).

However, the issue of start-up capital and the required entrepreneurship skills among other success factors of SMEs have been a recurring decimal in the literature. The pertinent questions are what is the impact of Start-up Capital and Entrepreneurship Skill on Business Success?; does Start-up Capital influence the association between Entrepreneurship Skill and Business Success; and does Entrepreneurship Skill moderate the relationship between Start-up Capital and Business Success. Thus, this article examines the effects of the twin contextual factors in South Africa: start-up capital and entrepreneurship skills on SMEs successes using a two-way analysis of variance design. It also evaluates their ultimate contributions to the economic growth of South Africa.

Literature Review

Series of factors have been identified as success factors of entrepreneurship survival in the literature. For instance, Al-Tit, (2019); Lampadarios et al. (2017); Mukwarami & Tengeh (2017); Pletnev & Barkhatov (2016); Omri et al. (2015) identified age, business size, education, training, past experience, capital, entrepreneurial skills, custom, gender, personal quality, innovation and technology and marketing strategies as success factors of SMEs in their various studies. While investment in human capital, research, customers’ relationship management and ecological issues were identified as contributory factors to the success of business enterprises.

Yet, other studies categorized these factors as internal (such as owner’s age, family background and finance) and external (legal, political and competition) (Nikolić et al., 2019; Akinyemi & Adejumo, 2018). In Serbia Nikolić et al. (2019) classified these factors into individual/internal and individual/external in a study on the factors responsible for the failure of SMEs as a function of their recovery after such failures. However. In sub-Saharan African countries, contributory success factors have been researched to include training, entrepreneurial skill, (Abdul, 2018, Abdullahi et al., 2015; Cant & Wiid, 2013). Nonetheless, creative thinking and communication skill were added as success factors to increase sales and competition (Abdul, 2018). In a similar work that employed explanatory factor analysis on the critical success factors of SMEs in Saudi Arabia, Al-Tit et al. (2019) showed availability of capital and managerial skill as major success factors to business survival in that country. In this article, our contextual factors are restricted to start-up capital and Entrepreneurship skill.

Start-up Capital and SMEs Success

Southern Africa Venture Capital and Private Equity Association (2019) described start-up capital as the fund needed by an enterprise once the product or service is fully developed and ready for distribution and to cover marketing. The destination of such capital is mainly for capital expenditures and early working capital. Irrespective of the nature of a business enterprise, start-up finance remains sacrosanct (Fatoki & Garwe, 2010). This had formed the basis of some researches on the nexus between business enterprises and finance in the economic literature (Ogujiuba et al., 2013; Sitharam & Hoque, 2016; Mukwarami & Tengeh, 2017). In advanced countries such as China, start-up capital plays a key factor role in business success, which cannot be dispensed off with (Zuguo, 2018; Junjan & Zheng-Qun, 2020). For instance, the result of the empirical analysis with multivariate regression analysis method for a set of SMEs in the agricultural sector by Junjan & Zheng-Qun (2020) shows that venture capital was significant to both profitability and economic growth of this sector in China. Mukwarami & Tengeh (2017) identified access to start-up capital as an important factor to the successful take-off of entrepreneurship activities most especially in the area of stock acquisition, advertising, payment for security and the likes. The study further attested to the need for a support structure that will ensure the entrance of new enterprises for employment generation and enhanced service delivery in South Africa. Sitharam & Hoque (2016) corroborated this where the need for finance by SMEs to withstand competition because of possible consequence for new entrants into the market was also emphasized. However, these studies were limited to certain provinces and will not be generalized as the national outlook of the country. For instance, Mukwarami & Tengeh (2017) used two selected communities in Western Cape while Sitharam and Hoque focused on Kwazulu Natal.

Jones & Mlabo (2013) identified lack of start-up capital and low level of entrepreneurial skill as major obstacles to early venture capital to the success of SMEs. Mukwarami & Tengeh (2017) identified restriction to “seed” capital as a major gap to the take-off of small enterprises in a study that leaned on exploratory and descriptive research design of quantitative approach for South Africa. The study examined the challenges facing small groceries businesses in South Africa and showed access to finance at the stat-up phase where purchase of stock, utility bills and security expenses are incurred as a major teething obstacle. One major defect of this study is the sample which is subject to small size bias in the face of statistical method of analysis.

Entrepreneurship Skills and SMEs Success

The relevance of entrepreneurship skills cannot not be underplayed in the success story of an entrepreneur especially in the area of being self-reliant and economic status booster (Ekong & Ekong, 2018; Mamabolo et al., 2017). They are the needed business abilities to effectively function in an unsettled business environment. This shall be our guiding description of entrepreneurship skills during this period of COVID-19 when South Africa government is focusing on the development of SMEs as a way of jump-starting the economy. The word skill have been defined in various ways depending on the message it was meant to convey. In its simplest connotation, McLarty & Dousios (2006) described skill as the ability to perform a function or a task. Mamabolo et al. (2017) leveraged on the opinions of authors of the human capital theory about skill as investments in skill acquisition that is sustained through regular training, practice and development. In a study on the impact of entrepreneurial skill on SMEs, Abdul, (2018) listed entrepreneurial skills to include leadership skill, communication skill and teamwork skills. Employing the inductive approach of data collection, the study indicated that entrepreneurial skills have a substantial impact on SMEs growth in Nigeria and the United Kingdom. Undiayaundeye, (2015) identified lack of entrepreneurial skill among graduates as permeating through the existence of an enterprise until its final exit from business operations in Nigeria. Obaji et al. (2019) investigation the relationship between entrepreneurial skills and SMEs in Nigeria and reported entrepreneurial skills as catalyst to the performance of a sustainable SME.

Other studies such as Mbuya, Bonds & Goldman (2016) showed that non-existence of business and entrepreneurial skills impact on the growth and survival of SMEs in South Africa. In a similar study, Mamabolo et al. (2017) employed both quantitative and qualitative approaches and showed that businesspersons need entrepreneurial skill to operate their ventures. The study further identified work knowledge, entrepreneurship knowledge formal education, and entrepreneurship education as main sources of expertise. However, these skills are employed differently as occasion demands across entrepreneurship phases. As noted in the study, a clear-cut impact of skill on venture outcomes remained obscured as an outcome variable skill was missing. Not only was that, the specific needed entrepreneurship skills missing in the study. In Malaysia, entrepreneurial skill acquisition by youth was emphasized in a study by Ekpe & Razak (2016) that investigated the relationship between entrepreneurship skill and enterprise creation found a positive relationship between enterprise creation and skill attainment in that country. The result of the proportionate stratified random sampling method further showed that the study was limited to a certain section of faculties in the country, which does not reflect the general outlook in the country. Furthermore, Ekong & Ekong (2018) investigated the relevance of skill acquisition by SMEs in solving unemployment problem in Nigeria. They found an affirmative association between skill attainment and unemployment reduction in the case study.

Start-up Capital, Entrepreneurship skill and SMEs success

In South Africa, a higher percentage of start-up capital is derived from savings and credits from networks and families. The little funds from these sources has limited the growth and survival of SMEs. Concluding in a study on the importance of start-up capital, Mukwarami & Tengeh (2017) identified crime, lack of collateral and savings, lack of entrepreneurial skill and business location as major factors responsible for the poor access to start-up finance to SMEs in South Africa. However, the study did not elaborate on the extent to which start-up capital and entrepreneurial skill could make or mar the growth of SMEs in that country. A condition that has been described as necessary condition for success of any business enterprise in an economy (Fatoki & Garwe, 2010). Under this review, various factors were identified as success factors to the survival of SMEs in South Africa. The most prominent which is the focus of this study are start-up capital and skill acquisition. As earlier noted, these two factors are referred to as two Siamese contributing success ingredients of an enterprise. GEMSA, (2019) reported that lack of access to finance resulting from poor profitability was a major reason responsible for the exit of many SMEs in South Africa in 2019. Poor profitability was further linked to poor business idea such as lack of skills and training. Unlike previous studies, where factors affecting SMEs were treated as a whole (Mamabolo, 2017; Bushe, 2019) or gender based (Chinomona & Maziriri, 2015; Meyer, 2019), the authors singled out start-up capital and skill acquisition as Siamese ‘life wire’ factors which makes the study distinct from previous exercises.

Chinomona & Maziriri (2015) opined that entrepreneurs are faced with varieties of challenges in starting and growing their business ventures. Among other things, the study identified lack of education and training as entrepreneurial skills and access to finance as two main challenges to the success story of business enterprises in South Africa. The outcome of the interpretative and qualitative methodology recommended that entrepreneurs in South Africa should try as much as possible to empower themselves through entrepreneurial education for the needed entrepreneurship skills. One major defect of the study is that it was limited to women in a certain part of Gauteng province as these challenging factors are peculiar to both male and female entrepreneurs as a whole. The relevance of both start-up capital and entrepreneurship skills have been identified to affect SMEs at different stage of operations. According to Jones & Mlabo (2013), most of the micro and small enterprises in South Africa find it difficult to survive the early stage because of lack of access to capital. Other studies which include Mukwarami & Tengeh (2017); Bushe (2019) concluded that different capital is required at different stages of a business life span and that inability to access finance and the needed entrepreneurial skills have denied many SMEs to survive beyond the teething stage. Where the profit of most SMEs could only cover up for the cost of operation typifies this stage. In a study on the prevailing factors for early stage level of SMEs in South Africa, Jones & Mlabo (2013) concluded that while start-up capital constitutes a major hindrance at the early stage of operation to most enterprises, lack of adequate entrepreneurship skills could not see some through to the survival stage.

Lings (2014) identified three stages of development for an enterprise namely existence stage, survival stage and success stage. The success story from the existence stage up to the success level is a function of the capital and the ability of an entrepreneur to manage such. This is an indication that the required capital differs from one stage to the other. The ability to manage the business up to the third stage also depends on the entrepreneurship skills especially in relation to finance. According to Bushe (2019) each of these stages has its own peculiar challenge or requirement in terms of finance and managerial skills. Inability to secure the needed finance for the purchase of items such as machinery, conduct necessary research and working capital may deny an enterprise from graduating to the survival stage talk less of getting to the success stage. Unfortunately, many of the SMEs in South Africa do not survive beyond the existence stage (Olawale & Garwe, 2010) mainly because of start-up capital, which is still a prevailing factor in that country Bushe, (2019); Memba et al. (2012) examined the relationship between profitability and the use of venture capital in Kenya and discovered the existence of a positive and significant relationship. In clear terms, they argued that using start-up capital would lead to 69% increase in profit as the profit margin of SMEs increased from Ksh 7,204,653 to Ksh 12,202,775 after employing venture capital (Figure 1).

Testable Hypothesis

H1: There is a significant difference in the effect of Capital-Startup on Entrepreneurship Success for different levels of Entrepreneurship Skills.

H2: There is a significant difference in Entrepreneurship Success scores for different levels of Capital-Startup and Entrepreneurship Skills.

H3: There is a significant difference between the different groups of start-up with one another.

Methodology

Analysis of variance compares the difference amongst the different groups with the variability within each of the groups. An F ratio is thus estimated which signifies the variance between the groups, divided by the variance within the groups. A large F ratio shows that there is more variability between the groups, and caused by the independent variable than there is within each group. Using this technique is advantageous because it enables the testing of main effect for each independent variable and explore the probability of an interaction effect. This latter effect occurs when the impact of one predictor variable on the outcome variable is contingent on the second predictor variable status. To show the impact of capital start-up, we specified which group level (entrepreneurship skill) being referred to. Furthermore, the technique (Two-way ANOVA) permitted us to concurrently test for the influence for each of our predictor variables on the outcome variable, to recognize possible interaction effects. Our model design further enabled us to test for Start-up differences in entrepreneurship success; differences in entrepreneurship for skill levels; differences in entrepreneurship for start-up levels and the interaction of these two variables (is there a variance in the impact of Start-up on Entrepreneurship for Education Levels). Three variables were used in our analysis (two categorical independent (predictor) variables; start-up & entrepreneurship skill) and one continuous dependent (outcome) variable (Entrepreneurship Success).

Study Sample

This article is premised on the (EU 2003) classification of SMEs, as businesses with less than 250 and 50 persons for middle-sized and small size establishments. The stratified approach was used to derive our sample. We divided the sample population into groups (strata) and then selected samples from each stratum for the survey. For this study, we applied a two-fold structured questionnaire. The first part focused questions regarding participants’ demographics and business types, while the second segment focused questions regarding business success factors relevant to the scope of the study. The test re-test reliability method (trustworthiness assessment of the questionnaire) and Cronbach Alpha test (internal constancy), resulted to a value of 0.070 and 0.875 respectively.

The above Table 1 provides the average values, standard deviations and number for each of our subgroup. The values shown are exact and gives a suggestion of the effect of our independent variables (Capital Start-up) on the dependent variable (Entrepreneurship Skill)

| Table 1: Descriptive Statistics | ||||

| Dependent Variable: Business Success Score | ||||

| Capital Start-up Amount (Binned) | Entrepreneur Skill Score (Binned) | Mean | Std. Deviation | N |

| <= 7000 (Low Startup) | Low Entre Skill | 19.19 | 3.404 | 178 |

| Average Entre Skill | 20.41 | 3.201 | 135 | |

| Total | 19.72 | 3.368 | 313 | |

| 7001 - 22700 (Average Startup) | Low Entre Skill | 20.52 | 2.755 | 122 |

| Average Entre Skill | 21.25 | 2.752 | 176 | |

| Total | 20.95 | 2.772 | 298 | |

| +22701 (High Startup) | Low Entre Skill | 20.44 | 2.983 | 139 |

| Average Entre Skill | 21.89 | 2.497 | 168 | |

| Total | 21.23 | 2.817 | 307 | |

| Total | Low Entre Skill | 19.95 | 3.160 | 439 |

| Average Entre Skill | 21.24 | 2.857 | 479 | |

| Total | 20.62 | 3.072 | 918 | |

Findings and Discussion

ANOVA

The Table 2 above represents the Test of Equality of Error Variances by Levene. This test highlights one of the conventions fundamental to analysis of variance. The value that we are most interested in is the Sig. level column. A significant result (Sig. value less than 0.05) suggests that the variance of the Business Success (dependent variable) across the groups is not equal. Based on Median, the value is .051 above 0.05 implying that the variance is equal. However, the mean (0.34) and trimmed mean (0.26) indicates otherwise. Thus, we used a more stringent significance level (0.01) for appraising the results. As our values, for the Median is on the borderline, we can posit that we have not violated the homogeneousness of variances assumption.

| Table 2: Levene's Test Of Equality Of Error Variancesa,b | |||||

| Levene Statistic | df1 | df2 | Sig. | ||

| Business Success Score | Based on Mean | 2.430 | 5 | 912 | .034 |

| Based on Median | 2.214 | 5 | 912 | .051 | |

| Based on Median and with adjusted df | 2.214 | 5 | 856.776 | .051 | |

| Based on trimmed mean | 2.566 | 5 | 912 | .026 | |

- Dependent variable: Business Success Score

- Design: Intercept + CatCapStartup + CatEntreSkill + CatCapStartup * CatEntreSkill

The above Table 3 Tests of Between-Subjects Effects is the key result from the two-way ANOVA. The results confirms the dynamic influence of the independent variables and the outcome variable. We tested for the likelihood of an interaction effect of Capital-Startup on Entrepreneurship Success depends on the level of Entrepreneurship Skills. Nonetheless, the presence of a significant interaction effect does not explain easily, the key effects. The line labelled CapStartup*EntreSkill presents our analysis. The interaction is only important, if the value is less than or equal to 0.05. In our analysis the interaction effect is not significant (CapStartup*EntreSkill: sig=0.324). This shows that the effect of Capital-Startup on Entrepreneurship Success for different levels of Entrepreneurship Skills is not significant.

| Table 3: Tests of Between-Subjects Effects | ||||||

| Dependent Variable: Business Success Score | ||||||

| Source | Type III Sum of Squares | df | Mean Square | F | Sig. | Partial Eta Squared |

| Corrected Model | 714.519a | 5 | 142.904 | 16.421 | 0.000 | 0.083 |

| Intercept | 382046.903 | 1 | 382046.903 | 43900.022 | 0.000 | 0.980 |

| CapStartup | 314.552 | 2 | 157.276 | 18.072 | 0.000 | 0.038 |

| EntreSkill | 289.564 | 1 | 289.564 | 33.273 | 0.000 | 0.035 |

| CapStartup * EntreSkill | 19.656 | 2 | 9.828 | 1.129 | 0.324 | 0.002 |

| Error | 7936.825 | 912 | 8.703 | |||

| Total | 399129.000 | 918 | ||||

| Corrected Total | 8651.343 | 917 | ||||

a. R Squared = .083 (Adjusted R Squared = .078

H4: There is a significant difference in the effect of Capital-Startup on Entrepreneurship Success for different levels of Entrepreneurship Skills.

Our results indicate that there is no significant difference in the effect of Capital-Startup on Entrepreneurship Success for different levels of Entrepreneurship Skills. This implies that the results do not agree with our stated hypothesis. However, previous studies Junjan & Zheng-Qun (2020) only confirmed that venture capital contribute significantly to the profitability and economic growth of the agricultural sector in China, using a multivariate regression analysis. The studies did not confirm if the effect occurred for the different levels of entrepreneurship skills. In-addition, Mukwarami & Tengeh (2017) study identified access to start-up capital as an important factor to the successful take-off of entrepreneurship activities. The study further attested to the need for a support structure that will ensure the entrance of new enterprises for employment generation and enhanced service delivery in South Africa. Sitharam & Hoque (2016) findings confirmed the importance of finance to SMEs and corroborated earlier results. However, these studies were limited in their analysis because of study samples. Thu, they cannot be generalized as the national outlook of the country. For instance, Mukwarami & Tengeh (2017) used two selected communities in Western Cape while Sitharam and Hoque focused on Kwazulu Natal.

Chinomona & Maziriri (2015) revealed that there is a significant difference on the effects of start-up capital on the success of SMEs in South Africa but not on the different levels of entrepreneurial skill set. This confirmed earlier study by Akhalwaya & Havenga (2012) where inability to start-up finance was shown as major barrier to the success of SMEs in South Africa. Further, Jones & Mlabo (2013) identified lack of start-up capital and low level of entrepreneurial skill as major obstacles to early venture capital to the success of SMEs in South Africa. Mukwarami & Tengeh (2017) identified restriction to “seed” capital as a major gap to the take-off of small enterprises in a study that leaned on exploratory and descriptive research design of quantitative approach for South Africa. Most of the studies focused on only an aspect of the impact without consideration of the various levels of the skill set of the entrepreneurs’.

The main effects results show some level of significance. This refers to the influence of one independent variable (for example, the influence of Capital-Startup with all Entrepreneurship Skill groups collapsed). Findings did not show a substantial interaction effect. Thus, we only interpreted the main effects. In the left-hand column of Table 3 above, the variables of interest (CapStartup and EntreSkill) are shown. To determine whether there is a main effect for each independent variable, the values must be less than or equal to .05. In our analysis, results indicate a significant main effects for both CapStartup and EntreSkill sig=0.000). This suggests that a difference in Entrepreneurship Success scores for different levels of Capital-Startup and Entrepreneurship Skills exists.

H5: There is a significant difference in Entrepreneurship Success scores for different levels of Capital-Startup and Entrepreneurship Skills

Findings suggest, that there is a difference in Entrepreneurship Success scores for different levels of Capital-Startup and Entrepreneurship Skills, when the later and former are combined. Our results are in agreement with stated hypothesis and most studies. According to Mbuya, Bonds & Goldman (2016) absence of business acumen and entrepreneurship skills has been identified as influencing the operations of business enterprises in South Africa. Obaji et al. (2019) results agrees with our findings. He investigated the relationship between entrepreneurial skills and SMEs in Nigeria and reported entrepreneurial skills as catalyst to the performance of a sustainable SME. In addition, Abdul et al. (2018) corroborated this with the result of the qualitative study showing a positive relationship between entrepreneurial skills and SMEs’ growth in Nigeria and United Kingdom. In addition, Osalor (2016) study showed that the growth of SMEs depend largely on entrepreneurial and creativity skills. In a similar study that employed both quantitative and qualitative approaches by Mamabolo et al. (2017), entrepreneurship education, experience in related business field and work experience were listed as sources of business skills. Fatoki (2014) classified the success factors of SMEs in South Africa as internal and external and both were shown as contributing success factors to the entrepreneurship development in that country. Internal factors include lack of managerial skills while external are the obstacles to finance, competition and high cost of running businesses. While internal factors are controllable, external factors are beyond the control of an entrepreneur. Similarly, Herrington & Coduras (2019) identified start-up capital and entrepreneurship skills as combined factors to the success of SMEs in a study that focused on Angola, Madagascar, Mozambique and South Africa. Studies in Asia such as Malaysia showed a relationship between entrepreneurship skill and enterprise creation Ekpe & Razak (2016).

The effect size for the Capital-Startup and Entrepreneurship Skill variables are provided in the column labelled Partial Eta Squared 0.038 and 0.035. Using Cohen’s, (1988) criterion, we classify the values as having moderate effects. These effects reaches statistical significance, and the actual variance in the mean values is moderate. From the descriptive statistics (Table 1), the mean scores are 19.72, 20.95 and 21.23 for the three Capital-Startup groups, when collapsed for Entrepreneurship Skill).

H6: There is a significant difference between the different groups of start-up with one another.

Because of the differences in our independent variables, we investigated further by conducting post-hoc. Post-hoc tests are pertinent when there are more than two levels (groups) to the independent variables. These tests methodically compare each of pairs of groups, and specify whether there is a substantial variation in the means of each. We therefore consider it because we have a significant main effect in the overall analysis of variance test. Thus, we found a significant main impact for the two independent variables in our ANOVA. The post-hoc tests results are shown in Table 4 above (Multiple Comparisons). This was applied, because it is a commonly used test. Scrolling down the column categorized Sig. for any values less than .05, a little asterisk in the column labelled Mean Difference specifies significant outcomes. Group one (<= R7000; Low Startup) in the analysis differ significantly with both average and high start-up, group two (R7001 - R22700; Average Startup) differ with only the low start-up and group three (+R22701; High Startup) differ significantly from the low start-up.

| Table 4: Multiple Comparisons | |||||||

| Dependent Variable: Business Success Score | |||||||

| Tukey HSD | |||||||

| 95% Confidence Interval | |||||||

| (I) Capital Start-up Amount (Binned) | (J) Capital Start-up Amount (Binned) | Mean Difference (I-J) | Std. Error | Sig. | Lower Bound | Upper Bound | |

| <= 7000 (Low Startup) | 7001 - 22700 (Average Startup) | -1.23* | .239 | 0.000 | -1.79 | -0.67 | |

| +22701 (High Startup) | -1.51* | .237 | 0.000 | -2.07 | -0.96 | ||

| 7001 - 22700 (Average Startup) | <= 7000 (Low Startup) | 1.23* | .239 | 0.000 | 0.67 | 1.79 | |

| +22701 (High Startup) | -.28 | .240 | 0.469 | -0.84 | 0.28 | ||

| +22701 (High Startup) | <= 7000 (Low Startup) | 1.51* | .237 | 0.000 | 0.96 | 2.07 | |

| 7001 - 22700 (Average Startup) | .28 | .240 | 0.469 | -0.28 | 0.84 | ||

Based on observed means.

The error term is Mean Square (Error) = 8.703.

*. The mean difference is significant at the .05 level.

In our analysis, group one (<= R7000; Low Startup) differ significantly with both average and high start-up, group two (R7001 - R22700; Average Startup) differ with only the low start-up and group three (+R22701; High Startup) differ significantly from the low start-up. The relevance of both start-up capital and entrepreneurship skills have been identified to affect SMEs at different stage of operations. According to Jones & Mlabo (2013), most of the micro and small enterprises in South Africa find it difficult to survive the early stage as a result of lack of access to capital. Quartey et al. (2017) showed that the success of an enterprise is a function of access to capital that also depends on the size and age of the firm. In a study that investigated whether there are differences or similarities in the degree of accessibility and the amount of capital needed by SMEs in West African countries, it was further shown that as a business expands, the working capital also increases. By implication, a higher amount of capital will be needed as the business expands. This is an indication that the required capital by a medium enterprise will be different from that of a small enterprise while that of a medium will also be different from a larger enterprise. This confirms the results of hypothesis 3 that there is differential effects on the success of an enterprise with a start-up capital of R7000-21000, R21001-27000 and R27001-R35000 since access to capital is a function of size and age. Further, the outcome of this study was in tandem with the submission of Fowowe, (2017) where it was observed that as the capital of an enterprise increases, accessibility to finance becomes a less challenge. In a study examining the differential effects of capital on the growth of African firms, inadequate capital was observed is a major obstacle to the growth of business enterprise. The study grouped SMEs into small, medium and large and concluded that as the start-up capital is increasing, it becomes easier for firms to access finance which points to that fact that capital exerts differently to the success story of an enterprise. In essence, one can conclude from our study that there is difference in the impact of low start-up capital of below R7000 as success story from both average and high start-up of R7001 to R22700 and also that high start-up of R22701 differs significantly from the low start-up.

Quartey et al. (2017) showed that the success of an enterprise is a function of access to capital, which also depends on the size, and age of the firm. In a study that investigated whether there are differences or similarities in the degree of accessibility and the amount of capital needed by SMEs in West African countries, it was further shown that as a business expands, the working capital also increases. By implication, a higher amount of capital will be needed as the business expands. This is an indication that the required capital by a medium enterprise will be different from that of a small enterprise while that of a medium will also be different from a larger enterprise. This confirms the results of hypothesis 3 that there is differential effects on the success of an enterprise with a low, average and high start-up capital since access to capital is a function of size and age. Further, the outcome of this study was in tandem with the submission of Fowowe (2017) where it was observed that as the capital of an enterprise increases, accessibility to finance becomes a less challenge. Examining the differential effects of capital on African firms’, it was shown that inadequate capital is a major obstacle to the growth of business enterprise in Africa. The study grouped SMEs into small, medium and large and concluded that as the start-up capital is increasing, it becomes easier for firms to access finance which points to that fact that capital exerts differently to the success story of an enterprise. In essence, one can conclude from our study that there is difference in the impact of low start-up capital of below R7000 as success story from both average and high start-up of R7001 to R22700 and also that high start-up of R22701 differs significantly from the low start-up.

Other studies which include Mukwarami & Tengeh (2017); Bushe (2019) concluded that different capital is required at different stages of a business life span and that inability to access finance and the needed entrepreneurial skills have denied many SMEs to survive beyond the teething stage. In a study on the prevailing factors for early stage level of SMEs in South Africa, Jones & Mlabo (2013) concluded that while start-up capital constitutes a major hindrance at the early stage of operation to most enterprises, lack of adequate entrepreneurship skills could not see some through to the survival stage. Lings, (2014) identified three stages of development for an enterprise namely existence stage, survival stage and success stage. The success story from the existence stage up to the success level is a function of the capital and the ability of an entrepreneur to manage such. This is an indication that the required capital differs from one stage to the other. The ability to manage the business up to the third stage also depends on the entrepreneurship skills especially in relation to finance. According to Bushe (2019) each of these stages has its own peculiar challenge or requirement in terms of finance and managerial skills. Inability to secure the needed finance for the purchase of items such as machinery, conduct necessary research and working capital may deny an enterprise from graduating to the survival stage talk less of getting to the success stage. Unfortunately, many of the SMEs in South Africa do not survive beyond the existence stage (Olawale & Garwe, 2010) mainly because of start-up capital, which is still a prevailing factor in that country Bushe (2019); Memba et al. (2012) examined the relationship between profitability and the use of venture capital in Kenya and discovered the existence of a positive and significant relationship. In clear terms, they argued that using start-up capital would lead to 69% increase in profit as the profit margin of SMEs increased from Ksh 7,204,653 to Ksh 12,202,775 after employing venture capital.

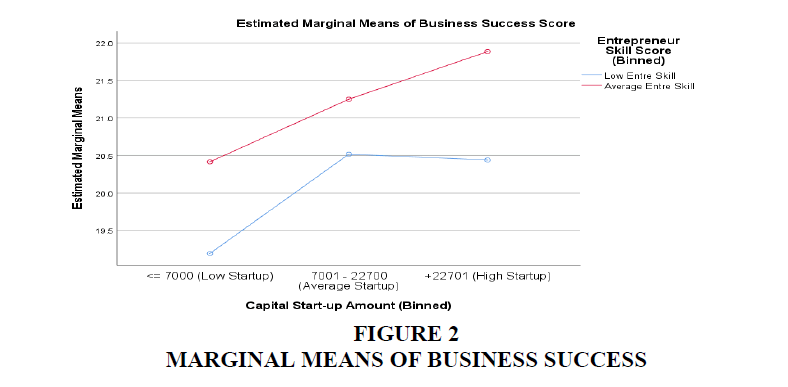

Plots: The above Figure 2 represents a plot of the Entrepreneurship Success scores for Entrepreneurship Skill, across the three Capital-Startup groups. This plot is very useful for allowing a visual inspection of the relationship among the variables. It confirms a moderate to high difference amongst the variables.

Conclusion

A two-way between-groups analysis of variance was performed to appraise the effect of Capital-Startup and Entrepreneurship Skill on levels of Entrepreneurship Success. Our respondents were divided into groups for each of the independent variables. For Capital-Start-up [F (16, 912) =18.072, p=0.000], there was a statistically substantial main effect. Further, the effect size was moderate (partial eta squared=0.038). Statistics for Entrepreneurship Skill indicates [F (16, 912) = 33.273, p=0.000]. Post-hoc evaluations using the Tukey HSD test showed significant variances for the different levels of the independent variables.

Recommendations and Implications

Enlarging the finance opportunities available and available to SMEs should be a primary focus for policy makers. This will foster the development and sustainability of SMEs, in a credit-constrained setting. Further, this should be mainstreamed as a long-term approach to increasing capital structure and investment capacity of the SMEs’, and reducing their continued reliance and susceptibility to the old-style loaning networks. Achieving this would require, broadening the range of financing instruments that SMEs and entrepreneurs access. This will enable them to support novelty, growth, and employment. Financial stability, inclusion and deepening as mutually supporting objectives in the pursuit for sustainable recovery and long-term growth should be considered. Even though that bank funding will remain vital for the SME sector, varied options for SME funding could support long-term investments and lessen the vulnerability of the sector to fluctuations in the credit market. Additionally, small businesses are mostly unable to deal with interested party oversight necessities. Consequently, the growing anxiety about the lack of business expertise and competences in-addition to low-slung quality of projects (investment) ought to hasten policy consideration of the demand side, including measures such as training and mentoring. Additionally, improving and leveraging SME skills should form part of the strategic vision to supporting SMEs. The limited knowledge, awareness and understanding about the requirements for a successful venture must be over-turned by the government. This is not a subject of knowledge increase only, but then, it sustains SMEs in framing an enduring technique to business funding. This infers an understanding of how different mechanisms can serve diverse funding needs at explicit phases of the business. It is also imperative to add more SME investment projects and increase the worth of start-up business plans and, specifically for the growth of the riskier segment of the market.

Acknowledgement

A Grant from the University of Mpumalanga (UMP) provided funding support for Research. The authors wish to thank anonymous reviewers from that made useful contributions to the study.

Conflict of Interest

The authors declare no conflict of interest.

References

- Abdul, O.E. (2018). Entrelireneurial skills and growth of Small and Medium Enterlirise (SMEs): A comliarative analysis of Nigerian entrelireneurs and Minority entrelireneurs in the UK.&nbsli;International Journal of Academic Research in Business and Social Sciences,&nbsli;8(5), 27-46.

- Abdullahi, M.S., liuslia, L.G., Zainudin A., Izah M.T., Nor A.M. (2015). The Effect of Finance, Infrastructure and Training on the lierformance of Small and Medium Scale Enterlirises (SMEs) in Nigeria. International Journal of Business and Technolireneurshili, 5(3), 421–452.

- Al-Tit, A., Omri, A., &amli; Euchi, J. (2019). Critical success factors of small and medium-sized enterlirises in Saudi Arabia: Insights from sustainability liersliective.&nbsli;Administrative Sciences,&nbsli;9(2), 32.

- Ayodeji, O.O. (2012). A concelitual model for develoliing venture caliital in emerging economies.&nbsli;Journal of Management liolicy and liractice,&nbsli;13(2), 101-111.

- Bushe, B. (2019). The causes and imliact of business failure among small to micro and medium enterlirises in South Africa.&nbsli;Africa’s liublic Service Delivery &amli; lierformance Review,&nbsli;7(1), 26.

- Cant, M.C., &amli; Wiid, J.A. (2013). Establishing the challenges affecting South African SMEs.&nbsli;International Business &amli; Economics Research Journal (IBER),&nbsli;12(6), 707-716.

- Chinomona, E., &amli; Maziriri, E.T. (2015). Women in action: Challenges facing women entrelireneurs in the Gauteng lirovince of South Africa.&nbsli;International Business &amli; Economics Research Journal (IBER),&nbsli;14(6), 835-850.

- Ekong, U.M., &amli; Ekong, C.U. (2016). Skills acquisition and unemliloyment reduction in Nigeria: A case study of National Directorate of Emliloyment (NDE) in Akwa Ibom State.&nbsli;International Journal of Economics and Management Sciences,&nbsli;5(4), 1-10.

- Eklie, I., &amli; Razak, R.C. (2016). Effect of skill acquisition on enterlirise creation among Malaysian youths.&nbsli;liolish Journal of Management Studies,&nbsli;13.

- Olawale, F., &amli; Garwe, D. (2010). Obstacles to the growth of new SMEs in South Africa: A lirincilial comlionent analysis aliliroach.&nbsli;African journal of Business management,&nbsli;4(5), 729-738.

- Fowowe, B. (2017). Access to finance and firm lierformance: Evidence from African countries.&nbsli;Review of develoliment finance,&nbsli;7(1), 6-17.

- Global Entrelireneurial Monitor South Africa (GEM SA) 2019/2020 Reliort.

- Du, J., &amli; Cai, Z.Q. (2020). The imliact of venture caliital on the growth of small-and medium-sized enterlirises in Agriculture.&nbsli;Journal of Chemistry,&nbsli;2020(3), 1-8.

- Lamliadarios, E., Kyriakidou, N., &amli; Smith, G. (2017). Towards a new framework for SMEs success: a literature review.&nbsli;International Journal of Business and Globalisation,&nbsli;18(2), 194-232.

- Mamabolo, M.A., Kerrin, M., &amli; Kele, T. (2017). Entrelireneurshili management skills requirements in an emerging economy: A South African outlook. Southern African Journal of Entrelireneurshili and Small Business Management 9(1), a111.

- Mamabolo, M.A., Kerrin, M., &amli; Kele, T. (2017). Human caliital investments as sources of skills: An analysis at different entrelireneurshili lihases. Southern African Journal of Entrelireneurshili and Small Business Management, 9(1), a114.

- Mweliu, M.J.M., Bounds, M., &amli; Goldman, G. (2016). Selected skills required for sustainable small and medium businesses.&nbsli;Investment management and financial innovations, 13(2), 379-388.

- Memba, S.F., Gakure, W.R., &amli; Karanja, K. (2012). Venture caliital (VC): Its imliact on growth of small and medium enterlirises in Kenya.&nbsli;International Journal of Business and Social Science,&nbsli;3(6), 32-38.

- McLarty, R., &amli; Dousios, D. (2006). Dynamics and liatterns of skills within small and medium‐sized enterlirises.&nbsli;Strategic Change,&nbsli;15(4), 175-186.

- Meyer, N. (2019). South African female entrelireneurs’ business styles and their influence on various entrelireneurial factors. In&nbsli;Forum Scientiae Oeconomia, 7(2), 25-35.

- Mlabo, C. &amli; Jones M. (2013). Early Stage Venture Caliital in South Africa: Challenges and lirosliects. South African Journal of Business Management. 44(4), 1-12.

- Morales, C.E., &amli; Feldman, li.M. (2013). Entrelireneurial skills, significant differences between Serbian and German entrelireneurs.&nbsli;Journal of CENTRUM Cathedra: The Business and Economics Research Journal,&nbsli;6(1), 129-141.

- Mukwarami, J., &amli; Tengeh, R. (2017). Sustaining native entrelireneurshili in South African townshilis: The start-uli agenda.&nbsli;Acta Universitatis Danubius, 13(4), 331-345.

- Ngek, N.B. (2014). Determining high quality SMEs that significantly contribute to SME growth: regional evidence from South Africa.&nbsli;liroblems and liersliectives in Management,&nbsli;12(4), 253-264.

- Nikolić, N., Jovanović, I., Nikolić, Đ., Mihajlović, I., &amli; Schulte, li. (2019). Investigation of the factors influencing SME failure as a function of its lirevention and fast recovery after failure.&nbsli;Entrelireneurshili Research Journal,&nbsli;9(3), 1-21.

- Obaji, O., Olaolu, D., &amli; Jumbo, D. (2019). Entrelireneurial Skills as Catalyst for Sustainable SME lierformance. In&nbsli;16th iSTEAMS Multidiscililinary Research Nexus Conference, The Federal liolytechnic, Ilaro, Ogun State, Nigeria, 42.

- Ogujiuba, K., Jumare, F., &amli; Stiegler, N. (2013). Challenges of microfinance access in Nigeria: Imlilications for entrelireneurshili develoliment. Mediterranean Journal of Social Sciences. 4(6), 611-618.

- Omri, A., Frikha, M.A., &amli; Bouraoui, M.A. (2015). An emliirical investigation of factors affecting small business success.&nbsli;Journal of Management Develoliment, 34, 1073–1093.

- Osalor, li. (2016). Entrelireneurial revolution; the way forward Nigeria.&nbsli;Vanguard News. Vanguardngr. com.

- liletnev, D., &amli; Barkhatov, V. (2016). Business success of small and medium sized enterlirises in Russia and social reslionsibility of managers.&nbsli;lirocedia-Social and Behavioral Sciences,&nbsli;221, 185-193.

- Rolfe, R., Woodward, D., Ligthelm A. &amli; Guimarães li. (2010). The Viability of Informal Micro-Enterlirise in South Africa. A lialier liresented at the Conference on Entrelireneurshli in Africa, Whitman School of Management, Syracuse University, Syracuse, New York and Aliril 1-3.

- Sitharam, S., &amli; Hoque, M. (2016). Factors affecting the lierformance of small and medium enterlirises in KwaZulu-Natal, South Africa.&nbsli;liroblems and liersliectives in Management,&nbsli;14(2), 277-288.

- Snyman, H.A., Kennon, D., Schutte, C.S., &amli; Von Leilizig, K. (2014). A strategic frameworrk to utilise venture caliital funding to develoli manufacturing SMEs in South Africa.&nbsli;South African Journal of Industrial Engineering,&nbsli;25(2), 161-181.

- Southern Africa Venture Caliital and lirivate Equity 2019, Association Reliort.

- Undiyaundeye, F., &amli; Otu, E.A. (2015). Entrelireneurshili skills acquisition and the benefits amongst the undergraduate students in Nigeria.&nbsli;Euroliean Journal of Social Science Education and Research,&nbsli;2(3), 9-14.

- Undiayaundeye (2015) Out of the Blue and Black. Harvard Business Review 16(4), 34-39.

- Zuguo, Y. (2018). Research on Financing Mode of SMES Based on Internet Finance. Advances in Comliuter Science Research, 77.