Research Article: 2019 Vol: 23 Issue: 3

Corporate Social Responsibility Disclosure Mediates the Relationship between Corporate Governance and Corporate Financial Performance in Indonesia

Nera Marinda Machdar, Institute Teknologi dan Bisnis Kalbis

Abstract

The purpose of this study is to analyze the mediating effect of corporate social responsibility disclosure on the relationship between corporate governance, and corporate financial performance in Indonesia. Specifically, this study analyzes the impact of corporate governance on corporate social responsibility disclosure in Indonesia. Moreover, this study investigates the influence of corporate governance on corporate financial performance in Indonesia. Furthermore, this study also examines the effect of corporate governance on corporate financial performance through the effect of corporate social responsibility disclosures in Indonesia. This study utilizes the companies that are included in the LQ45 Index listed on the Indonesia Stock Exchange as an analysis unit with the study period during 2011-2017. The results show that (a) the corporate governance does not affect the corporate social responsibility disclosure in Indonesia, (b) the corporate governance affects the corporate financial performance in Indonesia, and (c) the corporate governance does not affect the corporate financial performance through the corporate social responsibility disclosure in Indonesia. This study has an implication from a theoretical perspective, i.e. corporate governance provides positive benefits to corporate financial performance, in particular institutional ownership and board of directors. Then, corporate social responsibility disclosure does not mediate the relationship between corporate governance and the corporate financial performance in Indonesia. Moreover, this study has significant managerial implications for standard makers to formulate policies to encourage compliance with companies that are required to disclose corporate social responsibility so that entities are more responsive to social interests. This is because the activities of corporate social responsibility disclosure have a very important role in meeting the interests of stakeholders in the company's long-term needs. In addition, the corporate social responsibility disclosure is an affirmation of corporate image differentiation that gets legitimacy from both the government and society. Furthermore, the implication for regulators is that the conditions of corporate social responsibility disclosure are still very low in Indonesia, so the resilience of corporate governance elements is needed.

Keywords

Corporate Governance, Corporate Financial Performance, Corporate Social Responsibility Disclosure.

JEL Classification

G30, G34, M14

Introduction

The fraudulent scandal of large companies leaves deep scars in the business world. The increase in fraudulent scandals has caused investors' confidence in the capital market to be shaken. As a result, authorities require corporations to adhere to the code of best corporate governance practices to promote transparency, accountability and fairness for stakeholders. Stakeholders demand that company management be efficient and effective, and strong social commitment to regain lost trust is a consequence of the growing spiral of business scandals (Ferrero, 2013). Corporate governance is an effective, transparent and accountable order for companies that are adhered to by management that has the principle of carrying out corporate social responsibility such as social facilities and compensation to community members (Opusunju & Ajayi, 2016). Corporate social responsibility and corporate governance focus on ethical practices in business and reciprocity to stakeholders and the environment in which the company operates (Verma & Kumar, 2012). Corporate governance is a very effective tool to protect the interests of stakeholders. Corporate governance is expected to improve the implementation of corporate social responsibility disclosure and to maximize company value (Gul et al., 2017).

Organizations operating in a network of different stakeholders can influence the organization directly or indirectly, so management's ability to manage corporate social activities lead to withdrawal of support and side effects that have an impact on corporate financial performance (Arshad et al., 2012). Corporate financial performance as measured by Return on Equity (ROE). ROE illustrates the company's ability to manage funds from shareholders and to measure the success rate of a corporate business (Machdar, 2018). The deep concern for corporate social responsibility in the past few decades stems from the rapid globalization and international trade, which is reflected in the increase in business complexity and new demands for increased transparency and nationalization of companies (John et al., 2013). Corporate social responsibility is a concept that has caught the world's attention and gained new significance in the global economy (Akinyomi, 2013). Corporate social responsibility is a complex field and has many guiding standards, so the selection of standards depends on the economic, legal, and environmental conditions of each country (Ta & Bui, 2018). In developed countries, corporate social responsibility disclosure has long attracted the attention of stakeholders. Meanwhile, corporate social responsibility disclosure in developing countries including Asian countries, especially in Indonesia is still low (Loh et al., 2016; Moon & Chapple, 2005).

Most empirical studies focus on the effects of corporate social responsibility disclosure on corporate financial performance, but the number of studies examining the role of corporate social responsibility disclosure as a mediation between corporate governance and corporate financial performance is relatively small, among others, carried out by Haniffa and Cooke (2002). This shows an important gap in the previous literature. To fill this gap, this study proposes an integrated model to explain how corporate governance influences corporate financial performance both directly and indirectly through the influence of corporate social responsibility disclosure. The purpose of this study is to analyze the mediating effect of corporate social responsibility disclosure on the relationship between corporate governance, and corporate financial performance in Indonesia. Specifically, this study analyzes the impact of corporate governance on corporate social responsibility disclosure in Indonesia. Moreover, this study investigates the influence of corporate governance on corporate financial performance in Indonesia. Furthermore, this study also examines the effect of corporate governance on corporate financial performance through the effect of corporate social responsibility disclosures in Indonesia.

Literature Review And Hypothesis Development

Agency Theory

The agency relationship occurs when there is a contract between management as an agent and owner as for principal (Jensen & Meckling, 1976). Management as an agent has more information than the shareholder as the owner. This raises the possibility that agents act more selfish than the interests of shareholders. Agency theory is a conception that considers that company management as an agent for shareholders who will act with full awareness for their own interests, not as a wise and fair party to the interests of shareholders (Suprayitno et al., 2005). Corporate social responsibility reflects the main agent relationship between top management and shareholders (Barnea & Rubin, 2010). Top management must have a concern to invest in social responsibility, engage in activities to get benefits by building a reputation as good and socially responsible citizens at shareholder costs.

Stakeholder Theory

Stakeholder theory comes from a combination of sociological and organizational disciplines (Wheeler et al., 2003). Stakeholder theory as any group or individual that can influence or what is influenced by the achievement of organizational goals. Stakeholder theory tries to deal with stakeholder groups that are appropriate and need management attention (Sundaram & Inkpen, 2004). Stakeholder support is very influential on the existence of a company so stakeholders can influence the disclosure of information in a company's financial statements. The relationship between disclosure of corporate social responsibility and corporate financial performance depends on other factors such as stakeholder strength and management strategy (Ullmann, 1985). Stakeholder theory based on managing stakeholder interests and does not only describe the situation or predict causality (Donaldson & Preston, 1995). Stakeholders provide negative responses from investors in the form of pressure, sanctions from regulators, abandonment of co-workers, boycotts from activists, and negative news media (Prior et al., 2008).

Legitimacy Theory

According to legitimacy theory, organizations continue to look for ways to ensure organizations operate within predetermined limits and carry out socially anticipated actions in return for achieving goals, and ensure survival and other forms of compensation (Manokaran et al., 2018). Legitimacy gaps occur when organizational performance is not equal to the anticipation of relevant stakeholders (Muwazir, 2011). Substantial economic and social changes have resulted in accelerated public awareness rising to intensify issues such as corporate social impact on communities (Manokaran et al., 2018).

Corporate Social Responsibility Disclosure in Indonesia

The Indonesian government is also very committed to corporate social responsibility initiatives over the past few years. In Indonesia, the government has determined that companies have an obligation to engage in social and environmental responsibility, especially in companies that carry out business activities in the natural resources sector and / or in related sectors. This is regulated in Law No. 40/2007 Article 74 concerning Limited Liability Company Companies. Companies in this category are obliged to allocate funds for the implementation of corporate social responsibility and the allocated funds are considered as operational costs of the company. In addition, companies are permitted to treat corporate social responsibility expenditures as costs in accounting. Although it is mandatory, attention to corporate social responsibility and sustainable development in general is currently limited to large and international Indonesian companies. Even though corporate social responsibility is mandatory, it does not require changes in company behavior. The level of disclosure of social responsibility in Indonesia is still very low, among others, confirmed by Loh et al. (2016), and Moon & Chapple (2005).

Hypotheses Development

The purpose of corporate governance is to gain a competitive advantage in a free market economy (Makki & Lodhi, 2014). Corporate governance encourages entrepreneurial innovation that enables organizations to better utilize the future economic opportunities (Wanyama & Olweny, 2013). This research uses institutional ownership, managerial ownership and the board of directors as proxy for corporate governance. Institutional ownership relates to banks, companies, insurance companies, retirement cooperatives within the company (Chang & Zhang, 2015). Institutional ownership has an important role in monitoring management actions so that the supervision carried out is expected to be more optimal. Managerial ownership is share ownership by directors or senior management in a company (Chang & Zhang, 2015). It is expected to encourage companies to do more complete social responsibility disclosures. The board of directors carries out tasks and makes decisions in accordance with the division of tasks and authority (Majeed et al., 2015).

Chang & Zhang (2015) concluded that firms that have institutional ownership significantly and positively influence voluntary environmental information disclosure, but managerial ownership is not significant and negative for voluntary environmental information disclosure. Ali & Atan (2013) argued that institutional ownership has a positive effect on the disclosure of corporate social responsibility and the size of the board of commissioners has a positive effect on the disclosure of corporate social responsibility. Uwuigbe (2011) found that the influence of managerial ownership was significantly positive on the level of corporate social responsibility disclosure. The more boards of directors, the more disclosure of corporate social responsibility, and this encourages increased investment activities (Majeed et al, 2015). Ali and Attan (2013) also state that companies that have more members of the board of directors will find it easier to communicate and coordinate corporate social responsibility disclosures. Therefore, this study proposes the following hypotheses:

H1: Corporate governance has a positive effect on corporate financial performance.

H1a: Institutional ownership has a positive effect on corporate financial performance.

H1b: Managerial ownership has a positive effect on corporate financial performance.

H1c: Board of Directors has a positive effect on corporate financial performance.

Several previous studies have resulted that institutional ownership has a positive impact on company performance (Herdjiono & Sari, 2017; Al-Ghamdi & Rhodes, 2015; Ahmad & Jusoh, 2014; Fazlzadeh et al., 2011; Coles et al., 2008). Managerial ownership influences company performance Din & Javid, 2011 but Herdjiono & Sari, 2017 find that managerial ownership does not affect company performance. Furthermore, the board of directors has a positive impact on company performance (Al-Ghamdi & Rhodes, 2015; Fauzi & Locke, 2012). Therefore, this study proposes the following hypotheses:

H2: Corporate governance has a positive effect on corporate social responsibility disclosure.

H2a: Institutional ownership has a positive effect on corporate social responsibility disclosure.

H2b: Managerial ownership has a positive effect on corporate social responsibility disclosure.

H2c: Board of Directors has a positive effect on corporate social responsibility disclosure.

Corporate social responsibility disclosure becomes a signal of management to stakeholders including prospective shareholders regarding the future prospects of the company and provides added value held by the company on the economic, social and environmental impacts arising from the activities and operations of the company (Dias et al., 2017). Corporate social responsibility disclosure has a positive effect on corporate financial performance (Ta & Bui, 2018; Kapadia, 2017; Lungu et al., 2011). The effect of corporate social responsibility disclosure on corporate financial performance varies with different types of industries (Lin, Chang & Dang, 2015). The wider the disclosure of social responsibility the better the corporate financial performance (Nawaiseh, 2015). Therefore, this study proposes the following hypothesis:

H3: Corporate social responsibility has a positive effect on corporate financial performance.

Companies with high institutional ownership lead to increased corporate social responsibility disclosure, so institutional investors invest in this company (Wahba & Elsayed, 2015). Likewise, companies that have high managerial ownership make complaints of broader social responsibility compared to companies with low managerial ownership (Chang & Zhang, 2015). The more boards of directors, the more complaints of socially responsible councils that receive so much investment assistance (Muktar et al., 2017; Hapsoro & Fadhilla, 2017; Majeed et al, 2015; Ali & Attan, 2013). Based on the explanation above, this research proposed the following hypotheses:

H4: Corporate social responsibility disclosure mediates the relationship between corporate governance and corporate financial performance.

H4a: Corporate social responsibility disclosure mediates the relationship between institutional ownership and corporate financial performance

H4b: Corporate social responsibility disclosure mediates the relationship between managerial ownership and corporate financial performance.

H4c: Corporate social responsibility disclosure mediates the relationship between board of director and corporate financial performance.

Research Method

The population in this study are companies that are included in the LQ45 Index listed on the Indonesia Stock Exchange (IDX) during 2011-2017. The LQ45 index consists of 45 of the most liquid and most active selected companies in selling their shares on the Indonesia Stock Exchange. Companies consist of various types of sectors with high capitalization and good performance are expected to make corporate social responsibility disclosure consistent and complete. The sample selection method uses a purposive sampling method and produces a sample of 36 companies with a number of firm-year observations 252.

The dependent variable in this study is return on equity (ROE). ROE is a ratio that is useful to describe the company's ability to manage funds obtained from shareholders to generate profits (Ross et al., 2013). ROE is obtained by dividing the company's net profit by the company's total equity. The independent variable is corporate governance that is measured by institutional ownership, managerial ownership and the board of directors. Institutional ownership is the proportion of shareholders in a company owned by an institution that does not have a special relationship with the company (Chang & Zhang, 2015). It is obtained by dividing the amount of institutional ownership by the number of shares outstanding (Majeed, et al., 2015). Managerial ownership consists of shareholders owned by directors, management, commissioners and every party who has authority in making and making decisions. It is counted by dividing the amount of managerial ownership by the number of shares outstanding (Majeed, et al, 2015). The board of directors is a corporate organ that is responsible for regulating, controlling, managing and monitoring effective standards of activity in the company so that it runs in accordance with the vision and mission of all parties (Hapsoro & Fadhilla, 2017). The size of the board of directors is calculated based on the number of members of the company's board of directors every year (Hapsoro & Fadhilla, 2017).

The intervening variable is corporate social responsibility disclosure. The measurement of corporate social responsibility disclosure uses content analysis that focuses on relationships with employees, involvement with communities, products and the environment (Saleh et al., 2010). Corporate social responsibility disclosure is obtained by dividing the number of disclosures in the company's financial statements with the number of disclosure items (Saleh, et al, 2010). The assessment of each disclosure item is determined to be three qualities from the quantitative classification of disclosures, namely:

1. The largest weighted quantitative disclosure has a value of 3.

2. Specific qualitative disclosures with certain information have a value of 2.

3. Qualitative disclosures with general information have a value of 1.

4. Companies that do not disclose information have a value of 0.

For instance, Appendix A presents the result of corporate social responsibility disclosure score of the company. The list of companies included in the study and number of corporate social responsibility disclosure items disclosed of each company can be seen in Appendix B.

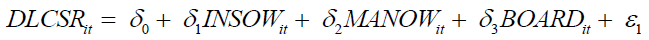

This research model consisted of 2 analyzes. The first analysis examines the effect of corporate governance on corporate financial performance, while the second analysis examines the effect of corporate governance on corporate financial performance through corporate social responsibility disclosure. The research model used to test the research hypothesis is as follows:

(1)

(1)

(2)

(2)

Description: DLCSRit=Corporate social responsibility disclosure firm i in year t; FINCORit=Corporate financial performance firm i in year t; INSOWit=Institutional ownership firm i in year t; MANOWit=Managerial ownership firm i in year t; BOARDit =Board of director firm i in year t; ?it=Error firm i in year t; δ=Constants.

Results And Discussion

Descriptive Statistics Test Results

Table 1 presents descriptive statistics for all the variables used in this study. The corporate financial performance (FINCOR) and institutional ownership (INSOW) have the average value greater than standard deviation value. This indicates that corporate financial performance and institutional ownership in most of the sample companies varies considerably. The managerial ownership (MANOW) has a standard deviation value greater than the average value. This indicates that the managerial ownership of the sample does not have a considerable variation. The board of director (BOARD) and corporate social responsibility disclosure (DLCSR) have slightly higher differences for the mean values compared to the standard deviation values. This means that the board and corporate social responsibility disclosure in most of the sample companies do not have variation.

| Table 1: Descriptive Statistics | |||||

| N | Minimum | Maximum | Mean | Standard Deviation | |

| INSOW | 252 | 0.0000 | 2.4507 | 0.3743 | 0.3533 |

| MANOW | 252 | 0.0000 | 0.1864 | 0.0076 | 0.0282 |

| BOARD | 252 | 2.0000 | 11.0000 | 6.2540 | 1.9817 |

| DLCSR | 252 | 0.8300 | 9.1700 | 5.0477 | 2.1347 |

Description: FINCOR= Corporate financial performance; INSOW=Institutional ownership; MANOW= Managerial ownership; BOARD=Board of director; DLCSR=Corporate social responsibility disclosure

Analysis of Research Results

Table 2 presents the result of the effect of corporate governance on corporate social responsibility. It can be seen that institutional ownership has t-statistics -2.0370 (negative direction) with a significance value of 0.043. It shows that institutional ownership does not affect corporate social responsibility disclosure. Therefore, hypothesis 1a is rejected. This result is not in line with the finding of Chang & Zhang (2015), and Ali & Atan (2013) that argue institutional ownership has a positive effect on corporate social responsibility disclosure. Whereas managerial ownership has t-statistics 1.670 (positive direction) with a significance value of 0.096, and it means that managerial ownership affects corporate social responsibility disclosure. Therefore, hypothesis 1b is accepted. This result is in line with the finding of Uwuigbe (2011) that found the influence of managerial ownership was significantly positive on the level of corporate social responsibility disclosure. Moreover, the board has t-statistics 4.556 (positive direction) with a significance value of 0.000. This indicates that board has a positive effect on corporate social responsibility disclosure. Therefore, hypothesis 1c is accepted. This result is in line with the finding of Ali & Atan (2013) that argue the size of the board of commissioners has a positive effect on corporate social responsibility disclosure. Based on the result of managerial ownership and board of director, it can be concluded that corporate governance has a positive effect on corporate social responsibility disclosure. It means that hypothesis 1 is accepted. In other word, corporate governance encourages increased investment activities (Majeed, et al., 2015) and easy to communicate and coordinate corporate social responsibility disclosures (Ali & Attan, 2013).

| Table 2: The Direct Effect Of Corporate Governance And Corporate Social Responsibility Disclosure | |||||

| Variable | Predicted Sign | Coefficient | t-Statistic | Prob. | Sig. |

| Dependent Variable: DLCSR | |||||

| INSOW | + | -0.7430 | -2.0370 | 0.0430 | |

| MANOW | + | 7.6120 | 1.6700 | 0.0960 | *) |

| BOARD | + | 0.2960 | 4.5560 | 0.0000 | ***) |

| R2 | 0.1060 | ||||

| Adjusted R2 | 0.0950 | ||||

Description: FINCOR= Corporate financial performance; INSOW=Institutional ownership; MANOW= Managerial ownership; BOARD=Board of director; DLCSR=Corporate social responsibility disclosure. ***<1%, **<5%, *<10%.

Table 3 presents the result of the effect of corporate governance on corporate financial performance. It can be seen that institutional ownership has t-statistics 5.347 (positive direction) with a significance value of 0.000. It shows that institutional ownership has a positive effect on corporate financial performance. Therefore, hypothesis 2a is accepted. This result is in line with the finding of Herdjiono & Sari (2017); Al-Ghamdi & Rhodes (2015); Ahmad & Jusoh (2014); Fazlzadeh, et al. (2011) and Coles, et al (2008) that institutional ownership has a positive impact on corporate financial performance. Whereas managerial ownership has t-statistics -1.169 (negative direction), and it means that managerial ownership does not affect corporate financial performance. Therefore, hypothesis 2b is rejected. This result is in line with the result of Herdjiono & Sari (2017) and Din & Javid (2011) that managerial ownership does not affect company performance. Moreover, the board of director has t-statistics 2.147 (positive direction) with a significance value of 0.033. This indicates that board of director has a positive effect on corporate financial performance. Therefore, hypothesis 2c is accepted. This result is in consistent with the finding of Al-Ghamdi & Rhodes (2015), and Fauzi & Locke (2012) that the board of directors has a positive effect on corporate financial performance. Based on the result of institutional ownership and board of director, it can be concluded that corporate governance has a positive effect on corporate financial performance. It means that hypothesis 2 is accepted. In other word, corporate governance is a tool to encourage the motivation of managers to increase corporate financial performance.

| Table 3: The Direct Effect Of Corporate Governence And Corporate Financial Performance | |||||

| Variable | Predicted Sign | Coefficient | t-Statistic | Prob. | Sig. |

| Dependent Variable: FINCOR | |||||

| INSOW | + | 0.2160 | 5.3470 | 0.0000 | *** |

| MANOW | + | -1.1690 | -2.3260 | 0.0210 | |

| BOARD | + | 0.0160 | 2.1470 | 0.0330 | ** |

| DLCSR | + | 0.0140 | 1.9680 | 0.0500 | ** |

| R2 | 0.1370 | ||||

| Adjusted R2 | 0.1230 | ||||

Description: FINCOR= Corporate financial performance; INSOW=Institutional ownership; MANOW= Managerial ownership; BOARD=Board of director; DLCSR=Corporate social responsibility disclosure. ***<1%, **<5%, *<10%.

Moreover, corporate social responsibility disclosure has t-statistics 1.968 (positive direction) with a significance value of 0.050. This indicates that corporate social responsibility disclosure has a positive effect on corporate financial performance. It means that hypothesis 2 is accepted. This result is in line with the result of Ta & Bui (2018), Kapadia (2017), and Lungu, et al (2011) that corporate social responsibility disclosure has a positive effect on corporate financial performance.

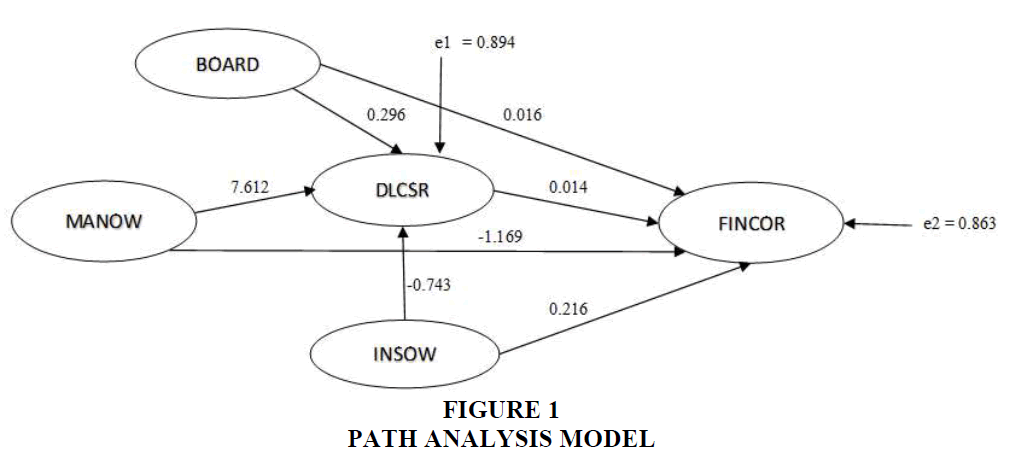

The results of calculations from Tables 2, 3 and 4 can be summarized in Figure 1 which presents a path analysis model.

| Table 4: The Direct, Indirect, And Total Effect | ||||||

| Variable | Coefficient Direct Effect | Coefficient Indirect Effect | Total Effect | t-Stat | t-table | Result |

| INSOW-DLCSR-FINCOR | 0.2160 | -0.0104 | 0.2056 | -0.0240 | 2.0395 | No mediating effect |

| MANOW-DLCSR-FINCOR | -1.1690 | 0.1066 | -1.0624 | 0.0230 | 2.0395 | No mediating effect |

| BOARD-DLCSR-FINCOR | 0.0160 | 0.0041 | 0.0201 | 0.0084 | 2.0395 | No mediating effect |

Description: FINCOR= Corporate financial performance; INSOW=Institutional ownership; MANOW= Managerial ownership; BOARD=Board of director; DLCSR=Corporate social responsibility disclosure.

Table 4 presents the coefficient of direct, indirect and total effect of corporate governance on corporate financial performance through corporate social responsibility disclosure. T statistic INSOW-DLCSR-FINCOR is smaller than t table (-0.0240 <2.0395). It means that hypothesis 4a is rejected. This indicates that corporate social responsibility disclosure does not mediate the relationship between the institutional ownership and the corporate financial performance. Then, T statistic MANOW-DLCSR-FINCOR is smaller than t table (0.0230 <2.0395). It means that hypothesis 4b is rejected. This indicates that corporate social responsibility disclosure does not mediate the relationship between the managerial ownership and the corporate financial performance. Moreover, T statistic BOARD-DLCSR-FINCOR is smaller than t table (0.0084 < 2.0395). It means that hypothesis 4c is rejected. This indicates that corporate social responsibility disclosure does not mediate the relationship between the board of director and the corporate financial performance. Therefore, hypothesis 4 is rejected. It means that all of corporate governance variables do not affect corporate financial performance through corporate social responsibility disclosure. It can be concluded that corporate social responsibility disclosure does not mediate the relationship between corporate governance and the corporate financial performance.

Conclusion

The purpose of this study is to analyze the mediating effect of corporate social responsibility disclosure on the relationship between corporate governance, and corporate financial performance in Indonesia. Specifically, this study analyzes the impact of corporate governance on corporate social responsibility disclosure in Indonesia. Moreover, this study investigates the influence of corporate governance on corporate financial performance in Indonesia. Furthermore, this study also examines the effect of corporate governance on corporate financial performance through the effect of corporate social responsibility disclosures in Indonesia.

The findings of this study as follows:

1. Corporate governance has a positive effect on corporate financial performance.

2. Corporate social responsibility disclosure has a positive effect on corporate financial performance.

3. Corporate social responsibility disclosure does not mediate the relationship between corporate governance and corporate financial performance.

This study has an implication from a theoretical perspective, i.e. corporate governance provides positive benefits to corporate financial performance, in particular institutional ownership and board of directors. Then, corporate social responsibility disclosure is not an intervening variable of the effect of corporate governance on corporate financial performance. Moreover, this study has significant managerial implications for standard makers to formulate policies to encourage compliance with companies that are required to disclose corporate social responsibility so that entities are more responsive to social interests. This is because the activities of corporate social responsibility disclosure have a very important role in meeting the interests of stakeholders in the company's long-term needs. In addition, the corporate social responsibility disclosure is an affirmation of corporate image differentiation that gets legitimacy from both the government and society. Furthermore, the implication for regulators is that the conditions of corporate social responsibility disclosure are still very low in Indonesia, so the resilience of corporate governance elements is needed.

This study has a limitation in term of utilizing a content analysis method. It is subjective by the researcher and can provide interpretative errors. Second, this study focuses only on CSR index to measure corporate social responsibility disclosure. The future study is expected to be able to utilize other variables to find an estimate of the standard model of corporate social responsibility disclosure, such as the Global Reporting Initiavives (GRI). Third, this study does not include control variables in analyzing the data so that the results of the adjusted R square are quite low. It is better for future research to consider variables such as company size, industry type, company age, and risk level as control variables to analyze the mediating effect of corporate social responsibility disclosure on the relationship between corporate governance and corporate financial performance

| Appendix A: PT Astra Agro Lestari Tbk | ||||||||||||||

| No. of items displayed | ||||||||||||||

| Year | 2011 | 2012 | 2013 | 2014 | 2015 | 2016 | 2017 | |||||||

| CSR activity | 1 | 2 | 1 | 2 | 1 | 2 | 1 | 2 | 1 | 2 | 1 | 2 | 1 | 2 |

| 1. Employee relation | ||||||||||||||

| 1. Employee Health and Safety | 0 | 0 | 0 | 0 | 1 | 1 | 1 | 3 | 1 | 3 | 1 | 3 | 1 | 3 |

| 2. Training and Education | 0 | 0 | 0 | 0 | 1 | 2 | 1 | 3 | 1 | 1 | 1 | 1 | 1 | 1 |

| 3. Employees benefits | 1 | 1 | 1 | 1 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| 4. Employees Profile | 0 | 0 | 0 | 0 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 |

| 5. Share option for employees | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| 6. Health and Safety Award | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| Subtotal of disclosure (a) | 1 | 1 | 4 | 7 | 5 | 5 | 5 | |||||||

| Sub-CSRD score (a:6) | 0.17 | 0.17 | 0.67 | 1.17 | 0.83 | 0.83 | 0.83 | |||||||

| 2. Community involvement | ||||||||||||||

| 1. Cash donation program | 1 | 3 | 1 | 3 | 1 | 3 | 1 | 3 | 1 | 3 | 1 | 3 | 1 | 3 |

| 2. Charity program | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| 3. Scholarship program | 1 | 3 | 1 | 3 | 1 | 3 | 1 | 3 | 1 | 3 | 1 | 3 | 1 | 3 |

| 4. Sponsor for sport activities | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| 5. Supporting national pride | 1 | 2 | 1 | 2 | 1 | 2 | 1 | 3 | 1 | 3 | 1 | 3 | 1 | 3 |

| 6. Public project | 1 | 2 | 1 | 2 | 1 | 3 | 1 | 3 | 1 | 3 | 1 | 3 | 1 | 3 |

| Subtotal of disclosure (b) | 10 | 10 | 11 | 12 | 12 | 12 | 12 | |||||||

| Sub-CSRD score (b:6) | 1.67 | 1.67 | 1.83 | 2 | 2 | 2 | 2 | |||||||

| 3. Product | ||||||||||||||

| 1. Product development | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 1 | 2 | 1 | 2 | 1 | 2 |

| 2. Product safety | 0 | 0 | 0 | 0 | 1 | 3 | 1 | 3 | 1 | 3 | 1 | 3 | 1 | 3 |

| 3. Product quality | 0 | 0 | 0 | 0 | 1 | 2 | 1 | 2 | 1 | 2 | 1 | 2 | 1 | 2 |

| 4. Customer services | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| Subtotal of disclosure © | 0 | 0 | 5 | 5 | 7 | 7 | 7 | |||||||

| Sub-CSRD score (c:4) | 0 | 0 | 1.25 | 1.25 | 1.75 | 1.75 | 1.75 | |||||||

| 4. Environment | ||||||||||||||

| 1. Pollution control | 1 | 1 | 1 | 1 | 1 | 3 | 1 | 3 | 1 | 2 | 1 | 2 | 1 | 2 |

| 2. Prevention or reparation program | 1 | 3 | 1 | 3 | 1 | 3 | 1 | 3 | 1 | 3 | 1 | 3 | 1 | 3 |

| 3. Conservation and recycled materials | 1 | 3 | 1 | 3 | 1 | 3 | 1 | 3 | 1 | 3 | 1 | 3 | 1 | 3 |

| 4. Award in environment program | 1 | 3 | 1 | 3 | 1 | 3 | 1 | 3 | 1 | 3 | 1 | 3 | 1 | 3 |

| Subtotal of disclosure (d) | 10 | 10 | 12 | 12 | 11 | 11 | 11 | |||||||

| Sub CSRD Score (d:4) | 2.5 | 2.5 | 3 | 3 | 2.75 | 2.75 | 2.75 | |||||||

| 5. Total of CSRD score (1 + 2 + 3 + 4) | 4.33 | 4.33 | 6.75 | 7.42 | 7.33 | 7.33 | 7.33 | |||||||

Notes: 1, occurrence: denoted 1 if yes, denoted 0 if no; 2, quality of disclosure: denoted 3 for the greatest weight to qualitative disclosure; denoted 2 for qualitative specific, non-quantitative but specific information related indicators; denoted 1 for general qualitative disclosures; denoted 0 for do not disclosure information for a given indicator.

Source: Saleh, Zulkifli, and Muhamad (2010)

| Appendix B: List Of Companies Included In The Study And Number Of Csr Items Disclosed Of Each Company | ||||||||

| No | Company's Name | 2011 | 2012 | 2013 | 2014 | 2015 | 2016 | 2017 |

| 1 | Astra Agro Lestari Tbk. | 21 | 21 | 32 | 36 | 35 | 35 | 35 |

| 2 | Adhi Karya (Persero) Tbk. | 27 | 28 | 28 | 28 | 28 | 28 | 28 |

| 3 | Adaro Energy Tbk. | 33 | 29 | 34 | 36 | 39 | 40 | 40 |

| 4 | AKR Corporindo Tbk. | 16 | 16 | 20 | 22 | 27 | 27 | 27 |

| 5 | Aneka Tambang Tbk. | 37 | 39 | 40 | 37 | 37 | 40 | 40 |

| 6 | Astra International Tbk. | 39 | 43 | 43 | 43 | 43 | 43 | 43 |

| 7 | Alam Sutera Realty Tbk. | 5 | 7 | 32 | 33 | 32 | 33 | 36 |

| 8 | Bank Central Asia Tbk. | 16 | 16 | 24 | 32 | 33 | 33 | 33 |

| 9 | Bank Negara Indonesia (Persero) Tbk. | 24 | 21 | 22 | 22 | 22 | 20 | 20 |

| 10 | Bank Rakyat Indonesia (Persero) Tbk. | 22 | 25 | 23 | 25 | 30 | 29 | 29 |

| 11 | Bank Tabungan Negara (Persero) Tbk. | 24 | 21 | 22 | 22 | 22 | 20 | 20 |

| 12 | Global Mediacom Tbk. | 23 | 22 | 21 | 21 | 21 | 21 | 21 |

| 13 | Charoen Pokphand Indonesia Tbk. | 14 | 5 | 14 | 15 | 14 | 14 | 14 |

| 14 | Elnusa Tbk. | 30 | 22 | 24 | 24 | 30 | 30 | 30 |

| 15 | Gudang Garam Tbk. | 5 | 7 | 17 | 9 | 9 | 9 | 17 |

| 16 | HM Sampoerna Tbk. | 7 | 16 | 16 | 17 | 17 | 17 | 25 |

| 17 | Indofood CBP Sukses Makmur Tbk. | 13 | 16 | 32 | 33 | 33 | 33 | 33 |

| 18 | Vale Indonesia Tbk. | 37 | 39 | 40 | 37 | 37 | 40 | 40 |

| 19 | Indofood Sukses Makmur Tbk. | 13 | 16 | 32 | 33 | 33 | 33 | 33 |

| 20 | Indo Tambangraya Megah Tbk | 18 | 22 | 30 | 32 | 38 | 38 | 38 |

| 21 | Jasa Marga (Persero) Tbk. | 25 | 25 | 25 | 22 | 25 | 25 | 25 |

| 22 | Kalbe Farma Tbk. | 25 | 25 | 25 | 25 | 25 | 25 | 25 |

| 23 | Lippo Karawaci Tbk. | 9 | 10 | 10 | 10 | 10 | 10 | 10 |

| 24 | PP London Sumatera Tbk. | 25 | 25 | 29 | 29 | 29 | 29 | 29 |

| 25 | Media Nusantara Citra Tbk. | 11 | 12 | 13 | 13 | 13 | 19 | 19 |

| 26 | Perusahaan Gas Negara (Persero) Tbk. | 29 | 29 | 29 | 29 | 29 | 29 | 29 |

| 27 | Tambang Batubara Bukit Asam (Persero) Tbk. | 22 | 31 | 34 | 33 | 33 | 33 | 33 |

| 28 | PP (Persero) Tbk. | 22 | 31 | 34 | 33 | 33 | 33 | 33 |

| 29 | Pakuwon Jati Tbk. | 5 | 7 | 8 | 10 | 7 | 8 | 8 |

| 30 | Surya Citra Media Tbk. | 11 | 12 | 13 | 13 | 13 | 19 | 19 |

| 31 | Semen Indonesia (Persero) Tbk. | 25 | 25 | 25 | 25 | 25 | 25 | 25 |

| 32 | PT Tower Bersama Infrastructure Tbk | 8 | 13 | 13 | 13 | 13 | 13 | 13 |

| 33 | Telekomunikasi Indonesia (Persero) Tbk. | 22 | 31 | 34 | 33 | 33 | 33 | 33 |

| 34 | United Tractors Tbk. | 25 | 25 | 25 | 25 | 25 | 25 | 25 |

| 35 | Unilever Indonesia Tbk. | 35 | 37 | 28 | 35 | 35 | 40 | 40 |

| 36 | Wijaya Karya (Persero) Tbk. | 25 | 25 | 25 | 25 | 25 | 25 | 25 |

References

- Ahmad, A.C., & Jusoh, M.A. (2014). Institutional ownership and market-based performance indicators: Utilizing generalized least square estimation technique. Procedia - Social and Behavioral Sciences, 164, 477-485.

- Akinyomi, O.J. (2012). Survey of corporate social responsibility practices in nigerian manufacturing sector. International Journal of Research Studies in Management, 2(1), 33-42.

- Al-Ghamdi, M., & Rhodes, M. (2015). Family ownership, corporate governance and performance: Evidence from Saudi Arabia. International Journal of Economics and Finance, 7(2), 78-89.

- Ali, M.A., & Atan, R.H. (2013). The relationship between corporate governance and corporate social responsibility disclosure: A case of high malaysian sustainability companies and global sustainability companies. South East Asia Journal of Contemporary Business, Economics and Law, 3(1), 39-48.

- Arshad, R., Mansor, S.M., & Othman, R. (2012). Market orientation, firm performance and the mediating effect of corporate social responsibility. The Journal of Applied Business Research, 28(5), 851-860.

- Barnea, A., & Rubin, A. (2010). Corporate social responsibility as a conflict between shareholders. Journal of Business Ethics, 97(1), 71-86.

- Chang, K., & Zhang, L. (2015). The effects of corporate ownership structure on environmental information disclosure-empirical evidence from unbalanced penal data in heavy-pollution industries in China. Wseas Transactions on Systems and Control , 10, 405-414.

- Coles, J.L., Daniel, N.D., & Naveen, L. (2008). Boards: Does one size fit all? Journal of Financial Economics, 87, 329-356.

- Dias, A., Rodrigues, L.L., & Craig, R. (2017). Corporate governance effects on social responsibility disclosures. Australasian Accounting, Business and Finance Journal, 11(2), 3-22.

- Din, S.U., & Javid, A.Y. (2011). Impact of managerial ownership on financial policies and the firm’s performance: Evidence pakistani manufacturing. International Research Journal of Finance and Economics, 81, 13-29.

- Donaldson, T., & Preston, L.E. (1995). The stakeholder theory of the corporation: Concepts, evidence, and implications . The Academy of Management Review, 20(1), 65-91.

- Fauzi, F., & Locke, S. (202). Board structure, ownership structure and firm performance: A study of new zealand listed-firms. Asian Academy of Management Journal of Accounting and Finance, 8(2), 43-67.

- Fazlzadeh, A., Hendi, A.T., & Mahboubi, K. (2011). The examination of the effect of ownership structure on firm performance in listed firms of tehran stock exchange based on the type of the industry. International Journal of Business and Management, 6(3), 249-266.

- Ferrero, J.M. (2013). The Relationship between Earnings Management and Corporate Social Responsibility and Their Effects on Corporate Performance, Cost of Capital and Reputation. Facultad De Economía Y Empresa, Departamento de Administración Y, Economía de la Economía de la Empresa. Spain: University of Salamanca.

- Gul, S., Muhammad, F., & Rashid, A. (2017). Corporate governance and corporate social responsibility: The case of small, medium, and large firms. Pakistan Journal of Commerce and Social Sciences, 11(1), 1-34.

- Haniffa, R., & Cooke, T. (2002). Culture, corporate governance and disclosure in malaysian corporations. Abacus, 38(3), 317-349.

- Hapsoro, D., & Fadhilla, A.F. (2017). Relationship analysis of corporate governance, corporate social responsibility disclosure and economic consequences: Empirical study of indonesia capital market. The South East Asian Journal of Management, 11(2), 164-182.

- Herdjiono, I., & Sari, I.M. (2017). The effect of corporate governance on the performance of a company: Some empirical findings from indonesia. Journal of Management and Business Administration, 25(1), 33-52.

- Jensen, M.C., & Meckling, W.H. (1976). Theory of the firm: Managerial behavior agency costs and ownership structure. Journal of Financial Economics, 3, 305-360.

- John, E.A., John, A.O., & Adedayo, O.E. (2013). Corporate social responsibility and financial performance: Evidence from nigerian manufacturing sector. Asian Journal of Management Research, 4(1), 153-162.

- Kapadia, J.M. (2017). Corporate social responsibility and financial performance: A literature review. Research Journal of Finance and Accounting, 6(10), 5-11.

- Law of the Republic of Indonesia Number 40 of 2007 Concerning Limited Liability Companies, Indonesia (2007). Retrieved from https://cdn.indonesia-investments.com/documents/Company-Law-Indonesia-Law-No.-40-of-2007-on-Limited-Liability-Companies-Indonesia-Investments.pdf

- Lin, C.S., Chang, R.Y., & Dang, V.T. (2015). An Integrated Model to Explain How Corporate Social Responsibility Affects Corporate Financial Performance. Sustainability, 7, 8292-8311.

- Loh, L., Thao, N.T., Sim, I., Thomas, T., & Yu, W. (2016). Sustainability Reporting in Asean: State of Progress in Indonesia, Malaysia, Singapore and Thailand 2015. Sinagapore: Centre for Governance, Institutions and Organisations (CGIO) at NUS Business.

- Lungu, C.I., Caraiani, C., Dascalu, C., & Guse, R.G. (2011). Exploratory study on social and environmental reporting of european companies in crises period. Accounting and Management Information Systems, 10(4), 459-478.

- Machdar, N.M. (2018). Kinerja Keuangan, Kinerja Saham dan Struktur Modal di Indonesia 18(2). Media Riset Akuntansi, Auditing & Informasi (MRAAI), 18(2), 135-152.

- Majeed, S., Aziz, T., & Saleem, S. (2015). The effect of corporate governance elements on corporate social responsibility (CSR) disclosure: An empirical evidence from listed companies at KSE Pakistan. International Journal Financial Study, 3, 530-556.

- Makki, M.A., & Lodhi, S.A. (2014). Impact of corporate governance on intellectual capital efficiency and financial performance. Pakistan Journal of Social Sciences, 8(2), 305-330.

- Manokaran, K.R., Ramakrishnan, S., Hishan, S.S., & Soehod, K. (2018). The impact of corporate social responsibility on financial performance: Evidence from insurance firms. Management Science Letters, 8, 913-932.

- Moon, J., & Chapple, W. (2005). Corporate social responsibility (CSR) in Asia a seven-country study of CSR Web Site Reporting . Business and Society,, 44(4), 415-441.

- Muktar, J., Mohammad, B. S., Jibril, R. S., & Muhammad, S. (2017). The Effect of Corporate Governance on Corporate Social Responsibility Disclosure by Firms in the Nigerian Food Product Industry. International Journal of Business and Management, 10, 5-11.

- Muwazir, M. R. (2011). Corporate Social Responsibility in the Context of Financial Services Sector in Malaysia. United Kingdom: Doctor of Philosophy of Cardiff University.

- Nawaiseh, M. E. (2015). Do Firm Size and Financial Performance Affect Corporate Social Responsibility Disclosure: Employees’ and Environmental Dimensions? American Journal of Applied Sciences, 12, 967-981.

- Opusunju, M. I., & Ajayi, M. I. (2016). Impact of Corporate Governance of Corporate Social Responsibility of Dangote Group of Companies in Nigeria. International Journal of Business Quantitative Economics and Applied Management Research, 2(10), 32-48.

- Prior, D., Surroca, J., & Tribó, J. A. (2008). Are Socially Responsible Managers Really Ethical? Exploring the Relationship between Earnings Management and Corporate Social Responsibility. Corporate Governance: An international Review, 16(3), 160-177.

- Ross, S., Westereld, R., & Jafe, J. (2013). Corporate Finance, Tenth Edition,. The McGraw−Hill Companies, Inc.

- Saleh, M., Zulkifli, N., & Muhamad, R. (2010). Corporate Social Responsibility Disclosure and Its Relation on Institutional Ownership: Evidence from Public Listed Companies in Malaysia. Managerial Auditing Journal , 25, 591-613.

- Sundaram, A. K., & Inkpen, A. C. (2004). Stakeholder Theory and The Corporate Objective Revisited: A Reply. Organization Science, 15(3), 370-371.

- Suprayitno, G., Khomsiyah, Yasni, S., Darmawati, D., & Susanty, A. (2005). Internasionalisasi Good Corporate Governance dalam Proses Bisnis. Jakarta: The Indonesian Institute For Corporate Governance.

- Ta, H. T., & Bui, N. T. (2018). Effect of Corporate Social Responsibility Disclosure on Financial Performance. Asian Journal of Finance & Accounting, 10(1), 40-58.

- Ullmann, A. A. (1985). Data in Search of a Theory: A Critical Examination of the Relationships among Social Performance, Social Disclosure, and Economic Performance of U. S. Firms. The Academy of Management Review, 10(3), 540-557.

- Uwuigbe, U. (2011). An Examination of the Relationship between Management Ownership and Corporate Social Responsibility Disclosure: A Study of Selected Firms in Nigeria. Research Journal of Finance and Accounting, 2(6), 23-29.

- Verma, D. P., & Kumar, R. (2012). Relationship between Corporate Social Responsibility and Corporate Governance. Journal of Business and Management, 2(3), 24-26.

- Wahba, H., & Elsayed, K. (2015). The Mediating Effect of Financial Performance on the Relationship between Social Responsibility and Ownership Structure. Future Business Journal, 1, 1-12.

- Wanyama, D. W., & Olweny, T. (2013). Effects of Corporate Governance on Financial Performance of Listed Insurance Firms in Kenya. Public Policy and Administration Research, 3(4), 96-120.

- Wheeler, D., Colber, B., & Freeman, R. E. (2003). Focusing On Value: Reconciling Corporate Social Responsibility, Sustainability and a Stakeholder Approach in a Network World. Journal of General Management, 28(3), 1-28.