Research Article: 2019 Vol: 22 Issue: 5

Diversifying the Roles of Haramayn in Islamic Financial System Using Zakatul Fitr for an Effective Poverty Reduction beyond Saudi Arabia

Yusuff Jelili Amuda, Prince Sultan University

Abstract

Zakat in general and Zakatul Fitr in particular have been known as tools for poverty reduction in Islamic financial system. Many Qur’Änic verses and prophetic traditions have explicated on the significance of Zakat. Zakatul Fitr is given prior to the congregational prayer of fasting festival (Eidul Fitr) annually. More specifically, Q87:14-15 according to ‘Ibn ῾Umar was revealed on the paramount importance of Zakatul Fitr. The scholars of four jurisprudential schools of thought have extensively discussed about collection and distribution of Zakatul Fitr. Nonetheless, with 2.5 million Muslims that performed lesser hajj in 2018 and they were all expected to give out Zakatul Fitr of 15 Saudi Riyal per head which is amounting to 37.5 million. More importantly, two days is allocated for the collection of Zakatul Fitr via recognized embassy attached to each country where money could be transferred. However, there is an insufficient academic research examining the diversification of the roles of haramayn on Zakatul Fitr beyond the domain of its collection in order to achieve the motive of which it is collected-helping the poor and the needy Muslims. The primary objective of this paper is to examine the diversification of the roles of Haramayn on Zakatul Fitr as an Islamic financial instrument in addressing poverty reduction among the Muslims. Content analysis of classical and modern literatures is used as methodology of the paper. The results show that with analogical deduction (Qiyas), the distribution of Zakatul Fitr could be diversified beyond the domain of its collection because a prominent companion of the Prophet (S.A.W.) collected Zakat in Yemen and distributed to poor and needy Muslims in MadÄ«nah. If mandatory Zakat is distributed beyond its domain of collection, then Zakatul Fitr by the performers of lesser Hajj can also be distributed to the needy and poor Muslim beyond the domain of Saudi Arabia. In conclusion, it is not arguable to posit the Zakatul fitr like other Islamic financial instruments is meant for providing comfort for the Muslims. It is therefore suggested that the collectors should put necessary mechanisms in place specifically by opening a window or an office in Haram whose primary task is to be in-charge of collection and distribution of Zakatul fitr beyond Saudi Arabia in order to respond to social demands of contemporary Muslims across the world.

Keywords

Islamic Finance, Poverty Reduction, “Zakatul Fitr”, Analogical Deduction (Qiyas).

Introduction

Islam balances between two extremes where it balances between excessive richness and abject poverty. The balance is reflected from establishing different socio-economic parameters to mediate between the excess of the rich and alleviate the suffering of the poor and the needy. Islamic economic system is considered as an impetus for human economic development in the Muslim countries (Mirakhor & Askari, 2014). The Islamic economic system is important in addressing poverty in order to promote human wellbeing in the Muslim countries (McGillivray and Clark, 2006; Ikejiaku, 2009). Even, the World Bank (2006) advocates that distribution of wealth of Nations is a determinant in measuring capital in the 21st Century. Of such mechanism being put in place in Islam is the institution of “Zakat”. The judicious utilization of Islamic economic concepts is undoubtedly indispensable towards realization of individual and collective wellbeing in the society.

In this regard, “Zakatul Fitr” could be used to bring about improvement with respect to socio-economic development of Muslim communities (Sadeq, 1990). In other words, it is noteworthy to say that material well-being of an individual is significant element of socio-economic success because poverty needs to be addressed through judicious utilization of various institutions meant for poverty alleviation. It is in the light of the advocacy for proper utilization of “Zakatul Fitr” that Islamic economic system is contrary to material development traceable to enlightenment period of the seventeen and eighteen centuries as literature expounds (Chapra, 2008).

The paramount importance of Zakat in general and “Zakatul Fitr” in particular have been elucidated by the Muslim scholars. It should be stressed that contemporary Muslim scholars have rejuvenated the discourse on the vital significance of “Zakatul Fitr” resources in reducing poverty within the Muslim communities. In this regard, literature posits that, there are almost seven international conferences on issues on Zakat held in countries such as: Pakistan, Jordan, Saudi Arabia and Egypt etc. More specifically, the sixth International Conference on Contemporary Zakat Issues was held in Kuwait in 1997. However, there is no sufficient academic research assessing the diversification of the roles of haramayn on “Zakatul Fitr” especially looking beyond the domain of its collection in order to address poverty in the Muslim countries. Therefore, this paper primarily examines the diversification of the roles of Haramayn on “Zakatul Fitr” as an Islamic financial instrument in addressing poverty reduction among the Muslims.

According to the World Bank Report in 2000, fifty-seven (57) Islamic countries are living below $1 per day where twenty-nine (29) countries are below $760 per capital income and sixteen (16) countries are low-medium-income nations between $760 and $3030. In addition, eight (8) countries are high-medium-income between $3030 and $9360 while four (4 )countries are high-income above $9360 respectfully. In many Islamic countries a relatively high proportion of people are living below the poverty line, the less previledged people are living on less than $1 per day as a result poverty. This can be traced to the following countries as an examples such as Uganda 82.2 percent (1996), Mali 72.8 (1994), Nigeria 70.2 (1997), Niger 61.4 (1995), Burkina Faso 61.2 (1994), Gambia 59.3 (1998), Sierra Leone 57.0 (1989), and Bangladesh 36.0 (2000) (the World Bank, 2000). There is need for cemented efforts to support less previledged people across the Muslim countries by using “Zakatul Fitr” for human development. (World Bank, 2000; Majid et al.,1999).

Theoretical Framework

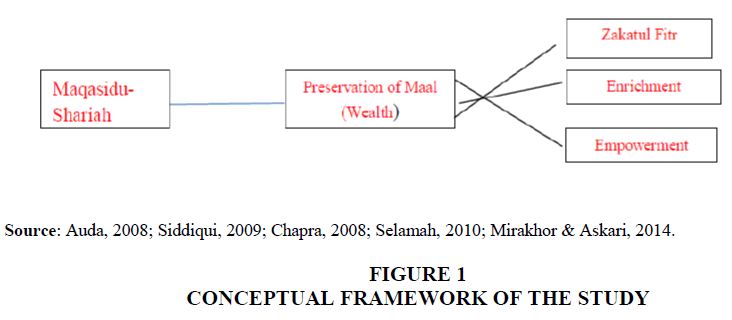

In this part, theoretical basis of “Zakatul Fitr” in connection to boosting socio-economic development of Muslims is explained. “Maqasid al-Shari‘ah” is specifically utilized as a framework of this paper because of its comprehensiveness and relevance. It is noteworthy to say that:

“Maqasid al-Shari‘ah is considered as central philosophy of Islamic law (Auda, 2008) and it is used to rejuvenate Islamic economic system towards a just distribution of wealth (Chapra, 1985; Atiyah, 2008).”

Literature identifies five essential indicators of “Maqasid al-Shari‘ah” namely:

1. Al-Deen (religion).

2. Al-Nafs (human life).

3. Al-Aql (intellect).

4. Al-Nasl (family institution).

5. Al-Maal (wealth).

This paper is delimited to only one element of Maqasid al-Shari‘ah which is preservation of “al-Maal” (wealth). It is so because, it is directly related to the central discussion of this paper. According to Selamah (2010), “al-Maal” or wealth is considered as all properties or resources endowed to man by Allah (S.W.T.). Hence, “Maqasid al-Shari‘ah” should be used to address the future of economic especially utilizing it in preserving resources from “Zakatul Fitr” (Chapra, 1985).

Undoubtedly, Chapra (2008) provides a framework through which “Maal” (wealth) can be better preserved when indicators of enrichment of “Maal” (wealth) are properly utilized. Of such as indicators are: education, employment and self-employment opportunities, alleviation of poverty and equitable distribution of wealth among others. Scholars such as Al-Ghaz?l? and Al-Sh??ib? are of the view that other compnents of “Maqasid al-Shari‘ah” required enrichment. This position could also be inferred from the paramount importance of “Zakatul Fitr” that it also needs enrichment in order to achieve wealth development as an integral part of objectives of Shariah as literature expounds (Siddiqui, 2009; Selamah, 2010).

Indeed, wealth is essential in discharging most of religious obligations such as alms-giving, pilgrimage among others. Literature asserts that, Islam allows acquisition of wealth through legal means and disallows its accumulation through illegal means such as stealing, corruption etc. (Hapsari and Herianingrum, 2014). The wealth is expected to be preserved according to explanation given my most of scholars. Hence, since “Zakatul Fitr” is also considered as wealth and it ought to be preserved. It should be reiterated that:

“Zakatul Fitr” needs to be sustained as an integral part of Islamic economic because literature agitates for the paradigm shift for sustainable economic development (Astrom, 2011).

In so doing, literature advocates for the revitalization of “Maqasid al-Shari‘ah” for socio-economic development of the Muslim countires (Atiyah, 2008; Hapsari and Herianingrum, 2014).

More importantly, literature such as Amin contends that scholars like al-Juwayn? and Al-Ghaz?l? emphatically stressed that wealth should be protected against theft. Similarly, resources from “Zakatul Fitr” could also be preserved and judiciously utilized. Scholars like Chapra (2000) posit that there is need for availability, circulation and investment of wealth. Regarding the investment of wealth, “Zakatul Fitr” can be collected and distributed on especially considering the paramount roles that the Holy mosques (Haramayn) could play. Prior to the explanation of these roles, it is essential to explain the classical conception of “Zakatul Fitr”. Figure 1 presents conceptual framework of the study:

Classical Conception of “Zakatul Fitr” in Islam

“Zakatul Fitr” etymologically comes from two Arabic words namely: “Zakat” and “Fitr”. The former means purity while the later means breaking a fast. Technically, “Zakatul Fitr” is known world widely as a charity given for the purpose of purifying oneself and consequently improving the condition of the poor and needy Muslims at the end of Ramadan fasting (Sayed, 1991). “Zakatul Fitr”. More specifically, Allah says:

“Indeed whosoever purifies himself (by avoiding polytheism and accepting Islamic Monotheism) shall achieve success. And remembers (glorifies) the Name of his Lord (worships non but Allah), and prays (the five compulsory prayers and the Nawafil-additional prayers” (Q87:14-15).

According to ‘Ibn ?Umar, the aforementioned Qur’anic verses were revealed on the paramount importance of “Zakatul Fitr” (Bayhaqi). Abu Sa’?d Al-Khudr? was reported to have said that the Prophet (S.A.W.) said that:

“Whosoever purifies himself shall achieve success and remembers and prays”.

Corroboratively, Abdullahi bin Umar reported that:

“The Prophet (S.A.W.) made “Zakatul Fitr” as a compulsory arms-giving during fasting (Ramadan) on everyone freed or servant, man or woman, young or old either from moudle or dates or millet (Narrated by Malik, an-Nasa’i and Muslim).”

In another narration, it was said by the Prophet (S.A.W.) that:

“Whoever gives it out before the prayer it is an accepted “Zakatul Fitr” but whoever gives it after prayer it is considered as voluntary arms-giving (Sayed, 1991).”

Literature contends that the ordinance of “Zakatul Fitr” by Allah was given precisely in the second year of migration of Allah’s messenger (S.A.W.) from Makkah to Mad?nah (Kamal, 2010).

Furthermore, it should be reiterated that, there are two major rationales behind the legality of “Zakatul Fitr”. First, to purify one from licentiousness, frivolousness and false utterances and all forms of abominations being consciously or unconsciously committed in during fasting. Second, to extend the helping hand or assistance to the poor and the needy Muslims in order to make them delightful on the day of festival. These two rationales have been narrated in the had?th that the Messenger of Allah (S.A.W.) enjoined “Zakatul Fitr” on those who fast to shield them from any indecent act or speech, and for the purpose of providing food for the needy Muslims in society and nation at large. Based on the aforementioned had?th, a renowned scholar, Al-Qarad?w? contends that the two purposes of “Zakatul Fitr” deals with individual and the society. First, as regards to an individual, it is considered as compensation for any indecent act. Second, as for the society, it is used to promote love, happiness, unity and peaceful co-existence among Muslims (National Zakat Foundation Australia, 2018). It can therefore be inferred that, perhaps it is because of the assertion of Al-Qarad?w? that made Al- Khatt?b? to contend that “Zakatul Fitr” was considered as compulsory for all fasting Muslims (National Zakat Foundation Australia, 2018). The scholars of four jurisprudential schools of thought have extensively discussed about collection and distribution of “Zakatul Fitr”.

It should be reiterated that:

“Zakatul Fitr particularly has been known as a tool for poverty reduction in Islamic financial system. Many Qur’?nic verses and prophetic traditions have explicated the significance of Zakat”.

“Zakatul Fitr” is given prior to the congregational prayer of fasting festival (Eidul Fitr) and it is according to jurists regarded as compulsory expected to be given by every Muslim. Notably, it is Zakat given per head either male or female, young or old and Prophetic tradition spells out that four double handfuls or goblet (Sa’a) of dried dates or one Sa’a of barley or grain is given, a Sa’a equivalent to three (3) litres or 750ml. Literature acknowledges the significance of “Zakatul Fitr” as being promoting wealth circulation from the rich to the poor. In addition, it also facilitates bonds, love and sense of brotherhood and generosity among the Muslims. More importantly, it helps to improve psycho-spiritual.

Institutionalization and Standardization of “Zakatul Fitr”

It is essential to reiterate that “Zakatul Fitr” needs to be institutionalized and standardized. A number of Prophetic traditions (ahad?th) have emphatically stressed on the payment of “Zakatul Fitr”. It is not disputable that various items that can be given to the poor Muslims on the day of Eid have been identified in several prophetic narrations. The obligatory nature of “Zakatul Fitr” could not be repudiated. Nonetheless, contemporarily, various items that could be given as “Zakatul Fitr” vary from one Muslim country to the other. Muslim scholars have tried to offer explanation pertaining to the payment of “Zakatul Fitr”. It is permissible to make the payment of “Zakatul Fitr” right from the beginning and middle of the month of Ramadan in order to ascertain that beneficiaries or the needy receive the food items prior to Eid prayer so that they can make use of it as well as on their dependents (Sayed, 1991).

There are two major opinions with respect to when “Zakatul Fitr” is due. On one hand, Scholars like: Malik, al-Shafi’ and Al-Thawr? contend that, giving out “Zakatul Fitr” is due at the sunset of the last day of fasting. On the other hand, Al-Layth, Hanafi school, Al-Shafi’ (in another opinion) and Malik (in another view) posit that “Zakatul Fitr” is due at the start of Fajr (dawn) of the day of Eid as a result of the fact it is directly related with the Eid. It is noted that, Umar reported that the Prophet (S.A.W.) used to order the payment of “Zakatul Fitr” before performing Eid prayer. Despite the fact the prophetic tradition has explained various items that could be used as “Zakatul Fitr”, there is need to explore the scope of “Zakatul Fitr” (Sayed, 1991).

Furthermore, it is important to say that despite the fact that, the fore going opinions of jurists as regard to when its payment is due, scholars also explain about the time of payment. The general assumption is that, jurists of four schools of thought contend that it is impermissible to delay “Zakatul Fitr” until the time of Eid prayer. Nonetheless, some scholars like al-Nakha’?, Ahmad and Ibn Sir?n are of the opinion that there is no harm in delaying the payment of “Zakatul Fitr”. However, Abu Han?fah contends that it can be paid even before Ramadan but Al-Shafi’ said that it is allowed to give it out at the beginning of Ramadan (Kamal, 2010).

Al-Qarad?w? asserts that, the classical opinion of one day or two days in giving out “Zakatul Fitr” was due to the fact that during the time of the Prophet, the population of the Muslims was not large however, the spread of Islam to other places, jurists made it permissible to pay Zakatul Fitr from the beginning or middle Ramadan in order to make sure that, “Zakatul Fitr” reached the less privilege Muslims who are eligible as beneficiaries as long as the motive of paying it is fulfilled. Thereby, it is necessary to contend that an appropriate approach can be used as long as it the wisdom and purpose of “Zakatul Fitr” is fulfilled.

In the past, the practice in the payment of “Zakatul Fitr” vary from one country to another or from one locality to another. With the spread of Islam beyond the domain of its origin (i.e. Makkah), it is important to look inwardly in expanding the scope of some concepts especially Islamic financial system of which “Zakatul Fitr” is its integral part in fulfilling the needs of poor Muslims. As an attempt to expand the scope of “Zakatul Fitr”, its institutionalization and standardization remains herculean task in most Muslim countries. Nonetheless, it should be reiterated that, Sultan Hajj Sha mosque of the International Islamic University Malaysia (IIUM) since few years have taken the challenge of institutionalizing and standardizing the collection and distribution of “Zakatul Fitr” in order to achieve the objective of which it is established.

Roles of Haramayn in “Zakatul Fitr” beyond Saudi Arabia

The two prominent mosques “Ka’abah and Mad?nah” are historic places of worship for all Muslims across the world. Since no ritualistic worships of “Hajj or Umrah” are complete without making reference to these two places, it is thus essential to say they have pertinent roles to play with respect to the collection and distribution of “Zakatul Fitr”. More importantly, scholars are unanimous that collection and distribution of “Zakatul Fitr” should be given in one’s local environment. This assertion is justifiably buttressed with the instruction of the Prophet (S.A.W.) to Mu’aath bin Jabal according to Ibn Abbas when he was sent to Yemen that:

“Convey unto them that Allah has commanded them to pay obligatory Zakat, it should be taken from the rich and given to the poor”.

Inferably, it can be said that, the Prophet (S.A.W.) commanded that Zakat should be collected and distributed among people of Yemen.

However, the wisdom of Islam on “Zakatul Fitr” according to Al-Qarad?w? is not only on the rich but also on the on every Muslim. Majority of the jurists like Shafis, Anbalis and Malikis contend that, “Zakatul Fitr” should not be given on an embryo; however, Imam Ahmad argues that “Zakatul Fitr” is also compulsory for an embryo because it is allowed in Islam to allot property to an embryo through a will. It should be posited that Haramayn mosques-Ka’abah and Mad?nah have important role to play in coordinating the collection and distribution of “Zakatul Fitr”. It is essential to assert that, there are different types of food that can be used as “Zakatul Fitr” as literature contends.

For instance, Hanbali identifies different types of food that can be given out which are follows: dates, wheat, barley, dry cottage cheese and dates. Imam Ahmad said that dates any kind of staple grain are allowed. It is also said by Malikis and Shafis that any common food available in a particular region can be used. However, Hanafis contends that, the value of “Zakatul Fitr” can be paid in its money equivalent. Nonetheless, Al-Qarad?w? posits that there are two reasons why the Prophet (S.A.W.) did not use money namely: First, to avoid hardship or difficulty on Muslims because hard currency was rare among Arabs especially the Bedouins. Second, the Prophet (S.A.W.) did not use money because of the fact that the purchasing power used to change from time to time. However, unstable value of money does not negate the position of Hanafis with regard to the payment of “Zakatul Fitr” with its money equivalent.

Nonetheless, scholars have unanimously agreed that, resources obtained from either Zakat or “Zakatul Fitr” could be transferred to other Muslim communities. However, there are guidelines laid down by the scholars for the distribution of “Zakatul Fitr” to other Muslim communities. According to the recommendations of the Sixth International Conference on Contemporary Zakat Issues held in Kuwait in 1997, it is stated among others that:

“It is permissible to give Zakatul Fitr in currency by paying the equivalent value of what is obliged. Those Muslim institutions entrusted with its collection and distribution are required to assess the value of the originally specified items in their areas, and to disseminate that information in their communities, accordingly”.

Hence, with 2.5 million Muslims that performed lesser hajj in 2018 and they were all expected to give out “Zakatul Fitr” of 15 Saudi Riyal per head which is amounting to 37.5 million. More importantly, two days is allocated for the collection of “Zakatul Fitr”. The study make simple illustration and use Nigeria as a case study and sample. Let assume that 2.5 million Muslims performed lesser hajj known as umurah during Ramadan and it means 2, 500, 000 x SR15= SR37,500,000 (Thirty-seven million and five hundred thousands). If the collected money is coverted into dollars it will be SR37,500,000x3.75=$10,000,000. If it’s converted into Nigerian money (Naira) which means SR37,500,000xN97.33=N3, 649,953,750. If the total amount of N100,000 is distributed for each needy Muslim in Nigeria, it will give the total number of needy Muslims equal to N3,649,953, 750÷N100,000=36,499,537 needy Muslims. In Nigeria, thirty-six million four hundred and nity-nine thousand and five hundred and thirty seven would be empowered and benefited from “Zakatul Fitr” collection. It means 30% of Nigerain Muslims will benefited. Similarly, the study illustrate Malaysia as another sample If the total amount of colleted “Zakatul Fitr” is converted into Malaysian money (RM) which means SR37,500,000xRM 0.915414=RM40,965,075 which is fourt million nine hundred and sixty-five thousand and seventy-five riggint. RM40,965,075÷RM20,000=2,048,253 needy Malaysian Muslims Muslims will benefited from the collected “Zakatul Fitr”. funds in haramayn.

It is noteworthy to say that Ibn Qayyim posited that the messenger of Allah (S.A.W.) considered Sa’a as a prescription of “Zakatul Fitr”. Indeed, four double handfuls of various items like dates, barley etc. is regarded as Sa’a. Indeed, contemporary Muslim scholars have made clear that one Sa’a is between 2.6 kilogram and 3 kilogram. Onwards, it is posited that the minimum due is equivalent to 2 kg of barley, wheat, flour or rice depending on the popular items to be used in a particular country of a Muslim’s residence. In fact, the amount equivalent to the above mentioned is $5.5 per person. Nonetheless, money equivalent to prescribed Sa’a could be paid or transferred. However, some scholars posit that criterion should emphatically stresses on measure rather than on weight of the kinds of food to be given as “Zakatul Fitr”. Reference is made to money because Muslim scholars have made it permissible to use cash equivalent in a situation where food items are not available.

With analogical deduction (Qiy?s), the distribution of “Zakatul Fitr” could be diversified beyond the domain of its collection because a prominent companion of the Prophet (S.A.W.) collected Zakat in Yemen and distributed to poor and needy Muslims in Mad?nah. If mandatory Zakat is distributed beyond its domain of collection, then “Zakatul Fitr” by the performers of lesser Hajj can also be distributed to the needy and poor Muslims beyond the domain of Saudi Arabia. It is not arguable to posit the “Zakatul Fitr” like other Islamic financial instruments is meant for providing comfort for the Muslims.

It is essential to contend that the flexibility of Islam is indicated in the permissibility of “Zakatul Fitr” to be paid with money as being maintained by scholars like Hassan al-Basr?, al-Thawr? and Hanafis. Nevertheless, the other scholars of three school of thought disallowed the payment of “Zakatul Fitr” with money. Based on the analogical deduction (Qiyas), the distribution of “Zakatul Fitr” could be diversified beyond the domain of its collection because a prominent companion of the Prophet (S.A.W.) collected Zakat in Yemen and distributed to poor and needy Muslims in Mad?nah. If mandatory Zakat is distributed beyond its domain of collection, then “Zakatul Fitr” by the performers of lesser Hajj can also be distributed to the needy and poor Muslim beyond the domain of Saudi Arabia.

Suggestions

The following are the suggestions of the paper:

1. The two mosques (Ka’abah and Madinah) should institutionalize a centre or window whose primary task is to collect “Zakatul Fitr” from the performers of lesser Hajj.

2. The two mosques (Ka’abah and Madinah) should collaborate with Ministry of Religious Affairs and Islamic centres for effective and efficient collection of “Zakatul Fitr” in order for subsequent distribution beyond Saudi Arabia.

3. The proposed coordinating centre/unit of “Zakatul Fitr” at the two mosques (Ka’abah and Madinah) should make it their responsibility in determining and announcing the monetary value of “Zakatul Fitr” on yearly basis.

4. That the central focus of this paper should be tested empirically especially in connection with operational framework of “Maqasid al-Shari‘ah” provided by Chapra (2008) in order to address the likely challenges that might emanate in measuring different dimensions that are too generic.

Conclusion

This paper has explored theoretical and conceptual frameworks of “Zakatul Fitr”. It is asserted that “Zakatul Fitr” is an integral part of Islamic financial instruments meant to for providing comfort for the Muslims. It has been demonstrated that Islam is not only focusing on spirituality but also considers paramount importance of socio-economic development of the Muslim countries especially in improving material well-being of the society. In so doing, “Zakatul Fitr” could be properly utilized in solving the problem of poverty in the society. It is stressed that the collection and distribution of Zakat should be institutionalized and standardized whereby the roles of Haramayn could not be underestimated in this regard. Various opinions of the scholars have been explicated that “Zakatul Fitr” could be paid with monetary value of various items measured in the hadith and classical works of Muslim scholars.

References

- Astrom, Z.H. (2011). Paradigm shift for sustainable development: The contribution of islamic economics. Journal of Economic and Social Studies, 1(1), 73-82.

- Atiyah, G.E. (2008). Towards revitalizing al-Maqasid. International Institute of Islamic Thought, Herndon, USA.

- Auda, J. (2008). Maqasid al-Shari’ah as philosophy of Islamic law, a system approach. International Institute of Islamic Law, London.

- Chapra, M.U. (1985). Towards a just monetary system. Leicester: The Islamic Foundation.

- Chapra, M.U. (2000). The future of economics: An islamic perspective. Leicester: The Islamic Foundation.

- Chapra, M.U. (2008). The Islamic vision of development in the light of maqasid al-shariah.

- Hapsari, M.I., & Herianingrum, S. (2014). Maqasid index, a success indicator ofthe social economic development. developing a framework for maqasid al-sharia-based index of socio-economic development.

- Ikejiaku, B. (2009). The relationship between poverty, conflict and development. Journal of Sustainable Development, 2(1), 1-11.

- Kamal, A.M. (2010). It is true Fakhasnh, and his evidence, and clarify his mother's tails. Darul Tawqifiyah Lil-Turath, Cairo: Egypt.

- Majid, S., Shekoofeh, F., & Fateme, E. (2007). A spatial analysis of poverty in muslim countries. Iranian Economic Review, 12(1), 161-178.

- McGillivray, M., & Clarke, M. (2006). Understanding human well-being. United Nations University Press Tokyo.

- Mirakhor, A., & Askari, H. (2014). Islam and the path to human and economic development. New York: Palgrave Macmillan.

- National Zakat Foundation Australia. (2018). All about zakatul fitr.

- Sadeq, A.M. (1990). Economic development in Islam. Pelanduk Publications.

- Sayed, S. (1991). Fiqh sunnah. Fatih lil-I’laam Al-Arabi, Cairo: Egypt.

- Selamah, A.Y.(2010). Measuring wealth development based on maqasid al-shari’ah. Hifdh al-Maal index (HMI)

- Siddiqui, M.N. (2009). Objectives of the shari’ah. Markazi Maktabah-e-Islami: New Dehli.

- World Bank. (2000). World development report.

- World Bank. (2006). Where is the wealth of nations? Measuring capital in the 21st century. The World Bank, Washington D.C.