Research Article: 2022 Vol: 26 Issue: 1

Could Google Search Be Used in Gold Investments Strategy? Dynamic Relation between Google Search Volume and Gold

Gamaliel Anindyajati, Universitas Indonesia

Arief Wibisono Lubis, Universitas Indonesia

Citation Information: Anindyajati, G., & Lubis, A.W. (2022). Could Google search be used in gold investment’s strategy? Dynamic relation between Google search volume and gold. Academy of Accounting and Financial Studies Journal, 26(1), 1-18

Abstract

This paper intends to investigate the dynamic relations between investor attention to gold, captured by Google search volume index (GSV), and gold price, Indonesian Composite Index (IHSG) and USD/IDR exchange rate, using multivariate Vector Autoregressive (VAR). Driven by previous findings from the USA & India that reveal causalities between GSV and gold return, we try to confirm whether it also took place in Indonesia and the reliance on GSV could be used as another strategy for gold investment. Our study covers both ongoing Covid-19 and pre-Covid-19 periods, from May 2016 to May 2021. Unlike previous findings, we find only one directional causality from gold return to GSV in all sample and pre-Covid-19 period. This result suggests that retail investors’ attention to gold in Indonesia is driven by recent changes in gold price, but not vice versa. Additionally, we also find bi-directional causality between gold and IHSG return, as well as gold and currency rate return, in all sample period. Thus, it suggests that gold price is driven more by its traditional relation with economic condition rather than investor attention, in particular stock market, where we find one directional causality from IHSG to gold return consistently in all three periods; whole sample, pre-Covid-19 and Covid-19 period.

Keywords

Covid-19, Gold Investment’s, Strategy.

Introduction

The number of internet users is doubled since the last decade, from only 25.3% of the world population in 2009 to 51.1% in 2019 (The World Bank, n.d.). This internet connectivity provides easier and faster access to obtain information, especially for retail investors. Retail investors could actively search the information they need in an instant using internet search engine for free, such as Google. Google itself has become a dominant internet search engine in the last decade, with more than 85% market share worldwide (Statista, 2021). The popularity of Google search engine has led Da et al. (2011) to utilize Google search volume (GSV) as a proxy to capture retail investor attention in the US stock market.

Ever since Da et al. (2011) introduced GSV as proxy for investor attention, number of studies have been conducted to investigate the relations between GSV and stock market (Aouadi et al., 2013; Takeda & Wakao, 2014; Bijl et al., 2016; Tantaopas et al., 2016; Kim et al., 2019), as well as cryptocurrency (Kristoufek, 2013; Fry and Cheah, 2016; Urquhart, 2018; Figa-Talamanca and Pataca, 2020). The results are also various; Da et al. (2011) find that GSV could predict future stock return, while Tantaopas et al. (2016) find only one-way causality from stock market to GSV in most of countries of their study and no causality in Singapore and Thailand. In the commodity market, especially gold, GSV has also been used as a proxy for investor attention. Baur & Dimpfl (2016) find positive causality between GSV and gold return. Furthermore, Jain & Biswal (2019) as well as Vozlyublennaia (2014) discover two-way causality between GSV and gold return in India and USA, respectively.

In this study, we try to investigate the dynamic relation between investor attention to gold and gold price, stock and exchange rate return in Indonesia. This study also aims to confirm whether the relation between GSV and gold price also exist in Indonesia, as previously found in USA and India, due to Indonesian unique investors’ characteristics and culture. Not only gold is perceived as “safe heaven” asset (Gurgun & Unalmıs, 2014), in Indonesian multiethnic society, gold is also used in various religious and cultural ceremony. Susilowati (2012) shows that gold is being used by Batak ethnic group in engagement and funeral ceremony. Moreover, the number of internet users in Indonesia is the 4th largest in the world after China, India and USA (Miniwatts Marketing Group, 2019), where Google search engine has 97% market share in 2020 (Statcounter, n.d.). We expect that our study could provide further insights on whether reliance on GSV could be used as another strategy for gold investment in Indonesia. Additionally, our study also covers the ongoing Covid-19 pandemic, from May 2016 to May 2021.

The remaining of this paper is structured as follow: the second section presents the literature review, which focuses on investor attention and gold pricing, as well as hypotheses’ development; followed by the method used in this research is elaborated; then continued with presentation of the results, as well as discussions on some of the main findings; and lastly, this paper is closed with conclusion of the whole discussion and limitations in the study.

Literature Review

Investor Attention

Investor behavior is often considered as a less important factor in asset pricing. As stated in Efficient Market Hypothesis (Fama, 1970) and classical finance theorem, most of investors tend to react rationally and avoid uncalculated risk. However, Merton (1987) describe the existence of “Market Indexers”, that build and hold stock portfolio based on market index without primarily analyze its market value. Further, Baker and Wurgler (2007) find investor sentiments have a significant effect on stock prices cross-sectionally, hence switching the questions from whether sentiments are affecting stocks, towards how to quantify sentiment and attentions.

The effect of investor attention on asset pricing was initiated by Merton (1987). He argues that news about a particular company might attract the attention of new investors to buy its stock, therefore moving the price and volume in short term. That short-term movement might catch the attention of other investors and attract them to trade, thus moving the price and volume further.

Furthermore, due to “home bias” phenomenon (Barberis and Thaler, 2005), investors tend to invest on companies and commodities they are familiar with. Ding and Hou (2015) state that in order to be familiarized with a particular stock or commodity, investors spent more time and effort to gather relevant information and affirming that investor attention could predict future trading activity. Nevertheless, there are limitations especially for retail investors, who do not have abundance of time nor resources. In “attention theory” (Barber and Odean, 2008), it is described that retail investors have a tendency to buy stocks that attract their attention, as a result of their limited time and resources to study and observe all available stocks and commodities. Due to this limitation, retail investors might also use free internet search engine to gather information, such as Google. Vozlyublennaia (2014) further argue, that the investor attention captured by GSV is better to be used at more general index rather than individual stock, since less sophisticated retail investors who have limited resource to gather information and limited knowledge to evaluate individual stock data, might utilize Google search engine.

The utilization of internet search volume as a proxy for investor attention was pioneered by Da et al. (2011), in which they confirm that GSV could capture investors’ attention and predict future stocks’ returns in USA. Following Da et al. (2011), numerous studies have been conducted, yet the results are various and inconclusive, such as the finding of a strong correlation between GSV and trading volume in French stock market (Aouadi et al., 2013), one way Granger causality from GSV to stock return, in almost all observed countries in Asia-Pacific (Tantaopas et al., 2016), as well as no correlation and causality between GSV and stock return in Norway (Kim et al., 2019). Inconclusive findings are also seen in the studies of the relationship between GSV and cryptocurrency, where Kristaufek (2013) finds strong two-way relation between GSV and Bitcoin, on the other hand Urquhart (2018) find no causality between GSV and cryptocurrency return. In the commodities market, especially gold, so far, the result is quite conclusive, where Baur and Dimpfl (2016) find positive relationship between GSV and gold price volatility, while both Jain & Biswal (2019) and Vozlyublennaia (2014) find two-way causality between GSV and gold return in India and USA.

Gold Pricing

Unlike other consumed commodities (i.e., Oil, Coffee), gold supply is accumulated over time. However, Qian et al. (2019) state that its additional 2% annual supply globally from mining does not sway the price. Further, they argue that the supply and demand balance of gold was relatively stable and might not have a significant impact on the gold price, hence examining others factors that could influence gold price is the goal of their study. On the other hand, World Gold Council (2020) specifically mentions other factors that could affect gold price, which are Opportunity Cost, Risk and Uncertainty, Momentum, and Economic Expansion.

Stock market is commonly used as an indicator for economic growth. Stock and gold are the common assets investors used to construct a portfolio, the two are substitutable, since stocks are riskier but yield higher return compared to gold (Qian et al., 2019). Jain & Biswal (2019) state that since gold were considered as “safe heaven” in India, when the stock market is bearish, gold is used to hedge the risk of stocks. On the other hand, in a bullish market, investors substitute their investment from gold to stock. In their study, Jain & Biswal (2019) find that gold return has a negative causal effect to Indian NIFTY index return, while Qian et al., (2019) find negative correlation between gold and S&P 500 index price.

A depreciation of US Dollar (USD) to Indian Rupee is seen as an opportunity for investors to import and invest in gold, hence moving the gold price up (Jain & Biswal, 2019). Such behavior shows that investors tend to exploit the opportunity of exchange rate appreciation against USD and avoid the opportunity cost if it is missed. Jain & Biswal (2019) find that a decline in gold price causes an appreciation in the exchange rate and the other way around, a depreciation in the exchange rate causes a rise in gold prices, while Wong (2014) find that an increase in gold price might lead to depreciation of the USD to Malaysian Ringgit. Additionally, Qian et al., (2019) describe that investor also utilize gold to hedge the risk of exchange rate depreciation.

Beside its previous return, investor attention captured by GSV could be considered as another measurement of momentum. Vozlyublennaia (2014) shows that investors might perceive the information obtained from the internet as an indicator of gold price movement in the future. Therefore, an increase of attention in gold could generate pressure for investor to invest. Previous study by Kou et al. (2018) find that high internet search volume has significant effect on gold absolute return in China, while both Vozlyublennaia (2014) and Jain & Biswal (2019) find bi- directional causality between GSV and gold.

Data

In order to be better at representing the limited resources of retail investor, in this study we use secondary data obtained from free to access sources within the period of May 2016 to May 2021. Similar to Vozlyublennaia (2014) and Jain & Biswal (2019), we also use weekly frequency data in this study. Unlike stock and currency, which are traded only in working days, retail gold is traded for the whole week, where it is officially sold in online marketplace that could be accessed in 24 hours. Moreover, Google search engine could also be accessed anytime throughout the week. Due to time restriction of retail investors in working days, it is likely that they might also access Google to gather information not only on weekdays, but also in the weekend. Therefore, weekly data was chosen to be better illustrate such condition.

The period chosen in our study covers the ongoing Covid-19 pandemic, as our intention is to further confirm whether the finding is consistent throughout the crisis. During Covid-19 pandemic, many are required to work from home (WFH), subsequently, retail investor might have more time to access the internet to collect information for their personal financial investment. We further divide our sample into two sub period, pre-Covid-19 and Covid-19, at first week of March 2020, when the first Covid-19 disease was first identified in Indonesia (March 2nd, 2020).

The GSV data is extracted from Google Trend, a service from Google that provide historical analysis of a keyword relative to its total search volume within a period of time, in 0- 100 scale. The keyword used in this study is “harga emas” (“gold price” in Indonesian). We choose this keyword combination, instead of just “gold” to avoid possibility resulting searches of “gold” others than commodities, such as color or medal. This keyword combination should also accommodate longer related keyword such as “gold buying price” and “gold price today”. Further, we apply location filter to incoming searches from Indonesia and category filter to the default “all category”.

The gold price data used in this study is the selling price of 1 gram gold produced by PT. Aneka Tambang (Antam), retrieved from www.harga-emas.org. Although there are golds produced by other companies, Antam’s gold is better known to Indonesian investors, since Antam is government owned company, and it is commonly traded all over the country. The quantity of 1 gram is also chosen to cover all different classes of retail investors, rather than 1 Kg or 500 grams gold bar which might only be affordable for high class investors. Meanwhile, the Indonesian Composite Index (IHSG) and USD to IDR exchange rate (USD/IDR) are obtained from www.investing.com.

To study the dynamic relation between investor attention for gold, gold price, stock market and currency exchange rate, we apply multivariate Vector Autoregressive (VAR) model of four variables, namely GSV, gold price (Antamgold), IHSG and USD/IDR. To properly fit the variable into VAR model, first we examine the stationarity of the data. We apply two unit root tests, Augmented Dickey Fuller (ADF) and Phillip Perron (PP) test for robustness. Similar with Jain & Biswal (2019), the non-stationary data is then transformed by log-differencing it into log-return form.

(1)

(1)

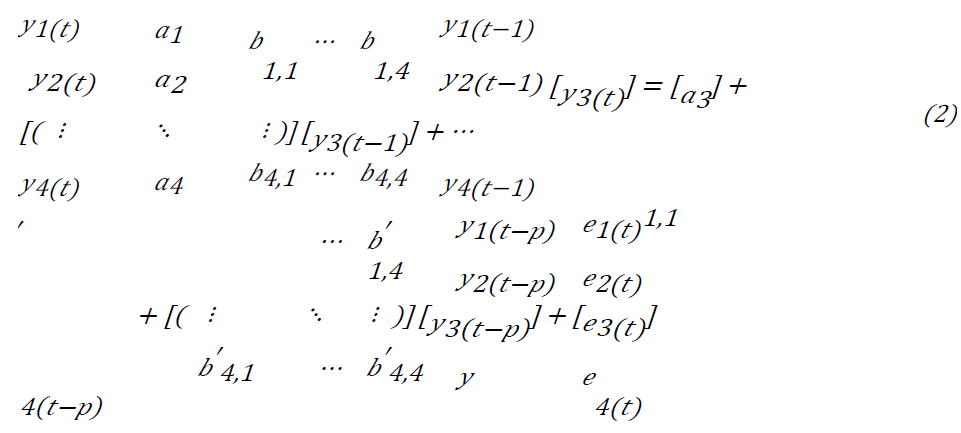

The stationery variables are then fitted into multivariate VAR models. The optimum lag for the VAR model is determined by Akaike Information Criteria (AIC) (Jain & Biswal 2019).

Where y(t) is the vector of observed stationery variables (GSV, Antamgold, IHSG and USD/IDR), p is the optimum lag and e(t) is the error vector.

Then, we utilized Granger causality test, based on the VAR model, to study the causal relation between variables. The effects of causality between variables are analyzed from the coefficient in the VAR model.

Results

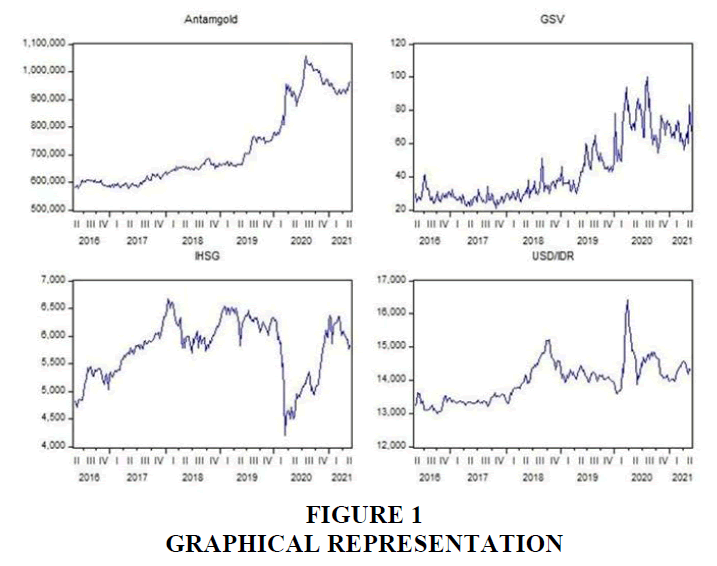

After adjusting for public holiday, when the Indonesian stock market closed for the whole week, we obtain 1,052 weekly data samples during the period of May 2016 to May 2021, 792 samples in pre-Covid-19 period and 260 samples for Covid-19 period. Figure 1 depicts the graphical representation of the series, where co-movement between Antamgold and GSV could be observed, suggesting a positive correlation between the two. During Covid-19 pandemic, Antamgold is at the highest point, while IHSG hit the lowest, indicating negative correlation between Antamgold and IHSG, especially in Covid-19 period. Meanwhile, the relationship between Antamgold and USD/IDR is difficult to understand from the graph alone.

Both ADF and PP unit root test have null hypothesis of “there is a unit root in the series”. The result of unit root test (Table 1) shows that GSV is stationary on the level data series, while Antamgold is non-stationary in all three periods. IHSG series is only stationary at 5% significance in Covid-19 period, but non-stationary in all sample and pre-Covid-19 period. The USD/IDR is stationary at 5% significance level in all samples, but non-stationary in pre-Covid-19 and has different unit root results in Covid-19 period, where ADF test shows non-stationarity and PP test reveal stationarity at 10% significance level. Therefore, we log-difference Antamgold, IHSG and USD/IDR. All the log-return series (dl_Antamgold, dl_IHSG and dl_USD/IDR) are stationary in all three periods.

| Table 1 Unit Root Test | ||||||

| Variable All Sample Pre-Covid-19 Covid-19 | ||||||

| ADF | PP | ADF | PP | ADF | PP | |

| GSV | -4.777*** | -4.573*** | -4.828*** | -4.490*** | -4.138*** | -4.127*** |

| Antamgold | -1.827 | -1.895 | -1.367 | -1.157 | -2.455 | -2.455 |

| dl_Antamgold | -16.527*** | -16.527*** | -15.099*** | -15.251*** | -8.125*** | -8.121*** |

| IHSG | -2.234 | -2.334 | -1.499 | -1.289 | -3.787** | -3.975** |

| dl_IHSG | -16.006*** | -16.006*** | -14.834*** | -14.842*** | -7.204*** | -7.171*** |

| USD/IDR | -3.688** | -3.460** | -2.492 | -2.293 | -2.788 | -3.377* |

| dl_USD/IDR | -7.841*** | -13.643*** | -10.738*** | -10.738*** | -6.364*** | -6.436*** |

The descriptive statistics of all stationary series are presented in Table 2. The GSV maximum value of 100 occurred in Covid-19 period, while the mean is also doubled from 34.24 in pre-Covid-19 to 71.98 in Covid-19 period. This value affirms that during Covid-19 pandemic, there are higher incoming searches of “gold price” compared to the prior period, as many were required to WFH, hence having more time to gather information for their personal investments. The standard deviation of the financial data (dl_Antamgold, dl_IHSG and dl_USD/IDR) is also doubled during Covid-19 period, which indicates there is an increase of volatility during the crisis. All financial data are also shown to have high kurtosis value. Positive skewness also presents in the financial data, except for dl_IHSG. The standard deviation value compared to its mean is also high for the financial data, which indicates the presence of extreme values and high volatility. However, all extreme values are included in the study due to the high volatility nature of the financial data. (Tsen, 2014).

| Table 2 Descriptive Statistic | ||||||||

| Mean | Median | Max | Min | Std. Dev | Skew | Kurtosis | n | |

| all sample | ||||||||

| GSV | 43.56654 | 35 | 100 | 21 | 19.2450 | 0.8896 | 2.6124 | 263 |

| dl_Antamgold | 0.00191 | 0.00072 | 0.09217 | -0.04246 | 0.0145 | 1.2825 | 10.4465 | 262 |

| dl_IHSG | 0.00074 | 0.00235 | 0.08027 | -0.15690 | 0.0230 | -1.8847 | 14.0104 | 262 |

| dl_USD/IDR | 0.00029 | 0.00006 | 0.07529 | -0.05198 | 0.0104 | 0.8958 | 16.7455 | 262 |

| pre-Covid-19 | ||||||||

| GSV | 34.23737 | 31 | 78 | 21 | 10.2477 | 1.3877 | 4.7096 | 198 |

| dl_Antamgold | 0.00164 | 0.00142 | 0.03749 | -0.03057 | 0.0108 | 0.0787 | 4.0356 | 197 |

| dl_IHSG | 0.00062 | 0.00173 | 0.05212 | -0.07583 | 0.0177 | -0.9421 | 6.3431 | 197 |

| dl_USD/IDR | 0.00041 | 0.00041 | 0.04145 | -0.02187 | 0.0075 | 0.5587 | 7.7839 | 197 |

| Covid-19 | ||||||||

| GSV | 71.98462 | 71 | 100 | 54 | 10.1727 | 0.7186 | 3.0445 | 65 |

| dl_Antamgold | 0.00272 | 0.00000 | 0.09217 | -0.04246 | 0.0223 | 1.3365 | 6.8167 | 64 |

| dl_IHSG | 0.00108 | 0.00468 | 0.08027 | -0.15690 | 0.0346 | -1.9046 | 10.0140 | 64 |

| dl_USD/IDR | -0.00007 | 0.00000 | 0.07529 | -0.05198 | 0.0164 | 0.8240 | 10.1575 | 64 |

Based on AIC, we find the optimum lag length of VAR model for all sample, pre-Covid- 19 and Covid-19 period are 4, 2 and 1, respectively.

Table 3 presents the multivariate Granger causality of the VAR model. We find bi- directional Granger causality between gold and market index return, as well as between gold and exchange rate return in all sample, while one-way Granger causality from gold return to GSV and from market index to exchange rate return are observed at 5% significance level. Whereas in pre- Covid-19 period, we find one-way causality from gold return to GSV and from market index to gold return at 1% and 10% levels of significance, respectively. Dring Covid-19 pandemic, wefind only one-way causality from market index to gold return and from exchange rate to gold return, at 5% significance level, but no causality between GSV and gold return is observed.

| Table 3 Multivariate Granger Causality Test | ||||||||

| Granger Causality | Chi-Square | |||||||

| All Sample | Pre-Covid-19 | Covid-19 | ||||||

| dl_IHSG | → | dl_Antamgold | 11.41705 | ** | 5.434959 | * | 5.817417 | ** |

| dl_USD/IDR | → | dl_Antamgold | 17.46971 | *** | 2.074144 | 5.443535 | ** | |

| GSV | → | dl_Antamgold | 2.654569 | 3.390733 | 0.778455 | |||

| dl_Antamgold | → | dl_IHSG | 15.55217 | *** | 2.108864 | 2.331245 | ||

| dl_USD/IDR | → | dl_IHSG | 5.235864 | 2.669968 | 0.474053 | |||

| GSV | → | dl_IHSG | 1.767958 | 2.237218 | 0.211486 | |||

| dl_Antamgold | → | dl_USD/IDR | 16.70321 | *** | 1.597767 | 0.471448 | ||

| dl_IHSG | → | dl_USD/IDR | 11.54297 | ** | 1.566077 | 2.074173 | ||

| GSV | → | dl_USD/IDR | 5.350688 | 2.081129 | 2.534345 | |||

| dl_Antamgold | → | GSV | 9.950943 | ** | 17.46761 | *** | 0.289695 | |

| dl_IHSG | → | GSV | 7.682118 | 0.364904 | 1.111714 | |||

| dl_USD/IDR | → | GSV | 5.897018 | 1.324941 | 0.675012 | |||

To study the effect between individual variable, we analyze the regression coefficients of the VAR model. The estimation of VAR model for all sample periods is presented in Table 4, where it could be observed that the previous week’s market index and exchange rate return have significant negative effects on gold return. Both gold and exchange rate return also have negative effects on market index return at 5% level of significance. We find negative significant effect from market index to exchange rate return, while also observe mixed results in the effect of gold to exchange rate return, where it is found to have a significant negative coefficient (1%) at lagged three-week and positive coefficient (10% significance) at lagged four. The exchange rate return is also significantly affected by its own previous return. The GSV is positively affected by the previous gold return (lagged 1 at 10% and lagged 2 at 1% significance) and its own previous value, while the previous return of market index and exchange rate are found to have negative effects on GSV at 10% significance. The result of VAR model regression is slightly different from the Granger causality test. While it confirms all the findings in Granger causality test, there are additional causalities found in the VAR model regression even though the significance levels areless than 1%, those are the negative effects from exchange rate to market index return (5%) and the negative effects from market index (5%) and exchange rate return (10%) to GSV.

| Table 4 Multivariate Var Estimation – All Sample | |||||

| Independent | Dependent | ||||

| dl_Antamgold | dl_IHSG | dl_USD/IDR | GSV | ||

| dl_Antamgold (t-1) | -0.08583 | 0.13710 | -0.05027 | 47.60580* | |

| dl_Antamgold (t-2) | 0.02897 | -0.25413** | 0.01757 | 76.07892*** | |

| dl_Antamgold (t-3) | -0.10614 | 0.18654 | -0.15362*** | -13.16609 | |

| dl_Antamgold (t-4) | 0.01120 | -0.22088** | 0.08825* | -13.70316 | |

| dl_IHSG (t-1) | -0.14124*** | 0.06313 | -0.10138*** | -41.58210** | |

| dl_IHSG (t-2) | 0.04574 | -0.03430 | -0.03888 | 13.22008 | |

| dl_IHSG (t-3) | 0.01454 | -0.02790 | 0.01827 | -31.53634* | |

| dl_IHSG (t-4) | -0.01694 | 0.11220 | -0.00469 | -7.24425 | |

| dl_USD/IDR (t-1) | 0.37017*** | -0.04156 | 0.08516 | -63.18340 | |

| dl_USD/IDR (t-2) | -0.03162 | 0.12534 | 0.04320 | 13.82519 | |

| dl_USD/IDR (t-3) | 0.21203** | -0.35080** | 0.21153*** | -80.03875* | |

| dl_USD/IDR (t-4) | 0.03635 | 0.18068 | -0.21225*** | -9.06207 | |

| GSV (t-1) | 0.00003 | 0.00025 | 0.00004 | 0.74447*** | |

| GSV (t-2) | -0.00008 | -0.00019 | 0.00018 | 0.15461* | |

| GSV (t-3) | 0.00023 | 0.00021 | -0.00005 | -0.05989 | |

| GSV (t-4) | -0.00012 | -0.00027 | -0.00018 | 0.12364* | |

| C | -0.00026 | 0.00077 | 0.00068 | 1.76065** | |

| R2 | 0.20965 | 0.09954 | 0.19660 | 0.92114 | |

| Adj. R2 | 0.15717 | 0.03976 | 0.14326 | 0.91591 | |

The estimation result of VAR model regression in pre-Covid-19 period is presented in Table 5. The results are consistent with Granger causality test where the previous 1 and 2 week of gold returns have positive significant effect on GSV, beside the GSV’s own previous value. However, we find positive effect with 5% significance level from market index to gold return, where in all sample period the effect is found to be negative.

| Table 5 Multivariate Var Estimation – Pre-Covid-19 | ||||

| Independent Dependent | ||||

| dl_Antamgold | dl_IHSG | dl_USD/IDR | GSV | |

| dl_Antamgold (t-1) | -0.09470 | -0.00617 | -0.05291 | 93.57048*** |

| dl_Antamgold (t-2) | -0.09224 | -0.18185 | 0.03115 | 97.80409*** |

| dl_IHSG (t-1) | -0.00465 | -0.13372 | -0.03501 | -7.73960 |

| dl_IHSG (t-2) | 0.11619** | -0.04671 | -0.03062 | 8.65943 |

| dl_USD/IDR (t-1) | 0.09541 | -0.34064 | 0.14681* | -17.97032 |

| dl_USD/IDR (t-2) | 0.14914 | 0.06731 | -0.10456 | 58.51799 |

| GSV (t-1) | 0.00002 | 0.00027 | -0.00017 | 0.69135*** |

| GSV (t-2) | 0.00013 | -0.00040 | 0.00013 | 0.22281*** |

| C | -0.00341 | 0.00549 | 0.00189 | 2.86717** |

| R2 Adj. R2 |

0.05193 0.01115 |

0.04089 0.81958 -0.00036 0.81182 |

0.05136 0.01055 |

|

The results of VAR estimation in Covid-19 period Table 6 are also consistent with Granger causality findings, where we found market index return has negative effect on gold returnand exchange rate return has positive effect on gold return, both at 5% significance level. Meanwhile, no other variables except its own previous value have significant effect to GSV.

| Table 6 Multivariate Var Estimation Covid-19 | ||||||

| Independent | Dependent | |||||

| dl_Antamgold | dl_IHSG | dl_USD/IDR | GSV | |||

| dl_Antamgold (t-1) | -0.17548 | 0.32997 | -0.06893 | 25.71432 | ||

| dl_IHSG (t-1) | -0.20446 | ** | 0.18102 | -0.10732 | -37.38888 | |

| dl_USD/IDR (t-1) | 0.44560 | ** | 0.24883 | 0.06311 | -65.63873 | |

| GSV (t-1) | 0.00021 | -0.00021 | 0.00033 | 0.68325 | *** | |

| C | -0.01246 | 0.01490 | -0.02376 | 22.61885 | *** | |

| R2 | 0.34059 | 0.06930 | 0.10911 | 0.47254 | ||

| Adj. R2 | 0.29589 | 0.00620 | 0.04871 | 0.43678 | ||

Discussion

Unlike previous study by Jain & Biswal (2019) and Vozlyublennaia (2014) that find bi- directional causality between investor attentions, captured by GSV, and gold return, we find only one-way causality from gold return to GSV during our research period from May 2016 to May 2021. This result supports the findings of Tantaopas et al. (2016), in their study about the relationship between GSV and stock market, and implies that investors’ attention to gold is driven by its recent changes in gold price but not vice versa. The multivariate VAR regression also reveals strong evidence of positive effect of gold return on GSV, as well as from its previous value. This result suggests that as the recent gold price increases, it amplifies the investors’ attention to gold. Whereas the Google feed, suggestion and autocomplete of trending searches, also increases the GSV of gold price. Mixed evidence of causality from market index and exchange rate return are also observed, where we find less significant negative effect from market index and exchange rate return to GSV, while no causality was observed in Granger causality test between these variables. Another interesting thing is that we find the adjusted R2 for GSV VAR regression is also high, at 91.59%, which suggests that the model is a good fit, hence the explanatory variables could very well explain the model.

We also find strong evidence of bi-directional causalities between gold and market index return, as well as between gold and currency exchange return in all sample period. The regression coefficients also show a significance negative effect between gold and market index return. This finding aligns with previous finding from Jain & Biswal (2019), suggesting a substitution between gold and stock in retail investors’ portfolio, where in bearish market retail investors tend to swap their stock into gold, as it is often perceived as a “safe heaven” asset. However, we find mixed results in the causality effect between gold and currency exchange rate return, where we find a positive effect from previous exchange rate return to gold return, while on the other hand, previous gold return has negative effect on exchange rate return. Although these results seem to contradict, the positive effect from exchange rate to gold return found in this study is in line with Qian et al. (2019), which state that gold is often used as hedging instrument against the risk of exchange rate depreciation. Since the data used in this study is the value of 1 USD to IDR, higher value means depreciation in IDR, therefore depreciation/appreciation in IDR might increase/reduce the gold demand. Meanwhile the result of negative effect from gold to exchange rate return is somewhat align with Jain & Biswal (2019) finding. As Indonesia is also a gold importing country, the increasing gold price might halt the import of gold, hence eases the import burden and allow IDR to appreciate. On the other hand, a decline in gold price might be viewed as an opportunity to import gold, hence further depreciates IDR. We also suspect that these mixed results could also be caused by the existing Covid-19 crisis in our study.

We further examine the results by splitting the research period into pre-Covid-19 and Covid-19 sub-period. We find a positive effect from IHSG return to gold return, while the causality between gold and exchange rate return is vanished and the positive effect from gold return to GSV persists in pre-Covid-19 period. Although we found a different effect from stock market index to gold return in pre-Covid-19, whereas it is found to be negative in all sample period, the result is consistent with World Gold Council (n.d.) that found economic expansion has positive effect on gold demand. As the stock market index is also one of the indicators for economic growth, positive IHSG returns might imply economic expansion in Indonesia prior to Covid-19 pandemic. During the economic expansion, gold demands do not only come from implied investments. Due to its prestigious value, gold also acts as a mean to display wealth and social standings, as well as to accumulate wealth, whether in the forms of jewelries and/or coins. Moreover, in Indonesian multiethnic society, gold is also used in various religious and cultural ceremony. Therefore, as the economic condition flourish, the demand for gold outside of investment purposes are also increase, hence raise the gold price.

Meanwhile in Covid-19 period, the positive effect from exchange rate return to gold return, as well as the negative effect from market index return to gold return persist. These results support both Qian et al. (2019), where we find that gold is utilized to hedge IDR depreciation risk; and Jain & Biswal (2019), where gold is also used to hedge against the stock market risk, especially in the Covid-19 crisis. However, although we find that the number of Google searches for “gold price” is doubled in Covid-19, the causality effect from gold return to GSV is diminished. We postulate one possible explanation that during Covid-19 pandemic, many are required to WFH, consequently retail investors might have more time to search information not only for gold, but also for their own investment in other financial market. Therefore, the causality from gold return to GSV is no longer existed during Covid-19 crisis period. As gold is already regarded as a “safe heaven” asset, the attention to gold is not only come from its previous return but also from overall economic condition, especially in bearish economic condition. Nevertheless, since the Covid-19 is still ongoing, the finding in Covid-19 period is preliminary.

Conclusion

The aim of this study is to investigate the dynamic relation between investors’ attention to gold and gold price, stock and exchange rate return in Indonesia. We find only one directional causality from gold return to GSV in all sample and pre-Covid-19 period, which suggests that investors’ attention to gold in Indonesia is driven by recent changes in gold price, but not vice versa. We also find that gold price is driven more by Indonesian economic condition, especially stock market, where we find one directional causality from IHSG return to gold return consistently in all three periods; all sample, pre-Covid-19 and Covid-19 period. Therefore, gold investment strategy in Indonesia should rely on the overall economic condition rather than investor attention. Additionally, although Indonesia has the 4th largest internet users in the world, we could not confirm the causality from investors’ attention for gold to gold price, as previously found in USA and India, which suggests that causality between investor attention and gold price found in one country might not be applicable to all countries, due to unique characteristic of each country. Therefore, whether the relation between investor attention and gold price exist in a specific country should be confirmed by further studies.

Limitation of the Research

The Covid-19 pandemic is still ongoing, hence the result in Covid-19 period in this study is still preliminary, as the samples in Covid-19 period is also limited. Therefore, further studies that cover longer Covid-19 pandemic period are needed to further confirm the result.

References

Baur, D. G., & Dimpfl, T. (2016). Googling gold and mining bad news. Resources Policy, 50, 306-311.

Da, Z., Engelberg, J., & Gao, P. (2011). In search of attention. The Journal of Finance, 66(5), 1461-1499.

Figà-Talamanca, G., & Patacca, M. (2020). Disentangling the relationship between Bitcoin and market attention measures. Journal of Industrial and Business Economics, 47(1), 71-91.

Jain, A., & Biswal, P. C. (2019). Does internet search interest for gold move the gold spot, stock and exchange rate markets? A study from India. Resources Policy, 61, 501-507.

Merton, R. C. (1987). A simple model of capital market equilibrium with incomplete information.

Miniwatts Marketing Group. (2019). TOP 20 COUNTRIES WITH THE HIGHEST NUMBER OF INTERNET USERS.

Statcounter. (n.d.). Search Engine Market Share Indonesia. Search Engine Market Share Indonesia. Retrieved June 30, 2021, from https://gs.statcounter.com/search-engine-market-share/all/indonesia

Statista. (2021, July). Worldwide desktop market share of leading search engines. Worldwide Desktop Market Share of Leading Search Engines from January 2010 to June 2021.

Susilowati, N. (2012). Emas Dalam Budaya Batak. Berkala Arkeologi Sangkhakala, 15(2), 257–277.

The World Bank. (n.d.). Individuals using the Internet. Individuals Using the Internet (% of Population).

Urquhart, A. (2018). What causes the attention of Bitcoin?. Economics Letters, 166, 40-44.

World Gold Council. (2020). Gold Value Framework Your gateway to understanding gold performance. World Gold Council.

World Gold Council. (n.d.). Gold as an Investment: A source of return. Gold as an Investment: A Source of Return.

Kristaufek, A. (2021). Cryptocurrency in context of fiat money functions. The Quarterly Review of Economics and Finance, 82, 44-54.

Wong, C. (2017). Big data analytics: Opportunity or threat for the accounting profession?. Journal of Information Systems, 31(3), 63-79.