Research Article: 2021 Vol: 20 Issue: 6

Economic Security Strategy for Managing and Supporting Businesses in the Context of the Covid-19 Pandemic

Aleksandr Evgenievich Suglobov, Financial University under the Government of the Russian Federation

Tatyana Ivanovna Kuzmina, Plekhanov Russian University of Economics

Elena Anatolyevna Bessonova, Southwest State University

Sergey Valeryevich, MIREA-Russian Technological University

Olga Anatolievna, University of Technology

Citation: Suglobov, A.E., Kuzmina, T.I., Bessonova, E.A., Valeryevich, S., & Anatolievna, O. (2021). Economic security strategy for managing and supporting businesses in the context of the covid-19 pandemic. Academy of Strategic Management Journal, 20(6), 1-8.

Abstract

In practice, small and medium-sized businesses often have a limited range of suppliers, which in some way can act as a protection against acute crisis manifestations. Thus, the companies involved in regional supply chains were the least affected by the developing pandemic. At the same time, in other situations, small and medium-sized businesses are directly connected with foreign supplies from countries that are more affected by the events related to COVID-19, which increases the danger to the economic security of companies. Small and medium-sized businesses are in dire need of assistance from the state in the form of financial and non-financial support measures that will help maintain their economic security. These entities can also maintain the desired economic security on their own: the search for new markets and corresponding niches, trading platforms, the expansion of the product range, and the spectrum of services through the development of the Internet space and remote work in the online mode. The purpose of the study was to assess the effectiveness of the provision of Russian state support to maintain the economic security of small and medium-sized businesses and the rationality of the strategy for managing such businesses in the context of the COVID-19 pandemic. Based on statistical data and economic facts, it was confirmed that the state support implemented in the context of the pandemic turned out to be small and insufficient. At the same time, there is a fault of small and medium-sized businesses themselves. In addition, direct financial support did not receive extensive popularity, in contrast to the countries of the Organization for Economic Cooperation and Development, where it appeared to be an efficient and effective way to help in the pandemic.

Keywords

Economic Security, Small Business, Medium Business, Pandemic, COVID-19, Region.

Introduction

As the experience shows, small and medium-sized businesses are more exposed to risks and negative impacts than large businesses during the crisis phenomena of the economy. Consequently, the established complex of ensuring economic security for these business entities is violated (Sushchenko & Eliseeva, 2012; Sekerin et al., 2019).

The business sectors represented during the crisis, as evidenced by the current economic downturn caused by the pandemic, are in dire need of state assistance in the form of financial and non-financial support measures that will help maintain their economic security (Yu, 2020; Bogoviz et al., 2019).

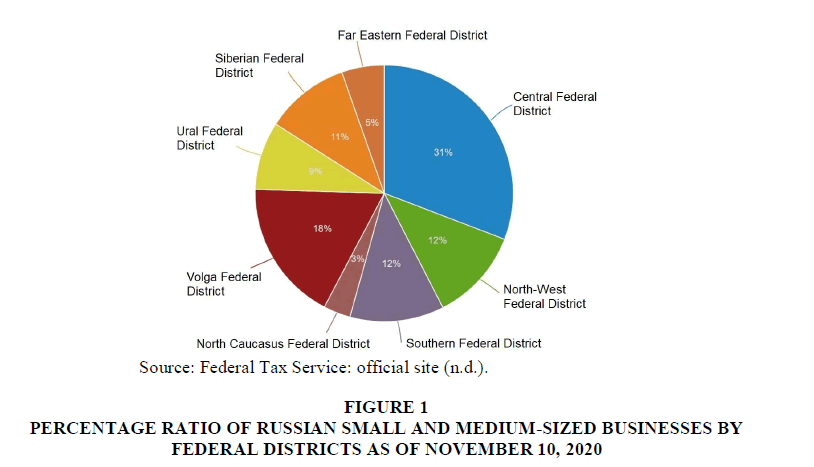

The issue of providing concomitant support to maintain economic security for small and medium-sized businesses operating in regions particularly affected by the spread of coronavirus infection is particularly acute. As of November 10, 2020, there is the following percentage spread of operating Russian small and medium-sized businesses by federal districts (Figure 1).

Figure 1: Percentage Ratio of Russian Small and Medium-Sized Businesses by Federal Districts as of November 10, 2020

In addition to the above, small and medium-sized businesses can maintain the desired economic security on their own: search for new markets and relevant niches, trading platforms, expansion of the product range and range of services through the development of the Internet space and remote work in the online mode (Levashenko & Koval, 2020).

However, this does not apply to all small and medium-sized businesses. Thus, the retention of economic security is more appropriate and expedient for companies with a trade orientation. Also for those who can provide appropriate services not only through the personal presence of a specialist but also remotely through various types of communication.

For example, such vectors of functioning as the tourist business, the organization of entertainment and sports institutions, the beauty industry, public catering, etc. cannot implement their functionality on a remote online basis, so such a business undergoes irreparably lost opportunities and irreparable losses in the context of a pandemic, as a result, economic security is violated.

It is important to point out that even doing business in the online mode does not guarantee stable economic development in other areas of small and medium-sized businesses. Falling incomes of the population, the acute epidemiological situation and the economic downturn in the country somehow violate the economic security of small and medium-sized businesses (Levashenko & Koval, 2020; Dudin et al., 2016).

Therefore, it is argued that the economic security of small and medium-sized businesses cannot be fully ensured or is not provided at all without the support of the state in the context of a pandemic.

Materials and Methods

It is believed that the current COVID-19 crisis will bring changes to the employment aspects of the small and medium-sized business segment, creating opportunities for its development in some industries associated with an online business. The share of such companies must have increased before the pandemic, but the processes of informatization and digitalization are accelerating in the circumstances of the self-isolation regime and subsequent state restrictions (Portanskii et al., 2020).

The cash gap has also formed and is only growing, which in the future may lead to the bankruptcy of a large number of small and medium-sized companies that are unable to quickly adapt and switch to online activities (Yu, 2020; Dianov et al., 2018).

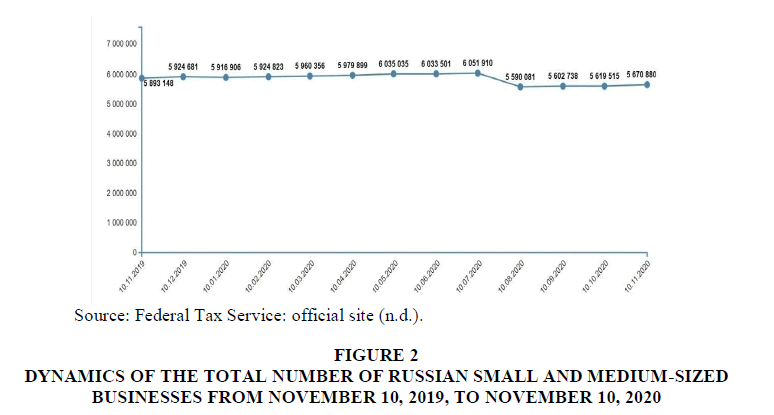

Let us estimate the dynamics of the total number of Russian small and medium-sized businesses for the period from November 10, 2019, to November 10, 2020 (Figure 2).

Figure 2: Dynamics of the Total Number of Russian Small and Medium-Sized Businesses from November 10, 2019, to November 10, 2020

According to the information provided by the Unified Register of Small and Medium-sized Businesses, as of April 10, when the self-isolation regime was already in effect, the total number of these entities increased by more than 19 thousand. A similar situation can be traced in each subsequent month until August 10, when a sharp quantitative decline was noted to 5,590,081 subjects, which formed the “minimum point” since the beginning of the pandemic (and as of March 10 – 5,960,356) (Federal Tax Service: official site, n.d.).

Such quantitative growth from month to month with the economic crisis gaining momentum should not be misleading. This phenomenon is explained by the fact that during a calendar year, the Federal Tax Service does not remove small and medium-sized companies that are no longer operating or functioning from the register, but rather “resets” the register annually in August, entering information about new and already closed businesses (Portanskii et al., 2020).

With the easing of government restrictions, the previously affected small and medium-sized business sector “rises”, and there is a promising quantitative growth of subjects for the period from August 10 to November 10, which indicates the rehabilitation of the sector and the strengthening of the economic security of the relevant companies.

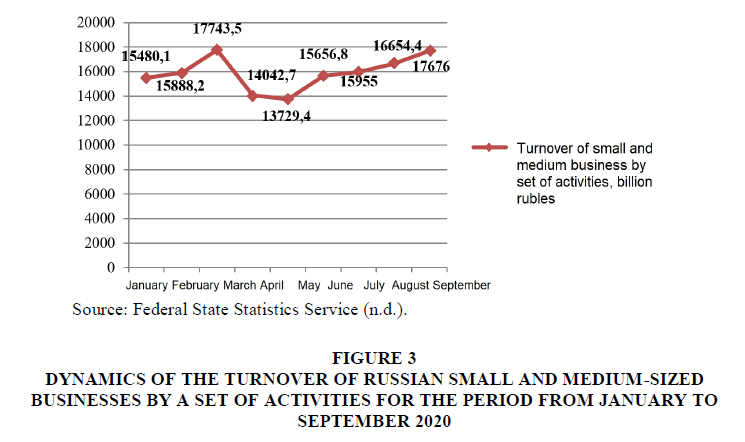

The effectiveness of providing Russian state support to maintain the economic security of small and medium-sized businesses will be assessed by statistics, namely, the dynamics of the turnover of small and medium-sized businesses by a set of activities for the period from January to September 2020 (Figure 3).

Figure 3: Dynamics of the Turnover of Russian Small and Medium-Sized Businesses by a set of Activities for the Period from January to September 2020

It can be assumed that the implemented state support in the context of the pandemic was small and insufficiently effective, at the same time, there is a fault of the small and medium-sized businesses themselves: some increased their turnover volumes in the online mode, managed to adapt, others – “have remained deadlocked” for various external and internal reasons.

According to analysts, according to the future statistical results on the functioning of small and medium-sized businesses in 2020, a significant increase in the share of Internet services is expected, as in the self-isolation mode and in the subsequent existing restrictive measures, the demand for such areas of activity as:

- delivery;

- Internet services;

- information technology;

- getting education remotely;

- medical consultations in the online mode.

The organization of leisure and entertainment, the services of coaches in sports areas, and many other areas have also become common in the online mode, it is significant that the payment for them may not be recorded in official statistical resources.

When considering the current situation in the context of the pandemic, from a pessimistic point of view, a significant minimization of small and medium-sized businesses, their outflow to the shadow segment of the economy, as well as a decrease in employment in the studied subjects by several million involved personnel is likely to be expected (Yu, 2020).

If the estimated opinion expressed by analysts is correct, then a quantitative reduction of small and medium-sized businesses even by 1% of the total mass can lead to a decrease in the gross regional product in the range of 0.06-0.17 in percentage terms. In this case, the possible termination of activity from the pessimistic point of view of about 50% of the studied business entities can cause a decline in the gross regional product in the context of regions, and therefore, the total gross domestic product of the state, even up to 10% for the annual period.

According to the official statistics provided (in the general access, information is provided only for the 1st, 2nd quarters, and 1st half of the year, respectively), the current indicators of gross domestic product production in 2020 in the context of the pandemic are as follows (Table 1).

| Table 1 Gross Domestic Product Production in 2020 in the Context of a Pandemic |

|||

| Indicator | First-quarter | Second-quarter | The first half of the year |

|---|---|---|---|

| Volume in current prices, billion rubles. | 25,317.6 | 23,288.2 | 48,605.8 |

| Volume index relative to the same period of the previous year in constant prices, % | 101.6 | 92 | 96.6 |

| Physical volume index relative to the previous model period in constant prices, % | 81.3 | 98.1 | - |

Source: Federal State Statistics Service (n.d.).

It can be argued that the indicators of GDP and the index of physical volume relative to the same period of the previous year for the 2nd quarter of 2020 are inferior to these indicators for the 1st quarter, in addition, such dynamic situations are not uncommon outside of a particular current crisis. Therewith, the volume index relative to the previous model period reflects that the ratio of the 2nd quarter of 2020 to the 1st quarter of 2020 even exceeded the identical indicator in the case of the ratio of the 1st quarter of 2020 to the 4th quarter of 2019.

Results and Discussion

Thus, ensuring the economic security of small and medium-sized businesses in the context of a pandemic is expressed through special measures of support from the state. Zayed et al. (2021) believe that the state should select the most affected enterprises and entrepreneurs to provide financial assistance in a targeted but differentiated manner (the amount of assistance is determined depending on the criteria). Md. Rayhanul Islam et al. (2021) believe that efforts should be focused on preparing and implementing an employment retention program (people employed in businesses and entrepreneurs who have been hit hard by the pandemic). The state should consider the possibility of paying unconditional cash subsidies to employees in the amount of US $ 95.

We believe that among the main measures of support provided by the state to small and medium-sized businesses, it is necessary to highlight the following: deferred rent payments for the use of premises, deferred payment of loan obligations, a time limit associated with the opening of bankruptcy cases. These measures can be considered for Russia. On the one hand, they have never been introduced in such a massive manner in the post-Soviet economy in Russia. On the other hand, they make it possible to avoid the use of subsidies. Due to complex organizational reasons, the allocation and distribution of subsidies is a process that requires time and financial and labor costs. Therefore, a temporary deferral of obligations, at that time, was an effective way to assist small and medium-sized businesses in the pandemic. Let us take a closer look at each measure.

Deferred payment of credit obligations

From the government reserve fund, 5,000,000,000 rubles were allocated to credit institutions to provide credit deferrals on payments from small and medium-sized businesses. The sequence of implementation of these subsidies and the provision of funding to the regions for the provision of urgent measures to support small and medium-sized businesses in the context of an economic downturn due to the spread and progression of the consequences of the pandemic was determined.

The Bank of Russia recommended changing the terms of existing credit agreements for small and medium-sized businesses if the borrower faced economic difficulties due to the spread and progression of the consequences of the pandemic. Until September 30, 2020, the Bank of Russia provided a condition stating that the reserves for probable losses on loans to such small and medium-sized enterprises should not increase.

For microfinance institutions and credit consumer cooperatives, a permit was determined so that the reserve funds for debt that was overdue in payment after February 1, 2020, would not increase. In addition, loans restructured in identical situations were not recognized in the process of forming reserves for probable losses.

In crisis-prone industries, small and medium-sized businesses could get a loan to pay their employees' salaries. The interest of such a loan must be covered by the state budget, without creating additional expenses for the borrower. After six months, this loan is issued at a rate of 4% (Imaeva, 2015).

A temporary restriction associated with the opening of bankruptcy cases on the initiative of creditors

Such a moratorium was introduced on the opening of bankruptcy cases given the applications received from creditors regarding separate debtors, which include strategic and leading companies that are more susceptible to the pandemic crisis (Egorova & Koroleva, 2020).

Deferred payment of rent to the state and municipalities

It was important for small and medium-sized businesses to be involved in the moratorium on rent payments for residents of certain business zones – industrial parks, technoparks, coworking, etc. For the studied subjects, there was an opportunity to obtain a temporary deferral of rent payment concerning state property. The procedures for the terms and conditions of such deferral under lease agreements concerning real estate were defined, which reflect recommendations for companies to minimize the level of rent.

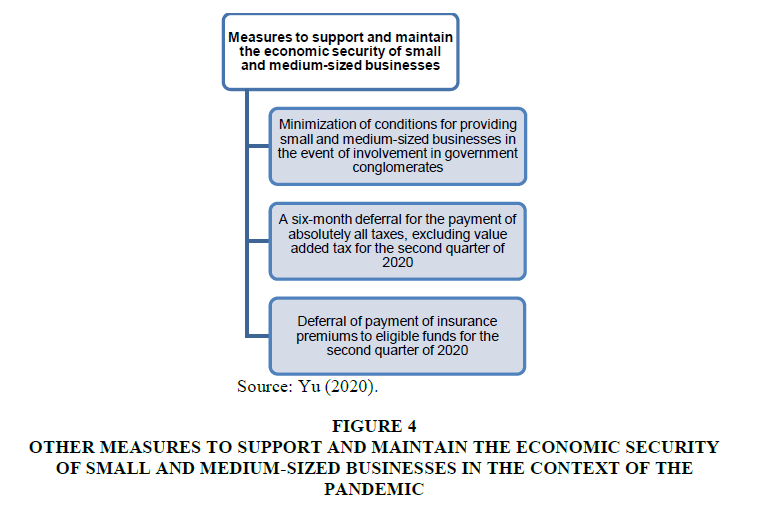

In addition to these large-scale support measures, other measures that are no less relevant and help maintain the economic security of small and medium-sized businesses were introduced in Russia (Figure 4).

Figure 4: Other Measures to Support and Maintain the Economic Security of Small and Medium-Sized Businesses in the Context of the Pandemic

As of November 2020, there is a decree on the further extension of the implementation of these permits and other features concerning licensing processes.

Conclusions

It is important to point out that with the undoubted state support and measures to ensure the economic security of small and medium-sized businesses, direct financial support has not been widely popularized, which has proved to be an extremely effective way to help in the context of the pandemic in the countries of the Organization for Economic Cooperation and Development, in addition, timely and adaptive.

Now, it seems that in the ongoing negative crisis manifestations, the actual solution should be flexible and accurate informing of small and medium-sized businesses, which find it difficult to navigate the huge amount of information and respond rationally to the crisis, about the current measures and possible ways of functioning. Small and medium-sized businesses need to be provided with information support from the perspective of aspects of building functioning processes and commercial relations to prevent the crisis and maintain their economic security.

References

- Bogoviz, A.V., Mishchenko, V.V., Zakharov, M.Y., Kurashova, A.A., & Suglobov, A.E. (2019). Strategy of provision of wireless future’s security. In Ubiquitous Computing and the Internet of Things: Prerequisites for the Development of ICT (pp. 941-947). Springer, Cham.

- Dianov, D.V., Suglobov, A.E.E., Kuznetsova, E.I., Rusavskaya, A.V., & Minakov, A.V. (2018). Statistical toolkit for assessing the financial security of regions. International Journal of Engineering and Technology (UAE), 7(3.15), 230-232.

- Dudin, M.N., Gayduk, V.I., Sekerin, V.D., Bank, S.V., & Gorohova, A.E. (2016). Financial crisis in Greece: challenges and threats for the global economy. International Journal of Economics and Financial Issues, 6(5S), 1-6.

- Egorova, N. E., & Koroleva, E. A. (2020). Lending to Russian Small Businesses: Transforming the Traditional Banking Model into a Partner One. Economic news zhurnal Vysshey shkoly ekonomiki, 191-214.

- Federal State Statistics Service (n.d.). Retrieved from https://rosstat.gov.ru/

- Federal Tax Service: official site (n.d.). Unified register of small and medium enterprises. Retrieved from https://ofd.nalog.ru/statistics.html

- Imaeva, G.R. (2015).Teoretiko-metodologicheskie aspekty izucheniya sotsialnoi roli malogo i srednego predprinimatelstva. Monitoring obshchestvennogo mneniya: ekonomicheskiye i sotsial'nyye peremeny, 4(128), 141-153.

- Islam, M.R., Chowdhury, S.A., Rahman, S., & Zayed, N.M. (2021). An analysis of the detrimental effect of covid-19 pandemic: A study in Bangladesh. Journal of Humanities, Arts and Social Science, 5(1), 116-124.

- Levashenko, A.D. & Koval, A.A. (2020). Measures for financial and non-financial support to SMEs in the context of COVID-19. Ekonomicheskoe Razvitie Rossii, 27(5), 66-70.

- Portanskii, A.P., Sudakova, Y.M., & Larionov, A.V. (2020). Preconditions for the global economic crisis and its onset in the spring of 2020 in connection with the COVID-19 pandemic. Vestnik Mezhdunarodnykh Organizatsii: Obrazovanie, Nauka, Novaya Ekonomika, 15(2), 191-212.

- Sekerin, V., Dudin, M., Gorokhova, A., Bank, S., & Bank, O. (2019). Mineral resources and national economic security: current features. Mining of Mineral Deposits, 13(1), 72-79.

- Sushchenko, D.I., & Eliseeva, T.P. (2012). Conceptual bases of development of small and average forms of business activity in the sphere of services. Terra Economicus, 10(3-3), 50-53.

- Yu, S.E.S.M. (2020). State policy of Republic of China on Chinese small and medium-sized enterprises in the context of COVID 19. Public Administration. E-Journal, (79), 25-49.

- Zayed, N.M., Khan, S., Shahi, S.K., & Afrin, M. (2021). Impact of coronavirus (covid-19) on the world economy, 2020: A conceptual analysis. Science, 5(1), 1-5.