Research Article: 2020 Vol: 19 Issue: 6

Determinants Cash Holding of Coal Mining Companies Listed on the Indonesian Stock Exchange

Endri Endri, Universitas Mercu Buana

Sulastri Sulastri, Universitas Mercu Buana

Afriapollo Syafarudin, Universitas Mercu Buana

Bambang Mulyana, Universitas Mercu Buana

Erna S. Imaningsih, Universitas Mercu Buana

Sri Setiawati, STIE Manajemen Bisnis Indonesia

Abstract

Determining cash holding level is important to make operational companies activity can run properly. The availability of cash can affected to liquidity company level and reflection to their ability to fulfill the obligation. This study is primarily aimed at identifying significant factors that affect the level of cash holding of coal mining companies listed in the Indonesia Stock Exchange for the period 2010 to 2019. Purposive sampling technique used to select 9 coal mining companies that met the sample criteria. The test was conducted on a panel of random effect model. This study was able to prove that debt to assets ratio and net working capital had a positive effect on holding cash, while firm size, growth opportunity and coal price partially insignificant on the level of cash holding.

Keywords

Cash Holding, Debt to Asset Ratio, Firm Size, Growth Opportunity, Net Working Capital, Coal Price.

Introduction

Cash or cash equivalents had a vital role in the business activities and operations company. In terms of working capital, cash had a dominant role to daily transaction conducted by the company. Cash is liquid asset that can be cashed immediately (Endri et al., 2019). To achive the efficiency to carrying out the company’s operation activities, proper financial management is required. The effective and efficient cash management can be reflected to their ability to fulfill the obligation. Cash management refers to the financial aspects related to collection, management and cash use. Cash management activities include assessing market liquidity, cash flow and investments and are responsible for preparing a funding strategy to finance short and long term investments (Harahap et al., 2020). Cash holding is the amount of cash stored or available in the company for investment in fixed assets and also can be distributed dividends to investor. Cash holding is important to maintain company liquidity, is the measure of corporation’s ability to pay its bills on time event bad situations hits the business activities (Gill & Shah, 2012). Cash flow analysis is important to do to determine the potential income present and future when mining is carried out on a material deposit. Herewith the annual cash analysis of a mining company requires the consideration: 1) Tonnage mined a year and production levels, 2) Royalty payment on mineral selling price income each year, 3) Annual production cost, and 4) Corporate income tax. The considerations should be made due to different characteristics of the mining companies with other industries. The differences in the cash flow analysis include estimating income, estimating business risk, estimating operating costs, the concept of royalties and so on.

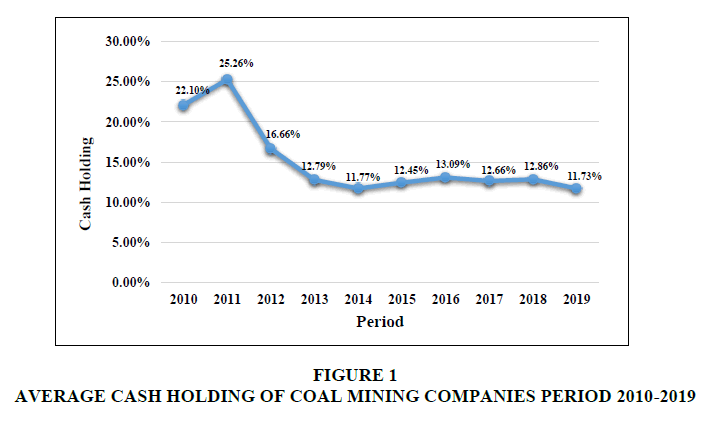

Figure 1 shows the average cash holding of coal mining companies listed in the Indonesia Stock Exchange in 2010-2019. In this picture, 2011 is the highest average of cash holding, 25.26% and furthermore gradually decreased. Generally, mining company’s cash flow is negative for several years when the project started (pre-production period) and will be positive during the production period. However, at the end of production period, the cash flow will be decreased as reduced reserves and production and it can be negative due to incur reclamation cost, mine closure cost or other social cost.

This study aims to determine factors that affect the level of cash holding of coal mining companies listed in the Indonesia Stock Exchange for the period 2010 to 2019. William & Fauzi (2013) studied about factors that effected to cash holding in mining companies period 2009-2011. The study used net working capital, cash conversion circle and growth opportunity as independent variabels and shows significant relationship with cash holding. Another study conducted by Andika et al. (2017) shows in a sample of customer good industry; it was found there was insignificant effect between net working capital and cash holding while cash conversion circles, debt to asset ratio and growth opportunity had a positive relationship with cash holding. Ogundipe et al. (2012) conducted a study on the factors that influence cash holding in non-financial companies in Nigeria showing that net working capital and firm size have negative effect with cash holding, while the relationship between debt to asset ratio and growth opportunity has a positive effect to cash holding. Aftab et al. (2018); Al-Najjar (2013) and Gill & Shah (2012) investigated that firm size had a negative impact to cash holding, this is contrast to Sutrisno & Gumanti (2016) that found firm size has a positive impact to cash holding. Arora (2019); Aftab et al. (2018) and Shabbir et al. (2016) concluded that growth opportunity has a positive effect to cash holding. Meanwhile Anjum & Malik (2013) and Thu (2018) said that growth opportunity is insignificant impact to cash holding.

Literature Review

Cash held by company is cash holding. Ogundipe et al. (2012) said that cash holding is an amount of cash held by the company that can be converted into cash easily. According to Keynes theory (Bouhdaoui & Bounie, 2012) the company have three motives of holding cash, there are transcation motive, speculative and precautionary motive, and then compensation motive. In addition to Keynes’s theory, there are two models that explain the determination of target cash balances, Baumol Model and Miller Orr Model. The Baumol Model describes the supply of cash balances and the Miller Orr Model which determines the limits in cash balances.

Debt to assets ratio is leverage ratio that shows the comparations between amount of debt and amount of assets (Endri et al., 2020). Arfan et al. (2017) explain that if financial leverage is considered as company’s ability to issue debt, the effect of financial leverage on cash holding is negative. However, if a large financial leverage is considered as a potential bankruptcy due to high agency problem of the debt, then the effect of financial leverage on the cash holding is positive. This opinion is supported by the statement of Al-Najjar (2013) which said that according to trade off theory, firm operating with high leverage likely to stockpile more cash due to their higher probability of financial distress. Ogundipe et al. (2012) argue that companies can use debt as a substitute for holding cash because leverage acts as a proxy for the company's ability to issue debt. Meanwhile, Anjum & Malik (2013) said that there is negative impact between cash holding and debt to asset ratio due to company with higher debt should be paid their responsibility, so they have less cash. In this investigation, we develop hypothesis relating to influence of debt to asset ratio on the level of cash holding as follows:

H1 Debt to Assets Ratio have influence to Cash Holding of coal mining companies listed on the Indonesia Stock Exchange in 2010-2019

Firm size is an important determinant of cash holding. Ogundipe et al. (2012) explained that smaller companies tend to have more financial constraints to make them keep more cash. Lined with Al-Najjar (2013) opinion that large firms are found to hold less cash than their small counterparts because the economic scale. The large firms have cash less because their can be got the external founding with the lower cost easly. However, Singh & Misra (2019) found that larger companies achieve growth through profitability and are likely to retain more cash than smaller one. Moreover, companies operating in large competitive industries hold larger cash reserves as compared to other industries and the companies having large access to capital market raise fund from exteral investor (Shabbir et al., 2016). In this investigation, we develop hypothesis relating to influence of firm size on the level of cash holding as follows:

H2 Firm Size have influence to Cash Holding of coal mining companies listed on the Indonesia Stock Exchange in 2010- 2019

Bigelli & Sánchez-Vidal (2012) explained that private companies with high growth opportunities as relating to high cash holding level. Arora (2019) claim that there is a positive impact between cash holding and growth opportunity, based on trade off theory. A similar opinion is expressed by Shabbir et al. (2016) that companies also consider growth opportunities while optimizing the level of cash holding. Companies having more growth opportunities are expected to carry a higher level of investment into the liquid assets. Therefore, companies with high growth opportunity have more cash reserves. Most of the empirical studies show positive impact between growth opportunity and cash holding. In this investigation, we develop hypothesis relating to influence of growth opportunity on the level of cash holding as follows:

H3 Growth Opportunity have influence to Cash Holding of coal mining companies listed on the Indonesia Stock Exchange in 2010-2019

Ogundipe et al. (2012) found negative coefficient of net working capital which is proxy for liquidity variable that firms with more liquid assets will tend to reduce their cash levels, since there assets can be used as cash subtitutes. In specific period the company only maintains one of cash or liquid assets at a high level. Occasionally, net working is also necessary to sustain activities of the company without having to wait for revenue from the main activity such as sales, so that if the company has a high net working capital, it will automatically reduce their cash balance (Arfan et al., 2017). Anjum & Malik (2013) studied determinan cash holding of non financial companies in Pakistan, they found that net work capital has positive significant relationship with cash holding and an increase in net working capital leads to higher cash balance therefore highly liquid firm tend to have higher cash balance as against lesser liquid firms. In this investigation, we develop hypothesis relating to influence of net working capital on the level of cash holding as follows:

H4 Net Working Capital has influence to Cash holding of coal mining companies listed on the Indonesia Stock Exchange in 2010 – 2019

As one of the worldwide largest coal exporting country, Indonesia becomes a world coal price reference. Coal price fluctuations makes determine of coal price in the sale and purchase agreement more difficult (Anindita, 2017). Coal price decreased were cause excess coal stock while the emergence of new energy sourcing reduce the coal demand rate and make the firms have difficulty getting the liquidity level as they want, resulting in difficulty selling the inventories by producent in obtaining cash asset to maintain liquidity. This issue makes the company more conservative and tries to minimize the liquidity risk by maintaining the liquidity level with managing the level of cash the firm has. In this investigation, we develop hypothesis relating to influence of coal price on the level of cash holding as follows:

H5 Coal price have influence to Cash Holding of coal mining companies listed on the Indonesia Stock Exchange in 2010-2019

Research Methodology

This research was conducted at coal mining companies on the Indonesia Stock Exchange in 2010 - 2019. There is total 22 coal mining companies that listed on Indonesia Stock Exchange. The research sample was selected based on purposive sampling technique according to the predetermined criteria and 9 companies that met these criteria were selected. The data used in this research is panel data which is a combination of cross section data and time series. Panel data regression analysis model which aims to determine the effect of debt to assets ratio, firm size, growth opportunity, net working capital and coal price on cash holding. Meanwhile, the data analysis used is the panel least square. The results of the Chow, Hausman, and Lagrange Multiplier tests to determine the common effect regression model (CEM), the fixed effect model (FEM) and the random effect model (REM) show that the random effect model is most suitable for the analysis.

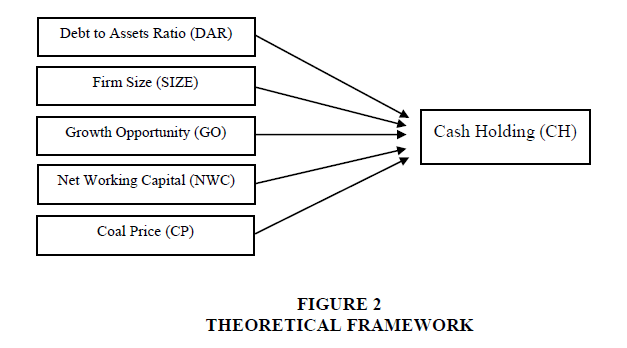

The research model in this research can be seen in Figure 2 below.

Measurement

The following are the measurements of the variables which are used in this study:

a. Cash holding (CH) is calculated by dividing cash and cash equivalents by the total assets owned by the company.

b. Debt to asset ratio (DAR) is a ratio which is used to measure the comparison between total debt and total assets.

c. Growth opportunity (GO) is proxied by sales calculated from sales in period t minus sales in period t-1 divided by sales in period t-1.

d. Net working capital (NWC) is determined by the difference between current assets and current debt and then compared with the total assets

e. The coal price (CP) is obtained from the reference coal price (HBA) at 6322 kcal calories per kg of GAR. Coal price is calculated by HBA in period t minus HBA in period t-1 then divided by HBA t-1.

Analuysis and Results

The average cash holding value of 15% indicates that cash and cash equivalents have a relatively large proportion compared to assets other than cash. The minimum value is 0.00513 and the maximum value is 0.63961 and the standard deviation is 0.13682 shows (Table 1) the difference of the company's strategies in holding cash.

| Table 1: Descriptive Statistics | ||||||

| DAR | SIZE | GO | NWC | CP | CH | |

| Mean | 0.48039 | 18.51037 | 0.12397 | 0.12701 | 0.03118 | 0.15137 |

| Median | 0.40549 | 18.46399 | 0.026 | 0.16593 | -0.04791 | 0.12432 |

| Maximum | 2.99814 | 27.60867 | 2.3036 | 0.85731 | 0.38946 | 0.63961 |

| Minimum | 0.07115 | 12.31274 | -0.74087 | -1.94502 | -0.21291 | 0.00513 |

| Std. Dev. | 0.39524 | 4.2661 | 0.49081 | 0.35763 | 0.21839 | 0.13682 |

| Skewness | 4.62862 | 0.78365 | 2.10239 | -3.26698 | 0.38167 | 1.61582 |

| Kurtosis | 27.74393 | 2.8893 | 9.71632 | 18.43866 | 1.52338 | 5.67348 |

The difference in cash holding strategies in this study is thought to be caused by information asymmetry that is reflected in the standard deviation of firm size and growth opportunity.

Based on the paired test results using the Chow test, the Hausman test, and the Breusch-Pagan Lagrange Multiplier test on the three panel data regression models above which can be seen in Table 2, it can be concluded that the random effect model is chosen to estimate and analyze the cash holding determinants of the coal mining companies listed on the Indonesia Stock Exchange in 2010 - 2019.

| Table 2: Conclusion OfData Panel Regression Model Test | |||

| No | Method | Test | Result |

| 1 | Chow Test | Common Effect vs Fixed Effect | Fixed Effect |

| 2 | Hausman Test | Fixed Effect vs Random Effect | Random Effect |

| 3 | Lagrange Multiplier BP | Common Effect vs Random Effect | Random Effect |

Estimation Model

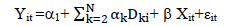

The regression equation model of random effect model in this study can be mathematically expressed by:

Through the estimation results with the Eviews 10 software are generated the estimation of panel data regression random effect model white cross section (no-heteroscedasticity) that can be seen on the Table 3 below:

| Table 3: Variable Coefficient | ||||

| Variable | Coefficient | Std. Error | t-Statistic | Prob. |

| C | 0.012339 | 0.110732 | 0.111435 | 0.9115 |

| DAR | 0.250367 | 0.067401 | 3.714587 | 0.0004 |

| SIZE | -0.00039 | 0.004761 | -0.08159 | 0.9352 |

| GO | -0.01794 | 0.018855 | -0.9515 | 0.3441 |

| NWC | 0.206763 | 0.087957 | 2.350734 | 0.0211 |

| CP | 0.061384 | 0.041274 | 1.487227 | 0.1407 |

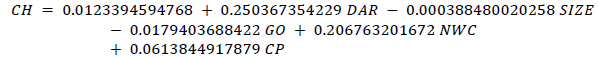

The estimation results can be written in the following equation:

Debt to asset ratio (DAR) has a β coefficient with a positive value of 0.250367 with a t-count value of 3.714587 and a significance value of 0.0004 which is smaller than α = 0.05. This shows that the DAR is proven to have a positive and significant effect on the cash holding of coal mining companies listed on the Indonesia Stock Exchange in 2010 - 2019. Firm Size (SIZE) has a coefficient of β with a negative value of 0.000388 with a t-count value of -0.081589 and a significance value of 0.9352 greater than α = 0.05. This shows that the SIZE is proven to have no effect on the cash holding of coal mining companies listed on the Indonesia Stock Exchange in 2010 - 2019. Growth opportunity (GO) has a β coefficient with a negative value of 0.017940 with a t-count value of -0.951496 and a significance value of 0.3441 greater than α = 0.05. This shows that the GO is proven to have no effect on the cash holding of coal mining companies listed on the Indonesia Stock Exchange in 2010-2019. Net working capital (NWC) has a coefficient of β with a positive value of 0.206763 with a t-count value of 2.350734 and a significance value of 0.0211 which is smaller than α = 0.05. This shows that the NWC is proven to have a positive and significant effect on the cash holding of coal mining companies listed on the Indonesia Stock Exchange in 2010 - 2019. Coal price (CP) has a β coefficient with a positive value of 0.061384 with a t-count value of 1.487227 and a significance value of 0.1407 greater than α = 0.05. This shows that the CP is proven to have no effect on the cash holding of coal mining companies listed on the Indonesia Stock Exchange in 2010 - 2019.

Discussion of Finding

Debt to asset ratio has positive significant effect on cash holding. Firms with large leverage ratio will increase their cash holding to reduce the financial distress possibility. Firms with high leverage level get external debt easily because trusted by creditors. The firm loan capability is used to cash substituting to maintain sufficient balance for the firm’s operation. When crisis period, the company will increase their debt to gain more cash (Jebran et al., 2019). The result is consistent with Ogundipe et al. (2012); Gill & Shah (2012) and Jebran et al. (2019) that debt to asset ratio has positive effect to cash holding. Whereas study of Arfan et al. (2017), Thu (2018); Maheswari & Rao (2017); Al-Najjar (2013) and Uyar & Kuyez (2014) showed negative effect between cash holding and debt to asset ratio. Firm size has an insignificant effect to cash holding. Most companies in Indonesia are conglomerate or families companies whose have one ultimate owner, so the cash holding level regulacy controlled by the ultimate (Fathony et al., 2020). This result is supports study of Thu (2018) in Energy companies on Vietnam stock market; they found that firm size has an insignificant effect to cash holding. Consistent with Arora (2019) who reported the absence of relationship between cash holding and firm size on 266 companies in India period 2005-2015. This result is contradiction with Singh & Misra (2019) and Al-Najjar (2013) who explained that firm size has negative effect to cash holding. Meanwhile, Jebran et al. (2019) study in 280 companies listed on Pakistan stock exchange found that firm size have positive effect to cash holding. Growth opportunity has an insignificant effect to cash holding due to sales growth insignificant relationship with cash holding. This result lined with Jebran et al. (2019) states that the growth opportunity doesn’t take important role in determining cash holding level in Pakistan. Thu (2018) also explained that growth opportunity has insignicant effect to cash holding in 28 Energy companies listed on Vietnam stock exchange 2010-2016. However Uyar & Kuyez (2014) argue that as partially, growth opportunity has a positif significant effect on cash holding level of non financial companies in Turkey. Ogundipe et al. (2012) showed that growth opportunity has a positive effect to cash holding of non financial companies in Nigeria.

An increase in net working capital leads to a higher cash balance because highly liquid companies tend to have more cash balance and vice versa. Cash is part of net working capital, so when cash increases, net working capital also increases. In addition, current assets beside cash can’t be used as a substitute for cash at any time because under certain condition due to current asset difficult converted into cash. Therefore, company manager usually make cash reserves to maintain the liquidity. This result supported to Anjum & Malik (2013) in Pakistan that found positive significant between net working capital and cash holding. However this result are different from previous studies conducted in various countries such as seperti Ogundipe et al. (2012) di Nigeria; Bayyurt & Nizaeva (2016) in Turki; and Gill & Shah (2012) that found negative effect between net working capital and cash holding. The result shows that firms with more liquid assets will tend to reduce their cash level because these assets can be used as a substitute for cash. Finally, this result indicated that the decision on the cash holding level of coal mining companies listed on Indonesia stock exchange in 2010-2019 is not determined by coal price reference because coal prices are very sensitive to political and economic situation of state. According to Keynes in Endri (2019) one of holding cash motive by firm is speculative and precautionary motive, so firms should be ensured the cash availability in whatever situation.

Conclusion

A higher leverage level and an increase net working capital leads to a higher cash balance due highly liquid companies tend to have more cash balance and able to comply their short term debt on time. So the operational activities can be running properly and efficiently. The companies also get opportunity to invest with their cash. As generally, the investor looked the leverage as company’s capability to satisfy their third parties, that is crediture who provide loans to the company, however some investors view that growing companies will definitely need debt as additional capital to support their operational cost which impossible to using their own capital. Cash holding in this study only revolves around the coal mining company, in further research it can be expanded to the entrie mining sector or the other industry. Furthermore, the research can be added internal ratio of firm and other external factor that are not used in this study. This research can be developed using a co cointegration panel data regression model which considers that the mean (mean) and variance are constant over time so that the estimation results are expected to be better.

References

- Aftab, U., Javid, A.Y., & Akhter, W. (2018). The determinants of cash holdings around different regions of the world. Business and Economic Review, 10(2), 151-181.

- Al-Najjar, B. (2013). The financial determinants of corporate cash holdings: Evidence from some emerging markets. International Business Review, 22(1), 77-88.

- Andika, S., Efni, Y., & Rokhmawati, A. (2017). Analysis of the influence of cash conversion cycle, leverage, net working capital, and growth opportunity on company cash holdings (Case study of consumer goods industry companies in Indonesia stock exchange 2010-2015 period). JOM Fekon, 4 (1), 1479-1493.

- Anindita, T. (2017). Analysis of the effect of usd exchange, referenced coal price, and production volume on export volume in bukit asam (persero) tbk. Journal of Industrial Management and Logistics, 1 (2), 111-120.

- Anjum, S., & Malik, Q.A. (2013). Determinants of corporate liquidity-An analysis of cash holdings. Journal of Business and Management, 7(2), 94-100.

- Arfan, M., Basri, H., Handayani, R., Shabri, M.S.A., Fahlevi, H., & Dianah, A. (2017). Determinants of cash holding of listed manufacturing companies in the Indonesian stock exchange. DLSU Business and Economics Review, 26(2), 1-12.

- Arora, R.K. (2019). Corporate Cash Holdings: An Empirical Investigation of Indian Companies. Global Business Review, 20(4), 1088-1106.

- Bayyurt, N., & Nizaeva, M. (2016). Determinants of Corporate Cash Holdings: The Case Of An Emerging Market. Journal of International Scientific Publications, 10(1), 191-201.

- Bigelli, M., & Sánchez-Vidal, J. (2012). Cash holdings in private firms. Journal of Banking & Finance, 36(1), 26-35.

- Bouhdaoui, Y., & Bounie, D. (2012). Modeling the share of cash payments in the economy: An application to France. International Journal of Central Banking, 8(4), 175-195

- Endri, E. Dermawan, D., Abidin, Z., & Riyanto, S. (2019). Effect of financial performance on stock return: Evidence from the food and beverages sector. International Journal of Innovation, Creativity and Chang, 9(10), 335-350.

- Endri, E., Susanti, D., Hutabarat, L., Simanjuntak, T.P., & Handayani, S. (2020). Financial performance evaluation: empirical evidence of pharmaceutical companies in Indonesia. Systematic Reviews in Pharmacy, 11(6), 803-816.

- Endri. (2019). Determinant of firm’s value: Evidence of manufacturing sectors listed in Indonesia shariah stock index. International. Journal of Recent Technology and Engineering, 8(3), 3995-3999.

- Fathony, M., Khaq, A., & Endri, E. (2020). The effect of corporate social responsibility and financial performance on stock returns. International Journal of Innovation, Creativity and Change, 13(1), 240-252.

- Gill, A., & Shah, C. (2012). Determinants of corporate cash holdings: Evidence from Canada. International journal of economics and finance, 4(1), 70-79.

- Harahap, I., Septiani, I., & Endri, E. (2020). Effect of financial performance on firms’ value of cable companies in Indonesia. Accounting, 6(6), 1103-1110.

- Jebran, K., Iqbal, A., Bhat, K.U., Khan, M.A., & Hayat, M. (2019). Determinants of corporate cash holdings in tranquil and turbulent period: Evidence from an emerging economy. Financial Innovation, 5(1), 3.

- Maheswari, Y., & Rao, V.K.T. (2017). Determinants of corporate cash holding. Global Business Review, 8(2), 1-12.

- Ogundipe, S.E., Salawu, R.O., & Ogundipe, L.O. (2012). The determinants of corporate cash holdings in Nigeria: Evidence from general method of moments (GMM). World Academy of Science, Engineering and Technology, 61, 978-984.

- Shabbir, M., Hashmi, S.H., & Chaudhary, G.M. (2016). Determinants of corporate cash holdings in Pakistan. International Journal of Organizational Leadership, 5, 50-62.

- Singh, K., & Misra, M. (2019). Financial determinants of cash holding levels: An analysis of Indian agricultural enterprises. Agricultural Economics–Czech, 65, (5), 240-248.

- Sutrisno, B., & Gumanti, T.A. (2016). The influence of the global financial crisis and company characteristics on cash holding companies in Indonesia. Journal of Business Strategy, 20 (2), 130-142.

- Thu, P.A. (2018). Factors effect on corporate cash holdings of the energy enterprises listed on Vietnam's stock market.

- Uyar, A., & Kuzey, C. (2014). Determinants of corporate cash holdings: Evidence from the emerging market of Turkey. Applied Economics, 46(9), 1035-1048.

- William, W., & Fauzi, S. (2013). Analysis of the effect of growth opportunity, net working capital, and cash conversion cycle on cash holdings of mining companies. Journal of Economics and Finance, 1 (2), 14877.