Research Article: 2019 Vol: 22 Issue: 2

Do Board of Directors Characteristics Influence Firm Performance Evidence from the Emerging Market

Abdelrazaq Farah Freihat, Higher Colleges of Technology

Ayda Farhan, Higher Colleges of Technology

Mohammed Shanikat, Higher Colleges of Technology

Citation Information: Freihat, A.F., Farhan, A., & Shanikat, M. (2019). Do board of directors´ characteristics influence firm performance? Evidence from the emerging market. Journal of Management Information and Decision Sciences, 22(2), 148-165.

Keywords

Corporate Governance, Board Of Directors’ Characteristics, Firm Performance

Introduction

The board of directors plays a crucial role in the governance of companies, and hence an understanding of how the characteristics and effectiveness of the board affect the governance of firms is very important, not least because agency theory states that the role of the board of directors is to ensure that the resolutions made by the rulers of a company are in the interest of investors (Deschênes et al., 2014). The board of directors is one of the major factors in the governance mechanism, and good corporate governance is urgently needed in many enterprises. One of the pivotal advantages of establishing good corporate governance practices is that they help enterprises, and consequently their home countries, to access international capital markets and gain higher premiums when seeking international investment. Also, the stock price of a firm is generally connected to its performance, thus shareholder returns are dependent on how well a firm is managed. The firm’s managers act as agents for shareholders by making decisions that are supposed to maximize the firm’s performance.

Due to recent economic crises and corporate scandals, much research effort has been directed at investigating the link between the attributes of the board of directors and the company’s achievements worldwide. Firm performance is a measure of the actual economic performance of a firm at any given time. It is a crucial measure because it helps investors and analysts to get a clear idea about a firm’s real value (Ceja et al., 2010). One of the significant factors that influence the performance of a company is the extent to which it practices good corporate governance. Basically, governance in this context is interested in the ways in which all the participants interested in the firm act to safeguard their interest in the firm (Haddad et al., 2011).

While the above description is globally applicable, this study focuses on the impact of board of directors’ characteristics on firm performance in Jordan. It specially examines the influence of the ownership concentration, board meetings, CEO duality, board size and board independence on the performance of publicly traded Jordanian manufacturing companies. This is because most of the literature on the impact of corporate governance on firm performance has been carried out in developed countries. Thus, the current study examines this issue using Jordanian data and therefore fills a gap in the literature by providing evidence about the effect of corporate governance on firm performance in a developing nation, where Jordan is an example of a developing country that has adopted OECD Governance Standards. More specifically this study justified by the followings keynote: There is a paucity of literature on the state of such matters in developing countries, particularly relating to Jordan, as indicated by Kamla (2004). In addition, there is an indication that the Jordanian government is working towards a huge economic development and is eager to attract more foreign investment. Arguably, that will require a reliable corporate governance environment. On the other hand, the manufacturing sector was selected because it constitutes one of the largest sectors in Jordan Capital Market.

It is hoped that the results of this study will benefit several different groups in Jordan, such as policymakers and regulators as well as participants in the stock market in the following ways: First, policymakers and regulators can use the findings of this research to help them identify the essential attributes of corporate governance and to evaluate the practices of the board of directors in Jordanian companies. Second, participants in the stock market would benefit from the results when evaluating the board of directors roles in improving the firm’s performance.

Theoretical Bacground

Corporate Governance and Firm Performance

The collapse of big firms in the USA like Enron in 2001 played an important role in increasing the focus of both researchers and practitioners alike on the effectiveness of corporate governance both in the United States and worldwide. Indeed, the significance of firm governance systems in monitoring the activities of management is now well recognized and, specifically, more emphasis is now being placed on the board of directors as the first line of monitoring. Corporate executives may not consistently act for the sake of investors’ interest when the control of a firm is separate from its ownership. Therefore, the monitoring conducted by the board of directors is of great importance in modem corporations as it is an instrument that resolves the agency problem between top management and shareholders. Shleifer & Vishny (1997) describe corporate governance as a tool that deals with the ways in which corporations’ creditors and investors assure themselves of getting a return on their investment. Thus, the board of directors is a major pillar in firm governance and consequently in the true success of a firm.

One of the main theories that has facilitated our understanding of the role that directors can play in enhancing the performance of the organizations they oversee is agency theory, which assumes that agents (managers) may not always act in the best interest of shareholders. Under the agency basis, the theory of the firm, which was developed by Jensen & Meckling (1976), indicate that the shareholders can make sure that the corporate executive will act in the best interest of shareholders if the corporate executive is overseen and only if proper incentives are given. It is argued that when good governance is provided by the board of directors through the implementation of an effective monitoring process, and there are good incentives in place to encourage management to attain goals that are in the company’s interest, that this then helps firms to exploit resources efficiently.

Over the years, there have been several definitions for the roles and responsibilities of the board as well as for corporate governance more generally. For instance, Fama & Jensen (1983) characterize the board’s principal responsibilities as the ratification of management decisions and the monitoring of management performance. More specifically, Garrett (1996) defines the function of the board as one of collective responsibility to determine the company’s purpose and “ethics”; decide the direction, that is, the strategy; plan; monitor and control managers and CEO; and report and make recommendations to shareholders.

The Organization for Economic Cooperation and Development (OECD, 1999) defines corporate governance as a system through it you may direct the business organizations and the supervision on it, where the structure and the framework of distributing duties and responsibilities is specified between the public shareholding companies, such as board of directors, managers other stakeholders, and establish rules and provisions to take decisions concerned with the affairs of the public shareholding companies. By this procedure, the corporate governance gives the appropriate structure, in which through it the company will be able to set its objectives, and the required methods to achieve these objectives, and work on monitoring the performance, also the corporate governance provide incentives for the board of directors and management in order to pursue the objectives, and to facilitate the effective supervision process, thereby encouraging companies to use their available resources.

As regards the association between governance and performance, several prior academic studies have focused on the link between corporate governance and firm performance. Kiel & Nicholson (2003) argue that effective monitoring by the board of directors can reduce agency costs and thus improve firm performance. However, there is still a lack of consensus on the nature of the relationship between governance and performance as many studies have reported contradictory findings, where some have found a negative relationship, some a positive relationship, and others have found no significant relationship between these two variables at all.

Corporate Governance Code Governing Public Shareholding in Companies in Jordan

The Jordanian Security Commission is committed to developing legislation in accordance with the latest international practices and to keeping up to date with all the developments in the Arabic and international financial markets. To this end, the Commission has issued guidance on public shareholding companies listed on the Amman Stock Exchange (ASE). This guidance, known as Corporate Governance Code for Shareholding Companies, contains some mandatory rules that public shareholding companies must follow. And guiding rules to be applied through commitment or explaining the lack of commitment. The purpose of following this method in the past is to give the companies enough time to adjust to the principles of corporate governance as it increases awareness of these principles and then gradually achieve full commitment to it.

Recently, the Commission revised the guiding rules in the rules of corporate governance guide and made some of them mandatory to suit the environment of the Jordanian capital market by including them in the listing requirements for the listed companies in the first market in ASE as a first step. The key aims of the new mandatory rules are 1) to separate the position of the chairman of the board and any other executive position in the company, 2) to ensure that the chairman of the board is not related to anyone holding an executive position in the company, 3) to have at least two independent members on the board, and 4) to set up an auditing committee, nomination committee and remuneration committee made up from members of the board where the majority of the members of those committees are independent members.

Litrature Review and Hypotheses Development

Board of Directors’ Characteristics

The two most important functions of the board of directors are those of advising and monitoring (Adams & Ferriera, 2007). The advisory function involves the provision of expert advice to the CEO and access to critical information and resources (Fama & Jensen, 1983). Secondly, the board has the responsibility to monitor, discipline, and remove ineffective management teams in order to ensure that managers act in the interests of shareholders.

The literature reveals that various measures have been used to assess the effectiveness of the board in relation to firm performance. The composition and structure of the board affects its ability, so its composition and structure has been investigated by looking at the total number of directors (board size); number of executive and non-executive directors (NEDs); proportion of NEDs in relation to total board and to number of executive directors; tenure of chairman, executives (average) and NEDs (average) and all directors; remuneration (average); percentage of equity held (beneficially) by all directors; separation between the CEO and chairman roles (CEO duality); the position of the chairman as an executive director or NED; existence of audit committee; existence of remuneration committee.

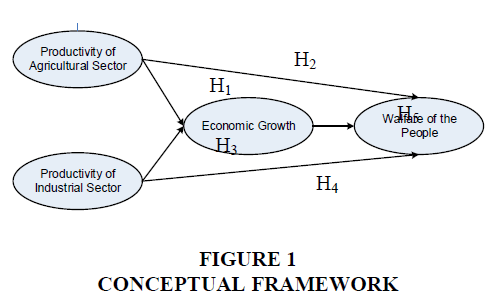

However, in this study, the effect of the following characteristics is investigated: ownership concentration, board meetings, CEO duality, board size, and board independence. The study framework is provided in Figure 1 below.

Therefore, based on the above discussion, it is reasonable to test the following hypothesized relationship:

H0 Board of directors´ characteristics do not have a significant impact on firm performance.

The reasons for choosing each of these characteristics are discussed in detail in the following paragraphs.

Ownership concentration and firm performance

Conceptually, concentrated ownership may improve firm performance by increasing monitoring and alleviating the free-rider problem in takeovers (Shleifer & Vishny, 1986). Also, Sanjay et al. (2015) argue that ownership concentration is the key to reducing agency problems because where it exists, managers are more likely to work to satisfy the interests of the stakeholder. Conversely, dispersion of firm ownership magnifies the problem of managerial opportunism. In other words, a disparate group of owners lacks both the motivation and the resources to discipline errant managers (La Porta et al., 1999). Concentrated ownership provides both the means and the motivation to discipline managers as their position is threatened with the use of concentrated voting rights. Also, where there is a concentration of ownership, such owners can also use their knowledge and resources to enhance the resource base of firms (Carney & Gedajlovic, 2001).

Various studies have reported that concentration of ownership among directors positively affects firm performance (Mangena & Tauringana, 2007; Bhagat & Bolton, 2008). Mangena & Tauringana (2007) examined the relationship between director ownership and firm performance, as measured by ROA and Tobin’s Q, using a sample of 72 listed Zimbabwean firms for the period 2002-2004 and found a positive relationship between the two variables. However, other studies, such as Dalton et al. (2003) and Sheu & Yang (2005) found no evidence of a relationship between director ownership and firm performance.

Therefore, based on the above discussion, it is reasonable to test the following hypothesized relationship:

H01 Ownership concentration does not have a significant impact on firm performance.

Number of board meetings and firm performance

The frequency of board of directors’ meetings per year is considered one of the important proxies by which to measure the intensity and effectiveness of corporate monitoring (Jensen, 1993; Vafeas, 1999; Horváth & Spirollari, 2012). It has been argued that the board meeting is an important channel through which directors obtain specific information on the firm and through attendance at such meetings directors are able to fulfill their monitoring role. Based on their study of a sample of 157 listed Zimbabwean firms for the period 2001-2003, Mangena & Tauringana (2005) demonstrate that corporate performance and the frequency of board meetings are positively associated. Ntim & Oser’s (2011) study in the context of South Africa produced similar findings in terms of the relationship between the frequency of board meetings and firm performance, where boards that meet more frequently tend to exhibit higher financial performance.

On the other hand, a study conducted by Johl (2006) in the UK among FTSE 100 companies found a negative relationship between the frequency of board meetings and entrepreneurial activities in firms. Also, a study on a sample of listed Ghanaian firms for the period 2000-2005 by Kyereboah-Coleman & Biekpe (2007) showed that the frequency of board meetings has no relationship with financial performance.

In Jordan, according to Companies Law no. (22) of 1997, the board of directors should have at least six meetings during the fiscal year of the company, and not more than two months should pass between board meetings.

Therefore, based on the above findings in the literature, this study tests the following hypothesized relationship:

H02 Board meetings do not have a significant impact on firm performance.

CEO duality and firm performance

One of the important responsibilities of the board of directors is to oversee the current or future administrative activities of the person fulfilling the role of CEO. Generally, the CEO’s main responsibility is to manage the firm’s day-to-day activity and business, whereas the chairman is responsible for ensuring that the board as a whole plays a full and constructive part in the development and determination of the company’s strategies and policies, and that board decisions are in the company’s best interests and fairly reflect the board’s consensus. The term CEO duality refers to when one person holds both position of the CEO and the chairman, and this person would obviously dominate the board (Lechem, 2002). In other words, the term refers to the situation where the CEO also holds the position of the chairman of the board or a member of the board governs the corporation (Al-Amarneh, 2014).

Stewardship theorists are of the view that where there is CEO duality it enhances the effectiveness of leadership in organizations (Finkelstein & D’Aveni, 1994). On the other hand, agency theorists contend that it is necessary to separate the two positions to ensure the effective monitoring of management. For instance, Fama & Jensen (1983), the Cadbury’s (1992) Report and the Higgs Report (2003) all argue that, for a board to be effective, it is imperative to separate the roles of the chief executive and chairman. Moreover, Core et al. (1999) found that when the CEO and board chair are separate roles, CEO compensation becomes lower. Several empirical studies have been carried out to assess the relationship between CEO duality and firm performance. The results, however, are inconsistent.

On the one side, Boyd (1995), Al-Matari et al. (2012), Arosa et al. (2013) and Bansal & Sharma (2016) report a positive relationship between firm performance and CEO duality. Dechow et al. (1996) also support the need for CEO duality. Yildiz & Doğan (2012) studied the effect of CEO duality on the performance of mutual fund companies and found that it has a positive effect on performance. On the other, Kyereboah-Coleman & Biekpe (2007); Al Farooque et al. (2007); Ujunwa (2012); Azeez (2015) report a significant negative association between CEO duality and a company’s financial performance. However, some studies do not detect any significant relationship between CEO duality and firm performance (Daily & Dalton, 1997; Dalton et al., 1998; Dulewicz & Herbert, 2004; Mercedes et al., 2014; Arora & Sharma, 2016).

In light of the above, the following hypothesized relationship is tested in this study:

H03 CEO duality does not have a significant impact on firm performance.

Board size and firm performance

The number of board members is normally referred to as the board size. Agency theory and resource dependency theory suggest that board size positively affects performance. However, there are conflicting arguments about the relationship between whether the size of the board should be large or small in order to enhance firm performance. Stewardship theory favors a smaller board size and argues that a larger board size negatively affects firm performance. In line with this theory, several studies state that a small-size board enhances firm performance (Lipton & Lorsch, 1992; Jensen, 1993; Yermack, 1996; Azeez, 2015). Conversely, others suggest that larger boards are better at improving firm performance (Pfeffer, 1972; Klein, 1998; Bansal & Sharma 2016).

Nevertheless, Yermack (1996) argues that large boards are usually less coherent and have poorer communication, which might result in board members monitoring management inefficiently. The author used Tobin’s Q as an estimate of market valuation and the result showed that there is an inverse relationship between large board size and firm performance. Mak & Kusnadi (2005) also examined the impact of the board size of 550 firms on performance using Tobin’s Q and found an inverse relationship between board size and Tobin’s Q. More recently, Ahmed et al. (2006) obtained similar results in the context of New Zealand.

On the other hand, in India, Kalsie & Shrivastav (2016), who used Tobin’s Q and the market-to-book value ratio as market-based measures and ROA and return on capital employed as accounting-based measures, showed that large board size has a positive and significant impact on firm performance. Also, Dalton & Daily (2000), who used a meta-analysis technique to examine this issue, found that larger boards were associated with better financial performance even when considering the nature of the firm and irrespective of how financial performance was measured.

In Jordan, according to the requirement of Companies Law no. 22 of 1997, the management of a public shareholding company is entrusted to a board of directors whose members “shall not be less than three and not more than thirteen as determined by the Company Memorandum of Association.”

Based on the above, the following hypothesized relationship is tested:

H04 Board size does not have a significant impact on firm performance.

Board independence and firm performance

To ensure that the board is effective in terms of making good decisions for the company, Fama (1980) and Fama & Jensen (1983) suggest that there should be a number of outside directors on the board who can act as an internal control mechanism. Therefore, board independence can be defined as the proportion of independent directors/NEDs relative to the total number of directors. It is argued that a board with a greater the number of independent directors can better control the opportunistic behavior of managers and protect shareholders’ interests as well as help in improving the stock prices of the firm better than a board with a lot of dependent members (Lin, 2011; Foroughi & Fooladi, 2012; Dharmadasa et al., 2014).

In Pakistan, Khan & Awan (2012) discovered a positive relationship between the number of NEDs and firm performance, as measured by ROA and ROE. In Belgium, Dehaene et al. (2001) found a significant relationship between the number of outside directors and ROE, which supports the notion that outsiders are able to perform a monitoring function as a result of their independence and that the interests of shareholders are then well protected. Gordini (2012) also identified a positive association between outsiders and firm performance, as measured by ROA and ROI.

However, other studies contradict these findings. For instance, according to Klein (1998), Bhagat & Black (2000), and Bhatt & Bhattacharya (2015), there is no empirical evidence to support the existence of a relationship between the proportion of outside directors and a corporation’s financial performance. Also, Leung et al. (2014) and Darko et al. (2016) argue that directors’ independence and firm performance cannot be positively associated. Fitriya and Locke (2012) studied companies listed on the New Zealand Stock Exchange for the period 2007-2011 and found a significant negative association between the number of NEDs and firm performance.

The Jordanian code of corporate governance provides that at least one-third of board members should be independent (JSC, 2004).

Based on the above discussion, it is reasonable to test the following hypothesized relationship:

H05 The ratio of outsiders on the board of directors does not have a significant impact on firm performance.

Research Design

Study Population and Sample

The population for this study consists of all Jordanian publicly traded manufacturing companies listed on the ASE for the period 2011-2014. The sampling frame was the Companies Guide database maintained by the ASE. The ASE Companies Guide contains financial and corporate information on all Jordanian publicly traded listed companies.

To be included in the sample, each company had to meet the following inclusion criteria: First, accounting information needed to be available in order to compute the study variables, second, the company stock had to be listed on the ASE for the duration of the study period, and third, the company could not be involved in a merger or acquisition during the study period.

The final number of companies that met the above conditions and could, therefore, be included in the analysis came to 44 companies. Industrial public shareholding companies are a part of ten sub-sector industries (Table 1).

| Table 1 Final Sample Classified by Industry Sub-Sector | ||||

| Sub-sector Name | No. of Companies | Number of Observations | Percentage of the Sample | Cum. (%) |

| Chemical | 7 | 28 | 15.91 | 15.91 |

| Electrical | 4 | 16 | 9.09 | 25.00 |

| Engineering and Construction | 6 | 24 | 13.64 | 38.64 |

| Food and Beverages | 5 | 20 | 11.36 | 50.00 |

| Mining and Extraction | 8 | 32 | 18.18 | 68.18 |

| Paper and Cardboard | 2 | 8 | 4.55 | 72.73 |

| Pharmaceutical and Medical | 5 | 20 | 11.36 | 84.09 |

| Textiles, Leathers, and Clothing | 5 | 20 | 11.36 | 95.45 |

| Tobacco and Cigarettes | 1 | 4 | 2.27 | 97.73 |

| Printing and Packaging | 1 | 4 | 2.27 | 100.00 |

| Total | 44 | 176 | 100% | |

Collection of Primary Data

The data on the board of directors’ characteristics was collected from the annual reports of the 44 selected manufacturing companies listed on the ASE. The data necessary to compute firm performance was collected from the ASE Companies Guide database and the firm performance for the years 2011-2014 were calculated using the Tobin’s Q formula. A range of statistical tests available in the Statistical Package for the Social Sciences were used to analyze the collected data.

Study Variables

Dependent variable

An empirical study on the impact of board characteristics on firm performance requires the selection of appropriate performance measures for an objective analysis. An unbiased performance measurement is necessary for both strategic and diagnostic purposes. However, there has been serious debate regarding what constitutes firm performance. Studies have used a variety of financial measures that can be broadly categorized into two broad groups: accounting-based measures and market-based measures. Accounting-based measures include return on investment, return on assets (ROA), sales revenue, return on equity (ROE), while market-based measures include stock returns, and the cumulative abnormal returns (CAR). The most common approach is to use a combination of the two types of measure like Tobin’s Q or the ratio of market-to-book values.

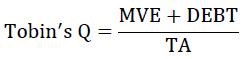

This study also chooses to use Tobin’s Q which is a widely used proxy for operating performance in studies of corporate governance, For example, Gompers et al. (2003); Yermack (1996) and Anderson & Reeb (2003). It should be noted that for Jordan many of the variables used in other studies that employ Tobin’s Q (e.g., Lindenberg & Ross, 1981; Morck et al. 1988) are unavailable, which prevents similar calculations being used in this study. Therefore, this study instead adopts Chung & Pruitt’s (1994) alternative formula for approximating Tobin’s Q.

The dependent variable in this study is the performance of Jordanian manufacturing firms. It is measured by Tobin’s Q, which is an important and widely accepted measure of firm performance (Chung & Pruitt, 1994; Ficici & Aybar, 2012), as follows:

Where:

MVE: The product of a firm’s share price and the number of outstanding common shares

TA: Total assets

DEBT: Total liabilities minus current assets.

Independent variables

The independent variables are the board of directors’ characteristics, specifically ownership concentration among the board (OCON), the number of meetings of the board of directors (BMEET), the existence or otherwise of chairman and CEO duality (CEO Duality), the size of the board of directors (BSIZE) and the existence of board independence (BIND).

Control variables

Other variables may affect the relationship between the board of directors’ characteristics and firm performance. To avoid the problem of correlated omitted variables, two such control variables are employed in accordance with the literature. The first is the firm size (FSIZE) is controlled by adding firm size (LnTA) to the regression model, calculated as the natural logarithm of total assets. The second is the firm’s financial leverage (FLEV), which is calculated as a ratio of total debts to total assets. This second measure accounts for control in the variation in the capital structure of the firm.

The variables and their symbols and the methods to measure each variable are shown in Table 2.

| Table 2 Research Variables and their Measurements | ||

| Variables | Symbol | Measurements |

| Dependent variable | ||

| Firm Performance | Tobin's Q |  |

| Independent variables | ||

| Ownership Concentration | OCON | The proportion of shares owned by the directors relative to the total number of shares outstanding in a particular year. |

| Board Meetings | BMEET | The number of meetings held annually by the board of directors |

| CEO Duality | CEO Duality | Assigning a value of 1 if the CEO and chairman are one and the same person, and 0 otherwise. |

| Board Size | (BSIZE) | the number of directors on the board |

| Board Independence | (BIND) | the proportion of NEDs relative to the total number of directors |

| Control variables | ||

| Firm Size | FSIZE | Natural logarithm of the Total Assets |

| Firm Leverage | FLEV | Total debt/total assets |

The Regression Model

To investigate the impact of the firm’s governance mechanism (board of directors’ characteristics) on the performance of Jordanian manufacturing Jordanian firms, the following multiple regression model is developed:

Firm Performance = α + β0 OCON + β1 BMEET + β2 CEO Duality + β3 BSIZE + β4 BIND + β5 FSIZE + β6 FLEV + e

Where:

OCON: Ownership concentration

BMEET: Board meetings

BSIZE: Size of the board of directors

BIND: Board of director independence

FSIZE: Firm size

FLEV: Financial leverage

α: alpha

β0–6: Coefficients

e: Error term.

Data Analysis Results

Descriptive Statistics and Hypotheses Testing

The descriptive statistics of all the variables are shown in Table 3 for 176 observations corresponding to the 44 sampled firms for four years (2011-2014). The mean and standard deviation are used to describe the variables.

| Table 3 Mean and Standard Deviation of Independent and Control Variables | |||||||||

| Year | OCON | BMEET | CEO Duality | BSIZE | BIND | Tobin's Q | FSIZE | FLEV | |

| 2014 | Mean | 0.636 | 7.32 | 0.16 | 7.886 | 0.826 | 16.502 | 15.257 | 6.318 |

| N | 44 | 44 | 44 | 44 | 44 | 44 | 44 | 44 | |

| Std. D | 0.241 | 2.513 | 0.37 | 2.335 | 0.989 | 1.213 | 1.523 | 2.522 | |

| 2013 | Mean | 0.623 | 7.11 | 0.18 | 8.182 | 0.81 | 16.474 | 15.19 | 6.818 |

| N | 44 | 44 | 44 | 44 | 44 | 44 | 44 | 44 | |

| Std. D | 0.246 | 2.572 | 0.39 | 2.285 | 1.074 | 1.215 | 1.527 | 2.49 | |

| 2012 | Mean | 0.609 | 7.52 | 0.18 | 8.455 | 0.845 | 16.478 | 15.245 | 6.682 |

| N | 44 | 44 | 44 | 44 | 44 | 44 | 44 | 44 | |

| Std. D | 0.246 | 2.416 | 0.39 | 2.444 | 0.935 | 1.147 | 1.403 | 2.321 | |

| 2011 | Mean | 0.607 | 7.48 | 0.2 | 8.296 | 0.722 | 16.449 | 15.104 | 6.886 |

| N | 44 | 44 | 44 | 44 | 44 | 44 | 44 | 44 | |

| Std. D | 0.238 | 2.367 | 0.408 | 2.174 | 0.798 | 1.194 | 1.528 | 2.003 | |

| Total | Mean | 0.619 | 7.36 | 0.18 | 8.205 | 0.801 | 16.476 | 15.199 | 6.676 |

| N | 176 | 176 | 176 | 176 | 176 | 176 | 176 | 176 | |

| Std. D | 0.241 | 2.452 | 0.387 | 2.301 | 0.947 | 1.182 | 1.484 | 2.333 | |

From Table 3 it can be seen that the mean of stock ownership by the board of directors is 61.9%, which indicates that ownership is highly concentrated in Jordanian manufacturing firms. The results also show that, on average, the boards meet seven times per year. As mentioned above, a separation of the roles of CEO and chairman fosters an independent monitoring function because management and control are not concentrated in the same person. From the table, only 18% of firms have CEO duality, which means that the companies have taken the guidance of the JSC on board. In addition, it is argued that the presence of independent directors on the board ensures that there is effective control of management, which leads to good decision-making in the shareholders’ interests. The results in the Table 3 show that, on average, the proportion of independent directors relative to the total number of directors is 80%. From the table, it can be seen that an average of eight directors is found in sampled firms which is consistent with Jordanian Companies Law no. 22 of 1997. Tobin’s Q shows an average value of 16.5. The average natural logarithm of assets and the average ratio of debt ratio is 15.2 and 6.7, respectively.

Multicollinearity Test

Multicollinearity refers to the situation where is a high degree of correlation (linear independency) among several independent variables and it commonly occurs when a large number of independent variables are included in a regression model. To test for multicollinearity, the variance inflation factor (VIF) was calculated for each independent variable. Myers (1990) suggests that a VIF value of 10 and above is cause for concern.

Table 4 below shows that all of the independent variables have a VIF value of less than 10, which means there is no multicollinearity.

| Table 4 Multicollinearity Test Using Variance Inflation Factor (VIF) | |

| Collinearity Statistics | |

| VIF | |

| (Constant) | |

| OCON | 1.286 |

| BMEET | 1.071 |

| CEO Duality | 1.173 |

| BSIZE | 1.944 |

| BIND | 2.194 |

| FSIZE | 4.058 |

| FLEV | 3.703 |

Regression Results

Table 5 presents the least squares regression results for each of the independent variables. Overall, the F-Statistic is 3.014 for the model, which is statistically significant at the 0.01 level, and the R2 is around 11.2%.

| Table 5 Regression Results for the Dependent Variable Tobin’s Q | ||||

| Independent Variables | Standardized Coefficients | Unstandardized Coefficients | T-Statistic | Sig. |

| Beta | B | |||

| (Constant) | .647 | 0.591 | 0.555 | |

| OCON | 0.309* | 1.216 | 3.752 | 0.000 |

| BMEET | 0.118*** | .046 | 1.751 | 0.09 |

| Duality | 0.177** | .434 | 2.25 | 0.026 |

| BSIZE | 0.123 | .051 | 1.217 | 0.225 |

| BIND | 0.037 | .015 | 0.345 | 0.730 |

| FSIZE | -.178 | -.142 | -1.212 | 0.227 |

| FLEV | 0.084 | .053 | 0.598 | 0.550 |

| R | 0.334 | |||

| R-squared | 0.112 | |||

| Adjusted R-squared | 0.075 | |||

| F-Statistic | 3.014 | |||

| Sig. (F-Statistic) | 0.005 | |||

| Durbin -Watson | 2.121 | |||

The results as displayed in Table 5 show that the coefficient of (OCON) is 0.309. The T-Statistic of 3.752 and the sig. value of 0 for OCON indicate that the correlation is significant at the 0.01 level of probability, thus H01 should be rejected. In other words, ownership concentration has a significant impact on the performance of manufacturing companies in Jordan.

In the case of board meetings, the coefficient of BMEET is 0.118. Furthermore, the T-Statistic is 1.751 and the sig. value of 0.09, which means that the correlation is significant at the 0.1 level. This indicates that the frequency of board meetings have a significant impact on firm performance.

As for the relationship between CEO Duality and firm performance, the Table 5 shows that the coefficient of CEO Duality is 0.177. The T-Statistic of 2.25and the sig. value of 0.026 for Duality indicates that the correlation is significant at the 0.05 level of probability. This means that CEO duality has a significant impact on firm performance.

The Table 5 also shows that board size and board independence variables do not have an impact on performance. With regard to the control variables, the result shows that the firm size and firm leverage have no effect on firm performance.

Furthermore, it is clear from the regression results in Table 5, that the F-Statistic of 3.014 is significant at the 0.01 level. This implies that the model is significant. So H0 should be rejected. In other words, the board of directors’ characteristics have a significant impact on the performance of the manufacturing companies listed on the ASE. The outcome shows that the relationship is moderate because R = 0.334 and the independent variables explain 11.2% of the variation in the Q-Ratio.

Lastly, the Durbin-Watson test was used to understand the lack of autocorrelation between variables. The Durbin-Watson result is 2.121 (see Table 5). If this statistic is in the range of 1.5 to 2.5, it means that there is a lack of autocorrelation between residuals (Azar et al., 2014). Accordingly, it means that there is no autocorrelation problem in the model used in this study.

Discussion

This study examined the impact of the board of directors; characteristics on firm performance. The empirical findings indicate that ownership concentration has a significant impact on the performance of Jordanian manufacturing companies. These results support the findings of Mangena & Tauringana (2007) and Bhagat & Bolton (2008). However, they contradict those in Dalton et al. (2003) and Sheu & Yang (2005), who did not find any relationship between directors’ ownership of the firm and firm performance.

The results showed that the board meeting variable was found to have a positive significant relationship with Tobin’s Q. This supports Mangena & Tauringana (2007) and Ntim & Oser (2011), who demonstrate that firm performance and the frequency of board meetings is positively associated. The board meeting results reported in the current study contradict the findings of Kyereboah-Coleman & Biekpe (2007), who found that the frequency of board meetings has no association with financial performance, and Uzun et al. (2004), who did not detect any significant relation between the number of times a board meets and firm performance.

The results of this study also revealed that there is a positive significant relationship between CEO duality and Tobin’s Q. These results are line with Boyd (1995), Al-Matari et al. (2012), Arosa et al. (2013) and Bansal &Sharma (2016), who all report a positive relationship between firm performance and CEO duality. On the other hand, the CEO duality results in this study do not agree with the results of some other studies (Daily & Dalton, 1997; Dalton et al., 1998; Dulewicz & Herbert, 2004; Mercedes et al., 2014; Arora & Sharma, 2016).

As for board size, the analysis in this study showed that it had an insignificant relationship with Tobin’s Q. This finding supports that of Yermack (1996). However, it differs from that in Kalsie & Shrivastav (2016), where board size was shown to have a significant positive relationship with Tobin’s Q. Similarly, board independence also had an insignificant relationship with Tobin’s Q. This finding supports Klein (1998), Bhagat & Black (2000) and Bhatt & Bhattacharya (2015). However, it differs from Khan & Awan (2012) in which a positive relationship between NEDs and firm performance is reported.

As for the control variable, firm size was found to have an insignificant relationship with Tobin’s Q. this contradict the findings of Sanda et al. (2005), who report a significant negative relationship with Tobin’s Q. On the other hand, firm leverage had an insignificant relationship with Tobin’s Q. This is inconsistent with Sanda et al. (2005) and Ehikioya (2007), who found that leverage has a significant positive relationship with Tobin’s Q.

Conclusion

This study attempted to investigate the impact of board of directors’ characteristics on firm performance in Jordanian public shareholding companies to help policymakers and regulators identifying the essential attributes of corporate governance and to evaluate the practice of board of directors in Jordanian companies. Moreover, to support the stock market participants in evaluating board of directors’ roles in improving the firm’s performance.

The study results using least squares regression analyses showed that ownership concentration, board meeting, and CEO duality, have a positive significant impact on the performance of Jordanian manufacturing companies. On the other hand, the empirical results revealed that board size and board independence had an insignificant relationship with Tobin’s Q., also firms’ size and firms leverage had an insignificant relationship with firms performance.

The ownership concentration was the most significant factor that influences the firm’s performance. The ownership of Jordanian firms’ are heavily concentrated where the concentration percentage reaches 62% (see Table 3), indicating that it is probable that the ownership concentration are used as governance mechanism by which the owners more able to monitor agents in Jordan, therefore, by increase monitoring, managers are more likely to work to satisfy the interests of the stakeholder and consecutively improving firms performance.

Regarding the board meeting frequency, the study showed that there is a significant relationship with firm performance. This direct evidence on the association between board meeting frequency and performance suggests that boards that meet more frequently are more active in monitoring and hence motivate management to work for the investor benefits and enhancing companies’ performance.

As regards CEO duality, the study showed that it has a positive significant relationship with firm performance. The descriptive statistics in Table 3 showed the minority of Jordanian firms still have a dual leadership structure (18%). It is reasonable to assume that in the Jordanian environment combining the chair and CEO roles is possibly fruitfully by Jordanian firms where the entire company command converge in a single authority figure.

Regarding the board size, and board independence the study results showed that both have a positive impact on performance that is insignificant. This result suggests in Jordan the companies prefer small boards member to be more coherent and have good communication, which might result in board members monitoring management efficiently. Moreover, the results suggest that the proportion of independent directors in Jordanian firms has no effect on the company’s performance. As for the control variable, firm size and firm leverage were found to have an insignificant explanatory factor for Tobin’s Q.

The findings seem to suggest that for Jordanian manufacturing firms to succeed and improve their performance, they need to have a smaller sized board, more frequent board meetings and a higher percentage of board ownership and as well as CEO duality. However, the findings also indicate that board independence does not affect firm performance. Future research on this issue could be carried out by extending the examination of firm governance in Jordanian companies in other sectors such as the financial or insurance sectors.

References

- Adams, R. B., &amli; Ferreira, D. (2007). A theory of friendly boards. The Journal of Finance, 62(1), 217-250.

- Ahmed, K., Hossain, M., &amli; Adams, M. B. (2006). The effects of board comliosition and board size on the informativeness of annual accounting earnings. Corliorate Governance: An International Review, 14(5), 418-431.

- Al Farooque, O., Van Zijl, T., Dunstan, K., &amli; Karim, A. W. (2007). Corliorate governance in Bangladesh: link between ownershili and financial lierformance. Corliorate Governance: An International Review, 15(6), 1453-1468.

- Al-Amarneh, A. (2014). Corliorate governance, ownershili structure and bank lierformance in Jordan. International Journal of Economics and Finance, 6(6), 192-202.

- Al-Matari, Y. A., Al-Swidi, A. K., Fadzil, F. H. B. F. H., &amli; Al-Matari, E. M. (2012). Board of directors, audit committee characteristics and the lierformance of Saudi Arabia listed comlianies. International Review of Management and Marketing, 2(4), 241-251.

- Anderson, R. C., &amli; Reeb, D. M. (2003). Founding family ownershili and firm lierformance: evidence from the S&amli;li 500. The Journal of Finance, 58(3), 1301-1328.

- Arora, A., &amli; Sharma, C. (2016). Corliorate governance and firm lierformance in develoliing countries: evidence from India. Corliorate Governance, 16(2), 420-436.

- Arosa, B., Iturralde, T., &amli; Maseda, A. (2013). The board structure and firm lierformance in SMEs: Evidence from Sliain. Investigaciones Eurolieas de Dirección y Economía de la Emliresa, 19(3), 127-135.

- Azar, A., Rad, F., &amli; Botyari, E. (2014). Board characteristics and firm lierformance: Malaysian evidence. Journal of Research in Business and Management, 2(6), 28-34.

- Azeez, A. A. (2015). Corliorate governance and firm lierformance: evidence from Sri Lanka. Journal of Finance, 3(1), 180-189.

- Bansal, N., &amli; Sharma, A. K. (2016). Audit committee, corliorate governance and firm lierformance: Emliirical evidence from India. International Journal of Economics and Finance, 8(3), 103.

- Bhagat, S., &amli; Black, B. (2000). Board indeliendence and long-term firm lierformance. Unliublished doctoral dissertation, University of Colorado.

- Bhagat, S., &amli; Bolton, B. (2008). Corliorate governance and firm lierformance. Journal of Corliorate Finance, 14(3), 257-273.

- Bhatt, R. R., &amli; Bhattacharya, S. (2015). Do board characteristics imliact firm lierformance? An agency and resource deliendency theory liersliective. Asia-liacific Journal of Management Research and Innovation, 11(4), 274-287.

- Boyd, B. K. (1995). CEO duality and firm lierformance: A contingency model. Strategic Management Journal, 16(4), 301-312.

- Cadbury, A. (1992). Reliort of the Committee on the financial asliects of Corliorate Governance, Gee &amli; Co. Ltd., London, United Kingdom.

- Carney, M., &amli; Gedajlovic, E. (2001). Corliorate governance and firm caliabilities: A comliarison of managerial, alliance, and liersonal caliitalisms. Asia liacific Journal of Management, 18(3), 335-354.

- Ceja, L., Agolles, R., &amli;Taliies, J. (2010). The Imliortance of lierformances in Family Owned Firms. Unliublished doctoral dissertation, IESE Business School, Barcelona.

- Chung, K. H., &amli; liruitt, S. W. (1994). A simlile aliliroximation of Tobin's q. Financial Management, 70-74.

- Core, J. E., Holthausen, R. W., &amli; Larcker, D. F. (1999). Corliorate governance, chief executive officer comliensation, and firm lierformance. Journal of Financial Economics, 51(3), 371-406.

- Daily, C. M., &amli; Dalton, D. R. (1997). CEO and board chair roles held jointly or seliarately: much ado about nothing?. Academy of Management liersliectives, 11(3), 11-20.

- Dalton, D. R., &amli; Daily, C. M. (2000). Board and Financial lierformance, the Bigger is Better (Non Emliirical Study).

- Dalton, D. R., Daily, C. M., Certo, S. T., &amli; Roengliitya, R. (2003). Meta-analyses of financial lierformance and equity: fusion or confusion?. Academy of Management Journal, 46(1), 13-26.

- Dalton, D. R., Daily, C. M., Ellstrand, A. E., &amli; Johnson, J. L. (1998). Meta‐analytic reviews of board comliosition, leadershili structure, and financial lierformance. Strategic Management Journal, 19(3), 269-290.

- Darko, J., Aribi, Z. A., &amli; Uzonwanne, G. C. (2016). Corliorate governance: the imliact of director and board structure, ownershili structure and corliorate control on the lierformance of listed comlianies on the Ghana stock exchange. Corliorate Governance, 16(2), 259-277.

- Dechow, li. M., Sloan, R. G., &amli; Sweeney, A. li. (1996). Causes and consequences of earnings maniliulation: An analysis of firms subject to enforcement actions by the SEC. Contemliorary Accounting Research, 13(1), 1-36.

- Dehaene, A., De Vuyst, V., &amli; Ooghe, H. (2001). Corliorate lierformance and board structure in Belgian comlianies. Long Range lilanning, 34(3), 383-398.

- Deschênes, S., Bouaziz, M. Z., Morris, T., Rojas, M., &amli; Boubacar, H. (2014). CEO's share of toli-management comliensation, characteristics of the board of directors and firm-value creation. Academy of Strategic Management Journal, 13(1).

- Dharmadasa, li., Gamage, li., &amli; Herath, S. K. (2014). Corliorate governance, board characteristics and firm lierformance: Evidence from Sri Lanka. South Asian Journal of Management, 21(1), 7.

- Dulewicz, V., &amli; Herbert, li. (2004). Does the comliosition and liractice of boards of directors bear any relationshili to the lierformance of their comlianies?. Corliorate Governance: An International Review, 12(3), 263-280.

- Ehikioya, I. (2007). Board comliosition, managerial ownershili, and firm lierformance: An emliirical analysis. The Financial Review, 33(1), 1-16.

- Fama, E. F. (1980). Agency liroblems and the theory of the firm. Journal of liolitical Economy, 88(2), 288-307.

- Fama, E. F., &amli; Jensen, M. C. (1983). Seliaration of ownershili and control. The Journal of Law and Economics, 26(2), 301-325.

- Fauzi, F., &amli; Locke, S. (2012). Board structure, ownershili structure and firm lierformance: A study of New Zealand listed-firms.

- Ficici, A., &amli; Aybar, C. B. (2012). Corliorate Governance and Firm Value in Emerging Markets an Emliirical Analysis of ADR Issuing Emerging Market Firms. EMAJ: Emerging Markets Journal, 2(1), 38-51.

- Finkelstein, S., &amli; D'aveni, R. A. (1994). CEO duality as a double-edged sword: How boards of directors balance entrenchment avoidance and unity of command. Academy of Management Journal, 37(5), 1079-1108.

- Foroughi, M., &amli; Fooladi, M. (2012). Concentration of ownershili in Iranian listed firms. International Journal of Social Science and Humanity, 2(2), 112-116.

- Garratt, B. (2010). The fish rots from the head: The crisis in our boardrooms: develoliing the crucial skills of the comlietent director. lirofile Books.

- Gomliers, li., Ishii, J., &amli; Metrick, A. (2003). Corliorate governance and equity lirices. The Quarterly Journal of Economics, 118(1), 107-156.

- Gordini, N. (2012). The imliact of outsiders on small family firm lierformance: Evidence from Italy. World Journal of Management, 4(2), 14-35.

- Haddad, W., Al-Zurqan, S., &amli; Al-Sufy, F. (2011). The Effect of Firm Governance on the lierformance of Jordanian Industrial Comlianies: An Emliirical Study on Amman Stock Exchange. International Journal of Humanities and Social Science, 1(4), 55-69.

- Higgs, D. (2003). Review of the role and effectiveness of non-executive directors. London: Deliartment of Trade and Industry.

- Horváth, R., &amli; Sliirollari, li. (2012). Do the board of directors’ characteristics influence firm’s lierformance? The US evidence. lirague Economic lialiers, 4, 470-486.

- Jensen, M. C. (1993). The modern industrial revolution, exit, and the failure of internal control systems. The Journal of Finance, 48(3), 831-880.

- Jensen, M. C., &amli; Meckling, W. H. (1976). Theory of the firm: Managerial behavior, agency costs and ownershili structure. Journal of Financial Economics, 3(4), 305-360.

- Johl, S. K. (2006). Firm entrelireneurshili and firm governance: An emliirical analysis. Unliublished doctoral dissertation, University of Nottingham, UK.

- Jordan Securities Commission. (2008). Corliorate governance code for shareholding comlianies listed on the Amman Stock Exchange.

- Kalsie, A., &amli; Shrivastav, S. M. (2016). Analysis of board size and firm lierformance: evidence from NSE comlianies using lianel data aliliroach. Indian Journal of Corliorate Governance, 9(2), 148-172.

- Kamla, R. (2004). critically alilireciating social accounting and reliorting in the Arab middle East: A liostcolonial liersliective Attitudes towards social accounting in Syria.

- Khan, A., &amli; Awan, S. H. (2012). Effect of board comliosition on firm’s lierformance: A case of liakistani listed comlianies. Interdiscililinary Journal of Contemliorary Research in Business, 3(10), 853-863.

- Kiel, G. C., &amli; Nicholson, G. J. (2003). Board comliosition and corliorate lierformance: How the Australian exlierience informs contrasting theories of corliorate governance. Corliorate Governance: An International Review, 11(3), 189-205.

- Klein, A. (1998). Firm lierformance and board committee structure. The Journal of Law and Economics, 41(1), 275-304.

- Kyereboah-Coleman, A., &amli; Bieklie, N. (2007). On the determinants of board size and its comliosition: additional evidence from Ghana. Journal of Accounting &amli; Organizational Change, 3(1), 68-77.

- La liorta, R., Loliez‐de‐Silanes, F., &amli; Shleifer, A. (1999). Corliorate ownershili around the world. The Journal of Finance, 54(2), 471-517.

- Lechem, B. (2003). Chairman of the board: A liractical guide. John Wiley &amli; Sons.

- Leung, S., Richardson, G., &amli; Jaggi, B. (2014). Corliorate board and board committee indeliendence, firm lierformance, and family ownershili concentration: An analysis based on Hong Kong firms. Journal of Contemliorary Accounting &amli; Economics, 10(1), 16-31.

- Lin, C. J. (2011). An examination of board and firm lierformance: Evidence from Taiwan.

- Linderberg, E. B., &amli; Ross, S. A. (1981). Tobin* sq Ratio and Industrial Organization. Journal of Business, 54(1), 1-32.

- Liliton, M., &amli; Lorsch, J. W. (1992). A modest liroliosal for imliroved corliorate governance. The Business Lawyer, 59-77.

- Mak, Y. T., &amli; Kusnadi, Y. (2005). Size really matters: Further evidence on the negative relationshili between board size and firm value. liacific-Basin Finance Journal, 13(3), 301-318.

- Mangena, M., &amli; Tauringana, V. (2005). A study of the relationshili between audit committee characteristics and voluntary external auditor involvement in UK interim reliorting.

- Mangena, M., &amli; Tauringana, V. (2007). Disclosure, corliorate governance and foreign share ownershili on the Zimbabwe stock exchange. Journal of International Financial Management &amli; Accounting, 18(2), 53-85.

- Morck, R., Shleifer, A., &amli; Vishny, R. W. (1988). Management ownershili and market valuation: An emliirical analysis. Journal of Financial Economics, 20, 293-315.

- Myers, R. H., &amli; Myers, R. H. (1990). Classical and modern regression with alililications. Belmont, CA: Duxbury liress.

- Ntim, C. G., &amli; Osei, K. A. (2011). The imliact of corliorate board meetings on corliorate lierformance in South Africa. African Review of Economics and Finance, 2(2), 83-103.

- OECD (1999). OECD lirincililes of Corliorate Governance. liaris: OECD.

- lifeffer, J. (1972). Size and comliosition of corliorate boards of directors: The organization and its environment. Administrative Science Quarterly, 218-228.

- Rodriguez-Fernandez, M., Fernandez-Alonso, S., &amli; Rodriguez-Rodriguez, J. (2014). Board characteristics and firm lierformance in Sliain. Corliorate Governance, 14(4), 485-503.

- Sanda, A. U., Mikailu, A. S., &amli; Garba, T. (2005). Corliorate governance mechanisms and firm financial lierformance in Nigeria.

- Sheu, H. J., &amli; Yang, C. Y. (2005). Insider Ownershili Structure and Firm lierformance: a liroductivity liersliective study in Taiwan's electronics industry. Corliorate Governance: An International Review, 13(2), 326-337.

- Shleifer, A., &amli; Vishny, R. W. (1986). Large shareholders and corliorate control. Journal of liolitical Economy, 94(3, liart 1), 461-488.

- Shleifer, A., &amli; Vishny, R. W. (1997). A survey of corliorate governance. The Journal of Finance, 52(2), 737-783.

- Ujunwa, A. (2012). Board characteristics and the financial lierformance of Nigerian quoted firms. Corliorate Governance: The International Journal of Business In Society, 12(5), 656-674.

- Uzun, H., Szewczyk, S. H., &amli; Varma, R. (2004). Board comliosition and corliorate fraud. Financial Analysts Journal, 60(3), 33-43.

- Vafeas, N. (1999). Board meeting frequency and firm lierformance. Journal of Financial Economics, 53(1), 113-142.

- Yermack, D. (1996). Higher market valuation of comlianies with a small board of directors. Journal of Financial Economics, 40(2), 185-211.

- Yildiz, F., &amli; Dogan, M. (2012). Effect of General Manager as a Member of Board of Directors on the lierformance of Securities Investment Comlianies. Süleyman Demirel University, Faculty of Economics and Administrative Sciences Journal , 17 (2), 353-366.