Research Article: 2017 Vol: 16 Issue: 2

Development Trends of Russia's Meat Industry

Marat Mirsayfovich Galeyev, Perm State Agro-Technological University

Alexander Sergeevich Baleevskikh, Perm State Agro-Technological University

Keywords

Food, Meat Industry, Sanctions, Dependence on Import, Innovations, Self-Sufficiency.

Introduction

Economy of any country as well as its subjects is apt to the impact of surrounding factors and conditions of the internal managing actions. In the modern world indicators of the economic development of states are smoothly related to inter-country integration interrelations and political power of governments to occupy the protection position in relation to the development of the leading sectors of their own economy.

The destruction of the system of socially-focused and planned economy that had taken place after the USSR (Union of Soviet Socialist Republics) collapse led the development of the modern Russia to instability and permanent financial risks for almost three decades. At the same time there is the understanding of the price the country has to pay for defending its geopolitical interests and independence.

Along with this, the destruction of global integration relations with a number of economically developed countries due to their sanction extortion made the Russian government take the counter measures. Since August 2014 they have included the limitation on importing some food of animal and plant origin from these states.

Initially the Russian government intended to limit this measure by a year’s term. In the earlier publications the authors hereof made assumptions that the probability of the long-term sanctions counteraction was high. Due to it, there was a natural issue about the possibility of the national agrarian sector to ensure its food safety without external food borrowings.

This issue was preceded by a long-term fall of food production tempos inside the country. It caused the growth of the state dependence on food supplies from abroad. In 2013 food and agricultural raw materials for the amount of almost USD 37.0 billion were imported from non-CIS countries. It was RUB 1,230 bln. As calculated at the USD rate as on the late 2013 (Galeev, Katlishin & Baleevskih, 2014).

According to Mukherjee the nature of products and services is often related to the lack of the required reserves and sufficient raw materials’ base, as well as unpreparedness of qualified personnel and a special character of the economy development stage (Mukherjee, 2012).

During economic crises problems of expanding import become urgent. According to Semykin et al. it helps to overcome the lack of economy, mitigates crises of certain sectors, enterprises and regions, forms tactical and strategic reserves, finds close interrelations with other countries and companies. Logics of this statement is sustained and related to indicators of the import for 2005-2015 (Table 1).

| Table 1: Volumes Of Products’ Import In The Russian Economy, tln. Rub | ||||

| Indicators | Years | 2015, folds as to 2005 | ||

|---|---|---|---|---|

| 2005 | 2010 | 2015 | ||

| Gross domestic product | 21.6 | 46.3 | 76.4 | 3.5 |

| Import | 4.9 | 9.8 | 12.8 | 2.6 |

| Import as to GDP, % | 22.7 | 21.2 | 16.8 | 0.7 |

It is possible to see from Table 1 that Russia has high tempos of the GDP (Gross Domestic Product) growth and large import volume. In spite of the fact that during the recent time the share of import as to the country GDP increases, the import in agricultural and food areas of economy, agricultural equipment and new technologies is still high (Galeev, Radosteva & Bartova, 2015; Ivanova, 2011).

The vector of the modern global policy of a number of developed countries goes on tilting toward measures on counteracting the Russian economy development. It is possible to respond only with a crucial change of the paradigm of state impact on the economy structuredness, including the development of agricultural production to fully provide the population with own food. The country needs a new development strategy. It must be focused, according to the President Putin, on “...active policy of import substitution”. Appearing on the plenary meeting of the 18th Saint-Petersburg International Economic Forum in May 2014, he said, “I think it is necessary to analyze opportunities of the competitive import substitution in industry and agriculture within a short period of time...” (Speech of Putin during the Plenary Meeting of the 18th Petersburg International Economic Forum). He emphasized the importance of the political solution and set the task focused on the universal supply of the country with domestic food during the nearest 4-5 years.

According to Lavrikova & Averina, today the problem of advanced import substitution is the main task of the federal and regional policy of countries and regions’ development (Lavrikova & Averina, 2015). According to Grabowski import substitution as a state economic policy is the substantiated long-term governmental policy on rationalizing import of goods and services by stimulating national producers of similar goods and indirect regulating of import by protectionism tools (Grabowski, 1994).

However, the way to achieving the goal must not seem to be simple and impermanent. According to Illarionova, import substitution strategy is a gradual transfer from producing simple goods to research-driven and high technological ones by improving the level of production and technologies development, as well as by relevant professional training and education of broad layers of population (Illarionova, 2015). This supposition of the author has a timely and urgent nature, above all, for agrarians. It is necessary to agree that at that period of time on the background of instability of the Russian economy many representatives of the agrarian business had an alert attitude to achieving the target indicators of the food complex development. The doubts were based on objective peculiarities of the natural and economic impact on the sustainability of the agrarian economy functioning. In particular, the plant growing sector cannot instantly have high results because of the long-term vegetation periods of cereals, vegetables, feed and industrial crops. Their quality and crop retrieval depend not only on the impact of the nature and climate, but also on the management potential of producers that must be focused on improving the selection work in plant and vegetables’ growing, implementation of innovation technologies of producing agricultural crops. In its turn, it requires the use of reliable, highly-productive and resource saving power equipment and other technical facilities. It is also necessary to keep in mind maintaining of soils’ fertility by using the required amount of mineral and organic fertilizers. It is related to considerable financial expenses.

Methods

The development of stock raising industries also requires innovation approaches and technologies. It is impossible not to notice that in a number of areas there have been positive changes by the moment the government tool limitation measures, the national meat production. In the total volume of all types of meat and meat products sold to the population, according to data for 2013, the volume of own production was 72% or 8.5 mln.t. It made it possible to provide every citizen of the country with 58.6 kg of meat while the medical average annual standards of consumption are 73-75 kg. During the above period, in the structure of the sold meat, poultry was 42% against 30% for pork and 24% for beef. However, this structure contained a high share of imported beef-31%, pork-18% and poultry-13% (What Impact Sanctions Will Have on the Meat Market, 2014). These data say that the poultry segment was less dependent on the import products and the broiler meat imported before Russia adopted anti-sanctions in the amount of 562 thous.t. had been entirely substituted by own production by 2016. In this case the state policy of import substitution was duly pursued and became an important event for a part of the agrifood complex because it was the first time for the post-Soviet period when the country’s self-sufficiency with poultry products became a real fact. A number of factors helped national stockbreeders to achieve high results. One of them is a high (in a number of cases 100%) level of mechanization and automation of broilers’ breeding, which explains the increasing efficiency of labour of poultry farms’ employees. Another important component of the poultry breeding is the scientific approach to using genetic potential of poultry strengthened by a considerable level of the global selection work. Crossing of highly-productive breeds of meat-type chickens allows decreasing the term of breeding broilers with the carcass of 1.1-1.3 kg from 56 down to 34 days.

Import substitution of deficient meat products becomes one of the top priority state tasks. Of course, in order to solve it, it is necessary to have a considerable state support in the form of various financial tools, including direct investments in construction of new and expanding of the existing complexes on breeding and feeding meat production stock, subsidizing a part of interest profit margins of state and commercial banks providing loans for acquiring highly-productive breeding stock, establishing stock raising facilities and acquiring the required circulating capital goods. Especially pig breeding, dairy production and beef breeding need such actions of the state today.

Pig breeding is fast-gaining and the perspective of its development is obvious. According to the Rosstat (Federal State Statistics Service), as on the end of 2016 the self-sufficiency with pork was 99%, while in 2013 the volume of its import excluding countries of the Customs Union achieved 603 thous.t. (What Impact Sanctions Will Have on the Meat Market, 2014). According to the Russian Union of Pig Keepers, in 2-3 years this amount can be substituted, which consequently was proved in practice.

Prerequisites of the import substitution and self-sufficiency growth became the capacities put into exploitation, the construction of which in the country’s regions started in the 2010-2011s. Leaders of the industry are the Caucasian, Southern, Uralskiy & Far Eastern Districts, Belgorod, Kursk and Voronezh Regions. According to the results of 2016, in total they produced about 2,000 thous.t. of pork. It means that there is a new situation on this market when the priority of pork production and supplies on the market is defined by its purposeful and gradual transfer to national producers. According to Professor Ogarokov, the country implements about 40 investment projects on constructing pig complexes with the capacity of 500 thous.t. meat per year. It will be enough to substitute all import of pork (Chuykov, 2014).

Unlike poultry and pork, beef is the most vulnerable part of the meat market of the country. As a whole, the Russian citizens’ self-sufficiency with cattle meat is about 70%. Producers have to buy the insufficient part of meat raw materials for processing abroad (Table 2). The Republic of Byelorussia, Brazil, Paraguay, Argentina & Uruguay are the main suppliers.

| Table 2: Distribution Of The Russian Federation Cattle Meat Import By Countries | ||||||||

| Partner’s country | 2013 | 2014 | 2015 | 2016 | ||||

|---|---|---|---|---|---|---|---|---|

| Tons | Price, $ thous. | Tons | Price, $ thous. | Tons | Price, $ thous. | Tons | Price, $ thous. | |

| AUSTRALIA | 27,088 | 130,403.9 | 2,167 | 16,496.0 | 0 | 0 | 0 | 0 |

| AUSTRIA | 865 | 4,706.7 | 2,153 | 7,587.0 | 0 | 0 | 0 | 0 |

| ARGENTINA | 14,879 | 63,019.0 | 22,975 | 99,491.9 | 6,613 | 24,658.6 | 3,547 | 12,346.4 |

| ARMENIA | 0 | 0 | 0 | 0 | 22 | 68.9 | 0 | 0 |

| BELARUS | 75,636 | 305,483.7 | 97,860 | 417,522.0 | 122,699 | 395,840.3 | 139,490 | 427,373.3 |

| BELGIUM | 125 | 535.8 | 149 | 490.8 | 0 | 0 | 0 | 0 |

| BRAZIL | 310,633 | 1,366,942.1 | 364,730 | 1,334,385 | 164,140 | 585,308.0 | 129,100 | 400,863.9 |

| HUNGARY | 85 | 593.3 | 24 | 241.7 | 0 | 0 | 0 | 0 |

| GERMANY | 1,864 | 7,519.6 | 5,504 | 18,790.0 | 0 | 0 | 0 | 0 |

| DENMARK | 3,054 | 13,509.9 | 1,811 | 7,926.2 | 0 | 0 | 0 | 0 |

| IRELAND | 996 | 3,970.8 | 1,857 | 6,645.2 | 0 | 0 | 0 | 0 |

| SPAIN | 2650 | 11076.1 | 1441 | 5987.1 | 0 | 0 | 0 | 0 |

| ITALY | 2,723 | 15,765.4 | 523 | 2,948.9 | 0 | 0 | 0 | 0 |

| KAZAKHSTAN | 70 | 350.3 | 639 | 2,672.3 | 878 | 3,606.8 | 3,807.8 | 797.9 |

| CANADA | 44 | 443.7 | 0 | 0 | 0 | 0 | 0 | 0 |

| COLUMBIA | 0 | 0 | 1,598 | 6,913.4 | 6,448 | 21,849.6 | 4898 | 14,499.6 |

| LITHUANIA | 7,947 | 37,889.9 | 6,608 | 29,035.2 | 0 | 0 | 0 | 0 |

| MEXICO | 314 | 1083.5 | 0 | 0 | 0 | 0 | 0 | 0 |

| REPUBLIC OF MOLDOVA | 3,483 | 13,377.5 | 1,793 | 6,757.9 | 1,405 | 3,237.5 | 2,163 | 5,312.4 |

| MONGOLIA | 0 | 0 | 480 | 1591.8 | 740 | 2,356.7 | 660 | 1,574.7 |

| NETHERLANDS | 546 | 2,797.4 | 223 | 1,662.1 | 0 | 0 | 0 | 0 |

| NICARAGUA | 924 | 3773.4 | 258 | 867.8 | 24 | 64.2 | 0 | 0 |

| NEW ZEALAND | 1,567 | 6,884.1 | 930 | 6,354.7 | 441 | 4,459.0 | 268 | 2,430.9 |

| PARAGUAY | 139,437 | 619,480.5 | 129,807 | 560,595.5 | 94,496 | 348,1852 | 74,597 | 229,828.4 |

| POLAND | 10,413 | 40,790.7 | 5,902 | 22,146.7 | 0 | 0 | 0 | 0 |

| SERBIA | 325 | 1,764.8 | 121 | 335.9 | 0 | 0 | ||

| UNITED STATES | 56 | 697.3 | 22 | 373.4 | 0 | 0 | 0 | 0 |

| UKRAINE | 17,104 | 68,801.8 | 13,811 | 45,746.0 | 24,511 | 64,015 | 0 | 0 |

| URUGUAY | 35,351 | 148,797.5 | 23,659 | 103,638.3 | 6,315 | 22,787.9 | 5,234 | 15,384.6 |

| FRANCE | 509 | 2,025.2 | 352 | 1,930.8 | 0 | 0 | 0 | 0 |

| CROATIA | 60 | 230.7 | 0 | 0 | 0 | 0 | 0 | 0 |

| CHILE | 0 | 0 | 8 | 109.8 | 0 | 0 | 0 | 0 |

| ESTONIA | 20 | 93.2 | 0 | 0 | 0 | 0 | 0 | 0 |

| JAPAN | 0 | 0 | 0 | 0 | 2 | 143.9 | 3 | 239.6 |

| Others | 1 | 5.8 | 0 | 0 | 0 | 0 | 3 | 17.6 |

| Total | 658,442 | 2,874,126.0 | 633,203 | 2,722,151.6 | 438,475 | 1,508,492.8 | 366,445 | 1,179,854.4 |

| Far-abroad countries | 79,288 | 518,827 | 2,249,453.6 | 288,960 | 1,041,724.2 | 224,592 | 696,370.9 | |

| CIS countries | 96,293 | 388,013.2 | 114,103 | 472,698.0 | 149,515 | 466,768.5 | 141,854 | 433,483.5 |

Table 2 shows that the EU countries such as Austria, Belgium, Hungary, Germany, Denmark, Ireland, Spain, Italy, Lithuania, the Netherlands, Poland, France, Croatia, Estonia as well as Australia, Canada, Japan, the United States have ceased supplying meet to the Russian Federation. Such countries as Belarus and Kazakhstan have significantly increased meat supplies to Russia. Currently, due to continuing sanctions and anti-sanctions, there are global changes in export/import meat supplies to Russia. All the above countries shall take into account current changes and modify their foreign trade policy.

The prospects of self-sufficiency in this segment of the cattle meat market are not so impressing as in the above two. There are several reasons for it. Firstly, even at the times of the Soviet planned economy, 99% of beef was obtained from breeding and slaughter of dairy cattle. Unlike beef-producing animals, these animals’ type and genetics are focused on the reproduction functions and milk production. Their body weight that achieves on average 480-530 kg with cows and low (50-58%) beef yield cannot be compared and compete with beef-producing animals. The weight of beef-producing cows in terms of various breeds can vary from 600 to 800 kg. The terms of feeding young animals for meat also differ considerably. As for dairy breeds, economically efficient expenses for breeding and the highest nutrition value of meat can be achieved at the age of 16-18 months old with the head weight of only 380-430 kg. In the context of short feeding this term can be decreased by one month, while the young beef-producing animals mature when they are 13-14 months old.

Secondly, during the post-Soviet period there was a tendency on decreasing the milk breeder herd. As compared to 1991 by the 2016 the decrease in cows has achieved the quadruple-8.5 mln. animals. The latter means that in the reality there is the situation of the “lost opportunity” related to the lack of gets from them for further feeding to produce meat. Approximate calculations show that every year the marker receives less than 1,560 thous.t. of beef. Such quantity could easily substitute import supplies of this type of meat.

The third reason of restraining the growth of domestic beef production is a considerable period for returning investments made in the industry. To the agrarian specialists’ mind, in the nearest future small vendibility of production will not cause the necessary result. It is necessary to create large scale production of cattle meat. However, producers have a rather skeptical attitude to such type of business because the beef production does not provide the desired economic return in the short-term period. The producers’ risk is found in the fact that the creation of new dairy and feeding complexes requires to invest a lot of money which payoff period reaches 7-10 years.

Certainly, the creation of breakthrough points of growth is first of all related to the active state support for the meat cattle industry. In 2013 the country launched a state target program on developing agriculture for the period of up to 2020. Product acceleration is also contributed by the increase in the expenses for the agro-industrial complex from RUB 200 to 308 bln. since 2014 that was budgeted by the government earlier. The real fact of the marbled beef entering the market was the agricultural enterprises of the Lipetsk region with the annual production of more than 6 thous.t. Since 2014 feeding complexes have been put into operation in the Voronezh Region, the Republic of Mordovia and Altai Krai. An important element of the consistency in terms of the growth and development of the meat industry is the recovery of genetic potential of specialized beef-producing cattle. Purposeful actions have been started and along with the import of pedigree beef-producing animals from abroad, the country started establishing genetic centres like the pedigree centre in the Kaluga Region. In accordance with its development project, every year it is planned to sell up to 12 thous. of Aberdeen Angus pedigree female young stock in the country.

The emergent positive results of the tempos of the industry development make it possible to suppose that it is necessary to expect essential changes in the area of meat supplies on the beef market by 2020.

It is possible to forecast the reality of suppositions by using a number of mathematic calculations that make it possible to get an idea about the values of indicators of self-sufficiency, import dependence and import substitution in the current dynamics. We pursue this goal due to the fact that in the context of globalization in terms of many types of modern products and raw materials for producing them, the economy does not manage to entirely avoid the dependence on import (Supporting Investment in Knowledge Capital, Growth & Innovation, 2013). Along with this, today the strategy on transforming the model of the economic development by moving to import substitution productions and technologies in strategically important areas is determining for Russia (Vertakova & Plotnikov, 2014; Ivanov, 2015). First of all, it is necessary to refer to the meat industry of the agrarian sector of economy.

Results

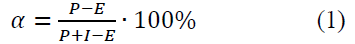

Indicators of the resourceful provision of the country with meat shown in Table 3 are calculated by using the following formula:

| Table 3: Russian Self-Sufficiency With Meat And Meat Products Since 2005 To 2015, Thous.Tons | |||||||||||

| Indicators | Years | ||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|

| 2005 | 2006 | 2007 | 2008 | 2009 | 2010 | 2011 | 2012 | 2013 | 2014 | 2015 | |

| I. RESOURCES | |||||||||||

| Reserves at the beginning of the year | 592 | 650 | 676 | 733 | 744 | 804 | 802 | 791 | 838 | 870 | 807 |

| Production: Meat-raw materials, meat-products (sausages, etc.) | 4.972 | 5.259 | 5.79 | 6.268 | 6.72 | 7.167 | 7.52 | 8.09 | 8.545 | 9.07 | 9.473 |

| Import | 3.094 | 3.175 | 3.177 | 3.248 | 2.919 | 2.855 | 2.707 | 2.71 | 2.48 | 1.952 | 1.321 |

| Export | 67 | 57 | 65 | 90 | 65 | 97 | 76 | 128 | 117 | 135 | 143 |

| Resource, in total | 8.658 | 9.084 | 9.643 | 10.249 | 10.383 | 10.826 | 11.029 | 11.591 | 11.863 | 11.892 | 11.601 |

| II. INDICATORS | |||||||||||

| Self-efficiency | 0.61 | 0.62 | 0.64 | 0.66 | 0.69 | 0.71 | 0.73 | 0.75 | 0.77 | 0.82 | 0.87 |

| Import substitution | 0.01 | 0.03 | 0.05 | 0.08 | 0.1 | 0.12 | 0.13 | 0.16 | 0.21 | 0.26 | |

| Dependence on import | 0.3896 | 0.3801 | 0.3592 | 0.3449 | 0.3068 | 0.2876 | 0.2663 | 0.255 | 0.2278 | 0.1783 | 0.1233 |

Where the numerator is the entry of domestic products in the national economy (P) excluding export (E); and the denominator is full entry of products, both domestic and import (I).

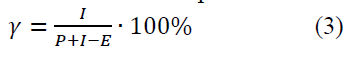

The import substitution indicator for the t period is:

It is possible to calculate the indicator of dependence on import by using the formula:

The indicators of self-sufficiency (α) and dependence on import (γ) are complementary:

According to the data from Table 3, in 2015 the self-sufficiency indicator reached the level of 87% (0.87), which is 2% higher than the minimum allowed indicator of the ration of domestic products on the internal market that meets the need in meat and meat products due to own production, in compliance with the Doctrine of Food Safety (Doctrine of the food safety of the Russian Federation, 2010). By this time the indicators have not reached the Doctrine values. It says that the industry is dependent on import. Along with this, all values of the import substitution indicator happened to be positive and the dependence on import systematically decreased 3.2 times from 0.3896 in 2005 down to 0.1233 in 2015.

During our research we have established correlation links between import, production and export indicators to determine if it is possible to decrease meat import in 2017-2018 by increasing own production.

The federal and regional powers set the main task to substitute import goods by domestic ones. The conducted analysis of import dependence and import substitution indicators for meat and meat products says that although this industry was not stable, because the indicator of self-sufficiency of 0.88 (which is higher than the standard of 0.85) was achieved only in 2015), by 2015 the requirements of the Doctrine of Food Safety had been complied with. These researches can be useful for governmental authorities that supervise the meat industry, as well as meat producers and processers. It is possible to continue the researches by determining correlation relations between such indicators as “import”, “production”, “export”, which will allow defining the possibility to decrease the meat import by increasing own production.

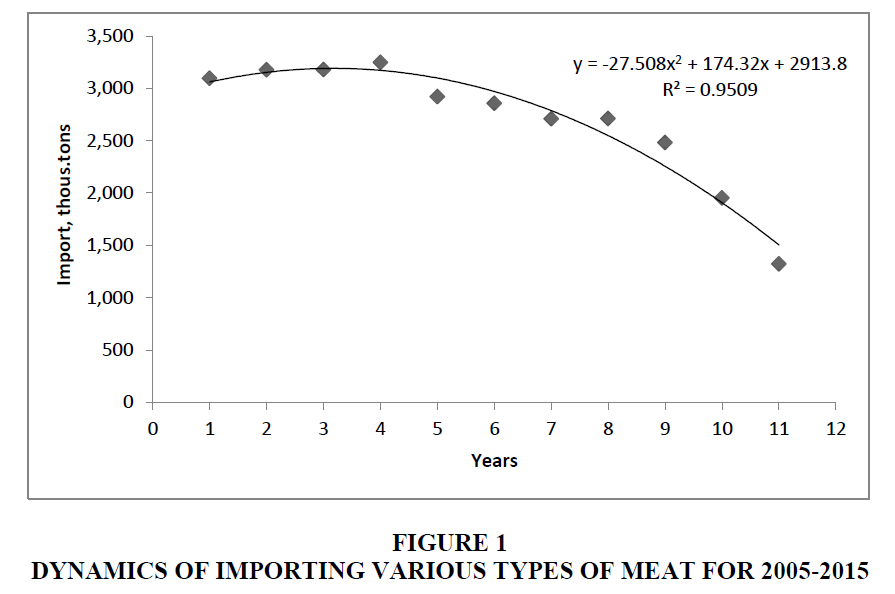

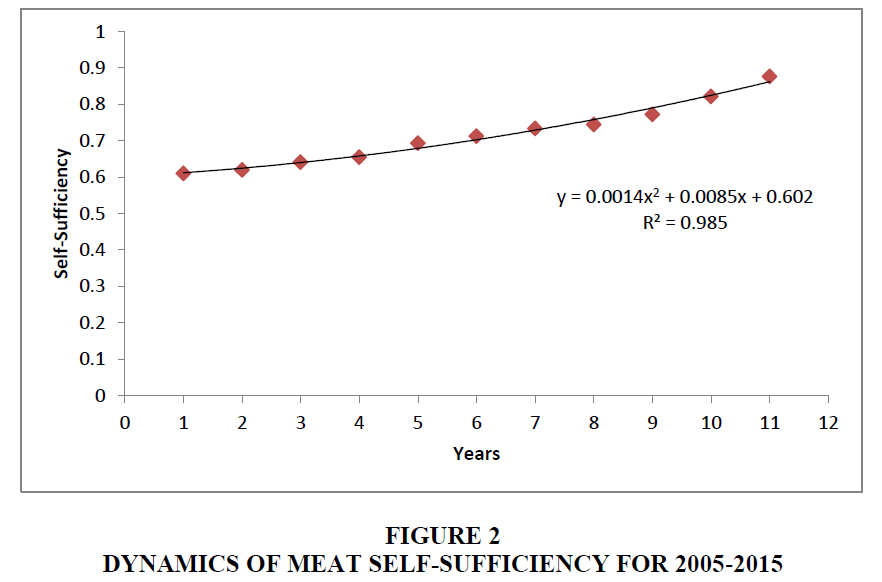

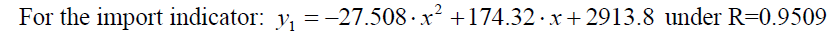

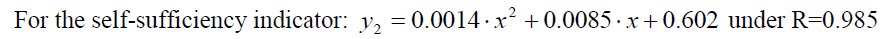

The graphic analysis of the dynamics of the indicators related to import and self-sufficiency with meat and meat products is shown in Figures 1 and 2.

The MathCad 11 mathematic software made it possible to apply the correlation and regressive analysis of defining quadratic polynomials for constrains shown on graphs from Figures 1 and 2 and to make the forecasting scenario of import and self-sufficiency dynamics (Cohen, Tiplica & Kobi, 2016; Henn & Meindl, 2015).

The above indicators show that the value of the approximation veracity (R) is close to 1. It means that the obtained equations make it possible to define the forecast indicators of import and self-sufficiency in 2017 and 2018 (Table 4).

| Table 4: Forecast Of Indicators On Import And Russian Self-Sufficiency With Meat For 2017 and 2018 | ||

| Indicator | 2017 | 2018 |

|---|---|---|

| Import, thousand tons | 531 | 37 |

| Self-sufficiency | 0.9491 | 0.9954 |

According to Table 4, the forecast for meat export obtained by calculations for 2017 and 2018 shows that the nearest future will see a significant reduction in procurements of meat from foreign suppliers due to the growth of own meat production, the self-sufficiency coefficient of which will almost reach 1 by 2018.

Conclusion

The federal and regional authorities in the Russian Federation are striving for complete provision of the population with own food commodities during the next 2-3 years. For this purpose, the rural sector of the country’s economy has found significant opportunities in the form of state financial support. Starting with 2014, the Russia’s agribusiness industry has been receiving annually more than 500 bln RUB in the form of various financial instruments. This enabled increasing the production of the meat industry and, by 2015, enter the self-sufficiency level of 87% of meat of various species of agricultural animals and poultry. The rated forecast data make us believe that meat and meat products of own production in Russia will be sufficient after 2018. The aims of these researches have been met.

Our following studies will closely focus on the issues related to the species structure of the meat consumed by the Russian population. Now the country sees that people switch to consuming less caloric but easily digestible food. The population starts buying poultry and poultry products. There is an adequate response of the market to consumer demands. More and more turkey and duck meat are produced in the country. In this connection, there are doubts concerning the need to increase the production of beef and pork for internal purposes.

References

- Chuykov, A.A. (2014). Melkoposelkovaya strana [Small villages? country]. Week Arguments, 39(3).

- Cohen, A., Tiplica, T. & Kobi, A. (2016). Design of experiments and statistical process control using wavelets analysis. Control Engineering Practice, 49, 129-138.

- Doktrina prodovolstvennoy bezopasnosti Rossiyskoy Federatsii (2010). Approved by order of the president of the Russian Federation. Doctrine of the food safety of the Russian Federation

- Galeev, M.M., Katlishin, O.I. & Baleevskih, A.S. (2014). Vozmozhnye stsenarii razvitiya prodovolstvennogo kompleksa Rossii v sovremennyh usloviyah [Possible scenarios of developing the food complex of Russia under modern conditions]. Materials of the International Research and Practice Conference (Perm, November 11-14, 2014) ?Food industry: Safety and integration?. Publishing House of the ?Prokrost? IPT.

- Galeev, M.M., Radosteva, E.M. & Bartova, E.V. (2015). Vozmozhnosti importozamescheniya v sisteme prodovolstvennoy bezopasnosti Rossii [Possibilitties of import substitution in the system of food safety in Russia]. Science Studies, 3(28).

- Grabowski, R. (1994). Import substitution, export promotion and the state in economic development. The Journal of Developing Areas, 28(4), 535-554.

- Henn, J. & Meindl, K. (2015). Statistical tests against systematic errors in data sets based on the equality of residual means and variances from control samples: Theory and applications. Acta Crystallographic Section A: Foundations and Advances, 71, 203-211.

- Illarionova, N.F. (2015). Problemy i perspektivy importozamescheniya produktsii APK [Problems and perspectives of import substitution of products of the agro-industrial complex]. Bulletin of the Don State Agrarian University, 2-2(16), 40-50.

- Ivanov, V.V. (2015). Kontseptualnye osnovy natsionalnoy tehnologicheskoy initsiativy [Conceptual basics of the national technological initiative]. Innovations, 1, 8-14.

- Ivanova, G.N. (2011). Mezhdunarodnye standarty protiv nestabilnoy ekonomiki [International standards against unstable economy]. Standards and Quality, 11, 72-74.

- Kak otrazyatsya sanktsii na rynke myasa. (2014). What impact sanctions will have on the meat market. Economy of Agricultural and Processing Enterprises, 9, 68-70.

- Lavrikova, Y.G. & Averina, L.M. (2015). Strategicheskie osnovy realizatsii potentsiala importozamescheniya na primere zheleznodorozhnogo mashinostroeniya [Strategic basics of implementing the potential of import substitution through the example of railway machine-building]. Economy and social changes: Facts, Tendencies and Forecast, 3, 85-96.

- Mukherjee, S. (2012). Revisiting the debate over import-substituting versus export-led industrialization. Trade and Development Review, 1(5), 64-76.

- OECD (2013). Supporting investment in knowledge capital, growth and innovation. OECD: OECD publishing.

- Vertakova, Y.V. & Plotnikov, V.A. (2014). Importozameschenie: Teoreticheskie osnovy i perspektivy realizatsii v Rossii [Import substitution: Theoretical basics and perspectives of implementing in Russia]. Economics and Management, 11, 11-47.

- Vystuplenie Putina, V.V. (2017). Na plenarnom zasedanii 18-go Peterburgskogo mezhdunarodnogo ekonomicheskogo foruma [Speech of V.V. Putin during the plenary meeting of the 18th petersburg international economic forum]. Retrieved May 5, 2017, from http://www.kremlin.ru