Research Article: 2022 Vol: 26 Issue: 3S

Credit Facilities Relationship to Consumer Buying Behavior: Applied Study to Saudi Families in the Eastern Region

Khaled Alsaeed Qamar, Imam Abdulrahman Bin Faisal University

Mohamed H Rabie, Imam Abdulrahman Bin Faisal University

Mohamed Noureldin Sayed, Imam Abdulrahman Bin Faisal University

Citation Information: Qamar, K.A., Rabie, M.H., & Sayed, M.N. (2022). Credit facilities' relationship to consumer buying behavior: applied study to saudi families in the eastern region. Academy of Accounting and Financial Studies Journal, 26(S3), 1-18.

Abstract

This research seeks thorough investigation and analysis to describe and analyze the disparity or conformity in the perception of the Saudi family towards the dimensions of credit facilities on the one hand, and the behavior of consumer purchasing behavior, according to their demographic characteristics, as well as to reveal the type and strength of the relationship between the dimensions of credit facilities (consumer loans, sale in installments), and the behavior of consumer purchase, by applying to Saudi households palm To achieve this goal, a survey list was designed that was distributed to a sample of 500 eastern region families. Preliminary data were analyzed using the SPSS statistical program, and the results showed that there is no relation between the perception of Saudi families, towards the dimensions of credit facilities and age, gender type, education level. However, there is a relation between the perception of Saudi families, towards the dimensions of credit facilities and monthly income, dimensions of the credit facilities (loans, installments). By enhancing competition and improving credit facilities, banks are developing new products and changing their customers' purchasing behaviors, encouraging them to switch banks and to make balanced decisions in obtaining certain types of financial products.

Keywords

Consumer Buying Behavior, Credit facilities.

JEL Classifications

F6, F61, G21.

Introduction

Identifying research gab by investigating previous studies that dealt with the subject of the study, therefore the problem of research is to verify the relationship of the dimensions of credit facilities obtained by Saudi families, to the behavior of consumer purchase of these families, and the problem of study can be translated into a set of questions as follows:

1. Is there a statistically significant difference between the perception of Saudi families, towards the dimensions of credit facilities (consumer loans, sale in installments), according to their different demographic characteristics (age, type, educational qualification, family monthly income)?

2. Is there a statistically significant difference between the perception of Saudi families, towards the behavior of consumer purchasing, according to their different demographic characteristics (age, type, educational qualification, monthly income of the family)?

3. Is there a statistically significant relationship between the dimensions of credit facilities (consumer loans, sale in installments) obtained by Saudi families, and the behavior of consumer purchasing of these families?

Research Objectives

This research aimed at examining the role of credit facilities obtained by Saudi families in guiding the behavior of consumer purchasing of these families, and several sub-objectives are derived from this goal:

1. Revealing the similarity or difference between the perception of Saudi families, towards the dimensions of credit facilities (consumer loans, sale in installments), according to their different demographic characteristics (age, type, educational qualification, monthly income), according to their different demographic characteristics (age, type, educational qualification, family monthly income).

2. Revealing the similarity or difference between the perception of Saudi families, towards the behavior of consumer purchasing, according to their different demographic characteristics (age, type, educational qualification, monthly income of the family).

3. Identifying and describing the type and strength of the relationship between the dimensions of credit facilities (consumer loans, sale in installments) obtained by Saudi families, and the behavior of consumer purchasing of these families.

4. Determining the relative importance between the dimensions of credit facilities (consumer loans, retail sales) obtained by Saudi families, and the behavior of consumer purchasing of these families.

Research Hypotheses

Focusing on the problem and questions of the study, the researcher formulated the following assumptions:

1. There is no statistically significant difference between the perception of Saudi families, towards the dimensions of credit facilities (consumer loans, sale in installments), according to their different demographic characteristics (age, type, educational qualification, family monthly income).

2. There is no statistically significant difference between the perception of Saudi families towards consumer purchasing behavior, depending on their different demographic characteristics (age, type, educational qualification, family monthly income).

3. There is no statistically significant relationship between the dimensions of credit facilities (consumer loans, installment sales) obtained by Saudi families, and the behavior of consumer purchasing of these families.

Research Importance

Scientific importance

The importance of the study stems from the scientific aspect as follows:

1. Few types of research addressed the impact of the dimensions of credit facilities on the consumer buying behavior of these Saudi households.

2. Building an integrated vision of the dimensions of credit facilities that affect consumer buying behavior among Saudi households.

3. Develop variables that enjoy confidence/stability and credibility that can be used by researchers in other research fields.

Second aspect: applied importance

1. Pay more attention to the dimensions of credit facilities provided to Saudi families and their implications for the consumer buying behavior of these families.

2. Assisting the credit facility provider to develop its performance to achieve a positive image among its clients.

3. The results of the study draw more attention towards the dimensions of credit facilities that get Saudi families, which contributes to reducing the negative effects of consumer buying behavior among these families

Literature Reviews

Credit Facilities

Credit facilities are vital elements of financial growth, improving economic development (Bajwa, 2019). The literature reviewed indicates that significant fiscal growth assists spur economic development. Fouzi (2021) notes that the most vital aspect of credit facilities is the country's financial situation and the quality of its credits. A swift credit growth ideally leads to adverse selection and may be linked to minimized credit quality as the risk-taking intensifies during such periods. Over the past decade, the credit quality of the loan portfolios in Saudi Arabia remained relatively steady until the financial crisis hit the economy between 2007 and 2008. Since then, the credit facilities' wealth quality has deteriorated adversely. Credit growth is an excellent indicator of the credit facilities sector stability; hence most of the literature captures the relationship between the credit facilities activities and consumer behaviour (Fouzi, 2021). Positive economic developments and an increase in deposit potential led to significantly higher credit growths. As well as domestic deposits indicate a positive and symmetrical dimension to credit growth (Alnefaee, 2019). The evidence from Amidu's (2014) review suggests that the credit facilities' particular traits like liquidity, capitalization, and lender’s default metrics significantly affect credit provision.

Consuming Loans and Instalments Variables Globally

Based on Fouzi's (2021) arguments consuming loans play a vital role in the global economy since they inject liquidity and stimulate investment and consumption. The theoretical underpinnings of the link between credit facilities and consumer behaviour are based on consumer loans and instalments (Al-sadig, 2013; Sudacevschi, 2014). Consequently, there are controversial perspectives regarding the causal link between credit facilities activities and consumers' behavior in most dimensions. The issue is still a research gap in most nations of the world; therefore, the research focuses on exploring the extent of two economic variables: consuming loans and installments sales. Naser & Hadi (2014) note that for the emerging markets, global aspects enhanced the vitality of impacting the credit facilities lending medium as reserve surges have become more significant and significantly elastic in defiance of the context of a relatively simple international monetary condition. The current global economy is driven by credit since it initiates global economic activities that allow international businesses and individuals to invest beyond their cash at hand (Sudacevschi, 2014). In that case, Gani & Al-Muharrami (2016) state that an installment sale is one in which the price of the services offered by the credit facilities is to be paid for in fixed portions at the specified intervals. Naser & Hadi (2014) refer that in most Western Countries, like in Europe and the United States, the installment sales within the credit facilities are more of a means of benefiting finances and not a mere exchange than Islamic banks in Saudi Arabia. In other words, the dividends income from the installment’s sales credit is independent of sales profit, and according to its payback period.

Fouzi (2021) explored the link between the economic variables in Algeria between 1997 and 2017. The results indicated a short and long-run causal link between the two variables and credit lending. From the study, consumer loans have attained a significant place in the global economy. On the other hand, Cororaton (2018) emphasis that the 2007-2008 economic recession had a significant impact on the global economies due to its uncertainties. in that case in line with the aim of economic recovery, most of the credit facilities restricted their activities on consumer loans and focused more on retaining and restructuring the existing credits rather than expounding the credit base to more risky dimensions. Olegario (2019) conducted a study on the impact of instalment sales in America. The results indicated that the incidence of instalment sales is closely linked to income, where there is an increased need for credit from low-income individuals in America, which increases instalment sales usage. Although the details in the area are not complete, the issue's dimensions indicate that low-income groups make extensive use of the credit facilities that seem to be readily available to them regardless of the risk status. Interest rate risk, liquidity risk and Credit risk are important factors of financial risk management that are prospective to reduce the financial sector’s performance (Ahmed, 2021).

Amidu (2014) explored credit lending determinants in twenty-four sub-Saharan nations by utilizing credit facilities and state-level information. The results were that there are linkages of the credit facilities balance sheet on investment sales and lending. Credit facilities traits like capitalization and loan value ideally assist in ascertaining the credit facilities activities retardation among the MENA nations after the 2008 international financial upheaval. Research narrowing down on the Gulf Cooperation and Council (GCC) financial institutions acknowledge various variables impacting the lending facilities (Gani, 2016).

Consuming Loans and Instalments Sales in Saudi Arabia

The beneficial impact of the financial deepening inclusive of reclusive credit on the economic development is extensively minimal in oil distributing nations like Saudi Arabia because of the frailer monitoring and regulative traits and considerably restricted ingress to fiscal utilities (Miyajima, 2017). A large capacity of the literature has directed their focus on credit variables like consuming loans and instalments within monetary policy transmission. According to Naser & Hadi (2014), an instalment sale is a form of revenue recognition where the expenditure and revenue are acknowledged at the period of cash exchange. In Saudi Arabia, lending has a limited impact on the transferal technique of the fiscal policies significantly because of the subsidized credit facilities to the diverse mercantile sectors and the credit facilities lending trait (Miyajima, 2020). Bank credit facilities in various sectors have played an important role in promoting non-oil economic growth in Saudi Arabia (Alzyadat, 2021). As well as, competition is much more significant in the deposit market rather than the loan markets. In the past few years, the decline in oil prices made the credit institutions report a minimal lending opportunity. The facilities adopted a wait and saw stance towards any lending activities (Miyajima, 2017). Saudi Arabia has embraced instalment sale through Islamic credit financing, where the credit facilities grant the loans and sell the goods in instalments and obtain the price in the future (Askari, 2011). Al-sadig (2013) notes that this allows Islamic credit facilities to offer both individuals and enterprises finances for varied economic processes. Instalment sales will enable the credit facility to provide the consumer with the desired service and sell it to the user of the instalments.

The underlying reason for the rapid development of consumer loans in Saudi Arabia is the nations' capacity to secure an assignment of salary for consumer loans. The collateral has been tailored by establishing an interbank payment structure that allows the transfer of the consumer salaried from the workplaces to any credit facility within the jurisdiction. It has allowed the credit facilities to secure their loans by a tripartite agreement between the workplace, the staff, and the credit facilities like the banks at the consumer's initial right. This has been a critical stimulator for the swift growth of consumer loans in Saudi Arabia. Secondly, the credit facilities in Saudi Arabia have also come up with current types of consumer loans for margin trading, which is secured by shares and real estate. Saudi Arabia is also experiencing a rapid and youthful population that aims to finance its education, housing, shares trading, and even automobiles. Therefore, this is one reason why the country is experiencing rapid development in consumer loans (Miyajima, 2020).

Waemustafa & Sukri (2015) reveal a significant link between economic activities' stability and the consumption of loans within the credit facilities in Saudi Arabia. In that case, despite the adverse economic conditions, the nation's credit facilities continue to expand their activities to enterprises and households. The total credit extended to the households and the enterprises has increased while the private sector accounts for the bulk of credit extension (Bajwa, 2019).

Naser & Hadi's (2014) investigations confirm the vitality of a formidable balance between the instalment sales and the credit facilities regulation in fostering a robust credit development. More so, the state-owned credit facilities compelled a recurrent stabilizer responsibility in the international financial upheaval (Al-sadig, 2013). In short, the credit grew faster in government-owned credit facilities as opposed to the private sector. Saudi Arabia was not materially impacted by the 2007-2008 financial crisis like the other countries in the world due to the varied realm of bolsters like the conventional overseeing structure and a formidable credit facility framework (Cororaton, 2018). Also, since the Islamic entities are the ones that occupy the majority of the financial scope in Saudi Arabia, they demonstrated a more resilient nature as opposed to the conventional credit facilities due to the Islamic entity’s avoidance of interest (Billah, 2019).

Naser & Hadi (2014) note that the Islamic credit facilities in Saudi Arabia tend to elevate the credit more swiftly rather than the non-Islamic institutions, based on data from a broad selection of GCC facilities and the categorization of the credit facilities by the sample of activity scope. Alnefaee (2019) agrees that the Islamic credit institutions' business framework is harnessed significantly towards the assets and giving credit in eminent development contexts like real estate. The conventional form of credit is not an appropriate framework of financial lending under the Islamic guidelines in Saudi Arabia; therefore, the credit facilities utilize incentive models such as profit sharing and leasing arrangements and instalment sales.

Consuming Buying Behavior

Consumer behavior affects marketing performance, especially about market segmentation and identifying the demographic characteristics of individuals (Bente, 2012). As well as buying behavior a line with spending factors and consumer preferences affects the process of repeat purchases on the part of consumers and also affects the promotion of loyalty on their part towards the products they prefer (Chen, 2014). However, the price factor is not a big deal, especially the convenience of buying it and having confidence in the product's origin (Doan, 2021). Family enterprises have an important role in buying behavior as (Nikodemska-wo?owik, et al., 2019) refer that contemporary trend analytic thinking, to outcomes are critical for marketers’ re-evaluation of current family enterprises campaigns. With a far better understanding of consumer perceptions of family enterprises, marketing messages are often developed and evaluated for effectiveness in connecting with young consumers by understanding their latest trends and related perceptions of family enterprises. Although family enterprises are also considered inherently traditional, young consumers’ current conceptualization of tradition in family enterprises is critical for today’s marketers. Shopping costs can influence consumer buying behavior as purchase costs make depreciation of products less profitable, while loss-based pricing is more profitable than in contexts where consumers bear the cost of the purchase. The existence of a purchase cost makes removing the product less profitable while making the price as a flagship product more profitable than in a context where consumers are not charged a purchase fee (Florez-Acosta, 2020). Communication channels and repetitive messaging over time had a significant impact on reducing food waste to customers. The main conclusion of this paper is that retailers can influence the pro-environmental behavior of customers by using traditional communication channels; however, the messages are needed to be repeated to have a long-term impact (Young, 2018). Attitudes, motivations, and behavior play a role in consumer behavior and self-reported control variables have some effects on the relationship between saving attitudes and actual saving behavior, concurring with Ajzen's model of planned behavior, but only if income is high. Positive and negative attitudes towards buying on installment and credit card use are not correlated with saving attitudes or behaviour (Minibas-Poussard, 2022). “Buy now pay later” leads Generation Y (Gen Y) in Malaysia to excessively use their credit cards for expenditure, as well as, credit card knowledge and self-efficacy are negatively related to credit card misuse amongst Gen Y in Malaysia. In contrast, positive relationships were found to exist between credit card attitudes, materialism, and social norm and the dependent variable (Zainudin, 2019). The quick growth of credit card use causes the potential for card overuse and the accumulation of increased debt, consumers’ attitude towards money is more important in explaining card spending and debt variation than socio-demographic characteristics and card features, as well as credit limit set for a card, obligations to other loans and the method of paying for ordinary shopping, demonstrate positive effects on both card paying and card debt, while age exhibits a negative effect (Moustafa Nasra, 2014). Furthermore, card consumption is positively linked with card debts, but the factors that influence card spending do not necessarily affect card debt and vice versa. Interest-bearing debt, card tenure, minimum card debt payments, cash advances have no effect on card spending but have positive effects on card debt. Furthermore, income and gender have opposite effects on card spending and debt (Lin, 2019).

Research Methodology

Research community

This study is concerned with verifying the relationship of the dimensions of credit facilities provided to Saudi families, with the consumer buying behavior of these families, where the research community of Saudi families, estimated by the General Authority for Statistics according to the latest statistics, reached about 528214 single.

Due to the large size of the study community for all Saudi families in the eastern region and the spread of its vocabulary, it was decided that the research community should be limited to the province of Dammam.

Research Sample

Due to the large size of the study community for all Saudi families in the eastern region and the spread of its vocabulary, which leads to the difficulty of applying the comprehensive inventory, and due to time and cost considerations, the researcher relied on the method and procedures of samples to collect the initial data needed for the study.

Customer Sample Size

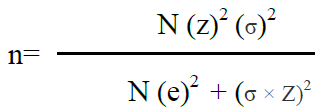

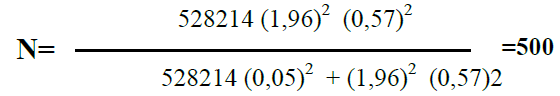

The size of the research sample from Saudi families in the eastern region of Saudi Arabia can be determined by the following law:

Where:

n =sample size.

N =the size of the search community.

Z =standard score at 95%.

Σ =standard deviation of society.

E =the size of the standard error accepted in representing the search community.

U sing the previous equation, it is clear that the sample size of employees in public sector commercial banks is:

Data Types

The researcher relied on two types of data:

Secondary Data

This is through access to books, scientific references, and periodicals in Arabic and English, as well as research, studies, reports, and scientific letters related to the subject of research, as well as the documentary survey of records of the competent official authorities concerned with the population of Saudi Arabia, about the period covered by the study to meet the data on the models of collecting the quantitative data needed to test the validity of the assignments.

Preliminary Data

The researcher relied on the following methods:

1. Directing survey lists of Saudi families in the eastern region.

2. Use the method of interviews with Saudi families in the eastern region, to collect the initial data needed to test the research assignments.

Research Tool and Data Collection Method

This study relied mainly on the list of surveys in the collection of the necessary preliminary data, and its design took into account simplicity and clarity, and the list addressed to Saudi families in the eastern region included (3 pages) other than the cover page, where the first page was designed to present the study and its purpose, while the other pages included three main questions, the first question (20words) related to measuring the perception of Saudi families in the eastern region towards the dimensions of facilities Credit (consumer loans, retail sales), obtained by these families, while the second question (15words) relates to measuring the perception of Saudi households in the eastern region towards consumer purchasing behavior, and finally the third question (4 terms) relates to the identification of some personal variables for these families.

Research Variables and Methods of Measuring Them

The main objective of the current study is to explore the nature of the relationship between credit facilities (consumer loans, retail sales) and the consumer purchasing behavior of the Saudi family, in addition to testing the impact of demographic variables on credit facilities and the behavior of consumer purchase of this family, and in light of this, the current study includes three variables, which are as follows:

Credit Facilities (Independent Variable)

Through a comprehensive review of the previous relevant study (some references are developed), the researcher was able to develop the terms of the credit facilities, which numbered (20words), and made adjustments to them by the nature of the current study and the field of application.

To measure the trend of customers towards the dimensions of credit facilities obtained by Saudi families, the Likert scale was used for approval or disapproval consisting of five degrees, where the number (5) indicates total approval, while the number (1) indicates disapproval with a neutral score in the middle (see table 1).

| Table 1 Credit Facility Variables | |

| Variables | Phrases |

| Consumer loans | (1-13 on the survey list) |

| Sale in installments | (14-20 on the survey list) |

Consumer Purchasing Behavior (Independent Variable)

Through a comprehensive review of the previous relevant study (some references are developed), the researcher was able to develop the phrases related to the behavior of consumer purchase of Saudi families, which numbered (15phrases), and made adjustments to them by the current study and the field of application.

To measure the trend of customers towards the consumer purchasing behavior of Saudi households, the Likert scale was used for approval or disapproval comprising five degrees, with a number (5) indicating total approval, while number (1) indicates disapproval with a neutral score in the middle (see table 2).

| Table 2 Consumer Purchasing Behavior Variables | |

| Variables | Phrases |

| Consumer purchasing behavior | (1-15 on the survey list) |

Demographic Variables

It comprised (the age of the head of the family, the type of head of the family, the educational qualification of the head of the family, the monthly income of the family), and was measured using closed questions with pre-determined responses.

Discussing the Results of the Field Study

This section discusses the results of the analysis of field study data, which relied mainly on the survey of customers of online shopping sites.

First imposition validity test

The first hypothesis in this research states that: There is no statistically significant difference between the perception of Saudi families, towards the dimensions of credit facilities (consumer loans, sale in installments), according to their different demographic characteristics (age, type, educational qualification, family monthly income).

The alternative imposition in this research states that: There is no statistically significant difference between the perception of Saudi families, towards the dimensions of credit facilities (consumer loans, sale in installments), depending on their different demographic characteristics (age, type, educational qualification, family monthly income).

Saudi families are aware of the dimensions of credit facilities (consumer loans, retail sales), depending on the type: To determine the differences between the perception of Saudi families, towards the dimensions of credit facilities (consumer loans, sale in installments), by type, the researcher applied the method of statistical description using the calculation average, in addition to testing "T" for two independent samples where the results were shown in table 3.

| Table 3 Descriptive Analysis and Results of Variance Analysis of the Dimensions of Credit Facilities by Type | ||||

| Variables | male | female | Test T | Level of significance |

| Average | Average | |||

| Consumer loans | 2.5253 | 2.7444 | -1.614 | .111 |

| Sale in installments | 2.3525 | 2.4600 | -.537 | .593 |

Source: Results of statistical analysis.

The results of Table 3 confirm that there are no statistically significant differences between Saudi households' perception of the dimensions of credit facilities (consumer loans, retail sales), depending on the type, as the value of (t) is moral at a level below 0.05.

Saudi households are aware of the dimensions of credit facilities (consumer loans, sale in installments), depending on the age: To determine the differences between the perception of Saudi households, towards the dimensions of credit facilities (consumer loans, sale in installments), depending on the age, the researcher applied the method of statistical description using the arithmetic average, in addition to the one-way ANOVA variance analysis test where the results were shown in table 4.

| Table 4 Descriptive Analysis and Results of Variance Analysis of the Dimensions of Credit Facilities by Age | |||||

| Variables | 30 and less. | Less than 40 | 40 and more | P test | Level of significance |

| Average | Average | Average | |||

| Consumer loans | 2.509 | 2.496 | 2.569 | .423 | .655 |

| Sale in installments | 2.086 | 2.263 | 2.241 | 2.201 | .113 |

Source: Results of statistical analysis

The results of Table 4 confirm that there are no statistically significant differences between Saudi households' perception of the dimensions of credit facilities (consumer loans, sale in installments), depending on the age as the value of (P) is moral at a level below 0.05.

Saudi families are aware of the dimensions of credit facilities (consumer loans, sale in installments), depending on the educational qualification: To determine the differences between the perception of Saudi families, towards the dimensions of credit facilities (consumer loans, sale in installments), depending on the educational qualification, the researcher applied the method of statistical description using the arithmetic average, in addition to the one-way ANOVA variability analysis test where the results were shown in Table 5.

| Table 5 Descriptive Analysis Results of Variance Analysis of the Dimensions of Credit Facilities According to Educational Qualification | |||||

| Variables | pre-university | Bachelor | Graduate | P test | Level of significance |

| Average | Average | Average | |||

| Consumer loans | 2.556 | 2.527 | 2.447 | 1.255 | .287 |

| Sale in installments | 2.231 | 2.206 | 2.150 | .370 | .691 |

Source: Results of statistical analysis

The results of Table 6 confirm that there are no statistically significant differences between Saudi households' perception of the dimensions of credit facilities (consumer loans, sale in installments), depending on the educational qualification as the value of (P) is moral at a level below 0.05.

| Table 6 Descriptive Analysis and Results of Variance Analysis of the Dimensions of Credit Facilities by Monthly Income | ||||||

| Variables | Arithmetic average | P test | Level of significance | |||

| Less than 5000 riyals | From 5000 - less than 10,000 riyals | From 10,000 - less than 20,000 riyals | Over 20,000 riyals | |||

| Consumer loans | 2.585 | 2.559 | 2.503 | 2.444 | 1.059 | .367 |

| Sale in installments | 2.316 | 2.175 | 2.185 | 2.163 | .610 | .609 |

Source: Results of statistical analysis

Saudi families are aware of the dimensions of credit facilities (consumer loans, sale in installments), depending on monthly income: To determine the differences between the perception of Saudi households, towards the dimensions of credit facilities (consumer loans, sale in installments), depending on the monthly income, the researcher applied the method of statistical description using the arithmetic average, in addition to the one-way ANOVA variance analysis test where the results were shown in table 6.

The results of Table 6 confirm that there are no statistically significant differences between Saudi households' perception of the dimensions of credit facilities (consumer loans, sale in installments), depending on monthly income as the value of (P) is moral at a level below 0.05.

Results of the First Imposition Validity Test

The first hypothesis in this research states that: There is no statistically significant difference between the perception of Saudi families, towards the dimensions of credit facilities (consumer loans, sale in installments), according to their different demographic characteristics (age, type, educational qualification, family monthly income).

The alternative imposition in this research states that: There is no statistically significant difference between the perception of Saudi families, towards the dimensions of credit facilities (consumer loans, sale in installments), depending on their different demographic characteristics (age, type, educational qualification, family monthly income).

In the light of the results of the previous statistical analysis and the results of the "T" and "F" tests, the alternative imposition must be rejected and imposing non-existent, there is no statistically significant difference between the perception of customers of e-shopping sites in Saudi Arabia, towards the behavior of electronic procurement, according to their different demographic characteristics (age, type, educational qualification, monthly income).

The Second Imposition Validity Test

The second hypothesis in this research states that: There is no statistically significant difference between the perception of Saudi families, towards the behavior of consumer purchasing, according to their different demographic characteristics (age, type, educational qualification, family monthly income).

The alternative imposition in this research states that: There is no statistically significant difference between the perception of Saudi households towards the behavior of consumer purchasing, depending on their different demographic characteristics (age, type, educational qualification, family monthly income).

Saudi households are aware of consumer purchasing behavior, depending on the type: To determine the differences between the perceptions of Saudi households towards consumer purchasing behavior, depending on the type, the researcher applied the method of statistical description using the arithmetic average, in addition to testing "T" for two independent samples where the results were shown in table 7.

| Table 7 Descriptive Analysis and Results of Variation Analysis of Consumer Purchasing Behavior by Type | ||||

| Variables | male | female | Test T | Level of significance |

| Average | Average | |||

| Consumer purchasing behavior | 2.4492 | 2.6544 | -1.392 | .169 |

Source: Results of statistical analysis

The results of Table 7 confirm that there are no statistically significant differences between Saudi households' perception of dimensions towards consumer purchasing behavior by type, as the value of (t) is moral at a level below 0.05.

Saudi households are aware of consumer purchasing behavior, depending on age: To determine the differences between the perceptions of Saudi households towards consumer purchasing behavior, depending on the age, the researcher applied the method of statistical description using the arithmetic average, in addition to the one-way ANOVA variance analysis test where the results were shown in table 8.

| Table 8 Descriptive Analysis and Results of Variation Analysis of Consumer Purchasing Behavior by Age | |||||

| Variables | 30 and less. | Less than 40 | 40 and more | P test | Level of significance |

| Average | Average | Average | |||

| Consumer purchasing behavior | 2.238 | 2.324 | 2.303 | .838 | .434 |

Source: Results of statistical analysis

The results of Table 8 confirm that there are no statistically significant differences between Saudi households' perception of dimensions towards consumer purchasing behavior, depending on the age as the value of (P) is moral at a level below 0.05.

Saudi families are aware of the behavior of consumer purchasing, depending on the educational qualification: To determine the differences between the perception of Saudi families towards consumer purchasing behavior, depending on the educational qualification, the researcher applied the method of statistical description using the arithmetic average, in addition to the one-way ANOVA variance analysis test where the results were shown in table 9.

| Table 9 Descriptive Analysis and Results of Variation Analysis of Consumer Purchasing Behavior by Educational Qualification | |||||

| Variables | pre-university | Bachelor | Graduate | P test | Level of significance |

| Average | Average | Average | |||

| Consumer purchasing behavior | 2.394 | 2.291 | 2.162 | 5.089 | .007 |

Source: Results of Statistical Analysis

The results of Table 9 confirm that there are no statistically significant differences between Saudi households' perception of dimensions towards consumer purchasing behavior, depending on the educational qualification as the value of (P) is moral at a level below 0.05.

Saudi households are aware of consumer purchasing behavior, depending on monthly income

To determine the differences between Saudi households' perception of consumer purchasing behavior, depending on monthly income, the researcher applied the method of statistical description using the arithmetic average, in addition to testing the one-way ANOVA variance analysis where the results were shown in Table 10.

| Table 10 Descriptive Analysis and Results of Variation Analysis of Consumer Purchasing Behavior by Monthly Income | ||||||

| Variables | Arithmetic average | P test | Level of significance | |||

| Less than 5000 riyals | From 5000 - less than 10,000 riyals | From 10,000 - less than 20,000 riyals | More than 20,000 riyals | |||

| Consumer purchasing behavior | 2.364 | 2.386 | 2.284 | 2.172 | 2.508 | .059 |

Source: Results of Statistical Analysis

The results of Table 10 confirm that there are statistically significant differences between Saudi households' perception of dimensions towards consumer purchasing behavior, depending on monthly income as the value of (P) is moral at a level below 0.05, and about the statistical description contained in table 10, it indicates that these differences have increased in favor of the income level of more than SAR 5,000 to SAR 10,000.

Results of the Second Imposition Validity Test

The second hypothesis in this research states that: There is no statistically significant difference between the perception of Saudi families, towards the behavior of consumer purchasing, according to their different demographic characteristics (age, type, educational qualification, family monthly income).

The alternative imposition in this research states that: There is a statistically significant difference between the perception of Saudi households towards the behavior of consumer purchasing, depending on their different demographic characteristics (age, type, educational qualification, family monthly income).

In the light of the results of the previous statistical analysis and the results of the "T" and "F" tests, the alternative imposition must be rejected and the imposition of non-existent, there is no statistically significant difference between the perception of Saudi households towards the behavior of consumer purchasing, according to their different demographic characteristics (age, type, educational qualification, family monthly income).

Results of the Third Validity Test

The third imposition of this research states that: There is no statistically significant relationship between the dimensions of credit facilities (consumer loans, installment sales) obtained by Saudi families, and the behavior of consumer purchasing of these families.

The alternative imposition in this research states: There is a statistically significant relationship between the dimensions of credit facilities (consumer loans, installment sales) obtained by Saudi families, and the behavior of consumer purchasing of these families.

Matrix of transactions linking the dimensions of credit facilities (consumer loans, retail sales): Table 11 shows the correlation between the dimensions of credit facilities (consumer loans, installment sales):

| Table 11 Matrix of Transactions Linking the Dimensions of Credit Facilities (Consumer Loans, Installment Sales) | ||||

| Dimensions | Consumer loans | Sale in installments | Credit facilities | Consumer purchasing behavior |

| Consumer loans | 1 | .531** | .832** | .369** |

| Sale in installments | .531** | 1 | .912** | .382** |

| Credit facilities | .832** | .912** | 1 | .429** |

| Consumer purchasing behavior | .369** | .382** | .429** | 1 |

| x1 | x2 | x | y | |

| x1 | 1 | .531** | .832** | .369** |

| x2 | .531** | 1 | .912** | .382** |

| x | .832** | .912** | 1 | .429** |

| y | .369** | .382** | .429** | 1 |

The previous table shows a moral correlation between the dimensions of the credit facility, the correlation transactions ranged from (0.369, 0.912) all of which are a statistical function at a moral level (0.01) where the value of the correlation factor between the after-credits and the sale in installments (0.531), and the researcher considers that this link is due to

The relationship between the dimensions of the credit facilities understudy and consumer purchasing behavior has taken overall for Saudi families in Saudi Arabia:

A- The type and strength of the relationship: The simple regression analysis of the relationship between the dimensions of the credit facilities under study as an independent variable, and consumer purchasing behavior, can be summarized as a dependent variable through Table 12.

| Table 12 The Type and Strength of the Relationship Between the Dimensions of Credit Facilities and the Overall Consumer Purchasing Behavior | ||||

| Consumer purchasing behavior | Slope Coefficient B | Beta standard regression factor | T-value | Moral |

| Constantfixed | 1.240 | 8.287 | .000 | |

| Consumer loans | .242 | .231 | 3.539 | .000 |

| Sale in installments | .201 | .259 | 3.968 | .000 |

| Rlink coefficient | .430 | |||

| R Square Selection Coefficient | .185 | |||

| F value p | 30.094 | |||

| Degrees of freedom | 430-2 | |||

| Sig.Level of significance | .000 | |||

Source: Results of statistical analysis

Table 12 shows that there is a statistically significant relationship between the dimensions of the credit facilities under study, and the behavior of consumer procurement of Saudi families, which is highly strong (0.430 according to the R link factor in the form).

The dimensions of the security facilities understudy, can explain about 0.185 (according to the R2 selection factor in the form) of changes in the behavior of consumer purchasing of Saudi households.

The relative importance of the dimensions of credit facilities: The results of the simple regression method showed that the dimensions of credit facilities, enjoy a written relationship with statistical significance between them and the behavior of consumer purchasing of Saudi families.

The relationship between the consumer loan variable under study and the consumer purchasing behavior of Saudi families is taken individually

A- The type and strength of the relationship: The simple regression analysis of the relationship between the consumer loan variable under study as an independent variable, and the behavior of consumer purchasing of Saudi households, can be summarized as a dependent variable through Table 13.

| Table 13 The Type and Strength of the Relationship Between the Consumer Loan Variable and the Behavior of Consumer Procurement Taken Individually | ||||

| Consumer purchasing behavior | Slope Coefficient B | Beta standard regression factor | T-value | Moral |

| Constantfixed | 1.318 | 8.648 | .000 | |

| Consumer loans | .387 | .369 | 6.489 | .000 |

| Rlink coefficient | .369 | |||

| R Square Selection Coefficient | .136 | |||

| F value p | 42.113 | |||

| Degrees of freedom | 431-1 | |||

| Sig.Level of significance | .000 | |||

Source: Results of statistical analysis

Table 13 shows that there is a statistically significant relationship between the consumer loan variable under study and the consumer purchasing behavior of Saudi households, which is highly strong (.369 according to the R link factor in the form).

The consumer loan variable understudy can explain about 0.136 (according to the R2 selection factor in the form) of changes in the behavior of consumer purchasing of Saudi households.

B. The relative importance of the money availability variable with the client: The results of the simple regression method showed that the consumer loan variable has a statistically significant linear relationship with the consumer purchasing behavior of Saudi households.

The relationship between the sale variable in installments under study and the consumer purchasing behavior of Saudi families taken individually:

A- The type and strength of the relationship: The simple regression analysis of the relationship between the sale variable in installments studied as an independent variable, and the behavior of consumer purchasing of Saudi families can be summarized as a child variable through Table 14.

| Table 14 The Type and Strength of the Relationship Between the Retail Variable and the Consumer Purchasing Behavior of Saudi Families Taken Individually | ||||

| Consumer purchasing behavior | Slope Coefficient B | Beta standard regression factor | T-value | Moral |

| Constantfixed | 1.641 | 16.388 | .000 | |

| Sale in installments | .296 | .382 | 6.759 | .000 |

| Rlink coefficient | .382 | |||

| R Square Selection Coefficient | .146 | |||

| F value p | 45.690 | |||

| Degrees of freedom | 431-1 | |||

| Sig.Level of significance | .000 | |||

Source: Results of statistical analysis

Table 14 shows that there is a statistically significant relationship between the sale variable in the installments studied, and the behavior of consumer purchasing of Saudi families, which is of high strength(0.382 according to the R link factor in the form).

The sale variable in installments understudy, can explain about 0.146 (according to the R² selection factor in the form) of changes in the behavior of consumer purchasing of Saudi households.

B. The relative importance of variable, Money with the customer: The results of the simple regression method showed that the variable selling in installments enjoys a linear relationship with statistical significance between it and the behavior of consumer purchasing of Saudi.

Results of the Third Imposition Validity Test

The third imposition of this research states that: There is no statistically significant relationship between the dimensions of credit facilities (consumer loans, installment sales) obtained by Saudi families, and the behavior of consumer purchasing of these families.

The alternative imposition in this research states: There is a statistically significant relationship between the dimensions of credit facilities (consumer loans, installment sales) obtained by Saudi families, and the behavior of consumer purchasing of these families.

In the light of the results of the previous statistical analysis, the imposition of nothingness must be rejected and the alternative imposition accepted, there is a statistically significant relationship between the dimensions of credit facilities (consumer loans, retail sales) obtained by Saudi families, and the behavior of consumer procurement of these families.

The research findings have demonstrated that consumer buying behavior is considerably influenced by the Credit Facilities, and this is in line with (Al-sadig, 2013), (Naser et al., 2014) researches. This has enriched our knowledge of how consumer purchasing behavior different financial products but perhaps more significantly it has drawn our attention to the role of credit facilities. these findings can suggest that one important of the introduction of new types of credit facilities which will impact considerably upon the consumer purchasing behavior.

Conclusion

The emphasis on trust and having a relationship, especially in particular the strategies of financial service providers. Enhanced competition and improvements in new credit facilities are Develop bank products and changing consumer purchasing behavior by encouraging consumers' attention to switch banks and make balanced decisions in the obtaining of certain types of financial products. The ability to keep customers and increase customer profitability by cross-selling high margin basic credit facilities products is, therefore, very important. In this regard, this research has contributed to our knowledge and understanding of the important factors involved in dealing with different credit facilities and the associated strategies that financial service providers may adopt to increase customer preservation and profitability.

References

Ahmed, Z., Shakoor, Z., Khan, M.A., & Ullah, W. (2021). The role of financial risk management in predicting financial performance: A case study of commercial banks in Pakistan. The Journal of Asian Finance, Economics and Business, 8(5), 639-648.

Indexed at, Google Scholar, Cross Ref

Alnefaee, S.M. (2019). Macroeconomic Determinants of Consumer Lending in Saudi Arabia. Journal of Accounting, Business and Finance Research, 5(2), 60-66.

Indexed at, Google Scholar, Cross Ref

Al-sadig, A. (2013). Government specialized credit institutions and private domestic investment: the case of Saudi Arabia. Review of Middle East Economics and Finance, 9(1), 51-64.

Alzyadat, J.A. (2021). Sectoral banking credit facilities and non-oil economic growth in Saudi Arabia: application of the autoregressive distributed lag (ARDL). The Journal of Asian Finance, Economics, and Business, 8(2), 809-820.

Indexed at, Google Scholar, Cross Ref

Amidu, M. (2014). What influences banks lending in Sub-Saharan Africa?. Journal of Emerging Market Finance, 13(1), 1-42.

Askari, H., Iqbal, Z., & Mirakhor, A. (2011). New issues in Islamic finance and economics: Progress and challenges.

Bajwa, I.A., Syed, A.M., Alaraifi, A., & Rafi, W. (2019). Assessment of Creditrisk Management of Saudi Banks. Academy of Accounting and Financial Studies Journal, 23(5), 1-13.

Bente, G., Baptist, O., & Leuschner, H. (2012). To buy or not to buy: Influence of seller photos and reputation on buyer trust and purchase behavior. International Journal of Human-Computer Studies, 70(1), 1-13.

Billah, M.M.S. (2019). Islamic Trade Financing Instruments and Mechanisms. In Islamic Financial Products (pp. 167-182). Palgrave Macmillan, Cham.

Chen, W., & Scott, S. (2014). Shoppers' perceived embeddedness and its impact on purchasing behavior at an organic farmers' market. Appetite, 83, 57-62.

Indexed at, Google Scholar, Cross Ref

Cororaton, A. (2018). The Impact of Objectives on Firm Decisions: Bank and Credit Union Lending in the Great Recession. SMU Cox School of Business Research Paper, 18-36.

Indexed at, Google Scholar, Cross Ref

Doan, H. Q. (2021). Critical Factors Affecting Consumer Buying Behaviour of Organic Vegetables in Vietnam. The Journal of Asian Finance, Economics and Business, 8(9), 333-340.

Indexed at, Google Scholar, Cross Ref

Florez-Acosta, J., & Herrera-Araujo, D. (2020). Multiproduct retailing and consumer shopping behavior: The role of shopping costs. International Journal of Industrial Organization, 68, 102560.

Indexed at, Google Scholar, Cross Ref

Fouzi, A. (2021). The Effect of Economic Variables on Banking Credits: An Empirical Study of Algeriancommercial Banks (1997-2017).

Gani, A., & Al-Muharrami, S. (2016). The effect of institutional quality on bank lending in the gulf cooperation council countries. Review of Middle East Economics and Finance, 12(1), 55-63.

Indexed at, Google Scholar, Cross Ref

Lin, L., Revindo, M.D., Gan, C., & Cohen, D.A. (2019). Determinants of credit card spending and debt of Chinese consumers. International Journal of Bank Marketing.

Indexed at, Google Scholar, Cross Ref

Minibas-Poussard, J., Bingol, H.B., & Roland-Levy, C. (2018). Behavioral control or income? An analysis of saving attitudes and behavior, credit card use and buying on installment. European Review of Applied Psychology, 68(6), 205-214.

Indexed at, Google Scholar, Cross Ref

Miyajima, K. (2017). An empirical investigation of oil-macro-financial linkages in Saudi Arabia. Review of Middle East Economics and Finance, 13(2).

Indexed at, Google Scholar, Cross Ref

Miyajima, K. (2020). What influences bank lending in Saudi Arabia? Islamic Economic Studies.

Indexed at, Google Scholar, Cross Ref

Moustafa Nasra, W. (2014). Body Components and Their Relationship with Skill Performance within Top Level Wrestlers. Journal of Applied Sports Science, 4(3), 40-46.

Indexed at, Google Scholar, Cross Ref

Naser, S., & Hadi, P. (2014). A Study of Installment Sale and Its Formation in the Banking Systems of Iran, France, and the United States. European Online Journal of Natural and Social Sciences, 3(3), 707.

Nikodemska-Wolowik, A.M., Bednarz, J., & Foreman, J.R. (2019). Trends in young consumers'behaviour–implications for family enterprises. Economics & Sociology, 12(3), 11-24.

Olegario, R. (2019). The history of credit in America. In Oxford Research Encyclopedia of American History.

Sudacevschi, M. (2014). Managementul riscului de creditare in bancile din Romania. Management Intercultural, (30), 248-253.

Waemustafa, W., & Sukri, S. (2015). Bank specific and macroeconomics dynamic determinants of credit risk in Islamic banks and conventional banks. International Journal of Economics and Financial Issues, 5(2), 476-481.

Young, C.W., Russell, S.V., Robinson, C.A., & Chintakayala, P.K. (2018). Sustainable retailing–influencing consumer behaviour on food waste. Business Strategy and the Environment, 27(1), 1-15.

Indexed at, Google Scholar, Cross Ref

Zainudin, R., Mahdzan, N.S., & Yeap, M.Y. (2019). Determinants of credit card misuse among Gen Y consumers in urban Malaysia. International Journal of Bank Marketing.

Indexed at,Google Scholar, Cross Ref

Received: 25-Nov-2021, Manuscript No. AAFSJ-21-10032; Editor assigned: 27-Nov-2021, PreQC No. AAFSJ-21-10032(PQ); Reviewed: 14-Dec-2021, QC No. AAFSJ-21-10032; Revised: 15-Jan-2022, Manuscript No. AAFSJ-21-10032(R); Published: 22-Jan-2022