Research Article: 2021 Vol: 24 Issue: 1S

Covid-2019: Building Trust In E-Commerce Websites and New Online Applications

Noorjahan Sherfudeen, College of Administration and Financial Sciences, Saudi Electronic University

Wejdan A. Alhammad, College of Administration and Financial Sciences, Saudi Electronic University

Nouf Mohammed Rasheed, College of Health Sciences, Saudi Electronic University

Danya Salem Bashraf, Academic Researcher

Abstract

The world is currently experiencing significant challenges caused by the outbreak of the COVID-19 pandemic. Most people are staying at home to reduce the spread of the virus which influenced people to embrace e-commerce and online banking. Presently, people are carrying out online shopping from various e-commerce websites. COVID-19 has, therefore, revolutionized online shopping and banking. While the e-commerce evolution provides an opportunity for businesses to enhance their digital capabilities during the COVID-19 era, understanding and addressing concerns about trust, privacy, security, and attitudes towards online shopping and banking is an imperative effort that has to be made by organizations to consistently and transparently expedite their engagement with customers. As such, this research paper applies SPSS to carry out a critical analysis aimed at identifying the critical and dominant factors for establishing trust in e-commerce, to review the role of customer attitudes towards online banking, and to assess the relationship between trust, privacy, and security of e-commerce websites during a pandemic. The findings indicate that the size of online transactions and e-commerce has exploded during the COVID-19 epidemic. The purchasing behaviors of customers have been transformed as consumers turn to online buying while businesses design websites and applications to serve these growing interests. The customers' attitudes towards online shopping and banking have positively changed because of the outbreak of the pandemic. The findings identified that consumer’s trust in e-commerce websites or new apps is directly and positively related to attitude and security, but a negative relationship between trust and privacy.

Keywords

Trust, Privacy, Security, Attitude, COVID-19 Pandemic, E-Commerce

Introduction

The COVID-19 epidemic is a major cause of the revolution evident in the online transactions and e-commerce frontier of modern business. It has greatly changed consumer purchasing behaviors driving businesses to integrate digital payments and to invest in e-commerce capabilities that enhance online consumption by consumers. Due to the social distancing restrictions occasioned by the COVID-19 epidemic, there has been an acceleration of online shopping across demographic segments leading to bolstering of e-commerce platforms. The evolving online landscape has generated high business volumes for firms that have integrated online payments and other support features of e-commerce, marking the shift as an important practice heading to the future. However, the unprecedented growth of online purchasing behavior and payments has raised concerns regarding the issues of trust, security, the privacy of the customer’s data, and their respective attitudes necessitating close examination of these elements and the underlying opportunities and barriers to businesses and customers alike. For instance, consumers in the contemporary world have embraced online banking and the use of websites as a way of adapting to the new-normal caused by the Covid-19 pandemic. Presently, many customers are using online banking systems while paying for goods and services ordered from various e-commerce websites. Evidence from the past studies indicates that most customers had a negative attitude towards using the online banking systems in various parts of the world. The negative attitudes were caused by the issues of security and privacy of the sensitive data belonging to customers. However, the outbreak of the Covid-19 pandemic has influenced most customers across the world to change their attitudes towards online banking and the use of websites. With the increased use of e-commerce websites, most customers have changed their attitude towards online banking and are have embraced this digital way of making payments. While the e-commerce evolution provides an opportunity for businesses to enhance their digital capabilities during the COVID-19 era, understanding and addressing concerns about trust, privacy, security, and attitudes towards online shopping and banking is an imperative effort that has to be made by organizations to consistently and transparently expedite their engagement with customers. The pandemic has brought about drastic changes or lifestyles of the people throughout the world.

The pandemic Covid-19 was imported to Saudi Arabia in March 8, 2020, cinemas were closed on March 11, March 15-all malls, restaurants, and cafes were closed. Prayers in the mosque were suspended work from home guidelines for the private sector was issued on March 17, taxi services were suspended on March 20, domestic flights and public transportation were suspended on 21st march. First, curfew was initiated for 21 days starting from March 23 and simultaneously imposed fines on curfew violators. The first death of coronavirus was identified in the kingdom on 24, March. In different phrases, the curfew was extended throughout the kingdom until May. On June 21st curfew came to an end except for some parts of the kingdom (Al Arabia News, 2020). The survey conducted by Kearney Middle East exposes that 95% of the respondents in Saudi Arabia have changed their shopping habits, further 69% of the respondents prefer to continue their shopping habits even after the pandemic (Saudi Gazette, 2020). The pandemic has forced civilians to transform from offline shopping to online shopping. Hence the study planned to investigate the consumers about the factors that forced the customers to build trust on the e-commerce websites and many new apps.

Literature Review

Trust in E-Commerce Websites or New Apps during the Covid-19 Period

According to Maadi, et al., (2016) trust is one of the most important elements of e-commerce due to the absence of human touch and communication during transactions. The basic role of trust is also caused by the replacement of the real environment with a virtual platform between a merchant and consumer necessitating high reliability of the exchanged utility (Stouthuysen, 2020). On the other hand, Ilmudeen (2019) attributes the growing need for trust to the identity uncertainty that creates an impersonal nature in transactions which threatens the communication and exchanges between customers. As a result, trust is used to address the separation between buyers and sellers on the web which supports the decision-making abilities of the two parties during exchanges (Habibi et al., 2014). The physical distance between consumers and the online merchant imposes the need to establish mutual trust for fair purchases to be facilitated over the internet (Subramaniam & Andrew, 2016). According to the study undertaken by Subramaniam & Andrew (2016), trust reduces the emanating uncertainties affecting vulnerable consumers which empower their purchasing intentions leading to the improvement of online trading. According to Naggar & Bendary (2017), the obligations associated with some business brands with e-commerce capabilities create certain perceptions that drive customers to gain trust in their online activities. As a result, trust is a key determinant of purchasing behaviors on e-commerce sites since it positively enhances adoption behavior and influences the attitudes and beliefs about a brand.

According to Mansoureh, Maadi & Javidnia (2015) trust in online activities of a brand using e-commerce platforms is affected by the perceived reputation of the vendor to serve its customers consistently with integrity and honesty. Additionally, Mansoureh, et al., (2015) attribute personal factors in creating a connection between customers and online merchants with the propensity to rely on such brands affected by previous shopping experiences. Trust is also established by the product characteristic and their propensity to offer the customer the expected satisfaction (Stouthuysen, 2020). It is also affected by the performance uncertainties surrounding the firm indicating that the future of most e-commerce platforms is pegged on their ability to address quality concerns and personalization needs of customers (Habibi, Laroche & Richard, 2014). The tendency to trust on the web requires proclaimed assurances that ensure that firms exemplify competence in providing customers with unique perspectives and services (Stouthuysen, 2020). On the other hand, Safa & Von Solms (2016) creates a close connection between trust and e-loyalty whereby the propensity to commit and develop positive attitudes about e-commerce operations of a firm are affected by the motivation and engagement between the firm and the customer. As a result of the loyalty formation, customers tend to trust and involve themselves in the e-commerce operation of certain companies than others.

Habibi, et al., (2014) argue that an important factor for establishing trust in e-commerce is enhancing the brand equity of merchants to ensure loyalty and positive attitudes from customers leading to adoption behavior that encourages direct purchasing and payments online. By handling internal customer responses and stimulating customer experiences, brands can enhance the purchasing decisions indicating the ability of the customer to trust merchants with the highest overall brand awareness while enhancing the performance of such brands (Naggar & Bendary, 2017). On the other hand, Stouthuysen (2020) attributes the penetration of trust in e-commerce to brand associations that support relationship development concepts between firms and customers. The trust-loyalty relationship enhances e-commerce by ensuring that shared experiences between customers and the community influence them to adopt positive feelings about products (Habibi et al., 2014). According to Patil (2017), the strength and intensity of these feelings create an identity that influences customers to experience the perceived quality of goods and services offered on the web. With physical and emotional evidence from other users, there is a quality assessment that influences trust and loyalty to the brand and the experiences promised to online consumers using the e-commerce platform.

Security in Ecommerce Websites or New Apps during the Covid-19 Period

The security of e-commerce applications is a growing area of concern in the COVID-era due to its effect on the reliability and trustworthy interactions between sellers and buyers. According to Niranjanamurthy & Chahar (2013), heavy usage of online applications for online business creates complexities due to the amount of personal data shared and the risk of such information being accessed by unwarranted parties. Therefore, security has the propensity to jeopardize the trust and efficiencies of e-commerce necessitating the need to educate consumers about the critical elements of the online infrastructure and how to overcome security pitfalls (Patil, 2017). With the electronic commerce explosion, security is an important factor to ensure that parties engaging in exchanges undergo required authentication that gives buyers the confidence and trust to pay and engage in banking services (Stouthuysen, 2020). Improving the authorization mechanisms used in e-commerce is essential in reducing the security vulnerabilities that negatively affect the mutual trust between sellers and buyers. According to Niranjanamurthy & Chahar (2013), the complexities of the security function require constants technological modifications to ensure that online visitors enjoy the clarity of thought and loyalty to enhance their convection into avid users of the e-commerce function. Security protection enhances the trust in the internal and external capabilities of the e-commerce website, payment portals, and customer representatives Patil, (2017). The correct matching of customer’s data enhances their positive attitudes which deliver trust and empowers them to continue using the service (Niranjanamurthy & Chahar, 2013). On the other hand, the e-commerce site can reciprocate the trust by ensuring that all sensitive information about the customer is used confidentially with all transactional safeguards engaged to improve the safety and secrecy of customers.

According to Stouthuysen (2020), security guarantees on e-commerce platforms provide web-based trust that enhances direct and indirect experiences of customers while providing a springboard to overcome purchasing behavior resistance. By responding to security questions, e-commerce platforms during the COVID-19 era can progressively reduce the resistance to adoption behavior among consumers which enhances the overall trust and reduces circumstances causing institutional inefficiencies (Stouthuysen, 2020). On the other hand, Safa & Von Solms (2016) argues that a sense of security generates reliable payment systems and improves customer’s perception about the security of online transactions. Sustaining security protocols helps to alleviate fraud and other cyber-crimes that are responsible for creating misconceptions and resistance to online transactions among most consumers (Safa & Von Solms, 2016). With the role played by third parties to facilitate and enhance security components of online transactions, most consumers exhibit fear which creates identity uncertainty and threatens the exchange of monetary information and the handling of online orders and service (Ilmudeen, 2019). As a result, there are external pressures that affect the trust regarding the quality of products, convenience of online orders, quality of information exchanged, and the reliability of the involved merchant.

Privacy in E-Commerce Websites or New Apps during the Covid-19 Period

According to Ilmudeen (2019), privacy concerns in online transactions are an important determinant of the reliability of web-vendors which affects the rates of e-commerce adoption. The risk perceptions cover the ability of the e-commerce site to ensure that customer’s information is kept secure throughout their interaction with online vendors. On the other hand, Niranjanamurthy & Chahar (2013) notes that the presence of third parties with malicious intentions threatens monetary and personal information which has elevated hackers as one of the most organized threats to privacy in online business. Privacy concerns are primarily caused by the separation of consumers and businesses which creates fears of identity uncertainty threatening the safe handling of monetary information such as credit card details (Ilmudeen, 2019). According to Subramaniam & Andrew (2016), privacy vulnerabilities affect online trust by increasing uncertainties and overall awareness levels to the quality of online transactions which necessitate parties involved to exercise confidentiality when trading online. With the increased levels of online commerce and the adoption of business apps during the COVID-19 era, privacy improvement has emerged as an important modification to ensure that customers and firms have full control of their online data (Stouthuysen, 2020). As customers search for goods and services online, they are faced with circumstances where they need to share their personal and financial information on websites. Ilmudeen (2019) argues that there is a growing limitation in accessing knowledge on which information to share or not which indicates the problems of information control facing modern consumers. For risk-averse consumers, privacy concerns are major deterrents against their online activities due to the fear that personal information may be retrieved illegally (Subramaniam & Andrew, 2016). As a result, service providers are required to ascertain the reliability of their websites, applications, and customer service by ensuring that privacy concerns are addressed and online footprints from both users are protected.

According to Mohammed & Zeki (2015), privacy can be considered as a basic human right since it centrally conserves the dignity of users and guarantees them the opportunity to determine themselves and the extent of their personal information available to other people. The value of privacy in online transactions requires all vendors to ensure that information availed from customers, directly and indirectly, is shared with other users with the consent of customers (Wang, Wang & Liu, 2016). As a result, any online transaction is not complete or reliable if there are risks of identity theft, usage tracking, spamming, and data fraud indicating the inability of the users to secure private information. Subramaniam & Andrew (2016) argues that from a technical point of view, privacy concerns can be addressed by improving authorization to ensure that owners of information have full authority to make informed consent on when their information can be accessed or not. However, with the explosion of e-commerce during the COVID-era, there are risks that more consumers are voluntarily giving up their information unwillingly over the internet which exposes their data to third party users. On the other hand, Stouthuysen (2020) suggests that with the limited usage guidelines, poor monitoring strategies and size of data transacted online, the ability of users to control their online data is impaired leading to risks that customers in the post-COVID-era will continue to lose control over their online data. Although current laws and organizational practices offer customers a reasonable level of protection, there is a need for both parties to generate agreements that determine how personal information will be shared among users electronically (Patil, 2017). According to Mohammed & Zeki (2015), an important direction of this development is the identification of data users to guarantee that personal information is subject to multiple authorizations while ensuring that anonymous data is not used to manipulate consumers and businesses to make unwarranted disclosures of sensitive information. As a result, the customer’s claim to control of personal information should be considered a central component of e-commerce.

Customers’ Attitude towards Online Banking Amidst Covid-19 Pandemic

The outbreak of the Covid-19 pandemic has been associated with numerous challenges. Based on the containment protocols put in place in Saudi Arabia to reduce the spread of this virus, people have been forced to stay at home. As explained by Alshammari, Altebainawi & Alenzi (2020), the containment protocols of Covod-19 have forced people to embrace e-commerce to abide by the social distancing guidelines. As a result, in the course of purchasing various products and services from different e-commerce websites, consumers end up making payments using the online banking system. According to Yousufani, Courbe & Babczenko (2020), the outbreak of the Covid-19 pandemic has revolutionized the online banking sectors in the whole world. Aldarabseh (2020) says that consumers’ attitude toward online banking has greatly changed. According to Aldarabseh (2020), consumers not only in Saudi Arabia but across the world have embraced online banking systems. With the increasing number of people contracting the novel coronavirus, most customers purchasing different products and services from different online websites have been forced to embrace online banking. Aldarabseh (2020) concludes that before the outbreak of the virus, online banking services were being used by a few members in Saudi Arabia. However, the outbreak of the Covid-19 has increased the total number of people using these services.

Hossain, Bao, Hasan & Islam (2020) hold that various factors have influenced a change of attitude towards online banking. Apart from the pandemic, Hossain, et al., (2020) postulate that consumer’s attitude towards online banking has positively changed because of the enhancement of these services. Presently, most banks in Saudi Arabia have shifted their focus on ensuring that they provide convenient and efficient online banking services amidst the pandemic to reduce the total number of people visiting banks. This efficiency has positively changed consumer’s attitudes towards online banking. According to Singh & Srivastava (2020), apart from enabling customers to abide by social distancing protocols formulated by relevant authorities, consumers have largely embraced online banking because of service automation. Form just a single click; a customer can check the available balance in their respective bank accounts, pay bills to various online websites and companies, transfer funds, and download and print their statements without necessarily visiting a psychical banking hall. This convenience and efficiency have changed the consumer’s attitudes towards online banking in Saudi Arabia. Singh and Srivastava (2020) conclude that the outbreak of Covid-19 has been a blessing in disguise to the online banking sector because it has led to an increase of people using these services. The early negative attitude that was meted towards online banking has greatly changed, and people are currently embracing these new modes of making payments directly from their accounts using the internet.

Besides, a change in consumer’s attitude towards online banking in Saudi Arabia has been influenced by the enhancement of cybersecurity. Presently, most companies have shifted to online service provision to reduce social interactions and counter the spread of the Covid-19 pandemic. As a result, Yousufani, et al., (2020) hold that Saudi Arabia has invested much in enhancing cybersecurity during Covid-19 to prevent any cases of cybercrime. According to Aldarabseh (2020), Saudi Arabia is among the leading countries with enhanced cybersecurity infrastructures. Enhancing cybersecurity has been essential in changing the consumers’ attitude towards online banking. Apart from increasing the total number of people using various online shopping websites, enhancement of cybersecurity amidst the pandemic has positively changed consumer’s attitudes towards online banking (Yousufani et al., 2020). The number of people that trust online banking has increased since the outbreak of the pandemic because the enhancement of cybersecurity has demystified the security fears that were being faced by many customers. As explained by Hossain, et al., (2020), many consumers in Saudi Arabia had a fear of using online banking services due to security and privacy fears of their money and sensitive data. However, the enhancement of cybersecurity in this region has increased the total number of consumers embracing online banking. Also, various banks in Saudi Arabia have enhanced their security features to protect both the money and private information of their customers. Banks offer assurance against any form of hacking, making it easy for people to embrace online banking. As such, the outbreak of the Covid-19 pandemic has positively influenced the use of online banking in Saudi Arabia. After purchasing various products and services from e-commerce websites, most customers opt to pay for these services using online banking applications.

Objectives of the Study

• To identify the important and dominant factors for establishing trust in e-commerce.

• To recognize the attitude towards online transactions during COVID-19.

• To assess the relationship between trust, privacy, and security of e-commerce websites and new online apps during a pandemic.

Hypothesis

H1: Consumer’s attitude towards online purchase is positively related to trust in the new online application and e-commerce websites.

H2: Security involved in online purchases is positively related to the new online application and e-commerce websites.

H3: Privacy is positively related to the new online application and e-commerce websites.

Material and Method

Data Collection Technique

The study adopted a convenient non-probability sampling method that means samples were chosen based on their availability for the researchers to collect data from potential respondents throughout Saudi Arabia. The questionnaire was drafted in such a way that all the questions are closed and easy for the participants to respond to. The different items used in the questionnaire was adapted from numerous sources and the independent variables construct was framed from (David, 2000; Jarvenpaa et al., 2000; Hans van der Heijden et al., 2003; Koufaris & Hampton-Sosa, (2004); Kwek Choon Ling et al., 2011; Nesha et al., 2018; Athapaththu & Kulathunga, 2018; Phuong Viet Le-Hoang, 2020).

To make the responses more consistent and easier Likert’s scale was used in the questionnaire. Considering the present scenario, the questionnaire was distributed digitally. Survey monkey was used as a platform for publishing the questionnaire to the available respondents, further the survey was also posted on different social media platforms such as FB, Twitter, and an Instagram social media platform was applied by (Nesha et al., 2018) in his study. The questionnaire was available online for 10 days, in total the samples received were 301 but the study rejected 66 samples since it was incomplete, only 235 samples were fully completed and were considered for further evaluation. The IBM SPSS software version 27 was used for analyzing the collected data.

Data Analysis

The SPSS software was used as a statistical tool to analyze the data that was collected through the survey. Since the present study is based on a Likert scale Pearson’s correlation method was used to analyze and interpret the data. If a correlation alpha coefficient value is above 0.500 means that there is a moderate relationship and if the value is above 0.700 it is inferred as a strong relationship (Jacqueline, 2013). To evaluate the multi-linear regression model, it is significant to consider the beta coefficient and simultaneously consider if the t-value exceeds the critical value.

Results and Discussion

Reliability and Validity

Reliability implies the internal consistency of a test that signifies the accuracy of the measure. To measure the internal reliability of the different variables that are applied in the present study, Cronbach’s Alpha was tested. The Cronbach’s Alpha score for all the 20 items (question) was 0.821, reveals that the questions used in the present study meet the internal reliability. Cronbach’s alpha value for the different subscales presented in table 1 is reached between 0.715(security), 0.812(Privacy), 0.823(Attitude), and 0.861(Trust). The Cronbach alpha score for the items applied for the present study meets the required score of 0.70 (Taber, 2017) for high internal consistency, implying that the measurement scales for the items are stable and consistent. Cronbach’s Alpha score was greater than 0.7 in a study conducted by (Ngoc Thang Ha et al., 2019). The outcome of the study confirms that all the items used in the study are related and hence the items used in the study are the accurate measurements for further evaluation.

| Table 1 Reliability of The Variables |

||

|---|---|---|

| Factors | α Value | Comments |

| Trust | 0.861 | Good |

| Attitude | 0.823 | Good |

| Privacy | 0.812 | Good |

| Security | 0.715 | Acceptable |

Source: Survey Data, 2020

Even though total respondents participated in the survey is 301, but only 235 respondents completed the survey, 66 samples were not included or considered for the study since the questionnaire was incomplete. Table 2 shows the demographic profile of the respondents. The demographic variable executed for the study includes variables such as gender, age group, and the education of the respondents is used for the study. Of the total samples, 145 of them were female while the rest were male. The highest age group of the respondents who participated in the survey is between 21 to 29 years about 98 respondents. On the other hand, the lowest age group of the respondents was above 50 years with 6 respondents. Based on the level of education around 55 % of the respondents were diploma holders followed by degree holders with 30 % of respondents.

| Table 2 Demographic Profile of The Samples |

||

|---|---|---|

| Profile variables | Frequency | Percentage |

| Gender | ||

| Male | 90 | 38.3 |

| Female | 145 | 61.7 |

| Age group | ||

| <20 | 23 | 9.8 |

| 21-29 | 98 | 41.7 |

| 30-39 | 84 | 35.7 |

| 40-49 | 24 | 10.2 |

| >50 | 6 | 2.6 |

| Educational Qualification | ||

| High School | 14 | 6.0 |

| Bachelor | 20 | 8.5 |

| Diploma | 130 | 55.3 |

| Post Graduate Studies | 71 | 30.2 |

Source: Survey Data, 2020

Dominant Factors for Online Purchase in E-Commerce Websites

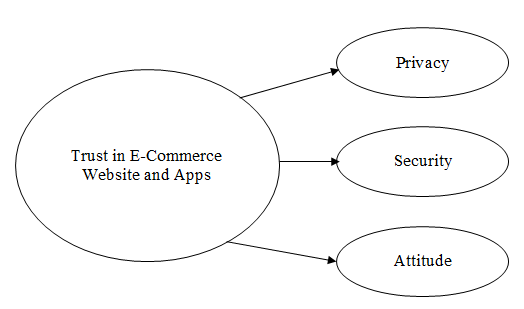

The study intended to find the different factors that establish among the consumers for the purchase in different online e-commerce website, particularly during the pandemic situation. Based on literature to identify the factors for establishing the consumers through the e-commerce website, the exploratory factor analysis is used. The factor analysis method is applied to measure the construct of validity (Ling et al., 2010). The principal component method of factor analysis with Eigenvalues greater than one through varimax rotation was carried out. Table 3 illustrates the summary of factor analysis for different factors for online purchase in e-commerce websites. Figure 1 represents the factors that influence trust in e-commerce website and the new apps by the customers.

The outcomes of the Kaiser-Meyer-Olkin (KMO Test) measure of sampling adequacy is (KMO=0.879) and Bartlett’s Test of Sphericity was significant (p=0.000; the degree of freedom=190) indicates that the factor analysis method is appropriate. The study extracted four factors for a total of 60.789% variation on 20 variables. Each dimension contributes to 32.911% (Trust), 13.239% (Attitude), 8.542% (Privacy) and 6.07% (Security).

| Table 3 Dominant Factors For Online Purchase in E-Commerce Websites Identified By Principal Component Factor Analysis |

|||||

|---|---|---|---|---|---|

| Factor’s Name | Variable | Factor Loading | Eigenvalue | Percentage of Variance Explained | Cronbach’s Reliability Coefficients |

| Trust | Websites and/or apps compile with the procedures and terms they announced. | 0.759 | 6.582 | 32.911% | 0.861 |

| Websites and/or apps I purchase from are a reliable place to shop from. | 0.752 | ||||

| I believe the websites and/or apps I purchase from are trustworthy. | 0.727 | ||||

| Website and/or apps sell the right products and/or services, quality, and design as posted. | 0.716 | ||||

| I expect websites and/or apps to do the right job (from the login until receiving the order). | 0.693 | ||||

| Websites and/or apps meet my expectations. | 0.610 | ||||

| Websites and/or apps allow checking products and/or services before receiving them. | 0.585 | ||||

| I feel secure about the electronic payment system of websites and/or apps. | 0.558 | ||||

| Attitude | Online shopping is efficient in many ways. | 0.803 | 2.648 | 13.239 | 0.823 |

| Online shopping can save more time than in-store/offline shopping. | 0.768 | ||||

| Online shopping is not a hassle. | 0.761 | ||||

| I can easily buy any product and/or service I need online. | 0.713 | ||||

| Websites and/or apps are users’ friendly and easy to navigate in menus. | 0.534 | ||||

| Privacy | I am aware that websites and/or apps may share my personal information with other entities without my authorization. | 0.887 | 1.708 | 8.542 | 0.812 |

| I am aware that websites and/or apps may use my personal information for other purposes without my authorization. | 0.871 | ||||

| I am aware that unauthorized persons (e.g., hackers) may have access to my personal information collected by the website and/or apps. | 0.794 | ||||

| I am aware that websites and/or apps may collect any personal information from me. | 0.615 | ||||

| Security | Websites and/or apps ensure that only I can access my information. | 0.828 | 1.219 | 6.097% | 0.715 |

| My personal information will not be revealed. | 0.708 | ||||

| Websites and/or apps will take responsibility for requests they process on my account. | 0.643 | ||||

| Cumulative % of Variation | - | - | 60.789% | - | |

| Cronbach’s Alpha | - | - | - | 0.821 | |

Note: Kaiser Meyer- Olkin Measure of Sampling Adequacy=0.879; p=0.000 (p<0.05); df =190

Extraction Method: Principal Component Analysis

Rotation Method: Varimax with Kaiser Normalization

Multiple Linear Regression Analysis

To detect the factors that affect the online purchase in e-commerce websites, the multiple linear regressions have been applied and the results are presented in Table 4. The factors that influence the e-commerce website are independent variables and the trust in an e-commerce website is a dependent variable. The values of the un-standardized Beta coefficient for the independent variable lies between -0.011 (Privacy), 0.265 (Attitude), and 0.390 (Security). The findings of the multiple linear regression model suggest that the p-value for attitude (p=0.000) and security (p=0.000) is less than the alpha value 0.005. On the other hand, the p-value for privacy (p=0.792) is greater than the alpha value (0.005). The multiple regression analysis explains further that the trust in the e-commerce website depends to the extent of 31.9 % by three independent variables (attitude, security, and privacy) accounting to 56.4%. From the results, it is evident that attitude and security are positively and significantly affects the trust in e-commerce website since the alpha value is less than 0.05 (p value=0.000), privacy in an e-commerce website is negatively related to the consumer trust in e-commerce website since the alpha value is greater than 0.05 (p=0.792).

From the results, the Multiple Linear regression equation is constructed as follows:

Customer Trust in Ecommerce website=0.935+0.265 (Attitude towards online purchase)+0. 390 (Security) - 0.011 (Privacy).

| Table 4 Output of Multiple Linear Regression Analysis |

|||||

|---|---|---|---|---|---|

| Influencing factors | Unstandardized Coefficients | Standardized Coefficients | T | Sig. | |

| B | Std. Error | Beta | |||

| Intercept | 0.935 | 0.182 | 5.123 | 0.000 | |

| Attitude(X1) | 0.265 | 0.057 | 0.268 | 4.652 | 0.000 |

| Security (X2) | 0.390 | 0.055 | 0.414 | 7.104 | 0.000 |

| Privacy(X3) | -0.011 | 0.040 | -0.015 | -0.265 | 0.792 |

| N | 235 | - | - | - | - |

a Dependent Variable: Trust

Independent variables: Security, Privacy, Attitude

R=0.564; R Square=0.319; Adjusted R Square=0.310.

F=36.011; P=0.000 (p<0.05)

Findings of the Study

Based on previous literature sources and the results, the study identified that trust is influenced by major factors such as attitude of the customers, security involved in e-commerce websites or new apps, and privacy towards e-commerce websites or new apps during pandemic. The study has formulated three hypotheses to justify the objectives and the results of the hypothesis are presented in table 5.

Hypothesis1: Based on the results the p value for attitude (p=0.000) is less than the alpha value 0.05. Hence the study infers that attitude towards online purchase is positive and significantly reflects the dependent variable Trust in e-commerce websites or the new apps. The hypothesis is valid and accepted.

Hypothesis 2: The P-value for security (p=0.000) is less than the alpha value 0.05. Therefore, the study concludes that security is positive and significantly reflects the dependent variable Trust in Ecommerce websites or new apps.

Hypothesis 3: Since the P-value for privacy (.792) is greater than the alpha value 0.05. The study rejects the hypothesis stating that privacy is positively related to the new online application and e-commerce websites or new apps.

| Table 5 Findings of the Study |

||

|---|---|---|

| variables | Hypotheses | Result |

| Attitude | Attitude towards online purchases is positively related to trust in the new online application and e-commerce websites. | Accepted |

| Security | Security involved in online purchases is positively related to the new online application and e-commerce websites. | Accepted |

| Privacy | Privacy is positively related to new online applications and e-commerce websites. | Rejected |

Conclusion

The size of online transactions and e-commerce has exploded during the covid-19 epidemic as most shoppers and businesses depart from conventional consumption due to restrictions on mass movements and social distancing rules. As a result, the purchasing behaviors of customers have been transformed as consumers turn to online buying while businesses design websites and applications to serve these growing interests. Acceleration of online transaction has created the need to address the issues of trust, privacy and security as key components of the interaction between buyers and sellers. With the loss of human communication and direct interactions, trust has emerged as an important enabler of online transactions since it bridges the separation between buyers and sellers. On the other hand, security features on e-commerce sites enhances their reliability and creates positive perceptions on the ability of online business to achieve the same utility as conventional trade. Finally, with online transactions, there is heightened sharing of personal information which necessitate privacy protocols for customers and merchants to ensure that information is not manipulated by malicious third-party users. With these considerations, digital transactions during the Covid-19 epidemic will be improved as attitudes about its trustworthiness, security and privacy are positively transformed.

References

- Aldarabseh, W.M. (2020). Determinants of online Islamic banking use in Almadinah, Saudi Arabia. MEC-J (Management and Economics Journal), 4(1), 1-10.

- Alshammari, T.M., Altebainawi, A.F., & Alenzi, K.A. (2020). Importance of early precautionary actions in avoiding the spread of COVID-19: Saudi Arabia as an example. Saudi Pharmaceutical Journal, 28(7).

- Hossain, S.A., Bao, Y., Hasan, N., & Islam, M.F. (2020). Perception and prediction of intention to use online banking systems. International Journal of Research in Business and Social Science (2147-4478), 9(1), 112-116.

- Singh, S., & Srivastava, R.K. (2020). Understanding the intention to use mobile banking by existing online banking customers: An empirical study. Journal of Financial Services Marketing, 1-11.

- Yousufani, M., Courbe, J., & Babczenko, K. (2020). How retail banks can keep the lights on during the COVID-19 crisis—and recalibrate for the future.

- David, G. (2000). E-commerce: The role of familiarity and trust. The International Journal of Management Science, Omega 28, 725-737.

- Habibi, M.R., Laroche, M., & Richard, M.O. (2014). The roles of brand community and community engagement in building brand trust on social media. Computers in Human Behavior, 37, 152–161.

- Hans van der Heijden, Tibert, V., & Marcel, C. (2003). Understanding online purchase intentions: Contributions from technology and trust perspectives. European Journal of Information Systems, 12, 41–48.

- Ilmudeen, A. (2019). Factors influencing consumers' trust on e-commerce adoption in Sri Lanka. 7th International Symposium 2017 (IntSym2017) - SEUSL Conference Paper, 1-14.

- Jacqueline, M. (2013). Likert data: What to use, parametric, or non-parametric? International Journal of Business and Social Science, 4(11), 258-264.

- Athapaththu, J.C., & Kulathunga, K.M.S.D. (2018). Factors affecting online purchase intention: A study of Sri Lankan online customers. International Journal of Scientific & Technology Research, 7(9), 120-128.

- Ling, K.C., Chai., L.T., & Piew, T.H. (2010). The effects of shopping orientations, online trust and prior online purchase experience toward customers’ online purchase intention, published by Canadian center of science and education. International Business Research, 3(3), 63-76.

- Ling, K.C., Daud, D.B., Piew, T.H., Keoy, K.H., & Hassan, P. (2011). Perceived risk, perceived technology, online trust for the online purchase intention in Malaysia. International Journal of Business and Management, 6(6).

- Mohammed, A.Y., & Zeki, A. (2015). The most principle security issues in e-commerce. International Journal of Scientific and Research Publications, 5(12), 556-561.

- Mansoureh, M., Maadi, M., & Javidnia, M. (2015). Identification of factors influencing building initial trust in e-commerce. Iranian Journal of Management Studies (IJMS), 9(3), 483-503.

- Marios, K., Hampton-Sosa, W. (2004). The development of initial trust in an online company by new customers. Information & Management, 41, 377–397

- Naggar, R.A., & Bendary, N. (2017). The impact of experience and brand trust on brand loyalty, while considering the mediating effect of brand equity dimensions, an empirical study on mobile operator subscribers in Egypt. The Business and Management Review, 9(2), 16-25.

- Nesha, A.U., Rashed, M.S., & Raihan, T. (2018). Identifying the factors that influence online shopping intentions and practices: A case study on Chittagong Metropolitan City. The Comilla University Journal of Business tudies. Bangladesh. 5(1), 157-171.

- Ha, N.T., Nguyen, T.L.H., Nguyen T.P.L., & Nguyen, T.D. (2019). The effect of trust on consumers’ online purchase intention: An integration of TAM and TPB. Management Science Letters, 9, 1451–1460.

- Niranjanamurthy, M., & Chahar, D. (2013). The study of e-commerce security issues and solutions. International Journal of Advanced Research in Computer and Communication Engineering, 2(7), 1-12.

- Patil, P. (2017). Study on e-commerce security issues and solutions. International Journal of Computer Science and Mobile Computing, 6(1), 100-102.

- Le-Hoang. P.V. (2020). Factors affecting online purchase intention: The case of e-commerce on Lazada. Independent Journal Of Management & Production (IJM&P), 11(3).

- Safa, N., & Von-Solms, R. (2016). Customers repurchase intention formation in [Text Wrapping Break] e-commerce. South African Journal of Information Management, 18(1), 1-9.

- Sirkka, L., Jarvenpaa, N., Tractinsky., & Michael, V. (2000). Consumer trust in an Internet store. Information Technology, and Management, 1, 45–71. Baltzer Science Publishers BV.

- Stouthuysen, K. (2020). A 2020 perspective on “The building of online trust in e-business relationships.” Electronic Commerce Research and Applications, 100929,1-2.

- Subramaniam, B., & Andrew, A. (2016). Security and privacy perception on online brand trust in e-commerce industry. Journal for Studies in Management and Planning, 2(1), 180-190.

- Taber, K. (2017). The use of Cronbach’s alpha when developing and reporting research instruments in science education. Research in Science Education.

- Wang, W.T., Wang, Y.S., & Liu, E.R. (2016). The stickiness intention of group-buying websites: The integration of the commitment–trust theory and e-commerce success model. Information & Management, 53(5), 625–642.

- Al Arabia News. (2020). https://english.alarabiya.net/en/News/gulf/2020/04/06/Coronavirus-Saudi-Arabia-imposes-24-hour-curfew-in-several-cities-including-Riyadh

- Saudi Gazette. (2020). 69% of KSA consumers to maintain current shopping habits post COVID-19.