Research Article: 2021 Vol: 20 Issue: 6S

Determinants Affecting Tax Compliance of FDI Enterprises in Ho Chi Minh City

Dao Le Trung, University of Finance – Marketing (UFM)

Nga Phan Thi Hang, University of Finance – Marketing (UFM)

Thi Thuy Hang Le, University of Finance – Marketing (UFM)

Keywords:

Tax, Compliance, FDI, Enterprises, HCMC and UFM

Abstract

Over the past ten years, the tax compliance issue of large enterprises has become the top concern of policymakers and tax administrators around the world. Many enterprises concern profit maximization, business operations and spread across many regions. Besides, enterprises, especially multinational corporations, are at risk of high tax compliance. Tax compliance is not a small challenge for tax authorities. Therefore, this paper aims to determine factors affecting tax compliance of FDI enterprises in Ho Chi Ninh City (HCMC). Besides, the study surveyed 450 FDI enterprise managers and answered 16 questions, but 430 samples were processed. The data collected from June 2020 to November 2020 in HCMC. The authors used CronbachâÂ?Â?s Alpha test, Exploratory Factor Analysis (EFA), and Structural Equation Model (SEM) analysis in this study. The research results showed that there are three factors influencing tax compliance with a significance level of 0.01. Moreover, this article had policy recommendations for enhancing the tax compliance of FDI enterprises.

Introduction

Nowadays, Vietnam has implemented the policy of attracting FDI for socio-economic development. Practice shows that, with the open-door policy and strong incentives, the amount of FDI into Vietnam has continuously grown, contributing to the prosperity of Vietnam’s economy. Besides, every month, thousands of businesses register their business activities across the country. It is a challenge for tax authorities of the State to manage tax collection effectively from these enterprises. The issue of taxpayers’ tax compliance is always an essential factor that the tax authorities consider. Tax authorities are very interested.

Assessing the taxpayer’s tax compliance level to have appropriate and effective behavior in tax administration practice is the core task of tax administration agencies by Hanchez & Juan (2015). This study aims to determine the influencing factors and the degree of impact of each element on the tax compliance of taxpayers. The research results are a practical basis to help tax authorities perfect tax policies and laws. They are reforming tax administrative procedures to create maximum favorable conditions for taxpayers in complying with tax laws, meeting state budget revenue and economic management requirements in line with the ability of actors to contribute to the economy and promote production and business growth. The study surveyed more than 450 FDI enterprises’ managers in Ho Chi Minh City from June 2020 to November 2020 in HCMC. Assessing the taxpayer’s tax compliance level to have appropriate and effective behavior in tax administration practice is the core task of tax administration agencies. Therefore, this paper aims to determine critical factors affecting tax compliance of FDI enterprises in Ho Chi Minh City.

Literature Review

Tax Compliance (TAXC)

According to Hubbard (2015), Tax compliance is reporting all income paid in the complete set of tax obligations by implementing the provisions, ordinance, or court order. While according to Mann (2017), tax compliance defined means the taxpayer files a tax return appropriately and fully fulfills tax obligations as prescribed by tax laws and court decisions. Moreover, enterprises pay taxes on time. Finally, enterprises comply with taxes by Talm & Torgler (2014). Tax compliance is the extent to which the subject Taxpayers must fulfill their tax obligations by Macker (2016). Tax compliance is the taxpayer’s act of complying with tax obligations fully, voluntarily, and for the law on time by Ming & Bee (2014). FDI enterprises declare the correct information of taxable income. Therefore, considering this study’s scope is the concept of tax compliance defined as the taxpayer’s proper conduct, complete and timely tax obligations specified in current tax law Siti (2014).

The Complexity of Tax Policy (CTP)

Erard & Feinstein (2018) studied a factor proposed from the author’s qualitative research. A complex tax system is understood as a system with too many cumbersome calculations and procedures, making it difficult for tax officials to implement and maintain - businesses in tax declaration. In Sirchler (2019) study, a complex tax system is a significant cause of tax non-compliance. Tandmo (2017) asserted that the system structure taxation is an essential factor strongly influencing compliance taxpayers’ taxes. Besides, Martin & Parboteeah (2019) showed that the tax rate targets measure the system structure; events fairness of the tax system. System complexity tax; the level of technology application in tax declaration by Tomney (2015).

According to Sajzen (2014) showed that the tax system is a collection of different taxes with a unified, dialectical, and interdependent relationship, directed towards a common goal to perform specific tasks of the State in each period. Enterprises must also refer to/update other relevant regulations to calculate the correct amount of tax payable. They have rules on accounting, asset depreciation, loan interest, additional expenses, etc., which are deducted from fees when calculating tax by Sosgun (2014). CTP1: Tax policies need to be complicated for businesses to increase tax compliance by Nanouchehr & Aida (2019). CTP2: Tax policies need to be changed regularly to increase the tax compliance of enterprises. CTP3: Businesses will be less likely to voluntarily comply with taxes if tax policies are not complex by Schulze, (2016). CTP4: Maintaining a high tax rate is necessary for businesses to increase tax compliance by Sandmo (2017). From there, the hypothesis is:

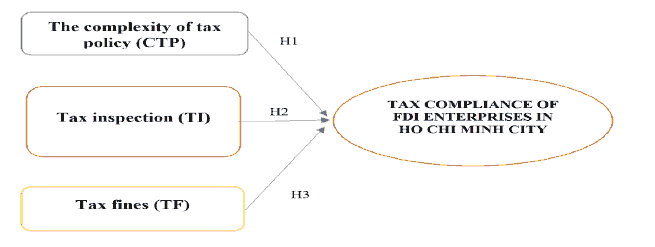

Hypothesis H1: The complexity of tax policy (CTP) positively impacts the tax compliance of FDI enterprises in HCMC.

Tax Inspection (TI)

The possibility of tax audit is a factor demonstrated in the study of Trephen (2018) on the substantial impact on tax compliance behavior. The frequency and thoroughness of the inspection make businesses more thorough in declaring and reporting income following tax obligations, and at the same time, increasing voluntary compliance. However, research by Wartick & Mark (2018) showed that coercion does not have a positive effect on tax compliance but also causes a negative correlation with tax compliance. Tax inspection is the operation of the management bodies of tax to assess the compliance with the laws of the payer taxes, verify and collect evidence to identify violations of the law on tax-based analysis information and data related to the submitter by Minsey (2017).

Rowski & Wearing (2013) studied that the tax inspection is a regular job of the tax administration’s professional nature. It is carried out at the tax office’s headquarters based on its tax return. The tax inspection is carried out at the taxpayer’s office only when they do not voluntarily amend and supplement the incorrect contents that the tax authorities have checked, discovered, and requested by Wuehlbacher & Kirchler (2017). The scope of tax inspection is examining the completeness and accuracy of information and documents in tax records to assess the taxpayer’s compliance with tax laws by Charmee (2016). TI1: The more regular the tax audit and inspection, the better the business is tax compliant by Hoelzl & Kirchler (2018). TI2: After each tax inspection - tax inspection, the better the tax compliance business. TI13: Tax audits - the more violations are detected, the better the company complies with taxes. TI14: The better the tax authority organizes tax support, the easier it is for businesses to comply with tax by Mebley (2014). So, the hypothesis is:

Hypothesis H2: Tax inspection (TI) positively impacts the tax compliance of FDI enterprises in HCMC.

Tax Fines (TF)

Tax fines are costs incurred by a taxpayer due to his or her obligation to comply with the relevant tax laws of a country by Wilde (2014). Often related to two aspects are money and time invested in tax compliance. High tax compliance costs will make business owners unhappy and avoid them by employing outside experts to evade taxes and avoid taxes subtly. The larger the penalty for tax non-compliance, the more tax-compliant businesses are. The acceptable amount is more significant than the benefit from tax evasion, tax avoidance, tax debt. The company will be more tax compliant by Kurgoyne & Webley (2013). The raising of the penalty after each act of compliance. Tax will make businesses more tax compliant. The more familiar companies are with the regulations of Tax laws, are more tax compliant Businesses need compliance costs to comply with higher tariffs by Hessing (2019).

According to Uadiale & Noah (2018), the satisfactory level is low, so it is not preventive enough. It is not strict enough for taxpayers to raise their awareness of tax compliance with the tax registration and declaration obligations—items on tax returns. To perfect the sanctioning mechanism, thereby improving the taxpayer’s sense of compliance and self-discipline to comply with the tax law, and at the same time ensuring synchronization and consistency with regulations and following the actual situation.

To improve the effectiveness and efficiency of the sanctioning of tax and invoice administrative violations by Traithwaite (2016). TF1: The larger the penalty for tax non-compliance, the better the business is tax compliant. TF2: The acceptable amount is more significant than the benefit from tax evasion, tax avoidance, tax debt, which will make companies better tax compliance. TF3: Raising the penalty level after each tax compliance act will make businesses better tax compliant by Schwarzen (2017). TF4: The more familiar companies are with the regulations of tax law, better tax compliance. TF5: Businesses need compliance costs to comply with higher taxes by Rokny (2016). So, the hypothesis is:

Hypothesis H3: Tax fines (TF) positively impacting the tax compliance of FDI enterprises in HCMC.

A research model for factors affecting the tax compliance of FDI enterprises in HCMC following as shows in Figure 1:

Figure 1: A Research Model for Factors Affecting Tax Compliance of Fdi Enterprises in Ho Chi Minh City

(Source: Authors proposed)

Methods of Research

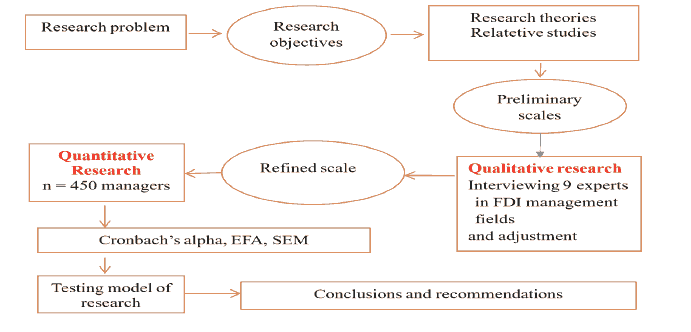

This article presents the research methods and processes used. Research methods are in the paper, including a combination of qualitative and quantitative methods as shows in Figure 2.

Figure 2: The Research Process for Factors Affecting the Tax Compliance of FDI Enterprises in HCMC

(Source: Authors proposed)

The article applied a combination of qualitative and quantitative methods.

Qualitative methods: The researchers interviewed 09 managers of 9 FDI enterprises in HCMC. The surveying results had 09 managers who agreed that all of the factors affecting the tax compliance of FDI enterprises in HCMC by Hair, Anderson, Tatham & Black (2010).

Quantitative methods: The authors surveyed 450 managers related to tax management in 150 FDI enterprises. They observed more than 10.000 FDI enterprises represented and answered 16 questions, but the sample size of 430 samples processed, and 20 samples lacked information.

The authors collected the primary sources of data from June 2020 to November 2020 in HCMC. The authors were surveying by hard copy distributed. All data collected from the questionnaire coded, processed by SPSS 20.0 and Amos. The authors tested scale reliability with Cronbach’s alpha coefficient, and Exploratory Factor Analyses (EFA) performed.

The purpose of Confirmatory Factor Analysis (CFA) helps the author to clarify: (1) Unilaterality, (2) Reliability of scale, (3) Convergence value, and (4) Difference value.

A research model considered relevant to the data if Chi-square testing is P-value>5%; CMIN/df ≤ 2.0, some cases CMIN/df maybe ≤ 3.0 or <5.0; GFI, TLI, CFI ≥ 0.9.

However, according to recent researchers’ opinions, GFI is still acceptable when it is more significant than 0.8; RMSEA ≤ 0.08. Apart from the above criteria, the test results must also ensure synthetic reliability>0.6; the Average variance extracted must be greater than 0.5 by Hair, Anderson, Tatham & Black (2010).

Finally, the authors had conclusions and recommendations for enhancing the tax compliance of FDI enterprises in HCMC.

Research Results

Testing Cronbach’s alpha for factors affecting the tax compliance of FDI enterprises in HCMC following:

Table 1 showed that Cronbach’s alpha of FDI enterprises’ tax compliance is 0.907>0.6. Besides, Cronbach’s Alpha, if Item Deleted, is more than 6.0.

| Table 1 Cronbach’s Alpha of the Tax Compliance of Fdi Enterprises |

||||

|---|---|---|---|---|

| Code | Scale Mean if Item Deleted | Scale Variance if Item Deleted | Corrected Item-Total Correlation | Cronbach’s Alpha if Item Deleted |

| TAXC1 | 6.5884 | 3.488 | 0.791 | 0.887 |

| TAXC2 | 6.6884 | 3.194 | 0.880 | 0.811 |

| TAXC3 | 6.7791 | 3.315 | 0.777 | 0.900 |

| Cronbach’s alpha is 0.907 | ||||

Table 2 showed that Cronbach’s alpha of the Complexity of Tax Policy (CTP) at FDI enterprises in HCMC is 0.865>0.6. Besides, Cronbach’s Alpha, if Item Deleted, is more than 6.0.

| Table 2 Cronbach's Alpha of the Complexity of Tax Policy (CTP) |

||||

|---|---|---|---|---|

| Code | Scale Mean if Item Deleted | Scale Variance if Item Deleted | Corrected Item-Total Correlation | Cronbach’s Alpha if Item Deleted |

| CTP1 | 10.3349 | 5.687 | 0.723 | 0.824 |

| CTP2 | 10.2233 | 5.400 | 0.732 | 0.819 |

| CTP3 | 10.3581 | 5.540 | 0.668 | 0.847 |

| CTP4 | 10.3512 | 5.548 | 0.734 | 0.819 |

| Cronbach’s alpha is 0.865 | ||||

Table 3 showed that Cronbach’s alpha of Tax Inspection (TI) at FDI enterprises in HCMC is 0.937>0.6. Besides, Cronbach’s Alpha, if Item Deleted, is more than 6.0.

| Table 3 Cronbach's Alpha of Tax Inspection (TI) |

||||

|---|---|---|---|---|

| Code | Scale Mean if Item Deleted | Scale Variance if Item Deleted | Corrected Item-Total Correlation | Cronbach’s Alpha if Item Deleted |

| TI1 | 9.3628 | 7.500 | 0.872 | 0.912 |

| TI2 | 9.3744 | 7.531 | 0.819 | 0.929 |

| TI3 | 9.3209 | 7.696 | 0.854 | 0.918 |

| TI4 | 9.2953 | 7.463 | 0.863 | 0.914 |

| Cronbach’s alpha is 0.937 | ||||

Table 4 showed that Cronbach’s alpha of the Tax Fines (TF) at FDI enterprises in HCMC is 0.874>0.6. Besides, Cronbach’s Alpha, if Item Deleted, is more than 6.0.

| Table 4 Cronbach’s Alpha of the Tax Fines (Tf) |

||||

|---|---|---|---|---|

| Code | Scale Mean if Item Deleted | Scale Variance if Item Deleted | Corrected Item-Total Correlation | Cronbach’s Alpha if Item Deleted |

| TF1 | 9.7256 | 6.055 | 0.598 | 0.871 |

| TF2 | 9.5907 | 5.426 | 0.746 | 0.836 |

| TF3 | 9.6721 | 6.156 | 0.597 | 0.871 |

| TF4 | 9.6302 | 5.306 | 0.836 | 0.814 |

| TF5 | 9.5581 | 5.203 | 0.746 | 0.837 |

| Cronbach’s alpha is 0.874 | ||||

Table 5 showed that the testing of the Confirmatory Factor Analysis (CFA) at FDI enterprises with KMO is 0.799>0.6; Sig is 0.00 (<0.01). Table 5 showed there are four components.

| Table 5 Testing of the Confirmatory Factor Analysis (Cfa) |

||||||

|---|---|---|---|---|---|---|

| Component | Initial Eigenvalues | Extraction Sums of Squared Loadings | ||||

| Total | % of variance | Cumulative % | Total | % of variance | Cumulative % | |

| 1 | 4.817 | 30.107 | 30.107 | 4.817 | 30.107 | 30.107 |

| 2 | 3.142 | 19.639 | 49.746 | 3.142 | 19.639 | 49.746 |

| 3 | 2.764 | 17.277 | 67.023 | 2.764 | 17.277 | 67.023 |

| 4 | 1.444 | 9.027 | 76.050 | 1.444 | 9.027 | 76.050 |

| 5 | 0.711 | 4.443 | 80.494 | |||

| 6 | 0.666 | 4.163 | 84.657 | |||

| 7 | 0.494 | 3.085 | 87.742 | |||

| 8 | 0.375 | 2.347 | 90.089 | |||

| 9 | 0.303 | 1.895 | 91.984 | |||

| 10 | 0.264 | 1.649 | 93.633 | |||

| … | … | … | … | |||

| 16 | 0.111 | 0.693 | 100.000 | |||

| KMO and Bartlett’s Test is 0.799; Sig is 0.00 | ||||||

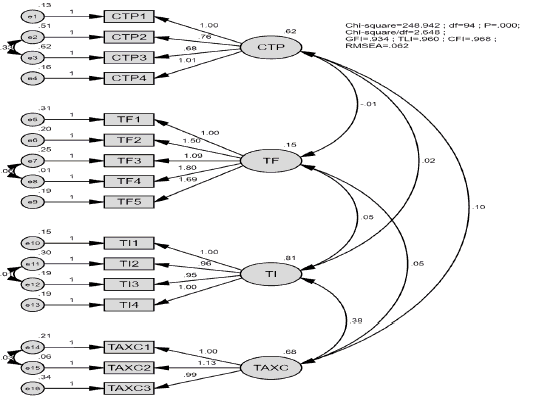

Figure 3 had the Chi-square=248.942; df=94; p=0.000; Chi-square/df=2.648; GFI=0.934; TLI=0.960; CFI=0.968; RMSEA=0.062.

Figure 3: Testing Cfa for Factors Affecting the Tax Compliance of Fdi Enterprises in Hcmc

(Source: Data processed by SPSS, Amos)

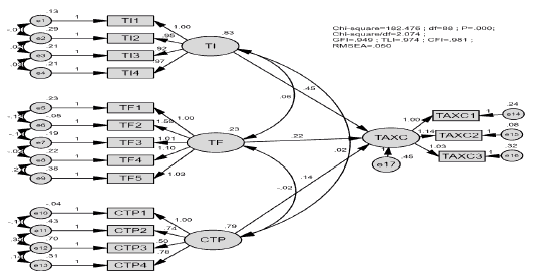

Table 6 showed that column "P"<0.01 with significance level 0.01. This result indicated that three factors affected the tax compliance of FDI enterprises in HCMC with a significance level of 0.01. Three factors have the Complexity of Tax Policy (CTP), Tax Inspection (TI), and the Tax Fines (TF) at FDI enterprises in HCMC.

| Table 6 Factors Affecting The Tax Compliance Of Fdi Enterprises In Ho Chi Minh City |

|||||||

|---|---|---|---|---|---|---|---|

| Relationships | Estimate | Standardized Estimate | S.E. | C.R. | P | ||

| TAXC | <--- | TI | 0.446 | 0.503 | 0.043 | 10.281 | *** |

| TAXC | <--- | TF | 0.218 | 0.129 | 0.070 | 3.130 | 0.002 |

| TAXC | <--- | CTP | 0.136 | 0.150 | 0.048 | 2.863 | 0.004 |

Table 7 showed that column “Bias”<0.01. This result showed that three factors affected the tax compliance of FDI enterprises in HCMC with a significance level of 0.01. Three factors including the Complexity of Tax Policy (CTP), Tax Inspection (TI), and the Tax Fines (TF) at FDI enterprises in HCMC.

| Table 7 Testing Bootstrap with N=10.000 Samples |

|||||||

|---|---|---|---|---|---|---|---|

| Parameter | SE | SE-SE | Mean | Bias | SE-Bias | ||

| TAXC | <--- | TI | 0.066 | 0.000 | 0.445 | -0.002 | 0.001 |

| TAXC | <--- | TF | 0.069 | 0.000 | 0.212 | -0.006 | 0.001 |

| TAXC | <--- | CTP | 0.049 | 0.000 | 0.139 | 0.003 | 0.000 |

Figure 4 had the Chi-square=182.476; df=88; p=0.000; Chi-square/df=2.074; GFI=0.949; TLI=0.974; CFI=0.981; RMSEA=0.050.

Figure 4: The Structural Model Showing the Structural Linkage Between TI, TF, CTP, and TAXC

(Source: Data processed by SPSS 20.0 and Amos)

Conclusions & Managerial Implications

Conclusions

Currently, the tax compliance situation in FDI enterprises in HCMC is still low. Research results showed that three factors affected the tax compliance of FDI enterprises in HCMC with a significance level of 0.01. Three factors including the Complexity of Tax Policy (CTP), Tax Inspection (TI), and the Tax Fines (TF) at FDI enterprises in HCMC. FDI enterprises should be to promote tax compliance. It is necessary to strengthen the work of inspection - examination, supplement human resources in both quantity and quality, and at the same time increase the expansion of tax inspection - assessment, bring in inspection activities. Become more frequent. In addition, the Ministry of Finance and the Tax Department, and the competent authorities need to study the tax rate reduction roadmap so that the Vietnamese tax rate is similar to the economic growth situation, creating motivation for the implementation of tax compliance for the taxpayer. At the same time, the research changes towards increasing the penalty for tax non-compliance, thereby promoting better tax compliance behavior. Finally, the authors had managerial implications for improving the tax compliance situation in FDI enterprises in HCMC.

Managerial Implications

Based on the results mentioned above, to enhance the tax compliance of FDI enterprises in HCMC, the authors had recommendations following:

(1) The Tax Department of Ho Chi Minh City should continue promoting and innovating tax law and policy propaganda methods, diversifying contents and forms of propaganda, and classifying objects to choose an effective and approachable way to improve consensus and understanding. The Tax Department should train taxpayers’ knowledge, agreement on sharing the responsibility of sectors, organizations, and society as a whole, especially services to support organizations and individuals of taxpayers to improve understanding and voluntarily comply with tax obligations.

Besides, the current urgent solution is to complete the legal framework on tax compliance risk management. The issuance of guiding documents on the content of applying the risk management mechanism in tax administration of the Law on Tax Management Tax No. 38/2019 needs to be implemented soon. The Government should closely direct the Ministry of Finance to put the above documents into practice soon. Besides, tax compliance risk management cannot be highly effective if it is not linked with other macro-policy reforms. Therefore, the Government should quickly direct the synchronous reform of relevant policies such as policies to attract foreign direct investment, policies on enterprises, labor policies, and banking - finance, import and export. These policies need to consider tax as an essential lever, combined with tax policy to create synergy in socio-economic development.

(2) The Tax Department of Ho Chi Minh City should encourage taxpayers to use information technology applications to support tax declaration by the barcode technology to improve the quality of tax declaration has limited many errors in tax declaration. We are strengthening the inspection and control of taxpayers’ tax declarations to detect cases of incorrect or insufficient representation promptly. Thereby, the Tax Department of Ho Chi Minh City should take corrective and sanctioning measures to raise self-discipline for compliance with tax laws.

Besides, the Tax Department should strengthen information exchange and information linkage with the international community. Actual research shows that: In Vietnam, FDI enterprises with a high risk of tax compliance. Previous studies have also demonstrated that multinational corporations tend to transfer prices from places with high tax rates to areas with low tax rates to reduce tax payable. So, the inspection work on Transfer pricing for economic groups is becoming increasingly important in tax administration. However, to analyze the tax compliance risks of multinational corporations, domestic data is not enough. Therefore, building a database on taxpayers should also aim to connect and exchange information between countries worldwide.

(3) The Tax Department should coordinate with risk management at the General Department of Taxation level through the Risk Management Board, tax departments, and tax sub-departments that do not conduct a full-time risk assessment. To meet the requirements of applying a risk management mechanism in all stages of tax administration as prescribed in the Law on Tax Administration No. 38/2019, a risk management assessment needs for all levels in the tax sector, including the general department, department, and branch level. To limit the establishment of more departments and not increase the number of focal points, the risk management function in departments and branches assigned to inspections and examination room and the inspection and examination team as the focal point.

The Tax Department should coordinate with functional sectors to organize training for enterprises with solid knowledge of the accounting profession, understanding tax laws and policies. Only then will it be possible to improve legal compliance and tax law of taxpayers. Violate the law, causing damage to the interests of taxpayers according to the provisions of the Law on Tax Administration. The Tax Department should have the criteria to serve inspection and examination planning. It is necessary to add additional measures to evaluate the compliance of taxpayers by tax type. At the same time, it is required to add other criteria to assess the phenomenon of profit manipulation to avoid tax. According to the business model, there is the sensation of pushing revenue or hiding costs, the criteria for evaluating the phenomenon of manipulating financial statements according to the business model, world experience to improve the effectiveness of tax risk analysis.

References

- Charmee, J.F. (2016). Tax structure and tax compliance. Review of Economics and Statistics, 14(16), 153-160.

- Erard, T., & Feinstein, R. (2018). Factors affecting tax compliance in Thailand. Journal of economic literature, 3(2), 81-96.

- Hair, J., Anderson, R., Tatham, R., & Black, W. (2010). Multivariate data analysis with readings. US: Prentice-Hall: Upper Saddle River, NJ, USA.

- Hanchez, G.H., & Juan, A. (2015). Factors affecting the tax compliance. Journal of Business Ethics, 1(4), 45-51.

- Hessing, K.J. (2019). Tax compliance and tax evasion: An experimental approach. Journal of Economic Behavior and Organization, 4(3), 153-161.

- Hoelzl, E., & Kirchler, E.F. (2018). Tax compliance: Similarities between Australian taxpayers and tax officers. Journal of Economic Psychology, 7(4), 50-57.

- Hubbard, M.R. (2015). Improved tax administration? Journal of Public Administration and Development, 2(1), 211-222.

- Kurgoyne, A.M., & Webley, P.N. (2013). Tax communication and social influence: Evidence from a Thailand sample. Journal of Social Psychology, 19(3), 137-146.

- Macker, S.J. (2016). Combining psychology and economics in the analysis of compliance: From Enforcement to Cooperation. Economic Analysis & Policy, 4(2), 13-25.

- Mann, T.R. (2017). Tax administration and income tax evasion in Switzerland. Public Choice, 18(8), 116-127.

- Martin, K., & Parboteeah, K.D. (2019). National culture and firm-level tax evasion. Journal of Business Research, 3(6), 11-27.

- Mebley, P.R. (2014). FDI business owners’ attitudes on tax compliance in the UK. Journal of Economic Psychology, 22(2), 19-32.

- Ming, L., & Bee, W.Y. (2014). Tax noncompliance among FDI enterprises in Malaysia: Tax Audit Evidence. Journal of Applied Accounting Research, 15(2), 25-34.

- Minsey, K.J. (2017). Understanding taxpaying behavior: A conceptual framework with implications for research. Law & Society Review, 2(4), 63-76.

- Nanouchehr L.F., & Aida, R.S. (2019). Improving tax compliance for VAT department in Tehran. International Journal of Basic Sciences, 13(2), 29-38.

- Rokny, H.F. (2016). An investigation into the determinant of practical factors on tax evasion. Empirical study of Iran Tax Affairs Organisation. American Journal of Scientific Research, 3(4), 99-113.

- Rowski, P., & Wearing, A.J. (2013). Taxation agents and taxpayer compliance. Journal of Australian Taxation, 6(2), 16-27.

- Sajzen, I.H. (2014). Estimating the determinants of taxpayer compliance with experimental data. National Tax Journal, 5(1), 17-28.

- Sandmo, K.A. (2017). Income tax evasion: A theoretical analysis. Journal of Public Economics, 1(4), 23-328.

- Schulze, W.T. (2016). Why do people pay taxes? Journal of Public Economics, 8(1), 21-38.

- Schwarzen, B.H. (2017). Misperception of chance and loss repair: On the dynamics of tax compliance. Journal of Economic Psychology, 2(8), 67-79.

- Sirchler, T.L. (2019). Tax compliance: Knowledge and evaluation of taxation, norms, fairness, and motivation to cooperate. National Tax Journal, 13(8), 5-14.

- Siti, N.S. (2014). Reengineering tax service quality using a second-order confirmatory factor analysis for self-employed taxpayers. International Journal of Trade, Economics, and Finance, 15(5), 42-49.

- Sosgun, S.G. (2014). Tax knowledge and attitudes towards taxation: A report on a quasi-experiment. Journal of Economic Psychology, 7(3), 38-48.

- Talm, J., & Torgler, B.J. (2014). Do ethics matter? Tax compliance and morality. Journal of Business Ethics, 1(12), 63-72.

- Tandmo, A.J. (2017). Income tax evasion: A theoretical analysis. Journal of Public Economics, 2(2), 15-23.

- Tomney, J.K. (2015). Tax compliance: Evidence from Australia, Singapore, and the United States. Journal of Business Ethics, 114(1), 19-38.

- Traithwaite, V.G. (2016). Understanding FDI business taxpayers - issues of deterrence, tax morale, fairness, and work practice. International Small Business Journal, 3(5), 13-28.

- Trephen, A.H. (2018). Factors affect tax compliance among FDI enterprises (SMEs) in Central Nigeria. International Journal of Business and Management, 17(2), 18-27.

- Uadiale, F.O., & Noah, A.E. (2018). The ethics of tax evasion: Perpetual evidence from Nigeria. European Journal of Social Science, 7(3), 36-47.

- Wartick, D.M., & Mark, M.J. (2018). Detection probability and taxpayer compliance: A review of the literature. Journal of Accounting Literature, 1(1), 1-16.

- Wilde, L.H. (2014). The economics of tax compliance: Facts and fantasy. National Tax Journal, 3(8), 55-63.

- Wuehlbacher, S., & Kirchler E.G. (2017). Tax compliance by trust and power of authorities. International Economic Journal, 2(4), 67-74.