Research Article: 2024 Vol: 30 Issue: 3S

Current Trends of Airport Privatization in India: Opportunities and Challenges

Mohan Phuyal, Soka University of Japan, Japan

Citation Information: Phuyal, M. (2024). Current trends of airport privatization in India: Opportunities and challenges. Journal of the International Academy for Case Studies, 30(S3), 1-16.

Abstract

Until the 1990s, airports and air-related services operated under the Government of India. However, with the increase in air passengers, customs, and aircraft movements since the 1990s, there has been a growing need to develop and upgrade airport services. Additionally, the future growth of the Indian economy and airport users have further emphasized improving airport services. The Government of India (GoI) decided to commercialize and privatize the airports through the Public-Private Partnership (PPP) model. There exist 15 airports under the PPP model in Greenfield and Brownfield investment. There are several challenges and constraints in PPP airports. Therefore, this paper delves into the background of the privatization of Indian airports, its characteristics, and the challenges of PPP airports.

Keywords

Privatization, Public-Private Partnership, Airports Authority of India, Economic Regulation.

Introduction

The airport sector is an essential transport sector for every country’s economic development (Junior, Hollaender, Mazzanati, & Bortoletto, 2021). Airports relate to the tourism industry and support the movement of goods and people across countries and regions (Bagler, 2008). The airport’s business focuses on aeronautical and non-aeronautical components (Gillen & Mantin, 2014). For the efficient development and success of airport operations, aeronautical and non-aeronautical studies are emphasized (Kumar, Dash, & Sahu, 2018; Chourasia, Jha, & Dalei, 2021).

Like other countries, India has had a history in the airport sector since 1912. It operated an airport and airline-related business under the Government of India (GoI). Since the 1990s, there has been growth in air passengers, and the demand for safety issues has increased. Until 1994, there were restrictions for the private sector to be involved in the development and management of Indian airports (Wang, Zhang, & Zhang, 2018). Due to budgetary constraints, GoI has realized the necessity of private sector involvement in the airport’s operation, development, and management. As an institutional development, the Indian government merged the International Airports Authority of India and the National Airports Authority of India in 1995. It established the Airports Authority of India (AAI) in full government ownership (Barde, Pantelias, & Zerjav, 2016). To date, there are 486 airports, airstrips, flying schools, and military-owned air bases under the ownership of AAI (Chakraborty S., Ghosh, Sarker, & Chakraborty, 2022). Currently, 153 airports operate, and only 123 have scheduled commercial flights. Additionally, the Indian Government has forecasted that 250 more airports will be built by 2030 (Latiff & IMM, 2015). The government has also estimated the investment of Indian rupees to be 420-450 billion (US $ 5.99-6.41 billion) in fiscal year FY 18-23 (IBEF, 2022). Similarly, Airports Council International (2018) forecasted that India will surpass 22 billion air passengers by 2040. To fulfill the demand for air transport, the AAI has planned to construct 100 more airports and heliports by 2024 in the Public and Private Participation (PPP) model. India has only partially privately operated and privatized airports (Phuyal, 2023).

Objectives of this study

The main objective of this paper is:

a) To understand the institutional development and the characteristics of Indian airports.

b) To know the airport privatization process and the characteristics, opportunities, and challenges.

Review of Literature

Privatization shifts assets and service responsibilities from the public to the private sector (Poole & Fixler, 1987). Airports are also state-owned and governed public entities (Adler & Liebert, 2014). Airport privatization is always a controversial and increasingly important theme in policy studies. The private sector participation in the airport sector is a multifunctional marketing enterprise (Freestone, Baker, & Stevens, 2011). The operation mechanism of the airport is an increasingly competitive market and is commercially oriented. Lehmann, Characteristics of airports, (2019) has characterized airports as complicated and structurally diverse infrastructures. His research focused on the fundamental aspects of airport design, services, and air-land relationships. Airports planners distinguish between “landside” capacity (the capacity to handle passengers in terminals and automobiles in car parks), “airside” capacity (the capacity to accommodate aircraft landings and departures), and mix-ups to make airport mechanisms. The airport demonstrates its capability by generating of non-aeronautical and aeronautical revenue (Brito, Oliveira, & Dresner, 2021). Due to the nature and characteristics of airports, both aeronautical and non-aeronautical services require more investment with adequate private sector participation in operation, management, and development (Engel, Fischer, & Galetovic, 2018). Graham, (2011) has identified the importance of airport privatization in the following issues: (1) the improvement of efficiency and performance, (2) no loss of taxpayer money, (3) providing new technology, (4) competition and regulation (Domney, Wilson, & Chen, 2005), (5) the increment of finance, (6) lessening government involvement, and (7) upgrading investments in infrastructure sectors. Augustyniak (2009) Claimed that privatized airports are a better incentive to tackle risks. Several, researchers, studied the efficiency of airports in services and found that privately owned and operated airports are more efficient than publicly owned airports. There are very few cases in a comparative study of privatized airports. Abdullahu & Reshidi (2018) have studied the efficiency of three internationally privatized airports, Prishtina in Kosovo, Skopje at Petrovec, and Tirana in Albania, and found that privately operated airports are more efficient than publicly operated airports. In this way, airports have socioeconomic values and norms. In emerging countries airport infrastructure markets are in the premature stage. Premature markets could uplift if there are changes in policies (Deloitte, 2006). Sugimura & kato, (2022) emphasizes the Initial Public Offerings (IPO) and trade sales in airport development. According to the market maturity curve research, India possesses a low and sophisticated area in private sector investment. Das, Bardhan, & Fageda, (2022) Studied the growing demand for internal and international air travel. International air travel demands that Indian airports enhance their capacity. India’s decision to invite private capital to modernize its metro airports could benefit passengers, airlines, and the government (CAPA, 2014). There is considerable literature related to Indian airport privatization. (Ohri, 2009) It covers the rationale for Indian airport privatization and has focused on PPP models. Early analyses of airport privatization in the Indian context include (Rajan, Sharad, & Sinha, 2009) and (Sambrani, 2014). Similarly, early developments and discussions of airport privatization and economic regulation include (Singh, Dalei, & Raju, 2015) on performance efficiency (Kumar, Dash, & Sahu, 2018) issues discussed (Gupta, 2015). Similarly, a conceptual review on airport privatization in (Shanmuganathan & krishnan, 2023), (Chourasia, Dalei, & Jha, 2023) which evaluated the PPP’s role in the sustainability of privatized airports.

Research Methodology

This research uses an explanatory approach and synthesizes several works in the literature. The methodology section follows Yin 2009. It used a doctrinal method and visits the websites of the Ministry of Civil Aviation (MoCA) of India and the Airports Authority of India (AAI).

Airport Regulating Scenario

Airports have traditionally been owned and managed as government entities (Zhang & Czerny, 2012). The Ministry of Civil Aviation (MoCA) operates all airlines and airport-related businesses in India. MoCA can formulate airport and airline-related policies and programs (Krishnan, 2021). The objective of the MoCA is to ensure the orderly growth of civil air transport in India. Until the late 1980s, civil aviation was fully functioning under the GoI. Also, there are several airports operated by the Indian armed forces and are restricted in private participation (Raghuram & Varkkey, 2001). As a first step of deregulation, the GoI started to provide permissions to private sectors to provide taxi services. At the time, the mega airports in New Delhi, Trivandrum, Madras, Calcutta, and Bombay were operating International airports under the IAAI (Indian Numbered Acts, 1971), and the rest of the domestic airports through the National Airport Authority NAA (AAI, 1985). The operation criteria of NAAs were limited to domestic service (Hooper, Privatization of airports in Asia, 2002). The MoCA provided a capital fund to invest in runways, terminals, and other buildings. Airports were under government intervention and revenues are raised through airside and landside fees. Airport capacity and service decisions made at the national level. Airports had a very small role in decision-making. For further privatization or private involvement, MoCA 1977 has released comprehensive policies indicating preparedness for airport privatization (Hooper, Privatization of airports in Asia, 2002b).

For these reasons, merging international and national airport operating organizations into one authority was necessary. Based on the AAI Act 1994, the IAAI and NAA merged on April 1st, 1995, forming AAI (ICAO, 2013). AAI is a 100% GoI-owned organization. AAI serves and monitors civil aviation development, management, and operation (Paulose, 2013). It has the right to decide whether to lead the private sector to participate in airport development. Besides from managing airports, AAI controls air traffic management and provides communication navigation and surveillance services (Francina, Selvavinayagam, & Elavarasan, 2020). Regarding privatization and commercialization, the GoI had a substantive role in policies focusing on private sector investment and operational efficiencies in providing the airport. Today’s airport business in India is the outcome of liberalized policies (Table 1).

| Table 1 The Development of Several Acts and the Establishment of the Authorities | ||

| Sector | Relevant Act | Establishment of Regulatory Authority |

| Airports | Aircraft Act, 1934 Aircraft Rules Act, 1937 Air Corporation Act, 1953 (Nationalized airlines) International Airport Authority Act, 1971 Air Carriage, 1972 Anti-Hijacking Act, 1982 National Airport Authority, 1986 AAI Establishment Act, 1994 AERA Act 2008 Rules on Carrying of Dangerous Goods Act, 2003 Greenfield Airport Policy, 2008 |

Establishment of Civil Aviation 1911 AERA acts as the Sectorial Regulator and determines the aeronautical tariff for Major Airports International Airports Authority of India Establishment of MoCA Development of Domestic Airports Establishment of DGCA Establishment of AAI Establishment of BCAS Establishment of the AERA, 2008 |

The Indian air transport back to December 1912 after commencing the first international flight London -Karachi- Delhi route (Singh, Sharma, & Srivastava, 2019). The business of civil air transport started in 1932. The first private company, Tata Sons, started air services. Indian National Airways began operations with light single-engine aircraft for the carriage of mail (Prasada, 1956). Air services were nationalized as early as 1953 (Saraf, 1989). The Aircraft Act, of 1934, the Aircraft Rules Act, of 1937, the Air Corporation Act, of 1953, the Carriage by Air Act, of 1972, and the Anti-Hijacking Act, of 1982 enacted and are the essential policies modernizing Indian airports and aviation. Additionally, the development of several commercialization and privatization policies in the 1970s, 1980s, and 1990s contributed to the emergence of a more competitive and market-oriented Indian airport industry (Castro & Lohmann, 2014). As urban airports face increasing congestion and environmental challenges, the GoI introduced the Greenfield Airports (GFA) policy in 2008, providing a framework for constructing and commissioning new airports. The GoI has approved 21 Greenfield airports nationwide under the GFA, policy (MoCA, 2023).

The establishment of airport-related authorities

This section begins by discussing established authorities and their characteristics. It ends with a summary of India’s airport governance scenario.

Airports Authority and the Characteristics

The AAI is a governing body of airport and airline services in India. AAI was established in 1995 to accelerate the expansion, modernization, and development of the Indian airport and aviation industry (Rajani & Reddy, 2022). Since its establishment, AAI has focused on expanding airport airline-related infrastructure, passenger terminals, air traffic services, and cargo. AAI has been actively involved in modernizing and expanding India’s airport infrastructure to accommodate the growing demand for air travel. The investment policy includes the development of new Greenfield and brownfield airports and the expansion of existing airports. AAI focuses on the safety and security of passengers. It also works with other government agencies or regulatory bodies to enforce aviation safety standards. AAI provides navigation services to international overflying traffic through its five oceanic controls after installing a network of VOR/DVOR. In addition, its AAI is also responsible for research and development activities to improve aviation technology and infrastructure. Environmental initiatives such as eco-friendly and smart airports are currenlty in the planning.

Table 2 summarizes the number of operational airports in India. According to the AAI website, the airports operating in India are number 29 in international, 114 in domestic, and 10 in customs services. India also has hundreds of unused airports, also called ‘ghost airports’ (Bhattacharya, 2018). Airfreight transportation is also paramount for expanding trade in India (Veerappan, Sahu, Pani, Patil, & Sarkar, 2019). To date, there are 10 custom airports under the AAI operation. To date, in custom airports, there are no private sector involvements. However, India has no fully privatized airports or 100% airport privatization policies.

| Table 2 AS of 2020 | |||||

| International Airports | Domestic Airports | ||||

| 1. | AAI (Including Delhi, Mumbai, and Nagpur) | 21 | AAI Operational | 55 | |

| 2. | AAI Civil Enclaves | 3 | 2. | AAI Civil Enclaves Operational | 20 |

| 3. | JV/State | 5 | 3. | AAI Non-Operational | 25 |

| Total International Airports | 29 | 4. | AAI Civil Enclaves Non-operational | 3 | |

| Custom Airports | 5. | JV/State Private Operational | 11 | ||

| 1. | AAI | 6 | Total Domestic Airports | 114 | |

| 2. | AAI Civil Enclaves (Defence Airports) | 4 | |||

| Total Customs Airports | 10 | Total Airports (AAI& JV/State/Pvt) Intl+Dom | 153 | ||

The Directorate General of Civil Aviation and the Characteristics

The DGCA is a regulatory organization under the GoI, and it regulates Indian aviation (Rathore, Nandi, & Jakhar, 2020). DGCA is an organization of many working groups created to implement and adopt advancements in the airport sector (Saraswati, 2001). DGCA, was established in 1971 under the MoCA. As a regulatory autonomous body for looking after safety issues. It regulates air transport services and helps to enact air safety, and airworthiness standards. DGCA operates under the DGCA guidelines. Under the guidelines of DGCA, private sectors are allowed to invest up to 100% via FDI through automatic routes.

Airports Economic Regulatory Authority

The economic regulation of Indian airports Airport Economic Regulatory Authority (AERA) was established in 2008 (Singh, Dalei, & Raju, 2015). AERA determines the tariffs for aeronautical services, user charges, and monitoring rights of the performance standards of significant airports (AERA, 2008). The primary function of the AERA is to regulate airport handling. Currently, AERA monitors airports that have 1.5 or more million passengers yearly, e.g., Bengaluru, Chennai, Delhi, Goa, Mumbai, Kolkata, Hyderabad, Thiruvananthapuram, Calicut, and Pune, and monitors their performance standards (ICAO, 2022).

AERA permits development fees for private airports in developing and restructuring airports (George, 2015). The investments are offered through the Joint-Venture (JV) route. As a result, Kochi, Hyderabad, and Bangalore are in Greenfield investments (Aniyeri & Nadar, 2016). AERA performs the following functions concerning major airports:

a) It helps to determine the tariff and fees for major airports.

b) It determines the amount of the development fees concerning major airports.

c) To determine the amount of the passenger service fee levied under the Aircraft Rules 1937.

d) AERA monitors and reports on performance standards, quality, continuity, and reliability.

Indian Aviation

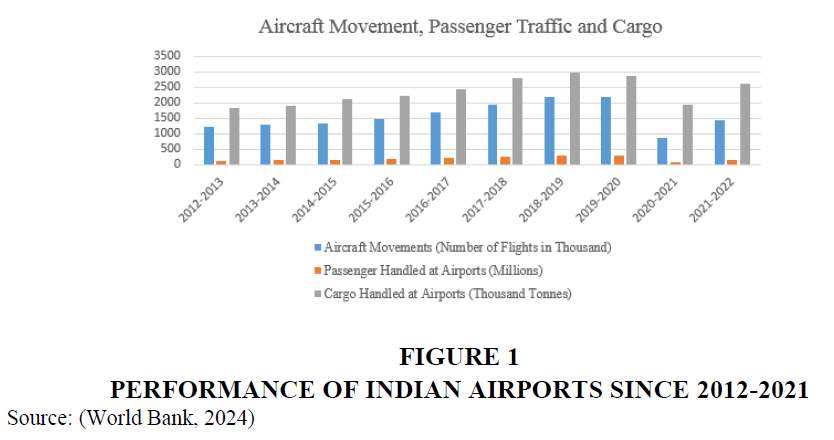

After AAI was established in 1995, the airlines corporatized following the Air Corporations Act 1953. Several private carriers allowed operating scheduled services. Indian airlines operate both domestic and international flights, connecting major cities within the country and serving international destinations. Major cities such as Delhi, Mumbai, Chennai, and Bangalore serve as international hubs. The private carriers then started to establish. Jet Airways, Deccan in 2003, Spice-Jet Indigo, Go-Air, and Jet-Lite launched between 2005 and 2007 (Yu, Zhang, Zhang, Wang, & Cui, 2019). Low-cost carriers, like Indigo, Air India, Spicejet GoAir, and Vistara started the operation. The aviation industry has started to count as one of the growing industries in India. It has contributed 30 billion USD to the Indian GDP in 2021 (IBEF, 2017). The development of the Indian aviation industry has been a remarkable journey marked by significant growth and transformation (Shome & Verma, 2020). It has a long history of establishment, and currently, it lies in the 5th position globally in terms of size. Since the liberalization of the airline sector in 2004, the civil aviation industry has been growing steadily (Mahtani & Garg, 2018). Every year, the Indian aviation sector witnessed significant improvements in traffic movement in both the passenger and cargo segments (Satpathy, Patnaik, & Kumar, 2017). The number of domestic and international passengers has been steadily increasing. This is due to increased affordability, a wide range of flight options and improved infrastructure (Figure 1).

The emergence and success of low-cost carriers such as IndiGo, SpiceJet, and GoAir contributed significantly to India’s air travel democratization. Indian airlines continued to expand their international routes, connecting major Indian cities to destinations across Asia, the Middle East, Europe, and North America. The FDI policy allowed foreign airlines to invest in Indian carriers, and reforms aimed to improve the ease of business in the aviation sector. The initiation of schemes such as the UDAN has improved regional air connectivity. Aviation is also embracing digital technologies for ticket booking, passenger services, maintenance, and operations. Digital transformation also supports boosting efficiency and customer experiences. Indian civil aviation is predicted to be the third-largest market by 2024 (Thummala & Hiremath, 2022).

Airport Governance

Governance means one authority or entity governs or controls another entity (Nobuo, 2007). Airport governance refers to the structure and management of airports, including the policies, regulations, and decision-making processes that govern the operation. Ample dimensions govern an airport that constitute an airport’s governance structure (National Academies of Sciences, Engineering, and Medicine, 2009). Using the developed airport governance models, airports in India have implemented a public majority model for all international airports and a full public model for domestic airports, including regional and local airports. Since 2006, there has been a shift in the governance of operated airports. In international airports, the GoI operates with private investors, and in domestic airports, there are private players in operation and management.

Table 3 describes the categories and the critical components practiced in the governance of the Indian airports. Basic facilities include aeronautical infrastructure such as taxiways, runways, aprons, and strips, for private sectors could develop the landing and take-off of aircraft. The building facilities include non-aeronautical infrastructure. Models of airport management elucidate the types of airport management models prevailing in India. International airports have PPPs in the form of BOO, BOT, and JV. In India, there is no entirely privately governed airport. The principal motivation for engaging a firm to run an airport is to increase its economic viability by increasing its revenues and decreasing its costs (Poole, Jr, 1997).

| Table 3 The Current Situation of Airport Governance | ||||

| Categories | Basic facilities | Parking Facility | Building facilities | Air traffic control |

| Public-Private Partnership (PPP) | Private Company | Private Company | Private Company | National Government (AAI) |

| AAI-owned and operated | Government | Government | Government | Government (AAI) |

| Public and State Governments | Central and State (Cochin International Airport) |

Central and State | Central and State | Central and State (AAI) |

Motives for Privatizing Indian Airports

Critical characteristics of airport privatization:

a) To increase the economic efficiency in the region.

b) To practice privatization models, such as trade sale, share flotation, concession, management contracts, project finance privatization, Build, Operate and Transfer, BOT, etc. (Carney & Mew, 2003).

c) To reduce the financial burdens of the government.

d) To attract private investment in airport development, operation, and management

e) To improve the overall performance of Indian airports.

Therefore, comprehensive research in the Indian context assessing airport privatization, its regulations, and problems is essential to understanding its success.

Airport PPP/Privatization

Indian airports need more technology and human resources to operate a major international airport. In major airports, issues like investment problems, contract cancellation, concession problems with AAI and operating companies, etc., are rising and creating issues in airport privatization. Well-developed airport infrastructure is a prerequisite for the aviation industry to grow and add to the economic development in India. The GoI envisages a substantive role for PPP policies focusing on private sector investment and operational efficiencies in providing the airport. In this way, the airport infrastructure has resulted in a policy outcome as a liberalized business in India.

Airport privatization is all about the growth of passengers and the economy (Dörnberg, 2008). Several governments have appealed for private funding to build the efficiency of operations. Additionally, financial self-sufficiency arose, and airports did not rely on government support (Tsunoda, 2023). In 2020, approximately 20 percent of airports privatized (Belsie, 2023). The method of privatization is vivid. Similarly, ample experiments conducted in the airport privatization process defining the relationships relating airport regulators, investors, and management (Carney & Mew, 2003).

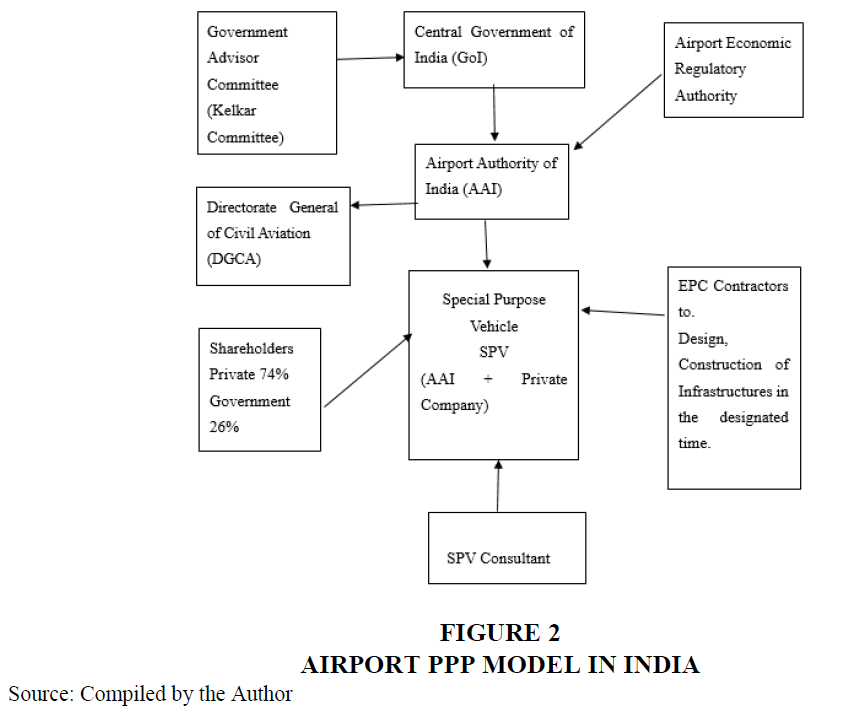

In the case of India, the PPP model has been the cornerstone of airport privatization. Under this model, private companies or consortiums granted long-term leases to operate, maintain, and upgrade airports. The objective of PPP implementation in airports is to enhance the efficiency of government-owned enterprises (Brito, Oliveira, & Dresner, 2021). The policies of PPPs defined as the most consequential economic development of modern times, and they resemble privatization policies (Havrylyshyn & McGettigan, 1999).

India has used concession agreements in the construction and development of airports. The concession approach is an agreement of charges or payments made by the airport authority to the business owner to conduct commercial activities (Kim & Shin, 2001). The concession is intended to develop, modernize, operate, and manage the airport infrastructure (Sambrani, 2014). According to the World Bank (2022), the obligation of airport concession includes 30 years of defined investments, payment of fixed annual royalty, design-build specifications and deadline of completion, operating standards, protection of the environment and local communities, guaranteeing equal, fair access to airport facilities and services. As a first step in the privatization of Delhi, Mumbai, Bengaluru, and Hyderabad entered into a PPP agreement in 2006 (In, Casemiro, & Kim, 2017). Additionally, the Union Cabinet on 08.11.2018, had accorded in Principle approval for leasing out six more airports to the Adani enterprises namely a) Ahmedabad, b) Lucknow, c) Mangaluru, d) Guwahati, e) Jaipur, and f) Trivandrum, for operation, and development through PPP (MoCA, 2021). Adani enterprises with six airports PPP for 50 years with Adani enterprises (Vandana, et al., 2020). Except for the stated number of airports, the GoI has planned to establish more than 250 airports to under the PPP policy (Figure 2).

PPP has emerged as a preferred mode of airport privatization. The first private sector participation in a PPP model started at Cochin International Airport in 1994 at Kochi (Kashiramka, Banerjee, Kumar, & Jain, 2016). Subsequently, airports such as DIA, Mumbai, and Dr. Babasaheb Ambedkar International Airport at Nagpur airports also started to modernize participation through the PPP model Joint-Venture (JV) under and adopted several models (Singh, Dalei, & Raju, 2015).

SPV stands for special purpose vehicle a joint venture (JV) company for a certain period of construction, operation, and management of airports over specific facilities in a contract (Fuhr & Beckers, 2006). Air Traffic control is under AAI control due to national security. The GoI does not interrupt the design, construction, or completion unless it is a national emergency. Concession agreements allow the SPV to develop, construct, operate, and maintain the airport for a designated time. The state and the central government manage the land acquisitions Even though there are ample issues in land acquisition in India. Private sectors invest 74% of the investment, and the rest of the 26% is from the public sector. Firstly, the consortium is for 30 years and extended by 30 years. The airport’s performance is monitored through the passenger survey in the Global Airport Monitoring Survey Standards IATA. In the first phase of privatization in major international airports, Cochin, Delhi, Mumbai, Hyderabad, and Bangalore, on the PPP/JV model (Chourasia, Dalei, & Jha, 2021). The privatization policies in airport infrastructure have produced institutional restructuring, improved operational efficiency, and introduced private-sector financing necessities. As a first step of privatization, in 2006 Delhi, Mumbai, in 2009 Bengaluru, and Hyderabad stepped into the PPP model (In, Casemiro, & Kim, 2017).

Table 4 and 5 are shows the privately operated or partially airports in India in Greenfield and Brownfield airports since 1999-2024. Additionally, 21 airports are on the way with Greenfield Investment. In the first phase of airport privatization the trend is followed in major international airports, Cochin, Delhi, Mumbai, Hyderabad, and Bangalore, on the PPP/JV model (Chourasia, Dalei, & Jha, 2021). The privatization policies in airport infrastructure have produced institutional restructuring, improved operational efficiency, and introduced private-sector financing necessities. As a first step of privatization, in 2006 Delhi, Mumbai, in 2009 Bengaluru, and Hyderabad stepped into the PPP model. The PPP model is the outcome of a liberalized business, encouraging the private sector to invest in aviation sector (Viswanath & Kumar, 2008). The privatization of CIAL project was initiated in 1992 by the Central Government of India, the state of Kerala and the City of Cochin. Cochin International Airport became the first airport built by the private sector investment in PPP structure (Rajan, Sharad, & Sinha, 2009). Cochin International Airport is operated by Cochin International Airport Limited (CIAL) and was founded in 1994. This is the first Greenfield airport built in the PPP model (Paulose, 2013). Most international airports have offered the Joint-Venture (JV) route. Respectively, three Greenfield airports at Bangalore, Hyderabad, and Kochi, with major private sector shareholding, are being developed. Currently, AAI-owns principal five airports, Ahmedabad, Jaipur, Mangalore, Lucknow, Guwahati, and Thiruvananthapuram, are being developed and privatized under PPP with other several airports in Greenfield and Brownfield developments.

| Table 4 PPP Airports Under Greenfield Investment | |||

| Name of Airport/ Location | Private Enterprise | Privatization year | Nature of Contract |

| Sindhudurg Airport | MIDC and ISAPL | 25th September, 2009 | Project Development Agreement |

| Noida International Airport | NIAL and YIAPL | 7th October, 2020 | Concession Agreement DBFOT |

| Navi Mumbai International Airport | City and Industrial Development Corporation of Maharashtra and Navi Mumbai International Airport Private Limited | 8th of January 2018 | Concession Agreement DBFOT |

| Manohar International Airport, Mopa, Goa | GMR Goa International Airport Limited | 8th January 2016 | DBFOT |

| Bhogapuram Airport | AAI & GMR Visakhapatnam International Airport Limited | 16th May 2023 | Develop, Design Finance, Construct, Complete and Operate |

| Kempegwoda International Airport, Bengaluru | Bangalore International Airport Limited | 5th July 2004 | Concession Agreement Development, Construction, Operation and Maintenance |

| Rajiv Gandhi International Airport, Hyderabad | Hyderabad International Airport Limited | 20th December 2004 | Concession Agreement |

| Table 5 PPP Airports Under Brownfield Investment | |||

| Airports Location | Private Enterprises | Privatization Year | Privatization Modes |

| Chaudhary Charan Singh, Lucknow | ALIAL | 14th February 2020 | Concession Agreement |

| Mangaluru International Airport | AMIAL | 14th February 2020 | Concession Agreement |

| Thiruvananthapuram International Airport | ATIAL | 19th January 2021 | Concession Agreement |

| Sardar Vallabhbhai patel International Airport, Ahmedabad | AAIAL | 14th February 2020 | Concession Agreement |

| Lokpriya Gopinath Bordoloi Interantional Airport, Guwahati | AGIAL | 19th January 2021 | Concession Agreement |

| Jaipur International Airport | AJIAL | 19th January 2021 | Concession Agreement |

| Indira Gandhi International Airport, Delhi | DIAL | 4th April 2006 | OMDA for 30 Years |

| Chhatrapati Shivaji Maharaj International Airport, Mumbai | MIAL | 4th April 2006 | OMDA For 30 Years |

Major Private Players in Indian Airports

Several private players are involved in the Operation Management Development Agreement (OMDA) through PPP models and concessions. Instead of selling airports to the private sector, the private participation is a choice of the GoI to privatize Indian airports. Private companies are intervening to share investment, technology, risks, and managerial performance in airport development. Practicing private participation in airports affects economic regulations, ownership, airport charges, airport efficiency, and investment decisions. The aeronautical and non-aeronautical sectors appeal to more investment with adequate private sector participation in operation and management. Researchers contemplate that private investment in the airport sector deals with airport infrastructure challenges in the long run (Table 6).

| Table 6 Major Private Players in the Indian Airport Industry | |

| Name of Private Company | Name of Airports |

| GMR Group | Hyderabad International Airport Delhi International Airport |

| GVK | Modernization of Mumbai International Airport |

| SIEMENS | Development of Bengaluru International Airport |

| Larsen and Tourbo | Development of Navi Mumbai International Airport |

| ADANI | Development of Ahmedabad and Thiruvananthapuram Airports |

The nature of contracts, the characteristics of private companies, the systems, and the revenue-sharing provision affect the successful airport privatization. The section aims to understand the critical issues with the private participation of airports in India. Private ownership airports have resulted in passenger traffic, employment generation, and stimulated investments. They are showing efficiency and providing quality services.

Challenges of PPP airports

The private sector involves airports such as Chennai, Hyderabad, Kolkata, Mumbai, New Delhi, and Bengaluru, which have concentrated on providing good airport service quality (ASQ) in different passenger categories (Prakash & Barua, 2016). Despite this growth, the Indian aviation sector faces infrastructure constraints, high operating costs, and regulatory hurdles. Since the beginning of the privatization process, India has faced the following challenges.

a) Monopolistic Practices: The primary concern is the emergence of monopolistic practices by private operators who often control multiple airports. This can lead to higher prices for passengers and airlines, limited choices, and reduced competition. For example, in 2019, Adani Enterprises won contracts to operate and manage six airports in Ahmedabad, Guwahati, Jaipur, Lucknow, Mangalore, and Thiruvananthapuram, for 50 to 50 years. Apart from running these airports, the ambitions of private enterprises would lead to a monopoly on Indian aviation.

b) Higher User Fees: Privately operated airports tend to charge high user fees to recover their investments and make a profit. This can result in increased ticket prices for passengers and operational costs for airlines, making air travel more expensive.

c) Labor Issues The labor unions in the aviation sector could influence political decisions regarding employment wages and working conditions. Strikes and labor disputes can also disrupt airport operations.

d) Political Risks: There are massive political problems in India in airport infrastructure. A change in a government after the election changes in decisions always have public opposition to an airport project. Political groups, including local citizens, labor unions, and stakeholders, are concerned about job security, service quality, and potential price increases for airport users, which lead to public protests and political pressure against privatization efforts. Foreign ownerships in Indian airports are restricted.

e) Price Regulation Approach in PPP Airports: The enticement of PPP airports in India is likely to maximize profit. In most of the PPP airports, private enterprises own 74% stakes, and 26% remains with the Government. In 2009, the Airports Economic Regulator Authority (AERA), an independent authority was established to monitor regulation, tariffs, and aeronautical services, and monitor airports’ performance standards.

Conclusion

Indian aviation has transformed over the years, focusing on growth, affordability, and improving infrastructure. It also faces opportunities and challenges, including market competition, regulatory issues, and environmental concerns. Well-developed airport infrastructure is a prerequisite for the aviation industry to grow and add to economic development in India. After the 1990s economic liberalization, airport deregulation and disinvestment have quickened in India. Under the new monetary policy, investment in the private sector in the air transport industry is permitted and the industry deserves the exclusive purview of the public sector. The move to partial private ownership in Indian airports has embraced the privatization trend. The major driving force provides good service quality at airports. In significant airports, privatization issues such as investment problems, contract cancellation, concession problems, and delays with AAI and Operating companies are rising and creating issues in airport privatization and commercialization.

Limitation of this study

This study is limited in discussing the background scenario of Indian Airports and the path of adopted privatization policies. Comparative studies with cases from diverse countries are necessary for further studies.

References

AAI. (1985). The National Airports Authority Act. New Delhi: The Gazette of India, No 64.

Abdullahu, L. (2018). Factors Influencing Airport Selection case of: Prishtina, Skopje and Tirana Airport. Journal of Danubian Studies and Research, 8(1).

Adler, N., & Liebert, V. (2014). Joint impact of competition, ownership form and economic regulation on airport performance and pricing. Transportation Research Part A, 64, 92-109.

Indexed at, Google Scholar, Cross Ref

AERA. (2008, 12 5). The Airports Economic Regulatory Authority of India Act, 2008.

Airports Auhtority of India. (2024, 4 4).

Airports Council International. (2018, 9 18). Privatization has proven successful in developing airport infrastructure to cope with traffic growth.

Aniyeri, R., & Nadar, C. R. (2016). A dissect of Indian airport. 41613-41630: International Journal of Current Research, 8(11).

Augustyniak, W. (2009). Impact of Privatizatin on Airport Performance: Analysis of Polish and British airports. Journal of International Studies, 2(1), 59-65.

Indexed at, Google Scholar, Cross Ref

Bagler, G. (2008). Analysis of the airport network of India as a complex weighted network. Physica A: Statistical Mechanics and its Applications, 387(12), 2972-2980.

Indexed at, Google Scholar, Cross Ref

Barde, T., Pantelias, A., & Zerjav, V. (2016). Assessment of Airport Performance in India. RICS COBRA 2016 The construction, Building and Real State Research Conference of the Royal Institution of Chartered Surveyors 20-22 September 2016. Toronto, Canada: COBRA 2016.

Belsie, L. (2023). Privatizing Infrastructure: Evidence from Airports. National Bureau of Economic Research.

Bhattacharya, S. (2018). Yojana: Giving Wings to Small Town India. YOJANA .

Brito, I. R., Oliveira, A. V., & Dresner, M. E. (2021). An econometric study of the effects of airport privatization on airfares in Brazil. Transport Policy, 114, 338-349.

Indexed at, Google Scholar, Cross Ref

CAPA. (2014, 3 28). India airports Public Private Partnership model is transformational but key lessons to be learned.

Carney, M., & Mew, K. (2003). Airport governance reform: a strategic management perspective. Journal of Air Transport Management, 9(4), 221-232.

Indexed at, Google Scholar, Cross Ref

Castro, R., & Lohmann, G. (2014). Airport branding: Content analysis of vision statements. Research in Transportation Business & Management, 10, 4-14.

Indexed at, Google Scholar, Cross Ref

Chakraborty, S., Ghosh, S., Sarker, B., & Chakraborty, S. (2022). An integrated performance evaluation approach for the Indian international airports. Journal of Air Transport Management, 88, 101876.

Indexed at, Google Scholar, Cross Ref

Chourasia, A. S., Dalei, N. N., & Jha, K. (2021). Critical success factors for development of public-private-partnership airports in India. Journal of Infrastructure, Policy and Development, 5(1), 1-21.

Chourasia, A. S., Dalei, N. N., & Jha, k. (2023). Evaluating public-private partnership role on the sustainability of airports in India. Sustainable Development, 31(5), 3595-3608.

Indexed at, Google Scholar, Cross Ref

Chourasia, A. S., Jha, K., & Dalei, N. N. (2021). Development and planning of sustainable airports. Journal of Public Affairs, 21(1), 1-9.

Indexed at, Google Scholar, Cross Ref

Das, A. K., Bardhan, A. K., & Fageda, X. (2022). What is driving the passenger demand on new regional air routes in India: A study using the gravity model. Case Studies on Transport Policy, 10, 637-646.

Indexed at, Google Scholar, Cross Ref

Deloitte. (2006). Closing the Infrastructure Gap: The Role of Public-Private Partnership. New York: The World Bank.

Domney, M. D., Wilson, H. I., & Chen, E. (2005). Natural monopoly privatisation under different regulatory regimes: A comparison of New Zealand and Australian airports. International Journal of Public Sector Management, 18(3), 274-292(19).

Indexed at, Google Scholar, Cross Ref

Dörnberg, A. v. (2008). Airport Privatization and Takeover- Creating Value for all Stakeholders? In R. Conrady, & M. Buck, Trends and Issues in Global Tourism 2008 (pp. 47-60). Berlin, Heidelberg: Springer.

Indexed at, Google Scholar, Cross Ref

Engel, E., Fischer, R., & Galetovic, A. (2018). The joy of flying: Efficient airport PPP contracts. Transportation Research Part B: Methodological, 114, 131-146.

Indexed at, Google Scholar, Cross Ref

Francina, J. V., Selvavinayagam, K., & Elavarasan, R. (2020). A Study on Operations of Airport Service with Special Reference To Chennai Airport. ICTACT, Journal of Management Studies, 6(3), 1276-1282.

Freestone, R., Baker, D., & Stevens, N. (2011). Managing airport land development under regulatory uncertainty. Research in Transportation Business & Management, 1, 101-108.

Indexed at, Google Scholar, Cross Ref

Fuhr, J., & Beckers, T. (2006). Vertical Governance between AIrlines and Airports- A Transaction Cost Analysis. Review of Network Economics, 5(4), 386-412.

Indexed at, Google Scholar, Cross Ref

George, M. (2015). Development Fee in India AIrports - A Case Study . Journal of Air Law and Commerce, 80(1), 18-52.

Gillen, D., & Mantin, B. (2014). The importance of concession revenues in the privatization of airports. Transportation Research Part E: Logistics and Transportation Review, 68, 164-177.

Indexed at, Google Scholar, Cross Ref

Graham, A. (2011). The objectives and outcomes of airport privatisation. Research in Transportation Business & Management, 1(1), 3-14.

Indexed at, Google Scholar, Cross Ref

Gupta, R. (2015). Issues in Airport Infrastructure Development under Public Private Partnership. International Journal of Business and Management Invention, 4(6), 66-77.

Indexed at, Google Scholar, Cross Ref

Havrylyshyn, O., & McGettigan, D. (1999). Privatization in Transition COuntries: Lessons of the First Decade. Economic Issues, 18.

Indexed at, Google Scholar, Cross Ref

Hooper, P. (2002). Privatization of airports in Asia. Journal of Air Transport Management, 8(5), 289-300.

Indexed at, Google Scholar, Cross Ref

IBEF. (2017, 2).

IBEF. (2022, 5 24). Indian Aviation Industry.

ICAO. (2013). Case Studies on Commercialization, Privatization and Economic Oversight of Airports and Air Navigation Services Providers India.

ICAO. (2015). Public Private Partnership (PPP)- Case study- India.

ICAO. (2022, 5 19). Case Study on Commercialization, Privatization and Economic Oversight of Airports and Air Navigation Services Providers India.

In, S. Y., Casemiro, L. A., & Kim, J. (2017). A decision framework for successful private participation in the airport sector. Journal of Air Transport Management, 62, 217-225.

Indexed at, Google Scholar, Cross Ref

Indian Numbered Acts. (1971, 12 8). International Airports Authority Act 1971.

Junior, A. C., Hollaender, P. S., Mazzanati, G. V., & Bortoletto, W. W. (2021). Efficiency drivers of international airports: A worldwide benchmarking study. Journal of Air Transport Management,90, 101960.

Indexed at, Google Scholar, Cross Ref

Kashiramka, S., Banerjee, R., Kumar, A., & Jain, P. K. (2016). Efficiency Analysis of Airports in India in a Changing Environment. Journal of Transport Economics and Policy, 50(4), 384-403.

Kim, H. b., & Shin, J. H. (2001). A contextual investigation of the operation and management of airport concessions. Tourism Management 22(2), 149-155.

Indexed at, Google Scholar, Cross Ref

Krishnan, L. R. (2021). Privatisation of Commercial Airports in India: Carry Over Legacy, A Nightmare Managing The People Agenda. Journal of the International Academy for Case Studies, 27(4), 1-9.

Kumar, A., Dash, M. K., & Sahu, R. (2018). Performance efficiency measurement of airports: A comparative analysis of airports authority of India and public private partnership. International Journal of Strategic Decision Sciences (IJSDS), 9(2), 19-37.

Indexed at, Google Scholar, Cross Ref

Latiff, K., & IMM, S. N. (2015). The Impact of Tourism Service Quality on Satisfaction. International Journal of Economics and Management, 9(S), 67-94.

Lehmann, C. (2019). Characteristics of airports. In Exploring Service Productivity. Markt-und Unternehmensentwicklung Markets and Organizations (pp. 93-101). Wiesbaden: Springer Gabler.

Indexed at, Google Scholar, Cross Ref

Mahtani, U. S., & Garg, C. P. (2018). An analysis of Key factors of financial distress in airline companies in India using fuzzy AHP Framework. Transportation Research Part A: Policy and Practice, 117, 87-102.

Indexed at, Google Scholar, Cross Ref

MoCA. (2021). Annual Report 2020-21. New Delhi: Ministry of Civil Aviation Government of India.

MoCA. (2023, 06 20).

MoCA. (2023, 7 24). In- Principle approval to set up 21 new Greenfield Airport in Country .

National Academies of Sciences, Engineering, and Medicine . (2009). Airport Governance and Ownership. Washington, DC: The National Academies Press.

Nobuo, A. (2007). RIETI. Research Institute of Economy, Trade and Industry.

Ohri, M. (2009). Discussion Paper: Airport Privatization in India. Netw and Spat Econ, 12, 279-297.

Indexed at, Google Scholar, Cross Ref

Paulose, D. (2013). Risks and Strategies for a Build-Own-Operate International Airport Project in India. International Journal of Risk and Contingency Management, 2(1), 1-17.

Phuyal, M. (2023). Understanding the Indian Way of Airport Privatization: Case of Indira Gandhi International Airport, Delhi. Open Journal of Social Sciences, 11(6), 237-254.

Indexed at, Google Scholar, Cross Ref

Poole, Jr, R. W. (1997). Privatization: A New Transportation Paradigm. The Annals of the American Academy of Political and Social Science, 553, 94-105.

Indexed at, Google Scholar, Cross Ref

Poole, R. W., & Fixler, R. W. (1987). Privatization of Public-Sector Services in Practice: Experience and Potential. Journal of Policy Analysis and Management, 6(4), 612-625.

Indexed at, Google Scholar, Cross Ref

Prakash, C., & Barua, M. K. (2016). A Robust Multi-Criteria Decision-Making Framework for Evaluation of the Airport Service Quality Enablers for Ranking the Airports. Journal of Quality Assurance in Hospitality & Tourism, 17(3), 351-370.

Prasada, S. (1956). Indian Airlines Corporation. Indian Journal of Public Administration , 34-49.

Indexed at, Google Scholar, Cross Ref

Raghuram, G., & Varkkey, B. (2001). Public Private Partnership in Airport Development- Governance and Risk Maangement Implications from Cochin International Airport Ltd. Econ Papers , 1-29.

ajan, T. A., Sharad, S., & Sinha, S. (2009). PPP in Greenfield Airport Development: A Case Study of Cochin International Airport Limited. In A. Akintoye, & M. Beck, Policy, Finance & Management for Public-Private Partnerships (pp. 97-122). WILEY-BLACKWELL.

Rajani, N. S., & Reddy, V. B. (2022). Social Security Schemes in Aviation Indsutry: A Case Study of Airport Authority of India. Journal of Positive School Psychology, 2161-2173.

Rathore, H., Nandi, S., & Jakhar, S. K. (2020). The future of Indian aviation from the perspective of environment-centric regulations and policies. IIMB Management Review, 32(4), 434-447.

Sambrani, V. N. (2014). PPP from Asia and African perspective towards infrastructure development: a case study of Greenfield Bangalore International Airport, India. Procedia-Social and Behavioral Sciences, 157, 285-295.

Indexed at, Google Scholar, Cross Ref

Saraf, D. N. (1989). Public Utility Services with Special Reference to Air Services and the Consumer. Journal of the Indian Law Institute, 31(2), 136-153.

Saraswati, S. K. (2001). Civil Aviation Environment in India. Economic and Political Weekly, 36(19), 1639-1645.

Satpathy, I., Patnaik, B., & Kumar, S. (2017). Indian aviation industry: An overview. International Journal of Academic Research and Development, 2(6), 802-805.

Shanmuganathan, S., & krishnan, L. (2023). A Conceptual Review on Privatization of Indian Airports- A New Dimension in People Management Explored. Journal of the International Academy for Case Studies, 29(s3), 1-14.

Shome, S., & Verma, S. (2020). Financial Distress in Indian Aviation Industry: Investigation Using Bankruptcy Prediction Models. Eurasian Journal of Business and Economics, 13(25), 91-109.

Indexed at, Google Scholar, Cross Ref

Singh, D. P., Dalei, N. N., & Raju, T. b. (2015). Airport Privatization and Economic Regulation: An Indian Experience. International Journal of Multidisciplinary Research and Development, 2(5), 414-418.

Singh, J., Sharma, S. K., & Srivastava, R. (2019). What drives Indian Airlines operational expense: An econometric model. Journal of Air Transport Management, 77, 32-38.

Sugimura, Y., & kato, A. (2022). Airport concession in Japan: Current status, problems, and future directions. Research in Transportation Business & Management, 43, 1-15.

Indexed at, Google Scholar, Cross Ref

Thummala, V., & Hiremath, R. B. (2022). Green Aviation in India: Airline's implementation for achieving sustainability . Cleaner and Responsible Consumption, 7, 1-11.

Indexed at, Google Scholar, Cross Ref

Tsunoda, Y. (2023). Airport concession revenue sharing and entry deterrence. Economics of Transportation, 33, 1-11.

Indexed at, Google Scholar, Cross Ref

Vandana, B., Shaun, A. T., Vaishnav, K. P., Abraham, J., Nevin, K. G., & Shubham, A. (2020). Investigation of critical factors influencing construction of airports: the case of India. International Journal of Construction management, 1-10.

Indexed at, Google Scholar, Cross Ref

Veerappan, M., Sahu, P. K., Pani, A., Patil, G. R., & Sarkar, A. K. (2019, 5 26-30). Analysing and modelling the relationship between air freight movement and airport characteristics in India. Transportation Research Procedia, 48, 74-92.

Viswanath, A., & Kumar, C. J. (2008). Building Infrastructure Through PPP Model: Policy Lessons from RGIA. Indian Journal of Public Administration, 54(3), 587-594.

Indexed at, Google Scholar, Cross Ref

Wang, K., Zhang, A., & Zhang, Y. (2018). Key determinants of airline pricing and air travel demand in China and Indai: Policym ownershil and LCC competition. Transport Policy, 63, 80-89.

Indexed at, Google Scholar, Cross Ref

Yu, H., Zhang, Y., Zhang, A., Wang, K., & Cui, Q. (2019). A comparative study of airline efficiency in China and India: A dynamic network DEA approach. Research in Transportation Economics, 76, 1-12.

Indexed at, Google Scholar, Cross Ref

Zhang, A., & Czerny, A. I. (2012). Airports and airlines economics and policy: An interpretive review of recent research. Economics of Transportation, 1 (1-2), 15-34.

Indexed at, Google Scholar, Cross Ref

Received: 09-May-2024, Manuscript No. JIACS-24-14796; Editor assigned: 10-May-2024, Pre QC No. JIACS-24-14796 (PQ); Reviewed: 24-May-2024, QC No. JIACS-24-14796; Revised: 02-July-2024, Manuscript No. JIACS-24-14796 (R); Published: 10-Nov-2024