Research Article: 2019 Vol: 23 Issue: 1S

Credit Accessibility Model of Small Enterprises Based on Firm Characteristics and Business Performance (Case Study at Small Enterprises in West Sumatera Indonesia)

Sulaeman Rahman Nidar, Universitas Padjadjaran

Asep Mulyana, Universitas Padjadjaran

Mokhamad Anwar, Universitas Padjadjaran

Abstract

The purpose of this research is to empirically test the influence of firm characteristics and business performance on credit access in small businesses. The study was conducted with 221 small enterprises in West Sumatera Province-Indonesia using a survey instrument. Data analysis using the Structural Equation Model Lisrel 8.72. The result of this study indicates those firm characteristics have a positive and significant influence on credit access. Business performance as mediating in the relationship between firm characteristics and credit access. It means the stronger of firm characteristics will lead to an increase in the business performance of small enterprises, which will finally have an effect on credit access. Therefore, it is recommended that there should be a strategy to strengthen the firm characteristics to improve the credit accessibility of small businesses.

Keywords

Firm Characteristics, Business Performance, Credit Access, Small Business.

Introduction

According to BI & LPPI (2015), of 57 billion units of Micro Small Medium Enterprises (MSMEs) in Indonesia, only 30% has the ability to access finance. Out of the percentage, 76.1% earned credits from banks, and the rest earned credit from non-bank. It means that in Indonesia, 60-70% of MSMEs have no access to the banks’ credit. Although finance from banks is a great financial source, they have difficulties to fulfil the bank requirements for obtaining the loan.

According to BI & LPPI (2015), of 57 billion units of Micro Small Medium Enterprises (MSMEs) in Indonesia, only 30% has the ability to access finance. Out of the percentage, 76.1% earned credits from banks, and the rest earned credit from non-bank. It means that in Indonesia, 60-70% of MSMEs have no access to the banks credit. Although finance from banks is a great financial source, they have difficulties to fulfil the bank requirements for obtaining the loan.

There are some factors that influence small business owners to get loan from banks. According to Oladele et al. (2014), there was a connection between available financial source and the owners of small-medium enterprises and their business performance. Meanwhile, business performance is influenced by internal and external factors (Munizu, 2010; Nicolescue, 2009). In other words, there is a correlation between business performance and access to credit. The successful business owners will tend to convince that they have the ability to repay the loans.

One of the factors that affect credit access and business performance is firm characteristics. Some authors stated that firm characteristics have the same meaning with firm profile or SMEs characteristics. Although in different terms, firm characteristic/firm profile/ SMEs characteristics show firms attributes which may be different dimensions among authors. Several studies (Too & Simiyu, 2019; Ndiaye et al., 2018; Garg & Phaahla, 2018) show that firm characteristics effect on performance. While other studies such as (Balogun et al., 2016; Musamali & Tarus, 2013; Kira & He, 2012) show that firm characteristics affect credit access. Also, there are some studies that tested the relationship between business performance and credit access such as Kiboki, Sakwa, & Kiriago (2014), Kira & He (2012), and Pandula (2011).

This study examined the relationships between firm characteristics, business performance and credit access at small business in West Sumatera. Furthermore, this paper testifies the effect of firm characteristics on the access to credit, the effects of firm characteristics on business performance. It also tests this mechanism works through analysis on the mediating effect of business performance. It is expected that the study finding proposes some strategies to strengthen the small enterprises’ abilities to access the banks’ credit via business performance and firm characteristics.

Literature Review And Hypotheses Development

Firm Characteristics

The term of firm characteristics may differ among different authors such as firm profile, and SMEs characteristics, but the meaning is still the same. Firm characteristics are defined as firm personalities or attribute that tend to describe a firm or tell us about the Firm (Lucky & Minai, 2011). Musamali & Tarus (2013) preferred to use the term firm profile to explain firm characteristics. In their study, firm profile consists of ownership structure, size of the firm, business type, and age of the business. According to Fatoki & Asah (2011) firm characteristics are traits of features specifics to the firm which can affect positively or negatively the performance of the firm. Firm characteristics include factors such as the age of the firm, the size of the firm and the ability of collateral and business information. While Kira & He (2012) classified firm characteristics as business information, firm’s location, type of industry, firm scale, age of the firm, legality, incorporation, and collateral. Based on the previous research, the dimension of firm characteristics in this research are the age of the business, the legality of business, type of business, asset as a collateral and firm’s location (Fatoki & Asah, 2011; Kira & He, 2012).

Business Performance

Lingensiya (2012) explained that performance is the ability of a business to use its resources in competition and its readiness to face external pressure, including globalization. Wheelen & Hunger (2015) noted that the performance of a business is the final result of empowering resources through efficient and effective strategies. The same description is given by Adebisi et al. (2015) that performance is the ability of a business to use resources effectively. Meanwhile, According to Adebisi et al. (2015), the performance of a business can be expressed by financial and non-financial means. The same opinion was stated by Lingensiya (2012) that business performance can be measured by financial and non-financial means. Harash et al. (2014) in their research noted that business performance is indicated by (1) financial performance, (2) market performance and (3) the level of return to the shareholder. Based on the previous research, in this research, the dimension of business performance was financial measures (capital, profit, sales) and non-financial measures (market) (Adebisi et al., 2015; Harash et al., 2014). There are four dimensions of the business performance variables that are growth of capital, sales, profit growth and market (Adebisi et al., 2015; Harash et al., 2014).

Credit Access

Akudugu et al. (2009) emphasized that access to credit was the situation where individuals have the rights to make decisions related to the allocation in the short term and repay according to schedule and interest rate committed. Credit access can be stated as the ability and the will of the owner/manager of business to get credit (Ogubazhi & Muturi, 2014), and also the ability of the company to get and use financial services that can be used according to the need (Claeseens, 2006) According to Kira & He (2012), credit access was the ability to get credit for financing business. In their research, this variable was measured by the number of credits received by small-medium enterprises. The other explanation was given by Nakinyingi (2010) that it was called credit access if there was no restriction relating to cost administration or procedure from financing institution that they are felt when they proposed for credit. It has two dimensions: the number and frequency of credit received. It can be summarized that credit access relates to the ability of the business to get external financing and using the credit according to its needs and match the expectation about credit term such as interest rate, administration cost, maturity time, etc. In the present study, two dimensions were used to explain the access to credit variable, such as the amount and frequency of credit received (Nakinyingi, 2010; Nkundabanyanga et al., 2014).

Relationship between Firm Characteristics and Business Performance

The previous studies investigated the role of business characteristics on performance (Ganyaupfu, 2013; Cieslik et al., 2014, Too & Simiyu, 2018; Ndiaye et al., 2018). They discussed firm characteristics and firm performance by using different indicators. Ganyaupfu (2014) pointed out that firm characteristics have a statistically significant positive effect on the success of SMEs in Gauteng Province. In this research, the firm characteristics were measured by period in business, size of the firm, sector of firm and location of firm. This result was supported by Cieslik et al., (2014) who confirmed that firm characteristics influenced export performance in Central and Eastern Europe. The probability exporting was increased by research & development spending, the percentage of employees with universities degree, the foreign ownership, the use of foreign technology, the age of firm and the size of the firm. Ndiaye et al. (2018) stated that factors that determine business performance should be different between small and medium enterprises. They argued that firm characteristics such as size, age, ownership type, and legal status effect on SMEs’ performance. Too & Simiyu (2018) studied the impact of firm characteristics on financial performance in the insurance firms in Kenya and found that capital structure and firm age have a positive and significant influence on the financial performance. However, there were some previous studies that had different results. According to Al-Tit, Omri & Euchi (2019), firm characteristics had no significant impacts on the success of small-medium sizes enterprises (SMEs) in Saudi Arabia. Also, Islam et al. (2011) pointed out that firm characteristics were found not to be a significant factor on business success of SMEs in Bangladesh.

Lucas (2017) stated that age of the firm has a positive effect on performance. The reason for this, because as a firm grows old or ages, this performance becomes better (or improve) due to efficiency level and skill improved with time. Islam et al. (2011) noted that a long time in operation may be associated with the learning curve. So old players most probably have learned much from their experience than have done by newcomers. Therefore, length time in operation was significantly linked to the business success (Kristiansen et al., 2003). The same opinion was also stated by Too & Simiyu (2018); Mothibi (2015); Ganyaupfu (2013) who stated that the period of business has statistically significant positive effects on the performance of the SMEs. While Indarti & Langenberg (2004) pointed out that a long time in the operation of business had no significant association/ correlation with business success.

Lucas (2017) pointed out that business will perform better when it is a either partnership, or a cooperative, or s private company or public limited company than it is family owns. It means the legality of business affects the success of business. Indarti & Langenberg (2004) stated that the legality of business had a significant negative correlation with business success. Complicated bureaucracy and legal aspect that take too many resources of the SMEs to deal with are of the explanation. It was recommended that the simplicity of bureaucracy and deregulation of the legal aspect increase the development of SMEs in Indonesia.

Essel et al. (2019) found that the type of industry sector influence significantly business performance. They explained that for small enterprises in Ghana, business in the processing industry especially agro-processing tend to be more successful than the artisan and service industry. The reason for this, because there was improved in agricultural growth during the study was conducted compared to other periods. In a study completed by Mothibi (2015), the business sector has a significant positive effect on the performance of SMEs in Pretoria. The respondents of his study represented the four broad categories of SMEs: namely construction, retailing, manufacturing, and tourism sectors. Ganyaupfu (2013) also stated that sector of the firm has a statistically significant positive effect on the success of SMEs in the Gauteng Province. In his study, the respondents operated the business in hair and dressing sector, retailing sector, manufacturing sector, and tourism sector.

According to Islam et al. (2011), larger enterprises were found to have a higher level of success. In other words, the more assets the company had, the higher the possibility to get success.

Garg & Phaahla (2018) added that firm characteristics such as the location of business were positively related to the business performance. The reason for this, suitable locations such as closeness to the markets and easiness accessibility of infrastructure will impact on increasing in sales and lowering in cost. Therefore it will affect business performance. They did their research at Micro Small Medium Enterprises (MSMEs) in Sekhuhune-South Africa. Mothibi (2015) & Ganyaupfu (2013) also agreed that the location of the business has a positive effect on business performance. Mothibi (2015) recommended that the manager/owner of the business should choose competitive areas strategically for the location of the business to sustain competition in the market.

Relationship between Firm Characteristics and Credit Access

Regarding firm characteristics, there were several studies that investigated the effect of firm characteristics on access to finance. Some studies (Kira & He 2012; Musamali & Tarus, 2013); Balogun et al. (2016)) found that that a firm characteristics influenced access to finance. Kira & He (2012) explained in their research that a firm’s location, industry, size, business information, age, incorporation, and collateral were classified as firm characteristics affect business performance. Eltahir (2018) revealed that SMEs characteristics, external environment, customer & markets, the way of doing business & cooperation, resources and finance have a significant positive effect on the business success of SMEs in Omdurman-Sudan.

Younger firms have difficulties to access debt finance due to informational disparities (Kira & He, 2012). Very young firms (below 3 years) were found to have a lack of collateral and information capacity, in regards to access finance (Kung’U, 2011). Therefore the older of the business, the more likely to access credit (Kiboki et al., 2011), because of older firms have network capital that generated overtime and also their business history can be used by the lender to predict their performance to consider their credit proposal (Musamali & Tarus,2013). According to Zarook et al. (2013) older firm have more opportunity to gain access to finance in Libya due to they have more experience and a better possibility to produce new goods than younger firms, also banks in Libya are more comfortable in dealing with older firms due to their well-known history.

The study conducted by Fatoki & Asah (2011) explained there was a positive relationship between the legal form of business organization and debt financing. A similar result has been found by Malefho & Moffat (2015) that formality level of firm influence access to finance, due to formal business less risky compare to informal business, especially in the case of bad debt and unavailability to repay the loan.

Regarding type of business or type of industry, it implies access to finance (Fatoki & Asah, 2011; Hendrawan, 2012; Anggraini et al., 2015). Each business sector has different characteristics to be considered for creditors to lend, one consideration is tangibility asset of the company (Anggraini et al., 2015). According to Musamali & Tarus (2013), service industry is riskier compared to the manufacturing industry, because of service industries do not have tangible assets to be acted as collateral. The similar opinion was also stated by Aggraini et al., (2015) who added that one of the most characteristics into consideration for creditors is tangibility of the company, which in general manufacturing companies have a higher level than the tangibility of services and retail companies (Anggraini et al., 2015).

Having assets of business will relate to the size of the business. The size of the business affect the ability to access finance, due to larger firms is likely to have collateral that acts as a security in securing finances (Musamali & Tarus, 2013). According to Zarook et al. (2013), larger firms have better opportunities to gain access to finance than small and medium firms among the SMEs. Larger firms have a better ability to manage and are efficient in production. The same opinion was stated by Anggraini et al. (2015) that the size of the company affects the credit access. Banks or lenders will have more confidence to larger companies that are considered to have survivability and experience in running business. Balogum et al. (2016) recommended that to get funding from banks, the owner of the firm has to have a business or personal asset to be used as collateral.

According to Hendrawan (2012) firm location has a positive connection and statistically significant to the SMEs possibility of accessing debt. This finding was consistent with previous research by Fatoki & Asah (2011) who stated that it was easier for banks to access and assess borrowers’ performance due to the closeness of location between them. The result indicates that firms that are located in urban areas are more likely to be successful in their credit application compared to firms located in rural areas. Kira & He (2012) added that access to debt financing is positively related to firm location. Firms located in urban areas have a higher possibility of access to a loan or debt financing than firms located in the rural area. Hendrawan (2012) explained that the location of a SME within business/industrial park has a positive connection and statistically significant to the SME possibility of acquiring debt. The reason for this, the SME within the business/industrial park would have easier access to debt finance than those located outside the business/industrial park. Also, SMEs located inside the park have an advantage in the financial relations with the banking system because of a very clear location and easier to monitor by the lenders.

Relationship between Business Performance and Access to Credit

There was a positive relationship between financial information and access to debt finance, due to financial information shows the business ability to meet the financial obligation (Nangaki et al., 2014). There was some previous research explained that business information had an impact on access to credit (Kira & He 2012; Fatoki & Asah 2011; Fatoki & Odeyemi 2010). According to Adzido et al. (2016) business with increasing trends of profits and sales are more attractive to the banks than the poor performing. However, they require reliable financial information, preferably audited financial statements as a useful basis for granting credit facilities. Business information shows about the business current asset, future performance and the ability of a business to repay the loan (Kira & He 2011), therefore it can be predicted as the business condition.

While Pandula (2011) pointed out that financial performance was the main factor that influences access to finance. The same opinion was stated by Sarapaivanich & Kotey (2006) that there was a significant positive effect of financial information quality on the ability to access external funds of SMEs in Thailand. Kitindi et al. (2007) studied that financial information provided by borrowers was used by creditors, banks, and lenders to analyse business performance and to predict future performance. Fatoki & Asah (2011) added that information obtained from financial statement can be used as an indicator of borrower’s prospects and ability to repay the loan. Therefore, there was a positive relationship between financial information maintained by a firm and access to debt finance. Kira & He (2012) explained that lenders use the business information to decide the borrower’s credibility whether to issue or to extend a loan or not. Absence of sufficient information in this activity will lead to information asymmetry and may jeopardize access to credit finance (Sarapaivanich & Kotey 2006).

Research Methodology

The research was carried out in seven districts in West Sumatera Province, Indonesia. The study used a survey method and the total unit analysis consisted of 221 small businesses, the details of which were as follows: in Pasaman (13 units), Pesisir Selatan (18 units), Dharmasraya (16 units), Bukittinggi (32 units), Padang (100 units), Solok (22 units); Payakumbuh (22 units). Stratified and purposive random sampling was used in selecting the respondents for the study, while the observation unit was the owners/managers of the small businesses. In this study, several districts were selected as the samples based on the consideration that in the areas, there were at least 4% of the total number of small scale businesses operating in West Sumatera. In this study, the data were collected using structured questionnaires and all the variables were measured using a five-point Likert scale with level 1=strongly disagree, 2=disagree, 3=fairly agree, 4=agree and 5=strongly agree. The time horizon of this research was the cross-section /one shoot.

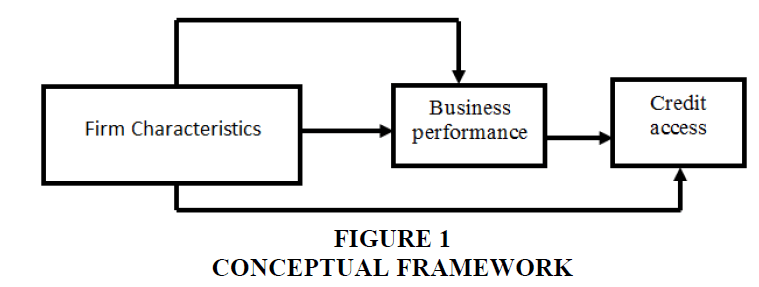

Conceptual framework is provided in Figure 1 below:

To examine the effect of business characteristics for business performance and credit access, the following hypotheses are proposed.

H1: Firm characteristics have an influence on business performance

H2: Firm characteristics have an influence on accessing credit

H3: Firm performance has an influence on accessing credit

H4: Firm characteristics have an influence on accessing credit via business performance

Results And Discussion

The Validity and Reliability

The validity and reliability are the two main criterion used in SEM. The validity criteria were assessed using Confirmatory Factor Analysis (CFA) or loading factor. The reliability was assessed using Construct Reliability (CR) and Variance Extracted (VE). The result of validity and reliability can be seen at Table 1.

The result of the analysis in Table 1 shows a validity and reliability test for each construct. Loading factor at all constructs which were analysed above 0.5 considered valid. Also, they have CR ≥ 0.7 and VE ≥ 0.5 Therefore all constructs are considered valid and reliable (Hair et al., 2014).

| Table 1: Construct Reliability And Validity Analysis | ||||

| Variabel | Dimension | Loading Factor | CR>0.70 | VE> 0.50 |

|---|---|---|---|---|

| Firm Characteristics |

Firm age | 0.964 | 0.871 | 0.694 |

| Legality | 0.875 | 0.863 | 0.684 | |

| Type of business | 0.942 | 0.879 | 0.708 | |

| Asset | 0.849 | 0.902 | 0.755 | |

| Firm location | 0.896 | 0.823 | 0.513 | |

| Business Performance |

Capital growth | 0.828 | 0.887 | 0.728 |

| Sales | 0.861 | 0.884 | 0.721 | |

| Profit growth | 0.873 | 0.894 | 0.808 | |

| Market growth | 0.784 | 0.818 | 0.600 | |

| Credit access | Amount received | 0.649 | 0.963 | 0.705 |

| Frequency of access | 0.878 | - | - | |

Based on Table 1, it can also be stated that all dimensions of firm characteristics have positive loading factors. In this study, firm characteristics consist of five dimensions which are firm age, legality, type of business, asset and business location.

Firm age has a positive effect on business performance. This is in line with the findings of authors like Essel & Amankwah (2019); Too & Simiyu (2018); Lucas (2017); Mothibi (2015); Ganyaupfu (2013). Contrary finding of this study, the study conducted by Indarti & Langenberg (2004) showed that the length of business operation has no effect on business performance.

The legality of business has a positive and significant effect on business performance. This finding is consistent with the results of previous research which was conducted by Ndiaye et al. (2018) who stated that informality businesses tend to have difficulties in expanding the business. However, this result is contrary to Indarti & Langenberg (2004) who found that complicated bureaucracy and legal aspect, and limitation in resources of business make legality has no significant correlation on business success. In regard to bureaucracy, in Algerian, SMEs have difficulties to deal with the requirements of government regulations, because costly and timely procedures to obtain licenses and permits register property and move collateral (Bouazza et al., 2015). In other words, the complication of bureaucracy for small businesses to get firm legality to become obstacles.

Type of business has a positive and significant effect on business performance. These findings are consistent with the studies conducted by Essel et al., (2019); Mothibi (2015); Ganyaupfu (2013). The asset has a positive and significant effect on business performance. Similar results were also revealed by Ganyaupfu (2013); Islam et al. (2011). Firm location has a positive and significant effect on business performance. The finding was consistent with previous research by Garg & Phaahla (2018); Mothibi (2015) & Ganyaipyu (2013).

Firm age has a positive effect on credit access. Similar results have been found by Musamali & Tarus (2013); Fatoki & Asah (2011); Kira & He (2012). Mutoko & Kapunda (2017) indicated that longevity in position and annual turnover have a positive impact on getting access to bank loans. According to Fatoki & Asah (2011), SMEs established more than five years have a far better chance to be successful in their credit application compared with SMEs established for less than five year. This finding is not agreement with Hendrawan (2012) who stated that the firm age seems to have no significant impact on SME’s ability to acquire debt.

The legality of business has a positive effect on credit access. The result was consistent with previous studies such as Malefho & Moffat (2015), Nikaido et al. (2015); Yildirim, Yavuz & Eksi (2013). Abdulsaleh & Worthington (2013) explained that regarding to ownership type, and legal form of business, owner structure and type of the firm were found to have a significant impact on the use of bootstrap financing.

Type of business has a positive effect on credit access. Similar results have been found by Anggraini et al. (2015), Musamali & Tarus (2013); Zarook et al. (2013); Kira & He (2012). Business assets and the type of asset have a positive effect on credit access. This results in line with the previous study by Balogun et al. (2016); Issac et al. (2011). However, these results are contrary to Fatoki & Asah (2011) who stated that there is no significant relationship between the industry (line of business) and access to debt finance.

According to Fatoki & Asah (2011), SMEs with collateral (personal or business property) are significantly more likely to be successful in their credit application compared to SMEs without collateral. Also, SMEs that have more than 50 employees are significantly more likely to be successful in their credit applications compared to SMEs that have less than 50. The smaller firms experienced difficulties in accessing credit due to inadequate information. In other words, the larger the firms, the greater the ability of firms in getting loan from banks.

Business location has a positive effect on credit access. The same things expressed by Fatoki & Asah (2012); Kira & He (2012); Hendrawan (2012). Abdulsaleh & Worthinghon (2013) stated that the geographical area where a firm is located in the proximity of banks is also believed to have an influence on the firm ability to gain external finance. Fatoki & Asah (2011) indicated that there was a significant positive relationship between SMEs that are located in the urban areas and access to finance, therefore SMEs that are located in rural areas significantly more likely to be successful in their credit application compared to SMEs located in rural areas. According to Hendrawan (2012), the availability of business in one area such as business park area tends to have greater access to credit due to the easiness for banks to monitor SMEs.

Direct Effects

The study results support the hypotheses testing as follows:

Hypothesis 1

Firm characteristics has a positive and significant effect on business performance. Regression coefficient = 0.223 ; t value =2.904 > t table = 1.96

As expected, this finding supports earlier study by Essel et al. (2019), Et-Tahir (2018), Mothibi (2016); Ganyaupfu (2013) stated that firm characteristics have significant positive effects on performance. Mothibi (2016) added that firm characteristics that are period of enterprise in business, location of firm, size of the firm and sector of the firm have the statistically significant positive effects on SMEs’ success. Similar results have been found by Chittithaworn et al. (2011) who indicated that SMEs’ characteristics, customers and markets, the way of doing business and cooperation, resources and finance and external environment have a significant positive effect on business success of SMEs in Thailand.

These findings were not in agreement with Al-Tit et al. (2019); Islam et al. (2011), who agreed that characteristics of SMEs were found to have no significant effect on the business success of SMEs. In their study, SMEs characteristics referred to the original enterprise, length time in operation, size of enterprise, and capital source. It is recommended that SMEs should spend more time for communicating with partners, customer, suppliers, and employees. While, Indarti & Langenberg (2004) in their research about factors affecting business success among SMEs in Indonesia, found that characteristics of SMEs which were the origin of enterprise, length time in operation, and size of enterprise did not have significant correlation with the business success, but capital source had significant association with business performance.

Hypothesis 2

Firm characteristics have a positive effect on credit access.

Regression coefficient = 1.75; t value =3.164 > t table = 1.96

This is in line with the findings of authors like Balogun et al. (2016); Musamali & Tarus (2013); Kira & He (2012). Fatoki & Asah (2011) revealed that firm characteristics impact on access to debt finance by SMEs in South Africa. The dimensions of firm characteristics were tested by them were age, size, business information, location & insurance, industry, and incorporation. Kung’U (2011) stated that firm characteristics had an influence on SMEs’ access to funding. Kira & He (2012) noted that firm characteristics impact the access of financing by small medium sized enterprises in Tanzania. The study recommends that Tanzania SME operators should maintain attractive firm attributes to stimulate lenders to extend debt financing to their investment. According to Zarook et al. (2013) there was significant relationship and interdependence between demographic factors (size, age, sectors) of SMEs and access finance in Libya.

Hypothesis 3

Business performance has a positive effect on credit access.

Regression coefficient = 0.494; tvalue =7.708 > ttable = 1.96

The results are consistent with Kira & He ( 2012), Fatoki & Asah (2011); Fatoki & Odeyemi (2010) who stated that business information impacts credit to access. According to Kiboki et al. (2014) the performance of business significantly affected access to credit. Therefore, the better perform of business, the greater the accessibility to get credit. Information on performance is used to determine the ability of an enterprise to repay the borrowed funds. The same results were revealed by Pandula (2011), that a firm’s financial performance is a key determinant of access to financing as it indicates the firm’s ability to refund the loan. Malefho & Moffat (2015) added that financial performance and the level of formality were important factors in influencing access to finance. A similar result was also revealed by Nangaki et al. (2014) who stated that financial performance of business had positive influence on credit access. This finding is not in agreement with Zarook et al. (2013) who stated that there was no significant influence on financial performance on access to finance in Libya’s SMEs. The authors argued it could be other factors such as socio demography, and political factors were playing vital roles in accessing credit in Libya. The same results identified by Isaac et al. (2011) that the provider of finance was not considering the enterprise financial performance because during the research was conducted, there was a hyperinflationary Zimbabwe dollar era and most firms were reported losses during that period.

Sobel Test

Sobel test can be used to test the role of variable mediation.

Based on Table 3, the influence of firm characteristics on credit access which is mediated by the business performance shows significant results. tSobel is higher than 1.96 (tsobel=7.745 > ttable =1.96); therefore, the relationships in Table 3 are significant.

| Table 2: The Result Of Structural Model Parameter Estimation | ||

| Path | Standardized | t-value |

|---|---|---|

| Firm characteristics→business performance | 0.223 | 2.904 |

| Firm characteristics →credit access | 0.175 | 3.164 |

| Business performance → credit access | 0.494 | 7.708 |

Hypothesis 4

Business performance has a partial mediating effect on entrepreneurial characteristics and credit access.

The result of this study confirmed that firm characteristics are important for business performance and credit access. Implementation of firm characteristics will help small businesses improve their performance and it will lead to greater accessibility to earn the bank loan. This study is also in line with those conducted by Kiboki et al. (2014). Cull & Xu (2005) added that banks tend to allocate funds to firms that have better performance outcomes in China. Poor business performance is the major reason why small enterprises do not receive credit (European Commission, 2003). In other words, Business with good performance tends to obtain credit easier compared to poor performance ones. Good business performance means that businesses can operate continuously and able to repay creditors.

Indirect Effects

Based on Table 4, firm characteristics have a direct effect on business performance (0.223). Firm characteristics also have a direct effect credit access (0.175). Meanwhile, when firm characteristics had an indirect effect on credit access the total effect becomes bigger which is Total Effect (0.285) = Direct Effect (0.175)+Indirect Effect (0.110). In other words, through business performance as a mediating variable, there is a stronger effect of firm characteristics to credit access compared to without mediating business performance. The role of firm characteristics in credit access through business performance increases from 0.175 to 0.285. It proves that business performance acts as a mediating variable. The result of this analysis provides empirical evidence that business performance acts as a mediating factor of firm characteristics with credit access.

| Table 4: The Effect Of Firm Characteristics On Credit Access Via Business Performance | |||

| Path | Direct Effect | Indirect Effect | Total Effect |

|---|---|---|---|

| Firm Characteristics →Business Performance | 0.223 | - | - |

| Firm Characteristics →Credit Access | 0.175 | 0.110 (0.223 x 0.494) |

0.285 |

| Business Performance →Credit Access | 0.494 | - | |

Conclusion

The result of the study explains that business performance affects credit to the access of small enterprises, the higher the business performance, the greater ability of small enterprises in accessing credit. Meanwhile, firm characteristics influence business performance. So the business performance is mediating influence firm characteristics and credit access. Increasingly strong in firm characteristics will cause higher business performance, which will ultimately lead to greater accessibility on credit financing. The relationships between firm characteristics, business performance and access credit may provide guidance how small businesses should have greater accessibility to bank credit by improving firm characteristics such as the firm age, legality, type of business, asset and firm location. In this case, business characteristics can be used as predictors of credit access through partial mediation of the small business’ performance.

Acknowledgment

The authors would like to express gratitude to the Ministry of Finance through Lembaga Pengelola Dana Pendidikan (LPDP) and Ministry of Research, Technology and Higher Education (Kementrian Riset, Teknologi dan Pendidikan Tinggi) for providing the funds of this research.

References

- Abdulsaleh, A., & Worthington, A., (2013). Small and Medium- Sized Enterprises Financing: A Review of Literature. International Journal of Business and Managemen, 8 (14),. 36-65.

- Adebisi, S.A., Alaneme, G.C., & Ofuani, A.B. (2015). Challenges of finance and the performance of small and medium enterprises (SMEs) in Lagos State. Developing Countries Studies, 5(8), 46-57.

- Adzido, R.Y., Sedro, E., & Dorkpah, O. (2016). Assesment of demand side factors of smes and external financing by rural banks in Ghana. The International Journal of Business & Management, 4(4), 458-472.

- Akudugu, A., Egyir, M., & Mensah, B.A. (2009). Women farmers’s access to credit from rural banks in Ghana. Agricultural Finance Review, 69(3), 84-99.

- Al-Tit, A.A., Omri, A., & Euchi, J. (2019). Critical success factors of small and medium-sized enterprises in saudi arabia: insights from sustainability perspective. Administrative Science, 9(32), 1-12.

- Anggraini, R., Yohan, & Gurendrawati, E. (2015). Firm size, ownership cocentration and business sector: The influence to credit access smes in Indonesia. International Journal of Finance and Accounting, 4(5), 231-235.

- Balogun, O.A, Nazeem, A., & Agumba, J.N. (2016). Determinant predicting credit accessibility within small and medium-sized enterprises in the South African construction industry. Procedia Engineering, 164, 473 -480.

- Bouazza, A.B., Ardjouman, D., & Abada, O. (2015). Establishing the factors affecting the growth of sme in Algeria. American International Journal of Social Science, 4(2).

- Chittithaworn, C., Islam, M., Keawchana, T., & Yusuf, D.H.M. (2011). Factors affecting business success of small & medium enterprises (SMEs) in Thailand. Asian Social Science,7(5), 180-190.

- Cieslik, A., Michalek, J., & Michalek, A. (2014). The influence of firm characteristics and export performance in central and eastern europe: comparison of Visegrad, Baltic and Caucasus States. Entrepreneurial Business and Economics Review, 2(1), 7-18.

- Claeseens, S. (2006). Access to financial services: A review of the issues and public policy objectives. The world Bank Research Observer, 2(2), 207-240.

- Cull, R., & Xu, L.C. (2005). Institutions ownership and finance: The Determinants of profit reinvestment among chines firms. Journal of Financial Economics, 77, 117-146.

- Eltahir, A.B. (2018). Factors affecting the performance & business success of small & medium enterprises in Sudan (Case study :Omdurman). International Journal of Small Business & Entrepreneurship Research, 6(6), 14-22.

- Essel, B.K., Adams, F., & Amankwah, K. (2019). Effect of entrepreneur, firm and institutional Characteristics on small-scale firm performance in Ghana. Journal of Global Entrepreneurship Research, 9(5), 1-20.

- Fatok, O., & Asah, F. (2011). The impact of firm and entrepreneurial characteristics on access to debt finance by smes in king william town South Africa. International Journal of Business and Management, 6(8). August, 170-179.

- Fatoki, O., & Odeyemi, A. (2010). Which new small and medium enterprises in South Africa have access to bank credit. International Journal of Business and Management, 5(10), 128-136.

- Hair, J.F., Black, W.C., Babin, B.J., & Anderson, R.E. (2014) Multivariate data analysis. Seven Editions. Pearson New International Edition, USA.

- Harash. E., Timimi, S.A., & Alsaadi, J. (2014). Effect financing on performance of small medium enterprises (SMEs). International Journal of Engineering & Innovative Technology, 4(3), 161-167.

- Hendrawan, B. (2012). The small medium sized enterprises characteristics in Batam free trade zone that able to acquire debt. Procedia Economics & Finance, 4, 76-85.

- Ganyaupfu, E.M. (2013). Entrepreneur & firm characteristics affecting success of small, medium enterprises (SME) in Gauteng Province, South Africa. International Journal of Innovative Research in Management, 9(2), 1-8.

- Garg, A.K., & Phaahla, P.N. (2018). Factors affecting the business performance on small business in Sekhukhune. Journal of Economics and Behavioral Studies, 10(4), 54-67.

- Isaac, M., Blessing, M., Simbarashe, M., & Divaris, J. (2011). Factor influencing micro, small enterprises; Access to finance since the adoption of multy currency system in Zimbabwe. Journal of Business Management and Economics, 2(6), 217-222.

- Indarti, N., & Langenberg, M. (2004). Factors affecting business success among SMES: Empirical evidences from Indonesia. Proceedings of the Second Bi-Annual European Summer University (19) 20 & 21 September. University of Twente Enschede, the Netherlands.

- Islam, M.A., Khan, M.A., Obaidullah, A.Z.M., Alam, M.S. (2011) Effect of entrepreneur and firms characteristic on the business success of small medium enterprise (SMEs) in Bangladesh. International Journal of Business and Management. 6 (3), March. 289-299.

- Kiboki, A.K., Sakwa, M., Kiriago, A.N. (2014) The relationship between small scale enterprises performance abd access to credit from microfinance institutions in mount eigon constituency, Kenya. International Journal of Academic Research in Business & Social Science, 4(9), 507-518.

- Kira, R.A., & He, Z. (2012). The Impact of firm characteristics in access of financing by small and medium sized enterprises in Tanzania. International Journal of Business and Management, 7(24), 108-119.

- Kitindi, E.G, Magembe, B.A.S., & Sethibe, A. (2007). Lending decision making and financial information: The usefulness of corporate annual reports to lenders in Bostwana. The International Journal of Applied Economics and Finance, 1(2), 55-67.

- Kristiansen, S., Furuholt, B., & Wahid, F. (2003). Internet cafe entrepreneurs: pioneers in information dissemination in Indonesia. The International Journal of Entrepreneurship and Innovation, 4(4), 251-263.

- Kung’U, G.K. (2011). Factors influencing SMEs access to finance: A case study of westland division, Kenya. MPRA paper (Munich Personal RePEc Archive) No. 66633

- Lingensiya, Y. (2012). Identifying factors to indicate the business performance of small scale industries: Evidence from Srilanka. Global Journal of Management and Business Research, 12(21), 74-82.

- Lucas S. (2017). The impact of demographic and social factors on firm performance in Kenya. Journal of Business and Economic Development, 2(4), 255-261.

- Lucky, E.O., I., & Minai, M.S. (2011). Re-investigating the effect of individual determinant external factor and firm characteristics on small firm performance during economic downturn. African Journal of Business Management, 5(26), 10-46.

- Malefho, K., & Moffat, B. ( 2015). Factor influencing micro and small enterprises access to finance in Bostwana. Journal of Social Economic Policy, 12(2), 65-76.

- Mothibi, G. (2015). The Effects of entrepreneurial and firm characteristics on performance of small and medium enterprises in Pretoria. International Journal of Economics, Commerce and Management, 3(3), 1-8.

- Munizu, M. (2010). The Influence of External Factors and Internal Factors on MSE Business Performance in South Sulawesi. Journal Manajemen & Kewirausahaan, 12(1), 33-41.

- Musamali, M.M., & Tarus, D.K. (2013) Does firm profile influence financial access among small & medium enterprises In Kenya. Asian Economic & Financial Reviews, 3, 714-72.

- Mutoko, W.R. & Kapunda, S.M. (2017). Factors influencing small, medium and micro-sized enterprises’ borrowing from banks: The case of the Botswana manufacturing sector. Acta Commercii-Independent Research Journal in Management Sciences, 17(1), 426.

- Nangaki, L., Namusonge, G.S., & Wandera, R.W. (2014). Factors influencing access debt finance by micro and small enterprises: A case of chwele township, Bungoma County. Innovative Space of Scientific Research Journal, 12(1), 70-93.

- Nakinyingi, J. (2010). Managerial Competencies, Access to Credit and Business Sector. Makarere University.

- Ndiaye, N., Razak, L.A,, Nagayev R, & Adamn Ng (2018) Demystifying small and medium enterprises’(SMEs) performance in emerging and developing economies. Science –Direct-Borsa Istambul Review, 18(4):269-281

- Nicolescu O (2009) Main Features of SMEs Organisation System. Review of International Comparative Management, 10(3), 405-413.

- Nikaido, Y., Pais, J., & Sarma, M. (2013). What hinders and what enhaces small enterprises’ access to formal credit in india ? Review of Development Finance, 5, 43-52.

- Nkundabanyanga, K., Nalukenge, K.D., & Tauringana, V. (2014). Lending Terms, Financial Literacy and Formal Credit Accessibility. International Journal of Social economics, 41(5), 342-361

- Ogubazhi, K.S., & Muturi, W. (2014). The effect of age and educational level of owner/ manager on smes access to bank loan in Eritrea: Evidence from asmara city. American Journal of Industrial & Business Management, 632-643.

- Oladele P.O., Oloowokere B.A., Akinruwa T.E. (2014). Sources of finance and small and medium scale enterprises performance in ado-ekiti Metropolis. European Journal of Business & Management, 6(28), 88-98.

- Pandula, (2011). An empirical investigation of small and medium enterprises access to bank finance: The case on emerging economy. Proceeding of the ASBBS Annual Conference, Las Vegas, 18. 255-273.

- Sarapaivanich N, & Kotey, B. (2016). The effect of financial information quality on ability to access external funds and performance of SMES in Thailand. Journal of Enterprising Culture, 14(3), 219-239.

- Too, I., C., & Simiyu, E. (2018). Firm characteristics and financial performance of general insurance firms in Kenya. International Journal of Business Management & Finance 1(39):672-689.

- Wheelen T., & Hunger, W. (2015). Strategic management and Business Policy: Toward Global Policy Thirteen Edition, New Jersey: Pearson.

- Yildirim, S., Yavuz, A., & Eksi, I.H. (2013). The effect of firm characteristics in accessing credit for SMEs. Journal of Financial Service Marketing, 18(1), 40- 52.

- Zarook, T., Rahman, M.M., & Khanam, R. (2013) Does Financial performance matter in accessing finance for libya’s SMEs. International Journal of Economics and Finance, 5(6), 11-19.

- Zarook, T., Rahman, M.M., & Khanam, R. (2013). The impact of demographic factors on accessing finance in Libya’s SMEs. International Journal of Business and Management, 8(14), 55-64.