Research Article: 2021 Vol: 20 Issue: 1

Economic Impediment of Covid-19 Lockdown on Airbnb Performance in Cape Town Neighbourhood

EA Ndaguba, The University of the Free State

Abstract

Some economies are shrinking, while others are experiencing downtime due to the spread of the coronavirus disease pandemic. Social integration and rural development are weakened in municipalities in South Africa as a result of government mediated approach for reducing the curve of the Coronavirus disease, such as a lockdown. This paper assesses the effect of COVID-19 lockdown on Airbnb performance between May 2017 and April 2020 in 17 cities in Cape Town neighbourhood with a focus on the COVID-19 era January 1-April 30, 2020. Our finding demonstrates that COVID-19 did not have a significant effect on Airbnb performance in Cape Town. However, policies for flattering the COVID-19 curve, such as lockdown which brought about travel restrictions, depleted international and local guests significantly and reduced the revenue of Airbnb by over 200 million Rands in a month March to April 2020 in 17 cities in the Cape Town neighbourhood.

Keywords

Airbnb, Cape Town, COVID-19, Lockdown, Sharing Economy, Tourism.

Introduction

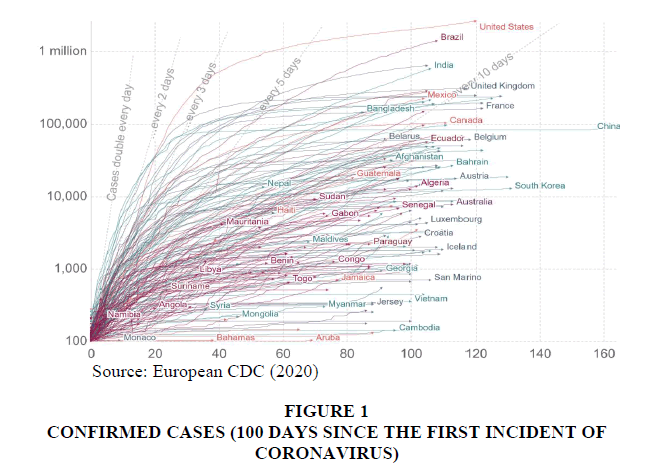

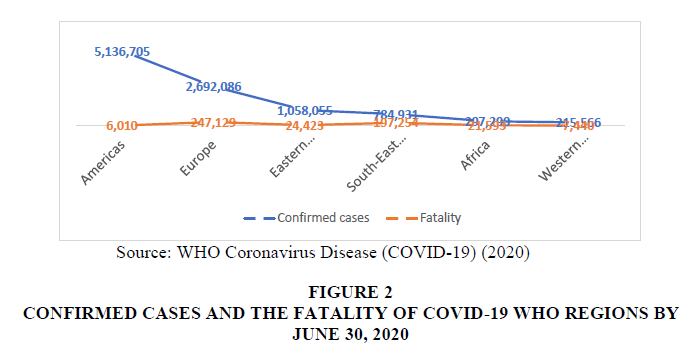

Some economies are shrinking, and others are witnessing extreme economic contraction owing to escalating numbers of Coronavirus disease infected persons, which appears to plummet economic vivacity of enterprise globally (Baker et al., 2020). On the other hand, social integration and interaction are weakened by social distancing policies, and the lockdown policy weakens development agenda of continents (United Nations Department of Economic and Social Affairs, 2020). The lockdown policy initiated by the Government of South Africa on March 26, 2020 (Egbe & Ngobese, 2020) is one of the three measures (quarantine and social distancing) to flatten the curve of Coronavirus caused by the severe acute respiratory syndrome – coronavirus 2 (SARS-CoV-2) disease (Han et al., 2020; Harapan et al., 2020). The World Health Organisation directorate declared SARS-COV-2 a global pandemic on March 11, 2020, with 118,000 confirmed cases in about 114 countries with 4,291 fatalities (Ghebreyesus, 2020). By June 30, 2020, making the 100th day since WHO reported the first case (Figure 1), there have been over 10 million confirmed cases spreading across 216 countries with 503,862 fatalities (Figure 2) (Whiting, 2020) and most confirmed cases and fatalities were recorded in Spain, Italy, the United States and China (Lee et al., 2020).

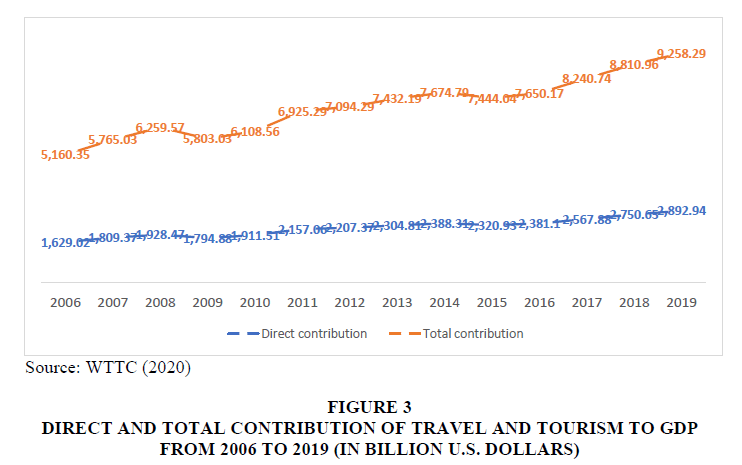

SARS-CoV-2 has adversely affected several industries globally. We assess one of these sectors, the tourism sector, with a narrow perspective on Airbnb within the informal tourism accommodation sector (Guttentag, 2015). The travel and tourism service is a highly volatile sector and any hostile perception or hazard, disrupt its growth. On a global scale, travel and tourism services had directly contributed approximately over $USD 2.9 trillion to the Gross Domestic Product in 2019. In the same year, America received the highest direct contribution from the sector of about $ USD 580.7 billion; however, Macau generated the highest share of the GDP of any economy in the globe (Figure 3).

Figure 3: Direct and Total Contribution of Travel and Tourism to GDP from 2006 to 2019 (In Billion U.S. Dollars)

In 2017, it generated over 119 million jobs worldwide, in essence, supporting one in ten jobs globally (Ndaguba, 2019; World Travel & Tourism Council, 2018). Worthy of note, the travel and tourism services generate three kinds of effect on the economy:

1. direct (airlines, hotels, and Airbnb),

2. indirect (public relation and marketing, maintenance and cleaning, food production and catering) and,

3. induced (technology, banks, education and healthcare, among others) (World Travel & Tourism Council, 2018).

These effects (indirect and induced) are not generic but are moderated by the direct effect to a large extent because the benefits of the direct effect stimulate both the indirect and the induced effect. However, projection amid the Coronavirus disease has seen the figures in the travel and tourism services plummeted. According to Faus (2020), the World Travel and Tourism Council argues that the COVID-19 pandemic may result in a cut of 50 million of the 119 million jobs created by the sector worldwide. Faus (2020) projects that Asia tourist market would be disrupted severely, the study estimated job loss at 30 million, while 7 million in Europe, 5 million in the Americas and 8 million job loss for the rest of the world (Faus, 2020).

However, amid the spread of the disease, travel and tourism services are considered potential losers, resulting from government mediated approaches, such as lockdown, which has led to grounded flights, cancellations on flights and Airbnb accommodation, self-isolation, social distancing and handwashing to flatten the curve of the disease (Asher, 2020; Churches, 2020). The COVID-19 disease is arguably the single most disruptive virus in the 21st century surpassing the disruption of the financial markets between 2008-2009. Although the remains of the financial hiccup still linger in many developing markets, COVID-19 has made a case for growth in most developing countries appear impossible.

The economic growth of a nation depends on the 3 Ps - Population, Participation and Productivity. One of the quintessential factors for calculating the GDP is the GDP Per Capita. The GDP Per Capita measures the economic output of a country and accounts based on the population size, and it divides the GDP by its population. GDP Per Capita creates an image of the distribution of individual survival kit in the society, which may be narrowed to personal income. Personal income is estimated as the total gross earnings from wages, business ventures, dividends, investment, rent derived, and profits. In most developing nations where the financial and service sector is weak compared to developed countries, avenues through which individuals can generate extra income is non-negotiable. For instance, South Africa has various entry point through which one can gain extra income such as entrepreneurship, advertising, agribusiness, small and medium scale manufacturing and tourism.

In this paper, the tourism discourse is advanced, and in the tourism industry, the disruptive brand of Airbnb will take centre stage as a means through which individuals can generate extreme incomes. Thus, in this paper, we would look at the sharing economy as the umbrella of disruptive innovation, before looking at the multifaceted effect of lockdown in South Africa in framing the literature for this paper. After that, we show how we used data from AirDNA to demonstrates the effect of COVID-19 and public policy on Airbnb in 17 cities in the Cape Town neighbourhood of Bloubergstrand, Cape Town City Centre, Sea Point, Greenpoint, Hout Bay, Camps Bay, Somerset West, Gardens and Constantia. Including De Waterkant, Strand, Woodstock, Rondebosch, Century City, Kommetjie, Newlands and Walmer Estate. The data from AirDNA database showed the economic shock and contraction between the months when the lockdown policy was implemented being March 26 2020. Before discussing the findings of the research and the conclusion, however, the literature review comes next.

Literature Review

The disruption created by COVID-19 appears to have affected all sectors of human cognition, positively (health and medicine, vaccine research, internet) and negatively (tourism, manufacturing). In this paper, the literature gives a perception of both the sharing economy about access-based services such as Airbnb and the multilayered effect of lockdown on the South African economy.

Several studies have utilised sharing economy as either a conceptual or theoretical framework for understanding Airbnb from various perspectives. Ert, Fleischer, and Magen (2016) used the concept to demonstrate how personal photos on the Airbnb platform, increasing the reputation and trust of the host. Quattrone et al. (2016) attributed the rise of Airbnb to the sharing economy and discussed four initiative for regulating the sector: how, when, where and what, including issues dealing with enforcement. Wang & Nicolau (2017) using a listing 33 cities demonstrate price determinant, and Airbnb gentrification was emphasised by (Wachsmuth & Weisler, 2018).

The above studies demonstrate that transformation in the modus operandi of tourism accommodation business is attributed to the notion of sharing economy, emphasising the access over ownership as described by Belk (2007). The sharing economy is the umbrella or uniform for online platforms for exchange, sharing, home rentals and the delivery of services with others for economic gains (Taeihagh, 2017). The idea is a derivative of the shared initiative, shared network, and shared communication (Frazer, 1915) practised in the mundane era. What can be deduced from that era was that sharing intelligence tends to save the cost of hiring agents. Sharing communication and networks assist in building professional connections that enable events to occur faster, information disseminated quickly and saved the cost of the protocol. The current sharing economy is an improvement in the trade by barter system of exchange (Belk, 2007), which has enormously impacted both local and national economics.

Global economies have dramatically evolved, from financial stocks to blockchains and cryptocurrencies (Huckle, Bhattacharya, White, & Beloff, 2016), mono-economy to sharing and gig economies (Steinberger, 2018), formal to informal tourism accommodation (Guttentag, 2015; Udéhn, 1993), and access over ownership (Belk, 2007; Botsman & Rogers, 2010b; Rinne, 2019). The adoption of digital platforms is congruent with the assumptions of accelerated growth by disruptive innovative firms. Disruptive techniques such as technological change and innovation have led to a new paradigm or model for business ventures (Blanke, 2015; Borrás, 2019; Drucker, 1986; Grillitsch et al., 2019; Krueger, 2006).

Disruptive innovations in the 21st century have had an enormous effect on virtually all fields of human endeavours from the music to video coverage and streaming services (Botsman & Rogers, 2010a, 2011; Zentner, 2006), smart and electric transportation (Christensen et al., 2015; Zeleny, 2012). Open source of publishing is a developing paradigm from the standard hard print journal papers (Broome, 2014). Also, this trend has transformed the manufacturing (Pattinson & Woodside, 2008; Zeleny, 2012), and education (Al-Imarah & Shields, 2019; Ellis et al., 2019). The idea of consumer consumption (Yu & Hang, 2010), communication (Latzer, 2009; Pegoraro, 2014), and data storage and computing hardware (Cãtinean & Cândea, 2013) are evolving within the disruptive innovative framework.

Over and above, the tourism sector is taking a severe hit by disruptive innovation (Fayos-Solà & Cooper, 2019; Guttentag, 2015; Guttentag & Smith, 2017; Katsoni, 2019; Romero & Tejada, 2019), particularly in the tourism accommodation sectors globally, with the rise of Airbnb and other platform accommodation enterprise (Brown et al., 2019; Campbell et al., 2019).

In South Africa, the two major sectors experiencing significant disruption are the transportation and tourist accommodation sector. While Uber leads the transportation revolution, the tourism accommodation leans towards Airbnb (Grillitsch et al., 2019; Kohli & Melville, 2019; Visser et al., 2017). In 2019, while the tourism industry contributed about R425 billion estimated at 3% to the national economy, Airbnb contributes directly over R10 billion to the South African Government budget of R1.41 trillion Rands in 2017 (Malinga, 2018; National Treasury Republic of South Africa, 2018). However, the spread of Coronavirus has resulted in a deficit in government expenditure and has heightened government borrowing.

Lockdown and its Effect on the South African Economy

Globally, there are three propositions for reducing the COVID-19 disease pandemic, among them, include lockdown, social distancing and quarantine. Lockdown involves the complete shutdown of the government and private functionaries to curb a disease outbreak with an infectious character. Social or physical distancing are public health measures stipulated to lessen the risk or frequency of contacts from one person to another to flatten the curve of COVID-19 (Fong et al., 2020). Quarantine is described as the restriction of an individual/ groups movement who presumably has been exposed to a contagion disease (in this case, covid-19) but may or may not have shown symptoms of ill-health (Cetron & Landwirth, 2005). There are two mediums for quarantining people: self-isolation and state-isolation. Quarantining can either be mandatory or voluntary. It is compulsory when the incidence of the spread of the disease is on the rise. However, where it is managed effectively, and individuals abide by self-restrictions governing self-isolation measures as proposed by the government and the curve is experiencing a decline, the voluntary isolation is necessary.

There are several methods through which the lockdown and other policies for flattening the curve of COVID-19 are expected to affect the South African economy, and by extension, the housing market, tourism and tourism accommodation. Some of these may include coerced reduction in production, (ii) tourism due to restrictions on international and local travels, (iii) uncertainty on investment due to the spread of fear than hope and (iv) the impact of the disrupted global supply chain on South Africa's import and export (Arndt et al., 2020).

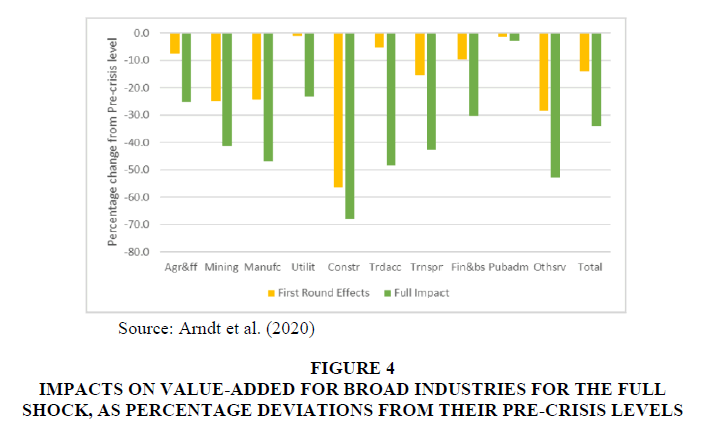

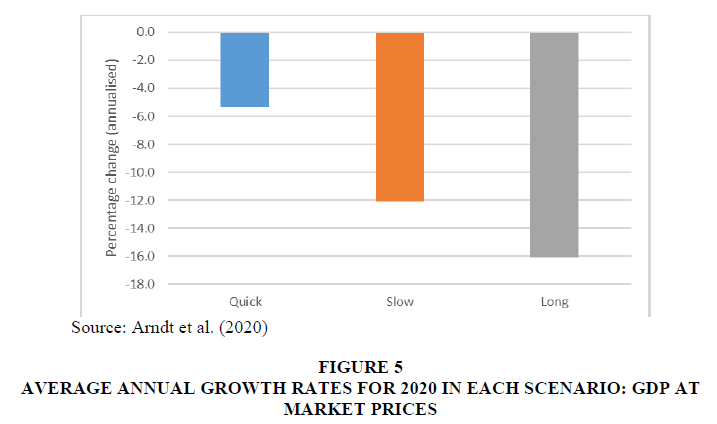

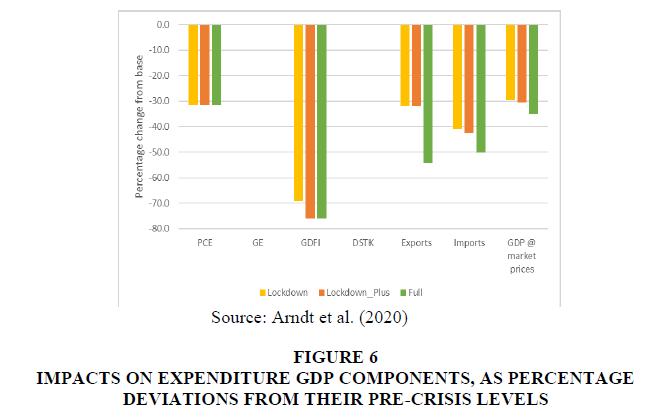

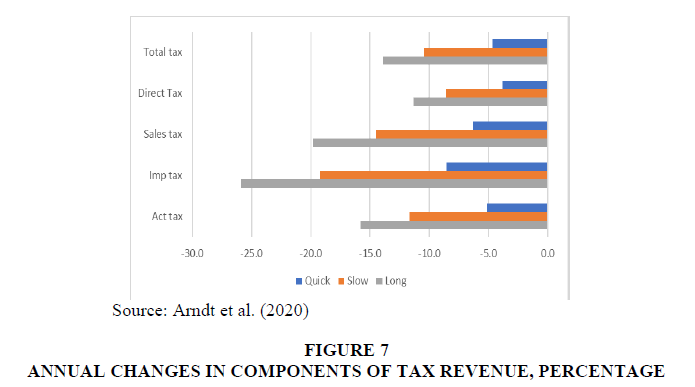

To generate Figures 3-8, the authors used the social accounting model (Arndt et al., 2020). The SAM is not necessarily a model in itself; however, it assists in representing macro-meso data for an economy. In the SAM-based multiplier framework, when demand on commodity changes, two demand trends are derived the disrupted trend and the figure before the disruption of the economy, which they categories into 'first-round and full round' impact (Arndt et al., 2020; Roland-Holst & Sancho, 1995). The significant differentials between the first and the full impact on the value-added for broad industries for the full shock. The former offers a point of view through which shocks transmit economic systems. The latter provides an opportunity to view the shocks from a multidimensional angle and the effect the shock has on the economic systems that may extend to their purchasing power and household expenditure.

Figure 4: Impacts on Value-added for Broad Industries for the Full Shock, As Percentage Deviations from their Pre-Crisis Levels

Figure 6: Impacts on Expenditure GDP Components, as Percentage Deviations from their Pre-Crisis Levels

Figure 3 demonstrates that public administration (Pubadm) and utility are the less likely to have been affected in South Africa, while construction, other services, trade and accommodation services, manufacturing and transport are the most affected. There are several reasons why the latter were severally impacted by the former. One of such reasons is because government operations were largely not shut down in South Africa compared to private organisations. The provision of utility is quintessential for the people to continue to comply with the lockdown policies of the government. More so, according to studies on COVID-19 disease experiment, colder temperate regions are much likely to spread the disease than hotter client regions. With South Africa in the winter season, utility and administration of welfare are very imperative to motivate citizens to avoid a rampage, which will lead to a spike in the disease in the country.

Figure 4 shows the effect of lockdown on the household, government, domestic investment and the stock exchange. Household expenditure during phase 1 and phase 2 in the country have resulted in a loss of 30% expenditure to the country. However, investment, import and export rates have been impacted adversely with the most impact on domestic fixed investment; hence, banks in South Africa are feeling significant pressure. With a negative balance of payment based on importation, exportation and investment, Figure 6 demonstrates the direct impact on taxes from four perspectives, sales, direct, import and accounting tax.

Method and Results

A significant number of scholars publishing in peer review journals (Agarwal, Koch, & McNab, 2019) and consultancies (CBRE Hotel Americas Research, 2017; Kelley & Asad, 2015) appear to rely on AirDNA for estimating Airbnb activities. In many cases, data from AirDNA has been used to survey host features in comparison to couch surfing (Jung et al., 2016). HVS Consulting & Valuation Division of TS Worldwide (2015) utilised data from AirDNA to approximate the effect of New York City tourism accommodation market and demonstrated that Airbnb significantly impacted hoteliers' revenues. Another market research demonstrates that Airbnb in America is not merely spreading in metropolitan regions, but may exceed hotel ADR in some localities (CBRE Hotel Americas Research, 2017).

Gunter (2018) used data from AirDNA in examining how the host becomes superhosts. In Dogru and Pekin (2017), AirDNA dataset was used to demonstrate that private rooms and entire room listing with pictures, and host responsiveness appear to have more occupancy to shared rooms and too unresponsive hosts. Kakar, Voelz, Wu, and Franco (2017) have utilised occupancy data from AirDNA to prove that Asian and Hispanic hosts charges lower between 8% and 10% of the market price, however, they provide additional information on values, neighbourhood property and demographics.

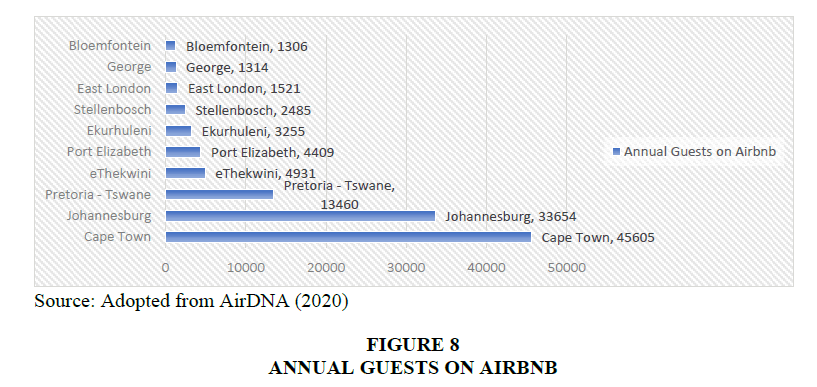

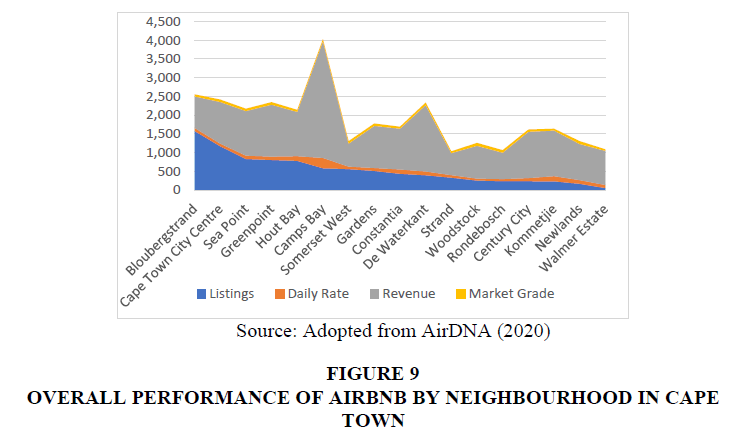

A reason for the choice of Cape Town as the study site is because it has the highest number (Figure 9) and it is an acclaimed destination area on the African continent.

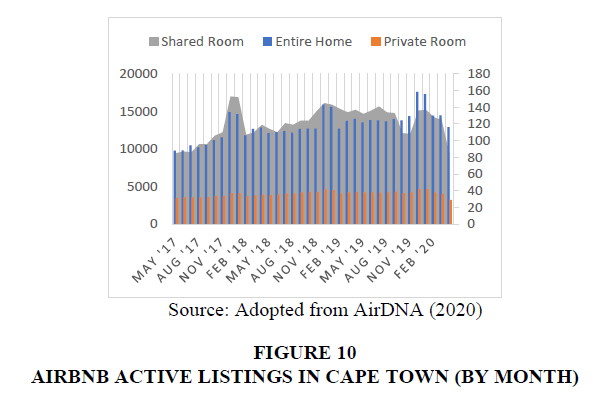

AirDNA database shows that there are three rental types of data on AirDNA, the entire home, private room and shared room. Active rentals are about 16,210 in the 17 cities constituting the Cape Town neighbourhood on AirDNA, with the entire home grabbing 79%, 20% for private rooms and 1% for shared rooms. The rental size, studio and two-bedroom flats seem to be more lucrative commanding 32% and 30%. In this study, the entire home may not necessarily be a 4 or 5 bedroom, but a studio apartment may constitute an entire home.

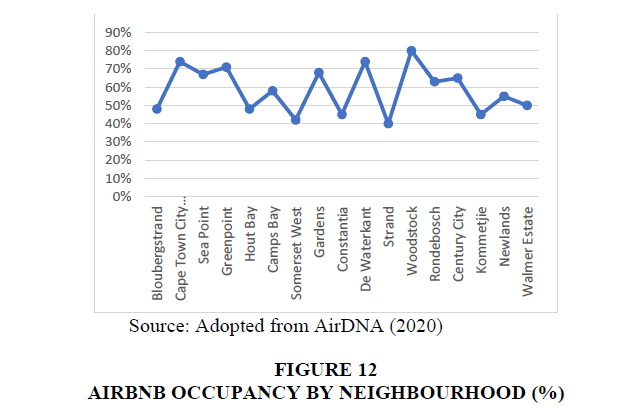

Following existing research that used AirDNA for data analysis, such as Agarwal et al. (2019); CBRE Hotel Americas Research (2017); Gunter (2018) and Kakar et al. (2017). In examining Airbnb performance, we used AirDNA dataset between May 2017 to April 2020 from the following 17 cities in the Cape Town neighbourhood, Bloubergstrand, Cape Town City Centre, Sea Point, Greenpoint, Hout Bay, Camps Bay, Somerset West, Gardens and Constantia. Including De Waterkant, Strand, Woodstock, Rondebosch, Century City, Kommetjie, Newlands and Walmer Estate in Cape Town with a focus between on the lockdown effect on the Airbnb economy March and April. In this study, we used the following data from AirDNA to assess Airbnb performance:

1. overall performance of Airbnb by neighbourhood,

2. Airbnb active listings,

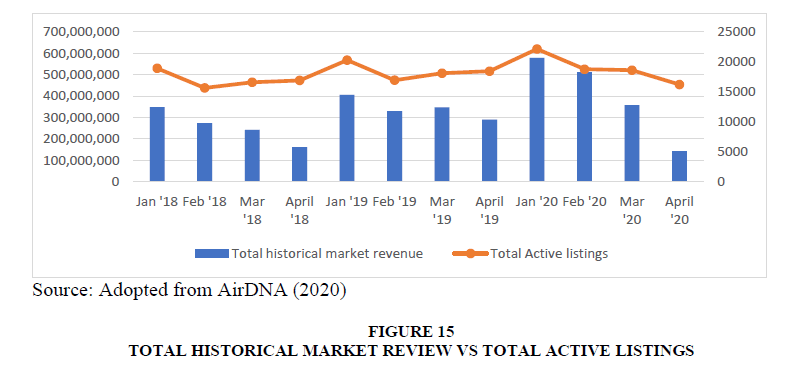

3. Airbnb historical market revenue (by Month),

4. Airbnb occupancy by neighbourhood,

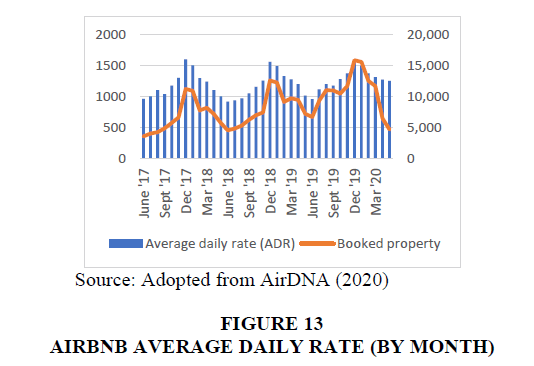

5. Airbnb average daily rate (by Month), and

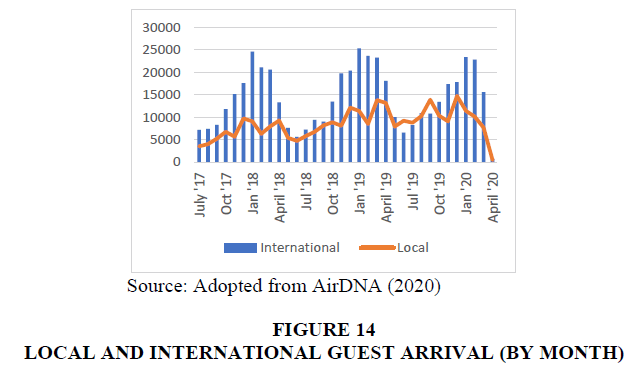

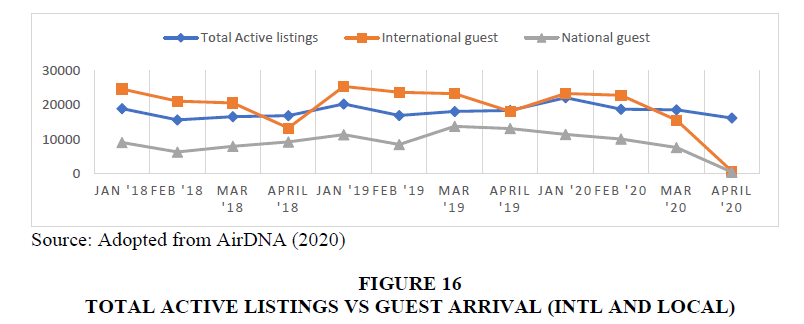

6. local and international guest arrival (by Month) (Figures 10-14)

Discussion

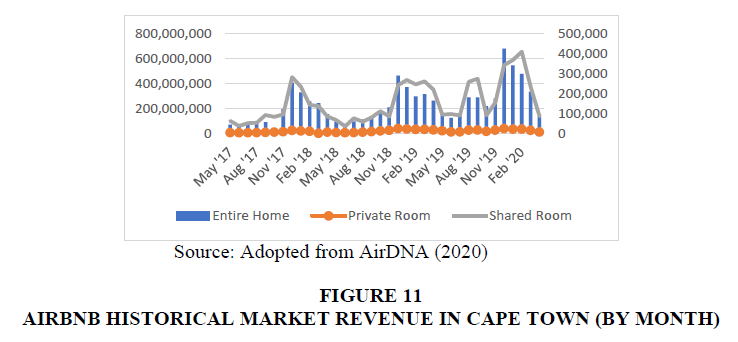

Based on the AirDNA data for the period May 2017 to April 2020, Figures 9 and 10 argues that about 623,589 Airbnb listings (473,370 for the entire home, 145,685 for the private room and 4354 for a shared room) generated an estimate of 8,906,548,312 billion Rands within the three years (where entire homes, private rooms and shared rooms account for the estimated value in Rands to about 8,239,842,700; 661,104,700 and 5,600,912 respectively). This shows that government data for accessing the actual estimate for Airbnb may be problematic. While government report demonstrates that Airbnb reached 10 billion Rands in 2018 (National Treasury Republic of South Africa, 2018) and the Tourism Amendment Bill estimating that Airbnb total contribution, direct, indirect and induced accounts for about 8.7 billion in 2017 (Airbnb, 2019). This research shows that Airbnb within the three years generated an average of 2,968,849,437 billion Rands in each year within the three years under review from the 17 cities in the Cape Town neighbourhood.

However, when we triangulate January to April in each of the three years based on total historical market review and the total active listings (Figure 15), it shows the effect of COVID-19 on both variables. Particularly, when, we probe further to ascertain the effect of COVID-19 in 17 cities in the Cape Town neighbourhood between March and April and take into account government policy on lockdown than the rise of COVID-19 patients. The estimated difference based on historical market revenue between the Month – March and April 2020 stood at about 19.76% in 2018, 8.76% in 2019, and 42.68%.in 2020. We acknowledge that there is not much difference for January and February for all the years. Between 2018 and 2019 there is no significant difference in the AirDNA dataset. However, significant disruption is witnessed within the 17 cities in the Cape Town neighbourhood.

More so, triangulating total active listings and guest arrival (local and international) for the three years using the same months, we established that the lockdown announced by the South Africa Government on March 26 resulted in the severe decline of guests on the Airbnb platform. Despite, the total active listings for 2020 fluctuation practically sustainable, based on the narrative for 2018 and 2019. Guest arrival (international and local) fell from 15,595 international guests on Airbnb in March 2020 to 720 international guests by April 2020. On the contrary, local tourist visit to Airbnb apartment is inconsistent, for instance, in 2018, after March Airbnb witnessed an increase in guest stay, however, in 2019, it recorded a slight decline post-March. However, the platform appears to witness a decline prequel to Coronavirus and the lockdown policy for flattening in 2020. However, the figure plummeted from about 7,633 in March to 481 by April 2020 (Figure 15), accounting for the loss of over 200 million Rands during this period.

Conclusion

In a world abruptly disruptively disengaged, as humans we desire connection, we crave to touch, hold, hug, or give a handshake and the sharing economy with regard to Airbnb is not helping. The little things we took for granted appear to have disappeared and considered abysmal due to the fear and spread of COVID-19. We are no longer allowed to travel either to congregate for prayers or family braai and drinks: bars, pub and bottle-shops are on shutdown. Freedom and human right appear unimportant due to fear of the spread of the disease amid restrictions. No one is visiting the beaches, as animals in Cape Town have come out of hiding while humans are in cages (see clustered image). Cape Town is now a shadow of itself, a once vibrant economic region have become moribund, and COVID-19 is at the centre of it. As a result of the disease locals who crave for Cape Town where the first to flee from the cities (Figure 16).

Tourist hotspots such as Table Mountain, Boulders Beach Penguin Colony, Victoria and Alfred Waterfront, Cape Point, Kirstenbosch National Botanic Gardens, Castle of Good Hope and Robben Island, among others that once attracted tourists to visit and stay in an Airbnb apartment have resulted in over 200,000,000 million Rand in deficit to Airbnb.

In conclusion, the full extents of the damage Coronavirus disease are causing remains speculative. What we know from a financial perspective are the potential losers and gainers or a month by month evaluation amid the pandemic, which may still not be all-encompassing. In a developing country such as South Africa where social intervention is miniature, Airbnb hosts stand little or no chance of receiving support from the government as an enterprise or small business. The lockdown policy orchestrated due to the increasing incidence of the Coronavirus may also be putting the vulnerable workers employed by Airbnb host at risk. Such workers like the cleaners, gardeners, and plumbing service, among others the Airbnb host employees. The lockdown is justified by the statement of Nana Akufo-Addo, the President of Ghana, "we know how to bring the economy back to life. What we do not know is how to bring people back to life". Despite, Airbnb performance dwindling and the future of a vaccine for COVID-19 still in the testing stage, Airbnb in the future must rely on health checks to boost its performance to recover.

References

- Agarwal, V., Koch, J.V., & McNab, R.M. (2019). Differing views of lodging reality: Airdna, STR, and Airbnb. Cornell Hospitality Quarterly, 60(3), 193-199.

- Airbnb. (2019). Airbnb in South Africa: The positive impact of healthy tourism. In: Airbnb Inc.

- Al-Imarah, A.A., & Shields, R. (2019). MOOCs, disruptive innovation and the future of higher education: A conceptual analysis. Innovations in Education and Teaching International, 56(3), 258-269.

- Arndt, C., Davies, R., Gabriel, S., Harris, L., Makrelov, K., Modise, B., Robinson, S., Simbanegavi, W., Van Seventer, D., & Anderson, L. (2020). Impact of Covid-19 on the South African economy. Southern Africa-Towards Inclusive Economic Development Working Paper, 111.

- Asher, N. (2020). Coronavirus isolation measures taking toll on people who live alone. Retrieved from https://www.abc.net.au/news/2020-04-01/coronavirus-self-isolation-measures-causing-loneliness/12107884

- Baker, S., Bloom, N., Davis, S.J., Kost, K., Sammon, M., & Viratyosin, T. (2020). The unprecedented stock market reaction to COVID-19. Covid Economics: Vetted Real-Time Papers, 1(3).

- Belk, R. (2007). Why not share rather than own? The Annals of the American Academy of Political Social Science, 611(1), 126-140.

- Blanke, J. (2015). The biggest economic change the world has ever seen?.

- Borrás, S. (2019). Innovation policies in Europe and the US: The new agenda. London: Routledge.

- Botsman, R., & Rogers, R. (2010a). Beyond zipcar: Collaborative consumption. Harvard Business Review, 88(10), 30.

- Botsman, R., & Rogers, R. (2010b). What's mine is yours: The rise of collaborative consumption. New York, NY, USA: HarperBusiness.

- Botsman, R., & Rogers, R. (2011). What's mine is yours: how collaborative consumption is changing the way we live.

- Broome, M. E. (2014). Open access publishing: A disruptive innovation. Nursing Outlook, 62(2), 69-71.

- Brown, K., Djajadikerta, H., Jie, F., Goh, E., Marinova, D., Jogulu, U., & Ndaguba, E. A. (2019). Submission to the Parliamentary Inquiry into Short-Stay Accommodation in Western Australia.

- Campbell, M., McNair, H., Mackay, M., & Perkins, H.C. (2019). Disrupting the regional housing market: Airbnb in New Zealand. Regional Studies, Regional Science, 6(1), 139-142.

- Cãtinean, I., & Cândea, D. (2013). Characteristics of the cloud computing model as a disruptive innovation. Revista de Management Comparat International, 14(5), 783.

- CBRE Hotel Americas Research. (2017). Hosts with multiple units—A key driver of Airbnb growth. Retrieved from https://www.ahla.com/hosts-multiple-units-key-driver-airbnb-growth

- Cetron, M., & Landwirth, J. (2005). Public health and ethical considerations in planning for quarantine. The Yale Journal of Biology and Medicine, 78(5), 329.

- Christensen, C.M., Raynor, M.E., & McDonald, R. (2015). What is disruptive innovation. Harvard Business Review, 93(12), 44-53.

- Churches, T. (2020). We can “shrink” the COVID-19 curve, rather than just flatten it.

- Dogru, T., & Pekin, O. (2017). What do guests value most in Airbnb accommodations? An application of the hedonic pricing approach. Boston Hospitality Review, 5(2), 1-3.

- Drucker, P.F. (1986). The changed world economy. Foreign Affairs, 64(Spring Issue), 768-791.

- Egbe, C.O., & Ngobese, S.P. (2020). COVID-19 lockdown and the tobacco product ban in South Africa. Tobacco Induced Diseases, 18.

- Ellis, V., Souto-Manning, M., & Turvey, K. (2019). Innovation in teacher education: towards a critical re-examination. Journal of Education for Teaching, 45(1), 2-14.

- Ellis, V., Steadman, S., & Trippestad, T.A. (2019). Teacher education and the GERM: Policy entrepreneurship, disruptive innovation and the rhetorics of reform. Educational Review, 71(1), 101-121.

- Ert, E., Fleischer, A., & Magen, N. (2016). Trust and reputation in the sharing economy: The role of personal photos in Airbnb. Tourism Management, 55, 62-73.

- European, C.D.C. (2020). Situation update worldwide (1st July 2020). Retrieved from https://ourworldindata.org/covid-cases

- Faus, J. (2020). This is how coronavirus could affect the travel and tourism industry Retrieved from https://www.weforum.org/agenda/2020/03/world-travel-coronavirus-covid19-jobs-pandemic-tourism-aviation/

- Fayos-Solà, E., & Cooper, C. (2019). Introduction: Innovation and the Future of Tourism. In The Future of Tourism (pp. 1-16): Springer, Cham.

- Fong, M.W., Gao, H., Wong, J.Y., Xiao, J., Shiu, E.Y., Ryu, S., & Cowling, B.J. (2020). Nonpharmaceutical measures for pandemic influenza in nonhealthcare settings—social distancing measures. Emerging Infectious Diseases, 26(5), 976.

- Frazer, L. (1915). Economy.-II. The importance of co-operation. Saturday REVIEW of Politics, Literature, Science and Art, 120(3121), 176-177.

- Ghebreyesus, T.A. (2020). WHO Director-General's opening remarks at the media briefing on COVID-19.

- Grillitsch, M., Hansen, T., Coenen, L., Miörner, J., & Moodysson, J. (2019). Innovation policy for system-wide transformation: The case of strategic innovation programmes (SIPs) in Sweden. Research Policy, 48(4), 1048-1061.

- Gunter, U. (2018). What makes an Airbnb host a superhost? Empirical evidence from San Francisco and the Bay Area. Tourism Management, 66, 26-37.

- Guttentag, D. (2015). Airbnb: disruptive innovation and the rise of an informal tourism accommodation sector. Current Issues in Tourism, 18(12), 1192-1217.

- Guttentag, D. A., & Smith, S. L. (2017). Assessing Airbnb as a disruptive innovation relative to hotels: Substitution and comparative performance expectations. International Journal of Hospitality Management, 64, 1-10.

- Han, Q., Lin, Q., Jin, S., & You, L. (2020). Coronavirus 2019-nCoV: A brief perspective from the front line. Journal of Infection, 80(4), 373-377.

- Harapan, H., Itoh, N., Yufika, A., Winardi, W., Keam, S., Te, H., Megawati, D., Hayati, Z., Wagner, A.L., Mudatsir, M. (2020). Coronavirus disease 2019 (COVID-19): A literature review. Journal of Infection and Public Health.

- Huckle, S., Bhattacharya, R., White, M., & Beloff, N. (2016). Internet of Things, blockchain and shared economy applications. Procedia Computer Science, 98, 461-466.

- HVS Consulting & Valuation Division of TS Worldwide. (2015). Impact analysis report: Airbnb and impacts on the New York City lodging market and economy. Retrieved from https://www.hanyc.org/wp-content/uploads/2015/10/HVS-Impact-Study-FINAL-Airbnb-and-the-NYC-Lodging-Market-10-27-15-copy.pdf

- Jung, J., Yoon, S., Kim, S., Park, S., Lee, K.-P., & Lee, U. (2016). Social or financial goals? Comparative analysis of user behaviors in Couchsurfing and Airbnb. Paper presented at the Proceedings of the 2016 CHI Conference Extended Abstracts on Human Factors in Computing Systems.

- Kakar, V., Voelz, J., Wu, J., & Franco, J. (2017). The visible host: Does race guide Airbnb rental rates in San Francisco? Journal of Housing Economics.

- Katsoni, V. (2019). Sharing economy perspectives in the tourism accommodation sector. In Mediterranean Cities and Island Communities (pp. 283-297): Springer, Cham.

- Kelley, S., & Asad, D. (2015). Lodging. Airbnb: Deep dive with data from AirDNA. Industry overview. In: Bank of America Merrill Lynch.

- Kohli, R., & Melville, N.P. (2019). Digital innovation: A review and synthesis. Information Systems Journal, 29(1), 200-223.

- Krueger, A. O. (2006). The World Economy at the Start of the 21st Century. Paper presented at the Annual Gilbert Lecture, Rochester University, New York.

- Latzer, M. (2009). Information and communication technology innovations: radical and disruptive? New Media & Society, 11(4), 599-619.

- Lee, T.W., Park, J., & Hung, D. (2020). Gaussian Statistics and Data-Assimilated Model of Mortality due to COVID-19: China, USA, Italy, Spain, UK, Iran, and the World Total. medRxiv.

- Malinga, S. (2018). Airbnb contributes R10bn to SA economy. Retrieved from https://www.itweb.co.za/content/VgZeyqJAd5bMdjX9

- National Treasury Republic of South Africa. (2018). Budget review. Cape Town: National Treasury Republic of South Africa

- Ndaguba, E.A. (2019). Social and economic impact of short-stay accommodation: The case of the Shire of Augusta-Margaret River (Proposal). (Ph.D. Doctoral), Edith Cowan University, Joondalup.

- Pattinson, H.M., & Woodside, A.G. (2008). Capturing and (re) interpreting complexity in multi-firm disruptive product innovations. Journal of Business & Industrial Marketing, 24(1), 61-76.

- Pegoraro, A. (2014). Twitter as disruptive innovation in sport communication. Communication & Sport, 2(2), 132-137.

- Quattrone, G., Proserpio, D., Quercia, D., Capra, L., & Musolesi, M. (2016). Who benefits from the sharing economy of Airbnb? Paper presented at the Proceedings of the 25th international conference on world wide web.

- Rinne, A. (2019). 4 big trends for the sharing economy in 2019. Global Agenda: Digital Economy and Society.

- Roland-Holst, D.W., & Sancho, F. (1995). Modeling prices in a SAM structure. he Review of Economics and Statistics, 361-371.

- Romero, I., & Tejada, P. (2019). Tourism intermediaries and innovation in the hotel industry. Current Issues in Tourism, 1-13.

- Steinberger, B.Z. (2018). Redefining employee in the gig economy: Shielding workers from the uber model. Fordham Journal of Corporate and Financial Law, 23, 577-595.

- Taeihagh, A. (2017). Crowdsourcing, Sharing Economies and Development. 33(2), 191-222. doi:10.1177/0169796x17710072

- Udéhn, L. (1993). Twenty-five years with the logic of collective action. Acta Sociologica, 36(3), 239-261.

- United Nations Department of Economic and Social Affairs. (2020). Responses to the COVID-19 catastrophe could turn the tide on inequality. Retrieved from

- Visser, G., Erasmus, I., & Miller, M. (2017). Airbnb: The emergence of a new accommodation type in Cape Town, South Africa. Tourism Review International, 21(2), 151-168.

- Wachsmuth, D., & Weisler, A. (2018). Airbnb and the rent gap: Gentrification through the sharing economy. Environment Planning A: Economy Space, 50(6), 1147-1170.

- Wang, D., & Nicolau, J.L. (2017). Price determinants of sharing economy based accommodation rental: A study of listings from 33 cities on Airbnb. com. International Journal of Hospitality Management, 62, 120-131.

- Whiting, K. (2020). COVID-19: What you need to know about coronavirus on 30 June. Retrieved from https://www.weforum.org/agenda/2020/06/covid-19-what-you-need-to-know-about-coronavirus-on-30-june/

- WHO Coronavirus Disease (COVID-19). (2020). WHO Coronavirus Disease (COVID-19) Dashboard.

- World Travel & Tourism Council. (2018). Travel & tourism global economic impact & issues 2018. Washington, D.C.: World Travel & Tourism Council.

- WTTC. (2020). Direct and total contribution of travel and tourism to GDP from 2006 to 2019 (in billion U.S. dollars). Retrieved from https://wttc.org/

- Yu, D., & Hang, C.C. (2010). A reflective review of disruptive innovation theory. International Journal of Management Reviews, 12(4), 435-452.

- Zeleny, M. (2012). High technology and barriers to innovation: From globalization to relocalization. International Journal of Information Technology & Decision Making, 11(02), 441-456.

- Zentner, A. (2006). Measuring the effect of file sharing on music purchases. The Journal of Law Economics, 49(1), 63-90.