Original Articles: 2018 Vol: 22 Issue: 2

Does Institutional Ownership Affect the Level of Online Financial Disclosure?

Abdalmuttaleb MA Musleh Al-Sartawi, Ahlia University

Keywords

Online Financial Disclosure, Institutional Ownership, GCC Countries.

Introduction

The Internet has diluted the conventional boundaries that once existed between companies and users of financial information. According to Jain & Kumar (2013), financial information can be disclosed efficiently and effectively through the Internet. Thus, through online financial disclosure (OFD) unrestricted information can be presented in real time, with high interaction capabilities, where investors can have unlimited access to a greater volume of data.

Nonetheless, shareholders are interested in investing in companies with strong corporate governance mechanisms that provide them with transparent as well as accurate information that would help them in making sound decisions (Lipunga, 2014). Good corporate governance enhances investors' confidence and helps firms to expand and attract local and foreign investments (Al-Sartawi et al., 2017; Abhayawansa & Johnson, 2007). OFD can be considered as an effective tool that could improve the level of information disclosure by companies, hence reducing asymmetrical information and agency-associated costs.

In addition to OFD, Al-Sartawi (2015) stated that corporate governance could be improved by giving investors a bigger role in monitoring management practices. Institutional owners are becoming the main forces shaping the new financial landscape and as blockholders they have the incentive to monitor companies they own, unlike individual investors. However, previous studies (Shleifer & Vishny, 1997; Bushee et al., 2014) argued that institutional ownership minimizes disclosure levels due to increased conservatism, while Chen et al. (2015) claimed that the higher levels of institutional ownership lead to less conservatism in financial reporting.

Generally, there is an understanding that the level of institutional ownership in any country depends on the level of regulation, which will guarantee a fair level of disclosure and the right of stakeholders (Chung & Zhang, 2011; Bushee et al., 2014). The Gulf Cooperation Council is considered as a hub for financial institutions, has become an intended destination for many foreign investors. As the GCC countries are calling for economic diversification, they strive to move beyond their oil-based economies by attracting investors and global businesses. They have recently introduced their own corporate governance codes to enhance the social and regulatory environments, hence attracting more investors by encouraging voluntary disclosure.

These investors ask for financial information and carry on certain decisions whether to continue with a certain company or not and this is provided through OFD.

A limited number of studies have undertaken the relationship between OFD and institutional ownership in the GCC countries, so it is interesting to test this relationship from such a perspective. Therefore, the research objectives can be summarized as research questions of:

1. What is the level of institutional ownership in the GCC Countries?

2. What is the relationship between the level of institutional ownership and the level of content dimension in the GCC companies?

3. What is the relationship between the level of institutional ownership and the level of presentation dimension in GCC companies?

4. What is the relationship between the level of institutional ownership and the level of OFD in GCC companies?

Accordingly, this study would be an important contribution in filling the gap in the current literature in the GCC region. Additionally, this research is significant for both the users and producers of financial information as it addresses the regulations in the GCC Countries and how it affects economic decisions.

Literature Review

In an asymmetrical disclosure situation, managers will hide information and seek their own interest and not the shareholders' interest. Fama & Jensen (1983) added that according to the agency theory, managers may have the incentive to take actions that benefit themselves yet are costly to shareholders. The recent financial crisis has raised many concerns over the effectiveness of financial reporting, accounting standards, corporate governance and accountability around the world (Kiel & Nicholson, 2003). Therefore, countries have started paying more attention to improving their regulations to boost the economy by attracting more investors and by encouraging the companies to keep a powerful internal control system and promoting accurate and timely disclosure of all material matters related to the performance (Ramadhan, 2014).

In addition, improving regulations would lead to increasing the level of disclosure to the interested users, thus, lowering the companies' capital cost, improving the marketability of shares and gain investors' confidence (Apostolos & Konstantinos, 2009). On the other hand, regulations and the corporate governance systems are known to be a crucial determinant for institutional investment (Bushee et al., 2014) since regulations will insure the transparency of disclosure (Juhmani, 2013). Furthermore, Bushee et al. (2014) added that institutional ownership prefer companies with better governance mechanisms because these mechanisms can reduce the risk of their undiversified investments Institutional ownership seek companies with high level of corporate governance and internal monitoring mechanisms because they believe that corporate governance can influence the transparency of disclosure and decrease costly monitoring activities (McCahery et al., 2016 and Chung & Zhang, 2011).

There are two theories regarding corporate governance and institutional ownership. The first theory states that institutions might directly monitor firms in which they invest in. Large shareholders have more incentive to be involved in direct monitoring activities. The second theory states that institutions would act as active traders who prefer liquidity more than concentrated ownership. Institutions would express their dissatisfaction with the management by liquidating their shares (Gillan et al., 2003).

According to previous studies, institutional ownership hold a large number of assets and are therefore thought to be capable of realizing the benefits of monitoring managers' activities. Shleifer & Vishny (1997) also agreed that large shareholders have more incentive to monitor the management; however, the gains realized by the investors from their direct monitoring efforts are shared with non-monitoring shareholders. In addition, Gillan et al. (2003) mentioned that institutional ownership might exert direct monitoring efforts over firms that they are investing in. However, monitoring efforts are costly and as a result, only large shareholders have the incentive to engage in directly monitoring the management. Likewise, Bushee et al. (2014) mentioned that institutional ownership hold large investment portfolios which might cause high monitoring costs.

Moreover, when investors hold a small stake of ownership, the monitoring cost increases, therefore, increasing the incentives to free ride the monitoring efforts (Al-Sartawi & Sanad, 2018 and Hartzell & Starks, 2003). In addition, Crane & Koch (2013) stated that if a single shareholder owns all the shares of the firm, this shareholder will accrue all of the benefits of the monitoring. But, if the ownership is dispersed, any individual shareholder has less incentive to monitor the management. Consequently, institutional ownership tends to prefer firms with internal monitoring mechanisms in order to substitute their costly monitoring activities (Bushee & Noe, 2000). Chen et al. (2015) further stated that companies that have more long-term institutional ownership tend to implement less conservative reporting policies. Therefore, timely presented financial information, through a tool such as OFD, will reduce costs related to agency, as well as defending the rights of investors and thus improving their confidence.

The rise of the Internet has resulted in the evolution in the way firms communicate with stakeholders. Many companies in developed and developing economies have websites dedicated to communicating financial information to investors (Yap & Saleh, 2011). OFD is advantageous as it allows companies to disseminate information to unidentifiable consumers, contrary to the paper-based financial reports (Agboola & Salawu, 2012). According to Khan & Ismail (2012), the internet has become one of the most popular sources of getting the information. Consequently, traditional financial reporting is becoming less effective when compared with OFD as electronic-based reporting removes the restrictions of paper based reports (Almilia, 2009). Online financial disclosure can therefore be defined as the use of the firms’ websites to disseminate information regarding their financial performance (Poon & Yu, 2012). OFD can also be defined as the public reporting of financial and operating data by a business enterprise by the related Internet-based communications medium (Hunter & Smith, 2010). Moreover, other authors explained OFD as the disclosure of the financial statements reporting through the use of technology such as multimedia and Web tools analysis (Lizzcharly et al., 2013).

Factors that influence online financial disclosure include profitability, firm size and leverage (Almilia, 2009). Other factors include such as capital adequacy ratio, leverage, return on assets, auditor type and industry (Basuony & Mohamed, 2014). Furthermore, a study by Elsayed et al. (2010) concluded that board size and ownership diffusion are positively associated with OFD, while institutional ownership is negatively associated with OFD. Kamalluarfin (2016), on the other hand, found that there is a significant negative relationship between board independence and OFD.

Methodology

The data used in determining the level of OFD was collected from 274 companies listed in the financial sector of the GCC bourses at the end of 2016. The financial sector was selected because the regulatory and social frameworks are similar across the GCC countries. Additionally, due to the size of funds in invested in it, the financial sector is considered the largest sector. A checklist used by Al-Sartawi (2016) which consisted of 71 items for the content dimension of OFD and 19 items for the presentation dimension of OFD was adopted to calculate the index of OFD depending on the binary representation, whereby a company receives a score = ‘1’if it reports an item included in the checklist and receives a score = ‘0’ if it does not report an item in the checklist. Consequently, the company indices were determined by dividing the total actual scores of 0s and 1s/by the total possible scores for the company.

Moreover, the researcher used the percentage of shares owned by institutional ownership to the total of shares outstanding to determine the institutional investor ratio for the sample of companies.

Hypotheses

Several research studies have addressed the issue of corporate governance in the GCC countries (Mousa & Desoky, 2012; Ramadhan, 2014; Sanad & Al-Sartawi, 2016; Al-Sartawi et al., 2017). These studies have investigated the level of institutional ownership as control or independent variables. Yet there are negligible studies that actually investigate the association of institutional ownership with online financial disclosure. Therefore, based on the theoretical and empirical literature, this paper aims to study this association and establishes the main hypothesis as:

H1: There is a relationship between institutional ownership and the level of OFD by companies listed in GCC Bourse.

The main hypothesis consists of the following sub-hypotheses:

Hypothesis One

The OFD index consists of the content dimension as well as the presentation dimension. The content dimension mainly deals with financial reports such the statement of cash flow, financial position, shareholder information and key financial ratios. In addition, it constitutes non-financial reports related to social responsibility disclosures and corporate governance. Institutional ownership is interested in the content of information reported by the companies in order to make their own decision and to monitor the management. Thus, it is hypothesized that:

H1-a1: There is a relationship between institutional ownership and the level of content disclosed by companies listed in GCC Bourses.

Hypothesis Two

The second dimension is the presentation dimension and it is evaluated on the way the information is displayed, i.e., whether it can be processed or not. It is also evaluated based on the ease of use which is determined through the existence of a search engine. Institutional ownership are interested in the way of presenting information reported by the companies. The presentation dimension also covers the actability and the understandability of information and without this dimension, information would be useless for investors to make decisions. Therefore, this study hypothesizes:

H1-a2: There is a relationship between institutional ownership and the level of presentation used by companies listed in GCC Bourses.

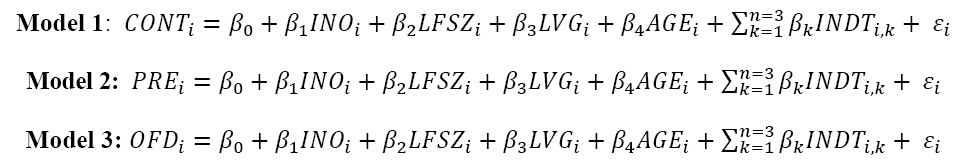

Models

The following regression models were used to test sub- hypothesis 1 and 2 and eventually the main hypothesis. The regression models were developed using the OFD dimensions as well as various control variables such as company size, age, financial leverage and industry type (Models 1-3).

Where:

| Code | Variable Name | Operationalization |

| Dependent variable – Content index: | ||

| CONT | Dimension of Content % | Total scored items by the company/Total maximum scores |

| PRE | Dimension of Presentation % | Total scored items by the company/Total maximum scores |

| OFD | Online financial disclosure % | Total scored items by the company/Total maximum scores |

| Independent Variables - Board Characteristics: | ||

| INO | Institutional Ownership % | The ratio of shares held by institutional ownership to total number of shares outstanding. |

| Control Variables: | ||

| LFSZ | Firm size | Natural logarithm of Total Assets |

| LVG | Leverage | Total liabilities/ Total Assets |

| AGE | Firm Age | The difference between the establishing date of the firm and the report date |

| Industry Type | ||

| Banks | This is a binary Wherein 1 means that the company is Banks and 0 otherwise | |

| Insurance | This is a binary Wherein 1 means that the company is Insurance and 0 otherwise | |

| Investment | This is a binary Wherein 1 means that the company is Investment and 0 otherwise | |

| εi | Error | |

Data Analysis

Descriptive Statistics

Table 1 demonstrate the differentiating levels of online financial disclosure among the GCC Countries as well as the industry types. The lowest level of total OFD was 70% by Bahraini companies and the highest level was 84% by Qatari companies. With regards to industry types, banks had the highest level of total online financial disclosure at 77%, while investment companies got the lowest at 75%. Additionally, the findings report the overall level of OFD at 77%. This can be regarded as a good level of reporting by the GCC companies. The findings further reveal that the level of institutional ownership differed among industry types and countries, whereby the institutional investor level was 51%, indicating that the large number of the GCC companies are owned by institutional ownership.

| Table 1 Level Of Online Financial Disclosure And Institutional Investor |

|||||||||

| Country | N. | Content | Presentation | OFD | INO | ||||

| Mean | St.d | Mean | St.d | Mean | St.d | Mean | St.d | ||

| KSA | 52 | 0.75 | 0.17 | 0.77 | 0.10 | 0.76 | 0.15 | .50 | .25 |

| Kuwait | 66 | 0.72 | 0.22 | 0.76 | 0.18 | 0.73 | 0.20 | .56 | 0.25 |

| Bahrain | 21 | 00.69 | 00.20 | 0.72 | 0.18 | 0.70 | 0.20 | 0.48 | 0.28 |

| Qatar | 17 | 0.84 | 0.089 | 0.84 | 0.10 | 0.84 | 0.08 | 0.51 | 0.22 |

| Oman | 26 | 0.75 | 0.21 | 0.81 | 0.17 | 0.76 | 0.20 | 0.42 | 0.21 |

| UAE | 92 | 0.80 | 0.14 | 0.79 | 0.14 | 0.80 | 0.14 | 0.50 | 0.25 |

| Total | 274 | 0.76 | 0.18 | 0.78 | 0.15 | 0.77 | 0.17 | 0.51 | 0.25 |

| Industry | N. | Content | Presentation | OFD | INO | ||||

| Mean | St.d | Mean | St.d | Mean | St.d | Mean | St.d | ||

| Banks | 80 | 0.76 | 0.17 | 0.79 | 0.14 | 0. 77 | 0. 16 | 0.48 | 0.25 |

| Insurance | 91 | 0.77 | 0.19 | 0.78 | 0.13 | 0. 77 | 0. 1 7 | 0.50 | 0.24 |

| Investment | 103 | 0.75 | 0.19 | 0.77 | 0.18 | 0. 75 | 0.18 | 0.54 | 0.25 |

| Total | 274 | 0.76 | 0.18 | 0.78 | 0.15 | 0. 7 7 | 0. 17 | 0.51 | 0.25 |

Table 2 shows the control variables, where it reports that the minimum value of total assets was 20297 BD millions and the maximum value was 168.1 million, with a mean of 1.20 million BD. Natural logarithm was used during the regression analysis due to the skewness of total assets. Additionally, the minimum value of leverage was 0.12% and the maximum value was 96%, with a mean of 63.5%. This indicates very high debts. Finally, the age of the firms range from 2 to 60, with a mean of 22.06.

| Table 2 Descriptive Statistics For Control Variables |

|||||

| Variable | N. | Min. | Max | Mean | S.D |

| Assets | 274 | 20297 | 1681844040 | 1.20E8 | 2.837E8 |

| Size | 274 | 9.92 | 21.24 | 15.5671 | 2.90170 |

| Leverage | 274 | 0.12 | 0.96 | 0.6345 | 0.21114 |

| Age | 274 | 2 | 60 | 22.06 | 15.148 |

Validity

Various validity tests were conducted to check the data for multicollinearity. This included conducting a Variance Inflation Factor (VIF) as reported in Table 3 which shows that no score exceeded 10 for the variables of the model.

| Table 3 Collinearity Statistics Test |

||

| Model | Tolerance | VIF |

| INO | 0.974 | 1.027 |

| Size | 0.776 | 1.288 |

| Leverage | 0.884 | 1.131 |

| Age | 0.901 | 1.110 |

| Industry type | 0.802 | 1.247 |

Moreover, Table 4 revealed that the Durbin Watson value was 2.077 for model 1 and 2.101 for model 2. Finally, the value for the overall model was 2.088, which indicate that there are no autocorrelation issues with the models.

| Table 4 Autocorrelation Test |

|||||

| Model | R | R Square | Adjusted R Square | Std. Error of the Estimate | Durbin-Watson |

| 1 | 0.573 | 0.446 | 0.128 | 0.07984 | 2.077 |

| 2 | 0.452 | 0.335 | 0.117 | 0.04860 | 2.101 |

| 3 | 0.567 | 0.442 | 0.125 | 0.06675 | 20.088 |

Testing the Hypotheses

The results (Table 5) indicate that there is an insignificant negative relationship between institutional ownership and the level of OFD (content and presentation). From the point of view of the researcher, the percentage of institutional ownership is more than 51% indicating there is a concentration of the ownership in the GCC companies which will affect the reporting in general. This interpretation is consistent with Al-Sartawi & Sanad (2018) and Shiri's et al. (2016) studies which showed that ownership concentration positively affect information asymmetry. According to the agency theory, in a separated ownership situation, firms increase disclosure by providing additional information to signal that the managers are acting in the best interests of stakeholders, in order to reduce information asymmetry and consequently agency costs. Hence, information asymmetry is negatively related to corporate disclosure. This explains the negative relationship, when the percentage of ownership of majority shareholders increases.

| Table 5 Regression Analysis Models |

||||||||||||

| Variables | Coefficients | Std. Error | t-statistics | Sig. | ||||||||

| M.1 | M.2 | M.3 | M.1 | M.2 | M.3 | M.1 | M.2 | M.3 | M.1 | M.2 | M.3 | |

| INO | -0.059 | -0.026 | -0.056 | 0.045 | 0.04 | 0.041 | -0.98 | -0.43 | -0.92 | 0.33 | 0.67 | 0.36 |

| Size | 0.217 | 0.078 | 0.200 | 0.004 | 0.004 | 0.004 | 3.21 | 1.14 | 2.9 | 0.002 | 0.25 | 0.004 |

| Leverage | -0.042 | -0.014 | -0.038 | 0.06 | 0.05 | 0.05 | -0.66 | -0.23 | -0.60 | 0.51 | 0.82 | 0.55 |

| Age | -0.001 | -0.155 | -0.029 | 0.001 | 0.001 | 0.001 | -0.01 | -2.5 | -0.49 | 0.99 | 0.02 | 0.64 |

| Industry | 0.04 | 0.02 | 0.04 | 0.015 | 0.012 | 0.014 | 0.56 | 0.32 | 0.54 | 0.58 | 0.75 | 0.59 |

| R2 | 0. 446 | 0.335 | 0.442 | |||||||||

| A R2 | 0. 128 | 0.117 | 0.125 | |||||||||

| F Stat | 2.571 | 1.966 | 2.375 | |||||||||

| PF | <0. 01 | <0. 01 | <0. 01 | |||||||||

| No. | 274 | 274 | 274 | |||||||||

| ***P<0.01, **P<0.05 and *P<0.1 level | ||||||||||||

The results also, report a positive relationship between OFD (content and presentation) and firm Size i.e., when the total Assets of the firm increase, the level of content disclosed increases. This could be due to large firms producing sophisticated information and using a large volume of disclosure to explain the information to their users (Hossain et al., 2012). The findings further reveal a negative relationship between the debt ratio and OFD (content and presentation). This indicated that when the level of debts increases, the companies attempt to decrease the disclosure in order to hold back information from stakeholders and potential future investors. These results contradict Al-Shammari et al. (2011) findings.

With regards to age, the results showed a negative insignificant relationship with the level of OFD (content and presentation), indicating that younger companies are willing to disclose more information than the older ones. This could be because the type of management in the GCC countries is not willing to share more information and the older firms having a large percentage of ownership concentration which will affect reporting. This result is contradicting Hossain et al., 2012. Furthermore, the study finds a weak relationship between Industry type and level of OFD (content and presentation) disclosed.

Accordingly, we can summarize that the level of institutional investor in the GCC has a negative relationship with the level of OFD. Nevertheless, this relation is not widely supported in this research. This result contradicts Chen et al. (2015) who stated that with higher levels of institutional holdings and more long-term institutional investors, firms are more likely to engage in less conservative reporting policy.

Conclusion and Recommendation

This study investigated the relationship between institutional ownership and the level of OFD in the GCC countries. The content and presentation dimensions were used to measure the level of OFD disclosed by GCC companies. The results reported that the total level of OFD was 77% and the level of institutional investor was 51% of the total ownership of the GCC companies. However, there is a negative relationship between these two variables.

This paper is important as it seeks to contribute empirical evidence to the literature regarding the relationship between institutional ownership and the level of OFD in developing countries, particularly in the GCC countries. From a theoretical perspective, this study contributes in filling the gap in the current literature in the GCC region. Additionally, from a practical perspective this research is significant for both the users and producers of financial information as it addresses the regulations in the GCC Countries and how it affects economic decisions. This research recommends companies to widely adopt OFD mechanisms and to pay more attention to the percentage of institutional ownership to keep it at a reasonable level.

The research was conducted using the financial sector companies in the GCC Countries, thus, the sample size is small compared to the total listed companies. In addition, there were a few companies that did not have a running website. Therefore, the study findings may not be generalizable.

Furthermore, the researcher suggests having a study that further investigates the relationship between online financial disclosure and performance: Financial, operational and stock.

References

- Abhayawansa, S. & Johnson, R. (2007). Corporate governance reforms in developing countries: Accountability versus performance, in R Johnson (ed.), Reading in Auditing, John Wiley and Sons Australia, 2(7), 84-98.

- Agboola, A. & Salawu, M. (2012). The determinants of internet financial reporting: Empirical evidence from Nigeria. Research Journal of Finance and Accounting, 3(11), 95-105.

- Almilia, L. (2009). Determining factors of internet financial reporting in Indonesia. Accounting and Taxation, 1(1), 87-99.

- Al-Rawahi, F.E. & Sarea, A.M. (2016). An investigation of the level of compliance with international accounting standards (IAS 1) by listed firms in Bahrain Bourse. International Journal of Islamic and Middle Eastern Finance and Management, 9(2), 254-276.

- Al-Sartawi, A. & Zakeya, S. (2018). Institutional ownership and corporate governance: Evidence from Bahrain. Afro-Asian Journal of Finance and Accounting (Accepted Paper).

- Al-Sartawi, A. (2015). The effect of corporate governance on the performance of the listed companies in the Gulf Cooperation Council Countries. Jordan Journal of Business Administration, 11(3), 705-725.

- Al-Sartawi, A. (2016). Measuring the level of online financial disclosure in the gulf cooperation council countries. Corporate Ownership and Control, 14(1), 547-558.

- Al-Sartawi, A., Fatema, A. & Zakeya, S. (2017). Board characteristics and the level of compliance with IAS 1 in Bahrain. International Journal of Managerial and Financial Accounting, 9(4), 303-321.

- Al-Shammari, B. (2011). Factors influencing the extent of mandatory compliance with international financial reporting standards: The case of Kuwaiti listed companies. Journal of International Business and Economics, 11(4).

- Apostolos, K.A. & Konstantinos, A.N. (2009). Voluntary accounting disclosure and corporate governance: Evidence from Greek listed firms. International Journal of Accounting and Finance, 1(4).

- Basuony, M.A.K. & Mohamed, E.K. (2014). Determinants of internet financial disclosure in GCC countries. Asian Journal of Finance and Accounting, 6(1), 70-89.

- Bushee, B. & Noe, C.F. (2000). Corporate discloser practices, institutional investors and stock return volatility. Journal of Accounting Research, 38(3), 171-202.

- Bushee, B., Carter, M.E. & Gerakos, J. (2014). Institutional investor preferences for corporate governance mechanisms. Journal of Management Accounting Research, 26(2), 123-149.

- Chen, F., Hou, Y., Richardson, G. & Ye, M. (2015). Auditor quality and litigation loss contingency disclosures. Working paper, University of Toronto.

- Chung, K.H. & Zhang, H. (2011). Corporate governance and institutional ownership. Journal of Financial and Quantitative Analysis, 46(1), 247-273.

- Crane, A.D. & Koch, A. (2013). Free riding and ownership structure: Evidence from a natural experiment. http://www.business.pitt.edu/katz/sites/default/files/koch_0.pdf

- Elsayed, A., El-Masry, A. & Elbetagi, I. (2010). Corporate governance, firm characteristics and internet financial reporting: Evidence from Egyptian listed companies. Corporate Ownership & Control, 7(4), 397-426.

- Fama, E. & Jensen, M. (1983). Separation of ownership and control. The Journal of Law & Economics, 26(2), 301-325.

- Gillan, S., Hartzell, J. & Starks, L. (2003). Explaining corporate governance: Boards, bylaws and charter provisions. SSRN Working paper. http://ssrn.com/abstract=442740

- Hamdan, A.M. & Al-Sartawi, A. (2013). Corporate governance and institutional ownership: Evidence from Kuwait's financial sector. Jordan Journal of Business Administration, 9(1), 191-203.

- Hossain, M., Mahmood, A.M. & Shirely, L. (2012). Internet financial reporting and disclosure by listed companies: Further evidence from an emerging country. Corporate Ownership and Control Journal, 9(4), 351-366.

- Hunter, S.A. & Smith, L.M. (2010). Impact of internet financial reporting on emerging markets. Journal of International Business Research, 8(2), 21-40.

- Jain, S.K. & Kumar, P. (2013). Corporate financial reporting on internet: A study of user’s perception. Pacific Business Review International, 5(12), 45-55.

- Juhmani, O. (2013). Ownership structure and corporate voluntary disclosure: Evidence from Bahrain. International Journal of Accounting and Financial Reporting, 3(2).

- Kamalluarfin, W. (2016). The influence of corporate governance and firm characteristics on the timeliness of corporate internet reporting by top 95 companies in Malaysia. Procedia Economics and Finance, 35, 156-165.

- Khan, M. & Noor, L. (2012). Bank officers’ views of internet financial reporting in Malaysia. International Conference on Asia Pacific Business Innovation and Technology Management, 57(9), 75-84.

- Kiel, G.C. & Nicholson, G.J. (2003). Board composition and corporate performance: How the Australian experience informs contrasting theories of corporate governance. Corporate Governance: An International Review, 11(3), 189-205.

- Lipunga, A. (2014). Internet financial reporting in Malawi. International Journal of Business and Management, 9(6), 138-161.

- Lizzcharly, P., Henny, M., Widya, S. & Budi, H. (2013). Internet financial reporting index analysis: An overview from the state owned enterprise in Indonesia. Journal of Economics, Business and Management, 1(3), 281-284.

- McCahery, J.A., Sautner, Z. & Starks, L.T. (2016). Behind the scenes: The corporate governance preferences of institutional investors. Journal of Finance, 71(6), 2905-2932.

- Mousa, G.A. & Abdelmohsen, M.D. (2012). The association between internal governance mechanisms and corporate value: Evidence from Bahrain. Asian Academy of Management Journal of Accounting and Finance, 8(1), 67-92.

- Poon, P.L. & Yu, Y.T. (2012). Degree of internet corporate reporting: A research framework. Information Research, 17(1), 509.

- Ramadhan, S. (2014). Board composition, audit committees, ownership structure and voluntary disclosure: Evidence from Bahrain. Research Journal of Finance and Accounting, 5(7).

- Sanad, Z. & Al-Sartawi, A. (2016). Investigating the relationship between corporate governance and internet financial reporting (IFR): Evidence from Bahrain bourse. Jordan Journal of Business Administration, 12(1), 239-269.

- Shiri, M.M., Mahdi, S. & Ali, R. (2016). A study of impact of ownership structure and disclosure quality on information asymmetry in Iran. The Journal for Decision Makers, 41(1), 51-60.

- Yap, K. & Saleh, Z. (2011). Internet financial reporting in Malaysia: The preparers’ view. Asian Journal of Finance & Accounting, 3(1), 138-161.