Research Article: 2021 Vol: 24 Issue: 6

Economic and legal aspects of EU insurance market development

Zoriana Buryk, Vasyl Stefanyk Precarpathian National University

Citation Information: Buryk, Z. (2021). Economic and legal aspects of EU insurance market development. Journal of Management Information and Decision Sciences, 24(4), 1-9.

Abstract

Background: Differences related to the development of the insurance market in the EU countries have led to the development and implementation of a regulatory environment through the implementation of the relevant Directives of the European Parliament and the Council of the European Union. Such legal changes provide for the unification of requirements for the activities of insurance companies and are aimed at improving the conditions for the development of the EU internal insurance market.

The purpose of the study: to study the main indicators of the EU insurance market and to assess the measures taken by EU member states to transpose the requirements of regulatory directives into national law.

Methods: quantitative and qualitative analysis; synthesis; system approach; content analysis; prognostication; trend models.

Results: The EU insurance market is the largest segment of the global insurance market. In terms of insurance premiums in most EU countries, the insurance business tends to grow. In 2018, almost 7,000 both national and foreign insurance companies operated in the EU market. It was found that the number of relevant regulatory measures to transpose the requirements of Directive 2009/138 / EU Solvency II was higher in those EU countries where the insurance market is less developed, i.e. their legislation did not meet the generally accepted requirements. The existing regulatory regime of the EU countries has led to differences in approaches to the transposition by national authorities of the requirements of Insurance Distribution Directive 2016/97 / EU. The results of forecasting based on the trend model show that the insurance market tends to grow, as the positive impact of changes in the legal regulation of EU member states will have a lasting effect.

Keywords

Insurance regulation in the EU; The effectiveness of Solvency II; EU insurance markets; Legal regulation of the insurance market.

Introduction

The EU is characterized by a high level of development of the insurance market and a gradual reduction of differences in the regulation of the insurance business between member states. Common rules are being implemented to unify and facilitate the activities of insurance companies in the EU, ensure the protection of policyholders, expand the market for services and improve them. The development of various sectors of the economy, including the expansion of agriculture, internal contradictions and external threats cause new contradictions related to the insurance of production, institutional, market, price, financial risks (Kulawik, 2018). In addition, the issue of lack of standards for the activities of insurance intermediaries remains relevant (Marano, 2019). Another important issue of insurance within the EU is the supervision of systemic risk due to low interest rates, the general vulnerability of insurers, ongoing supervision and cooperation in the field of control in the context of information exchange (Schoenmaker, 2016). Directive 2009/138/EC of the European Parliament and of the Council of 25 November 2009 on the taking-up and pursuit of the business of Insurance and Reinsurance (Solvency II) has had a significant impact on the EU insurance market through new requirements and a new regulatory regime for insurance companies. EU member states had to make appropriate changes to their national legislation to implement Solvency II, which was expected to affect the insurance business. At the same time, the need to study the problems and challenges related to the regulation of the EU insurance market and the response of business to changing operating conditions is emerging.

Literature Review

The scientific literature does not sufficiently study the changes that have taken place in the insurance market in the EU countries after the entry into force of Directive 2009/138/EU Solvency II. Research focuses on the general issues of legal regulation of insurance activities and the importance of insurance in business and the national economy (Mrówczyńska-Kamińska & Standar, 2016); issues of the legal framework in the technological segment of insurance (Marano, 2019); regulation of international and national supervision over the functioning of the EU internal insurance market (Schoenmaker, 2016); the conditions of the insurance market in connection with the introduction of Solvency II (Peleckienė, 2018); study of the theoretical foundations of agricultural risk insurance (Kulawik, 2018); insurance regulation and fragmentation of the EU insurance market, gaps in the legal framework, features of EU insurance requirements (Kunertová, 2017); study of the peculiarities of insurance market regulation at the international level, in particular through the analysis of EU Directives and the International Association of Insurance Supervisory (IAIS) (Pukała et al., 2017); analysis and assessment of insurance risks in the new legal conditions of insurers (Bølviken & Guillen, 2017; Weber, 2018; Manolache, 2019).

The concept of Solvency II was based on the Own Risk and Solvency Assessment (ORSA) system (Pukała et al., 2017). “Solvency II has definitely promoted enterprise risk management (ERM) in the European insurance industry and improved the system of governance of insurance companies” (Santomil & González, 2020). In a study by Pukała et al. (2017) proved the impact of Solvency II regulatory priorities on the development of insurance, in particular in the field of supervision through risk assessment and solvency by insurers. They note, among others, that Solvency II regulates the scope of permitted activities of insurance undertaking. Insurance companies limit the objects of insurance and operations, which leads to problems of interpretation and discussion of the provisions of Solvency II in different EU countries (Kunertová, 2017). In fact, Solvency II has led to a number of legal conflicts and their impact on the insurance market, which is actively discussed in the scientific literature. The new Directive has led Member States to misunderstand the types of insurance, which insurers can deal with, and one of the gaps is the lack of standards for insuring certain types of business risks (Kulawik, 2018; Marano, 2019). At the same time, Peleckienė (2018) emphasizes the advantages of the new Directive, as “Solvency II introduces a new, harmonized EU-wide regulatory regime, which replaces 14 existing insurance Directives”. Eling & Jung, (2020) compare the regulatory component of Solvency II with other global models for insurers' capital and note a significant increase in requirements in the EU market. Pradier & Chneiweiss (2017) believe that the main components of insurance market regulation are aimed at preventing possible future crises of insurance companies. Some relevant studies can be found in Shvets et al. (2013) and Romanenko & Chaplay (2016).

In addition to Solvency II, the scientific literature discusses the implementation of Directive (EU) 2016/97 of the European Parliament and the Council on insurance distribution (IDD), (Köhne & Brömmelmeyer, 2018). Studies prove the feasibility of adopting this Directive, which covers the activities of all insurance companies, taking into account the growth of liabilities in order to reduce systemic risks. At the same time, there is a somewhat excessive regulation provided by the IDD norms (Köhne & Brömmelmeyer, 2018).

Methodology

Realization of the purpose of research provides use of such methods: content analysis of the EU Solvency II and IDD Directives on the requirements for the activities of insurance companies and the conditions of regulation of the insurance market of the EU countries; analysis of data on the implementation of the provisions of the Solvency II and IDD Directives by EU countries; systematic and logical analysis, method of information synthesis for the formation of conclusions and recommendations for the development of the insurance market of the European Union; systematization, generalization of statistical data that characterize the development of the EU insurance market.

The study used information from EUR-lex, as the official website of EU legislation and public documents, Insurance Europe - to obtain up-to-date information (Insurance Data) to assess the European insurance industry, and the Organization for Economic Co-operation and Development and Statists to assess the dynamics of the insurance market of the world and the EU. The study period covered 2008-2018 as such, when EU countries implemented the requirements of Solvency II and IDD.

In order to form a forecast for the development of the EU insurance market, trend models of time (time) series were used. The selection of the trend function is carried out by the method of least squares. To determine the accuracy of the model, a coefficient of determination was used, built based on estimates of the variance of empirical data and values of the trend model. To forecast the development of the insurance market, countries with different indicators of insurance premiums (the amount paid to an insurance company for an insurance policy and make up the primary revenue source for insurers) were selected.

Results

The activity on the insurance market in the EU countries reflects a positive result in the context of ensuring the formation of efficient business during the study period. In fact, the EU countries are the largest segment of the global insurance market and are characterized by the development of developed legislation governing the insurance business (Table 1).

| Table 1 Worldwide Insurance Premiums (Million USD) | |||||

| World Premiums, | Europe | Asia | North America | Latin America | Other |

| 2009 | 1600 | 1050 | 1252 | 108 | 78 |

| 2010 | 1602 | 1214 | 1279 | 131 | 86 |

| 2011 | 1640 | 1338 | 1346 | 155 | 95 |

| 2012 | 1552 | 1398 | 1398 | 167 | 99 |

| 2013 | 1631 | 1319 | 1391 | 174 | 100 |

| 2014 | 1713 | 1389 | 1398 | 179 | 105 |

| 2015 | 1509 | 1399 | 1433 | 159 | 102 |

| 2016 | 1457 | 1521 | 1463 | 153 | 101 |

| 2017 | 1546 | 1615 | 1520 | 168 | 107 |

| 2018 | 1641 | 1683 | 1597 | 163 | 110 |

According to the Organization for Economic Co-operation and Development (OECD, 2020) and Statists (2020) in 2018 based on insurance premiums, the United Kingdom, France and Germany were the three largest European insurance markets (Table 2).

| Table 2 Insurance Premiums in EU Countries (Million USD) | |||||||||||

| 2008 | 2009 | 2010 | 2011 | 2012 | 2013 | 2014 | 2015 | 2016 | 2017 | 2018 | |

| United Kingdom | 454666 | 342609 | 325141 | 339365 | 368525 | 340385 | 365688 | 336743 | 403794 | 394114 | 469120 |

| France | 279451 | 302185 | 297324 | 289082 | 258641 | 275750 | 294033 | 250873 | 314251 | 314319 | 338708 |

| Germany | 303291 | 247779 | 241052 | 255708 | 302739 | 333713 | 338764 | 293086 | 294660 | 311208 | 335669 |

| Italy | 144169 | 167509 | 169910 | 156982 | 138232 | 161161 | 193455 | 165854 | 151423 | 150732 | 163781 |

| Netherlands | 71889 | 67436 | 52450 | 58654 | 51267 | 51142 | 48603 | 37399 | 77358 | 80465 | 86997 |

| Spain | 91805 | 85507 | 76388 | 86378 | 72880 | 77177 | 76604 | 65514 | 73655 | 74242 | 78578 |

| Sweden | 31435 | 25465 | 25624 | 28062 | 24669 | 27203 | 49890 | 40254 | 39107 | 44382 | 49044 |

| Ireland | 87328 | 46847 | 45313 | 44591 | 45586 | 45314 | 52557 | 48802 | 54182 | 49821 | 48129 |

| Denmark | 32505 | .. | .. | 33844 | 32745 | ... | 37098 | 31997 | 33498 | 37549 | 40976 |

| Belgium | 42982 | 39735 | 39209 | 40872 | 41936 | 37521 | 38345 | 30746 | 30432 | 30839 | 33703 |

| Luxembourg | 15952 | 23156 | 27464 | 19176 | 25168 | 24705 | 28945 | 21278 | 20289 | 24314 | 24539 |

| Austria | 26438 | .. | .. | .. | .. | 25084 | 25102 | 21091 | 20647 | 20485 | 21880 |

| Poland | 24641 | 16475 | 17963 | 19289 | 19231 | 18307 | 17412 | 14539 | 14213 | 16495 | 17211 |

| Portugal | 22605 | 19806 | 21066 | 15642 | 13559 | 17003 | 18667 | 13945 | 12079 | 12941 | 14868 |

| Czech Republic | 8191 | 7562 | 8167 | 8764 | 7846 | 7998 | 7608 | 6173 | 6002 | 6402 | 7052 |

| Finland | 9123 | 9508 | 11626 | 10133 | 9352 | 13061 | 14125 | 11917 | 10012 | 10084 | 5156 |

| Slovak Republic | 3009 | 2899 | 2816 | 2998 | 2772 | 2959 | 2986 | 2400 | .. | 5047 | .. |

| Greece | 7811 | 7244 | 6954 | 6893 | 5781 | 5407 | 5056 | 3964 | 3908 | 4213 | 4485 |

| Hungary | 5145 | 4081 | 4053 | 4054 | 3377 | 3582 | 3584 | 2991 | 3146 | 3484 | 3767 |

| Slovenia | 2864 | 3033 | 2888 | 3039 | 2816 | 2808 | 2783 | 2386 | 2416 | 2596 | 2863 |

| Estonia | .. | 344 | 566 | 561 | 617 | 774 | 839 | 764 | 815 | 924 | 1092 |

| Lithuania | .. | .. | 596 | 686 | 665 | 753 | 798 | 716 | 786 | 895 | 1037 |

| Latvia | .. | 514 | 434 | 555 | 574 | 626 | 687 | 589 | 589 | 730 | 893 |

In 2018, about 7,000 insurance companies operated in the European market, including 528 national companies in Germany, 402 national companies in the United Kingdom, 1,445 foreign companies and 264 national companies in France.

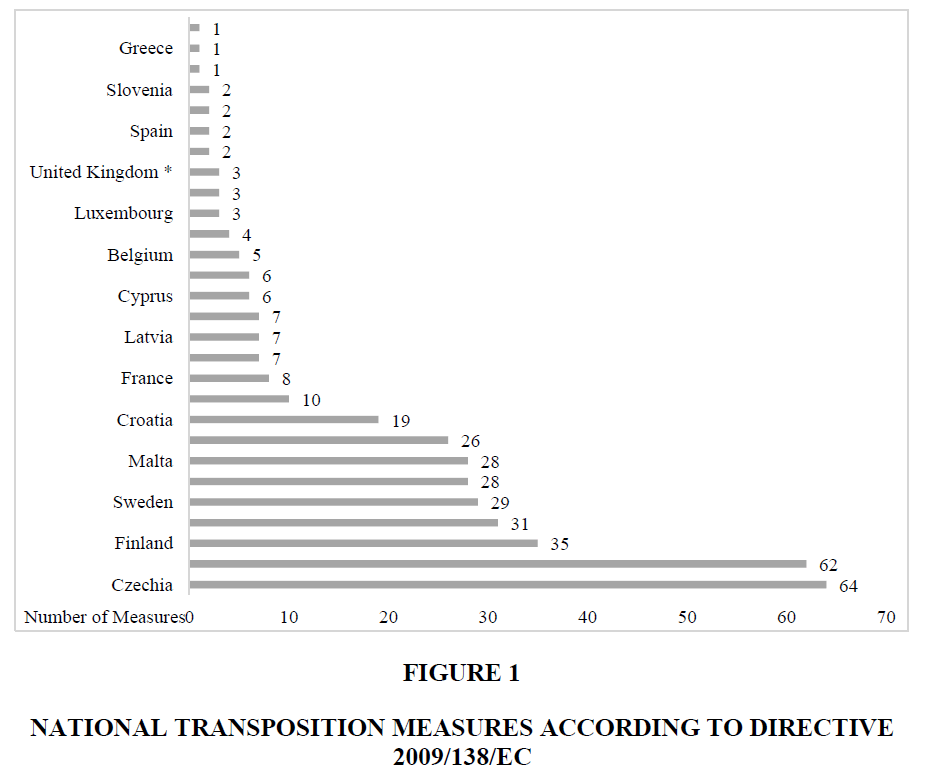

Following the adoption of Directive 2009/138/EU Solvency II, EU Member States were required to develop and implement national measures to transpose the requirements of the Directive, which entered into force on 1 January 2016. According to EUR-Lex (2020), the number of regulatory measures required to bring national legislation in line with the Directive was greater in EU countries where the insurance market was less developed (Figure 1).

Most countries with a high level of insurance market development have implemented a small number of legislative documents at the national level, as their market is generally in line with EU requirements. For example, in Germany in 2015 was adopted the single normative document “Law on Modernization of Financial Supervision on Insurance”; in Italy was adopted the “Implementation of Directive 2009/138/EU on the taking-up and pursuit of the business of Insurance and Reinsurance” (Solvency II ), Spain - “Law 20/2015 of 14 July 2003 on the organization, supervision and solvency of insurance and reinsurers” and “Royal Decree 1060/2015 of 20 November 2003 on the organization, supervision and solvency of insurance and reinsurers”. In fact, the introduction of the principles of the insurance market has ensured the unification of the activities of senior citizens,

Following the implementation of the Solvency II Directive, companies only carry out insurance activities after obtaining a permit from the country's supervisory authority, but such a permit is valid throughout the EU. EU insurance companies need to have equity in line with their risk profiles to ensure that they have sufficient financial resources to withstand financial difficulties. Companies also create an adequate and transparent management system with a clear division of responsibilities, publicly disclose information and have the administrative capacity to address various issues (insurance risk management, compliance with the law, internal audit). Insurance companies regularly conduct Own Risk and Solvency Assessment (ORSA), which assesses risk profiles and their compliance with financial resources.

The IDD Directive was adopted in order to increase the level of consumer protection and ensure a level playing field for insurance business, which has already been applied to the banking, investment and insurance sectors. To implement the Directive, EU member states had to make appropriate changes to national legislation by 2018. At the same time, the existing regulatory regime of each country has led to differences in approaches to the transposition of IDD requirements by national authorities (Table 3).

| Table 3 IDD Transposition and Expected Challenges and Impacts from a Number of EU Countries | |||||||||

| United Kingdom | Belgium | France | Spain | Netherlands | Ireland | Italy | Denmark | Czech Republic | |

| Needs analysis | Less strict | More strict | Similar | Less strict | Similar | Similar | Less strict | Similar | Less strict |

| Suitability and appropriateness regime (IBIPs) | Less strict | Similar | More strict | None | None | Similar | Less strict | Less strict | Less strict |

| Inducements | More strict | More strict | None | Less strict | More strict | Similar | None | Less strict | Less strict |

| Conflicts of interest | Less strict | More strict | None | Less strict | Similar | Similar | Similar | Similar | Similar |

| Professionalism requirements | Less strict | Less strict | Less strict | More strict | Similar | Similar | Similar | Less strict | Less strict |

| Information to clients | Less strict | More strict | Less strict | Less strict | Similar | Similar | Similar | Similar | Similar |

| Product governance | Similar | Less strict | None | None | Less strict | Less strict | None | Similar | None |

| Comparison websites | Similar | None | Less strict | None | Less strict | Similar | None | Less strict | None |

The information in Table 3 shows the significant differences between different EU countries in the transition from the existing rules of insurance intermediation and market behavior. The diverse set of rules is the result of mixed national insurance market rules, as many countries (e.g. Belgium, Italy, the United Kingdom) have internal regulation of consumer protection, which further fragments the regulatory sphere. The IDD still leaves a lot of flexibility and allows Member States to impose stricter rules and requirements. For example, in the UK, the insurance market regulator has made it clear that, despite Brexit, insurance companies must continue to comply with their obligations and transpose legislation based on previous EU commitments and requirements.

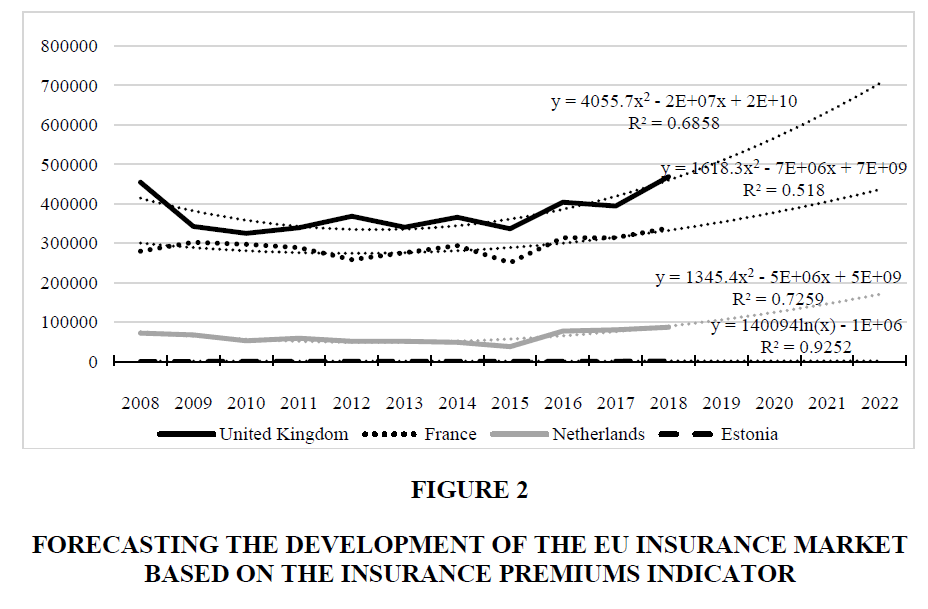

The implementation of the Solvency II and IDD Directives is aimed not only at unifying the rules on the activities of insurance companies, ensuring the professionalism of insurance intermediaries and improving consumer protection, but also at strengthening and further developing the domestic European insurance market. To assess the prospects for the development of the insurance market in the EU based on the indicator Insurance Premiums (Table 3) we use trend models of time (time) series. To forecast the development of the insurance market, countries with different indicators of insurance premiums were selected (Figure 2).

Figure 2 Forecasting the Development of the EU Insurance Market Based on the Insurance Premiums Indicator

Trend models that describe Insurance Premiums forecasting were selected based on the coefficient of determination. The R2 is closer to 1, the more accurately the proposed models describe economic processes. As you can see, according to the results of statistical analysis, the most accurate forecast of Insurance Premiums reflects the polynomial trend line, which confirms that the data characterizing the development of the insurance market in the EU fluctuate during the study period.

Discussion

After the financial crisis of 2007-2008, insurance in the EU reached a fundamentally new level, and the key drivers of development were the transnational aspect of business, varying degrees of influence of rules in different countries, the participation of different parties in insurance development (Marano, 2017). The EU Solvency II Insurance Market Regulation Directive has provided comparable macroeconomic stability for insurers. At the same time, companies are affected by the new conditions of the insurance market due to the need to comply with legal norms. Unification and concentration of the insurance market are prerequisites for significant systemic transformation. As noted by Trinh et al. (2016), the legal component is a key basis for the development of insurance in different countries. At the same time, it is proved that the level of development of the country and its insurance market determines the degree of influence of legal regulation on companies. The Directive (EU) 2016/97 ensures the achievement of an equal level of protection for all clients regardless of the level of reinsurance. This rule is in line with the Solvency II principle of equal protection of consumers of insurance products and final beneficiaries. Financial stability is the main goal of IDD's new requirements for market functioning, while Mariani (2017) proves the ineffectiveness of the Solvency II and IDD Directives in forming an integrated market. The Solvency II and IDD directives provide for the coherence of insurance markets, harmonization, strict risk management, strengthening the level of management in insurance companies (Rae et al., 2018). However, among the problems of the Directives are pro-cyclicality, market consistency in different countries (Rae et al., 2018), inconsistency with other regulations. Unification of insurance market requirements has led to different approaches by EU Member States to transpose the requirements of the Solvency II and IDD Directives, and the number of adopted laws and regulations has been higher in EU countries where the insurance market is less developed. This confirms the countries' use of a liberal approach in regulating the activities of insurers (Galetić & Loborčec, 2016). At the same time, the UK's exit from the EU did not mean a change in approaches to the functioning of the insurance market (Burling, 2017).

Conclusion

The study proves the need to regulate the EU insurance market as the world's largest market, and the effectiveness of the implementation of the new Solvency II and IDD Directives by EU member states. The legal framework in the solvency crisis will reduce the systemic risks of insurance companies, as a result, consumers of insurance services will receive the prescribed insurance payments and equity of insurers, taking into account the risks will be at a sufficient level to make timely payments. The main disadvantages of the Solvency II and IDD Directives are the over-regulation and concentration of the insurance market, which, however, ensure financial stability through the supervision of insurers at the supranational level.

The EU insurance market is unevenly developed, despite the active implementation of general insurance requirements at EU level, as evidenced by the different number of regulations and the different nature of national regulatory measures to transpose the requirements of the Solvency II and IDD Directives. The main conclusion is that the implementation of the Solvency II and IDD Directives will have a positive impact on the activities of insurance companies and the EU insurance market as a whole, and the effect of the implementation of measures by EU member states will be long lasting. At the same time, regulatory gaps between the insurance markets of different EU countries cannot be resolved by regulatory measures alone, as disparities are related to economic, historical, social one and many other factors, the study of which has prospects for further research.

References

- Bølviken, E., & Guillen, M. (2017). Risk aggregation in Solvency II through recursive log-normals. Insurance: Mathematics and Economics, 73, 20-26.

- Burling, J. (2017). The Potential Effect of Brexit on Insurance Regulation in the UK. In: Insurance Regulation in the European Union pp. 79-106. Palgrave Macmillan, Cham.

- Deloitte (2018). Insurance Distribution Directive2018: a challenging year for the European insurance sector. Retrieved from https://www2.deloitte.com/lu/en/pages/insurance/articles/idd-challenge-european-insurance-sector.html

- Directive (2009). Directive 2009/138/EU of the European Parliament and of the Council of 25 November 2009 on the taking-up and pursuit of the business of Insurance and Reinsurance (Solvency II) (recast) (Text with EEA relevance). Available at: http://data.europa.eu/eli/dir/2009/138/2015-03-31

- Directive (2016). Directive 2016/97 of the European Parliament and of the Council of 20 January 2016 on insurance distribution (recast) (Text with EEA relevance). Retrieved from http://data.europa.eu/eli/dir/2016/97/oj

- Eling, M., & Jung, K. (2020). Risk aggregation in non-life insurance: Standard models vs. internal models. Insurance: Mathematics and Economics, 95, 183-198.

- EUR-Lex (2020). National transposition measures communicated by the Member States concerning: Directive 2009/138/EC of the European Parliament and of the Council of 25 November 2009 on the taking-up and pursuit of the business of Insurance and Reinsurance (Solvency II). Retrieved from https://eur-lex.europa.eu/legal-content/EN/NIM/?uri=CELEX:32009L0138

- Galetić, F., & Loborčec, M. (2016). Concentration And Market Power On The Life And Non-Life Insurance Market In The Republic Of Croatia. Economy & Business Journal, 10(1), 1-11.

- Insurance Europe (2020). Worldwide insurance premiums. Retrieved from https://www.insuranceeurope.eu/statistics/worldwide-insurance-premiums

- Köhne, T., & Brömmelmeyer, C. (2018). The New Insurance Distribution Regulation in the EU-A Critical Assessment from a Legal and Economic Perspective. The Geneva Papers on Risk and Insurance-Issues and Practice, 43(4), 704-739.

- Kulawik, J. (2018). Neoclassical Approach to Traditional Business Insurance–Introduction to the Theory of Agricultural Insurance. Problems of Agricultural Economics, 1(354), 39-55.

- Kunertová, T. (2017). Regulation of the EU insurance market. Impact of the lamfalussy structure on EU insurance acts. The Lawyer Quarterly, 7(2). 119-126.

- Manolache, A. E. D. (2019). Stress and scenario tests in the context of a Romanian non-life insurance company. Proceedings of the International Conference on Business Excellence, 13(1), 149-161.

- Marano, P. (2017). Sources and tools of the insurance regulation in the European Union. In: Marano P., Siri M. (eds). Insurance Regulation in the European Union. Palgrave Macmillan, Cham.

- Marano, P. (2019). Navigating InsurTech: The digital intermediaries of insurance products and customer protection in the EU. Maastricht Journal of European and Comparative Law, 26(2), 294-315.

- Mariani, M. P. (2017). From market fragmentation to market integration in the EU insurance industry: can EU regulation unify what is separate at birth?. Retrieved from https://iris.unibocconi.it/handle/11565/3995650#.X4SXiLJR2M8

- Mrówczyńska-Kamińska, A., & Standar, A. (2016). The role of business insurance in national economy in Poland. Journal of Agribusiness and Rural Development, 41(3), 337-344.

- OECD (2020). Insurance Statistics. Retrieved from https://stats.oecd.org/Index.aspx?DataSetCode=PT5#

- Peleckienė, V. (2018). Influence of Solvency II to development of insurance industry. Proceedings of XVIII International scientific conference pp. 95-98.

- Pradier, P. C., & Chneiweiss, A. (2017). The evolution of insurance regulation in the EU since 2005. In: Douady R., Goulet C., Pradier PC. (eds). Financial Regulation in the EU. Palgrave Macmillan, Cham.

- Pukała, R., Vnukova, N., & Achkasova, S. (2017). Identification of the priority instruments affecting regulations on the development of insurance in the framework of international requirements. Journal of Insurance, Financial Markets and Consumer Protection, 23(1), 28-40.

- Rae, R. A., Barrett, A., Brooks, D., Chotai, M. A., Pelkiewicz, A. J., & Wang, C. (2018). A review of Solvency II: Has it met its objectives?. British Actuarial Journal, 23, 1-72.

- Romanenko, Y. O., & Chaplay, I. V. (2016). Marketing communication system within public administration mechanisms. Actual Problems of Economics, 178(4), 69-78.

- Santomil, P. D., & González, L. O. (2020). Enterprise risk management and Solvency II: the system of governance and the Own Risk and Solvency Assessment. The Journal of Risk Finance, 21(4), 317-332.

- Schoenmaker, D. (2016). European insurance union and how to get there. International business, 55(60), 65.

- Shvets, V. Y., Rozdobudko, E. V., & Solomina, G. V. (2013). Aggregated methodology of multicriterion economic and ecological examination of the ecologically oriented investment projects. Naukovyi Visnyk Natsionalnoho Hirnychoho Universytetu, 3, 139-144.

- Statista (2020). Insurance industry in Europe – Statistics & Facts. Retrieved from https://www.statista.com/statistics/820920/insurance-total-gross-written-non-life-premiums-european-countries/

- Trinh, T., Nguyen, X., & Sgro, P. (2016). Determinants of non-life insurance expenditure in developed and developing countries: an empirical investigation. Applied Economics, 48(58), 5639-5653.

- Weber, S. (2018). Solvency II, or how to sweep the downside risk under the carpet. Insurance: Mathematics and economics, 82, 191-200.