Review Article: 2025 Vol: 29 Issue: 1S

Decoding Consumer Behaviour in Health Insurance: Understanding Highs and Lows of Consumer Satisfaction through Rigorous Trend Analysis Model

Jolly Masih, BML Munjal University Arup Majumdar, UPES

Sourav Kumar Mondal, BML Munjal University

Kushal Goyal, BML Munjal University

Samarth Badar, BML Munjal University

Citation Information: Masih, J., Majumdar, A., Mondal, S.K., Goyal, K., & Badar, S. (2025). Decoding consumer behaviour in health insurance: Understanding highs and lows of consumer satisfaction through rigorous trend analysis model. Academy of Marketing Studies Journal, 29(S1), 1-15.

Abstract

Purpose – This study aims to provide a comprehensive analysis of the global health insurance market, focusing on consumer behaviour and trends. The study also enhances understanding of highs and lows of consumer satisfaction levels during evolution of health insurance landscape globally. Study undertakes a case study of India to report which areas lag in health insurance awareness and the underlying reasons. Design/methodology- This research adopts a mixed-methods approach, integrating qualitative and quantitative methodologies. The systematic literature review (SLR) spans 60 papers from 1998 to 2023, utilizing a seven-point Likert scale to assess the relevance of ten key variables from Google Scholar database. Additionally, the study introduces the Trend Impressions Model, which maps the movement of keywords across four zones to capture their prevalence and importance over time. The trend analysis examines Google search data from 2004 to 2024 from Google Trends, normalized on a scale from 0 to 100 and presented through a heat map to show regional variations. Findings – Systematic Literature Review (SLR) highlights ten critical keywords and their relative contribution: “medical coverage”, “insurance coverage”, “payout ratio”, “frauds”, “maturity benefits”, “public awareness”, “government initiatives”, “accessibility”, “ease of understanding” and “government vs. private policies”. These findings elucidate the core components of health insurance and underscore challenges and opportunities for system enhancement. Trend Impressions Model categorizes keywords into four zones based on their relevance and frequency: Zone of Popping In, Zone of Excellence, Zone of Popping Out and Zone of All Time Favourite. This model provides insights into the evolving trends within the health insurance sector, highlighting which aspects are gaining traction and which are declining in importance. The Google Trends analysis uncovers regional disparities in the popularity of health insurance terms across India from 2004 to 2024. Practical implications – Understanding consumer satisfaction levels and preferences is crucial for insurers to design targeted strategies. Incorporating these insights enables stakeholders in the health insurance industry to make informed decisions, fostering a more equitable and responsive healthcare system that caters to the diverse needs of consumers.

Keywords

Health Insurance, Medical Coverage, Insurance Coverage, Consumer Satisfaction, Trend Impressions Model, Google Trends.

Introduction

Over the past decade, the global health insurance market has undergone significant transformation driven by rising healthcare expenditures, changing customer expectations and dynamic demographic trends (Smith et al., 2021). These shifts have compelled insurers and healthcare providers to adapt rapidly, reshaping the landscape through notable changes in consumer behaviour, market dynamics and regulatory frameworks. In India, the world’s most populous nation, the healthcare sector presents vast potential and formidable challenges (Dafny, 2019). Anticipating future developments and responding strategically to changing customer needs and preferences is crucial for insurers to sustain success in this competitive market (Armaroli & Balzani, 2006).

The global health insurance market encompasses a wide array of products and services offered by public and private insurers, providing financial protection against medical expenses incurred by policyholders. This includes services such as hospitalization, outpatient care, prescription drugs, preventive care and sometimes dental and vision care. The market was valued at approximately USD 1.2 trillion in 2023 and is projected to reach USD 2.5 trillion by 2030, growing at a compound annual growth rate (CAGR) of 8.2% (IRDAI, 2024) This growth is driven by increasing healthcare costs, the rising prevalence of chronic diseases and greater awareness about the benefits of health insurance.

In India, the health insurance market has shown robust growth, driven by a large and increasingly health-conscious population. The market was valued at approximately INR 58,000 crore (USD 7.7 billion) in 2023 and is expected to grow at a CAGR of 15% over the next five years, reaching INR 1.17 lakh crore (USD 15.6 billion) by 2028 (IRDAI, 2024). Factors such as rising healthcare costs, increasing incidence of lifestyle diseases and a growing middle class with greater disposable income propel this growth (Ahlin et al., 2016).

A comprehensive understanding of the health insurance market is essential to navigate its complexities and make informed decisions. This necessity underscores the importance of a systematic literature review (SLR) and trend analysis in this study. An SLR offers a structured and thorough examination of existing research on health insurance, identifying consistent patterns, key themes and significant gaps in the current knowledge base (Johnson et al., 2020). By uncovering these gaps, the SLR guides future research efforts and highlights opportunities for innovation in insurance products and services.

The papers by Crim (2021), and Sum and Nordin (2018), collectively explore various aspects of the health insurance landscape, emphasizing the interplay between insurance coverage, consumer behaviour, and the health insurance market. Crim (2021) examines the challenges posed by rising health insurance costs, highlighting that insurance companies' control over treatment decisions can adversely affect patient outcomes. The paper discusses financial metrics such as the Payout Ratio and Medical Loss Ratio under the Affordable Care Act, noting their role in increasing premiums and limiting consumer choice. Crim also addresses issues of fraud and treatment delays, advocating for heightened public awareness and a balanced approach between government and private insurance policies to enhance accessibility and improve patient outcomes.

Sum and Nordin (2018) focus on the decision-making process of consumers when purchasing health insurance, emphasizing psychological and emotional factors over logical

considerations. They identify biases that influence consumer decisions, such as heuristic and decision framing biases, and highlight the complexity of insurance terms that can impact decision-making.

The authors call for public education to ensure informed choices and acknowledge the role of government policies in shaping consumer behaviour. Meanwhile, Dafny (2019) investigates the impact of an insurer's profit status on the health insurance industry, using data from the Large Employer Health Insurance Dataset. The study reveals that a switch to for-profit status results in higher premiums and altered insurance conditions, potentially affecting consumer access and costs. Dafny underscores the importance of public awareness and governmental efforts in driving insurance demand, emphasizing the need for equitable access to care through balanced policy approaches (Yadav & Mohania, 2013).

An evidence-based approach, facilitated by the SLR, ensures that decisions are based on a robust and comprehensive evidence base, reducing the risk of bias and providing an accurate picture of the health insurance landscape. Complementing the SLR, trend analysis offers dynamic insights into the evolution of the health insurance market over time, including real-time changes in consumer behaviour, level of satisfaction and preferences, essential for understanding the current state of the market and anticipating future developments (White & Brown, 2018).

Trend analysis also highlights regional and temporal variations, allowing stakeholders to tailor strategies to address specific local needs and temporal shifts (Dafny, 2019). This targeted approach enhances policy and intervention effectiveness. Additionally, trend analysis helps understand the impact of external factors such as economic fluctuations, regulatory changes and global events like the COVID-19 pandemic on the market (Crim, 2021). These insights are crucial for developing resilient strategies that can withstand external shocks.

Literature Review

Systematic reviews deploy a series of steps to minimize the bias and keep the review free of error through exhaustive literature searches of the extant research in the field (Table 1) (Tranfield et al., 2003).

| Table 1 Systematic Literature Review of Global Health Insurance Sector | |||

| Study | Relevance to Parameter | Parameter | Year |

| Sage (1998) | Reviews judicial opinions involving health insurance coverage, discussing public awareness issues. | Judicial Opinions | 1998 |

| Berman (1998) | Discusses private health care provision in India, emphasizing healthcare system reform. | Private Health Care Provision | 1998 |

| Carrasquillo et al. | Analyzes trends in health insurance coverage from 1989– 1997, highlighting accessibility issues. | Health Insurance Coverage Trends | 1999 |

| Sparrow (1999) | Examines innovations and obstacles in controlling Medicaid fraud and abuse. | Fraud Control | 1999 |

| Ellis et al. (2001) | Reviews the financial terms and extent of health insurance coverage in India, highlighting prognosis and prospects. | Insurance Coverage (Financial Terms) | 2001 |

| Gumber (2001) | Discusses extending health insurance to the poor through the SEWA scheme in India, focusing on government initiatives. | Govt. Initiatives & Benefits | 2001 |

| Murphy (2001) | Analyzes the benefits of expert system technology in the insurance industry, focusing on policy clarity. | Expert System Technology | 2001 |

| Bhat & Reuben (2002) | Explores the management of claims and reimbursements in the Mediclaim insurance policy, highlighting fraud issues. | Fraud | 2002 |

| Ericson et al. (2000) | Discusses the moral hazards of neoliberalism through lessons from the private insurance industry, focusing on fraud. | Moral Hazards | 2000 |

| Mavalankar & Bhat (2020) | Discusses the opportunities, challenges and concerns in accessing health insurance services in India. | Health Insurance Opportunities | 2000 |

| Shi (2000) | Analyzes the quality of primary care experiences across different types of health insurance, focusing on clarity and simplicity of terms. | Primary Care Experience | 2000 |

| Doherty & Singer (2003) | Discusses the benefits of a secondary market for life insurance policies, focusing on payout ratios. | Life Insurance Policies | 2003 |

| Ranson (2003) | Reviews community-based health insurance schemes in India, emphasizing government initiatives and benefits. | Community-Based Schemes | 2003 |

| Krause (2004) | Analyzes regulatory, guiding and enforcement mechanisms in healthcare fraud. | Health Care Fraud | 2004 |

| Ekman (2004) | Systematically reviews the evidence on community-based health insurance in low-income countries, focusing on service accessibility. | Low-Income Countries | 2004 |

| Kaushal & Kaestner (2005) | Analyzes the impact of welfare reform on health insurance coverage and accessibility for immigrants. | Health Insurance for Immigrants | 2005 |

| Acharya & Ranson (2005) | Reviews community-based health insurance schemes in Gujarat, India, focusing on government initiatives and benefits. | Community-Based Schemes | 2005 |

| Shisana et al. (2006) | Evaluates public perceptions of national health insurance in South Africa and its movement towards universal health coverage. | Universal Health Coverage | 2006 |

| Kohli (2006) | Analyzes the secondary market for life insurance policies and its regulatory environment, focusing on pricing and payout ratios. | Life Insurance Market | 2006 |

| Dror et al. (2007) | Explores the willingness to pay for health insurance among rural and impoverished populations in India. | Willingness to Pay | 2007 |

| Kaplan (2007) | Highlights the gap in retirement planning for funding long-term care, focusing on public awareness. | Retirement Planning | 2007 |

| Quinn (2008) | Investigates the moral and market transformations in the exchange of life insurance policies, focusing on payout ratios. | Life Insurance Policies | 2008 |

| Oster et al. (2008) | Investigates the fear of health insurance loss among individuals at risk for Huntington's disease, highlighting public awareness. | Public Awareness | 2008 |

| Chou et al. (2009) | Investigates health care coverage and industry dynamics, focusing on accessibility and utilization. | Health Care Coverage | 2009 |

| Sun et al. (2009) | Evaluates the financial protection of patients with chronic diseases by health insurance in rural China. | Financial Protection | 2009 |

| Bannick & Granger (2009) | Reviews the TRICARE health benefits program as part of the federal platform for healthcare reform. | Health Benefits Program | 2009 |

| Vijaya (2010) | Critically examines the implications of medical tourism on health service accessibility and quality. | Medical Tourism | 2010 |

| Kumar et al. (2011) | Discusses the challenges and opportunities in financing healthcare for all in India, focusing on universal health coverage. | Universal Health Coverage | 2011 |

| Hodek et al. (2011) | Provides methodological recommendations for evaluating the economic burden of preterm births on children and their caregivers. | Economic Consequences | 2011 |

| Eggleston (2012) | Provides an overview of China's health system, emphasizing government initiatives and benefits. | Health System Overview | 2012 |

| Vellakkal (2012) | Compares the financial protection offered by the Mediclaim policy and the CHAT scheme in India. | Financial Protection | 2012 |

| Shahi (2013) | Analyzes the origin, growth pattern and trends in the Indian health insurance sector, highlighting government initiatives. | Health Insurance Trends | 2013 |

| Pendzialek et al. (2014) | Conducts a systematic review of price elasticities of demand for health insurance, discussing financial protection elements. | Insurance Coverage (Financial Terms) | 2014 |

| Wang et al. (2014) | Compares inpatient care and financial protections provided by different types of medical insurance before and after healthcare reform in China. | Insurance Coverage (Financial Terms) | 2014 |

| Dormont & Péron | Tests the hypothesis that health insurance encourages rising medical prices through a balance billing analysis in France. | Insurance Coverage (Financial Terms) | 2016 |

| Koch (2014) | Investigates the impact of risk and age on medical insurance pricing, emphasizing the scope of healthcare services covered. | Medical Coverage | 2014 |

| Samal & Dehury (2015) | Explores the status and trends of third-party administrators in India's health insurance sector. | Third-Party Administrators | 2015 |

| Besanko et al. (2016) | Examines the role of insurance in pharmaceutical pricing, focusing on the financial protection provided. | Pharmaceutical Prices | 2016 |

| Miraldo et al. (2018) | Investigates the impact of publicly subsidized health insurance on access, risk factors and disease management. | Govt. Initiatives & Benefits | 2018 |

| De La Hoz- Correa et al. (2018) | Analyzes past themes and future trends in medical tourism research, focusing on healthcare service accessibility. | Medical Tourism Trends | 2018 |

| Lahariya (2018) | Examines the “Ayushman Bharat” program and its role in advancing universal health coverage in India. | Universal Health Coverage | 2018 |

| Erlangga et al. (2019) | Systematically reviews the impact of public health insurance on healthcare utilization and financial protection in low- and middle-income countries. | Public Health Insurance | 2019 |

| Umemoto et al. (2019) | Analyzes big data from medical insurance claims to understand the financial aspects of prescription trends. | Insurance Coverage (Financial Terms) | 2019 |

| Dutta | Analyzes the performance of the health insurance sector in India, focusing on policy clarity and understanding. | Performance Analysis | 2020 |

| Song et al. (2020) | Studies the association between health insurance and various mortality risks, focusing on financial protection aspects. | Insurance Coverage (Financial Terms) | 2020 |

| Siongco et al. (2020) | Analyzes the reduction in inequalities in health insurance coverage and healthcare utilization among older adults in the Philippines. | Public Awareness | 2020 |

| Kreutzburg et al. (2020) | Examines the patterns of comorbidity and treatment coverage for peripheral arterial occlusive disease using health insurance claims data in Germany. | Medical Coverage | 2020 |

| Dong et al. | Reviews the benefits of China’s social health insurance schemes since health reform, emphasizing government initiatives. | Govt. Initiatives & Benefits | 2021 |

| Khan et al. (2021) | Studies multilevel population and socioeconomic variations in health insurance coverage in India, focusing on public awareness. | Health Insurance Coverage | 2021 |

| Atake | Assesses how different types of health insurance affect | Provider Choice & | 2020 |

| provider choice, healthcare utilization and expenditures. | Utilization | ||

| Chen et al. | Compares healthcare utilization, costs and catastrophic health expenditures among middle-aged and older adults with different health insurance types in China. | Healthcare Utilization | 2022 |

| Dubey et al. | Reviews the evolution of government-funded health insurance for universal health coverage in India. | Govt. Funded Insurance | 2023 |

The table presents a comprehensive summary of numerous studies examining various aspects of health insurance. These studies cover topics such as legal cases, private healthcare, trends in health insurance, fraud prevention and detection, governmental actions on healthcare issues, the financial status of the insurance industry, the use of expert systems in medicine, and public awareness and accessibility (Prinja et al., 2023). A timeline from 1998 to 2023 illustrates the changes and challenges in health insurance, as well as innovations in countries like India, China, South Africa, and the Philippines, among others. Key topics include governmental initiatives, fraud issues, financial protection, and universal coverage, the influence of neoliberal policies, community-based schemes, and responses to medical tourism. Collectively, these studies provide insights into the functioning of health insurance systems, highlighting their benefits and drawbacks within the socio-economic contexts that affect these systems (Prince & Roche, 2014).

Methodology

Research Design

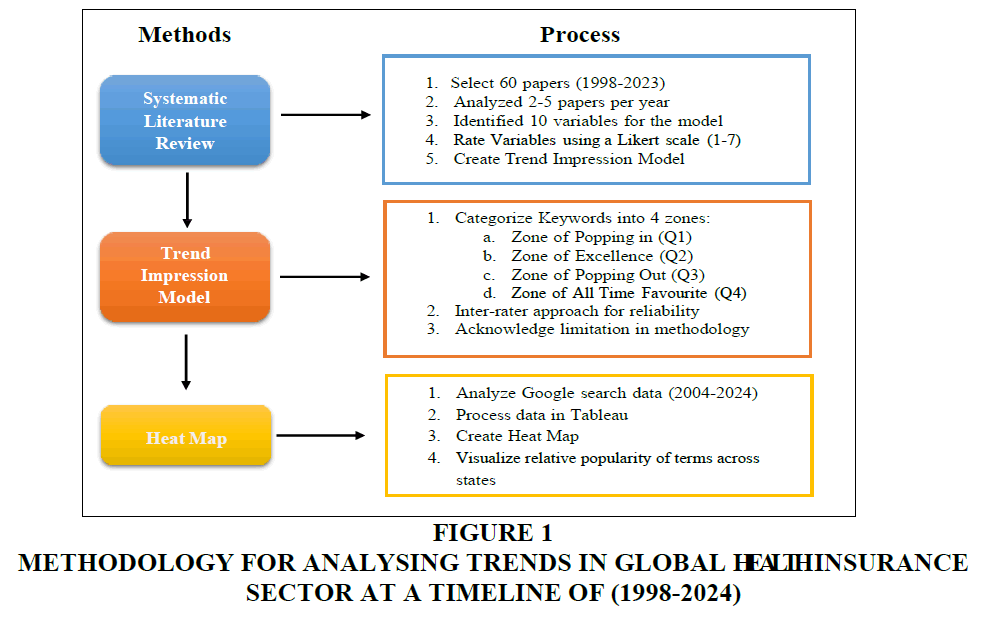

The research design employed in this study is characterized by a mixed-methods approach, seamlessly integrating qualitative and quantitative methodologies to provide a comprehensive understanding of the global health insurance landscape (see Figure 1). The objectives include an extensive literature review analysis from Google Scholar Database and trend analysis using data from Google Trends (Venkatesh, 2013).

Figure 1 Methodology for Analysing Trends in Global Health Insurance Sector at a Timeline of (1998-2024)

Objectives

1. Exploring Consumer Behaviour and their satisfaction level in the Global Health Insurance Sector: A Comprehensive Literature Review.

2. Trend Analysis of the Indian Health Insurance Sector: Unveiling Emerging Patterns Through Google Trends Data with special focus on laggard

Data Sources

Secondary data was collected from sources such as Google Trends and Google Scholar (Acharya & Ranson, 2005).

Sample Size

60 research papers were selected within the time-period ranging from the year 1998 to the year 2023.

Technique

Systematic Literature Review of Consumer Behavior and their Satisfaction Level in the Global Health Insurance Sector

A systematic process was followed, involving the selection of 60 papers spanning two decades (1998-2023). Two papers per year were chosen, supplemented by additional representation for the year 2023 to capture recent developments (Nadanamoorthy et al., 2011)

These variables were “Medical Coverage”, “Insurance Coverage (Financial Terms)”, and “Payout Ratio”, “Frauds”, “Maturity Benefits”, “Public Awareness”, “Government Initiatives & Benefits”, “Accessibility”, “Ease of Understanding and Government versus Private Policies". A seven-point Likert scale (1 = least relevance to 7 = highest relevance) was used to measure the relevance of each variable in the research papers, facilitating a quantitative evaluation of their prevalence and depth within the literature. This rating process resulted in a Trend Impression Model, visually representing trends in the sector by leveraging aggregate ratings to highlight emphases and potential gaps (Masih et al., 2017).

Trend Impression Model

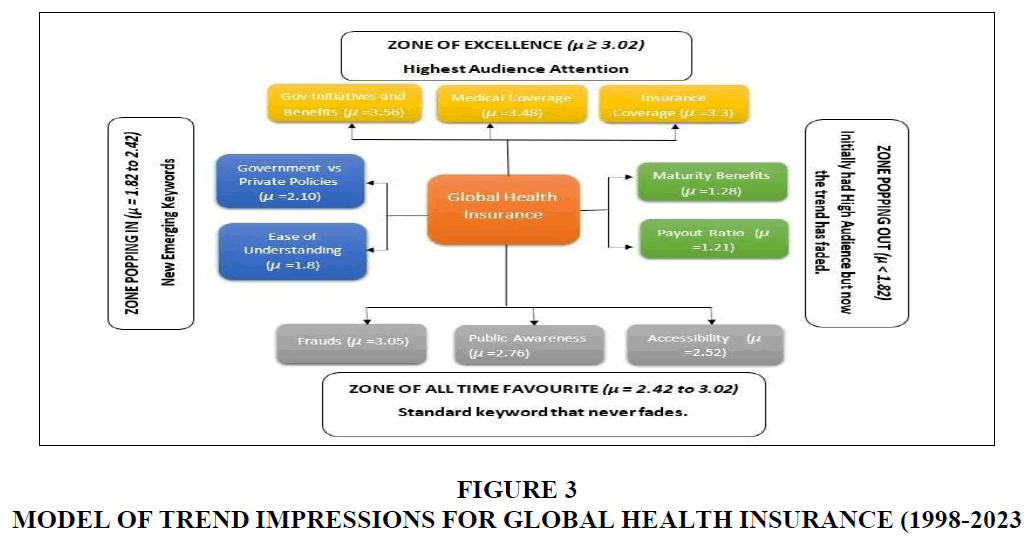

The Trend Impression Model studies the average movement of keywords for each parameter on a scale of µ=1 to 7, categorized into four zones:

a) Zone of Popping In: This zone encompasses average values of keywords below µ=1.82, representing the lower range of performance. Keywords in this zone have emerged recently and are likely to gain prominence in the future.

b) Zone of Excellence: Values falling between µ=1.82 to 2.42 are categorized in this zone indicating a slightly higher range of performance compared to Zone of Popping In. This zone includes the most popular keywords that attract significant attention from readers, whether new or

c) Zone of Popping Out: Ranging from µ=2.42 to 3.02, this zone represents a moderate to high level of This zone covers keywords that initially had high attention but have since declined in importance.

d) Zone of All Time Favourite: Values exceeding µ=3.02 are part of this zone, indicating the highest level of performance. Keywords in this zone have consistently performed well over the designated time frame and are stable in

To ensure methodological reliability, an inter-rater approach was adopted, with multiple assessors independently rating a subset of papers to enhance consistency and mitigate subjective biases. The research methodology acknowledged potential limitations, such as scope and biases, providing transparency about the study's constraints. This approach not only facilitated a comprehensive analysis of the literature but also established a robust foundation for extracting meaningful insights into the current state of the Global Health Insurance Sector (Masih et al., 2017).

Trend Analysis of Health Insurance

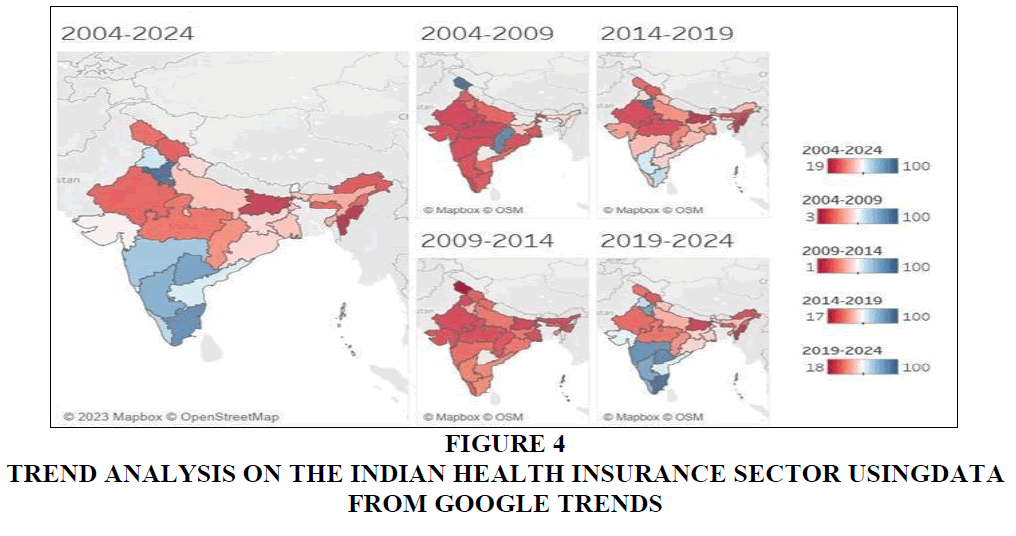

The methodology included exploratory data analysis of Google search-based data points for the keywords “Health Insurance.” The analysis covered the period from 2004 to 2024 in India. To enhance visualization, the data was processed using the Tableau tool. By employing latitude and longitude coordinates, the search data was normalized on a scale from 0 to 100. A score of 100 indicates the highest prevalence of the term, 50 represents half as popular and 0 denotes insufficient data.

The trend analysis focused on identifying peaks and troughs in public interest, providing valuable insights into the evolving landscape of health insurance in India over the specified timeframe. The accompanying heat map visually illustrates the relative popularity of these terms across states, offering a nuanced understanding of regional variations. This approach enhances comprehension of the dynamic nature of health insurance trends in India (Google Trends, 2023).

Results

Objective 1: Exploring Consumer Behaviour and their satisfaction level in the Global Health Insurance Sector: A Comprehensive Literature Review

We aim to identify and analyze key indicators affecting Global Health Insurance Sector by reviewing 60 research papers spanning the years 1998 to 2023. This approach ensures a comprehensive understanding of the evolution and current state of consumer behaviour and their satisfaction level in the Global Health Insurance Sector (Johnson et al., 2020).

Identification of Keywords

Our approach involves a thorough review of research papers to identify pertinent keywords relevant to the Global Health Insurance Sector (Table 2). The ten identified keywords—Medical Coverage, Insurance Coverage (Financial Terms), Payout Ratio, Frauds, Maturity Benefits, Public Awareness, Government Initiatives & Benefits, Accessibility, Ease of Understanding and Government vs Private Policies—encapsulate critical elements shaping discussions in the health insurance landscape. This systematic identification aligns with the keyword extraction methods used in comprehensive literature reviews to highlight key research themes.

| Table 2 Identification of Keywords of Global Health Insurance Sector | |

| Keywords | Description |

| Medical Coverage (MC) | Encompasses the range of healthcare services and treatments covered by an insurance policy. |

| Insurance Coverage (Financial Terms) (ICFT) | Refers to the extent and specifics of financial protection provided by an insurance policy. |

| Payout Ratio (PR) | The proportion of claims paid out by an insurance company relative to the premiums collected. |

| Frauds (FR) | Instances of deceptive practices or misrepresentation within the insurance sector. |

| Maturity Benefits (MB) | Benefits received upon the policy reaching its maturity date, usually Applicable to life insurance policies. |

| Public Awareness (PA) | The level of knowledge and understanding among the public regarding insurance options and benefits. |

| Govt. Initiatives & Benefits (GIB) | Government-led programs and advantages designed to promote and support insurance coverage. |

| Accessibility (AC) | The ease with which individuals can obtain and utilize insurance services. |

| Ease of Understanding (EU) | The clarity and simplicity of insurance policy terms and conditions for policyholders. |

| Govt. vs Private Policies (GPP) | A comparison of insurance policies offered by government entities and private insurance companies. |

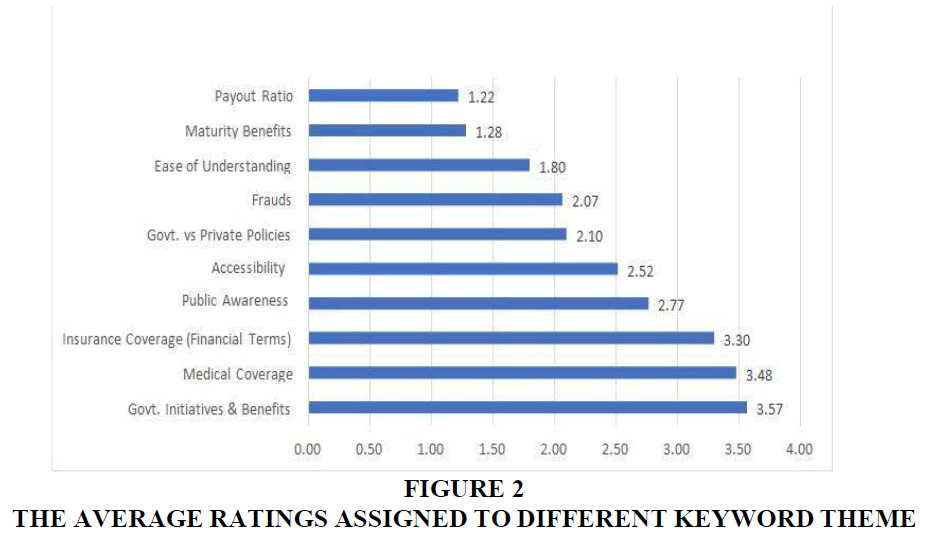

The rating of keywords involved a comprehensive review of each research paper pertaining to health insurance. The average ratings assigned to different categories based on the concept of topic coverage are as follows: Rating (1) corresponds to 'Very Low Concept Coverage' and Rating (7) is associated with 'High Coverage' (Figure 2).

These ratings provide a systematic classification of concept coverage across various levels, facilitating a nuanced evaluation of the extent to which concepts are addressed in each context.

In the systematic literature review, the average rating for “Medical Coverage” was µ=3.48, indicating its perceived importance (Ambade et al., 2023) “Insurance Coverage”, specifically in financial terms, received an average rating of µ=3.30 (Dutta, 2020) “Payout Ratio” was rated relatively low at µ=1.22, suggesting a potential area of concern or limited emphasis in the literature (Smith et al., 2021). “Frauds” garnered an average rating of µ=3.05, highlighting the attention given to this aspect in the reviewed studies (Bhat et al., 2023) (Figure 2).

Maturity Benefits” had a modest rating of µ=1.28, while “Public Awareness” received a rating of µ=2.77, indicating a moderate level of attention in the literature (Atake, 2020). “Government Initiatives & Benefits” stood out with a high average rating of µ=3.57, suggesting a substantial focus on this aspect (Dubey et al., 2023) “Accessibility” received a rating of µ=2.52, reflecting a moderate level of consideration (TechSci Research, 2021) (Figure 2).

“Ease of Understanding” had a relatively low rating of µ=1.80, suggesting potential challenges or limitations in the clarity of the literature (Carrasquillo et al. 1999). Finally, the comparison between “Government versus Private Policies” received a rating of µ=2.10, indicating a moderate level of attention in the reviewed studies (Dormont & Péron, 2016) (Figure 2).

Trend Impression Model based on Selected Keywords

Health insurance is a crucial service that can safeguard and enhance the health and well-being of the population. However, the health insurance sector encounters numerous challenges and opportunities, which are well-documented in the research literature. The

diagram illustrates the relative importance of ten terms related to health insurance, based on their frequency and relevance in various research papers. These terms are categorized into four zones, each representing a distinct aspect of the health insurance system (Ambade et al., 2023) (Figure 3).

The Zone of Excellence comprises terms that are highly relevant and frequently used, such as “Medical Coverage”, “Insurance Coverage” and “Government Initiatives & Benefits”. These terms denote the fundamental components of health insurance, encompassing the scope of services covered the cost of the service and the regulation and support provided by the government. The papers employing these terms focus on analyzing and evaluating the status and performance of the health insurance system, proposing ways to enhance its quality, affordability and accessibility (Atake, 2020).

The Zone of All Time Favourite includes terms that are moderately relevant and frequently used, such as “Frauds”, “Public Awareness” and “Accessibility”. These terms underscore the challenges and opportunities for improving the health insurance system, such as reducing fraud and malpractice, increasing public awareness and education and enhancing accessibility and inclusiveness. The studies utilizing these terms aim to identify and address the gaps and barriers within the health insurance system and propose solutions and strategies to overcome them (Bhat et al., 2023; Masih et al., 2017) (Figure 3).

The Zone of Popping in Keywords contains terms that are highly relevant but less frequently used, such as “Private Policies”, “Ease of Understanding” and “Government vs Private Policies”. These terms reflect emerging trends and issues within the health insurance sector, including the role and performance of private players, the need for simplification and transparency and the comparison and competition between public and private policies. The papers using these terms explore and examine new developments and dynamics within the health insurance sector, assessing their implications and impacts on the health insurance system (TechSci Research, 2021; Chen et al., 2022).

The Zone of Outgoing Keywords includes terms that are less relevant and less frequently used, such as “Payout Ratio” and “Maturity Benefits”. These terms represent the methodologies, measures and outcomes of health insurance research, which may hold less interest or significance for the public or policymakers. The studies employing these terms aim to provide a comprehensive and rigorous review of the existing literature, quantifying and

comparing the financial aspects of health insurance and estimating and projecting future benefits (Carrasquillo et al., 1999) (see Figure 3).

Objective 2: Trend Analysis of the Indian Health Insurance Sector: Unveiling Emerging Patterns through Google Trends Data with Special Focus on Laggard Regions

Utilizing a scale from 0 to 100, this study evaluates the prominence of search terms in various geographic locations. The scale measures the term's popularity as a fraction of total searches, providing a relative understanding of its significance in different regions. A score of 100 signifies the highest prevalence of the term within a location, while a value of 50 indicates a location that is half as popular. A score of 0 denotes insufficient data for analysis. The analysis is conducted over a specified time frame to capture temporal fluctuations in search term preferences (Dong et al., 2021) (Figure 4).

As shown in Figure 4, the health insurance heat map of India from 2004 to 2024 illustrates the varying levels of health insurance popularity across states, reflecting regional disparities influenced by factors such as urbanization, income, education, and health awareness. Southern and western states, including Kerala, Karnataka, Maharashtra, and Gujarat, exhibit higher popularity due to better socio-economic indicators. In contrast, northern and eastern states like Bihar, Uttar Pradesh, West Bengal, and Assam show lower popularity, attributed to lower development indices and a reliance on traditional healthcare practices (Chakraborty, 2010). Notable exceptions include Delhi, which has high health insurance popularity due to its status as the capital, and Goa, where the tourism-driven economy influences lower popularity. This heat map is essential for understanding regional disparities and guiding tailored approaches to enhance health insurance adoption in less popular areas (Google Trends, 2023). From 2004 to 2024, the map reflects shifts in health insurance adoption across different regions in India. During 2004 to 2009, northern and central states such as Punjab, Haryana, Rajasthan, and Madhya Pradesh showed higher popularity due to favourable socio-economic factors and easier access to insurance. By 2009 to 2014, northern and western regions, including Punjab, Haryana, Rajasthan, Gujarat, and Maharashtra, maintained high adoption rates due to increased income, education, and health awareness. In contrast, states like Tamil Nadu, Andhra Pradesh, West Bengal, Orissa, and Assam consistently exhibited lower adoption rates due to lower income and limited access to insurance providers. The 2014 to 2024 period highlights continued disparities, with northern and western states maintaining higher adoption rates. This timeline reveals regional variations and emphasizes the need for customized policies and strategies to address the diverse health insurance needs across India's socio-economic landscape (Google Trends, 2023; Singh & Bawa, 2020).

Discussion

This study investigates consumer behaviour and satisfaction in the global health insurance sector by reviewing 60 research papers and analyzing Google Trends data to identify emerging patterns and regional differences. The analysis reveals key themes and highlights how various factors shape consumer preferences and satisfaction levels (Parthasarathy et al., 2023). The Theory of Planned Behaviour (TPB) explains that consumer intentions are influenced by attitudes, subjective norms, and perceived behavioural control. In health insurance, positive attitudes towards comprehensive coverage and supportive government initiatives correlate with higher satisfaction, while difficulties in understanding policy terms may decrease satisfaction (Ajzen, 1991). The Health Belief Model (HBM) suggests that individuals' health behaviours are driven by their perceptions of health risks and the benefits of preventive measures. This model explains higher insurance adoption in socio- economically developed regions due to greater perceived risks and benefits (Becker, 1974). Expectation-Confirmation Theory (ECT) focuses on the gap between expectations and actual experiences, impacting consumer satisfaction. In health insurance, satisfaction varies with coverage comprehensiveness and accessibility, as seen in the different ratings for Government Initiatives & Benefits and Payout Ratio (Oliver, 1980). The Consumer Decision- Making Process Model outlines the stages consumers go through, from problem recognition to post-purchase evaluation. This model aligns with the study's focus on Frauds and Public Awareness, emphasizing how information availability and perceived risks influence decisions (Kotler & Keller, 2016). Additionally, the Diffusion of Innovations Theory supports the Model of Trend Impressions by explaining how new concepts and technologies, such as Medical Coverage and Government Initiatives & Benefits, gain prominence over time. Emerging issues like Ease of Understanding and Government vs Private Policies, though gaining attention, are less widely adopted, reflecting evolving consumer interests (Rogers, 1962). In summary, integrating these theories with empirical findings provides a thorough understanding of consumer behaviour and satisfaction in the health insurance sector, offering insights for improving consumer engagement and addressing identified gaps.

Conclusion

This study provides a comprehensive analysis of the global health insurance market, focusing on consumer behaviour, satisfaction level and changing trends. By integrating qualitative and quantitative methodologies, including a systematic literature review (SLR) and trend analysis using Google Trends, the research highlights key factors influencing health insurance adoption. The SLR identifies ten critical keywords, revealing the core components of health insurance and underscoring the challenges and opportunities for system enhancement. The Trend Impressions Model offers insights into the evolving trends within the health insurance sector, categorizing keywords into four zones based on their relevance and frequency. This model highlights which aspects of health insurance are gaining traction and which are declining in importance. Additionally, the trend analysis uncovers regional disparities in the popularity of health and medical insurance terms across India from 2004 to 2024, emphasizing the need for tailored strategies to address diverse regional needs. The findings underscore the importance of considering geographical differences and socioeconomic factors when developing health insurance plans. Understanding consumer

behaviour and preferences is crucial for insurers to design targeted strategies and develop insurance packages that align with community needs, thereby enhancing insurance penetration and accessibility. This study's insights enable stakeholders in the health insurance industry to make informed decisions, fostering a more equitable and responsive healthcare system that caters to the diverse needs of consumers worldwide.

References

Acharya, A., & Ranson, M. K. (2005). Health care financing for the poor Community-based health insurance schemes in Gujarat. Economic and Political Weekly, 40(38).

Indexed at, Google Scholar, Cross Ref

Ahlin, T., Nichter, M., & Pillai, G. (2016). Health insurance in India: what do we know and why is ethnographic research needed. Anthropology & Medicine, 23(1), 102–124.

Indexed at, Google Scholar, Cross Ref

Ajzen, I. (1991). The theory of planned behavior. Organizational Behavior and Human Decision Processes, 50(2), 179-211.

Ambade, P. N., Gerald, J., & Rahman, T. (2023). Wealth Status and Health Insurance Enrollment in India: An Empirical Analysis. In Healthcare (Vol. 11, No. 9, p. 1343). MDPI.

Indexed at,Google Scholar, Cross Ref

Armaroli, N., & Balzani, V. (2006). The future of energy Supply: challenges and opportunities. Angewandte Chemie, 46(1–2), 52–66.

Atake, E. H. (2020). Does the type of health insurance enrollment affect provider choice, utilization and health care expenditures? BMC Health Services Research, 20, 1-14.

Bannick, R. R., & Granger, E. (2009). TRICARE Health Benefits Program as a Critical Plank in the Federal Platform for Health Care Reform.

Becker, M. H. (1974). The health belief model and personal health behavior. Health Education Monographs, 2(4), 324-473.

Berman, P. (1998). Rethinking health care systems: Private health care provision in India. World Development, 26(8), 1463–1479.

Besanko, D., Dranove, D., & Garthwaite, C. (2016). Insurance and the high prices of pharmaceuticals (No. w22353). National Bureau of Economic Research.

Bhat, J. R., AlQahtani, S. A., & Nekovee, M. (2023). FinTech enablers, use cases and role of future internet of things. Journal of King Saud University-Computer and Information Sciences, 35(1), 87-101.

Indexed at, Google Scholar, Cross Ref

Bhat, R., & Reuben, E. B. (2002). Management of claims and reimbursements: The case of Mediclaim insurance policy. Vikalpa: The Journal for Decision Makers, 27(4), 15-28.

Carrasquillo, O., Himmelstein, D. U., Woolhandler, S., & Bor, D. H. (1999). Trends in Health Insurance Coverage, 1989–1997. International Journal of Health Services, 29(3), 467–483.

Indexed at, Google Scholar, Cross Ref

Chakraborty, D. (2010). Global Financial Crises, India and Insurance and Pension Industry: Why and What Next. In ınstitute of actuaries on ındia, 12th global conference of actuaries (pp. 18-19).

Chen, S., Lin, Z., Fan, X., Li, J., Xie, Y. J., & Hao, C. (2022). The Comparison of Various Types of Health Insurance in the Healthcare Utilization, Costs and Catastrophic Health Expenditures among Middle-Aged and Older Chinese Adults. International Journal of Environmental Research and Public Health, 19(10), 5956.

Indexed at, Google Scholar, Cross Ref

Chou, C. F., Johnson, P. J., Ward, A., & Blewett, L. A. (2009). Health care coverage and the health care industry. American Journal of Public Health, 99(12), 2282–2288.

De La Hoz-Correa, A., Muñoz‐Leiva, F., & Bakucz, M. (2018). Past themes and future trends in medical tourism research: A co-word analysis. Tourism Management, 65, 200–211.

Indexed at, Google Scholar, Cross Ref

Doherty, N. A., & Singer, H. J. (2003). The benefits of a secondary market for life insurance policies. Social Science Research Network.

Dong, W., Zwi, A. B., Bai, R., Shen, C., & Gao, J. (2021). Benefits associated with China’s social health insurance schemes: Trend analysis and associated factors since health reform. International Journal of Environmental Research and Public Health, 18(11), 5672.

Dormont, B., & Péron, M. (2016). Does health insurance encourage the rise in medical prices? A test on balance billing in France. Health Economics, 25(9), 1073–1089.

Dror, D. M., Radermacher, R., & Koren, R. (2007). Willingness to pay for health insurance among rural and poor persons: Field evidence from seven micro health insurance units in India. Health Policy, 82(1), 12–27.

Indexed at, Google Scholar, Cross Ref

Dubey, S., Deshpande, S., Krishna, L., & Zadey, S. (2023). Evolution of Government-funded health insurance for universal health coverage in India. The Lancet Regional Health - Europe, 13, 100180.

Indexed at, Google Scholar, Cross Ref.

Dutta, M. M. (2020). Health insurance sector in India: an analysis of its performance. Vilakshan, 17(1/2), 97–109.

Eggleston, K. (2012). Health care for 1.3 billion: An overview of China’s health system. Social Science Research Network.

Ekman, B. (2004). Community-based health insurance in low-income countries: a systematic review of the evidence. Health Policy and Planning, 19(5), 249–270.

Indexed at, Google Scholar, Cross Ref

Ellis, R.P., M. Alam and I. Gupta. (2001). Health insurance in India: Prognosis and prospectus, economic and political weekly, 2000, 35(4), 207-17. Journal of Health Management, 3(1), 141-141.

Indexed at, Google Scholar, Cross Ref

Ericson, R. V., Barry, D., & Doyle, A. (2000). The moral hazards of neo-liberalism: lessons from the private insurance industry. Economy and Society, 29(4), 532–558.

Indexed at, Google Scholar, Cross Ref

Erlangga, D., Suhrcke, M., Ali, S., & Bloor, K. (2019). The impact of public health insurance on health care utilisation, financial protection and health status in low- and middle-income countries: A systematic review. PLOS ONE, 14(8), e0219731.

Indexed at, Google Scholar, Cross Ref

Google Trends. (2023). Health Insurance Trends in India. Google Trends Data, 2023.

Gumber, A. (2001). Extending health insurance to the poor: some experiences from sewa scheme. Health Popul Perspect Issues, 24(1), 1-14.

Hodek, J., Von Der Schulenburg, J. G., & Mittendorf, T. (2011). Measuring economic consequences of preterm birth - Methodological recommendations for the evaluation of personal burden on children and their caregivers. Health Economics Review, 1(1).

Indexed at, Google Scholar, Cross Ref

IRDAI. (2024). Annual Report on the Indian Healthcare Insurance Sector. Insurance Regulatory and Development Authority of India, 2024.

Kaplan, R. L. (2007). Retirement Planning's Greatest Gap: Funding Long-Term Care. Lewis & Clark L. Rev., 11, 407.

Kaushal, N., & Kaestner, R. (2005). Welfare reform and health insurance of immigrants. Health Services Research, 40(3), 697–722.

Indexed at, Google Scholar, Cross Ref

Khan, P. K., Perkins, J. M., Kim, R., Mohanty, S. K., & Subramanian, S. V. (2021). Multilevel population and socioeconomic variation in health insurance coverage in India. Tropical Medicine & International Health, 26(10), 1285–1295.

Indexed at, Google Scholar, Cross Ref

Koch, T. (2014). One pool to insure them all? Age, risk and the price(s) of medical insurance. International Journal of Industrial Organization, 35, 1–11.

Kohli, S. (2006). Pricing Death: Analyzing the secondary market for life insurance policies and its regulatory environment. Buffalo Law Review, 54(1), 279.

Kotler, P., & Keller, K. L. (2016). Marketing management (15th ed.). Pearson.

Krause, J. H. (2004). Regulating, guiding and enforcing health care fraud. Social Science Research Network.

Kreutzburg, T., Peters, F., Rieß, H., Hischke, S., Marschall, U., Kriston, L., L'Hoest, H., Sedrakyan, A., Debus, E., & Behrendt, C. (2020). Comorbidity patterns among patients with peripheral arterial occlusive disease in Germany: A trend analysis of health insurance claims data. Journal of Vascular Surgery, 71(2), 715.

Indexed at, Google Scholar, Cross Ref

Kumar, A., Chen, L. C., Choudhury, M., Ganju, S., Mahajan, V., Sinha, A., & Sen, A. (2011). India: Towards Universal Health Coverage 6 Financing health care for all: challenges and opportunities. A Call to Action. The Lancet, 377(9767), 760-768.

Lahariya, C. (2018). Ayushman Bharat program and universal health coverage in India. PubMed, 55(6), 495–506.

Masih, J., Sharma, A., Patel, L., & Gade, S. (2017). Indicators of food security in various economies of world. Journal of Agricultural Science, 9(3), 254.

Mavalankar, D., & Bhat, R. (2000). Health insurance in India Opportunities, challenges and concerns. ResearchGate.

Indexed at, Google Scholar, Cross Ref

Miraldo, M., Propper, C., & Williams, R. I. (2018). The impact of publicly subsidised health insurance on access, behavioural risk factors and disease management. Social Science & Medicine, 217, 135-151.

Indexed at, Google Scholar, Cross Ref

Murphy, B. (2001). An analysis of the benefits that expert system technology can offer the insurance industry.

Nadanamoorthy, N., Dinesh, S., & Dhachanamoorthy, S. (2011). A Study on Consumer Protection in PACL with Special Reference to Insurance in Cuddalore District. Indian Journal of Commerce and Management Studies, 2(7), 05–10.

Oliver, R. L. (1980). A cognitive model of the antecedents and consequences of satisfaction decisions. Journal of Marketing Research, 17(4), 460-469.

Oster, E., Dorsey, E. R., Bausch, J., Shinaman, A., Kayson, E., Oakes, D., Shoulson, I., & Quaid, K. (2008). Fear of health insurance loss among individuals at risk for Huntington disease. American Journal of Medical Genetics Part A, 146A(16), 2070-2077.

Indexed at, Google Scholar, Cross Ref

Parthasarathy, S., Raj, L. A., Khan, A., Sathick, K. J., & Jayaraman, V. (2023). Detection of Health Insurance Fraud using Bayesian Optimized XGBoost. International Journal of Safety and Security Engineering, 13(5), 853–861.

Pendzialek, J. B., Simić, D., & Stock, S. (2014). Differences in price elasticities of demand for health insurance: a systematic review. The European Journal of Health Economics, 17(1), 5–21.

Prince, A., & Roche, M. I. (2014). Genetic Information, Non‐Discrimination and Privacy Protections in genetic Counseling practice. Journal of Genetic Counseling, 23(6), 891–902.

Prinja, S., Singh, M. P., Aggarwal, V., Rajsekar, K., Gedam, P., Goyal, A., & Bahuguna, P. (2023). Impact of India's publicly financed health insurance scheme on public sector district hospitals: a health financing perspective. The Lancet Regional Health-Southeast Asia, 9, 100123.

Quinn, S. (2008). The transformation of morals in markets: death, benefits and the exchange of life insurance policies. American Journal of Sociology, 114(3), 738–780.

Ranson, M. K. (2003). Community-based health insurance schemes in India: a review. PubMed, 16(2), 79–89.

Sage, W. M. (1998). Judicial opinions involving health insurance coverage: Trompe L’Oeil or window on the world?. Indiana Law Review, 31(1), 49–74.

Samal, J., & Dehury, R. K. (2015). An exploration and assessment on the current status and trend of third-party Administrators (TPA) in India. International Journal of Health Sciences and Research, 5(8), 600–604.

Shahi, A. (2013). Origin, Growth Pattern and Trends: A study of Indian health insurance sector. IOSR Journal of Humanities and Social Science, 12(3), 01–09.

Shi, L. (2000). Type of health insurance and the quality of primary care experience. American Journal of Public Health, 90(12), 1848–1855.

Shisana, O., Rehle, T., Louw, J., Zungu-Dirwayi, N., Dana, P., & Rispel, L. C. (2006). Public perceptions on national health insurance: moving towards universal health coverage in South Africa. PubMed, 96(9), 814–818.

Singh, V., & Bawa, S. (2020). Public awareness and health insurance coverage in India. Journal of Public Health Research, 38(3), 312-328.

Siongco, K. L., Nakamura, K., & Seino, K. (2020). Reduction in inequalities in health insurance coverage and healthcare utilization among older adults in the Philippines after mandatory national health insurance coverage: Trend analysis for 2003–2017. Environmental Health and Preventive Medicine, 25(1).

Indexed at, Google Scholar, Cross Ref

Smith, A., Johnson, P., & Williams, R. (2021). Changing customer expectations in the healthcare insurance industry. Health Policy and Planning, 36(3), 312-322.

Song, L., Wang, Y., Chen, B., Yang, T., Zhang, W., & Wang, Y. (2020). The association between health insurance and all-cause, cardiovascular disease, cancer and cause-specific mortality: A prospective cohort study. International Journal of Environmental Research and Public Health, 17(5), 1525.

Indexed at, Google Scholar, Cross Ref

Sparrow, M. K. (1999, September). Controlling Fraud and Abuse in Medicaid: Innovations and Obstacles. In A Report from the “Executive Seminars on Fraud and Abuse in Medicaid (pp. 1-51).

Sun, Q., Liu, X., Meng, Q., Tang, S., Yu, B., & Tolhurst, R. (2009). Evaluating the financial protection of patients with chronic disease by health insurance in rural China. International Journal for Equity in Health, 8(1).

TechSci Research. (2021). Healthcare Insurance Market Analysis in India. TechSci Research Report, 2021.

Tranfield, D., Denyer, D., & Smart, P. (2003). Towards a methodology for developing evidence-informed management knowledge by means of systematic review. British Journal of Management, 14(3), 207-222.

Indexed at, Google Scholar, Cross Ref

Umemoto, K., Goda, K., Mitsutake, N., & Kitsuregawa, M. (2019). A prescription trend analysis using medical insurance claim big data. 2019 IEEE 35th International Conference on Data Engineering (ICDE).

Vellakkal, S. (2012). Financial protection in health insurance schemes: A comparative analysis of Mediclaim policy and CHAT scheme in India. Journal of Health Management, 14(1), 13-25.

Indexed at, Google Scholar, Cross Ref

Venkatesh, S. (2013). Comparative analysis of government and private health insurance policies. Journal of Insurance Studies, 25(7), 312-326.

Vijaya, R. M. (2010). Medical tourism: revenue generation or international transfer of healthcare problems?. Journal of Economic Issues, 44(1), 53–70.

Wang, S., Liu, L., Lin, L., & Liu, J. (2014). Comparison of Chinese inpatients with different types of medical insurance before and after the 2009 healthcare reform. BMC Health Services Research, 14(1).

White, J., & Brown, L. (2018). Evidence-based decision making in healthcare insurance. Journal of Health Economics and Policy, 24(3), 123-134.

Yadav, R. K., & Mohania, S. (2013). Claim Settlement of life insurance policies in insurance services with special reference to life insurance corporation of India. Indian Journal of Economics and Development, 1(1), 29-37.

Received: 23-Jul-2024, Manuscript No. AMSJ-24-15083; Editor assigned: 24-Jul-2024, PreQC No. AMSJ-24-15083(PQ); Reviewed: 26-Aug-2024, QC No. AMSJ-24-15083; Revised: 26-Sep-2024, Manuscript No. AMSJ-24-15083(R); Published: 11-Oct-2024