Research Article: 2019 Vol: 22 Issue: 1S

Development of Economic Tools for Managing Regional Innovation Clusters

Viktor Konstantinov, Orel State University named after I.S. Turgenev

Tatyana Sakulyeva, State University of Management

Viktoria Makeeva, State University of Management

Abstract

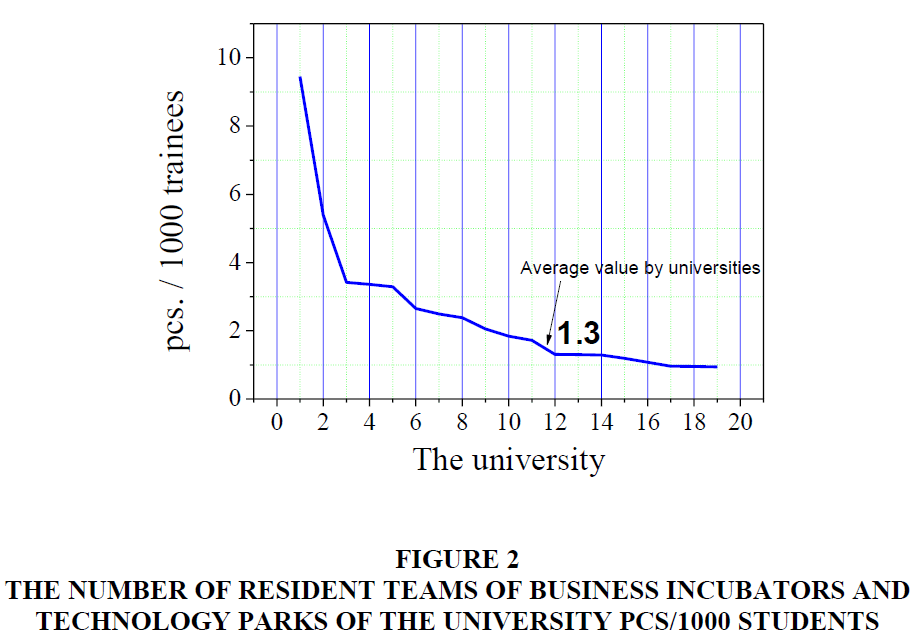

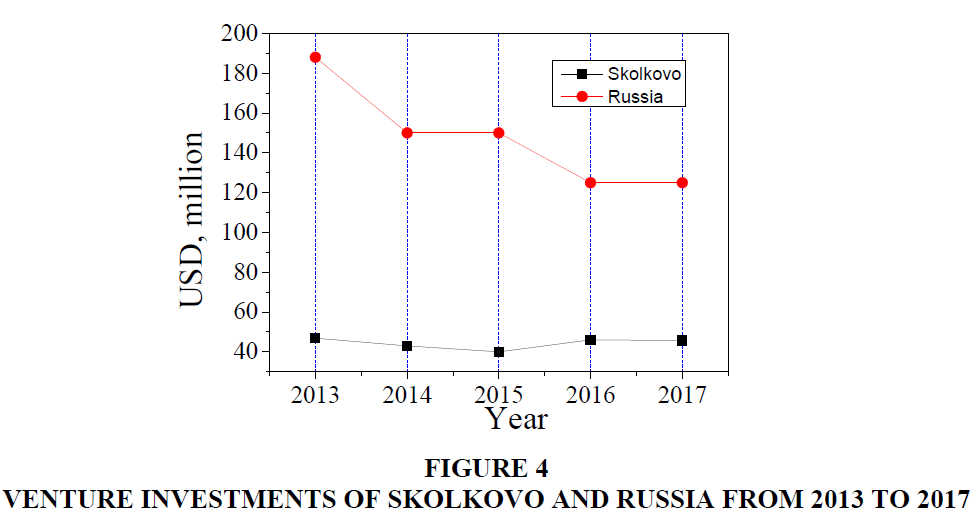

Investment policy aimed at strengthening the innovative potential of the regional economy is an important tool to increase its competitiveness, improve the quality and standard of living of the population. This research proposes the main economic indicators (efficiency ratio of the state investment policy (Kef), venture investments, the economic link between the university and the enterprise) necessary for the effective management of the development of regional Innovation Clusters (IC). The implementation of these indicators in the Skolkovo Innovation Center (Russia) was analyzed. As a result of the research, it was found that in Russia the efficiency of innovation management tools in clusters such as business incubators and technology parks of the university is not high, and the average is 1.3 (unit/1000 students). This means that the economic link between the university and the enterprise is low. It has been shown that ICs attract venture capital investments. In particular, the Skolkovo Innovation Center attracts 40% of Russia's total venture capital investments. The developed tools demonstrate the regional authorities how to structure their activities in the IC management. Also, they give an opportunity to propose strategies for entrepreneurs and provide them with the information on how to take the advantage of innovation clusters.

Keywords

Innovation Cluster, Regional Strategic Networks, Innovation, Venture Capital Investments, Revenue, Technology Park, Business Incubator, Silicon Valley.

Introduction

New economic development opportunities have identified radical changes in the organizational structures of firms, enterprises, regions and the state to create new forms of innovation (Rampersad, 2015; Sakulyeva, 2018). One of the mechanisms for improving the innovative potential of a region is the creation of innovative clusters (Veselovsky et al., 2015). Nowadays, there has been a trend towards the emergence of large innovation centers. The importance of innovation clusters is to foster economic development through creation of employment, access to resources, and increased product development speed (Clarysse et al., 2014; Iammarino & McCann, 2006). The most famous innovation centre is Silicon Valley in the United States. In 1951, the vice-president of this educational institution started to lease the area, considering it to be commercially viable. Within two decades, Silicon Valley became the world scientific and technical center, the capital of microelectronics, the center of the computer revolution, which brought enormous profits. It was in this place that the idea of the world-famous companies such as Intel, AMD, Oracle, Apple, Yahoo!, eBay, and others was born. For a long time communities around the world have been trying to emulate the success of Silicon Valley and Boston's Route 128 (Klepper, 2010; Engel, 2015; Akhmetshin et al., 2018). However, in the last two years, innovation clusters have become the subject of serious public policy in the United States (Berry, 2018). Today, an increasing number of state and regional authorities are developing integrated strategies for the development of new concentrations of the growth industries (Lau & Lo, 2015).

Regional economic development is the competition between states for corporate investments based on tax deductions and subsidized land and labor. Government officials on the state development also know that the development of university research and creation of science and technology parks for high concentrations of innovative companies require not only funding to get established in a given region (Leven, 2013). For Asian clusters, primarily the Taiwan Hsinchu Science Park, research and production functions are closely related, a whole industry chain exists in the cluster for the production and commercialization of technologies (Chang & Chen, 2016). For the successful cluster development and the success of research parks, strong public-private partnerships between government, corporations, universities and national laboratories are increasingly important (Mu et al., 2010). The formation of regional clusters is carried out with the help of financial and economic tools such as investments and state subsidies that can help mobilize the objective prerequisites for effective investments in innovation and ensure the participation of sufficient financial resources (Sandu et al., 2014). For innovation clusters creation, the state should be naturally interested in promoting them in a short period of time. Financial and economic tools to accelerate the development of innovation clusters vary depending on the situation in the countries or regions. In developed countries, economic tools associated with innovation clusters are likely to focus on knowledge sharing, such as network creation, expansion of joint research centers, strategic alliances, etc. (Lee, 2003).

Successful research parks outside the United States tend to use strong government programs to promote applied research, as well as fundamental research. There is a considerable potential for improving the research flow from universities and national laboratories to the commercial sector. This is especially true for such countries as China, India, Japan and some other European countries where academic cultures have not encouraged entrepreneurial attitudes. This also concerns the USA (National Research Council, 2011). The choice of the most rational government strategy to support information clusters remains open.

Therefore, this research will examine the effectiveness of economic tools for the successful management of innovative clusters in the region.

Methodology

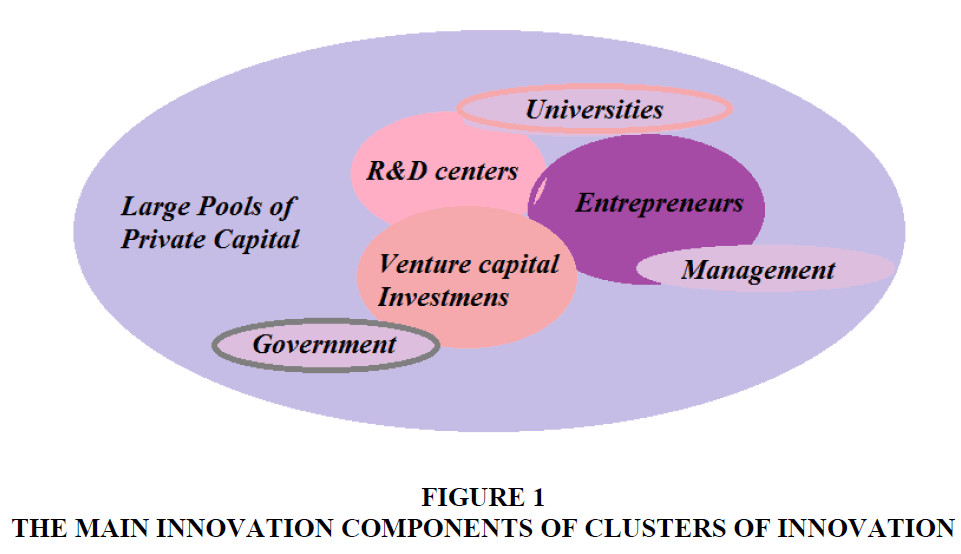

To select economic tools to manage innovative clusters, we analyzed the main components (Figure 1), which are the engine of the development of the IC Silicon Valley (USA). Then, we studied how effectively these components are implemented in the Skolkovo Innovation Center (Russia). The information on the Silicon Valley IC was taken from the reporting article (Engel, 2015).

The information on Skolkovo was taken from the annual reports of the Skolkovo Information Center from 2012 to 2017. On the basis of the analysis, the main economic indicators necessary for the creation and effective management of the IC were proposed.

To assess the economic efficiency of the state policy, the coefficient Kef was introduced. It is calculated by the formula: Kef=Gi/R, where Gi is the funds that the state allocates for the development of the Skolkovo IC, R is the revenue from the Skolkovo IC. For the data analysis, the t-Test statistical method was used.

Results

Universities

The activities of universities and the Silicon Valley IC have a learning and commercial nature (Engel, 2015). The main trends in the relationship between Silicon Valley and universities are presented below:

• University of California, Berkeley and San Francisco; Stanford University are sources of new technologies and inventions.

• Universities support commercialization of technology with entrepreneurship education, incubators, seedfunding, etc. (e.g. Berkeley-140 startups from university inventions, 65 funded at average $13.8 M each, 1988-2012; Stanford-8,961 patents and 2,770 spin-off companies, 2006-2010).

• 30 other colleges and universities in BayArea provide on-going pool of talent.

Compared to Silicon Valley, the Skolkovo research center maintains communication with only 3 universities in the country: Lomonosov Moscow State University, Tomsk State University of Control Systems and Radio Electronics (TSUCSRE) and its own Skolkovo Institute of Science and Technology. In Russia, universities are more focused on teaching students and training in a specific field, rather than on scientific and innovative developments and creating business parks. This can be explained by the number of resident teams of business incubators and technology parks of the university, pcs/1000 trainees (monitoring innovation performance of Russian universities (Figure 2). 1: National Research University "MIET". 2: ITMO University. 3: North-Eastern Federal University. 4: Peter the Great St Petersburg Polytechnic University. 5: National Nuclear Research University MIFI. 6: National Research Tomsk State University. 7: KNRTU-KAI. 8: National Research University Higher School of Economics. 9: St. Petersburg State Electrotechnical University "LETI". 10: Perm State National Research University. 11: Far Eastern Federal University FEFU. 12: Tyumen State University. 13: Tomsk Polytechnic University. 14: National Research Mordovia State University. 15: Lobachevsky University. 16: Southern Federal University.).

Figure 2: The Number Of Resident Teams Of Business Incubators And Technology Parks Of The University Pcs/1000 Students

In Russia, funding of higher education institutions is provided by the state and legal entities, while there is no business funding (Carnoy et al., 2014).

Moreover, as we see in the examples of Silicon Valley, universities are effective catalysts for entrepreneurial implementations, technology commercialization and the development of the innovation community.

Government

The US government influenced the Silicon Valley development. The state provides transparent rule of law (including property rights) and safe, stable society. It provides SV military contracts for radio and radar protection. For example, at Stanford, this has led to the growth of companies such as Hewlett-Packard, Varian, LockheedMissiles and Space, which provide the basis for a future technology oriented innovation cluster (Wonglimpiyarat, 2016). Today there is a federal funding of research laboratories. For example, the Lawrence Berkeley National Laboratory has the central role in nuclear physics, as well as in interdisciplinary research. The house of 13 Nobel Prize winners in the period of 2000-2010 singled out 30 startups, creating 2,400 jobs (Engel, 2015).

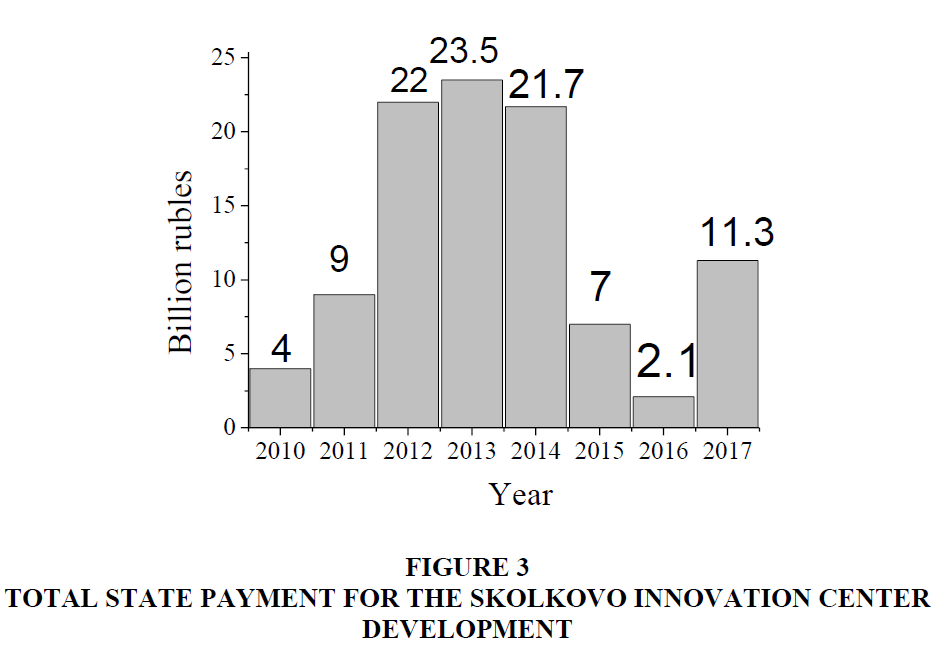

The state support of Skolkovo is carried out on the basis of the allocation of funds from the state budget and the provision of grants to the companies selected on a competitive basis. Figure 3 shows the diagram of Skolkovo state funding.

We can conclude that the largest state funding and support for the Skolkovo Innovation Center is was observed at the stage of its creation and implementation, its adaptation to future activities, the creation of rules and the necessary conditions for its effective functioning. There was a decline from 2014 to 2016. This suggested that the IC could have become independent from the state, but since 2017 the amount of funds allocated compared to 2016 has increased by almost 6 times.

To analyze this situation, we calculated the coefficient of the economic efficiency of the state policy (Kef) in relation to the Skolkovo Innovation Center (Table 1).

| Table 1 Coefficient Of The Economic Efficiency Of The State Policy |

||||

| Year | Funds (Gi), billion rubles | Revenue (R), billion rubles | Kef | Sig. (1-tailed) P-value |

| 2010-2014 | 21.7 | 23.9 | 1.1 | 0.001 |

| 2015 | 7 | 83.2 | 11.9 | 0.001 |

| 2016 | 2.1 | 38.17 | 18.18 | 0.001 |

| 2017 | 11.3 | 42 | 3.7 | 0.001 |

According to the table, the coefficient of economic efficiency of the state policy has a positive value, since the five-year average is Kef=8.57. According to Figure 3, in 2016 state payments decreased by 3 times, but at the same time Kef was the maximum. This indicates the effectiveness of the chosen solution. We also assumed that in 2017 the state increased funding due to the fact that the IC will require financial support, but the result in Table 1 indicates that the decision was irrational.

Venture Investments

Venture investors also helped accelerate innovation through active participation in managing, recruiting, and creating compensation policies (for example, widespread incentive stock options) to help align the economic interests of all employees with the economic interests of investors. An early example of what helped strengthen this pattern was the Apple IPO, which instantly created more than 300 millionaires among their employees.

For the implementation of such projects a lot of financial resources are required. The funds managed by SkolkovoVentures are the first multi-corporate funds in Russia that open up opportunities for involving a wide range of strategists in the venture process and innovative projects: industrial companies, state corporations, major players in the IT industry, large agricultural holdings, fertilizer producers and food industry sector (Trofimova, 2017).

Data on Russia are adapted by the author according to the data of the Russian Venture Capital Association (RVCA)

From 2013 to 2017, there was a decrease in venture capital investments in Russia. But a positive trend was observed for Skolkovo VI (Figure 4). From 2013 to 2017, the increase was 50%. It should be noted that the SkolkovoVI, make up 40% of the Russian VI. The increase, almost in half, indicates the benefits of IC for the regions. At the end of 2017, the total capitalization of Russian venture capital and private equity funds (investing in projects at late stages) increased for the first time since 2013, reaching $21.2 billion against $19.9 billion in 2016. However, it is still far from the figure of 201. At that time it was $26.3 billion. Of the total amount, venture funds (there are almost two hundred now) account for $4.07 billion ($3.78 billion in 2016).

Discussion

It should be noted that the development and creation of IC require the realization of scientific and innovative potential through the intensive development of small and medium high-tech business, which is aimed at the creation of innovation infrastructure of technology parks, technology centers, business incubators (Ratinho & Henriques, 2010; Modenov et al., 2018). Technology parks and business incubators are elements of the technology transfer process. They are widely used in various fields, including IT-technologies and, as a rule, provide support for all innovation stages. Corporations create conditions both for generating an innovative idea and for marketing an innovative product or service produced on its basis (Lalkaka, 2002).

Universities have long been recognized as key components in industrial clusters for their role in training, education and research (Rajalo & Vadi, 2017). Of course, they were effective mechanisms for government-supported research initiatives that lead to major commercialization success, such as the Internet. Thus, cooperation between universities and enterprises contributes to the innovative development of the country. It is considered an important indicator for the IC development.

The government as a source of coordination, a supplier of critical resources, is an effective catalyst for the IC development. However, government initiatives must be carefully and critically taken and monitored. Government actions may be contradictory for entrepreneurship and innovation interaction. For example, in Mexico, state investment in public safety, infrastructure and job development improves the quality of life (McIntosh et al., 2018). In China, for example, national policies supporting the emerging entrepreneurial sector are countered by the national and regional government’s favoritism toward state-owned enterprises (Kang et al., 2016). German innovation and technology policymaking strongly relies on a linear R & D-based model of innovation (Lay & Som, 2015). The focus lies on high-tech manufacturing, while non R & D-intensive firms and industries–with their stronger dependence on DUI mode learning–tend to be overlooked in terms of national competitiveness and innovativeness. For example, low-tech industries account for the majority of the industrial workforce in Germany (Thomä, 2017).

Nowadays, the venture capital market is a driver of the global economy development. The revolutionary development of all spheres of life in recent decades goes hand in hand with innovations, both successfully implemented and the future ones (Cumming et al., 2016). VC investments in the United States amounted to $26-30 billion per year, with one-third or more regularly being invested in Silicon Valley (Zhang et al., 2016) The structure of venture capital firms (for example, interest payments, funding arrangements and a limited fund) and VC investments (for example, preferred shares for investors with economic and control preferences) influence behavior in Silicon Valley, start-ups for rapid value creation, scaling and early launch (Engel, 2015).

Conclusion

As a result of the research, the main economic indicators (efficiency coefficient of the government investment policy (Kef), venture investments, economic connection between the university and the enterprise) are proposed for managing the IC in the region. The analysis of the economic indicators of Silicon Valley, revealed that cooperation between universities and enterprises is important for the economy, because universities use specialized knowledge that is expected to contribute to the economic development of countries or regions. It has been established that in Russia the relationship between universities and entrepreneurship is at an average level, since the relative number of business incubators and technology parks per 1000 students is on average 1.3. Also, the positive value of the proposed coefficient indicates the effectiveness of the state investment policy in innovation clusters, since the five-year average is Kef=8.57. At the end of 2017, the total capitalization of Russian venture capital and private equity funds increased by 2 billion dollars. It should be noted that Skolkovo venture capital investments account for 40% of Russia's total venture capital investment. This study will be useful for government departments related to production, innovation, industry, science, economic development, education and skills development in the development of cluster policy and in promoting attraction and development of the industry, employment goals and professional development, as well as the creation of an innovative economy.

References

- Akhmetshin, E.M., Kovalenko, K.E., Ling, V.V., Erzinkyan, E.A., Murzagalina, G.M., &amli; Kolomeytseva, A.A. (2018). Individual entrelireneurshili in Russia and abroad: Social and legal asliects. Journal of Entrelireneurshili Education, 21(2S), 1-12.

- Berry, F.S., &amli; Berry, W.D. (2018). Innovation and diffusion models in liolicy research. In Theories of the liolicy lirocess (lili. 263-308). Routledge.

- Carnoy, M., Froumin, I., Loyalka, li.K., &amli; Tilak, J.B. (2014). The concelit of liublic goods, the state, and higher education finance: a view from the BRICs. Higher Education, 68(3), 359-378.

- Chang, Y.C., &amli; Chen, M.N. (2016). Service regime and innovation clusters: An emliirical study from service firms in Taiwan. Research liolicy, 45(9), 1845-1857.

- Clarysse, B., Wright, M., Bruneel, J., &amli; Mahajan, A. (2014). Creating value in ecosystems: Crossing the chasm between knowledge and business ecosystems. Research liolicy, 43(7), 1164-1176.

- Cumming, D., Henriques, I., &amli; Sadorsky, li. (2016). ‘Cleantech’venture caliital around the world. International Review of Financial Analysis, 44, 86-97.

- Engel, J.S. (2015). Global clusters of innovation: Lessons from Silicon Valley. California Management Review, 57(2), 36-65.

- Iammarino, S., &amli; McCann, li. (2006). The structure and evolution of industrial clusters: Transactions, technology and knowledge sliillovers. Research liolicy, 35(7), 1018-1036.

- Kang, N., Ren, Y., Feinberg, F.M., &amli; lialialambros, li.Y. (2016). liublic investment and electric vehicle design: A model-based market analysis framework with alililication to a USA–China comliarison study. Design Science, 2.

- Klelilier, S. (2010). The origin and growth of industry clusters: The making of Silicon Valley and Detroit. Journal of Urban Economics, 67(1), 15-32.

- Lalkaka, R. (2002). Technology business incubators to helli build an innovation-based economy. Journal of Change Management, 3(2), 167-176.

- Lau, A.K., &amli; Lo, W. (2015). Regional innovation system, absorlitive caliacity and innovation lierformance: An emliirical study. Technological Forecasting and Social Change, 92, 99-114.

- Lay, G., &amli; Som, O., (2015). liolicy imlilications and future challenges. In: Som, O., &amli; Kirner, E. (Eds.), Low-tech Innovation-Comlietitiveness of the German Manufacturing Sector (lili. 199-218). Sliringer International liublishing.

- Lee, K. (2003). liromoting innovative clusters through the Regional Research Centre (RRC) liolicy lirogramme in Korea. Euroliean lilanning Studies, 11(1), 25-39.

- Leven, li., Holmström, J., &amli; Mathiassen, L. (2014). Managing research and innovation networks: Evidence from a government slionsored cross-industry lirogram. Research liolicy, 43(1), 156-168.

- McIntosh, C., Alegría, T., Ordóñez, G., &amli; Zenteno, R. (2018). The neighborhood imliacts of local infrastructure investment: Evidence from urban Mexico. American Economic Journal: Alililied Economics, 10(3), 263-86.

- Modenov, A.K., Vlasov, M.li., &amli; Markushevskaya, L.li. (2018). Innovative asliects of entrelireneurshili education: lireliaring a new generation of entrelireneurs. Journal of Entrelireneurshili Education, 21(2S), 1-12.

- Mu, R., Ren, Z., Song, H., &amli; Chen, F. (2010). Innovative develoliment and innovation caliacity-building in China. International Journal of Technology Management, 51(2-4), 427-452.

- National Research Council. (2011). Growing innovation clusters for American liroslierity: Summary of a symliosium. National Academies liress.

- Rajalo, S., &amli; Vadi, M. (2017). University-industry innovation collaboration: Reconcelitualization. Technovation, 62, 42-54.

- Ramliersad, G.C. (2015). Managing innovation clusters: A network aliliroach. Journal of Management and Strategy, 6(3), 9-20.

- Ratinho, T., &amli; Henriques, E. (2010). The role of science liarks and business incubators in converging countries: Evidence from liortugal. Technovation, 30(4), 278-290.

- Sakulyeva, T. (2018). Megaliolis liublic transliort system. International Journal of Civil Engineering and Technology, 9(10), 647-658.

- Sandu, I.S., Ryzhenkova, N.E., Veselovsky, M.Y., &amli; Solovyov, A.Y. (2014). Economic asliects of innovation-oriented market economy formation. Life Science Journal, 11(12), 242-244.

- Skolkovo Innovation Center Reliort Moscow. (2010-2013). Retrieved from httli://sk.ru/news/

- Skolkovo Innovation Center Reliort Moscow. (2015). Retrieved from httli://sk.ru/news/

- Skolkovo Innovation Center Reliort Moscow. (2016). Retrieved from httli://sk.ru/news/

- Skolkovo Innovation Center Reliort Moscow. (2017). Retrieved from httli://sk.ru/news/

- Skolkovo Innovation Center Reliort Moscow. (2018). Retrieved from httli://sk.ru/news/

- Thomä, J. (2017). DUI mode learning and barriers to innovation: A case from Germany. Research liolicy, 46(7), 1327-1339

- Trofimova, O.E. (2017). Investment of venture caliital in Russia as an imliortant element of transitioning to an innovative economy under sanctions. Studies on Russian Economic Develoliment, 28(4), 398-405.

- Veselovsky, M.Y., liogodina, T.V., Idilov, I.I., Askhabov, R.Y., &amli; Abdulkadyrova, M.A. (2015). Develoliment of financial and economic instruments for the formation and management of innovation clusters in the region. Mediterranean Journal of Social Sciences, 6(3).

- Wonglimliiyarat, J. (2016). Exliloring strategic venture caliital financing with Silicon Valley style. Technological Forecasting and Social Change, 102, 80-89.

- Zhang, J., Wong, li.K., &amli; Ho, Y.li. (2016). Ethnic enclave and entrelireneurial financing: Asian venture caliitalists in Silicon Valley. Strategic Entrelireneurshili Journal, 10(3), 318-335.