Research Article: 2022 Vol: 28 Issue: 3S

Deregulating An Economic Sector in Ghana: An Analysis of the Telecom Sector Liberalization and SME Growth

Eric Osei Owusu-Kumih, Ghana Communication Technology University

Millicent Asah-Kissiedu, Koforidua Technical University

Millicent Wiafe-Kwagyan, Ghana Communication Technology University

Citation Information: Owusu-Kumih, E.O., Asah-Kissiedu, M., & Wiafe-Kwagyan, M. (2022). Deregulating an economic sector in ghana: an analysis of the telecom sector liberalization and SME growth. Academy of Entrepreneurship Journal, 28(S3), 1-20.

Abstract

After the telecommunication reform Act was passed in 1996, Ghana's telecommunication evolution began. The emergence and dominance of small and medium companies (SMEs) in Ghana is a backdrop to this liberalization and deregulation success story. The goal of this study is to find empirical evidence to support, if any, the influence of liberalization in the telecommunication sector on Ghana's steady growth of SMEs. The 261 SME owner respondents from Ghana's three major commercial centers were analyzed using a survey research design and structural equation modeling (PLS-SEM). The findings revealed that liberalizing the telecom sector has influenced SMEs' growth in Ghana via the mediating roles of technology and innovations, market accessibility, and resource availability, all of which are key growth determinants for SMEs in Ghana. This means that liberalization provided an opportunity for SMEs to innovate, build new market channels, and develop the correct technology applications for effective and efficient resource scouting, acquisition, and development for their own use using the technological tools accessible to them.

Keywords

Telecommunication, Deregulation, Liberalization, Structural Equation Model, SMEs, Ghana.

Introduction

Today, telecommunication affects almost all socio-economic life of every nation. This influence is anchored on the strategic linkages the sector provides within an economy, For a developing world, modern telecommunications infrastructure is not only essential for domestic economic growth, but also a prerequisite for participation in increasingly competitive world markets and for attracting new investments. The role of telecommunication in enhancing economic growth has been a subject of discourse in the economic literature for well over a decade. Arguments are that the development of a modern nation to its full potential in contemporary world can never be attained without a well-developed telecommunications system (Tella et al., 2007). However, for any country to fully realize the full potentials of the sector, that country needs to liberalized its telecommunication industry in order to create a competitive market between service providers and also institute an independent regulatory authority, who will establish a vigilant and sound regulatory environment (Gensollen & Laubie, 1994; Datta & Agarwal, 2004). The increasing pace of technological development and higher rates of innovations at all levels of business functional areas are making firms rely on the technologies out to boost their competitive advantage within their market space (Frempong, 2007). According to Waverman et al. (2005) these developments affect economic growth of developing countries which relies hugely on Small to Medium Size Enterprises (SMEs).

Deregulation of the telecommunication sector for the purposes of this research would be defined as introducing competition within the telecommunication sector by private participation through a well-defined regulations, rules and policies. Researchers and historiographers have concluded that the interference and the management by States of the telecommunications sector was partly due to the common believe that the assets and infrastructures of that sector has both strategic and national security relevance hence the states ought to procure and manage them (Allotey & Akorli, 1999; Watts, 2003; De Bruijne & Van Eeten, 2007). In 1996, Ghana liberalized and privatized some telecom assets, and created duopoly which preceded the establishment of independent regulatory body; the national communications authority.

Small-to Medium Size Enterprises (SMEs) have been recognized as the engine of economic development across the world, and has consistently contributed significantly to the creation of new jobs in the world’s economy (Edmiston, 2007; Chodokufa, 2009; Dzakovic et al., 2011). The impact of SME is however felt at the developing economies where SME is known to create employment for the skilled as well as the unskilled workforce who happens to be in abundance (Phillips & Bhatia-Panthaki, 2007). A more precise definition of SME based on the number of employees in developing countries was adopted from by Afrifa, (2013): A small firm in has between 5-19 employees, while a medium firm has between 20-99 workers.

Since the 1980s, many practitioners and experts in the telecommunication industry have commended the wave of liberalizations across the world; even in more protectionist idiosyncratic countries. However, there seems to be lack of empirical evidence on whether or not these liberalizations within the telecommunication industry have influenced economic activity with a clear emphasis on small and medium scale enterprises. The question therefore is, has the deregulation of the telecommunication industry influenced the growth of SMEs in countries where such liberalizations have taken place? This study is therefore to fill the lacuna created over the years on whether telecommunication deregulation has played any influential role on the growth of SMEs (Tella et al., 2007).

Theoritical Framework

Entrepreneurial Orientation

Entrepreneurship and Entrepreneurial Orientation (EO) are respectively seen as drivers of SMEs’ growth. A study by Fatoki (2012) looked at the influences of entrepreneurial orientation on SMEs growth and development in South Africa. He found that although it had a positive effect on SMEs growth, other factors mediated this effect. These results suggest that entrepreneurial orientation can have both direct and indirect effect. Again, in their study, Eggers et al. (2013) used the structural equation model to empirically investigate how customer orientation and entrepreneurial orientation which was represented by proactiveness, innovativeness and risk-taking impacts on SMEs growth. The research found that, if an SME want to grow, entrepreneurial orientation is a significant source to fuel these growth aspirations. And that, EO might drive growth because of its emphasis on innovation to renew the firm's growth trajectory (Eggers et al., 2013).

From the above, the following hypothesis could be drawn:

H1A: Entrepreneurial orientation has a direct and a positive influence on SME growth

H1B: Entrepreneurial orientation has an indirect positive influence on SME growth through competitive advantage

H1C: Entrepreneurial orientation acts as moderating effect of telecommunication liberalization’s influence on SME growth

Innovation and Technology

Research work done by Ngugi et al. (2013) concluded that innovativeness does influence the growth of SMEs in Kenya. Goedhuys & Veugelers (2012) also stressed the importance of combining both product and process innovation which jointly affect the success and growth of SMEs. Furthermore Wu et al. (2008) also explored the mediating effect of innovation on SMEs growth. They found that effects of innovation exist at significant levels which suggest a perfect mediating effect of innovation on growth. There is also available empirical evidence to suggest a strong relationship between innovation and the growth of SMEs (Coad & Rao, 2008; Kiraka et al., 2013; Ngugi et al., 2013; Mwangi, 2014). Kasseeah (2013) agreed with Becheikh et al. (2006) when he suggested that, for a firm to remain relevant and be able to have a competitive advantage over its peers or gain an easy entry into a market which is uncharted, technological innovation cannot be avoided. Indeed, the World Bank postulates that the increasing universal access to telecommunication is promoting innovation amongst entrepreneurs in Africa. And that some of the innovations are very visible in the areas of agriculture, climate change, education, financial services, government, health, ICT competitiveness, and trade facilitation (World Bank Report, 2012). Again, Dutta & Shalhoub (2007) have suggested that the use of information communication technology (ICT) by SMEs have largely been triggered by the increased investments by the telecommunication firms.

From the above therefore, the following hypothesis could be established;

H2A: Innovation and Technology have a direct and a positive influence on SME growth

H2B: Innovation and Technology have an indirect positive influence on SME growth through competitive advantage

H2C: Innovation and Technology moderates the direct and positive influence of telecommunication liberalization on SME growth.

Resource Availability

Mambula (2002) studied the constraints to SME growth in Nigeria. One of his main points was the unavailability of resources to SMEs for growth albeit the nature of the resources was stated as materials and financial resources in that particular study. Krasniqi (2007) also worked on the barriers to entrepreneurship and SME growth in transitional Kosovo. He also made similar findings that financial resources which is needed to make the necessary technological change to promote innovation is one of the fundamental barriers to SME growth. Mcmahon (1998) also studied the capabilities and the expertise of the resource and a determinant of SME growth. Brown and Kirchhoff (1997) have also studied the resource availability on firm’s growth and have reported that there is a correlation between the two. Huge investments and business evolutions in the telecommunication sector have become a precursor to the increasing use of ICT by SMEs (Roberts, 2000; Leenders & Wierenga, 2002; Roberts, 2000). The increasing rates of teledentsity and mobile penetration have help promote the use of technology for doing business, hence lowering the resources needs of SMEs.

Therefore, the following hypothesis could be stated:

H3A: Resource Availability has direct and a positive influence on SME growth

H3B: Resource Availability has an indirect and a positive influence on SME through Competitive advantage

H3C: Resource Availability moderates the direct and positive influence of telecommunication liberalization on SME growth

Age of the Firm

Many researchers have worked and found that the age of a firm plays an important role the growth of firms (Haltiwanger et al., 2013; Coad et al., 2013). Haltiwanger et al. (2013) showed that firms have significantly demonstrated that the net growth of firms improves over time. This is important because it makes the age of a firm an important growth control factor in any longitudinal study of independent growth factors (Coad et al., 2013). Early studies suggested that age matters in the growth of firms (Dunne et al., 1989; Dunne & Hughes, 1994; Almus & Nerlinger, 2000). Almus & Nerlinger (2000); Glancey (1998); Wijewardena & Tibbits (1999) all discovered a certain level of relationship between firm age and growth. Therefore, the following hypothesis could be stated:

H4A: Age of firm has a direct and a positive influence on SME growth

H4B: Age of firm has an indirect and a positive influence on SME through Competitive advantage

H4C: Age of Firm moderates the direct and positive influence of telecommunication liberalization on SME growth

Laws and Regulations

A study conducted by Djankov et al. (2006) demonstrated that businesses nations with better regulations do grow faster. This research was in line with previous studies conducted by (Hall & Jones, 1999) as well as (Acemoglu et al., 2001) which showed that proper constituted institutions are the key determinant of both wealth and long-term growth. Many researchers in the past, have done extensive work on the liberation, deregulation and the participation of private enterprises in the then state controlled telecommunication business (Blanchard, 1991; Newberry, 1991); (Carpenter, 2003). While some researchers (Blanchard, 1991) dilly-dallied whether propelling investments in the telecommunication industry through privatization process should be quick or slow on the other hand, emphasized the attention to the rule of law and other institutional issues which ought to be addressed before increasing investments. Increased investments go hand in hand with a proper institutional framework as well as rule of law which would provide sureties for the investments (Esselaar, 2006). Therefore, the following hypothesis were made;

H5A: Laws and Regulations have a direct and a positive influence on SME growth

H5B: Laws and Regulations have an indirect and a positive influence on SME through Competitive advantage

H5C: Laws and Regulations moderates the direct and positive influence of telecommunication liberalization on SME growth

Competitive Advantage

Competitive advantage is known to be present in most predictors of business growth. For instance, Wiklund & Shepherd (2003); Zahra & Covin, (1995) concluded that entrepreneurial orientation of the management of a firm influences the firm’s competitive advantage and growth. According to firm’s resource-based theory, competitive advantage only arises from the use of scarce, intangible and firm-specific assets (Spender, 1996). The use of technology which has largely originated from telecommunication has been known increase competitive advantage (Blili & Raymond, 1993; Bhatt et al., 2005; Mahdi et al., 2015). Therefore, the following hypotheses were made:

H6A: Competitive advantage has a direct and a positive influence on SME growth

Access to Market and Market Knowledge

Mobile telecommunication has a significant effect on the prices of goods and service of SMEs (Jensen, 2007; Gruber & Koutroumpis, 2011). suggested that mobile telecommunications have a significant effect of access to market and marketing decisions of farmers. Other researchers including Shimamoto et al. (2015), Hsiao & Chen, (2015) and Arinloye et al. (2016) have suggested that mobile telecommunication have improved access to market information particularly by SMEs. The market knowledge acquired through the use of technology gives a certain level of competitive advantage to the informed SME and propels it for growth (Argote & Ingram, 2000; Levy & Powell, 2004). The following hypothesis could therefore be drawn for the above literature:

H7A: Access to market and market knowledge has a direct and a positive influence on SME growth

H7B: Access to market and market knowledge has a positive influence on SME growth through Competitive advantage acting as a moderator

H7C: Access to Market and market moderates the positive influence of Telecom liberalization on SME growth

Telecommunication Deregulation

Deregulating the telecommunication sector is an avenue to increase affordability, quality and reach of the telecommunication service (Bortolotti et al., 2002). This according to Frempong & Aturba (2001) has a positive correlation on growth and development on a developing country. The main objectives of deregulating or liberalizing a telecommunication sector is to attract private capital to improve on the infrastructure which would in turn, led to the growth of mobile and other wireless services (Frempong & Aturba, 2001; Gao & Lyytinen, 2000). Reynolds et al. (2003) suggests that the overflows or the excesses of the private capital which comes to economies because of telecommunication liberalization could be made available to businesses which ultimately will promote growth. A significant amount of literature has shown that liberalization of the telecommunication market acts as a harbinger to reduction in communication and labor market efficiency as well as improving business access to information and market (Jensen, 2007; Klonner & Nolen, 2008; Aker, 2008;2010).As well as linked the information technology which is a product of telecommunication to entrepreneurship and innovation. Again, the telecommunication liberalization has created competitive advantage (Doh, 2000; Adi, 2015; Njoroge, 2015). The following hypothesis is therefore drawn:

H8A: Telecommunication liberalization has an indirect and a positive influence on Entrepreneurial orientation.

H8B: Telecommunication liberalization has an indirect and a positive influence on Access to Market.

H8C: Telecommunication liberalization has an indirect and a positive influence on technology and innovation.

H8D: Telecommunication liberalization has an indirect and a positive influence on law and order

H8E: Telecommunication liberalization has an indirect and a positive influence on resource availability

H8F: Telecommunication liberalization has an indirect and a positive influence on age of firm.

H8G: Telecommunication liberalization has an indirect and a positive influence on Competitive advantage

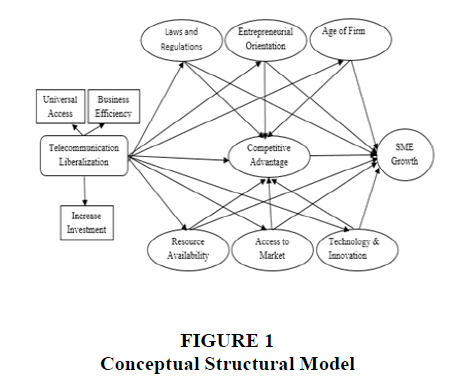

Conceptual Structural Model

The Figure 1 below shows the direct and indirect relationships that exist amongst constructs.

Methodology

An analysis of data from 50,060 active SMEs in Ghana's three major centers of Accra, Kumasi and Koforidua employed the structural equation model. 261 out of 300 SME owners returned the questionnaire.

The Structural Equation Model was run using SPSS version 20 and SMART-PLS version 3. (SEM). This statistical model aims to explain the correlations between numerous latent variables (Hu & Bentler, 1999). This study employed SEM to evaluate the interactions between various dependents and their independent conceptions (Hu & Bentler, 1999).

With SEM, the researcher may assess a model's measurement and structural components (Hu & Bentler, 1999; Gefen et al., 2000). Due to these key features, SEM analytical methods have grown quite popular in every area (Henseler et al., 2016). Because of the various independent-dependent interactions, SEM is the preferred approach of analysis. This study employed variance-based partial least square SEM (PLS SEM) (Storey, 2016).

Empirical Results

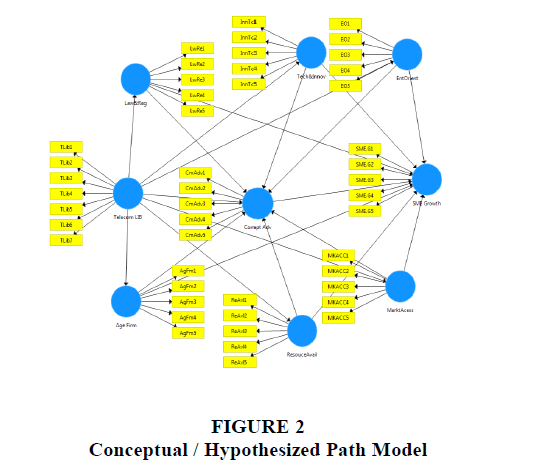

Figure 2 displays the developed inner and outer models with endogenous and exogenous latent variables indicators. The PLS route algorithm has not been run in this figure. The latent variable indicators are as follows: Age of Firm (AgFm1, AgFm3, AgFm4, AgFm5); Competitive Advantage (CmAdv1, CmAdv2, CmAdv3, CmAdv4, CmAdv5); Entrepreneurial Orientation (EO1, EO2, EO3, EO4, EO5); Technology and Innovation (InnTc1, InnTc2, InnTc3, InnTc4); Law and Regulations (LwRe2, LwRe3, LwRe4, LwRe5); Market Access (MKACC1, MKACC2, MKACC3, MKACC4, MKACC5); Resource Availability (ReAvl1, ReAvl2, ReAvl3, ReAvl4, ReAvl5); SME Growth (SME.G1, SME.G2, SME.G3, SME.G4, SME.G5). Some of the indicators express reflective scales while other are formative:

Assessment of the Measurement Model

Tests were done on the reliability and validity of the latent constructs and the indicators that were given. The measurement model was used for this purpose. When a researcher tests model fit, an approximate model fit may be established. An approximate model fit criteria helps researchers determine the size of the model-implied against empirical correlation matrix discrepancies. It would be impermissible for a researcher to ignore major contradictions. The standardized root mean square residual (SRMR) is presently the sole approximate model fit criteria used for PLS path modeling, according to Henseler et al. (2016). A Zero Standardized root mean squared residual (SRMR) means perfect fit. But less than 0.05 or 0.08 will indicate a good fit (Byrne, 2008; Hu & Bentler, 1999). Recommended that the normed fit index (NFI) be utilized as a determinant for the approximation model fit criteria (AMFC). However, for the factor model, any number over 0.90 is acceptable (Byrne, 2008). Because PLS-based goodness-of-fit is still in its infancy, most researchers are wary of assessing and reporting it, especially when testing or comparing models. Despite the warnings, this researcher has reported on the approximate model fit (Saturated Model) in Table 1.

| Table 1 Summary Of The Values For The Fit |

||

|---|---|---|

| Indicators | Meaning | Saturated Model |

| SRMR | Standardized Root Mean Square Residual | 0.080 |

| d_ULS | Squared Euclidean Distance | 5.714 |

| d_G1 | Geodesic Distance 1 | 2.928 |

| d_G2 | Geodesic Distance 2 | 3,115.247 |

| χ2 | Chi-Square | 0.627 |

| NFI | Normed Fit Index | 0.148 |

Assessing Reliability and Validity of Construct

The The PLS program calculates Composite Reliability, Dillon-rho Goldstein's A, and Cronbach's Alpha. Cronbach's Alpha's importance in assessing PLS reliability has been reduced in recent work since its use is found to underestimate the genuine reliability of the constructs (Sijtsma, 2009; Dijkstra & Henseler, 2015). To pass, all dependability measures must be greater than 0.70. The Again, researchers are advised to ensure that factor measurements are free of systematic mistakes. This entails ensuring convergent validity. Fornell and Larcker recommended using the average variance extracted (AVE) to do this (1981). They said an AVE of 0.5 or higher was acceptable. Two further criteria have been shown to be discriminant-informative. The Fornell-Larcker criteria (1981) and the HTMT (1993) were proposed by (Fornell & Larcker, 2016). "A factor's AVE should be larger than its squared correlations with all other components in the model," adds Fornell-Larcker. The HTMT score must be less than one for researchers to distinguish between two components. Finally, researchers should assess the variance inflation factor (VIF) of the hidden variable indicators. If the VIF values are exceedingly high (over 4), then multicollinearity may be a factor. Table 2 and 3 shows the reliability and validity values after SmartPLS runs (Nunnally & Bernstein, 1978).

| Table 2 Construct Reliability And Validity Values |

||||

|---|---|---|---|---|

| Constructs |

Cronbach's Alpha | rho_A | Composite Reliability | Average Variance Extracted (AVE) |

| Age of Firm | 0.809 | 0.826 | 0.873 | 0.633 |

| Competitive Advantage | 0.894 | 0.896 | 0.922 | 0.704 |

| Entrepreneurial Orientation | 0.895 | 0.908 | 0.922 | 0.704 |

| Law & Regulation | 0.834 | 0.868 | 0.887 | 0.662 |

| Market Access | 0.839 | 0.844 | 0.886 | 0.608 |

| Resource Availability | 0.877 | 0.881 | 0.911 | 0.671 |

| SME Growth | 0.797 | 0.802 | 0.860 | 0.551 |

| Tech & Innovation | 0.804 | 0.806 | 0.872 | 0.632 |

| Telecom Lib | 0.829 | 0.830 | 0.880 | 0.595 |

| Table 3 Fornell Larcker Criterion Values For Discriminant Validity |

|||||||||

|---|---|---|---|---|---|---|---|---|---|

| Age of Firm | Compt Advant | Ent Orient | Law & Reg | Market Access | Resour Avail | SME Growth | Tech& Innov | Telcom Lib | |

| Age of Firm | 0.796 | ||||||||

| Competitive Advantage | -0.072 | 0.839 | |||||||

| Ent. Orientation | 0.635 | -0.040 | 0.839 | ||||||

| Law& Regulation | 0.531 | -0.070 | 0.606 | 0.814 | |||||

| Market Access | 0.175 | 0.512 | 0.066 | 0.120 | 0.780 | ||||

| Resource Avail | 0.607 | 0.060 | 0.791 | 0.513 | 0.126 | 0.819 | |||

| SME Growth | -0.021 | 0.678 | -0.013 | -0.006 | 0.628 | -0.007 | 0.742 | ||

| Tech& Innovation | -0.059 | 0.597 | -0.003 | 0.055 | 0.485 | -0.008 | 0.722 | 0.795 | |

| Telecom Lib | 0.258 | 0.403 | 0.210 | 0.235 | 0.383 | 0.164 | 0.564 | 0.591 | 0.771 |

The Table 4 and 5 shows the Results for the Construct Reliability and Validity. Form the table all the dataset for the constructs passed the reliability with Cronbach’s Alpha, rho A and Composite Reliability in respect of Age of Firm (0.809, 0.826, 0.873); Competitive Advantage (0.894, 0.896, 0.922); Entrepreneurial Orientation (0.895, 0.908, 0.922); Law & Regulation (0.834, 0.868, 0.887); Market Access (0.839, 0.844, 0.886); Resource Availability (0.877, 0.881, 0.911); SME Growth (0.797, 0.802, 0.860); Technology & Innovation (0.804, 0.806, 0.872); Telecom Liberalization (0.829, 0.830, 0.880). The Average Variance Extracted (AVE) was used to measure the construct validity. The values measured for each variable is as follows: Age of Firm (0.633); Competitive Advantage (0.704); Entrepreneurial Orientation (0.704); Law & Regulation (0.662); Market Access (0.608); Resource Availability (0.671); SME Growth (0.551); Technology & Innovation (0.632); Telecom Liberalization (0.595).

|

Table 4 |

|||||||||

|---|---|---|---|---|---|---|---|---|---|

| Ageof | Competir | Ent | Law& | Market | Reson | SME | Tech& | Telcom | |

| Firm | Advant | Orient | Reg | Access | Arail | Growth | Innor | Lib | |

| Age of Firm | |||||||||

| Competitire Advantage | 0.154 | ||||||||

| Ent. Orientation | 0.747 | 0.084 | |||||||

| Law & Regulation | 0.642 | 0.118 | 0.718 | ||||||

| Market Access | 0.214 | 0.582 | 0.101 | 0.14 | |||||

| Resource Arail | 0.717 | 0.103 | 0.888 | 0.617 | 0.157 | ||||

| SME Growth | 0.115 | 0.795 | 0.1 | 0.102 | 0.762 | 0.123 | |||

| Tech & Innovation | 0.171 | 0.704 | 0.108 | 0.108 | 0.579 | 0.135 | 0.886 | ||

| Telecom Lib | 0.318 | 0.466 | 0.252 | 0.261 | 0.456 | 0.21 | 0.678 | 0.718 | |

| Table 5 Inner Vif Values Of Collinearity Statistics (Vif) Toward Establishing Discriminant Validity |

|||||||

|---|---|---|---|---|---|---|---|

| Age of Firm | Competive Advantage | Ent & Orient | Law and Regular | Market Access |

Resou Avail |

SME Growth |

|

| Age of Firm | 2.072 | 1.980 | |||||

| Competive Advantage | 1.855 | ||||||

| Ent & Orient | 3.362 | 3.365 | |||||

| Law and Regular | 1.698 | 1.728 | |||||

| Market Access |

1.415 | 1.582 | |||||

| SME Growth |

2.847 | 2.936 | |||||

| Tech & Innovation | 1.957 | 1.742 | |||||

Again, the Table 3 shows the results for the discriminant validity using the Fornell-Larcker Criterion. From the table, all the variables passed the Fornell-Larcker Criterion. This is because the factor’s AVE was higher than its squared correlations with all other factors in the model. The closest was the SME growth and the Technology and Innovation of which the difference was 0.020 (Lipton & Sachs, 1992).

The Table 4 also shows the results for the Heterotrait-Monotrait Ratio (HTMT) which is also used for measuring discriminant validity of the latent variables within the construct. From the table above all then values were within the acceptable range which is that for a construct to be deemed to have been valid, its HTMT values should be lesser than one (1).

Finally, Tables 5 also shows the results for the Inner VIF Values and the VIF Values for Outer Loadings. The variance inflation factor (VIF) of the indicators of the latent variables as well as of the variables themselves have shown from the tables that none of the values have shown to be an extreme value away from one (1). Therefore, multicollinearity has not been established making the results acceptable.

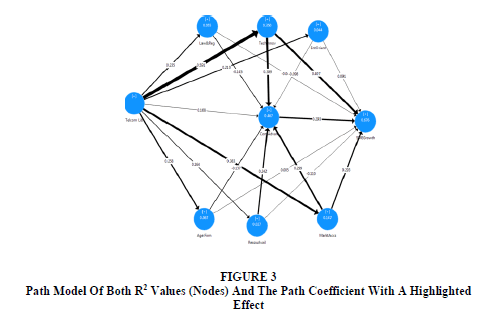

Assessment of the Structural Model

The structural model was assessed using the endogenous (Variable Variance Explain – R2), Direct Effects (Path coefficient absolute size, sign; Significance p-value; confidence interval; effect size), Indirect Effect (coefficient absolute size, sign; Significance p-value; confidence interval) and the Total Effects (Coefficient (absolute size, sign; Significance p-value; confidence interval). In order to measure the significant effects, researchers should determine how substantial the effect are by assessing the effect size f2; if the values are above 0.02, 0.15, and 0.35. The effects could be regarded as weak, moderate and strong respectively. The R2 ranges from zero (0) to one (1) whiles 1 defines the perfect predictor. To test the significance of the values for the path coefficient, a bootstrapping would have to be done with a sample of 5000. A T-Statistics of above 1.96 and a P-Value of less than 0.05 would show that the path is statistically significant and supported (Ringle et al., 2015). The Figure 3 shows the values for both R2 and F2 while the Tables 6 and 7 below sum up the discussed criteria for construct model assessment.

| Table 6 Results For The Path Coefficient Of Construct Model |

||||||||

|---|---|---|---|---|---|---|---|---|

| Age of Firm | Competive Advantage | Ent & Orient | Law and Regular | Market Access |

Resou Avail |

SME Growth |

Tech & Innovation | |

| Age of Firm | -0.137 | 0.005 | ||||||

| Competive Advantage | 0.293 | |||||||

| Ent & Orient | -0.098 | 0.091 | ||||||

| Law and Regular | -0.145 | -0.044 | ||||||

| Market Access |

0.299 | -0.293 | ||||||

| Resou. Avail | 0.242 | -0.110 | ||||||

| SME Growth |

||||||||

| Tech & Innovation | 0.389 | 0.407 | ||||||

| Telecom Lib | 0.258 | 0.108 | 0.210 | 0.235 | 0.383 | 0.164 | 0.591 | |

| Table 7 Summary Of Structural Models And Paths (T-Stats And P-Values) |

|||||

|---|---|---|---|---|---|

| Hypothesis | Original Sample (0) | T Stats (O/STDEVI) | P Values | Supporteur/Not supported | |

| Entrepreneurial Orientation -> SME Growth | H1A | 0.091 | *1.268 | 0.205 | Not supported |

| Entrepreneurial Orientation > Competitive Advantage | H1B | -0.098 | *0.977 | 0.329 | Not supported |

| 6.659 | 0.000 | supported | |||

| Technology & Innovation -> SME Growth | H2A | 0.407 | |||

| Technology & Innovation > Competitive Advantage | H2B | 0.389 | 4.819 | 0.000 | supported |

| *1.692 | 0.091 | Not supported | |||

| Resource Availability -> SME Growth | H3A | -0.110 | |||

| Resource Availability -> Competitive Advantage | H3B | 0.242 | 2.636 | 0.008 | supported |

| *0.084 | 0.933 | Not supported | |||

| Age of Firm > SME Growth | H4A | 0.005 | 2.116 | 0.034 | Not supported |

| Age of Firm -> Competitive Advantage | H4B | *-0.137 | 2.237 | 0.025 | Not supported |

| Law & Regulation Competitive Advantage | H5B | *-0.145 | *0.863 | 0.388 | Not supported |

| Law & Regulation - SME Growth | H5A | -0.044 | 4.425 | 0.000 | supported |

| Competitive Advantage -> SME Growth | H6A | 0.293 | |||

| Market Access > SME Growth | H7A | 4.057 | 0.000 | supported | |

| Market Access -> Competitive Advantage | H7B | 0.293 | 4.439 | 0.000 | supported |

| Telecom LIB -> Entrepreneurial Orientation | HSA | 0.299 | 2.671 | 0.008 | supported |

| Telecom LIB -> Market Access | HSB | 0.210 | 4.041 | 0.000 | supported |

| Telecom LIB -> Technology & Innovation | HSC | 0.383 | 8.152 | 0.000 | supported |

| Telecom LIB > Law & Regulation | HSD | 0.591 | 2.527 | 0.012 | supported |

| Telecom LIB -> Resource Availability | HSE | 0.235 | 2.022 | 0.043 | supported |

| Telecom LIB -> Age Firm | HSF | 0.164 | 2.895 | 0.004 | supported |

| 0.258 | *1.558 | 0.119 | Not supported | ||

| Telecom LIB > Competitive Advantage | HSG | 0.108 | supporteur/Not supported | ||

Discussion of the Results

To begin with, the results showed that the largest ISIC classification grouping respondents belonged to the Wholesale and retail trade, repair of motor vehicles, motorcycles and personal and household goods (G). A second largest group belonged to the H- Hotels and Restaurants. The least represented ISIC classification grouping is the manufacturing; only 3% of the total respondents belonged to the manufacturing sector and had the ISIC Classification as D affirmed that retailing, wholesale, automotive repair works were mostly found in urban towns or cities, while very little home-made manufacturing are found within the rural centers. The results findings are indeed demonstrating some research consistency within this specific area.

Secondly, the results also demonstrated how SMEs opined telecommunication liberalization. Some respondents said that it means improvement in business processes, still others agreed it means more affordable or lower cost of services rendered by the network services providers to their business. Yet other said that the liberalization has brought about improved service quality to amongst the network service providers. The last group of SME respondents said that to them telecommunication liberalization means there is increased accessibility and reach. The percentages of the above responses scattered around a quarter of a percentile. Furthermore, all the responses on the on growth of SMEs post the telecommunication liberalization solicited extremely high percentage of affirmation. Specifically, growth of sales, growth in relative employment, growth of Assets, growth of market share and profitability growth all showed above 80% in affirming that indeed their SME business have seen growth. The analysis of the PLS-SEM was to determine of the SME growth confirmed by the respondents had been as a result of the stated growth factors and whether or not the telecommunication liberalization played any role in influencing the growth over the period. After the dataset passing all the quality benchmark criteria: construct reliability and validity, discriminant validity, collinearity or multicollinearity as well as model fit, the results on the growths factors are as follows:

The results showed all the factors outlined had somewhat on the growth of the SMEs however, the effects of entrepreneurial orientation, age of firm, law and regulation, as well as resource availability did not have a statistically significant effect on SME growth. Indeed, law and regulations as well as resource availability had a reverse effect which means that as the SME experience growth, it affects the firms willing to regularize its business operations and would be seen to be lawful and formerly. Krasniqi (2007) had suggested that start-up SMEs are unable to follow the appropriate administrative, institutional and legal procedures because they are expensive and in most cases public officials demand brides before these services are rendered to them. This somewhat confirms the reverse effect of SME growth of law and regulations; when the business access to more money it is able to pay for these kinds of legal and administrative services. Again, the reverse effect on the resource availability could also be explained in similar manner. In fact, the findings confirm work done by Brown and Kirchhoff (1997) who studied the relationship between resource availability and growth of business and reported a correlation between the two.

Furthermore, only technology and innovation, access to market and competitive advantage had a direct effect on SME growth confirming earlier research work done by Ngugi et al. (2013) who concluded that innovativeness does influence the growth of SMEs in Kenya. Also, Goedhuys & Veugelers (2012) had stressed that innovation affects the success and growth of SMEs) also had concluded earlier that there was a significant positive relationship between innovativeness and growth among firms in China. The findings also confirm previous studies that Competitive advantage creates value for firms and hence influencing growth (Africa Competitiveness Report, 2009; Newbert, 2008). Also from the results, it was seen that, the SME growth was also directly influenced by access to market. This again was consistent with early work done by (Argote & Ingram, 2000) as well as Levy and Powell, (2004) who had also said that knowledge of the market and accessing it propels firms’ growth.

Moreover, the analysis of the results for the inner model (R2) again showed that, technology and innovation, access to market and competitive advantage alone could explain more than 67% of the variance in the SME growth; this is extremely significant for firm owners. With regards to indirect effects of the factors on the SME growth, the results showed that only technology and innovation, access to market and resource availability showed a statistically significant indirect effect to affect SME growth through competitive advantage which acted as mediator. This again was consistent with extant literature on technology creating competitive advantage. Prior researchers concluded that access to technology gives a certain level of competitive advantage to the informed SME which ultimate influences growth (Argote & Ingram, 2000; Levy & Powell, 2004). Most importantly, the analysis of the results for the inner model (R2) also showed that, technology and innovation, access to market and resource availability alone could explain more than 46%% of the variance in the competitive advantage; this is extremely significant to industry watchers. With regards to telecommunication liberalization, the results showed that, it had a statistically significant effect on all the factors except the competitive advantage. However, it influences on their variance is very insignificant except for access to market and technology and innovation. Indeed, the analysis of the results for the inner model (R2) showed that telecommunication liberalization could explain only 2.7%, 6.7%, 4.4% and 5.5% of the variance in Resource Availability, Age of Firm, Entrepreneurial Orientation, and Law & Regulation respectively. This means that for instance there are other 97.3% influencing factors which affect resource availability other than telecommunication liberalization. It also means that there are other influencing factors of law and regulation that could cause 94.5% of the changes.

However, with regards to Market Access telecom liberalization explains approximately 15% of the changes that occur. The figure might not very imposing but it is very significant especially considering that many factors affect access to market across various industry. The results (R2) again showed that telecom liberalization explains 35.0% of all variance that occur within the technology and innovation latent variable. Again, this might seem moderate but it is very significant considering the many potential variables which could affect technology and innovations. Competitive advantage acting as a mediator for telecommunication liberalization affecting SME growth yielded three significant and positive results. Resource availability, technology and innovations as well as access to market. All three had statistically significant and supported paths to competitive advantage. The results somewhat confirm prior studies by Wu et al. (2008) who found a perfect mediating effect role of innovation on SME growth. In fact, the three factors alone explain approximately 47% of the variance in the competitive advantage amongst SMEs. That again is moderate, but it is very significant.

Conclusion

The SMEs in Ghana have grown as a result of the liberalization of the telecom industry, as seen by the facts presented above. This indicates that over two decades of multi-billion-dollar investments in Ghana's telecom industry have raised penetration rates, improved service quality, and reduced customer costs. These have created an opportunity for SMEs to leverage the digital tools provided by the industry to innovate, build new market channels, and develop the appropriate technology applications for effective and efficient resource scouting, acquisition, recruiting, and development. In the process, it generated a competitive edge for SMEs that took advantage of the opportunity and fostered development.

The significance of liberalization of an economic sector in a developing nation has been underlined by this study. Lower entrance barriers to industries are one of the primary benefits of economic sector liberalization, which also aids in enhancing innovation, entrepreneurship, competitiveness, and efficiency. Again, liberalization stimulates economic development by making business simpler for businesses, encouraging free market competition, and decreasing costs. If liberalization policy is implemented correctly, without regard to political reasons or self-interested motivations, the trickle-down effects may be enormous and long-lasting: everyone in the country is better off because of this.

Finally, it's important for small and medium-sized businesses to pay attention to the indicators of technology and innovation, access to the market, and resources available. For the simple reason that understanding and reacting to them will secure the long-term success of the business.

References

Acemoglu, D., Johnson, S., & Robinson, J.A. (2001). The colonial origins of comparative development: An empirical investigation. American Economic Review, 91(5), 1369-1401.

Indexed at, Google Scholar, Cross Ref

Adi, B. (2015). An evaluation of the Nigerian telecommunication industry competitiveness: Application of porter’s five forces model. World Journal of Social Sciences, 5(3), 15-36.

Africa Competitiveness Report, (2009). The Africa competitveness report. World economic forum. Retrieved March 5, 2016 from

Afrifa, G. (2013). Working Capital Management And AIM Listed SME Companies Profitability: A Mixed Research Method Approach (Doctoral dissertation, Bournemouth University).

Aker, J.C. (2008). Does digital divide or provide? The impact of cell phones on grain markets in Nigeria. Center for Global Development Working Paper, (154).

Aker, J.C. (2010). Information from markets near and far: Mobile phones and agricultural markets in Nigeria. American Economic Journal: Applied Economics, 2(3), 46-59.

Allotey, F.K.A., & Akorli, F.K. (1999). Ghana in Eli Noam (Ed). Telecommunications in Africa (pp.178-192). New York: Oxford University Press.

Almus, M. (2000). Testing" Gibrat's Law" For Young Firms–Empirical Results For West Germany. Small Business Economics, 15(1), 1-12.

Argote, L., & Ingram, P. (2000). Knowledge transfer: a basis for competitive advantage in firms. Organizational Behavior and Human Decision Processes, 82(1), 150-169.

Arinloye, D.D.A.A., Linnemann, A.R., Hagelaar, G., Omta, S.W.F., Coulibaly, O.N., & van Boekel, M.A.J.S. (2016). Willingness to pay for market information received by mobile phone among smallholder pineapple farmers in Benin. Quality and Innovation in Food Chains. Wageningen Academic Publishers, The Netherlands, 75-100.

Indexed at, Google Scholar, Cross Ref

Becheikh, N., Landry, R., & Amara, N. (2006). Lessons from innovation empirical studies in the manufacturing sector: A systematic review of the literature from 1993–2003. Technovation, 26(5-6), 644-664.

Bhatt, G.D., & Grover, V. (2005). Types of information technology capabilities and their role in competitive advantage: An empirical study. Journal of Management Information Systems, 22(2), 253-277.

Blanchard, O.J. (1991). Current and anticipated deficits, interest rates and economic activity. In International Volatility and Economic Growth: The first ten years of the international seminar on macroeconomics (pp. 361-390). Elsevier Science Publishers BV.

Indexed at, Google Scholar, Cross Ref

Blili, S., & Raymond, L. (1993). Information technology: Threats and opportunities for small and medium-sized enterprises. International Journal of Information Management, 13(6), 439-448.

Bortolotti, B., D’Souza, J., Fantini, M., & Megginson, W.L. (2002). Privatization and the sources of performance improvement in the global telecommunications industry. Telecommunications Policy, 26(5-6), 243-268.

Brown, T.E., & Kirchhoff, B.A. (1997). The effects of resource availability and entrepreneurial orientation on firm growth. Frontiers of Entrepreneurship Research, 32-46.

Byrne, B.M. (2013). Structural Equation Modeling With EQS: Basic Concepts, Applications, and Programming. Routledge.

Carpenter, C. (2003). SME Finance in Nigeria. Paper presented to the Roundtable on “Making Small Business Finance Profitable in Nigeria”.

Chodokufa, K. (2009). An Analysis of the Business Relationship Between Smes and Insurance Companies Ikn the Nelson Mandela Metropolitan Area (Doctoral dissertation, University of Fort Hare).

Coad, A., & Rao, R. (2008). Innovation and firm growth in high-tech sectors: A quantile regression approach. Research Policy, 37(4), 633-648.

Coad, A., Segarra, A., & Teruel, M. (2013). Like milk or wine: Does firm performance improve with age? Structural Change and Economic Dynamics, 24, 173-189.

Datta, A., & Agarwal, S. (2004). Telecommunications and economic growth: A panel data approach. Applied Economics, 36(15), 1649-1654.

De Bruijne, M., & Van Eeten, M. (2007). Systems that should have failed: Critical infrastructure protection in an institutionally fragmented environment. Journal of Contingencies and Crisis Management, 15(1), 18-29.

Dijkstra, T.K., & Henseler, J. (2015). Consistent partial least squares path modeling. MIS Quarterly Management Information Systems Quarterly, 39(2), 297-316.

Djankov, S., McLiesh, C., & Ramalho, R.M. (2006). Regulation and growth. Economics Letters, 92(3), 395-401.

Doh, J.P. (2000). Entrepreneurial privatization strategies: Order of entry and local partner collaboration as sources of competitive advantage. Academy of Management Review, 25(3), 551-571.

Dunne, P., & Hughes, A. (1994). Age, size, growth and survival: UK companies in the 1980s. The Journal of Industrial Economics, 115-140.

Dunne, T., Roberts, M.J., & Samuelson, L. (1989). The growth and failure of us manufacturing plants. The Quarterly Journal of Economics, 104(4), 671-698.

Dutta, S., Shalhoub, Z.K., & Samuels, G. (2007). Promoting technology and innovation: Recommendations to improve arab ict competitiveness. Arab World Competitiveness Report, 81-96.

Dzakovic, V., Lalic, B., Zrnic, D., & Palcic, I. (2011). Evaluating the impact of environmental factors on the international competitiveness of small and medium-sized enterprises in the western balkans. African Journal of Business Management, 5(4), 1253-1265.

Indexed at, Google Scholar, Cross Ref

Edmiston, K.D. (2007). The role of small and large businesses in economic development. Available at SSRN 993821.

Eggers, F., Kraus, S., Hughes, M., Laraway, S., & Snycerski, S. (2013). Implications of customer and entrepreneurial orientations for SME growth. Management Decision.

Indexed at, Google Scholar, Cross Ref

Esselaar, S., Stork, C., Ndiwalana, A., & Deen-Swarray, M. (2006, May). ICT Usage and its impact on profitability of smes in 13 African Countries. In 2006 International Conference on Information and Communication Technologies and Development (Pp. 40-47). IEEE.

Fatoki, O. (2012). The impact of entrepreneurial orientation on access to debt finance and performance of small and medium enterprises in South Africa. Journal of Social Sciences, 32(2), 121-131.

Indexed at, Google Scholar, Cross Ref

Fornell, C., & Larcker, D.F. (1981). Evaluating structural equation models with unobservable variables and measurement error. Journal of Marketing Research, 18(1), 39-50.

Indexed at, Google Scholar, Cross Ref

Frempong, G. (2007). Trends in ICT Usage by small and medium scale enterprises in Ghana. ATDF Journal, 4(1), 3-10.

Frempong, G., & Henten, A. (2005). Telecom development and investment in Ghana. In Stimulating Investment in Network Development: Roles for Regulators, Case Studies and Research from WDR Research Cycle 2 (Pp. 291-308). Forma Estudio.

Frempong, G.K., & Atubra, W.H. (2001). Liberalisation of telecoms: The Ghanaian Experience. Telecommunications Policy, 25(3), 197-210.

Frempong, Godfred. (2007). Trends in ICT Usage by Small and medium scale enterprises in Ghana. ATDF Journal, 4(1), 3-10.

Gao, P., & Lyytinen, K. (2000). Transformation of China's telecommunications sector: A Macro Perspective. Telecommunications Policy, 24(8-9), 719-730.

Gensollen, M., & Laubie, A. (1995, February). The role of telecommunications in economic development. In Annales Des Télécommunications, 50(2), 315-324).

Glancey, K. (1998). Determinants of growth and profitability in small entrepreneurial firms. International Journal of Entrepreneurial Behavior & Research.

Indexed at, Google Scholar, Cross Ref

Goedhuys, M., & Veugelers, R. (2012). Innovation strategies, process and product innovations and growth: Firm-level evidence from Brazil. Structural Change and Economic Dynamics, 23(4), 516-529.

Gruber, H., & Koutroumpis, P. (2011). Mobile telecommunications and the impact on economic development. Economic Policy, 26(67), 387-426.

Hall, R.E., & Jones, C.I. (1999). Why do some countries produce so much more output per worker than others? The Quarterly Journal of Economics, 114(1), 83-116.

Haltiwanger, J., Jarmin, R.S., & Miranda, J. (2013). Who creates jobs? small versus large versus young. Review of Economics and Statistics, 95(2), 347-361.

Henseler, J., Hubona, G., & Ray, P.A. (2016). Using PLS path modeling in new technology research: Updated Guidelines. Industrial Management & Data Systems.

Indexed at, Google Scholar, Cross Ref

Hsiao, M.H., & Chen, L.C. (2015). Smart phone demand: An empirical study on the relationships between phone handset, internet access and mobile services. Telematics and Informatics, 32(1), 158-168.

Hu, L.T., & Bentler, P.M. (1999). Cutoff criteria for fit indexes in covariance structure analysis: Conventional criteria versus new alternatives. Structural Equation Modeling: A Multidisciplinary Journal, 6(1), 1-55.

Indexed at, Google Scholar, Cross Ref

Jensen, R. (2007). The digital provide: Information (Technology), Market performance, and welfare in the South Indian Fisheries Sector. The Quarterly Journal of Economics, 122(3), 879-924.

Kasseeah, H. (2013). Innovation and performance in small-and medium-sized enterprises: Evidence From Mauritius. Innovation and Development, 3(2), 259-275.

Kiraka, R., Kobia, M., & Katwalo, A.M. (2015). Micro, Small And Medium Enterprise Growth And Innovation In Kenya: A Case Study On The Women Enterprise Fund).

Klonner, S., & Nolen, P. (2008). Does ICT Benefit The Poor? Evidence From South Africa. Unpublished Mimeo.

Krasniqi, B.A. (2007). Barriers to entrepreneurship and sme growth in transition: The case of kosova. Journal of Developmental Entrepreneurship, 12(01), 71-94.

Leenders, M.A., & Wierenga, B. (2002). The effectiveness of different mechanisms for integrating marketing and R&D. Journal of Product Innovation Management: An International Publication of the Product Development & Management Association, 19(4), 305-317.

Indexed at, Google Scholar, Cross Ref

Levy, M., & Powell, P. (2004). Strategies for Growth in SMEs: The Role of Information and Information Systems. Elsevier.

Lipton, D., & Sachs, J. (1992). Privatization in Eastern Europe: The case of Poland. In Development Policy (Pp. 169-212). Palgrave Macmillan, London.

Mahdi, H.A.A., Abbas, M., Mazar, T.I., & George, S. (2015). A comparative analysis of strategies and business models of nike, Inc. And Adidas Group With Special Reference To Competitive Advantage In The Context Of A Dynamic And Competitive Environment. International Journal of Business Management and Economic Research, 6(3), 167-177.

Mambula, C. (2002). Perceptions of SME Growth Constraints in Nigeria. Journal of Small Business Management, 40(1), 58-65.

McMahon, R.G.P. (1998). Stage models of sme growth reconsidered. Small Enterprise Research, 6(2).

Mwangi, A.K. (2013). The effect of financial innovation on financial performance of deposit taking micro-finance institutions in Kenya (Doctoral Dissertation, University Of Nairobi).

Newbert, S.L. (2008). Value, rareness, competitive advantage, and performance: A conceptual-level empirical investigation of the resource based view of the firm. Strategic Management Journal, 29(7), 745-768.

Newbery, D.M. (1991). Reform in hungary: Sequencing and privatisation. European Economic Review, 35(2-3), 571-580.

Ngugi, J.K., McOrege, M.O., & Muiru, J.M. (2013). The influence of innovativeness on the growth of smes in Kenya. International Journal of Business and Social Research (IJBSR), 3(1), 25-31.

Njoroge, P.T. (2015). Competitive strategies adopted by the telecommunication mobile service providers in Kenya: A Case of Telkom Kenya (Doctoral Dissertation, University Of Nairobi).

Nunnally, J.C., & Bernstein, I.H. (1978). Psychometric theory mcgraw-hill New York. The Role of university in the development of entrepreneurial vocations: A spanish study. 387-405.

Phillips, C., & Bhatia-Panthaki, S. (2007). Enterprise development in Zambia: Reflections on the missing middle. Journal of International Development: The Journal of the Development Studies Association, 19(6), 793-804.

Reynolds, T., Kenny, C., Liu, J., & Qiang, C.Z.W. (2004). Networking for foreign direct investment: The telecommunications industry and its effect on investment. Information Economics and Policy, 16(2), 159-164.

Ringle, C.M., Wende, S., & Becker, J.M. (2015). Mobile banking choices of entrepreneurs: A Unified Theory of Acceptance and Use of Technology (UTAUT) Perspective. Smartpls 3. Boenningstedt: Smartpls Gmbh, accessed on the 10/06/2017 from http://www. smartpls. com.

Roberts, J. (2000). From Know-How to Show-How? Questioning the role of information and communication technologies in knowledge transfer. Technology Analysis & Strategic Management, 12(4), 429-443.

Shimamoto, D., Yamada, H., & Gummert, M. (2015). Mobile Phones and Market Information: Evidence from rural Cambodia. Food Policy, 57, 135-141.

Sijtsma, K. (2009). On the use, the misuse, and the very limited usefulness of Cronbach’s Alpha. Psychometrika, 74(1), 107.

Spender, J.C. (1996). Organizational knowledge, learning and memory: Three concepts in search of a Theory. Journal of Organizational Change Management.

Storey, D.J. (2016). Understanding The Small Business Sector. Routledge.

Google Scholar, Cross Ref

Tella, A.S., Amaghionyeodiwe, L.A., & Adesoye, B.A. (2007). The effects of investment in telecommunication infrastructure on economic growth in Nigeria. In UN-IDEP and AFEA Joint Conference On “Sector-Led Growth In Africa And Implications For Development.

Watts, A. (2003). A dynamic model of network formation. in networks and groups (pp. 337-345). Springer Berlin Heidelberg.

Waverman, L., Meschi, M., & Fuss, M. (2005). The impact of telecoms on economic growth in developing countries. The Vodafone Policy Paper Series, 2(3), 10-24.

Wijewardena, H., & Tibbits, G.E. (1999). Factors contributing to the growth of small manufacturing firms: Data From Australia. Journal of Small Business Management, 37(2), 88.

Wiklund, J., & Shepherd, D. (2003). Knowledge based resources, entrepreneurial orientation, and the performance of small and mediu sized businesses. Strategic Management Journal, 24(13), 1307-1314.

World Bank Report (2012). ICTs Delivering Home-Grown Development Solutions in Africa. Accessed on the 17th March, 2015 from http://www.worldbank.org/en/news/feature/2012/12/10/ict-home-grown-development-solutions-in-africa

Wu, W.Y., Chang, M.L., & Chen, C.W. (2008). Promoting innovation through the accumulation of intellectual capital, social capital, and entrepreneurial orientation. R&D Management, 38(3), 265-277.

Zahra, S.A., & Covin, J.G. (1995). Contextual influences on the corporate entrepreneurship-performance relationship: A Longitudinal Analysis. Journal of Business Venturing, 10(1), 43-58.

Received: 20-Dec-2022, Manuscript No. AEJ-21-10577; Editor assigned: 23-Dec-2022, PreQC No. AEJ-21-10577(PQ); Reviewed: 03- Jan-2022, QC No. AEJ-21-10577; Revised: 12-Jan-2022, Manuscript No. AEJ-21-10577(R); Published: 14-Jan-2022