Research Article: 2022 Vol: 28 Issue: 4

Determinants of Entrepreneurial Growth in Nigeria: Factor and Principal Component Analyses

Egberi, Kelvin A, Delta State University of Sciences and Technology

Citation Information: Kelvin, E.A. (2022). Determinants of entrepreneurial growth in Nigeria: Factor and principal component analyses. Academy of Entrepreneurship Journal, 28(4), 1-8.

Abstract

This paper investigated the determinants of entrepreneurial growth in Nigeria using the cross-sectional survey design. Five (5) determinants of entrepreneurial growth were assessed - global competition, cultural resistance to entrepreneurial activity, taxes and regulations, capital financing and economic potential of innovation. To carry out the study, questionnaires were administered to five hundred and forty-five (545) respondents in the six (6) geopolitical regions of Nigeria. The analytical framework was based on the factor and principal component analyses. The approximation chi-square result supports the factorability of correlation matrix and suitability of dataset for factor analysis. More so, the principal component analysis showed that among the identified determinants of entrepreneurial growth, capital financing had the highest commonality while taxes and regulations had the lowest. This implies that capital financing is the most significant factor driving or determining the growth of entrepreneurial activities in Nigeria. Based on the findings, it was recommended among others that Nigerian government and other established agencies on entrepreneurships should assist in promotion of entrepreneurial activities by providing the required funding for the growth of entrepreneurs.

Keywords

Entrepreneurship, Capital Financing, Taxes, Global Competition, Culture.

JEL Classifications

L25, M10, M19.

Introduction

In recent times, entrepreneurship serves as one of the most vital mechanisms of economic growth in developing economies, given that entrepreneurs create value in diverse such as offering goods and services for customers, creating of jobs for the unemployed as well as expanding the tax base of the government. According to Vukovi´c et al. (2022), entrepreneurship has become a dynamic for promoting economic growth and has assisted most economies in manpower, innovations and revenue generation. Amundam (2019) opines that Nigeria as a nation has seen vital economic transformation due to the appearance of entrepreneurial activities.

Onwumere & Egbo (2008) asserted that the factors enhancing entrepreneurial growth in Nigeria are neither very high nor very low; however, they are merely fair enough to stimulate entrepreneurial growth. Thus one of the reasons why Africa and Nigeria inclusive, are still struggling to create wealth for themselves and the local community (Olawale, 2010; Cant & Wiid, 2013; Sitharam & Hoque, 2016). Fundamental among the factors promoting entrepreneurial growth as acknowledged in management literature encompassed but not limited to global competition, cultural resistance to entrepreneurial activity, taxes and regulations, capital financing and economic potential of innovation (Alexander & Honig, 2016; Jwara & Hoque, 2018; Megaravalli & Sampagnaro, 2019; Bashir et al., 2020).

Unfortunately, these factors inter-alia has acted unfairly in stimulating growth of entrepreneurial activities, thus resulting to underperformance of entrepreneurship in Nigeria and their inability to occupy the ‘front seat’ in global economy. More so, the downturn in economic growth has shown inadequacies of infrastructures in all regions of the Nigerian federation in promoting the creation and growth of entrepreneurial activities. In light of the above, this paper attempts to assess the determinants of entrepreneurial growth in Nigeria using the factor and principal component analysis.

Review of Related Literature

Determinants of Entrepreneurial Growth

In this study, five (5) determinants of entrepreneurial growth were identified and briefly discussed:

Capital financing

In Nigeria, most entrepreneurs have very inadequate access to capital financing (financial support) for their enterprise. Bar-Lev et al. (2019) noted that access to capital financing is the starting point for successful ventures. The issue of capital financing is worsened due to the fact that majority of Africa and Nigerian populace are impoverished and hence has little or no savings from which they can fund their enterprise (Haron et al., 2013; Martínez Sola et al., 2014).

Furthermore, since salaries and wages are squat for even the working class who may the desirous of funding entrepreneurial activities coupled with the high level of unemployment rate, the opportunity for entrepreneurs to have access to fund becomes very inadequate or limited (Eryanto & Swaramarinda, 2018; Awan & Ahmad, 2017). Given the widespread financial circumstance of the people, and economic condition in particular, the chances of having access to capital funding from friends, relations and government is also limited.

With this, entrepreneurs strive to obtain loans from deposit money banks and even when the loans are approved, the rates of interests are mostly very high for the entrepreneurs to contend with. Consequently, one of the surest ways they can get capital financing for their enterprise is via instrumentality of the government and agencies targeted at promoting entrepreneurial activities (Linan & Chen, 2009). In this paper, we identified capital financing, so as to see if it serves as a determinant of entrepreneurial growth in Nigeria.

Taxes and Regulations

Prior empirical studies have shown that taxes and government regulations affect the growth of entrepreneurial activities (Bergmann et al., 2018; Toktamysov et al., 2019). Studies have shown that marginal tax rates affect the creation and exit of entrepreneurial activities (Megaravalli & Sampagnaro, 2018; Avram & Sabou, 2016). Perhaps, the effect imposed by tax and stern government regulations may have influenced the creation and the numbers of entrepreneurs leaving the business landscape.

Remarkably, there is a general consensus that small enterprises face inexplicably greater compliance cost per employee when compared to larger enterprises when observing government regulations, and this has affected entrepreneurial growth in Nigeria. In this paper, we identified taxes and government regulations, so as to see if it serves as a determinant of entrepreneurial growth in Nigeria.

Cultural Resistance to Entrepreneurial Activity

Realistically, many middle-aged and older adults tend to resist entrepreneurial activities (Tsakiridou & Stergiou, 2014). According to Kolstad & Wiig (2015), most of the middle-aged and older adults condemn entrepreneurial activities and have been known to create circumstances that may be unfavorable for their growth; resistance to entrepreneurial activities has been widely known to emerge due to cultural disparity (Amundam, 2019; Bashir et al., 2020; Vukovi et al., 2022).

In the views of Alexander & Honig (2016), resistance to entrepreneurial activities may be firmly understood when it is considered that many of the middle-aged and older adults are forced to live under government influences (policies and restrictions), which in turn prohibits ownership of enterprises by them. In this paper, we identified cultural resistance to entrepreneurial activities, so as to see if it serves as a determinant of entrepreneurial growth in Nigeria.

Global Competition

In recent times, the key players in the business environment are faced with stern competition, locally and globally; this applies to entrepreneurs in Nigeria. In the management literature, there are widespread studies on global competition as it affects entrepreneurial growth (Olawale, 2010; Avram & Sabou, 2016; Amundam, 2019; Megaravalli & Sampagnaro, 2018).

Notably, entrepreneurship can effectively and efficiently compete both locally and globally, if they continue to meet the need of consumers, rely on technology and keep the business environment more flexible (Awan & Ahmad, 2017; Bar-Lev et al., 2019; Eryanto & Swaramarinda, 2018). In this paper, we identified global competition, so as to see if it serves as a determinant of entrepreneurial growth in Nigeria.

Economic Potential of Innovation

By and large, most nations seem not to pay attention to potentials on innovation in their pursuit for entrepreneurial growth (Onwumere & Egbo, 2008; Sitharam & Hoque, 2016). It is relatively factual that Nigeria has produced experts in diverse area of study but there is a fundamental disparity in these talented people to their counterparts in other countries of the world.

This fundamental disparity is one of the reasons why there are countless other world-beating, massive wealth-creating organizations from other countries of the world (Onwumere & Egbo, 2008). Thus, economic potential of innovation seeks to expand the economy and entrepreneurial activities. In this paper, we identified economic potential of innovation, so as to see if it serves as a determinant of entrepreneurial growth in Nigeria.

Methodology

In this paper, cross-sectional survey design was used because the study attempts to obtain perceptions of diverse individuals on determinants of entrepreneurial growth. The study population consists of entrepreneurs in the six (6) geopolitical regions of Nigeria. Given the large population, the purposive sampling technique was used in selecting one hundred (100) entrepreneurs from each regions of Nigeria, resulting to six hundred (600) as the study’s sample.

The main instrument of data collection was the questionnaire designed on a 4-point scale of strongly agree (SA), agree (A), disagree (D) and strongly disagree (SD) and administered to entrepreneurs in the six geopolitical regions of Nigeria. Linan & Chen (2009) recommended multi-item scales for survey study as they are considered more reliable than single-item scale.

The questionnaire was divided into two (2) segments – socio-demographic of the respondents and thematic questions on five (5) determinants identified to trigger entrepreneurial growth in Nigeria, namely global competition, cultural resistance to entrepreneurial activity, taxes and regulations, capital financing and economic potential of innovation.

The entrepreneurial determinant dimensions are likened to those employed in the studies of (Jwara & Hoque, 2018; Alexander & Honig, 2016). The reliability of the research instrument was tested via Cronbach Alpha. A study group of sixty (60) were administered the research instrument and Alpha of 0.86 was obtained, which according to Crobach as cited in (Okoro & Okoye (2016); Okoro & Ekwueme, 2020), is considered reliable for a research questionnaire.

Data obtained were analyzed by means of descriptive (graph, mean, standard deviation, minimum and maximum values) and inferential (factor and principal component analyses).

Results

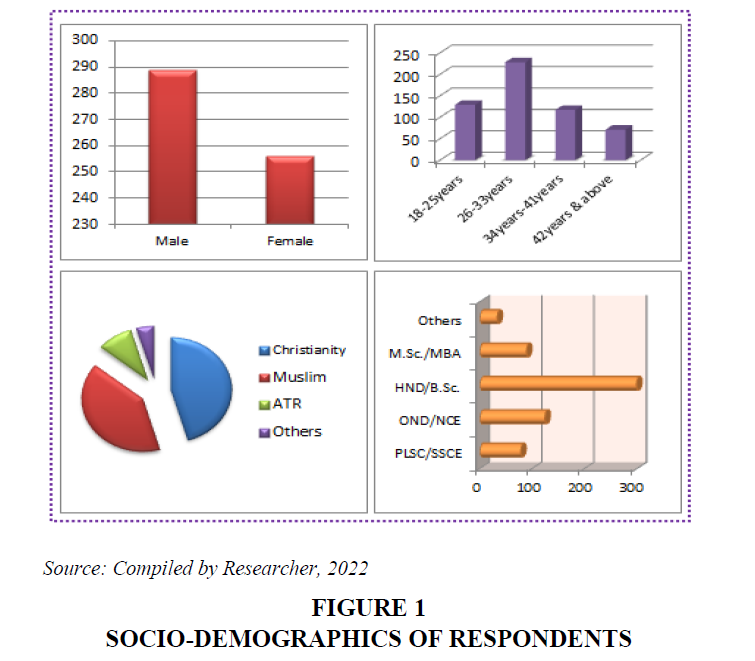

The socio-demographic of the respondents (sex, age, religion and highest level of qualification) were graphically represented as follows:

Presented in figure 1, are the socio-demographics of the respondents involving five hundred and forty-five (545) respondents retrieved out of the six hundred (600) questionnaires administered to the respondents in the six (6) geopolitical regions of Nigeria. The results revealed that two hundred and eighty-nine (289) and two hundred and fifty-six (256) of the respondents are males and females respectively. Besides, one hundred and twenty-nine (129) and two hundred and twenty-eight (228) of the respondents are within the age brackets of 18-25years and 26-33years respectively while one hundred and seventeen (117) and seventy –one (71) are within 34-41years and 42years and above respectively.

Furthermore, it was found that most of the respondents practiced Christianity (248) and Muslim (220). In terms of highest educational qualification of the sampled entrepreneurs, it was shown that seventy-eight (78) and one hundred and twenty-four (124) had primary school leaving certificate (PLSC)/secondary school certificate (SSCE) and ordinary national diploma (OND)/national education certificate (NCE) respectively while most of the respondents had first degree (HND/B.Sc. 299).

Kaiser-Meyer-Oklin (KMO) measure of sampling adequacy showed .904, which is greater than 0.05%, indicating that the research instrument on determinants of entrepreneurial growth are good enough for conducting factor analysis. Besides, Barlett test of sphericity showed that the result is statistically significant (p=0.000<0.05). The approximation chi-square (χ2=98.2) supports the factorability of correlation matrix and thus confirms its suitability for factor analysis (Table 1 and Table 2).

| Table 1 Kmo and Bartlett's Test For Determinants of Entrepreneurial Growth

|

||

|

Kaiser-Meyer-Olkin Measure of Sampling Adequacy |

.904 |

|

|

Bartlett's Test of Sphericity |

Approx. Chi-Square: |

98.2 |

|

Degree of Freedom: |

539 |

|

|

Level of Significance: |

.000 |

|

| Table 2 Eigenvalue of The Factors |

|||||

| Factor | Factor 1 | Factor 2 | Factor 3 | Factor 4 | Factor 5 |

| Eigenvalue | 1.058 | 1.044 | 1.159 | -0.123 | -0.124 |

The Eigenvalue are robustly correlated with the dimensions for assessing factors predicting entrepreneurial growth in Nigeria. In the study, there were five (5) dimensions found with Eigenvalues (global competition, cultural resistance to entrepreneurial activity, taxes/regulation, capital financing & economic potential of innovation). However, the first 3-factors (factor 1, factor 2 and factor 3) were greater than one, using the rule of thumb.

Presented in Table 3 is the factor loading estimates; the result showed that five variables are well correlated with some specific dimensions of entrepreneurial growth and this strongly showed the extent to which the variables load on the factors (global competition, cultural resistance to entrepreneurial activities, taxes and regulations, capital financing and potential of innovation.

| Table 3 Factor Loading Estimates | |||||

| S/N |

Parameters |

Factor1 | Factor2 | Factor3 | Factor4 |

| 1 2 3 4 5 |

Global competition |

0.447 0.479 0.411 0.370 0.329 |

-0.096 -0.215 -0.090 -0.095 -0.101 |

-0.211 -0.018 0.192 0.191 0.191 |

-0.212 -0.018 0.176 0.164 0.171 |

Presented in Table 4, is the commonality measurement of the determinants of entrepreneurial growth in Nigeria. The results revealed that capital financing is the major determinants of entrepreneurial growth (70%), followed by potential of innovation (58%) and cultural resistance to entrepreneurial activities (51%), and global competition (48%) while taxes and regulations (45%) had the lowest commonality loading. This implies that capital financial is the most significant factor affecting entrepreneurial growth in Nigeria.

| Table 4 Commonality Measurement

|

|||

| S/N

|

Variables

|

Uniqueness

|

Commonality (loading)2 or 1(-uniqueness)%

|

| 1 2 3 4 5

|

Capital financing |

0.297 0.420 0.490 0.520 0.550

|

70% 58% 51% 48% 45%

|

Presented in Table 5 are explained variances of dimensions of entrepreneurial growth; the results revealed that factors 1 to 4 explained about 78% of the total variance; thus global competition, cultural resistance to entrepreneurial activity, taxes and regulations, capital financing and economic potential of innovation are major determinants of entrepreneurial growth in Nigeria. The findings of the study in part corroborates with the results of (Jwara & Hoque (2018); Alexander & Honig (2016).

|

Table 5 Explained Variance |

|||

|

S/N |

Factors |

Proportion |

Explained Variance |

| 1 | Factor 1 |

0.524 |

0.78 |

| 2 | Factor 2 |

0.323 |

or |

| 3 4 |

Factor 3 Factor 4 |

0.210 |

78% |

Conclusion and Recommendations

This paper investigated the determinants of entrepreneurial growth in Nigeria. Five (5) dimensions of entrepreneurial growth were identified, namely global competition, cultural resistance to entrepreneurial activity, taxes and regulations, capital financing as well as economic potential of innovation. In order to carry out the study, questionnaire were administered to six hundred (600) respondents in the six (6) geopolitical regions of Nigeria out of which, five hundred and forty-five (545) were completely retrieved.

The analytical framework of the study was the factor and principal component analyses. Using the Kaiser-Meyer-Oklin measure of sampling adequacy, it was found that research instruments on determinants of entrepreneurial growth are good for conducting factor analysis and approximation chi-square supports the factorability of correlation matrix and suitability of dataset for factor analysis.

The commonality measurement showed that among the identified determinants of entrepreneurial growth, capital financing had the highest commonality while taxes and regulations had the lowest. Impliedly, capital financing is the most significant factor driving or determining the growth of entrepreneurial activities in Nigeria.

Based on the findings, it was recommended that the Nigerian government and other established agencies on entrepreneurships should assist in the promotion of entrepreneurial activities by providing the required funding for the growth and sustainability of entrepreneurs. Furthermore, innovation and global competition were found to be factors driving entrepreneurial activities; hence entrepreneurs should be well trained in the art of being innovative in their activities and also provided the platform for gaining global recognitions by the government.

The contribution of the study lies on the fact that it showed that capital financing is the most significant factor driving entrepreneurial growth while taxes are not. More so, the study contributes to entrepreneurship literature by filling the gaps in the literature on what is known about the determinants of entrepreneurial growth.

References

Amundam, D.N. (2019). Enhancing potential social innovative thinking, responsible, social entrepreneurship education: A curriculum content and teaching method model. Journal of Entrepreneurship Education, 22(5), 1-21

Alexander, I.K., & Honig, B. (2016). Entrepreneurial intentions: A cultural perspective. Africa Journal of Management, 2(3), 235-257.

Indexed at, Google Scholar, Cross Ref

Avram, B., & Sabou, S. (2016). The Influence of Education on the Entrepreneurial behaviour in Romania”. Analele Universitaii din Oradea-tiine Economice, 25(1), 447-457.

Awan, N., & Ahmad, N. (2017). Intentions to become an entrepreneur: Survey from university students of Karachi. International Journal of Business, Economics and Law, 13(2), 19-27.

Indexed at, Google Scholar, Cross Ref

Bar-Lev, S., Beimel, D., & Rechavi, A. (2019). To be or not to be an entrepreneur? Entrepreneurial tendencies and future orientation among male and female information-systems students. Journal of Entrepreneurship Education, 22(5), 1-13.

Bashir, Z., Arshad, M.U., Asif, M., & Khalid, N. (2020). Driving factors of growth evidence in the food and textile sectors of Pakistan. Financial Internet Quarterly, 16(1), 11-19.

Indexed at, Google Scholar, Cross Ref

Bergmann, H., Geissler, M., Hundt, C., & Grave, B. (2018). The climate for entrepreneurship at higher education institutions. Research Policy, 47(4), 700-716.

Indexed at, Google Scholar, Cross Ref

Cant, M.C., & Wiid, J.A. (2013). Establishing the challenges affecting South African SMEs. International Business & Economics Research Journal (IBER), 12(6), 707-716.

Indexed at, Google Scholar, Cross Ref

Eryanto, H., & Swaramarinda, D.R. (2018). Influence ability, perception of change and motivation to intention of entrepreneurship: overview of analysis in students of faculty of economics Universitas Negeri Jakarta. Journal of Entrepreneurship Education, 21(3), 1-10.

Haron, H., Said, S.B., Jayaraman, K., & Ismail, I. (2013). Factors influencing small medium enterprises (SMES) in obtaining loan. International Journal of Business and Social Science, 4(15).

Jwara, N., & Hoque, M. (2018). Entrepreneurial intentions among university students: A case study of Durban University of Technology. Academy of Entrepreneurship Journal, 24(3), 1-19.

Kolstad, I., & Wiig, A. (2015). Education and entrepreneurial success. Small Business Economics, 44(4), 783-796.

Indexed at, Google Scholar, Cross Ref

Linan, F. (2008). Skill and value perceptions: how do they affect entrepreneurial intentions? International Entrepreneurship and Management Journal, 4(3), 257-272.

Indexed at, Google Scholar, Cross Ref

Megaravalli, A.V., & Sampagnaro, G. (2018). Firm age and liquidity ratio as predictors of firm growth: evidence from Indian firms. Applied Economics Letters, 25(19), 1373-1375.

Indexed at, Google Scholar, Cross Ref

Megaravalli, A.V., & Sampagnaro, G. (2018). Predicting the growth of high-growth SMEs: evidence from family business firms. Journal of Family Business Management.

Indexed at, Google Scholar, Cross Ref

Martínez-Sola, C., García-Teruel, P.J., & Martínez-Solano, P. (2014). Trade credit and SME profitability. Small Business Economics, 42(3), 561-577.

Indexed at, Google Scholar, Cross Ref

Okoro, E.G. & Ekwueme, C.M. (2020). Does spirituality belong to accounting? Insights from morality, relevance and fairness dogma. Jalingo Journal of Social and Management Sciences, 2(4), 118-125

Okoro, E.G., & Okoye, E.I. (2016). Taming creative accounting via international financial reporting standards: The Nigerian scenario. Business Trends, 6(4), 11-17.

Olawale, F., & Garwe, D. (2010). Obstacles to the growth of new SMEs in South Africa: A principal component analysis approach. African journal of Business management, 4(5), 729-738.

Indexed at, Google Scholar, Cross Ref

Onwumere, J.U.J., Egbo, O.P., & Campis, E. (2008). Debilitating Factors to Entrepreneurial Development in Africa. African Journal of Entrepreneurship, 1(3).

Sitharam, S., & Hoque, M. (2016). Factors affecting the performance of small and medium enterprises in KwaZulu-Natal, South Africa. Problems and perspectives in Management, 14(2), 277-288.

Indexed at, Google Scholar, Cross Ref

Toktamysov, S.Z., Vekilova, A.I.Q., Gasimzade, E.E., Kurilova, A.A., & Mukhin, K.Y. (2019). Implementing the education of future entrepreneurs in developing countries: Agile integration of traditions and innovations. Journal of Entrepreneurship Education, 22(5), 1-13.

Tsakiridou, H. & Stergiou, K. (2014). Entrepreneurial competences and entrepreneurial intentions of students in primary education. International Journal of Humanities Social Sciences and Education, 1(9), 106-117

Vukovic, B., Peštovic, K., Mirovic, V., Jakšic, D., & Milutinovic, S. (2022). The Analysis of company growth determinants based on financial statements of the European companies. Sustainability, 14(2), 770.

Received: 11-Mar-2022, Manuscript No. AEJ-22-11391; Editor assigned: 13-Mar-2022, PreQC No. AEJ-22-11391(PQ); Reviewed: 25-Mar-2022, QC No. AEJ-22-11391; Revised: 05-Apr-2022, Manuscript No. AEJ-22-11391(R); Published: 11-Apr-2022