Research Article: 2020 Vol: 19 Issue: 1

Corporate Governance, Analyses and Theories: The Case of Albania

Ylber Bezo, University College of Business

Rezart Dibra, University College of Business

Abstract

Corporate governance is the system of rules, practices, and processes by which a firm is directed and controlled. Corporate governance refers to the entire system for managing and supervising a company. Corporate Governance is a broad term that defines the methods, structure and the processes of a company in which the business and affairs of the company are managed and directed. Corporate governance is the system by which business corporations are directed and controlled. Corporate Governance brings real benefits to corporations and financial institutions while laying down a clear framework for defining and achieving corporate objectives. Corporate governance describes how rights and responsibilities are distributed among corporate bodies according to applicable laws, rules and internal processes. Corporate governance also defines the decision-making systems and structure through which owners directly or indirectly control a company. This paper aims to create a methodology to measure responsible corporate governance, analysis effective corporate governance in Albania. Therefore, responsible corporate governance lies in entrepreneurial democracy, which systematically questions the organization’s mission and its relation to the common good. Good corporate governance therefore sets the balance between economic and social growth.

Keywords

Corporate Governance, Responsible Corporate Governance, Responsible Corporate Governance Index.

Introduction & Literature Review

The Corporate Governance (CG) is one of the most controversial issues today because it affects how it is managed, administered and controlled by a private or public corporation. All the companies, especially anonymous company (anonymous partnership), have their code of corporate governance (CG). Corporate governance deals with how the suppliers of capital ensure that corporate managers make efficient use of that capital and provide investors with a return commensurate with the risk of the investment (Ananchotikul, 2007; Berle & Means, 1932; Berndt, 2013). Corporate Governance aims to enable business owners or business managers to have a strategic and transparent direction throughout the business. This allows anyone involved in the process to understand the part they play in the organization's continued growth. Shleifer & Vishny (1997) define corporate governance as “the ways in which suppliers of finance to corporations assure themselves of getting a return on their investment”. OECD in 1999 defined corporate governance as “Corporate governance is the system by which business corporations are directed and controlled”. Corporate governance is the broad term describes the processes, customs, policies; laws and institutions that direct the organizations and corporations in the way they act administer and control their operations. Corporate governance is a set of regulations and the corporate governance has traditionally specified the rules of business decision making that apply to the internal mechanisms of companies (Bostan & Grosu, 2010; Güler & David, 2010). This set of norms and laws has, first and foremost, served to shape the relations among boards of directors, shareholders, and managers as well as to resolve agency conflicts1. Good corporate governance is the basis for our decision-making and control processes and comprises responsible, value-based management and monitoring focused on long-term success, goal-oriented and efficient cooperation between our Managing and Supervisory Boards, respect for the interests of our shareholders and employees, transparency and responsibility in all our entrepreneurial decisions and an appropriate risk management system. The importance of corporate governance in terms of performance and quality of financial reporting has been the focus of research since the explosion of scandals and fraud in companies such as Parmalat (2002-2003), Enron (October 2001), Xerox (2000), Aig (2004) which lower the trust level to potential shareholders and investors in the ability of management teams to report transparent and accurate financial information. Corporate governance refers to the entire system for managing and supervising a company. This includes the organization, values, corporate principles and guidelines as well as internal and external control and monitoring mechanisms (Anand et al., 2006).

These failures of transparency and credibility of financial information in many companies led to the need to improve reporting quality, expanding corporate structures by implementing: audit committee, structure and characteristics of the board of directors, external auditing and other rules of corporate governance. The major interest of his research was to cover the area that where the interests of managers diverge from those of the interests of shareholders. He kept in view the agency relationship and the agency cost which arises from these relationships. He extended the work of Jensen & Meckling (1976) who defined the agency relationship as a type of contract in which the principal keeps the agent to carry out the services of the firm on his behalf. The agency problem arises due to the different interest and the conflict between the ownership and control as principal delegates some decision making authority to the agent. Jensen & Meckling (1976) argued that this delegation authority reduces the value maximizing decisions taken by the manager in the firm. Himmelberg et al. (1999), argued Jenson and Meckling (1976) by saying that principal agent problem are not similar in all firms rather they are different in different firms, different industries and also in different cultures. Himmelberg et al. (1999) said that Jenson’s original theory “nexus of contract” suggests the same. McColgan (2001) agreeing with the authors said that agency problem can be reduced by the help of effective corporate governance mechanism which can be important in reducing the agency cost and the ownership problems in the firms. Since the early 19th century, when the first corporate concepts emerged in the UK, there have been a number of changes to the organization and financing of companies. To understand how these theories are applied in corporate governance, we will refer to the two most controversial “mandatory” issues or common actions that try to understand how corporations are governed and how their governance system can be improved. The first way usually refers to the “primary-agent” theory (or agency theory), whereas the second mode is commonly called the “contenders” theory.

In the literature of the firm's theory, we often find the term “ownership and control division”, but what does that mean? If we go back to the 19th century some of the big companies were owned and under the control of their founders. During this time, the original founders were able to accumulate enough assets with increasing profits from the business. However, owners realized that their resources were not enough to fund a steady increase. In most cases, they were able to raise additional capital in order not to weaken their ownership and control of the company. But there is a limit to the financial debt that the company can afford. To keep the competitive edge from economies of scale, there was a tremendous demand for the company's continued growth. That is why they demanded raising additional capital from the stock market. This would mean that their personal ownership diminished in relation to the company. Moreover, after they retired or died, the stakes were separated from their offspring. At the beginning of the 20th century, it was evident that large investors were fragmenting and disappearing over time. In other words, there was a reduction in ownership concentration. The highest standards of corporate governance are essential to the business integrity.

The Ownership as a Form of Corporate Governance

Strong corporate governance is an integral part of the company's core values, supporting the Company's sustainable growth mission. A number of corporate scandals and corporate governance failures in the 1990/2000s occasioned by fraud and insufficient systems of control raised the question on the credibility of corporations and particularly the governance. The Supervisory Board has the responsibility to ensure that the Company’s activities and operations are in compliance with all laws and regulations. It reviews and monitors any actual or potential situations of conflict of interest and compliance with the law.

What do we mean by ownership? It is a common truth to say that owners own the company. Unfortunately, this formulation offers limited insight into complex corporate governance issues. In fact, as Blair (1995) has said, we are usually troubled by important issues, rather than teaching them. A specific explanation for the features of investors should be compared to the physical ownership of a home object:

When I say that I own a house, you will understand that I am the one who decides who enters or lives or can live in it, I will determine how the house and furniture will be decorated and that I have the right to all or part of it for my personal benefit. When I buy a share in BT (British Telecom) I have none of these rights but expect a more limited version. (Kay, 1995)

In reality this is the essence of the problem. Especially in small investor cases, property rights are too limited and practice to take dividends and their shares. Usually when the company has performed poorly in the past it can hardly be improved in the future. Thus, this is relatively a passive form of ownership. It is true since shareholders have the right to vote in the general assembly of the year, and the ability of small shareholders to balance the collection is the same as individual voters who determine the government in general elections.

It is very important in the corporate governance the manager ownership. By Jensen & Meckling (1976), more equity ownership by the manager contributes to the better alignment of monetary incentives between the manager and other owners, so that it may increase performance. A classic reference is Jensen & Meckling (1976). These economists tried to develop a theory of the ownership structure of the firm by integrating elements from the theory of agency, the theory of property rights and the theory of finance. However, on the other side, concentrated ownership also has its costs, which are basically represented by possibility of expropriation by large investors of other investors and stakeholders of the firm (Shleifer & Vishny, 1997; Aggarwal & Chandra, 1990)

The Market for Corporate Control

Supporters of agency theory determine the market for corporate control as an important way in discipline of agents and promote their motivation to act in the best interest of the investor. The mechanism to achieve this is the desire of managers to avoid hostile purchases of their companies (as they are likely to lose their jobs). At the end of this, managers try to keep a “high” rating for the stakes. High stock rating has a number of advantages for managers. For a reason, a high stock value means it is less expensive to receive additional finance from stock exchanges. But the main benefit to managers in terms of job security is that a high stock rating makes it more costly for predators to take control of the situation. According to the agency's rules, managers consider responsibility to meet the requirements of investors, so high stock rating is attractive and for the primary.

It is imperative that, in order to achieve a high stock rating, managers need not focus on short-term objectives, as these policies may be inaccurate to achieve long-term success. Companies that view short-term targets can focus intensively on particular financial indicators, such as short-term profit or earnings per share (Albert, 1993).

It is also important that the financial reporting system is sufficiently mechanized to ensure that the markets are not “misleading” by manipulating the manager's balance sheet data. The underlying problem is that managers focus mainly on short-term objectives because financial benefits are many times greater than implementing long-term objectives. This can be seen as damaging to the company's prospect because excessive focus on short-term benefits means a deficiency in the pursuit of the R&D area. These types of spending tend to have a future benefit, a benefit that is uncertain, but for many companies, investment in research and development remains essential to market existence.

Nowadays, Anglo-American companies have paid particular attention to the interests of investors and many financial analysts have supported this idea. But why should we have such a case? Kay (1995) argued that this situation is created by threats of hostile purchases. In other words, the main threat of the directors is whether another company is prepared to offer a substantial sum for the purchase of existing shares. A hostile buyer could organize such a case if the target price of the target is lower than the average of similar companies in the industry. If a company is not efficient in using its assets, the adversary may take control and may be more productive in asset utilization. As a result, the gains and stock prices increase and reflect the future growth of the company.

Risk preference is also a major source of conflict between the principal and the agent. Shareholders associated with the market risk and the risk of stock returns whereas managers always concerned with the company risk because their survival depends on the firm risk. The area of corporate governance is lacking with the external disciplining devices. The firms through the effective corporate governance can implement these devices, which includes the composition of the board of directors, increase number of shareholders, maximize the inside ownership and by providing different financial policies and compensation packages.

The Coca-Cola Company is committed to good corporate governance, which promotes the long-term interests of shareowners, strengthens Board and management accountability and helps build public trust in the company (www.coca-colacompany.com/investors/corporate-governance).

Methodology

Bushman & Smith (2003) point out that corporate governance disclosure is one of the useful tools in assessing the credibility of financial information, as well as in accurately setting expectation and reducing uncertainty concerning the firm’s performance. The methodology used in this paper combines primary data with secondary data. Primary data are obtained through questionnaires, is distributed in different cities in joint stock companies as consolidated market companies and which undoubtedly hold an important part of the economy sector and more specifically the manufacturing, service, processor or processing industry etc. Secondary data are the result of an extensive and up-to-date review of the corporate governance literature.

This paper is based on data obtained from some companies in Albania. The data was analyzed using simple descriptive statistics. We have used the SPSS program for analysis of all the information.

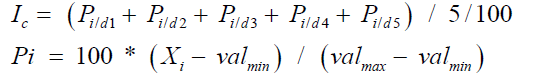

The purpose of this part of the study is to rank European developing countries based on an index of responsible corporate governance. To implement this aim, we first identified the necessary dimensions measure responsible corporate governance (GCR). The components of each dimension are sub-indices, the second one defines a method to calculate the Corporate Governance Index (GCR) for developing European countries, the third we rank states according to the value of the Corporate Governance Index Fourthly, we have made the correlations between the indicators that form the different dimensions of responsible corporate governance. Also, having in mind the GDP (GDP) of the countries surveyed, we have also classified the countries according to the GCR and GDP/GDP index per capita. Finally we have conducted a correlation between the Corporate Governance Index (GDP) and GDP/capita to confirm the hypothesis of this section.

The Stakeholders’ Theory

Some authors argue that the agent-primer model focuses exclusively on investor interests. But managers may be more concerned with shareholders who are only interested in short-term benefits and consequently neglect long-term benefits. Short-term benefits are generated by long-term performance sacrifices. A viable solution to this problem is by encouraging long-term investors. But the main concern is that what is optimal for investors is usually not optimal for the rest of society. This means that corporate policies that generate the greatest benefits to investors may not be policies that generate social benefits (Blair, 1995; Crane & Ruebottom, 2011; Adams et al., 2007).

Results & Discussion

Good corporate governance in a corporate set up leads to legal maximization of shareholders’ value, in an ethical and sustainable manner, while ensuring equity and transparency to every stakeholder-customers, employees, investors, vendor-partners, government, and community.

According to agency theory, the firm's main goal is to maximize investor profits. Supporters of the theory of contenders argue that these close objectives do not go with the responsibilities of modern corporations that have a special regard for customer relations, suppliers and the environment.

However, agency theory supporters argue that any corporate governance reform should be guided by the common interest between managers and investors, for example by awarding directors with annual bonuses at company profit rates. The general bonus earned by directors tends to be re-invested in the company and helps it to create financial resources to spend more on research and development projects that are vital to long-term objectives. The result of this action will be other actors who will benefit from this situation. Generally, employees will benefit from increased job security and the environment will benefit from investments to improve efficiency and protect the environment (Weber, 2015).

In other words, looking at the perspective of agency theory, maximizing profit may match the improvement of all stakeholders and investors. In this context, an important element is the independence of the board of directors, which helps in coordinating the interests of the primary and the agent by allowing the primary to better monitor agents’ actions and thus helps solve the problems between the primary and the agent.

Supporters of agency theory isolate control, market discipline, and the pressure that should be exercised against agents. Although this can be a satisfying first result from the perspective of investors, from the point of view of the actors the benefits may not be as clear.

Corporate Governance in Albania: Analysis of variables-Corporate Responsible Governance Index (GCR)

In Albania there are still very few studies. Emerging Europe Monitor grouped these countries into three categories (Emerging Europe Monitor, 2012): Central Europe & Baltic States (Czech Republic, Estonia, Hungary, Latvia, Lithuania, Poland and Slovakia), Russia & CIS (Armenia, Azerbaijan, Belarus, Georgia, Kazakhstan, Kyrgyzstan, Moldova, Russia, Tajikistan, Turkmenistan, Ukraine, Uzbekistan) and South-East Europe (Albania, Bosnia-Herzegovina, Bulgaria, Croatia, Macedonia, Montenegro, Romania, Serbia, Slovenia).

In many emerging countries, corporate governance remains a controversial idea in terms of conceptual basis, characteristics, efficiency and future development (Kuznetsov et al., 2009).

Albania in relation to the GCR (Corporate Responsible Governance) index is ranked 18th in the country. While in terms of GDP per capita as an indicator of living standard is ranked in the 20th place. We should not forget the fact that countries such as Poland, the Czech Republic, Hungary, Lithuania, Slovenia, Estonia, Latvia, Bulgaria and Romania are EU Member States (the last two countries joined the EU in January 2007) and have advanced in terms of economic indicators and corporate governance.

According to the OECD dimensions of measuring responsible corporate governance, structured as follows: D1 - Shareholders' rights and their equal treatment; D2 - Relations with stakeholders; D3 - Responsibilities of the Management Board in pursuing corporate objectives; D4 – Ethical corporate conduct; D5 - Transparency and the implementation of internal and external control systems.

Where: Xi=the value of the indicator to be normalized, valmax =maximum value, valmin =minimum value; Ic =composite index, Pi/d1, 2, 3, 4, 5=points for indicator i after weighting.

Highly-ranked countries also have a high corporate governance index that is in the right proportion, so we say there is a correlation between these variables. The standard of living of a country's citizens is directly related to employment in the private sector or nationally influential in economic development (we have a livelihood and an increase in incomes). Judge & Elenkov (2005) showed a positive relationship between GCR and GDP. Albania needs to do more to climb the rankings of countries (shown in our paper). The real fact as I say above is the analysis of some Albanian companies to see how corporate governance appears in them and that is analyzed in the fourth chapter.

Developing countries have many energies and assets, and all segments of the private or state sector must demonstrate the ability to respond to corporate governance standards. Good corporate governance enhances its market access. The premium to buy a company with good corporate governance ranges from 30% to Eastern and African companies and 22% to Asian and Latin American companies. Also, according to the study, 63% of the interviewed companies would avoid investing in those companies where governance is not good (Global Investor Opinion Survey, July 2002, Mc Kinsey & Company).

Businesses operating in the economic environment in Albania that have been studied 80.3% have been working for over 10 years in Albania, where 68.4% of them are considered medium-sized enterprises. According to the results of the study (GCI link to the Turn / Capital ratio) only two companies have done a good job in terms of corporate governance ranked at Executives. 60% of companies have the highest average score in terms of the government's index of governance responsive corporate but low level of turnover/capital ratio being classified into the Sensitive. Losers represent about 1/3 of firms and have a low level of responsible corporate governance as well as low turnover/capital ratio. Meanwhile, indifferent consist of 2 companies with real opportunities to develop corporate responsible corporate governance practices as they have high turnover/capital ratio. They have potential opportunities to increase the corporate governance index.

As far as the GCI indicator is concerned, compared to the net/capital ratio, from the categorization division analysis, we see that the Losers are a total of 8 companies, the Sensitized 56 companies and the Indifferences 2 companies and finally the Executives in total 10 companies. The case escorts are again at a low level.

Contest Analysis Table- Chi Square (Hi-square): Test of Pearson Coefficient

One of the most salient relationships in economic life is the positive link between investment and economic growth. By constantly adding to the quality and quantity of fixed capital and human skills, OECD economies have for more than a century experienced an unprecedented increase in real income per capita. In some emerging countries, the national system of corporate governance is reflected in standards and measures aimed at increasing foreign investment and channeled towards protecting investors (Kuznetsov et al., 2009).

Presenting the statistics of the two variables, we express it with the Cross-tabulation tabulation to explain the relationship between the two variables.

The contiguity table is a statistical element that compiles the data to create a table, which is known by the etiquette insignia. These types of tables are mainly used in scientific and engineering research, surveys, and so on. They give an overview of the links between the two variables and can help to find the interactions between them.

If the dimensions in different columns differ significantly between rows (or vice versa), we say there is a contiguity between the two variables. In other words, the two variables are not independent so they have dependencies between them. If there is no contingency, we say both variables are independent.

The simplest type of contingency table is a table in which each variable has only two levels; this is called the 2x2 table of contingencies, where the following for these tables will also have a special point of analysis. In principle, any number of rows and columns can be used. There may be even more than two variables.

As determined in the theoretical analysis, the Chi Square Test of Pearson Coefficient analyzes whether there is a link between two qualitative variables. As part of the crosstabs procedure, SPSS produces a chart that, like any of the below, includes the Chi Square statistic and its value of importance otherwise known as the Likelihood Ratio. Chi-Square Coefficient Pearson tests whether the two variables are independent.

Statistical (meaning) is quite small (usually Sig <0.05 where 5% is the level of reliability) then we reject the hypothesis that the variables are independent and accept the hypothesis that they have a relation between them.

The selection of questions is made by supporting a logical justification for the relationships that may exist between them and then they are transformed into the resulting tables of the combination of these questions that contain the respective responses that emerge from the program (including the degrees of freedom) as a value of importance. Pearson's Chi-Square statistical analysis in our analysis begins on case 1 and ends on case 10.

The relation between the variables is significant (i.e. variables are dependent) if the value of Sig <0.05, and if this value is> 0.05 we say the variables are independent between them. The alternative of “Chi Square” is the Pearson coefficient based on the maximum length theory. Let's start by studying the combination of cases. There were 10 selected cases with combinations of their relevance. The combination questions are from the questioners prepared for companies (result of analyses), concretely the combination of questions, and concretely more important questions.

Case 1

Are you familiar with the Code of Internal Management of Non-Registered Shareholding Companies published by Ministry of Finance and Economy (MFE) and are you familiar with it? With the question what is the division of companies by type?

From the first case analysis (Table 1), the value of the Chi- Square static is=13.401. This value is statistically significant when p <0.001. This value from question processing results to be significant (p=0.009 <0.05), indicating that we have a dependency relation between the variable expressed in the question “Are you informed about the Internal Code of Non-Registered Shareholding Companies on Burse published by MFE and do you have knowledge of it?”, and with the variable expressed with the question “What is the division of societies by type?”, so there is a link between the variables. Variables specifically result in dependence.

| Table 1: Case 1: Chi-Square Tests | |||

|---|---|---|---|

| Value | df | Asymp. Sig. (2-sided) | |

| Pearson Chi-Square | 13.401a | 4 | 0.009 |

| Likelihood Ratio | 16.253 | 4 | 0.003 |

| Linear-by-Linear Association | 8.821 | 1 | 0.003 |

| N of Valid Cases | 76 | ||

Note: a. 5 cells (55.6%) have expected count less than 5. The minimum expected count is 0.67.

An alternative to the “Pearson Chi Square coefficient” is the Pearson statistical coefficient based on the maximum length theory. As we said above, the Loss Report test is a statistical test used to compare two models for their averages if they are statistically the same (which is the zero hypothesis) and the other case when they are not the same (alternative hypothesis).

Lynch ratio in our case (Likelihood Ratio) =16.253. As in the case of chi-square we will analyze p-ne, p=0.03 <0.05. Variables with this condition result to be dependent. The used statistical test revealed a significant link between the variables, namely the variables are dependent and the relation between them is justified.

Case 2

What is the deadline for announcing General Meeting of Shareholders (GMSH) agenda? With the question: What is the way to notify the MPA meeting?

The value of the Pearson Chi Square coefficient in the Table 2 is=4.823. This value is not significant as p = 0.567> 0.05. This value in the case below is not important because it results not within the appropriate static parameter (p<0.05), indicating that we have no connection between the above variables. The test did not prove satisfactory.

| Table 2: Case 2: Chi-Square Tests | |||

| Value | df | Asymp. Sig. (2-sided) | |

|---|---|---|---|

| Pearson Chi-Square | 4.823a | 6 | 0.567 |

| Likelihood Ratio | 5.066 | 6 | 0.535 |

| Linear-by-Linear Association | 0.976 | 1 | 0.323 |

| N of Valid Cases | 76 | ||

Note: a. 8 cells (66.7%) have expected count less than 5. The minimum expected countis 0.16.

The Likelihood Ratio is 5.066. This confirms the main hi-square result=0.535 (p= 0.535 & lt; 0.05) by showing that the variables are not so unrelated, so an acceptable result link cannot be judged.

Case 3

Are all shareholders aware of the GMSH meeting appropriately notified? With the question: Have you had cases when the agenda changed after it was sent to the shareholders?

The value of the Pearson Chi Square coefficient in the Table 3 is = 0.387. This value is not statistically significant since p = 0.534> 0.05 indicating that we have no relation between the above variables. The test did not prove satisfactory.

| Table 3: Case 3: Chi-Square Tests | |||

| Value | df | Asymp. Sig. (2-sided) | |

|---|---|---|---|

| Pearson Chi-Square | 0.387a | 1 | 0.534 |

| Continuity Correctionb | 0.000 | 1 | 1.000 |

| Likelihood Ratio | 0.652 | 1 | 0.419 |

| Fisher's Exact Test | |||

| Linear-by-Linear Association | 0.382 | 1 | 0.537 |

| N of Valid Cases | 76 | ||

Note: a. 2 cells (50.0%) have expected count less than 5. The minimum expected count is 0.28. b. Computed only for a 2x2 table.

The Likelihood Ratio is 0.652 and p=0.419> 0.05. The main Chi-square expression is confirmed, which expresses (p=0.652> 0.05) that the variables are independent where, and in this case as in case 3, an acceptable result link cannot be considered.

Case 4

Is the accounting excise, if any, or audit, assisting shareholders for tax problems or procedures during the year as well as during tax audits? And the question Have you had cases where the accounting officer, if any, has held responsibility for the last 5 years if you are penalized by the tax authorities?

The value of the Pearson Chi Square coefficient in the Table 4 below is = 14.738. This value is wholly meaningful as p=0.005 <0.05. We point out that this value in the case below is significant because it results within the static parameter (p<0.05), indicating that we have links between the above variables. This value is significant when p<0.001. In this case it is completely so, so it matched.

| Table 4: Case 4: Chi-Square Tests | |||

| Value | df | Asymp. Sig. (2-sided) | |

|---|---|---|---|

| Pearson Chi-Square | 14.738a | 4 | 0.005 |

| Likelihood Ratio | 17.738 | 4 | 0.001 |

| Linear-by-Linear Association | 4.393 | 1 | 0.036 |

| N of Valid Cases | 76 | ||

Note: a. 4 cells (44.4%) expected to count less than 5. The minimum expected count is 0.71.

The test was completely satisfactory and with a full connection. The Likelihood Ratio is = 17.738. The main result Chi Square (p=0.001<0.05) extracts us at the concatenation of the variables are considered dependent.

Case 5

Do you have a special structure that takes care of GMSH meetings (pooling of shareholders), organization, shareholder relations, announcements, clarifications etc.? And the question Do you think the time has come for such a structure?

The Chi Square statistic value according to Pearson coefficient in the Table 5 below is =0.056. This value is statistically significant when p <0.001. This value is not significant (p= 0.812>0.05), indicating that we do not have a link between the aforementioned variables. The Likelihood Ratio is = 0.109. The main result Chi Square (p=0.741>0.05) gives us the concatenation of the variables are considered independent, namely we have no relation between the variables.

| Table 5: Case 5: Chi-Square Tests | |||

| Value | df | Asymp. Sig. (2-sided) | |

|---|---|---|---|

| Pearson Chi-Square | 0.056a | 1 | 0.812 |

| Continuity Correctionb | 0.000 | 1 | 1.000 |

| Likelihood Ratio | 0.109 | 1 | 0.741 |

| Fisher's Exact Test | |||

| Linear-by-Linear Association | 0.056 | 1 | 0.814 |

| N of Valid Cases | 76 | ||

Note: a. 3 cells (75.0%) have expected count less than 5. The minimum expected count is 0.05. b. Computed only for a 2x2 table.

Case 6

Is a corporate governance report prepared by the administrators or AK (Administration Council) for your company's shareholders? Do you think the time has come to prepare such a report as part of the GMSH materials as information that needs to be prepared as compulsory?

The Chi Square statistic value in the Table 6 below is=0.103. This value is known to be significant when p <0.001. This value is not significant (p=0.950>0.05), indicating that we have no connection between the above variables.

| Table 6: Case 6: Chi-Square Tests | |||

| Value | df | Asymp. Sig. (2-sided) | |

|---|---|---|---|

| Pearson Chi-Square | 0.103a | 2 | 0.950 |

| Likelihood Ratio | 0.195 | 2 | 0.907 |

| Linear-by-Linear Association | 0.091 | 1 | 0.762 |

| N of Valid Cases | 76 | ||

Note: a. 5 cells (83.3%) have expected count less than 5. The minimum expected count is 0.04.

Maximum length ratio is 0.195. Chi-square (p=0.907>0.05). The variables have no relation (are independent).

Case 7

Is the site of GMSH meeting fit and easily accessible by the company's shareholders (a.)? And question A does the administrator (or administrators) have to be clear that should ensure that the agenda is not changed after being sent to all shareholders?

The value (Chi-Square) in the Table 7 is=18.240. This value is wholly meaningful as p =0.000<0.001. This value in the case below is significant because it results even within the static parameter p<0.05, indicating that we have links between the above variables. The test was completely satisfactory.

| Table 7: Case 7: Chi-Square Tests | |||||

| Value | df | Asymp. Sig. (2-sided) | Exact Sig. (2-sided) | Exact Sig. (1-sided) | |

|---|---|---|---|---|---|

| Pearson Chi-Square | 18.240a | 1 | 0.000 | ||

| Continuity Correctionb | 4.067 | 1 | 0.044 | ||

| Likelihood Ratio | 6.150 | 1 | 0.013 | ||

| Fisher's Exact Test | 0.053 | 0.053 | |||

| Linear-by-Linear Association | 18.000 | 1 | 0.000 | ||

| N of Valid Cases | 76 | ||||

Note: a. 3 cells (75.0%) have expected count less than 5. The minimum expected count is 0.05. b. Computed only for a 2x2 table.

The maximum length ratio is = 6.150. Again this confirms the main hi - square result (p =0.013<0.05) with a fully acceptable value, so the variables can be considered addictive.

Case 8

Which of the following issues will be made public by your company? And the other question: If all the information is not fully published what are the obstacles to not doing so?

The Chi-Square statistic value in the Table 8 is = 16.262. This value is significant when p<0.001. This value of the analysis results to be not significant (p=0.435>0.05), indicating that there is no link between the above variables, so the static link cannot be considered as meaningful.

The maximum length ratio is=15.063. The main hi-square result (p=0.520>0.05) results in an unacceptable value, so the variables can be considered non-dependent, therefore not suitable.

| Table 8: Case 8: Chi-Square Tests | |||

| Value | df | Asymp. Sig. (2-sided) | |

|---|---|---|---|

| Pearson Chi-Square | 16.262a | 16 | 0.435 |

| Likelihood Ratio | 15.063 | 16 | 0.520 |

| Linear-by-Linear Association | 0.710 | 1 | 0.399 |

| N of Valid Cases | 76 | ||

Note: a. 21 cells (84.0%) have expected count less than 5. The minimum expected count is 0.03.

Case 9

Are the company's leading officials familiar with corporate governance practices in OECD countries? And question Do you think that the OECD practices in corporate governance with the step-by-step changes should be recognized by your company?

The Chi-Square value in the Table 9 is=57.925. This value is wholly meaningful as p= 0.000<0.001. This value in the case below is significant because it results in full compliance with the static parameter (p<0.05), indicating that we have links between the above variables. The test was satisfactory.

| Table 9Case 9: Chi-Square Tests | |||

| Value | df | Asymp. Sig. (2-sided) | |

|---|---|---|---|

| Pearson Chi-Square | 57.925a | 4 | 0.000 |

| Likelihood Ratio | 62.872 | 4 | 0.000 |

| Linear-by-Linear Association | 42.312 | 1 | 0.000 |

| N of Valid Cases | 76 | ||

Note: a. 4 cells (44.4%) have expected count less than 5. The minimum expected count is 0.26.

The maximum length ratio is=62.872. The main hi-square result (p=0.000 <0.05) with an acceptable connection, so variables can be considered fully dependent.

Case 10

Do you need training and consultancy on issues of improvement of company governance (e.g. your own)? And the next question: Do you think the company should plan training funds in corporate governance?

The Chi-Square value in the Table 10 is=50.887. This value is wholly meaningful as p =0.000<0.001. This value in the case below is remarkable since results in full compliance with the static parameter (p<0.05), indicating that we have links between the above variables. The test was satisfactory.

| Table 10: Case 10: Chi-Square Tests | |||||

| Value | df | Asymp. Sig. (2-sided) | Exact Sig. (2-sided) | Exact Sig. (1-sided) | |

|---|---|---|---|---|---|

| Pearson Chi-Square | 50.887a | 1 | 0.000 | ||

| Continuity Correctionb | 42.860 | 1 | 0.000 | ||

| Likelihood Ratio | 34.505 | 1 | 0.000 | ||

| Fisher's Exact Test | 0.000 | 0.000 | |||

| Linear-by-Linear Association | 50.217 | 1 | 0.000 | ||

| N of Valid Cases | 76 | ||||

The maximum length ratio is=34.505. The main hi-square result (p=0.000<0.05) with an acceptable connection, so variables can be considered fully dependent.

Conclusion

The aim of the article is to analyze the corporate governance. Albania in relation to the GCR (Corporate Responsible Governance) index is ranked 18th in the country. While in terms of GDP per capita as an indicator of living standard is ranked in the 20th place. We should not forget the fact that countries such as Poland, the Czech Republic, Hungary, Lithuania, Slovenia, Estonia, Latvia, Bulgaria and Romania are EU Member States (the last two countries have joined the EU in January 2007) and have advanced in terms of economic indicators and corporate governance. Highly-ranked countries also have a high corporate governance index that is in the right proportion, so we say there is a correlation between these variables. The standard of living of a country's citizens is directly related to employment in the private sector or nationally influential in economic development (we have a livelihood and an increase in incomes).

Hence, corporate conduct and culture, based on attributes of self-regulation and openness contribute most to the essence of corporate governance. While setting the goals and objectives, a company must consider various expectations of the stakeholders into consideration. The Company’s corporate governance is based on the annual general meeting, the legislation and regulations mentioned above as well as the group’s policies, procedures, and practices. It is clear that the merits of agency theory and investor theory will be debated for a long time. However, having a consideration for the analysis of different theories, it is necessary to determine two ways for corporate governance - one based on the importance of investors and one based on the importance of different actors. It should be noted that in reality, governance remains somewhere between two extreme positions.

End Notes

1 Certainly, financial reporting provides valuable information in other contracting relationships beyond those involving capital providers (e.g., suppliers, customers, auditors etc.). In this survey, we confine our discussion to contracts involving capital providers for three reasons: 1) these areas are major focal points in the literature; 2) the literature on agency conflicts between managers and capital providers constitutes a natural, interconnected subset of papers that lend themselves to a relatively cohesive discussion, and; 3) an effort to keep the scope of our review more manageable.

References

- Adams, J., Khan, H.T., Raeside, R., & White, D.I. (2007).Research methods for graduate business and social science students. SAGE publications India.

- Aggarwal, R., & Chandra, G. (1990). Stakeholder management: Opportunities and challenges.Business,40(4), 48-51.

- Albert, M. (1993).Capitalism vs. capitalism: How America's obsession with individual achievement and short-term profit has led it to the brink of collapse. New York: Four Walls Eight Windows.

- Ananchotikul, N. (2007).Does foreign direct investment really improve corporate governance? Evidence from Thailand.

- Anand, A., Milne, F., & Purda, L.D. (2006). Voluntary adoption of corporate governance mechanisms.

- Berle, A.A., & Means, G.C. (1932). The modern corporation and private property, New York, World.

- Berndt, M. (2013).Global differences in corporate governance systems: Theory and implications for reforms. Springer-Verlag..

- Blair. (1995). About corporate governance http://bit.do/fu4tN

- Bostan, I., & Grosu, V. (2010). The role of internal audit in optimization of corporate governance at the groups of companies.Theoretical & Applied Economics,17(2).

- Bushman, R.M., & Smith, A.J. (2003). Transparency, financial accounting information, and corporate governance.Financial Accounting Information, and Corporate Governance. Economic Policy Review,9(1).

- Crane, A., & Ruebottom, T. (2011). Stakeholder theory and social identity: Rethinking stakeholder identification.Journal of Business Ethics,102(1), 77-87.

- Güler, A., & David, C. (2010). A handbook of corporate governance and social responsibility.Fanham: Gower.

- Himmelberg, C.P., Hubbard, R.G., & Palia, D. (1999). Understanding the determinants of managerial ownership and the link between ownership and performance.Journal of Financial Economics,53(3), 353-384.

- Jensen, M.C., & Meckling, W.H. (1976).Theory of the firm: managerial behavior, agency costs and ownership structure En: Journal of Finance Economics,3.

- Judge, W.Q., & Elenkov, D. (2005). Organizational capacity for change and environmental performance: an empirical assessment of Bulgarian firms.Journal of Business Research,58(7), 893-901.

- Kay, J. (1995). Silberston.Corporate Governance, National Institute Economic Review.

- Kuznetsov, A., Kuznetsova, O., & Warren, R. (2009). CSR and the legitimacy of business in transition economies: The case of Russia.Scandinavian Journal of Management,25(1), 37-45.

- McColgan, P. (2001). Agency theory and corporate governance: a review of the literature from a UK perspective.Department of Accounting and Finance Working Paper,6, 0203.

- Shleifer, A., & Vishny, R.W. (1997). A survey of corporate governance.The Journal of Finance,52(2), 737-783.

- Weber, Y. (2015). Development and training at mergers and acquisitions.Procedia-Social and Behavioral Sciences,209, 254-260.