Research Article: 2023 Vol: 27 Issue: 4S

Cost Management and Financial Sustainability of Manufacturing Companies in Nigeria

Oladipupo Adebawojo, Babcock University

Citation Information: Adebawojo, O. (2023). Cost Management And Financial Sustainability. Academy of Accounting and Financial Studies Journal, 27(3), 1-26.

Abstract

Studies have shown that Cost Management has not been effectively institutionalized in manufacturing companies in Nigeria. This study therefore investigated the effect of cost management on the financial sustainability and performance of manufacturing companies in Nigeria. An expost-facto research design was adopted. The study population included all 33 manufacturing companies in Nigeria as at December 2019 while the sample size consisted 10 Foods and Beverages companies selected based on Purposive and Judgmental Sampling Techniques. Validity and Reliability of data obtained were based on the statutory audit of the financial reports. Data was analyzed using Multiple Regression. The results revealed that Cost Management without Company Size as control variable significantly affected Financial Sustainability of Manufacturing Companies with Adjduste R2= 0.0941, F-statistics (3.96) = 4.43, P-value < 0.05. On the other hand, with the inclusion of Company Size as control variable, Cost Management maintained significant effect on Financial Sustainability with Adjusted R2= 0.0887, F-statistics (3.96) = 3.41, and P-value <0.05. The results further confirmed that Cost Management also significantly affected Financial Performance proxy by ROCE, NPM, EPS and DPS with Adjusted R2 of 0.1376, F-statistics (3,96) =5.11 and P-value < 0.05. The study concluded that Cost Management affect Financial Sustainability of Manufacturing Companies in Nigeria. Our findings showed that Manufacturing companies’ management should establish formidable cost management strategies that will identify and control all cost drivers such that operational costs are reduced to ensure profitability and enhance financial sustainability of manufacturing companies.

Keywords

Cost Management, Financial Sustainability, Manufacturing Companies, Net Profit Margin, Financial Performance, Quoted Companies.

Introduction

The Contributions of manufacturing Industries to economic development of any nation cannot be over emphasized because they act as the driver of other industries within economy particularly the developing economy. According to Yongchun et al. (2020), the majority of nations regarded as economic powerhouses today selected manufacturing as the engine for the growth of other sectors, which in turn led to the expansion of their entire national economies. Onodje & Farayibi (2020) saw manufacturing industry as a major catalyst for development due to its multiple effects of industrial growth on every part of economy. Other scholars also confirmed that the industrial sector in most modern economy serves as the vehicle for production of goods and services, provision of employment and enhancement of income. It is described as the fulcrum on which a nation’s economic growth and development rotates (Sola et al., 2013; Osifo & Omoruyi, 2016). Hence, it is germane that companies in the manufacturing sector of a nation, particularly in a developing nation like Nigeria, are Financially Sustainable in other to make positive and significant contributions to the national economic development.

Ayayi & Sene (2010) defined financial sustainability as the capability to cover all expenditure with revenue and produce a surplus of revenue over expenses in order to finance future growth. In other words, financial sustainability of organization could be described as the extent to which an organization is able to generate sufficient income to cover her total costs and produce sufficient profit or surplus for the future growth and development. According to Zabolotny & Wasilewski (2019), financial sustainability is the capacity of businesses to create value for their owners and maintain operational continuity over the long term by using the best possible mix of investments and financing sources. Thus, firms particular the manufacturing ones would need to efficiently manage their resources to be able achieve financial sustainability. In addition, Osazefua (2020) in his attempt to define financial sustainability defined it as the capacity of a corporation to cover both its operational and financial obligations as well as minimize financial risk while keeping adequate earnings to finance expansion. These definitions imply that a manufacturing firm that is not financially stable may have its profitability and growth threatened in a way that could result in a loss of competitive capacity, which, if not carefully managed, could further lead to distress and eventually lead to the death of such a firm.

In Nigeria today, businesses including the manufacturing type of business operate within an inflationary economy as a result of uncontrolled increase in prices of commodities. The economic report presented by the National Bureau of Statistics for June 2021 which indicated that the inflation rate in Nigeria as at May 2021 increased by 17.75 percent which suggests that the Nigeria economy is an inflationary one. Additionally, because of Nigeria's complex tax system, inefficient power generation and distribution, severe insecurity, and inadequate transportation and infrastructural facilities, the business environment becomes unfavorable and difficult (Anekwe et al., 2019; Adebawojo et al., 2022). The effects of these unfavorable economic and environmental circumstances may result in a major increase in the operational costs of manufacturing companies, which may have a significant negative impact on their profitability as well as their capacity to compete and be financially sustainable. As a result, managing operating expenses in terms of cost of sales, cost of distribution and administration, and cost of finance is necessary for manufacturing enterprises in order to consistently reduce operating costs. Studies revealed that manufacturing firms are facing the challenges of poor Financial Sustianability as market based performance and companies based performance are below the budget and industry average, which have chain effect on the growth and expansion of poor businesses.

Cost management refers to a number of procedures used by an organization's management to maintain consistently low operational costs. It deals with projected, anticipated, past, and historical expenditures (DeltaCPE, 2017). Cost management is a technique for lowering operational or costs of production in order to offer consumers less priced goods or services Accounting Dictionary. This concept implies that in order to maintain profitability and be financially sustainable, manufacturing enterprises must consistently keep low their expenses for raw materials, conversion, administrative, distribution, and finance charges.

Consequently, the study evaluated the effect of cost management (CM) on the financial sustainability of listed manufacturing business in Nigeria with the following specific objectives:

1. To evaluate the effect of cost management on the financial sustainability in terms of ROCE, NPM, EPS, DPS, LR and SR of quoted manufacturing companies.

2. To ascertain the effect of cost management on financial performance in terms of return on capital employed (ROCE), Net Profit Margin (NPM), Earnings Per Share (EPS), and Dividend Per Share (DPS) of quoted manufacturing companies in Nigeria.

We posed the following research questions which were answered in this study in order to achieve the stated objectives.

1. How does cost management affect the financial sustainability in terms of the ROCE, NPM, EPS, DPS, LR and SR of publicly quoted Nigerian manufacturing companies?

2. In what ways does cost management affect the financial performance in terms of the return on capital employed (ROCE), Net Profit Margin (NPM), Earnings Per Share (EPS), and Dividend Per Share (DPS) of quoted manufacturing companies in Nigeria?

In line with these stated research questions we developed and tested the following research hypotheses:

1. Ho Cost Management does not significantly affect the financial sustainability interms of the ROCE, NPM, EPS, DPS, LR and SR of publicly quoted Nigerian manufacturing companies.

2. Ho Cost Management does not significantly affect the Financial Performance in terms of the Return on Capital Employed (ROCE), Net Profit Margin (NPM), Earnings Per Share (EPS), and Dividend Per Share (DPS) of quoted manufacturing companies in Nigeria.

Review Of Literature and Theoretical Framework

Conceptual Review

Cost management

Manufacturing companies' financial reports classify and present costs as Cost of Sales (Material and Conversion Costs), Distribution and Administrative Costs, and Finance Costs (2020 Dangote Financial Report). Cost is an measurement of the economic resources that have been or will be sacrificed in the future in order to achieve a specific goal (DeltaCPE, 2017, Lawal, 2017). Organizations, especially those in the manufacturing industry, must effectively manage all of their costs, including sales, administrative, and finance costs, in order to maintain the quality of their goods and maximize profitability. Actions made by management to satisfy consumers while consistently lowering and regulating expenses can be categorized as cost management (Adeniji, 2002).

According to Accounting Dictionary cost management is a technique for lowering operational or manufacturing costs so that consumers can purchase goods or services at lower prices. According to Fadare & Adegbie (2020), cost management is the management of real or anticipated costs incurred by a business or organization. A commercial organization might use it to anticipate impending expenses and prevent overspending. In other words, it refers to the method used by management to evaluate and streamline production or operational processes in order to control costs and manage future. When describing cost management, Hansen & Mowen (2006) stated that it is a process that is far more comprehensive than a costing system, which is only concerned with how much an item or items cost. Information for managers' internal use is the focus of cost management. It specifically finds, gathers, measures, categorizes, and provides data that is helpful to managers in figuring out the costs of products, suppliers of customers, and other pertinent items for planning, managing, making continuous improvement, and making decisions. A company operating in a competitive environment must employ cost management practices to improve cost control and cost reduction if it is to achieve effective financial management (Eneisik, 2021).

Cost of Sales

The total of all direct costs associated with purchasing or producing the commodities that a business sells is known as the "cost of goods sold" or "cost of sales," as the name implies. It is a crucial indicator for determining the gross margin or gross profit of a business. In financial reporting for businesses, gross profit is calculated by subtracting cost of sales from revenue (Hayes, 2020). The price of the raw materials used in production and the cost of conversion are included in the cost of the goods sold. The cost of turning acquired and consumed raw materials into finished or semi-finished products is referred to as conversion cost. The total of direct wages, direct expenses, and absorbed production overheads make up this conversion cost (Lucy, 2009). Francisca & Christina (2019) defined cost of sales as an expense made when producing and selling goods in a market as a part of business operations. The disclosure of cost of goods sold is recognized as a functional expense by the International Accounting Standard (IAS)2 (Deloitte, 2020). The conclusion of Lawal (2017) suggests that, in order for a company to have a sufficient gross margin that can cover its administration and distribution costs as well as its financing costs, the cost of goods sold must be adequately controlled by adopting strategies that would achieve consistently low raw material and conversion costs. If not, there could be a risk of continuous losses which may endanger the company's financial sustainability.

Distribution and Administrative Cost

Distribution costs are all expenses, direct and indirect, required to ensure efficient product distribution. Thus, it is not only related to the direct costs of activities for marketing the products, securing orders, and shipping products; it also includes the costs related to the general management functions as long as they have to do with the creation of marketing policies, the oversight of the work of sales management, and the provision for the control over the business's financial factors (Castenhol, 1927). The term "distribution expenses" in accounting can also refer to "marketing and distribution costs" or "sales and distribution costs." This is because, when it comes to cost classification, marketing and distribution costs are typically grouped together.

A manufacturing company's financial accounts must reflect all costs incurred. These expenses can be divided into manufacturing and non-manufacturing costs (Bala, 2013). Marketing and selling expenses as well as administrative expenditures might be included in the category of non-manufacturing costs. The different elements of the financial statement are affected by each type of costs, making these categories crucial for manufacturing businesses. While manufacturing expenses have an impact on the cost of goods made statement, non-manufacturing expenses have an impact on the income statement as current period expenses. Non-manufacturing costs include marketing, distribution, and administrative costs that are predominantly incurred in the current period with the goal of producing revenue (Bala, 2013; Hayes & Mansa, 2020). The profit of a company is typically impacted by selling, distribution, or administrative costs (Oyedokun et al., 2019).

Finance Cost

In order to maintain continuous operations and production, business organizations—particularly those in the manufacturing industry—typically need enormous resources or fund. In the majority of cases, business owners are unable to offer these resources, and as a result, there is lack of funding for both operations and expansion. According to Bazot (2014), the primary purpose of finance is to shift resources from players with surpluses to those in deficit. Commonly, financial intermediation is used to accomplish this. Bazot (2014) continues by saying that financial intermediation pools risks, offers liquidity, and lessens knowledge asymmetries that obstruct the transmission of funds. In order to offset the risks taken by the fund providers, such funds are typically supplied with a cost.

Finance costs are defined by the International Accounting Standard (IAS) 23 as interest and other expenses incurred by an entity in connection with borrowing money. It is also known as borrowing expenses. The financing of a company's activities can come from a variety of sources. The funding source may come from equity financing, borrowings, or loans; while equity fund providers seek dividends and capital gains as compensation for the risks associated with releasing their funds, loan providers seek interest payments on their investments. The cost of borrowing money and taking out loans is the interest rate. Finance costs include interest paid on short-term debt, such as bank overdrafts and notes payable, as well as interest paid on long-term debt including mortgages on real estate. However, a broader definition of finance costs includes expenses beyond from interest payments. Finance charges for finance leases, amortization of discounts or premiums related to borrowings, amortization of ancillary costs incurred in connection with borrowing arrangements, exchange differences resulting from foreign currency borrowings to the extent that they are regarded as an adjustment to interest costs, and so on (Ready Ratios, 2020).

The International Accounting Standard (IAS) 23 (Deloitte, 2022) provides a uniform method of accounting for or treating finance charges in the financial statement by making the following two recommendations:

One is to classify the costs of finance as expenses in the period in which they are incurred. When this method is used, all costs finance, regardless of how they are used, will be expensed. Alternately, finance costs may be capitalized as a portion of the cost of a qualifying asset, if the expense can be directly linked to the creation, production, or acquisition of the qualifying asset. Capitalization is only permitted if it is likely that the qualifying asset will generate future economic advantages that can be accurately evaluated. Additionally, interest capitalization automatically ends and any subsequent finance costs will be fully expensed whenever any portion of such a qualifying expenditure is used. According to Innocent (2017), financial sustainability will be boosted by a decrease in borrowing costs and an effective decrease in lending rates. If not carefully handled, finance costs are a significant expense that could harm an organization's capacity to remain financially stable. Borrowing money to fund an organization's operations could have a financial leverage effect, increasing risks for holders of common stock (Ashmarine et al., 2016).

Sustainable Development

The survival and sustainability of businesses, especially those in manufacturing, has become a worry for business managers as a result of the challenging economic, political, and environmental conditions present around the world. Business enterprise is a significant part of the national economy, according to (Pulatovich, 2019). Modern business managers must therefore consider sustainability in all facets of their business strategy and act accordingly. Three pillars of sustainability are discussed in relation to sustainable development: economic sustainability, social sustainability, and environmental sustainability (Magdalena et al., 2018). According to Sola et al. (2013), the idea of sustainable development includes sustainable manufacturing or production. Sustainable Manufacturing as defined by the United States Environment Protection Agency, is the creation of manufactured products by using processes that are economical to minimize negative environmental effects while saving energy and national resources. They further explained that friendly manufacturing also improves worker, community, and product safety. Similar to this, sustainable production is the process of producing goods and services through systems and practices that are not only non-polluting but also resource and energy efficient, profitable, safe and healthy for consumers, communities, and workers, as well as socially creative and rewarding for all workers (Sola et al., 2013), citing Lower Centre for Sustainable Production. Sustainable manufacturing and production are essential to a country's economic growth because they advance industrialization, which is necessary for any meaningful economic growth to occur. This position was supported by Uma et al. (2019), who noted that every economy views industrialization policies and the role of the manufacturing subsector as essential for utilizing the economy's current resources and repositioning the state to raise the standard of living. They went on to say that the production of a variety of sustainable economic goods and services is crucial for economic growth.

Financial Sustainability

If a manufacturing company's financial resources are weak, it will be challenging for them to prosper and expand within any country. To effectively contribute to the economic development of Nigeria, manufacturing firms must be able to sustain their operations. Financial sustainability is the ability of an organization to meet all of its costs with its revenue and to produce a profit to fund its expansion (Ayayi & Sene, 2010). This term was developed from the profit perspective. The ability to generate value for owners and ensure operational continuity over the long term by using the best possible mix of investments and financing sources is another way to define financial sustainability from the perspective of value creation. The definition makes use of the going concern notions to help readers understand the concept of continuity (Zabolotnyy & Wasilewski, 2019).

Zabolotnyy and Wasilewski go on to further define this term and compare financial sustainability to the idea of the risk-return model in investment theory. The risk-return concept suggests a higher return at greater risk. This means that the likelihood of achieving greater profit is increased by taking on larger risk, as reflected by price volatility of a financial instrument. They also pointed out that a consistent or steadily declining relationship between value and continuity could push a company into financial trouble or bankruptcy. On the other hand, in order to maintain an entity's continuity, managers typically maximize solvency and liquidity, which may lower business profitability. Managers must therefore choose whether to minimize risk and retain liquidity and solvency, or to optimize return on investment and increasing financial leverage. A comfortable balance between risk and return must therefore be struck by the manager. The financial sustainability of a corporation, particularly manufacturing companies, can be measured using a number of different variables. These include the following: short-term profit, efficiency, liquidity, and solvency ratios; asset turnover; debt to asset ratios; ratios of interest expense to earnings before interest and taxes; retained earnings to revenue ratios; and price-to-book value ratios (Ayayi & Sene, 2010; Zabolotnyy & Wasilewski, 2019; Osazefua, 2020).

Return on Capital Employed

Generally Financial ratios allows financial analysts to have better understanding of business financial report in order to make informed decisions. Financial ratio is a relationship between two pieces of financial data extracted from either statement of financial position, or Statement of Profit or Loss and Comprehensive Income. Return on capital employed is one of the financial ratios that are usually computed for the assessment of profitability of a company or a business enterprise. It is a ratio that shows the overall profitability of business and it is sometimes refers to as Return on investment (ROI) or Primary Ratio (PR) (Olowe, 2017).

Return on Capital Employed Measures efficiency and profitability of the capital or the investment employed in a business or corporation. The ratio simply indicates whether or not the company is earning sufficient revenues and profits by making the best use of its capital assets. High ROCE suggests that a business or company has competitive advantage. It is an indication that a company is able to offer special products or service that commands high return, (Singh & Yadau, 2013). Thus, the level of returns or margin of a company is very important as it impacts on capital employed. Companies with low returns or margin may be in danger of making losses if trading conditions deteriorate. Usually to have a better assessment of a company in terms of ROCE, the company’s ROCE should be compared with that of other companies in the same sector and the industry average. ROCE is expressed in percentage as follows:

EBIT is referred to as Earnings Before Interest and Taxes (EBIT) or Profit Before Interest and Taxes (PBIT), whilst Capital Employed is defined as Total Assets less Current Liabilities. This represents the whole of the Ordinary and Preferences Share Capital as well as Reserves, Debentures, Loan Stocks, All Borrowings, Including Obligations under Finance Leases, Bank Overdraft, Minority Interests, and Provisions. The deductions include investments in connected companies. Consequently, the major goal is to ascertain how much money, from whatever source, is being used in a company's operations (Singh & Yadav, 2013; Olowe, 2017).

Net Profit Margin

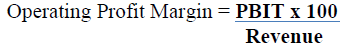

As earlier mentioned Return on Capital Employed is a primary ratio for measuring profitability and efficiency of business organization. Net Profit Margin on the other hand is one of the secondary ratios that measure profitability. According to Olowe (2017), Operating Profit Margin shows the relative efficiency of the business after considering all revenues and operating expenditures. The main focus of computing operating profit margin or ratio is the assessment of management’s operational efficiency. Operating profit is the net profit generated by an organization's regular business operations and activities, excluding any unrelated transactions and expenses of a purely financial nature (Tulsian, 2014).

Tulsian (2014) explained this concept by noting that, the greater the operating profit ratio, the better the company's operational efficiency would be and that a higher operating profit ratio is a sign that the company is able to reduce its operating costs. Operating profit margin or operating profit Ratio is computed as:

PBIT or EBIT is defined as sales revenues less operating expenditures and adding back any non-operating income produced by the firm. Operating expenses consist of cost of products sold, cost to sell items, and general or administrative expenses in order to produce revenues for the business (Singh & Yadau, 2013).

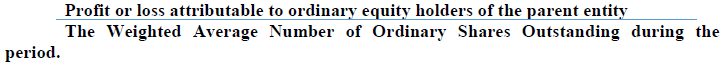

Earning Per Share (EPS)

Earnings Per share (EPS) is one of the major ratios of interest to investors in stock exchange market. This is because it impacts on the share prices and the market value of their investments. It allows investors to have basis for comparison of alternative investments. Robbetse et al. (2017) stated that Earnings per share (EPS) is regarded as an essential accounting indicator of risk, entity performance and corporate success. They further confirmed that changes in Earnings Per share usually reflect in share price behavior because it is used to project potential future growth in share prices. Earnings per share is the portion of business earnings after tax and preference shareholder’s dividend that is allocated to each share of equity or ordinary shareholders (Islam et al., 2014; Olowe, 2017).

Generally, Earnings Per share (EPS) is computed as =

The profit available for ordinary shareholders is defined as Net Profit after tax (from continuing operation) minus non-controlling interest in the case of a consolidated account minus preference dividends. However, according to Delloitte (2020) the international Accounting standard (IAS)33 recognizes and sets out the standard for computing two types of EPS as follows:

The Basic EPS

This is computed as:

The numerator used in the computation which is the net profit or loss from continuing operations should be after all expenses inclusive of taxes, non-controlling interest and preference dividends must have been deducted. Preference dividends include all preference dividends whether declared or paid during the period but excluding preference dividends in respect of cumulative preference shares paid or declared during the period which are preference dividends for past periods. Also the number of shares used in computation as denominator is computed by adjusting the shares in issue at the beginning of the period by the number of shares bought back or issued during the period, multiplied by a time-weight factor. The time weighted factor is the number of days the shares were outstanding compared to the total number of days in the period. The denominator also includes all contingently issuable shares when the contingency has crystalized

Diluted EPS

Diluted EPS simply describes or reveals the likely behavioral pattern of EPS when there is expansion in the number of shares in issue to include the effect of potential ordinary shares that are currently in existence. This situation will come to play when a company has issued certain securities which presently have no right to equity earnings at the end of the period under review but for which such right to equity earnings may be due in future. Examples of such securities include convertible debt, convertible preference shares, share warrants, share options, share rights employee stock purchase plans, contracted rights to purchase shares and contingent issuance contracts or agreement such as may be the case in business combination (Okwuosa, 2005; Olowe, 2017). The future dilutive effect of potential ordinary share will result in increase in the future number of equity shares. The future increase in the number of ordinary shares according to Okwusa (2005) will cause a dilution or watering down of equity. Hence, it will result in dilution or reduction of EPS. This will allow investors to have a proper assessment of the likely effect of future dilution on their investments.

Liquidity Ratios

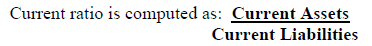

The term "liquidity" refers to the amount of money that is readily available to cover immediate expenses and run a business organization on a day-to-day basis. A corporate organization must have sufficient cash in order to meet commitments or obligations. Thus an organization must be able to promptly and cheaply turn its assets into cash (Priya & Nimalathasan 2013; Hayes, 2020; Elsharif, 2016). In order to prevent the risk of insolvency or inadequate finances to meet various commitments or obligations, organizations must adequately planned, managed and controlled their current assets and current liabilities (Priya & Nimelathasan, 2013; Olowe, 2017). A key financial measure of a company's or organization's degree of liquidity is the ratio of Current Assets to Current Liabilities of an organization. Major liquidity ratios include:

Current Ratio

This determines the extent or how far the short-ter assets can cover the short-ter liabilities of an individual or organization. Hence, a high current ratio indicates a high margin of safety for short-term creditors. As a general principle, a current ratio of 2:1 is acceptable to be a normal industry average.

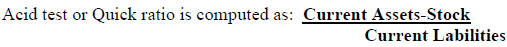

Acid Test or Quick Ratio

it is a more precise guide for measuring liquidity. It determines how far the cash and the near cash assets available can meet the demands of short-term creditors. However, stock or inventory is not considered as part of liquid asset hence, it is excluded from the computation of Quick ratio. Generally, a good industry average for Acid test or Quick ratio is considered to be ratio 1:1.

There are other ratios for assessment of business liquidity, this include: Debtors Turnover, Average collection period, Creditors Payment Periods, Stock Turnover and Stock Turnover Period. Liquidity ratios are very important in assessing and evaluating the short term solvency of business. Thus, it may likely impact on financial sustainability of a business organization.

Solvency Ratios

While business or an organization’s ability to meet its short-term financial commitments is referred to as liquidity, Solvency is the capacity of organization to be able to meet its long-term financial commitment or obligation. Hence, it is an important measure of the financial strength of organizations. This is because it reveals the capacity of organization to operate into a foreseeable future without financial stress. A quick evaluation of a company’s solvency status can be checked by comparing its total assets with its total liabilities. The difference in total assets and total liabilities should equal the shareholder’s equity. However, the difference may sometimes result in negative shareholder’s equity for some companies which is an indication of insolvency. The implication of negative shareholder’s equity is that, in the event of immediate call for liquidation or involuntary liquidation, the owners of the business may be at risks of personal losses if such business is not covered by limited liability (Hayes & Young, 2020).

In addition to this quick method of determining an organization's solvency, there are other crucial financial ratios listed in financial literature that can be computed for a more thorough examination of a company's solvency. These ratios include Fixed Interest Cover, Fixed Charge Cover, Cashflow Interest Cover, Fixed Dividend Cover, Total Debt to Shareholder Funds, Proprietary Ratio, Gearing or Financial Ratio, Debt Ratio, and Equity Multiplier. A company with a good Solvency Ratio is indication that the company will able to sustain its operations financially into a foreseeable future without likely threat of financial stress (Olowe, 2017; Akinsulire, 2019).

Cost Management Models

The primary goal of cost management is to realize cost efficiency, which is the realization of an ideal relationship between operational costs and results (Ivana et al., 2014). The inability of Traditional Cost Management Models, such as Job Order Costing, Process Costing, Standard Costing and Variance Analysis, Traditional Budgeting and Cost Volume Profit Analysis, to successfully address the challenges of cost control and cost reduction in Modern Manufacturing Companies, resulted in the development of Modern Cost Management Models Kalplan as cited by (Ivana et al., 2014). The following Modern Cost Management Models support the concept of Cost Management and Financial Sustainability in manufacturing companies discussed in this study:

Activity Based Management

This model aims at providing Management with a simplified method of introducing and managing process and organization change. It involves activity analysis, analysis of cost drivers, continuous improvement, operational control and performance evaluation. It considers business to be a set of linked activities that ultimately add value to customers and it focuses on managing businesses based on the activities that make up organization.

Advanced Manufacturing Technology (AMT)

This Technology has revolutionized the process of manufacturing in world class Manufacturing Companies, (AMT) includes Automated Production Technology, Computer Associated Design and Manufacturing (CAD/CAM), Flexible Manufacturing System (FMS), Robotics Systems, Total Quality Control (TQC), Advanced Production Management which include Material requirement and Manufacturing planning and Just in Time(JIT). The application of Advanced Manufacturing Technology by Manufacturing Companies would enhance efficiency in Cost Management Process as a result of; greater control over manufacturing process, reduction in set up times, better production quality, reduction of rework and scrap items, less reliance on direct labor, efficient planning of raw material order and efficient scheduling of product manufacturing and assembly.

Life Cycle Costing

Life Cycle Cost Management Models estimates and accumulated costs over a product’s Life Cycle or Life Span. It tracks cost and revenue from the period of idea generation till the deletion of product from product range. This will help to determine whether profits earned during manufacturing phases will be sustained and cover the costs incurred during the Pre and Post manufacturing stages. Product Life Cycle costs include the Research and Development Costs, Costs of Acquiring Technical Data, Marketing Costs, Production costs, Training Costs, Inventory Costs and Disposal Costs. Efficient Management of these costs would reduce production costs of manufacturing companies and ultimate improves profitability.

Target Costing

It is one of the popular models in use in Japanese companies and it is also adopted by companies in Europe and United States. It is a customer oriented technique which involves setting a target cost by subtracting a desired profit margin from a competitive market price. Target Costing model involves; Determining the target price which customers will be prepared to pay for the product, deduction of the target profit margin from the target price in order to determine the target cost, estimation of the actual cost of product and finally investigation of possible ways of reducing actual cost to the target cost in a situation where actual cost exceeds the target cost

Kaizen Costing Model (KC)

Kaizen Costing is the process of continuous improvement of manufacturing process. It encourages constant reduction of waste in the production process by tightening standards and thereby further lower costs below the initial targets specified during the design stage. It is also a cost reduction technique that is widely used in Japanese companies. It allows for continuous improvement on target costing by driving down production cost through reduction of waste, time and product improvement.

The relevance of the various modern cost management models to this this study is on the assumption that, the application of any or combination of these models in manufacturing process will reduce cost of operations, improve profitability and ultimately enhanced the financial sustainability of manufacturing companies.

Theoretical Framework

Stakeholder Theory

Freeman the father of stakeholders’ theory in 1984, credited the earliest definition of stakeholder to the 1963 report of Stanford Research Institute which defines stakeholders has those groups without whose support the organization would cease to exist. Freeman in a bid to further develop this theory in order to make it appropriate and fit into development in the corporate world and changes in business models, continue to modify the definition of stakeholders. In 1984, he defined stakeholders as any group or individual who can affect or is affected by the achievement of the organization objectives. In 2004, he defined stakeholders as those groups who are vital to the survival and success of the organization. However, this definition was considered to be too organization created. Hence, Friedman in 2006 noted that the freeman definition of stakeholder in 1984 was more balance and acceptable in academics (Fontaine et al., 2006). Yussoff & Alhaji (2012) explaining stakeholder noted that the traditional view of firms sees shareholder as the only stakeholders recognized by business law in most countries because, they are the owners of the companies. As a result, firms have fiduciary duty to maximize their returns and satisfy the needs of the shareholders first. According to them the most recent business model recognized that institutions convert input from investors, employees, suppliers into saleable form and give returns to stakeholders. The need of the investors, employees, suppliers and customers were addressed by this model. Thus the main groups recognized by the theory as stakeholders include: Shareholders, Employees, Customers, Suppliers and distributors, Local communities. Hence, in response to modern business model the theory expands the scope of stakeholders to include government bodies, political groups, trade association, trade unions, communities, associated corporations, prospective employees and general public. Also there are cases where competitors and prospective clients can be regarded as stakeholders to help improve business efficiency in the market place (Fontaine et al., 2006; Yusoff & Alhaji, 2012).

The theory is relevant to this study because the activities of each of the stakeholders already mention may impact either cost management or the financial sustainability of an organization. For instance, the investors as shareholders must provide the necessary funds for acquisition of modern plant that can enhance production efficiency, suppliers must be able to guarantee raw materials of the right quality and in required quantity at a competitive price and there must be ready made markets where customers are ready to buy all items produced. Government on their own as stakeholder must create enabling environment for successful manufacturing and production. Thus when there is synergy in the business relationships among the various stakeholders and the firm such synergy is expected to enhance the firm’s performance and improves its financial sustainability.

Empirical Review

As earlier noted in this study, Return on Capital Employed is a measure of how organization has efficiently utilized the capital invested in the business to earn sufficient revenue and profits. Thus high ROCE for a company indicates that the company has competitive advantage (Singh & Yadau, 2013). Musah et al. (2019) exploring the Link between Operational Efficiency and Companies Financial Performance in terms of Return on Asset (ROA), Return on Equity (ROE) and Return on Capital employed (ROCE) noted operational efficiency significantly affects Return on Asset ROA. However, for Return on Equity (ROE) and Return on Capital Employed (ROCE), they observed that both have insignificant relationship with Operational Efficiency. They further noted that managers can improve their Operational Efficiency and Financial Performance by improving the capital base, reducing their operational cost, improving their assets quality, employing revenue diversification strategies and maintaining adequate amount of liquid assets. Also, from the study of Murtala et al. (2018) on Capital Structure and Return on Capital Employed of construction companies, they discovered that Capital Structure which is a relationship between Equity and Debt financing significantly and negatively affects Return on Capital Employed (ROCE). The significant negative effect as presented from their result is likely to be as a result of the Finance Cost associated with Debt Finance. Hence, they further noted that, managers of construction companies must exercise caution when using debt finance and finance their operations as much as possible with retain earnings. According to Ozasefue (2019) Return on Asset gives an overall view of profitability as it measures a company’s financial self-sufficiency and long term profitability in a broader view. He further explained that Net profit margin, measures profitability in short term because its relates profit to periodic short term revenue or sales while return on equity measures profitability only from the perspective of shareholders. Hence, it is myopic.

The study of Oyerogba et al. (2014) on the relationship between cost management and firm performance of manufacturing organization, indicated that a significant positive relationship existed between Cost management practice and firm’s performance in the manufacturing organization using operating profit as proxy of profitability to measure firm’s performance. They concluded that cost reduction strategy with emphasis on the reduction of production overhead and Administrative overhead cost should be explored in other to achieve the profit maximization and wealth creation objective. Also the findings of Oyedokun et al. (2019) was in tandem with that of Oyerogba et al. (2014) using Net Profit after tax as a measure of profitability, it was confirm that there was a significant negative or inverse relationship between raw material cost and profit before tax of manufacturing companies in Nigeria. Hence their study concluded that cost control has a significant effect on the profitability of manufacturing firm. These findings were also further strengthened by the findings of Raymond, Nwokoby & Okoye (2015) confirming that significant effect exist between cost management, operating profit and earnings per share in Nigeria corporate firms. Thus they recommended that modern strategic cost management method should be adopted by Nigeria corporate firms for effective operations so as to ensure competitive advantages of these firms.

In support of this view, the work of Lasisi & Nuhu (2015) revealed that high cost of manufacturing overheads is the problem of manufacturing companies. This implies that manufacturing overhead costs must be controlled in manufacturing companies otherwise, the profitability and financial sustainability of such companies would be threatened. The position of Siyanbola & Raji (2013) is not different. Their work also confirmed that cost control has positive impact on the profitability of manufacturing industries. On the other hand, (Zabolotnny & Wasilewski, 2019). In their study on the concept of financial sustainability measurement consider more variables as measures of financial sustainability. They however, recognized profitability as one of the variable that is highly associated with organization’s financial sustainability. Furthermore, Raymond et al. (2016) concluded in their study that sustainability environmental cost has significant positive impact on performance of corporate organizations. Mamida & Akinola (2019) also confirmed that Cost Management in Manufacturing Companies have significant effect on Profits from production operation. They the concluded that having efficient Cost Management will significantly influence profitability.

Earnings Per Share as earlier discussed is the Portion of Business Earnings after tax and Preference Shareholder’s Dividend that is allocated or apportioned to each share of equity or ordinary shareholders. This was confirmed by Agha (2014) when stated that earnings per share provides the Net Profit Earned by a piece of Equity share. Thus earnings per share is directly related to business earnings or profit and therefore it is expected that all determinants of Profit particularly cost would have effect on Earnings Per Share. Generally, Earning Per Share (EPS) is considered as most important factor that determines share price and firm value. Hence, investors take their investment decisions based on (EPS) (Md et al., 2014).

Agha (2014) established that Earnings per share has positive and significant impact on Net Profit Margin and Return on Assets which are measures of Financial Performance of Organization. This was in tandem with the findings of Henry & Yellowe (2016) confirming that Earnings per share (EPS) has positive effect on return on investment and Net Profit Margin of quoted manufacturing firms. The findings of Mamidu & Akiola (2019) on Cost Management and Corporate Performance in quoted manufacturing companies also affirmed that Cost Management in Manufacturing Firms significantly impacts the profits from production operation. They concluded that efficient Management of Cost has significant influence on profitability. These position was in consonance with the finding of Raymond, Nwakoby & Okoye (2015) who discovered a significant effect between Cost Management, Operating Profit and Earnings per share. Hence, these findings are indications that manufacturing companies must adopt Cost Management strategies that are efficient enough for the firms to continue to have robust earnings that will ensure their Financial Sustainability.

The evidence from the study of Bessony et al. (2020) on the impact of Environmental Cost on Earnings Per Share was at Variance with economic apriori expectation on cost, while their findings revealed that oil spillage and gas flaring cost has no significant relationship with earnings per share as a result of the monopolistic nature of oil and gas Companies, they however, discovered that fines and penalties costs paid for oil spillage and gas flaring negatively affected the earnings Per Share which was in conformity with the economic apriori expectation. Hence, the finding is an indication of relationship between Cost and Earnings Per Share. Thus, effective management of cost is expected to positively impacts on such relationship. Simeon-Oke & Ologunwa (2016) established from the conclusion of their study that increases in Earnings Per Share is among dynamic factors that determine the performance of firms in Nigeria economy another factors noted by them include return on investment and Dividend Per Share.

Abdur (2018) noted three core areas of corporate finance to include financing decision, investment decision and dividend decision he further explained that in dividend decisions firms decide whether to retain earnings or pay it out as dividend to shareholders in form of cash or stock dividend based on firms’ dividend policies. They also decide if earnings must be retained, what quantum of earnings must be retained. Dividend is the basic profit or returns on the shareholders’ investment (Shehzad et al., 2015). As earlier mentioned in this study while Earnings Per Share measures companies’ profitability by determining amount of net income that is available for each outstanding share of a company, Dividend Per Share is the amount or quantum of the companies’ earnings paid or to be paid to each ordinary shareholder per share.

Like the case of Cost Management and Earnings per share in which we have dearth of studies, there is also death of literatures on Cost Management and Dividend per share. However, from the findings of (Raymond et al., 2015). Cost Management revealed significant effect on Operating Profits. This implies that Cost Management will also affect Dividend Per Share since there is relationship between operating profit, earnings per share and Dividend. In support of this position, Shehzad et al. (2015) confirmed the fact that there exists a significant effect of dividend payout ratio (DPR) which is the ratio of Dividend Per Share and Earnings per share on profitability. The findings of Thafani & Abdullah (2014) also supports the fact that there is a direct relationship between Dividend per share, Earnings Per Share and Profitability by confirming from the results of their study that a significant relationship exist between dividend payout ratio and corporate profitability measured in terms of Return on Assets, Return on Equity and Earnings Per Share. Henry & Yellowe (2016) confirmed that Dividend Payout Ratio has positive effect on the return on investment and net profit margin of manufacturing firm as measure of profitability.

In addition, Farrukh et al. (2017) found from their research that Dividend Policy measured by Dividend Per Share and Dividend Yield has a positive and significant impact on Shareholders Wealth measured by Earnings Per Share and Share Price and also has a significant impact on firms' performance in terms of Return on Equity. Additionally, the research by Abdur (2018) showed a negligible but favorable correlation between return on equity and dividend per share. Thus, it is implied that raising the dividend per share would boost the chosen companies' return on equity. Therefore, all cost of operations, including cost of sales, distribution and administrative costs, and finance costs, must be efficiently managed in order for manufacturing companies to sustain strong dividend payments that could guarantee adequate return on investment in order to attract investors and ensure financial sustainability.

Also from the empirical study of Adebawojo et al. (2022) on liquidity and solvency as measures of financial sustainability, it was confirmed that Cost Management significantly affected liquidity as a proxy of financial sustainability. This was supported by the findings of Adegbie & Adesanmi (2020) who noted that liquidity management has significant effect on corporate sustainability. Also the findings in the studies of Akinleye & Ogunleye (2019), Maina (2018) and that of Owolabi & Obida (2012) all supported this position. Futhermore, Adebawojo et al. (2022) confirmed that Cost Management has significant effect on Solvency of Nigeria manufacturing companies in term of Debt Ratio, Gearing Ratio an Interest Covered. Liquidity is the measure of an organization’s ability to meet its current financial commitment or obligations as they fall due without any interruption to the normal operations of the organization. It is determined by the ratio of current asset to current liability (Gichuki, 2014).

Furthermore, solvency unlike liquidity measures the financial stability of a firm in long-term (Zorn et al., 2018). It measures the financial stability of a firm to repay all its debts if all of the assets were to be sold. Variables that can be used in measuring solvency include Debts to Assets ratio, Equity to Assets ratio or Debt to Equity ratio (Gichuki, 2014). The work of Zorn et al. (2018) further explained that solvency indicates the viability of a firm after a financial adversity. That is, the ability to continue firm operations. This by extension to manufacturing companies would imply the viability of a manufacturing company after a financial disorder. That is, the ability of manufacturing company to continue operations. In support of this Ajibola et al. (2018) study on capital structure and financial performance of listed manufacturing firms in Nigeria confirmed from their findings that both long-term debt ratio and total debt ratio which are measures of solvency have significant positive relationship with the return on equity which is one of the variable that measures profitability. They also confirmed positive but insignificant relationship between short-term debt ratio and return on equity. Thus their study concluded that capital structure which is the combination of debt and equity used by a firm to finance its operations has a positive effect on companies’ financial performance. Also Ng’ang’a & Kibati (2016) in their study of determinants of financial sustainability concluded that capital structure was highly important to enhance financial sustainability of college. Hence, the conclusion of their study was in consonance with the view that the solvency of a firm would likely impact on her financial sustainability. In support of this Ashmarina et al. (2016) confirmed in their study that financial Leverage influences

Capital structure and also has great impact on financial sustainability of organization. In Russia, Wanguu & Kipkirui (2015) in their own study further confirmed that leverage has significant and positive relationship with profitability of cement manufacturing company in Kenya. Thus this submission implies that Leverage will have impact on financial sustainability. Its direct impact on profitability may affect financial sustainability on the long-run.

Gaps in the Study

Zabolotnyy & Wasilewki (2019) noted that there is a limited research on financial sustainability. From the review of literatures carried out so far, we noted that, the available research works on financial sustainability which is the dependent variable of this study, measured financial sustainability using either one or two factors like ROCE, ROA, NPM or EPS at a time to measure Financial Sustainability. This study considered such approach as weak. Hence, in order to bridge this gap, the study introduced additional factors or elements and used them in aggregate as combined variables for measuring financial Sustainability. We further noted that not many studies integrated Cost Management in the pursuit of Financial Sustainability.

Methodology

This empirical study employed an ex-post facto research design. The research population consisted of the 33 manufacturing companies in Nigeria that were listed on the Nigerian Stock Exchange as of December 2019 in the consumer products and industrial goods sectors. 20 out of the 33 companies that were categorized as manufacturers of consumer items made up the sample frame for this investigation. Using Purposive and Judgmental Sampling Techniques, the sample size was determined to be the 17 specific Foods and Beverage Manufacturing Companies that were included in the sample frame. The other three (3) of the twenty (20) businesses in the sample frame were not selected since they did not produce foods and beverages. These seventeen companies represented the study’s sample size. However, we observed that seven companies out of the seventeen did not have a complete set of published financial reports for the ten years under consideration 2010-2019. Hence, we isolated these seven companies from the sample size thus reducing the actual sample size of the study to ten Foods and Beverages Manufacturing companies. The statutory audit of the financial reports served as the foundation for the data's validity and reliability. Multiple Regression Model which is an inferential statistic was used to analyse the data for the study with the use of Stata a statistical analysis software.

Operationalization of the variables

Financial Sustainability (FS) = Y in terms of (y1, y2, y3, y4, y5, y6)

yi = Return on Capital Employed - ROCE

y2 = Net Profit Margin – NPM

y3 = Earnings Per share – EPS

y4 = Dividend per share =- DPS

y5 = Liquidity Ratio – LR

y6 = Solvency Ratio - SR

Cost Management =X in terms of:

x1 = cost of Sales (Material and Conversion Cost) CS

x2 = Distribution and Admin Costs (DA)

x3 = Finance Costs (FC)

x4 = Company Size (CZ) = Representing the Control Variable

X = x1, x2, x3, X4

Functional Relationship

Financial Sustainability (FS) is Y= f(CS, DA, FC) …….Equation 1 (Objective 1)

Introducing company size (Cz) as control variable for Financial Sustainability FS:

Then: Financial Sustainability (FS) is Y = f(CS, DA, FC, Cz) ……….Equation 1b

Since FS is Y = F(X)u

Then; Financial Sustainability (FS) which is Y=y1, y2, y3, y4, y5, y6

Cost Management (CM) which is X =x1, x2, x3, and x4 as Control Variable

Therefore, Y=x1, x2, x3 (Without Control Variable)

Financial Performance (FP) is y1+ y2+ y3+ y4

Financial Performance (FP) = f(CS, DA, FC) ……..Equation (Objective 2)

Model Specification

Model 1

Y = βo + β1 log CS +β2 log DA + β3 log FC+ u. For Financial Sustainability (FS). (No Control Variable)

Model 1b

Y = βo + β1 log CS +β2 log DA + β3 log FC+ β4 log CZ+u. For Financial Sustainability. (With Control Variable)

Model 2

FP = βo + β1 log CS +β2 log DA + β3 log FC+ u. For Financial Performance.

u = Error Level.

Results and Discussions

Test of Hypothesis One

Effect of Cost Management on Financial Sustainability of Quoted Manufacturing Companies in Nigeria.

Objective One: To evaluate the effect of cost management on the financial sustainability measured in terms of ROCE, NPM, EPS, DPS, LR and SR of quoted manufacturing companies.

Research Question One: How does cost management affect the financial sustainability in terms of the ROCE, NPM, EPS, DPS, LR and SR of publicly quoted Nigerian manufacturing companies?

Research Hypothesis one: Ho Cost Management does not significantly affect the financial sustainability in terms of the ROCE, NPM, EPS, DPS, LR and SR of publicly quoted Nigerian manufacturing companies.

By providing answers to research question one, we were able to achieve the objective one of this study. This was done by testing our hypothesis one with the use of Multiple Regression analysis which the results were shown in Tables 1 and 2.

| Table 1 Regression Table For The Effect Of Cost Management On Combine Variables Of Financial Sustainability Without Control Variables |

|||||||

|---|---|---|---|---|---|---|---|

| Source | Sum of Square ( SS) | DF | Mean Square (MS) |

F- Ratio | Sig | R Squared | Adjusted R2 |

| Model | 118545541 | 3 | 39515180.4 | 4.43 | 0.0058 | 0.1215 | 0.0941 |

| Residual | 856775723 | 96 | 8924747.12 | ||||

| Total | 975321265 | 99 | 9851729.95 | ||||

Source: Researcher’s Result (2020)

From the results of Multiple Regression Analysis presented in Tables 1 and 2, we established that Cost Management with or without control variable has significant effect on Financial Sustainability of quoted manufacturing companies in Nigeria. Table 1 shows that Cost Management without control variable has significant effect on Financial Sustainability at F-Statistics = 4.43 p-value = 0.0058, and Adjusted R-Squared = 0.0941. The Adjusted R—Squared of 0.0941 shows that the composition of cost management variables in financial sustainability without control variable is 9.41% while the balance of 90.59% is represented by factors not considered in this model.

On the other hand, Cost Management from Table 2, with total Asset as Control Variable also shows significant effect on Financial Sustainability at F-Statistics =3.41, p-value = 0.0119, and Adjusted R-Squared = 0.0887. The Adjusted R-Squared of 0.0887 shows that the composition of cost management variables in Financial Sustainability taken all variables together with the inclusion of control variable is 8.87% while the balance of 91.13% is represented by factors that were not considered in this model.

| Table 2 Regression Table For The Effect Of Cost Management On Combine Variables Of Financial Sustainability With Control Variable |

|||||||

|---|---|---|---|---|---|---|---|

| Source | Sum of Square (SS) | DF | Mean Square (MS) | F-Ratio | Sig | R Squared | Adjusted R2 |

| Model | 122378513 | 4 | 30594628.2 | 3.41 | 0.0119 | 0.1225 | 0.0887 |

| Residual | 85 2942752 | 95 | 8978344.76 | ||||

| Total | 975321265 | 99 | 9851729.95 | ||||

Source: Researcher’s Result (2020)

Decision

At an adopted significance level of 0.05, the F-Statistics is 4.43, while the p-value of F-Statistics is 0.0058 for financial sustainability without control variable Table 1. Also, the F-Statistics is 3.41 while the p-value of F-Statistics is 0.0119 for Financial Sustainability with control variable in Table 2. Since the p-values of both F-Statistics (Controlled and uncontrolled variables) are less than the adopted p-value of 0.05 the study rejected the null Hypothesis. This means that Cost Management has significant effect on Financial Sustainability with or without control variable. This implies that company size also determines the effect of Cost Management Strategies on Financial Sustainability of Manufacturing Organization Tables 3 & 4.

| Table 3 Parameter Of Estimate Of Relative Contribution Of Cost Management To Financial Sustainability Without Control Variable |

||||

|---|---|---|---|---|

| Model | Beta coefficient | Standard Error | T. value | Sig |

| Cost of Sales | 2399.386 | 904.0932 | 2.65 | 0.009 |

| Distribution and Administrative Expenses | -1731.231 | 879.9044 | - 1.97 | 0.052 |

| Finance Cost | -511.1906 | 212.3839 | -2.41 | 0. 018 |

| Constant | -2905.662 | 3723.4 23 | - 0 .78 | 0. 437 |

Source: Researcher’s Result (2020)

From Table 3 Cost management without control variables, the coefficient of Cost of Sales is 2399.393 which shows that a change of 1% is Cost of Sales without control variable will lead to Financial Sustainability which is significant at p-value of 0.009 and t-statistics of 2.65. The coefficient of Distribution and Administrative Expenses is -1731.236 which show that a change of 1% in Distribution and Administrative Cost variable will lead to a reduction of 1731.24 in Financial Sustainability. This is significant at p-value of 0.052 and t-statistics of -1.97. For Finance Cost (FC) the coefficient is -511.19078 which is an indication of the fact that a change of 1% in finance cost will lead to reduction of 511.19 in financial sustainability which is significant at p-value of 0.018 and t-value of -2.41. Thus the regression model for Financial Sustainability without control variable can be restated by inserting the coefficients of Cost Management variables in the Model as follows:

FS = -2905.677 + 2399.393CS - 1731.236DA – 511.1908FC (No control Variable)

Furthermore, Table 4 shows that the coefficient of Total Asset as control variable is-1335.234. This shows that a Change of 1% in Total Asset will lead to a negative growth in Financial Sustainability of 1335.23. This is not significant at p-value of 0.515 and t-Statistics of -0.65. For Cost of Sales, it has a coefficient of 3283.246 which means that a change of 1% in Cost of Sales with Control Variable will lead to 3283.25 increases in Financial Sustainability. This is significant at p-value of 0.047 and t-statistics of 2.02. Also, the coefficient of Distribution and Administrative cost is -1554.555 which shows that a change of 1% of Distribution and

| Table 4 Parameter Of Relative Contribution Of Cost Management To Financial Sustainability With Control Variable As Total Assets |

||||

|---|---|---|---|---|

| Variables | Co-efficient | Standard Error | T. value | Sig. |

| Total Assets | -1335.208 | 2043.522 | -0.65 | 0.515 |

| Cost of Sales | 3283.222 | 1628.525 | 2.02 | 0.047 |

| Distribution and Admin Expenses | -1554.55 | 923.0395 | - 1.68 | 0.095 |

| Finance Cost | -489.6573 | 215.555 | -2.27 | 0.025 |

| Constant | -550.6541 | 5190.169 | - 0.11 | 0.916 |

Source: Researcher’s Result (2020)

Administrative Cost will lead to a reduction of 1554.56 in overall Financial Sustainability. This is not significant at p-value of 0.095 and t-statics of 1.68. For Finance Cost with the Control Variable, the coefficient is -489.6566. This shows that a change of 1% in Finance Cost with control variable will lead to a reduction of 489.66 in overall Financial Sustainability. This is significant at p-value of 0.0025 and T-statistics of -2.27. Hence, the regression model for overall Financial Sustainability with Control Variable can be restated as follows

FS = -550.6541 + 3283.25CS + 1554.56DA – 489.66FC-1335.23CZ

Hence, the overall results implied that Financial Sustainability of manufacturing companies is highly sensitive to Cost Management in terms of Cost of Sales, Distribution and Administrative Expenses and Finance Cost. In the light of these findings deliberate efforts must be made by manufacturing companies to establish a robust system of Cost management that would ensure quality product at lowest Cost in order to ensure firms financial sustainability. The findings of this study was substantiated by Oyadonghan & Ramond (2014) who established that quality Cost Management practices affect profitability of firms. This implies that financial sustainability will also be affected since profitability is one of the variables that measures financial sustainability. In a similar manner Oyerogba et al. (2014) confirmed a positive significant relationship between Cost Management and performance of manufacturing organization. The finding of Siyanbola (2013), Mutya (2018), and Egbide et al. (2019) all corroborated the findings of this study.

Also with the introduction of total Assets as control variable, the results of the study consistently maintained significant effect of Cost Management on Financial Sustainability. It further revealed that Total Assets contributed significantly to Financial Sustainability. These were in tandem with the findings of Omar (2015) who concluded that firms size represented by logarithm of assets has significant relationship with the performance. To further substantiate this position, Akinyomi & Olayanju (2013) confirmed that firm size in terms of Total Assets and Total Sales have effect on the profitability of Nigeria Manufacturing Companies. The findings of other researchers like Maja & Josipa (2012), Omenyo & Muturi (2019) and Oyelade (2019) all supported the findings of this study. They all established that company size represented by either total assets or other variables significantly affect profitability or performance of organization. Hence, financial sustainability will also be affected since variables that measure performance also measures Financial Sustainability.

Test of Hypothesis Two

Effect of Cost Management on Financial Performance of Quoted Manufacturing Companies in Nigeria.

Objective Two: To ascertain the effect of cost management on financial performance in terms of return on capital employed (ROCE), Net Profit Margin (NPM), Earnings Per Share (EPS), and Dividend Per Share (DPS) of quoted manufacturing companies in Nigeria

Research Question Two: In what ways does cost management affect the financial performance in terms of the return on capital employed (ROCE), Net Profit Margin (NPM), Earnings Per Share (EPS), and Dividend Per Share (DPS) of publicly quoted Nigerian manufacturing companies?

Research Hypothesis Two: H0. Cost Management does not significantly affect the Financial Performance in terms of the Return on Capital Employed (ROCE), Net Profit Margin (NPM), Earnings Per Share (EPS), and Dividend Per Share (DPS) of publicly quoted Nigeria manufacturing companies.

By providing answers to research question two, we were able to achieve the objective two of this study. This was done by testing our hypothesis two with the use of Multiple Regression analysis which the results were shown in Table 5.

Regression Model for this hypothesis was FP= βo+β1 log CS+β2 log DA+ β3 Log FC +μ Where y1+y2+y3+y4 = FP

Log CS, Log DA and log FC were Cost of Sales, Distribution and Administrative Expenses, and Finance Costs which were variables of Cost Management respectively while β = coefficient of the variables.

The results presented in the Table 5 shows that costs of Sales, Distribution and Administrative Expenses and Finance Cost altogether have significant effect on the combined variables of financial performance measured by ROCE, NPM, EPS and DPS of manufacturing firms with F- Statistics = 5.11, p-value = 0.0025 and R2 of 0.1376. The Adjusted R2 of 0.1106 shows that the composition of Cost Management variables in Financial Performance measured in terms of these combined variable (ROCE, NPM, EPS and DPS) is 11.06% while the balance of 88.94% is represented by factors not considered in this model.

| Table 5 Table Of Regression Showing The Effect Of Cost Management On Combined Variables Of Financial Performance |

|||||||

|---|---|---|---|---|---|---|---|

| Source | Sum of Square (SS) | DF | Mean Square (MS) | F-Ratio | Sig | R2 | Adjusted R2 |

| Model | 5342.03978 | 3 | 1780.67993 | 5.11 | 0.0025 | 0.1376 | 0.1106 |

| Residual | 33481.4931 | 96 | 348.765563 | ||||

| Total | 38823.5329 | 99 | 392.156898 | ||||

Source: Researcher’s Study Result (2020).

Decision

At a level of significance of 0.05, the F- Statistics is 5.11, while the p-value of F-Statistics is 0.0025 which is less than 0.05 adopted level of significance. The study therefore rejected the null hypothesis. This means that Cost of Management has significant effect on Financial Performance when all variables of performance are aggregated and considered altogether.

The Table 6 shows the β value which is the coefficient of Cost of Sales (CS), Distribution and Administration Cost (DA) and Finance Cost (FC). It shows that the coefficient of Cost of Sales (CS) is -6.38531, which shows that a change of 1% in Cost of Sales will lead to a 6.3% decrease in Financial Performance. This is not significant at a p-value of 0.261 and t-Statistics of -1.13. The coefficient of Distribution and Administrative Cost from the table is 14.80469 which shows that 1% change in DA will lead to 14.8% increase in Financial Performance. It is significant at a p-value of 0.008 and t-Statistics of 2.69. The coefficient of finance cost is = 0.470284 which shows that 1% change in Finance Cost will lead to a increase in Financial Performance by 0.47% which is not significant at a p-value of 0.724 and t-Statistics of 0.35. Thus the Regression Model can be restated by substituting the coefficients of Cost Management Variables in the models as follows:

| Table 6 Parameter Of Estimate Of Relative Contribution Of Identified Variables Of Cost Management To Combined Variables Of Financial Performance |

||||

|---|---|---|---|---|

| Model | Beta coefficient | Standard Error | T -value | Sig |

| Cost of Sales | -6.38531 | 5.651738 | -1.13 | 0.261 |

| Distribution and Administrative expenses | 14.80469 | 5.500527 | 2.69 | 0.008 |

| Finance Cost | 0.470284 | 1.327671 | 0.35 | 0.724 |

| Constant | -47.39239 | 23.27615 | -2.04 | 0.044 |

Source: Researcher’s Study Result (2020)

FP = -47.39239 – 6.38531 CS + 14.80469 DA+ 0.470284FC.

This finding was supported by the findings of osazefua (2019) who studying operational efficiency and financial sustainability discovered that operating expenses had significant negative relationship with return on Asset (ROA) of manufacturing companies. Although Musah et al. (2019) in their study of the link between operational efficiency and financial performance, observed insignificant relationship among Return on Equity, Return on Capital Employed and Operational Efficiency of firms. It should be noted that Return on Asset (ROA) and Return on Capital Employed are measures of how efficiently organizations used their resources to generate profits. For manufacturing companies to improve their Return on Capital Employed (ROCE) or Return on Asset (ROA) so as to ensure improved Financial Performance, their Distribution and Administrative cost must be efficiently managed.

Also Oyedokun et al. (2019) and Oyerogba et al. (2014) using Net Profit as the only proxy of Financial Performanace all confirmed a significant relationship between Cost Management and Financial Performance which is in tandem with the position of this student. This position was further strengthened by Raymond, Nwokoby & Olaoye (2015) who noted in their study that Cost Managements significantly affected operating profit and earnings per share in Nigeria Corporate Firms. Furthermore, in support of the findings of this study Thafani Abdullah (2014) noted significant direct relationship among Dividend Per Share, Earnings Per Share and Profitability. Hence, this suggest that whatever factor that either of these variable of performance would also impacts on the others. Bessony et al. (2020) and Simeon-Oke (2016) were all in support of the findings of this study. Thus for manufacturing companies to improve their Financial Performance and remain competitive efficient cost management strategies most be adopted.

Implications of the Findings

We established from the results of this study that Cost Management significantly affects the Financial Sustainability and Financial Performance of Manufacturing Companies. This implies that:

1. Business Regulators like Government, Security Exchange Commission and Central Bank of Nigeria must collaborate to develop economic policies that will positively impact and reduce the cost of operations of manufacturing companies in Nigeria. This will reduce financial distress and corporate failures among Nigeria Manufacturing Companies

2. There is need to further strengthened the Practice of Accounting and Corporate Financial reporting within the Nigeria Manufacturing companies. The Professional Accountants particularly those working in Manufacturing Companies must leave up to their professional callings by ensuring adequate financial disclosures and detailed analysis of operational costs are given in financial reports to ensure organizations make decisions that are cost effective decisions in order to improve profitability, liquidity, and long-term financial strength.

3. The results of this study is an indication to the investors and stakeholders of manufacturing companies in Nigeria that effective Cost Management Process would impact on Financial Performance of the companies in terms of ROCE, NPM, EPS, and DPS. This ultimately guides the decions of investors and stakeholders.

Conclusion and Recommendations

Based on the empirical findings of this study and the results of the hypotheses tested, we concluded in this study that, Cost Management in terms of Cost of Sales, Distribution and Administrative Costs and Cost of Finance impacts significantly on the combined variables of Financial Sustainability of manufacturing companies in Nigeria in terms of ROCE, NPM, EPS, DPS, LR and SR. We also concluded that Cost Management has signifinantly affects combined variables of Financial Performace in terms of ROCE, NPM, EPS an DPS. In the light of these we therefore recommend that Management of Manufacturing Companies reviews Cost Management Strategies in order to identify and adequately manage all cost drivers within their operations. This will ensure low cost of operations and enhance organizations profitability, liquidity, as well as solvency which ultimately enhance Financial Sustainability and Financial Performance.

Contribution to Future Research

By filling up the gaps in the body of knowledge regarding cost management and the financial sustainability of manufacturing companies, this study has added to our knowledge and broadened the academic conversation. It demonstrated how each variable of Financial Sustainability and Financial Performance is impacted by Cost Management and consequently, the impact on the financial health of Manufacturing Companies in Nigeria.

References

Adebawojo O.A,, Adegbie, F.F., & Adebawo, O.O. (2022). Cost management and financial sustainability: Evaluating its effect on liquidity and solvency of manufacturing companies, Academy of Accounting and Financial Study Journal, 26 (3),1-16.

Adegbie, F.F., & Adesanmi, T. (2020). Liquidity Management and corporate sustainability of listed oil and gas companies: Empirical Evidence from Nigeria, European Journal of Accounting, Auditing and Finance Research 8 (8),30-72.

Adeniji, A.A. (2002). Simplified management accounting (1st ed.). Lagos: Value Analysis Consult.

Agha A.N. (2014). Earnings per share impact on non-financial firms Performance, Journal of Economic Info, 1(4), 1-7.

Indexed at, Google Scholar, Cross Ref

Ajibola, A., Wisdom, O., & Qudus, O.L. (2018). Capital structure and financial performance of listed manufacturing firms in Nigeria, Journal of Research in International Business and Management, 5(1), 81-89.

Indexed at, Google Scholar, Cross Ref

Akinleye, G.T., & Ogunleye, J.S. (2019). Liquidity and the profitability of manufacturing firms in Nigeria, Applied Finance and Accounting, 5(2), 68-73.

Indexed at, Google Scholar, Cross Ref

Akinyomi, O.J., & Olagunju, A. (2013). Effect of firm size on profitability: Evidence from Nigerian manufacturing sector, Prime Journal of Business and Management, 3(9), 1171-1175.

Ashmarina, S., Zotova, A., & Smolina, E. (2016). Implementation of financial sustainability in organizations through valuation of financial leverage effect in Russian practice of financial management, International journal of environmental & science education, 11(10), 3775-3782.

Ayayi, A.G., & Sene, M. (2010). What drives microfinance institutions financial sustainability, The Journal of Developing Areas, 44 (1), 303-324.

Indexed at, Google Scholar, Cross Ref

Bala, S. (2013). Accountancy 2203 review workshop. Retrieved from: https://www.slideserve.com/alissa/accountancy-2203-review-workshop-sindhu-bala Sepetember 29, 2020.

Bazot, G. (2018). Financial consumption and the cost of finance: Measuring financial efficiency in Europe (1950–2007), Journal of the European Economic Association, 16(1), 123-160.

Indexed at, Google Scholar, Cross Ref