Research Article: 2024 Vol: 28 Issue: 6

Economic Policy Uncertainty (EPU) and Corporate Investment Risk

Amit Hedau, National Institute of Construction Management and Research

Citation Information: Hedau, A. (2024). Economic policy uncertainty (epu) and corporate investment risk. Academy of Marketing Studies Journal, 28(6), 1-10.

Abstract

This study examines the impact of economic policy uncertainty (EPU) on firms' risk-taking behaviour. The study uses firm-level data from India for the period 2010-2024. According to the data, EPU can drastically reduce the amount of risk that companies take. However, this substantial evidence is mostly available for firms that are not state-controlled. Moreover, the extent to which a firm's financing constraints affect its risk-taking is a critical variable in determining how EPU affects firms' risk-taking; research shows that firms with financing constraints are more likely to be risk-averse when faced with EPU shocks. To help firms make more informed decisions about high-risk, high-reward investment initiatives, this research provides both theoretical foundations and practical guidance.

Keywords

Economic Uncertainty Index, EPU, India, Investment Risk, JEL E61, E66, M21, P52.

Introduction

Uncertainty is the most certain thing in the world. It symbolises the concern that management, customers and legislators have about the future. Around the world, a number of shocks have kept uncertainty high, including the Russia-Ukraine war, Brexit, and trade disputes between the US and China. The recent shocks to the global economy, in some cases exacerbated by international political divisions, have established a new normal for volatility. In addition, these events have raised uncertainty to unprecedented levels, which has hampered economic growth. It's also worth noting that people are becoming more aware of the impact of political policies on business investment and profitability. Companies may have to reduce production, staff pay and often business investment when there is uncertainty. Uncertainty has been identified as one of the main causes of the delayed recovery from the global financial crisis. A new body of research examines the impact of uncertainty on corporate financial decisions, including capital structure, cost of capital, cash holdings, mergers and acquisitions, and business investment. Because economic uncertainty is not always obvious, it can be difficult to understand. In response, economists have produced a large and dynamic body of work that attempts to quantify uncertainty and to assess the theoretical and empirical effects of increasing uncertainty on the economy. The main challenge is to decide how to measure uncertainty and to find a good proxy for it. There are three categories of proxies for uncertainty: forecaster disagreement, newspaper-based and finance-based. One finance-based measure of uncertainty is stock market volatility. Stock market volatility has gained popularity as a proxy for uncertainty due to its real-time availability and relative comparability across countries. These stock market volatility indicators have the disadvantage of having a weak relationship with economic activity. While corporate profits and economic activity are related, much of the short-term volatility in stock prices is determined by other factors (Cochrane, 2011). The creation of the Economic Policy Uncertainty (EPU) index, a revolutionary method of quantifying uncertainty based on newspaper data. The underlying assumption of the metric is that newspaper coverage does not cause economic uncertainty, but can provide insight into it.

Unlike previous metrics, the EPU takes into account the frequency of newspaper stories containing terms related to uncertainty, politics and the economy. It represents the ambiguity of who decides on economic policy, what policies will be adopted and who will be affected by the financial consequences of these decisions.

The uncertainty in India has increased significantly as a result of events such as the change in political power at the federal level, demonetisation, the implementation of the GST, the outbreak of COVID-19, high crude oil prices and high unemployment. India's huge economy is predicted to be the fastest growing in the world over the next few years. With its low GDP per capita and massive catch-up potential, it should be able to grow at annual rates above 7%. Consequently, there is a growing interest in the literature on the influence of EPU on various macroeconomic variables, asset prices and firm-level decisions. Given the high degree of unpredictability in the Indian economy in recent times, this paper examines how EPU affects the investment decisions of listed Indian firms. In addition to the impact of EPU on business risk-taking, this research will also consider the impact of financial constraints on risk-taking.

Literature Review

A firm or organisation faces economic policy uncertainty when it can't say with certainty when, if or how the government will change its current economic policies. Since its proposal by (Baker et al., 2016), many publications have examined the relationship between EPU and macroeconomic factors (Bahmani & Saha, 2019). Uncertainty about government policies is a well-known factor in the firm's choice of investment projects. There is a lack of research on the relationship between financial strategy vulnerability and firms' propensity to take risks, although several studies have shown the impact of strategy vulnerability on capital (Gulen & Ion, 2015), mergers and acquisitions (Nguyen & Phan, 2017), cash (Phan et al., 2019), hiring and investment (Bloom, 2014), and other aspects. There are a number of ways in which firms' willingness to take risks is affected by economic policy uncertainty. First, firms' risk decisions are affected by the extent to which they can predict future government action, which in turn affects their own policies. The authors of the previous study were (Nguyen et al., 2019). Furthermore, studies suggest that political volatility increases the costs associated with obtaining external funding, which may pose challenges for projects that are considered more risky in securing the necessary financial resources (Kim, 2018; Liu & Zhong, 2017; Pastor & Veronesi, 2012). Ultimately, in situations of high economic policy uncertainty, firms tend to opt for more secure investments (Gulen & Ion, 2015).

In the context of India, this research seeks to examine how EPU affects corporate risk-taking. As a crucial aspect of investment decision making, corporate risk-taking reflects the propensity of firms to seek and compensate for high profits (Lumpkin & Dess, 1996). This is reflected in the deliberate selection of investment projects that are both high risk and high reward (Amihud & Lev, 1981). Both the expected reward and the associated risk must be weighed in any financial decision (Bluhm & Krahnen 2014). In (Gupta & Banerjee, 2019) suggest that many ideas could potentially make sense of the adaptation of risk avoidance. They hypothesise that the sharp decline in stock prices and other significant disruptions could lead investors to exhibit greater risk aversion. According to (Gupta & Krishnamurti, 2018), firms' risk taking is influenced by macroeconomic factors. Firms may avoid "bad" vulnerability and use "good" uncertainty to their advantage by anticipating and planning for future possibilities (Segal et al., 2015).

Firms can increase their value and profits by avoiding the bad uncertainty and making the most of the "good" opportunities that come with future uncertainty (Segal et al., 2015). Here are the reasons why India was chosen. Compared to the developed world, India is more affected by political uncertainty due to its unique economic and political structure. In developed countries such as the US, governments rely on the notion of the invisible hand to allocate resources. However, in India, the economic system is characterised by public ownership as the primary substance and the cooperative promotion of different types of ownership. India also uses the visible hand to control and stabilise the macroeconomy. Thus, the visible hand makes the financial markets of enterprises unpredictable and volatile (Luo et al., 2017).

Firms that are willing to take more risks need to set aside more money in case they miss out on high-return investment opportunities, which means they need to spend more on capital or invest more in research and development (Li and Lu, 2018). As the EPU grows, it becomes more difficult for firms to obtain financing. As a result, firms may be less willing to take risks and engage in high-return investment projects and firms' capital expenditures are highly dependent on their internal cash flow when their funding constraints are severe (Bolton et al., 2019).

In (Bhagat et al., 2016) find a negative correlation between India's EPU and fixed investment and GDP. By (Priyaranjan & Pratap, 2020) construct three different indicators to measure the degree of uncertainty in the Indian economy. Results from an econometric framework based on local projections show that uncertainty shocks affect both the Indian real economy and financial markets. They find that both real GDP growth and investment activity decline as economic uncertainty increases. The most recent analysis for India is by (Ghosh et al., 2022). During the pre-COVID-19 and COVID-19 periods, they conducted an empirical investigation of the impact of India's Economic Policy Uncertainty Index (EPU) on a number of macroeconomic indicators, including imports, exports, interest rate, exchange rate, inflation rate and stock market. There is a growing body of research on the factors that influence business investment, but not much on the investment decisions of Indian firms. The objective was to determine the correlation between the cycles of business, financial and economic policy uncertainty in India. They found that the main shock transmitter is political uncertainty, while the main shock receivers are the business and financial cycles.

Although a lot of research has been done on the relationship between macroeconomic variables and economic policy uncertainty, not as much has been done on the impact of economic policy uncertainty on business investment. This is considered to be a significant gap that provides a new angle for research. To the best of author’s knowledge, this is the first study to explicitly examine the investment decisions of Indian companies in the light of EPU. Previous studies have mostly focused on the correlation between economic policy uncertainty (EPU) and firm performance.

The author examines the impact of economic policy uncertainty (EPU) on risk-taking using a large dataset of non-financial companies listed in India. The sample was then split into state-owned and non-state-owned firms to analyse the effect of EPU on risk-taking within each group. Finally, the impact of financial constraints on firms' ability to take risks is assessed. This research adds to the current information base in more ways than one. The research adds to the current body of literature by showing that firms' risk-taking is significantly affected by EPU.

Data

The firms included in this study are those that have been listed on the National Stock Exchange between 2010 and 2024. Total 466 companies are selected after applying the following filter:

(1) The stock is listed on the National Stock Exchange during the period of study i.e from April 2010 to March 2024. (466*15 years data gives total 6990 observations)

(2) Historical financial information about research variables is available.

The effect of outliers is reduced by winsorising all data. This study uses both micro and macro data, the former from the PROWESS database and the latter from other sources. Infographics on the Indian economy compiled from the website of the Reserve Bank of India, India’s Central Bank.

Variable Definition

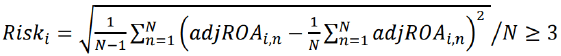

The dependent variable is the amount of risk taken by firms. Two different approaches to risk assessment are presented in this paper. According to (Shahzad, 2019), deviation in the income (Risk1) is determined by calculating the standard deviation of income before unusual items, which is then adjusted by dividing it by total equity over the last three years. The second concern is the unpredictability of earnings (John et al., 2008). It is calculated as the standard deviation of the company's return on assets (ROA) for each observation period, divided the company's annual ROA by the industry average to determine the volatility (Risk2)

The calculation formula is as follows:

(1)

(1)

(2)

(2)

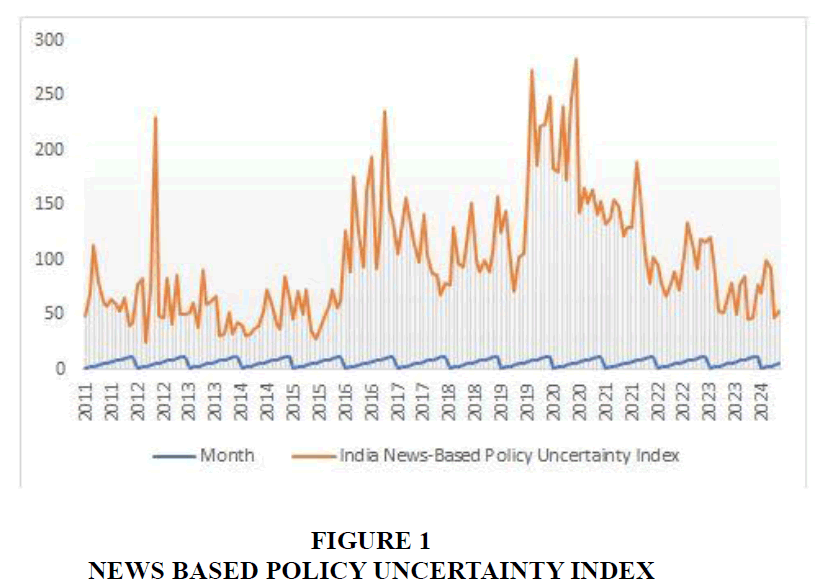

It is the EPU that serves as the independent variable. To measure policy uncertainty, author used the methodology, which is based on newspaper data from mainland India. A trend chart of the EPU index for the years 2010-2024 is presented, as shown in Figure 1, to provide an accessible representation of the level of uncertainty. Source: https://www.policyuncertainty.com/. When analysed in relation to major political events in India's past, the uncertainty index is generally in line with these events. (Figure 1)

Finally, in line with previous research (John et al., 2008), we include a large number of control factors that affect business risk taking. First, the author can control for firm-level variables such as age, size, price-to-book ratio, operating margin and operating expenses. As a result, it can influence governance factors such as ownership concentration and the responsibility of the largest investor. Two variables that require further regulation are the logarithm of the previous year's gross domestic product (lnGDP) and the inflation rate (Inf). In addition, the year is taken into account to adjust for empirical regressions.

Empirical Model

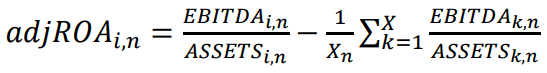

Due to the panel data nature of the sample, this article primarily uses a fixed effects regression model to remove the impact of individual firm effects. The regression variable used to calculate the regression coefficient is the logarithmic differentiation by EPU/100. The test model is set up as follows:

To test the hypothesis that there is a difference in ownership between state-owned and private firms, the sample is split into two groups. Finally, it is examined that how EPU affects risk-taking as a result of firms' financing constraints. There is a lack of direct observation of corporate financing constraints, so current measures of these constraints are indirect. This article examines the business climate of Indian listed firms and uses the SA Financial Constraints Index to assess the extent to which these firms face financing constraints. The SA index serves as an indicator of the magnitude of these constraints, with larger values indicating lower levels of financing constraints, and conversely, smaller values suggesting higher levels of financing constraints faced by firms. SA Index is computed as − 0.737 × Size + 0.043 × Size 2 -0.040 × Age, where Size is the natural logarithm of inflation-adjusted book assets and Age is the number of years since the firm's accounting data (Hadlock & Pierce, 2010)

Empirical Results

Descriptive Statistics

The regression estimates are based on the factors described in Table 1. Indian companies may be taking greater risks when compared to their Western counterparts. Uncertainty varies considerably over time, with a low of -0.122 and a high of 0.679, but the average EPU is 0.116. Size (18.770), age (2.146), profit margin (12.77) and ownership (0.646) are some of the statistics in the Table 1 that suggest an imbalance in the growth of sample companies. (Table 1)

| Table 1 Descriptive Statistics | |||||

| Variable | Obs | Mean | Std. Dev. | Min | Max |

| Age | 6990 | 2.146 | 3.365 | 2.698 | 1.594 |

| EPU | 15 | 0.116 | 0.211 | -0.122 | 0.354 |

| EPU_US | 15 | 1.176 | 1.029 | 0.752 | 1.600 |

| GDP | 60 | 7.252 | 5.361 | 5.541 | 8.963 |

| Inflation | 60 | 6.615 | 1.256 | 3.456 | 9.774 |

| Operating Expenses | 6990 | 7.895 | 6.897 | 1.987 | 13.803 |

| Owner | 6990 | 0.646 | 0.456 | 0.214 | 1.078 |

| Owner Concentration | 6990 | 12.556 | 7.598 | 12.589 | 12.523 |

| Price to Book | 6990 | 3.49 | 4.21 | 0.658 | 6.322 |

| Profit Margin | 6990 | 12.77 | 24.365 | -18.659 | 44.199 |

| Risk_SD of Income | 6990 | 6.548 | 5.665 | 1.256 | 11.840 |

| Risk_SD of ROA | 6990 | 3.215 | 3.325 | 0.569 | 5.861 |

| Size | 6990 | 18.77 | 11.236 | 28.658 | 8.882 |

| State | 6990 | 0.541 | 0.698 | 0 | 1 |

| Dummy | 6990 | 0.128 | 1.258 | 0 | 1 |

Baseline Regression Estimates

The results of the baseline regression are shown in Table 2. At the 5% level of statistical significance, both measures of firms' risk-taking have negative coefficients, suggesting that risk-taking decreases as EPU shocks increase. With the goal of "avoiding losses", uncertainty increases operational risks for firms, affects management's risk tolerance and loss expectations, and ultimately affects VC project selection.

| Table 2 EPU On Corporate Risk Taking | ||

| Dependent Variable | Risk | |

| SD of Income | SD of ROA | |

| Age | -0.112 | 0.569 |

| (-1.2) | (-.077) | |

| EPU | -0.019** | -0.002** |

| (-3.321) | (-2.369) | |

| GDP | -0.169 | -0.011*** |

| (-1.69) | (-3.15) | |

| Inflation | 0.148 | 0.000*** |

| (-1.697) | (-1.98) | |

| Operating Expenses | 0.456 | 0.568 |

| (-0.78) | -0.784 | |

| Owner | 0.021** | 0.112 |

| (2.215) | (1.198) | |

| Owner Concentration | 0.215 | 0.067* |

| (-1.09) | (-1.69) | |

| Price to Book | 0.001*** | 0.004*** |

| 5.654 | 2.236 | |

| Profit Margin | 0.000*** | 0.023** |

| 2.215 | -2.258 | |

| Size | 0.650 | -0.617 |

| 0.898 | (-1.890) | |

On the other hand, large, successful firms are more likely to increase their risk-taking in the face of uncertainty. This is probably due to their ability to make bold investment decisions that pay off in the face of danger. Moreover, studies show that firms with higher EPU spend less on research and development and mergers and acquisitions (Nguyen & Phan, 2017). As a result, they have more cash on hand to deal with future risks and are more likely to make prudent and cautious decisions about management changes (Table 2).

The way in which a firm is structured as a legal entity affects its willingness to take risks. If the firm is government-owned, the value of the STATE dummy variable is 1, and if it is not, the value is 0. The risk-taking of government-owned firms is less affected by the EPU, as shown in Table 3, but non-government firms are more negatively affected by it. India's economy is characterised by a market-oriented approach, but the government often uses a 'visible hand' to control the entire sector, which distinguishes it from the United States (Luo et al., 2017). Politically connected individuals are more likely to choose investment projects that are in line with policy, in part because of their ties to the government and the increased costs associated with managing state-owned enterprises (Huang et al., 2011). On the other hand, individuals without political connections are less likely to prioritise policy alignment and are more inclined to choose projects with lower risks (Wang et al., 2014). According to (Morck et al., 2013), the reliability of monetary policy communication was found to be higher for state-controlled banks. Therefore, non-state firms in India are better able to adapt to policy changes in the economy, while state-owned firms in India are less affected by EPU as they are more dependent on bank credit (Table 3).

| Table 3 Ownership Influence | ||||

| Dependent Variable | Risk_SD of Income | Risk_SD of ROA | ||

| State_Private | Statae_Govt | State_Private | State_Govt | |

| Age | -0.0324** | -0.88 | 0.774 | 0.458 |

| (-1.96) | (-0.059) | (0.32) | (0.69) | |

| EPU | -0.029** | -0.128 | -0.036** | -0.198 |

| (-1.98) | (-1.55) | (-1.916) | (-1.11) | |

| GDP | -.784 | -0.111 | -0.369 | -0.0119** |

| (-0.216) | (-1.55) | (-1.369) | (-2.87) | |

| Inflation | 0.666 | 0.114 | .0214 | 0.0195 |

| (.36) | (1.36) | (1.21) | (2.89) | |

| Operating Expenses | 0.698 | 0.369 | 0.669 | 0.521 |

| (0.34) | (0.77) | (0.51) | (0.33) | |

| Owner | 0.314 | 0.025** | 0.365 | 0.51 |

| (0.78) | (1.98) | (1.22) | (0.79) | |

| Owner Concentration | 0.222 | 0.55 | 0.123 | 0.365 |

| (1.38) | (0.85) | (1.21) | (1.66) | |

| Price to Book | 0.000*** | 0.011** | 0.07* | 0.369 |

| (3.321) | (2.222) | (1.56) | (1.44) | |

| Profit Margin | 0.000*** | 0.021** | 0.000*** | 0.044** |

| (2.589) | (2.125) | (2.698) | (3.349) | |

| Size | 0.555 | 0.425 | -0.658 | -.458 |

| (0.52) | (0.459) | (0.91) | -0.21) | |

The Impact of Financing Constraints on Corporate Risk-Taking

Below is the regression results obtained using the SA Financial Constraints Index to assess the extent to which the firm is constrained by financial resources. Firms with limited financial resources engage in risky behaviour, as shown in Table 4. The EPU coefficient remains negative and statistically significant for firms facing financing constraints. Political unpredictability increases the need for external funding and makes it more difficult to obtain funding for risky initiatives (Kim, 2018; Liu & Zhong, 2017). Investors are less likely to put their money in banks, which slows down their ability to lend and increases the cost of capital due to political uncertainty (Pastor & Veronesi, 2012; Berger et al., 2017; Vural-Yavas, 2020). The way in which the firm finances its investment initiatives is determined by its financial position. Financially constrained organisations use internal cash flow to meet investment objectives; managers will be more cautious in their investment choices when faced with the development of EPU (Mulier et al., 2016). Investors may demand higher risk premium returns to protect themselves from potential losses when uncertainty is high, as it lowers their expectations and confidence in future returns (Table 4).

| Table 4 Financing Constraints and Investment Risk | ||||

| Dependent Variable | Risk_SD of Income | Risk_SD of ROA | ||

| State_Private | Statae_Govt | State_Private | State_Govt | |

| Age | 0.489 | -0.0478** | 0.0269** | -0.159 |

| (0.7) | (-1.87) | (3.65) | (-1.258) | |

| EPU | 0.589 | -0.0211** | 0.659 | -0.036** |

| (0.42) | (-1.98) | (0.66) | (-1.87) | |

| GDP | -0.259 | -0.897 | 0.78 | -0.014** |

| (-0.897) | (-0.125) | (0.25) | (-3.10) | |

| Inflation | 0.458 | 0.698 | -0.698 | 0.0158** |

| (0.77) | (0.36) | (-0.26) | (1.99) | |

| Operating Expenses | 0.0789* | -0.558 | 0.658 | 0.324 |

| (1.32) | (-.66) | (0.55) | (2.36) | |

| Owner | 0.0298** | 0.234 | 0.118 | 0.361 |

| (1.78) | 1.22) | (1.64) | (0.77) | |

| Owner Concentration | 0.456 | 0.7852 | 0.125 | 0.745 |

| (0.25) | (0.33) | (0.125) | (0.125) | |

| Price to Book | 0.001*** | 0.0001*** | 0.589 | 0.111 |

| (2.147) | (3.82) | (0.558) | (1.69) | |

| Profit Margin | 0.035** | 0.0115** | 0.0258** | 0.0123** |

| (3.698) | (3.125) | (0.87) | (0.345) | |

| Size | 0.55 | -0.147 | -0.589 | -0.258 |

| (0.66) | (-1.36) | (-0.112) | (-1.47) | |

Conclusion

This article uses a sample of Indian listed firms that fall into either the category of 'state-owned enterprises' or 'non-state-owned enterprises' to examine how EPU has affected their risk-taking practices from 2010 to 2024. According to the data, EPU has a negative impact on firms' risk-taking, and this effect is particularly pronounced for non-state-owned firms. In other words, it's easier to shelve such high-risk, high-reward investment initiatives when external uncertainty is high, because management is more pessimistic about the future, investment decisions are more cautious, and behavioural patterns are more stable. Additional evidence suggests that the negative effect of EPU on corporate risk-taking is particularly pronounced for companies with low financial resources. Businesses would be well advised to make an informed assessment of economic developments while keeping a close eye on risk management, as research suggests that uncertainty about economic policy discourages risk-taking. Progress in identifying risks and opportunities, mitigating 'bad' uncertainty and fully understanding and exploiting 'good' uncertainty are all necessary steps to achieving long-term operational sustainability and value maximisation. However, there are certain limitations to the study. Firstly, the validity of the secondary data used to support the conclusions of the study will determine how reliable the results are. Secondly, because some of the variables are not available in the database, the study does not take into account all the factors that influence the performance of the sample companies. On the other hand, it is expected that projects such as this will raise awareness of the issue and justify further research in this area, particularly in the Indian context.

References

Amihud, Y., & Lev, B. (1981). Risk Reduction as a Managerial Motive for Conglomerate Mergers. The Bell Journal of Economics, 12(2), 605.

Indexed at, Google Scholar, Cross Ref

Bahmani-Oskooee, M., & Saha, S. (2019). On the effects of policy uncertainty on stock prices: an asymmetric analysis. Quantitative Finance and Economics, 3(2), 412–424.

Indexed at, Google Scholar, Cross Ref

Baker, S. R., Bloom, N., & Davis, S. J. (2016). Measuring economic policy uncertainty. The quarterly journal of economics, 131(4), 1593-1636.

Berger, A. N., Guedhami, O., Kim, H. H., & Li, X. (2022). Economic policy uncertainty and bank liquidity hoarding. Journal of Financial Intermediation, 49, 100893.

Indexed at, Google Scholar, Cross Ref

Bhagat, S., Ghosh, P., & Rangan, S. (2016). Economic policy uncertainty and growth in India. Economic and Political Weekly, 72-81.

Bloom, N. (2014). Fluctuations in uncertainty. Journal of economic Perspectives, 28(2), 153-176. Google Scholar, Cross Ref

Bluhm, M., & Krahnen, J. P. (2014). Systemic risk in an interconnected banking system with endogenous asset markets. Journal of Financial Stability, 13, 75–94.

Indexed at, Google Scholar, Cross Ref

Bolton, P., Wang, N., & Yang, J. (2019). Investment under uncertainty with financial constraints. Journal of Economic Theory, 184, 104912.

Indexed at, Google Scholar, Cross Ref

Cochrane, J. H. (2011). Presidential address: Discount rates. The Journal of finance, 66(4), 1047-1108.Indexed at, Google Scholar, Cross Ref

Ghosh, R., Bagchi, B., & Chatterjee, S. (2022). The effect of economic policy uncertainty index on the Indian economy in the wake of COVID-19 pandemic. Journal of Economic and Administrative Sciences.

Indexed at, Google Scholar, Cross Ref

Gulen, H., & Ion, M. (2015). Policy uncertainty and corporate investment. The Review of financial studies, 29(3), 523-564.

Indexed at, Google Scholar, Cross Ref

Gupta, K., & Banerjee, R. (2019). Does OPEC news sentiment influence stock returns of energy firms in the United States? Energy Economics, 77, 34–45.

Gupta, K., & Krishnamurti, C. (2018). Do macroeconomic conditions and oil prices influence corporate risk-taking? Journal of Corporate Finance, 53, 65–86.

Indexed at, Google Scholar, Cross Ref

Hadlock, C. J., & Pierce, J. R. (2010). New Evidence on Measuring Financial Constraints: Moving Beyond the KZ Index. Review of Financial Studies, 23(5), 1909–1940.

Indexed at, Google Scholar, Cross Ref

Huang, W., Jiang, F., Liu, Z., & Zhang, M. (2011). Agency cost, top executives’ overconfidence, and investment-cash flow sensitivity — Evidence from listed companies in China. Pacific-Basin Finance Journal, 19(3), 261–277.

Indexed at, Google Scholar, Cross Ref

JOHN, K., LITOV, L., & YEUNG, B. (2008). Corporate Governance and Risk-Taking. The Journal of Finance, 63(4), 1679–1728.

Kim, O. S. (2019). Does political uncertainty increase external financing costs? Measuring the electoral premium in syndicated lending. Journal of Financial and Quantitative Analysis, 54(5), 2141-2178.

Indexed at, Google Scholar, Cross Ref

Li, C., & Lu, J. (2018). R&D, financing constraints and export green-sophistication in China. China Economic Review, 47, 234–244.

Liu, J., & Zhong, R. (2017). Political uncertainty and a firm’s credit risk: Evidence from the international CDS market. Journal of Financial Stability, 30, 53–66.

Lumpkin, G. T., & Dess, G. G. (1996). Clarifying the entrepreneurial orientation construct and linking it to performance. Academy of management Review, 21(1), 135-172.Indexed at, Google Scholar, Cross Ref

Luo, D., Chen, K. C., & Wu, L. (2017). Political uncertainty and firm risk in China. Review of Development Finance, 7(2), 85–94.

Indexed at, Google Scholar, Cross Ref

Morck, R., Yavuz, M. D., & Yeung, B. (2013). State-controlled banks and the effectiveness of monetary policy. Cambridge: National Bureau of Economic Research.

Mulier, K., Schoors, K., & Merlevede, B. (2016). Investment-cash flow sensitivity and financial constraints: Evidence from unquoted European SMEs. Journal of Banking & Finance, 73, 182–197.

Indexed at, Google Scholar, Cross Ref

Nguyen, N. H., & Phan, H. V. (2017). Policy Uncertainty and Mergers and Acquisitions. Journal of Financial and Quantitative Analysis, 52(2), 613–644.

Pastor, L., & Veronesi, P. (2012). Uncertainty about government policy and stock prices. The journal of Finance, 67(4), 1219-1264.

Indexed at, Google Scholar, Cross Ref

Phan, H. V., Nguyen, N. H., Nguyen, H. T., & Hegde, S. (2019). Policy uncertainty and firm cash holdings. Journal of Business Research, 95, 71–82.

Priyaranjan, N., & Pratap, B. (2020). Macroeconomic effects of uncertainty: a big data analysis for India. Priyaranjan, N., & Pratap, B.(2020). Macroeconomic Effects of Uncertainty: A Big Data Analysis for India. RBI Working Paper, (04).

Segal, G., Shaliastovich, I., & Yaron, A. (2015). Good and bad uncertainty: Macroeconomic and financial market implications. Journal of Financial Economics, 117(2), 369–397.

Indexed at, Google Scholar, Cross Ref

Shahzad, F., Lu, J., & Fareed, Z. (2019). Does firm life cycle impact corporate risk taking and performance? Journal of Multinational Financial Management, 51, 23–44.

Vural-Yavas, Ç. (2020). Corporate risk-taking in developed countries: The influence of economic policy uncertainty and macroeconomic conditions. Journal of Multinational Financial Management, 54, 100616.

Wang, Y., Chen, C. R., & Huang, Y. S. (2014). Economic policy uncertainty and corporate investment: Evidence from China. Pacific-Basin Finance Journal, 26, 227–243.

Indexed at, Google Scholar, Cross Ref

Received: 20-Jun-2024, Manuscript No. AMSJ-24-14936; Editor assigned: 21-Jun-2024, PreQC No. AMSJ-24-14936(PQ); Reviewed: 26-Jul-2024, QC No. AMSJ-24-14936; Revised: 26-Aug-2024, Manuscript No. AMSJ-24-14936(R); Published: 16-Sep-2024