Research Article: 2022 Vol: 26 Issue: 2S

Determinants Associated With Participating In the Young Farmers Fund in Korea

Song Soo Lim, Korea University

Dae Eui Kim, Korea University

Eun Chan Choi, Korea University

Seong-Bong Jeong, Agricultural Policy Insurance & Finance Service

Abstract

The decline and aging of farmers are threatening sustainable agriculture and rural areas in Korea. The reduction in young farmers is the biggest obstacle to agriculture and rural development. To cope with such a serious challenge, the Korean government established a young farmers fund as an investment vehicle in 2020. As an ex-ante analysis, this study analyzed the perception, attitude, and willingness to participate in the investment scheme by young farmers. To this end, a survey was conducted across the country and the logistic regression model was estimated to reveal the factors that determine young farmers’ intention to participate. Results show that the financial characteristics of farms, including gross receipts, are the positive predictor of the probability of young farmers’ participation in the investment fund. The larger the sizes of government subsidies and the loan balance, the higher the interest in investment, suggests young farmers face financial constraints and collateral problems. Only when the low awareness of the young farmers fund is improved can a desirable investment ecosystem be created in the long run.

Keywords

Young Farmers, Young Farmers Fund, Agricultural Investment, Startups

Introduction

The establishment of young farmers has been a concern for agricultural policy. It is because young farmers make farming more sustainable and adaptive and contribute to climate action by using modern technologies. For instance, the European Union notes that young farmers are essential for the sustainability and competitiveness of European agriculture in the long run (Council of the European Union, 2014). However, concerns over the rapidly changing farm structure in a relatively short period arose from the fact that only one in ten European farmers were under the age of 40 years old in 2016 (Eurostat, 2020).

To foster effective generational renewal, the Common Agricultural Policy includes support measures, namely, direct payment support to young farmers (Regulation (EU) 1307/2013) and support to business startups for young farmers (Regulation (EU) 1305/2013) (European Commission, 2021). In 2007-2020, the EU allocated 9.6 billion euros or 18.3 billion euros including co-financing from member states of the setting up aid (European Court of Auditors, 2017). While recognizing the limitations and shortcomings of these measures, studies find the CAP’s support measures contribute to greater agricultural production, attracting young people into farming, and continuation of their farming career (Badan & Fintineru, 2021; Nordin & Loven, 2020; Pitson et al., 2020; Kallay & Bryan, 2019).

Likewise, under the context of Korea, the rapidly changing farm structure and the widening demographic gap between young and aged farmers is an emerging threat raising concerns about agricultural sustainability. Between 1990 and 2018, the number of farms reduced from 1.8 million in 1990 to 1.0 million in 2018, and the agricultural population dropped from 6.7 million to 2.3 million (Rhew et al., 2020). The number of farms managed by young farmers under 40 years old declined from 91,516 in 2000 to 6,859 in 2019, accounting for only 0.7% of all farms (Lim & Ma, 2021). Compared with those of the United States for 6%, Japan for 5%, and the United Kingdom for 4%, the proportion of young farmers in Korea records a minimal level (Lim & Ma, 2021).

Policy efforts to address these demographic challenges by the Korean government have been extensively developed since the 1970s, such as fostering successors and new entrants to become managers of their own farms, establishing Korea National College of Agriculture and Fisheries and initiatives to facilitate urban-rural migration (Ma et al., 2018). Albeit belated about 20 years than western developed countries and since 2010, the wave of urban-rural migrants for farming has also increased inflows of potential and new young people into agricultural sectors (Ma et al., 2018). In addition to loan and tax benefits for purchasing farmland and housing, successors and young migrants to farming are eligible for direct payment support for settlement over a three-year period (Kim, 2017; Jung, 2020).

Traditionally, the government focused on financial support policies to help smallholder or young farmers out of financial exclusion (Kim, 2014; Ojo & Baiyegunhi, 2020; Strzelecka & Zawadzka, 2021). Credit constrained farmers are those who do not have agricultural assets or land, such that they are not allowed to use them as collateral. By eliminating credit constraints, policy support can boost agricultural productivity and improve farm households (Ali et al., 2014).

A paradigm shift in public agricultural financing in the country emerged from the 2010 Act on Formation and Operation of Agricultural, Fisheries and Food Investment Funds, under which agricultural goods fund of funds was formally established. As a new policy financing instrument, the fund of funds is targeted to promote investment in the agri-food industry through public-private joint ventures. However, fund of funds has rarely been used in the agricultural investment market. A longer investment recovery period given agricultural production cycles and lower economic profitability or higher price volatility associated with raw agricultural products are considered as substantial access barriers by private investors (Park et al., 2017). Such disadvantages have been aggravated to small-scaled raw agricultural producers, who are subject to production risk deriving from the uncertain natural growth process of crops and livestock.

In a way to overcome these limitations and thus stimulate the participation of agricultural smallholders, the Korean government created a special purpose fund, the so-called Young Farmers Fund (YFF) in 2020. YFF is designed to provide funds on the basis of business ideas and growth potentials with no requirement of collaterals. Since the success of YFF is contingent on young farmers’ participation and cooperation, this study aims to perform a survey to find out young farmers’ perceptions and attitudes toward YFF and analyze potential factors that would affect their willingness to participate in the YFF scheme. This ex-ante study is the first to explore YFF’s feasibility from the perspective of young farmers and find room for improvement in its operation.

Literature Review

In the literature, there are only a few studies on fund of funds or institutional investment for agricultural venture enterprises. An earlier work by Brophy & Guthner (1988) showed that fund of funds produced superior risk-adjusted returns in the market. Regarding the factors of venture capital investment, Li & Mahoney (2011) provided evidence that market volatility deterred venture capital investments in the United States between 1980 and 2007, but its delay effect was attenuated by the high sales growth of the target industry. Zhang (2012) also emphasized a positive contribution of information to the selection of venture capital investment for non-transparent and non-liquid agricultural enterprises. Studies on venture capital funding in emerging markets show that innovation, legal structure and GDP growth are important drivers of investment (Cumming et al., 2010; Cherif & Gazdar, 2011; Groh & Wallmeroth, 2016; Bustamante et al., 2021).

Studies that examine the performance of publicly backed venture capital investments can shed light on YFF operation initiated by the Korean government. In the case of the European Investment Fund, Buzzacchi, et al., (2013) finds public ownership has a longer duration for the investment. This effect is observed for investments that yield intermediate financial returns. Using patents as a proxy for innovation, Pierrakis & Saridakis (2017) finds that publicly backed funds have a weaker impact on patent creation.

As for the performance of young farmers in Korea, Hwang, et al., (2017) find success factors, including farming scales, technological innovation and value addition, and quality certification for their products. Jeong, et al., (2019) identifies relative advantages for young farmers in terms of education levels, farmland sizes, and the adoption of new technologies. By contrast, disadvantageous factors for young farmers are identified as the lack of specialized farms, passive participation in producer organizations, and low availability of farm machines. Jeong (2020) suggests that the development of social farming create a novel opportunity for young beginning farmers, while Kim (2021) takes regionally distributed practical farms as a platform wherein regions and young farmers share production and regional base for environmental skill development, economic and educational functions and local settlement.

Materials and Methods

A survey questionnaire was built to explore young farmers’ willingness, perceptions, and attitudes towards YFF. A pre-test for the questionnaire was carried out over January 25th-29th, 2021, and it was modified and revised accordingly. This study assumed that potential beneficiaries of YFF would be found among young farmers’ organizations. In collaboration with 4-H Korea, an online survey was run by randomization between February 1st and 10th, 2021. A total of 302 questionnaires were collected, of which 300 were regarded as valid for empirical analysis.

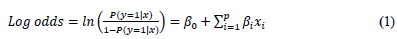

A logistic regression model is specified to explore the determinants of young farmers’ willingness to participate in YFF. Let Y is a binary response variable such that the event that Y=1 denotes the farmer’s “willing to participate” in YFF, and Y=0 is otherwise. The linear relationship between predictor (independent) variables and the log-odds or logit of Y=1 can be written in the following mathematical equation.

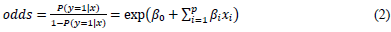

Where represents predictor variables, is the coefficient of each predictor variable and is the probability of Y=1. Then the odds can be recovered from the log odds.

is the probability of Y=1. Then the odds can be recovered from the log odds.

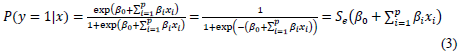

The probability of Y=1 can also reconstructed as follows.

Where Se is the sigmoid function that has a characteristic S-shaped curve. Once the coefficients of predictor variables, βiare estimated, the probability and log-odds that Y=1 for a given observation can be easily computed.

Various predictor variables can be specified to explain whether young farmers would apply for YFF. Park, et al., (2010) finds that the larger in farming scales and younger the farm households are, the more active they are in agricultural investment. It also finds evidence of the external capital constraint that farmers who lack the ability to provide collateral due to their small assets have to reduce their investment plan. Similarly, Gouk, et al., (2017) finds that the younger the farm households are, the higher propensity for making an investment. Other statistically significant variables include farm sizes, the type of crops, farming education, farm assets, and liability.

Recognizing these findings, this study forms two hypotheses on the factors that may determine whether to participate in YFF. First, the financial characteristics of young farmers, including gross receipts and net income, would be important drivers for their investment decision. Second, since farmers prefer government subsidies and financial loans to investment funds, subsidies and loans would play as a competitor to YFF. This hypothesis is built on in-depth interviews with many farmers that tend to retain their ownership in farm business and avoid interventions by investors.

H1: Financial characteristics of young farmers will affect their investment decision.

H2: Government subsidies and commercial loans will be competing factors with investment funds.

In addition to the logistic model, this study adopts a probit model to compare their results. The probit model is a specification for a binary response model, estimating the probability of an observation with particular characteristics that will fall into the Y=1 or Y=0 group. As such, the probit model deals with the same task as does the logistic model using similar techniques.

Emprical Results

Table 1 shows the regional distribution of survey respondents. Among the total of 300 respondents, Chungcheongnam-do accounts for the largest share with 27%, followed by Gyeongsangbuk-do with 22% and Jeollabuk-do with 16%. Survey respondents are evenly distributed in other regions.

| Table 1 Regional Distribution of Survey Respondents |

||||||

|---|---|---|---|---|---|---|

| Province | No. of respondents | Share (%) | Province | No. of respondents | Share (%) | |

| Gyeonggi-do | 22 | 7.3 | Chungcheongnam-do | 82 | 27.3 | |

| Incheon city | 5 | 1.7 | Chungcheongbuk-do | 14 | 4.7 | |

| Busan city | 5 | 1.7 | Gyeongsangnam-do | 21 | 7.0 | |

| Jeollanam-do | 16 | 5.3 | Gyeongsangbuk-do | 66 | 22.0 | |

| Jeollabuk-do | 47 | 15.7 | Gangwon-do | 22 | 7.0 | |

| Total | 300 | 100 | ||||

Table 2 shows legal entities and farm types of survey respondents. Respondents are mostly characterized by individual farms in their legal forms of entities and full-timers in their farm types. Respondents belonging to relatively large-scale agriculture corporations account for 12%, who are supposed to have better access to financial resources, including venture capital investments.

| Table 2 Legal Entity and Farm Types of Survey Respondents |

|||||

|---|---|---|---|---|---|

| Legal status | No. of respondents | Share (%) | Farm types | No. of respondents | Share (%) |

| Individuals | 263 | 87.7 | Full time | 224 | 74.7 |

| Agricultural association corporation | 28 | 9.3 | 1st type part time(farm income is larger than non-farm income) | 32 | 10.7 |

| Agricultural corporation | 9 | 3.0 | 2nd type part time (farm income is smaller than non-farm income) | 44 | 14.7 |

| Total | 300 | 100 | Total | 300 | 100 |

Table 3 provides summary statistics for survey respondents. The average age of respondents is about 32 years old, which is far lower than the national average of 58 years old in 2020. The average farming years are recorded at 6 years. Gross receipts are averaged to 145 million won. The average net income of 53 million won is higher than the average household income of 45 million won for all farms in 2020. About 82% of respondents answered that they had received government subsidies or loans from financial institutions. Of which, only 31% of young farmers said they had government subsidies only, while 14% of respondents said they have had only loans. The average levels of government subsidies and the loan balance are 6 million won and 168 million won, respectively.

| Table 3 Summary Statistics |

||||||

|---|---|---|---|---|---|---|

| Element | Age | Farming years | Gross receipt (100 million won) | Net income (100 million won) | Gov.Subsidies(100 million won) | Loans(100 million won) |

| Mean | 32.2 | 5.9 | 1.45 | 0.53 | 0.06 | 1.68 |

| Median | 32.0 | 5.0 | 0.6 | 0.3 | 0.04 | 0.5 |

| Maximum | 48.0 | 22.0 | 28.0 | 12.0 | 0.2 | 20 |

| Minimum | 17.0 | 1.0 | 1.1 | 1.1 | 0 | 0 |

| Std.deviation | 5.11 | 4.23 | 3.17 | 1.02 | 0.07 | 3.64 |

| Skewness | -0.09 | 1.33 | 5.55 | 8.02 | 0.94 | 3.88 |

| Kurtosis | 2.57 | 4.64 | 38.03 | 81.52 | 2.38 | 18.9 |

Survey respondents’ awareness of YFF turned out to be very low at 3.3%. In other words, most of the respondents learned about YFF through this survey. The respondents who are willing to explore YFF replied that they would like to use the investment funds to diversify their business, scale the farm size up and expand facilities. Facing credit constraints or the lack of collateral, many young farmers tend to view YFF as a window of opportunities to scale up their activities. Conversely, the provision that repayment obligations may arise after the investment is found to reduce their preference for YFF.

Table 4 shows t-test results for two groups of respondents, Y=1 and Y=0. The t-test suggests that there is a statistically significant difference between the two groups with respect to farming years, gross receipts, net income, government subsidies, and loans. The age of farmers is the only variable not to be statistically different between the two groups, which can be attributable to a narrowly defined age profile of survey respondents.

| Table 4 The Student’s T-Test Results |

||||||

|---|---|---|---|---|---|---|

| Predictor variables | Age | Farming years | Gross receipts | Net income | Government subsidies | Loans |

| P-value | 0.9470 | 0.0130** | 0.0265** | 0.0868* | 0.0385** | 0.0144** |

Table 5 shows the estimated results for the logistic regression model. For comparison, the probit model’s results are also presented. The results of the two models are quite similar, though. Estimated results suggest that farming years, gross receipts, government subsidies, and the loan balance are positively associated with the probability of the respondents’ willingness to participate in YFF. In particular, the positive coefficient estimate for gross receipts appears to support the first hypothesis that the financial characteristics of young farmers can be a valid predictor for their attitude towards YFF.

The second hypothesis is also supported by estimated results. The positive coefficient estimates indicate that investment funds like YFF can be seen as an alternative financial resource for those farmers with already high levels of government subsidies or loans. This explanation is based on the common observation that farmers in Korea prefer government subsidies or loans to an investment due to their concessional nature and secured business ownership.

| Table 5 Estimated Results |

||

|---|---|---|

| Predictor variables | Logistic model | Probit model |

| Constant | -0.5351*(0.3236) | -0.3260*(0.1978) |

| Farming years | 0.1238*** (0.0500) | 0.0770***(0.0295) |

| Gross receipts | 0.2592*(0.1544) | 0.1498*(0.0847) |

| Government subsidies | 4.1831*(2.4354) | 2.5108*(1.4070) |

| Loan | 0.2408**(0.1048) | 0.1477**(0.0629) |

2. Standard errors in parentheses.

Discussion and Conclusions

The decline and aging of farmers are threatening sustainable agriculture and rural areas in Korea. If the number of farmers continues to decrease and the aging farmers are furthered, the agricultural foundation that has been laid can collapse in the near future. The reduction in young farmers is the biggest obstacle to agriculture and rural development. To cope with such a serious challenge, the Korean government established a young farmers fund as an investment vehicle in 2020. YFF aims to provide up to 500 million won in investment funds to startups or successor farmers who are under 50 years old.

At the time of the launch of YFF, this study analyzed the perception, attitude and willingness to participate in the investment scheme for young farmers. To this end, a survey was conducted across the country and the logistic regression model was estimated to reveal the factors that determine young farmers’ intention to participate. The implications derived from this study are summarized as follows.

First, YFF is a double-edged sword due to its nature. The provision that collateral is not needed to trigger the investment funds is a decisive factor in young farmers’ positive attitude toward YFF. On the other hand, a ceiling of investment at 500 million won is insufficient for capital-intensive farms to create an enabling environment of business profitability. Nevertheless, the revealed high response that they are willing to be part of YFF suggests that financial constraints exist.

Second, financing priorities for farm households are in the order of government subsidies, loans, and investments. This is because agricultural policies that provide a variety of subsidies and loan concessions are much more advantageous from the perspective of farmers. Besides, the provision of repayment obligation often embedded in investment funds gives the perception that investment is virtually no different from loans. This in turn suggests that there may be a balance between subsidies and investments from the standpoint of individual farm households. In addition, it proposes that investment awareness will gradually improve as market-oriented farm policy programs are promoted over time.

Third, the empirical results imply that young farmers’ attitude toward YFF depends on the financial characteristics of the farms and a competitive relationship of YFF with other policy instruments. Especially, the fact that the larger the gross receipts, the higher the willingness to attract investment suggests that young farmers seek better opportunities for the economies of scale in farming. The larger the size of the loan balance, the higher the interest in YFF can be seen from the aforementioned collateral requirements.

Finally, the low awareness of the investment system by young farmers indicates the government and related organizations should actively promote and improve the accessibility of the scheme. This is because in the long run, agricultural investment competes with government subsidies or loans, creating an investment ecosystem that produces win-win results for all stakeholders, including the government, investors, and young farmers.

Acknowledgement

Funding Information

The research team fully stated that this research was funded by under the research grant of agricultural policy insurance & finance service Korea for the year 2020 and supported by a Korea university grant. The authors also stated that there was no conflict of interest in the publication of this research.

References

Ali, D., Deininger, K., & Duponchel, M. (2014). Credit constraints and agricultural productivity: Evidence from rural Rwanda. The Journal of Development Studies, 50(5), 649-665.

Crossref, GoogleScholar, Indexed at

Badan, D.N., & Fintineru, G. (2021). The new payment scheme for Romanian young farmers: Evolution and territorial characteristics.Scientific Papers Series Management, Economic Engineering in Agriculture and Rural Development, 21(3), 149-158.

Brophy, D., & Guthner, M. (1988). Publicly traded venture capital funds: Implications for institutional “fund of funds” investors. Journal of Business Venturing, 3(3), 187-206.

Crossref, GoogleScholar, Indexed at

Bustamante, C., Mingo, S., & Matusik, S. (2021). Institutions and venture capital market creation: The case of an emerging market. Journal of Business Research, 127, 1-12.

Crossref, GoogleScholar, Indexed at

Buzzacchi, L., Scellato, G., & Ughetto, E. (2013). The investment strategies of publicly sponsored venture capital funds. Journal of Banking & Finance, 37(3), 707-716.

Crossref, GoogleScholar, Indexed at

Cherif, M., & Gazdar, K. (2011). What drives venture capital investments in Europe? New results from panel data analysis. Journal of Applied Business and Economics, 12(3), 122-139.

Council of the European Union. (2014). Presidency conclusions on strengthening of EU policies for young farmers. Agriculture and Fisheries Council meeting, Brussels, 15 December 2014.

Cumming, D., Schmidt, D., & Walz, U. (2010). Legality and venture capital governance around the world. Journal of Business Venturing,25(1), 54-72.

Crossref, GoogleScholar, Indexed at

European Commission. (2021). Evaluation of the impact of the CAP on generational renewal, local development and jobs in rural areas. Commission staff working document, SWD (2021) 78 final, Brussels.

European Court of Auditors. (2017). EU support to young farmers should be better targeted to foster effective generational renewal.

Eurostat. (2020). Agriculture, forestry and fishery statistics, (2020 Edition). Luxembourg: Publication Office of the European Union.

Gouk, S., Kim, M., Hwang, E., Choi, J., & Han, B. (2017). Strategy for encouraging investment in the agricultural sector for future growth of Korean agriculture (year 2 of 2). Korea Rural Economic Institute, Research report R831.

Groh, A., & Wallmeroth, J. (2016). Determinants of venture capital investments in emerging markets. Emerging Market Review, 29, 104-132.

Hwang, I.S., Lee, J., Joo, J., Yang., & Kim, J. (2017). A study on characteristics of establishment in farming and farming level of young farmers: Focusing on excellent examples of alumnus of Korea National College of Agriculture and Fisheries. Journal of Regional Studies, 25(1), 21-45.

Jeong, S. (2020). The roles of social farming for young beginning farmers. Journal of Agricultural Extension & Community Development, 27(2), 89-110.

Jeong, Y., Hwang, J., Choi, Y., & Choi, J. (2019). Factors affecting the characteristics of agricultural management and the management performance of young farmers. Journal of Agricultural Extension & Community Development, 26(3), 143-151.

Kallay, P., & Bryan, J. (2019). Evaluation of the impact of the CAP on generational renewal. European Economic and Social Committee, Information report, NAT/766.

Kim, K. (2021). The characteristics of practical farm for young farmers. Journal of Rural Society, 31(1), 363-396.,

Li, Y., & Mahoney, J. (2011). When is venture capital projects initiated?Journal of Business Venturing, 26(2), 239-254.

Crossref, GoogleScholar, Indexed at

Lim, S., & Ma, S. (2021). Young farmers, the essence of sustainable agriculture. Korea Rural Economic Institute, Agricultural Outlook report E04-2021.

Ma, S., An, S., & Park, D. (2018). Urban-rural migration and migrants’ successful settlement in Korea. Journal of Asian sociology, 47(2), 285-312.

Nordin, M., & Loven, I. (2020). Is the setting up aid mitigating the generational renewal problem in farming?European Review of Agricultural Economics, 47(5), 1697-1715.

Crossref, GoogleScholar, Indexed at

Ojo, T., & Baiyegunhi, L. (2020). Determinants of credit constraints and its impact on the adoption of climate change adaptation strategies among rice farmers in South-West Nigeria. Journal of Economic Structures, 9, 28.

Park, J., Kim, M., Eom, J., & Han, B. (2017). Establishment of the early investment market for the agri-food industry and long-term development for agri-food fund of funds. Korea Rural Economic Institute report, November 2017.

Park, J., Hwang, E., & Kim, M. (2010). A study on investment behavior of specialized farm households and policy implication. Korea Rural Economic Institute, Research report R620.

Pitson, C., Appel, F., & Balmann, A. (2020). Policy brief on future farm demographics and structural change in selected regions of the EU. SURE Farm Policy Brief, Leibniz Institute of Agricultural Development in Transition Economies, March 2020.

Rhew, C., Kim, T., & Ha, I. (2020). Structural transformation in Korean agriculture: Changes and challenges (Year 2 of 2). Korea Rural Economic Institute, Research report R921.

Strzelecka, A., & Zawadzka, D. (2021). (CRT) Analysis to identify the agricultural households at risk of financial exclusion. Procedia Computer Science 2021, 192, 4532-4541.

Zhang, X. (2012). Study on venture capital investment risk avoiding vase on option pricing in agricultural production and processing enterprises. Physics Procedia, 33(2012), 1580-1587.

Crossref, GoogleScholar, Indexed at

Received: 10-Nov-2021, Manuscript No. ije-21-9665; Editor assigned: 16-Nov-2021, PreQC No. ije-21-9665 (PQ); Reviewed: 21-Nov-2021, QC No. ije-21-9665; Revised: 15-Dec-2021, Manuscript No. ije-21-9665 (R); Published: 01-Jan-2022