Research Article: 2023 Vol: 27 Issue: 5

Economy and Business during Covid-19: Effects on International Markets between March and July, 2020..

Socorro Márquez, Félix Oscar, Complutense University of Madrid

Reyes Ortiz, Giovanni Efraín, Del Rosario University, Bogotá-Colombia

Citation Information: Socorro, F., & Reyes, G., (2023). Economy And Business During Covid-19: Effects On International Markets Between March And July, 2020. International Journal of Entrepreneurship, 27(S5),1-08

Abstract

Keywords

International Economics, Business Administration and Pandemic Conditions, International Markets.

Introduction

This is not the first time that the world has faced a pandemic; there are historical records from 1200 BC, which place known humanity in the middle of a similar situation. But it is the first time that it has faced a global pandemic with a very high level of coverage that has made it possible to monitor and record its behavior in real time.

In addition to the psychological impact that compulsory confinement, excessive sanitary measures, constant pressure from the media and improvised measures by some official sectors have on society; It is impossible to ignore the impact that COVID-19 has had on the economy and business and how it has significantly affected the behavior of international markets in the first four months of 2020.

It is evident that the local, national and international economy would be affected by the well-known domino effect, when a lockdown was decreed, no matter how short it might be.

Stopping the production and trade of goods and products immediately translates into loss of income and increases the costs of storage and maintenance of merchandise.

Facing the aforementioned scenario, this study chase to answer the following question: What have been the effects of the pandemic on international markets?

Based on the aforementioned question, the main aim of this study is to discuss and analyse the main economic and business administration conditions that different countries were facing during the Covid-19 pandemic circumstances and the impact on their markets between March and July 2020.

This study has made use of a qualitative methodology, with an emphasis on documentary review and deductive reasoning, to consult and analyse the physical and electronic sources that studied the most critical moments of the pandemic.

The absence of commercial activity does not mean the absence of demand, the general population needs to satisfy various needs, especially the basic ones, for which products some markets, given the impossibility of exporting their production due to sanitary restrictions, were able to make use of the local networks to reduce stored products, but other international markets do not suffer the same fate and their profitability is affected by the forced closure of operations and the forced stop of the global economy.

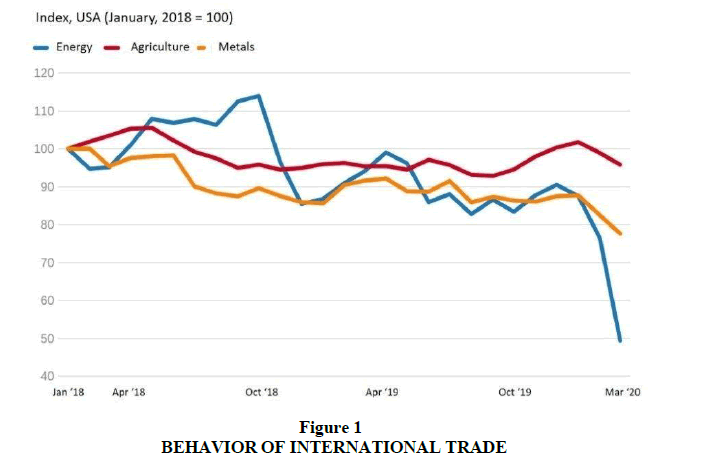

At the end of April, the World Bank (2020), published the behaviour of international trade under the influence of the coronavirus under the title “Shock like no other has been seen: COVID- 19 shakes commodity markets”, mainly highlighting the energy, agricultural and metals market. The first named market being the one that was most affected at the time of registration of its activity and the agricultural market one of the least affected at that time. See Figure 1.

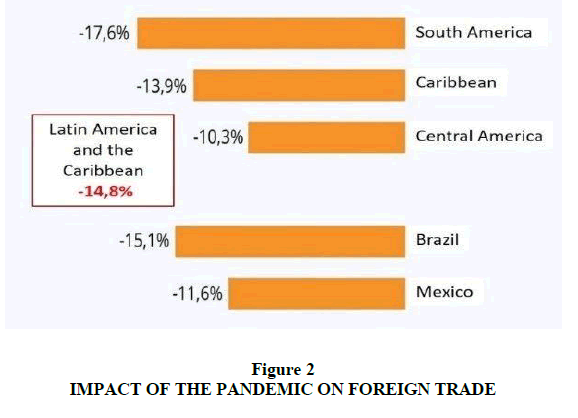

Additionally, according to provisional data provided by ECLAC, for April 2020, Pasquali (2020) indicates that the average impact of COVID-19 on the foreign trade of Latin America and the Caribbean registered a drop of -14.8%, being South America with -17.6% the most affected. See Figure 2.

Pasquali (2020) explains that ECLAC “estimates that Brazil will export goods and services for a value 15% lower than in 2019, while Mexican exports will suffer a fall of almost 12%” (p.1).

Based on the previous table, the impact of Covid-19 on the behaviour of these three international markets will be analysed in the following paragraphs.

International Markets During Covid 19

The Oil Market

The oil market is one of the markets that is most affected during the presence of COVID- 19 between March and May 2020, at which time, a significant number of countries call for quarantine and immediately paralyze commercial operations to consequence of it.

As is known, three types of products are traded on the oil market: OPEC, Brent and WTI oil. Take the West Texas Intermediate (WIT) case as an example.

On April 30, Semana (2020) published an article referring to the situation of this market in the midst of the pandemic, in which it stated:

Oil had the blackest day in its history. At the end of the day, the WTI reference closed with a price of -37.63 dollars, which means that many pay to get rid of this crude due to the high storage costs.

Semana (2020), continued explaining:

For its part, a barrel of Brent (…), fell 5.16% to US $ 26.60 a barrel. Fact that reveals a notorious gap between the prices of the two references. The particular case of the WTI is explained because today the contract for sale expired in May, which is why many wanted to leave their positions in this asset, which led to them having to offer money to receive them.

The above aspects justify the qualification of "the blackest day in history" if the WTI oil prices for the month of January are compared, located at USD 57.52, as reflected by Expansión (2020), compared to -37.63 dollars with which that neighbourhood was sold in April of the same year, representing a loss of its value by just over 165%.

The Metal Market

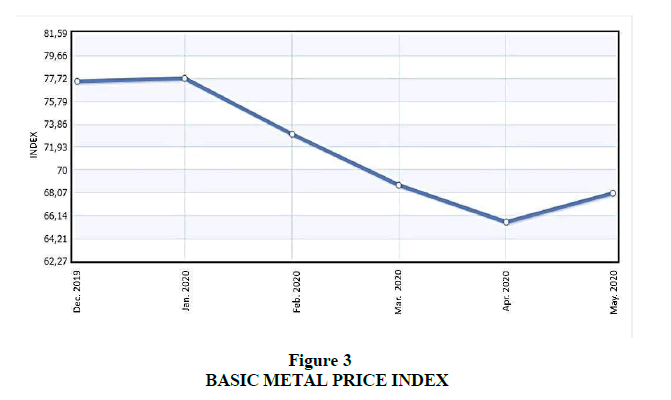

According to the International Monetary Fund (IMF), the metals market showed a sharp drop between February and April 2020, in what corresponded to its exchange rate, just in the months where there was greater control as a result of the presence of the COVID-19. See Figure 3.

In its explanation, the IMF (2020) highlights the following table:

| Table 1 Imf (2020) Highlights |

||

|---|---|---|

| Month | Price | Exchange rate |

| Dec. 2019 | 77,47 | - |

| Jan. 2020 | 77,7 | 0,30% |

| Fb. 2020 | 73,02 | -6,03% |

| Mar. 2020 | 68,71 | -5,90% |

| Apr. 2020 | 65,55 | -4,59% |

| May. 2020 | 68,01 | 3,74% |

In Table 1, we can see the fall in the exchange rate between December 2019 and April 2020, to later recover significantly for the month of May, when the measures taken due to the pandemic begin to become more flexible.

The foregoing may be related to the same reasons that made possible the sale in negative quantities of oil, related to expiration dates, storage or costs due to the stoppage of production.

The Agricultural Market

In a publication of the World Bank (2020), it is explained in relation to the agricultural market that:

The spread of the COVID-19 pandemic (…), added a completely different set of factors [to that market]: weaker demand, a sharp reduction in input costs (energy and fertilizers), trade restrictions, interruption in supply chains (on both the input and output sides), a much stronger US dollar and panic buying.

This factor affected the internal consumption of available products, due to panic purchases, keeping the domestic market still active.

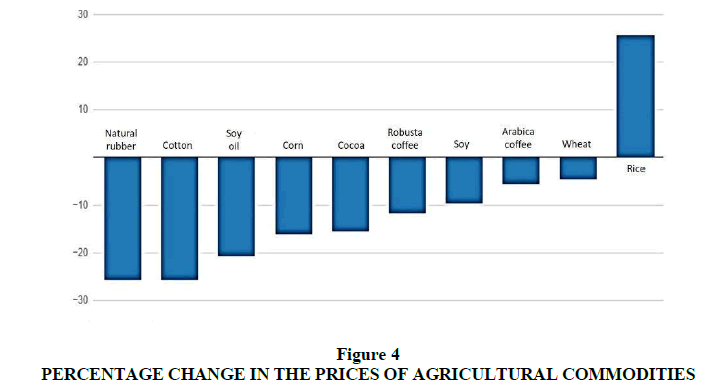

According to Baffes and Nagle (2020) “most of the prices of staple foods decreased in response to mitigation measures to contain the spread of the pandemic” (p.7). See Figure 4.

As a consequence of COVID 19, Felsenthal (2020), in the World Bank communiqué No. 2020/173 / EFI, warned in April that “despite abundant supplies of agricultural commodities, disruptions to trade and supply chain supply pose food security problems” (p.1)

In the same statement, this entity also stated that “although the impact on the outlook for most agricultural commodities is only moderate, supply chain disruptions and government measures to restrict exports or stockpiling of commodities raise concerns that food security may be in danger in some places” (p.2).

Felsenthal (2020), also commented that “agricultural prices are less linked to economic growth, and in the first quarter of 2020 only minor decreases were registered”. (idem).

Business During Covid 19

Given the above scenario, it is logical to assume that other aspects associated with business were significantly affected during the highest peak of the pandemic caused by COVID-19.

Smith & Hariharan (2020), refer to three aspects: (1) travel restrictions, which interrupted the supply chains of consumer goods and pharmaceutical products, (2) The decrease in prices of basic products and reduction of production by producers and, finally, (3) the fall of consumption in markets such as “aviation, education abroad, infrastructure, tourism, entertainment, hospitality, electronics, consumer and luxury goods” (p.3).

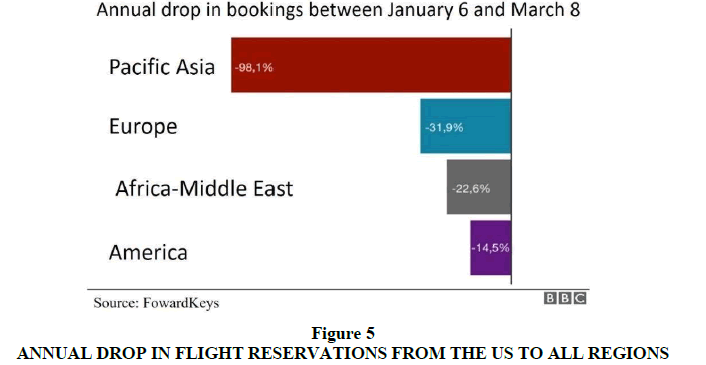

Jones et al. (2020), made a summary where it can be seen, graphically what was explained in the first point by Smith & Hariharan (2020), in relation to travel restrictions, these represented in the decrease in flight reservations from the United States of America to other regions. See Figure 5.

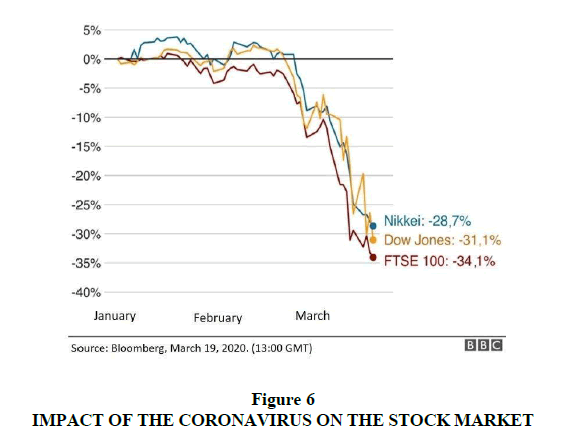

For its part, Deloitte (2020), although it coincides with Smith & Hariharan (2020), adds that for the period March and April 2020, with regard to business, risk “could reveal that one or more key agents of the financial market have adopted investment positions that are not profitable under current conditions, which further weakens confidence in financial instruments and markets” (p.3).

Deloitte (2020) also warned at the time that there was the possibility of “a significant decline in equity and corporate bond markets, as investors prefer to hold government securities (particularly those of the United States Treasury) due to the uncertainty created by the pandemic” (idem).

What was raised by Deloitte (2020), in relation to the stock market, can be seen in the graph shown by Jones et al. (2020), in the month of March. See Figure 6.

Conclusion

The confinement conditions derived from the Covid-19 coronavirus pandemic face a combined supply and demand shock in the countries. The main effects are focused on the impact on health systems, cushioning the falls in demand and employment, while the fiscal regulations of the governments necessarily move away from the more orthodox regulations of the economy through supply.

Emerging countries certainly have less chance of containing the pandemic given the weakening of the institutions in health, particularly in rural and marginal regions of urban centres. However, this structural feature, the country most hit by the pandemic at the time of writing these notes, is the United States, where infections have already exceeded 4.5 million people, with a total of fatalities that has exceeded 150,000. The second most affected country is Brazil, with more than 110,000 deaths and more than 3 million infections.

The five main transmission links of the pandemic crisis, between developed and less developed nations, focus on: (i) stopped or deteriorated conditions of production chains in globalized industries, for example, the automotive sector in Brazil and Mexico; (ii) low demand for export products from Latin America; (iii) low prices for exports from Latin America and the Caribbean; (iv) reduction of external financing amounts; (v) ostensible drops in tourism, with a special impact on the Caribbean; and (vi) after a drastic fall in equity funds in May, recovery of those levels by July 2020

References

Baffes, J., and Nagle, P. (2020, April 23). https://blogs.worldbank.org. Retrieved from Las perspectivas de los mercados de productos básicos y los efectos del coronavirus en seis gráficos: https://blogs.worldbank.org/es/voices/las-perspectivas-de-los-mercados-de-productos-basicos-y-los-efectos-del-coronavirus-en-seis

Deloitte. (2020). El impacto económico de COVID-19 (nuevo coronavirus). Retrieved from https://www2.deloitte.com/: https://www2.deloitte.com/ec/es/pages/strategy/articles/el-impacto-economico-de-covid-19--nuevo-coronavirus-.html

Expansión. (2020, July 3). https://datosmacro.expansion.com. Retrieved from Precio petróleo tipo West Texas Intermediate (WTI). Spot. $USA por barril: https://datosmacro.expansion.com/materias-primas/petroleo-wti

Felsenthal, M. (2020, April 23). https://www.bancomundial.org. Retrieved from El precio de la mayoría de los productos básicos bajará en 2020 ante la reducción de la demanda y la interrupción de la oferta ocasionadas por el coronavirus: https://www.bancomundial.org/es/news/press-release/2020/04/23/most-commodity-prices-to-drop-in-2020-as-coronavirus-depresses-demand-and-disrupts-supply

IMF. (2020, June 1). https://www.indexmundi.com. Retrieved from Indice de precios de metales: https://www.indexmundi.com/es/precios-de-mercado/?mercancia=indice-de-precios-de-metales

Jones, L., Brown, D., and Palumbo, D. (2020, March 20). Coronavirus: 10 gráficos que muestran el impacto económico en el mundo del virus que causa covid-19. Retrieved from https://www.bbc.com: https://www.bbc.com/mundo/noticias-51971991

Pasquali, M. (2020, April 30). https://es.statista.com. Retrieved from ¿Cómo afectará la crisis del coronavirus a las exportaciones de América Latina?: https://es.statista.com/grafico/21569/variacion-del-valor-de-exportacion-en-latinoamerica/

Semana. (2020, April 20). https://www.semana.com/economia. Retrieved from El petróleo cerró la jornada con precios negativos: https://www.semana.com/economia/articulo/desplome-historico-de-los-precios-del-petroleo/284435/

Smith-Bingham, R., and Hariharan, K. (2020, March 31). El impacto del coronavirus COVID-19 en los negocios. Retrieved from https://www.marsh.com: https://www.marsh.com/co/insights/research/coronavirus-impacto-negocios.html

World Bank. (2020). Commodity Markets Outlook: Implication os Covid-19 for commodities. Washington, DC: World Bank Group.

WTO (2020, April 8). https://www.wto.org. Retrieved from Desplome del comercio ante la pandemia de COVID-19, que está perturbando la economía mundial: https://www.wto.org/spanish/news_s/pres20_s/pr855_s.htm

Received: 25-May-2023, Manuscript No. IJE-23-13664; Editor assigned: 28-May-2023, Pre QC No. IJE-23-13664 (PQ); Reviewed: 12-June-2023, QC No. IJE-23-13664; Revised: 17-June-2023, Manuscript No. IJE-23-13664(R); Published: 24-May-2023