Research Article: 2022 Vol: 26 Issue: 1S

Difficulties faced by Rural Consumers Post Covid19 and Digital Solutions for them

Suhail Gupta, Shri Mata Vaishno Devi University

Syeda Shazia Bukhari, Shri Mata Vaishno Devi University

Citation Information: Gupta, S., & Bukhari, S.S. (2022). Difficulties faced by rural consumers post covid19 and digital solutions for them. Academy of Marketing Studies Journal, 26(S1), 1-15.

Abstract

Covid -19 has done something which no amount of advertising by brands could do: it has made consumers change their preferences. Preferences have never been easy to change; they are stubborn and often impervious to marketing communication pleas. But a pandemic changed the game faster than what brands could have ever imagined. Almost overnight, hardwired mall shoppers and reluctant fence sitters were pushed into the deep end of the online commerce pool. And in a matter of days there is a high level of dexterity and comfort in online shopping across the board. Will this new found environmental change mutate the mall crawling gene which consumers have had ever since retailing started? Will this shift to a different channel be permanent? Will malls and high street stores be reduced to mere show windows? Admittedly, it is too early to claim that, but with new hygiene and contagiousness concerns, it is possible that people will reconsider venturing into public domains such as shopping malls and movie theatres with the same carefree and reckless gusto as before. Or at least not as unarmed as before now a bottle of sanitizer and a mask would be minimal essential weapons for anyone going anywhere outside of their homes. In addition there could be paranoia about the physical distance to be maintained with the nearest guy trying to be too social. Would retail sales persons need to pitch their voices louder and farther in times of physical distancing? Would there have to be teams to manage queues outside popular supermarkets as lines snake away? If demonetization jumpstarted the digital payments mindset in India, it may be safe to suggest that C-19 might change the way we behave as consumers.

Keywords

COVID19; Digital Platform.

Introduction

The sudden lockdown due to COVID-19, brought daily life to standstill and disturbed all economic activities. It restricted movement of people, induced labour shortages, impacted factory operations, disrupted logistics, led to outlet closures for non-essential products and food service providers, triggered panic buying among consumers for staples and left retailers with stock-outs in few categories. Despite easing of lockdown from 4 May 2020, the movement of goods continues to be the pain point for CP companies that have drawn up plans to improve operations to 50-75% of capacity from 20-30% currently1. Truck availability has improved to only 10% from 8% out of a total vehicle count of nine million pan-India during strict lockdown. Shortage of manpower to work in factories as well as distribution centres continues to challenge industry players. The Indian consumer products sector is in a flux. The industry has been facing demand pressure (especially from rural consumers) due to agri-slowdown, liquidity crunch and employment challenges. The already challenging market environment is now further exacerbated by the onset of COVID-19 pandemic. The maximum effect would be seen in consumer discretionary categories, while consumer staples like food would see lesser impact Asprou (2020); Browne (2020); Cooney (2020); Digitaleurope (2020).

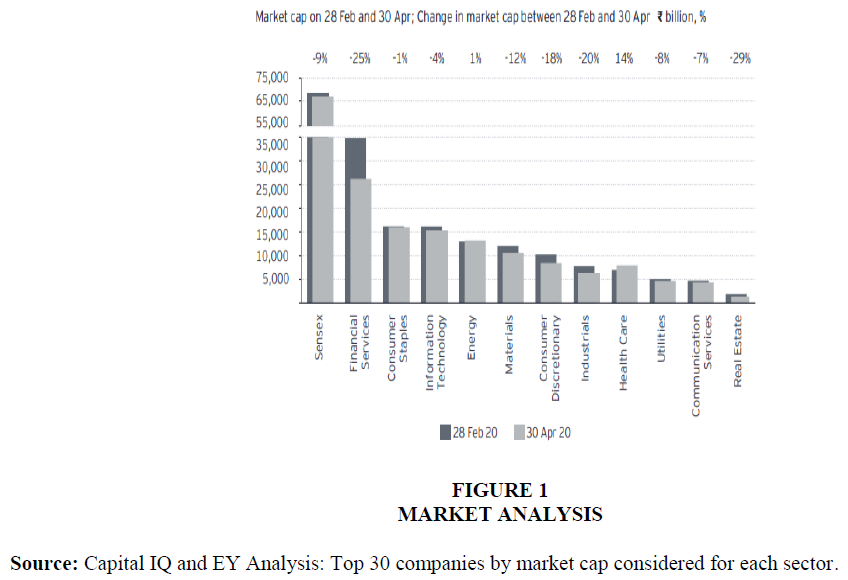

This is also being reflected in what investors are expecting. After the onset of the pandemic in India, Healthcare is the only industry to have witnessed market cap expansion during March - April 2020. Consumer staples are well protected from market cap erosion despite ongoing challenges in the industry, while consumer discretionary sector and various other sectors are facing a tough time Figure 1.

Figure 1 Market Analysis

Source: Capital IQ and EY Analysis: Top 30 companies by market cap considered for each sector.

1. India’s private final consumption was about $1,700 billion in FY19.

2. Food and non-alcoholic beverages, accounting for $510 billion of consumption is likely to see lesser impact of the pandemic and lockdown.

3. Discretionary categories like clothing and footwear ($100 billion), appliances ($50 billion); and restaurants and salons ($30 billion) are likely to see higher impact.

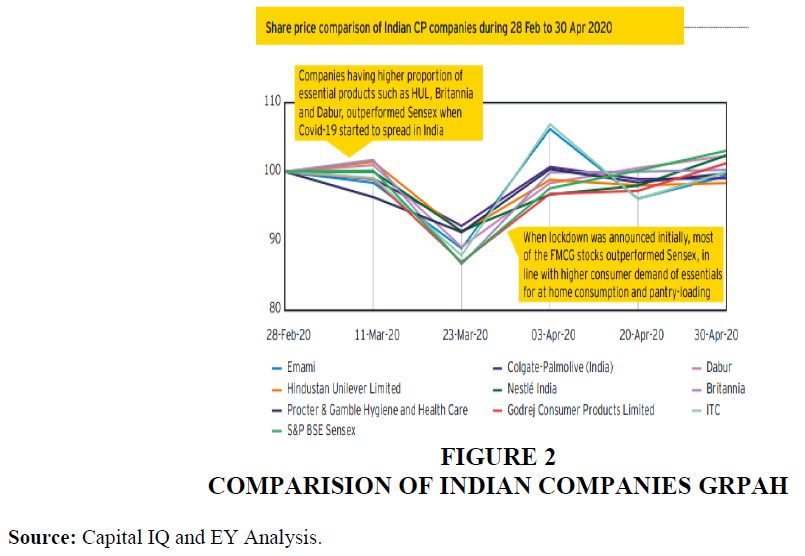

As the pandemic is evolving, the restrictions are being gradually lifted; however, restoring normalcy will be a long-drawn process. During this time, we expect the market along with consumer products companies to navigate through three different phases Figure 2.

Donkin (2020); Emarketer Editors (2020); Kats (2020); Kemp (2021); Stanbic Bank Uganda (2013).

Currently, companies are in the ‘Now’ phase where they are grappling to understand upfront challenges, assess initial impact and decide immediate actions to respond to the crisis. In the ‘Next’ phase, companies will have to streamline operations to mitigate any ongoing challenges and seek fitting opportunities arising from the crisis. In the ‘Beyond’ phase, companies will have to consider strategic transformations and prepare to prevent similar future disruptions.

Key Challenges Faced By Consumer Products Companies

Consumer products companies found themselves in an uncharted territory after the lockdown was announced. While consumption for categories like hygiene and groceries surged, companies were unable to quickly move production lines or ramp up manufacturing to match the demand. Online demand for products was rising, but companies were unable to rapidly adapt channel partnerships. Government regulations have been restricting full production in some regions, while other regions are facing labour shortages. The uncertainty in the business environment is expected to continue for few more weeks. To evaluate on-the-ground reality, we spoke with several consumer products companies, and from our conversations, we understand that the senior leadership is concerned about many challenges, ranging from near-term disruptions to long-term implications Universal Postal Union (2020); Wellcome (2020).

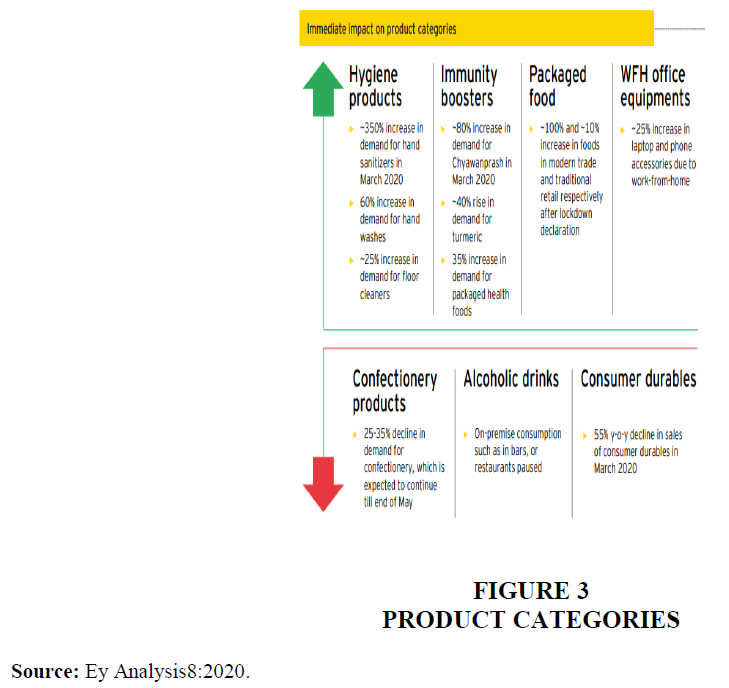

Changing Dynamics for Product Categories

The short-term changes in consumer behaviour are being reflected in sales of product categories. Increased awareness about personal hygiene has led to a jump in demand for hand washes and sanitizers. Emphasis on immunity boosting has led to a surge in demand for healthier foods and preventive products. Some categories like grocery, food and home-essential products, are seeing a surge in consumption. On the other hand, demand for more discretionary categories, such as non-essential personal care like beauty and make-up, large ticket consumer durables and appliances as well as on premise consumption of alcohol and carbonated beverages has been impacted. In the quarter ended March, India’s FMCG sector grew 6.3% (including e-commerce) in value terms, down sharply from the 13.8% growth in the same period last year. Demand for packaged foods and staples grew by 7.8%, while non-food categories grew by a mere 1.8% during the same period7.

Going ahead, we believe that the short-term spikes in demand would stabilize over the next few weeks, and categories that witnessed stockpiling would see demand slowdown. As the economic fallouts of the pandemic, such as job losses or decrease in income levels, become clearer, we think that consumers would become more cautious in spending, especially on discretionary products. It is estimated that ~54% consumers plan to decrease spends on luxury brands and leisure travel; 43% plan to defer spending more on fashion, personal grooming and home décor and 42% plans spend less on alcohol and tobacco products9.

Considering the socio-economic impact of the pandemic, we believe that changing consumer behavior will leave lasting impressions on category dynamics.

Every business crisis disrupts normality and pushes companies out of their comfort zone; it also offers opportunities to reinvent business models to make them fitter for the new world. While preparing for the resilience strategies, companies need to take hard look at their operations to cull out inefficiencies and reorient the business to drive future growth.

People

Establishing a constant connect with employees, especially factory workers, around their health and financial well-being during this time will enable them to cope better with the current crisis and bounce back with renewed motivation. For example, Dabur has reinforced several safety measures at its units, including thermal screening of employees during entry and exit at the security gate and restricting the number of employees travelling together in elevators. Moving forward, it will be imperative for companies to:

1. Re-visit staffing models to develop dynamic workforce

2. Optimize resources

3. Re-design jobs and compensation models

4. Re-think skill development and upskilling staff to transition to new digital ways of working

Consumer

Communicating safety and hygiene of products will be the first step in winning trust of consumers. In the long-term, companies should:

1. Re-align brands towards purpose

2. Review product portfolio

3. Invest in developing new categories, such as hand sanitizers and disinfectants (if relevant).

4. For example, Emami extended its flagship brand Boroplus into the hand sanitizer segment by launching BoroPlus Advanced anti-germ hand sanitizer with 70% alcohol base and natural ingredients

5. Review pricing and reset promotion strategies to win back customers

Operations

The immediate focus for CP companies is to keep their supply chain operational, including adjusting production as per demand fluctuations and channel partnerships for last-mile delivery. For example: HUL shifted to larger order sizes and direct shipping from factories and Marico launched ‘Saffola Store’ on food delivery platforms Swiggy and Zomato. The next focus will be to:

1. Enhance plant safety and capacity utilization

2. Shift towards distributed manufacturing and digital integration with contract manufacturers

3. Renew channel strategy – explore direct-to-consumer distribution channels

4. Diversify supply chain – identify alternate suppliers across geographies

5. Build demand-responsive supply chain using automation and predictive analytics

6. Set digital internal audit or controls system

Finance

Companies must reassess immediate cash requirements using scenario modelling to mitigate working capital blockages including deferring non-critical spend. After that, companies must:

1. Make provisions to extend financial support to channel partners. ITC, HUL and Cargill have extended credit and making early payments to kirana stores16.

2. Conduct strategic portfolio reviews - acquire new and divest non-core/ low-margin brands.

Risk

Companies must establish and empower emergency response teams to continuously monitor and mitigate emerging risks. While planning to resume operations after the crisis, it is imperative for companies to:

1. Use scenario modeling to plan different response strategies

2. Develop a Covid-19 checklist to monitor implementation

3. Leverage analytics to uncover potential risks and timely management of disruptions

Government

Companies must comply with the government directed emergency measures. To ensure that essential products reach low-income families, HUL is working with social organizations like the United Way and the United Nations Development Programme. It is also collaborating with public health authorities (in Maharashtra, Uttar Pradesh and Karnataka), to upgrade medical facility infrastructures in hospitals treating COVID-19 patients and is in the process of procuring personal protective equipment for the frontline medical staff at these hospitals17. Moving forward, companies must:

1. Assess impact of regulatory changes and restrictions

2. Utilize various schemes announced by government such as moratorium for repaying bank loans and job support subsidy

Technology

Companies should provide IT tools such as physical hardware (like laptops) and secure networking capabilities (like video calling apps) to enable remote working of employees (to the extent possible). Nestlé used an electronic shareholder portal for its Annual General Meeting held on 23 March, to enable shareholders to exercise their voting rights. Going ahead, it will be imperative for companies to:

1. Upgrade critical technology infrastructure.

2. Establish security protocols for cyber-attacks.

3. Invest in emerging technologies such as VR for remote product walk-throughs for B2B/B2C sales.

4. Digital tools to track real time-changes in consumer behaviour will improving efficiency.

A New Industry Landscape

The COVID-19 situation is still evolving, and it is difficult to quantify the impact on the CP industry. Consumers are re-allocating their budgets from non-essentials to stockpile essentials such as food, personal care and disinfectants. Companies that will evolve their portfolio of products built around health, immunity and protection – stand to gain in the future. E-commerce and home delivery would assume a far greater prevalence in the buying pattern of consumers. The pace of digitalization of the future consumer will be advanced by years. Hence, companies that digitally transform their route to market and build robust direct to consumer capabilities, including e-commerce, will win in the long-term. This will entail a focused and coordinated effort to build more agile, transparent and responsive supply chain, from identifying alternate suppliers, flexible production management to digital inventory control. Finally, this pandemic is a trigger for companies to invest in advanced analytics to understand the changing business environment and respond with agility. COVID-19 is a reminder to the CP industry about the fragility in ways of doing business. It will be a game-changer for companies that will focus on evolving business models and transformational change with new and emerging technology.

The Virus as Catalyst

The shift to digital had witnessed reluctant spurts from time to time but C-19 was the catalyst which online companies and ecommerce firms would have been praying for, although the mass mortalities and the contagiousness were not part of the bargain. Instead of an organic, gradual shift to digital, what crashed down on us was a tsunami of change. If and when malls do finally reopen, what are the likely changes that we could witness? First of all, it is generally agreed that the number of people who would visit physical retail would first spike as release from enforced lockdown happens which later on taper out and stabilize. But the new ‘normal’ is estimated to be lower than before as a new hygiene and mortality consciousness kicks in. Maybe governments and local authorities should control the release of people into retail locations systematically so that confidence in visiting retail establishments can resurface.

Consumer Behavior and Culture

Consumer behavior is influenced deeply by cultural factors. We are a social community with a high need for group activities – travel, tourism, shopping, religion, and entertainment. Festivals and rituals form a deep part of our religiously inclined psyche. C-19 lockdown notwithstanding, people have been known to conduct religious gatherings, wedding ceremonies and birthday parties even at the peak of the pandemic. These are aberrations, hopefully. Are they? In Kerala, the most well managed state in the C-19 fight so far with an excellent tracking efficiency and a mortality rate of just 0.58 percent (all India 3 percent and world average of 5.75 percent), on April 20 when the government partially lifted the lockdown there was a huge rush of humanity to city centres and shopping malls, so much so that the government there had to seriously consider the re-imposition of the lockdown.

Unsure Spending Power

As a result of a new vulnerability to job losses and pay cuts, there will be lower spending at retail for some time to come, till sentiments climb back up. As jobs, increments, and promotions get the axe during the pandemic, the cheer needed for economy-pumping spending will be missing for some time. Brands must think of what can be done to bring optimism and positivity to how consumers behave after the virus is vanquished, or is in a state of suspended abeyance? It will always be good to have been a caring brand during the C-19 pandemic. If a retail brand puts profits above people, those people are going to remember the betrayal. If a retail brand comforted victims and took positive actions like making PPE kits, or N95 masks, or transported daily need material to needy areas it will be remembered to some extent as a sensitive brand –the cynics might say that all this is just eyewash – companies are never really for the customer, they are for themselves only.

Search for Optimism-filled Experiences

After the long and indeterminate lockdown ends, retail brands must offer exhilarating and refreshing experiences to customers. There is going to be a psychological impact of this lockdown on people who relieve the stress to some extent currently by making “we shall overcome” videos and sharing Covid memes. For once they would have known exactly what “house arrest” means! The feeling of relief when the lockdown is ultimately lifted must be planned for in advance. The feeling will not be just about freedom of movement but also the exhilaration of having survived a diabolical killer. What as a retail brand are you going to do? Just join the band wagon of templated, me-too events or come up with some truly memorable and unique “victory over corona” adventures?

Hygiene as a Customer Attracter

Consumer views about retail space cleanliness and employee and co-shopper hygiene is likely to play on retail shoppers’ minds for some time to come. We might feel socially awkward about suspecting everyone around us of being potential Corona carriers. And yet for our own survival, we might be forced to replace the handshake or a shoulder pat with an aloof smile. Stepping into a mall lift will be a mental challenge for many. Mall managers would have to ensure that such fears do not persist for long by constantly making health and hygiene assurances. Consumer behaviour must be engineered to tilt toward the old familiar as soon as possible.

The Long Term Game

On the whole it will be better and wiser to play the long term game as a retailer in anticipation of consumers who might have changed visibly or surreptitiously forever by the corona virus. As a shopper whether some consumer behavior genes mutate or not only time will tell. Most consumers will be unsure of how to navigate a post Covid-19 consumer world. They might be tempted to continue on the digital commerce journey forever. Retailers should be visionary enough and smart enough to help consumers navigate between online and offline experience journeys seamlessly by investing in an omni-channel world. Changes that were expected to gradually come upon us over the next half decade or so have been forced on both the consumer and the retailer like an oncoming express train.

Customer Experience for a Post-Covid-19 World

The COVID-19 crisis will end at some point. We expect changes in consumer preferences and business models to outlast the immediate crisis. This has begun to play out in China, where there has been a 55 percent increase in consumers intending to permanently shift to online grocery shopping, and an increase of three to six percentage points in overall e-commerce penetration in the aftermath of COVID-19.7 Some consumers will be trying digital and remote experiences for the first time. In China, the share of consumers over the age of 45 using e-commerce increased by 27 percent from January to February 2020, according to Chinese market-research firm Quest Mobile. Once they are acclimated to new digital or remote models, we expect some consumers to switch permanently or increase their usage, accelerating behavior shifts that were already underway before the crisis. Further, once the public-health crisis has subsided, economic impacts will persist. Leading companies will deliver on the customer experiences that are emerging as most important in the “next normal,” while finding ways to save and self-fund.

Covid-19 Impact Rural Demand

Setting the tune of the webinar Pradeep Kashyap, founder, MART said, “It’s India’s historic moment with rural development integrating towns and cities. He said, for the first time in history, out of 120 million migrants, 20 million have come back to their own villages to stay back in their own states as was highlighted in MART’s study. They will help boost economy as government would have to dole MNREGA (Mahatma Gandhi National Rural Employment Guarantee Act) and other schemes.

He shared the example of China in 1978 which had very large PSUs, had latest CNC (computer controlled machines) but China dismantled PSUs as were making losses. Chinese skilled workers had to go back to their villages and started using high level skills to make discrete components of different kinds. These were called ‘Township and Village Enterprises’ as they would make discrete components and sent to district towns and final products made, were marketed and branded. This enabled 400 million Chinese people to pull out of poverty. As past advisor to Ministry of Rural Development, Kashyap said, India’s approach had been piecemeal with no future vision for rural India.

He shared that with India’s 600,000 villages and 8000 towns (Hub & spoke model), integrated rural development programme needs to be followed especially in 50,000 to 500,000 population villages. He emphasized that only 70 percent of our workforce is on our regular sector, so we need to formalize our workforce from an informal economy. He shared companies offered no benefits to migrant labours during lockdown and no formalization. In fact there was no Ministry for migrant labourers. He further highlighted India’s largest employer was agriculture and shared migrant workers were single largest component of workforce but there was no voice for them. Pankaj Mishra, Head of Research & Consumer Insights at MART shared highlights from MART’s primary study on migrant workers to understand what are the next steps and how can we answer key questions for the industry to plan strategies in the post COVID scenario. He shared migration workers from corridors of UP, Rajasthan & Bihar migrate to Delhi, Haryana and Punjab. He emphasised 1 of 4 people in city are migrant workers, specifically in construction, agriculture labour and domestic help. He said this was the largest numbers in migration in Indian history, 20 million migrated during partition but 25 million reverse migration took place post-COVID-19 lockdown. He shared a presentation on how migrants will behave post-COVID-19 so various sectors can plan activities in various states and how this would impact rural demand?

Migration in India: An overview

Out of 497 million workforces in India, 120 million are migrated workforce, largely from states like Uttar Pradesh, Bihar, Rajasthan, Madhya Pradesh and Odisha. According to an estimate, 25 million migrated workers have migrated back to their villages. Agriculture, construction sector, textile, domestic work and transportation play important role in providing livelihoods to the migrated workforce.

Reason for Reverse Migration

Responding to a question on why did they returned to their villages, as many as 50 percent of the respondents said that they returned from the cities due to the fear of Coronavirus infection, 42 percent lost their jobs, 12 percent had no savings, 10 percent didn’t get wages and salaries from their employers while 7 percent said other reasons. Many of them had multiple reasons for returning to their villages.

Would they Come Back?

According to the study, 56 percent of migrated workers who returned to their villages would return to earlier place of work, 25 percent will stay back at their native places while 19 percent will migrate to nearby towns and cities.

How much they Travel for Job?

According to the MART study, as many as 18 percent travel to 500 km, 36 percent travel to 500-1000 km while 46 percent travel more than 1000 km.

Why do they migrate from their villages?

As many as 49 percent respondents of the study said they migrated for better earnings at other places, 26 percent had no job at their native places, 14 percent for better job opportunities while 7 percent had relatives and friends there.

Dr. Amar Patnaik, Member of Parliament (Rajya Sabha) was keen to take MART’s recommendations as a committee to the Rajya Sabha for action. Addressing the webinar, Dr. Patnaik expressed lots of works needed to be done on migrant labourers’ issue. He stressed health and social benefits for the migrant labourers. He said for the first time, capital is worried so liquidity needs to be infused by MSMEs. There is a need to promote women self-help groups (SHGs) to engage them into agriculture based industries like food processing. He expressed the government should encourage more community based enterprises and link them to micro and small enterprises, make supply chain robust and reform agriculture. He said people abroad will in future cut unnecessary expenditure and also invest more in agro-processing and knowledge products.

Speaking on the occasion, Sanjay Panigrahi, Chief Customer Officer, Pidilite Industries shared insights on rural market consumption, demand generation, smart villages and how rural a significant role plays in food supply chain. He felt a large population of migrant labourers were still left behind. He said, “New normal intra- state will become more normal than inter-state with labourers travelling lesser distance. The reverse migration has impacted the urban to rural remittances. Around 70 percent of production of FMCG may come down to price point.” Additionally, he talked about digital penetration along with behavioural change in the rural supply chain. He expressed people would work harder in post COVID-19 scenario and the role of wholesaler will be important and direct selling by companies will boost rural consumption.

Addressing the webinar, Rakesh Gupta, Senior Vice President, JK Lakshmi Cements said, construction was the biggest employer after agriculture and in cement industry, demand has gone up post COVID-19. He said, 40 percent of demand has been influenced by government aided funding. He also said incremental construction -- building of new units -- is on the increase. He shared aspects of decongestion and de-urbanisation and was very much confident, industry will be moving to where skills are available. Policymakers need to keep in mind the changes in construction practices -- less labour intensive and more technology driven due to labour shortage.

How Covid-19 Is Impacting the Rural Market

COVID-19 has struck deep into the global economy and India is no exception. In the near future, there will be obstacles like weak financial quarters, job losses, salary cuts, and lower profit margins. However, this phase too shall pass.

Today, everyone is talking about the impact of COVID-19, but only from a national perspective or urban centric perspective. Unfortunately, not much has been spoken about the impact of COVID-19 on the rural sector, which constitutes a large part of the economy and overall consumption across product categories in the country.

For the record, as per a United Nations report published in 2019, 69% of India’s population resides in rural areas, which constitutes to more than 700 million people comprising farmers, housewives, SME’s, government servants and youth.

Impact

The first visible impact of COVID-19 in the rural sector is on the agricultural supply-chain. While the government has issued permits to trucks allowing them to carry groceries, fruits, and cereals, a large number of transporters are yet to receive their permits. This has increased the time taken for the farm produce to reach the market. On the other hand, there is a slight impact on the demand side as the restaurants have been ordered to shut down for the interim period. This is causing a sizeable revenue loss to many farmers across states. As per a published report, the railway ministry suggests that freight loading has dipped from a usual 10,000 cargo rakes per day to just about 3-4,000 now. As a result, the farmer has to sell his crop at a cheaper price, settle with a lower profit.

The second impact of COVID-19 is the delay in sowing and harvesting of crops due to the unavailability of products such as seeds, tractors, ancillary support, medicines for crop protection. Traditionally, this is the best time for brands from the above-mentioned sectors to market their products to the farmers. Even the e-commerce brands in agriculture have been impacted as the transportation of these products have stopped and there is no inventory.

The third impact of COVID-19 is the expected job cuts in the agricultural sector. As per the government, there are nearly nine crore farmers along with a similar number (if not more) landless agricultural labour. While the farmer will be receiving relief from the government directly, the latter is placed in a difficult position at this time.

The fourth big impact is the complete shutdown of exports. India has been a major exporter of crops and as per APEDA, India’s overall agri-exports in 2018-19 were to the tune of Rs 685 billion. Currently, all the ports have been locked and huge inventory has piled up with the traders and farmers.

The fifth impact is on the MSME & SME’s. These include small industry units, businesses/traders, and shops that manage a decent size inventory and employ numerous direct and indirect employees. Post lockdown, their businesses are shut down and facing a revenue hit. They may have to let go of their employees for a variety of reasons including financial viability, migration, health and other. People stand to lose jobs without a clear idea of when the situation is going to stabilize.

The sixth impact is the prediction of a weak consumption trend post COVID-19. Once things return to normal, the primary focus of people would be to secure jobs and get their businesses going. During such time both families and businesses will be keeping stringent checks on their spending patterns. This trend will also be an impediment to the expansion plans of the global/national brands giants in this region. They will take a while before reconsidering their entry to this market.

It is nearly impossible to even put a ballpark Figure 3 to the kind of financial hit rural areas would take due to the COVID-19.

Way Forward

These are testing times and both Union and State Governments are working to their full capacity in fighting the novel COVID-19. It has made health as its top priority.

It is extremely important to give equal priority to rural regions as post COVID-19, the region will play a big role in bringing the consumption trend and economy back on track.

The Central government has begun by announcing a relief package for the farmers, post COVID-19, to even the hit they have taken during this time. Government had announced Rs 2,000 to farmers in the first week of April under existing PM Kishan Yojana. They have reduced the burden of EMI’s for next three months on the people as it will give breathing space to many in the region. In another landmark announcement, the government has increased the daily wages of MGNREGA workers in the region that will benefit approximately 5 crore families across the country.

As per published reports, India’s farming market was worth INR 16,587 Billion in 2018 and was projected to reach INR 30,675 Billion by 2024, growing at a CAGR of 10.8% during 2019-2024. The relief package will give farmers the necessary support to get back on track.

The state governments are closely working at the Tehsil levels to ensure that the farmers get the agri-inputs and logistic support to send the produce to the market. However, each state is working with their own rules at Tehsil level and a uniform country-wide policy on this, which is well defined, is the need of the hour. Secondly, there are no community meetings or BTL activities; hence there must be an alternative plan to aware farmers of such decisions and policies. In this scenario, e-commerce players operating in the agricultural sector can be a big game changer. They have a targeted base of farmers that can be directly leveraged by the government, thereby reducing the time gap and increasing effectiveness in reaching out to them. E-commerce can help in ensuring that the agri-input needs of the farmers are met effectively. Given the adequate support, these e-commerce players can deliver the goods to the farmers at their doorsteps, sanitized at the warehouse level, thereby reducing the woes and helping in a better yield.

And, finally, it is very important to urge the MSME and SME’s to retain their employees to reduce the job cuts. This will help boost the consumption, once we leave COVID-19 behind. For the record, the rural sector drives massive consumption across categories. For instance, annual FMCG consumption in rural areas was around $24 bn and is projected to reach $100 billion by 2025.

The road ahead is definitely not easy, but I am still an optimist and hopeful that India will be able to come out of this crisis.

Research Methodology

The process used to collect information and data for the purpose of making business decisions. The methodology may include publication research, interviews, surveys and other research techniques, and could include both present and historical information.

Research Design

The research design had been the combination of Exploratory and Descriptive designs. This study had been conducted in various steps:

1. Firstly, the relevant information had been collected to meet the need of objectives.

2. Secondly, an analysis had been made.

3. Thirdly, the finding and suggestion had been given.

Data Sources

Information was gathered through primary and secondary sources.

Primary Data: It consists of original information gathered for the specific purpose. This data was generally collect by observation and survey method.

Secondary Data: It consists of information that already exists somewhere were collected for another purpose. Ex: Books, Magazines, Internet etc.

Tools used for Data Collection

1. Primary data was collected through questionnaire and informal interviews:

2. Secondary data was collected through various articles in magazines, journals.

3. Questionnaire (This questionnaire is distributed among the 200 users of 3 cities of Jammu.

Other Secondary data sources were

1. Internet sites

2. Magazines

3. Reference books

4. Newspapers

5. Other records

Procedure for Data Collection: Communication, asking question & receiving a response in person.

Research Design: Exploratory design.

Sample Plan: Random Sampling, Text books

Sampling Technique

The techniques used for conducting the study were convenience sampling technique as sample of respondents was chosen according to convenience.

Statically Tools

The tools used in this study were MS-EXCEL, MS-WORD. MS-EXCEL was used to prepare pie-charts and graphs. MS-WORD was used to prepare or write the whole project report.

Method Use to Present Data

Data Analysis & Interpretation – Classification & tabulation transforms the raw data collected through questionnaire in to useful information by organizing and compiling the bits of data contained in each questionnaire i.e., observation and responses are converted in to understandable and orderly statistics are used to organize and analyze the data:

a. Calculating the percentage of the responses.

b. Formula used = (no. of responses / total responses) * 100

Graphical analysis by means of pie charts bar graphs etc.

1. Bar chart (Bar charts has been used for comparing two or more values that will be taken over time or on different conditions, usually on small data set).

2. Pie-chart (Circular chart divided in to sectors, illustrating relative magnitudes or frequencies).

Future Consumer Index – Survey of Indian Consumers

To understand and track emerging consumer behaviors and sentiments, we have created the ‘EY Future Consumer Index19 by surveying consumers around the world. The aim is to continually track consumer behavior and sentiments throughout the evolution of the pandemic. It will help us understand how consumer preferences are changing and how consumer products companies should respond. The initial survey results of Indian consumers show that some consumers are making deep cuts in spending, while others are continuing to spend as normal but are changing how they live in other ways. Looking across all the Index data, we have identified four segments of behaviour emerging now from the current crisis. ¬ We also asked consumers what they believe they will do once they feel the crisis is over. Based on the results, we feel that the four segments emerging now could evolve into five segments going ahead. It does not provide guarantee on what they will do, but it does enable us to track their changing expectations about the future WTO (2017); WTO (2020).

A majority of the respondents belong to “Hibernate and spend” segment and are most concerned about the pandemic but are also the best positioned to deal with it. Hence, after COVID-19, most of them will migrate to “Back with a bang” segment as they are waiting to get back out and spend money on shopping. By contrast, consumers in the “Cut deep” group are significantly impacted by the pandemic and have seen the most impact on their employment. Their purchase decisions will be influenced by pricing and most of them will either “Stay frugal” or “Keep cutting” their expenditure on all categories except groceries. Consumers in “Save and stockpile” are worried about their families, and less optimistic about the future. Most of them are expected to remain frugal. Consumers belonging to ‘Stay calm, carry on’ group are less impacted. They are expected to resume their old shopping behaviours as for them all things will be same as before.

References

Donkin, C. (2020). Consumers urged to turn away from cash in virus fight. Mobile world live.

Kemp, S. (2021). Digital 2021: Global overview report. Datareportal. https://datareportal.com/reports/digital-2021-global-overview-report.

Stanbic Bank Uganda, (2019). The most affordable way to send money in Uganda. YouTube. https://www.youtube.com/watch?v=AowYJCOb-Fg

World Trade Organization (WTO), (2020). Trade Facilitation. World Trade Organization.