Research Article: 2021 Vol: 25 Issue: 4S

Determinants of Financial Performance of Private Commercial Banks in Ethiopia

Adugna Megenasa Biru, Wollega University, Lecturer, Department Of Accounting and Finance, Nekemte, Ethiopia

Citation Information: Biru, A.M. (2021). Determinants of financial performance of private commercial banks in ethiopia. Academy of Accounting and Financial Studies Journal, 25(S4), 1-17.

Abstract

This study was aimed to investigate determinants of financial performance of private commercial banks in Ethiopia. The study has employed explanatory research design in quantitative research approach. An audited financial statement of private commercial banks was used for the period 2010 to 2019 to carry out the study. Out of the 16 private commercial banks; eight (8) banks were selected as sample using purposive sampling based on the banks’ age and experience. The data were analyzed using descriptive and inferential statistics such as correlation analysis, Random and Fixed effect regression analysis. The finding of the study indicates that microeconomic factors namely; capital adequacy, asset quality, liquidity position and number of bank branch had positive and significant effect on return on asset (ROA) & return on equity (ROE) of private commercial banks in Ethiopia. From macroeconomic factors interest rate had a negative significant effect on return on asset and had no effect on return on equity. Similarly, Gross Domestic Product had negative and significant effect on return on asset (ROE) & had insignificant effect on return on asset (ROA) of private commercial banks in Ethiopia. Therefore, the private commercial banks should give due consideration on improving those internal factors since they significantly and positively affect their financial performance. Similarly, the concerned executive body should get updated information about coming change GDP and interest rate and adjust their bank functions according to change in the environment and be efficient since these factors had negative and significant impact on bank financial performance.

Keywords

Private Commercial Banks, Financial Performance, Internal Factors, External Factors.

Introduction

Banks play an important role in the economic resource allocation of countries. They channel funds from depositors to investors continuously. They can do so, if they generate necessary income to cover their operational cost they incur in the due course. In other words for sustainable intermediation function, banks need to be profitable. Beyond the intermediation function, the financial performance of banks has critical implications for economic growth of countries. Good financial performance rewards the shareholders for their investment. This, in turn, encourages additional investment and brings about economic growth. On the other hand, poor financial performance can lead to banking failure and crisis which have negative repercussions on the economic growth.

Understanding the factors that influence the financial performance of commercial banks is critical not only to the management of these commercial banks but also to other stakeholders and interest groups such as the country’s Central Bank, the government as a whole, the banker’s association as well as other financial authorities in the country (Ayele, 2012). Financial performance of banks is usually expressed as a function of internal and external determinants. The internal determinants originate from bank accounts and therefore could be termed micro or bank-specific determinants of performance. The external determinants are variables that are not related to bank management but reflect the economic and legal environment that affects the operation and performance of financial institutions. Studies carried out to evaluate the determinants of the financial performance of commercial banks have revealed various factors such as the internal (bank specific) factors, industry specific factors and external (macro-economic factors) (Sufian & Chong, 2008). It is however important to note that countries differ in terms of the macro-economic conditions, the financial systems as well as the operating environment of these banks (Ongore & Kusa, 2013). This shows that factors that influence performance in one country may not be the same as those in another country (Lipunga, 2014).

A search for literature in this area shows that there are various studies that have been carried out both on the international arena, in the African context as well as locally. Obamuyi, (2013) evaluated the determinants of a bank’s profitability in a developing economy and focused on the banking industry in Nigeria. The study found that bank specific factors such as efficient management of expenses and increased interest income and macro environment factors such as favorable economic conditions lead to improved profitability of commercial banks. This study did not evaluate the influence of industry specific factors on the performance of the commercial banks and this will be a focus of the current study. Lipunga, (2014) also carried out a similar study and focused on the banking industry in Malawi. The results of the study found that the size of the bank, the efficiency of the bank’s management and the liquidity of the bank influenced its profitability measured by ROA. This study only focused on internal factors or firm specific factors only and did not consider the influence of external factors such as the GDP or interest rates as it is used in the current study.

Most studies conducted in relation to bank performance focused on sector specific factors which affected the entire banking sector performance. For instance, comparative studies of foreign and local banks in Thailand by Chantapong, (2005) and the profitability of European banks: a cross- sectional and dynamic panel analysis by (Goddard et al., 2004). Also, Ongore & Kusa, (2013) studied the effects of various factors in banking sector performance in Kenya. The results of the study showed that board and management decisions influence the performance of commercial banks in Kenya and also that macro-economic factors have insignificant influence on their performance. This study however omitted the effects of industry specific factors on the performance of commercial banks. Literature has not specifically focused on identifying the specific factors that influence bank performance in developing countries but the available literature shows determinants in all economies (Karasulu, 2001). Macro-economic factors that influence the performance of commercial banks have also not been evaluated in the Ethiopian context despite their importance in determining the performance of any industry in the economy.

As to the best of the researcher’s knowledge, there are previous few research works have been made in Ethiopia in “the determinants of bank profitability: in case of private commercial banks” by considering both internal and external factors with varying types and numbers of variables (e.g. Habtamu, 2012; Gemechu, 2016; Samueal, 2015; Elefachew & Rao, 2016; Rao & Tekeste, 2012; and others). But still the findings are inconsistent. For example, Habtamu, (2012) concluded that managerial efficiency and level of GDP have a strong influence on the profitability of private commercial banks in Ethiopia, while others like Samueal, (2015) concluded that managerial efficiency have stastically insignificant and Rao & Tekeste, (2012) concluded that GDP have statically insignificant influence on the profitability.

Thus, to the best of the researcher’s knowledge, it appears that adequate studies have not been made that exhaustively analyzed the determinants of commercial banks profitability in Ethiopia, particularly on ROA & ROE. Therefore, this study tries to fill the gap by incorporating both internal factors and external factors.

Literature Review

In Ethiopia, modern banking system started in 1906 by British owned national bank of Egypt under the management of Egyptian national bank; the bank called bank of Abyssinia (Chekole, 2016). From 1975 to 1994 there were four state owned banks and one state owned insurance company, i.e., the National Bank of Ethiopia (The Central Bank), the Commercial Bank of Ethiopia, the Housing and Savings Bank, the Development Bank of Ethiopia and the Ethiopian Insurance Corporation (Habtamu, 2012).

According to Ebisa, (2012) after the down fall of the Derg regime, there are opportunities to invest in financial institutions with policies encouraging private investors to invest in the banking, MFIs and insurance companies. Although the history of private commercial banks in the country is very short, the banks have managed to contribute their part in provision of banking services and sharing the monopolies enjoyed formerly by the state owned Commercial Bank of Ethiopia Ebisa, (2012). Accordingly , in Ethiopia the lists of private commercial banks include Awash International Bank, which is the first private commercial bank in the country and others followed like Dashen Bank, United Bank, Wegagen Bank, Bank of Abyssinia, and Cooperative Bank of Oromia, Lion International Bank, Oromia International Bank, Zemen bank, Bunna International Bank, Nib Bank, Berhan International Bank and others under formation such as Addis cooperative Bank, Hawassa bank, Debub Global Bank ,Abay bank, and others under formation are included. Currently, the banking industry of Ethiopia is dominated by the two state owned banks namely, commercial bank of Ethiopia and development bank of Ethiopia.

According to access capital banking sector review for the 2010 fiscal year; the Ethiopian private commercial banking industry enjoyed high growth, high profits, and showing progressive developments in terms of number of branches, total assets, human resource utilization (Chekole, 2016).

As pointed by (R.o, 2013), bank makes profit from the spread between interest charged on deposit and loan interest rate and these differentials ought to compensate adequately for the investors contribution, the service provider as well, if corporate governance has to be used a yard stick in determining bank performance.

According to the annual report dated in (report, 2010/11), banks operating in the Ethiopia registered high profit, enhanced their resource mobilization, expanded their capital base, disbursed significant amount of credit and reduced their non-performing loans to a minimum level. But bank performance is not determined by inputs alone but is also dependent on the environment within which the bank operates.

Economic Significance of Banks

The existence of a strong and effective banking system is very important for the economic development of a country. According to Li yuqi, (2007) banks through acceptance of deposit of money from persons who do not need it at the present and lending it to persons who want it for investment, serve as financial intermediaries there by providing ideal source of fund for investment that is crucial in increasing production, exports, creation of jobs and foreign exchange earnings of the country. Similarly, bank lending to customers who need the money for consummation, purchase of various goods and services, construction of houses, and education increases demand for those goods and services, thereby encouraging producers and service providers to expand their undertakings and increase production (Fasil & Merhatibeb, 2009). Expansion and increase in production requires employment of additional workers, thereby creating new jobs, encourage producers and suppliers of raw materials to increase their production and supply. Banks also play a positive role in encouraging savings by providing an incentive to save through payment of interest on deposits/savings and providing safety and security. Saving is also an important source of future investment and the improvement of the living standards of the society (Wubitu, 2012).

Meaning and Measures of Financial Performance

Financial performance is the level of performance of a firm over a specific period of time and expressed in terms of the overall profits or losses incurred over the specific period under evaluation (Bodie et al., 2005). There is a long run relationship between commercial banks deposits and the profitability of the banks (Ekki, 2004). According to Hassan, (2016), suggest that bank profitability is best measured by ROA in that ROA is not distorted by high equity multipliers and ROA represents a better measure of the ability of a firm to generate returns on its portfolio of assets. For this study the researcher also used ROA as measurements of profitability and it described by the earnings before interest and tax divided by total asset Mulunesh, (2008) ROA shows the profit earned per dollar of assets and most importantly, it reflects the management's ability to utilize the banks financial and real investment resources to generate profits. For any bank, ROA depends on the bank's policy decisions as well as on uncontrollable factors relating to the economy and government regulations (Hassan, 2016). It measures the ability of the bank management to generate income by utilizing company assets at their disposal. In other words, it shows how efficiently the resources of the company are used to generate the income. It further indicates the efficiency of the management of a company in generating net income from all the resources of the institution (Khrawish, 2011). Wen, (2010), state that a higher ROA shows that the company is more efficient in using its resources.

ROE is a financial ratio that refers to how much profit a company earned compared to the total amount of shareholder equity invested or found on the balance sheet. ROE is what the shareholders look in return for their investment. A business that has a high return on equity is more likely to be one that is capable of generating cash internally. Thus, the higher the ROE the better the company is in terms of profit generation. It is further explained by Khrawish, (2011) that ROE is the ratio of Net Income after Taxes divided by Total Equity Capital. It represents the rate of return earned on the funds invested in the bank by its stockholders. ROE reflects how effectively a bank management is using shareholders’ funds. Thus, it can be deduced from the above statement that the better the ROE the more effective the management in utilizing the shareholders capital.

Determinants of Bank Performance

The determinants of bank performances can be classified into bank specific (internal) and macroeconomic (external) factors Al-Tamimi, (2010). These are stochastic variables that determine the output. Internal factors are individual bank characteristics which affect the banks performance. These factors are basically influenced by internal decisions of management and the board. The external factors are sector-wide or country-wide factors which are beyond the control of the company and affect the profitability of banks. The overall financial performance of banks in Ethiopia in the last two decade has been improving. However, this doesn't mean that all banks are profitable, there are banks declaring losses Ahmed, (2010). Studies have shown that bank specific and macroeconomic factors affect the performance of commercial banks (Flamini et al., 2009).

As explained above, the internal factors are bank specific variables which influence the profitability of specific bank. These factors are within the scope of the bank to manipulate them and that they differ from bank to bank. These include capital size, asset quality, liquidity position, Number of bank branch, liabilities, size and composition of credit portfolio, labor productivity, and state of information technology, risk level, management quality, bank size, ownership and the like.

Internal Factors (Microeconomic Factors)

Capital: It is one of the bank specific factors that influence the level of bank profitability. Capital is the amount of own fund available to support the bank's business and act as a buffer in case of adverse situation (Athanasoglou et al., 2008). Banks capital creates liquidity for the bank due to the fact that deposits are most fragile and prone to bank runs. Moreover, greater bank capital reduces the chance of distress (Diamond, 2000). However, it is not without drawbacks that it induces weak demand for liability, the cheapest sources of fund. Capital adequacy is the level of capital required by the banks to enable them withstand the risks such as credit, market and operational risks they are exposed to in order to absorb the potential loses and protect the bank's debtors. Capital adequacy ratio shows the internal strength of the bank to withstand losses during crisis. Capital adequacy ratio is directly proportional to the resilience of the bank to crisis situations. It has also a direct effect on the profitability of banks by determining its expansion to risky but profitable ventures or areas (Sangmi, 2010).

The quality of assets it is significant aspect to assess the degree of financial strength of a bank. The principal purpose of measuring the assets quality is to determine the composition of non-performing assets (NPAs) as a percentage of the total assets (Aspal & Dhawan, 2016). Thus, lowest non-performing loan shows that the good health of the portfolio of asset at banks. The lower the ratio the better the bank performing (Sangmi & Nazir, 2010). It is a method of measuring the banks’ financial performance using Non-Performing Assets / Net advances (the lower the better) and standard advances (net of total advances and gross NPAs) / total advances (the higher the better) (Srinivasan & Saminathan, 2016). Muralidhara & Lingam, (2017) also measured asset quality in terms of institution’s total non-performing asset and their ratio to total net asset: net NPA to net advances, net NPA to net assets and owners total investment to total assets. In addition, Mulualem, (2015) measured it by the ratio of provisions of loan to total loan provided and the lower the loan loss provision to total loan ratio indicate the quality of the asset of the bank is relatively better than the other banks. As Mulualem, (2015) clearly showed, asset quality has positive correlation with return on equity and return on asset. Tadios, (2016) stated that the prime objective of measuring the assets quality is to ascertain the component of nonperforming assets (NPAs) as percentage of the total assets. Tadios, (2016) measured it by total loans and advances to total assets ratio (loans and advances/ total assets) and total investments to total assets ratio (total investment/total asset). Asset quality assesses the perils linked with the bank’s asset portfolio i.e. the quality of loans issued by the bank. Quality of asset of banks will be measured using loan reserve (provision) to total loans ratios (Andebet, 2016). According to the study of Ermias, (2016), asset quality has a negative but statistically significant effect on bank’s profitability (ROA). This implies that management can enhance its profitability by carefully watching the health status of its assets (loans and advances). Dawit, (2016) measured it by non-performing loans to total loans and the result indicated as it has a negative effect on ROA signifying that that a bank which has high non-performing loans has low finical performance (ROA) and indicating that a bank which has high non-performing loans has low finical performance (ROE) and it has insignificant but negative impact on NIM indicating that the collectivity of disbursed loans is very small with their interest income according to the schedule in Ethiopian commercial banks. It is similar with the result of Iheanyi, (2017); Yiregalem, (2015) which means assets quality has a negative impact on that profit of the bank.

Liquidity: It is another factor that determines the level of bank performance. Liquidity refers to the ability of the bank to fulfill its obligations, mainly of depositors. According to Dang, (2011) adequate level of liquidity is positively related with bank profitability. The most common financial ratios that reflect the liquidity position of a bank according to the above author are customer deposit to total asset and total loan to customer deposits. Other scholars use different financial ratio to measure liquidity. For instance, Ilhomovich, (2009) used cash to deposit ratio to measure the liquidity level of banks in Malaysia. However, the study conducted in China and Malaysia found that liquidity level of banks has no relationship with the performances of banks (Said & Tumin, 2011). Some related studies were conducted by different researchers in Ethiopia. Specifically, Worku, (2006) argued that liquidity has an impact on the performance of commercial banks in Ethiopia and there was an inverse relation between deposit/net loan and ROE. And the coefficient of liquid asset to total asset was positive and directly related with ROE. Worku, (2006) also studied capital adequacy and found that the capital adequacy of all banks in Ethiopia were above threshold, means there was sufficient capital that can cover the risk-weighted assets. Depositors who deposit their money in all banks were safe because all the studied banks fulfilled NBE requirement (Worku, 2006). Worku used different ratios when analyzing liquidity effect on banks performance and these ratios were liquid asset/net profit, liquid asset/total assets, net loans/net deposits, interest income/net deposit and interest income/interest expense (Worku, 2006).

Number of bank branch: According to Antanasoglou & Gioka (2007), bank branch network as locating the firm in different location with the aim of gaining more access to the customers. Adeyinka (2013) stated that expanding the branch network can also be defined as dispersion of bank branch network to boost availability of bank products and services, improve customer access to their place of residence and improve tha bank’s cooperation with its clients. Antanasoglou & Gioka, (2007) argue that increasing the number of bank branch network results into the increase of sales, risk reduction and cosr minimization. Contrary to this, Davidson and steffens, (2009) opine that spread in branch network does not guarantee the firm increased sales and profits generated by that particular branch.

External factors (Macroeconomic Factors)

The macroeconomic policy stability, Gross Domestic Product, Inflation, Interest Rate and Political instability are also other macroeconomic variables that affect the performances of banks.

Gross domestic product (GDP): It is one of the factors that affect the financial performance of banks. It is used to account for economic environment and it is measured by real GDP growth. GDP growth varies over time but not among the banks. GDP growth is expected to have a positive impact on bank profitability according to the literature on the association between economic growth and financial sector profitability (Demirguc-Kunt & Huizinga, 1999; Bikker & Bos, 2006; Athanasoglou et al., 2006). Accordingly, we expect a positive relationship between bank profitability and GDP development as the demand for lending is increasing (decreasing) in cyclical upswings (downswings).

However, BenNaceur & Goaid, (2005) suggest that GDP growth does not tell any characteristic of the banking regulation and the advanced technology in the banking sector. By the other side, Staikouras & Wood, (2003) find two of their three macroeconomic indicators, the variability of interest rate and the growth of GDP, have a negative impact, while the level of interest rate have a positive effect on bank.

Inflation (INF): is also one of the macroeconomic determinants and used to represent the changes in the general price level or inflationary conditions in the economy and it is measured by annual country inflation rate. Abreu & Mendes, (2000), point out a negative relationship between the inflation rate and bank’s profitability in European countries. Likewise Ayadi & Boujelbene, (2012), report a negative effect of inflation on Tunisian bank profitability over the 1995- 2005 period. In the same way, Demirguc-Kunt & Huizinga, (1999) suggest that banks with high capital ratio in developing countries tend to be less profitable in inflationary environments.

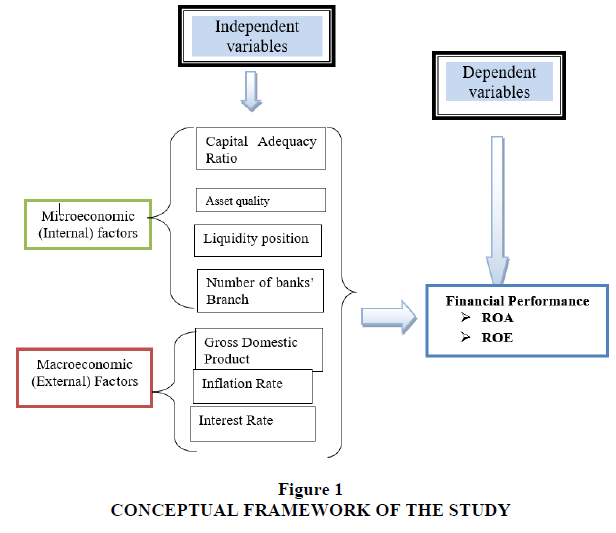

Market Interest Rate (IR): It is considered to be very phenomenal factor in financial market. In today’s market of liberalization, the worldwide financial markets have led to enhance the volatility in the global economy. Consequently a numerous researchers, practitioners and policy makers have seen interest in the impact of bank profitability and rate fluctuations. The evaluation of trade off among the stability of the market rate of interest and policies becomes more expected. Beside this type of evaluation, different policies makers would be able to put suitable weight of the interest rate strategies, with other links. As a result, the discussed paper examines the interest rate effect on bank’s profitability in the Pakistan banking sector by using regression technique (2008-2012). The increased volatility of the company’s market interest rate is caused by the changed in unexpected interest rate and is the major contributor in financial market. According to English (2002), to measure the effect of changes in bank’s profitability, it is mandatory to evaluate and asses the overall fluctuations of interest rate on the economy and to depict the implications of interest rate on cash flow. Sufian, (2011) stated the effect of banks inside aspects and macroeconomic components on the banks’ profitability during 1992-2003 in Korea. Liquidity has negative effect on banks profitability with minor liquidity level, to establish superior profitability (Figure 1).

Conceptual Framework of the Study

Data and Methodology

Data in this study explanatory research design was used in order to explain the cause effect relationship that exist between the dependent variables (return on asset &return on equity and independent `variables The study used annual time series data for the period 2010-2019, for the purpose of analyzing the determinants of financial performance of private commercial banks in Ethiopia and this period was chosen for availability of related data with variables to study. The data have been collected from audited financial statements of the eight sample private commercial banks for the period 2010 to 2019 from National Bank of Ethiopia and Ministry of Finance and Economic Cooperation.

Methodology

This study has applied quantitative research approach which would allow the researcher to measure and analyze the data collected. This study is purely quantitative research and in order to achieve the research objective secondary data have been used. The data have been collected from eight sample private commercial banks based on their years of establishment, sample private commercial banks were are taken namely, Lion International Bank, United Bank, Nib International Bank, Dashen Bank, Awash International Bank, Bank of Abyssinia, Wegagen Bank, and Cooperative Bank of Oromia. The sample constitutes 50% of the total private commercial banks in the industry which is reliable to infer to the total population in the industry. The researcher has used Pearson Product Moment correlation matrix to assess the strength of relation between (capital adequacy ratio, asset quality, liquidity position, number of bank branch, gross domestic product, inflation rate and interest rate) and private commercial banks’ profitability measured by ROA & ROE for the period 2010 to 2019. Multiple regression analysis was also applied to test the association of (capital adequacy ratio, asset quality, liquidity position, number of bank branch, gross domestic product, inflation rate and interest rate) with private commercial banks’ profitability measured by ROA & ROE for the period 2010 to 2019. First of all the necessary data was collected and STATA 14.0 software program was used for data processing. The data processed was presented by the use of picture and table. Data was analyzed using descriptive statistics like mean, standard deviation, minimum and maximum. The inferential statistics, correlation and OLS regression have been used.

The dependent variable of this study was return on asset (ROA) & return on equity (ROE). The independent variables of this study were capital adequacy ratio (CAR), Asset Quality (AQ), Liquidity position (LP), number of bank branch (NBB), Gross domestic product (GDP), inflation rate (INR) & interest rate (IR).

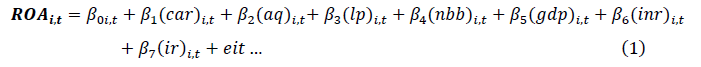

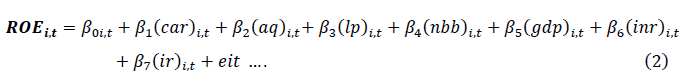

The following equations indicates fixed and random effect ordinary Least Square regression model with respect to two bank performance indicators namely ROA and ROE.ROA and ROE Multivariate Regression models formulated as follows.

The ROA Multivariate Regression model before estimation was;

The ROE Multivariate Regression model before estimation was:

Where:

ROAi, t=Return on Asset of bank i, in time t INRi, t= Inflation Rate i, in time t

ROEi, t=Return on Equity of bank i, in time t IRi, t=Interest Rate i, in time t

CARi, t= Capital Adequacy Ratio i, in time t B0i, t=Intercept of the equation of bank i, in

AQi, t= Asset Quality i, in time t time t

LPi, t= Liquidity position i, in time t Bi=Coefficients of the explanatory

NBBi, t= Number of bank branch i, in time variables

DPi, t= Growth Domestic Product i, in time t Εi= is the stochastic error term

Study Hypotheses

The study attempt to examine the following null hypotheses

H1 Capital adequacy ratio has no significant effect on private commercial banks’ profitability measured by ROA & ROE.

H2: Asset quality ratio has no significant effect on private commercial banks’ profitability measured by ROA & ROE.

H3: Liquidity position has no significant effect on private commercial banks’ profitability measured by ROA & ROE.

H4: Number of bank branch has no significant effect on private commercial banks’ profitability measured by ROA & ROE.

H5: GDP has no significant effect on private commercial banks’ profitability measured by ROA & ROE.

H6: Inflation rate has no significant effect on private commercial banks’ profitability measured by ROA & ROE.

H7: Interest rate has no significant effect on private commercial banks’ profitability measured by ROA & ROE.

Results and Discussion

Descriptive Analysis

The summary of descriptive statistics of all dependent and independent variables gives the general distribution of the data set. It measures the mean distribution, the standard deviations, minimums and maximums of the wide range of return on asset and seven explanatory variables (abbreviated) for the 8 sample banks over the ten years of study period. Both return on asset and return on equity related to independent variables namely capital adequacy ratio, asset quality, liquidity position, number of bank branch, gross domestic product, inflation rate and interest rate in Table 1.

| Table 1. Descriptive Statistics Result | |||||

| Variable | Obs | Mean | Std.Dev. | Min | Max |

| car | 80 | 0.13465 | 0.0284218 | 0.085 | 0.195 |

| aq | 80 | 0.700887 | 0.4021555 | 0.003 | 3.62 |

| lp | 80 | 37.45975 | 16. 84643 | 16.61 | 77.38 |

| nbb | 80 | 2. 176596 | 0.3106044 | 1.63347 | 2.862 |

| gdp | 80 | 6.21175 | 0.6071823 | 5.67 | 7.84 |

| inr | 80 | 0.06172 | 0.0064942 | 0.0562 | 0.0784 |

| ir | 80 | 5.382 | 0.0060378 | 5.38 | 5.4 |

| roa | 80 | 3.023625 | 0.723536 | 0.31 | 4.94 |

| roe | 80 | 23.14891 | 6.605863 | 2.65 | 40.44 |

As it is observed from table 1, the average capital adequacy ratio for the periods 2010 to 2019 stood 0.134% with standard deviation 0.028%, the result indicated in the eight private commercial banks over the ten years were not vary as a result of capital adequacy and the asset quality ratio averaged 0.07% with std. deviation 0.04%, indicating that asset quality is vary among private commercial banks. The average liquidity position for the selected period of private commercial banks is 37.45% with std.dev of 16.84%. This indicates that there is variation of liquidity position among the private commercial banks. The average of number of banks branch is 2.17% with std. deviation 0.31% indicated that eight private commercial banks under study were slightly vary as a result of their number of banks branch. The average GDP, inflation rate and interest rate is 6.21%, 0.061% and 5.38% with standard deviation of 0.6%, 0.064% and 0.06% respectively. This shows that there is no variation among these variables in the selected private commercial banks. The return on asset (ROA) and return on equity (ROE) is averaged 3.02% and 23.14% with std.dev of 0.721% and 0.511% respectively indicating that there is variation of ROA and ROE among private commercial banks of Ethiopia for the period 2010 to 2019.

Correlation Analysis

The primary objective of correlation analysis is to measure the strength or degree of linear association between two variables and the researcher is advised to treat two variables symmetrically; between the dependent and explanatory variables (Gujarati, 2004). As per Mashotra (2007) a correlation coefficient of ≥0.75 is considered strong in Table 2.

| Table 2 Correlation With Roa | ||||||||

| roa | Car | Aq | Lp | nbb | gdp | inr | ir | |

| roa | 1 | |||||||

| car | 0.4202 | 1 | ||||||

| aq | 0.178 | -0.0054 | 1 | |||||

| lp | 0.5936 | 0.0726 | 0.1368 | 1 | ||||

| nbb | 0.5199 | -0.0021 | 0.1665 | 0.4267 | 1 | |||

| gdp | 0.0872 | -0.2766 | -0.0956 | 0.2239 | 0.185 | 1 | ||

| inr | 0.1924 | -0.0697 | 0.1065 | 0.3935 | 0.4363 | 0.2428 | 1 | |

| ir | 0.1003 | -0.1227 | 0.3429 | 0.4308 | 0.2196 | 0.2787 | 0.3567 | 1 |

As it can be seen from Table 2, the return on asset has moderate and positive correlation with liquidity position, number of bank branch and capital adequacy ratio accounting for 0.5936, 0.5199 and 0.4202 respectively showing that as liquidity position, the number of banks branch and capital adequacy ratio increase the banks return on asset will be improved in private commercial banks under study. As it can be seen from the above table the correlation coefficient of asset quality, gross domestic product, inflation rate and interest rate with return on asset is .178, .872, .192 and .10 respectively. This indicates that there is positive association of these variables with return on asset of private commercial banks.

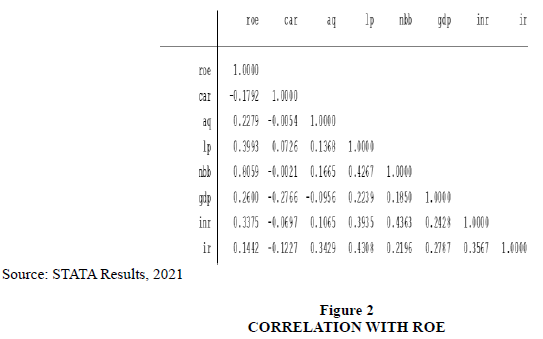

As it can be observed from the above Figure 2 the correlation coefficient of return on equity to number of branch is 0.8059 indicating that an increase in number of branch by private commercial bank has to make return on equity to increase by the same direction which means there is strong positive correlation.

The correlation coefficient of return on equity to asset quality, liquidity position, gross domestic product, inflation rate and interest rate is 0.227, 0.399, 0.260, 0.337 and 0.144 respectively indicating that there is positive association between theses variable and return on equity of private commercial banks under study for the study period. The correlation coefficient of capital adequacy ratio with return on equity is -0.179 which indicate that there weak negative correlation between them.

Regression Analysis

This section presents the overall results of the regression analysis on the determinants of bank financial performance. In this study ROA and ROE was used as proxy for performance measure.

The regression coefficients are analyzed for the independent and dependent variables to identify both magnitude and the direction of impact. Under the following regression outputs the beta coefficient may be negative or positive; beta indicates that each variable’s level of influence on the dependent variable. P-value indicates at what percentage or precession level of each variable is significant. R2 values indicate the explanatory power of the model and in this study adjusted R2 value which takes into account the loss of degrees of freedom associated with adding extra variables were inferred to see the explanatory powers of the models. The random effect regression result was presented in the following Figure 2 below.

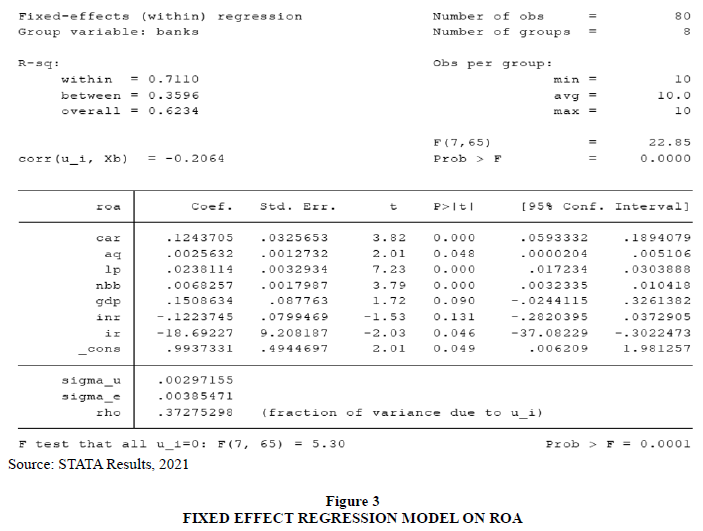

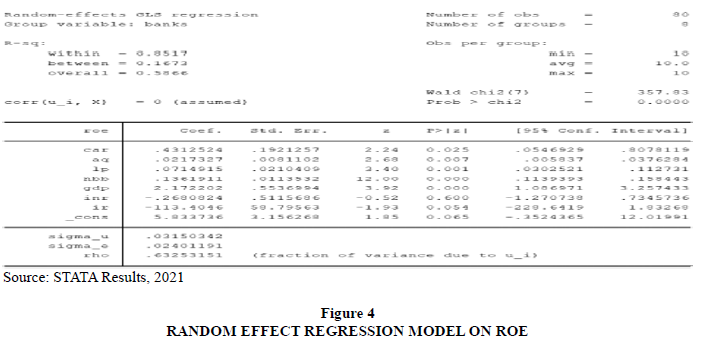

To determine either to use fixed or random effect model for ROA the researcher has used hausman test.Since the p value is less than five (p<5%), fixed effect model was selected. Therefore, fixed effect model is more fit and explain the dependent variable considering the independent variables. On the other hand, to decide either to use fixed or random effect model for ROE, the researcher has used Hausman test and random effect model was selected. Hence, random effect model was more fit and explain the dependent variable with independent variables.

The hypotheses of the study have been tested by using ordinary Least Square fixed effects methods; Figure 2 shows the results. It can be noticed from Figure 3 the F statistics in the fixed effect model (FE) is 22.85 with probability (F = 0.000) which indicates a good fitness of the predictability of the model used. This indicates that the overall model is highly significant at 1% and that all the independent variables are jointly significant in causing variation in banks’ ROA means there is significant relationship between the dependent variable and the independent variables. The R-squared indicates the strength of interpretation in fixed effect model as it is explained by 62.34% variation in the profitability in private commercial bank of Ethiopia for the period 2010 to 2019 as measured by (ROA) but the remaining 37.66% variation in return on asset of banks’ under study are caused by other factors that are not included in this study.

Based on the Figure 4, the internal factors; capital adequacy, asset quality, liquidity 2position and number of bank branch had significant effects on financial performance of private commercial banks measured by ROA. Furthermore, among the external variables only interest rate had significant impact on performance.

The p-value for the internal factors namely, capital adequacy, asset quality, liquidity position and number of bank branch were 0.000, 0.048, 0.000 and 0.000 respectively. This indicates that all bank specific factors used in this study were statistically significant at 5% significance level. On the other hand the p- value for external factors namely, gross domestic product, inflation rate and interest rate were 0.090, 0.131 and 0.046 respectively this shows that only interest rate were statistically significantly to affect the financial performance of private commercial banks.

When we see the above table individual coefficient among the explanatory variables, capital adequacy, asset quality, liquidity position, number of bank branch and gross domestic product had a coefficient of 0.124, 0.0025, 0.023, 0.006, and 0.150 respectively. This revealed that there was a positive relationship between the independent variables like capital adequacy, asset quality, liquidity position, number of bank branch and gross domestic product with the dependent variable ROA. Thus, the decrease of those variables will lead to a decrease in ROA and also the increase of those variables will lead to an increase in ROA. On the other hand the coefficient of explanatory variables, inflation rate and interest rate were -0.1223 and -0.1869 respectively. This revealed that there was a negative relationship between these independent variables and ROA.

Research hypothesis is a predictive statement that relates an independent variable to dependent variable. Hypothesis-testing will result in either accepting the hypothesis or in rejecting the hypothesis based on the P-values and the most common decision rule is to reject the null hypothesis if the p-value is less than or equal to 0.05 and to retain or accept it otherwise (Bryman & Cramer, 2005; Kothir, 2004). Accordingly, the seven null hypotheses formulated on the return on asset were tested at 5 percent significance level. Therefore, the first (Ho1), second (Ho2), third (Ho3), fourth (Ho4), and seventh (Ho7), null hypothesis were rejected which indicates that there is significant relationship between capital adequacy, asset quality, liquidity position, number of bank branch and interest rate and return on asset in private commercial bank of Ethiopia for the period 2010 to 2019. It indicates that the alternate hypothesis has been accepted. However, the fifth null hypothesis (Ho5) and sixth null hypothesis (Ho6) were accepted which indicates that there is no statistically significant relationship between GDP and ROA; and between Inflation and ROA respectively in private commercial bank of Ethiopia for the period 2010 to 2019 as observed in Figure 4.

The hypotheses of the study were tested by using ordinary Least Square random effects methods; Figure 3 shows the results. It can be noticed from Figure 4 the Wald chi square statistics in the random effect model (RE) is 357.83 with probability (F= 0.000) which indicated a good fitness of the predictability of the model used. Indicates that the overall model is highly significant at 1% and that all the independent variables are jointly significant in causing variation in banks’ ROE means there is significant relationship between the dependent variable and the independent variables.

Based on the Figure 3, the internal factors; capital adequacy, asset quality, liquidity position, number of bank branch had significant effects on performance of private commercial banks. Furthermore, among the external variables only GDP had significant impact on financial performance of private banks measured by ROE. The p-value for the internal factors namely, capital adequacy, asset quality, liquidity position and number of bank branch were 0.025, 0.007, 0.001 and 0.000 respectively. This indicates that all bank specific factors used in this study were statistically significant at 5% significance level. On the other hand the p- value for external factors namely, gross domestic product, inflation rate and interest rate were 0.000, 0.600 and 0.054 respectively this shows that only gross domestic product were significantly affect the financial performance of private commercial banks measured by ROE.

When we see the above table individual coefficient among the explanatory variables, capital adequacy, asset quality, liquidity position, number of bank branch and gross domestic product had a coefficient of 0.43, 0.021, 0.071, 0.136, and 2.172 respectively. This revealed that there was a positive relationship between the independent variables like capital adequacy, asset quality, liquidity position, number of bank branch and gross domestic product with the dependent variable ROE. Thus, the decrease of those variables will lead to a decrease in ROE and also the increase of those variables will lead to an increase in ROE.

Here also the seven null hypotheses formulated on the return on equity were testes at 5 percent significance level. Therefore, the first five null hypothesis; Ho1, Ho2, Ho3, Ho4, and Ho5 were rejected which indicates that there is relationship between return on equity and capital adequacy, asset quality, liquidity position, number of bank branch and gross domestic product in private commercial bank of Ethiopia for the period 2010 to 2019.

However, the sixth (Ho6) and seventh (Ho7) null hypothesis were accepted which indicates that there is no statistically significant relationship between inflation rate and ROE; and between interest rate and ROE respectively in private commercial bank of Ethiopia for the period 2010 to 2019 as observed in Figure 4 and Table 3.

| Table 3 Summary of Hypothesis Testing | ||

| Hypothesis | Result | |

| ROA | ROE | |

| Ho1: Capital adequacy ratio has no significant effect on private commercial banks’ profitability | Rejected | Rejected |

| Ho2: Asset quality ratio has no significant effect on private commercial banks’ profitability measured by ROA & ROE. | Rejected | Rejected |

| Ho3: Liquidity position has no significant effect on private commercial banks’ profitability measured by ROA & ROE. | Rejected | Rejected |

| Ho4: Number of bank branch has no significant effect on private banks’ profitability measured by ROA & ROE. | Rejected | Rejected |

| Ho5: GDP growth rate has no significant effect on private commercial banks’ profitability measured by ROA & ROE. | Accepted | Rejected |

| Ho6: Inflation rate has no significant effect on private banks’ ROA & ROE. | Accepted | Accepted |

| Ho7: Interest rate has no significant effect on private banks’ profitability measured by ROA & ROE. | Rejected | Accepted |

Conclusion and Recommendations

Conclusion

This study has tried to analyze the determinant of financial performance (in terms of ROA & ROE) in private commercial banks of Ethiopia for the period 2010-2019. To conduct the study, secondary data particularly audited financial statements were collected from eight sampled private banks. Besides, both descriptive and inferential analyses were used to analyze the data. The major findings of the study were as follows;

Capital adequacy ratio has positive significant impact on both banks return on asset (ROA) & return on equity (ROE). That means, the higher equity capital the banks have, the more the banks become financially sound. Asset quality has also positive and significant effect on return on asset (ROA) & return on equity (ROE). This indicates that good asset quality will increase the banks financial performance. Liquidity position has positively and significantly affected both return on asset (ROA) & return on equity (ROE). This indicates that the higher liquidity positions of the banks are the higher their ability they generate profit. As per this study number of bank branches has positive and significant effect on banks return on asset (ROA) & return on equity (ROE). This reveals that as number of banks branch increase the financial performance of the banks will increase. Gross domestic product has positive & insignificant impact on banks return on return on equity (ROE). Interest rate has negative insignificant impact on banks return on asset. This indicates increasing interest rate make private commercial bank to decrease their banks return on asset (ROA).

Recommendations

Based on the above findings, researcher forwarded the following possible recommendations to the concerned bodies. Based on the finding of the study, the Ethiopian commercial banks were mainly affected by the internal factors, because all the bank specific factors had significant impact on the bank financial performance. According to this study, capital adequacy has positive and significant effect on return on asset (ROA) & return on equity (ROE) of private commercial bank. Therefore, private commercial banks in Ethiopia should create enough capital through issuance of shares, investment and increasing the amount of retained earnings to run their business in healthy way since better capital reduces the chance of suffering and it increase their profit. Asset quality has also positive and significant impact on return on asset (ROA) & return on equity (ROE). This shows that Poor asset quality increases risk relative to companies with more stable asset quality and may limit future growth potential, both of which may negatively impact returns to shareholders. Therefore, the private commercial banks should make investment on more stable asset quality. Liquidity position of banks has also statistically positive impact on the financial soundness of private commercial banks. Therefore, the private commercial banks should improve the liquidity position by using long-term financing rather than short-term financing to finance projects. Removing short-term debt from the balance sheet allows a company to keep some liquidity which may enhances them to improve their financial performance. According to this study, expansion of bank branch has positive and significant effect on return on asset (ROA) & return on equity (ROE) of private commercial bank. Therefore, private commercial banks under study board of directors & concerned management body are suggested to increase bank branch where existing and potential customers are situated in Ethiopia.

Direction for Further Research

This study can be replicated in other industries to establish what the determinants of firm performance are. Thus studies can be done in other sectors of the economy such as manufacturing sector to determine the firm specific factors that influence their performance. Other researchers are also recommended to include other variables by broadening its base and updated situations. There is also need to carry out the same study in the banking industry in Ethiopia while employing a different model and approach in order to compare the results and for generalization

References

- Ahmad, A.U.F., & Hassan, M.K. (2007). Regulation and Performance of IslamicBanking in Bangladesh Thunderbird International Business Review, 49(2).

- Akingunola, R.O., Adekunle, O.A., & Adedipe, O.A. (2013). Corporate governance and bank’s performance in Nigeria (Post–bank’s consolidation). European Journal of Business and Social Sciences, 2(8), 89-111.

- Alem, G. (2011). A study on the application of corporate governance principles in the Ethiopian private commercial banks in case of lion international bank.

- Aspal, P.K., & Sanjeev, Dh. (2016). Camels Rating Model for Evaluating Financial Performance of Banking Sector: A Theoretical Perspective. International Journal of System Modeling and Simulation, 1(3).

- Athanasoglou, A.D., & Gioka.D. (2007). The use of data envelope analysis in banking institution performance, Evidence from commercial bank of Greece, Interfaces, 30(2),81.

- Athanasoglou, P., Brissimis, S., & Delis, M (2008). Bank-specific, industry-specific and macroeconomic determinants of bank profitability. Journal of International Financial Markets, Institutions, and Money, 18(1), 121-36.

- Ayele, H.N. (2012). Determinants of bank profitability: An empirical study on Ethiopian private commercial banks. Addis Ababa University.

- Ayele, H.N. (2012). Determinants of Bank Profitability: An Empirical Study on Ethiopian Private Commercial Banks. Unpublished MBA Project, Addis Ababa University.

- Bodie, Z., Kane, A., Marcus, A.J., & Mohanty, P. (2005). Investments. 6th Edition, Tata McGraw-Hill Publishing Company. New Delhi.

- Bogale, Y.W. (2019). Factors Affecting Profitability of Banks: Empirical Evidence from Ethiopian Private Commercial Banks. Journal of Investment and Management, 8(1), 8-15.

- Chantapong, S. (2005). Comparative Studies of Foreign and local banks in Thailand.

- Chekole, Y.D. (2016). Internal Determinants of Dividend Payout in Private Commercial Banks in Ethiopia. Addis Ababa, Ethiopia: unpublished.

- Davidsson, P., Steffens, P., & Fitzsimmons, J. (2009). Growing profitable or growing from profits: Putting the horse in front of the cart?. Journal of business venturing, 24(4), 388-406.

- Dawit, F. (2016). Determinants of commercial banks financial performance in Ethiopia. A thesis, Department of Accounting and Finance College of Business and Economics Addis Ababa University, Addis Ababa, Ethiopia.

- Demirguc-Kunt, A., & Huizinga, H. (1999). Determinants of Commercial Bank Interest Margins and Profitability Some International Evidence.

- Diamond, D.W., & Dybvig, P.H. (1983). Bank runs, deposit insurance, and liquidity. Journal of Political Economy, 91(3), 401-419.

- Ebisa, D. (2012). The effects of post 1991 Era financial sector deregulations in Ethiopia: An inspirational guide for agribusiness. Basic Research Journal of Agricultural Science and Review, 1(4), 81-87.

- Ermias, M. (2016). Financial Performance of Private Commercial Banks in Ethiopia: A CAMEL Approach. A Thesis. Department of Accounting and Finance Addis Ababa University, Addis Ababa, Ethiopia.

- Erna, R., & Ekki, S. (2004). Factors Affecting Mudaraba Deposits in Indonesia. Working Paper in Economics and Development Studies. Padjadjaran University, Indonesia.

- Fasil, A., & Merhatbeb, T. (2009). Law of banking, negotiable instruments and insurance. Teaching Material.

- Flamini, V., McDonald, C.A., & Schumacher, L.B. (2009). The determinants of commercial bank profitability in Sub-Saharan Africa. IMF Working Papers, 1-30.

- Gemechu. A. (2016). Determinants of banks’ profitability: evidence from banking industry in Ethiopia. International Journal of Economics, Commerce and Management, 4(2), 442-463.

- Goddard, J., Molyneux, P., & Wilson, J.O. (2004). The profitability of European banks: a cross-sectional and dynamic panel analysis. The Manchester School, 72(3), 363-381.

- Gujarati, D.N. (2003). Basic Econometrics” fourth edition McGraw-Hill. New York.

- Gul, S., Irshad, F., & Zaman, K. (2011). Factors Affecting Bank Profitability in Pakistan. Romanian Economic Journal, 14(39).

- Hassan Al-Tamimi, H.A. (2010). Factors influencing performance of the UAE Islamic and conventional national banks. Global Journal of Business Research, 4(2), 1-9.

- Hassan, O.M. (2016). Effect of interest rate on commercial bank deposits in Nigeria (2000-2013). In Proceeding of the First American Academic Research Conference on Global Business, Economics, Finance and Social Sciences (AAR16 New York Conference).

- Iheanyi, I.H., & Sotonye, I. (2017). Assessing the performance of Nigeria’s bank through camel model. Journal of Accounting and Financial Management, 3(1).

- Ilhomovich, S.E. (2009). Factors affecting the performance of foreign bank in Malaysia (Doctoral dissertation, Universiti Utara Malaysia).

- Karasulu, M. (2001). The profitability of the banking sector in Korea. IMF Country Report, July.

- Khrawish, H.A. (2011). Determinants of commercial banks performance: Evidence from Jordan. International Research Journal of Finance and Economics, 81(1), 148-159.

- Kothari, C.R. (2004). Research methodology: Methods and techniques. New Age International.

- Li, Y. (1999). Determinants of Banks ‘Profitability and its Implication on Risk Management Practices: Panel Evidence from the UK in the Period.

- Lipunga, A.M. (2014). Determinants of profitability of listed commercial banks in developing countries: Evidence from Malawi. Research Journal of Finance and Accounting, 5(6), 41-49.

- Mulualem, G. (2015). Analyzing Financial Performance of Commercial Banks in Ethiopia: CAMEL Approach (Doctoral dissertation, Addis Ababa University).

- Mulunesh, T. (2018). Determinants of deposit mobilization of private commercial banks in Ethiopia. Nekemete: Wollega University.

- Muralidhara, P., & Lingam, C. (2017). Camel Model as an Effective Measure of Financial Performance of Nationalised Banks. International Journal of Pure and Applied Mathematics, 117(7), 255-262.

- Obamuyi, T.M. (2013). Factors influencing investment decisions in capital market: A study of individual investors in Nigeria. Organizations and markets in emerging economies, 4(07), 141-161.

- Olalekan, A., & Adeyinka, S. (2013). Capital adequacy and banks’ profitability: An empirical evidence from Nigeria. American International Journal of Contemporary Research, 3(10), 87-93.

- Ongore, V.O., & Kusa, G.M. (2013). Determinants of Financial Performance of Commercial Private Commercial Banks. Unpublished MBA Project, Addis Ababa University.

- Palamalai, S., & Saminathan, Y. (2016). A CAMEL model analysis of public, private and foreign sector banks in India. Pacific Business Review International, 8(9), 45-57.

- Rao, K.R.M., & Lakew, T.B. (2012). Determinants of profitability of commercial banks in a developing country: Evidence from Ethiopia. International journal of accounting and financial management research, 2(3), 1-20.

- Report. (2010/11) annual, Governor’s Note, 2010/11, unpublished. Ethiopia.

- Said, R.M., & Tumin, M.H. (2011). Performance and financial ratios of commercial banks in Malaysia and China. International Review of Business Research Papers, 7(2), 157-169.

- Samuel, A. (2015). Determinants of Commercial Banks Profitability: The Case of Ethiopian Commercial Banks. Unpublished Master’s Thesis. Addis Ababa University.

- Sangmi, M.U.D., & Nazir, T. (2010). Analyzing financial performance of commercial banks in India: Application of CAMEL model. Pakistan Journal of Commerce and Social Sciences (PJCSS), 4(1), 40-55.

- Semu, Z.S. (2010). Impact of reducing loan by Ethiopian banks on their own performance (Doctoral dissertation).

- Sisay, M. (2008). Determinants of Recent Inflation in Ethiopia. MPRA Paper.

- Tadios, M. (2016). A Comparative Study on the Financial Performance of Commercial Banks in Ethiopia-An Application of CAMEL Model. Thesis, Department of Project Management, Addis Ababa University, Addis Ababa, Ethiopia.

- Wen, W. (2010). Ownership structure and banking performance: New evidence in China. Universitat Autònoma de Barcelona Departament D’economia de L’empresa, 24, 674-712.

- Worku, G. (2006). liquidity and its impact on performance of commercial banks in Ethiopia'. MSc project paper: Addis Ababa University.

- Zafar, S.T., Chaubey, D.S., & Khalid, S.M. (2012). A study on dividend policy and its impact on the shareholders wealth in selected banking companies in India. International Journal of Financial Management, 2(3), 79.