Research Article: 2019 Vol: 18 Issue: 3

Customer Participation, Value, Satisfaction, Trust and Loyalty: An Interactive and Collaborative Strategic Action

Md. Shakib Hossain, East West University

Rashedul Hasan, East West University

Sara Bintey Kabir, East West University

Nafisa Mahbub, East West University

Nurul Mohammad Zayed, Daffodil International University

Abstract

The paper is mainly accentuate on exploring the interactive and inter-relation strategic option that a firm can pull off competitiveness through the collaboration of customer participation, customer value, customer satisfaction, customer trust and unquestionably the optimization of customer loyalty. A simple random sampling method has used as an instrument for exploring the compelling and articulate result and the data analysis has employed confirmatory factor analysis and structural equation modeling method to accumulate the concreteness and validation. It has observed that customer participation is positively make consequence over customer value and subsequently customer value makes affirmative impact on the customer satisfaction and customer trust very predominantly and that reflects positively over the customer loyalty as well.

Keywords

Confirmatory Factor Analysis, Structural Equation Modeling, Customer Participation, Customer Value, Customer Satisfaction, Customer Trust, Customer Loyalty

Introduction

A customer is always an inseparable element for a business entity. The company has adopted the manifold business strategies and adds the distinctive attributes and values for ensure the customer satisfaction because that facilitates the ultimate desire customer loyalty. Through the customer participation the companies are aggregating the conclusive and decipherable assumption about their future demand and need, that indubitable helps the company to accelerate the distinctive values. The values that facilitate by the company surely accomplish the substantial amount of customer satisfaction and triumph the customer trust. Rigorous effort and continuous improvement of the product in terms of the service, feature, quality and many more assists the firm to reach the customer loyalty that explore and proliferate the competitiveness and superiority. Due to the intense competition the firms has the conviction that customer loyalty is a commensurate , intricate and interactive approach that helps the firms to attain the long term competitive advantages through the acuteness, propitious action and customer participation. Relationship marketing hinges on the development of lasting customer-brand bonds which allows the firms to create a sustainable competitive advantage.

Literature Review

Appropriate and effective customer participation can enhance customer perceived value of product, reduce the risk perception of product quality customer products, reduce the cost of acquisition, can bring customer experience value, relationship value, learning value and psychological benefits value (Liu et al., 2007). According to marketing theory, every customer can facilitate the customer-value. Customer value has a relationship with customer satisfaction (Nauman & Giel, 1995). Customer satisfaction is customers’ respond to what they expect and what they experienced from a Product/process (Hallowell, 1996). It is increasingly acknowledged that focusing on the connection and collaboration between the firm and the customer results in greater customer satisfaction and customer trust (Ramani & Kumar, 2008). A strong relationship with the customers is positively affecting the brand loyalty.

Customer Participation and Customer Value

A research has accomplished by Mekhail et al. (2013) indicates that customer values can be attained through the customer participation because due to the engagement with the customer economic benefits can attain, a propitious relationship is establish between seller and the customer and of course understanding about the future offering and needs.

H1: Customer participation is positively related to customer value.

Customer Value and Customer Satisfaction

Customer satisfaction can be optimize with the accentuate of distinctive values that offer by the company .An empirical research by proofs that customer value is contributes to customer satisfaction.

H2: Customer value is positively related to customer satisfaction.

Customer Value and Customer Trust

Receiving the expected value from the respecting product surely augmenting the trust of the respective brand (Shirin & Puth, 2011). An affirmative relationship exists between the perceived value and the trust because the soaring level of perceived value can amplify the postpurchase confidence of the product (Pirzad & Karmi, 2015).

H3: Customer value is positively related to customer trust.

Relation of Customer Trust with Strengthening the Customer Relationship

Different distinguish marketing researcher has explored that there is a significant positive relation between trust and the customer relation, highest the trust surely strengthening the relationship (Crosby et al., 1990).

H4: Customer trust helps to strengthening the customer relationship.

Customer Satisfaction and Strengthening the Customer Relationship

According to Fleming et al. (2005), satisfaction decreases the level of switching towards the company and increases the sense of belonging, which makes the relationship between the company and the customer stronger than before.

H5: Customer satisfaction helps to strengthening the customer relationship.

Strength of the Relationship and Customer Loyalty

According to Evanschitzky & Wunderlich (2006), the strong relations between sellers and buyers reinforce and reinvigorate the customer loyalty.

H6: Strengthening the relationship has positively effect on the customer trust.

Methodology

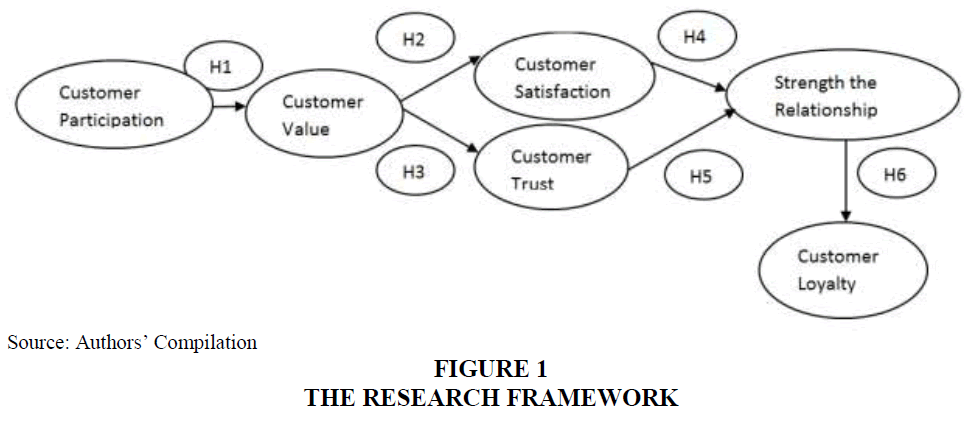

This framework mainly verifies the relationship between customer participation, customer value, customer satisfaction, customer trust, strength the relationship and customer loyalty in the food manufacturing industry in Bangladesh. The research framework has mentioned in the following Figure 1. The target population of this study was the 10 different food manufacturing company in Bangladesh. From the target population 825 employees who worked in the management position more than 12 years has used as a sample. Random sampling method was used in the sample selection method. The study was based on primary data that was collected by using a questionnaire. The questionnaire used both open and closed ended questions. For the closed ended questions, the study adopted a five point Liker scale where the target respondents indicated the extent of their agreement/disagreement with each statement.

Results and Discussions

From the Table 1 it has exposed that the mean value of customer trust was 11.295 and this is the highest mean score with a standard deviation 2.155, whereas customer participation was the second highest mean value and value is 11.295 with a standard deviation 1.126. On the other hand strength the relationship was the third highest mean value with a score of 11.284 and the standard deviation is 1.983.

| Table 1 Descriptive Analysis | ||

| Factor | Mean Value | Standard Deviation |

| Customer Participation | 11.295 | 1.126 |

| Customer Value | 13.636 | 1.982 |

| Customer Satisfaction | 9.561 | 0.964 |

| Customer Trust | 16.661 | 2.155 |

| Strength the Relationship | 11.284 | 1.983 |

| Customer Loyalty | 11.217 | 1.992 |

Confirmatory Factor Analysis

From the analysis it has showed χ²/(df=128)=3.105, (p<0.000) good fit index (GFI)=0.913; comparative fit index (CFI)=0.929, incremental fit index (IFI)=0.915, Tucker Lewis index (TLI)=0.922, normed fit index (NFI)=0.928; and a root mean square error of approximately (RMSEA)=0.059. The values of such as GFI, CFI, IFI, TLI and NFI has achieved the value from zero to one, a good fit data was close to one and the value reached higher than 0.90 was acceptable. RMSEA reached a close fit value with the value between 0.04 and 0.08 and the SRMR value was (Standardized RMR)=0.0693 which was acceptable.

From the Table 2, we have observed that construct reliability (CR) higher than 0.70 and reaching from 0.709 to 0.766. The value of Average variance extracted (AVE) extends 0 .50 and reaching from 0.772 to 0.814. The value of JoresKog’s Rho extends 0.70 and reaching from 0.704 to 0.804 and from the Cronbach, it has observed that value range 0.720 to 0.793 which was acceptable.

| Table 2 Confirmatory Factor Analysis | ||||||||

| Variable | Indicator | Standard Factor Loading | Error Variance | SMR | CR | AVE | Α Cronbach | JoresKog’s Rho |

| Customer Participation | CP1 | 0.814 | 0.315 | 0.650 | 0.729 | 0.803 | 0.768 | 0.755 |

| CP2 | 0.842 | 0.418 | 0.616 | |||||

| CP3 | 0.816 | 0.318 | 0.704 | |||||

| CP4 | 0.805 | 0.360 | 0.716 | |||||

| Customer value | CV1 | 0.874 | 0.295 | 0.663 | 0.754 | 0.772 | 0.751 | 0.793 |

| CV2 | 0.849 | 0.331 | 0.628 | |||||

| CV3 | 0.837 | 0.319 | 0.694 | |||||

| Customer Satisfaction | CS1 | 0.815 | 0.338 | 0.672 | 0.709 | 0.786 | 0.720 | 0.704 |

| CS2 | 0.838 | 0.352 | 0.662 | |||||

| CS3 | 0.852 | 0.371 | 0.601 | |||||

| CS4 | 0.881 | 0.393 | 0.675 | |||||

| Customer Trust | CT1 | 0.864 | 0.383 | 0.715 | 0.711 | 0.815 | 0.793 | 0.767 |

| CT2 | 0.819 | 0.317 | 0.726 | |||||

| CT3 | 0.811 | 0.328 | 0.695 | |||||

| CT4 | 0.842 | 0.391 | 0.664 | |||||

| Strength the Relationship | SS1 | 0.850 | 0.353 | 0.628 | 0.748 | 0.785 | 0.779 | 0.804 |

| SS2 | 0.863 | 0.342 | 0.712 | |||||

| SS3 | 0.893 | 0.353 | 0.735 | |||||

| SS4 | 0.873 | 0.380 | 0.711 | |||||

| Customer Loyalty | CL1 | 0.846 | 0.361 | 0.636 | 0.766 | 0.814 | 0.746 | 0.773 |

| CL2 | 0.870 | 0.370 | 0.679 | |||||

| CL3 | 0.836 | 0.381 | 0.646 | |||||

| CL4 | 0.874 | 0.344 | 0.738 | |||||

The discriminant validity results (Table 3) have showed that the average variance extracted PVC (calculated for the evaluation of convergent validity) exceeds the square of correlations between latent variables.

| Table 3 Discriminant Validity Results | |||||||

| Convergent Validity (Joreskog’s Rho) | CP | CV | CS | CT | SR | CL | |

| CP | 0.818 | 0.714 | |||||

| CV | 0.794 | 0.698 | 0.712 | ||||

| CS | 0.805 | 0.751 | 0.702 | 0.706 | |||

| CT | 0.793 | 0.712 | 0.705 | 0.741 | 0.714 | ||

| SR | 0.755 | 0.701 | 0.761 | 0.732 | 0.716 | 0.709 | |

| CL | 0.798 | 0.693 | 0.752 | 0.736 | 0.773 | 0.727 | 0.715 |

Structural Model Analysis

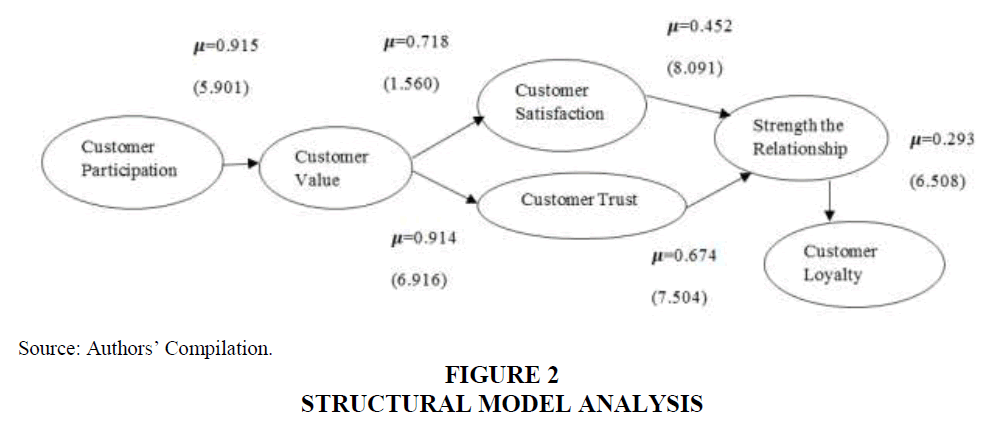

From the analysis it has observed that the model fit with Chi-Square=308.316, Chisquare/( df=121)=2.548, (p<0.001), RMSEA (Root Mean Square Error of Approximation)= 0.056; GFI=0.938; NFI (Normed Fit Index)=0.945; IFI (Incremental Fit Index)=0.966; TLI= 0.957; CFI (Comparative Fit Index)=0.966. The values of CFI, IFI, TLI, and NFI were close to 1.00 and greater than 0.90, fulfilling the criteria of model fit. Moreover, RMSEA reached a close fit value with the value between 0.04 and 0.08 and the SRMR value is (Standardized RMR)= 0.0681 which was acceptable.

The result of construct and item reliability, standard factor loading, error variance, SMR, CR, Cronbach, AVE and Joreskog’s Rho the value that have gathered has fulfilled the criteria. The Construct Reliability (CR) was higher than 0.70 reaching from 0.721 to 0.783. The value of Average Variance Extracted (AVE) extends 0.50 and reaching from 0.752 to 0.846. The value of JoresKog’s Rho extends 0.70 and reaching from 0.761 to 0.858 and from the Cronbach, it has observed that value range 0.771 to 0.870 which was also acceptable.

The result in Table 4 has showed that the relationship between the customer participation and customer values has accepted (Figure 2). The effect was significant and positive (estimate=0.915, t-value=5.901, p=0.000). Therefore, H1 has accepted. The relationship between the customer value and customer satisfaction has accepted. The effect was also explore significant and positive (estimate=0.718, t-value=1.560, p=0.000). Therefore, H2 has accepted. The relationship between the customer value and customer trust has accepted. The effect was also explore significant and positive (estimate=0.914, t-value=6.916, p=0.000). Therefore, H3 has also accepted. The relationship between the customer satisfaction and strength the relation has accepted. The effect was also found significant and positive (estimate=0.452, t-value=8.091, p=0.000).

| Table 4 Hypothesis Testing | ||||

| Hypothesis | Estimate | C.R | Pv | Result |

| H1 | 0.915 | 5.901 | 0.000 | Accepted |

| H2 | 0.718 | 1.560 | 0.001 | Accepted |

| H3 | 0.914 | 6.916 | 0.000 | Accepted |

| H4 | 0.452 | 8.091 | 0.000 | Accepted |

| H5 | 0.674 | 7.504 | 0.001 | Accepted |

| H6 | 0.293 | 6.508 | 0.000 | Accepted |

Therefore, H4 has also accepted. The relationship between the customer loyalty and strength the relation has accepted. The effect was also explore significant and positive (estimate=0.674, t-value=7.504, p=0.000). Therefore, H5 has accepted. The relationship between the strength the relation and customer loyalty has accepted. The effect was also originate significant and positive (estimate=0.293, t-value=6.508, p=0.000). Therefore, H6 has also accepted.

Conclusions and Recommendations

The result has explained that each and every element has significant effect with on to another as our literature review explained. Firstly, customer participation has positive effect on the customer value, (Dong et al., 2008; Yim et al., 2012) has been widely accepted in the literature. Secondly, customer value has also make a considerable effect on the customer satisfaction , thirdly customer value also make a significant effect on the customer trust, Fourthly both customer trust and customer satisfaction helps to strengthen the customer relationship and lastly customer relationship helps to establish the customer loyalty. The firms are adopting the multifarious strategy to ensure the customer loyalty and ultimately that leads to consolidate the market share and a firm can accelerate its market position (Payne et al., 2008; Vargo & Lusch, 2004).

References

- Crosby, L.A., Evans, K.R., & Cowles, D. (1990). Relationship quality in services selling: An interpersonal influence perspective. Journal of Marketing, 54, 68-81.

- Dong, B., Evans, K.R., & Zou, S. (2008). The effects of customer participation in co-created service recovery. Journal of the Academy of Marketing Science, 36(1), 123-137.

- Evanschitzky, H., & Wunderlich, M. (2006). An examination of moderator effects in the fourstage loyalty model. Journal of Service Research, 8(4), 330-345.

- Fleming, J.H., Coffman, C., & Harter, J.K. (2005). Manage your human sigma. Harvard Business Review, 107-114.

- Hallowell, R. (1996). The relationship of customer satisfaction, customer loyalty, and profitability: An empirical study. The International Journal of Service Management, 7(4), 27-42.

- Liu, W.B., Liu, B., & Chen, R.Q. (2007). Customer participation in the service encounter. Chinese Business Review, 6(4), 52-56.

- Mekhail, M., Elina, J., & Aino, H. (2013). Customer participation and value creation: A systematic review and research implications. Managing Service Quality: An International Journal, 23(4), 341-359.

- Nauman, E., & Giel, K. (1995). Customer satisfaction and management: Using the voice of the customer.

- Payne, A.F., Storbacka, K., & Frow, P. (2008). Managing the co-creation of value. Journal of the Academy of Marketing Science, 36(1), 83-96.

- Pirzad, A., & Karmi, E. (2015). Studying the relationship between service quality, customer satisfaction and customer loyalty through perceived value and trust. Journal of Social Issues & Humanities, 3(3), 275-281.

- Ramani, G., & Kumar, V. (2008). Interaction orientation and firm performance. Journal of Marketing, 72(1), 27-45.

- Shirin, A., & Puth, G. (2011). Customer satisfaction, brand trust and variety seeking as determinants of brand loyalty. African Journal of Business Management, 5(30).

- Vargo, S.L., & Lusch, R.F. (2004). Evolving to a new dominant logic for marketing. Journal of Marketing, 68(1), 1-17.

- Yim, C.K., Chan, K.W., & Lam, S.K. (2012). Do customers and employees enjoy service participation? Synergistic effects of self and other-efficacy. Journal of Marketing, 76, 121-140.