Research Article: 2020 Vol: 24 Issue: 2

Corporate Financial Attributes and The Value of Listed Financial Service Firms: The Nigerian Evidence

Edirin Jeroh, Delta State University

Abstract

This study investigates how corporate attributes of listed firms predicts the overall value of firms by drawing evidence from Nigeria. Thus, secondary data were carefully sourced for a 9-year period (2010 – 2018) from the financials of 32 listed firms in the financial service subsector. The entire panel data for all variables were analysed by means of descriptive, diagnostic and inferential statistics. Hypothesis was formulated and thereafter tested with the multivariate regression technique. Empirical evidence from the analysis and hypothesis testing revealed that the selected corporate attributes in this study (returns, revenue growth, earnings, leverage, company size and asset tangibility) exerted significant influence on two measures of firm value (share price and Tobin’s Q); whereas, no significant relationship was found between the selected corporate attributes of firms and the third measure of firm value (share price to book value). Specifically, while return on assets and earnings per share recorded positive correlation with all three measures of firm value, the same cannot be said for most of the explanatory variables. For instance, Revenue growth and leverage had positive correlation with Tobins’Q, but were negatively correlated with share price and share price to book value. It is however recommended that the management of entities should channel investments to the acquisition of tangible properties and equipments that will enhance the productive capabilities of their respective entities since the size of total assets possibly has proved to have the capability of enhancing share price and Tobins’Q significantly.

Keywords

Earnings, EPS, Tangibility of Firms, Firm Size, Book Value, Value Relevance, Stock Price.

JEL Classifications

M49, M40, G32

Introduction

The emergence of globalization and the computer age has resulted in e-commerce and cross-border trading such that investors in company shares now trade in the shares/stocks of listed companies across various markets irrespective of their nationalities and/or countries in which they reside. This has no doubt increased the amounts and volumes of foreign investments given the active participation of foreign investors in leading Stock Exchanges globally. Regulators and analysts have therefore called for more credible financial statements if the continuous inflow of foreign investments must be sustained especially for developing countries like Nigeria. This call is premised on the argument that the prediction of the overall value of firms by means of reported indices of firms (financial attributes/accounting numbers) has continued to remain an empirical issue within developed, emerging and developing economies over time (Chalmers et. al., 2010).

Noteworthy, given the associated complexities of today’s business world, studies have shown that the survival of corporations has necessitated the need for managers and chief executives to mobilize and channel available resources towards enhancing the overall value of their respective firms (Purwohandoko, 2017). This is consequent on arguments that higher values of firms largely influence present and potential investors’ confidence and perception of future prospects of reporting companies.

No doubt, the attendant developments, integration and growth of capital markets globally, has made it to be very possible for investors to practically compare the performance and overall value/state of affairs of listed companies through a careful analysis of the flow of foreign and other investments both at the global and national levels. Given this assertion, Ragab & Omran (2006) argued that accounting information/numbers, being relevant proxies for firm financial attributes, have become important factors of consideration by local and foreign investors when making international comparison. With firms jostling for competitive placement within the local and global markets, their respective interactions with existing financial markets and of course, the investing community have also witnessed significant surge. To date, researches have constantly prescribed the increased and continuous use of accounting information to practically and effectively communicate the value and well being of corporations.

Notably, the place of companies’ financial data on providing credible and strategic information about the overall well being of entities have so far been documented in prior literatures (Wang & Chang, 2008). Studies have also suggested that several financial indices can be used to measure the value of corporations. Such indices according to prior studies (Kusiyah & Arief, 2017; Davies & Macfubara, 2018) include market price, share price, market capitalization, tobins’Q, earnings per share, amongst others. While concerns of most prior studies have been on macro-economic factors, governance, market and capital structures as significant determinants of firm value (Jubaedah,Yulivan & Hadi, 2016; Aggarwal & Padhan, 2017; Hirdinis, 2019), much empirical Nigerian studies have not focused specifically on how firm financial attributes (encompassing bottom line and other financial indices in corporate reports) affects the value of corporations with specific reference to only companies within the financial service sector. This therefore forms the nub of this current study.

Problem Statement

Studies on the efficacy of corporate financial attributes/accounting numbers deal with the expediency of firm level data as reflected in the financials of organizations (Mutalib et al., 2014). On the basis of the pioneer study of Ball and Brown (1968), several researches (empirical or otherwise) have nosedived in attempt to ascertain the extent in which accounting numbers may have relatively predicted firm value by x-raying movements in the prices of companies’ securities/equity stocks.

Noteworthy, empirical evidence from both developed and emerging countries suggests the presence of a linear relationship between selected financial accounting numbers, governance attributes and firm value when measured by securities/share prices of corporate entities (Aman & Nguyen, 2008; Li, et al. 2013; Ntim, 2016; Lozano et al., 2016; Dang et al., 2017; Li & Zaiats, 2017; Cai et al. 2018; Latridis, 2018; Zhou & Zhu, 2019). Specifically, studies in this area have been depicted as value relevance studies, and have mostly focused on the presumed statistical link between share price of firms and earnings and book value per share (Sharma et al., 2012; Uwuigbe et al. 2016). Undoubtedly, the findings from these studies have proved to be mixed and contradictory. Additionally, much concern has not been tailored at establishing the interrelatedness between several measures of firm value and corporate attributes that will include additional accounting information like revenue growth, asset tangibility, capital structure and profitability measures.

Motivated by the above, and in line with the belief that the sizes of firms, their capital structure and profitability may influence firm value (Hirdinis, 2019), this study sets to examine a set of corporate attributes (measured by accounting numbers earnings, return on asset, revenue growth, capital structure leverage, firm size and asset tangibility) and their respective relationship with three (3) measures of firm value share price, tobins’Q and market to book value. This study distinct itself from others by focusing on three (3) measures of firm value.

Literature Review

The overall value of firms has so far been viewed and measured in relation to the perceptions of stakeholders about associated movements in the stock/equity prices of firms. According to Hirdinis (2019), companies basically exist to maximize their respective values or wealth. Such values are presumed to be a reflection of the bargaining power of each company’s stocks; hence, most likely, the prospects of listed companies have been linked by investors and analysts to movements in equity/stock prices. This accounts for why companies with higher stock prices are considered to be highly valued (Kusiyah & Arief, 2017).

According to Gharaibeh & Qader (2017), the value of firms is mostly influenced by both exogenous and endogenous variables/factors. While the management of firms may have control of such endogenous factors confronting the firms, the same cannot be mentioned for exogenous factors which are basically external to the organization. Since the endogenous factors are within the control of management, this current study therefore focused on selected endogenous corporate attributes and examines their presumed effect on firm value.

Noteworthy, evidence from prior empirical studies in accounting, corporate finance and the likes have shown that several approaches have been adopted to measure the overall value of firms. In the study of Kumar (2015) and Handoko (2016), firm value was measured as the ratio of stock price to book value (PBV) of firms. PBV is presumably a good measure of firm value that establishes the ability of companies to create values relative to the size of invested capital. High PBV is however a suggestion that stock prices are on the higher side as compared to the amount of book value per share. Note that higher stock prices connote higher levels of successes in creating values and shareholders’ wealth among companies (Handoko, 2016). The creation of value for firms increases shareholders’ expectations of higher profits and possibly higher dividends and return on investments. This is why PBV is used by analysts to ascertain the market price of companies’ shares in relation to their respective book values.

According to Hirdinis (2019), apart from PBV, firm value could be measured in terms of dividend yield and dividend payout ratios respectively. While dividend yield measures the amount of dividends paid in cash to shareholders relative to the companies’ market value per share; dividend payout ratio measures the amount of dividends relative to earnings (Anton, 2016).

Additionally, studies have also measured firm value with reference to firms’ share prices and Tobins’Q (Hessayri & Saïhi, 2017; Gharaibeh & Qader, 2017). Tobin’s Q (the q-ratio) is widely adopted by corporate finance and accounting researchers to measure the market value of the overall assets of companies relative to their respective book values. Studies have argued that the q-ratio accounts for the risk exposure of firms without distorting the results from other valuation measures or proxies. It is obtained by dividing a firm’s market value by the book value of its overall assets. According to Marvadi (2015), Tobin’s Q is theoretically and empirically proven to be a reliable and equivalent measure of value creation among firms. This however justifies why the ratio is used as one of the measures of firm value in this current study.

Empirical Evidence

Empirical substantiations on the relevance of financial accounting numbers on the prediction of firm value or stock price movements abound. Notably, most previous studies have majorly concentrated on how earnings and the book values of companies’ shares explain firm values and/or share prices. The current study is however designed in line with prior value relevance studies, but extends its purview to include other useful accounting ratios like return on assets, revenue growth, earnings per share, capital structure ratio, firm size and asset tangibility.

Noteworthy, earlier studies on the relevance of accounting information relative to firm value or stock price movements were conducted with data from listed firms in the United States of America (USA); although, recent empirical evidence indicate that studies in this area had spread to other stock markets in Europe, the world over (Suwardi, 2009).

Jubaedah et al., (2016) analysed the influence which the combination of macroeconomic factors, capital structure, and financial performance would have on firm value. The study focused on listed textile companies in Indonesia and secondary data were obtained from a sample of 20 companies in IDX. The panel regression approach was adopted and the data were subjected to descriptive, diagnostic and inferential statistical tests. Evidence from the analysis indicate that the combination of financial performance (ROA), macroeconomic factors (exchange, interest and inflation rates respectively), and capital structure measures (long term debts to total assets) had significant influence on firm value (PBV); although the ratio of short term debt to total asset exhibited no significant influence on PBV. The study concludes that better levels of performance are indications of higher firm values.

In evaluating the factors that determine firm value, Anton (2016) specifically analysed the influence which dividend policy may have on firm value by obtaining evidence from listed Romanian firms. Data were gathered from 63 non-financial firms over an 11 year period (2001 -2011). The panel regression approach was employed with emphasis on the results from the fixed effect model. Prior to the test of hypotheses, the data were subjected to descriptive and diagnostic tests. On the whole, evidence obtained showed that dividend policy as measured by the dividend pay-out ratios of firms had positive and significant influence on firm value. The study also found that leverage and the size of firms had significant and positive influence on firm value.

In the study of Handoko (2016), an examination of the influence which firm characteristics (size, liquidity, growth, profitability and tangibility) would have on capital structure and possibly firm value was conducted. Secondary data were practically sourced from the financials of 10 listed insurance companies in Indonesia (IDX) covering a 6 years period (2008-2013). Again, the panel regression approach was employed, combining both time series and cross-sectional data. The results indicated that firm characteristics had significant effect on firm value. Specifically, company size, growth potentials of firms and tangibility were found to exert negative influence on firm value while liquidity and profitability measures were found to be positively linked with firm value.

Adenugba et al. (2017), evaluated the relationship between leverage and firm value by obtaining empirical evidence from selected Nigerian listed firms. Data were drawn from a sample of 5 firms over a 6-year period which spanned from 2007-2012. Relying on the multiple regression technique, the study adopts the OLS in its test for the formulated hypotheses. Findings indicate that financial leverage had significant influence on firm value, thus leading to the conclusion that financial leverage assumes a better source of financing businesses and investments as compared to equity.

In Ghana, the study by Aveh & Awunyo-Vitor (2017) sets out to ascertain the endogenous measures of firms that determine stock prices in emerging markets. Secondary data were garnered from all the listed firms in Ghana between 2008-2014 and the panel regression model was the basis of data analysis. Evidence from the study showed that after the adoption of IFRS, firm attributes like EPS, ROE, book value and market capitalization were value relevant in explaining share price movements.

Furthermore, Ayuba et al. (2018) analysed how firm level data affects stock returns of Nigerian firms. Evidence was drawn from 21, out of the top 25 most-capitalized listed equities/firms and data were sourced for the size, PBV and the PE ratio respectively for the period, 2007-2016. Analysis was done using the panel regression technique based on the ex-post facto design. Discussions were based on the results from the descriptive, inferential, post-residual diagnostic tests along with the fixed effect, random effect and hausman specification tests. The result suggests that PBV had a significant positive effect on stock returns whereas; firm size had an insignificant negative on stock returns of the sampled firms. Additionally, PE ratio was found to have a positive, though insignificant effect on stock returns of the sampled Nigerian companies.

However, Githira, Muturi and Nasieku (2019) obtained data on the financial characteristics of firms and examined their respective influence on stock returns of listed firms in Nairobi, Kenya. Specifically, panel a 10-year (2007-2016) panel data on liquidity, financial health, leverage, firm value and shareholders’ concentration were obtained and used as proxy for the financial characteristics of firms. The study was anchored on the information asymmetry theory while analysis was based on the OLS regression technique. Results indicate that all the measures of the financial characteristics of firms had significant and positive influence on stock returns of the listed firms in the Nairobi Stock Exchange.

Hirdinis (2019) examined the effected which firm size and capital structure (as moderated by profitability measures) would have on firm value. The study adopts the causal comparative design and analysed secondary data sourced from the financials of 7, out of the 41 listed mining firms in Indonesia. The study covered a time period of 5 years (2011 – 2015). Analysis and discussions were based on the results of the descriptive, classical assumption tests respectively. The test of hypotheses was based on the t-test in the regression models and analyses. The study’s result indicates amongst others that capital structure significantly affects firm value positively whereas, firm size was found to have a significant negative effect on firm value.

Research Hypothesis and Conceptual Framework

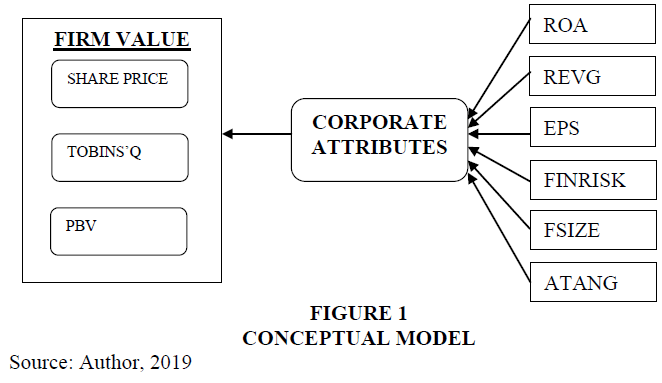

Given the aforesaid and consistent with prior researches, this study considers three (3) measures of firm value (share price, tobin’s Q and market price to book value) and examines the influence which six (6) measures of corporate attributes (return on assets, revenue growth, earnings per share, capital structure, firm size and asset tangibility) may collectively have on them. On this note, we therefore hypothesize as follows:

Corporate attributes do not have significant influence on the measures of firm value among listed Nigerian companies.

The study’s conceptual model based on the above hypothesis as depicted in Figure 1 however presents the pattern of interaction between the variables of concern.

Methodology

The ex-post-facto design was considered appropriate for this study; hence secondary data were collated for the variables and extracted from the financial records of 32 listed service companies (bank and non-bank financial service companies) in Nigeria. A period of 9 years which spanned from 2010-2018 was covered by this study. This period covers the most recent financial reporting regime in the country the post IFRS adoption era. On the basis of the study’s research design and in line with the conceptual model and the formulated hypothesis, the multivariate regression technique was adopted due to the number of proxies for the dependent variable (firm value). Given that panel data are usually generated over a time frame across different companies, the collated data were therefore subjected to diagnostic tests which include correlation analysis, multicollinearity and heteroscedasticity tests and panel unit root test respectively.

Model Specification

The steering model that will direct further analysis in this study is thus presented;

Firm Value = ƒ (ROA, REVG, EPS, FINRISK, FSIZE, ATANG) …………….…………...... Eqn.1

The above equation is further presented in its explicit form as shown in Eqn.2

Firm Valueit = β0+β1ROAit+β2REVGit+β3EPSit+β4FINRISKit+β5FSIZEit+β1ATANGit+Uit ………… Eqn.2

The variables’ description is presented in Table 1.

| Table 1 Definition and Description of Variables | |||

| Variables | Proxy | Label | Operationalization |

| Firm Value (Dependent Variables) | Share Price | SHPRICE | Last Day Share price of the company as reported in each company’s financial statement |

| Tobin’s Q | TOBINSQ | (Market capitalization plus Total liabilities Less Cashflow) divided by total assets | |

| Price to Book Value | PBV | Market price of each company’s shares divided by their respective book value | |

| Corporate Attributes - Independent Variable) | Return on Asset | ROA | Earnings after tax divided by total assets for each company in every given year |

| Revenue Growth | REVG | (Current year revenue less revenue of previous year) divided by previous year’s revenue. | |

| Earnings Per Share | EPS | Earnings divided by the number of shares outstanding as reported by each firm in every given year | |

| Capital Structure (Financial Risk) |

FINRISK | Total Liabilities divided by the total assets of each firm in every given year | |

| Firm Size | BSIZ | Natural Logarithm of the total assets of each firm in every given year | |

| Asset Tangibility | ATANG | Total Tangible Assets of each company, divided by their respective figures for Net Profit After Tax for each year. | |

Results and Discussion

Descriptive Statistics and Diagnostic Tests

The summarized result of the descriptive statistics for the entire data across all panels is presented in Table 2.

| Table 2 Summarized Results for the Descriptive Statistics | |||||

| Variables | Mean | Standard Dev. | Minimum Value | Maximum Value | No. of Observations |

| Shprice | 3.7695140 | 7.002836 | 0.20 | 47.95 | 288 |

| Tobins’Q | 0.7101736 | 0.260954 | 0.07 | 2.55 | 288 |

| PBV | 0.7409028 | 0.603008 | -0.47 | 4.88 | 288 |

| ROA | 2.1155900 | 4.679579 | -23.49 | 20.76 | 288 |

| REVG | 21.282950 | 72.77111 | -65.94 | 1,082.6 | 288 |

| EPS | 0.6670139 | 2.010612 | -12.66 | 21.35 | 288 |

| FINRISK | 63.687150 | 27.70592 | 4.46 | 254.75 | 288 |

| FSIZE | 7.9247220 | 0.9789537 | 6.67 | 10.77 | 288 |

| ATANG | 8.16527800 | 6.909088 | 0.03 | 39.39 | 288 |

As indicated, the approximate average value of share price (shprice) stood at 3.769 with a standard deviation (Std.Dev.) of about 7.0028. The standard deviation of 7.0028 is indicative of a seemingly significant difference in companies’ share prices across time. This was further confirmed by the minimum and maximum values of 0.20 and 47.95 respectively. Conversely, Tobins’Q, with an average value of 0.710 and a standard deviation of approximately 0.2609 exhibited insignificant difference across firms over the study period as further highlighted by the minimum value of 0.07 and a corresponding maximum value of about 2.55. The average Tobins’Q (0.710) is low when compared to the values reported by studies like Gharaibeh & Qader (2017) who reported an average Tobins’Q of 2.45297 with values ranging from 1.840 to 14.140 over a 10-year period (2005-2014) for a sample of 40 listed firms in Saudi Arabia. For the third dependent variable/measure of firm value (PBV), an average value of 0.7409 with a corresponding standard deviation of 0.6030 was reported. Values however ranged across firms and over time from a minimum of -0.47 to a maximum of 4.88.

Additionally, for the independent variables, the average values of 2.1156, 21.2829, 0.6670, 63.6871, 7.9247 and 8.1653 were reported for ROA, REVG, EPS, FINRISK, FSIZE and ATANG respectively; with a corresponding standard deviation of 4.6796, 72.7711, 2.0106, 27.7059, 0.9789 and 6.9091. Apart from REVG and FINRISK, the values of the standard deviation alongside the minimum and maximum values suggests that the values reported for most of the variables may not be significantly different across the respective firms and across time.

Correlation Analysis

The correlation analysis’ result for all variables is as presented (see Table 3).

| Table 3 Correlation Result | |||||||||

| Variables | Shprice | Tobins’Q | PBV | ROA | REVG | EPS | FINRISK | FSIZE | ATANG |

| Shprice | 1.0000 | ||||||||

| Tobins’Q | 0.2949 | 1.0000 | |||||||

| PBV | 0.5067 | 0.3855 | 1.0000 | ||||||

| ROA | 0.0848 | -0.1044 | 0.1018 | 1.0000 | |||||

| REVG | -0.0370 | 0.0049 | 0.0042 | 0.1356 | 1.0000 | ||||

| EPS | 0.4837 | 0.1133 | 0.1561 | 0.1975 | -0.0032 | 1.0000 | |||

| FINRISK | 0.2854 | 0.7128 | 0.0463 | -0.1918 | -0.0757 | 0.1388 | 1.0000 | ||

| FSIZE | 0.6153 | 0.3806 | 0.1245 | -0.0493 | -0.0482 | 0.3588 | 0.6550 | 1.0000 | |

| ATANG | -0.3444 | -0.2452 | -0.0840 | -0.1564 | -0.0428 | -0.2535 | -0.3945 | -0.6065 | 1.0000 |

As can be observed, apart from revenue growth (REVG) and asset tangibility (ATANG), the the other independent variables (ROA, EPS, FINRISK and FSIZE) had positive correlations with the Shprice. Additionally, while ROA and ATANG were found to be negatively correlated with Tobins’Q, we observed that REVG, EPS, FINRISK and FSIZE had positive correlations with Tobins’Q. The correlation between PBV and ATANG was also negative whereas, other independent variables (ROA, REVG, EPS, FINRISK and FSIZE) recorded positive correlations with PBV. A further scrutiny of the coefficients shows that no pair of explanatory variables had coefficient that is above the threshold of 0.70; a suggestion that the entire panel data for all variables may not suffer from multicollinearity. To confirm this position, we conducted and present the result and analysis of the Variance Inflation Factor (VIF) test (Table 4).

| Table 4 Result for VIF Test | |||||||

| Variables | FSIZE | FINRISK | ATANG | EPS | ROA | REVG | Mean VIF |

| VIF | 2.59 | 1.86 | 1.68 | 1.22 | 1.17 | 1.03 | 1.59 |

| 1/VIF | 0.3868 | 0.5389 | 0.5937 | 0.8175 | 0.8514 | 0.9747 | |

Test for Multi-collinearity and Unit Roots

The result in Table 4 confirms that given the range of VIF between 1.03 (for REVG) and 2.59 (FSIZE) with a mean value of 1.59, the data obtained for all the independent variables does not have problems relating to multi-collinearity. The mean VIF of 1.59 is below the general threshold of 10 (1.59<10), thus confirming that the specified models (Eqn.1 and Eqn.2) in this study are fit. To buttress this assertion, further diagnostic tests were conducted and the results presented in Tables 5 and 6.

| Table 5 Multivariate Tests for Normality and Compound Symmetry | |||

| Test for Normality of Residuals | Test for Compound Symmetry | ||

| Doornik-Hansen Chi2(18) | Prob>chi2 | Lawley chi2(35) | Prob>chi2 |

| 14,173.662 | 0.0000** | 852.22 | 0.0000** |

Note: **significant at 1%.

The normality test for the residuals was used to establish whether the residuals were normally distributed. It also checks the presence, or otherwise of outliers which may negatively affect the outcome of the regression analysis. As shown, with the value of 14,173.662 for the Chi2(18) with a corresponding prob. value of 0.0000, we conclude that the residuals were normally distributed across the panels and satisfy one of the conditions for multivariate analysis.

Also, the Lawley test for compound symmetry was employed to test the equality of the correlations obtained (that is, whether the correlation matrix for the variables in the entire panel data is compound symmetric). The result obtained [chi2(35) =852.22; prob>chi2=0.0000] suggests the rejection of the hypothesis that all correlations are equal, which again supports the test of hypothesis using multivariate regression analysis.

Unit Root Test

Notwithstanding, consistent with prior studies, since the panel data used in this study consist of time series data across firms, we further subject the data to panel unit root test using the Levin-Lin-Chu (LLC) test for unit roots. We present the result in Table 6.

| Table 6 Result for LLC Test | |||||

| Variables | At Levels | At 1st Difference | Decision | ||

| Statistics | p-value | Statistics | p-value | ||

| Shprice | -15.6548 | 0.0000** | -3.1648 | 0.0008** | I(0) |

| Tobins’Q | -19.6755 | 0.0000** | -2.5150 | 0.0060** | I(0) |

| PBV | -36.8967 | 0.0000** | -9.1699 | 0.0000** | I(0) |

| ROA | -18.8162 | 0.0000** | -15.7388 | 0.0000** | I(0) |

| REVG | -1.3e+02 | 0.0000** | -6.4517 | 0.0000** | I(0) |

| EPS | -8.6733 | 0.0000** | -17.1520 | 0.0000** | I(0) |

| FINRISK | -16.3000 | 0.0000** | -9.6323 | 0.0000** | I(0) |

| FSIZE | -8.3384 | 0.0000** | -4.2360 | 0.0000** | I(0) |

| ATANG | -19.7070 | 0.0000** | -7.1536 | 0.0000** | I(0) |

Source: Researcher’s Computation, 2019.

The indication from the results in Table 6 is that all variables are stationary both at levels and first difference. Impliedly, the hypothesis that panels may contain unit roots is rejected. With this outcome, we therefore proceed to test our postulated hypothesis using the multivariate regression technique.

Hypothesis Testing

Given that this study focused on three (3) dependent/outcome variables, the multivariate regression analysis was adopted in the test of the postulated hypothesis. Table 7 presents the results in this regard.

| Table 7 Result of Multivariate Regression Estimate | |||||||||

| Variables Statistics | Share Price | Tobins'Q | Price to Book Value | ||||||

| Coeff. | T | P>|t| | Coeff. | t | P>|t| | Coeff. | t | P>|t| | |

| ROA | 0.0725 | 1.04 | 0.301 | 0.0014 | 0.58 | 0.562 | 0.0111 | 1.35 | 0.177 |

| REVG | -0.0018 | -0.43 | 0.666 | 0.0002 | 1.33 | 0.184 | -0.00002 | -0.04 | 0.968 |

| EPS | 0.9645 | 5.80 | 0.000 | 0.0075 | 1.27 | 0.204 | 0.0316 | 1.63 | 0.105 |

| FINRISK | -0.0373 | -2.51 | 0.013 | 0.0079 | 14.93 | 0.000 | -0.0004 | -0.25 | 0.800 |

| FSIZE | 4.7145 | 9.50 | 0.000 | -0.0499 | -2.85 | 0.005 | 0.0708 | 1.22 | 0.223 |

| ATANG | 0.0750 | 1.32 | 0.187 | -0.0004 | -0.17 | 0.863 | 0.0015 | 0.23 | 0.816 |

| _CONS | -32.5847 | -8.59 | 0.000 | 0.5968 | 4.45 | 0.000 | 0.1516 | 0.34 | 0.732 |

| Obs. | 288 | 288 | 288 | ||||||

| R-Sq. | 0.4767 | 0.5288 | 0.0370 | ||||||

| F | 42.65436 | 52.56292 | 1.801893 | ||||||

| p-value | 0.0000** | 0.0000** | 0.0987 | ||||||

Source: Researcher’s Computation, 2019.

As indicated, ROA and EPS have positive correlation with all three measures of firm value. The empirical import of this is that the enhancement of the returns and earnings of firms would positively increase the overall value of firms; although, this position is only significant in the relationship between EPS and share price. Revenue growth (REVG) and leverage (FINRISK) had positive correlation with Tobins’Q, but were negatively correlated with share price and PBV. Note that the relationship between FINRISK and two measures of firm value (Share price and Tobins’Q) is significant. This is not the case with PBV. This means that where firms focus their strategies on incurring more debt with the hope of generating funds that would facilitate investment opportunities targeted at increasing the revenue base of their respective entities, the overall value of their firm in terms of equity price and book value will significantly plummet. Interestingly, since FSIZE and ATANG recorded a positive correlation with share price (4.7145 and 0.0750 respectively) and PBV (0.0708 and 0.0015 respectively), it means that the acquisition of properties, plants and equipments (tangible assets) will positively enhance the productive capability of firms, thus, increasing the overall value of such firms.

However, by holding other variables constant, the R2 of 0.4767 for share price suggests that approximately 47.67% of the variations in the share prices of the sampled firms were accounted for by movements in our explanatory variables (ROA, REVG, EPS, FINRISK, FSIZE and ATANG). The F-value of 42.65 (approximately) with a corresponding p-value of 0.0000 is an indication that the corporate attributes of firms as gauged by ROA, REVG, EPS, FINRISK, FSIZE and ATANG, have significant influence on firm value (when measured by share price).

On a similar note, we also observed from Table 7 that while ROA, REVG, EPS and FINRISK, recorded positive correlations with Tobins’Q (0.0014, 0.0002, 0.0075 and 0.0079 respectively), FSIZE and ATANG had negative correlations with Tobins’Q (-0.0499 and -0.0004 respectively). Apart from FINRISK (p-value = 0.000) and FSIZE (p-value = 0.005), all corporate attributes were found to individually exhibit insignificant relationship with Tobin’s Q.

Notwithstanding, by holding other variables constant, the R2 of 0.5288 for Tobins’Q suggests that movements in firms’ corporate attributes jointly accounts for approximately 52.88% of the variations in the Tobins’Q of the sampled firms. The F-value of 52.56 (approximately) with a corresponding p-value of 0.0000 means that that firm value (as measured by Tobins’Q) is significantly influenced by the corporate attributes of firms (when measured by ROA, REVG, EPS, FINRISK, FSIZE and ATANG). These results are in tandem with prior studies in different context as highlighted in our literature/empirical review (Handoko, 2016; Aveh & Awunyo-Vitor, 2017; Ayuba et al., 2018; Githira et al., 2019).

Contrary to the above findings, we observed that the explanatory variables could only account for about 3.70% of the systematic variations in PBV. Additionally, the F-value of approximately 1.802 (p-value = 0.0987) suggests that corporate attributes as explained by ROA, REVG, EPS, FINRISK, FSIZE and ATANG does not have significant influence on the price to book values (PBV) of listed service firms in Nigeria. This finding contradicts that of Handoko (2016); but supports the views of Jubaedah et al. (2016) who observed that certain firm level attributes does not exert significant influence on firm value when measured using PBV; Overall, these findings have policy implications.

Conclusion and Recommendations

Researchers have sought to ascertain how financial data relatively predicts firm value by separately analyzing and employing various existing measures of firm value. On this note, empirical evidences have either suggested that a linear relationship exist or does not exist between selected financial accounting numbers and firm value. This however prompted this study which was designed to examine the extent which selected endogenous corporate attributes exert influence on different measures of firm value, by drawing evidence from the financial service sector of Nigeria. This was premised on the contradictory findings in prior studies on the link between firm attributes and firm value coupled with the dearth of recent empirical evidence from the entire financial service sector in Nigeria which comprised of banks and other listed financial service companies.

Descriptive statistics, diagnostic tests and the Multivariate Regression estimate, were combined to estimate and evaluate our variables and specified regression model. Overall, our results indicate that the selected endogenous corporate attributes in this study (ROA, REVG, EPS, FINRISK, FSIZE, and ATANG) jointly exerted significant influence on two measures of firm value (share price and Tobin’s Q); whereas, no significant relationship was found between price to book value (PBV) and the corporate attributes of firms. Specifically, while ROA and EPS have positive correlation with all three measures of firm value, the same cannot be said for most of the explanatory variables. For instance, Revenue growth (REVG) and leverage (FINRISK) had positive correlation with Tobins’Q, but were negatively correlated with share price and PBV.

Given the empirical findings obtained in the course of this study’s analysis and evaluations, we recommend to the management of reporting entities as follows:

1. When designing strategies that may have prospects in enhancing revenue growth, companies should eschew over reliance on debt financing as this has proved to have significant negative influence on share prices and by extension, the value of firms.

2. Investments should be channeled at acquiring tangible properties and equipments that will enhance the productive capabilities of corporate entities since the size of total assets possibly has proved to have the capability of enhancing share price and Tobins’Q significantly.

Limitation and Suggestions for Further Studies

This study was conducted to possibly unveil the extent to which trends in the values of firms could be predicted by their respective corporate attributes. To this end, data used in the study spanned from 2010-2018 and were sourced from 32 listed firms in the financial service industry. This is considered a limitation to this current study which therefore calls for further empirical documentations that not only would span beyond 2010, but however may include firms from other sectors so that comparison of results across industrial categories could be made. Additionally, this study did not consider the effect which shocks from structural breaks may have on the study’s outcome. In this regard, we recommend future researches to extend the current study’s period and apply appropriate statistical techniques to ascertain the effect of structural breaks and other shocks on the relationship between corporate attributes of firms and their respective values.

References

- Adenugba, A.A., Ige, A.A. & Kesinro, O.R. (2017). Financial leverage and firms’ value: A study of selected firms in Nigeria. European Journal of Research and Reflection in Management Sciences, 4(1), 14-32.

- Aggarwal, D., & Padhan, P.C. (2017). Impact of capital structure on firm value: Evidence from Indian hospitality industry. Theoretical Economics Letters, 7, 982-1000.

- Aman, H., & Nguyen, P. (2008). Do stock prices reflect the corporate governance quality of Japanese firms? Journal of The Japanese and International Economies, 22(4), 647-662.

- Anton, S.G. (2016). The impact of dividend policy on firm value: A panel data analysis of Romanian listed firms. Journal of Public Administration, Finance and Law, 10, 107-112.

- Aveh, F.K., & Awunyo-Vitor, D. (2017). Firm-specific determinants of stock prices in an emerging capital market: Evidence from Ghana stock exchange. Cogent Economics & Finance, 5, 1-11.

- Ayuba, A. J., Balago, G.S., & Dagwom, D.Y. (2018). Effects of firm level attributes on stock returns in Nigeria. International Journal of Finance and Accounting, 7(4), 122-131.

- Ball, R., & Brown, P. (1968). An empirical evaluation of accounting income numbers, Journal of Accounting Research, 31(17), 159-178

- Cai, G, Xu, Y, Yu, D, Zhang, J., & Zheng, G. (2018). Strengthened board monitoring from parent company and stock price crash risk of subsidiary firms. Pacific-Basin Finance Journal, 56, 352-368.

- Chalmers, K., Navissi, F., & Qu, W. (2010). Value relevance of accounting information in China pre- and post-2001 accounting reforms, Managerial Auditing Journal, 25(8),792-813.

- Dang, N.H., Hoang, T.V.H., & Tran, M.D. (2017). The relationship between accounting information in the financial statements and the stock returns of listed firms in Vietnam stock exchange. International Journal of Economics and Finance, 9(10), 1-10.

- Davies, S.D., & Macfubara, M.S. (2018). Financial risk and value relevance of accounting information: Evidence from Nigeria quoted insurance firms. Journal of Accounting and Financial Management, 4(3), 45-63.

- Gharaibeh, A.M.O., & Qader, A.A.A.A. (2017). Factors influencing firm value as measured by the Tobin's Q: Empirical evidence from the Saudi stock exchange (TADAWUL). International Journal of Applied Business and Economic Research, 15(6), 333-358.

- Githira, C., Muturi, W., & Nasieku, T. (2019). Influence of firm financial characteristics on stock return of firms listed in Nairobi securities. American Based Research Journal, 8(3), 86-96.

- Handoko, D. (2016). The influence of firm characteristics on capital structure and firm value: An empirical study of Indonesia insurance companies. International Journal of Economics, Commerce and Management, 4(4), 1181-1206.

- Hessayri, M., & Saïhi, M. (2017). What would influence firm valuation? Financial reporting and shareholder governance. International Journal of Economics and Financial Issues, 7(2), 292-300.

- Hirdinis, M. (2019). Capital structure and firm size on firm value moderated by profitability. International Journal of Economics and Business Administration, 7(1), 174-191.

- Jubaedah, I.Y., & Hadi, A.R.A. (2016). The influence of financial performance, capital structure and macroeconomic factors on firm’s value: Evidence from textile companies at Indonesia stock exchange. Applied Finance and Accounting, 2(2), 18-29.

- Kumar, B.R. (2015). Determinants of value creation: An empirical examination from UAE market. International Journal of Economics and Financial Issues, 5(1), 75-85.

- Kusiyah, & Arief, M. (2017). The determinants of firm value on commercial banks in Indonesia. Journal of Engineering and Applied Sciences, 12(2), 408-416.

- Latridis, G.E. (2018). Accounting discretion and executive cash compensation: An empirical investigation of corporate governance, credit ratings and firm value. Journal of International Financial Markets, Institutions and Money, 55 (July), 29-49.

- Li, B., Boo, Y.L., Ee, M.S., & Chen, C. (2013). A re-examination of firm’s attributes and share returns: Evidence from the Chinese A- shares market. International Review of Financial Analysis, 28, 174-181.

- Li, T., & Zaiats, N. (2017). Corporate governance and firm value at dual class firms. Review of Financial Economics, Forthcoming. https://doi.org/10.1016/j.rfe.2017.07.001

- Lozano, M. B., Martinez, B. & Pindado, J. (2016). Corporate governance, ownership and firm value: Drivers of ownership as a good corporate governance mechanism. International Business Review, 25(6), 1333-1343.

- Marvadi, C.R. (2015). Determinants of shareholder value creation in Indian banking sector. International Journal of Business and Administration Research Review, 1(12), 75-84.

- Mutalib, Y.O., Abdulazeez, I., & Bello, F. (2014). Value relevance of Accounting information for firm’s decision-making process, Proceedings of the Multidisciplinary Academic Conference on Sustainable Development, 2(1),1-7

- Ntim, C.G. (2018). Corporate governance, corporate health accounting, and firm value: The case of HIV/AIDS disclosures in Sub-Saharan Africa. The International Journal of Accounting, 51(2), 155-216.

- Purwohandoko, (2017). The influence of firm’s size, growth, and profitability on firm value with capital structure as the mediator: A study on the agricultural firms listed in the Indonesian stock exchange. International Journal of Economics and Finance, 9(8), 103-110.

- Ragab, A.A., & Omran, M.M. (2006). Accounting information, value relevance, and investors’ behavior in the Egyptian equity market. Review of Accounting and Finance, 5(3), 1-29.

- Sharma, A., Kumar, S. & Singh, R. (2012). Value relevance of financial reporting and its impact on stock prices: evidence from India. South Asian Journal of Management, 19(2), 60-77.

- Suwardi, E. (2009). The dynamic relationship between accounting numbers and share prices on the Jakarta stock exchange. International Review of Business Research Papers, 5(5),16-24.

- Uwuigbe, O.R., Uwuigbe, U., Jafaru, J., Igbinoba, E.E., & Oladipo, O.A. (2016). Value relevance of financial statements and share price: a study of listed banks in Nigeria. Banks, and Bank Systems, 11(4), 135-143.

- Wang, H.C., & Chang, H.J. (2008). The association between Accounting information disclosure and stock price. Global Journal of Business Research, 2(2), 1-10.

- Zhou, H., & Zhu, J.Q. (2019). Firm characteristics and jump dynamics in stock prices around earnings announcements. The North American Journal of Economics and Finance, 50(November), Forth Coming, https://doi.org/10.1016/j.najef.2019.101003.