Research Article: 2021 Vol: 25 Issue: 3

Determination Of The Breakeven Point For Motivation Towards The Formalization Of Micro And Small Commercial Companies In Lima, Peru

Víctor Hugo Fernández-Bedoya, Universidad César Vallejo

Monica Elisa Meneses-La-Riva, Universidad César Vallejo

Josefina Amanda Suyo-Vega, Universidad César Vallejo

Johanna de Jesús Stephanie Gago-Chávez, Universidad César Vallejo

Citation Information: Fernández-Bedoya VH, Meneses-La-Riva ME, Suyo-Vega JA, Gago- Chávez JJS. (2021) Determination Of The Breakeven Point For Motivation Towards The Formalization Of Micro And Small Commercial Companies In Lima, Peru. International Journal of Entrepreneurship, 25(8), 1-8

Abstract

By the end of 2020, there were approximately 5.7 million micro or small enterprises in Peru, with approximately 80 percent of them being informal. Despite the extensive literature demonstrating that formalization helps businesses grow to a large extent, this manuscript describes the variables by which informal business owners wish to continue working in that condition. In light of this, the authors propose the break-even point analysis as a motivator for these businesses to formalize. The goal was to see if there was a link between the break-even point and the formalization of micro and small commercial enterprises in Lima, Peru. The authors developed a questionnaire with high levels of validity and reliability, which was administered to a sample of 139 people who declared themselves to be owners of some type of informal business. The data was analyzed using SPSS software, and Pearson's chi-square statistical test yielded an asymptotic significance of 0.009, which, being less than the standard value of 0.050, served as a strong test for the authors' hypothesis, because determining the break-even point has a significant effect on formalizing micro and small commercial enterprises in the context studied (Lima, Peru).

Keywords

Break-Even Point, Business Formalization, Costs, Sales Revenue, Commercial Companies.

Introduction

One of the main reasons why micro and small businesses do not formalize is the complexity of the process itself: there are relatively long procedures that are difficult for entrepreneurs to understand (Ghersi, 1997; Ochoa Valencia & Ordóez, 2004), and there are numerous institutions that must be approached to obtain licenses, permits, and registrations (Ochoa Valencia & Ordóez, 2004).

This scenario generates high formalization costs and greatly discourages its purpose, despite the fact that formalization brings benefits such as increased company competitiveness, access to bank financing, and the possibility of being taxed correctly, taking advantage of the benefits provided by the tax collecting entity (Benhassine et al., 2018; Floridi et al., 2020; Piza, 2018).

There are two completely different perspectives on formalization: a negative one, in whichit becomes synonymous with new obligations and money outflows (Prinz et al., 2014); and a positive one, in which the company achieves competitiveness, and thus more clients and income, with the possibility of growth through access to bank loans (Rand & Torm, 2012).

It should be noted that as organizations grow, so do their formalization requirements. Many formal firms around the world began informally (Zylbersztajn & Graça, 2003).

Formalization occurs through the incorporation of economic units recognized by national regulations (sole proprietorships, limited liability companies, and partnerships), followed by registration and compliance with documentary obligations before the tax authority (registration and declaration), followed by compliance with administrative obligations (licenses and certificates), and finally through incorporation of economic units recognized by national regulations (sole proprietorships, limited liability companies, and partnerships) (Goldstein et al., 2018; Song et al., 2009; Sutter et al., 2017).

Formalization can increase market positioning opportunities by greatly reducing potential legal issues, as well as allowing partnerships with other individuals or companies to achieve greater competitiveness, which leads to greater credibility and trust on the part of customers; however, formality also entails costs that must be borne by capital or shareholders (Ault & Spicer, 2020; Webb et al., 2013).

It should be noted that informal firms do not provide consumer security, so some customers may refrain from purchasing products from informal firms, resulting in a lower market share (Rand & Torm, 2012).

The incorporation of the company at the National Superintendence of Public Registries (hereinafter SUNARP), obtaining the single taxpayer registration (hereinafter RUC) at the National Superintendence of Customs and Tax Administration (hereinafter SUNAT), and the operating license (issued by the corresponding municipality) (SUNAT, 2021).

According to Villar (2017), there is an abundance of micro and small businesses in Peru, which account for 96.5 percent of all organizations and number approximately 5.7 million; of this large universe, nearly 80 percent are informal, implying that the vast majority of Peruvian businesses are informal, micro, or small. This only reflects the large database of companies whose activities are not reported to the government and thus do not pay taxes.

For Kirsten (1989) and Loayza (2007), the informal sector comprises companies, workers, and activities that operate outside the legal and regulatory frameworks that govern economic activity in a given region; thus, it is appropriate to state that belonging to this sector is generally associated with working in ignorance of all tax burdens and legal regulations, as well as not having the financial resources to do so.

Various international media outlets frequently present reports highlighting Peru's growth and economic stability, as well as the ease with which businesses can be formed. According to the World Bank Group (2018), Peru was ranked as one of the three easiest countries to do business in the year of publication of that article.

This demonstrates a completely different point of view than that perceived by entrepreneurs who operate informally and whose reasons for not formalizing have been exposed by Ghersi (1997), Grijalva Salazar et al. (2020), Ochoa Valencia & Ordóez (2004) and Schmal Simón et al. (2016).

In terms of the break-even point, according to Pauceanu (2016), this tool allows "calculating the lower or minimum quota of units to produce and sell so that a business does not incur losses"; based on this, we can infer that it could be used by competing current informal businesses to analyze how significant the costs and expenses incurred by formalization are and what the amount of merchandise will be.

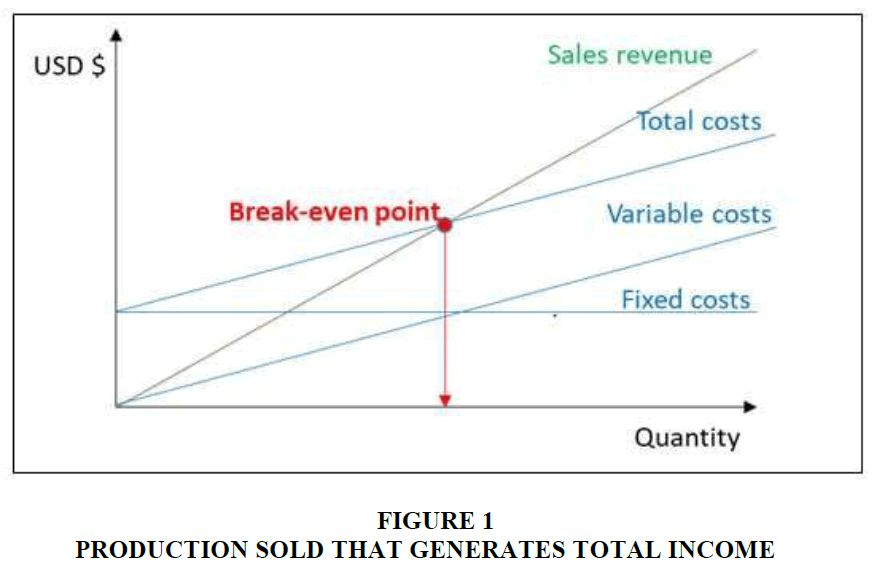

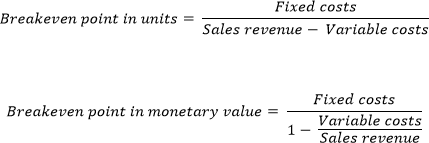

As per Blank (2001), the break-even point is the batch of production sold that generates total income that is exactly equal to the outgoings derived from the total costs incurred for such operation to be generated, as shown graphically in Figure 1.

Blank (2001) goes on to say that using the formulas described below, such a production lot can be determined for understanding or presentation in units or in its corresponding monetary value.

Although many organizations can generate significant revenues from their sales, these revenues are not always sufficient to cover the various costs and expenses incurred during the same period in which the sales were generated (Coromoto Morillo, 2007; Hernández, 2011; Yardin, 2002); in this case, the break-even point can help to determine how much the expected revenues should be.

According to a recent study conducted in Peru (Fernandez Bedoya, 2018), the use of the break-even point has the positive effect of improving a number of internal processes, in addition to supporting correct financial decision making. Given that one of the reasons why micro and small businesses in Peru do not formalize is due to economic factors, we can conclude that the break- even point can provide greater insight and clarity for the entrepreneur who is unsure about formalizing his business.

In Ecuador, Mazón et al. (2017) investigated the positive effects of the break-even point on decision making, providing very useful information that encourages entrepreneurs to use this tool and thus reduce business risk.

In the Netherlands, Singh et al. (2013) conducted a comprehensive analysis of a hospital center's income and expenses based on a new scenario that generated variations in these inputs for the calculation of the break-even point, discovering that this institution needed to perform 600 operations per year to reach the break-even point, motivating them to reformulate the sales targets and make them stricter.

In Bulgaria, Georgiev (2014) conducted a study in which he explained why the hotel industry in that context presented good financial indicators, even better than those of other countries in the region, discovering that among their good practices was the continuous analysis of the break-even point, which allowed them to manage differences in hotel bookings due to seasonality, differences in vacancy rates, and differences in vacancy rates.

Large companies that are now models to emulate began their operations informally. In Peru, for example, we have Artika ice cream, Anypsa paints, and Montalvo beauty salons, all of which began their operations in a rudimentary manner, with many characteristics that classify them as informal (Inga Martinez, 2016).

Despite the fact that many success stories are shared in educational institutions and other public entities, informal enterprises are hesitant to formalize, indicating a resistance to change. According to Minaya Cuba & Fernández Bedoya (2018), the use of detailed information and cost objects in a company facilitates decision making in daily activities while also increasing the perception of continuous improvement in the company.

Because the break-even point is a tool that transparently shows the minimum level of sales revenue for a company to not gain or lose profit based on costs and revenues, we can conclude that knowing the break-even point will aid in business decision making. Two studies outlining the proper analysis and determination of business costs in order to determine the break-even point can be found in the articles presented by Regonha et al. (2016) and Reynier et al. (2013).

Given the foregoing, the authors posed the following research question: Is there a significant relationship between the break-even point and the formalization of micro and small business enterprises in Lima, Peru?

The goal of this study was to see if there was a link between the break-even point and the formalization of micro and small commercial enterprises in Lima, Peru.

The proposed hypothesis was: there is a significant relationship between the break-even point and the formalization of micro and small commercial enterprises in Lima, Peru.

Material and Methods

The scope of this research was exploratory in nature. According to (Hernández Sampieri et al., 2014), exploratory studies "are used when the objective is to examine a research topic that has not been studied very much, about which there are many doubts, or that has not been previously addressed," specifically because of the situation of the country where the research was conducted, for which there is a lot of literature related to break-even point and for which there is a lot of literature related to.

The study took a quantitative approach because it allows for the collection of numerical data, which was then processed and analyzed using the tools provided by statistics (Cadena Iiguez et al., 2017).

The research level was explanatory, which allows for the establishment of cause and effect relationships, in this case that one variable influences (or motivates) the other, through statistical associations (Lafuente Ibáez & Marn Egoscozábal, 2008).

According to (Driessnack et al., 2007), the research design was non-experimental, which means that there was no random determination, manipulation of variables, or comparison groups, in addition to the fact that the researcher observed what happened naturally, without intervening in any way. At the same time, it is important to note that this was a cross-sectional study because the data was collected at a single point in time with no longitudinal analysis (Otzen & Manterola, 2017).

The survey technique was used, with the questionnaire instrument developed by the authors using the theoretical review as input, and presenting 42 items. In terms of the sample, 139 people were considered who claimed to be owners of non-formal companies because they do not have RUC registration, so they do not have formally registered workers, and they do not issue sales receipts, so they generate profits without paying any tax. It should be noted that because informality is punishable under current legislation, it was difficult to get people to respond voluntarily to the questionnaire.

It should be noted that the Cronbach's alpha coefficient was calculated in order to estimate the dependability of an instrument to be used (Cronbach, 1951). According to experts in the field, a value of 0.70 or more of these coefficients indicates that an instrument is reliable (Chaves- Barboza & Rodrguez-Miranda, 2018). This study tested the reliability of both instruments, yielding reliability coefficients of 0.757 and 0.843 for the first and second variables, respectively, allowing assurance of their dependability.

In terms of validity, the questionnaire was subjected to the scrutiny of seven experts, who evaluated the relevance and clarity of the items. Aiken's V. test (Aiken, 2003) yielded a general result of 0.94, classifying it as extremely valid.

The survey data was sorted, classified, recorded, and processed in the SPSS version 26 statistical software, where the Pearson's chi-square test was run.

Results and Interpretation of Data

The hypothesis test was carried out using Pearson's chi-square statistic, and the asymptotic significance was examined. If the resulting value is less than 0.05, the authors' hypothesis will be accepted; otherwise, it will be rejected. The statistic's outcome is shown in Table 1.

| Table 1 Pearson’s Chi-Square Tests | |||

| Value | Degrees of Freedom | Asymptotic Significance (2- Sided) | |

| Pearson’s Chi-Square | 25.960 | 4 | 0.009 |

| Likelihood Ratio | 29.237 | 4 | 0.006 |

| Linear-by-Linear Association | 5.658 | 1 | 0.001 |

| N of Valid Cases | 139 | ||

According to Table 1, the bilateral asymptotic significance obtained from Pearson's chi-square test is 0.009, which is less than 0.05, allowing the authors to have enough evidence to validate the hypothesis, indicating that there is a significant association between the break-even point and the formalization of micro and small commercial enterprises in Lima, Peru.

Because a statistical association allows us to determine that one variable is dependent on another, it is prudent to assert that determining the break-even point generates motivation for the formalization of micro and small commercial enterprises in Lima, Peru.

These findings enable us to move forward in this line of research because they provide a foundation for moving away from relational (or correlational) research and toward explanatory research, demonstrating that there is a cause and effect relationship between the variables and concluding that determining the break-even point has a significant impact on the context studied.

While it is true that Peru is one of the three countries in the world where doing business is easier (World Bank Group, 2018), it is worth noting that the respondents expressed a number of negative comments and fears, confirming what Ghersi (2007), Ochoa Valencia and Ordóez (2004), and Schmal et al. (2016) proposed.

The break-even point is a useful tool for demonstrating that a business can be formalized and remain profitable while also contributing to the country's economy.

Conclusions

Determining the break-even point is critical for the formalization of micro and small commercial enterprises in Lima, according to the research (Peru). This is because understanding the break-even point demonstrates that micro and small businesses can formalize while still making a profit and having a better chance of obtaining financing for their activities, allowing them to grow and make better business decisions.

The break-even point is important for the profitability of micro and small commercial enterprises in Lima, Peru, because it allows the entrepreneur to determine the minimum level of production at which his productive activity is profitable by determining the number of units of product (or service) produced and sold that equal the levels of income and costs.

In Lima, Peru, there is strong opposition to the formalization of micro and small commercial enterprises; however, this is due to the entrepreneurs' perceptions, as there is literature demonstrating that it is possible to formalize these businesses while still earning a profit by utilizing the tools and assistance provided by other institutions or the government.

Researchers in business sciences are encouraged to conduct similar studies in other contexts in order to stimulate discussion and expand the literature related to this line of research, which is framed in more than one of the United Nations' Sustainable Development Goals.

Funding Statement and Acknowledgments

This study was carried out and funded by the Universidad César Vallejo, within the framework of the work plan outlined in RVI N° 052-2019-VI-UCV.

References

- Aiken, L. (2003). Test psicológicos y evaluación. Pearson Educación.

- Ault, J.K., & Spicer, A. (2020). The formal institutional context of informal entrepreneurship: A cross-national, configurational-based perspective. Research Policy, 104160. https://doi.org/10.1016/j.respol.2020.104160

- Benhassine, N., McKenzie, D., Pouliquen, V., & Santini, M. (2018). Does inducing informal firms to formalize make sense? Experimental evidence from Benin. Journal of Public Economics, 157(November 2017), 1-14. https://doi.org/10.1016/j.jpubeco.2017.11.004

- Blank, R.M. (2001). Welfare Programs, Economics of. In International Encyclopedia of the Social & Behavioral Sciences (pp. 16426-16432). Elsevier. https://doi.org/10.1016/B0-08-043076-7/02275-0

- Cadena Iñiguez, P., Rendón-Medel, R., Aguilar-Ávila, J., Salinas- Cruz, E., De la Cruz-Morales, F.D.R., & Sangerman- Jarquín, D.M. (2017). Quantitative methods, qualitative methods or combination of research: an approach in the social sciences. Revista Mexicana de Ciencias Agrícolas, 8(7), 1603.

- Chaves-Barboza, E., & Rodríguez-Miranda, L. (2018). Análisis de confiabilidad y validez de un cuestionario sobre entornos personales de aprendizaje (PLE). Revista Ensayos Pedagógicos, 13(1), 71. https://doi.org/10.15359/rep.13-1.4

- Coromoto Morillo, M. (2007). Los costos del marketing. Actualidad Contable Faces, 10(14), 104-117.

- Cronbach, L.J. (1951). Coefficient alpha and the internal structure of tests. Psychometrika, 16(3), 297-334. https://doi.org/10.1007/BF02310555

- Driessnack, M., Sousa, V.D., & Mendes, I.A.C. (2007). Revisão dos desenhos de pesquisa relevantes para enfermagem: Part 2: Desenhos de pesquisa qualitativa. Revista Latino-Americana de Enfermagem, 15(4), 684-688. https://doi.org/10.1590/S0104-11692007000400025

- Fernández Bedoya, V.H. (2018). Punto de equilibrio y su incidencia en las decisiones financieras de empresas editoras en Lima. Quipukamayoc, 26(52), 95. https://doi.org/10.15381/quipu.v26i52.15507

- Floridi, A., Demena, B.A., & Wagner, N. (2020). Shedding light on the shadows of informality: A meta-analysis of formalization interventions targeted at informal firms. Labour Economics, 67(October 2019), 101925. https://doi.org/10.1016/j.labeco.2020.101925

- Georgiev, D. (2014). Application of ‘cost-volume-profit’ Analysis In The Hotel Industry (Based on Survey Data of High-ranking Hotels in the North-east Region of Bulgaria). Izvestiya, 3(1), 48-60. https://ideas.repec.org/a/vrn/journl/y2014i3p48-60.html

- Ghersi, E. (1997). The informal economy in Latin America. Cato Journal, 17(1), 99-108.

- Goldstein, M., Houngbedji, K., Kondylis, F.,O’Sullivan, M., & Selod, H. (2018). Formalization without certification? Experimental evidence on property rights and investment. Journal of Development Economics, 132(1), 57- 74. https://doi.org/10.1016/j.jdeveco.2017.12.008

- Grijalva Salazar, R.V., Fernández Bedoya, V.H., Esteves Pairazamán, A.T., & Ibarra Fretell, W.G.I. (2020). Systemof payment of tax obligations (SPOT) related to the payment capacity of construction companies in Peru. International Journal of Scientific and Technology Research, 9(1), 235-237. http://www.ijstr.org/final- print/jan2020/-System-Of-Payment-Of-Tax-Obligations-spot-Related-To-The-Payment-Capacity-Of- Construction-Companies-In-Peru.pdf

- Hernández, C. (2011). Cálculo de la relación de margen de contribución en los precios y el surgimiento de la proporción áurea en la estructura de utilidades. Contaduría y administración, 235(1), 77-98. http://www.scielo.org.mx/scielo.php?script=sci_arttext&pid=S0186-10422011000300005&lang=es

- Hernández Sampieri, R., Fernández Collado, C., & Baptista Lucio, P. (2014). Metodología de la investigación (6th ed.). McGraw-Hill.

- Inga Martínez, C. (2016). Tres empresas peruanas que surgieron desde cero y son exitosas. El Comercio, 1-8. https://elcomercio.pe/economia/dia-1/tres-empresas-peruanas-surgieron-cero-son-exitosas-240243-noticia/

- Kirsten, M. (1989). The other path: The invisible revolution in the Third World, by Hernando de Soto, Harper and Row publishers, New York, 1988. Development Southern Africa, 6(3), 390-392. https://doi.org/10.1080/03768358908439480

- Lafuente Ibáñez, C., & Marín Egoscozábal, A. (2008). Metodologías de la investigación en las ciencias sociales: Fases, fuentes y selección de técnicas. Revista EAN, 64(3), 5-18. https://doi.org/10.21158/01208160.n64.2008.450

- Loayza, N. (2007). The causes and consequences of informality in Peru. Estudios Económicos, 18(1), 1-22. https://www.bcrp.gob.pe/publicaciones/documentos-de-trabajo/dt-2007-18.html

- Mazón, L., Villao, D., Nuñez., W., & Serrano, M. (2017). Análisis de punto de equilibrio en la toma de decisiones de un negocio: caso Grand Bazar Riobamba-Ecuador. Revista de Estrategias del Desarrollo Empresarial, 3(8), 14-24. https://www.ecorfan.org/spain/researchjournals/Estrategias_del_Desarrollo_Empresarial/vol3num8/Revista_de_Estrategias_del_Desarrollo_Empresarial_V3_N8_2.pdf

- Minaya Cuba, M., & Fernández Bedoya, V. H. (2019). Implementación del sistema de costeo ABC y la percepción de la mejora continua en empresas industriales de metal mecánica en Lurigancho, Lima. Año 2017. UCV- SCIENTIA, 10(1). https://doi.org/10.18050/revucv-scientia.v10n1a3

- Ochoa Valencia, D., & Ordóñez, A. (2004). Informalidad En Colombia. Causas, Efectos Y Características De La Economía Del Rebusque. Estudios Gerenciales, 20(90), 105-116.

- Otzen, T., & Manterola, C. (2017). Técnicas de Muestreo sobre una Población a Estudio. International Journal of Morphology, 35(1), 227-232. https://doi.org/10.4067/S0717-95022017000100037

- Pauceanu, A.M. (2016). Business Plan. En Entrepreneurship in the Gulf Cooperation Council (pp. 79-118). Elsevier. https://doi.org/10.1016/B978-0-12-811288-5.00004-X

- Piza, C. (2018). Out of the Shadows? Revisiting the impact of the Brazilian SIMPLES program on firms’ formalization rates. Journal of Development Economics, 134(5), 125-132. https://doi.org/10.1016/j.jdeveco.2018.05.002

- Prinz, A., Muehlbacher, S., & Kirchler, E. (2014). The slippery slope framework on tax compliance: An attempt to formalization. Journal of Economic Psychology, 40(1), 20-34. https://doi.org/10.1016/j.joep.2013.04.004

- Rand, J., & Torm, N. (2012). The Benefits of Formalization: Evidence from Vietnamese Manufacturing SMEs. World Development, 40(5), 983-998. https://doi.org/10.1016/j.worlddev.2011.09.004

- Regonha, E., Baungartner, R.R., & Scarpi, M.J. (2016). Cost analysis for ophthalmic clinics services. Revista Brasileira de Oftalmologia, 75(6), 461-469. https://doi.org/10.5935/0034-7280.20160093

- Reynier, R., David, P., Keitel, B., & Elizabeth, G. (2013). Determinación Y Análisis De Los Costos De Extracción De Plasma En El Banco De Sangre De Cienfuegos. Cuba. Revista Científica «Visión de Futuro», 17(1), 65- 80.

- Schmal Simón, R., Rivero Flores, S., & Vidal Silva, C. (2016). Formalización de un modelo de trabajo con empresas en una carrera de ingeniería. Ingeniare. Revista chilena de ingeniería, 24(1), 149-157. https://doi.org/10.4067/s0718-33052016000100014

- Singh, M.M., Choudhary, P.K., Patnaik, S.K., & Kaushal, G. (2013). Break-Even Analysis in Healthcare Setup. International Journal of Research Foundation of Hospital and Healthcare Administration, 1(1), 29-32. https://doi.org/10.5005/jp-journals-10035-1006

- Song, M., Di Benedetto, C.A., & Parry, M.E. (2009). The impact of formal processes for market information acquisition and utilization on the performance of Chinese new ventures. International Journal of Research in Marketing, 26(4), 314-323. https://doi.org/10.1016/j.ijresmar.2009.08.003

- SUNAT. (2021). ¿Cómo formalizar tu negocio? Aspectos tributarios. SUNAT. https://emprender.sunat.gob.pe/sites/default/files/inline-files/cartilla formalizacion_2020_r.pdf

- Sutter, C., Webb, J., Kistruck, G., Ketchen, D.J., & Ireland, R.D. (2017). Transitioning entrepreneurs from informal to formal markets. Journal of Business Venturing, 32(4), 420-442. https://doi.org/10.1016/j.jbusvent.2017.03.002

- Villar, P. (2017). ComexPerú: Mypes siguen aumentando pero formalización no avanza. El Comercio, 1-6. https://elcomercio.pe/economia/negocios/informalidad-micro-pequenos-negocios-peru-noticia-noticia- 448518

- Webb, J.W., Bruton, G.D., Tihanyi, L., & Ireland, R.D. (2013). Research on entrepreneurship in the informal economy: Framing a research agenda. Journal of Business Venturing, 28(5), 598-614. https://doi.org/10.1016/j.jbusvent.2012.05.003

- World Bank Group. (2018). Doing business 2019. Training for reform (16th ed.). World Bank Publications.

- Yardin, A. (2002). Una revisión a la teoría general del costo. Revista Contabilidade & Finanças, 13(30), 71-80. https://doi.org/10.1590/s1519-70772002000300006

- Zylbersztajn, D., & Graça, C. (2003). Costos de formalización de las empresas medición de los costos de transacción en Brasil. Revista de Economía Institucional, 5(9), 146-165.