Research Article: 2021 Vol: 24 Issue: 1S

Corporate Fraud: Undetectable Poison in the Thriving Economy

Emelia A. Girau, University Technologic MARA

Imbarine Bujang, University Technologic MARA

Agnes Paulus Jidwin, University Technologic MARA

Norhayati Mohamed, University Technologic MARA

Keywords

Corporate Fraud, Economic Conditions, GDP, Inflation Rate, Unemployment Rate.

Abstract

Corporate fraud occurs in situations in which conditions are right for it to happen. The question of whether corporate fraud happens during economic growth or economic downturn is yet to provide substantial empirical findings. This study attempts to provide empirical evidence on whether economic conditions influence firms' propensity to commit corporate fraud in Malaysia. The sample of fraudulent companies is the public listed companies charged by the Malaysian Securities Commission and were listed in the Securities Commission Enforcement Release (MSCER) from 1996 to 2016. Time-series regression analysis was used to analyze the association between economic conditions and corporate fraud. The empirical findings revealed that economic conditions play a significant role in influencing the manager’s decision to commit corporate fraud. This study may provide insights to business corporations on the need to update and review their internal control and monitoring mechanisms regularly regardless of the state of the economic conditions. Auditors may consider economic factors when evaluating corporate fraud risk and design proper investigation schemes that need to be implemented to detect corporate fraud. It will also shed some light on the investors and other users to have the knowledge and understand the importance of economic factors before or when making their financial investment decisions. It would also help policymakers to develop more effective guidelines and policies that focused on corporate fraud deterrence. Effective fraud prevention in business corporations will minimize fraud threats to public safety and will foster decent economic development in a nation.

Introduction

Companies face a wide variety of threats, and one of them is the risk of corporate fraud. Corporate fraud can be described as an intentional misrepresentation of a company’s financial information and corporate activities by management, employees, or third parties, on or against a company with the intention to mislead the public and gain advantages over others (Chartered Institute of Management Accountant, 2009). Investigating corporate fraud is a continuing concern as it has a devastating threat to all organizations regardless of their nature and sizes around the world (Association of Certified Fraud Examiners (ACFE), 2018). The study by the ACFE, (2020) reported that, based on the analysis of 2,504 cases of occupational fraud from 125 countries investigated between January 2018 until September 2019, the estimated total global fraud loss was more than USD3.6 billion. On average, the estimated loss for each case was USD1.5 million. Meanwhile, in Malaysia, the survey conducted by PricewaterhouseCoopers (PwC) (2020 & 2018) revealed that the number of Malaysian organizations fraud victims that reported losses exceeding USD 1 million had increased to 24% during the year 2020 compared to 22% in 2018. In addition to the organization victims' financial losses, the survey further described that corporate fraud also resulted in a significant social impact on employee morale, business relationship, and organizations’ reputations. Therefore, these severe consequences of corporate fraud require critical attention on the need for corporations to have adequate control and monitoring mechanism to be implemented, regardless of the state of the economic conditions to enhance corporate and management ethical conduct. It is also important for shareholders and other stakeholders to understand and identify the red flag of corporate fraud to avoid being the victims of corporate fraud, hence minimize fraud losses.

Corporate fraud is not a random occurrence. It happens in situations in which conditions are right for it to happen. The fraud triangle theory by Donald Cressey (1953) explains the reasons why people commit fraud. Prior to making any efforts to combat fraud and manage risk proactively, any organization needs to identify the factors leading to fraudulent behaviour. The theory describes three factors that lead to fraudulent behaviour: perceived pressure, perceived opportunity, and rationalization. Albrecht,(2008) pointed out that perceived pressure is a significant factor influencing perpetrators to commit fraud. Perceived pressure can be related to finance, such as financial loss, the need to maintain the financial performance of the company, failure to compete with other firms, and the requirement to meet the high target of the company as well as analysts’ expectation (Albrecht, Albrecht, & Albrecht, 2004). Non-financial factors such as the need to maintain status or reputation, afraid to be seen as a failure, and pressure to create false and optimistic views of the firm’s performance also motivate corporate fraud. This element could be exacerbated when rewards or incentives are tied to the managers' performance. Kassem & Higson (2012) also pointed out that perceived pressure could derive from an external source such as an economic factor. Generally, an economic recession can cause businesses to experience a decrease in revenue and profit due to the high-interest rates and inflation that limit business liquidity and reduce consumer purchasing power. As declining revenue showed up in the firm's quarterly financial report, the firm's stock price may fall, hence dividend payment will slump or disappear entirely. As a result, investors may sell and reinvest the proceeds into better-performing stocks, which consequently further depresses the firm's stock price. Clearly, at this point in time, the incentive or pressure to commit corporate fraud is high because of the financial pressure, unrealistic targets, the intention to help the organization grow intensifies, and most employees are on the verge of losing their employment.

The theory states that fraudsters need to have a perceived opportunity to commit fraud. Perceived opportunity is present when the fraudster finds a way to use their trust position to solve the financial problem and believing that they are unlikely to be caught. Meanwhile, Rae & Subramaniam (2008) describe perceived opportunity as a weakness in the system, such as poor segregation of duties, inadequate documentation and records, ineffective information systems, no oversight and review of monitoring mechanisms, where fraudsters may exploit the situation to commit fraud. Economic stress may present many perceived opportunities to commit fraud during an economic downturn that might not be present during better times. Often, during the economic recession, many companies struggle to survive by implementing drastic moves such as employees' retrenchment, a significant reduction in budgets for training and operation, and a reduction in monitoring activities to save cost. Reduction in cost for monitoring, such as cutting back on internal audits, will impact the effectiveness of internal control checks and balances. Therefore, in this situation, many companies will be exposed to the risk and threat of fraud activities due to a lack of monitoring activities and weak internal control.

The rationalization concept suggests that the perpetrator must formulate some type of morally acceptable rationalization before engaging in unethical behaviour (Albrecht, 2004). As stated by Cressey (1953), the perpetrator even believes that they only "borrowing the money" or since everyone is doing it, it is not wrong to do it because they are also entitled to do it. Rationalization is a justification of fraudulent behaviour due to a lack of personal integrity or poor moral reasoning (Rae & Subramaniam, 2008). This claim suggests that the desire to commit fraud depends on the individual ethical values and personal characteristics. In relation to economic conditions, due to the effect of economic recession, top management or employee may rationalize any unethical conduct or wrongdoings. They may convince themselves that it is acceptable to commit any unethical conduct as they are doing it to save the company's reputation. Besides, they may also believe that it is the only option available. Thus, during an economic downturn, perceived pressure increases, as do the perceived opportunities to commit fraud; hence, rationalizing the fraudulent actions is made easier. Companies may quickly resort to desperate measures as they struggle to survive, such as misstatement of financial statements, falsification of reports and documents, and other unethical conducts.

The argument on whether corporate fraud occurs in a good economic or an economic downturn remains debatable. Past literature that discussed the influence of economic conditions on corporate fraud occurrence is yet to provide sufficient empirical findings. Studies such as Omidi, Min & Omidi (2017), Tilden & Janes (2012), and Fernandes and Guedes (2010) argued that fraud is more likely to occur during an economic downturn. However, Wallis & Roselli (2015), Davidson (2011), Povel & Winton (2007), Dennis (2000) argue that fraud is often committed during the economic boom period but only discovered in the later recession period. Therefore, this argument suggested that corporate fraud can occur in any state of the economic condition and warrant more study to assess whether economic conditions influence the propensity of firms to commit corporate fraud in Malaysia. Concerning this, this study's objective is to examine whether economic conditions will influence the occurrence of corporate fraud in Malaysia.

The corporate fraud issue has been discussed extensively in the literature. However, most of the previous studies have been conducted in developed markets. In a developing market, specifically in Malaysia, research on the connection between corporate fraud and economic conditions is still limited. Therefore, there is a need to study this issue in the Malaysian context. The boom to bust period in the economic cycle can give managers and companies unique challenges to design appropriate measures to minimize the risk of being the victim of fraud. This study may provide some insights to business corporations on the need to continuously review and design effective controlling mechanisms to prevent corporate fraud regardless of the state of the economic conditions. Auditors may consider economic factors when evaluating corporate fraud risk and design proper investigation schemes that need to be implemented to detect corporate fraud. It will also shed some light on the investors and other users to have the knowledge and understand the importance of economic factors before or when making their financial investment decisions. It may also help policymakers to develop more effective guidelines and policies that focused on corporate fraud deterrence.

Literature Review

The economic-financial crisis previously has witnessed many companies went bankrupt and liquidated. However, others have managed to survive and continue operating after economic conditions back to a less volatile situation. Usually, during the economic recession, companies unknowingly expose themselves up to high financial and reputational risk. This situation happens because when companies cut back on costs, they often increase their chances of being the victim of fraud. In a volatile economic condition, the three elements, as described in the fraud triangle theory, are more likely to exist and contribute to increased corporate fraud cases. This view is supported by Albrecht, Albrecht, Albrecht (2008). They stated that, on average, 95% of fraud cases were committed because of financial pressure. Similarly, the ACFE (2009) also revealed that the economic recession in 2008 had caused the number of fraud cases to increase by more than 50%. During this global financial crisis, the study highlighted that increased pressure was the main contributing factor for fraud occurrences at 47%, followed by the increased opportunity at 27%, while rationalization at 24%. This argument is further supported by Fernandes and Guedes (2010), who confirmed that there are fewer managers who overstate earnings when real economic conditions are favorable. Moreover, Tilden & Janes (2012) provide evidence of the increase in financial statement manipulation during the economic recession from 1950 to 2006.

However, other studies argued that fraud commonly happens in relatively good time as the boom phase is nearing the end (Wallis & Roselli, 2015; Povel & Winton, 2007; Dennis, 2000). Their study showed evidence that fraud is often committed during the economic boom period, but it is only discovered in the later recession period. In a thriving economy, companies are in good performance, and it is often easy to overlook the fact that they are at the risk of being the victim of fraud. Managers tend to focus on the demand for rapid growth, thus failing to discover that fraud is occurring (Campbell, Butler & Raiborn, 2014). Consequently, until the recession or bust period of the economic cycle began, the manager realized that the company has already become the victim of fraud. Fraud that is usually overlooked during the boom period would not be able to be sustained when it is becoming so large or uncontrollable. In many cases, this fraud will be revealed or discovered during the bust period (Wallis & Roselli, 2015). Povel & Winton (2007) also pointed out that in relatively good times, investors often overlook the fact that they are at the risk of being the victim of fraud due to the reduction in monitoring incentive. During the boom period, investors are overly optimistic and do not carefully monitor their investments, thus increasing the incentive for fraud. They asserted that when a firm requires financing from investors, the firm may manipulate the publicly available information to make it look better than it should be. Hence, it will deceive investors into providing funds to the firm without spending time and money monitoring the firm to learn its real situation. This situation is highlighted in the boom period throughout the 1990s, where the rapid growth in computing and communication technologies has greatly reduce investors monitoring incentives. At the time of very high investors' expectations, a wave of fraud occurred (Povel & Winton, 2007).

Many economic factors that influence fraud have been discussed in the existing literature. In this study, the macroeconomic variables, namely, gross domestic product (GDP), inflation rate, and unemployment rate, are used as proxies for the economic condition to examine the association between economic conditions and corporate fraud. GDP is defined as the total value of goods and services produced in a country for a specific period, either monthly, quarterly, or annually. GDP is used as an indicator of the size of an economy, and the GDP growth rate represents economic growth. It fluctuates because of the business cycle. The central banks and policymakers used GDP to analyze whether the economy is expanding or contracting, whether it needs to be restrained or boost, and whether it is about to experience a recession or widespread inflation. In general, the GDP growth rate is seen as an important indicator of economic health, where it measures how the economy's activities change over time. Studies such as Fernandes & Guedes (2010), Davidson (2011), Okoye & Gbegi (2013), D’Agostino, Dunne, and Pieroni (2016), Kim, Ha & Kim (2017), Omidi, Min & Omidi (2017), Mustafa & Khan (2020) have employed the GDP as the proxy for economic growth in their studies. In examining the influence of GDP on fraud, some researchers found that GDP is significantly positively associated with fraud (Fernandes & Guedes, 2010; Davidson, 2011). On the other hand, Mustafa & Khan (2020) revealed that a decrease in GDP would increase accounting fraud. Meanwhile, Omidi et al. (2017) argued that an increase in GDP in the industrial and manufacturing sector would reduce fraud. However, an increase in GDP in the service sector would positively affect fraud. Due to the inconsistent of the findings of the past studies, this study proposes the null hypothesis as follow:

H01 There is no association between GDP and corporate fraud incidences.

According to Shiskin (1976), Lovati (1975), and Cain (1979), the unemployment rate is useful as the key economic indicators that describe the stage of the current and future business cycle in the economy. It also explains the labour market situations in a country. During the economic recession, the unemployment rate increases significantly and decreases during the economic expansion. The unemployment rate has been used as the proxy for economic conditions in the past literature, for instance, (Omankhanlen, Tometi & Urhie, 2020); Mustafa & Khan (2020); Fallahi, Pourtaghi & Rodríguez (2012); Skousen & Twedt (2009), Cook & Zarkin (1985), Witt, Clarke & Fielding (1999), Cain (1979) & Lovati (1975). Therefore, the unemployment rate is employed as an indicator for general economic conditions. Studies such as Mustafa & Khan (2020) and Omankhanlen, et al. (2020) found that a high unemployment rate is positively associated with accounting fraud. Their empirical evidence supported Mackevi?ius & Giri?nas (2013), who pointed out that the risk of fraud incidences is high when the level of the unemployment rate is high. Therefore, this study proposes the hypothesis as follow:

H2 There is a significant positive association between the unemployment rate and corporate fraud incidences.

Inflation rate means a quantitative measure of the increase in the average price of selected goods and services from year to year and is often stated as a percentage. As the general level prices increases, the purchasing power of the currency of a country will decline. High inflation brings adverse effects to the economy as foreign investors are not confident to invest, hence bringing harmful economic development. In this case, a particular country's central bank will usually use monetary policy, usually by raising the interest rates to discourage borrowing and reduce the amount of money in the market. On the other hand, low inflation indicates that consumers can buy more goods and services. Interest rates are usually low and encourage more people to borrow money, thus boosting economic growth and strengthening foreign investors’ confidence to invest in that country. Therefore, the inflation rate is one of the crucial elements used to analyze the macroeconomic conditions. The use of inflation rate as the proxy for the economic condition has been employed by Wong (1992), Okoye & Gbegi (2013), Omidi, et al. (2017), Omankhanlen, Tometi & Urhie (2020), Mustafa & Khan (2020). In analysing the effect of the inflation rate and fraud incidences, Mackevi?ius and Giri?nas (2013) pointed out that a high level of inflation is among the condition that increases fraud risk. This statement is supported empirically by Omidi et al. (2017), Omankhanlen et al. (2020), Mustafa & Khan (2020). Therefore, the following hypothesis is proposed:

H3 There is a significant positive association between inflation rate and corporate fraud incidences.

As explained earlier, the argument on whether corporate fraud occurs in a good economic or an economic downturn remains debatable. Due to these inconsistent findings, the null hypothesis is stated as below:

H4 There is no association between the crisis period and corporate fraud incidences.

Methodology

In this study, the sample of fraudulent companies is the publicly listed companies charged with furnishing false statements to the Securities Commission of Malaysia and Bursa Malaysia Securities Berhad and were listed in the Securities Commission Enforcement Release (SCER) from 1997 to 2016. The list provided by SCER is appropriate as a proxy for fraud companies because it is evident that the managers of the companies in the SCER sample had committed fraudulent acts. Hence, the probability of Type I and Type II errors can be avoided. Moreover, the SCER sample also provides detailed information about the nature and timing of the manipulation. This information is useful for data collection purposes and tests the right environment when management starts to commit corporate fraud.

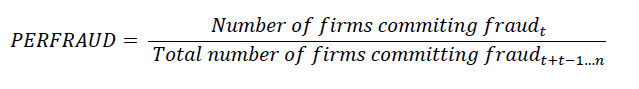

Similar to Davidson (2011), the dependent variable (corporate fraud) is measured as the number of firms committing corporate fraud during the current year divided by the total number of firms committing corporate fraud for the previous and current year. Corporate fraud, in this case, is denoted as PERFRAUD. The formula to calculate PERFRAUD is given as follow:

The independent variables are the economic conditions. The macroeconomic factors used as the proxies for economic conditions are the gross domestic product (GDP) growth rate, unemployment rate, and inflation rate. The measurements for these proxies are explained as follow:

Gross Domestic Product (GDP) Growth Rate

This study used the annual GDP growth rate (%) as the proxy for economic conditions based on The World Bank's definition. The GDP annual growth rate data were obtained from the World Bank Data from 1996 to 2016.

Unemployment Rate (UEMP)

The unemployment rate data is obtained from the Department of Statistics Malaysia (DOSM) from 1996 to 2016. The unemployment rate measurement is based on the DOSM measurement, which is calculated as the proportion of the unemployment figure to the total number of employed persons in Malaysia.

Inflation Rate (INF)

In this study, the data on the inflation rate was obtained from The World Bank Data. The data is measured based on the consumer price index (CPI), using the Laspeyres formula. The CPI reflects the annual percentage changes in the average consumer's cost of buying a basket of goods and services that may be fixed or changed at specified intervals, for example, yearly.

Crisis Period (CRISIS)

Apart from analyzing the direct relationship between the macroeconomic variables and corporate fraud, this study also performed further analysis of the influence of the economic crisis period on corporate fraud. For this analysis, the period of the economic crisis of the year 1997-1998 (Bank Negara Malaysia, 1998) and 2007-2008 (Bank Negara Malaysia, 2008) were identified when separating the fraud incidences during the crisis and non-crisis period. The crisis period is measured based on binary codes, denoted as ‘1’ for the years 1997, 1998, 2007, and 2008, and ‘0’ for other years.

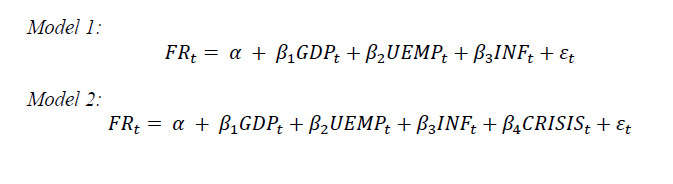

The empirical model, Model 1, analyzes the association between GDP, unemployment rate (UEMP), and inflation (INF) with corporate fraud incidences. Meanwhile, in Model 2, the crisis (CRISIS) variable is incorporated to examine whether corporate fraud occurrences are influenced by the crisis period or not. These models employ the time-series regression analysis to analyze the data. The models are presented as follow:

Findings and Discussion

The descriptive statistics are presented in Table 1. The mean value for the GDP is 5.33% ranging from 8.86% to -1.51. The value of the variance is 3.36, and the standard deviation indicates the dispersion of the data is 1.83. Meanwhile, the mean for the UEMP is 3.28 with 0.05 variance and standard deviation equal to 0.23. The highest UEMP is 3.7%, while the lowest is 2.9%. For the INF, the mean value is 2.39 and fluctuates between 5.43% to 0.60%. The variance and standard deviation values are 1.25 and 1.12, respectively. The value of kurtosis and skewness indicates that GDP data is not normal. Therefore, due to this normality issue, the data was transformed into a natural logarithm function.

| Table 1 Descriptive Statistics for Macroeconomic Variables |

|||||||

|---|---|---|---|---|---|---|---|

| Mean | Variance | Standard deviation | Maximum | Minimum | Kurtosis | Skewness | |

| GDP | 5.33 | 3.36 | 1.83 | 8.86 | -1.51 | 7.14 | -2.31 |

| UEMP | 3.28 | 0.05 | 0.23 | 3.7 | 2.9 | -1.13 | -0.01 |

| INF | 2.39 | 1.25 | 1.12 | 5.43 | 0.6 | 0.8 | 0.89 |

| Number of years (t) | 20 | ||||||

The unit root tests employed are the Augmented Dickey-Fuller (ADF) and Philip-Perron unit root tests. These tests are used to estimate the regression's slope coefficient, where the null hypothesis states that a unit root is present.

| Table 2 Augmented Dickey-Fuller And Philip-Perron Unit Root Tests |

||||

|---|---|---|---|---|

| Augmented Dickey-Fuller (ADF) | Philip-Perron | |||

| Level | First difference (xt- xt-1) | Level | First difference (xt- xt-1) | |

| (xt) | (xt) | |||

| PERFRAUD | -5.0272 | NA | -4.803 | NA |

| (0.0008)*** | (0.0001)*** | |||

| GDP | -5.483 | NA | -6.076 | NA |

| (0.0001)*** | (0.0001)*** | |||

| INF | -4.439 | NA | -4.439 | NA |

| (0.0028)*** | (0.0004)*** | |||

| UEMP | -2.8613 | -4.8402 | -2.857 | -4.872819 |

| (0.0687)* | (0.0014)*** | (0.0693)* | (0.0013)*** | |

As shown in Table 2, the findings show that PERFRAUD, GDP, and INF were stationary at level. These indicate that the null hypothesis is rejected, and these series have an absolute value equal to 1, I(0). However, the variable for UEMP was failed to reject the null hypothesis. Therefore, first differencing is appropriate for these series.

The heteroscedasticity test used is the Glejser test. The null hypothesis states that there is no heteroscedasticity problem in the model. Based on the outcomes presented in Table 3, the F-statistic is recorded at 1.766975, and the p-value is 0.1939 (p>0.05). These results indicate that it failed to reject the null hypothesis; thus, there are no heteroscedasticity problems in the model.

| Table 3 Glejser Test For Heteroscedasticity |

|||

|---|---|---|---|

| F-statistic | 1.766975 | Prob. F(3,16) | 0.1939 |

| Obs*R-squared | 4.977179 | Prob. Chi-Squared(3) | 0.1735 |

| Scaled explained SS | 4.059265 | Prob. Chi-Squared(3) | 0.2551 |

The autocorrelation or serial correlation test performed is the Breusch-Godfrey Serial Correlation LM test. The null hypothesis states that there is no autocorrelation problem in the model. The results of this test are presented in Table 4. The F-statistics is calculated at 0.864464, and the p-value is more than 0.05 (p=0.3672). These results imply that there is no autocorrelation problem in the model.

| Table 4 Breusch-Godfrey Serial Correlation LM Test |

|||

|---|---|---|---|

| F-statistic | 0.864464 | Prob. F(3,15) | 0.3672 |

| Obs*R-squared | 1.089812 | Prob. Chi-Squared(1) | 0.2965 |

Variance Inflation Factors (VIFs) are a method to measure the collinearity level in an equation among the regressors. The preliminary step to identify the presence of multicollinearity is using the pairwise correlation coefficient between the independent variables. The general rule of thumb states that if a simple correlation between two independent variables is more than 0.8 (>0.8), it indicates a severe multicollinearity problem (Midi, Sarkar, and Rana, 2010). The correlation analysis results are presented in Table 5 and show that the correlations between all the independent variables are less than 0.8. It shows that there is no presence of multicollinearity problems among the independent variables.

| Table 5 Correlation Matrix |

||||

|---|---|---|---|---|

| FRAUD | GDP | UNEMP | INF | |

| FRAUD | 1 | |||

| GDP | -0.0035 | 1 | ||

| UEMP | 0.0061 | -0.3732 | 1 | |

| INF | -0.0057 | 0.1899 | -0.283 | 1 |

However, Kutner, Nachtsheim, Neter & Li (2005) pointed out that the pairwise correlation coefficients may not disclose the presence of more severe multicollinearity issues.

Therefore, a formal method is used to detect the existence of multicollinearity, which is the variance inflation factors (VIF). The Centred VIF is the ratio of the variance of the original equation coefficient estimate, divided by the variance of the equation coefficient estimate with only the regressor and a constant.

| Table 6 Result of Variance Inflation Factor (Vif) |

||

|---|---|---|

| Coefficient Variance | Centred VIF | |

| Constant | 0.010815 | - |

| GDP | 5.73E-06 | 1.383877 |

| UEMP | 0.000762 | 1.451922 |

| INF | 4.75E-05 | 1.291358 |

The results shown in Table 6 revealed that all the VIF values are less than 2.5 (<2.5). It implies that there are no multicollinearity issues in the model.

The outcomes of the time-series regressions are presented in Table 7. In Model 1, the F-statistic is reported at 2.85 and statistically significant at 90% confident level (p=0.0726). The R-squared value is 0.2348, which suggests that the model can explain about 24% of the possible variation of the corporate fraud incidences.

| Table 7 Time-Series Regression Results |

|||

|---|---|---|---|

| Model 1 | Model 2 | ||

| Constant | Coefficient | -0.3509 | 0.0415 |

| t-statistic | -0.04 | 1.71 | |

| p-value | -0.967 | -0.109 | |

| GDP | Coefficient | 2.1697 | 0.0047 |

| t-statistic | 1.88 | 1.25 | |

| p-value | (0.080)* | -0.233 | |

| UEMP | Coefficient | 15.6281 | 0.0415 |

| t-statistic | 0.84 | 0.66 | |

| p-value | -0.412 | -0.522 | |

| INF | Coefficient | -0.0712 | -0.0053 |

| t-statistic | -0.06 | -0.64 | |

| p-value | -0.954 | 0.535 | |

| CRISIS | Coefficient | - | -0.0498 |

| t-statistic | - | -1.86 | |

| p-value | - | (0.083)* | |

| R-squared | 0.2348 | 0.2371 | |

| F-statistic | 2.85 | 4.42 | |

| Prob (F-statistic) | (0.0726)* | (0.0162)** | |

| Number of observations | 19 | ||

The results show that the GDP positively influences corporate fraud incidences at a 10% confidence interval. It explains that for every 1% change in the GDP, the number of companies committing corporate fraud increase by 2.16 times. Therefore, the null hypothesis of no association between GDP and corporate fraud incidences (H01) is rejected. This result is similar to the findings of Fernandes and Guedes (2010) and Davidson (2011). Meanwhile, the variable UEMP is positively correlated with corporate fraud incidences but not statistically significant with a t-value of 0.84 (p=0.142). These explain that the variable UEMP does not statistically influence corporate fraud occurrences. Therefore, the outcome rejects the hypothesis of there is a significant positive association between the unemployment rate and corporate fraud incidences (H2). Hypothesis 3 (H3) tests the hypothesis of a significant positive association between inflation rate (INF) and corporate fraud. The results reveal that variable INF has a negative coefficient but not statistically significant with the t-statistics value of -0.06 (p=0.954). These explain that the employment rate does not statistically influence the corporate fraud occurrences; thus, it rejects H3.

In Model 2, the inclusion of CRISIS in the model had improved the F-statistic value to 4.42 and statistically significant at a 95% confident level (p=0.0162). The R-squared (0.2371) indicates that the model is able to explain approximately about 24% of the possible variation of the corporate fraud occurrences. Based on the regression outcomes, CRISIS is statistically significantly associated with corporate fraud occurrences at a 10% confident interval (p=0.083) with the t-value calculated at -1.86 and related negatively (coefficient = -0.0498). Therefore, it rejects the null hypothesis of no association between the crisis period and the occurrence of corporate fraud. This result suggests that during the crisis period, corporate fraud incidences tend to decrease by 4.98%. In other words, corporate fraud incidences tend to increase during the non-crisis period (thriving economy). This finding is consistent with the findings in Model 1, where, as GDP increases (an indication of good economic condition), corporate fraud incidences also tend to increase. Nevertheless, the variable GDP, UEMP, and INF are not statistically significant in Model 2.

In examining the association between economic conditions and corporate fraud, the regression analysis results reveal that GDP has a significant positive association with corporate fraud. The significant level at a 10% confident interval indicates that this macroeconomic variable has little influence on the corporate fraud incidences. In Model 2, it is found that the crisis period has a negative association with corporate fraud. The result explains that during the economic crisis, corporate fraud incidences are decreasing. It means that the number of companies involved in fraudulent activities tends to increase during the boom period.

These outcomes suggest that in Malaysia, the number of companies committing corporate fraud increases in the thriving economy. This finding is consistent with the findings of Dennis (2000), Povel & Winton (2007), Davidson (2011), Wallis & Roselli (2015), where they also found that fraud is often committed in the thriving economy. As pointed out by Wallis & Roselli (2015), Povel & Winton (2007), in relatively good times, the incentive for fraud to happen is high due to the reduction in monitoring incentive. When a company requires financing from investors, the manager may manipulate the financial statements and other information to make the company’s performance look better than it should be. Because of the thriving economy, shareholders are excessively optimistic and focusing more on their demand for high investment return. Hence, this will deceive them into providing funds to the company without carefully monitoring the company to learn its real situation (Povel & Winton, 2007).

Conclusion

The empirical results show that GDP could be considered as an important macroeconomic indicator that may influence corporate fraud incidences. The findings also reveal that corporate fraud is more prone to happen during the thriving period. However, this study did not find any evidence to suggest that the unemployment and inflation rates can influence corporate fraud. The general conclusion that can be drawn from this study is that fraudulent activities tend to increase during stable economic conditions. Therefore, companies need to take appropriate measures to strengthen their monitoring and control activities on management to discourage them from committing corporate fraud, especially in the thriving economy.

To minimize the risk of being the victim of corporate fraud, companies should update and review their internal control and monitoring mechanisms regularly, especially in a thriving economy. Regular fraud risk assessments should be carried out to assess the specific organizational risk environment. As recommended by the MCCG 2017 under Principle B, every company should establish a Risk Management Committee, which comprises a majority of independent directors to monitor its risk management framework and policies. This recommendation suggests that this committee must review and understand outdated controls and policies to determine whether they are still valid or need to change. Being aware of the potential fraud risk that might happen during good or bad economic conditions would provide insights on the potential problems, allowing companies to enhance internal control and monitoring mechanisms. Apart from that, companies may enforce heavy penalties for any fraudulent acts and make it clear to all personnel levels about policies on zero tolerance on corporate fraud activities. The establishment of an anonymous tip line for whistle-blowers could also enhance the monitoring mechanism of a company.

The growing number of corporate fraud cases suggests that corporate fraud is becoming more complex and has become increasingly difficult for auditors to detect. Auditors could consider this study's findings in evaluating the risk of corporate fraud when designing audit plans and investigations in a public company. Understanding the economic situations prone for corporate fraud to occur will help a company design proper investigation schemes that need to be implemented to detect fraud.

Corporate fraud led to significant responses establishing regulations, rules, and codes of ethics. Policymakers play a significant role in designing successful policies, legislation, and regulatory frameworks while protecting shareholders' and other stakeholders' rights. Over time, policymakers can study and strengthen these laws to prevent or mitigate corporate fraud. This study may provide some insights to the policymakers to develop and design more effective rules, regulations, and institutional environments to address better the challenge of combating corporate fraud and reassure shareholders and other stakeholders that their rights are being protected.

The sample of fraudulent companies is restricted to public companies charged by the Malaysian Securities Commission and were listed in the Securities Commission Enforcement Release (SCER) from 1996 to 2016. This study can be further extended by collecting more samples of scandal companies from the Bursa Malaysia database. Since this study only focuses on the external factor that influences corporate fraud incidences, future studies may combine internal and external factors to analyse the factors that influence corporate fraud incidences. The addition of internal factors into the analysis may provide a comprehensive understanding of corporate fraud occurrences; hence the effort to combat corporate fraud can be taken effectively.

Acknowledgements

The authors would like to express their gratitude to The Accounting Research Institute and Universiti Teknologi MARA for funding and facilitating this research project.

References

- ACFE. (2009). Occupational fraud: A study of the impact of an economic recession. ACFE Report on Occupational Fraud, 1-15.

- Aghghaleh, S., Mohamed, Z.M. & Rahmat, M.M. (2016). Detecting financial statement frauds in Malaysia : Comparing the abilities of Beneish and Dechow Models. Asian Journal of Accounting and Governance, 7, 57-65.

- Albrecht, W.S., Albrecht, C.C. & Albrecht, C.O. (2004). Fraud and corporate executives: Agency, stewardship and broken trust. Journal of Forensic Accounting.

- Albrecht, W.S., Albrecht, C. & Albrecht, C.C. (2008). Current trends in fraud and its detection. Information Security Journal: A Global Perspective, 17(1), 2-12.

- Association of Certified Fraud Examiners (ACFE). (2018). Report to the Nations: 2018 global study on occupational fraud and abuse. Global Fraud Study, 15(2), 79.

- Association of Certified Fraud Examiners (ACFE). (2020). Report to the nations on occupational fraud and abuse: 2020 global fraud study. ACFE, 88.

- Bank Negara Malaysia. (1998). The real economy.

- Bank Negara Malaysia. (2008). Economic Report 2007/ 2008: Economic Developments in 2008.

- Cain, G.G (1979). The unemployment rate as an economic indicator. Monthly Labour Review, 103(3), 24-35.

- Campbell, L., Butler, J. & Raiborn, C. (2014). Minimizing fraud during a boom business cycle. Management Accounting Quarterly, 16(1), 1-12.

- Chartered Institute of Management Accountant. (2009). Corporate fraud. CIMA Report, 1(57), 1-18.

- Cleary, R. & Thibodeau, J.C. (2005). Applying digital analysis using Benford’s Law to detect fraud: The dangers of type I errors. Auditing.

- Cook, P.J. & Zarkin, G.A. (1985). Crime and the business cycle. The Journal of Legal Studies, 14(1), 115-128.

- Cressey, D.R. (1953). Other people’s money: A study in the social psychology of embezzlement. Clencoe Illinois: Free Press.

- D’Agostino, G., Dunne, J.P. & Pieroni, L. (2016). Government spending, corruption and economic growth. World Development, 84(2016), 190-205.

- Davidson, R.H. (2011). Accounting fraud: Booms, busts, and incentives to perform. University of Chicago Booth School of Business, 1-6.

- Dennis, A. (2000). The downside of good times. Journal of Accountancy, 190(5), 53-55.

- Fallahi, F., Pourtaghi, H. & Rodríguez, G. (2012). The unemployment rate, unemployment volatility, and crime. International Journal of Social Economics, 39(6), 440-448.

- Fernandes, N. & Guedes, J. (2010). Keeping up with the Joneses: A model and a test of collective accounting fraud. European Financial Management, 16(1), 72–93.

- Kassem, R., & Higson, A. (2012). The new fraud triangle model. Journal of Emerging Trends in Economics and Management Sciences, 3(3), 191-195.

- Kim, E., Ha,Y., & Kim, S. (2017). Public debt, corruption and sustainable economic growth. Sustainability.

- Kutner, M.H., Nachtsheim, C.J., Neter, J. & Li,W. (2005). Applied linear statistical models(5th edition). McGraw-Hill, New York.

- Lovati, J.M. (1975). The unemployment rate as an economic indicator. Federal Reserve Bank of St. Louis, (September), 1-66.

- Mackevi?ius, J. & Giri?nas, L. (2013). Transformational research of the fraud triangle. Ekonomika, 92(4), 150-163.

- Midi, H., Sarkar, S.K. & Rana, S. (2010). Collinearity diagnostics of binary logistic regression model. Journal of Interdisciplinary Mathematics, 13(3), 253-267.

- Mustafa, S. & Khan, D.F. (2020). The relationship between accounting frauds and economic fluctuations: A case of project based organizations in UAE. Journal of Economics and Public Finance, 6(1), p87.

- Okoye, E.I. & Gbegi, D. (2013). An evaluation of the effect of fraud and related financial crimes on the nigerian economy: Kuwait chapter of Arabian. Journal of Business and Management Review, 2(7), 81-91.

- Omankhanlen, A.E., Tometi, E.A.F. & Urhie, E. (2020). Macroeconomic factors, corporate governance and financial malpractices in Nigerian banks. Journal of Money Laundering Control.

- Omidi, M.M., Min, Q. & Omidi, M.M. (2017). Combined effect of economic variables on fraud, a survey of developing countries. Economics and Sociology, 10(2), 267-278.

- Povel, P. & Winton, A. (2007). Booms, busts, and fraud. The Review of Financial Studies.

- PwC. (2018). The fight against economic crime and corruption: Global economic crime survey. Malaysia Report.

- PwC. (2020). Fraud and corruption Malaysia has its say: PwC’s global economic crime and fraud survey-malaysia report, 1-15.

- Rae, K. & Subramaniam, N. (2008). Quality of internal control procedures: Antecedents and moderating effect on organisational justice and employee fraud. Managerial Auditing Journal, 23(2), 104-124.

- Shiskin, J. (1976). Employment and unemployment: The doughnut or the hole? Monthly Labor Review, 99(2), 3-10.

- Skousen, C.J. & Twedt, B.J. (2009). Fraud score analysis in emerging markets. Cross Cultural Management: An International Journal, 16(3), 301-316.

- Tilden, C. & Janes, T. (2012). Empirical evidence of financial statement manipulation during economic recessions. Journal of Finance and Accountancy, 10, 1-15.

- Wallis, D. & Roselli, L. (2015). Breaking the cycle of fraud: What senior financial executives should do. Financial Executives Research Foundation.

- Witt, R., Clarke, A. & Fielding, N. (1999). Crime and economic activity : A panel data approach. The British Journal of Criminology, 39(3), 391-400.

- Wong, K. Y. (1992). Inflation, corruption, and income distribution: The recent price reform in China. Journal of Macroeconomics.