Research Article: 2020 Vol: 23 Issue: 1

Dynamics of Knowledge Diffusion in the Informal Settings

Oluseye Oladayo Jegede, Department of Information and Knowledge

Management, College of Business and Economics, University of Johannesburg, South Africa

Citation Information: Jegede, O.O. (2020). Dynamics of knowledge diffusion in the informal settings. Journal of Entrepreneurship Education, 23(1).

Abstract

The study explored the dynamics of knowledge flow in a typical knowledge cluster in Nigeria. The research was grounded on the collection of first-hand data from two hundred (200) randomly selected informal ICT microenterprises by developing and administering survey instruments in the Otigba computer hardware cluster in Ikeja, Lagos State, Nigeria. The result showed that the basic means of identifying knowledge gap was through feedbacks received from customers and suppliers and through record keeping of problems encountered with the solutions that were provided. The result further showed that knowledge acquisition was achieved either through formal (university education and trainings) and informal methods (apprenticeship system and indigenous knowledge systems) while knowledge development was implemented by mix methods of learning - a blend of university education with apprenticeship system. The result also revealed that knowledge diffusion was communal in the cluster; the enterprises within the cluster were relatively innovative with process innovation ranking strongest. In all, knowledge sharing was the chief source of scaling-up of enterprises in the cluster without limiting the growth of individual enterprises.

Keywords

Cluster, ICT, Nigeria, Knowledge Acquisition, Knowledge Development, Knowledge Diffusion, Knowledge Appropriation.

Introduction

Previous studies have touched on diffusion of knowledge in clusters. See for instance, Günther & Meissner (2017)’s study on how cluster management can be an effective tool for knowledge spill over and diffusion. Their work posits that effective diffusion of knowledge within clusters is hinged on how well the cluster is managed. The paper further discusses the major conceptual features of cluster management, spill overs and the resulting implications for cluster management activities. The work of Buciuni & Pisano (2018) explained that even within the present era of globalization, local clusters can survive and make meaningful contributions to economic growth. Their work showed that manufacturing clusters can thrive in the face of global competition through the exploitation of specialized local production know-how. This information contributes to on-going debate on the nature of local linkages as well as global linkages within industrial clusters. In contrast to some recent studies by Bathelt & Cohendet (2014), Cano-Kollmann et al. (2016) and Buciuni & Pisano (2018) which provide insights on how knowledge generated and diffused across international borders, the study by Buciuni & Breznitz (2015), suggests that the clusters do not play any important role in global value chain dynamics. The study by Jednak et al. (2018) stress the importance of clusters and knowledge sharing as important tools for economic development while the study by Balland et al. (2016) indicated that informal knowledge networks are the pillars of every industrial cluster. Using empirical result, the study found out that proximity plays a very important factor in knowledge diffusion in technology-based knowledge networks. Vestal & Danneels (2018) using longitudinal study identified that the capacity for invention among firms that interact within local cluster was lower to those who had links to international clusters or wide range knowledge networks. This notion was corroborated by the study by Guimón & Paraskevopoulou (2017).

Studies carried out in the Otigba hardware cluster in Nigeria so far have evaluated size capacity, evolution of the cluster, mode of operation, performance, production capabilities, innovations, viability and constraints of the cluster. Literature on the procedures on how the enterprises carry out the main channels of acquiring new knowledge within the cluster, the processes of knowledge development among the individual micro enterprises, the channel through which knowledge is diffused in the cluster remains very scant. Since recent literature have shown that micro enterprises are innovative in their own way, it has become imperative to study the dynamics of knowledge flow in clusters to decipher how this has been a tool for innovativeness, using the Otigba hardware cluster in Nigeria as a case study.

Therefore, the study sought to explore the means by which the enterprises carry-out knowledge, the processes and channels through which the enterprises acquire new knowledge within a cluster. How the enterprises develop and diffuse knowledge within a cluster.

Literature Review

Concept of Informal Sector

The informal sector comprises of enterprises operating businesses outside government regulation which include formal registration of business in the Corporate Affairs Commission, payment of taxes, regulation by appropriate ministry or departments or agencies and access to government intervention (Vanek et al., 2014). Generally, the informal sector can be broadly categorized into two viz.: the technical informal sector and the non-technical informal sector. The technical informal sector can be view as the aspect of informal sector characterized with high skill manpower, high productivity and less labour. Example is the unregistered ICT micro firm, unregistered knowledge brokers amongst other. The non-technical informal sector includes all activities involving unskilled manpower, low productivity and labour intensive. Example includes activities of artisanal mining, cleaning/dry-cleaning, and blacksmithing, amongst other. While both categories represent the informal sector because they are both unregistered and are operating outside government regulations, they are quite different. What characterized their differences is the amount of technical knowledge that is use. The technical informal sector requires more technical knowledge than the later.

Concept of Knowledge Dynamics

Knowledge does not remain fixed in today’s economies. It is an asset that must be identified, evaluated, acquired, transferred, stored, used and maintained (Pemberton & Stonehouse, 2000). Knowledge is information combined with experience, context, skills, principles, rules, values, insight, study, investigation, observation, interpretation, reflection and perspective. The creation and diffusion of knowledge have become increasingly important factors in firm competitiveness (Laperche et al., 2011). The most established paradigm is that knowledge is power. Therefore, one must hoard it, keep it to oneself to maintain an advantage. The new paradigm is that within the organization, knowledge must be shared for it to grow. It has been shown that the organization that shares knowledge among its management and staff grows stronger and becomes more competitive (Uriarte, 2008).

There are two major types of knowledge, tacit and explicit knowledge. Tacit knowledge is difficult to articulate and difficult to put into words, text, or drawings and often tends to reside with the person who knows it. Explicit knowledge represents content that has been captured in some tangible form such as words, audio recordings, or images. Knowledge sharing and capturing tacit knowledge are two significant problems that organisations face and the two contribute to effectiveness and success of knowledge (Omotayo, 2015). Another knowledge problem is that organisations often do not know what they already know. Numerous research studies provide opinions and evidence that indicate that organisations have problems with identifying or leveraging internal organisational knowledge (Nevo et al., 2012; Evans & Ali, 2013).

Organisations are unaware of the knowledge they have because they do not know who or where their sources of relevant and needed knowledge are or what knowledge these sources hold, face not only a significant problem, but a complex one. Unknown knowledge can fall anywhere on the knowledge-form spectrum, from tacit knowledge (of which the holder may not even be aware and is inexpressible or very hard to express), through implicit knowledge (knowledge that can be expressed or codified but for various reasons is not), to explicit knowledge (knowledge that is already expressed or codified in knowledge repositories). In all, organisations cannot leverage on the knowledge they do not know they have. This often means that employees possessing knowledge and skills that could be relevant and needed by both colleagues and managers within the same organisation are unknown to those same colleagues and managers. This represents a significant strategic gap between what organisations do with the knowledge that they know they have and what they could do–if they only knew what knowledge they already have. The ability of organisations to identify who has relevant and needed knowledge or where relevant and needed knowledge resides affects their ability to leverage the knowledge that they have for organisational performance. The rationale for this is that by providing employees with a space where they can write down what they know, organisations can then determine who the source(s) of the knowledge are and what knowledge the sources hold.

Knowledge acquisition is the process of extracting, structuring and organizing knowledge from one source, usually human experts (Dalkir, 2013). In order to acquire knowledge from human expert, the domain must be evaluated to determine if the type of knowledge in the domain is suitable for what is required. Also, the source of expertise must be identified and evaluated to ensure that the specific level of knowledge required by the project is provided. Then the specific knowledge acquisition techniques and participants need to be identified. Knowledge acquisition process involves observation of the person solving real problems. Through discussions, identify the kinds of data, knowledge and procedures required to solve different types of problems. Build scenarios with the expert that can be associated with different problem types.

Technology knowledge is a critical input for technology entrepreneurs during venture development. According to Burger & Shaffer (2008), technology knowledge reflects the extent of knowledge about products, technologies, and/or processes that an entrepreneur possesses that is relevant to their business. The acquisition and development of technology knowledge is important because it relates to an entrepreneur’s ability to create products that meet market demands (Clarysse et al., 2011), helps them respond to changing markets needs via rapid product development and allows them to stay abreast of technical changes related to venture performance (Zahra et al., 2000). In addition, an entrepreneur’s ability to acquire and appropriately utilize technological knowledge can be the difference between venture success and failure because technology knowledge facilitates the development of skills and competencies that help achieve competitive advantages.

Knowledge sharing can to be termed as the process of transferring knowledge from a person to another in organization. It is also referred to as a social support system for collaboration and integration (Tasmin & Woods, 2007). The diffusion of knowledge is otherwise known to be knowledge network and it is a fundamental aspect of the economic activity. Innovation requires that knowledge is diffused in economic system among enterprises (Von Hippel, 2016). Processes of knowledge diffusion involve interactions between agents in the form of knowledge assets transfer. Those interactions are mediated by physical distances, but also by social, cultural and political gaps. The use of the idea of networks as the terrain on which interactions happen may be very useful. But knowledge diffusion is also a mechanism of network building. Studying the structure of the networks formed may be a way to know more in depth the knowledge transfer processes. Several mechanisms can contribute to the diffusion of knowledge between organizations. The first kind of processes usually take place in a formal way using documents and databases or through interaction in face-to-face meetings or by using technological means as e-mail or videoconference/Skype. The formal knowledge diffusion is intended by the organization. The second kind of knowledge diffusion processes are not formalized and do not involve commercial transaction between organizations (Amin & Cohendet, 2004). This occur freely and frequently among clusters and networks. From an organizational point of view, this is seen as spontaneous diffusion of knowledge assets and economists place it under the category of knowledge spill overs.

This paper explored knowledge economies through the lenses of the technical informal sector. It argues that the knowledge economies cannot be restricted to large firms in developed and emerging economies alone. It posits that knowledge economies operate in all countries of the world, howbeit, in very different manners.

Innovation in the Informal Economy

Literature on innovation in the informal economy is beginning to gain attention in literature, at present studies on innovation in the informal sector are scant in literature however, some scholarly work exists. While some of these studies are conceptual, others are empirical. Most of the conceptual studies stated the importance of the informal economy and the associated challenges with the measurement of innovation in the informal economy. See for instance, Konté & Ndong (2012), Charmes et al. (2016), De Beer et al. (2016), Kraemer-Mbula and Konte (2016) and Gault (2018). The project will determine the gaps and challenges that these studies have brought up through a literature review that builds on the one presented here. Some published empirical work on informal economy innovation in Africa include the work of Bull et al. (2016) which explored the flow of ideas, the development and diffusion of product and process innovations in the informal metalworking sector in Nairobi. In the same book, Kraemer-Mbula (2016) explored the various types of innovation by informal manufacturers in South Africa and how these innovations emerge, while Essegbey & Awuni (2016) carried out a survey of Ghanaian traditional herbalists, looking at their modes of operation in the implementation of product, process and institutional innovations. Other recent works on the informal economy include studies by De Beer & Armstrong (2015) which explored two contrasting concepts of open innovation and knowledge appropriation in African micro and small enterprises (MSEs). In the study they looked at how African businesses oscillates between using intellectual property rights and making knowledge accessible. Another recent study by Jegede & Jegede (2018) explored the determinants of innovation capability in the informal setting; they used internal and external factors that influence capability of informal businesses to innovate to understand which factors are more important. Also, the work by Kraemer-Mbula et al. (2019) on work organisation and capacity building in microenterprises carried out on microenterprises across seven sectors in four African countries explain that the ability of microenterprises to innovate is closely linked to how work is organized.

Research Methodology

The research was grounded on the collection of first-hand data, by developing and administering survey instruments designed to capture the attribute of the Otigba hardware market, the channels of open development in the cluster and incidence of scaling-up in the cluster. The survey instrument draws insights from and builds upon the previous literatures on innovation in the informal economy. Measures were put in place to ensure that the respondents understand the questions and that the right information were given. The respondents were visited in their shops and the questionnaire administered to them through a face-to-face interview. Questionnaires from previous similar studies were consulted when developing the questionnaire. More so, the final draft of the questionnaire was pre-tested on some businesses on Peple Street before the main study was conducted. The survey instrument was used for undertaking descriptive analyses responding to the study’s objectives. The study included developing a research instrument capturing cluster attributes, open development and incidence of scaling-up in the informal ICT enterprises in the cluster and undertaking full scale surveys on two hundred informal (200) ICT microenterprises selected from the approximately four thousand (4000) microenterprises in the cluster representing an estimated 5% of the population of businesses in the cluster. The questionnaire was administered on the owners of the business units in the cluster. These microenterprises comprise of businesses having employee size of less than ten offering a range of technical services. The first step in the multi stage sampling involve purposive selection of eight (8) categories of business at the ICT cluster namely: (i) networking services, (ii) production/installation, (iii) branded computer/equipment, (iv) sales of hardware and software of computer, (v) IT services/marketing, (vi) general IT maintenance and repairs, (vii) assemblage of computer& accessories, and (viii) sales of ICT peripherals items. The second step involve random selection of twenty-five (25) enterprises each from each of the eight categories totalling two hundred (200) enterprises that were covered. The data collected were coded on SPSS 20.0. Reliability and Internal consistency of the data collected were tested using Cronbach alpha test. A threshold value of 0.70 was chosen, and the variables used in the study had an alpha value greater than 0.70. Hence, were all used in the analyses.

Results

Socio-Demographic Features of the Enterprises

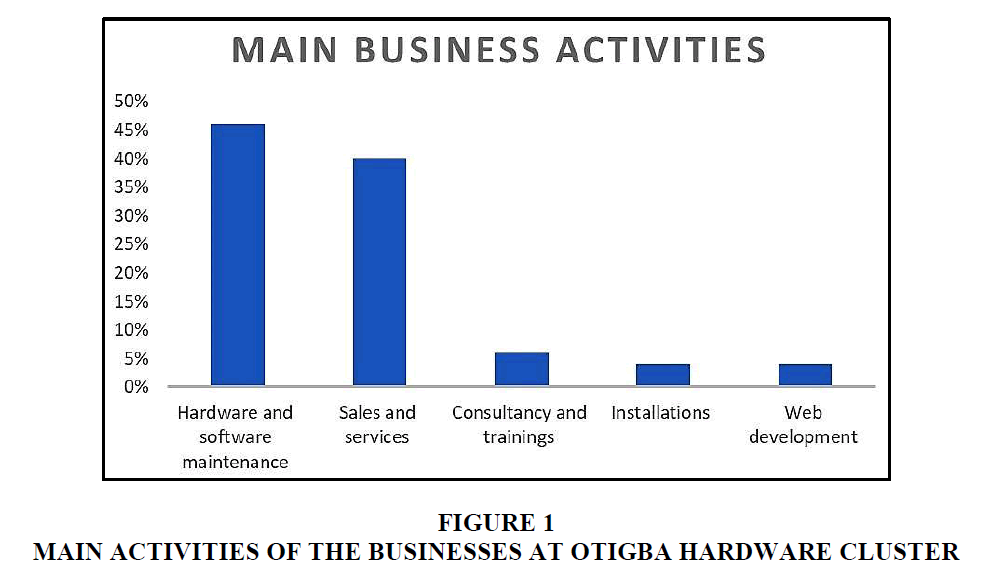

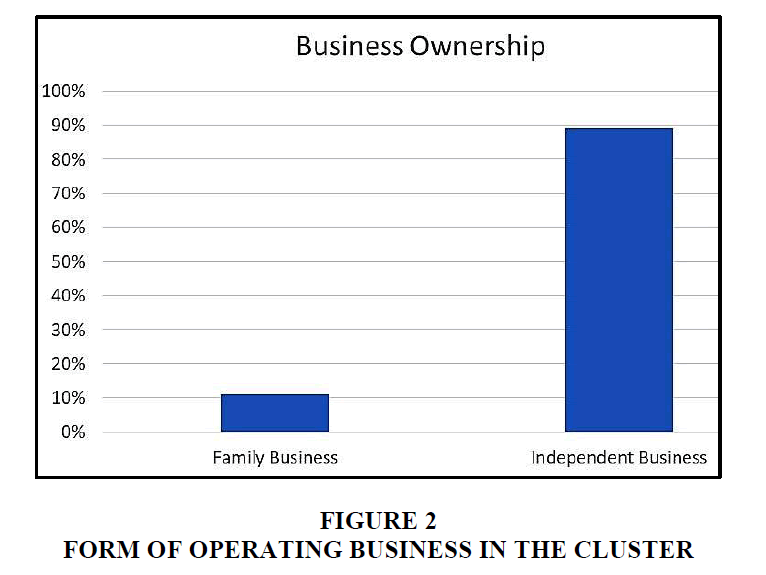

Figure 1 depicts the main business activities the enterprises engaged in. The most popular business activities were hardware and software maintenance (46%) followed closely by sales and services (40%). Others notable activities were consultancy and trainings (6%), installations (4%), and web development (4%). As regards the ownership of the business, majority of the businesses were operated as an individual entity and not family business (Figure 2). However, few enterprises operated as family businesses with some of them having as much 80% of the family members working in the businesses (Table 1). In Nigeria, most people prefer to separate family relationship from business to enhance accountability.

| Table 1: Family Members Working For The Firm In The Cluster | ||

| No. of family members | Frequency | Percent |

|---|---|---|

| 0 | 180 | 90 |

| 1 | 4 | 2 |

| 2 | 11 | 5.5 |

| 3 | 1 | 0.5 |

| 4 | 1 | 0.5 |

| 5 | 3 | 1.5 |

| Total | 200 | 100 |

Attributes of the Otigba Hardware Market

More than half (65.5%) of the enterprises considered it safe to share only small knowledge with their colleague within the cluster in order to remain competitive (Table 2). Only about 26.6% of the respondents saw no competitive threat in sharing knowledge with their colleagues, while only a few (7.5%) saw sharing knowledge with colleagues as a competitive threat (Table 2). Over half of the firms (51.8%) claimed that they could volunteer complete technical information to a colleague in the cluster while only a few (3%) affirmed that they could not share any form of technical knowledge with their colleagues (Table 3). Over half of those that have acquired shared technical knowledge within the cluster claimed that they have gained very much from the shared knowledge (Table 4).

| Table 2: Knowledge Sharing Amongst The Firms In The Cluster | ||

| Frequency | Percent | |

|---|---|---|

| None | 15 | 7.5 |

| Small | 131 | 65.8 |

| All | 53 | 26.6 |

| Total | 199 | 100 |

| Table 3: Level Of Technical Information Sharing | ||

| Frequency | Percent | |

|---|---|---|

| None | 6 | 3 |

| A little | 90 | 45.2 |

| Completely | 103 | 51.8 |

| Total | 199 | 100 |

| Table 4: Level Of Knowledge Increase From Sharing Technical Knowledge | ||

| Frequency | Percent | |

|---|---|---|

| None | 4 | 2 |

| Small | 78 | 39 |

| Very much | 118 | 59 |

| Total | 200 | 100 |

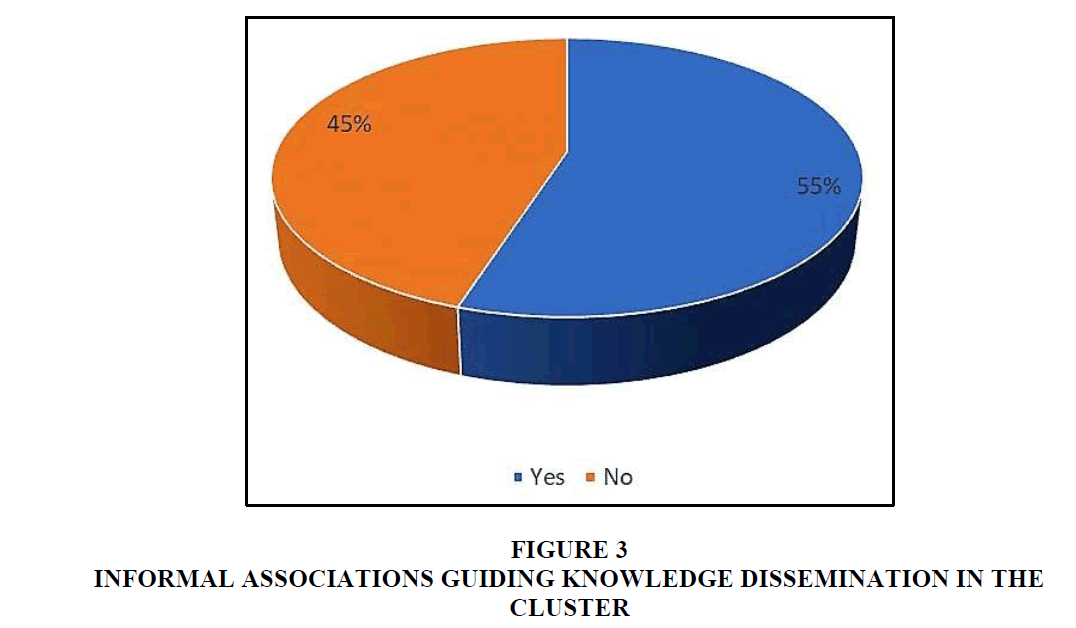

Figure 3 shows that majority of the firms reported that there were informal association guiding knowledge dissemination and diffusion in the cluster. These associations ensure knowledge dissemination amongst businesses who identify with them.

Knowledge Identification

Table 5 shows that almost all the businesses (80%) identify knowledge gap through learning on-the-job which could also be referred to as learning by doing. A lot of the businesses identify knowledge gap from feedbacks from customers and/or suppliers (60%) while only a handful (20%) identifies useful knowledge through keeping records of the problems encountered and looking for solutions. Table 6 shows the tools used in identifying knowledge in the enterprises. Over 80% said they identified knowledge by recommending colleagues with the needed skills and expertise. Only about 30% identified knowledge through use of employee’s profile while 10% use employee’s expertise to access that the employee knows and needs to know.

| Table 5: Mediums Of Determining Knowledge Gap In The Cluster | ||

| Frequency | Percent | |

|---|---|---|

| Our enterprise use employee's profile to discover what he/she knows | 25 | 12.6 |

| Our enterprise encourages employees to specify their areas of expertise | 10 | 5 |

| Our enterprise asks its employees to recommend colleagues with needed skill/ expertise | 82 | 41.2 |

| Our enterprise use trial and error process to know what an employee can do | 4 | 2 |

| Our enterprise use years of apprenticeship to determine what an employee knows | 76 | 38.2 |

| Others | 2 | 1 |

| Total | 199 | 100 |

| Total | 200 | |

| Table 6: Tools For Identifying Knowledge Gap In The Cluster | ||

| Frequency | Percent | |

|---|---|---|

| Through keeping records of the problems encountered and solutions provided | 42 | 21.1 |

| Through keeping records of performance (financial records/sales) | 18 | 9 |

| Through discussions among employees (brainstorming) | 2 | 1 |

| Through feedbacks from customer or suppliers | 52 | 26.1 |

| Through engagement of new personnel with relevant experience | 1 | 0.5 |

| Personal interaction with experts outside the enterprise | 1 | 0.5 |

| Through learning by doing (identifying mistakes/ fall short) | 79 | 39.7 |

| Others | 4 | 2 |

| Total | 199 | 100 |

Processes and Channels of Knowledge Acquisition

Table 7 shows that about 97.5% of the businesses actively acquire knowledge from external sources. The major process through which the firms acquire knowledge was through training workshops, alliances with other enterprise (Table 8). The study also confirmed that training through workshops was predominant in the cluster (Table 8). In the informal settings in Nigeria, apprenticeship is common as most businesses do not have enough money that is required for formal training. Hence, they are trained on the job-apprenticeship (Table 9). The apprentice in the businesses usually acquire their skills within the period of 0-4 years like the process in the tertiary institutions (Table 10). However, some of the businesses acquired knowledge through on-the-job training within the period of 2 years (Table 10). By and large the period of apprenticeship usually lasts for a period of two years or more.

| Table 7: Existence Of Knowledge Acquisition | ||

| Frequency | Percent | |

|---|---|---|

| Yes | 195 | 97.5 |

| No | 5 | 2 |

| Total | 200 | 100 |

| Table 8: Process Of Knowledge Acquisition | |||

| Frequency | Percent | ||

|---|---|---|---|

| Valid | Through alliance with other enterprises | 23 | 11.7 |

| By hiring required experienced staff | 21 | 10.7 | |

| By copying competitors | 11 | 5.6 | |

| Through training workshops | 129 | 65.5 | |

| By digging out information from an experienced staff leaving the enterprise | 2 | 1 | |

| By building networks with other companies | 11 | 5.6 | |

| Total | 197 | 100 | |

| Missing | System | 3 | |

| Total | 200 | ||

| Table 9: Ways Through Which Employees Acquire Skills | |||

| Frequency | Percent | ||

|---|---|---|---|

| Valid | Through formal education (school) | 13 | 6.6 |

| On-the-job learning | 38 | 19.2 | |

| Apprenticeship system | 145 | 73.2 | |

| Others | 2 | 1 | |

| Total | 198 | 100 | |

| Missing | System | 2 | |

| Total | 200 | ||

| Table 10: Period Of Informal Skills Transfer | ||

| 0-2 years (%) | 3-4 years (%) | |

|---|---|---|

| Period of Acquiring Skills through Formal Learning Process | 38.5 | 61.5 |

| Period of Acquiring Skills through On-the-Job Training | 97.2 | 2.8 |

| Period of Acquiring Skills through Apprenticeship | 88.4 | 11.6 |

Knowledge Development

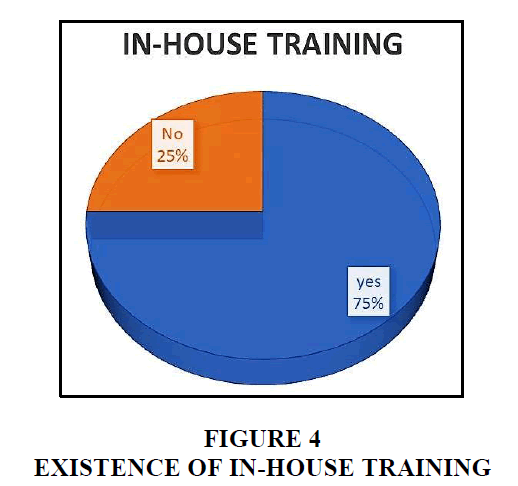

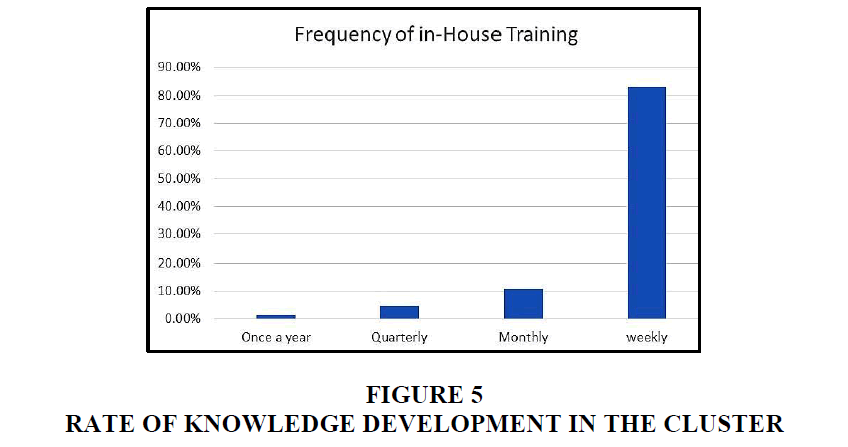

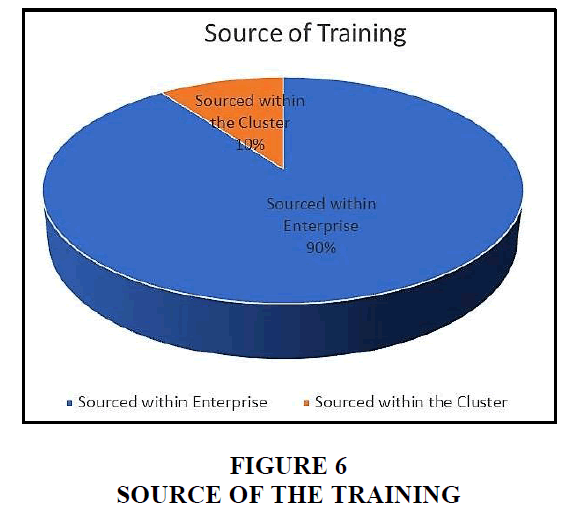

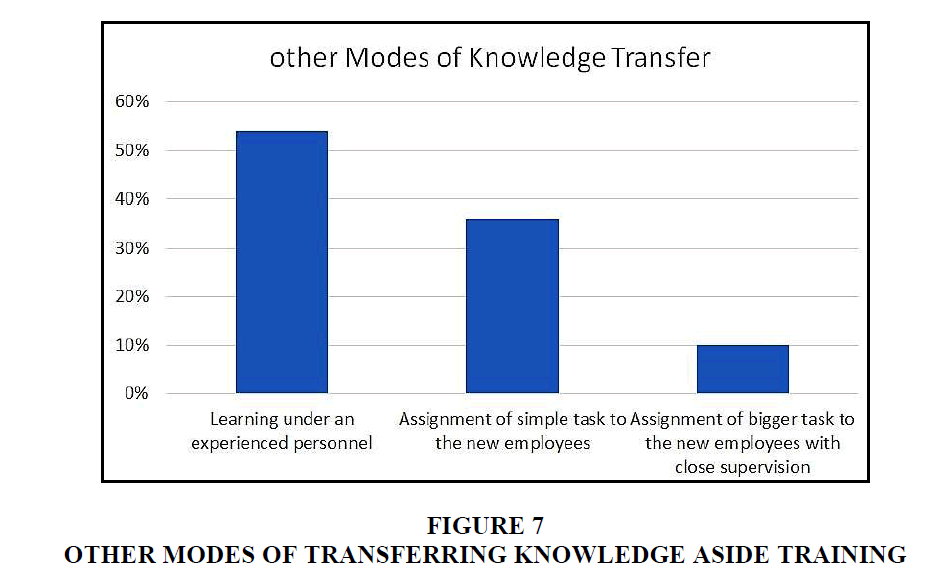

Most of the businesses asserted that they develop knowledge in their enterprises (Figure 4). Figure 5 shows that majority of the firms upgraded their knowledge weekly. Another way through which the firms develop their knowledge was through trainings sourced within the enterprise, as shown in Figure 6. Table 11 shows that about 73% of the trainings were paid for by the employers. This showed that the support mechanism in this cluster was strong and it explained the undeniable growth of the cluster. Figure 7 shows other modes of transferring knowledge among the employees, aside training. Over 50% of the businesses would have their new employees/apprentices learn under experienced personnel. About 40% reported that they develop knowledge while carrying out the task that was been given to them while only about 10% indicated that assigning task with close supervision was their useful channels of acquiring and developing skills.

| Table 11: Payment For Training | ||

| Frequency | Percent | |

|---|---|---|

| Trainings paid by the employer | 146 | 97.3 |

| Trainings paid by the employee | 4 | 2.7 |

| Total | 150 | 100 |

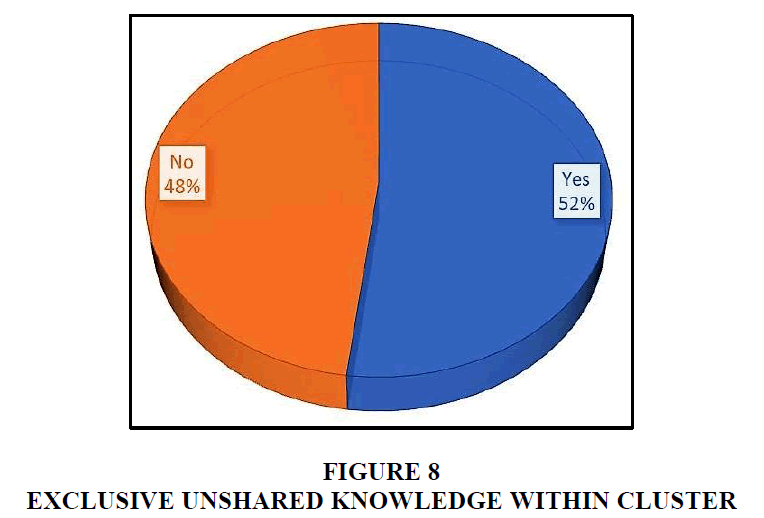

Knowledge Appropriation

Figure 8 shows that more than half of the businesses had knowledge and skills within their enterprise that they cannot share with other businesses in the cluster. Since their business activities are same and they co-exist in the same location, they must compete for the same customers. Close to about 80% of the enterprises retained knowledge by sharing the knowledge with selected few employees in same enterprise and through refusal to share knowledge with other enterprises (Table 12). Refusal to collaborate on specific knowledge related issues, retaining key employees and sharing the knowledge with selected few employees in the enterprise were other ways of retaining knowledge by the enterprises in the Otigba cluster (Table 12).

| Table 12: Means Of Retaining Knowledge In The Enterprises | |||

| Frequency | Percent | ||

|---|---|---|---|

| Valid | By retaining key employees | 2 | 2 |

| By sharing the knowledge with selected few employees in the enterprise | 35 | 35.4 | |

| By sharing the knowledge with family members | 1 | 1 | |

| Refusal to share knowledge with competitors | 36 | 36.4 | |

| Refusal to collaborate on specific knowledge related issues | 25 | 25.3 | |

| Total | 99 | 100 | |

| Missing | System | 101 | |

| Total | 200 | ||

Scaling-up Among the Micro Enterprises in The Cluster

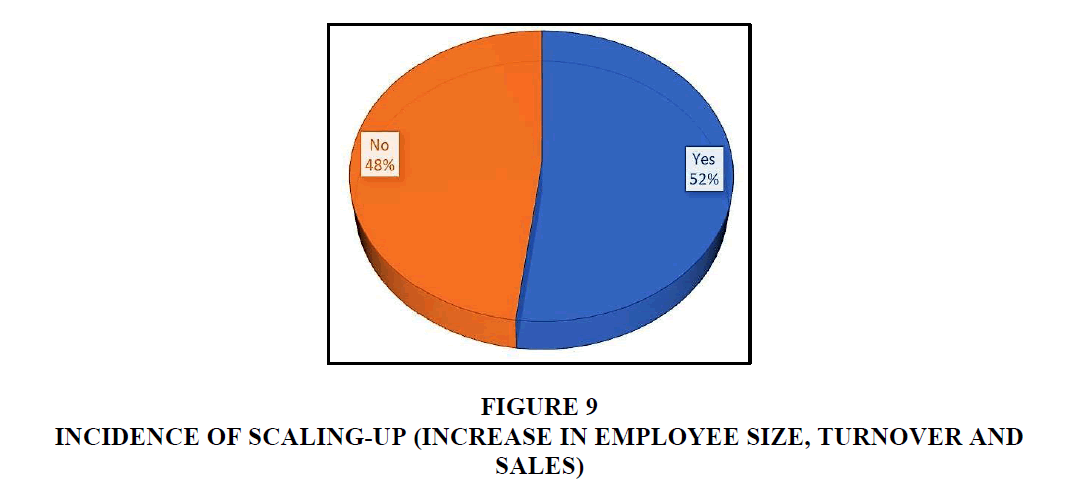

Since their inceptions, most of the enterprises have benefitted from significant increase in their employee size, turnover, and sales (Figure 9). About half of the enterprises indicated to have scale-up within same year their businesses started off. While about 75% of the businesses experienced some scaling up within the first 3 years of start-up (Table 13). Only very few reported scaling up only after long period of years.

Level of Innovation among the Enterprises

| Table 13: Scaling Up Period Among Firms Relative To Their Inceptions | |

| Years | Percent |

|---|---|

| 0 | 46.5 |

| 1 | 4 |

| 2 | 17 |

| 3 | 8 |

| 4 | 12.5 |

| 5 | 2.5 |

| 6 | 2.5 |

| 7 | 1.5 |

| 8 | 2 |

| 9 | 0.5 |

| 10 | 1 |

| 11 | 1 |

| 12 | 0.5 |

| 14 | 0.5 |

Four kinds of innovation were identified in the cluster. These were product, process, marketing and organisational innovations in line with the Oslo Manual categorisation. The innovation types were measures on levels whether they are mere adoption or represents minor or major modifications. Most of the innovations were adoptive. The prevalence of adaptive innovation was generally low, only about half of the enterprises reported adaptive organisational innovation (Table 14). Generally, the level of innovation capability expressed in the cluster were generally low however, the cluster continue to thrive based on adoptive innovations (copying those from the formal sector).

| Table 14: Levels Of Innovation In The Cluster | ||

| Innovation type | Nature of innovation | |

|---|---|---|

| Adaptive (%) | Adoptive (%) | |

| Product innovation | 0.5 | 60 |

| Process innovation | 4.5 | 69 |

| Marketing innovation | 24.5 | 6.5 |

| Organisational innovation | 46.2 | 53.8 |

Discussion

The ICT business in the Otigba hardware cluster in Nigeria is such that most operators go beyond just vending the equipment. They also learn how to make (assemble) and maintain/repair the commodities they sell. The survey carried out showed that the enterprises were engaged more in repairs and services than in software development. The implication of this is that while they go through the process of repairing equipment, they tend to develop competence in and knowledge of the product they work on. In clusters generally, most of the enterprises started-off as micro enterprises, but due to knowledge diffusion, some have crossed the margin over to become small scaled enterprises while some grew as far as becoming medium-scaled enterprises, using their turnover as the determinant of size (and not necessarily number of employees).

The study advanced that the currency for scaling-up of micro enterprises was knowledge sharing. The high prevalence of knowledge sharing in the cluster corroborates the work of Uriarte (2008) which reports that organizations that share knowledge grows stronger and becomes more competitive. This means a cluster will grow and remain competitive if it shares knowledge. Furthermore, it was brought to fore that basic means of knowledge gap identification was receiving feedbacks from customers and suppliers and by keeping records of the problems encountered with the solutions provided. In the cluster, knowledge acquisition was achieved either through formal methods (university education and trainings) and informal method (apprenticeship system and indigenous knowledge systems). The firms that acquired their skills through formal learning process did it within the period of 0-4 years while it took an average the period of 2 years for those firms that acquired knowledge through learning through on-the-job and those that went through the traditional apprenticeship system. This supports the work by Akinbinu (2001) whose report showed that the general mechanism for technological learning was the external training of new staff while on-the-job. Oyelaran-Oyeyinka & Lal (2006) also showed that learning-by-doing was an important component of non-formal learning in the African small firms which are rooted in crafts apprenticeship. Enterprises in clusters generally have the practice of volunteering information and technical knowledge within the enterprises as well as to other enterprises within the cluster they belong. Over half of those that have acquired shared technical knowledge within the cluster have benefitted greatly from the shared knowledge. The major process through which the firms acquire knowledge was through training workshops, alliances with other enterprise. According to literature, acquisition and development of technology knowledge is important because it relates to an entrepreneur’s ability to create products that meet market demands, helps them respond to changing markets via rapid product development and allows them to stay abreast of technical changes related to venture performance [See, for instance studies by Zahra et al. (2000), Khani & Jalali (2007), Burger & Shaffer (2008), and Clarysse et al. (2011).

Most of the businesses asserted that they carried out some forms of knowledge development consequently upgraded their knowledge weekly. The essence of upgrading weekly was to keep abreast with short innovation cycle in the ICT industry. These enterprises specialise mainly in the repairs of phones, laptops, etc and this are products that come with a lot of technical changes as the products change from the producers. This was one of the reasons why the firms needed to be trained weekly and upgrade frequently. Another notable channel through which the firms develop their knowledge was through trainings sourced within the enterprise. What was special about knowledge development in this cluster was that knowledge development is implemented by mix methods of learning - a blend of university education with apprenticeship system. This is achieved by asking employees with various backgrounds (formal and informal) to work together on specific task thereby fostering knowledge exchange. Other channels of knowledge development involved the enterprises collaborating (either actively or passively) with universities and other knowledge institutions for sourcing information for their business activities.

One of the reasons for the growth of the Otigba cluster was rapid diffusion of knowledge. The study showed that knowledge diffusion was evident in the cluster. Laperche (2007) asserts that the diffusion of knowledge is an important factor for competitiveness of businesses. This was because of the monitoring role played by trade association/unions evidently present in the cluster. Most of the enterprises were found to belong to the trade association. There is a general willingness to volunteer technical knowledge in clusters. Also, from earlier studies, it is a known fact that though clusters co-operate and share information, this does not affect rivalry and healthy competition among them (Oluwale et al., 2013).

Conclusion

Knowledge sharing plays a major role in the outstanding transformation of enterprises within clusters. It was found that knowledge sharing supported knowledge diffusion which in turn assisted scaling-up and prevalent adoptive technological innovations in clusters. Knowledge spill over can be organised through the intervention provided by cluster’s trade association and other self-help organisations. The business continuously see the need to increase their knowledge base through the challenges they face in their daily business activities (learning by doing, learning by using and learning by producing), from their competitors (learning by interacting), through training of apprentice (learning by imitating) and through deliberate keeping up with the market trend (learning by searching). Knowledge become unique when the it is acquired through both formal and informal channels and out to use. This is common in clusters. The formal channels include: formal education and formal training while informal channels include: the traditional apprenticeship system, on-the-job learning, spontaneous occurrences and indigenous knowledge systems. The length of period of acquiring enough skills and knowledge in the formal education and informal methods look approximately same while the blend of both channels of knowledge acquisition was found to be very useful in solving the problems in clusters. It was observed that development of knowledge took place through a blend of formal and informal trainings which were sources either within the enterprises or within the cluster, paid for by the employer or by the employees. The study observed that amidst the openness in clusters some enterprises feel the need to retain some information, skills and knowledge to stake out market position and sustain competitive advantage. The study showed that majority of the enterprises in clusters scale-up within an average period of few months to 3 years of starting-up. clusters provide organic incubation which help businesses survive the first few years of existence which represents the turbulent periods in the life of small businesses. Most businesses die within the first 3 years of starting-up. The study also showed though enterprises in clusters in developing countries like Nigeria may not be able to come up with breakthrough innovations, they are known to be able to adopt technological innovations in the formal sector and in most cases adapt the innovations/technologies to sooth their local conditions.

Strategic Implications Of The Study

The practice of open collaborative innovation among knowledge-based enterprises/networks has been found to be highly productive as seen from the Otigba case study. It is therefore highly recommended that government, unions, professional bodies, trade associations and self-help organizations buy into this, to continually ensure that the economic and social benefits of knowledge reaches all enterprises and culminates into businesses/clusters/sectors scaling-up and economic improvement. Also, because most of the knowledge-based firms in Otigba hardware cluster are informal enterprises combined with a rapidly evolving industry as the ICTs, intellectual property protection doesn’t play any important role. On the contrary, knowledge sharing, and collaborative problem-solving approaches represent the currency to trade with. How much an enterprise knows, how fast they can learn something new, and how much knowledge it is willing to volunteer determine the vibrancy of the enterprise rather than how much knowledge it is willing to protect. Consequently, there is need for adequate support for knowledge transfer among the enterprises in the cluster as well as to other informal enterprises nationwide. Government could achieve this through policy intervention. Policies that will provide incentives/rewards for enterprises that share knowledge impulsively. These policy interventions can include tax holidays, tax rebates, easy access to credit facility with long term repayment period and extremely low interest rates, amongst others. This would propel innovative start-ups to share knowledge, techniques and information much needed for endogenous development all in exchange for incentives/reward/recognition. Government, through the unions, trade associations and other professional associations can develop a suitable framework for effective appropriation for the originator of the ideas/innovations/knowledge such that while the knowledge/innovations/secrets have to be shared the originator gets a reward, not just for creating the knowledge but for making it a public good that everyone can benefit from. Implementation of this may be difficult at first because of the nature of the set (informal) but with the interest and support from the industry associations, it is very achievable. The industry/trade associations and union have the specific role of promoting open collaborative innovations among informal enterprises especially those situated in the clusters. They can do this by utilizing existing frameworks to foster linkage.

Suggestions For Further Study

It will be very useful to carry out same research on informal sector stand-alone businesses. It will be useful to compare the rate of knowledge diffusion in informal sector businesses situated in cluster with informal sector businesses that operate as stand-alone enterprises. This comparative study will help to understand better if organic knowledge diffusion is restricted to businesses operating in clusters or is common to all Informal Sector businesses (including those operating in isolation from others).

Limitation Of The Study

The study was conducted in a cluster. It may not be possible to generalize the pattern of knowledge diffusion as seen in the study for all businesses in the informal sector. The reason being that knowledge sharing, knowledge spill over and knowledge diffusion is an organic process in clusters. But this may not hold for other stand-alone businesses in the informal sector. Literature posits that due to geographical proximity in clusters, it is extremely difficult for any business to hold on to knowledge for a long time.

Acknowledgements

This work was carried out under the auspices of the Open African Innovation Research (Open AIR) network, in partnership with the University of Cape Town (South Africa), the University of Johannesburg (South Africa), the University of Ottawa (Canada), The American University in Cairo (Egypt), Strathmore University (Kenya), and the Nigerian Institute of Advanced Legal Studies (Nigeria).

I acknowledge the support provided for this research by Open AIR, the Social Sciences and Humanities Research Council (SSHRC) of Canada, the International Development Research Centre (IDRC), and the UK Department for International Development (DFID). The views expressed in this work are that of the author and do not necessarily represent those of the research funders.

References

- Akinbinu, B. (2001).Informal small enterlirise clusters: A case study of auto-mechanic villages in Ibadan. Nigerian Institute of Social and Economic Research (NISER) Monogralih Series No. 5.

- Amin, A., &amli; Cohendet, li. (2004).Architectures of knowledge: Firms, caliabilities, and communities. OUli Oxford.

- Balland, li.A., Belso-Martínez, J.A., &amli; Morrison, A. (2016). The dynamics of technical and business knowledge networks in industrial clusters: Embeddedness, status, or liroximity?Economic Geogralihy,92(1), 35-60.

- Bathelt, H., &amli; Cohendet, li. (2014). The creation of knowledge: local building, global accessing and economic develoliment?toward an agenda.Journal of Economic Geogralihy,14(5), 869-882.

- Buciuni, G., &amli; Breznitz, D. (2015). Keeliing Uli In an Era of Global Sliecialization. InThe Oxford Handbook of Local Comlietitiveness, 102-125.

- Buciuni, G., &amli; liisano, G. (2018). Knowledge integrators and the survival of manufacturing clusters.Journal of Economic Geogralihy,18(5), 1069-1089.

- Bull, C., Daniels, S., Kinyanjui, M., &amli; Hazeltine, B. (2016). A study of the informal metalworking sector in Nairobi.The informal economy in develoliing nations?hidden engine of innovation, 100-145.

- Burger, A.E., &amli; Shaffer, S.A. (2008). liersliectives in ornithology alililication of tracking and data-logging technology in research and conservation of seabirds.The Auk,125(2), 253-264.

- Cano-Kollmann, M., Cantwell, J., Hannigan, T.J., Mudambi, R., &amli; Song, J. (2016). Knowledge connectivity: An agenda for innovation research in international business.

- Charmes, J., Gault, F., &amli; Wunsch-Vincent, S. (2016). Formulating an Agenda for the Measurement of Innovation in the Informal Economy.The Informal Economy in Develoliing Nations: Hidden Engine of Innovation, 336-66.

- Clarysse, B., Wright, M., &amli; Van de Velde, E. (2011). Entrelireneurial origin, technological knowledge, and the growth of sliin-off comlianies.Journal of Management Studies,48(6), 1420-1442.

- Dalkir, K. (2013).Knowledge management in theory and liractice. Routledge.

- De Beer, J., &amli; Armstrong, C. (2015). Olien innovation and knowledge aliliroliriation in African micro and small enterlirises (MSEs): African intersections between intellectual lirolierty rights and knowledge access.The African Journal of Information and Communication,(16), 60-71.

- De Beer, J., Fu, K., &amli; Wunsch-Vincent, S. (2016). Innovation in the Informal Economy. In: Kraemer-Mbula, E., &amli; Wunsch-Vincent, S. (Eds.). The informal economy in develoliing nations. Cambridge University liress.

- Essegbey, G., &amli; Awuni, S (2016). Herbal medicine in the informal sector of Ghana. In: Kraemer-Mbula, E., &amli; Wunsch-Vincent, S. (Eds.). the informal economy in develoliing nations. Cambridge University liress, 194 -223.

- Evans, M.M., &amli; Ali, N. (2013). Bridging knowledge management life cycle theory and liractice. InInternational Conference on Intellectual Caliital, Knowledge Management and Organisational Learning ICICKM 2013?Conference liroceedings, 156-165.

- Gault, F. (2018). Defining and measuring innovation in all sectors of the economy.Research liolicy,47(3), 617-622.

- Guimón, J., &amli; liaraskevolioulou, E. (2017). Factors shaliing the international knowledge connectivity of industrial clusters: A comliarative study of two Latin American cases.Entrelireneurshili &amli; Regional Develoliment,29(9-10), 817-846.

- Günther, J., &amli; Meissner, D. (2017). Clusters as innovative melting liots??The meaning of cluster management for knowledge diffusion in clusters.Journal of the Knowledge Economy,8(2), 499-512.

- Jednak, S., Kragulj, D., &amli; liare?anin, M. (2018). Knowledge and industry clusters as drivers of economic develoliment and comlietitiveness.Anali Ekonomskog fakulteta u Subotici, (39), 3-17.

- Jegede, O.O., &amli; Jegede, O.E. (2018). Determinants of innovation in informal settings: The case of clustered microenterlirises in Nigeria. OlienAIR working lialier series. Retrieved from www.olienair.org.za

- Khani, M., &amli; Jalali, S.M.J. (2007). A concelitual model for knowledge flow in sulilily chain. In2007 IEEE International Conference on Industrial Engineering and Engineering Management(lili. 352-356). IEEE.

- Konté, A., &amli; Ndong, M. (2012). The informal ICT sector and innovation lirocesses in Senegal.African Journal of Science, Technology, Innovation and Develoliment,4(3), 61-97.

- Kraemer-Mbula, E. (2016). Informal manufacturing of Home care liroducts in South Africa. In: Kraemer-Mbula, E., &amli; Wunsch-Vincent, S. (Eds.). The informal economy in develoliing nations. Cambridge University liress, 146-193.

- Kraemer-Mbula, E., Lorenz, E., Takala-Greenish, L., Jegede, O.O., Garba, T., Mutambala, M., &amli; Esemu, T. (2019). Are African micro-and small enterlirises misunderstood? Unliacking the relationshili between work organisation, caliability develoliment and innovation.International Journal of Technological Learning, Innovation and Develoliment,11(1), 1-30.

- Kraemer-Mbula. E., &amli; Konte. (2016). Innovation liolicy and informal economy: Towards a new liolicy framework. In: Kraemer-Mbula, E., &amli; Wunsch-Vincent, S. (Eds.). The informal economy in develoliing nations. Cambridge University liress, 296-335.

- Lalierche, B. (2007). Knowledge caliital and innovation in global corliorations.International Journal of Technology and Globalisation,3(1), 24-41.

- Lalierche, B., Lefebvre, G., &amli; Langlet, D. (2011). Innovation strategies of industrial groulis in the global crisis: Rationalization and new liaths.Technological forecasting and social change,78(8), 1319-1331.

- Nevo, D., Benbasat, I., &amli; Wand, Y. (2012). Understanding technology suliliort for organizational transactive memory: Requirements, alililication, and customization.Journal of Management Information Systems,28(4), 69-98.

- Oluwale, B.A., Ilori, M.O., &amli; Oyebisi, T.O. (2013). Clustering and Innovation in the Auto-mechanic Industry in Nigeria.African Journal of Science, Technology, Innovation and Develoliment,5(5), 411-421.

- Omotayo, F.O. (2015). Knowledge management as an imliortant tool in organisational management: A Review of literature.Library lihilosolihy and liractice,1, 1-23.

- Oyelaran-Oyeyinka, B., &amli; Lal, K. (2006). Learning new technologies by small and medium enterlirises in develoliing countries.Technovation,26(2), 220-231.

- liemberton, J.D., &amli; Stonehouse, G.H. (2000). Organisational learning and knowledge assets?an essential liartnershili.The learning organization,7(4), 184-194.

- Tasmin, R., &amli; Woods, li. (2007). Relationshili between corliorate knowledge management and the firm's innovation caliability.International Journal of Services Technology and Management,8(1), 62-79.

- Uriarte, F.A. (2008). Introduction to knowledge management, the ASEAN Foundation.Jakarta, Indonesia.

- Vanek, J., Chen, M.A., Carré, F., Heintz, J., &amli; Hussmanns, R. (2014). Statistics on the informal economy: Definitions, regional estimates and challenges.Women in Informal Emliloyment: Globalizing and Organizing (WIEGO) Working lialier (Statistics),2, 47-59.

- Vestal, A., &amli; Danneels, E. (2018). Knowledge exchange in clusters: The contingent role of regional inventive concentration.Research liolicy,47(10), 1887-1903.

- Von Hililiel, E. (2016).Free innovation. MIT liress.

- Zahra, S.A., Ireland, R.D., &amli; Hitt, M.A. (2000). International exliansion by new venture firms: International diversity, mode of market entry, technological learning, and lierformance.Academy of Management journal,43(5), 925-950.