Research Article: 2020 Vol: 24 Issue: 5

Corporate Governance Quality and Financial Performance of Retail Firms: Evidence Using South African Data

Shaa’ista Mukaddam, University of South Africa

Athenia Sibindi, University of South Africa

Abstract

A great deal has been written about corporate governance over the last few decades. Notwithstanding, in the wake of the re-emergence of corporate scandals, environmental sustainability concerns and globalisation of firms, have necessitated that further research be conducted on the corporate governance practices of firms. Against this backdrop the primary aim of this paper is to determine if the corporate governance practices of retail firms in South Africa have an impact on their financial performance. The choice of the retail industry in South Africa as a unit of analysis was motivated by virtue of the fact that the wholesale and retail sector accounts for a large portion of South Africa’s Gross Domestic Product. The study employed a panel of 18 South African firms in the wholesale and retail sector for the period ranging from 2010 to 2019. Panel data techniques, namely the pooled ordinary least squares (POLS), fixed effects (FE) and random effects (RE) models were estimated. The study documented that board size were negatively related to financial performance. In addition, the study found that board independence and firm size were positively related to financial performance. Overall, the relationship between corporate governance and financial performance is not very strong among retail firms in South Africa. This could be due to firms not following the guidelines and regulations very strictly during the sample period.

Keywords

Corporate Governance, Financial Performance, Retail Sector, South Africa.

Introduction

South Africa’s economic sector is sophisticated and provides a full range of services from finance to manufacturing (Young, 2010). In earlier years, South Africa’s economy was heavily reliant on the primary sectors, but in the 1990s, due to the decline in primary sector outputs, the tertiary sector experienced positive economic growth (Du Plessis & Smit, 2006). Wholesale and retail are categorised as tertiary sectors and account for 15% of South Africa’s GDP (Statistics SA, 2018). South Africa, in comparison to other African countries, shows a great deal of economic growth and development. Retail firms play a large role in the economy of a country and have a significant impact on the environment, and it is worth examining the governance of these firms (Correia et al., 2015). Additionally, because the trade sector accounts for a huge part of GDP, it is worth analysing the impact of their corporate governance practices on their financial performance. The financial performance of these firms has bearing on their continued existence and contribution to the economic wellbeing of the country.

Corporate governance can be defined as the relationships between management, directors, shareholders and stakeholders, and it includes the policies and procedures through which a firm is managed (Correia, et al., 2015). The uniqueness of South Africa as an emerging market is that it is sophisticated and diverse thereby making it a suitable test-case to understand the impact that corporate governance practices have on a firm’s financial performance. Moreover, South Africa has been bedeviled by a number of corporate scandals in the past such as, the Fidentia scandal in 2007 and more recently, the KPMG and Steinhoff scandals in 2017 (Conway-Smith, 2017). Even though these scandals are associated with weak corporate governance, the relationship between corporate governance and financial performance remains unclear (Tshipa & Mokoteli, 2015). Adekunle and Aghedo (2014) and Ochola (2013) concluded that there is a relationship between good corporate governance practice and a firm’s performance, while Manafi et al. (2015) concluded that there is no significant relationship between corporate governance and financial performance.

Corporate governance has been a subject of extant research by academics, firms, policy makers and investors alike. Some have seen corporate governance as a solution to the successful management of a firm, while others have considered that there are inadequacies in the corporate governance practices which can be attributed to the 2008 global financial crisis (Kirkpatrick, 2009). To date, research into the impact and effects of corporate governance has been sparse and inconclusive; it is therefore crucial to understand the link between corporate governance and financial performance. The primary aim of this study paper is to determine the impact of corporate governance on financial performance of retail firms in South Africa.

Review of Related Literature

Theoretical Literature

Extant studies situated around corporate governance have been conducted in the academic world, with various scholars having different views on corporate governance. Cadbury (1992) formally defines corporate governance as a system by which firms are directed and controlled. Similar to capital structure, Wilson (2006) stated that corporate governance remains an unclear concept, but it involves how firms are directed, controlled and held accountable, and is also concerned with effective leadership to lead a firm in a sustainable and profitable way. Coleman (2010) avers that corporate governance describes a system, procedure and structure a firm uses to convey authority, responsibility and accountability among stakeholders. Therefore, corporate governance administers the interest of all parties such as firm employees, owners, creditors and customers to ensure the success of a firm. The shareholders are the primary stakeholders and depend on profitability and sustainability of the firm to receive their dividends. Essentially, good corporate governance practices include transparent relationships between the owners and management.

Kabir (2009) furthered on Cadbury’s (1992) corporate governance definition and surmised that corporate governance consists of two dimensions: direction and control. Direction refers to the responsibility of the board to plan and enhance the performance and sustainability of the firm. Control refers to the responsibility of the board to ensure that management executes the plans and strategies accordingly. Thus, corporate governance is a system by which firms are governed and controlled to increase shareholders value and, simultaneously, ensuring that all other stakeholders’ benefit. Firms should adhere to the following principles of transparency, accountability, and integrity. Corporate governance is when a firm make decisions in line with international and national practices in order for the firm to be sustainable and profitable (Cadbury, 1992).

Stewardship Theory

Davis, Schoorman and Donaldson (1997) argued that the executives of a firm are stewards working for the shareholders and that stewards will maximise shareholder wealth to maximise their shareholder profits. Contrary to the agency theory, stewardship theory postulates that stewards and executives share common goals to do what is best for the firm and leads to higher performance (Abdullah & Valentine, 2009). The executives aim to do work effectively and efficiently and to be great stewards of the assets they are controlling within the firm. The theory assumes that there are no disputes or lack of motivation within management.

Stewardship theory is relevant to corporate governance as managers need to be given a clear and unambiguous role. The firm structure should give authority, worth and power to the management to use in the best interest of the firm (Abdullah & Valentine, 2009). This is why the stewards are executives committed to the firm and acts in the interest of the firm.

Resource-dependency Theory

Resource-dependency theory states that the board of directors provides resources to the firm through their external relationships. Hillman et al. (2000) observed that the board of directors provides a variety of resources such as skills and information pertaining to suppliers, buyers, public policies and social groups. Therefore, this theory is in support of the importance of having directors on the board because they provide greater resources and information beneficial to the firm (Yusoff & Alhaji, 2012).

Resources originate from the environment around them which consists of other firms. Therefore, firms are dependent on each other in order to exchange resources; and resources are valuable, costly to imitate, rare and not substitutable (Abid et al., 2014). Resources and power are directly linked, and firms who have more resources are more powerful when compared to competitors who do not have access to the resources.

Shareholder Theory

Shareholder theory was advanced by Friedman (1970) and the theory states that the fundamental role of a firm’s manager is to maximise shareholder wealth. Essentially, a firm’s managers will ultimately do anything to increase and ensure the profitability of a firm. However, shareholder theory has been criticised as being short-sighted, focusing on short-term profits and overlooks unethical behaviour (Danielson et al. 2008).

Stakeholder Theory

The stakeholder theory was advanced by Freeman (1984) and focuses on groups outside of the firm. The assumption is that shareholders are not the only ones with a stake in the company; firms must thus take an interest in all other stakeholders. The stakeholder theory identifies, analyses, develops and manages the interactions among the stakeholders. Abdullah and Valentine (2009) described the stakeholders as a group or individual that is affected by a firm’s objectives. This theory however, opposes shareholder theory and firms include suppliers, customers, employees, communities and business partners when making decisions.

The stakeholder theory is widely recognised because it takes all parties in account and not just the shareholders. This theory suggests that the performance of a firm cannot be measured by shareholder returns alone and that all stakeholders must be considered (Jensen, 2001).

Comparing Corporate Governance Theories

The main differences among the corporate governance theories are tabulated in Table 1.

| Table 1 Comparison of Corporate Governance Theories | ||||

| Stewardship theory | Shareholder theory | Stakeholder theory | Resource-dependency theory | |

| Focus | Shareholder’s interest | Shareholder’s interest | Stakeholder’s interest | Firm resources and power |

| Objective | Maximize Productivity | Maximize Productivity | Long term relationships | Acquire and exploit resources |

| Base | Classical idea | Normative | Normative | Classical idea |

| Model | Collective | Individual | Collective | Collective |

| Time horizon | Long term | Short term | Long term | Long term |

| Theory originated | Law | Management | Management | Sociology and management |

| Behaviour | Pro- organizational | Opportunistic | Pro-social | Pro- organizational |

| Approach | Sociological and psychological | Sociological and psychological | Societal | Strategic |

| Main goal | Goal alignment | Goal alignment | Goal alignment | Goal congruence |

| Motivated by | Principal’s objectives | Self-objectives | Shareholder and other stakeholder’s objectives | |

| Structure | Facilitation and empowerment | Monitor and Control | Facilitation and empowerment | Monitor and Control |

| Need | Growth and achievement | Economic need | Economic and long-term firm growth | Economic and long-term firm growth |

Corporate Governance Practices

Corporate governance is a guideline firms use in managing a company. Corporate governance practices are the application of the different abovementioned theories. Firms with poor corporate governance practices may make bad debt decisions by taking on too much debt, thus becoming too leveraged. A notable example in this situation is the Global Financial Crisis of 2007-2009 whereby firms took on too much debt and housing prices fell because banks gave loans to homeowners with bad credit ratings who were unable to repay their loans (Tshipa & Mokoteli, 2015).

When analysing the relationship between capital structure and profitability, it is important to take note of a firm’s corporate governance practices. South African firms apply the Companies Act 2008; the King Report on Corporate Governance (2009) King codes I, II, III and IV; Committee of Sponsoring Organisations (COSO) and ISO 31000 framework as guidelines which outline the requirements of the governance practices that companies should fulfil (Tshipa & Mokoteli, 2015).

The Companies Act of 2008 sets out a guideline to promote transparency and accountability in South African firms and provides firms with rules to which they must adhere. The Companies Act specifies that in private companies there must be a minimum of one board director, and in a public company, a minimum of three. It also stipulates that directors are to execute decisions in good faith and that directors may be held liable for breaching their fiduciary duty to do so (Walker & Mokoena, 2011). The Companies Act of 2008 has several other regulations regarding the auditing committee and corporate responsibilities that firms should adhere to and follow through.

A code of conduct was developed and introduced in South Africa to strengthen corporate governance practices. The King reports on Corporate Governance also called King Codes, published in 1992. King I was issued in 1994, publishing finalised legislation pertaining to corporate governance procedures. King I was restricted to firms listed on the Johannesburg Stock Exchange; government and state-owned companies; as well as banks and insurance companies (Walker & Mokoena, 2011). Thereafter, in 2002, King II code was developed with the aim of improving on King I and the characteristics of good corporate governance were introduced: such as discipline, transparency, independence, accountability, responsibility, fairness and social responsibility. King III was introduced alongside the new Companies Act and replaced King II in 2010. King III incorporated leadership, sustainability and corporate citizenship into the report and the King III codes apply to any firm, private or public. More recently, King IV was released in 2016 and focuses on transparency and refines the codes between good practice and principles. King IV is centred around leadership and is applicable to any firm, namely: public or private, big or small firms and non-profit or profit firms (Walker & Mokoena, 2011). Furthermore, the COSO and ISO31000 are both frameworks for establishing good corporate governance, whereby ISO31000 pertains to international risk management standards, and COSO provides a model to assess the control models of a firm (Karanja, 2017).

There are numerous ways to measure corporate governance. The first method is board size. Board size can be defined as the total number of directors on the board of a firm. Board size has been a longstanding issue of debate, and there are still conflicting theories regarding board size and its effect on financial performance (Tshipa & Mokoteli, 2015). Zakaria et al. (2014) concluded that board size has a positive effect on financial performance; while Johl et al. (2015) findings are inconclusive in determining the relationship between board size and financial performance.

The second method in measuring corporate governance is institutional ownership. Arora and Sharma (2016) state that ownership control and institutional ownership are important when considering financial performance as they enhance market valuation, because the board of directors play a huge role in the operations and decisions making process. Mashayekhi & Bazaz (2008) found that institutional investors do not relate positively to financial performance, because institutional investors are big companies such as retirement funds, banks and hedge funds and they do not always consider the firms interest first. In reference to the stewardship theory, the board of directors must ensure that management acts in the best interest of the firm. The board of directors needs to examine capital structure and determine the most appropriate debt-to-equity ratio for firms to finance their assets, remain competitive, and meet daily operations and future growth (Correia, et al., 2015).

The third method in used to measure corporate governance is board independence. Board independence measures how much of the firm’s management are shareholders. Arora and Sharma (2016) state that if the board has more non-executive directors then the board is more independent. They also found a negative relationship between board independence and financial performance. Findings by Hamdan & Al Mubarak (2017) show that board independence slightly affects financial performance. However, Fuzi et al. (2016) found a positive relationship between financial performance and board independence. There are conflicting arguments regarding board independence, but in accordance with the King III guidelines, a board should be comprised of the majority of non-executive directors who should be independent of the firm. This guideline ensures that the interests of the shareholders and management are aligned, resulting in the smooth running of the firm; thus, positively affecting financial performance (Tshipa & Mokoteli, 2015).

Empirical Literature Review

Most studies reveal that good corporate governance practices enhance a firm’s performance while few studies have found a negative or no relationship between corporate governance and financial performance (Hutchinson, 2002; Young, 2003). The contradicting results can be attributed to the fact that some of the data is not publicly available or that the surveys are restricted. The performance indicators are accounting-based and as such have a limited use. There are various indicators of corporate governance, but studies do not use them all. This can change the results of the relationship between corporate governance and financial performance (Coleman, 2007). Further industry-specific studies need to be employed and a multivariate approach to determine the correlation between corporate governance and financial performance must be taken.

Akbar et al. (2016) conducted a study in the UK determining the relationship between corporate governance and financial performance and found that there is no significant relationship between the two variables. Sisoiu (2016) conducted a study to determine whether corporate governance affects financial performance using board size, board independence and the percentage shares held by person in management. There was a positive relationship between the variables and financial performance, indicating that corporate governance has an effect on financial performance. Sisoiu (2016) concluded that corporate governance is a form of management where decisions are made by consulting with shareholders and by taking into account their will and their interests. Shareholders are also willing to pay extra to implement good corporate governance models because this will render fair and efficient decisions synonymous with the Stewardship theory.

Rashid (2008) conducted a study determining the relationship between corporate governance and financial performance in Malaysia and Australia from the period 2000 to 2003, and the results suggested that market capitalisation and price to book value ratio had a positive relationship with the value of a firm. Board size, however, had a negative relationship with the value of a firm. The results were contradictory to the resource-dependency theory, where the board size positively affects the financial performance of a firm.

Wu et al. (2010) conducted a study on firms in Taiwan from 2001 to 2008 and concluded that board structure and board size is negatively related to financial performance. A larger board size will thus have a negative impact on the decision making and will impact financial performance negatively. However, board independence was positively related to financial performance, meaning that the more independent a board is, the better the firm will perform. Furthermore, inside ownership also had an effect on financial performance as the owner makes decisions that will benefit the shareholders’ interest and will, therefore, increase financial performance.

Merendino (2014) analysed the relationship between board mechanisms and financial performance in an Italian context and concluded that there is a relationship between the board of directors and financial performance. Their reason attributed to this is because the board is faced with multifaceted tasks and needs to consider all the stakeholders. It can therefore be assumed that these decisions will affect financial performance.

Coleman (2007) analysed the relationship between corporate governance and financial performance in Africa from 1997 to 2001. The study employed market-based and accountingbased performance measures, ROA and Tobin’s Q, and tested the relationship between performance and corporate governance variables and found a positive relationship.

Arora & Sharma’s (2016) study was based on Indian firms, and the results of the study show that there was a relationship between corporate governance and performance, but not a very strong one. This result could be attributed to Indian firms not following the guidelines and regulations. The main findings reflected that board size was negatively related to ROA and that board meetings had a positive relationship to financial performance. However, ROE, profitability, and stock returns were not related to corporate governance indicators, and the outcomes indicated that firms who comply with good corporate governance practices perform better. In theory, good corporate governance practices lead to reduced agency costs. This thus implies that firms in developing countries can improve their performance by implementing good corporate governance practices.

Naimah & Hamidah (2017) examined firms in an Indonesian context and the study concluded that board size, audit size and outside director does not significantly affect firm profitability. However, board independence had a negative effect on firm profitability. Moreover, the number of audit committee meetings and audit quality had a positive effect on profitability. Corporate governance principles have significant effects on profitability and leverage and firm size have a negative effect on firm profitability and performance. Further, Hove-Sibanda et al. (2017) analysed the impact of corporate governance and performance of small and medium enterprises in South Africa. The main findings were that the implementation of corporate governance had a positive relationship with financial performance.

Overall, the evidence from earlier studies suggests that there is a relationship between corporate governance and financial performance. On the one hand, some studies have documented a positive relationship and yet on another hand, other studies have established a negative relationship between corporate governance and financial performance. Existing studies have by and large conformed to apriori expectations predicated on the resource-dependency theory. Notwithstanding that there are slightly variations in the results of various studies, invariably, corporate governance variables such as board size and board independence have found to be strongly related to financial performance.

Data and Methodology

Sample Description and Data Sources

This paper focuses on the retail sector specifically, hence the population of this study comprises of all South African firms in the wholesale and retail sector. The sample comprises of all those 18 retail firms listed on the JSE. The data extracted is over a ten-year period ranging from 2010 to 2019.

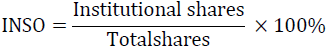

This paper employs two dependent variables that measures financial performance. The most effective way to measure financial performance is by analysing the ROA and ROE as it captures the accounting performance of a firm. Le & Phan (2017) as well as Tshipa & Mokoteli (2015) used ROA and ROE as dependent variables. Furthermore, Ochola (2013) used ROE to measure financial performance. The independent variables of the study are corporate governance measures. Corporate governance is measured by board size, board independence and institutional ownership. We take cue from previous studies by Muazeib et al. (2015); Arora & Sharma (2016) who have also used similar variables. Hamdan & Al Mubarak (2017); Mashayekhi & Bazaz (2008) have used board independence as a corporate governance measuring tool. The variables are defined in Table 2.

| Table 2 Variable Definition | |

| Variable | Variable Definition |

| Financial Performance Measures | |

| Return on Assets (ROA) |  |

| Return on Equity (ROE) |  |

| Corporate Governance Variables | |

| Board size (BSZ) | Board Size (BSZ) = Total number of Directors |

| Board independence (BIN) |  |

| Institutional ownership (INSO) |  |

| Control Variables | |

| Firm Size (FSZ) | FSZ = natural logarithm of total assets. |

Model Specification

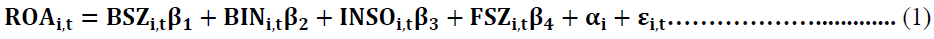

The first model is to test the relationship between financial performance and corporate governance the following static panel data model is going to be specified with return on assets (ROA) as the dependent variable:

where:

ROAit = Return on assets for firm i at time t

BSZit = Board size for firm i at time t

BINit = Board independence for firm i at time t

INSOit = Institutional ownership for firm i at time t

FSZit = Firm size of firm i at time t

β = slope parameter

αi= group-specific constant term that embodies all the observable effects

εi,t = composite error term that also takes care of other explanatory variables that equally determine financial performance but were not included in the model.

In the second instance, for robustness checks to test the relationship between financial performance and corporate governance the following static panel data model is going to be specified with return on equity (ROE) as the dependent variable:

where:

ROEit = Return on equity for firm i at time t

DOEit = Debt-to-Equity ratio for firm i at time t

DDEit = Debt-to-Capital ratio for firm i at time t

BSZit = Board size for firm i at time t

BINit = Board independence for firm i at time t

INSOit = Institutional ownership for firm i at time t

FSZit = Firm size of firm i at time t

β = slope parameter

αi= group-specific constant term that embodies all the observable effects

εi,t = composite error term that also takes care of other explanatory variables that equally determine financial performance but were not included in the model.

Empirical Results

Descriptive Statistics

The summary statistics are presented in Table 3. It was found that South African retail firms recorded profits during the period under review with a mean of 9.8% on return on assets (ROA) and 19.9% on return on equity (ROE) terms. The ROA ratio is important for retail firms because it relies on inventory to generate sales. The ROE is larger than ROA, which indicates that investors earn a higher return on their investment (equity). Hove (2017) recorded a ROE of 16.1%, which is relatively close to the ROE in this study.

| Table 3 Summary Statistics | |||||

| Variable | Mean | Median | Standard Deviation | Minimum | Maximum |

| ROA | 9.8069 | 9.1107 | 18.2013 | -52.5596 | 179.6895 |

| ROE | 19.9302 | 20.6948 | 27.775 | -129.0716 | 212.5638 |

| BSZ | 15.6875 | 14.0000 | 6.2113 | 6.0000 | 29.0000 |

| BIN | 63.2761 | 67.7083 | 20.4067 | 17.2413 | 100.0000 |

| INSO | 14.6466 | 17.7978 | 7.5555 | 0.0000 | 22.2222 |

| FSZ | 6.5674 | 6.8091 | 0.8293 | 4.6798 | 7.8128 |

The independent variables employed in this study were board size; board independence; institutional ownership, and firm size, which are used to test if the corporate governance practices affect the financial performance of firms in the retail sector. Board size has a mean of 15.7, therefore, on average, the South African retail firms have approximately 16 directors sitting on their boards. Board independence measures the number of non-executive directors constituting the boards of the South African retail firms and the mean is 63.3%. Institutional ownership refers to the ownership stake in the firm that is held by large financial organisations, pension funds or endowments. The mean is 14.6%, therefore, there are roughly 15 of such firms in every firm that has a stake in the retail firms of this study.

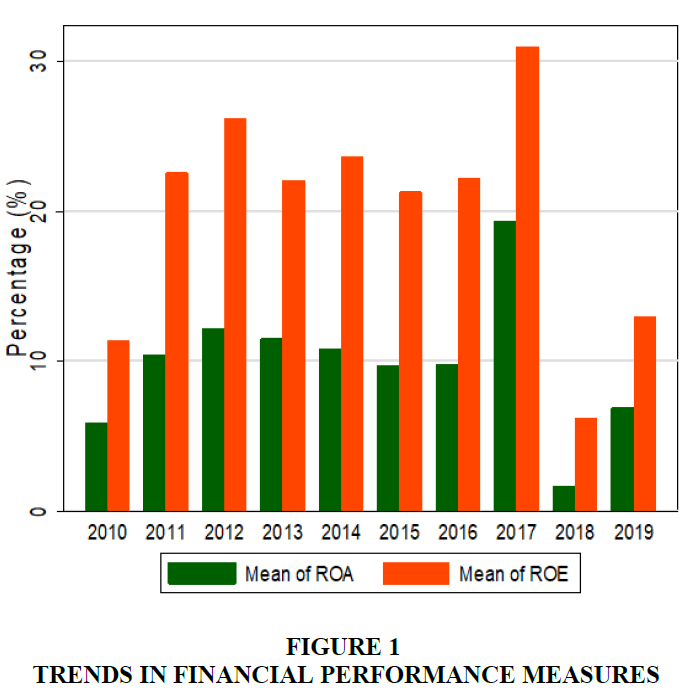

The trends in the financial performance of retail sector are depicted in Figure 1. The average financial performance of South African retail firms can be seen from the ROA and ROE. Figure 1 explains the relationship between assets, equity and profitability of retail firms in the sample. The ROA increases from 2010 at 6% to 2017 to about 19%. In 2018 the ROA took a massive plunge from 19% to 3% and increased in 2019 to 7%. Over the 10-year period, retail firms were able to utilise assets to generate earnings. ROE over the 10-year period is significantly higher than ROA. The ROE increased from 2010 at 11% to 2017 at 31%. In 2018, similarly to ROA, the ROE decreased to 6% and increased to 13% in 2019. Overall, retail firms used their equity and used investments to generate growth. These trends are depicted in Figure 1.

Empirical Findings

We make use of panel regression analysis as an estimation tool to determine the impact of corporate governance practices on the financial performance of South African retail firms. The pooled ordinary least squares (POLS), fixed effects (FE) and random effects (RE) were employed to test the relationships. Diagnostics tests were undertaken to ensure that the estimated model was specified to ensure that the results were reliable. In the presence of heteroscedasticity, the Fixed Effects with Driscoll & Kray (1998) estimator which controls for heteroscedasticity was deemed to be the most suitable estimator, and hence the inferences of the results are based on its estimation results. The results are presented in Table 4. The first regression model employed ROA as the performance indicator and board size, board independence, institutional ownership as corporate governance measures and firm size as the control variable. The second regression model was estimated with ROE as the performance indicator and similarly with board size, board independence, institutional ownership proxying corporate governance practices measures and with firm size as the control variable.

The findings of this study are documented as follows:

Board size (BSZ)

Firstly, the results of the study documented that financial performance was negatively related to board size. This finding is robust for both measures of financial performance employed in the study. This is consistent with the findings by Rashid (2008) and Wu et al. (2010) who established that a negative relationship subsisted. However, this is contrary to Arora and Sharma (2016) who found that a positive relationship subsists and found that larger boards are associated with greater knowledge, which in turn, improves the decision-making process and this translates to higher profits. The study, however, contradicts the resource-dependency theory, in that more resources have a negative influence on financial performance.

The resource-dependency theory states that larger boards are associated with greater knowledge, which in turn, improves the decision-making process and thus, translates to better financial performance. Therefore, the apriori expectation is that a positive relationship between board size and financial performance should exist. This study, however, contradicts the resourcedependency theory, in that more resources have a negative influence on financial performance. Furthermore, this also indicates that a smaller board size can be associated with a higher financial performance perhaps due to more closely monitored management.

Board Independence (BIN)

Secondly, the study established a positive relationship between board independence and financial performance. The results were robust in both estimations for the two measures of financial performance employed in this study (that is, ROA and ROE). The higher the board independence, the better the financial performance of the company. The results are consistent with the stewardship theory. The theory argues that executives share common goals and will have the best interests of the firm in mind; which in turn, leads to higher performance. It is worth nothing that firms need to ensure that the independent directors are not just hired for namesake but act independently. Therefore, there should be clear criteria when appointing directors. The retail sector in South Africa is well established, and even though South Africa is a developing country, the corporate governance regulations are upheld and the results of this study confirm this.

Institutional Ownership (INSO)

Thirdly, the study document that a negative relationship subsisted between the institutional ownership and the financial performance variables, though statistically insignificant. Notwithstanding, a number of studies document that institutional ownership has a positive effect on financial performance because large institutional investors have the opportunity, resources and ability to monitor, discipline, and influence managers (Mashayekhi & Bazaz, 2008; Hartzell & Starks, 2003).

Firm Size (FSZ)

Lastly, the study established that firm size was positively related to financial performance. This finding accords with that of Frank & Goyal (2003) and Abor (2005) who also found a positive relationship between firm size and financial performance. The more the assets that the firm, has the higher the profits that will be generated. Arguably, the firm would be enjoying economies of scale in scaling up production.

Conclusion

The primary aim of this study was to determine if corporate governance practices of retail firms in South Africa had an impact on their financial performance. The results of the study by and large confirmed that corporate governance practices of South African retail firms have a significant impact on their financial performance. Firstly, a negative relationship between board size and financial performance was established and this is contrary to the resource-dependency theory. Secondly, it was found that board independence and financial performance were positively related. Thirdly, the findings of the study were inconclusive with regards to the relationship between institutional ownership and the financial performance variables as a negative though statistically insignificant relationship was documented. Fourthly, a positive relationship between firm size and financial performance was documented to subsist. Larger firms could be highly leveraged compared to smaller firms and similarly larger firms are expected to have more assets. Therefore, there is a direct relationship between firm size and financial performance. The results were robust to both measures of financial performance employed in the study.

This paper examined the impact of corporate governance on financial performance in retail firms in South Africa. The results of this study documented that the relationship between corporate governance and financial performance was not very strong among retail firms in South Africa. This could be due to firms not following the guidelines and regulations very strictly during the sample period. Further studies could include more corporate governance variables as this study only focused on four variables which may not provide the full effect of corporate governance on financial performance of firms. As such, future studies could also employ other measurements of financial performance such as earnings per share and Tobin's Q which relate to the market value of firms. This study only used ROA and ROE which did not take in account the market value of firms.

References

- Abdullah, H., & Valentine, B. (2009). Fundamental and ethics theories of corporate governance. Middle Eastern Finance and Economics, 4(1), 88-96.

- Abid, G., Khan, B., Rafiq, Z., & Ahmed, A. (2014). Theoretical perspectives of corporate governance. Bulletin for Business and Economics, 3(4),166-175.

- Abor, J. (2005). The effect of capital structure on profitability: Empirical analysis of listed firms in Ghana. The Journal of Risk Finance, 6(5), 435-45.

- Adekunle, S.A., & Aghedo, E.M. (2014). Corporate governance and financial performance of selected quoted companies in Nigeria. European Journal of Business and Management, 6(9), 53-60.

- Arora, A., & Sharma, C. (2016). Corporate governance and financial performance in developing countries: evidence from India. Corporate Governance International Journal of Business in Society, 16(2), 420-436.

- Cadbury, S.A. (1992). Report of the committee on the financial aspects of corporate governance. Gee Ltd. London: Professional Publishing Ltd.

- Coleman Q. (2010). Explain the concept of corporate governance. Retrieved from http://www.ehow.com/m/about_6555387_explain-concept-corporate-governance.html

- Coleman, A.K. (2007). corporate governance and financial performance in Africa: a dynamic panel data analysis. Retrieved from: https://pdfs.semanticscholar.org/14ae/1ccbacaced1dce3c9003b61e3f73b1cee543.pdf

- Conway-Smith, E. (2017). Global companies snared in South Africa’s corruption scandal. Retrieved from: https://apnews.com/2fbbcbaf655a49009f45b17a5276fe78/Global-companies-snared-in-South-Africa%27s-corruption-scandal

- Correia, C., Flynn, D., Uliana, E., Wormald, M., & Dillon, D. (2015). Financial management (8th edition). Juta & Company Limited, Cape Town.

- Danielson, M.G., Heck, J.L., & Shaffer, D. (2008). Shareholder Theory - How Opponents and Proponents Both Get it Wrong. The Journal of Economic Perspectives, 4, 99-120.

- Davis, H., Schoorman, D., & Donaldson, L. (1997). The distinctiveness of agency theory and stewardship theory. The Academy of Management Review, 22(3), 611-613.

- Du Plessis, S., & Smit, B. (2006). Economic policy under democracy: A ten year review: Stellenbosch, October 28-29, 2005, Department of Economics. University of Stellenbosch.

- Frank, M.Z., & Goyal V.K. (2002). Testing the pecking order theory of capital structure. Journal of Financial Economics, 67, 217-248.

- Freeman, R.E., Wicks, A.C., & Parmar, B. (2004). Stakeholder theory and “the corporate objective revisited”. Organization Science, 15(3), 364–369.

- Friedman, M. (1970). The social responsibility of business is to increase its profits. Perspectives in business ethics, 1(1), 246–251.

- Fuzi, S.F.S., Halim, S.A.A., & Khudzari, J.M. (2016). Board independence and firm performance. Procedia Economics and Finance, 37, 460-465.

- Hamdan, A.M.M., & Al Mubarak, M.M.S. (2017). The impact of board independence on accounting-based performance: Evidence from Saudi Arabia and Bahrain. Journal of Economic and Administrative Sciences, 33(2), 114-130.

- Hartzell, J.C. & Starks, L.T. 2003. Institutional Investors and Executive Compensation. (Working paper). Retrieved From https://poseidon01.ssrn.com/delivery.php?ID=858106007111

- Hillman, A.J., Cannella, A.A., & Paetzold, R.L. (2000). The resource dependence role of corporate directors: strategic adaptation of board composition in response to environmental change. Journal of Management Studies, 37, 235-256.

- Hove-Sibanda, P., Sibanda, K., & Pooe, D. (2017). The impact of corporate governance on firm competitiveness and performance of small and medium enterprises in South Africa: A case of small and medium enterprises in Vanderbijlpark. Independent Research Journal in the Management Sciences, 17(1),1-11.

- Hove, R. (2017). The impact of capital structure on company profitability of industrial companies listed on the Johannesburg Stock Exchange. Master of Commerce. University of Pretoria, Pretoria.

- Hutchinson, M. (2002). An Analysis of the Association between Firms’ Investment Opportunities, Board Composition, and Financial performance. Asia Pacific Journal of Accounting and Economics, 9,17-39.

- Jensen, M. (2001). Value maximization, Stakeholders Theory and the Corporate Objective Function. Journal of Applied Corporate Finance, 14(3), 8-21.

- Kabir T.H 2009. The impact of the composition of the audit committee on Organisation and physical controls of banks in Nigeria. Nigeria Research Journal of Accountancy, 1(1), 58-80.

- Karanja, E. 2017. Does the hiring of chief risk officers align with the COSO/ISO enterprise risk management frameworks? International Journal of Accounting & Information Management, 25(3), 274-295.

- King Report, 1994, (2002). Corporate Governance for South Africa.

- Kirkpatrick, G. (2009). The Corporate Governance Lessons from the Financial Crisis. Financial market trends, 1(1), 1-30.

- Le, T.P.V., & Phan, T.B.N. (2017). Capital structure and financial performance: Empirical evidence from a small transition country. Research in International Business and Finance, 42, 710-726.

- Manafi, R., Mamoudian, A., & Zabihi, A. (2015). Study of the relationship between corporate governance and financial performance of the companies listed in Tehran stock exchange market. Mediterranean Journal of Social Sciences, 6(5), 56-61.

- Mashayekhi, B., & Bazaz, M.S. (2008). Corporate governance and financial performance in Iran. Journal of Contemporary Accounting and Economics, 4(2), 156-172.

- Merendino, A. (2014). Corporate governance: The relationship between board of directors and financial performance. Empirical evidence of Italian listed companies. European Scientific Journal, 1(1),191-201.

- Muazeib, A.I., Chairiri, A., & Ghozali, I. (2015). Does corporate governance drive capital structure of Johannesburg listed companies?. International Journal of Business, Economics and Law, 6(1), 23-34.

- Naimah, Z., & Hamidah, H. (2017). The role of corporate governance in financial performance. SHS Web of Conferences, 34, 34-40.

- Ochola, V.O. (2013). The relationship between corporate governance and financial performance of fund managers in Kenya. Master of Business Administration. University of Nairobi, Nairobi.

- Rashid, K. (2008). A Comparison of Corporate Governance and Financial performance in Developing (Malaysia) and Developed (Australia) Financial Markets. Doctoral Thesis, Victoria University, Melbourne.

- Sisoiu, A.E. (2016). The Effects of Corporate Governance on Financial performance. Doctoral Thesis. Bucharest Academy of Economic Studies, Bucharest.

- Statistics SA. (2018). Statistical release P6242.1. Pretoria: Statistics SA.

- Tshipa, J., & Mokoteli, T. (2015). The South African code of corporate governance: The relationship between compliance and financial performance: Evidence from South African publicly listed firms. Corporate Ownership & Control, 12(2), 149-169.

- Walker, D., & Mokoena, S. (2011). South Africa. In: Calkoen, W.J.L. ed. The corporate governance review. London: Law Business Research.1(1): 275-285.

- Wilson I. (2006). Regulatory and Institutional challenges of corporate governance in Nigeria post banking consolidation. The Nigeria Economic Summit Group (NESG) Economic indicators, 12(2), 1-10.

- Wu, M.C., Lin, H.S., Lin, I.C., & Lai, C.F. (2010). The effects of corporate governance on financial performance (Working Paper). Retrieved from http://120.107.180.177/1832/9901/099-2-06p.pdf

- Young, B. (2003). Corporate governance and financial performance: Is there a relationship? Ivey Business Journal Online, 1-4.

- Young, J. (2010). Corporate governance and risk management: A South African perspective. Corporate Ownership & Control, 7(3), 36-145.

- Zakaria, Z., Purhanudin, N., & Palanimally, Y.R. (2014). Board governance and financial performance: A panel data analysis. Journal of Business Law and Ethics, 2(1), 1-12.