Research Article: 2021 Vol: 25 Issue: 5

Do High-Quality Audits Reduce Stock Price Delays? Evidence from South Korea

Haeyoung Ryu, Hansei University

Soo-Joon Chae, Kangwon National University

Citation Information: Ryu, H., & Chae, S.J. (2021). Do high-quality audits reduce stock price delays? Evidence from south korea. Academy of Accounting and Financial Studies Journal, 25(7), 1-08.

Abstract

High-quality audits lower information asymmetry between managers and investors by improving the quality of financial reporting. Hence, we expect audit quality to be positively associated with investors' accurate understanding of companies’ financial information, which can reduce stock price delays. Within the emerging markets, we focus on 3,298 firm-year observations of South Korean listed companies. The results reveal that organizations audited by Big 4 accounting firms show fewer stock price delays. Additionally, after dividing the sample into conglomerate and non-conglomerate groups, the latter group shows fewer stock price delays compared to the former when audited by Big 4 firms.

Keywords

Audit Quality, Stock Price Delay, Chaebol, Emerging Markets.

JEL Codes

G14, G30

Introduction

The efficient market hypothesis (EMH) proposes that stock prices immediately reflect all the available information about firms. However, this is not always applicable to the real financial market due to information asymmetry (Akins et al., 2012), which causes stock price delays. Stock price delay is the delay in stock prices’ adjustment to specific information.

Recent studies link stock price delays to poor quality of firm-specific information (Callen et al., 2013). However, efficient auditors can detect material errors or misstatements in firms’ financial statements. High-quality audits increase financial statements’ credibility and resolve the information asymmetry between managers and investors, reducing the agency problems from the conflict of interest between managers and shareholders (Krishnan, 2003; Reichelt & Wang, 2010).

Therefore, there exists a positive correlation between audit quality and the reliability of financial information provided in companies’ annual reports, which is likely to reduce stock price delays. Furthermore, Big 4 accounting firms are more likely to detect firms’ managerial misconduct (e.g., accounting fraud and concealment of information), which can reduce managerial distortion of the firms’ financial information and reduce stock price delays. This study investigated the correlation between audit quality and stock price delays in the South Korean (henceforth, Korean) stock market.

Theory and Hypotheses

Departing from EMH, several studies have observed real market situations with information asymmetry, resulting in stock price delays against firm-specific information (Callen et al., 2000). However, accounting information quality (measured by accrual quality [AQ]) and audit quality are negatively correlated with information asymmetry, which reduces stock price delays (Callen et al., 2013). Studies show that stock price delays lead to information risks; therefore, shareholders need to be compensated with higher return premiums. Moreover, Qian et al. (2017) identify a positive relationship between stock turnover, a proxy for information uncertainty, and stock price delay. Therefore, these studies indicate that information asymmetry from poor-quality accounting information impedes the instantaneous adjustment of stock prices to relevant information.

However, efficient auditors can greatly reduce the information asymmetry between managers and external stakeholders, alleviating agency problems (Balsam et al., 2003; Reichelt & Wang, 2010). For instance, high audit quality implies the detection of material errors or misstatements in firm’ financial statements, which increases its credibility. Previous studies have commonly used audit firm size as a proxy for audit quality. Large audit firms have low economic dependence on their clients; therefore, DeAngelo (1981) argues that these firms have better audit quality due to greater independence compared to their smaller counterparts. Additionally, Big 4 firms are more concerned about their reputation and have a higher risk of being sued for audit errors, as they are perceived as being more capable of compensating for damages (Palmrose, 1988). Consequently, audit failures by Big 4 firms can result in a large amount of legal damages from lawsuits (Simunic & Stein, 1996). Therefore, these firms greatly emphasize auditor training and stringent quality control, ensuring their audit quality is better than that of most audit firms.

Thus, firms’ accounting information quality is expected to improve based on the audit quality of their auditors. A high-quality audit can help correct any accounting distortions used by the management due to information asymmetry, allowing stock prices to accurately reflect firm-specific information. Thus, we proposed the following:

H1: Firms using Big 4 auditors have fewer stock price delays than those using non-Big 4 auditors.

Korean conglomerates (known as chaebol) are large-scale industries with a group of affiliated companies predominantly owned and managed by their founding families. Chaebols’ active participation in state-led economic projects with aggregated capital and newly developed technologies has significantly contributed to the national economy. However, they are also criticized for their market dominance, monopoly practices, and overly interconnected affiliates (e.g., for sharing business risks). Accordingly, the US Fair Trade Commission (FTC) continuously monitors the market by regulating the anti-competitive practices of these large business groups. It has also established a business portal to improve the accessibility of information on these groups.

Although we expect audit quality to be negatively correlated with stock price delays, this is especially so for non-chaebol firms than for chaebol firms. Therefore, we proposed the following:

H2: Non-chaebol firms are more likely to experience reductions in stock price delays compared to chaebol firms, provided that their financial statements are audited by Big 4 firms.

Materials and Methods

Measuring Stock Price Delays

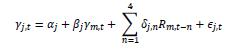

We used Hou & Moskowitz’s (2005) approach to measure stock price delay, our dependent variable.

(1)

(1)

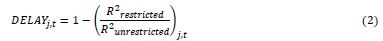

In equation (1), j,t indicates company j's weekly returns for each stock (t) and  represents the weekly returns on the market where the share (t) is listed. Thus, company j's stock returns can be evaluated based on the stock market returns. We tested the model to estimate the effect of the current market information on individual stock returns at the present time, where its explanatory power is defined as R2 specified. The effect of historical and current market information on the current individual stock returns was estimated with R2 specified as the explanatory power, where the average stock market return for four weeks was used to measure the historical market information. Additionally, if the value of R2 specified was greater than that of R2 specified the effect of the historical market information on individual stock returns was significant, indicating the extent of delayed stock price adjustment to market information. To test the hypothesis, we measured information delay using equation (2), where the higher the value of DELAY (a measure of stock price delay), the greater the delays in stock price adjustment to information.

represents the weekly returns on the market where the share (t) is listed. Thus, company j's stock returns can be evaluated based on the stock market returns. We tested the model to estimate the effect of the current market information on individual stock returns at the present time, where its explanatory power is defined as R2 specified. The effect of historical and current market information on the current individual stock returns was estimated with R2 specified as the explanatory power, where the average stock market return for four weeks was used to measure the historical market information. Additionally, if the value of R2 specified was greater than that of R2 specified the effect of the historical market information on individual stock returns was significant, indicating the extent of delayed stock price adjustment to market information. To test the hypothesis, we measured information delay using equation (2), where the higher the value of DELAY (a measure of stock price delay), the greater the delays in stock price adjustment to information.

Methodology

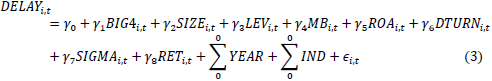

To examine the effect of audit quality on stock price delay, we developed a regression model by including, as an independent variable, BIG4 as the dummy variable describing the use or non-use of Big 4 auditors. Further, we included DELAY as the dependent variable. Following Hou & Moskowitz (2005) and Callen et al. (2013), we defined a set of variables that can affect stock price delays as the control variables.

The binary dummy (BIG4) representing the use/non-use of Big 4 auditors is the variable of interest in equation (1). Big 4-audited firms are associated with fewer stock price delays compared to other firms; therefore, the coefficient γ? for BIG4 should be negative.

An increase in business size increases the number of stakeholders and the speed of information dissemination, which mitigates stock price delays (Hong, Lim & Stein, 2000). Therefore, we included the natural log of market capitalization (SIZE) as a control variable. However, a greater dependence on leverage increases firms’ financial risks and induces the management to manipulate or conceal crucial financial information in firms that are highly dependent on leverage (Christie, 1982). For these firms, the debt equity ratio is likely to be positively correlated with stock price delays; thus, our model includes a leverage ratio (LEV; the ratio of total debt to the total assets). Additionally, profitable firms tend to provide high-quality information to maintain good reputation in the market. Therefore, corporate profitability is expected to have a negative relationship with stock price delays; thus, we included return on assets (ROA; the net income divided by total assets) as a control variable.

Further, companies with high growth potential seek to provide high-quality information to maintain their favorable position in the market (Hou & Moskowitz, 2005). As company growth potential is negatively correlated with stock price delays, our model also includes the market to book ratio (MB; the ratio of the market value of equity to its book value). Meanwhile, differences of opinion between investors are likely to cause stock price delays. Accordingly, the monthly stock turnover ratio (DTURN) was introduced as a control variable and is expected to have a significantly positive relationship with stock price delays. Previous research reports that firms generating high average market returns (RET) provide high-quality information to the market, resulting in fewer stock price delays (Hou & Moskowitz, 2005). Thus, RET (the average value of the firm-specific return multiplied by 100) was also included as a control variable. A high stock return volatility implies high levels of information uncertainty asymmetry for firms; Hou & Moskowitz (2005) confirm a positive correlation between stock return volatility and stock price delays. Therefore, the stock return volatility (SIGMA), calculated as the standard deviation of the firm-specific weekly returns, was introduced as a control variable. Finally, our model also includes year and industry dummies to control the effects of year and industry differences, respectively.

Data and Statistics

Our sample includes all the companies listed on the Korean securities market between 2012 and 2017. To ensure sample homogeneity, companies with the fiscal year ending in December and banking and financial service companies were excluded, as their financial statement items and accounting processes differ from those in other industries. We obtained audit firm, financial, and stock price data from KISVALUE, a database of Korea Investors Service Co., Ltd. Additionally, we winsorized all the variables at the 1% and 99% levels to eliminate the effect of extreme values. The final sample comprises 3,298 firm-years.

Table 1 summarizes the descriptive statistics of the variables used in the study. The mean of the binary variable (BIG4) is 0.668, implying that nearly 67% of the companies in our sample work with Big 4 audit firms. As a dependent variable, DELAY has a mean of 0.680 and a median of 0.723, which shows a negative skewness. Its minimum and maximum values are 0.015 and 1, respectively, indicating a range of 0–1, and its standard deviation is 0.263. These results reveal that while some companies' stock prices can be explained using the current market returns, those of others cannot. RET, representing the mean (median) of weekly returns, has values of -0.149 (-0.094), indicating that the average stock price of the companies has declined in Table 1.

Results

The results show that the coefficient γ0 of BIG4 is -0.023 (t-value = -2.19), which is significant at the 5% level. This result clearly supports H1; therefore, the speed of stock price adjustment to information is faster in firms using Big 4 auditors compared to their counterparts. The use of Big 4 auditors implies that the firms have systematic audits and provide high-quality accounting information, which reduces the information asymmetry between managers and investors. Accordingly, stock prices accurately reflect information about these firms, which reduces the time lag associated with price adjustment.

The regression results for H2 are presented in Columns (2) and (3) of Table 1. While the relationship between the use of Big 4 auditors and stock price delay is not significant in chaebols, the two variables are found to have a negative relationship in non-chaebol companies at the 1% level. This is due to the characteristics of chaebols, which vastly dominate the Korean market, involve a large number of stakeholders, and have well-controlled information quality under the supervision of government agencies such as FTC, leading to low levels of information asymmetry. Therefore, as long as the reputation of chaebols remains solid, audit quality cannot significantly affect abnormal phenomena of the capital market such as stock price delays. However, for non-chaebol companies, similar to government supervision, Big 4 auditors’ high-quality audits significantly affect information about these firms, effectively reducing the information asymmetry in the market in Table 2.

| Table 1 Descriptive Statistics (N = 3,298) |

|||||||

| Variables | Mean | Std. Dev | Min | 25% | 50% | 75% | Max |

|---|---|---|---|---|---|---|---|

| DELAY | 0.680 | 0.263 | 0.015 | 0.483 | 0.723 | 0.925 | 1.000 |

| BIG4 | 0.668 | 0.471 | 0.000 | 0.000 | 1.000 | 1.000 | 1.000 |

| GROUP | 0.185 | 0.388 | 0.000 | 0.000 | 0.000 | 0.000 | 1.000 |

| SIZE | 26.286 | 1.624 | 23.565 | 25.102 | 25.954 | 27.206 | 30.829 |

| LEV | 0.406 | 0.215 | 0.009 | 0.232 | 0.403 | 0.562 | 0.949 |

| MB | 1.355 | 1.301 | 0.204 | 0.622 | 0.947 | 1.529 | 8.048 |

| ROA | 0.017 | 0.081 | -0.405 | 0.003 | 0.025 | 0.052 | 0.234 |

| DTURN | 0.072 | 1.755 | -8.347 | -0.027 | 0.000 | 0.021 | 11.265 |

| SIGMA | 0.049 | 0.024 | 0.015 | 0.033 | 0.044 | 0.058 | 0.141 |

| RET | -0.149 | 0.169 | -1.007 | -0.167 | -0.094 | -0.054 | -0.011 |

All variables are defined in Appendix Table A1.

| Table 2 Audit Quality, Chaebol Affiliations, And Stock Price Delays |

||||||

| Variables | (1) Y = DELAY (Total) | (2) Y = DELAY (Chaebol) |

(3) Y = DELAY (Non-chaebol) |

|||

|---|---|---|---|---|---|---|

| Coef. | t-value | Coef. | t-value | Coef. | t-value | |

| Intercept | 0.756 | (8.32)*** | 1.041 | (5.23)*** | 0.721 | (5.57)*** |

| BIG4 | -0.023 | (-2.19)** | 0.001 | (0.04) | -0.030 | (-2.67)*** |

| SIZE | 0.001 | (0.11) | -0.009 | (-1.44) | 0.001 | (0.31) |

| LEV | -0.022 | (-0.96) | -0.143 | (-2.51)** | -0.007 | (-0.29) |

| MB | -0.001 | (-0.28) | 0.018 | (1.97)** | -0.003 | (-0.75) |

| ROA | 0.005 | (0.1) | -0.102 | (-0.73) | 0.020 | (0.28) |

| DTURN | 0.004 | (1.59) | -0.008 | (-0.74) | 0.005 | (2.00)** |

| SIGMA | -0.030 | (-0.04) | 0.619 | (0.37) | 0.095 | (0.13) |

| RET | -0.081 | (-0.89) | -0.071 | (-0.35) | -0.052 | (-0.51) |

| S IND, SYR | Included | Included | Included | |||

| Adjusted R2 | 0.096 | 0.082 | 0.113 | |||

| F-value | 15.12*** | 3.49*** | 14.78*** | |||

| N | 3,298 | 609 | 2,689 | |||

All variables are defined in Appendix Table A1.

***, **, and * represent significance at the 1%, 5%, and 10% levels, respectively.

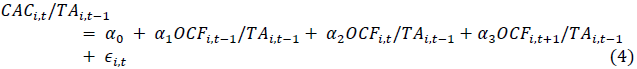

Callen et al. (2013) report that the lower the quality of accounting information, the slower the stock price adjustment. Therefore, to evaluate our model’s robustness, we added accounting information quality as a control variable due to its potential impact on stock price delay. The quality of accounting information was measured using AQ, as suggested by (Dechow & Dichev, 2002). We used the following equation:

where CAC = (ΔCurrent assets - ΔCash) - (ΔCurrent liabilities - ΔCurrent long - term liabilities); OCF = operating cash flows; and TA = Total assets

The residual from equation (4) indicates the accruals not realized in cash basis in the previous, current, and subsequent periods, respectively, where the absolute value of accruals was used as a proxy for AQ to measure the quality of accounting information. A higher absolute value of accruals indicates a lower AQ due to the increasing magnitude of current accruals not realized in the firms’ operating cash flows. The results based on the newly added AQ are consistent with the results of the first regression analysis, which supports the model’s robustness. Additionally, the coefficient of BIG4 is -0.043 (t-value = -3.22), which is significant at the 1% level, supporting H1. For the chaebol and non-chaebol companies, the use of Big 4 auditors in the non-chaebol group results in significantly fewer stock price delays at the 1% level in Table 3.

| Table 3 Accounting Information Quality, Chaebol Affiliations, And Stock Price Delay |

||||||

| Variables | (1) Y = DELAY (Total) | (2) Y = DELAY (Chaebol) |

(3) Y = DELAY (Non-chaebol) |

|||

|---|---|---|---|---|---|---|

| Coef. | t-value | Coef. | t-value | Coef. | t-value | |

| Intercept | 0.839 | (7.33)*** | 1.181 | (4.51)*** | 0.663 | (4.07)*** |

| BIG4 | -0.043 | (-3.22)*** | -0.055 | (-0.96) | -0.047 | (-3.31)*** |

| AQ | 0.069 | (0.99) | 0.278 | (1.87)* | -0.039 | (-0.49) |

| SIZE | -0.006 | (-1.41) | -0.016 | (-1.83)* | 0.000 | (0.08) |

| LEV | -0.033 | (-1.14) | -0.164 | (-2.22)** | -0.011 | (-0.36) |

| MB | 0.002 | (0.59) | 0.023 | (2.08)** | -0.003 | (-0.67) |

| ROA | -0.034 | (-0.46) | -0.165 | (-0.95) | -0.056 | (-0.65) |

| DTURN | 0.003 | (1.36) | -0.002 | (-0.22) | 0.004 | (1.67)* |

| SIGMA | 0.983 | (1.19) | -0.419 | (-0.2) | 1.607 | (1.74)* |

| RET | 0.055 | (0.52) | -0.151 | (-0.63) | 0.145 | (1.2) |

| S IND, SYR | Included | Included | Included | |||

| Adjusted R2 | 0.099 | 0.108 | 0.103 | |||

| F-value | 11.04*** | 3.35*** | 9.44*** | |||

| Sample Size | 3,052 | 593 | 2,459 | |||

Coeff. = Coefficient.

All variables are defined in Appendix Table A1.

***, **, and * represent significance at the 1%, 5%, and 10% levels, respectively.

Conclusion

The results confirm that audit quality is negatively correlated with stock price delays, as high-quality financial reporting reduces information asymmetry between managers and investors. Accordingly, investors are able to analyze firms’ financial performance more accurately to offset possible delays in stock prices’ adjustment to information. Particularly, firms using Big 4 auditors are negatively correlated with stock price delays, as the latter’s high-quality audits improve the credibility of the financial information disclosed in the market, allowing stock prices to reflect firm-specific information more instantaneously. Finally, compared to chaebol firms, non-chaebols’ use of Big 4 auditors significantly reduces their stock price delays, confirming that high-quality audits are more effective in reducing uncertainties in the capital market due to high information asymmetry.

Acknowledgement

This work was supported by the Ministry of Education of the Republic of Korea and the National Research Foundation of Korea (NRF-2021S1A5A8070518).

References

DeAngelo, L. (1981). Auditor size and auditor quality. Journal of Accounting and Economics, 3(2), 113-127.

Dechow, P., & Dichev, I. (2002). The quality of accruals and earnings: The role of accrual estimation errors. The Accounting Review, 77, 35-59.

Krishnan, G. (2003). Does Big 6 auditor industry expertise constrain earnings management? Accounting Horizons, 17, 1-16.

Palmrose, Z. (1988). An analysis of auditor litigation and audit service quality. The Accounting Review, 63, 55-73.

Appendix

| Table A1 Variable Definitions |

|

| Variable | Definitions |

|---|---|

| DELAY | = the value of the stock price delay phenomenon by Hou and Moskowitz (2005) |

| BIG4 | = Big 4 = 1, non-Big 4 = 0 |

| AQ | = Accrual quality by Dechow et al. (1995). |

| SIZE | = the logarithm of market value |

| LEV | = the ratio of total debt to total assets |

| MB | = the ratio of the book value to market value of equity |

| ROA | = the ratio of net income to total assets |

| DTURN | = the average of monthly stock trade turnover ratio |

| SIGMA | = the standard deviation of firm-specific weekly returns |

| RET | = the average firm-specific weekly returns multiplied by 100 |