Research Article: 2021 Vol: 20 Issue: 6S

Corporate Governance Practice and Accounting Conservatism Level of Malaysian Listed Construction Companies

Faiz Che’lah, Universiti Teknologi MARA

Amrizah Kamaluddin, Universiti Teknologi MARA Selangor

Nor Farizal Mohammed, Universiti Teknologi MARA, Malaysia

Abstract

Purpose: The aim of the study is to examine whether corporate governance practices namely CEO duality, board size, board independence and audit committee with financial expertise in Malaysian Listed Construction Companies, are associated with the level of accounting conservatism. Prior studies have recognized accounting conservatism as a fundamental feature of quality reporting and corporate governance as a monitoring mechanism. Methodology/Methodology/Approach: This study employs quantitative approach by analyzing 48 Malaysian listed construction companies for the period of 2015 to 2019, giving out to 152 observations. The accrual-based model is applied to measure accounting conservatism that serves as independent variable. Findings: The results show that board size and the number of audit committee with financial expertise are negatively related to the level of accounting conservatism. The results demonstrate that smaller board size is more effectively in monitoring the outcome of financial statements, while having more audit committee with financial expertise reduces the level of accounting conservatism. This is an interesting finding that questions the effectiveness of role played by independent directors and audit committee in Malaysia. The findings of this study contribute to the literature of corporate governance and accounting conservatism, by giving insights for the enhancement of corporate governance mechanism in ensuring accountability in financial reporting of companies. Indeed, this study paves avenue for further research in quality reporting and governance.

Keywords

Accounting Conservatism, Corporate Governance, Agency Cost, Information Asymmetry.

Introduction

Malaysia has successfully diversified its own economy which was initially based on agriculture and commodities to large manufacturing and services sectors which Malaysia has currently become one of the leading exporters in electronic equipment, parts and components. One of the eminent industries in Malaysia is construction. Construction sector contribution towards national income is significant in most countries with over 40% to 60% for the Gross Fixed Capital in developing countries (Wibowo & Mohamed, 2010) or RM 43 billion towards GDP (Gross Domestic Product) for the country (Bakar, Awang, Yusof, & Adamy, 2011). Thus, construction industry in Malaysia plays a vital role in economic growth especially in infrastructure, utilities and job creation. However, construction sector has been influenced and affected by economic uncertainties such as financial crisis and trade war (such as China and United States). Hence, construction sector is truly dependent on public and private sectors (Johnstone & Sundaraj, 2006).

During the period Malaysia faced financial crisis in 1997 and 2008, a lot of government and private construction projects have been stopped or delayed to reduce government spending as a measure to reduce the impacts of the crisis. As a result, construction sector also experienced a slump during the period. This has caused many of construction firms to fight to survive and many of them have been shut down during the tough time. According to IMF (International Monetary Fund), these factors such as weaknesses of corporate governance and corruptions are the factors contribute to the financial crisis (Tang & Liew, 2008); Tzeyin, 2013). Financial crisis has pressured managers to inform more positive news to reduce negative impact from the crisis (Laura & Mathew, 2002); Kaminsky & Schmukler, 1999; Shuhidan, et al., 2018). This resulted in the management to practice aggressive financial reporting through rapid recognition of good news over bad news due to sensitivity of investors toward bad news is higher than good news. So, it be can predicted that during financial crisis, accounting conservatism is lower than under normal economic conditions (Kong & Meek, 2010).

In order to maintain financial performance, there is possibility of earning management practice among the construction companies. According to Meek, Pacheco, & York (2010), before financial crisis during 1997/1998, managers tend to manage aggressive accounting practice by reporting good news and delaying recognition of bad news. This has made the accounting practice less conservative which managers tend to practice discretionary accruals. This happened due to weak governance and also ignorance on good practice and sustainability of business. After financial crisis hit Asian countries, they tried to comply with international accounting standards and stabilize their financial systems. Improving corporate governance and strengthening of regulations over financial market have assisted Asian countries to recover from the crisis. Kong & Meek (2010) investigated conservatism and earnings timeliness in the time of financial crisis 1997 in Hong Kong, Malaysia, Singapore and Thailand. They found that conservatism and earnings timeliness before financial crisis were low, but increased after financial crisis. The result indicates corporate governance reform has greater impact on accounting conservatism and earnings timeliness.

Accounting conservatism has attracted the attention of researchers in recent years. Accounting conservatism is one of subject that never been stopped to be debated because it was one of the most influence principle in accounting framework. In the latest International Accounting Standard Board (IASB) conceptual framework for financial reporting, the IASB has relooked conservatism as prudence as "a cautious response towards uncertainties and inherent risks in business courses" (IASB, 2018). This approach indicates that the IASB have recognised the significance of conservatism. The current study focuses on construction industry as subject matter because of risk exposure. This is because in economic crisis, construction sector is the most effected and there is possibility that earnings manipulation happens to sustain their financial strength.

The current study aims to investigate the accounting conservatism level influenced by corporate governance practice of public listed construction companies in the Malaysia Stock Exchange. This paper seeks to answer whether the corporate governance mechanisms (CEO duality, board size, board independence and audit committee with financial expertise) have relationship with accounting conservatism level. This study is also can become an instrumental to broaden the scope of stakeholders such as management, investors, lenders, analysts, auditors, forensic accountants, government and other financial experts to measure accounting conservatism of a company. Accounting conservatism measurement may assist these stakeholders to determine how conservative or aggressive they are in managing accounting practice. This can be an indicator as red flag before accounting manipulation to happen. Thus, they can take further action before any negative consequences happen to the company. Plus, this model is greatly useful for investors to measure the health of a company especially on their earnings quality before investment decision being made. Furthermore, this study is also significant to deliver evidence and strengthen this research with facts from previous studies and comparisons of their results that related to accounting and financial study field and at the same time, broadens the scope for future researchers to gather more sources of information and references. Additionally, this study also shed light on analysis of issues related to construction industry which is rarely put on focus in research field. The following sections are organized as follows; the literature; discusses on research design; explains the research analysis and concludes the study.

Literature Review

Accounting Conservatism

In accounting history, conservatism and prudence principle is one of the elements of accounting framework of corporate information, and has been existed for many centuries (Gigler, 2009). Conservatism concept is usually one of the most important principles of accounting (Cairncross, 2003). Bliss (1924) stated that conservatism is to expect no profit and all losses. This means accountant is required to distinguish between bad news and good news (Basu, 1997) Similarly, Watts & Zimmerman, (1986) defined conservatism as disclosure of lowest value of assets and reporting liabilities in higher value. Nowadays, accounting conservatism has become a debate among academicians and also industry players. The "no gain anticipated but all losses reported" scenario always occurred, hence, reports tend to require greater assurance for good news than bad news (Basu, 1997). Givoly (2011) stated that conservative accounting is more commonly used to identify unfavorable expected income events than to recognize anticipated beneficial events impact. A typical example of financial conservatism is lower costs of inventories and timely recognition of the cost estimates that will lead to future long-term contract losses, compared to those that resulted in future profits (Basu, 1997). Nevertheless, from a broader point of view, conservatism is also defined and interpreted as a preference for accounting to adopt accounting methods that result in lower assets and revenue values as well as higher liability and expenditure values (Belkaoui, 1985; Basu, 1997).

Agency Theory

An agency relationship is defined as a contract whereby one or more individuals (principle(s)) engage with another person (the agent) to carry out a service on their behalf that involves delegating the agent with certain decision-making authority (Jensen & Meckling, 1976). Meanwhile, Eisenhardt (1989) defined agency theory as where each person acts to maximize his or her interests over those of the other person and the willingness of investors and management to tolerate risk is varied. Zhang (2018) explained that the agency theory is the issue of modern business systems by identification of the agent and principal conflict of interest. For instance, in a company, the agent utilizes residual right to refuse shareholders’ interests (La Porta, 1999). According to Jensen & Meckling (1976) appropriate control mechanisms are needed to reduce interest divergence between investors and managers. Conservatism is viewed as making certain efficient contracts between agent and principle (Ball, 2001; Watts, 2003b). Lastly, Louis, Sun, & Urcan (2012) revealed that conservative accounting can help to decrease information risks of shareholders, control agency costs and increase value of shareholders.

Agency Theory and Accounting Conservatism

Separation of agent and principal in the firms allows agent to make decision on behalf of the principal. Thus, manager’s competency in accepting risk is varied (Flanagan & Clarke, 2007). This separation removes shareholder’s control and encourages agency conflicts (Letza, 2004). As a result of this agency conflict, the decision of managers may not always be taken to match the interests of investors (Jensen & Meckling, 1976) which can lead to expropriation problems due to information asymmetries between the two parties (Shleifer & Vishny, 1986). This issue will lead managers to make poor decisions-making investments and reduces value of the firms. Thus, the principal may suffer from the action of managers.

In order to solve this issue, R. L. Watts (2003b) suggested an approach to reduce information asymmetry and moral hazard problems arising from agency conflicts by the use of conservative accounting in contractual arrangements between parties related to a firm. Similarly, Francis & Martin (2010) revealed that conservatism accounting in time of existence of agency conflicts because of asymmetric information leads to profitable decisions that show conservatism accounting is a mechanism that encourage managers to prevent poor decisions-making investments. Additionally, Sultana (2015a) also mentioned that conservatism accounting plays a key role in reducing agency costs and litigation risk; hence, effective corporate governance should take conservative accounting approaches that lead to sound accounting information as a desirable element in financial reporting within an agency theory framework.

Corporate Governance

Differences in definitions of corporate governance are based on the concept behind the creation of corporate governance. OECD (2004) defined corporate governance as comprises a set of relations between the management, boards of directors, shareholders and other stakeholders of a company. Corporate governance also establishes the framework which organization targets are set and how these objectives can be achieved and how quality of monitoring is assessed (OECD, 2004). This is consistent with Boubakri (2005) who defined corporate governance as “a response to the problems in agency of the organization which arises from the ownership and control separation of a company”. Shleifer & Vishny (1997) defines corporate governance to make certain that financing providers will receive a return for their investment. Williamson (1988) defined corporate governance as a way to manage investors and management interests. Those definitions have described corporate governance as a guideline for the board of directors and the management of a company to perform based on the interests of shareholders, investors, and creditors (Azizah, Abidin, & Ahmad, 2007; Kazemian, et al., 2021).

Under Malaysian capital market framework, corporate governance has become vital after financial crisis hit Asia during 1997. Corporate governance is adopted by Securities Commission in broader perspective as framework, as a requirement from Securities Commission of Malaysia, Bursa Malaysia and other statutory bodies. The framework of corporate governance is governed by law, code and regulatory. The acknowledgement of Malaysia Code on Corporate Governance (MCCG) in 2000 as the main listing requirement of Bursa Malaysia is crucial to enhance for corporate governance development in Malaysia (Aswadi & Wahab, 2016).

Hypotheses Development

Prior research has prompted that accounting conservatism is related to corporate governance practices, since accounting conservatism is a feature of quality reporting, to facilitate effective monitoring of managers (Watts, 2003b; Ball & Shivakumar, 2008). Further, accounting conservatism has received emphasis in corporate governance as it has implications of minimizing management opportunism, potentially increasing firm value and thus safeguarding the rights of minority shareholders (R. L. Watts, 2003b). Accounting conservatism can help to reduce agency costs in contracts, as corporate governance is designed to eliminate the agency cost between managers and owners or shareholders (García Lara, García Osma, & Penalva, 2009). Managers should be monitored through the introduction of a number of corporate governance mechanisms in order to control management's estimates and also maintain conservative reporting. For example, the involvement of a large number of outsiders on the board could strengthen the oversight process and make financial reporting of managers more conservative (Lara, Osma, & Penalva, 2007).

In addition, several studies have shown that corporate governance mechanisms can improve conservative accounting. Chi et al. (2009) found that enhancing corporate governance also strengthens conservatism. This shows that conservatism can help managers and investors to distinguish and discriminate between good and bad investments, notify investors, and discourage managers from taking their wealth away. Amran & Manaf (2014) indicated that implementation of corporate governance in Malaysia’s corporation has significant impact on confident level of investors through promoting good accounting practice in financial reporting. For example, in a study on 300 Malaysian listed firms, Mohamed, Ahmar, & Sulaiman, (2014) have found positive relationship between corporate governance and accounting conservatism. The findings have shown that higher number of audit committee meetings and audit committee with financial expertise, and higher proportion of independent directors, are quicker to recognize bad news than good news. Similarly, Ball & Shivakumar (2005) and R. L. Watts (2003) also argued that corporate governance is facilitated by conservatism. This is because it needs to recognize loss over profits, therefore, board of directors will question managers in the case of negative net present value (NPV) projects and will be given a prompt consideration to investigate these projects.

Based on a prior empirical study, corporate governance practices accounting conservatism by promoting good accounting practices in financial reporting (Fama & Jensen, 1983; Amran & Manaf, 2014). Thus, the following sections explain the development of hypotheses.

CEO Duality and Accounting Conservatism

Agency theory argued as to the position of CEO and chairman is held by one person, since CEO in management and the board in monitoring should be separated (Nasr & Ntim, 2018b). There are many previous studies related to the impacts of CEO duality on accounting conservatism level and the findings from these studies are mixed. Brickley, Coles, & Jarrell (1997) and Klein (1998) argued, the merged structure allows the CEO cum chairman to make effective and dynamic decisions as well as boost the board's effectiveness, because inside directors have greater knowledge and experience on the operations of companies that external directors might be deficient. Meanwhile, Bliss, Muniandy, & Majid (2007) stated that combined structure was proved to be ineffective, whilst Krishnan & Visvanathan (2008) mentioned the separation of CEO and chairman is indicated to be a stronger mechanism. Besides that, Ng & Rezaee (2012) found companies with dual managing director can manipulate earnings more easily.

Accordingly, the findings of these previous studies showed separation of CEO and chairman plays an important role to enhance level of accounting conservatism (Rezaee, 2005). Thus, the following hypothesis is developed:

H1 There is negative relationship between CEO duality practice and accounting conservatism level.

Board Independence and Accounting Conservatism

Independent (outside) directors is among the most effective ways employed for internal corporate governance (Lim, 2011). Several studies have shown positive association between board independence and accounting conservatism. Ahmed & Duellman (2007a) revealed independent directors do not only monitoring management but also maximize firm value. Based on a research on Malaysia non-financial listed firm’s observation from 2001 to 2007, Mohamed et al. (2014) found that the higher number of independent directors employed into corporations, the quicker the corporations recognize bad news into earnings than good news. Other than that, another study by Nasr & Ntim (2018a) have conducted a research on 100 Egypt listed companies observation in 2015, which revealed the existence of independent directors aids to mitigate agency risk that emerge from separation of managers and shareholders, via effective management monitoring. However, in contrast to the above findings, based on a research conducted by Amran & Manaf (2014) on 866 Malaysia listed companies for observation from year 2000 to 2012, they found no significant association between board independence and accounting conservatism. Hence, this also implies the number of non-executive directors actually have no power and lack of "freedom" for supervision and advice to the board of directors. Nevertheless, Mohammed, Ahmed & Ji (2017) found that board independence is positively associated with accounting conservatism since independence dimension has an important role in upholding the integrity and credibility of financial statements.

Prior empirical studies is mixed, but most of studies have shown that higher number of independence directors indicates immediate recognization of bad news into earnings than good news (Mohamed et al., 2014). This proves the existence of a positive relationship between board independence and level of accounting conservatism. Thus, the following hypothesis is developed:

H2 There is positive relationship between board independence and accounting conservatism level.

Board Size and Accounting Conservatism

Board size is defined by the number of directors in the firms which comprises of executive and non-executive directors (Samaha, 2012; Wang & Hussainey, 2013). There are several other studies found that a large board improves the efficiency of monitoring process. This is because diversity in a large group in terms of skills can increase the influence of conservative accounting especially financial reporting (Ebrahim & Fattah, 2015). Apart from that, another study by Ahmed & Duellman (2007b) found that a manager's decisions in a large board are more evaluated by other directors.

Nevertheless, the results from prior studies on the effect of the number of board members on the level of accounting conservatism are varied. Some studies are in favour of a small number of board members which also may lead to a more conservative accounting (Beasley, 1996); Chi et al., 2009). A research conducted on 100 Egypt listed companies for observation year 2015, Nasr & Ntim, (2018b) revealed small board size is preferred because large board size may cause dispute among members, communication risk and inefficient decision making. Almutairi & Quttainah (2019) found that large board members request less accounting conservatism because management opportunities to manipulate financial reporting are affected by a large number of boards.

The findings based on prior empirical studies mentioned above are mixed. Large board size leads to low performance's firm quality (Cheng, 2008); Guest, 2009), high earnings manipulation (Rahman & Mohamed Ali, 2006; Wirama, 2017) and increased financial risk condition (Chang & Ruefli, 2009). Thus, the following hypothesis is developed:

H3 There is negative relationship between board size and accounting conservatism level.

Audit Committee with Financial Expertise and Accounting Conservatism

Financial experts are recognized by their knowledge and understanding of financial matters and reporting issues as the principal individuals within an audit committee with a greater responsibility for financial reporting process (Sultana, 2015a). Several studies have shown positive association between audit committee with financial expertise and accounting conservatism. Mohamed (2014) on their research conducted on 300 Malaysian listed firms over seven years, revealed the existing of audit committee with financial expertise reduces earnings manipulation (Bédard, 2004), mitigates earnings restatement (Abbott, Parker, & Peters, 2004) and applies more accounting conservatism (Krishnan & Visvanathan, 2008). Similar to another study on 159 banks over seven years by Martínez-ferrero & García-meca (2017) found that audit committee (financial expertise) enhances accounting conservatism through reduction of earnings manipulation, better internal control and mitigation of earnings restatement. Another research conducted on 929 S&P 500 firms over 3 years by Visvanathan (2008) also indicated that audit committee with financial expertise can increase accounting conservatism. This can be proven via performing in monitoring effectively and promoting conservative accounting when they have strong governance mechanisms.

Based on the prior empirical findings mentioned above, there is positive relationship between audit committee with financial expert and accounting conservatism practice (Mohamed et al., 2014). This indicates the existence of audit committee with financial expertise reduces earnings manipulation (Bédard et al., 2004), mitigates earnings’ restatement (Abbott et al., 2004), and applies more accounting conservatism (Krishnan & Visvanathan, 2008). Thus, the following hypothesis is developed:

H4 There is a positive relationship between audit committee financial expert and accounting conservatism level.

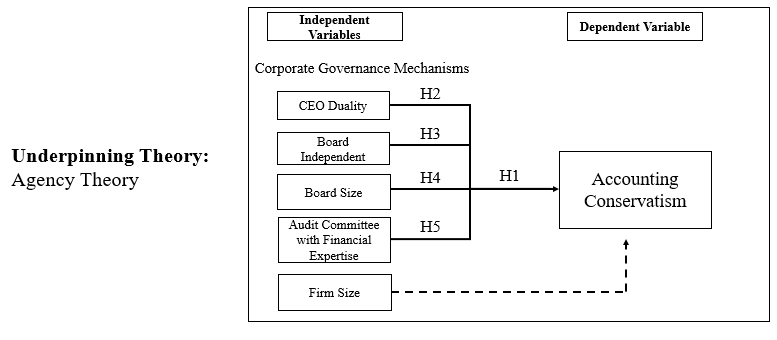

Research Framework

The Figure 1 below shows a research framework of this study. The framework illustrates relationship between independent and the dependent variables of this study. The independent variables are four corporate governance mechanisms which are CEO duality, board independence, board size and audit committee with financial expertise. Also, this research is added control variable of firm size to avoid any potential bias. Meanwhile, the dependent variable is accounting conservatism.

Research Design

Population and Sample

In this study, the population has taken to construct in this research is the Malaysian Public Listed Company. Currently in Malaysia, there are 897 listed companies in Bursa Malaysia which comprise of the main market and the ACE market as in 27th May 2019. The listed companies have been selected in this research are those from non-financial firms which conveniences available from Malaysia listed construction companies. Hence, this study is conducted on a sample size of 48 non-financial public listed companies (PLCs) in Malaysia in which the companies were selected from four consecutive years which are in 2015, 2016, 2017 and 2018. Purposive sampling was used to obtain data because are most readily or conveniently available.

Dependent Variable

Accounting Conservatism

One of the measurements of accounting conservatism is the existence of accumulated accruals over time. In reverse accruals, when net earnings exceed cash flows from operations are estimated to be followed with periods in negative (positive) accruals, the cumulative amount of net earnings before depreciation and amortization are expected to be converted into cash flow from operations in the long run (Givoly & Hayn, 2000a). The reason why accrual-based measurement is being used because accounting conservatism uses the accrual mechanism to delay economic gains' recognition and accelerate economic loss recognition (Wang, 2008). Through such a process of delaying gains and accelerating losses, the level of accumulated accruals in a firm gradually becomes more and more negative (Givoly & Hayn, 2000b). One strength of the accrual-based measurement is that it is a firm-specific measure of conservatism. Strength is that accrual-based measurement is generally easy to implement, as it does not require too many data items. Furthermore, the accrual-based measurement is not market-based, which makes it more widely applicable (e.g. to non-market firms) than the market-based measures such as market-to-book (MTB) (Wang, 2008).

Accrual-based measure of conservatism is equal to earnings before extra-ordinary items minus cash flow from operations plus depreciation expense deflated by average total assets, and averaged over 3 years’ period centered on year t, multiplied by negative one. Therefore, when the average accruals become more negative, this also indicates the accounting is more conservative (Ahmed & Duellman, 2007b; Elshandidy & Hassanein, 2014a). Thus, equation (1) is as follows:

ACC – CONS = (EBEXT – CFO + DEP)X – 1

ACC – CONS is accounting conservatism based on accrual-based measurement of conservatism for firm i in the year t;

EBEXT is earnings before extra-ordinary items for firm i in the year t;

CFO is cash flows from operations for the firms i in the year t;

DEP is depreciation expense for the firms i in the year t;

Independent Variables

CEO Duality

CEO duality is a separation of chairman and chief executive roles. CEO duality is measured via dummy variable that takes value of 1 if the position of the company CEO and chairman are held by different persons and 0 if both positions are held by same individual (Nasr & Ntim, 2018a); Mohamed et al., 2014).

Board Independent

Board independence or outside director is directors who are not involved in management of firm. Board independence is measured through the number of non-executive directors on the board divided by total number of directors on the board (Nasr & Ntim, 2018c); Mohamed et al., 2014); Amran & Manaf, 2014).

| Table 1 Summary of Accounting Conservatism, Four Independent Variables and One Control Variable |

||

|---|---|---|

| Variable | Measurement | Prevailing literature |

| Dependent Variable:Accounting conservatismACC CONS | ACC – CONS = (EBEXT – CFO + DEP)X – 1ACC – CONS is accounting conservatism based on accrual-based measurement of conservatism for firm i in the year t;EBEXT is earnings before extra-ordinary items for firms i in the year t;CFO is cash flows from operations for the firms i in the year t;DEP is depreciation expense for the firms i in the year t;(Elshandidy & Hassanein, 2014) | Elshandidy & Hassanein (2014a), Givoly & Hayn (2000b), A. S. Ahmed & Duellman (2007a), Nasr & Ntim (2018c) |

| Independent Variable:Separation chairman and CEO/ CEO duality | Measured as dummy variable that takes value of “1” if the positions of the company chairman and CEO are held by different persons and “0” otherwise | Nasr & Ntim (2018c), Mohamed et al. (2014), Alnasser (2012) |

| Independent Variable:Board independence | Measured as (Number of non-executive directors on the board/total number of directors on the board) x 100% | Nasr & Ntim (2018c), Said, Ashikin, Rahim, & Hassan (2018), Said et al. (2018), Mohamed et al. (2014), Haji (2014). |

| Independent Variable:Board size | Measured as total number of directors on the board | Nasr & Ntim (2018c), Almutairi & Quttainah (2019a), Said et al. (2018), Haji (2014), Mohamed et al. (2014), Alnasser (2012). |

| Independent Variable:Audit Committee(Financial expertise) | The audit committees are having financial expertise if either of the following conditions are fulfilled: (a) experience as a public accountant, auditor, principal or chief financial officer, controller, principal or chief accounting officer (frequently known as ‘accounting financial expertise’); and/or (b) experience as a CEO or president of a for-profit firm (known as ‘non-accounting financial expertise’).(% of audit committees are financial expertise) | Sultana (2015b), Sultana & Zahn (2013), Martinov-bennie, Soh, & Tweedie (2015), Bin-ghanem & Ariff (2016), J. W. Lin & Li (2006), Iyer, Bamber, & Griffin (2013) |

| (Control Variable)Firm Size | Measured as natural log of total assets | Nasr & Ntim (2018c), Lim (2011) |

Board Size

Board size is the total of board member that comprise of non-independent directors and independent directors (Nasr & Ntim, 2018); Mohamed et al., 2014).

Audit Committee with Financial Expertise

Audit committee with financial expertise is an audit committee with long experience gained and knowledge about the firm, which enables them to make financial decision (Vafeas, 2005); Sharma & Iselin, 2012). According to several prior studies, audit committees with financial expertise are measured by two conditions: (a) has experience as a public accountant, auditor, principal or chief financial officer (Frequently known as “accounting financial expertise”); and/ or (b) has experience as a CEO or president of a for-profit firm (known as “non-accounting financial expertise”) (Defond, 2005; Krishnan & Visvanathan, 2008; Sultana, 2015b).

Control Variable

Firm Size

Firm size is measured as a natural log of total assets (Nasr & Ntim, 2018b). Firm size is considered as control variable which is added to avoid potential bias (Ntim, 2017). Lim (2011) noted that firm size is positively associated with accounting conservatism. This is because larger firms are more inclined to be more conservative on their accounting practice due to scrutiny of public.

Regression Model

The following model is a multiple regression model to examine the effect of corporate governance mechanisms on the occurrence of accounting conservatism:

Model 1: ACC – CONSit = β0 + β1 S/CEODit + β2 %NXDit + β3 BSIZEit + β4 %AFCit + β5 FSIZEit + ?it

Where:

ACC – CONSit = accounting conservatism measured using equation (1), and for firm i in year t;

S/CEODit = separation of chairman/CEO roles;

%NXDit = percentage of non-executive directors;

BSIZEit = board size;

%AFCit = percentage of audit committee with financial expertise;

FSIZEit = firm size;

?it = error term for the model.

Research Analysis

Classification of Companies

The selected sample of Malaysian construction PLCs are for the period of 2015, 2016, 2017 and 2018. The first research objective is to identify the associations of corporate governance and accounting conservatism. Accounting conservatism is measured by employing the accrual basis method. This method assists to ascertain the sensitivity of accounting conservatism level through the corporate governance practice of the companies from 2015 to 2018. Companies which scored –ve (negative) value are considered as having low accounting conservatism as opposed to companies which scored +ve (positive) value. However, the lower or the more negative the level of accounting conservatism, the company is more likely to practice earnings management and have low earnings quality. Overall, there are 132 firm with less accounting conservatism level which is 70.58% of total sample and 55 firms with more accounting conservatism level. From Table 2, it is shown that the percentage of less accounting conservatism had consistently increase where by 4.16% in 2016, 0.28% in 2017 and 2.08% in 2018. Meanwhile, the more accounting conservatism are moving in an opposite direction by consistently decreasing from 2016 to 2018.

| Table 2 Classification of Less Accounting Conservatism Level and High Accounting Conservatism Level Companies |

|||

|---|---|---|---|

| Year | Less Accounting Conservatism Level-ve (Negative) | More Accounting Conservatism Level+ve (Positive) | Total |

| 2015 | 32 (66.67%) | 16 (33.33%) | 48 (100%) |

| 2016 | 34 (70.83%) | 14 (29.17%) | 48 (100%) |

| 2017 | 32 (71.11%) | 13 (28.89%) | 45 (100%) |

| 2018 | 34 (73.91%) | 12 (26.09%) | 46 (100%) |

| Total | 13 (20.58%) | 55 (29.42%) | 187 (100%) |

Normality Test

The analysis to determine the relationship involves the use of test of significant correlation and regression. The appropriate statistical tools for this depend on the normality or non-normality of observation values. A normality test was carried out using the Skewness and Kurtosis value on board independence, board size, audit committee independent, audit committee with financial expertise, firm size and accounting conservatism. The summary statistics are presented in Table 3.

| Table 3 Summary Statistics of Skewness and Kurtosis: Test of Normality |

|||||

|---|---|---|---|---|---|

| N | Skewness | Kurtosis | |||

| Statistic | Statistic | Std. Error | Statistic | Std. Error | |

| %NXD | 187 | .356 | .178 | -.715 | .354 |

| BSIZE | 187 | .643 | .178 | .518 | .354 |

| %AFC | 187 | .016 | .178 | -.998 | .354 |

| FSIZE | 187 | .204 | .178 | .648 | .354 |

| ACC-CONS | 187 | -1.484 | .178 | .654 | .354 |

ACC CONS: (Accounting Conservatism); %NXD: (Number of Independent Director); BSIZE: (Board Size); %AFC: (Number of Audit Committee with Financial Expertise); FSIZE: (Firm size)

It can be seen that the skewness and kurtosis value for all the variables are in the range -2 to 2. This means that the mean scores of board independence, board size, audit committee financial expertise, firm size and accounting conservatism are normally distributed. Following this conclusion, the study uses the parametric statistical tool in the following analysis. In determining the normality test, the value of skewness and kurtosis is justified to certain whether the data is indicated as reasonably normal or not normal of which the data justify to be reasonably normal in distribution when the range of skewness is within ±2 and for kurtosis the acceptable threshold is ±10 (Audu & Corresponding, 2011).

Correlation Analysis

Correlation analyses were carried out to determine the relationships, if any, between variables of board independence, board size, audit committee financial expertise, firm size and accounting conservatism. As the variable values were found to be normally distributed, the analyses were carried out using Pearson Coefficient Correlation, a parametric correlation tool. The summary statistics of the correlation analyses are presented in Table 4 and are discussed as follows:

| Table 4 Pearson Correlation Coefficient Matrix |

||||||

|---|---|---|---|---|---|---|

| Variables | ACC CONS | %NXD | BSIZE | %AFC | FSIZE | |

| ACC CONS | Pearson correlation | 1 | ||||

| Sig. (2-tailed) | ||||||

| %NXD | Pearson correlation | .058 | 1 | |||

| Sig. (2-tailed) | .434 | |||||

| BSIZE | Pearson correlation | -.291 | -.323** | 1 | ||

| Sig. (2-tailed) | .016 | .000 | ||||

| %AFC | Pearson correlation | -.341 | .074 | -.019 | 1 | |

| Sig. (2-tailed) | .044 | .312 | .799 | |||

| FSIZE | Pearson correlation | .256 | -.088 | .469** | .043 | 1 |

| Sig. (2-tailed) | .034 | .231 | .000 | .562 | ||

| *Correlation is significant at the 0.05 level (2-tailed) **Correlation is significant at the 0.01 level (2-tailed) | ||||||

ACC CONS: (Accounting Conservatism); %NXD: (Number of Independent Director); BSIZE: (Board Size); %AFC: (Number of Audit Committee with Financial Expertise); FSIZE: (Firm size).

Table 4 shows the correlation analysis of the five variables, which are accounting conservatism (ACC CONS), board independent (%NXD), board size (BSIZE), audit committee with financial expertise (%AFC) and firm size (FSIZE). Based on the table, variables accounting conservatism (ACC CONS) and board independence (BSIZE) show negative correlation with significant at -0.323. This shows there is low correlation but negative between ACC CONS and BSIZE. Meanwhile, there is low positive correlation between ACC CONS and Firm Size (original). It shows that there is positive correlation but low between ACC CONS and Firm Size (original).

Table 4 shows that board size (r = -0.291; p<0.05) and audit committee financial expertise (r = -0.291; p<0.05) are negatively but lowly correlated with accounting conservatism. That is, to a low extent, an increase of board size and audit committee financial expertise is associated with a decrease in accounting conservatism, and vice versa. The Firm size are positive and lowly correlated with performance (r = 0.256; p<0.05), that is, to a low extent, an increase of firm size will increase accounting conservatism, and vice versa.

The result also shows that there is no significant correlation between board independence with accounting conservatism (p>0.05). That is, on average, there is no relationship between board independence and accounting conservatism. None of the variables are correlated highly with each other, confirming the validity of the regression model.

Multicollinearity Test

Table 5 shows the result of muticollinearity test. It justifies that the model is good because all of the Variance Inflation Factors (VIF) of the independent variables are below 10, whereas all the Tolerance (1/VF) are above 0.10. This signifies that the variables are outfit to predict independent variables and the variables are not biased. Thus, regression analysis can be proceeding.

| Table 5 Multicollinearity Test and Variance Inflation Factor (VIF) |

||

|---|---|---|

| Variables | Tolerance | VIF |

| Board Independent | .887 | 1.128 |

| Board Size | .633 | 1.580 |

| Audit Committee (Financial expertise) | .993 | 1.007 |

| Firm Size | .696 | 1.437 |

Regression Analysis

A regression equation was estimated with accounting conservatism as the dependent variable, and CEO duality, board size, audit committee financial expertise and firm size as the independent variables. Table below presents the summary statistics of the estimated regression equation.

| Table 6 Estimated Regression Equation |

|||

|---|---|---|---|

| Variable | Coefficient | t-value | p-value |

| CEO duality | 0.021 | 0.768 | 0.443 |

| Board independence | 0.023 | 0.578 | 0.564 |

| Board size | -0.009 | -2.129 | 0.035* |

| Audit committee financial expertise | -0.048 | -2.024 | 0.044* |

| Log Firm size | 0.034 | 2.510 | 0.013* |

| F | 2.599 | 0.027* | |

| R2 | 0.367 | ||

| * Significant at 0.05** Significant at 0.01 | |||

The regression equation is statistically significant at 0.05 (p<0.05), implying that there is an association between accounting conservatism with any or all of the independent variables. However, the R-square value being 0.367 means that the five independent variables as a whole account for 37 per cent of the variation in the dependent variable (accounting conservatism).

In Table 6, from the individual regression coefficient, it can be found that only the coefficient of board size, audit committee financial expertise and Log firm size are statistically significant at 0.05 (p<0.05), whereas CEO duality, and board independence are not. The coefficient of board size (-0.009) and audit committee financial expertise (-0.048) means that an increase in board size and audit committee financial expertise decreases accounting conservatism. The coefficient of firm size (0.034) means that an increase in firm size increases the accounting conservatism, whilst the variables of CEO duality and board independence are not associated with accounting conservatism level.

| Table 7 Summary Hypothesis Results |

||

|---|---|---|

| Hypotheses | Results | |

| H1 | There is negative relationship between CEO duality practice and accounting conservatism level. | Not accepted |

| H2 | There is positive relationship between board independence and accounting conservatism level. | Not accepted |

| H3 | There is negative relationship between board size and accounting conservatism level | Accepted with significant negative |

| H4 | There is a positive relationship between audit committee financial expert and accounting conservatism level | Not accepted with significant negative |

Result and Discussion

This study found that two corporate governance mechanisms such as board of independence and CEO duality are not significant towards accounting conservatism. The model of accrual-based measurement (Nasr & Ntim, 2018b) is used in this study on the samples from 2015 to 2018. Based on 187 firm-year observations during 2015-2018, and the usage of accrual-based measure of accounting conservatism, we found that corporate governance mechanisms of board size and audit committee with financial expertise have significant negative association with accounting conservatism while other governance mechanisms which are, CEO duality and board independence have positive relationship but not significant with accounting conservatism. On the other hand, a control variable, firm size, has significant positive relationship with accounting conservatism. Audit committee with financial expertise can enhance management incentive to create financial reporting in favour of them discretely. However, this study showed that the audit committee is not genuinely independent even when all of the audit committees in construction public listed companies (PLCs) are independent. Amran & Manaf (2014) studied Malaysia PLCs from the year 2000 to 2012, found that the independent non-executive directors do not actually have the power of independence, monitoring and advising the board of directors. The role of audit committee in construction PLCs is still lacking in terms of delivering conservatism in accounting practice.

The number of directors is suggested not too big and not too small. Chi et al. (2009) revealed that large board will reduce accounting conservatism level. It also supports Beasley (1996) findings on an empirical study that larger board size correlates with the likelihood of financial reporting manipulation. A small number of directors are related to more effective board monitoring. Thus, this effectiveness delivers through higher conservatism practice in financial reporting. A growing company is due to the expanding of business. The growth business needs to substantial capital to purchase assets for operating purposes. Investors as capital contributor demand for good practice. The larger firm size is under the scrutiny of investors’ eyes. According to Lim (2011), firm size has positive association with accounting conservatism as larger firm size is under the scrutiny of public eyes. Thus, accounting conservatism may assist the investors to monitor and supervise the management of company. Lastly, in an approach to reduce asymmetry of information and moral risks caused by agency conflicts by the use of accounting conservatism in contractual arrangements between related parties of a firm? Accordingly, conservatism accounting plays the main role in reducing agency costs and litigation risk, hence, efficient corporate governance should take conservatism accounting approaches which lead to sound accounting information as a desirable item for financial reporting within an agency theory framework.

Conclusion

The current study examines the association between four corporate governance mechanisms (CEO duality, board size, board independence and audit committee with financial expertise) and accounting conservatism for Malaysian Listed Construction Companies in the year 2015 until 2018. The study focuses on the accounting conservatism in construction companies as this sector was mostly affected during the financial crisis in Malaysia. The construction sector was affected as some of the mega-developments were delayed or discontinued to reduce government spending. The findings demonstrate significant and negative relationship between board size and audit committee with financial expertise and accounting conservatism level. Smaller board size seems an effective mechanism in reducing agency cost. Bad news can be immediately recognized in the organization when having lower number of board size. Most interestingly, audit committee with financial expertise was influenced by management to allow them in practicing low accounting conservatism in financial reporting. Even though all of the audit committees in Malaysian listed construction companies are independent, but they are not “independent” in monitoring and advising the board of directors. The findings contribute to enhance of governance mechanism in ensuring accountability in financial reporting of companies. Hence, the implication of the finding of this study is the call for more effective role of board of directors in the Malaysian listed companies. The process of appointment of directors must be scrutinized and trainings must be given to the directors. One limitation of this study is there is only one measurement (accruals measurement) of accounting conservatism used. Further research may examine by utilizing other measurements of accounting conservatism.

Acknowledgement

We acknowledge the financial contributions from the Accounting Research Institute, Universiti Teknologi MARA.

References

- Abbott, L.J., Parker, S., & Peters, G.F. (2004). Audit committee characteristics and restatements. Auditing A Journal of Practice & Theory, 23(1), 69-87.

- Ahmed, A.S., & Duellman, S. (2007a). Accounting conservatism and board of director characteristics: An empirical analysis. Journal of Accounting and Economics, 43(2–3), 411-437.

- Ahmed, A.S., & Duellman, S. (2007b). Accounting conservatism and board of director characteristics: An empirical analysis. Journal of Accounting and Economics, 43(2-3), 411-437.

- Almutairi, A.R., & Quttainah, M.A. (2019). Corporate governance and accounting conservatism in Islamic banks. 1–20.

- Alnasser, S. (2012). What has changed?? The development of corporate governance in Malaysia. Journal of Risk Finance, 13(3), 269–276.

- Amran, N.A., & Manaf, A. (2014). Board independence and accounting conservatism in Malaysian companies. Procedia - Social and Behavioral Sciences, 164(August), 403–408.

- Aswadi, E., & Wahab, A. (2016). Political connections, corporate governance and tax aggressiveness in Malaysia. Asian Review of Accounting, 25(3), 424-451.

- Audu, A., & Corresponding, M. (2011). Determinants of Customer Behavioural Responses?: A Pilot Study. International Business Research, 4(1).

- Azizah, N., Abidin, Z., & Ahmad, H.N. (2007). Corporate Governance in Malaysia?: the effect of corporate reforms. Asian Academy of Management Journal.

- Bakar, A.H.A., Awang, A., Yusof, M.N., & Adamy, A. (2011). Strategies for survival during economic downturn in construction industry a survey on construction companies in Malaysia. World Applied Sciences Journal, 13(9), 1967-1974.

- Ball, R. (2001). Infrastructure requirements for an economically efficient system of public financial reporting and disclosure. Brookings-Wharton Papers on Financial Services.

- Ball, R., & Shivakumar, L. (2005). Earnings quality in UK private firms: Comparative loss recognition timeliness. Journal of Accounting and Economics, 39(1), 83-128.

- Ball, R., & Shivakumar, L. (2008). Earnings quality at initial public offerings. Journal of Accounting and Economics, 45(2-3), 324-349.

- Basu, S. (1997). The conservatism principle and the asymmetric timeliness of earnings. Journal of Accounting and Economics, 24(1), 3-37.

- Beasley, M.S. (1996). An empirical analysis of the relation between the board of director composition and financial statement fraud. Accounting Review, 71(4), 443-465.

- Bédard, J., Chtourou, S.M., & Courteau, L. (2004). The effect of audit committee expertise, independence, and activity on aggressive earnings management. AUDITING: A Journal of Practice & Theory, 23(2): 13-35..

- Belkaoui, A. (1985). Slack budgeting, information distortion and self-esteem. Contemporary Accounting Research, 2(1), 111-123.

- Bin-ghanem, H., & Ariff, A. M. (2016). The effect of board of directors and audit committee effectiveness on internet financial reporting. Journal of Accounting in Emerging Economies, 6(4), 429-448.

- Bliss, M.A., Muniandy, B., & Majid, A. (2007). CEO duality, audit committee effectiveness and audit risks: A study of the Malaysian market. Managerial Auditing Journal, 22(7), 716-728.

- Boubakri, N., Cosset, J.C., & Guedhami, O. (2005). Liberalization, corporate governance and the performance of privatized firms in developing countries. Journal of Corporate Finance, 11(5), 767-790.

- Brickley, J.A., Coles, J.L., & Jarrell, G. (1997). Leadership structure: Separating the CEO and Chairman of the Board. Journal of Corporate Finance, 3(3), 189-220.

- Cairncross, S.A., & Eichengreen, B. (2003). Sterling in decline: The devaluations of 1931, 1949 and 1967: Second Ed. In Sterling in Decline: The Devaluations of 1931, 1949 and 1967: Second Edition.

- Chang, H., Choy, H.L., Cooper, W.W., & Ruefli, T.W. (2009). Using Malmquist Indexes to measure changes in the productivity and efficiency of US accounting firms before and after the Sarbanes-Oxley Act. Omega.

- Cheng, S. (2008). Board size and the variability of corporate performance. Journal of Financial Economics, 87(1), 157-176.

- Chi, W., Liu, C., & Wang, T. (2009). What affects accounting conservatism: A corporate governance perspective. Journal of Contemporary Accounting and Economics, 5(1), 47–59.

- Defond, M.L., Hann, R.N., Xuesong, H.U., & Engel, E. (2005). Does the market value financial expertise on audit committees of boards of directors? Journal of Accounting Research, 43(2), 153-193.

- Ebrahim, A., & Fattah, T.A. (2015). Corporate governance and initial compliance with IFRS in emerging markets: The case of income tax accounting in Egypt. Journal of International Accounting, Auditing and Taxation, 25, 46-60.

- Eisenhardt, K. M. (1989). Agency theory: An assessment and review. Academy of Management Review, 14(1), 57-74.

- Elshandidy, T., & Hassanein, A. (2014). Do IFRS and board of directors’ independence affect accounting conservatism? Applied Financial Economics, 24(16), 1091-1102.

- Fama, E. F., & Jensen, M. C. (1983). Separation of Ownership and Control Separation of Ownership and Control. Journal of Law and Economics, 26(2), 301-325.

- Flanagan, J., & Clarke, K. (2007). Beyond a code of professional ethics: A holistic model of ethical decision-making for accountants. Abacus.

- Francis, J.R., & Martin, X. (2010). Acquisition profitability and timely loss recognition. Journal of Accounting and Economics, 49(1-2), 161-178.

- García Lara, J.M., García Osma, B., & Penalva, F. (2009). Accounting conservatism and corporate governance. Review of Accounting Studies, 14(1), 161-201.

- Gigler, F., Kanodia, C., Sapra, H., & Venugopalan, R. (2009). Accounting conservatism and the efficiency of debt contracts. Journal of Accounting Research, 47(3), 767-797.

- Givoly, D., & Hayn, C. (2000a). The changing time-series properties of earnings, cash flows and accruals: Has financial reporting become more conservative? Journal of Accounting and Economics, 29(3), 287-230.

- Givoly, D., & Hayn, C. (2000b). The changing time-series properties of earnings, cash flows and accruals: Has financial reporting become more conservative? Journal of Accounting and Economics, 29(3), 287-320.

- Givoly, D., Hayn, C., & Natarajan, A. (2011). Measuring Reporting Conservatism. The Accounting Review, 82(1), 65-106.

- Guest, P.M. (2009). The impact of board size on firm performance: Evidence from the UK. European Journal of Finance, 15(4), 385-404.

- Haji, A.A. (2014). The relationship between corporate governance attributes and firm performance before and after the revised code Some Malaysian evidence. European Journal of Marketing, 24(2), 134–151.

- Iyer, V.M., Bamber, E.M., & Griffin, J. (n.d.). Characteristics of audit committee financial experts?: An empirical study. Managerial Auditing Journal, 28(1), 65-78.

- Jensen, M. C., & Meckling, W. H. (1976). Theory of the firm: Managerial behavior, agency costs and ownership structure. Journal of Financial Economics, 3(4), 305-360.

- Johnstone, C.S.H., & Sundaraj, R. (2006). Occipital nerve stimulation for the treatment of occipital neuralgia - Eight case studies. Neuromodulation, 9(1), 41-47.

- Kaminsky, G.L., & Schmukler, S.L. (1999). What triggers market jitters?: A chronicle of the Asian crisis. Journal of International Money and Finance, 18(4), 537-560.

- Kazemian, S., Djajadikerta, H.G., Said, J., Roni, S.M., Trireksani, T., & Alam, M.M. (2021). Corporate governance, market orientation and performance of Iran’s upscale hotels. Tourism and Hospitality Research, 21(3), 344-357.

- Klein, A. (1998). Firm performance and board committee structure. Journal of Law and Economics, 41(1), 275-304.

- Kong, H., & Meek, G.K. (2010). The impact of the Asian financial crisis on conservatism and timeliness of earnings: Evidence from Hong Kong, Malaysia, Singapore, and Thailand. Journal of International Financial Management & Accounting, 21(1).

- Krishnan, G.V., & Visvanathan, G. (2008). Does the SOX definition of an accounting expert matter? The association between Audit committee directors’ accounting expertise and accounting conservatism. Contemporary Accounting Research, 25(3).

- La Porta, R., Lopez-de-Silanes, F., & Shleifer, A. (1999). Corporate ownership around the world. Journal of Finance, 54(2).

- Lara, J.M.G., Osma, B.G., & Penalva, F. (2007). Board of directors’ characteristics and conditional accounting conservatism: Spanish evidence. European Accounting Review, 16(4), 727-755.

- Laura, E.K., & Mathew, P. (2002). American Finance Association A Rational Expectations Model of Financial Contagion . Journal of Finance, 57(2), 769-799.

- Letza, S., Sun, X., & Kirkbride, J. (2004). Shareholding versus stakeholding: A critical review of corporate governance. Corporate Governance: An International Review, 12(3), 242-262.

- Lim, R. (2011). Are corporate governance attributes associated with accounting conservatism? Accounting and Finance, 51(4), 1007-1030.

- Lin, J. W., & Li, J. F. (2006). The effect of audit committee performance on earnings quality. Managerial Auditing Journal, 21(9), 921–933.

- Louis, H., Sun, A.X., & Urcan, O. (2012). Value of Cash Holdings and Accounting Conservatis?. Contemporary Accounting Research, 29(4), 1249-1271.

- Martínez-ferrero, J., & García-meca, E. (2017). Gender diversity, financial expertise and its effects on accounting quality.

- Martinov-bennie, N., Soh, D.S.B., & Tweedie, D. (2015). An investigation into the roles , characteristics, expectations and evaluation practices of audit committees. Managerial Auditing Journal, 30(8), 727–755.

- Meek, W.R., Pacheco, D.F., & York, J.G. (2010). The impact of social norms on entrepreneurial action: Evidence from the environmental entrepreneurship context. Journal of Business Venturing, 25(5), 493-509.

- Mohamed, R., Ahmar, S., & Sulaiman, N. (2014). The influence of internal governance mechanisms on accounting conservatism. Procedia - Social and Behavioral Sciences, 164, 501–507.

- Mohammed, N.F., Ahmed, K., & Ji, X.D. (2017). Accounting conservatism, corporate governance and political connections. Asian Review of Accounting, 25(2), 288-318.

- Nasr, M.A., & Ntim, C.G. (2018a). Corporate governance mechanisms and accounting conservatism?: evidence from Egypt. Corporate Governance, 18(3), 386-407.

- Nasr, M.A., & Ntim, C.G. (2018b). Corporate governance mechanisms and accounting conservatism: evidence from Egypt. Corporate Governance, 18(3).

- Nasr, M.A., & Ntim, C.G. (2018c). Corporate governance mechanisms and accounting conservatism: evidence from Egypt. Corporate Governance (Bingley), 18(3), 386-407.

- Ng, A.C., & Rezaee, Z. (2012). Sustainability Disclosures and Cost of Capital. SSRN Electronic Journal.

- Ntim, C.G., Soobaroyen, T., & Broad, M.J. (2017). Governance structures, voluntary disclosures and public accountability: The case of UK higher education institutions. Accounting, Auditing and Accountability Journal, 30(1), 65-118.

- Rahman, R. A., & Mohamed Ali, F. H. (2006). Board, audit committee, culture and earnings management: Malaysian evidence. Managerial Auditing Journal.

- Rezaee, Z. (2005). Causes, consequences, and deterence of financial statement fraud. Critical Perspectives on Accounting, 16(3), 277-298.

- Said, R., Ashikin, A., Rahim, A., & Hassan, R. (2018). Exploring the effects of corporate governance and human governance on management commentary disclosure. Social Responsibility Journal, 14(4), 843–858.

- Said, J., Asry, S., Rafidi, M., Obaid, R.R., & Alam, M.M. (2018). Integrating religiosity into fraud triangle theory: Empirical findings from enforcement officers. Global Journal Al-Thaqafah, 2018(S), 131-143.

- Samaha, K., Dahawy, K., Hussainey, K., & Stapleton, P. (2012). The extent of corporate governance disclosure and its determinants in a developing market: The case of Egypt. Advances in Accounting, 28(1), 168-178.

- Sharma, V.D., & Iselin, E.R. (2012). The association between audit committee multiple-directorships, tenure, and financial misstatements. Auditing A Journal of Practice & Theory, 31(3), 149-175.

- Shleifer, A., & Vishny, R.W. (1986). Greenmail, White Knights, and Shareholders’ Interest. The RAND Journal of Economics, 17(3), 293-309.

- Shleifer, A., & Vishny, R. W. (1997). A survey of corporate governance. The Journal of Finance, 52(20), 737-783.

- Shuhidan, S.M., Hamidi, S.R., Kazemian, S., Shuhidan, S.M., & Ismail, M.A. (2018). Sentiment analysis for financial news headlines using machine learning algorithm. International Conference on Kansei Engineering & Emotion Research, 9(6), 207-210.

- Sultana, N. (2015a). Audit committee characteristics and accounting conservatism. International Journal of Auditing, 19(2)

- Sultana, N., & Zahn, J.W.M. Van Der. (2013). Earnings conservatism and audit committee financial expertise.

- Tang, T.C., & Liew, V.K. (2008). Department of economics ISSN 1441-5429 discussion paper 29 / 09 Purchasing Power Parity (PPP) in a Transition Economy - Cambodia?: Empirical Evidence from Bilateral Exchange Rates.

- Tzeyin, L. (2013). Determinants of construction industry profitability in Malaysia.

- Vafeas, N. (2005). Audit Committees, Boards, and the Quality of Reported Earnings. Contemporary Accounting Research, 22(4).

- Visvanathan, G. (2008). Does the SOX definition of an accounting expert matter?? The association between audit committee directors’ accounting expertise and accounting conservatism. Contemporary Accounting Research, 25(3).

- Wang, M., & Hussainey, K. (2013). Voluntary forward-looking statements driven by corporate governance and their value relevance. Journal of Accounting and Public Policy, 32(3), 26-49.

- Wang, R.Z. (2008). Measures of accounting conservatism?: A construct validity perspective. Journal of Accounting Literature, 28.

- Watts, R.L. (2003a). Conservatism in accounting part I: Explanations and implications. Accounting Horizons, 17(3).

- Watts, R.L. (2003b). Conservatism in accounting part II: Evidence and research opportunities. Accounting Horizons, 17(3).

- Watts, R., & Zimmerman, J. (1986). Positive accounting theory. Prentice Hall: Cambridge.

- Wibowo, A., & Mohamed, S. (2010). Risk criticality and allocation in privatised water supply projects in Indonesia. International Journal of Project Management, 28(5), 504-513.

- Williamson, O.E. (1988). Corporate finance and corporate governance. The Journal of Finance, 43(3), 567-591.

- Wirama, D.G., Wiksuana, I.G.B., Mohd-Sanusi, Z., & Kazemian, S. (2017). Price Manipulation by Dissemination of Rumors: Evidence from the Indonesian Stock Market. International Journal of Economics and Financial Issues, 7(1), 429-434.

- Zhang, X., Gao, S., & Zeng, Y. (2018). An empirical study of relationships between accounting conservatism and executive compensation-performance sensitivity. International Journal of Accounting & Information Management, 27(1), 130-150.