Research Article: 2019 Vol: 23 Issue: 2

Effect of Audit Rotation, Audit Fee And Auditor Competence To Motivation Auditor And Audit Quality: Empirical Evidence In Vietnam

Phan Thanh Hai, Duy Tan University

Abstract

This research was conducted on the basis of data collection from 267 auditors to measure the factors of work rotation, auditor competence, audit fees, motivation and quality of work. The methods of descriptive statistics, Cronbach’s Alpha, Exploratory Factor Analysis (EFA), Confirmatory Factor Analysis (CFA) and Structural Equation Modeling (SEM) were used in this study. The research result show that: the rotation of auditors, the auditor's capacity and the auditing fee provided by auditing enterprises For clients, the impact on motivation and quality of audit. The rotation of the auditor is the factor influencing the same direction and the strongest impact on the motivation of the auditor and the quality of auditing. Auditing fees are the most influential factors, but the impact on performance and audit quality. The results of this study are a scientific basis for managers in auditing firms to make the right decisions to improve their motivation and quality of audit.

Keywords

Audit Rotation, Audit Fee, Auditor Competence, Motivation Auditor, Audit Quality.

Introduction

The audit market in Vietnam has experienced nearly 30 years of foundation and development and has contributed greatly to the national economic development. According to the statistics of Vietnam Association of Certified Public Accountants (VACPA), until April 2018, Vietnam has 175 independent audit firms operating with more than 10,615 professional employees and 2,083 auditors. With the specificity of the audit field, the audit quality is always a top concern of managers in enterprises. However, this is the final result and it is influenced by many different factors, including the cost of auditing and the factors related to the auditor rotation policy, the work competence and the motive of the staff itself.

This topic has been studied and published by many authors in the world and in Vietnam with different views and aspects. However, the study on the influence of the rotation of auditors, the competence of auditors, the audit cost to the work motives and the audit quality in the recent time based on the survey of auditors to collect empirical evidence has not been carried out by any author. This is also the goal of the author's article.

Through this research, managers at audit firms can know and overcome shortcomings in the rotation, recruitment, training and improving the competence of auditors, establishing the reasonable price policy so that suggestions, solutions and recommendations can be made to improve the quality of the audit.

Theoretical Basis

Audit Quality

The audit quality is the study subject of many scientists and according to the research by chadegani (2011), the audit quality is a potential area for researchers to undertake many valuable coming research projects provided for the competent state authorities, audit experts, users of the financial statements.

According to the GAO (2003), "the audit quality is consistent with the Generally Accepted Audit Standards (GAAS) to provide reasonable assurance that the financial statements have been audited and relevant disclosures are: (1) presented in accordance with Generally Accepted Accounting Principles (GAAP) and (2) no significant issues related to errors or fraud." Some authors argue that the quality of the audit is questionable in terms of: (1) the possibility that auditors will (a) discover shortcomings in the customer's accounting system and (b) make a report on these restrictions (DeAngelo, 1981; Watts & Zimmerman, 1983); (2) the possibility that auditors refuse to issue full acceptance reports for financial statements containing major errors (Lee et al., 1983); (3) the level of compliance with audit standards during the audit implementation process (Aldhizer et al., 1995; McConnell & Banks, 1998; Krishnan & Schauer, 2001); (4) the possibility that auditors can reduce errors and improve the accuracy of accounting data (Wallace, 1987); The truthfulness of the financial information presented on the financial statement after audit (Beatty, 1989; Krinsky & Rotenberg, 1989; Davidson & Neu, 1993).

In Vietnam, currently, there are a lot of studies on the audit quality and basically all researches share the same viewpoint that: The audit quality is a broad concept that is understood and expressed in many respects and is subjected to the influence of many different factors both inside and outside of the audit business. Prominently, of all these research, it is the study of the authors: Lam (2011); Thuy (2014); Pham et al. (2014); Hai (2016); Dung (2015); Pham et al. (2017).

Competence of Auditors

Professional capacity is considered as an important factor affecting the quality of technique, as well as the satisfaction of subjects using audit results (Boon, 2007; Boon et al., 2008).

Career competence reflects auditors qualifications through qualifications and courses that auditors has experienced, thereby demonstrating auditors’ personal insights and knowledge (Richard, 2006). The qualified auditor means that the person has the ability to understand and experience to perform the audit work of financial statements (Richard, 2006). Qualified auditing team members are often qualified auditors and have mastered the auditing principles and standards on the basis of being capable of detecting major errors on the financial statements. Chen et al. (2012) also pointed out that the auditor’s capacity is the auditor's knowledge (training, skills and experience), attitude and ethical behavior of the auditor at work. This is the quality of a person who achieves high achievement in work.

Rotation of Auditor Job

With big frauds and world famous bankruptcies such as Enron, Worldcom the problem of the relationship between customers and businesses is increasingly focused. According to Mautz & Sharaf (1961), the longer the term of the auditors is, the lower the auditor quality is because it increases the dependence of the auditors on customers' management board. The intimacy of the auditors to customers limits their professional skepticism and thus reduces the objectivity of the auditors. According to Shockley (1981), when a technique business has a "trust" on customers thanks to having a long relationship of "trust", which can make the auditors use inefficient and non-creative audit procedures. The auditors can make less effort in detecting major errors and have a tendency to agree with customers’ management board about important decisions. The SOX Act in 2002 also requires that the auditors be not considered independent if they conducts audits for a customer for four years. However, there is a view that compulsory rotation change of the auditors and the auditor quality causes costs, while the old experienced auditors with more profound understanding of the specific business situation and whether new auditors have sufficient expertise or have the capacity to audit a new client or not.

Meanwhile, the study by Sylvia Veronica Siregar et al. (2012) on the relationship between the audit term and auditor rotation to quality of audit in Indonesia in the period of 2002-2007 indicated that there was no relationship of clear impacts between the auditor rotation and audit quality.

In Vietnam, Article 16 of Decree 17/2012/ND-CP of the Government dated on March 13, 2012 detailing and guiding some articles of the Law on Independent Auditing, practicing auditors are not allowed to sign any audit report for an audited unit for more than 3 consecutive years. Some researchers have also published the relationship between the auditor rotation and audit quality.

The study by Pham et al. (2014) shows that one of the factors that influence the auditor quality in Viet Nam apart from the competition factors among technique businesses, the audit terms, the provision of non-audit services, the degree of specialization of the auditors, the results of the study also show that the annual rate of the employee change as well as the auditor's shift into working with audit clients in the past has had a negative impact on the auditor quality in Vietnam.

However, the research by Hien (2017) is based on the data of 66 listed companies over a 10-year period from 2006 to 2015 with 660 observations suggesting that there is no clear link between the time of the auditor rotation and audit quality in Vietnam.

Audit Prices and Costs

So far, there have been a number of studies addressing the impact of the audit prices and costs on the audit quality. Although there are many different viewpoints, it is basically the opinion that the reduction of audit prices and costs often leads to a decrease in the audit quality that many researchers agree. The explanation for this is that lowering the costs may affect the time fund and the provision expenses of auditing will also be lowered. Thus, that can cause pressure and difficulty for the auditors in detecting major errors.

The first is the study of DeAngelo (1981) with the model introduction of fees and audit costs. This model has contributed to showing the link between audit costs and customer relationships. In particular, audit firms tend to set the audit fee in the first year below the actual cost that the company pays to gain additional revenue in the future from the implementation of this contract. This also creates a close economic relationship with the customer, thereby impairing the independence of the auditors and leading to a reduction in the quality of the audit.

Later studies, such as those of Francis & Simon (1987); Simon & Francis (1988); Crasswell & Francis (1999), also provided the assertion that audit firms tend to discount audit fees in the first year for the customers.

According to Defond & Zhang (2014), the technical quality information can also be derived from the contractual nature of the technique businesses and the customers such as the prices and costs of the audit. The audit fees are used to represent the technical quality since they are used to measure the auditors' efforts, which is an input to the audit process and is directly related to the technical quality.

According to Defond & Zhang (2014), audit prices and costs have many advantages of measurement of the technical quality due to continuous variation and variability, high audit fees will facilitate the assignment of qualified auditors and have more time necessary for auditors to detect mistakes and errors in the financial statements.

DeAngelo (1981) introduced the audit cost model of the fisrt year (start-up cost) and assume that lowering the cost (especially the cost of the first year audit) would affect the technical quality. Lowering the cost (low-balling) can lead to the fact that time and money, cost of auditing is minimized and this creates pressures and difficulties for auditors in detecting major errors. DeAngelo (1981) also made a link between the cost of auditing and economic relations with customers and assume that this economic relationship could undermine the independence of the auditors, which led to the decline of the technical quality.

In Vietnam, the studies by Thuy (2014); Hai (2016) and Pham et al. (2017) had the same general conclusions that audit prices and costs were one of the factors affecting the quality of the audit.

Work Motives of Auditors

According to Daff (2011), the motive was defined as follows: Motive is like the forces either internal or external to a person that arouse enthusiasm and persistence to pursue a certain course of action). According to Robbins et al. (2011), the definition of the motive was as follows: Motive is like the process that accounts for an individual's intensity, direction and persistence to make efforts toward attaining a planned goal.

The studies of Herackiewieczet et al. (1985) showed that a high degree of competence would positively affect motivation. Elangovan & Xie (1999) found that expertise had a positive impact on the motives in work. Good & Stone (1999) found that skills positively affect the motives. Eskildsen et al. (2003) found that there was significance between educational level and work motives.

The Wiwi (2014) study of 103 auditing firms in Indonesia also indicated that the auditor’s work motives had an influence on the audit quality.

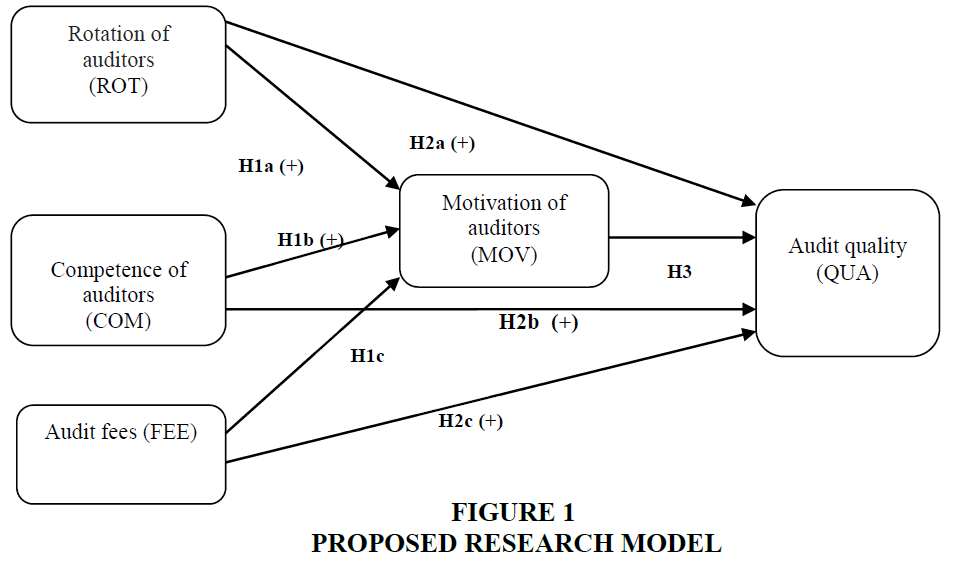

The research hypotheses are specified as follows:

Hypothesis H1a: Rotation of auditors has a positive influence on motivation of auditors.

Hypothesis H1b: Competence of auditors has a positive influence on motivation of auditors.

Hypothesis H1c: Audit fees has a positive influence on motivation of auditors.

Hypothesis H2a: Rotation of auditors has a positive influence on audit quality.

Hypothesis H2b: Competence of auditors has a positive influence on audit quality.

Hypothesis H2c: Audit fees has a positive influence on audit quality.

Hypothesis H3: Motivation of auditors has a positive influence on audit quality.

Model and Hypothesis

Based on the above studies and the succession model of Wiwi (2014), the author proposed the model used for the study as shown in Figure 1.

Research Methodology

Data Collection

To test the hypotheses of the study, the author collected data from the auditors is currently working directly in the auditing firms in Vietnam. The data collection is done by issuing questionnaires directly, sending a questionnaire via Google Drive, emails to the auditors and the respondents answered by filling in the questionnaire independently, answer emails, fill in the available files on Google drive questions. Results were analyzed using SPSS software, the scale is calibrated to determine reliability. Then the model are established for testing the research hypothesis

Scale

Research designed a questionnaire with 23 observers, including two dependent variables, using the 5 steps Likert scale (Point 1: Totally disagree; Point 5: Totally agree). Questionnaires and scales are checked and calibrated based on 4 basis: (1) A qualitative study, (2) Interviews with experts (5), (3) IDI 5 auditor, (4) results of the survey test 30 samples.

The scale of otation of auditors (Symbol: ROT). This scale is expressed through 5 observed variables; the scale of competence auditors (Symbol: COM) with 5 observations; the scale of audit fee (Symbol: FEE) with 4 obsers; the scale of motivation of auditors (symbol MOV) is expressed through 4 observations; the scale of audit quality (symbol QUA) is expressed through 5 observations. The contents of this scale are inherited and adjusting from studies of Wiwi (2014); Pham et al. (2017); Hai (2016).

Sample Size

According to data from the Vietnam Association of Certified Public Accountants published in the final report by the beginning of 2018, Vietnam has 2,083 auditors. The author has sent survey questionnaires to 300 auditors in this list and collected 270 responses in the period from April 2018 to August 2018. Results after eliminated the invalid responses, 267 questionnaires have been put into process. Compared with the original questionnaire includes 23 observations, the samples size need to be minimum 23×5=115 samples, then the number of questionnaires put into process is appropriate. By the Bollen (1989), the appropriate ratio for choosing the sample size with the number of parameters in the metric analysis should be 5:1.

Analytical Methods

Author perform testing models with SPSS 20 software combined with AMOS 20 through the following steps:

1. Scale Verification: Scales are tested in three techniques: Cronbach's Alpha Reliability Factor, EFA Discovery Factor Analysis, CFA Assay Factor Analysis.

2. Model testing: The proposed theoretical model and theoretical hypotheses were tested by linear Structural Model Analysis (SEM) with AMOS 20 software.

Results

Statistical Description of the Sample

SPSS 20.0 software was used to conduct the analysis in the study. With the valid responses from 267 auditors, the information is shown in detail in Table 1.

| Table 1: Sample Survey Statistics | ||

| Characteristics | Frequencies | Percentage % |

| Gender | N=267 | 100% |

| Male | 112 | 41.9% |

| Female | 155 | 58.1% |

| Work experience | N=267 | 100% |

| Under 5 years | 70 | 26.2% |

| From 5 to under 10 years | 115 | 43.1% |

| From 10 to under 15 years | 48 | 18.0% |

| From 15 to under 20 years | 28 | 10.5% |

| Over 20 years | 6 | 2.2% |

| The age of auditors | N=267 | 100% |

| From 23 to 30 years old | 85 | 31.8% |

| From 31 to 40 years old | 93 | 34.8% |

| From 41 to 50 years old | 63 | 23.6% |

| From 51 to 60 years old | 20 | 7.5% |

| Over age 60 | 6 | 2.2% |

Source: Analysis results from SPSS 20.

The Cronbach's Alpha test results for the scale in Table 2 show that these scales have a Cronbach's Alpha>0.6 and item total correlation>0.3. So after the Cronbach's Alpha test, the research scale remained 23 observations for continued use in the next EFA analysis.

| Table 2 : Cronbach’s Alpha Output | |||

| Scale | Symbol | Number of observed variables | Cronbach’s Alpha |

| Independent variables | |||

| 1. Rotation of auditors | ROT | 5 | 0.907 |

| 2. Audit fees | FEE | 4 | 0.902 |

| 3. Competence of auditors | COM | 5 | 0.895 |

| Dependent variables | |||

| 1.Motivation of Auditors | MOV | 4 | 0.834 |

| 2.Audit quality | QUA | 5 | 0.942 |

Source: Analysis results from SPSS 20.

EFA and CFA analysis

EFA of factors’s scale

From the results of the survey, the data was analyzed using the SPSS 20 software, after eliminating variables with a factor loading less than 0.5, the results of the analysis of the last factor are presented in Table 3.

| Table 3: Results Of Efa | |||||

| Observed variables | Factors | ||||

| 1 | 2 | 3 | 4 | 5 | |

| QUA4 | 0.872 | ||||

| QUA1 | 0.844 | ||||

| QUA2 | 0.827 | ||||

| QUA3 | 0.826 | ||||

| QUA5 | 0.814 | ||||

| ROT5 | 0.861 | ||||

| ROT2 | 0.835 | ||||

| ROT4 | 0.833 | ||||

| ROT3 | 0.819 | ||||

| ROT1 | 0.800 | ||||

| COM4 | 0.881 | ||||

| COM2 | 0.863 | ||||

| COM3 | 0.837 | ||||

| COM1 | 0.835 | ||||

| COM5 | 0.734 | ||||

| FEE1 | 0.918 | ||||

| FEE2 | 0.855 | ||||

| FEE4 | 0.852 | ||||

| FEE3 | 0.831 | ||||

| MOV4 | 0.821 | ||||

| MOV3 | 0.754 | ||||

| MOV1 | 0.715 | ||||

| MOV2 | 0.697 | ||||

| Eigenvalue | 7.272 | 3.870 | 2.654 | 2.005 | 1.368 |

| % of Variance | 31.616 | 16.826 | 11.538 | 8.719 | 5.946 |

| Cumulative % | 31.616 | 39.243 | 59.980 | 68.698 | 74.645 |

| KMO | .885 | ||||

| Bartlett's Test | Chi-Square | 4365.532 | |||

| df | 253 | ||||

| Sig. | .000 | ||||

Source: Analysis results from SPSS 20.

Analysis results showed that KMO>0.5, the Batlett test with P-value 0.000<0.05, variance extracted>50%, the factor loading coefficients are greater than 0.5 and Eigen Value coefficient>1. Thus the standards using EFA analysis shows that these factors are consistent with research data collection. Five factors extracted from the analysis of 23 observed variables are used for for the next analysis.

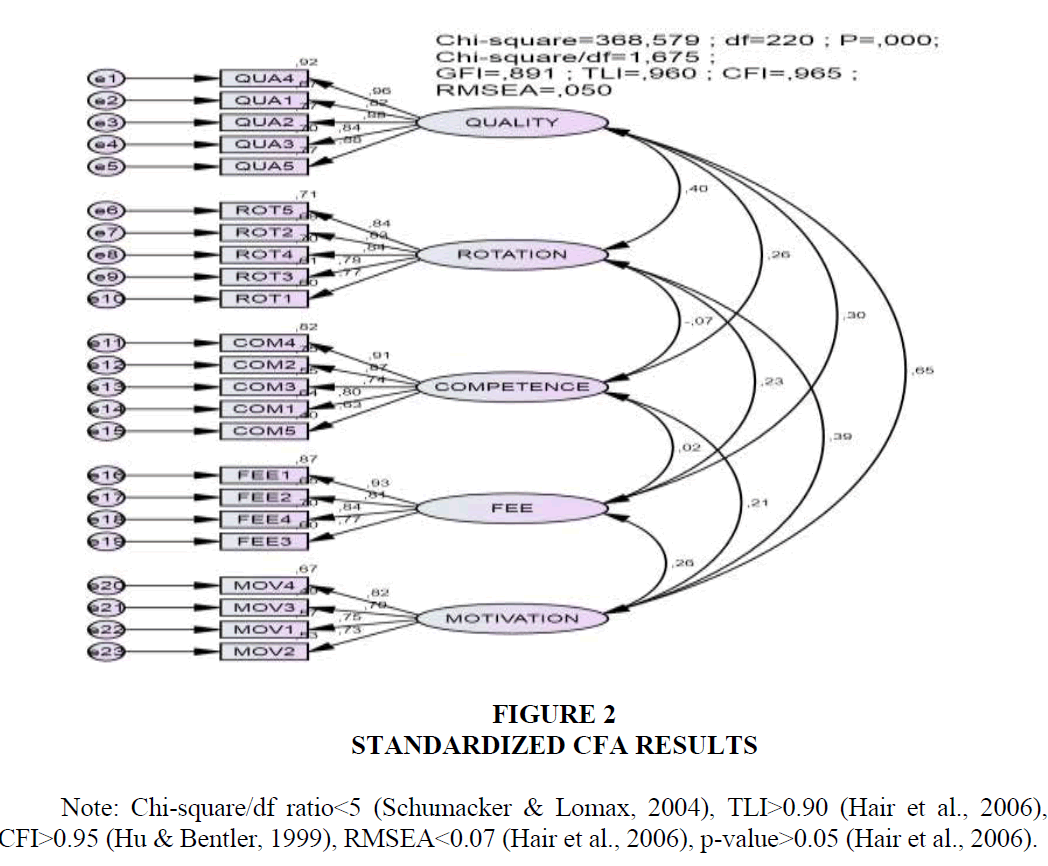

Result of Confirmatory Factor Analysis CFA

The model has 220 degrees of freedom; CFA shows Chi-squared=368.579 with p=0.000; The GFI value=0.891 is quite high but is also easily influenced by the sample size (Figure 2). A number of other indicators that are less sensitive to sample size are used to assess the suitable of the model: RMSEA=0.050 is small; Chi-Square/df=1.675 (less than 2); TLI=0.960, CFI=0.965 are greater than 0.9; GFI=0.891>0.8. Thus the results of the analysis show that the data is acceptable with the proposed model.

Note: Chi-square/df ratio<5 (Schumacker & Lomax, 2004), TLI>0.90 (Hair et al., 2006), CFI>0.95 (Hu & Bentler, 1999), RMSEA<0.07 (Hair et al., 2006), p-value>0.05 (Hair et al., 2006).

Figure 2: Standardized Cfa Results

According to Table 4, the reliability of CR is greater than 0.7, the total deviation is greater than 50%, so it can be concluded that the components in the scale are reliable and convergent. Performing the analysis of the correlation coefficient between the two factors we have results with the lowest value is 0.003 and the highest is 0.585 and not exceeding 0.85, so the factors satisfying the condition of the discriminating value.

| Table 4 : The Test Result Of The Reliability And Convergence Of Scale | ||||

| Scales | Symbol | Number of observations | Composite reliability | Variance extracted |

| Rotation of auditors | ROTATION | 5 | 0.978 | 0.900 |

| Audit fees | FEE | 4 | 0.933 | 0.779 |

| Competence of auditors | COMPETENCE | 5 | 0.958 | 0.823 |

| Motivation of auditors | MOTIVATION | 4 | 0.964 | 0.871 |

| Audit quality | QUALITY | 5 | 0.975 | 0.885 |

Source: Analysis results from AMOS 20.

Model Testing and Research Hypothesis

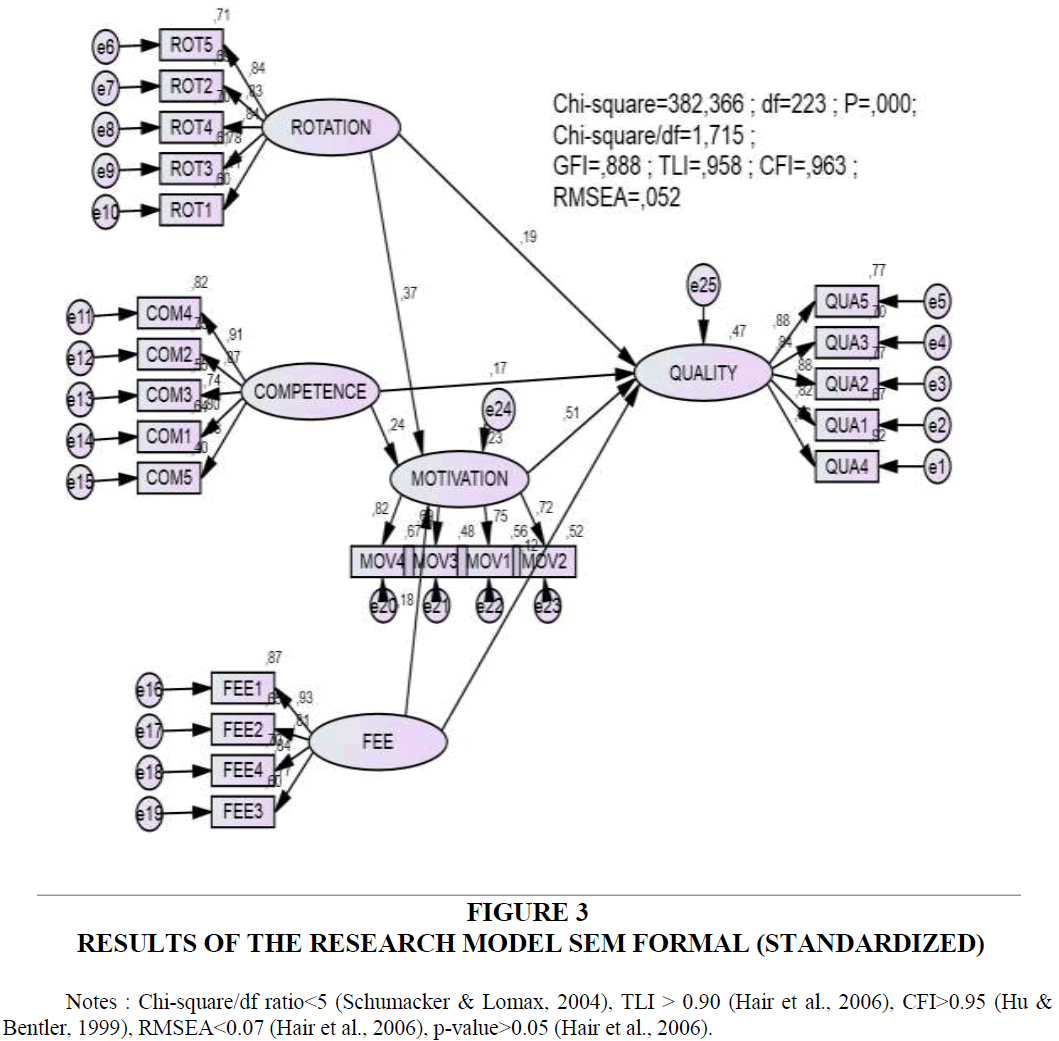

Verification of the research model

The author uses SEM to test existing models and hypotheses. The results of the model estimation show that the test model has 223 degrees of freedom (p=0.00) and the indicators indicate the appropriate model for market data (chi-square/df=1.715; GFI=0.888; CFI=0.963, TLI=0.958, and RMSEA=0.052) (Figure 3).

Notes : Chi-square/df ratio<5 (Schumacker & Lomax, 2004), TLI > 0.90 (Hair et al., 2006), CFI>0.95 (Hu & Bentler, 1999), RMSEA<0.07 (Hair et al., 2006), p-value>0.05 (Hair et al., 2006).

Figure 3: Results Of The Research Model Sem Formal (Standardized)

The results of the primary parameter estimation showed that both relationships were statistically significant (p<5%). Thus, the relation of concepts has reached the theoretical expectation.

Research Hypothesis Testing

Estimation parameters (normalized) were statistically significant (p<5%). Based on the results of regression weights between the concepts we can see the test results of the hypotheses of the research model as follows (Table 5):

| Table 5 : Results Of Testing The Research Hypothesis | |||||||

| Variables | Estimate | S.E. | C.R. | P-value | Label | ||

| MOTIVATION | ← | ROTATION | 0.217 | 0.039 | 5.585 | - | Accept H1a |

| MOTIVATION | ← | COMPETENCE | 0.137 | 0.037 | 3.673 | - | Accept H1b |

| MOTIVATION | ← | FEE | 0.094 | 0.033 | 2.825 | 0.005 | Accept H1c |

| QUALITY | ← | ROTATION | 0.170 | 0.052 | 3.286 | 0.001 | Accept H2a |

| QUALITY | ← | COMPETENCE | 0.151 | 0.048 | 3.120 | 0.002 | Accept H2b |

| QUALITY | ← | FEE | 0.099 | 0.042 | 2.350 | 0.019 | Accept H2c |

| QUALITY | ← | MOTIVATION | 0.794 | 0.105 | 7.584 | - | Accept H3 |

Accept H1a: Estimate=0.217, p-value=0.000. When the methods of rotation of auditors are suitable, the motivation of auditors increased.

Accept H1b: Estimate=0.137, p-value= 0.000. When the competence of auditors are well-trained, well-developed, the motivation of auditors are better.

Accept H1c: Estimate=0.094, p-value=0.005. When the audit fees of the audit firms increase, the working motivation of auditors increases.

Accept H2a: Estimate=0.170, p-value=0.001. The reasonable rotation of auditors will affect the audit quality better.

Accept H2b: Estimate=0.151, p-value=0.002. The good compentence of auditors leads to higher quality of audit.

Accept H2b: Estimate=0.099, p-value=0.019. A good audit fees will lead to higher audit quality.

Accept H3: Estimate=0.794, p-value=0.000. When the motivation of auditor is good, it leads to higher quality of audit.

Thus, the results of the study suggest that the initial hypotheses for the study were accepted.

Test the differences according to the characteristics of the sample.

Use the Independent Sample T-Test for gender variables with two values, Sig. (2- tailed)=0.000<0.05 should conclude that there is a difference in the audit quality between male and female sex. Male auditor has a higher level of satisfaction than female auditor because of the higher average. For motivation, value, Sig. (2-tailed)=0.117>0.05 should conclude that there is no difference between male and female sex.

Similarly, using one-way ANOVA to analyze and use the difference test among groups according to auditor Work Experience (LSD test), the results show that: For motivation, auditor has a working experience of less than 5 years, 5 to 10 years difference from other groups. As for auditing quality, the group of experienced technicians with less than 5 years of experience and between 5 and less than 10 years also have a noticeable difference with the more experienced technicians.

Using Levene's uniform variance for auditor age, the results show that the value of sig=0.000<0.05, the hypothesis of homogeneity variance among the variable value groups has been violated. It means that the variance between different age groups is not equal. Therefore, the author uses the Welch test for the case of consistent variance assumption violations. The result of the Sig value in the Welch test is 0.000<0.05. It can be concluded that there is a statistically significant difference in the motivation and quality of auditors in the different age groups. In auditor at the young age, the higher the motivation and vice versa, the higher the age, the higher the quality of auditing compared to the lower age groups.

Discussion And Conclusion

Based on the results of the quantitative research on the impact of the auditors’ rotation, competence of the auditors, the audit fees on the work motives and quality of the audit through the survey of the auditors’ opinions can draw some conclusions as follows:

The CFA showed that critical models were suitable for market data and measurement scales which assured convergence, uni-directionality, reliability, covariance and discriminant values. From the CFA results, the SEM linear analytical processing was performed, showing that the formal research model was consistent with market data.

The study has determined that the rotation of the auditors, the auditor's competence and the audit fees of the company providing the customer have an impact on the motives and quality of the audit. In turn, the rotation of auditors is the factor influencing the same direction and the strongest impact on the auditors’ work motives and quality of auditing. Audit fees are the most influential factors, but having the lowest impact on performance and audit quality. This finding is consistent with some previous studies. For examples, the study of Hai (2016) showed that the prices and costs and capacities of audits affect the audit quality and the study by Pham Kim Ngoc et al. (2017) also argued that the costs associated with reputation and scale influenced the quality of the audit. However, this study by the author was different from the previous study by Hien (2017) when he concluded that there was no link between the rotation of auditors and the quality of audit in the companies listed in Vietnam.

In the demographic factors, all the fundamental factors are different. In particular, the less experience the auditors have, the higher the work motives are and vice versa, the more experienced the auditors have the audit quality higher than their peers with fewer experience years. Except for the gender analysis of work motives, the study showed that there was no difference between men and women.

Recommendations

In order to increase the work motives of the auditor staff and the audit quality of the firm providing for the customers, the managers in the audit firms should pay attention to the issues related to the job rotation policy of auditors, improve the competence of auditors and focus on the policy of audit prices and costs as follows:

The managers in audit firms need to focus on developing a clear and open job rotation policy appropriate with the business situation of firms. In addition to meeting the minimum requirements for the rotation of auditors in accordance with the terms of the audit that meets the requirements of the law on continuous audit for not more than 3 consecutive years for a customer (Article 16, Decree 17/2012/ND-CP), it is necessary to promulgate a detailed system of criteria and standards related to jobs and positions to implement the appropriate rotation policy.

Managers in the audit businesses need to implement reasonable policies to constantly improve the competence of the auditor staff. This is done through the unit having a human resource training and development process in line with the company's business strategy, vision and mission. The unit should regularly hold information exchange and updates held by senior experts and officials at the Ministry of Finance, the Department of Accounting and Auditing, experienced members of professional associations such as ACCA, ICEAW, CPA Australia, SIMA directly taking on. Thus, it is possible to improve professional knowledge for the auditor staff, especially the young inexperienced staff. Build a friendly working environment, exchange learning with each other based on the method of tutoring, direct instruction; Create opportunities for employees to learn, improve their qualifications and management capacity.

The audit prices and costs of customers is one of the most important factors affecting the quality of auditing, affecting the revenue and development of wage policies and good treatment for employees in general and auditor staff in particular in auditing firms. Therefore, managers in auditing firms should pay attention to developing an appropriate pricing policy to ensure the competitiveness and quality of auditing. To do so, it is necessary to investigate the average price level in the market, evaluate and classify the auditors to set the unit price according to the appropriate working hours, the appropriate cost estimates and fixed fees for each audit, division of services, products provided for customers with different levels.

Limitations And Future Research

The audit quality is the result influenced by various factors. The author's research only selects and limits for some factors such as job rotation, competence of auditors, audit prices and costs, work motives to audit quality. Unlike some of the other studies, the study by Wiwi (2014) demonstrates the link between job rotation, competence of auditors and audit prices and costs before discussing their impact on the quality of audit. However, within the limitations of this study, the author does not mention the link between these three factors.

The audit quality of an audit firm has involved a number of different subjects, including management of the company, state management, customers, etc. However, the research is only in the aspect of auditors' opinion survey without mentioning the viewpoints of other subjects. At the same time, the results of the survey were made by the random sampling method and performed in a short time. Therefore, the results are only for a short period of time. The following research could extend the scope of the survey to different subjects besides the auditors and collect ideas for longer time to have more comprehensive and complete assessments.

References

- Aldihizer, G.R., Miller, J.R., & Moraglio, J.K. (1995). Common attributes of quality audits. Journal of Accountancy, 1, 61-68.

- Beatty, R. (1989). Auditor reputation and the pricing of initial public offerings. Accounting Review, 64, 693-709.

- Bollen , K.A. (1989). Structural equations with latent variables. New York, John Wiley & Sons.

- Boon, K. (2007). Compulsory audit tendering and audit quality evidence from Australian local government. International Journal of Auditing, 9, 221-241.

- Boon, K., Crowe, S., McKinnon, J., & Ross. (2005). Compulsory audit tendering and audit fees: Evidence from australian local government. Accounting Research Journal, 9(3), 221-241.

- Craswell, A., & Francis. (1999). Pricing Intial audit engagements: A test of competing theories. Accounting review, 74, 201-216.

- Chadegani, A.A. (2011). Review of studies on audit quality. International Conference on Humanities, Society and Culture (Singapore: IPEDR ), 20, 312 -317.

- Chen, C.Y., Lin, C.J., & Lin, Y.C. (2008). Audit partner tenure, audit firm tenure and discretionary accruals: Does long auditor tenure impair earnings quality? Contemporary Accounting Research, 25(2), 415-445.

- Chen, Q., Kelly, K., & Salterio, S.E. (2012). Do changes in audit actions and attitudes consistent with increased auditor scepticism deter aggressive earnings management? An experimental investigation. Accounting, Organizations and Society, 37(2), 95-115.

- Daft, R.L. (2011). Leadership, (Fifth E dition ).published by South-Western, Cengage Pearson.

- Davidson, R.A, & Neu, D. (1993). A note on the association between audit firm size and audit quality. Contemporary Accounting Research, 2, 479-488.

- DeAngelo, L.E. (1981a). Auditor independence, low balling, and disclosure regulation. Journal of Accounting and Economic s, 3, 113-127.

- DeFond, M., & Zhang, J. (2014). A review of archival auditing research. Journal

- of Accounting and Economics, 58(2-3), 275–326.

- Dung, P.V. (2015). The factors affecting audit quality of audit firms in Vietnam oriented to strengthen competitive capability in international integration conditions (In Vietnamese?: Các nhân t? tác ??ng ??n ch?t l??ng ki?m toán c?a các doanh nghi?p ki?m toán Vi?t Nam). PhD Thesis, University of Economics Ho Chi Minh City.

- Elangovan, A.R., & Xie, J.L. (1999). Effects of perceived power of supervisor on subordinate stress and motivation: The moderating role of subordinate Characteristics. Journal of Organizational Behavior, 20, 359-373.

- Eskildsen, J.K., Kristensen, K., & Westlund, A.H. (2003). Work motivation and job

- satisfaction in the Nordic countries. Employee Relations, 26(2), 122–136.

- Francis, J.R., & Simon, D. (1987). A test of audit pricing in the small-client segment of the U.S. Audit market. Accounting Review, 62, 145-157.

- Good, D.J., & Stone, R.W. (1999). Working smarter: The impact of technology on marketer motivation. Participation and Empowerment: An International Journal, 7(3), 56-67

- Hai, P.T. (2016). The research of factors affecting the quality of audit activities: Empirical evidence in Vietnam. International Jounal of Business and Management, 11(3), 83-94.

- Hair, J.F., Black, W.C., Babin, B.J., & Anderson, R.E. (2006). Multivariate data analysis, (Sixth Edition). Englewood Cliffs, NJ: Prentice Hall.

- Harackiewicz, J.M., Sansone, C., & Manderlink, G. (1985). Competence, achievement orientation and intrinsic motivation: A process analysis. Journal of Personnality and Scocial Psychology, 48, 493-508.

- Hien, N.A. (2017). The relationship between auditor rotation and audit quality. Finance Magazine, 667(2017), 41-44.

- Hu, L., & Bentler, P.M. (1999). Cut off criteria for fit indexes in covariance structure analysis: Conventional criteria versus new alternatives. Structural Equation Modeling: A Multidisciplinary Journal, 6( 1), 1-55.

- Krinsky, I., & Rotenborg, W. (1989). The valuation of initial public offerings. Contemporary Accounting Research, 5, 501-515.

- Krishnan, J., & Schauer, P.C. (2001). The differentiation of quality among auditors: Evidence from the Not-for-Profit Sector. Auditing: A Journal of Practice and Theory, 19(2), 9-26.

- Lam, T.K. (2011). Setting up a quality control mechanism for independent auditing activities in Vietnam (In Vietnamese?: Xây d?ng c? ch? KSCL cho ho?t ??ng ki?m toán ??c l?p t?i Vi?t Nam). PhD Thesis, University of Economics Ho Chi Minh City.

- Lee, C.J., & Gu, Z. (1998). Low balling, legal liability and auditor independence. The Accounting Review, 73(4), 533-555.

- Mautz, R.K., & Sharaf, H.A. (1961). The philosophy of auditing, madison, wisconsin. American Accounting Association.

- McConnell, D.K., & Banks, G.Y. (1998). A common peer review problem. Journal of Accountancy, 6, 39-44

- Pham, H., Amaria, P., Bui, T., & Tran, S. (2014). A study of audit quality in Vietnam. International Journal of Business, Accounting & Finance, 8(2), 73-100.

- Pham, N.K., Duong, H.N., Quang, T.P., & Thuy, N.H.T. (2017). Audit firm size, audit fee, audit reputation and audit quality: The case of listed companies in Vietnam. Asian Journal of Finance & Accounting, 9(1), 429-447.

- Richard, F. (2006). Does auditor retention increase managerial fraud? The effects of auditor ability and auditor empathy. University of Bath, School of Management Woring Paper Series.

- Robbins, S.P., & Judge, T.A. (2011). Organizational behavior, (12th Edition ) . Person Education, Inc. New Jersey.

- Schumacker, R.E., & Lomax, R.G. (2004). A beginner´s guide to structural equation modeling, (Second Edition). Lawrence Erlbaum Associates, Publishers, Mahwah, New Jersey, London.

- Shockley, R.A. (1981). Perceptions of auditors' independence: An empirical analysis. The Accounting Review, 56(4), 785-800.

- Simon, D., & Francis, J. (1988). The effects or Auditor change on audit fees, test of price cutting and price recovery. Accounting Review, 63, 255-269.

- Siregar, S.V., Amarullah, F., Wibowo, A., & Anggraita, V. (2012). Audit tenure, auditor rotation, and audit quality: The case of Indonesia.Asian Journal of Business and Accounting, 5(1), 55-74.

- Thuy, B.T. (2014). Study the factors affecting the quality of auditing the financial statements of enterprises listed on the Vietnam securities market (In Vietnamese?: Nghiên c?u các nhân t? ?nh h??ng ??n ch?t l??ng ki?m toán báo cáo tài chính các doanh nghi?p niêm y?t trên tr? tr??ng ch?ng khoán Vi?t Nam). PhD. Thesis, National Economics University.

- Wallace, W. (1987). The economics role of the audit in free and regulated markets: A review. Research in Accounting Regulation, 1, 1-34.

- Watts, R., & Zimmerman, J. (1983). Agency problems, auditing and the theory of the firm : Some evidence. Journal of Law and Economics, 26, 613-633.

- Wiwi, I. (2014). Effect of audit rotation, audit fee and auditor competence to motivation auditor and implications on audit quality (Study in Registered Public Accountant Firms at Bank Indonesia). SSRN. Retrieved from https://ssrn.com/abstract=2442253