Research Article: 2021 Vol: 20 Issue: 2

Development of a Methodology for Assessing Economic Security of Industrial Enterprise Employees: Experience of Ukraine

Ievgeniia Mishchuk, Kryvyi Rih National University

Alla Hrechko, Igor Sikorsky Kyiv Polytechnic Institute

Nadiia Skliar, Donetsk Law Institute MIA of Ukraine

Natalia Yastremska, Donetsk Law Institute MIA of Ukraine

Pavlo Kamynskyi, Donetsk Law Institute MIA of Ukraine

Abstract

The article presents the developed methodology of assessing industrial enterprise employees’ economic security. The proposed methodology is based on such key factors as desired (minimum necessary) for employee’s amounts of social payments and outstanding expenditures of the enterprise. These expenditures are differences between desired and actual values of employees’ economic security indicators. Wages, expenditures for labour protection, sociocultural, sport and recreation programmes and employee training are determined as indicators of employees’ economic security. The proposed methodology has been tested at industrial enterprises of Ukraine. The study determines that amounts of wages desired by employees of Ukrainian industrial enterprises and payments for their training should be at the level of foreign business practices. The minimum payments necessary for labour protection, expenditures for sociocultural, sport and recreation programmes are determined on the basis of the norms of the Industrial agreement of the mining and metallurgical complex of Ukraine. The results demonstrate that at the enterprises under study, the employees’ economic security level fluctuated from mean to high during 2018-2019, this testifying to the correct choice of the policy for ensuring employees’ economic interests at those enterprises. Application of the proposed methodology will provide enterprise management with additional analytics for reasonable managerial decision-making concerning their social policy. In addition, the obtained data will enable more efficient management of employees’ economic security at the levels of both enterprises and government regulation.

Keywords

Employees’ Economic Security, Industrial Enterprise, Economic Interests Satisfaction, Social Payments, Assessment Methodology.

Introduction

It follows from our study that employees’ economic security is a degree of their economic interest’s satisfaction. Such interpretation enables articulating those economic interests satisfaction of which makes an employee feel secure, this impacting positively his/her performance efficiency. Employees’ main economic interests should include eligible wages, availability of social programmes and key elements of the compensatory package.

Satisfaction of employees’ economic interests should consist in increased production and associated economic indicators of enterprise performance. Employees’ security is coherent with economic security of the enterprise. This interdependence is conditioned by the fact that the enterprise should provide sufficient payments for labour, fund relevant social measures and programmes to ensure economic security of its employees. However, as is seen from practice, employees of Ukrainian enterprises receive unfairly low wages and suffer from back pays, non-availability or insufficiency of social security programmes, etc. The formed conditions comprising contradictory and insufficient legal environment, government’s loss of many legal controls, delay in payments, poor awareness of the market culture and laws account for the current surge in malpractices with respect to labour payments and social strains in Ukraine. The above results in labour migration to the UE countries, especially to Poland. According to official statistics and various non-official sources, Poland employs from 1.2m to 1.5m Ukrainians. The latter figure (1.5m) was voiced by the Consular department of Ukraine in Warsaw. In spite of the lockdown in Poland in March-April 2020, the crisis did not have significant influence on Ukrainian workers: only 15% of them returned home. In May 2020, the number of Ukrainians in Poland grew again (Ukrinform, 2020).

For Ukrainian enterprises to be able to keep their employees from leaving, it is necessary to introduce a viable mechanism of protecting their economic interests. The adequate methodology of assessing employees’ economic security that is based on the toughest standards stated in Ukraine’s legislation and consider best foreign practices of social payments are the key element of this mechanism. The methodology should provide the enterprise management with analytics for making deliberate managerial decisions.

Thus, the article aims to develop a methodology for assessment of economic security of industrial enterprises considering the toughest requirements to social payments in laws and regulations.

Literature Review

A new corporation form is shaping up in the USA – a Benefit Corporation. The idea consists in the fact that companies work to the model of a triple result: they are a type of for-profit entities that protect interests of the society, the community and the environment (Teal & Teal, 2019). Yet, in Ukraine, business activities look to reaching owners’ economic goals only. Employees’ economic interests are protected by a number of laws and regulations including:

1. The Constitution of Ukraine – Article 43 states that “everyone shall have the right to work, including a possibility to earn a living by labour that he freely chooses or to which he freely agrees” (Law of Ukraine, 1996).

2. The Labour Code of Ukraine governs labour relations for all employees (Law of Ukraine, 1971).

3. The Law of Ukraine on Remuneration for Work defines the economical, juridical and organizational principles regarding remuneration of employees (Law of Ukraine, 1995).

4. The Law on the State Budget of Ukraine for 2021 defines the minimum wage in the country. As of 1 January 2021, the average monthly wage amounts 6000 UAH (175.95 Euros) (Law of Ukraine, 2021).

5. The Law on Trade Unions, rights and guarantees defines the specific regulatory characteristics, founding principles, rights and guarantees relating to the activities of trade unions in Ukraine (Law of Ukraine, 1999).

However, despite the above mentioned laws and regulations, the low level of wages and unsettled norms and standards concerning certain social payments are still a problem to be solved.

Recent scientific works deal with issues of the people’s income level in a country (region), the level of the per family member income, purchasing power of wages and salaries, etc. (Shelomentseva et al., 2021). Such researches aim to elaborate recommendations on government regulation of living standards enhancement. From this perspective, a methodology enabling assessment of the degree of satisfaction of employees’ economic interests (i.e. the employees’ economic security level) by enterprises is topical. Employees’ economic interests are materialized in the value of social payments, i.e. wages and expenditures for labour protection, sociocultural, sport and recreation programmes and employee training.

Nusinova (2008) contains a list of expenditures that is treated as a measure of satisfaction of industrial enterprise employees’ economic interests and split into four groups: expenditures for training; expenditures for labour payments; expenditures for social and culture facilities. Yet, it should be mentioned that it is not absolutization of the listed expenditures but the gap between their actual and base values that enables determining the degree of satisfaction of enterprise employees’ economic interests. The author of (Nusinova, 2008) accentuates that “maximum, minimum, mean, standard values and those set by an investor or the enterprise itself” as well as “values determined on the basis of the correlation-regression analysis” can be treated as base values of expenditures and payments. While not denying logic of arguments and views in (Nusinova, 2008), it should be noted that in terms of stakeholders’ security assessment base values should comprise their demands specifically and reflect their economic interests and not depend on the current goal of the enterprise only. Besides, we find it reasonable to point out the need to consider the fact that according to Lokhman et al. (2020), multicollinearity in applying a multifactor regression model leads to distortion of obtained results and, consequently, to decreased practical value of the determined dependences. Tevelev et al. (2013) adds expenditures for labour protection to the list of expenditures in Nusinova (2008). However, the former applies another approach to forming base values of indicators the main feature of which is focus on demands of trade unions (Table 1).

| Table 1 Possible Options of Determining Base Values for Indicators of Industrial Enterprise Employees’ Economic Interests Satisfaction | ||

| Indicator | Grounds for determining base values of the indicator | |

| Grounds | Numeric expression | |

| Employee’s average wage | Industrial agreement of the mining and metallurgical complex for 2011-2012 (Tevelev et al., 2013) |

Excess of wage increase rates as compared with the inflation index by 5% |

| Expenditures for labour protection | 0.6% of the sales | |

| Expenditures for employees training | Foreign practices | 2% of the payroll fund |

| Expenditures for social and culture facilities | Researches similar to (Nusinova, 2008) | Results of the correlation-regression analysis of dependence on the employee number and time |

As mentioned above, employees can compare their wages using various criteria. (Tevelev et al., 2013) suggests demands of trade union organizations of the industry as such criteria.

Concerning labour protection expenditures, it should be noted that Ukraine’s current Law on labour protection stipulates their luminal value of not less than 0.5% of the payroll fund of the previous year (Law of Ukraine, 1992). At the same time, in the Industrial agreement of the mining and metallurgical complex of Ukraine for 2011-2012 (which is still valid as according to the current legislation it is valid until a new agreement is concluded) this value makes 0.6% of the sales amount (Industrial Agreement of Ukraine, 2011; Tevelev et al., 2013). There are no similar financial norms in the EU countries but they have security levels that have to be kept to. Norm concerning labour protection expenditures can be found in Article 226 of the Labor Code of the Russian Federation according to which their value have to amount not less than 0.2% of the total expenditures for production (products, services) (Law of Russian Federation, 2001).

As for expenditures for labour protection, it should be noted that in Nusinova & Molodetskaya (2011) amounts of fines and penalties for violation of corresponding laws (on fire protection, industrial safety, mining supervision, occupational health and safety, etc.) serve as indicators.

The similar approach in the mentioned work is applied to the environmental component of economic security, the system of fines and penalties for violation of the environmental legislation being its indicators. A number of researches, in particular (??, 2019), note that foreign companies spent 1.2% of their annual earnings in 2017-2018 on employees training. Another important item is expenditures for sociocultural, sport and recreation programmes, work with children, and maintenance of social-cultural facilities. Their minimum necessary value is stated in the Industrial agreement between the State Emergency Service of Ukraine and the trade union organization of public officers of Ukraine and employees of the mining and metallurgical industry of Ukraine for 2017-2020 (Industrial Agreement of Ukraine, 2011). According to the agreement, it is determined at the level of not less than 0.3% of the payroll fund. In Point 8.6 of the Industrial agreement of the mining and metallurgical complex for 2011-2012, a similar indicator was set at the level of 0.5% of the payroll fund (Industrial Agreement of Ukraine, 2011). In the International Standard Classification of Labour Cost there are no such expenditures but there are social service ones. Different enterprises offer different services and besides they depend on traditions of individual countries. Best practices provide not only social protection but also a compensation package that includes health insurance for employees and their family members, payment or reimbursement of transportation to workplaces, meals at work, creches, mobile communications, company cars, gym membership, additional off-days for participation in sport competitions, etc.

Material and Methods

The methodological basis of the study is formed through application of general and specific scientific methods including those of abstract-logical and comparative analysis for determining options of base values of social payments; methods of analysis, synthesis, induction, deduction and logical generalization for developing approaches to assessing outstanding expenditures values by different indicators of employees’ economic security; the tabular method for visualizing the statistics and the results of calculation of the employees’ economic security level.

Summarizing available options of determining the comparison base for social expenditures of the enterprise to be used in assessing the level of employees’ economic security, we can work out our own concept. To determine threshold wages of employees, it is reasonable to look to their desired level, the average wage in Poland (the largest employer of Ukrainian workers who leave Ukrainian enterprises) being the most appropriate for this purpose. At that, with the foodservice costs being practically the same in both countries, wages should be adjusted by the housing rent and utility costs (Table 2).

| Table 2 Average Housing Rent and Utility Costs in Poland | |||

| Year | Average monthly rent and utility costs (up to 38 m2)*, PLN | Official rate of Narodowy Bank Polski (PLN/1€) | Average monthly rent and utility costs, Euros |

| 2017 | 750 | 4.2576 | 176.2 |

| 2018 | 950 | 4.2623 | 222.9 |

| 2019 | 1030 | 4.298 | 239.6 |

Source: developed by the authors on the basis of data from (Real estate website, 2021)

Officially, wages in Poland fluctuated as follows (Table 3):

| Table 3 Average Monthly Wages in Ukraine and Poland | ||||

| Year | Average monthly wages in Ukraine (before/ after tax: 18% PIT and 1.5% military tax), Euros | Average monthly wages in Poland, Euros (gross/net) | Average monthly wages in Poland minus housing rent and utility costs, Euros | NBU official exchange rate (UAH/100€) |

| 2017 | 237/190.8 | 1024/716.8 | 540.6 | 3000.42 |

| 2018 | 276/222.2 | 1060/742.0 | 519.1 | 3214.29 |

| 2019 | 363/292.2 | 1143/800.1 | 560.5 | 2895.18 |

The given amounts of average wages in Ukraine and Poland enable the conclusion that there exists a considerable gap between desired and actual wages. For later research, it should be noted that due to the downward bias of the actual wage amount as compared with the desired value, the payroll fund amount can also be considered too low. As mentioned above, the payroll fund is used to assess minimum necessary values of certain indicators according to a number of industrial agreements and the Law on labour protection of Ukraine. In this connection, we believe that it is unacceptable to use it for estimating most expenditure applied when assessing employees’ security.

Results and Discussion

The methodology of assessing economic security of industrial enterprise employees should be based on determining such values as the minimum necessary value of employees’ economic security indicators and the value of outstanding expenditures of the enterprise. Minimum necessary values of employees’ economic security indicators are values desired by employees of industrial enterprises. Desired values should correspond to either the toughest standards of a country’s legislation or the best business practices. Outstanding expenditures are the difference between desired and actual values of each indicator (Adamenko et al., 2020).

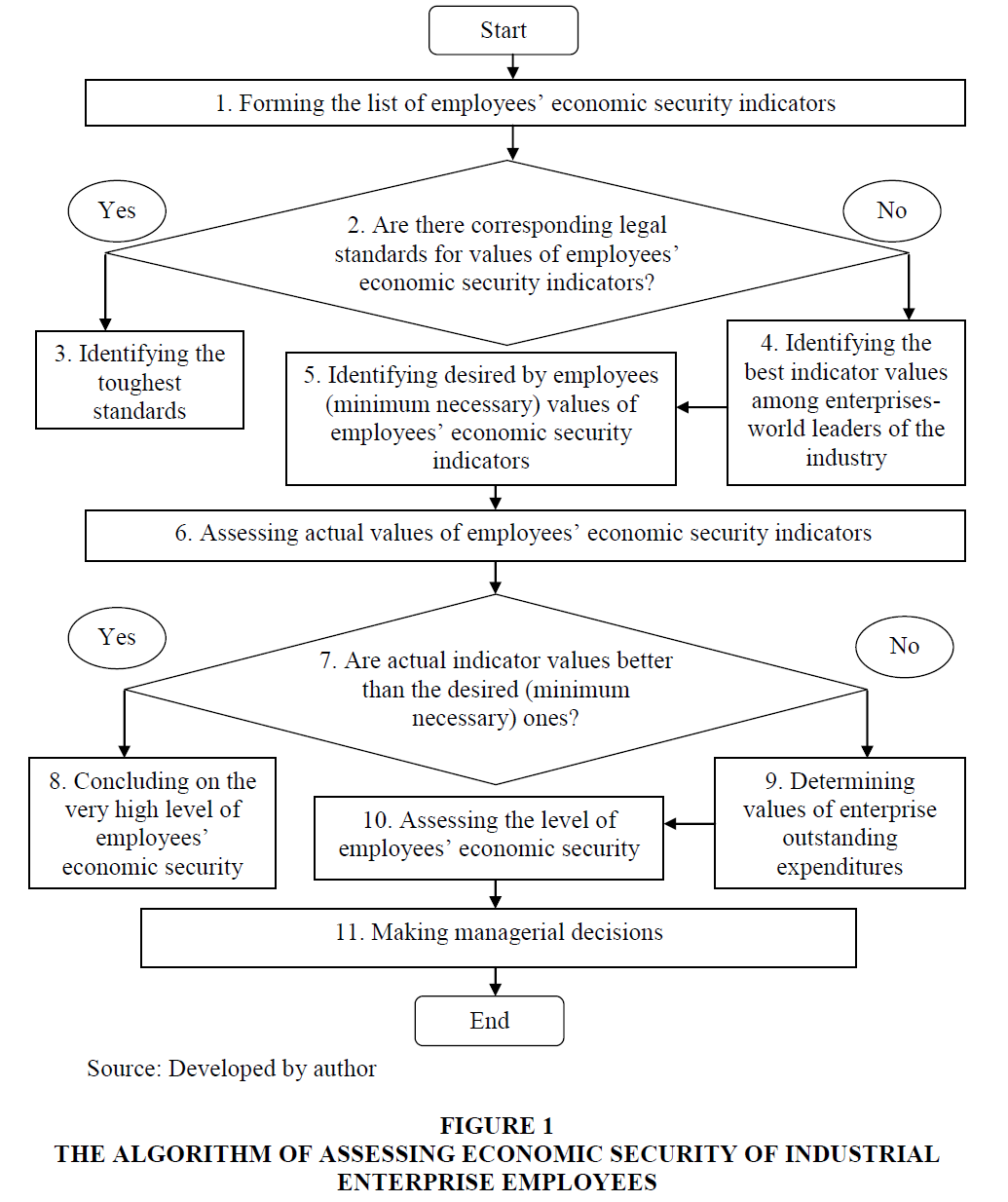

The following algorithm (Figure 1) is used in the methodology of assessing economic security of industrial enterprise employees.

Let us talk more specifically about determining the values of outstanding expenditures by indicators determined for employees of Ukrainian industrial enterprises.

The amount of outstanding annual expenditures for wages at the industrial enterprise (ΔEw) should be calculated as the difference between the desired (minimum necessary) amount and actual wages adjusted by the total number of its employees and multiplied by twelve months. For employees of Ukrainian industrial enterprises, the wage value in Poland (minus taxes and dues) is considered the desired one.

It should be noted that employees of many industrial enterprises are not satisfied with certain aspects of labour protection that resulted in a strike at the OJSC “ArcelorMittal Kryvyi Rih” (the city of Kryvyi Rih, Ukraine) in 2018 (Mishchuk, 2020 & 2021). Besides, there occur industrial injuries. That is why; we suggest the standard norms of the Industrial agreement of the mining and metallurgical complex of Ukraine as the minimum necessary value of expenditures for labour protection. This means that to assess the minimum necessary amount of expenditures for labour protection, it is necessary to compare the amount that should be obtained when observing the Industrial agreement and corresponding actual expenditures.

The resulted difference makes the amount of outstanding expenditures by the indicator of expenditures for labour protection (ΔElp):

ΔElp = 0.6%×PS – Elpa, (1)

Where, Elpa is the actual expenditures for labour protection at the enterprise in the period of assessment, UAH;

PS is the actual amount of the products sold in the period of assessment, UAH.

The amount of outstanding expenditures for employees training (ΔEt) is calculated by the formula:

ΔEt = 1.2%×R – Eta, (2)

Where, R is the actual annual output revenue in the period of assessment, UAH;

Eta is the actual amount of expenditures for employees training in the period of assessment, UAH.

As for the use of the compensation package, it should be noted that due to such factors as lack of coordination of current practices of its filling, insufficient development of corporate culture at Ukrainian enterprises, existence of the so-called “social package” and Ukrainian traditions, we find it more reasonable to consider expenditures for sociocultural, sport and recreation programmes. In this case, when determining the minimum permissible level of such expenditures it is reasonable to apply the payroll fund indicator. The amount of outstanding expenditures for the above programmes (ΔEcsr) is determined by the formula:

ΔEcsr = 0.5%×PFa – Ecsra, (3)

Where, PFa is the actual amount of the payroll fund of the enterprise in the period of assessment, UAH;

Ecsra is the actual amount of expenditures for sociocultural, sport and recreation programmes at the enterprise in the period of assessment, UAH.

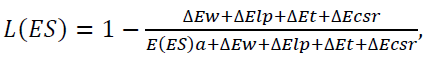

Employees’ economic security level (L (ES)) is determined by the formula:

(4)

(4)

Where, E(ES)a is the actual amount of expenditures for employees’ economic security that includes actual expenses for wages, labour protection, personnel training, sociocultural, sport and recreation programmes, UAH.

The following scale (?ishchuk, 2020 & 2021) should be used to interpret the obtained values:

1. at L(ES)=0 – the zero (catastrophic) level of employees’ economic security;

2. at 0< L(ES)<0.25 – the minimum level of employees’ economic security;

3. at 0.25≤ L(ES)<0.5 – the low level of employees’ economic security;

4. at 0.5≤ L(ES)<0.75 – the mean level of employees’ economic security;

5. at 0.75≤ L(ES)<1.0 – the high level of employees’ economic security;

6. at L(ES)=1.0 – the very high level of employees’ economic security.

Let us assess economic security of employees. Table 4 presents the results of determining the indicator of the employees’ economic security level at large industrial enterprises of Ukraine: the PrJSC “Northern mining and processing plant” (PrJSC Northern GZK), the PrJSC “Central mining and processing plant” (PrJSC Central GZK), the PrJSC “Zaporozhye Iron Ore Plant” (PrJSC ZZRK).

| Table 4 Indicators of Employees’ Economic Security by Industrial Enterprises in 2018-2019 | ||||||

| Indicator | 31.12.2018 | 31.12.2019 | 31.12.2018 | 31.12.2019 | 31.12.2018 | 31.12.2019 |

| PrJSC Northern GZK | PrJSC Central GZK | PrJSC ZZRK | ||||

| Minimum necessary amount of average monthly wage, thousand UAH | 16.685 | 16.227 | 16.685 | 16.227 | 16.685 | 16.227 |

| Actual amount of average monthly wage minus taxes and dues, thousand UAH | 11.606 | 15.758 | 12.578 | 15.919 | 13.013 | 17.835 |

| Outstanding expenditures for wages, thousand UAH | 363 616 | 33 944 | 225 907 | 17 016 | 203 902 | 0 |

| Minimum amount of labour protection expenditures, thousand UAH | 156 616 | 170 838 | 68 033 | 72 500 | 21 109 | 36 107 |

| Actual amount of labour protection expenditures, thousand UAH | 182 718 | 199 311 | 113 471 | 136 244 | 42 800 | 50 850 |

| Outstanding expenditures for labour protection, thousand UAH | 0 | 0 | 0 | 0 | 0 | 0 |

| Minimum amount of expenditures for training, thousand UAH | 313 231 | 341 676 | 136 065 | 144 999 | 42 218 | 72 214 |

| Actual amount of expenditures for training, thousand UAH | 7 633 | 10 503 | 4 062 | 5 212 | 704 | 1 204 |

| Outstanding expenditures for training, thousand UAH | 305 598 | 331 173 | 132 003 | 139 787 | 41 515 | 71 011 |

| Minimum amount of expenditures for sociocultural, sport and recreation programmes, thousand UAH | 5 160 | 7 069 | 4 296 | 5 450 | 4 488 | 6 284 |

| Actual amount of expenditures for sociocultural, sport and recreation programmes, thousand UAH | 10 732 | 14 704 | 9 968 | 12 643 | 21 272 | 29 785 |

| Outstanding expenditures for sociocultural, sport and recreation programmes, thousand UAH | 0 | 0 | 0 | 0 | 0 | 0 |

| Outstanding expenditures for employees’ security, thousand UAH | 669 214 | 365 116 | 357 911 | 156 803 | 245 417 | 71 011 |

| Liminal amount of expenditures for employees’ security, thousand UAH | 1 701 021 | 1 727 769 | 1 177 133 | 1 188 280 | 1 032 730 | 1 164 520 |

| Indicator of employees’ economic security level, unit fractions | 0.61 | 0.79 | 0.70 | 0.87 | 0.76 | 0.94 |

As is seen from Table 4, at all the enterprises under study actual expenditures for labour protection, sociocultural, sport and recreation work exceed the minimum necessary amounts. Yet, actual expenditures for wages and training are lower than the minimum necessary amount.

In 2018, all the enterprises but for the PrJSC ZZRK demonstrated the mean level of employees’ economic security. At the ZZRK, security reached the high level and the amount of average monthly wages was the largest (13,000 UAH). Nevertheless, even this indicator is lower than the minimum necessary amount of 16.6 thousand UAH. The security level indicator of 2018 is 0.76. In 2019, the PrJSC ZZRK reached the minimum necessary amount of the average monthly wages though expenditures for training were lower than their necessary amount even at this enterprise. Thus, the security indicator reached 0.94 and indicated the high level. At the other enterprises under study in 2019, the average monthly wages demonstrated significant increase. Most of the enterprises already possess the high security level.

The proposed methodology is helpful for top-management of industrial enterprises. It is expedient that government bodies should also consider the gaps between desired (minimum necessary) and actual social payments when establishing the government social policy aimed to enhance economic security of industrial enterprise employees.

Conclusion

Thus, the methodology has been developed to assess economic security of employees of industrial enterprises. The methodology is based on the toughest norms of the Ukrainian regulations and considers values of social payments in foreign practices. It is determined that amounts of wages desired by employees of Ukrainian industrial enterprises and payments for their training should be at the level of foreign business practices. The minimum necessary payments for labour protection, expenditures for sociocultural, sport and recreation programmes are determined on the basis of the standards of the Industrial agreement of the mining and metallurgical complex of Ukraine. The corresponding standards of Ukraine’s Law on labour protection prove to be more liberal. The proposed methodology has been tested at industrial enterprises of Ukraine. The results demonstrate that the employees’ economic security level fluctuated from mean to high during 2018-2019, this testifying to the correct choice of the policy for employees’ economic interests satisfaction at those enterprises. The obtained data will enable more efficient management of employees’ economic security at the levels of industrial enterprise top-management and government regulation.

References

- Adamenko, M., Mishchuk, I., & Zinchenko, O. (2020). Economic security and innovation activity of personnel – determinants of sustainable development of enterprises. The International Conference on Sustainable Futures: Environmental, Technological, Social and Economic Matters: E3S Web Conf., 166.

- ??, ?. (2019). Learning by the Numbers. Retrieved February 26, 2021 from https://www.td.org/magazines/td-magazine/learning-by-the-numbers

- Industrial Agreement of Ukraine. (2011). Industrial agreement of the mining and metallurgical complex of Ukraine for 2011-2012. Retrieved February 26, 2021 from https://www.msp.gov.ua/news/10205.html

- Law of Russian Federation. (2001). Labor Code of the Russian Federation of December 30, 2001 no. 197-FZ. Retrieved February 28, 2021 from http://www.kremlin.ru/acts/bank/17706

- Law of Ukraine. (1971). ??? Labour Code of Ukraine of December 10, 1971 no. 322-VIII. Retrieved February 25, 2021 from https://zakon.rada.gov.ua/laws/show/322-08#Text

- Law of Ukraine. (1992). Onlabourprotectionof October 10, 1992 no.2694-XII. Retrieved February 26, 2021 from https://zakon.rada.gov.ua/laws/show/2694-12#Text

- Law of Ukraine. (1995). On Remuneration for Work of March 24, 1995 no.108/95- VR. Retrieved February 26, 2020 from https://zakon.rada.gov.ua/laws/show/108/95-??#Text

- Law of Ukraine. (1996). Constitution of Ukraine of June 28, 1996 no. 254?/96-VR. Retrieved February 25, 2021 from https://zakon.rada.gov.ua/laws/show/254?/96-??#Text

- Law of Ukraine. (1999). On Trade Unions, rights and guarantees of September 15, 1999 no. 1045-XIV. Retrieved February 26, 2021 from https://zakon.rada.gov.ua/laws/show/1045-14#Text

- Law of Ukraine. (2021). On the State Budget of Ukraine for 2021 of December 15, 2021 no. 1082-IX. Retrieved February 26, 2021 from https://zakon.rada.gov.ua/laws/show/1082-20#Text

- Lokhman, N., Serebrenikov, V., Beridze, T., Cherep, ?., & Dashko, I. (2020). Analysis of economic and mathematical modeling of industrial enterprise functioning at multicollinearity based on parameterization. Naukovyi Visnyk Natsionalnoho Hirnychoho Universytetu, 2, 179-184.

- Ministry of Finance of Ukraine: Official Website. (2021). Retrieved February 27, 2021 from https://index.minfin.com.ua/ua/labour/salary/world/poland/

- Mishchuk, I., Zinchenko, O., Zinchenko, D., Dariusz, P., & Pohrebniak, A. (2020). Differences in the assessment of economic security of personnel and security of enterprise staff interests.

- Mishchuk, I., Rebrova, S., Krush, P., Zinchenko, D., & Astafieva, K. (2021). Digitalization security as a marker of modern mechanical engineering technology implementation in the context of ensuring strategic economic security of enterprises.

- Nusinova, O.V., & Molodetskaya, O.M. (2011). Comprehensive assessment of socio-economic security of enterprises (on the example of mining enterprises). Kryvyi Rih: Dionysus.

- Nusinova, Y. V. (2008). Estimation of activity of mining and processing plants taking into account coherence of corporate interests. Dnipropetrovsk, Ukraine.

- Real Estate Website: Otodom. (2021). Retrieved February 27, 2021 from https://www.otodom.pl

- Shelomentseva, V., Narynbayeva, A., Bespalyy, S., & Makenov, C. (2021). Standards and quality of living of the population is an indicator of socioeconomic development of the region. Academy of Strategic Management Journal, 20(1).

- Teal, E.J., & Teal, A.R. (2019). Benefit corporations: a newer legal option for structuring socially responsible for-profit enterprises in the U.S. Journal of Legal, Ethical and Regulatory Issues, 22(2).

- Tevelev, D.M., Nusinov, V.Y., Nusinova, O.V., & Lebid, I.O. (2013). Assessment of the level of reputation and corporate governance in enterprises. Kryvyi Rih: FO-P Chernyavsky D.O.

- Ukrinform: Analytical Portal. (2020). Retrieved February 26, 2021 from https://www.ukrinform.ua/rubric-society/2735716-blizko-15-miljona-ukrainciv-pracuut-u-polsi-ekspert.html