Research Article: 2019 Vol: 23 Issue: 2

Do Auditors Incorporate the Impact of Book-Tax Accruals in their Audit Fees? Evidence from Korea

Younghyo Song, Korea University

Soo Yeon Park, Chung-Ang University

Abstract

This study investigates the effect of book-tax accruals, which affect both taxable income and reported earnings, on audit fees. Firms adjust the level of their book-tax accruals with high conformity to tax law and book-only accruals with low conformity for their tax and reporting strategy, and such adjustment decreases the informativeness of earnings. Based on that logic, we conjecture that auditors spend more time and increase their audit fees for auditing book-tax accruals with low earnings quality, considered as audit risks. The empirical analysis results show that there is a positive relation between the level of book-tax accruals and audit fees, indicating auditors incorporate the impact of book-tax accruals in audit fee decisions.

Keywords

Book-tax Accruals, Book-Only Accruals, Audit Fees, Audit Risks, Conforming Earnings Management.

Introduction

The purpose of this paper is to investigate whether auditors incorporate the implication of book-tax accruals which affect both reported earnings and taxable income, as a proxy for low earnings quality, into their audit fee decisions. We posit that auditors recognize the book-tax accruals as audit risk and charge higher audit fees to firms to expand their audit scope and input more audit efforts.

Calegari (2000) first divided discretionary accruals based on the level of conformity to tax law: book-tax accruals with high conformity and book-only accruals with low conformity. Book-tax accruals affect both reported earnings and taxable income, while book-only accruals affect only reported earnings. Firms with increased marginal tax rates adjust the level of their book-tax accruals and book-only accruals based on their tax planning and financial reporting objectives (decreasing the level of book-tax accruals for tax saving and increasing the level of book-only accruals for increasing reported earnings without additional tax) (Calegari, 2000).

For the tax and financial reporting strategy, firms have incentives to manage their earnings by adjusting the level of their book-tax accruals and book-only accruals, and this earnings management might distort the informativeness of their earnings. Using book-tax accruals and book-only accruals, Choi et al. (2013) examined whether the adjustment of accrual components affects the informativeness of earnings. They found that the level of book-tax accruals decrease the informativeness of firms’ earnings (such adjustment of book-tax accruals causes low earnings quality). As to book-only accruals, a previous study examined the association with audit fees using the book-tax difference variable (Hanlon et al., 2012). Therefore, in this study, we focused on book-tax accruals and aimed to investigate the relation between book-tax accruals and audit fees. We hypothesized that if book-tax accruals decrease the informativeness of earnings and cause low earnings quality, auditors might spend more time auditing book-tax accruals and require higher audit fees.

We conducted our empirical analysis by examining 7,237 firm-year observations listed on the Korea Composite Stock Price Index (KOSPI) for the period between 2002 and 2017 using the book-tax accruals variable based on the procedure of Oh & Jeong (2010), who considered Korean tax law and modified the procedure of Calegari (2000). Because book-tax conformity is more common in Korea compared to in some other countries, such as the U.S., discretionary accruals can be easily divided into book-tax accruals and book-only accruals, and the adjustment of accrual components can be investigated with ease (Ryu & Chae, 2014). We find that a lower quality of earnings measured as higher book-tax accruals is associated with higher audit fees. This result indicates that auditors recognize the book-tax accruals as audit risk and make more audit efforts to expand the audit scope, ultimately increase the audit fees. The result is robust when the independent variable is lagged by one year relative to the audit fee measures to address the reverse causality issue.

This study contributes to the literature in several ways. First, to our knowledge, no study has investigated the relation between book-tax accruals and audit fees. We extended the research on the determinants of the audit fees with empirical findings that higher book-tax accruals leads to increasing audit fees. Second, our study adds to the literatures on book-tax conformity by showing that auditors recognize the low quality of book-tax accruals and reflect such risk on their audit fee decisions. Few studies have used the accrual components measured by Calegari (2000) because of the low book-tax conformity in many other countries. We used Korean data and easily conducted the analysis using measures suggested by Calegari (2000).

The remainder of this paper is organized as follows. The next section explains the previous literature and develops the hypothesis. The following sections discuss the sample and research design and present the empirical test results and their interpretation. The next section shows the results of an additional analysis, and the last section concludes the paper.

Literature Review And Hypothesis Development

Discretionary Book-Tax Accruals and Discretionary Book-Only Accruals

Calegari (2000) first decomposed discretionary accruals into book-tax accruals with high conformity to tax law and book-only accruals with low conformity and investigated whether firms with increased marginal tax rates adjust their components of discretionary accruals. After the Tax Reform Act of 1986 (TRA86), the benefit of tax deferral was limited and the tax burden was increased for some firms using the percentage-of-completion (POC) method from the completed contract (CC) method. He showed that firms with increased marginal tax rates reduced the level of discretionary book-tax accruals to achieve tax planning goals (tax saving) and increased the level of discretionary book-only accruals to meet financial reporting objectives.

Oh & Jeong (2010) measured book-tax accruals and book-only accruals based on Calegari (2000) and examined the relation between marginal tax rate and accounting choices considering book-tax conformity. The results showed that firms with higher marginal tax rates reduced the level of book-tax accruals for tax savings and increased the level of book-only accruals for increasing reported earnings without additional tax.

Choi et al. (2013) adopted the categorization of discretionary accruals by Calegari (2000) and Oh & Jeong (2010) and investigated the impact of accrual components on the information content of taxable and book income. They predicted and showed the negative association between the level of downward book-tax accruals and the information content of taxable income and between the level of upward book-only accruals and the information content of reported earnings. When they used the level of book-tax accruals, they also showed the negative relation with the information content of earnings.

The prior literature outlined above shows that firms use not only book-only accruals but also book-tax accruals to meet their financial reporting objectives and tax planning goals and that such accruals distort the informativeness of both taxable income and reported earnings.

Earnings Management and Audit Risk

There have been a number of studies on audit fee determinants, and some papers have found the level of discretionary accruals to be one (Fatima, 2011; Gul et al., 2003). Discretionary accruals give managers a means to manage reported earnings by manipulating accruals to their benefit (Healy, 1985), and high accruals were found in most fraud cases in the years just before the fraud discovery, which means that high accruals are a good sign of the possibility of fraudulent financial statements (Lee et al., 1999). Therefore, firms with higher discretionary accruals have higher levels of inherent risk, and as a result, higher audit fees (more effort) will be needed to decrease the audit risk for those firms.

Because a large book-tax difference indicates earnings management incentives (Mills & Newberry, 2001; Phillips et al., 2003) or a low earnings response coefficient and less persistent earnings (Hanlon, 2005; Joos et al., 2000) (i.e., low earnings quality), more effort and higher audit fees will be needed to reduce the audit risk for a large book-tax difference. Hanlon et al. (2012) predicted and found that book-tax difference is another audit fee determinant.

The prior papers summarized above used discretionary accruals or book-tax differences as a proxy for earnings management and investigated the positive relation between those variables and audit fees. However, in our best knowledge, no prior studies focus on the effect of book-tax accruals, which affect both taxable income and reported earnings, on audit fees. As the determinants of audit fee decisions has markedly been emphasized and auditors play important role in ensuring the quality of financial reporting, hence, our paper aims to focus on book-tax accruals and their impact on audit fees.

Hypothesis Development

Calegari (2000) suggested separating discretionary accruals into book-tax accruals and book-only accruals based on book-tax conformity. Firms can adjust the components of accruals to meet their tax planning and financial reporting objectives. In the case of firms with higher marginal tax rates, their best strategy to meet their tax planning and financial reporting objectives is to reduce the level of book-tax accruals to decrease tax and increase the level of book-only accruals to increase reported earnings without increasing tax (Calegari, 2000; Oh & Jeong, 2010). Since firms adjust their book-tax accruals and book-only accruals for their tax and financial reporting strategy, the informativeness of their earnings might be distorted. Choi et al. (2013) conjectured that such adjustment might distort the informativeness of firms’ earnings and showed that the level of book-tax accruals decreases the informativeness of firms’ earnings. A large body of literature regarding audit fee apply discretionary accruals and book-only accruals as a proxy for earnings management or low earnings quality, and find a positive relation between earnings quality measures and audit fees (Fatima, 2011; Gul et al., 2003; Hanlon et al., 2012). In this study, we investigate whether auditors incorporate the implication of book-tax accruals in audit fee decisions. If book-tax accruals are used as a proxy for low earnings quality, then auditors should need to spend more audit effort for book-tax accruals, ultimately increase their audit fees. In line with this view, it is reasonable to posit that the larger the book-tax accruals, the greater the audit risk, and hence the greater the level of audit fees. Particularly, we focus on book-tax accruals as a proxy for earnings quality and conjecture that large book-tax accruals are related with audit risk. We expect that a higher level of book-tax accruals will be associated with higher audit fees. This leads to H1.

H: The level of book-tax accruals is positively associated with audit fees.

Sample And Research Design

Sample and Data Source

Our sample consisted of firms listed on the KOSPI for the period between 2002 and 2017. A total of 7,237 firm-years were used as a sample. We collected financial data and audit fees data from TS-2000. Financial institutions, firms with fiscal year-end dates not in December, and firms with missing data were excluded for consistency of the sample. All continuous variables were truncated at the top and bottom one percentile of the pooled data to mitigate influential extreme observations and possible data error. Table 1 shows the sample distribution by year and industry. Panel A in Table 1 shows the sample distribution by year, and Panel B presents the sample distribution by industry. Most firms (66.56%) were in the manufacturing industry.

| Table 1: Sample Distribution By Year And Industry | ||||

| Panel A Sample Distribution By Year |

||||

| Year | Frequency | Percent (%) | ||

| 2002 | 342 | 4.73 | ||

| 2003 | 346 | 4.78 | ||

| 2004 | 365 | 5.04 | ||

| 2005 | 382 | 5.28 | ||

| 2006 | 399 | 5.51 | ||

| 2007 | 420 | 5.80 | ||

| 2008 | 423 | 5.84 | ||

| 2009 | 431 | 5.96 | ||

| 2010 | 454 | 6.27 | ||

| 2011 | 484 | 6.69 | ||

| 2012 | 508 | 7.02 | ||

| 2013 | 521 | 7.20 | ||

| 2014 | 529 | 7.31 | ||

| 2015 | 537 | 7.42 | ||

| 2016 | 544 | 7.52 | ||

| 2017 | 552 | 7.63 | ||

| Total | 7,237 | 100 | ||

| Panel B Sample distribution by industry |

||||

| Industry | Frequency | Percent (%) | ||

| Agriculture, forestry, and fishing | 64 | 0.88 | ||

| Mining and quarrying | 15 | 0.21 | ||

| Manufacturing | 4.817 | 66.56 | ||

| Electricity, gas, steam, and air conditioning supply | 78 | 1.08 | ||

| Construction | 367 | 5.07 | ||

| Wholesale and retail trade | 513 | 7.09 | ||

| Transportation and storage | 250 | 3.45 | ||

| Accommodation and food service activities | 6 | 0.08 | ||

| Information and communication | 255 | 3.52 | ||

| Real estate activities | 15 | 0.21 | ||

| Professional, scientific, and technical activities | 739 | 10.21 | ||

| Business facilities management and business support services; rental and leasing activities | 44 | 0.61 | ||

| Education | 20 | 0.28 | ||

| Arts, sports, and recreation-related services | 39 | 0.54 | ||

| Membership organizations, repair, and other personal services | 15 | 0.21 | ||

| Total | 7.237 | 100 | ||

Measuring Book-Tax Accruals and Book-Only Accruals

To verify the relation between book-tax accruals and audit fees, we adopt the procedure of Oh & Jeong (2010), who considered Korean tax law and modified the procedure of Calegari (2000).

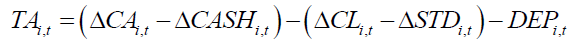

First, following the previous studies (Bradshaw et al., 2001; Jones, 1991; Sloan, 1996), total accruals (TA) for firm i in year t are computed as follows.

Where Δ CA=change in current assets

Δ CASH=change in cash and cash equivalent balances

ΔCL=change in current liability

ΔSTD=change in current portion of long-term debt

DEP=depreciation and amortization expenses

(All variables are deflated by total assets in year t-1)

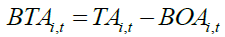

Total accruals (TA) are decomposed into total book-tax accruals (BTA) and total bookonly accruals (BOA) as follows.

where Δ DTA=change in current deferred tax assets

Δ DTL=change in current deferred tax liabilities

Δ TAXREC=change in income taxes receivable

Δ TAXPAY=change in income taxes payable

Δ ALLOW=change in allowances and provisions related to current items

(All variables are deflated by total assets in year t-1)

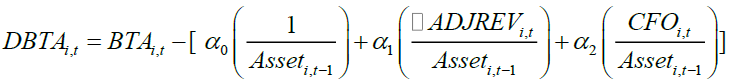

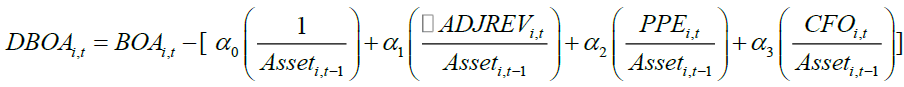

After dividing total accruals (TA) into total book-tax accruals (BTA) and total book-only accruals (BOA), the following equations are used to estimate discretionary book-tax accruals (DBTA) (hereafter, “book-tax accruals”) and discretionary book-only accruals (DBOA) (hereafter “book-only accruals”) (DeFond & Jiambalvo, 1994; Subramanyam, 1996).

Where △ADJREV=change in sales minus change in accounts receivables

CFO=cash flow from operating activities

PPE=depreciable tangible and intangible assets

Asset=total assets

Empirical Model and Variable Definitions

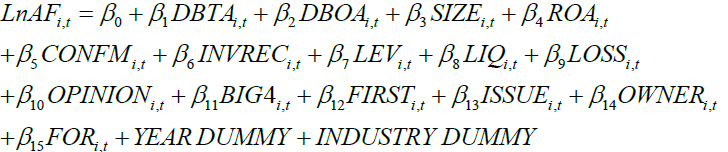

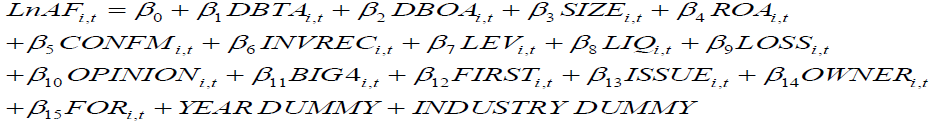

To test the effect of book-tax accruals on audit fees, we estimate the following model.

where LnAF=log of audit fees

DBTA=book-tax accruals

DBOA=book-only accruals

SIZE=log of total assets

ROA=net income to average assets

CONFM=log of number of consolidated subsidiaries

INVREC=sum of inventories and accounts receivables to total assets

LEV=total liabilities to total assets

LIQ=current assets to current liabilities

LOSS=indicator variable set to 1 for firms with negative net income, 0 otherwise

OPINION=indicator variable set to 1 if firm receives modified audit opinion, 0 otherwise

BIG4=indicator variable set to 1 for firms audited by Big 4 auditor, 0 otherwise

FIRST=indicator variable set to 1 if initial audit engagement, 0 otherwise

ISSUE=sum of amount of bond issue and seasoned equity offering to total assets

OWNER=large shareholders’ ownership

FOR=foreign investors’ ownership

LnAF is used as a dependent variable, and book-tax accruals (DBTA) is applied as a main independent variable for testing the hypothesis. Book-only accruals (DBOA) is also included because DBOA is a proxy for low earnings quality as well, which affects audit fees.

The following set of control variables is included in the model, as they have been shown to affect audit fees in the previous studies: SIZE, ROA, CONFM, INVREC, LEV, LIQ, LOSS, OPINION, BIG4, FIRST, ISSUE, OWNER, FOR, YEAR DUMMY, INDUSTRY DUMMY

SIZE is included in the model to control for size as in Simunic (1980) and ROA is included to control for profitability as in Kwon and Ki (2011). We included the log of the number of consolidated subsidiaries (CONFM) as a proxy for the complexity of the firm (Simunic, 1980). We also include INVREC to control for the auditing difficulties, and LEV, LOSS, and OPINION are included to control for financial distress (Simunic, 1980). We include LIQ as in Kwon & Ki (2011) because LIQ represents audit risk. We include BIG4 following Hanlon et al. (2012) and FIRST as in Kwon & Ki (2011). ISSUE is included to control for firm growth, and OWNER and FOR are included to control for ownership structure as in Kwon & Ki (2011). Lastly, year and industry indicators are included to control for time and industry fixed effects.

Results

Descriptive Statistics and Correlations

Table 2 shows the descriptive statistics of the variables used in our model. The mean (median) value of LnAF, log of audit fees, is 11.456 (11.290). The mean (median) value of DBTA, book-tax accruals, is 0.003 (0.000), and the mean (median) value of DBOA, book-only accruals, is -0,001 (-0.000). These values of accrual components are similar to those found in Park et al. (Median) value of ROA, net income to average assets, are 19.741 (19.503) and 0.031 (0.033), respectively. The mean (median) value of CONFM, log of the number of consolidated subsidiaries, is 0.514 (0) and the mean (median) value of INVREC, sum of inventories and accounts receivables to total assets, is 0.281 (0.273). The mean (median) value of LEV, total liabilities to total assets, and the mean (median) value of LIQ, current assets to current liabilities, are 0.433 (0.439) and 1.973 (1.361), respectively. The mean (median) value of LOSS, an indicator variable set to 1 for firms with negative net income, is 0.184 (0), and the mean (median) value of OPINION, an indicator variable set to 1 if the firm receives a modified audit opinion, is 0.001 (0). The mean (median) value of BIG4 is 0.650 (0), which means that the ratio of firms in the sample audited by a Big 4 auditor is 65%. The mean (median) value of FIRST is 0.177(0), which means that the ratio of firms in the sample in an initial audit engagement is around 18%. The mean (median) value of ISSUE, sum of the amount of bond issue and seasoned equity offering to total assets, is 0.020 (0) and the mean (median) value of OWNER, large shareholders’ ownership, is 0.425 (0.427). The mean (median) value of FOR, foreign investors’ ownership, is 0.098 (0.040).

| Table 2: Descriptive Statistics Of Main Variables | |||||||

| Variables | Mean | Std. Dev. | 25% | MED. | 75% | Min. | Max. |

| LnAF | 11.456 | 0.746 | 10.993 | 11.290 | 11.849 | 9.510 | 14.201 |

| DBTA | 0.003 | 0.070 | -0.032 | 0.000 | 0.038 | -0.369 | 0.306 |

| DBOA | -0.001 | 0.020 | -0.007 | -0.000 | 0.006 | -0.234 | 0.209 |

| SIZE | 19.741 | 1.412 | 18.731 | 19.503 | 20.527 | 16.736 | 24.389 |

| ROA | 0.031 | 0.068 | 0.007 | 0.033 | 0.064 | -0.506 | 0.970 |

| CONFM | 0.514 | 0.949 | 0 | 0 | 0.693 | 0 | 4.663 |

| INVREC | 0.281 | 0.151 | 0.172 | 0.273 | 0.381 | 0 | 0.847 |

| LEV | 0.433 | 0.194 | 0.280 | 0.439 | 0.577 | 0.012 | 1.038 |

| LIQ | 1.973 | 2.664 | 0.933 | 1.361 | 2.104 | 0.111 | 62.853 |

| LOSS | 0.184 | 0.387 | 0 | 0 | 0 | 0 | 1 |

| OPINION | 0.001 | 0.024 | 0 | 0 | 0 | 0 | 1 |

| BIG4 | 0.650 | 0.477 | 0 | 1.000 | 1.000 | 0 | 1 |

| FIRST | 0.177 | 0.381 | 0 | 0 | 0 | 0 | 1 |

| ISSUE | 0.020 | 0.051 | 0 | 0 | 0.011 | 0 | 0.607 |

| OWNER | 0.425 | 0.154 | 0.313 | 0.427 | 0.529 | 0.055 | 0.845 |

| FOR | 0.098 | 0.129 | 0.007 | 0.040 | 0.143 | 0 | 0.709 |

Table 3 reports the Pearson correlation coefficients for the variables used in our model. LnAF is positively correlated with DBTA but not correlated with DBOA. DBTA and DBOA are negatively correlated with each other, consistent with the results of previous studies (Park et al., 2019; Ryu & Chae, 2014). In Table 3, some correlations between variables are of the predicted signs based on the previous literature, but others are not. Since we cannot draw a definitive conclusion on the hypothesis based on this simple correlation test, the results of the final empirical analysis are reported in the following section based on the multivariate regression analysis.

| Table 3: Pearson Correlation Coefficients Between Variables Analyzed | ||||||||||||||||

| LnAF | DBTA | DBOA | SIZE | ROA | CONFM | INVREC | LEV | LIQ | LOSS | OPINION | BIG4 | FIRST | ISSUE | OWNER | FOR | |

| LnAF | 1.000 | 0.025** | 0.003 | 0.840*** | 0.030** | 0.205*** | -0.227*** | 0.222*** | -0.127*** | -0.018 | 0.014 | 0.400*** | -0.046*** | 0.060*** | -0.144*** | 0.438*** |

| DBTA | 1.000 | -0.194*** | 0.018 | 0.148*** | 0.015 | 0.061*** | -0.073*** | 0.089*** | -0.091*** | -0.017 | 0.019 | 0.002 | 0.087*** | -0.014 | 0.050*** | |

| DBOA | 1.000 | 0.028** | 0.089*** | -0.009 | -0.040*** | -0.033*** | 0.024** | -0.067*** | -0.003 | 0.001 | -0.009 | 0.002 | 0.025** | 0.015 | ||

| SIZE | 1.000 | 0.111*** | 0.262*** | -0.230*** | 0.187*** | -0.114*** | -0.097*** | 0.019 | 0.388*** | -0.028** | 0.021* | -0.058*** | 0.471*** | |||

| ROA | 1.000 | 0.094*** | 0.025** | -0.285*** | 0.102*** | -0.668*** | -0.031*** | 0.077*** | 0.005 | -0.149*** | 0.103*** | 0.254*** | ||||

| CONFM | 1.000 | -0.102*** | 0.107*** | -0.088*** | -0.084*** | 0.033*** | 0.079*** | 0.068*** | 0.037*** | -0.113*** | 0.174*** | |||||

| INVREC | 1.000 | 0.231*** | -0.101*** | -0.012 | -0.003 | -0.100*** | 0.018 | -0.048*** | -0.062*** | -0.151*** | ||||||

| LEV | 1.000 | -0.471*** | 0.254*** | 0.033*** | 0.035*** | 0.060*** | 0.126*** | -0.145*** | -0.116*** | |||||||

| LIQ | 1.000 | -0.093*** | -0.010 | -0.041*** | -0.020* | -0.024** | 0.060*** | 0.061*** | ||||||||

| LOSS | 1.000 | 0.019 | -0.062*** | 0.019 | 0.130*** | -0.113*** | -0.159*** | |||||||||

| OPINION | 1.000 | -0.020* | -0.011 | -0.004 | -0.005 | -0.000 | ||||||||||

| BIG4 | 1.000 | -0.041*** | -0.008 | 0.030** | 0.248*** | |||||||||||

| FIRST | 1.000 | 0.029** | -0.029** | -0.024** | ||||||||||||

| ISSUE | 1.000 | -0.080*** | -0.037*** | |||||||||||||

| OWNER | 1.000 | -0.189*** | ||||||||||||||

| FOR | 1.000 | |||||||||||||||

Regression Results

Table 4 presents our multivariate analysis results on whether audit fees are impacted by book-tax accruals (DBTA). The coefficient estimate on DBTA is 0.192 and significant at 1%, suggesting that firms with higher levels of book-tax accruals have higher audit fees. This result indicates that auditors recognize the book-tax accruals as audit risk and expand the audit scope and effort by reflecting the level of earnings quality, ultimately increasing audit fees. However, the coefficient estimate on DBOA is not significant probably because of the low level of bookonly accruals (DBOA) in the sample.

| Table 4: Results Of Multivariate Regression Analysis Of Effect Of Book-Tax Accruals (Dbtai,T) On Audit Fees (Lnafi,T) | |

|

|

| Dep Var= | LnAFi,t |

Intercept |

3.967*** |

| DBTAi,t | 0.192*** |

| DBOAi,t | -0.369 |

| SIZEi,t | 0.381*** |

| ROAi,t | -0.215** |

| CONFMi,t | 0.048*** |

| INVRECi,t | 0.085** |

| LEVi,t | 0.268*** |

| LIQi,t | -0.003 |

| LOSSi,t | 0.022 |

| OPINIONi,t | 0.148 |

| BIG4i,t | 0.122*** |

| FIRSTi,t | -0.054*** |

| ISSUEi,t | 0.276*** |

| OWNERi,t | -0.309*** |

| FORi,t | 0.371*** |

| Year | Fixed |

| Industry | Fixed |

| Adjusted R2 | 0.752 |

| Number of Samples | 7,237 |

Note: ***, **, and * denote significance levels (two-tailed) of 1%, 5%, and 10% or less, respectively.

Turning to the control variables, we find that coefficients on control variables are generally significant and of the predicted sign, consistent with the previous findings (Simunic, 1980; Kwon & Ki, 2011, Hanlon et al. 2012). SIZE and CONFM are both significantly positive, indicating that larger, more complex firms pay higher audit fees. Audit fees are lower for firms with higher ROA, a proxy for profitability. Larger INVREC is also significantly positive because inventory and accounts receivables accounts require more time to audit. The coefficient on the proxy for the level of distress is also significantly positive (i.e., audit fees are higher for higher liability levels (LEV)). The coefficient on BIG4 is significantly positive because Big 4 audit firms spend more time auditing to maintain their reputation. The coefficient on FIRST is significantly negative, indicating that firms in an initial audit engagement pay lower audit fees because of price discounts. Audit fees are higher for firms with higher ISSUE, a proxy for firm growth. Firms with lower large shareholders’ ownership (OWNER) and higher foreign investors’ ownership (FOR) pay higher audit fees.

Additional Analysis

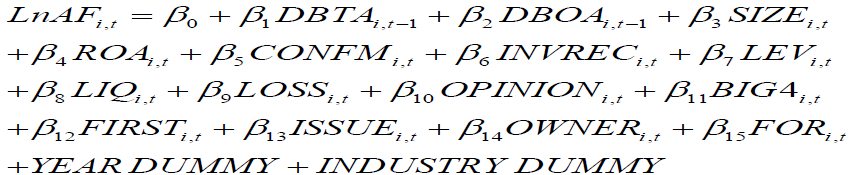

In Table 5, we estimate our audit fees regression using lagged DBTA and DBOA rather than current ones to investigate the relation under the assumption that the next year’s audit fees are set based on the current year’s DBTA and DBOA, similar to Hanlon et al. (2012).

| Table 5: Results Of Multivariate Regression Analysis Of Effect Of Lagged Book-Tax Accruals (Dbtai,T-1) On Audit Fees (Lnafi,T) | |

|

|

| Dep Var= | LnAFi,t |

| Intercept | 3.962*** |

| DBTAi,t-1 | 0.190** |

| DBOAi,t-1 | -0.330 |

| SIZEi,t | 0.382*** |

| ROAi,t | -0.296** |

| CONFMi,t | 0.050*** |

| INVRECi,t | 0.075* |

| LEVi,t | 0.256*** |

| LIQi,t | -0.005 |

| LOSSi,t | 0.009 |

| OPINIONi,t | 0.000 |

| BIG4i,t | 0.118*** |

| FIRSTi,t | -0.060*** |

| ISSUEi,t | 0.183* |

| OWNERi,t | -0.314*** |

| FORi,t | 0.395*** |

| Year | Fixed |

| Industry | Fixed |

| Adjusted R2 | 0.753 |

| # of Samples | 6,255 |

We find that lagged DBTA is positively related with current LnAF at the 5% significance level, consistent with the assumption. However, the coefficient on lagged DBOA is not significant.

Conclusion

This study investigated the association between book-tax accruals and audit fees using 7,237 firm-year observations of KOSPI-listed firms over the period from 2002 to 2017. Based on their tax planning and financial reporting objectives, firms can adjust the level of their book-tax accruals and book-only accruals and thus decrease the tax and increase reported earnings without additional tax (Calegari, 2000; Oh & Jeong, 2010). Such accruals adjustment might distort the informativeness of firms’ earnings, and Choi et al. (2013) showed that accruals adjustment decreases the earnings quality. Auditors may expand the audit scope and audit efforts to investigate such adjustments with low earnings quality, resulting increased audit fees. This paper explored whether auditors’ audit fee decisions are affected by the firm’s level of book-tax accruals considered as audit risk. We find that there is a positive relation between the level of book-tax accruals and audit fees.

Our study contributes in several ways. Although previous studies have not investigated the effect of book-tax accruals on audit fees, we focused on book-tax accruals and found that they had a positive effect on audit fees. Furthermore, by showing the positive relation between book-tax accruals and audit fees, this paper revealed that auditors exert more effort auditing book-tax accruals and showed the effectiveness of the auditor’s role in monitoring items with low earnings quality.

Acknowledgement

Younghyo Song is the first author and Soo Yeon Park Soo is corresponding author of this paper. Soo Yeon Park and Younghyo Song contributed equally in this paper.

References

- Bradshaw, M.T., Richardson, S.A., & Sloan, R.G. (2001). Do analysts and auditors use information in accruals? Journal of Accounting Research, 39(1), 45-74.

- Calegari, M. (2000). The effect of tax accounting rules on capital structure and discretionary accruals. Journal of Accounting and Economics, 30, 1-31

- Choi, W., Lee, H., & Lee, J. (2013). The impact of accrual components on information content of taxable and book income. Korean Accounting Review, 38(4), 297-332.

- DeFond, M.L. & Jiambalvo, J. (1994). Debt covenant violation and manipulation of accruals. Journal of Accounting and Economics, 17(2), 145-176.

- Fatima, A. (2011). Audit fees and discretionary accruals: Compensation structure effect. Managerial Auditing Journal, 26(2), 90-113.

- Gul, F.A., Chen, C.J.P., & Tsui, J.S.L. (2003). Discretionary accounting accruals, manager’s incentives and audit fees. Contemporary Accounting Research, 20(3), 441-64.

- Hanlon, M. (2005). The persistence and pricing of earnings, accruals and cash flows when firms have large book-tax differences. The Accounting Review, 80(10), 137-166.

- Hanlon, M., Krishnan, G.V., & Mills, L.F. (2012). Audit fees and book-tax differences. Journal of the American Taxation Association, 34(1), 55-86.

- Healy, P.M. (1985). The effect of bonus schemes on accounting decisions. Journal of Accounting and Economics, 7(3), 85-107.

- Jones, J.J. (1991). Earnings management during import relief investigations. Journal of Accounting Research, 29(2), 193-228.

- Joos, P., Pratt, J., & Young, D. (2000). Book-Tax Differences and the Value Relevance of Earnings. Working paper, Massachusetts Institute of Technology, Indiana University, and INSEAD.

- Kwon, S.Y. & Ki, E.S. (2011). The effect of accruals quality on the audit hour and audit fee. Korean Accounting Review, 36(4), 95-137.

- Lee, T.A., Ingram, R.W., & Howard, T.P. (1999). The difference between earnings and operating cash flow as an indicator of financial reporting fraud. Contemporary Accounting Research, 16(4), 749-86.

- Mills, L., & Newberry, K. (2001). The influence of tax and non-tax costs on book-tax reporting differences: Public and private firms. Journal of the American Taxation Association, 23(1), 1-19.

- Oh, K.W. & Jeong, S.W. (2010). The association between marginal tax rate and accounting choices considering book tax conformity. Korean Journal of Taxation Research, 27(4), 43-79.

- Park, S.J., Oh, M.J. & Lee, E.C. (2019). The effect of personnel characteristics in the internal accounting control system on discretionary tax accruals: evidence from Korea. Australian Accounting Review, 29(1), 6-19.

- Phillips, J., Pincus, M., & Rego, S. (2003). Earnings management: new evidence based on the deferred tax expense. The Accounting Review, 178(2), 491-522.

- Ryu, H., & Chae, S. (2014). The effect of book-tax conformity on the use of accruals: evidence from Korea. The Journal of Applied Business Research, 30(3), 753-762.

- Simunic, D. (1980). The pricing of audit services: theory and evidence. Journal of Accounting Research, 18(1), 161-190.

- Sloan, R.G. (1996). Do stock prices fully reflect information in accruals and cash flows about future earnings? The Accounting Review, 71(3), 289-315.

- Subramanyam, K.R. (1996). The pricing of discretionary accruals. Journal of Accounting and Economics, 22(3), 249-81.