Research Article: 2018 Vol: 17 Issue: 3

Development Factors of Export Potential of the Region: Capabilities in Minerals and Infrastructure Sector

Almakul Abdimomynova, Kyzylorda State University

Keywords

Export Potential, Industrial Resources, Foreign Trade Turnover, Raw Materials Potential, Regional Economic Expansion, Infrastructure Development, Export Diversification.

JEL Classifications: L10, O2

Introduction

Export potential is a complex phenomenon that includes both the natural resource base and regional economy situation providing the region with research and technology advancement, technological, industrial and socio-cultural development to achieve sustainable export processing rates and high standard of living considering current and projected market conditions (Arupov, 2002; Prince & Fitton, 2016; Fingerman et al., 2017). Regional development becomes particularly important due to globalization, when state's economy efficiency and competitiveness is dependent on the economic development of the region (Kovalenko, Polushkina & Yakimova, 2017).

Currently, Export Development Program provided basic provisions for export potential development and export state backing (Satubaldin, 1998; Madiyarova, 2004; Abbas & Waheed, 2015). In this regard, regions are less active-many of them still have not formed the basic export structure, without which potential use is impossible. This is largely determined by low competitiveness of the regional economy, the lack of experience on the international market, the lack of export support.

The study of export potential of regional economy, which is the economy subsystem, organized based on industrial-territorial division of labor, is conduct by taking into account the impact of a number of external and internal factors (Novikov, 1989; Maslennikov, 2008; Aslund, 2010).

Therefore, the following points must be studied in the research on region's export potential:

1. Secure efficient and sustainable region’s economic system development within global economic relations and determine export development priorities to redevelop regional economy faster (Cornel, 2017; Ibrayeva et al., 2017; Krichak et al., 2015);

2. Conduct related analysis of inter-regional and foreign economic relations with export processing possibilities (Jordaan, 2015; Pal, 2015; An, Hu & Tan, 2017);

3. Determine macroeconomic effectiveness of export-oriented production at the level of economic sector and priorities to raise it (Veselovsky et al., 2015; Madzinova et al., 2014).

Currently, Kazakhstan regions are under pressure of internal and external factors. The global market demands only certain types of raw materials, mainly fuel and energy resources (Schnieper, 1991; Madiyarova, 2004; Tekenov, 2004). The old method for regional planning does not work and the new one relevant to market economy is little known (Schnieper, 1991).

The purpose of the study is to study the nature of export potential, its formation and development.

Literature Review

It is necessary also to allocate socio-economic factors that influence foreign economic relations of the region (Kadochnikov & Fedyunina, 2013; Deng, Lu & Xiao, 2013; Parr, 2014).

1. Level of region's infrastructure development;

2. Climate and natural features;

3. Resource potential of the region;

4. Ecological situation;

5. Region’s role in state economic stability;

6. Social characteristics of the region.

That is why we shall consider the category of "region" first. The markets that define territorial and administrative units were formed on the territory of the republic. Therefore, territorial and administrative predetermination led to the understanding of many spatial formations, including the region (Qin, Zheng & Zhang, 2013; Riser, Scherer & Strauf, 2013; Parr, 2014). The region can be regarded as a "separate part of the country due to public (territorial) division of labor, characterized by production of certain goods and services, community and specific nature of reproduction process, integrated and holistic economy; managerial bodies that solve regional problems" (Arzhenovskiy, 2011).

According to Elkin, export potential of the region will consist of combined export potential of enterprises selling goods (service providers) on specific foreign markets (Elkin, 2008).

In general, export potential development is a core of economic promotion model in the region. Previously, economic potential of territorial systems depended on their production capabilities-capability of producing a large assortment of goods in the region. Currently, it depends on organization capability of the region-reactive production of new goods and services with effective use of means of cooperation and production capability of other countries and territories (Qin, Zheng & Zhang, 2013; Christopoulos, 2014). In this context, Zahmatov has an interest suggestion, according to which "the basis for export potential are not natural resources, but organizational and political factors and incentives for active individuals (employer and employee)" (Zahmatov, 1984).

Based on the above-considered opinions, we can consider export potential of the region as an integral part of country's export potential influenced by a variety of economic, geographic, climate and historical factors, as well as factors of technological and innovation nature. Therefore, region's export potential features are determined by socio-economic needs and multi-potential.

Method and Results

The theoretical and methodological basis of the research is the theory of regional economy sustainable development under various business forms and integration processes of the economy. Research validity and reliability are achieved by means of general scientific methods of analysis. The article provides generalized national and international experience on the issue of research. We used abstract-logical, analytical, economic and statistical methods.

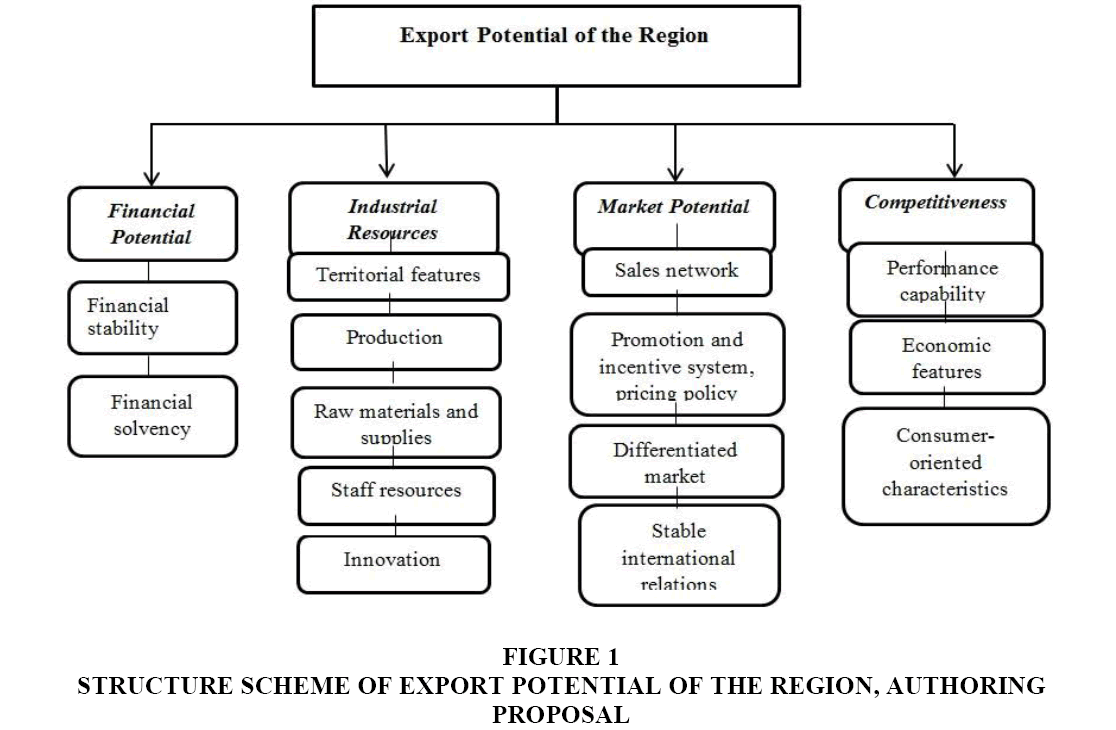

The concept of export potential is complex in terms of definition, as is combines interpretation of such economic categories as financial potential, industrial resources, market potential and competitiveness that are contributing to its development (Figure 1).

Factors of region’s export potential formation can affect the region both separately and cumulatively (Table 1).

| Table 1 Classification of Factors of Region's Export Potential Formation, Authoring Proposal |

|

| Indirect factors | Direct factors |

| Geographical field: 1 Location of the region and development level of market infrastructure; 2 Natural resources (security, characteristics, environmental condition); 3 Climatic resources. |

1. Gross Regional Product (GRP); 2. Foreign trade turnover of the region; 3. Retail turnover in the region; 4. Fixe-assets investments and foreign investments; 5. Industry outturn; 6. Population income; 7. Structure of human resources capacity of export enterprises; 8. Competitiveness of regional production; 9. Availability of consumers; 10. Export-oriented production in the region; 11. Increasing share of processed goods in region's exports. |

| Public policy: 1. Industrial policy; 2. Privatization policy; 3. Monetary policy; 4. Antimonopoly policy; 5. Investment policy; 6. Innovation policy; 7. Fiscal policy. |

|

| Economic sector: 1. Development level of market relations in the region; 2. Development level of economy institutional structure in the region; 3. Restructuring economic sectors in the region; 4. Existence or absence of administrative, technical and information barriers for market entry; 5. Openness of region's economy. |

|

| International field: 1.International division of labor; 2. International trade; 3. International competitiveness. |

|

| Sociodemographic field: 1. Population size; 2. Living standard, occupational level; 3. Social strain. |

|

Results

Kyzylorda region is an agrarian-industrial region. Rich natural resource potential of the region is a competitive advantage. However, there is a significant imbalance in production structure-predominance of the mining industry (94%) over manufacturing industry (6%). This situation places the region's economy in a vulnerable situation of varied prices for several kinds of export mineral resources, as well as of several oil and gas production companies.

Meanwhile, the export potential has to be analyzed. As previously mentioned, potential is a set of natural, industrial, scientific and technical, innovation-related and labor resources of the region, which can be used to develop international economic relations with near and far abroad. It verifies in content. Therefore, it must be represented in terms of significance and constituent elements. It is necessary to characterize the economic or export capacity as the amount of natural and labor resources, production capacities of material production and the length of transport network, vehicles, non-material sphere development, scientific and technological achievements, resources.

It is very difficult now to assess the state of export potential due to the current informational field under above components. The available informational basis allows us to characterize the export potential following a limited point of view, but according to a number of blocks. The assessment of the first one shall include natural resources and mineral deposits that are highly competitive and can be used to develop foreign trade. Thus, they can be leased, granted to concession, exported to the world market. This component of export potential has a strong material predetermined outcome. As its content is material, it comes to the number of barrels of oil, grain or any product or service.

The export production range of national economy characterizes the real or perspective export potential. The region has been exporting 17 products of 20 total commodity heading traditionally recorded in official statistics and importing 19 of 21 products.

Despite the conditions for agriculture, the region is not involved in manufacture and export of fats and animal or vegetable oils. Similar to this is the situation in branches’ development related to precious or semiprecious stones’ production and processing, as well as precious metals, jewelry and coins. The flows of import products are varied. Statistical reporting of the Republic does not contain two items, namely-artwork production, collectibles, antiques and other products.

The second component of the export potential includes production assets able to produce products that meet global market demands for the range and quality and to provide a wide range of foreign trade services. In 2017, the region received investment of 262 011, 6 million tenge for construction, which is less than in 2014 by 32.3%. In 2016, the investment was 371 934, 6 million tenge or 140.2% in comparison with 2015. In 2015, the investment was 244 584, 6 million tenge or 105.4% in comparison with 2014. At the same time, it should be noted that in recent years, there are attempts to increase investment in non-resource sector of economy on (Export opportunity analysis of Kazakh processed products, 2017).

The third component of the export potential is labor resources that can be drawn to develop export production and foreign trade infrastructure. At the beginning of reforms in the region, the EAP was over 70%. Labor resources were significantly affected by internal and external migration. Thus, the value of migration loss has been negative during the whole period (difference in number of population that left the region and the arrivals) due to low parameters for quality of living and area belonging to the zone of ecological disaster. The EAP number began to increase slightly with the area transfer from agrarian into industrial form. However, in most cases those are the non-residents, who occupy the jobs in highly efficient enterprises due to rotating schedule. Accordingly, in spite of active fund raising in the region and industrialization the EAP number in the area has not yet reached the level of 90-94 years.

The fourth component of the export potential includes research and educational institutions with latest results corresponding to modern international standards. The Science and Education have been developing in the region: there are research institutes, design bureaus, public academies of sciences, 297 general academic schools (126.3 thousand student), 34 technical and vocational institutions (over 24 thousand students in 103 professions and 157 specialties), 106 institutions in the field of health care, including 48 hospitals. In the recent past, there were experimental developments made, application-orientated research related to "connecting" design bureaus and research institutes developments with farm state and producers of their products. Most of them were in areas of health, space, clean water problems, land reclamation, anti-saline measures. As a rule, they were branches or structural subdivisions of the major research institutions, but now their work is difficult. This discourages scientific and technological potential development in the region. Currently, a significant part of research and design organizations have lost their independence or diverted to other activities.

The fifth component of the export potential is a sphere of material base elements of market infrastructure for foreign economic relations (transport, warehousing, foreign commercial organizations and customs and border services). The region has a significant transit potential. Modern infrastructure of the region contributed to current branch structure of transportation, where the predominant part of products and turnover belongs to rail transport and stationary means of transport, including pipelines.

Exports and imports of the region show that the main customers are consumers from abroad. At the same time, the difference in far-to-near abroad delivery ratio has leveled in recent years.

Referring to quantitative volume of export potential fixed for a particular period of development, we can conclude the following. Firstly, it is important to distinguish the real and perspective export potential. The real export potential fixes actual or achieved level of production capacity under certain manufacturing environment.

In terms of territory, export potential means that geographical point may be any region of the world, the country or local regions, separate economic areas of the country, region and district. Similarly, we can observe the export potential of the region developing actively at the national level.

According to statistics, foreign trade of Kyzylorda region amounted to USD 3.2 billion at year-end 2017. In stock turnover of the region, the export dominates with 92% or USD 3 billion, which decreased to USD 2.2 billion due to reduced oil supply. Imports decreased by 29% to USD 248 million (Table 2).

| Table 2 Foreign Trade of Kyzylorda Region, Made Up Based on (Export Opportunity Analysis of Kazakh Processed Products, 2017) |

||||||

| USD, million | 2014 | 2015 | 2016 | 2017 | Increase for 2017-2016 | Share |

| Stock turnover | 5 066.4 | 5 428.6 | 5 518.7 | 3 245.7 | -41.2% | 100% |

| Export | 4 727.1 | 5 003.1 | 5 168.1 | 2 997.8 | -42.0% | 92% |

| Import | 339.3 | 425.5 | 350.6 | 247.9 | -29.3% | 8% |

In terms of export, Kyzylorda region is on the 8th place to other regions of Kazakhstan and takes 3.8%.

In 2015, Kyzylorda exports amounted to USD 3 billion, less than in 2014 by 42%. The share of processed products in total exports of the region was 2% or USD 72.2 million with unfavorable growth of 37%.

Total exports of the region-USD 3 billion, of which: USD 23.2 million (0.8%)-the EAEU, USD 2 974.6 million-in other countries.

The export structure of the region:

1. 98.5% (USD 2 953.8 million)-mineral products (oil): PRC, Swiss Confederation, the Republic of Tajikistan;

2. 0.9% (USD 25.5 million)-food industry (rice, fish products): the Republic of Tajikistan, the Russian Federation, Kyrgyz Republic;

3. 0.5% (USD 16 million)-chemical industry (uranium): the Russian Federation;

4. 0.1% (USD 2.4 million)-other product groups.

In processed products export structure, there are intermediate consumption goods and finished goods in the ratio of 42% to 58%. Exports of finished goods decreased by 9% to USD 27.8 million. Rice has the largest volume of exports (USD 20 million), as well as fishery products (USD 5 million), mineral processing equipment (USD 1.1 million).

The region is mainly focused on PRC-92% (oil) and Swiss Confederation-5.7% (oil) if it is about export. Processed goods are exporting mainly to the EAEU (Eurasian Economic Union) and Central Asia (Central Asia)-78%. Exports within the EAEU have increased from 7.8 to USD 23.2 million by increasing uranium and rice supplies. It should be noted that uranium export was focused on the Russian Federation at year-end 2015-USD 16 million. In Central Asian, exports decreased in 1.8 times-from 62 to USD 34 million. Propane and butane supplies reduced by USD 26 million in the Republic of Tajikistan (Table 3).

| Table 3 Top-15 Export Markets of Kyzylorda Region, Made Up Based on (Export Opportunity Analysis of Kazakh Processed Products, 2017) |

||

| USD, million | 2017 | Main export products |

| The People's Republic of China | 2 754.8 | Crude oil-USD 2.7 billion |

| The Swiss Confederation | 169.8 | Crude oil-USD 169.8 million |

| The Republic of Tajikistan | 25.1 | Propane-USD 18.2 million; rice-USD 6.9 million |

| The Russian Federation | 23.2 | Uranium-USD 16 million; rice-USD 6 million |

| The Republic of Latvia | 10.1 | Petroleum products-USD 10.1 million |

| Kyrgyz Republic | 5.5 | Rice-USD 4 million; railroad cars-USD 0.7 million; Salt-USD 0.6 million |

| The Republic of Uzbekistan | 2.4 | Rice-USD 2.1 million; agricultural machinery-USD 0.1 million |

| The Kingdom of Denmark | 1.7 | Fish fillets-USD 1.7 million |

| The Republic of Austria | 1.2 | Fish fillets-USD 1.2 million |

| Turkmenistan | 1.0 | Rice – USD 0.8 million; railroad cars-USD 0.2 million |

| Romania | 1.0 | Agricultural machinery-USD 1 million |

| The Republic of Poland | 1.0 | Fish fillets-USD 1 million |

| Ukraine | 0.4 | Frozen fish-USD 0.3 million; rice-USD 0.1 million |

| The Federal Republic of Germany | 0.3 | Fish fillets-USD 0.3 million |

| Georgia | 0.1 | Frozen fish-USD 0.1 million; rice-USD 0.1 million |

Kyzylorda region’s import is 99.8% for processed goods-USD 247.4 million: USD 135.3 million (55% of the sum) accrue to engineering industry for region's industrial park technical development (special-purpose machines, pumps, agricultural machinery, valves), 22% or USD 54.6 million-to metallurgical industry (metal pipes, ferrous metals, pipe fittings). Chemical industry products have a share of 10% or USD 24.8 million.

The region is mainly focused on PRC if it is about import-49% of total imports in the region. The People's Republic of China is importing mainly the products of mechanical engineering and metallurgy. The EAEU import share is 27%, the main import products are agricultural machinery, metal pipes, light trucks, pumps.

Discussion

Export diversification of Kyzylorda region by FEACN product groups reveals the following facts. On average, there were recorded 20 export products over the past 5 years, wherein, export was concentrated just on the one type of product (oil). Export phenomena of considered region were recorded in 20 partner countries with the major share of exports accrued to only one country (China).

Therefore, we propose the following measures and proposals to implement the approach of forming regional innovative export-oriented structure of the economy:

1. "Comparative advantage" analysis of the region and modern regional scientific competence on creating products in demand in the international market (export potential);

2. "Comparative disadvantage" analysis of the region, which are particularly manifested under eliminating the consequences of economic crisis, to overcome which the regional technological policy should be directed. Major technologies selection, the implementation of which may cause a significant affect;

3. Structurally perspective sectors allocation ("regional growth poles") to increase the export potential and structurally unviable branches, which resources should be redistributed gradually to develop perspective sectors in the context of globalization and the who;

4. Incentives system creation in respect of perspective innovative companies (financing costs for certain types of research on "bringing" technology up to sales impact, environment creation for combining successful technologies, the use of regional tax, customs and other mechanisms to develop specific innovative business activity guidelines).

There were 21 projects within the Industrialization Map in the region over the past 5 years, which produce 10 types of goods. The perspective export-oriented list of products was formed by taking into account current production and successful projects. It was used to assess the export potential (Table 4).

| Table 4 Perspective Export-Oriented Products of the Region, Made up Based on (Export Opportunity Analysis of Kazakh Processed Products, 2017) |

|

| Product name and export supplies volume | |

| Rice-160 thousand tons per year | Feed-80 tons per day |

| Milk-4.1 thousand tons | Gas-400 million cubic meters per year |

| Meat-8 tons per year | Sulfuric acid-500 thousand tons per year |

| Food and technical products | Bricks-15 million pieces per year |

| Salt-200 thousand tons per year | Harvesting machinery and balers-100 facilities per year |

| Tomato products-3.8 thousand tons per year | LED lamps-31.2 thousand pieces per year. |

| Fish fillets-684 tons per year | |

Such export-oriented products as rice and fishery products were analyzed as an example to determine the export potential of products and to find alternative markets.

Currently, Kazakhstan is importing 24.6 thousand tons of rice: 19.3 thousand tons (79%) accrue to Aktobe region. This region imports stalk paddy from the Russian Federation (17.9 thousand tons), India (0.9 thousand tons) and the Republic of Tajikistan (0.5 thousand tons). In turn, Kyzylorda region has potential for rice export and internal market demand.

The Republic of Kazakhstan has imported 33.6 thousand tons of fishery products at year-end 2015: 8.4 thousand tons or a quarter of imports accrue to Karaganda region. This area is importing mainly frozen fish from the Kingdom of Norway (4.9 thousand tons), Russian Federation (1.2 thousand tons), Socialist Republic of Vietnam (0.9 thousand tons) and the Republic of Iceland (0.8 thousand tons). The export volume of Kyzylorda region amounted to 1.6 thousand tons, the average notional amount of exported fish-USD 3.2 thousand per ton.

In turn, Kyzylorda region has the potential for fishery product exports, both for the Republic and abroad.

In this regard, the region is offered with the support of exporters and producers, allocated export goods after entering foreign markets. In addition, there is a possibility to organize a joint trade mission with rice producers on new markets, such as the Republic of Turkey and Mongolia. In plans, we propose to present organizers for their product presentations at the International Agricultural Exhibition in the Republic of Turkey in 2016, taking into account the rice producers’ potential in the region.

With the right strategy of enhancing export volumes and positioning the region as a supplier of quality products in manufacturing sector the share of the region in country's exports will grow from 3.8% to 5.0%.

In addition, there is a liability to use resources to transform them into advantages. It allows increasing the export potential in several directions:

First direction-preservation of export-oriented production of oil and gas industry. Crude oil still will be the largest share in the export potential structure (over 90 per cent in export volume), as well as salt.

The second direction of export potential growth includes the revival of production export of engineering industry, in particular, header production. Along with this, the third direction may also be developed in the region-capacity building due to presenting enterprises of iron and steel production into export processing zone, in particular, gold and zinc mining. The areas of industrial and innovative development of the country are also perspective. Thus, a number of projects for building material production out of local raw materials, polished glass, bricks, concrete blocks, tiles, petrochemical products, including pipe products, plastic window and door frames, sewn products.

Tourism is a significant reserve in building export capacity (fourth direction). The region has potential for religious tourism development, as well as cultural and historical monuments. Tourism development can be connected with the Baikonur Cosmodrome. The last in the list may be development of service sector, roadside campsites, "Silk Road" tourist route in the segment of Kyzylorda region and other areas of tourism.

The fifth direction can also be connected with the Baikonur Cosmodrome, but in terms of international scientific and technical cooperation, trade and "know-how" transfer, professional’s background development.

Conclusion

Finally, we can conclude the following. Kyzylorda region’s export is poorly diversified and is focused only on one product-oil. The world practice shows that the higher is the level of export diversification; the lower is the dependence on external factors.

At the same time, the region is actively attracting investments, creating and modernizing production facilities, as well as setting up new projects within the Industrialization Map. Currently, there are more than 20 successful projects, which produce about 10 export-oriented products.

The analysis revealed that rice and fish products are of greatest potential for export. There are presented data on costs, alternative markets (in addition to traditional countries), as well as allocation of the optimal delivery routes for allocated products with export potential.

References

- Abbas, S. & Waheed, A. (2015). Pakistan's potential export flow: The gravity model approach. The Journal of Developing Areas, 49(4), 367-378.

- An, L., Hu, C. & Tan, Y. (2017). Regional effects of export tax rebate on exporting firms: Evidence from China. Review of International Economics, 25(4), 774-798.

- Arupov, A.A. (2002). Foreign economic relations of the country in transition period: Regulation, problems and prospects. Almaty: Gylym.

- Arzhenovskiy, I.V. (2011). Innovative activity analysis and modeling of regions. Rostov-on-Don.

- Aslund, A. (2010). Why doesn't Russia join the WTO? The Washington Quarterly, 33(2), 49-63.

- Christopoulos, D. (2014). Elite social capital and the regional economy. European Urban and Regional Studies, 21(3), 272-285.

- Committee on statistics of Kazakhstan regions (2015). Statistical yearbook.

- Cornel, C. (2017). Competitiveness management of agrifood products within the context of export stimulation in the Republic of Moldova. Development.

- Deng, P., Lu, S. & Xiao, H. (2013). Evaluation of the relevance measure between ports and regional economy using structural equation modeling. Transport Policy, 27, 123-133.

- Elkin, I.V. (2008). Approach to assessing the region’s export potential development impact on wealth growth of its population. Irkutsk State Economics Academy, 4(60), 41-44.

- Export opportunity analysis of Kazakh processed products (2017). National export and investment agency kaznex invest JSC.

- Fingerman, K.R., Nabuurs, G.J., Iriarte, L., Fritsche, U.R., Staritsky, I., Visser, L. & Junginger, M. (2017). Opportunities and risks for sustainable biomass export from the south?eastern United States to Europe. Biofuels, Bioproducts and Biorefining.

- Ibrayeva, A., Tashtemkhanova, R., Ospanova, A., Somzhurek, B. & Azmukhanova, A. (2017). Energy export potential in the Caspian region and its impact on EU energy security. Periodica Polytechnica: Social and Management Sciences, 25(2), 127.

- Jordaan, A.C. (2015). Determining South Africa’s export potential to Australia: A panel data approach. South African Journal of Economic and Management Sciences, 18(3), 354-365.

- Kadochnikov, S. & Fedyunina, A. (2013). The impact of related variety in export on economic development of Russian regions. Russian Journal of Economics, 9, 128-149.

- Kovalenko, E.G., Polushkina, T.M. & Yakimova, O.Y. (2017). State regulations for the development of organic culture by adapting European practices to the Russian living style. Academy of Strategic Management Journal, 16.

- Krichak, S.O., Barkan, J., Breitgand, J.S., Gualdi, S. & Feldstein, S.B. (2015). The role of the export of tropical moisture into mid-latitudes for extreme precipitation events in the Mediterranean region. Theoretical and Applied Climatology, 121(3-4), 499-515.

- Madiyarova, D.M. (2004). Foreign trade of the RK: Theory, methodology and practice orientation in the context of globalization of world economic relations. Almaty: Gylym.

- Madzinova, R., Sedlakova, I., Kaszuba, K. & Cierpal-Wolan, M. (2014). Comparative analysis of export potential of medium-sized enterprises in the Presov region in eastern Slovakia and in the sub-region Krosno-Przemysl in Podkarpacie.

- Maslennikov, M.I. (2008). Ways to increase export potential and foreign trade expansion of Russia and Ural regions. Yekaterinburg: Institute of Economics at the Russian Academy of Sciences.

- Novikov, V.F. (1989). Territorial administration: Problems and ways of restructuring. Moscow: Nauka.

- Pal, G. (2015). Analysis of export scenario and potential of Indian lac. Indian Forester, 141(5), 533-537.

- Parr, J.B. (2014). The regional economy, spatial structure and regional urban systems. Regional Studies, 48(12), 1926-1938.

- Prince, D.D.C. & Fitton, O.J. (2016). The North West cyber security industry: Export potential assessment.

- Qin, C., Zheng, Y. & Zhang, H.A. (2013). Study on the tendencies and features of the coordinated development of regional economy in China. Economic Geography, 1(1).

- Riser, A., Scherer, R. & Strauf, S. (2013). Impacts of the residential economy on the regional economy.

- Satubaldin, S.S. (1998). Dragons and tigers of Asia: Can the Kazakhstan's "snow leopard" follow their tracks. Almaty: Gylym.

- Schnieper, R.I. (1991). Region: Economic methods of management. Novosibirsk: Nauka.

- Tekenov, W.A. (2004). Participation mechanism of Kazakh regions in foreign economic relations: Strategy, methodology and instruments. Almaty: Gylym.

- Veselovsky, M.Y., Gnezdova, J.V., Romanova, J.A., Kirova, I.V. & Idilov, I.I. (2015). The strategy of a region development under the conditions of new actual economic. Mediterranean Journal of Social Sciences, 6(5), 310.

- Zahmatov, M.I. (1984). United States: The weakening of international economic position. Moscow: Nauka.